Department of Finance – Deputy Minister Information Binder: Policy branches

September 2023

Table of Contents

- Crown Investment and Asset Management Branch

- Economic Development Branch

- Economic Policy Branch

- Federal-Provincial Relations and Social Policy Branch

- Financial Sector Policy

- Fiscal Policy Branch

- International Trade and Finance Branch

- Office of the Special Representative for the Deputy Minister (Joe Wild)

- Tax Policy Branch

Crown Investment and Asset Management Branch

Briefing note

Transition Materials for Incoming Deputy Minister – CIAM Branch

For Information

Issue

- This note provides information on the organization and key files of the Crown Investment and Asset Management (CIAM) branch of the Department of Finance.

Background

- CIAM was created in August 2021 to provide expert advice to the Minister and government on issues touching on project and corporate finance and the management of the government's commercial assets. CIAM also provides oversight for the Canada Development Investment Corporation (CDEV), a Crown corporation in the portfolio of the Minister of Finance.

- CIAM is led by Assistant Deputy Minister Greg Reade. He is supported by a Director General (Marie-Josée Lambert), a Senior Director (Anne David), and a Director (Sean Keating). The branch has eight analysts, as well as one executive assistant.

Assessment

Near-term pressures (4-6 weeks)

Trans Mountain Corporation

*Redacted*

Parallel to this work, considerations around Indigenous economic participation in Trans Mountain is also being developed. *Redacted*, will be meeting with eligible Indigenous groups at the end of September to discuss options.

*Redacted*

Canada Growth Fund

- The Canada Growth Fund (CGF) is a $15 billion, arm's length investment fund targeting decarbonization and clean growth that was initially announced in Budget 2022 and stood up in the 2022 Fall Economic Statement as a subsidiary of CDEV.

- Budget 2023 announced that the Public Sector Pension Investment Board (PSP Investments) would serve as the investment manager for CGF. CGF and PSP Investments are currently finalizing the investment management agreement (IMA) that will govern their long-term relationship.

- *Redacted*

- *Redacted* CGF has developed a robust project pipeline and is working toward announcing initial investments this calendar year.

- CGF is able to issue contracts for difference, including carbon contracts for difference (CCFDs), which have generated significant interest from industry and stakeholders. More information on CCFD work is provided in the next section.

Pathways Alliance

- The Pathways Alliance is a consortium of six major oilsands producers seeking to develop a series of carbon capture, utilization and storage (CCUS) projects that would contribute to substantial decarbonization of the oil and gas sector.

*Redacted*

*Redacted*

Carbon Contracts for Difference

- Carbon contracts for difference (CCFDs) are a financial instrument that can provide greater certainty around carbon pricing. CCFDs are an agreement between two parties to exchange payments based on a contracted future price of carbon.

*Redacted*

- *Redacted*, the government also announced in Budget 2023 its intention to consult on a broad-based CCFD program. This work is led by the Economic Development Branch (EDB); CIAM has contributed to this work, *redacted*.

- Additional information on CCFDs, and the intersection of the CGF with the broad-based work, can be found in Attachment 1.

Canada Development Investment Corporation

- CDEV is a commercial Crown corporation that reports to Parliament through the Minister of Finance. Its mandate is to provide a commercial vehicle for Canada's investments and to manage Canada's commercial holdings. CDEV is also often called upon to procure and provide commercial and financial advice for the government.

- CDEV is the parent Crown corporation of 6 subsidiaries, including TMC, CGF Inc., the owner of CGF's investments (which are in turn managed by PSP Investments), and CEEFC (see section below).

*Redacted*

Large Enterprise Emergency Financing Facility

- The Large Enterprise Emergency Financing Facility (LEEFF) was part of the government's COVID-19 economic response. It provided financing support to large companies whose operations had been affected by COVID.

- LEEFF is delivered by the Canada Enterprise Emergency Funding Corporation (CEEFC), a CDEV subsidiary. CEEFC issued over $3 billion worth of financing support to eight companies, including four airlines.

- The application window to LEEFF was closed in July 2022, and CEEFC is now managing its loan portfolio, which consists of two active borrowers (Transat and Porter), plus voucher support for the four airlines (Transat, Porter, Air Canada and Sunwing). CEEFC owns approximately 6 per cent of Air Canada equity that it purchased as part of its 2021 LEEFF financing of the company.

*Redacted*

Atlantic Loop

- The Atlantic Loop is a proposed bi-directional electricity transmission line that would connect Quebec, New Brunswick, and Nova Scotia.

*Redacted*

*Redacted*

Long-term items

Support for Newfoundland and Labrador

- CIAM is responsible for several financial supports to the province of Newfoundland and Labrador (NL). These include:

- Hibernia Dividend Backed Annuity Agreement (HDBA): annual, defined payments to NL from Canada between 2019 and 2056, totalling $3.3 billion.

- Net Profits Interest net revenues: a commitment from the Minister of Finance, subject to parliamentary approval *redacted*, to transfer the net revenues from Canada's Net Profits Interest commercial agreement in the Hibernia project to NL on an annual basis.

- Lower Churchill Projects (LCP): support for the financial restructuring of the Lower Churchill electricity generation and transmission projects, including loan guarantees (managed by Natural Resources Canada) and a federal investment in the Labrador Island Link transmission station (administered by Export Development Canada).

*Redacted*

Drafted by: Crown Investment and Asset Management Branch

ADM: Greg Reade, *redacted*

Attachment (1)

2023FIN513011 – Information Memo to Minister on carbon contracts for difference

Briefing note for the minister of finance

Carbon contracts for difference – key design considerations

(For Information)

Issue

- The launch of the Canada Growth Fund (CGF) in Budget 2022 identified 'conracts for difference,' including carbon contracts for difference (CCFDs), as an investment instrument to address policy risk and improve project economics. Budget 2023 also announced an intent to consult on broad-based CCFDs.

- This memo outlines the status and key policy considerations around the design of CCFDs.

Background

- Canada's 2030 Emissions Reduction Plan (ERP) is underpinned by carbon pricing. However, firms that are exposed to the carbon price argue that uncertainty about its future is hindering their ability to make investment decisions in decarbonization projects. The carbon price will increase by $15/tonne each year, from $65/tonne in 2023 to $170/tonne in 2030 and absent further action would remain at $170/tonne thereafter.

*Redacted*

- Budget 2022 announced that the mandate of the CGF would include flexibility to invest across the capital structure via equity, debt and derivative contracts (and other forms of price assurance), including CCFDs, as a means to draw in private investment to projects and companies.

- *Redacted*

- In addition to CCFDs that guarantee the carbon price, the CGF will also be able to issue contracts for difference (CFDs), contractual instruments that guarantee the future price of a product (e.g., green hydrogen).

- CGF has a cash envelope of $15 billion. The financial objective of the CGF is to: (i) recover its capital on a portfolio basis; and (ii) recycle its capital base over the long term.

- Budget 2023 also announced that the government will consult on the development of a broad-based approach to CCFDs.*redacted*.

Assessment

*Redacted*

Drafted by: Ryan Gossack-Keenan, Jesse Shuster-Leibner, Riley McDonald, Economic Development Branch and Corporate Investment and Management Branch.

ADMs: Sam Millar (EDB), Greg Reade (CIAM).

*Redacted*

Economic Development Branch

Deputy Minister and Associate Deputy Minister of Finance Canada Transition

Economic Development Branch (EDB) Key Files and Priorities

- Pre-FES (next 4-6 weeks)

*Redacted*

Briefing note for the minister of finance

*Redacted*

(For Decision)

*Redacted*

Economic Policy Branch

Briefing note to the deputy minister of finance

Economic policy branch – on-boarding

(For Information)

Issue

- This note identifies the key priorities of the Economic Policy Branch, and attaches some initial reading material.

