How Finance Works

Table of contents

Mandate, structure, and management of the department

- Overview

- Structure and Management

- Finance Portfolio Organizations and Responsibilities

- Relationships with International Groups and Organizations

- Minister's Responsibilities for Appointments

- Federal-Provincial Relations

- Legislation and Statutory Responsibilities

- Branch Overview Decks

Overview

Department of Finance Legislation and Statutory Responsibilities

The Minister of Finance has broad responsibility for the overall stewardship of the Canadian economy. As well, the Minister is responsible for federal fiscal policy, tax policy, the $81.7 billion system of federal transfers to provinces and territories (e.g., the Canada Health Transfer, Canada Social Transfer, Equalization and Territorial Formula Financing), and the regulation of financial sector policies. The Minister’s mandate has a critical pan-Canadian focus, and is a senior leader at the Cabinet table and provides critical support to the Prime Minister.

Statutory Responsibilities

The Minister’s statutory responsibilities fall into three categories:

- statutes for which the Minister of Finance is named as the responsible minister, or those statutes that although they do not identify a responsible Minister, fall within the Minister of Finance’s responsibility (a total of 63 statutes, described in full detail in Section 7 in your binder);

- statutes for which another minister is named as the responsible minister but for which the Minister of Finance has policy responsibility by virtue of their responsibility under s. 15 of the Financial Administration Act for “the supervision, control and direction of all matters relating to the financial affairs of Canada not by law assigned to the Treasury Board or to any other minister” (a total of 15 statutes, described in full detail in Section 7 in your binder); and

- statutes under which the Minister of Finance has assigned powers, duties and functions but for which another minister is responsible to Parliament (a total of 78 statutes, described in full detail in Section 7in your binder).

Of particular importance are those responsibilities outlined in the Financial Administration Act, the Bank Act, and the Federal-Provincial Fiscal Arrangements Act.

Finance Portfolio Organizations and Responsibilities

The Minister of Finance has statutory responsibility for several crown corporations and agencies:

- Bank of Canada

- Canada Deposit Insurance Corporation

- Office of the Superintendent of Financial Institutions

- Financial Consumer Agency of Canada

- Financial Transactions and Reports Analysis Centre of Canada

- Canada Pension Plan Investment Board

- Canada Development Investment Corporation (of which the Trans Mountain Corporation and the Canada Hibernia Holding Corporation are subsidiaries)

- Royal Canadian Mint

- Canadian Securities Regulation Regime Transition Office

- Canadian International Trade Tribunal

In addition, there are 6 crown corporations and 2 other organizations for which the Minister has some statutory responsibility. the Minister also has responsibilities flowing from a number of agreements between the Government of Canada and not-for-profit corporations. A full description of the Minister’s portfolio is contained in Section 5 of your binder.

Relationships with International Groups and Organizations

The Minister of Finance has a wide range of international responsibilities with respect to international trade, finance and development. The Minister is responsible for Canada’s import policy and legislation. The Minister is also the Canadian Governor for the World Bank Group, the International Monetary Fund, the Asian Infrastructure Investment Bank and the European Bank for Reconstruction and Development. Together with the Ministers of Foreign Affairs and International Development, the Minister is charged with the management of the International Assistance Envelope. In addition, the Minister is called upon to attend a range of international meetings of Finance Ministers, including the G7, G20, the OECD, and APEC. Full details of the Minister’s responsibilities as they relate to international groups and organizations are included in Section 6 of your binder.

Federal-Provincial Relations

Major federal transfers help provincial and territorial governments finance various programs and services. The Canada Health Transfer is the primary federal contribution to health care in Canada and is the largest major transfer to provinces and territories. The Canada Social Transfer is a block transfer to provinces and territories in support of post-secondary education, social assistance and social services, early childhood development and early learning and childcare. Equalization and Territorial Formula Financing ensure that provincial and territorial governments have sufficient revenue to provide reasonably comparable levels of public services at reasonably comparable levels of taxation.

In 2020-21, major transfer payments will represent over $81 billion:

- The Canada Health Transfer: $41.9 billion

- The Canada Social Transfer: $15.0 billion

- Equalization: $20.6 billion

- Territorial Formula Financing: $4.2 billion

The Minister and the Department of Finance have a long-established process for consultations with provinces and territories. The consultative process largely consists of meetings at various levels, including among Finance Ministers once or twice a year. Senior Finance officials chair several committees that serve as a consultative venue for an exchange of ideas, including on taxation, fiscal, and economic issues. A full list of committees is included in Section 7 in your binder.

Structure and Management

- Federal-Provincial Relations and Social Policy Branch

- Economic and Fiscal Policy Branch

- Financial Sector Policy Branch

- Tax Policy Branch

- International Trade and Finance Branch

- Economic Development and Corporate Finance Branch

- Consultations and Communications Branch

- Law Branch

- Corporate Services Branch

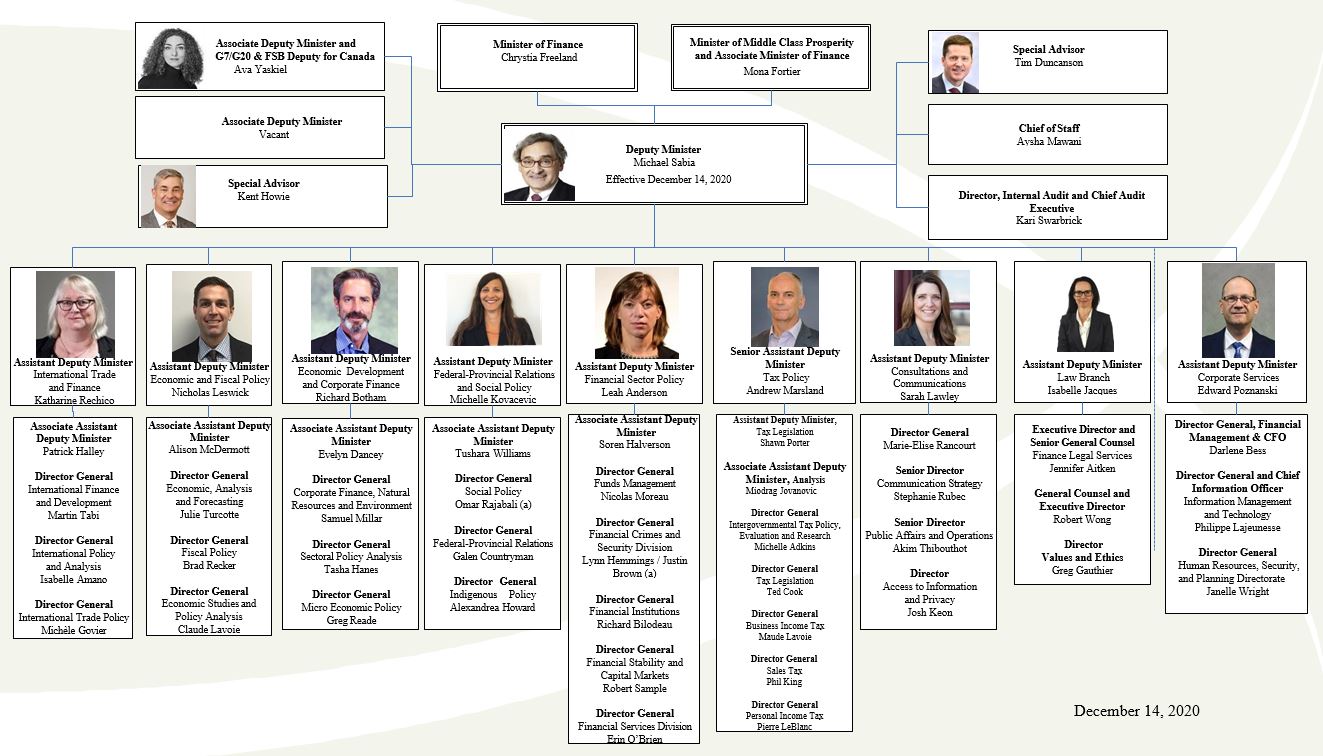

A full organizational chart is included in Section 2 of your binder.

Key Stakeholders by Sector

A list of stakeholders by sector is available upon request.

