Backgrounder: Tax Fairness for the Middle Class and Opportunity for All Canadians

Backgrounder

Canadians deserve to feel confident that their hard work will be rewarded with greater opportunities and a fair chance at success. A fair tax system forms the foundation for a stronger middle class and a growing economy, instills confidence in Canadians and helps to create opportunities for everyone.

Small businesses are a key driver of Canada's economy, accounting for 70 per cent of all private sector jobs. Low and competitive tax rates allow Canadian businesses to invest in their success, and create more good, well-paying jobs.

The Government is supporting hard-working small business owners by reducing the small business tax rate to 10 per cent, effective January 1, 2018, and to 9 per cent, effective January 1, 2019. By 2019, the combined federal-provincial-territorial average income tax rate for small business will be 12.6 per cent—the lowest in the G7 and the fourth lowest among members of the Organisation for Economic Co-operation and Development.

At the same time, the Government is taking steps to ensure that Canada's internationally competitive corporate tax rates are being used to support jobs and growth—by encouraging investment in things like machinery, equipment and skills training—rather than to create unfair tax advantages for the wealthy at the expense of others. Before the Government began taking action, someone earning $300,000 with a spouse and two adult children could, in some circumstances, use a Canadian-controlled private corporation (CCPC) and the small business tax rate to get tax savings that amount to roughly what the average Canadian earns in a year.

In July 2017, the Government engaged Canadians in an open discussion on proposals to address tax planning strategies using private corporations. In October 2017, the Minister of Finance took this feedback into account in announcing changes to the Government's proposed approach to address these strategies. Specifically, the Government announced that:

- It would cut taxes for small businesses, providing them with up to $7,500 in federal tax savings per year. For the average small business, this will leave an additional $1,600 per year for small business entrepreneurs and innovators to reinvest in new equipment, in growth and job creation.

- It would move forward with simplified proposals to limit income sprinkling, while making sure that family members who make a meaningful contribution to the business are not affected. Detailed legislative proposals to address income sprinkling were subsequently released on December 13, 2017, giving owners of private corporations until the end of 2018 to adjust to the proposed exclusion for significant shareholdings.

- It would move forward in Budget 2018 with measures to limit the tax deferral opportunities related to passive investments, while providing business owners with flexibility to build a cushion of savings for business purposes and deal with personal circumstances, such as for maternity leave, sick days or retirement.

- It would not move forward with parts of the July 2017 proposals due to concerns that they could have unintended consequences, particularly relating to the ability of farmers and fishers to hand down their business to the next generation.

Budget 2018 Actions to Ensure the Fair Treatment of Passive Investment Income

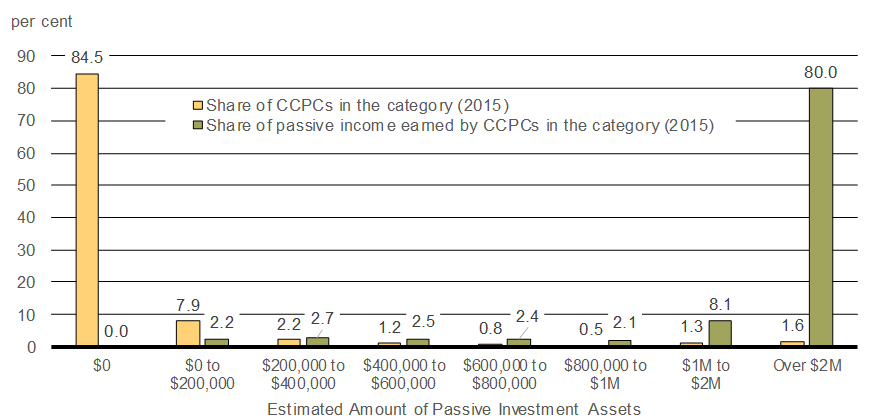

Currently, it is estimated that $300 billion1 in passive investments is being held by private corporations that are actively engaged in a business. About 80 per cent of this wealth is concentrated in 2 per cent of CCPCs. The Government is taking action to limit tax deferral benefits related to passive investment, while recognizing the role of savings within the business to provide a financial cushion to the business and to entrepreneurs. More than 97 per cent of private corporations will not be affected by the changes proposed in Budget 2018.

The passive investment tax changes proposed in Budget 2018 strike a balance between the need to ensure fairness and the need to support business investment and growth—without introducing undue complexity.

The small business tax rate is designed to help businesses get the capital they need in order to grow and focus on their day-to-day operations, not to provide tax advantages for the wealthiest to accumulate large, personal savings within a corporation. Known as passive investments, these portfolios of assets (such as stocks, bonds or real estate) are held within a private corporation and generate an income not related to the active business. Owners of private corporations can gain a tax advantage when they accumulate a large amount of wealth with income taxed at the small business rate, rather than the personal rate. Some of these savings are intended primarily for personal use.

Through Budget 2018, the Government proposes two measures that will improve the fairness of the tax system, while still enabling entrepreneurs to save within their business.