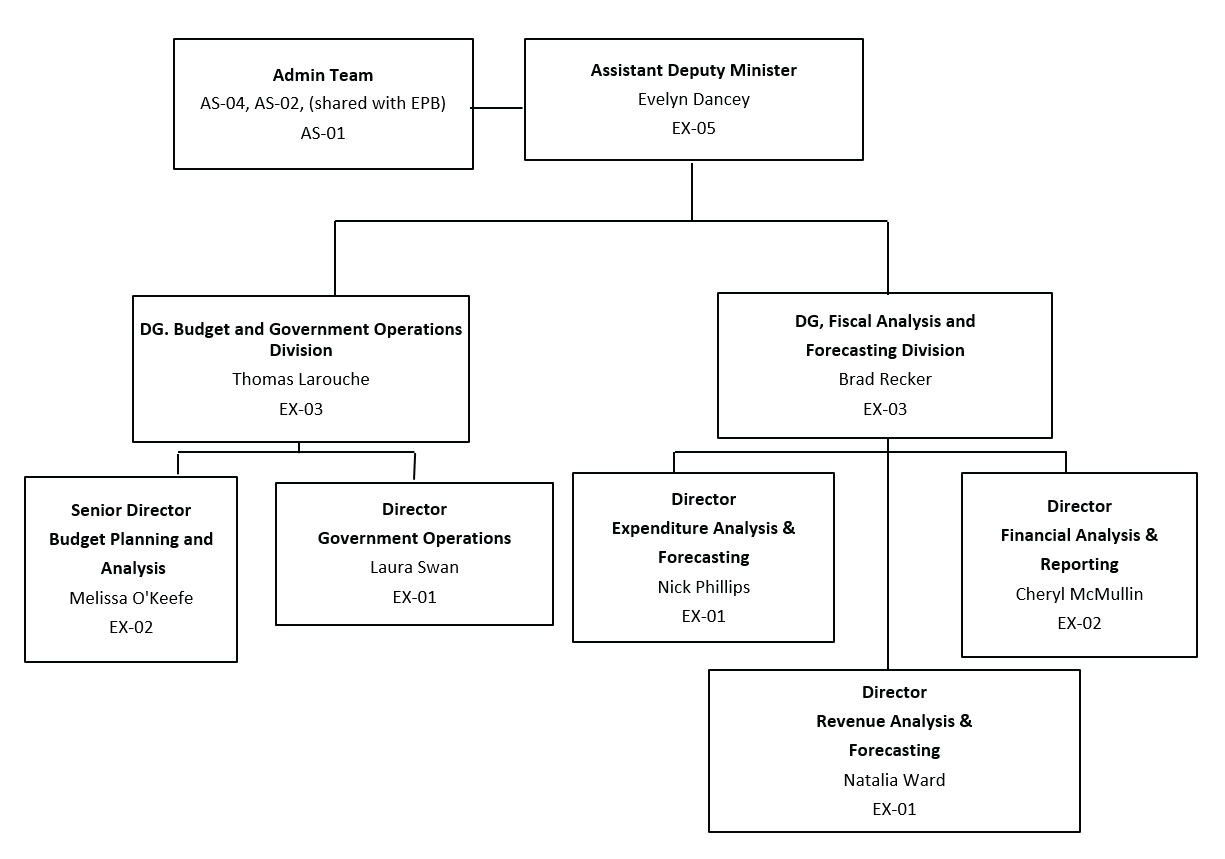

Background

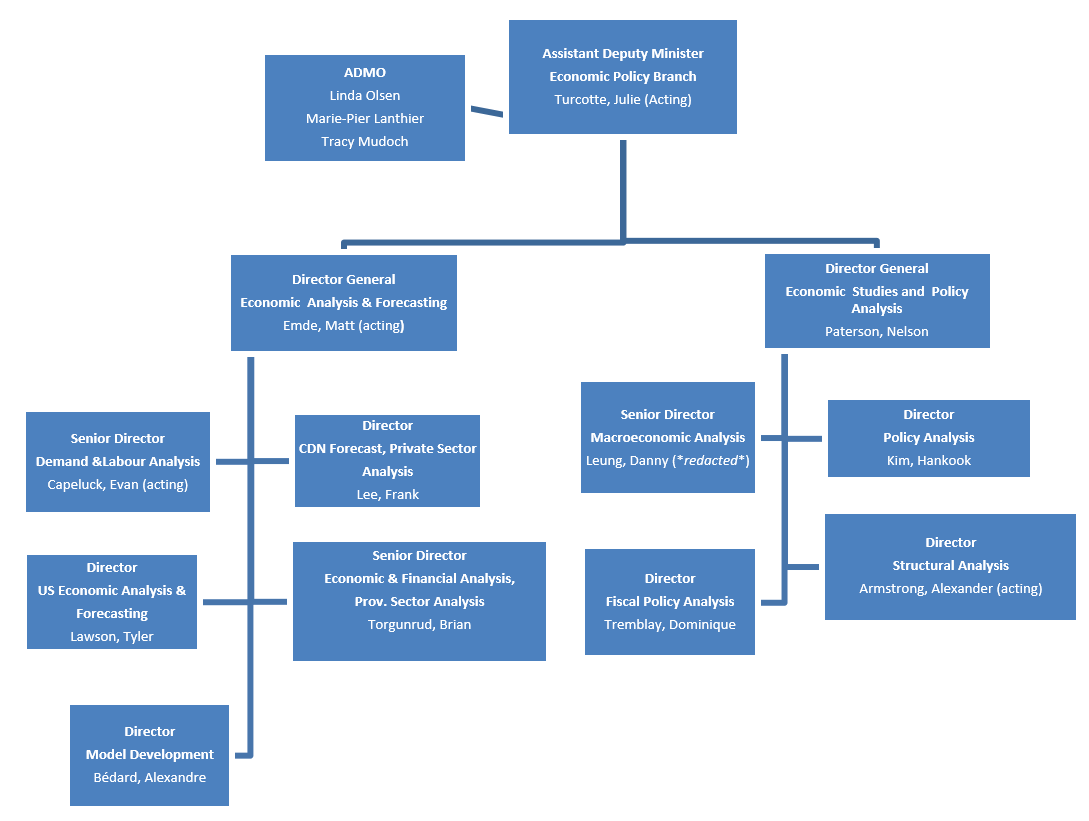

- In mid-2021, the previous Economic and Fiscal Policy Branch was separated into two branches. The Economic Policy Branch (EPB) retains all of the responsibilities under the Economic Studies and Policy Analysis Division and the Economic Analysis and Forecasting Division. Annex A provides the branch's executive org chart.

- A key responsibility of the branch is to track economic developments and prepare the economic forecast. In that regard, we are currently surveying the group of private sector economists between September 1st and September 12th, the results with which will form the basis of the economic and fiscal outlook presented in the upcoming Fall Economic Statement.

- With regards to the economic outlook, two questions have been front of mind, 1) is the disinflation process progressing as expected, and 2) to what extent economic growth will (or will need to) slow following historically steep rate hikes. See attached memo on the State of the Canadian Economy.

- Another important economic issue the Branch is tracking relates to housing market imbalances and price dynamics, in particular the housing affordability challenge. Housing unaffordability in much of the country reflects an inadequate supply response to strong demand. Affordability in both ownership and rental markets has been deteriorating for over a decade, but the situation has been exacerbated in the past few years amid a pandemic-induced desire for more space and ultra-low rates, and most recently, by a surge in immigration. Removing the barriers to more supply remains the primary solution to improving affordability. We will brief you separately on this issue.

Priority Files

- In addition to core economic and forecasting responsibilities, we have been focusing on a number of economic priorities for the government.

Green Transition and Climate Change

- Fiscal impacts of climate change: International organizations are increasingly calling on governments to begin taking better account of the fiscal consequences of climate change and related policies. Work is currently underway to evaluate potential fiscal implications *redacted*.

- Economic and Fiscal impacts from capping emissions in the Oil and Gas sector: The Branch is assisting ECCC in its work to model options for the cap. *Redacted*.

Internal Trade

- The Minister has taken a keen interest in advancing progress on internal trade and labour mobility and has featured the need for greater federal leadership on reducing these barriers in every budget since her appointment.

*Redacted*

Improving Competition

- The government is currently in the process of conducting a review of Canada's competition policy with an aim to modernize and strengthen the Competition Act.

*Redacted*

Fiscal Anchor

*Redacted*

Integrated Climate Lens

- The government has been piloting an Integrated Climate Lens (ICL) since the fall of 2021. The lens is to be applied to all funding proposals, Memorandum to Cabinet and Treasury Board Submissions. The ICL assesses the climate mitigation and adaptation implications of proposals as well as their potential economic implications.

- ECCC holds overall responsibility for the pilot and the ICL as a whole, however the Economic Policy Branch is responsible for all economic aspects of the ICL. Notably this includes performing quantitative assessments of the economic impacts of high value proposals on behalf of pilot departments using the Branch's economic models.

*Redacted*

Drafted by: Economic Policy Branch Management

AADM (acting): Julie Turcotte, *redacted*

Attachments (2): Briefing note to the Deputy Minister of Finance, State of the Canadian Economy; Briefing note to the Minister of Finance, Proposed Action on Internal Trade

Annex A

Department of Finance

Economic Policy Branch

Department of Finance

Economic Policy Branch

Briefing note to the deputy minister of finance

State of the Canadian Economy

(For Information)

Issue

- This note provides background information on the Canadian economic situation and outlook.

Background

Summary Perspectives

- The Canadian economy has slowed, but continues to hold up better than had been anticipated earlier this year. Canada, as well as many peer countries, has so far managed to avoid recession, and labour markets remain healthy.

- Supply chains have normalized, and commodity prices have declined from their war-induced peaks, leading to a faster-than-expected easing of headline inflation.

*Redacted*

- Globally, risks around the outlook remain elevated as central banks continue to probe for how long they need to keep interest rates restrictive to ensure inflation sustainably converges to target.