2020-2021 Departmental Budget

The Department has an operating budget of $105.5 million and a staff of 812 full-time equivalents (FTEs), excluding exempt staff working in the office of the Minister of Finance. In addition, the Department is responsible for the expenditure of roughly $99.5 billion in statutory items composed mainly of major transfers to other levels of government (e.g., Canada Social Transfer, Canada Health Transfer, etc.) and public debt charges.

Department of Finance

Figure 1 – Text version

Minister of Finance - Chrystia Freeland

Minister of Middle Class Prosperity and Associate Minister of Finance - Mona Fortier

Deputy Minister - Michael Sabia - Effective December 14, 2020

Associate Deputy Minister and G7/G20 & FSB Deputy for Canada - Ava Yaskiel

Associate Deputy Minister – Vacant

Special Advisor - Kent Howie

Special Advisor - Tim Duncanson

Chief of Staff - Aysha Mawani

Director, Internal Audit and Chief Audit Executive - Kari Swarbrick

Assistant Deputy Minister - International Trade and Finance Katharine Rechico

- Associate Assistant Deputy Minister - Patrick Halley

- Director General International Finance and Development - Martin Tabi

- Director General International Policy and Analysis - Isabelle Amano

- Director General International Trade Policy - Michèle Govier

Assistant Deputy Minister Economic and Fiscal Policy - Nicholas Leswick

- Associate Assistant Deputy Minister - Alison McDermott

- Director General Economic, Analysis and Forecasting - Julie Turcotte

- Director General Fiscal Policy - Brad Recker

- Director General Economic Studies and Policy Analysis - Claude Lavoie

Assistant Deputy Minister Economic Development and Corporate Finance - Richard Botham

- Associate Assistant Deputy Minister - Evelyn Dancey

- Director General Corporate Finance, Natural Resources and Environment - Samuel Millar

- Director General Sectoral Policy Analysis - Tasha Hanes

- Director General Micro Economic Policy - Greg Reade

Assistant Deputy Minister Federal-Provincial Relations and Social Policy - Michelle Kovacevic

- Associate Assistant Deputy Minister - Tushara Williams

- Director General Social Policy Omar - Rajabali (a)

- Director General Federal-Provincial Relations - Galen Countryman

- Director General Indigenous Policy - Alexandrea Howard

Assistant Deputy Minister Financial Sector Policy Leah Anderson

- Associate Assistant Deputy Minister - Soren Halverson

- Director General Funds Management - Nicolas Moreau

- Director General Financial Crimes and Security Division - Lynn Hemmings / Justin Brown (a)

- Director General Financial Institutions Richard - Bilodeau

- Director General Financial Stability and Capital Markets - Robert Sample

- Director General Financial Services Division - Erin O'Brien

Senior Assistant Deputy Minister Tax Policy - Andrew Marsland

- Assistant Deputy Minister, Tax Legislation - Shawn Porter

- Associate Assistant Deputy Minister, Analysis - Miodrag Jovanovic

- Director General Intergovernmental Tax Policy, Evaluation and Research - Michelle Adkins

- Director General Tax Legislation - Ted Cook

- Director General Business Income Tax - Maude Lavoie

- Director General Sales Tax - Phil King

- Director General Personal Income Tax - Pierre LeBlanc

Assistant Deputy Minister Consultations and Communications - Sarah Lawley

- Director General - Marie-Elise Rancourt

- Senior Director Communication Strategy - Stephanie Rubec

- Senior Director Public Affairs and Operations - Akim Thibouthot

- Director Access to Information and Privacy - Josh Keon

Assistant Deputy Minister Law Branch - Isabelle Jacques

- Executive Director and Senior General Counsel Finance Legal Services - Jennifer Aitken

- General Counsel and Executive Director - Robert Wong

- Director Values and Ethics - Greg Gauthier

Assistant Deputy Minister Corporate Services - Edward Poznanski

- Director General, Financial Management & CFO - Darlene Bess

- Director General and Chief Information Officer Information Management and Technology - Philippe Lajeunesse

- Director General Human Resources, Security, and Planning Directorate - Janelle Wright

Finance Portfolio Organizations and Responsibilities

Crown corporations part of the finance portfolio, for which the minister of finance has statutory responsibility

A. Bank of Canada (Tiff Macklem, Governor; Carolyn Wilkins, Senior Deputy Governor)

Relationship to Minister

The Bank of Canada is Canada's central bank, the corporation directly responsible for Canada’s monetary policy. The Bank of Canada Act provides that the Bank shall be under the management of the Board of Directors composed of the Governor, a Senior Deputy Governor, and twelve independent directors. The Minister of Finance, with the approval of the Governor in Council, appoints the directors for three-year terms. The Deputy Minister of Finance or designate sits on the Board and is a member of the Executive Committee but does not have a vote.

The Governor of the Bank, who chairs the Board, and the Senior Deputy Governor are appointed by the independent directors with the approval of the Governor in Council to serve during good behaviour for seven-year terms. Both can be reappointed. The remuneration of the Governor and Senior Deputy Governor, as well as the directors, must be approved by the Governor in Council. The current Governor was appointed on June 2, 2020.

The Bank is exempt from Part X of the Financial Administration Act and is thus not required to submit a corporate plan for approval by Treasury Board. The Board of Directors is solely responsible for setting spending priorities through the Bank’s annual budget process. The Bank prepares an annual report that the Minister of Finance must table in Parliament. The Minister must also table the Bank’s Annual Report to Parliament on the Administration of the ATI and Privacy Acts.

In carrying out its responsibilities, the Bank maintains close communication with the government. Officials from the Department of Finance work closely with colleagues at the Bank, particularly on issues related to macroeconomic performance, debt management, and financial sector regulation. In addition, the Act requires that the Minister of Finance and the Governor consult regularly on monetary policy with respect to its relation to economic policy but indicates that, in case of conflict, the Minister of Finance is ultimately responsible for monetary policy.

Relationship to Department

The Bank of Canada is responsible for the design and production of bank notes. Under the Bank of Canada Act, the Minister must approve the composition and design of bank notes. In addition, the Bank acts as fiscal agent for the government and is thus directly concerned with the

management of the public debt. The Bank advises the government on the method of financing to be used in raising money and on the terms of new issues and undertakes the management of daily cash balances for the government.

As fiscal agent for the government, the Bank of Canada also acts as agent and advisor in the management of Canada’s foreign exchange reserves, which are largely held in the Exchange Fund Account in the name of the Minister of Finance. The Governor is a member of the Senior Advisory Committee (SAC)Footnote 1 chaired by the Deputy Minister of Finance and a member of the Financial Institutions Supervisory Committee (FISC)Footnote 2.

The Bank of Canada is responsible under the Payment Clearing and Settlement Act to oversee core payment systems in Canada. The Governor of the Bank can designate payment systems as systemically important, with the approval of the Minister of Finance, if they can trigger or transmit major shocks across the domestic or international financial system due to the size or the nature of the payments they process. The Governor of the Bank can also designate, with the approval of the Minister of Finance, other payment systems as prominent if their failure or disruption could cause a significant adverse effect on economic activity in Canada by impairing the ability to make payments or producing a general loss of confidence in the overall Canadian payments system.

Significance

The Bank of Canada has a major influence on the economy. Its duties are to regulate credit and currency in the best interests of the economic life of the nation; to control and protect the national monetary unit; to mitigate by its influence fluctuations in the general level of production, trade, prices and employment, as far as possible within the scope of monetary actions; and generally to promote the economic and financial welfare of Canada. Financial markets, the business community, and economic analysts in Canada closely monitor the Bank of Canada’s actions.

The Bank receives no appropriations from government. The main source of the Bank’s revenue is interest earned on holdings of federal government securities.

The Bank of Canada remits its profit to the government quarterly. In 2019, this amount totalled

$1.0 billion.

B. Canada Deposit Insurance Corporation (Peter Routledge, President and CEO; Robert Sanderson, Chair of the Board of Directors)

The Canada Deposit Insurance Corporation’s (CDIC) mandate is to insure deposits in member institutions (up to $100,000 in each of the seven eligible categories) and promote and otherwise contribute to financial stability in Canada. CDIC also acts as the resolution authority for its members. This mandate is to be carried out for the benefit of those with deposits in CDIC member institutions, and in such a manner that minimizes the corporation’s exposure to loss.

