Lower Taxes for the Middle Class and People Working Hard to Join It

Backgrounder

To help all Canadians cover their most basic needs, no federal income tax is collected on a certain amount of income that a person earns. This is called the Basic Personal Amount (BPA). In 2020, the existing BPA would allow Canadians to earn close to $12,300 before owing any federal income tax.

Today, the Government is moving forward with a proposal that would put more money in the pockets of Canadians, by lowering taxes for the middle class, and people working hard to join the middle class. This would be accomplished by increasing the BPA to $15,000 by 2023 (see schedule of proposed increases in Table 1 below).

| Year | Existing BPA1 | Proposed BPA |

|---|---|---|

| 2020 | $12,298 | $13,229 |

| 2021 | $12,554 | $13,808 |

| 2022 | $12,783 | $14,398 |

| 2023 | $13,038 | $15,000 |

| 1 Based on Department of Finance Canada projections for indexation for 2021-2023 period. | ||

The Government also proposes to increase two related amounts, the Spouse or Common-Law Partner Amount ("Spousal Amount") and the Eligible Dependant Credit, to $15,000 by 2023, in tandem with the proposed increases in the BPA.

To ensure that this tax relief goes to the people who need help most, the Government would phase out the benefits of the increased BPA for wealthy individuals. Specifically, the increase in the BPA would be gradually reduced for individuals with net incomes above $150,473 in 2020 (the bottom of the fourth tax bracket). The Spousal Amount and Eligible Dependant Credit would also be gradually reduced for individuals with net incomes above $150,473 in 2020, and will continue to be reduced dollar-for-dollar based on the net income of the dependant.

Because the increases in the BPA and related amounts would be eliminated for individuals with net incomes over $214,368 in 2020 (the threshold for the top tax bracket), the wealthiest Canadians would not benefit from this proposed change. Instead, they would continue to receive the existing BPA, which will continue to rise with inflation.

An increased BPA would mean lower taxes for close to 20 million Canadians. When fully implemented in 2023, single individuals would save close to $300 in taxes every year, and couples or single parents would save nearly $600 every year. It would mean that nearly 1.1 million more Canadians would no longer pay federal income tax at all.

Consequential Changes

A number of income tax rules that use the value of the BPA would be amended to refer to the maximum value of the credit, as described below. Other income tax rules that refer to the value of the BPA, such as the rules relating to the transfer of unused credit amounts, would continue to refer to the BPA (as reduced due to the income test, if applicable).

Certain provisions of the Income Tax Act rely on the value of the BPA to determine whether a child or grandchild is considered to be dependent upon another individual. This proposal would update those provisions to reference the new maximum credit amount (without reduction due to the income test), including for the purposes of

- the Child Care Expense Deduction;

- establishing eligibility to roll over proceeds from certain registered plans of a deceased parent or grandparent;

- the definition "preferred beneficiary," which is relevant to certain trust rules; and

- the determination of the residency status of children dependent on certain individuals.

The Income Tax Regulations provide rules for the withholding of income tax from the taxable portion of amounts paid from a Registered Disability Savings Plan. The value of the BPA is used to determine the amount that may be paid from a Registered Disability Savings Plan before tax withholding is applied. This proposal would reference the new maximum BPA (without reduction due to the income test) when determining this amount.

Gender-Based Analysis Plus Summary of This Proposed Measure

Gender-based Analysis Plus (GBA+) is an analytical process used to assess how diverse groups of women, men and non-binary people may experience policies, programs and initiatives. The "plus" in GBA+ acknowledges that GBA goes beyond biological (sex) and socio-cultural (gender) differences to consider other identity factors such as ethnicity, age, income level, and mental or physical ability. For more information on the terms and fields in this summary, please see the introduction to Budget 2019's Gender Report.

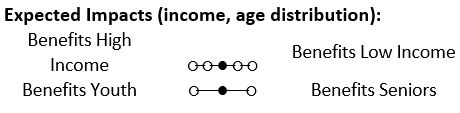

Increasing the BPA to $15,000 by 2023 would reduce taxes for all individual taxpayers, except those in the top tax bracket (essentially the top 1 per cent). Nearly two-thirds of Canadians who file a tax return would benefit, as over a third of filers already do not pay federal personal income tax.

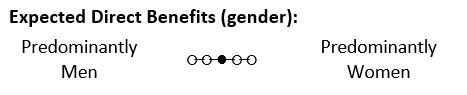

It is estimated that 52 per cent of beneficiaries would be men and 48 per cent women, and that the distribution of the dollar amount of tax relief would be very similar (53 and 47 per cent respectively).

Women would account for almost 60 per cent of the nearly 1.1 million individuals taken off the tax rolls by the measure.

Individuals in a couple are more likely to benefit from the proposal relative to single individuals (72 per cent vs. 54 per cent, respectively). In about 83 per cent of all couples, at least one member of the couple would benefit. Seniors are less likely to benefit compared to non-seniors (54 per cent vs. 68 per cent), but represent a significant share of all individuals taken off the tax rolls (41 per cent).

The measure would be beneficial for taxpaying single parents (about two-thirds of whom are women), as they would be eligible for both an increased BPA and an increased Eligible Dependant Credit. This would result in a tax reduction of nearly $600 for a single parent in 2023.

GBA+ was performed: Mid-point

Target population: Low- and middle-income taxpayers

Fiscal Cost

| 2019– 2020 |

2020– 2021 |

2021– 2022 |

2022– 2023 |

2023– 2024 |

2024– 2025 |

Total | |

|---|---|---|---|---|---|---|---|

| Reduction in Personal Income Tax | 690 | 3,015 | 4,050 | 5,145 | 6,020 | 6,230 | 25,150 |

| Funding for the Canada Revenue Agency | 0 | 1 | 1 | 1 | 1 | 0 | 4 |

| Net Fiscal Impact | 690 | 3,016 | 4,051 | 5,146 | 6,021 | 6,230 | 25,154 |

A Single Individual Would Save Close to $300 by 2023

- Paul lives in Wetaskiwin, Alberta. He has just graduated from college and has accepted a job paying $50,000 a year. The proposed increase to the BPA means that Paul would pay less tax starting in 2020, with tax savings of close to $300 in 2023.

A Two-Earner Couple Would Save Close to $600 by 2023

- Jean and Robert live in Regina. Robert works full-time and earns $40,000 per year, while Jean works part-time and earns $20,000. Both Jean and Robert would benefit from the proposed BPA increase starting in 2020; their combined tax savings in 2023 would be close to $600.

A One-Earner Couple With One Child Would Save Close to $600 by 2023

- Ian and Wendy live in Brampton. Ian stays at home with their child, while Wendy is self-employed and earns $100,000 a year. Wendy's taxes would be reduced starting in 2020. Since she can claim the Spousal Amount in addition to the BPA, her tax savings in 2023 would be close to $600.

A Single Parent Would Save Close to $600 by 2023

- Amrita is a single parent living in Cambridge Narrows, New Brunswick, with one child. She earns $40,000 a year and would see tax savings starting in 2020. Given she can claim the Eligible Dependant Credit in addition to the BPA, her tax savings would amount to close to $600 in 2023.