Recent Developments

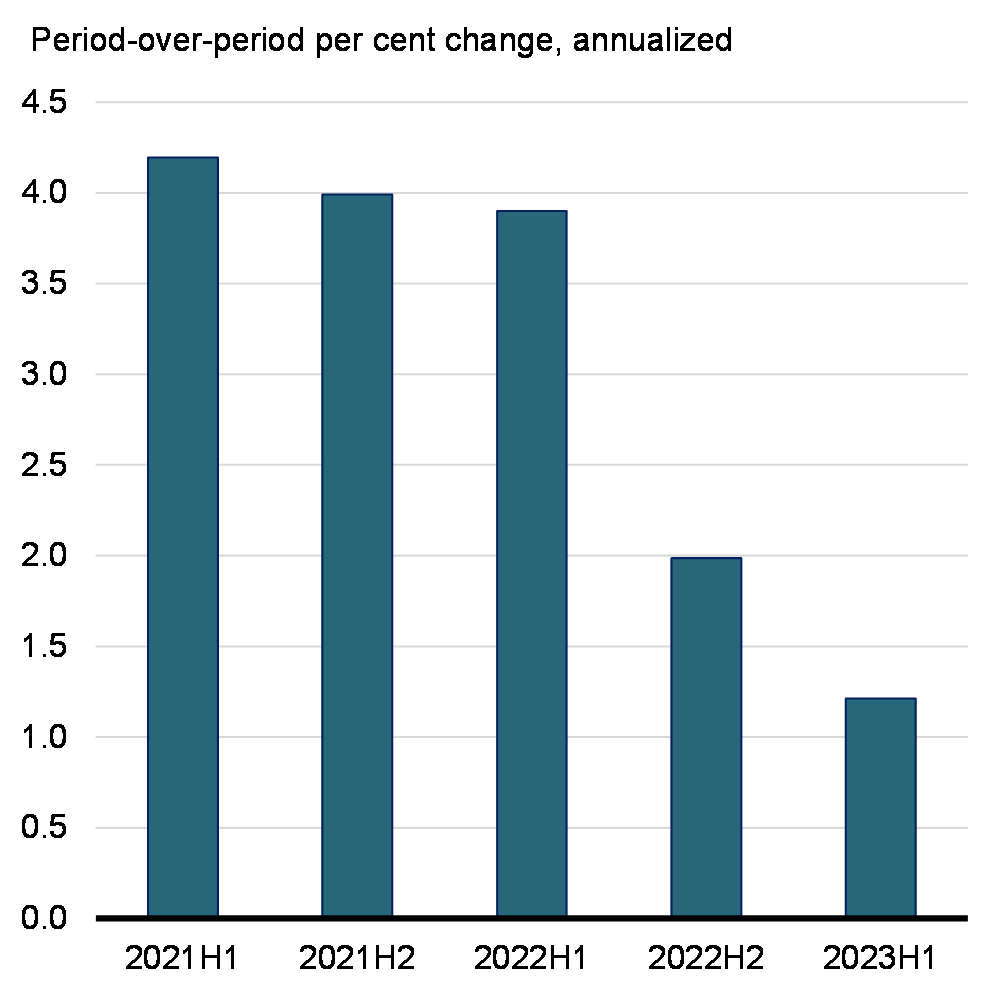

- The Canadian economy has slowed (Chart 1) though economic activity has been more resilient than projected in Budget 2023 despite historically steep rate hikes.

- At 3.1% (annualized), real GDP growth in 2023Q1 was significantly stronger than the slight contraction projected in Budget 2023 (-0.3%).

- Growth unexpectedly contracted in 2023Q2 (-0.2%), along with signs that monetary policy tightening is getting more traction and disruptions due to wildfires but second quarter activity was still above the Budget 2023 forecast (-0.8%).

- The economy's resilience reflects several tailwinds which have leaned against the drag from higher interest rates:

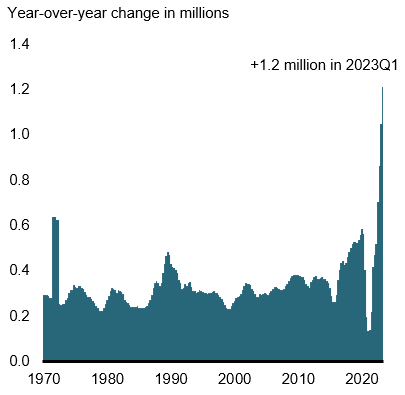

- Canada's population grew by over one million over the past year—the largest increase in absolute terms and more than double the pre-pandemic pace. Population growth has buoyed headline economic growth and job figures (Chart 2).

- Supply chain conditions have improved markedly, allowing manufacturing production and exports to catch up to global demand.

- Despite coming under pressure, household and business finances have remained in good shape, reflecting the build-up of cash reserves during the pandemic.

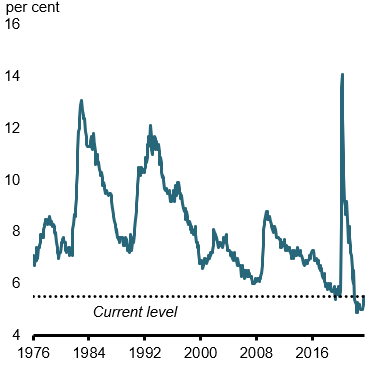

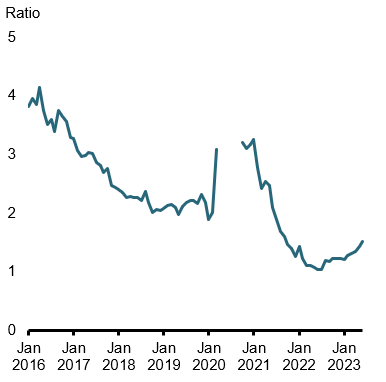

- The labour market remains robust but has softened in recent months with the surge in population growth outpacing job creation. As a result, the unemployment rate has risen to 5.5% in July – still historically low levels – from 5.0% a few months ago and the ratio of job-seekers to vacancies is gradually increasing (Charts 3 and 4). Overall, labour market conditions have eased gradually, with no apparent sign of a sharp turning point in the near-term.

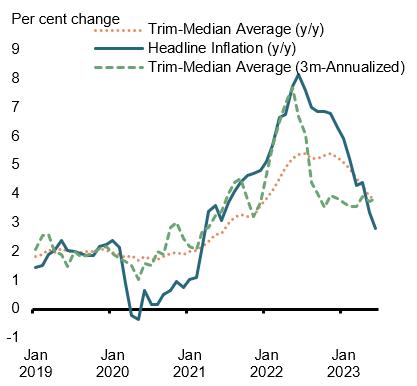

- With global supply chains returning to normal and energy and food prices coming down from their war-induced peak, inflation pressures have eased. Headline inflation in Canada fell from a peak of 8.1% in June 2022 to 2.8% this June, before rising to 3.3% in July.

- The sharp decline in headline inflation over the last year has masked limited improvement in core inflation (Chart 5). The Bank of Canada's two preferred measures of core inflation have remained in the range of 3.5 to 4.0% for almost a year. *Redacted*.

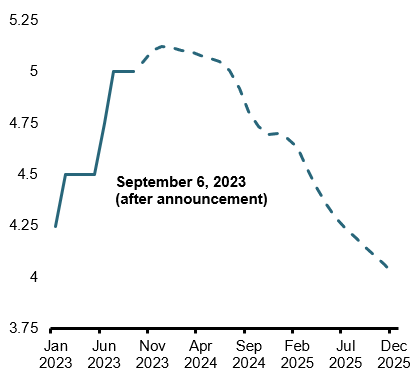

- After the Bank of Canada hiking its policy rate to 5.0% in July – its highest level since 2001 – the Bank of Canada kept its policy rate unchanged in September citing the recent moderation in the economy. With the uncertain inflation outlook, the Bank however re-introduced a hiking bias in its latest press release, saying it "is prepared to increase the policy interest rate further if needed".

Near-Term Outlook

- *Redacted*

- Notably, Canadian households are heavily indebted and the number of households facing higher debt payments will continue to grow as more borrowers renew their mortgages. There have already been early signs of an increase in household financial stress (e.g., rising delinquency rates) and household credit growth has slowed along with weaker demand induced by higher interest rates.

*Redacted*

- *Redacted*

- *Redacted* The Bank of Canada is currently expecting inflation to reach the 2% target in mid-2025.

- *Redacted*. As of early September, markets are split on whether the Bank will announce another 25 basis points increase by the end of the year. Modest rate cuts are only expected to begin in October 2024, with markets viewing the Bank's policy rate falling to 4% only by the end of 2025 (Chart 6).

Expected September 2023 Survey of Private Sector Economists

We are currently surveying private sector economists. We will send you a summary of the survey results after the survey closes on Tuesday, September 12th. *Redacted*

Real GDP Growth

Population Growth

Unemployment Rate

Unemployed-to-Job-Vacancies

Canadian Inflation Metrics

Implied Bank of Canada Policy Rate

*Redacted*

Drafted by: Geoffroy Bilodeau-Fortin, Brian Waterman, and Carl Gaudreault

Acting ADM Julie Turcotte (*redacted*)

Briefing note to the minister of finance

Proposed action on internal trade

(For Information)

Issue

*Redacted*

Background

- There are three major types of internal barriers (see further details in Annex A):

- Explicit trade barriers, stemming from carveouts to the CFTA and barriers enshrined in PT legislation;

- Implicit trade barriers, created by regulatory differences across provinces;

- Labour mobility barriers, primarily created by differences in accreditation and certification standards

- In 2017, the federal and PT governments signed the CFTA with the primary objective of reducing explicit barriers to trade and developing a more institutional approach for advancing internal trade liberalization, including regulatory reconciliation.

- With respect to labour mobility, PTs agreed that no material additional testing, training, or experience would be required for most certified workers seeking to work in another jurisdiction.

*Redacted*

- Reflecting these challenges, a new Federal Action Plan to Strengthen Internal Trade was launched in 2022 with the aim of increasing federal leadership on the internal trade file. Subsequent to the launch of the Action Plan, Budget 2023 announced its intention to develop a Federal Framework on Mutual Recognition (discussed below).

- Departments were allocated $21M for the Federal Action Plan to Strengthen Internal Trade, including funding for: PCO to conduct research on detailed barrier and solution identification and enhance stakeholder engagement (e.g., creation of advisory table consisting of key external stakeholders); the CFTA's Internal Trade Secretariat to enhance administrative activities and support work on mutual recognition; Statistics Canada to develop better data on internal trade.