CDIC members include federally incorporated deposit-taking institutions and any similar provincially incorporated institutions that are authorized by provincial legislation to apply for such deposit insurance.

The Minister has a number of duties relating to the operation of CDIC. Under Part X of the Financial Administration Act (FAA), the Minister recommends CDIC’s Corporate Plan for Governor in Council approval. As part of this process, the Minister recommends that Treasury Board approve CDIC’s operating and capital budgets, as well as its objectives for the planning period, the strategy to achieve those objectives, and its expected performance compared to its objectives. Annually, the Minister must also approve CDIC’s borrowing plan. The Minister can authorize CDIC to borrow from the Government of Canada or capital markets (currently up to a maximum of $25 billion) in order for it to make payments to depositors if a member institution fails. The Minister also approves the deposit insurance premiums CDIC charges member institutions, and approves any change in the formula used to calculate the premiums. Pursuant to the FAA, the Minister must also approve and table in Parliament the annual Summary of the Corporate Plan, as well as the CDIC Annual Report.

The CDIC Act establishes the various powers and tools CDIC can use to resolve one of its member institutions in case of failure. CDIC would assess possible resolution options with a view to formulate a recommendation to the Minister of Finance. The Minister would then, if they are of the opinion that it is in the public interest to do so, recommend to the Governor in Council that an order be made to execute the resolution strategy. The Governor in Council would make the final decision to enter the resolution process. The process would then be led by CDIC according to this decision. CDIC must pursue a strategy that will minimize its exposure to loss, unless exempted to do so by the GIC in an order. The GIC would make this exemption if the Minister (after consultation with the CDIC Board, the Superintendent of Financial Institutions, and the Governor of the Bank of Canada) is of the opinion that loss minimization might have an adverse effect on the stability of the financial system in Canada or public confidence in that stability.

Relationship to Department

The Deputy Minister of Finance is an ex-officio member of the CDIC Board of Directors. The Department works with CDIC and the Office of the Superintendent of Financial Institutions regarding financial institutions on their respective watch lists. The President of CDIC is a member of the SAC chaired by the Deputy Minister of Finance and a member the FISC chaired by the Superintendent of Financial Institutions.

Significance

CDIC has an important safety net role that helps maintain the stability of the financial sector. In 2019-20, it collected $668 million in insurance premiums and had approximately $5.7 billion in an ex ante fund to fund resolutions for problem financial institutions and future financial institution failures for CDIC member institutions. CDIC has 143 full time employees and is funded through the premiums it collects from member institutions.

Bill C-13 An Act respecting certain measures in response to COVID-19

Canada’s deposit insurance framework is established under the Canada Deposit Insurance Corporation Act. Bill C-13 amended the Canada Deposit Insurance Corporation Act to allow the Minister of Finance to increase the deposit insurance coverage limit until September 30, 2020.

Currently, CDIC insures eligible deposits held at its member institutions up to a maximum of

$100,000 per deposit per insured category.

Deposit insurance protects depositors’ savings up to the insured maximum. It reinforces public confidence in the financial system and promotes financial stability.

The legislation allows the Minister to respond quickly to protect financial stability and maintain consumer confidence during these extraordinary events. There is no intention to change the deposit insurance limit at this time.

C. Canada Development Investment Corporation (Stephen Swaffield, Chair of the Board of Directors; Michael Carter, Executive Vice President)

The Canada Development Investment Corporation (CDEV) is a Schedule III Part II Crown corporation under the Financial Administration Act, and an agent of Her Majesty. CDEV’s initial mandate was to manage Crown corporations and other government investments assigned to it, and to divest these holdings when appropriate. Since 2009, the CDEV has been mandated to assist the government by reviewing assets (e.g., commercially-oriented Crown corporations, airports), by securing expert third party financial, technical and strategic advice for the government on specific assets, and in acting as the government’s agent in the sale of Crown corporations (e.g., Ridley Terminals Incorporated). CDEV also has a role in fulfilling Canada’s obligations to the government of Newfoundland and Labrador under the 2019 Hibernia Dividend Backed Annuity Agreement. * Sentence redacted *

At present, the Corporation has four wholly-owned subsidiaries:

- The Trans Mountain entities, including Trans Mountain Corporation, which operate the existing Trans Mountain pipeline and related assets and are responsible for the Trans Mountain Pipeline expansion project.

- Canada Hibernia Holding Company (CHHC), a subsidiary which manages the Government’s 8.5% interest in the Hibernia oil project offshore of Newfoundland.

- Canada Eldor Inc., a subsidiary company which holds the remaining federal liabilities resulting from the 1988 privatization of Eldorado Nuclear.

- Canada Enterprise Emergency Funding Corporation (CEEFC), which is responsible for administering the Large Employer Emergency Financing Facility (LEEFF), which provides bridge financing for large Canadian companies who have been affected by the COVID-19 emergency.

Relationship to Minister

The Minister of Finance is the Minister responsible to Parliament for the Canada Development Investment Corporation. Under the provisions of Part X of the Financial Administration Act (FAA) the Minister of Finance makes recommendations to the Governor-in-Council (GIC) on appointments to the Board of Directors, including the chairperson. The Minister is also required to annually submit CDEV’s five-year corporate plans and capital budgets for Treasury Board consideration and approval. The Minister of Finance is also required to table:

- CDEV’s Corporate Plan Summary in Parliament within 30 sitting days of Governor-in- Council approval of the Corporate Plan;

- CDEV’s Annual Report in Parliament within 15 sitting days after September 1 of the year in which the report was prepared.

- Annual reports from CDEV and its subsidiaries under the Access to Information and Privacy acts.

Relationship to Department

The department provides advice to the Minister of Finance with respect to CDEV’s annual Corporate Plans and Budgets, as well as on issues concerning CDEV and its subsidiaries. CDEV supports the work of Finance officials by securing expert third-party advice, on an as-requested basis, in the context of the Corporate Asset Review.

In 2018, CDEV’s joint auditors, KPMG and the Auditor General, completed a special examination and identified an issue that CDEV was not in compliance with the FAA as the Executive Vice President has not been appointed by the GIC but was performing the duties of a President. The department has been working with CDEV and PCO to develop a process that would lead to a GIC-appointed President in the future.

Significance

As a federal institution reporting to Parliament through the Minister of Finance, CDEV brings unique expertise in the management and divestiture of commercial assets.

D. Royal Canadian Mint (Marie Lemay, President and Chief Executive Officer; Phyllis Clark , Chair of the Board of Directors)

The Royal Canadian Mint (the Mint) was established in 1908 as a branch of the Royal Mint in Great Britain, and it remained so until 1931. In that year, the RCM became a branch of the Department of Finance. In 1969, pursuant to the Royal Canadian Mint Act (RCMA), the Mint became a Crown corporation. Since 2011, the Mint has reported to Parliament through the Minister of Finance. Previously, the Mint had reported to Parliament through the Minister of Transport.

The Mint’s legislated mandate is to “mint coins in anticipation of profit and to carry out other related activities”. The Mint’s core activities are to produce the circulation and non-circulation coins of Canada, manage the coinage system and provide advice to the Minister of Finance on all matters related to coinage. The Mint has four main business lines: Canadian Circulation, Foreign Circulation, Numismatics, and Bullion Products & Services.

Relationship to Minister

Part I of the Currency Act, dealing with the responsibility of the Minister of Finance, provides for the production, issue, and removal of legal tender. The Mint issues circulation coins that the Government of Canada purchases from the Mint through a Memorandum of Understanding.

The Mint must prepare a Corporate Plan every year, for which the Minister of Finance is responsible for signing and recommending to Treasury Board for approval. The Corporate Plan includes a general description of planned activities looking forward five years. It also includes a Capital Budget, which must be approved by the Treasury Board. The Minister of Finance is also responsible for tabling a summary of the Corporate Plan and Capital Budget, and the Annual

Report before Parliament. The Minister of Finance is also responsible for approving the corporation’s borrowing.

The Minister of Finance is responsible for recommending approval, to the Governor in Council, for changes to circulation coin designs and new coin denominations. The Mint may also produce numismatic coins and precious metal coins. The Minister of Finance is required to approve designs for numismatic coins.

