A Made-in-Canada Plan: Affordable Energy, Good Jobs, and a Growing Clean Economy

Backgrounder

March 28, 2023

Today, the world's major economies are moving at an unprecedented pace to fight climate change, retool their economies, and build the net-zero industries of tomorrow. Budget 2023 investments in abundant and low-cost clean electricity will underpin other investments needed to create hundreds of thousands of middle class jobs, provide the energy that will power our daily lives and the entire Canadian economy, and provide more affordable energy to millions upon millions of Canadian homes.

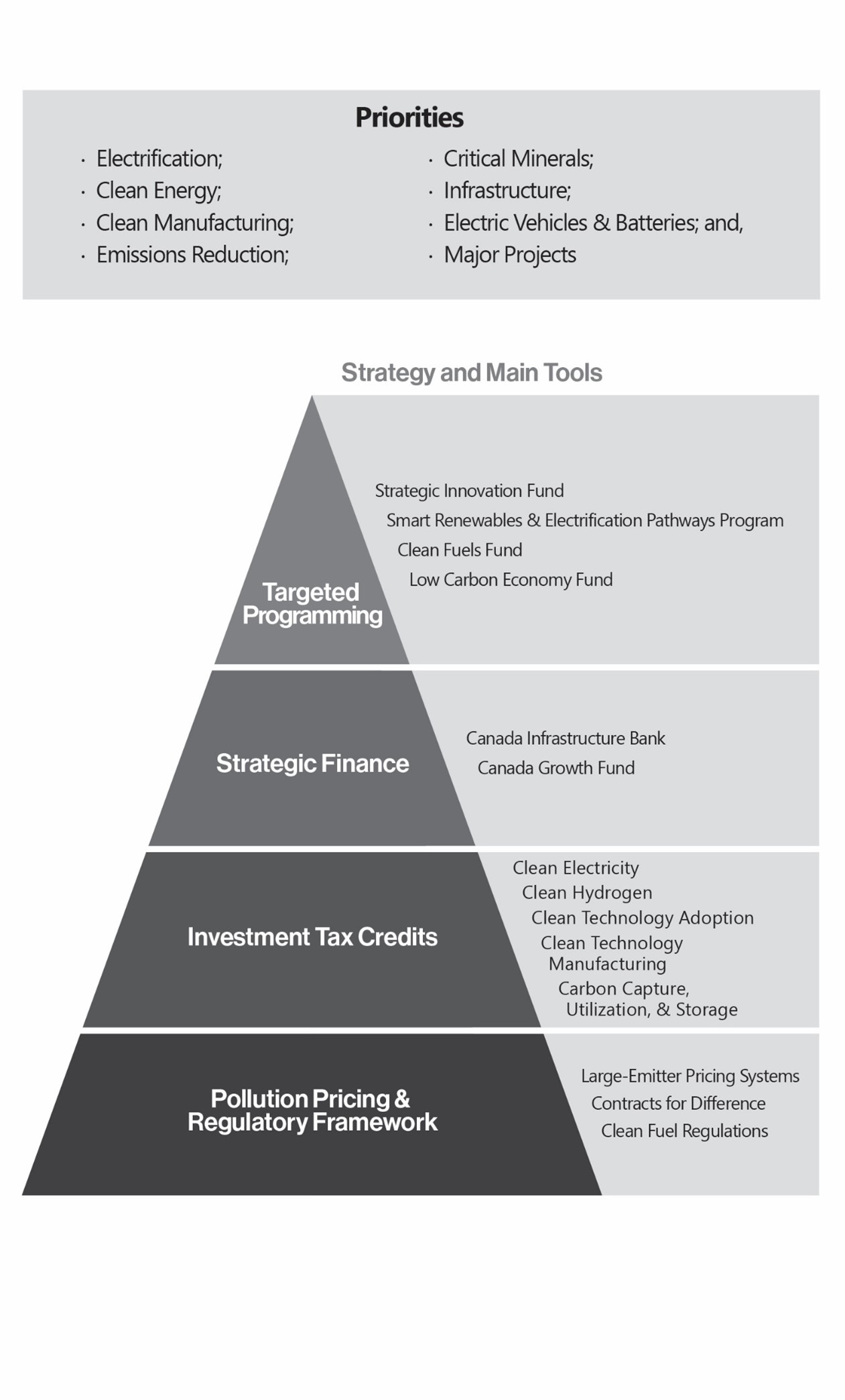

Our made-in-Canada plan is underpinned by a new federal toolkit for investing in the clean economy: a set of clear and predictable investment tax credits, low-cost strategic financing, and targeted investments and programming, where necessary, to respond to the unique needs of sectors or projects of national economic significance.