- The Federal Framework on Mutual Recognition is still in the development stage. *Redacted*.

Assessment

Explicit Trade Barriers

*Redacted*

Implicit (Regulatory) Trade Barriers

- There is significant opportunity for the to-be-developed Federal Framework on Mutual Recognition (led by Minister Leblanc supported by PCO) to play a strong role in providing pragmatic options for removing implicit barriers to internal trade.

- Unlike full harmonization, mutual recognition involves PTs simply agreeing to recognize the standards contained in the regulations of the other PTs as sufficient to meet the standards contained in their own regulations, avoiding the need to negotiate a new set of harmonized standards.

- For example, in 2020, 9 of the 13 PTs signed an agreement to mutually recognize each others' regulation of pressure vessel equipment (e.g., boilers). This eliminated the need for duplicative regulatory compliance reviews by each PT.

- In some areas, the current agreement could facilitate mutual recognition in the future. For instance, PTs have agreed to create a digital corporate registry, which could facilitate recognition of a corporate registration in various PTs, although the current purpose is purely to share information provided by registering firms.

*Redacted*

Removing Barriers to Labour Mobility

- There is broad recognition that barriers to labour mobility are inefficient and unnecessary. Some provinces have made important progress toward reducing barriers to credential recognition, particularly by committing to shorter wait times for license transfers (see Annex C for details).

- In 2021, Alberta introduced the Labour Mobility Act, which streamlines documentation requirements for certified out-of-province workers, reducing the processing time from up to 149 to just 20 business days. This applies to 100 regulated occupations, including optometrists, lawyers and engineers.

*Redacted*

Next Steps

*Redacted*

Drafted by: Kaleigh Dowsett, Economic Policy Branch

ADM: Economic Policy Branch, Julie Turcotte, *redacted*

FPRSP Branch, Alison McDermott, *redacted*

Economic Development Branch, Samuel Millar, *redacted*

Annex A – Types of Internal Trade Barriers

Canada faces three main types of internal trade barriers, each with their own root causes and an ideal mitigation strategy in the current environment:

- Explicit barriers are created when government regulations specifically limit or prohibit the trade between provinces. *Redacted*.

- Implicit barriers to trade stem from a large swath of regulatory differences that have arisen, often inadvertently, among PTs due to a lack of coordination between regulatory authorities in each jurisdiction (i.e., differences in regulations for occupational health and safety, transportation, standards and codes, etc.). *Redacted*. The initiative on mutual recognition announced in Budget 2023 could address these barriers, although it would depend on the extent of the final agreements and how the agreements are implemented by PTs.

- Barriers to labour mobility stem from differences in accreditation standards and the recognition of certification across PTs. In general, the primary impact of these barriers is that they inhibit the ability of workers in occupations that require certification to accept contracts and temporary employment opportunities across jurisdictions. For example, these workers often need to seek licence transfers between jurisdictions which can take months, may require additional provincial tests, training requirements, and administrative fees, even for Red Seal trades (e.g., electrician, carpenter) where national standards have been established in collaboration with PTs. These barriers can seriously restrict the ability of workers to benefit from short-term opportunities, increase entry costs and hinder the efficient allocation of labour. *Redacted*.

Annex B – List of CFTA Bodies and Their Roles

The CFTA created or incorporated several bodies and processes that play interrelated roles in advancing internal trade liberalization:

- The Committee on Internal Trade (CIT) is comprised of all FPT ministers responsible for internal trade, provides oversight over a number of CFTA working groups, and assists in the resolution of disputes. It also approves the annual operating budget of the Internal Trade Secretariat. They are supported by the Internal Trade Representatives (ITR), a group of public servants from all FPTs which shape the CIT agenda.

- The Internal Trade Secretariat (ITS) is responsible for supporting the administrative functioning of the CFTA in a neutral and independent manner. *Redacted* It is made up of one managing director and a small team of officers.

- The Forum of Labour Market Ministers (FLMM) is composed of FPT ministers responsible for labour market policies and is responsible for promoting discussion and cooperation on labour market matters and providing oversight over the Labour Mobility Working Group.

- Ad-hoc working groups made up of FPT officials-level representatives (public servants) are created to address specific topics. These currently include:

- Trade in Alcoholic Beverages Working Group,

- Dispute Resolution Working Groups,

- Financial Services Working Group,

- Working Group on Party-Specific Exceptions,

- Labour Mobility Working Group,

- Procurement Working group, and

- Northern Foods Working Group.

- The Regulatory Reconciliation and Cooperation Table (RCT) is an intergovernmental body of public servants from all FPTs tasked with overseeing the reconciliation of barriers to trade. The RCT follows a set workplan that includes reconciliation of the barriers that are identified by FPTs.

Annex C – Recent PT Labour Mobility Changes

- Severe labour shortages have recently renewed interest from PTs on the issue of labour mobility and promoted several legislative changes. *Redacted*.

Recent and proposed changes to inter-provincial recognition:

Alberta

- In 2021, Alberta introduced the Labour Mobility Act, which streamlines documentation requirements for certified out-of-province workers, reducing the processing time from up to 149 to just 20 business days. This applies to 100 regulated occupations, including optometrists, lawyers and engineers.

Atlantic provinces

- In 2023, the Atlantic provinces implemented a joint Atlantic Physicians Register that allows doctors to move across all four Atlantic provinces without additional licensing.

Ontario

- In 2022, Ontario announced plans to introduce changes to ensures workers from other provinces can get their credentials processed within a service standard of 30 business days for over 30 in-demand professions, largely in the skilled trades (e.g., auto mechanics, plumbers), and is looking to move from recognizing 52 of the red seal trades to all 55 national trades.

- In 2023, Ontario tabled a legislation that would allow out-of-province doctors and nurses to practice in Ontario without any registration or other paperwork.

Recent and proposed changes to foreign credential recognition:

Ontario

- In 2021, Ontario introduced legislation to ban regulated professions from requiring Canadian work experience. Professional Engineers Ontario has now dropped their requirement for Canadian work experience.

- In 2022, Ontario proposed recognizing foreign credentials for physicians after the completion of a 12-week program.

British Columbia

- In 2023, British Columbia committed $1.3 million to streamline the licensing process for nurses trained abroad.

Alberta

- In 2023, Alberta launched a pilot project to fast track the recognition of foreign credentials of doctors in the province, following up on the measure that has reduced the processing time for credential recognition of foreign-trained nurses.

*Redacted*

Federal-Provincial Relations and Social Policy Branch

Briefing note to the deputy minister

Transition – key files in FPRSP

Issue

- To inform you of key near term pressures that Federal-Provincial Relations and Social Policy Branch is currently working on.

*Redacted*

Drafted by: Thomas Ward (FPRSP)

- ADM: Michelle Kovacevic (*redacted*)

Annex A – Near-Term Pressures

| Issues | Description |

|---|---|

| Social Policy | |

| *Redacted* | *Redacted* |

| *Redacted* | *Redacted* |

| *Redacted* | *Redacted* |

| Labour Market Transfer Agreements | Budget 2023 provided $625M in 2023-24 to extend expiring top-up funding under the Labour Market Transfer Agreements (base funding of $2.9B/year ongoing). *Redacted* |

| 2024-2026 Immigration Levels Plan | The Government must table the new Levels Plan in Parliament by November 1. *Redacted*. There were more than 807,000 international students with study permits across all levels of education in 2022, up from about 300,000 in 2013. |

Indigenous

|

|

| Litigation | *Redacted* |

| Child Welfare and Jordan's Principle | The government reached a $23.3 billion settlement to compensate children and families who were harmed by the discriminatory underfunding of child welfare and Jordan's Principle (pending court approval).The government is currently negotiating long term program reforms to resolve the human rights complaint regarding child welfare on reserve and Jordan's Principle. *Redacted* |

| Justice and Security | |

| Gun Buy Back | The assault-style weapons ban occurred over three years ago, and the government is expected to show progress on its firearms buy-back program. *Redacted* |

| Wildfires/Emergency management | In response to the severe 2023 wildfires season, the government has deployed the Canadian Armed Forces, matched donations to support the Canadian Red Cross' and the United Way's emergency response efforts, and supported PTs in accessing existing programs which will cover up to 90% of P/T response and recovery costs (Disaster Financial Assistance Arrangements) and up to 100% of on-reserve response and recovery costs (Emergency Management Assistance Program).*Redacted* |

| FPT Relations | |

| *Redacted* | *Redacted* |

| Equalization and TFF renewal | Following consultations with PTs, BIA 2023 extended the authority to make Equalization and TFF payments to March 2029 with minor technical changes. *Redacted* |

| *Redacted* | *Redacted* |

| Finance Minister's Meeting | The Minister will need to decide on the timing and agenda for a Finance Minister's meeting (e.g., December). *Redacted*. FPT Finance Ministers last met in February and there has been no meeting or call since. *Redacted*. |

| Alberta Pension Plan | Alberta is expected to release an actuarial report, potentially in September, on the proposal to create an Alberta Pension Plan. *Redacted* |

| Survivor Benefit – Canada Pension Plan | The Government has a commitment to increase the survivor benefit in the Canada Pension Plan by 25 per cent; *Redacted* |

| Service Delivery | *Redacted* |

| Issues | Description |

|---|---|

| Social Policy | |

| Canada-Québec Accord on Immigration | *Redacted*Quebec received $726.7M in 2022-23 (+$29.7M relative to 2021-22). |

| Passports | *Redacted* |

| Indigenous Policy | |

| Water/Wastewater Infrastructure | As part of the Safe Drinking Water for First Nations Class Action settlement process, the government agreed to replace existing drinking water legislation and committed to $6 billion in spending. *Redacted* |

| Economic reconciliation/Access to Capital | There are 470 major natural resource projects under construction or planned over the next 10 years in Canada, worth approximately $520B in investment – many will directly impact Indigenous communities.Budget 2023 committed to explore additional access to capital support for Indigenous groups that wish to make equity investments in natural resource projects *redacted*. |

*Redacted*

Table 1: Indigenous Funding Pressures (pre-FES)

*Redacted*

Annex B – Supplementary Issues

*Redacted*.