The Board of Directors of the Mint consists of the Chairperson of the Board, the President and CEO (Master of the Mint) and nine other directors. The Board is responsible for overseeing the management of the business, activities and other affairs of the Mint with a view to both the best interests of the Mint and the long-term interests of its sole shareholder, the Government. The Chairperson of the Board is appointed by the Governor in Council, whereas other directors are appointed by the Minister with the approval of the Governor in Council.

Relationship to Department

The Financial Sector Policy Branch provides advice and recommendations to the Minister of Finance with respect to the Mint’s annual Corporate Plan and Capital Budget, borrowing plan, commemorative circulation coin designs, numismatic coin designs, appointments, and a number of other matters related to the Mint.

E. Canada Pension Plan Investment Board (Mark Machin, President and CEO)

The Canada Pension Plan Investment Board (CPPIB) was created in 1998 as part of a federal- provincial agreement to reform the Canada Pension Plan (CPP), of which the reform of the investment policy was a key element. CPPIB is an arm’s length investment corporation with a mandate to invest net new CPP contributions in a diversified portfolio of assets, including equities, fixed income securities, real estate, infrastructure and other assets in the best interests of plan members.

The federal government and the provinces have joint responsibility for CPPIB, including its enabling legislation and associated regulations.

Every three years, as part of the review of the CPP and related CPPIB legislation, the Office of the Chief Actuary issues a report on the financial sustainability of the Plan. Any changes to the CPP and CPPIB Acts require the approval of at least two-thirds of the provinces representing at least two-thirds of the population.

As at March 31, 2020, CPP assets totalled $409.6 billion. Over the past ten years, the average annual nominal rate of return on investment has been 9.9 per cent. The base CPP earned an 8.9 per cent net nominal rate of return on investments for fiscal 2020. The additional CPP account, which began receiving contributions on January 1, 2019, ended the same period with net assets of $2.3 billion. The additional CPP account achieved a return of $13 million or 4.2 per cent for fiscal 2020.

Relationship to Minister

As responsible Minister, the Minister of Finance has a number of statutory obligations in relation to CPPIB.

The Minister of Finance makes recommendations to the Governor in Council on appointments to the twelve-member board of directors, including the chairperson. Prior to making these recommendations, the Minister must consult with the appropriate Ministers of participating provinces (all but Quebec). Appointments to the board are made from a list of qualified candidates prepared by a federal/provincial nominating committee. The Minister of Finance appoints the chairperson of the nominating committee.

The Minister of Finance, in consultation with the provinces, is responsible for proposing any changes to the CPPIB legislative framework to Parliament.

Every six years, the Minister of Finance must cause a special examination of the CPPIB’s internal controls, systems, and management practices. Prior to causing this special examination, which has generally been conducted by CPPIB’s own auditor, the Minister must consult with provincial Ministers.

CPPIB must send the Minister of Finance its quarterly financial statements and annual report. The Minister of Finance must table the latter in Parliament.

The Chief Executive Officer of CPPIB is appointed by the board of directors and is not subject to GIC approval. The board of directors determines the fees paid to directors as well as the remuneration of the CEO. CPPIB is exempt from Part X of the Financial Administration Act and thus does not submit a corporate plan for approval by the Minister of Finance or Treasury Board.

Relationship to Department

As an arm’s length Crown corporation, the Department has no direct influence over CPPIB’s investment policies or practices, but it does closely monitor its governance, risk management and

factors that may affect the funding of the CPP. The Department is fully engaged with the Office of the Chief Actuary, the provinces, and CPPIB as appropriate, in managing the triennial review process and discussing any changes to CPPIB legislative framework. The Department also acts as the secretariat for the federal/provincial nominating committee, which identifies qualified candidates to serve on the board of directors.

Significance

The CPP is a key pillar of the Canadian retirement income system. As of January 1, 2019, the role of the Plan was expanded through the enhancement of CPP benefits, such that the maximum benefit level will grow from one-quarter to one-third of average work earnings covered by the CPP. Thus, the CPP consists of two parts: the base CPP (benefits in existence prior to the enhancement) and the additional CPP. To ensure the sustainability of the CPP, CPPIB invests monies not immediately required to pay CPP benefits in order to maximize returns without undue risk of loss. At March 31, 2020, CPPIB had 1,824 full-time employees and annual operating expenses of $1.25 billion.

Agencies part of the Finance Portfolio, for which the Minister of Finance has Statutory Responsibility

A. Office of the Superintendent of Financial Institutions (OSFI) (Jeremy Rudin, Superintendent)

The Office of the Superintendent of Financial Institutions (OSFI) is an independent federal government agency that regulates and supervises more than 400 federally regulated financial institutions and 1,200 pension plans to determine whether they are in sound financial condition and meeting their requirements.

OSFI’s mandate is:

To foster sound risk management and governance practices through the advancement of a regulatory framework designed to control and manage risk.

To supervise federally regulated financial institutions and pension plans to determine whether they are in sound financial condition and meeting regulatory and supervisory requirements.

To monitor and evaluate system-wide or sectoral developments that may have a negative impact on the financial condition of federally regulated financial institutions.

To protect the rights and interests of depositors, policyholders, financial institution creditors and pension plan beneficiaries while having due regard for the need to allow financial institutions to compete effectively and take reasonable risks.

OSFI reports to Parliament through the Minister of Finance. Although the Minister is responsible for OSFI, the Superintendent is independently responsible for the development of supervisory guidelines and regulations (such as capital and liquidity requirements) and the evaluation of the financial conditions of federally regulated financial institutions.

OSFI also administers the application process for transactions requiring Ministerial approval under the federal financial institutions statutes, such as a significant change in ownership and the incorporation or dissolution of an institution, and makes a recommendation to the Minister.

The Minister tables OSFI’s Annual Report in Parliament each year. The Minister also submits OSFI’s Departmental Plan and Departmental Results Report to the Treasury Board.

Relationship to Department

OSFI is required under the OSFI Act to establish a Financial Institutions Supervisory Committee (FISC) consisting of the Superintendent, the Governor of the Bank of Canada, the Chair of the Canada Deposit Insurance Corporation, the Commissioner of the Financial Consumer Agency of Canada and the Deputy Minister of Finance, to facilitate consultations and the exchange of information on matters relating to the supervision of financial institutions. OSFI also briefs the Minister regarding companies on OSFI’s watch list. The Superintendent is a member of the Senior Advisory Committee (SAC) chaired by the Deputy Minister of Finance and a Director of the CDIC Board.

Significance

In 2019-20, OSFI’s estimated total expenses is $168.3 million and approximately 780 full-time employees in offices located in Ottawa, Montreal, Toronto, and Vancouver. OSFI is funded mainly through assessments on the financial institutions and private pension plans it regulates and to a small extent, a user-pay program for selected services that are issued pursuant to a statutory authority. OSFI also receives an annual government appropriation (about $1 million in 2019-20) for actuarial services related to public sector employee pension and insurance plans.

B. Financial Consumer Agency of Canada (Judith Robertson, Commissioner)

The Financial Consumer Agency of Canada (FCAC) has the responsibility to supervise federally regulated financial institutions to determine whether they are in compliance with the consumer provisions in the financial institutions and payments statutes. In addition, the FCAC monitors voluntary codes of conduct designed to protect the interests of consumers, undertakes research on trends and emerging issues that impact consumers, and collaborates and coordinates activities with stakeholders to strengthen the financial literacy of Canadians. The Agency is headed by a Commissioner, who is empowered to administer the Financial Consumer Agency of Canada Act, and reports to the Minister of Finance on all matters within its mandate.

The Minister approves the FCAC’s corporate/financial documents, such as the Annual Report, which are tabled in Parliament, as well as a business plan that is made public. In addition, the financial institutions statutes require that the Commissioner of the FCAC, at least once in each calendar year, report to the Minister on the FCAC’s operations and on federally regulated financial institutions’ compliance with the legislative and regulatory consumer protection measures. The Commissioner must report to the Minister on any other special examinations carried out during the year.