The first measure proposes to limit the ability of private corporations with significant passive savings to benefit from the preferential small business rate. The current small business deduction limit allows for up to $500,000 of business income from an active business to be subject to the lower small business tax rate. Access to the lower tax rate is phased out on a straight-line basis for associated CCPCs with between $10 million and $15 million of aggregate taxable capital employed in Canada.

Budget 2018 proposes to introduce an additional eligibility mechanism for the small business deduction, based on the corporation's passive investment income. This will be simpler and more targeted than proposals originally outlined in the July 2017 consultation.

Under the proposal, if a corporation and its associated corporations earn more than $50,000 of passive investment income in a given year (equivalent to $1 million in passive investment assets, assuming a 5-per-cent rate of return), the amount of a corporation's active income eligible for the small business tax rate would be gradually reduced. The small business deduction limit would be fully phased out once passive income reaches $150,000 per year (equivalent to $3 million in passive investment assets, assuming a 5-per-cent rate of return). For the limited number of corporations earning that level of passive income or more, their businesses' active income would be taxed at the general corporate income tax rate. With this proposal, the Government is slowly withdrawing access to the small business tax rate if a business is accumulating large sums of passive investments.

For those earning less than $50,000 of passive income each year, there would be no change in tax treatment under this first measure. Moreover, the tax applicable to investment income remains unchanged—refundable taxes and dividend tax rates will remain the same, unlike the July 2017 proposal.

In addition, capital gains from the sale of assets used in the business or from the sale of shares of connected corporations, where these corporations are engaged in an active business and certain conditions are met, will not be taken into account for purposes of this measure.

For instance:

- A private corporation with passive investment assets of less than $1 million at a 5-per-cent rate of return would be unaffected by the proposal, and could continue to earn up to $500,000 in active business income at the small business tax rate.

- A private corporation with passive investment assets of $1.4 million at a 5-per-cent rate of return could earn up to $400,000 in business income per year without being affected by the proposal.

- A private corporation with passive investment assets of $2 million at a 5-per-cent rate of return could earn up to $250,000 in business income per year without being affected by the proposal.

- A private corporation with passive investment assets of $2.5 million at a 5-per-cent rate of return could earn up to $125,000 in business income per year without being affected by the proposal.

- A private corporation with passive investment assets of $3 million or more at a 5-per-cent rate of return would pay the general corporate tax rate on business income earned.

The second measure will correct an existing flaw in the tax system. It will apply to corporations paying tax at the general rate, which are typically larger corporations. Under current rules, corporations can trigger a refund of taxes paid on investment income, regardless of the source of the dividend (i.e., whether coming from investment income, or lower-taxed active business income). This allows larger corporations to gain an unintended tax advantage since they can choose to pay out dividends from their active business income (which qualify for a higher Dividend Tax Credit) and still benefit from a refund of taxes paid on investment income. The proposed measure will not increase the overall tax burden on investment income, but will place limits on the timing and conditions to receive a refund.

With these two proposals, less than 3 per cent of private corporations will be affected. It is estimated that more than 90 per cent of the tax impact from the two measures will be borne by households in the top 1 per cent (i.e., the wealthiest). In contrast, the reduction in the small business tax rate will be available to all small CCPCs.

These proposed measures will enhance the fairness of the tax system in a manner that is more targeted and simpler than the approaches proposed in the Government's July 2017 consultation paper, while ensuring Canada's low small business taxes continue to help companies grow and create jobs. They will take effect on a go-forward basis, applying to taxation years that begin after 2018.

Impact of Proposed Budget 2018 Passive Investment Changes

Less than 3 per cent of corporations will be affected. 90 per cent of the tax impact will be borne by households in the top 1 per cent (i.e. the wealthiest).

In contrast, the benefits of the reduction in the small business tax rate will be available to all small businesses. As a result, small businesses will be able to keep up to $7,500 more of their profits.

Those affected by the two proposals put forward in Budget 2018 earn on average $175,000 of passive investment income annually, which for most will represent only one of many sources of income. Passive income of $175,000 would represent passive assets of about $3.5 million (assuming a 5-per-cent rate of return).

By keeping taxes low for small businesses and ensuring that everyone pays their fair share of tax, the Government's actions are helping to create greater opportunities, including jobs, for all Canadians, and delivering on its fundamental promise: that hard work will be rewarded, and that every Canadian can have a real and fair chance at success.

Distribution of CCPCs and their Share of Taxable Passive Investment Income (2015)

Categorized by Magnitude of Passive Investment Assets

Note: No data is available on the value of passive investments held in private corporations. The asset

values used to produce the chart were imputed from passive investment income amounts reported by private corporations for tax purposes, using a hypothetical

rate of return of 5 per cent. The amounts include capital gains, portfolio dividends and other investment income, such as interest.

1 No data is available on the value of passive assets held in private corporations. The $300 billion estimate is imputed from passive income reported by CCPCs for tax purposes, using a hypothetical rate of return of 5 per cent. The amounts include capital gains, portfolio dividends and other investment income, such as interest.