- Public Safety Portfolio Challenges: *Redacted*.

- Immigration Detention Centres: *Redacted*.

- Federal-Provincial-Territorial-Indigenous landscape: Since 2015, Canada has advanced an ambitious reconciliation agenda, *redacted*.

- Indigenous co-development: The government has committed to co-develop policies across all areas of the Indigenous portfolio, and is now enshrined in legislation (United Nations Declaration on the Rights of Indigenous Peoples Act). *Redacted*.

- PCO priorities process: *Redacted*.

Briefing note to the minister of finance

Fall Economic Statement 2023 housing package – early directions

(For Information)

Issue

- To provide an update on the Department's work on potential housing measures *redacted*.

Background

- The Government has made significant efforts to respond to the crisis-like dynamics of Canada's current housing market, with principal initiatives focused on: (i) creating new affordable and market housing supply; and (ii) supporting homeownership and rent support, for example:

- Supply – CMHC National Housing Strategy flagship initiatives such as the National Co-Investment Fund, Rental Construction Financing Initiative, and new programs such as the Housing Accelerator Fund, and Co-Operative Housing Development Program; and,

- Ownership/Rent – Tax system supports such as the Tax-Free First Home Savings Account, Homebuyers Tax Credit – and programs such as the Canada Housing Benefit (and one-time top-up).

- The government has also implemented market integrity and anti-speculation measures, such as: Underused Housing Tax, Foreign Buyer Ban, and Residential Property Flipping Rule.

*Redacted*

Assessment

Status Report on Previous Investments

- Budget 2022 announced a suite of measures aimed at addressing housing affordability across the housing spectrum. Most of these initiatives are well underway (see Annex C for detailed list of measures and implementation status). Of note, two signature measures, the Tax Free First Home Savings Account and the Housing Accelerator Fund, have launched in recent months.

- Tax Free First Home Savings Account launched in April 2023 and will give prospective first-time home buyers the ability to save $40,000, on a tax‑deductible and non-taxable basis, towards the purchase of their first home.

- Housing Accelerator Fund is targeted at reducing municipal housing barriers and accelerating supply. *Redacted*.

*Redacted*.

Timing

*Redacted*

Financial Implications

*Redacted*

Drafted by: Megan Beverley, FPRSP

S/ADM: Michelle Kovacevic (*redacted*)

*Redacted*

Annex C – Selected Ongoing Housing Measures, By Area of Focus

| Municipal Barriers | |

|---|---|

Housing Accelerator Fund Budget 2022 Led by Canada Mortgage and Housing Corporation (CMHC) $4 billion over five years to launch a new program to incentivize municipalities to unlock new housing supply and fast-track the creation of 100,000 new homes across Canada. |

|

Conditionality on Infrastructure Programming Budget 2022 Led by Infrastructure Canada (INFC) Budget 2022 signalled the government's intention to create flexibility within federal infrastructure programs to tie access to infrastructure funding to actions by provinces, territories, and municipalities to increase housing supply, where it makes sense to do so. |

*Redacted* |

| Labour Supply - Construction/Skilled Trades | |

|---|---|

Targeted Selection via Express Entry Budget 2022 (BIA) Led by Immigration, Refugees and Citizenship Canada (IRCC) |

|

Federal Skilled Trades Program N/A - Longstanding program Led by Immigration, Refugees and Citizenship Canada (IRCC) |

|

Apprenticeship Supports Various Budgets Led by Employment and Social Development Canada (ESDC) |

|

Sectoral Workforce Solutions Program Budget 2021 Led by Employment and Social Development Canada (ESDC) Announced in Budget 2021, this program funds sectoral-led, third party organizations to design and deliver training that is relevant to the needs of small and medium-sized businesses, including in the construction sector. |

|

| Finance and Tax Incentives to Build Supply | |

|---|---|

Multigenerational Home Renovation Tax Credit Budget 2022 Budget 2022 proposes to introduce a Multigenerational Home Renovation Tax Credit, which would provide up to $7,500 in support for constructing a secondary suite for a senior or an adult with a disability. Starting in 2023, this refundable credit would allow families to claim 15 per cent of up to $50,000 in eligible renovation and construction costs incurred to construct a secondary suite. |

|

Rental Construction Financing Initiative Budget 2022 Led by Canada Mortgage and Housing Corporation *Redacted* |

*Redacted* |

Multi-unit mortgage loan insurance Led by Canada Mortgage and Housing Corporation CMHC offers concessional mortgage loan insurance (MLI) on multi-unit properties through its commercial activities. |

|

| Affordable Housing Supply | |

|---|---|

Co-Operative Housing Development Program Budget 2022 Led by Canada Mortgage and Housing Corporation *Redacted* |

|

Rapid Housing Initiative Budget 2022 Led by Canada Mortgage and Housing Corporation *Redacted* |

|

Federal Lands Initiative Led by the Canada Mortgage and Housing Corporation $200 million fund that supports the discounted transfer of surplus federal lands and buildings for development into affordable housing. |

|

National Housing Co-Investment Fund Budget 2022 Led by Canada Mortgage and Housing Corporation *Redacted* |

|

| Rent Support | |

|---|---|

Canada Housing Benefit Budget 2022 Led by the Canada Mortgage and Housing Corporation Launched in 2018, the $4.3 billion Canada Housing Benefit provides direct rent support, cost-matched and delivered by the PTs. |

|

| Homelessness | |

|---|---|

Reaching Home Budget 2022 Led by Infrastructure Canada *Redacted* |

|

Veteran Homelessness Program Budget 2022 Led by Infrastructure Canada *Redacted* |

|

| Marginalized Groups | |

|---|---|

Urban, Rural and Northern Indigenous Housing Strategy Budget 2022 Led by Canada Mortgage and Housing Corporation and Indigenous Services Canada $300 million over five years for CMHC to co-develop and launch an Urban, Rural and Northern Indigenous Housing Strategy. Budget 2023 announced $4 billion dollars over seven years, starting in 2024-25, for its implementation. |

|

| Green/Climate | |

|---|---|

Canada Greener Homes Grants Led by Natural Resources Canada The Fall Economic Statement 2020 provided $2.6 billion over 7 years starting 2020-21, to Natural Resources Canada to help homeowners make their homes more energy efficient. Of which $2.16 billion over 5 years, starting in 2020-21, would be to support up to 700,000 grants of up to $5,000 per homeowner for retrofits. |

*Redacted*

*Redacted* |

Canada Greener Homes Loans, Including Canada Greener Affordable Housing Stream Led by Canada Mortgage and Housing Corporation Budget 2021 provided $4.42 billion on a cash basis gross of loan disbursements to CMHC to deliver a home energy retrofit loan program designed for homeowners, called Canada Greener Homes Loans Initiative. Budget 2022 provided $458.5 million over seven years, starting in 2022-23, to CMHC to provide low-interest loans as part of the low-income stream of the Canada Greener Homes Loan program, called the Canada Greener Affordable Housing Program. |

*Redacted*

Greener Homes Affordable Home Loan Stream

|

| Market Integrity | |

|---|---|

Home Buyers' Bill of Rights Budget 2022 Led by Canada Mortgage and Housing Corporation $5 million over two years, starting in 2022-23, to engage with provinces and territories to jointly develop, and seek their commitment to implement, a Home Buyers' Bill of Rights and bring forward a national plan to end blind bidding. |

*Redacted* |

Protecting Canadians From Money Laundering in the Mortgage Lending Sector Budget 2022 To help prevent financial crimes in the real estate sector, Budget 2022 announced the government's intention to extend anti-money laundering and anti-terrorist financing requirements to all businesses conducting mortgage lending in Canada within the next year. |

|

| Investors in Real Estate | |

|---|---|

Making Property Flippers Pay their Fair Share Budget 2022 Budget 2022 proposed to introduce new rules to ensure profits from flipping residential properties are taxed fully and fairly. Specifically, any person who sells a property they have held for less than 12 months would be considered to be flipping properties and would be subject to full taxation on their profits as business income. Exemptions would apply for Canadians who sell their home due to certain lifecircumstances, such as a death, disability, the birth of a child, a new job, or a divorce. |

|

Underused Housing Tax To help ensure that Canadian housing is not used as a passive investment, the government implemented a 1% annual tax on the value of non-resident, non-Canadian owned residential property that is considered to be vacant or underused. |

|

GST/HST on Assignment Sales by Individuals Budget 2022 Currently, when an individual makes a new home assignment sale, GST/HST may or may not apply depending on the individual's original intention for the property. This results in the uneven application of GST/HST to new homes and creates an opportunity for speculators to be dishonest. Budget 2022 proposes to make all assignment sales of newly constructed or substantially renovated residential housing taxable for GST/HST purposes. |