FCAC employs about 143 people (with planned increases over the next three years) with an overall planned spending of $38.4 million for 2020-21 funded through assessments on federally regulated financial institutions (estimated at $33.4 million for 2020-21) and by an annual statutory appropriation of $5 million to support its financial literacy activities. However, the FCAC submits on an annual basis a request for the Minister’s approval to borrow from the Consolidated Revenue Fund (CRF), in order to allow it to carry out its activities, as the assessments from financial institutions are collected only once per year.

Relationship to Department

The FCAC is an independent body charged with regulatory functions under the financial institutions’ statutes. The Minister of Finance presides over, and is responsible for, the FCAC. In formulating policy advice, Finance maintains contacts with the FCAC with regards to changes affecting consumers and small businesses. The Commissioner is a member of the Financial Institutions Supervisory Committee (FISC), a Director of the CDIC Board and a member of the Senior Advisory Committee (SAC) chaired by the Deputy Minister of Finance.

Significance

FCAC plays a complementary role to OSFI’s, ensuring compliance with the federal consumer protection laws that apply to banks and federally incorporated trust, loan and insurance companies. It also plays a key role in providing consumers with accurate and objective information about financial products and services through its financial literacy initiatives. Budget Implementation Act 2018, No. 2 introduced significant legislative amendments to expand the mandate of the FCAC and provide it with new powers and tools to further empower and protect financial consumers. The new mandate and powers for the FCAC have come into force, and the FCAC and Finance are working together to implement the remaining elements of the new Financial Consumer Protection Framework, including new and enhanced measures that will further protect and empower consumers.

C. Canadian International Trade Tribunal (Jean Bédard, Chairperson)

Relationship to Minister

The Minister of Finance is designated, under the Canadian International Trade Tribunal Act, as the Minister responsible for the Canadian International Trade Tribunal (CITT). In this regard, the CITT reports to Parliament through the Minister of Finance (i.e., the CITT is required to submit an annual report on its activities to the Minister of Finance, who in turn is required to submit a copy of the report to Parliament). The Administrative Tribunals Support Service of Canada (ATSSC) provides support services (e.g., corporate services, registry services, research and legal services) for the CITT . The ATSSC consolidates the support services of 11 administrative tribunals and is part of the portfolio of the Minister of Justice. The CITT itself remains part of the Finance portfolio. It is currently comprised of one Chairperson, five permanent Members, and one temporary Member, all appointed by the Governor in Council. The CITT is an independent and quasi-judicial body and, as such, the Minister of Finance maintains a strict arms-length relationship with the CITT.

Relationship to Department

The Department has a central role in the formulation and management of Canada’s import policies and in the evaluation of domestic economic policies against Canada’s international obligations and relations with other countries. Day-to-day responsibility for CITT-related issues resides with the Department’s International Trade Policy Division.

Significance

The CITT is an administrative tribunal operating within Canada's trade system. It is responsible for the conduct of anti-dumping and countervailing duty injury inquiries under the Special Import Measures Act and safeguard injury inquiries under the CITT Act. It also conducts inquiries into any economic, tariff, trade and commercial matters that may be referred to it by the Governor in Council or the Minister of Finance. As well, the CITT hears appeals of decisions of the Canadian Border Services Agency and the Canada Revenue Agency relating to customs and excise matters, and provides for the challenge of procurement decisions by suppliers who believe that the federal government breached its obligations under certain trade agreements during the solicitation or evaluation of bids, or in the awarding of contracts by federal government departments.

The main laws and regulations governing the work of the Tribunal are the CITT Act, the Special Import Measures Act, the Customs Act, the Excise Tax Act, the Canadian International Trade Tribunal Regulations, the Special Import Measures Regulations, the Canadian International Trade Tribunal Procurement Inquiry Regulations and the Canadian International Trade Tribunal Rules (Rules).

D. Financial Transactions and Reports Analysis Centre of Canada (Nada Semaan, Director and Chief Executive Officer)

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is Canada's financial intelligence unit and anti-money laundering/anti-terrorist financing (AML/ATF) regulator. Its mandate is set out in the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). Its purpose is to facilitate the detection, prevention and deterrence of money laundering and terrorist financing activities, while ensuring the protection of personal information under its control.

FINTRAC was established as an independent agency, operating at arm’s length to the police and other departments and agencies of government to whom it can provide financial intelligence (e.g., RCMP, CRA, CSIS). Its mandate and powers were designed to safeguard individual privacy and Charter rights. FINTRAC operates within the scope of the PCMLTFA and its regulations. FINTRAC does the following:

- Collects and analyses information received from financial transaction reports and reports of suspicious financial activities;

- Ensures compliance by reporting entities with customer identification, reporting, record keeping and compliance obligations under the PCMLTFA;

- Makes disclosures of financial intelligence to the appropriate law enforcement agency or other designated authorities;

- Conducts outreach to reporting entities to enhance awareness and understanding of trends related to money laundering and terrorist financing;

- Conducts its activities while ensuring the protection of the personal information under its control; and,

- Administers an administrative monetary penalty regime for non-compliance with the PCMLTFA.

Relationship to Minister

While FINTRAC is an independent agency, the Minister of Finance is responsible for the Centre. The Minister of Finance has responsibility for reviewing and approving FINTRAC’s corporate/financial documents, such as the Annual Report, the Departmental Plan, and the Departmental Results Report, which are tabled in Parliament. FINTRAC also provides an annual report to the Minister on the measures it takes to ensure the compliance of reporting entities with their obligations under the PCMLTFA. FINTRAC, with the Minister’s approval, enters into Memoranda of Understanding with other countries for the sharing of information between FINTRAC and foreign financial intelligence units.

Relationship to Department

The Department has overall responsibility for policy co-ordination of the Canadian AML/ATF Regime, and thus works closely with FINTRAC, which is the only Canadian organisation whose sole mandate is related to AML/ATF. The Department advises the Minister of Finance on their responsibility for oversight of FINTRAC and works closely with FINTRAC and other Regime partners to advise the Minister on emerging developments related to AML/ATF and the PCMLTFA and its regulations. The Department also collects performance measurement indicators from Regime partners, including FINTRAC, on a regular basis.

Significance

For 2019-20, FINTRAC’s spending was $55.3 million with 352 full-time equivalent employees. FINTRAC supervises approximately 31,000 reporting entities including financial institutions, securities dealers, money services businesses, accountants, casinos, dealers in precious metals and stones, and life insurance and real estate companies. In 2019-20, FINTRAC received over 30 million financial transaction reports. FINTRAC’s main office is in Ottawa with regional offices in Toronto, Montreal, and Vancouver.

E. Canadian Securities Regulation Regime Transition Office (Doug Hyndman, President and CEO)

The Canadian Securities Regulation Regime Transition Office (CSTO) provides advice to the Government of Canada on enhancing systemic risk management and criminal enforcement in Canada’s capital markets in support of advancing the proposed federal Capital Markets Stability Act (CMSA). The CSTO also supports the Government of Canada’s participation in establishing the proposed Cooperative Capital Markets Regulatory System. The Government is working with the governments of British Columbia, Ontario, Saskatchewan, New Brunswick, Newfoundland and Labrador (most recent signatory (March 2020)), Nova Scotia, Prince Edward Island, and Yukon to establish the Cooperative System.

Douglas Hyndman is the President and Chief Executive Officer of the CSTO (GIC appointee). The CSTO has approximately 20 staff members, with offices in Toronto and Vancouver.

Relationship to Minister

Under the Canadian Securities Regulation Regime Transition Office Act, the CSTO is required to regularly inform the Minister of Finance of its activities and progress, including through the provision of an annual report, which the Minister must table in both Houses of Parliament.

Further, the Act provides that the Minister may:

- Make direct payments to fund the CSTO’s operations.

- Recommend to the Governor in Council the appointment, remuneration and allowances of a president, or two co-presidents.

- Recommend to the Governor in Council the appointment, remuneration and allowances of members of the Advisory Committee – a committee consisting of one provincially/territorially-nominated representative per participating jurisdiction that provides advice to the CSTO [now defunct].

- Approve any agreement between the CSTO and the government of a province or territory that the president considers necessary or advisable.

- Direct the CSTO to undertake any activity in carrying out its purpose.