By making significant investments to ensure Canada does not fall behind at this moment of profound global economic upheaval—and opportunity—Budget 2023 is ensuring a clean Canadian economy can deliver prosperity, middle class jobs, and more vibrant communities across Canada.

Clean Investment Tax Credits

Clean Electricity Investment Tax Credit

To support and accelerate clean electricity investment, Budget 2023 proposes to introduce a 15 per cent refundable tax credit for eligible investments in non-emitting electricity generation systems, abated natural gas electricity-fired electricity generation, stationary electricity storage systems, and equipment for the transmission of electricity between provinces and territories.

Taxable and non-taxable entities such as Crown corporations and publicly owned utilities, corporations owned by Indigenous communities, and pension funds, would be eligible for the Clean Electricity Investment Tax Credit.

Clean Technology Manufacturing Investment Tax Credit

Budget 2023 proposes a refundable tax credit equal to 30 per cent of the cost of investments in machinery and equipment used to manufacture or process key clean technologies, and extract, process, or recycle certain critical minerals essential to clean technology supply chains.

Clean Hydrogen Investment Tax Credit

Budget 2023 announces the details of the Clean Hydrogen Investment Tax Credit announced in the 2022 Fall Economic Statement, with the levels of support varying between 15 and 40 per cent of eligible project costs, with the projects that produce the cleanest hydrogen receiving the highest levels of support.

Enhancing the Carbon Capture, Utilization, and Storage Investment Tax Credit

Carbon Capture, Utilization, and Storage (CCUS) is a suite of technologies that captures carbon dioxide (CO2) emissions to either store the CO2 or to use it in other industrial processes, such as permanent mineralization in concrete. Budget 2023 proposes that the Investment Tax Credit for CCUS be expanded to cover additional equipment, and now be available for dedicated geological storage projects in British Columbia.

Expanding Eligibility for the Clean Technology Investment Tax Credit

Budget 2023 proposes to expand eligibility for the refundable Clean Technology Investment Tax Credit to include eligible geothermal energy systems, further supporting the growth of Canada's burgeoning clean technology sector. This is in addition to the support announced in the 2022 Fall Economic Statement, through this credit, for investments in clean electricity generation and storage, low carbon heating and industrial zero-emission vehicles, including related charging or refuelling equipment.

Investing in Clean Electricity

To reach our goal of achieving net-zero emissions by 2050—and to power our homes, vehicles, and industries for generations to come—Budget 2023 puts in place major, long-term investments to place Canada on a track to build a net-zero emissions economy and secure Canada's affordable clean electricity advantage. This plan includes:

-

Beyond the clean electricity investment tax credit, as needed, low-cost and abundant financing through a targeted focus on clean electricity from the Canada Infrastructure Bank; and,

-

Targeted electricity programs, where needed, to ensure critical projects get built.

A Clean Electricity Focus for the Canada Infrastructure Bank

Budget 2023 will position the Canada Infrastructure Bank to play a leading role in electrifying Canada's economy, supporting lower energy bills for Canadians and businesses, and ensuring that cleaner, affordable electricity is available from coast to coast to coast.

-

Budget 2023 announces that the Canada Infrastructure Bank will invest at least $10 billion through its Clean Power priority area, and at least $10 billion through its Green Infrastructure priority area. This will allow the Canada Infrastructure Bank to invest at least $20 billion to support the building of major clean electricity and clean growth infrastructure projects. These investments will be sourced from existing resources.

Supporting Clean Electricity Projects

Budget 2023 proposes to provide $3 billion over 13 years to:

-

Recapitalize funding for the Smart Renewables and Electrification Pathways Program to support critical regional priorities and Indigenous-led projects;

-

Renew the Smart Grid program to continue grid innovation support; and,

-

Create new investments in science-based activities to help capitalize on Canada's offshore wind potential, particularly off the coasts of Nova Scotia and Newfoundland and Labrador.

The Atlantic Loop

The federal government is committed to advancing the Atlantic Loop—a series of interprovincial transmission lines that will provide clean electricity among Quebec, New Brunswick, and Nova Scotia—and is currently negotiating with provinces and utilities to identify a clear path to deliver the project by 2030.