|

Tax Treatment of Real Estate Investment Trusts (REITs) Budget 2022 Budget 2022 announced a federal review of housing as an asset class, which would examine a number of options and tools, including potential changes to the tax treatment of large corporate players that invest in residential real estate, with potential early actions to be announced before the end of the year. |

|

Foreign Buyer Ban Budget 2022 Led by Canada Mortgage and Housing Corporation Budget 2022 set out the government's intent to implement a ban on foreign investment in Canadian housing for a period of two years. |

|

| Home Ownership | |

|---|---|

Tax-Free First Home Savings Account Budget 2022 Budget 2022 proposed to introduce the Tax-Free First Home Savings Account that would give prospective first-time home buyers the ability to contribute up to $40,000 to a new tax-advantaged registered plan. Like an RRSP, contributions would be tax-deductible, and withdrawals to purchase a first home—including investment income—would be non-taxable, like a TFSA. |

|

Home Buyers' Tax Credit Budget 2022 Budget 2022 proposes to double the First-Time Home Buyers' Tax Credit amount to $10,000, starting in 2022. The enhanced credit would provide up to $1,500 in direct support to home buyers |

|

First-Time Home Buyer Incentive Budget 2022 Budget 2022 extended the program through March 2025 and to consider options to make the program more flexible, including for single-led families. |

|

Supporting Rent-to-Own Projects Budget 2022 Led by: Canada Mortgage and Housing Corporation Budget 2022 announced $200 million in dedicated support to develop and scale up rent‑to-own projects under the existing Affordable Housing Innovation Fund |

|

*Redacted*

Financial Sector Policy

Briefing note to the deputy minister of finance

Key financial sector policy files – September 2023

(For Information)

Issue

- This memorandum lists key financial sector policy files requiring action in the near, medium, and longer term.

Near Term – Next 4-6 Weeks (Pre-FES)

*Redacted*

Sustainable Finance Taxonomy and the Sustainable Finance Action Council (SFAC)

*Redacted*

Crypto-Assets and Central Bank Digital Currency

*Redacted*

Financial Sector Legislative Review

- *Redacted*. Budget 2022 announced the review focused on digitalization and a timely launch is required to complete the review before the financial institutions statutes' sunset dates in mid-2025.

Financial Sector Security and Integrity

- The Minister has overall responsibility over banks and other federally regulated financial institutions. *Redacted*.

Canada Emergency Business Account

- The repayment deadline to receive forgiveness of up to 33 per cent (up to $20,000) for all Canada Emergency Business Account (CEBA) loans is December 31, 2023. After that deadline, businesses that have not repay will have until December 31, 2025 (i.e., two additional years) to repay the loan, with interest accruing starting January 1, 2024, at 5 per cent annually. *Redacted*.

*Redacted*

Fighting Predatory Lending

*Redacted*

Open Banking Framework

*Redacted*

Host Country Agreement for the Bank of International Settlement Hub

- In June 2020, the Bank of Canada and the Bank for International Settlements (BIS) announced they were entering into a partnership to set up a BIS Innovation Hub in Toronto, Ontario, to conduct research in areas such as cyber security, green finance, and central bank digital currencies. *Redacted*.

Retail Payment Activities Act Regime – Final Regulations

- *Redacted*. Under the RPAA regime, payment service providers will be supervised by the Bank of Canada and be required to register and meet fund safeguarding and operational risk management regulatory requirements. The regulations will support implementation of new national security safeguards in respect of retail payment activities. These safeguards will be under the authority of the Minister of Finance. Draft regulations were released for comment in February 2023 *redacted*.

Expanding Membership Eligibility in Payments Canada

*Redacted*

Consolidation of Canada Mortgage Bonds (CMBs)

*Redacted*

Parliamentary Review of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act

- Budget 2023 announced that the Government will launch the Parliamentary Review this year. *Redacted*. The Department released a consultation paper that closed on August 1, 2023, which included a number of policy and legislative proposals for the Committee to consider. *Redacted*.

Canadian Financial Crime Agency (CFCA)

- Budget 2022 announced the intent to establish a new Canada Financial Crimes Agency (CFCA) to become Canada's lead enforcement agency against financial crime, improving investigations, prosecutions, convictions, and asset forfeiture results in Canada. The Government committed to provide an update in the *redacted*.

Strengthening Support for Ukraine

*Redacted*

Medium Term – 5 Months *Redacted*

Minimum Qualifying Rate (pre-Budget / not Budget related)

*Redacted*

Sustainable Finance: Climate Disclosures and Net Zero Capital Allocation Strategies

*Redacted*

Voluntary Code of Conduct for the Credit and Debit Card Industry in Canada

- The Branch is in the process of concluding its multi-year review of the non-regulatory Code of Conduct for the Credit and Debit Card Industry in Canada. A decision from the Minister on the revised Code will be sought early in fall 2023.

The Real-Time Rail (RTR)

- The Real-Time Rail (RTR) is a national payments processing system being developed by Payments Canada to facilitate the near instantaneous exchange, clearing and settlement of data-rich payments. *Redacted*.

*Redacted*

Longer Term

Retail Payments Activities Act

*Redacted*

Digital Assets

- Ongoing work with federal and provincial regulators to assess the risks of crypto-assets and potential gaps.

- Ongoing work with the Bank of Canada to assess the potential need for and designs of a Canadian Central Bank Digital Currency.

Financial Services Trade and Relations

- Negotiations are ongoing with Indonesia, the Association of Southeast Asian Nations (ASEAN) and India to advance Canada's Indo-Pacific Strategy. Bilateral negotiations are also ongoing with the United Kingdom to implement a bespoke trade agreement in the post-Brexit context. FSP also has an annual financial sector policy dialogue with the European Union *redacted*.

FATF Mutual Evaluation

- The FATF will assess Canada's AML/ATF Regime in early 2025. The assessment will review Canada's technical compliance with global AML/ATF standards (i.e., Canada's laws and regulations), as well as the operational effectiveness of Canada's AML/AFT Regime. This assessment will be published in the summer of 2026. *Redacted*.

Interagency Coordination

- Senior Advisory Committee (SAC): This committee helps formulate advice to the Minister of Finance on a range of legislative, regulatory, and policy issues related to the Canadian financial system – particularly regarding financial stability risks and responses. SAC is chaired by the Deputy Minister of Finance and includes senior representatives from the Bank of Canada, the Office of the Superintendent of Financial Institutions, the Canadian Deposit Insurance Corporation, and the Financial Consumer Agency of Canada.

- *Redacted*

- Financial Institutions Supervisory Committee (FISC): This committee facilities consultation and the exchange of information on matters related to the supervision of federal financial institutions. FISC is chaired by the Superintendent of Financial Institutions and includes deputy heads from the Department of Finance, Canadian Deposit Insurance Corporation, the Bank of Canada, and the Financial Consumer Agency of Canada.

- Fall Meeting: September 20 (1:00-4:00pm)

- Winter Meeting: December 18 (2:00-5:00pm)

- Heads of Regulatory Agencies (HoA): Chaired by the Bank of Canada Governor, the HoA was established in 2002 as a forum to exchange information on topics of interest that have overlap/implications for capital markets. *Redacted*. The HoA meets twice per year (spring and fall).

- AML/ATF Regime DM Steering Committee: This committee is formed by the partner department and agencies of Canada's AML/ATF regime. Its purpose is the share information and discuss and coordinate initiatives related to the regime. The committee is co-chaired by the Department of Finance and the Department of Public Safety. It includes senior level representatives from 13 departments and agencies, including the RCMP, FINTRAC, the Canada Revenue Agency and the Department of Justice.

- Next meeting: late Fall

Drafted by: Financial Sector Policy Branch

ADM: Grahame Johnson, *redacted*Fiscal Policy

Briefing note to the deputy minister of finance

Fiscal Policy Branch – on-boarding

(For Information)

Issue

- This note identifies key issues for Fiscal Policy Branch and attaches some initial reading material, *redacted*.

Background

- In mid-2021, the previous Economic and Fiscal Policy Branch was separated into two branches. The Fiscal Policy Branch (FPB) retains all of the responsibilities of the earlier Fiscal Policy Division. Forecasting and strategic fiscal policy advice continues to be closely coordinated with the Economic Policy Branch.

- In recent years, FPB's responsibilities have grown significantly, such as for fiscal review as well as for challenge function on core government operations. As part of the branch's establishment, incremental funding was provided to establish a new challenge function dedicated section and director, as well as create a new DG position with oversight for challenge function and budget planning and production. Annex A provides the branch's executive org chart.

*Redacted*

Assessment

- A key responsibility of the branch in the short term is forecasting and coordination for the fall economic and fiscal update (critical dates in Annex B). Other near-term issues include:

- *Redacted*

*Redacted*

- Throughout this time, we will also be collaborating with the OECD's Budgeting Division, which will be providing us with advice to strengthen our green budgeting tools and methodologies. *Redacted*.

*Redacted*

Drafted by: Fiscal Policy Branch Management

ADM: Evelyn Dancey, *redacted*

Attachments (2): Memo to Minister: Near-Final 2022-23 Financial Results; *Redacted*

Annex A

Fiscal Policy Branch

Fiscal Policy Branch

Annex B

| Forecast Items | Date |

|---|---|

| Private sector survey closes | Tuesday, September 12 |

| First round of fiscal forecast: *redacted* | *Redacted* |

| Briefings with Minister begin on two-pagers *redacted* | *Redacted* |

| Fiscal forecast completed (to DMO) | *Redacted* |

| Final decisions from Minister* | *Redacted* |

| Final decisions from Prime Minister* | *Redacted* |

| Tabling target | *Redacted* |

| * Notional departmental dates | |

*Redacted*

Briefing note to the minister of finance

Near-final 2022-23 Financial Results

(For Information)

Issue

- The purpose of this memo is to provide a summary of the near-final financial results for the 2022-23 fiscal year and outline next steps for finalizing and releasing the results.