Relationship to Department

The CSTO provides advice to the Department of Finance Canada on matters related to enhancing systemic risk management and criminal enforcement in Canada’s capital markets, as it relates to advancing the proposed federal CMSA. The CSTO also provides advice on the Cooperative System initiative, including on the legislative framework and implementation, and it manages the provision of federal funds to the Capital Markets Authority Implementation Organization, the precursor body to the Cooperative Regulator.

Significance

The CSTO is comprised of leading securities lawyers and capital markets risk experts who provide high-quality advice to the Department of Finance Canada on all aspects of the establishment of the Cooperative System, with a focus on the proposed federal CMSA as well as implementation and launch options. It also oversees the administration of federal funds contributed to the Capital Markets Authority Implementation Organization (pre-cursor body to the Cooperative System/Regulator) for the implementation of the Cooperative System as well as

reporting to the Department of Finance Canada on the use of those funds, with a view to maximizing their efficient use.

Crown Corporations for which the Minister of Finance has some Statutory Responsibility

A. Business Development Bank of Canada (Michael Denham, President and Chief Executive Officer; Mike Pedersen, Chairperson)

Relationship to Minister

The Minister of Small Business, Export Promotion and International Trade is the designated Minister responsible to Parliament for the Business Development Bank of Canada (BDC). The BDC receives no annual appropriation. As a Crown Corporation, the BDC is governed under provisions of the Financial Administration Act, which provides the Minister of Finance the following powers and duties. Specifically, the Minister of Finance must:

- Approve the amounts, and terms and conditions for any borrowings from the capital markets or the Consolidated Revenue Fund and, has traditionally required that their recommendation, in addition to that of the Minister of Small Business, Export Promotion and International Trade, be obtained before the BDC’s corporate plans are submitted to the Governor in Council for approval.

The Minister of Finance’s concurrence or recommendation is also required in several instances under the Business Development Bank of Canada Act (1995). Specifically, the Minister of Finance must:

- Provide concurrence for the subscription of any un-issued shares;

- Recommend any by-laws relating to shares;

- Recommend approval for the issuance of hybrid capital instruments to persons other than the Crown; and,

- Be consulted when the Minister of Small Business, Export Promotion and International Trade undertakes a review of the BDC’s mandate.

Relationship to Department

In consultation with Innovation, Science, and Economic Development Canada (ISED), the Department ensures that the BDC has sound capital and risk management strategies. The Capital and Dividend Framework Policy for Financial Crown Corporations provides the BDC and other financial Crown corporations with principals to govern their capital management and dividend policies.

The BDC has also been tasked under Section 21 of the Business Development Bank of Canada Act to carry certain duties and functions and to serve as the agent of the government under the Venture Capital Action Plan initiative (VCAP), the Venture Capital Catalyst Initiative (VCCI), and the Cleantech Scale Up Initiative.

Significance

The BDC’s mandate under the Business Development Bank of Canada Act is to operate as a complementary financial institution to the private sector for addressing the needs of small and medium-sized enterprises (SMEs) with an emphasis on supporting entrepreneurship by providing financing (loans, venture capital and subordinate financing) and consulting services. The BDC has 123 business centres across Canada, serving over 56,000 clients. The BDC provides its services directly to Canadian SMEs on a commercial basis, at rates commensurate with risk.

BDC’s loan portfolio was approximately $32 billion in 2019-20, and is forecast to increase to over $66 billion in 2020-21, to account for the delivery of the COVID-19 response

(e.g., Business Credit Availability Program initiatives).

B. Export Development Canada (Mairead Lavery, President and CEO, Martine Irman, Chairperson)

Relationship to Minister

Export Development Canada (EDC) offers export credit insurance and financing services to support Canadian companies of all sizes pursuing international trade and investment opportunities.

The Minister for International Trade is responsible to Parliament for EDC. The Minister of Finance recommends the approval of EDC’s annual corporate plans and approves its Borrowing Plan. In addition, the Minister of Finance has a direct role in approving transactions proposed under Canada Account, which is an account administered by EDC that the Government may use to support exporters with loans, guarantees or insurance policies in cases where EDC is unable to rely on its Corporate Account due to financial capacity or risk constraints. For example, recent high profile Canada Account transactions include the Government of Canada’s acquisition of the Trans Mountain Pipeline from Kinder Morgan in May 2018, the repayable loan to General Dynamics Land System Canada in August 2019, and the Canada Emergency Business Account in March 2020. The Canada Account is also used to support industrial development in key sectors such as clean technology.

As part of the Government's response to Covid-19, emergency legislation made amendments to the Export Development Act to provide the Minister of Finance with flexibility to establish limits for paid-in-capital, contingent liability, and Canada Account until September 30, 2020. In addition, the Minister Finance and Minister of International Trade may now jointly request EDC to undertake domestic activities.

The Minister of Finance is also responsible, along with the Minister of International Trade, for the regulatory framework regarding EDC’s activities, which is reviewed every ten years. As required in the Export Development Act, a legislative review began in 2018 and a final report was tabled in Parliament on June 20, 2019. The next step in the legislative review process is for the report to be referred to a Parliamentary Committee for study, which has been delayed by the fall 2019 writ period and the Covid-19 pandemic. Following committee review and recommendations, a formal Government response is expected to be advanced.

FinDev Canada, Canada’s Development Finance Institution and subsidiary of EDC, launched its activities in in early 2018. As part of its activities, FinDev offers financing through loans and equity investments to support businesses in low and middle-income countries create jobs and opportunities for sustainable and inclusive growth. As a subsidiary of EDC, its corporate reporting is consolidated within that of EDC.

The Department has key oversight on a broad range of EDC activities. Finance’s interest in EDC relates to its financial market role, the issue of risk management, and the broader public policy role of the Corporation as a financial Crown corporation and Canada’s official export credit agency. For these reasons, the Minister of Finance is responsible to approve EDC’s borrowing plan and routinely exercises its authority to recommend EDC’s Corporate Plan for Treasury Board’s approval. Finance also manages transactions under Canada Account, including setting loan loss provisions in the fiscal framework. Provisions for the entire Canada Account portfolio are revised annually in advance of the publication of the Public Accounts. Finance also leads the Canadian delegation to the OECD Arrangement and the International Working Group (IWG) on export credits, two forums created to govern the use of official export credits.

Significance

EDC is a significant player in financial and insurance markets, facilitating over $100 billion in business per year. The government is financially responsible for the Corporation’s liabilities and directly bears the risks of Canada Account loans and insurance policies, and provisions against those risks.

EDC has played a significant role in the government’s economic response to Covid-19, both through administering government programs (including the Canada Emergency Business Account and elements of the Business Credit Availability Program) and increased support through traditional business lines. The Minister of Finance and the Minister of International Trade can request EDC to support domestic business for period specified by those Ministers; currently, EDC is requested to support domestic business until December 31, 2021.

C. Canadian Commercial Corporation (Carl Marcotte (Interim President and CEO) Douglas Harrison, Chairperson of the Board of Directors)

Relationship to Minister

The Canadian Commercial Corporation (CCC) acts as a prime contractor on behalf of Canadian suppliers in their export transactions with foreign government buyers. In doing so, the Government of Canada, through the CCC, guarantees the performance of Canadian suppliers to foreign governments. CCC’s two primary business lines support Canadian exporters contracting into the defence sector, primarily in the US, and non-defence sectors in foreign government markets.

A substantial share of CCC’s business is exporting defence products to the US under the “US Defence Production Sharing Agreement” (DPSA). CCC does not currently charge cost-recovery fees for this business, but instead uses revenues generated from its other business lines to cross subsidize US DPSA activities further to a diversification strategy launched in 2014. In 2018-19, for example, CCC generated a total of $28.4 million in fees from procurement contracts in various sectors such as defence sector sales to non-US countries, construction and infrastructure projects, clean technologies, and information and communications technologies. * Sentences redacted *

The review, led by Global Affairs Canada, focused on CCC’s public policy role, operational effectiveness, economic impact, and overall fit within the federal trade ecosystem. * Sentence redacted *

The Minister for International Trade is responsible to Parliament for CCC. The Minister of Finance approves the corporation’s Borrowing Plan and exercises the authority to recommend CCC’s Corporate Plan for Treasury Board’s approval. The Minister also has a direct role in approving CCC’s involvement in large capital projects further to the Significant Project Instruction (SPI). The SPI was developed to enhance oversight of CCC activities and requires that the Ministers of International Trade and Finance authorize capital projects over $100 million and all other transactions over $300 million.