Securing Major Battery Manufacturing in Canada

Cementing Canada's place in electric vehicle battery manufacturing will pay dividends now and in the future by creating good well-paying jobs and enabling growth in related industries like critical minerals mining and processing, battery components, and parts and automotive manufacturing. Canada recently secured a major investment with Volkswagen announcing that its subsidiary, PowerCo, will build its first overseas battery 'gigafactory' in St. Thomas, Ontario. This critical investment will help anchor the domestic battery manufacturing value chain for decades to come.

A Growing Clean Economy

Delivering the Canada Growth Fund

Announced in Budget 2022, the Canada Growth Fund—a new $15 billion arm's-length, public investment vehicle—will help attract private capital to build Canada's clean economy. Budget 2023 announces that the government intends to introduce legislative amendments to enable the Public Sector Pension Investment Board (PSP Investments) to manage the assets of the Canada Growth Fund to deliver on the Growth Fund's mandate of attracting private capital to invest in Canada's clean economy.

One of the investment tools the Canada Growth Fund will provide to support clean growth projects is contracts for difference. These contracts can backstop the future price of, for example, carbon or hydrogen, providing predictability that helps to de-risk major projects that cut Canada's emissions.

Enhancing the Reduced Tax Rate for Zero-Emission Technology Manufacturers

To drive investment and create new jobs, Budget 2021 reduced corporate income tax rates by half for zero-emission technology manufacturers. Budget 2023 proposes to extend the availability of these reduced rates by another three years, and to extend eligibility for them to include the manufacturing of nuclear energy equipment and the processing and recycling of nuclear fuels and heavy water.

Supporting Clean Technology Projects

Budget 2023 proposes to provide $500 million over ten years to the Strategic Innovation Fund to attract and spur high-quality business investments to support the development and application of clean technologies in Canada.

Getting Major Projects Done

Building Canada's clean economy will require significant and sustained private sector investment in clean electricity, critical minerals, and other major projects. Ensuring the timely completion of these projects is essential. In Budget 2023, the government is proposing further steps to ensure Canada's reviews of major projects are fit for purpose to meet our clean growth objectives while continuing to uphold the highest standards for environmental and other impacts.

-

By the end of 2023, the government will outline a concrete plan to improve the efficiency of the impact assessment and permitting processes for major projects, which include clarifying and reducing timelines, mitigating inefficiencies, and improving engagement and partnerships.

-

In addition, Budget 2023 proposes to provide $11.4 million to Crown-Indigenous Relations and Northern Affairs Canada to engage with Indigenous communities and to update the federal guidelines for federal officials to fulfil the Crown's duty to consult Indigenous Peoples and accommodate impacts on their rights.

Fair Pay for Workers Who Build the Clean Economy

Following consultations with unions and other stakeholders, Budget 2023 announces additional details on the labour requirements for the Clean Technology and Clean Hydrogen Investment Tax Credits:

- To be eligible for the highest tax credit rates, businesses must pay a total compensation package, one that equates to the prevailing wage. The definition of prevailing wage would be based on union compensation, including all benefits and pension contributions from the most recent, widely applicable multi-employer collective bargaining agreement, or corresponding project labour agreements, in the jurisdiction within which relevant labour is employed.

- Additionally, at least ten per cent of the tradesperson hours worked must be performed by registered apprentices in the Red Seal trades.

Budget 2023 also proposes these labour requirements be met in order to receive the full Clean Electricity Tax Credit, and announces the government's intent to apply labour requirements to the Investment Tax Credit for Carbon Capture, Utilization, and Storage, with details to be announced at a later date.

These labour requirements will come into effect on October 1, 2023. The government will consult with labour unions and other stakeholders to refine these labour requirements in the months to come.

Ensuring Fairness for Canadian Workers with Federal Reciprocal Procurement

The federal government is committed to having procurement policies that treat Canadian workers and businesses fairly—and this should include ensuring the government buys goods and services from countries that also grant Canadian businesses a similar level of access to their government procurement markets. In doing so, we will ensure that federal procurement dollars benefit Canadian workers and businesses, and support the development of mutually beneficial, reciprocal, and resilient supply chains.

-

To deliver these benefits, Budget 2023 announces the government will undertake targeted engagement with provinces and territories, industry stakeholders, and workers and unions on concrete reciprocal procurement measures, so they can be implemented in the near term. The proposed measures will include placing conditions on foreign suppliers' participation in federally-funded infrastructure projects, applying strict reciprocity to federal procurement, and creating a preference program for Canadian small businesses.

Beyond government procurement policies, in light of some of the restrictive eligibility conditions associated with new measures within the U.S. Inflation Reduction Act, the government will initiate targeted consultations on the possibility to introduce new reciprocal treatment for the measures in the government's plan to build a clean economy.