Assessment

*Redacted*

Release of the 2022-23 Fiscal Results

- The 2022-23 results will not be considered final until the financial statements and audit opinion are signed as planned *redacted* by the Secretary of the Treasury Board, Comptroller General, Deputy Receiver General, Deputy Minister of Finance, and the Auditor General.

- Following the signatories meeting, the final results for a fiscal year are typically released by the Minister of Finance via the Annual Financial Report of the Government of Canada (AFR) and presented to Parliament in the Public Accounts of Canada, tabled by the President of the Treasury Board.

- The AFR is designed to provide concise information regarding the government's financial results and includes the condensed consolidated financial statements of the Government of Canada and a separate audit opinion of the Auditor General. The condensed statements are a summarized version of the full set of consolidated financial statements presented in Section 2 of Volume I of the Public Accounts of Canada.

- The AFR is not required to be tabled in Parliament. However, the Auditor General has an explicit preference, in accordance with auditing standards, that the AFR not be released before the Public Accounts are tabled to ensure that the detailed audited financial statements upon which the condensed statements are based are publicly available.

- *Redacted*

Next Fiscal Forecast Update

- The department will be incorporating the final financial results into its fiscal projections and will provide a comprehensive revised outlook *redacted* following the results of the September survey of private sector forecasters (which will start after the release of the national accounts results for the second quarter of 2023 on August 31st).

*Redacted*

Drafted by: Fiscal Analysis and Forecasting Division

ADM: Evelyn Dancey, (*redacted*)

Annex A – Detailed Discussion of Variances

*Redacted*

International Trade and Finance Branch

Briefing note

International Trade and Finance Branch (ITF) key priorities

(For Information)

Issue

This note provides an overview of the key priorities for the ITF Branch that will require your attention, including upcoming international engagement.

Next 4-6 weeks

I. International engagement (Fall 2023):

*Redacted*

Pre-Planning for Canada's G7 Presidency (2025)

*Redacted*

III. Other priorities:

- Asian Infrastructure Investment Bank (AIIB) – Ongoing review of Canada's participation following the high-profile resignation of a Canadian national.

*Redacted*

Longer-term

*Redacted*

Attachments:

International Trade and Finance presentation

*Redacted*

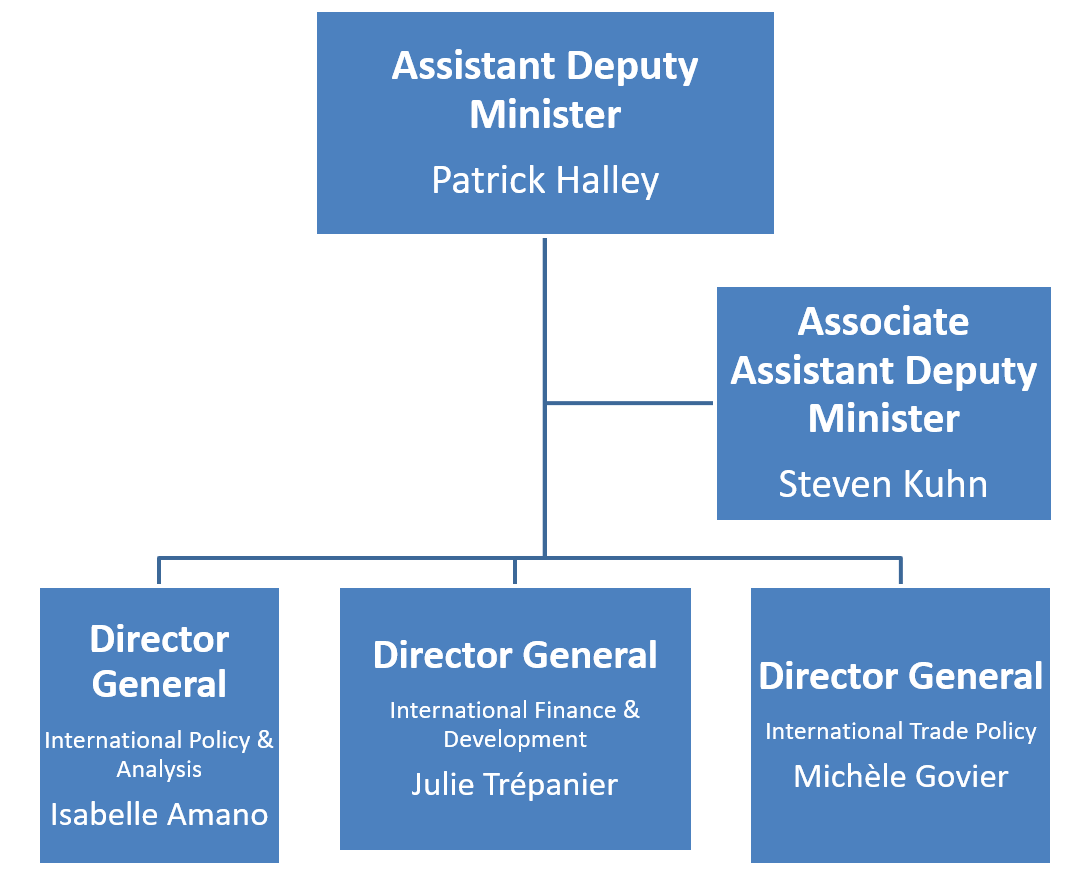

International Trade & Finance

Patrick Halley

Assistant Deputy Minister

Overview of the Branch

Our Landscape

- Canada is an open, rules-based trading nation

- Canada is a respected player on the global economic stage

- Canada is a member of several key global trade, economic and financial forums, where we play an active role

- Canada has substantial ownership positions in international financial institutions

- Canada is a significant provider of international development assistance

International Policy & Analysis

- Leadership and coordination of Finance Canada's participation in key multilateral for a (G7, G20, OECD, Five Finance Ministers, WEF, etc.)

- delivery of major initiatives (e.g. support for Ukraine, oil price cap, SDR channelling, etc.)

- provision of strategic advice for the Prime Minister, Minister of Finance, and senior officials

- Engagement with OGDs on cross-cutting issues and like-minded countries to advance shared objectives

- Support international bilateral relations (e.g., economic and financial dialogues, bilateral meetings, visits, etc.)

- Support the Minister of Finance as Governor of the International Monetary Fund (IMF) and provide advice to Canada's IMF Executive Director on IMF issues and operations

- Assess global economic and policy developments and provide analysis and assessment of emerging trends and risks

International Finance & Development

- Work with Global Affairs Canada (GAC) on the management of Canada's International Assistance Envelope that reached $13 billion in projected annual spending in 2022-23 – reflecting extraordinary COVID and Ukraine-related supports

- Support the Minister of Finance as Governor of the World Bank Group, European Bank for Reconstruction & Development, Asian Infrastructure Investment Bank, and provide advice on systemic multilateral development bank issues

- Represent and advance Canada's interests in international negotiations on sovereign debt (Paris Club) and rules to guide the use of government-backed export financing (Organization for Economic Cooperation and Development Arrangement on Export Credits)

- Engage on policy issues and provide a challenge function for international development and trade-related Crown corporations (FinDev Canada, Export Development Canada, Canadian Commercial Corporation)

- Work with GAC and EDC on Canada Account transactions and oversight

International Trade Policy

- Manage import policy and legislation

- Customs Tariff – $6.3B in annual revenue in 2022 ($5.1B in 2021)

- Special Import Measures Act

- Canadian International Trade Tribunal

- Duty remission requests

- Free Trade Agreements – lead or co-lead on elements of negotiations and implementation into domestic law (under overall GAC lead)

- Responses to U.S. trade-restrictive measures

- Border carbon adjustments – lead policy development and engagement

- Challenge function – on Global Affairs Canada foreign affairs & trade issues

- APEC – coordinate participation in Finance Ministers' track

Key Priorities

Policy & Analysis

- Monitoring and assessment of major international economic developments

- Working with likeminded countries on IMF issues, including SDR channeling, and championing the interests of the Caribbean and other small developing states

- Supporting discussions on economic resilience and economic security

- Supporting the priorities of G20 and G7 Presidencies

- Preparations for Canada's G7 Presidency in 2025

Finance & Development

- Participating in high-level initiatives to reform Multilateral Development Banks (MDBs), with a focus on championing the efficient use of MDB capital

- Advancing discussions on the long-term trajectory of Canada's International Assistance Envelope, including reforming its governance, planning discipline and objectives / priorities

- Overseeing the implementation Budget 2023 spending reductions for EDC, CCC and FinDev

- Facilitate time, orderly, and coordinated debt treatments for countries facing debt distress

Trade Policy

- Supporting DPM as chair of the Energy Transformation Task Force with the U.S.