Relationship to Department

Finance’s interest in CCC relates to the issue of risk management, borrowing, and the broader public policy role of the Corporation. Finance was also actively involved in the negotiations to restructure the contract governing the Armoured Brigades Program.

Significance

The government is financially responsible for the Corporation’s liabilities, however, CCC is not structured to take on financial risks. * Sentence redacted *

While CCC previously received an annual government appropriation ($15.5M in 2014-15) to fund its core business under the U.S. Defence Production Sharing Agreement (DPSA), this appropriation was phased-out in 2017-18.

D. Farm Credit Canada (Michael Hoffort, President and Chief Executive Officer; Jane Halford, Chair of the Board of Directors)

Relationship to Minister

Farm Credit Canada (FCC) is a Schedule III Part I Crown Corporation under the Financial Administration Act (FAA). Under the Farm Credit Canada Act, its purpose is “to enhance rural Canada by providing specialized and personalized business and financial services and products to farming operations, including family farms, and to those businesses in rural Canada, including small and medium-sized businesses, that are businesses related to farming”. FCC provides financing, insurance, software, learning products and business services to producers, agribusinesses and agri-food operations. FCC does not accept deposits. According to FCC’s annual report for 2019-20, loans receivable were $36.1 billion in 2018-19 and $38.4 billion in 2019-20.

The Minister of Agriculture and Agri-Food is responsible to Parliament for the FCC. However, as a Crown Corporation, FCC is governed under the provisions of the Financial Administration Act (Part X), which provides the Minister of Finance specific powers and duties under statutory provisions.

The Minister of Finance is responsible for approving the amounts and terms and conditions for any borrowings from the capital markets or the Consolidated Revenue Fund. FCC is one of several Crown corporations that participate in the Crown Borrowing Program. As of April 2008, all new borrowings for the corporation, including the rolling over of maturing debt, have been consolidated into the federal debt program. FCC must adhere to the Minister of Finance Guidelines for Market Borrowings by Crown Corporations, the Minister of Finance’s Financial Risk Management Guidelines, and Credit Policy Guidelines for Crown Corporations.

For the purpose of capital injections and at the request of FCC, the Minister of Finance may, with the approval of the Governor in Council, pay FCC (out of the Consolidated Revenue Fund) amounts not exceeding certain limits established through the Farm Credit Canada Act, or such greater aggregate amount as may be authorized from time to time under an Appropriation Act. These payments do not require reimbursement. The Minister of Finance may also, upon request from FCC, lend money to FCC from the Consolidated Revenue Fund, on such terms and conditions, as the Minister deems appropriate.

The Minister of Finance also has discretionary authority over the FCC’s Corporate Plan. Under Section 127(2) of the Financial Administration Act, the Minister of Finance may require that their recommendation, in addition to the recommendation of the Minister of Agriculture and Agri-Food, be obtained before the Corporate Plan or amendment is submitted to the Governor in Council for approval.

Significance

FCC is Canada’s largest agricultural lender delivering financing and other services to 100,000 primary producers, value-added operators, suppliers and processors along the agricultural value chain. FCC competes directly with other financial institutions and credit unions. Over the last decade, its market share has remained relatively constant with gains from 28 per cent in 2016, to

29.3 per cent in 2018. FCC is financially self-sustaining and profitable; * Information redacted *

FCC utilizes a dividend policy that is aligned to the Capital and Dividend Policy Framework for financial Crown corporations, which links dividend payments to its year-end capital adequacy assessment, based on their FCC’s existing internal capital ratio target of 15 per cent. FCC intends to pay in full any capital in excess of the 15 per cent target as dividends the following year. In 2019-20, FCC paid dividends of $394.8 million, with $2.2 billion in dividends projected over the 2020-21 to 2024-25 planning horizon.

E. Canada Mortgage and Housing Corporation (Evan Siddall, President and CEO; Derek Ballantyne, Chair of the Board of Directors)

Relationship to Minister

Canada Mortgage and Housing Corporation (CMHC) is an agent Crown corporation with an overall mandate to promote housing affordability and choice, to facilitate access to housing finance, and to contribute to the well-being of the housing sector. As Canada’s national housing agency, CMHC plays a significant role in administering federal investments in social housing through agreements with provinces and territories and First Nations communities. CMHC also plays a major role in the housing finance system and housing markets through the provision of mortgage loan insurance and securitization programs and through its role as administrator of the covered bond framework. CMHC also undertakes and disseminates research on Canada’s housing market.

The Minister of Families, Children and Social Development has been designated as the Minister responsible to Parliament for CMHC.

However, the Minister of Finance has certain legislated powers and duties, including:

- Minister of Finance approves CMHC borrowings

- Minister of Finance may choose to require their recommendation of CMHC’s Corporate Plan before it is submitted to GIC (the Minister traditionally has so required)

- Minister of Finance sets the parameters for government-backed insured mortgages (after consulting the Governor of the Bank of Canada and the Superintendent of Financial Institutions)

- Minister of Finance sets the parameters for government-backed mortgage securitization guarantees

- Minister of Finance sets the parameters for covered bonds

- Minister of Finance sets fees that CMHC must pay to compensate Her Majesty for Her exposure to risks related to mortgage insurance and mortgage securitization guarantees

In response to the COVID-19 pandemic, CMHC has taken on additional responsibilities under the Government’s economic response plan, including the administration of the Canada Emergency Commercial Rent Assistance for small businesses, and the Insured Mortgage Purchase Program, which provides stable funding to banks and mortgage lenders in order to ensure continued lending to Canadians.

Relationship to Department

The Department is involved in work in the following key areas:

- Collaboration with CMHC on housing finance policy development.

- Approval process for CMHC’s Corporate Plan and terms and conditions of CMHC’s borrowings.

- Engagement with CMHC in respect of its commercial programs, including in respect of the Minister of Finance’s authorities for commercial programs and the annual approval of the terms and conditions of CMHC’s securitization programs.

- Briefings for the Deputy Minister of Finance’s participation in meetings of the CMHC Board of Directors (5-6 meetings per year).

- Work with the Office of the Superintendent of Financial Institutions (OSFI) as it undertakes its role of reviewing and monitoring CMHC’s commercial activities and reporting on results to the Minister of HRSDC and the Minister of Finance.

- Engagement with CMHC on the policy development and implementation of new measures in the National Housing Strategy, with the goal of helping to ensure that Canadians have access to housing that meets their needs and that they can afford.

- Work related to the implementation of the First-Time Home Buyer Incentive, a shared equity mortgage program that would give eligible first-time home buyers the ability to lower their borrowing costs by sharing the cost of buying a home with CMHC.

- Work related to the Government’s COVID-19 response, including the implementation of the Government’s Canada Emergency Commercial Rent Assistance (CECRA), the implementation of the Insured Mortgage Purchase Program (IMPP), and temporary changes to the eligibility criteria for portfolio-insured mortgages to help mortgage lenders access the IMPP.

Significance

CMHC is one of the largest Crown corporations in the Government’s portfolio by assets, liabilities and revenue ($276 billion, $262 billion and $4.7 billion, respectively, at year end 2019). Through its mortgage insurance and securitization operations, CMHC is one of the largest financial institutions in Canada and plays an important role in the housing finance market and the financial sector more broadly. At the end of 2019, CMHC’s insurance-in-force was $429 billion and guarantees-in-force totalled $493 billion. As an agent Crown corporation, the Government fully backs CMHC liabilities, including its borrowings.

F. Canada Infrastructure Bank (Michael Sabia, Chair of the Board of Directors; President and CEO position currently vacant)

Relationship to Minister

The Canada Infrastructure Bank (CIB) is a Crown corporation established in 2017 through legislation with the purpose to invest, and seek to attract investment from private sector investors and institutional investors, in revenue-generating infrastructure projects that are in the public interest. The CIB works with provinces, territories and municipalities to deliver infrastructure in a more efficient and sustainable way by attracting private sector and institutional investors to finance, build and risk manage more infrastructure over the long-term.

The Minister of Infrastructure and Communities is designated as the Minister responsible to Parliament for the CIB. The CIB is governed under provisions of both the Financial Administration Act, and the Canada Infrastructure Bank Act (the CIB Act). The CIB Act gives the Minister of Finance statutory power to provide up to $35 billion out of the Consolidated Revenue Fund to the CIB; responsibility for providing concurrence to CIB corporate plans; and authorities with respect to the provision of loan guarantees by the CIB.

Relationship to Department

The Department is involved in work in the following key areas:

- Collaborating with Infrastructure Canada to support the activities of the Bank.

- Supporting the Minister of Finance in discharging responsibilities related to the CIB corporate plan process and provision of funding for the Bank’s operating and capital requirements..

Significance

The CIB is expected to play an important role in the longer term toward closing Canada’s infrastructure deficit and helping jurisdictions to adopt more fiscally sustainable practices around planning, financing and delivering necessary infrastructure for Canadians. The CIB is able to deploy $15 billion in funding on an accrual basis over 11 years ($35 billion on a cash basis).

Budget 2017 announced that the CIB would deliver at least $5 billion in each of the following priority areas: public transit; green infrastructure; and transportation infrastructure that supports trade. Budget 2019 announced the additional priority area of broadband, noting the CIB’s intent to invest up to $1 billion in this asset class, complementing other federal initiatives.

Other organizations for which the minister of finance has some statutory responsibility

A. Office of the Auditor General (Sylvain Ricard, interim Auditor General of Canada)

The Auditor General (AG) is an officer of Parliament, appointed by the Governor in Council under the Great Seal for a term of ten years, and removable from office only on joint address of the Senate and House of Commons.

The AG carries out three main types of legislative audits:

- Financial audits – testing whether financial transactions support the amounts and disclosures in the financial statements

- Performance audits – assessing of how well government is managing its activities, responsibilities and re resources

- Special examinations – assessing whether a Crown corporation’s systems and practices provide reasonable assurance that its assets are safeguarded, its resources are managed economically and efficiently, and its operations are carried out effectively.

The AG audits federal government departments and agencies, most Crown corporations, and many other federal organizations, and reports to Parliament. The AG is also the auditor for the governments of Nunavut, the Yukon, and the Northwest Territories, and reports directly to their legislative assemblies.

As part of the Minister’s mandate, the AG audits the Public Accounts of Canada and provides an opinion as to whether they present fairly information in accordance with the government’s stated accounting principles. The AG also expresses an opinion on the Annual Financial Report of the Government of Canada which is published by the Department of Finance.

The AG is authorized to investigate and report to the House of Commons (through the Speaker) on how well the financial affairs of Canada have been managed. The AG is required to report once a year and may make up to three other reports in a year, as well as a special report where it is a matter of urgency. Pursuant to the Standing Orders of the House, all reports of the AG are automatically referred to the Standing Committee on Public Accounts.

Relationship to Minister

The AG is independent of the government and reports directly to Parliament through the Speaker. The Minister of Finance has no statutory or Parliamentary responsibilities in respect of the AG. For historical reasons, the appropriations by Parliament to cover the expenditures of the

Office of the Auditor General appear in the Estimates under the Minister of Finance portfolio. As all submissions to Treasury Board require the signature of an authorized Minister, you have been designated to be that Minister with respect to submissions by the Auditor General. This arrangement does not carry any special duties or responsibilities for the Minister of Finance.

Relationship to Department

The AG is the auditor of the Department of Finance and all of the Crown corporations and agencies for which the Minister of Finance is responsible to Parliament, except the Bank of Canada, the Exchange Fund Account and the Canada Pension Plan Investment Board, which are audited by private audit firms.

The AG has specific duties relating to the public debt. Under the Auditor General Act, the AG may audit the accounts and records of any registrars appointed by the Minister of Finance under Part IV of the Financial Administration Act in respect government borrowings. The Minister of Finance may also require that the AG participate in the destruction of redeemed or cancelled debt securities.

Significance

The Reports of the AG generally attract wide-spread Opposition, media and public attention. The Reports often highlight areas where the department/agency/Crown under review can improve in its management of specific programs or on longer-term issues that the AG feels need to be addressed. The analyses and recommendations in these Reports often form the basis of proposed legislative and administrative changes. Parliamentary Committees, especially the House of Commons Standing Committee on the Public Accounts, to whom the Auditor General reports, will conduct hearings on certain elements of his/her reports, requiring departmental attendance and participation. The Committee uses such hearings to make specific recommendations to the Government, which need to be replied to within a prescribed number of days.

B. Canadian Payments Association (Eileen Mercier, Chair of the Board, Tracey Black, President and CEO)

The Canadian Payments Association (CPA), also referred to as Payments Canada, was established in 1980 by an Act of Parliament as a regulated not-for-profit, public-purpose corporation. All Canadian banks are required by law to be members of the CPA and constitute the vast majority of its membership. The CPA’s mandate is:

- to establish and operate national systems for the clearing and settlement of payments and other arrangements for the making or exchange of payments;

- to facilitate the interaction of its clearing and settlement systems and related arrangements with other systems or arrangements involved in the exchange, clearing or settlement of payments; and

- to facilitate the development of new payment methods and technologies.

The Act also identifies public policy objectives for the CPA. It states that the Association will promote the efficiency, safety and soundness of the clearing and settlement systems and will take into account the interests of users.

The CPA’s Board of Directors comprises 13 members; seven independent directors (including its Chair and Vice Chair), five directors representing member institutions, and the President and CEO of the CPA as an ex officio member.

Relationship to Minister

The Minister of Finance exercises public policy oversight over the CPA. The Minister has a directive power over the CPA, which can be used if the Minister is of the opinion that it is in the public interest to do so. The payment clearing and settlement systems operated by Payments Canada, the Large Value Transfer System (for immediate settlement of large value payments) and the Automated Clearing Settlement System (for deferred settlement of retail payments), are overseen by the Bank of Canada.

The CPA must submit a 5-year Corporate Plan on an annual basis for the approval of the Minister. The Minister is also consulted by the Board on any appointments to the CPA’s Stakeholders Advisory Council, a statutory body consisting of users of the payment system, with the mandate to provide counsel and advice to the CPA Board of Directors on payment, clearing and settlement matters and other related issues. As the CPA’s by-laws are statutory instruments, the Minister must also approve any new by-laws or by-law changes. In addition, any changes to CPA rules are subject to a 30-day period of examination by the Minister, during which time the Minister may disallow the rule in whole or in part.

Relationship to Department

The Department works closely with the CPA to discuss, and at times jointly analyze, developments in the payment system, including any prospective rule and by-law changes. The Assistant Deputy Minister (Financial Sector Policy) meets regularly with the CPA Chair and President and CEO, and addresses the Board of Directors at least once per year. In addition, the President and CEO is a permanent member of FinPay, a consultative committee of public and private sector representatives providing advice to the Department on developments related to public policy aspects of payments issues.

Significance

Canada’s clearing and settlement systems enable consumers and businesses to make and receive payments throughout the country quickly and reliably. The vast majority of payments involve moving funds between accounts at different financial institutions. The CPA operates the national clearing and settlement systems that facilitate this flow of funds between institutions and mitigates risk to payment system participants. In 2019, the CPA’s systems cleared and settled

$218 billion worth of payments each day, representing $55 trillion on an annual basis. These include cheques, wire transfers, direct deposits, pre-authorized debits, bill payments, and point- of-sale and online debits.

Banks are required to be members of the CPA and other regulated financial institutions (Caisse Populaires, Credit Unions, Trust Companies, etc.) can voluntarily join. Amendments to the Act came into force in 2015 to transform the CPA’s Board into a majority-independent Board.

The CPA is currently engaged in a multi-year Modernization project to bring about modern payment systems that are fast, flexible and secure, that promote innovation and strengthen Canada’s competitive position. A key outcome of this project will be the replacement of older technological infrastructure with new systems to meet more robust risk management standards and allow for faster, more efficient payments.

C. Capital Markets Authority Implementation Organization (Jill Leversage, Chair of the Board of Directors, and Kevan Cowan, Chief Executive Officer)