- Coordinating policy development on Border Carbon Adjustments, Global Arrangements for Sustainable Steel and Aluminum

- Strengthening trade remedy system

- Co-lead consultations and domestic implementation options for reciprocal procurement

- Reacting to challenging trade environment (e.g., U. S. and broader protectionism)

Ukraine-Related Work

Policy & Analysis

- Analyzing economic impacts of Russia's war on Ukraine

- Working with key partners (incl G7, G20 allies) and IFIs to:

- counter Russia's false narrative in international for a (G20, IFIs) and *redacted*

- assess Ukraine's financing needs and provide financial assistance to Ukraine (IMF Administered Account, Ukraine's new IMF program), as well as other affected countries

- Continued monitoring of the price cap on Russian oil

Finance & Development

*Redacted*

- Supporting Canada's response via federal and international coordination tables

Trade Policy

- Implementation of single tariff initiatives (tariff relief for Ukraine, withdrawal of MFN status for Russia and Belarus)

- Track and support GAC's trade-related sanctions work (e.g., ban on imports of steel and aluminum from Russia)

- GAC funding requests related to sanctions work

*Redacted*

Office of the Special Representative for the Deputy Minister (Joe Wild)

Briefing note to the deputy minister of finance

Indigenous economic participation in trans mountain

For Information

Issue

Next steps regarding Indigenous economic participation in Trans Mountain, including key upcoming decision points and engagement dates.

Background

- In 2019, Canada announced its intention to pursue Indigenous economic participation in Trans Mountain. Since then, the Department of Finance has been engaging with the Indigenous groups along the pipeline corridor and marine shipping route. The Department of Finance has also maintained dialogue with five proponent groups that have an interest in wholly owning Trans Mountain (e.g., Western Indigenous Pipeline Group, Project Reconciliation).

- In Budget 2022, the government stated that it would announce next steps within the year.

- The Office of the Special Representative of the Deputy Minister is responsible for leading the work of Indigenous economic participation in Trans Mountain.

*Redacted*

Current Status

*Redacted*

- In order to proceed with this process, key decision points are required. These have been outlined below.

Key Decision Points

*Redacted*

Drafted by: Tiara Bebi, Office of the Special Representative for the Deputy Minister; ADM: Joe Wild, *redacted*

Tax Policy Branch

Briefing note to the deputy minister of finance

Key tax policy files – September 2023

For Information

Issue

- This memorandum lists key tax policy issues requiring action in the near, medium, and longer term.

Next 4-6 Weeks (Pre-Fall Economic Statement)

*Redacted*

Clean Economy Investment Tax Credits

- As part of its plan to build a clean economy the government has announced a regime of investment tax credits (ITCs). From Budget 2022 through to Budget 2023, the Government has announced five ITCs aimed at spurring the shift to a low-carbon economy. The ITCs have been costed at over $80 billion between now and 2034.

- The Department is developing the specific design details of the proposed clean economy ITCs. The development of the ITCs is proceeding along different timelines, partly reflecting staggered announcement and coming into force dates.

- A summary of the Clean Economy ITCs (including the labour requirements attached to most of them), as well as a summary of their implementation status is attached.

*Redacted*

OECD/G20 International Tax Reform – Pillar One & DST

- Countries are working to finalize and sign a multilateral treaty by the end of 2023 to implement Pillar One of an OECD/G20 two-pillar reform plan. The treaty would reallocate taxing rights over large companies (including digital companies) toward market jurisdictions; in return, countries will remove Digital Services Taxes (DSTs).

- Canada did not join a July 2023 Outcome Statement agreed to by 138 countries because we could not agree to extend a two-year "standstill" (moratorium) on post-2021 DSTs that expires at the end of 2023, while pre-2022 DSTs are grandfathered. *Redacted*.

Consultation on draft legislative proposals (Summer Release)

- On August 4, 2023, the Department released draft legislative proposals relating to tax measures announced by the Government in Budget 2023 or earlier. These draft proposals are subject to a public consultation through September 8, 2023, except that the consultation on OECD/G20 Pillar Two (Global Minimum Tax) proposals closes on September 29, 2023. A list of the tax measures included in this release is attached.

- Stakeholder feedback received during the consultation will be considered, and decisions will be sought from the Minister over the next 6 weeks to identify measures for inclusion in BIA2 or a FES Bill along with any recommended tweaks to the proposals coming out of the consultation.

Review of the SR&ED Tax Incentive Program

- Budget 2022 announced the government's intention to review the Scientific Research and Experimental Development (SR&ED) tax incentive program, including consideration of adopting a patent box regime. Budget 2023 reaffirmed this commitment and stated that "the Department of Finance will continue to engage with stakeholders on the next steps in the coming months."

*Redacted*

Sharing Revenues from International Taxation Reform / Digital Services Tax (DST)

- Budget 2023 indicated the intention of the Government of Canada "to share with provinces and territories a portion of the revenues from the international tax reform," referring to Pillar One (or alternately, the DST) and Pillar Two of the OECD/G20 reform. *Redacted*

*Redacted*

Fuel, Alcohol, Cannabis, Tobacco (FACT) Sales Tax Framework

- Budget 2023 announced the government's continued engagement with interested Indigenous communities and organizations on a voluntary fuel, alcohol, cannabis, and tobacco (FACT) sales tax framework.

- The FACT framework will provide a new, flexible option for interested Indigenous governments to exercise tax jurisdiction by levying sales taxes, harmonized with the GST, on all sales of FACT products purchased on their reserves or settlement lands. *Redacted*.

Longer-Term

Inefficient Fossil Fuel Subsidies (IFFS)

- On July 24, 2023, the Government released the IFFS Self‑Review Assessment Framework and Guidelines, meeting its commitment to phase out or rationalize IFFS by 2023.

- Subsequent to the development of the Framework and Guidelines, Canada committed to undergo a G20 peer review process of IFFS. The key next steps to complete the peer review process will consist of holding discussions with experts to help inform the development of Canada's self-review report. This report will form the basis upon which an international expert review panel will assess Canada. Both the self-review and peer-review reports will be made public once the peer review is finalized. The Minister of Finance is the lead on the peer review process, in collaboration with the Minister of Environment and Climate Change. *Redacted*.

Automatic Tax Filing

- Budget 2023 announced that the CRA would expand its automatic filing programs for low-income Canadians, and pilot a new service targeted at vulnerable Canadians who currently do not file a return. *Redacted*.

Measures Included in the 2023 Summer Release of Draft Legislative Proposals

Draft legislative proposals were released on August 4, 2023 for public consultation on tax measures announced by the Government in Budget 2023 or earlier. Stakeholders have been invited to provide submissions on these measures through September 8, 2023 (except that the consultation on the Global Minimum Tax (Pillar Two) closes on September 29, 2023).

The following draft measures were included in this release:

- The Carbon Capture, Utilization and Storage (CCUS) Investment Tax Credit;

- The Clean Technology Investment Tax Credit

- Labour Requirements Related to Certain Investment Tax Credits

- Enhancing the Reduced Tax Rates for Zero-Emission Technology Manufacturers

- Flow-Through Shares and the Critical Mineral Exploration Tax Credit – Lithium from Brines

- Employee Ownership Trusts

- Registered Compensation Arrangements

- Strengthening the Intergenerational Business Transfer Framework

- The Income Tax and GST/HST Treatment of Credit Unions

- The Alternative Minimum Tax for High-Income Individuals

- Tax on Repurchases of Equity, including share buybacks

- Modernizing the General Anti-Avoidance Rule

- Global Minimum Tax (Pillar Two of OECD/G20 International Tax Reform)

- Digital Services Tax

- Excessive Interest and Financing Expenses Limitations (EIFEL);

- Enhancements to the vaping product taxation framework

- Tax-exempt sales of motive fuels for export

- Extending the quarterly duty remittance option to all licensed cannabis producers;

- Revised Luxury Tax draft regulations to provide greater clarity on the tax treatment of luxury items;

- Technical amendments to Goods and Services Tax / Harmonized Sales Tax (GST/HST) rules for financial institutions; and

- Other proposed technical tax amendments to improve the certainty and integrity of the tax system, and generally align the law with its intended policy.

| Measure | Eligibility and Conditions | In Force |

|---|---|---|

| Clean Electricity: Refundable 15% ITC |

|

Budget Day 2024 (Not available after 2034) |

| Clean Hydrogen: Refundable 15-40% ITC |

|

Budget Day 2023 (phase-out starts in 2034, not available after 2034) |

| Clean Technology Manufacturing: Refundable 30% ITC |

|

January 1, 2024 (Phase-out starts in 2032, not available after 2034) |

| Clean Technology: Refundable 30% ITC |

|

Budget Day 2023 (rate reduced to 15% in 2034, not available after 2034) |

|

||

| Carbon Capture, Utilization, and Storage: Refundable 60%, 50%, or 37.5% ITC |

|

January 1, 2022 (rates reduced by half after 2030, not available after 2040) |

|

||

| Labour Requirements Related to Certain ITCs |

|

October 1, 2023 |

Implementation Status of Clean Economy Investment Tax Credits

- Enacting legislation must receive royal assent before refundable investment tax credits (ITCs) can be administered by the Canada Revenue Agency.

| ITC | Next Steps |

|---|---|

| CCUS ITC (CIF: January 1, 2022) |

|

| Clean Technology ITC (CIF: March 28, 2023) |

|

| Labour requirements associated with Clean Technology, Clean Hydrogen, Clean Electricity, and CCUS ITCs (CIF: October 1, 2023) |

|

| Clean Hydrogen ITC (CIF: March 28, 2023) |

|

| Clean Technology Manufacturing ITC (CIF: January 1, 2024) | *Redacted* |

| Clean Electricity ITC (CIF: Budget Day 2024) | *Redacted* |

CIF = Coming into force. |

|