Tax Fairness for Every Generation

Backgrounder

Canada is one of the wealthiest countries in the world. For generations, this has meant Canada is a place where everyone could secure a better future for themselves and their children. This is in no small part is due to our commitment to progressive taxation. In order to build a fair economy, everyone needs to pay their fair share. To restore fairness for every generation the government is investing in housing; in building the clean, innovative economy of the future; in child care, health care, dental care, and pharma care; in Canada's security, and Canada's future. The government is doing this so that young people can have the same opportunities as previous generations. Canada's future success depends on their success. It is only fair that these important investments are funded by those who have benefited the most from all the opportunity that Canada has to offer.

Improving Tax Fairness

Canadians pay tax on the income from their job. But currently, they only pay taxes on 50 per cent of their capital gains, which is the profit generally made when an asset, such as stocks, is sold. This is the capital gains tax advantage—and it is more pronounced in Canada than in any other G7 country.

While all Canadians can benefit from this capital gains tax advantage if they have a capital gain, the wealthy, who tend to earn relatively more income from capital gains, disproportionately benefit compared to the middle class.

The current rules may result in situations where wealthy individuals face a lower marginal tax rate on their capital gains than what a middle class worker would face on their earnings. For instance, a nurse in Ontario earning $70,000 would face a combined federal-provincial marginal tax rate of 29.7 per cent. In comparison, a wealthy individual in Ontario with $1 million of income would face a marginal tax rate of 26.8 per cent on their capital gains. This is not right.

Tax fairness is important for every generation, and it is particularly significant for younger Canadians. In 2021, only about 5 per cent of Canadians under 30 had any capital gains at all. Only 0.01 per cent of Canadians under 30 are expected to have capital gains above the $250,000 annual threshold in 2025.

Budget 2024 proposes an increase in taxes on capital gains on the wealthiest 0.13 per cent.

To make Canada's system more fair, the inclusion rate—the portion of capital gains on which tax is paid—for capital gains for individuals with more than $250,000 in capital gains in a year will increase from one-half to two-thirds. Individuals will continue to only pay tax on 50 per cent of any capital gains up to $250,000 per year.

The inclusion rate will also increase to two-thirds for all capital gains realized by corporations and trusts.

The new rules will apply to capital gains realized on or after June 25, 2024.

Selling your principal residence will continue to be exempt from capital gains taxation.

Example of a High Income Individual

A high income individual living in Ontario with a $400,000 salary also has a $300,000 gain from the sale of a second property. Under the current rules, they pay income tax on 50 per cent—$150,000—of that capital gain.

If they have the same gain in 2025, they will now pay tax on $158,333 of the gain (50 per cent x $250,000 = $125,000) plus (2/3 x $50,000 = $33,333) = $158,333).

Because of their high income putting them in the highest marginal tax rate, the change to capital gains taxation will cost them $4,461 more in combined federal-provincial income tax.

For 99.87 per cent of Canadians, personal income taxes on capital gains will not increase.

Next year, 28.5 million Canadians are not expected to have any capital gains income, and 3 million are expected to earn capital gains below the $250,000 annual threshold. Only 0.13 per cent of Canadians with an average income of $1.42 million are expected to pay more personal income tax on their capital gains in any given year.

About 12 per cent of Canada's corporations would face the higher inclusion rate on their capital gains.

Middle class Canadians will continue to benefit from the $250,000 annual threshold, tax-free savings accounts, the principal residence exemption, and exemptions for registered pension plans.

Capital gains from principal residences will remain tax-free to ensure Canadians do not pay capital gains taxes when selling their home. Any amount you make when you sell your home will remain tax-free.

Capital gains within a Registered Retirement Savings Plan, Tax-Free Savings Account, Tax-Free First Home Savings Account, or other registered savings vehicle will remain tax-free. Capital gains within a registered pension plan and the Canada Pension Plan and Quebec Pension Plan will remain tax-free. Capital gains for individuals up to $250,000 from the sale of cottages, investment properties or stocks beyond the limits of tax-sheltered savings vehicles will continue to benefit from the current 50 per cent inclusion rate.

Business owners and entrepreneurs will benefit from new relief.

The Lifetime Capital Gains Exemption for capital gains on the sale of a small business, or fishing and farming property will increase by 25 per cent from about $1 million to $1.25 million, effective June 25, 2024, and indexed to inflation after 2025. Canadians with eligible capital gains of up to $2.25 million will be better off under these changes.

To encourage entrepreneurship, the government is proposing the Canadian Entrepreneurs' Incentive, which will reduce the inclusion rate to 33.3 per cent on a lifetime maximum of $2 million in eligible capital gains. Combined with the enhanced lifetime capital gains exemption, when this incentive is fully rolled out, entrepreneurs will have a combined exemption of at least $3.25 million when selling all or part of a business and entrepreneurs with eligible capital gains of up to $6.25 million will be better off under these changes.

This is not expected to hurt Canada's business competitiveness.

Increasing the capital gains inclusion rate is not expected to hurt Canada's business competitiveness.

First, corporations in most other countries, including the United States, pay corporate income tax on 100 per cent of their capital gains. With a two-thirds inclusion rate, corporate taxation in Canada remains competitive.

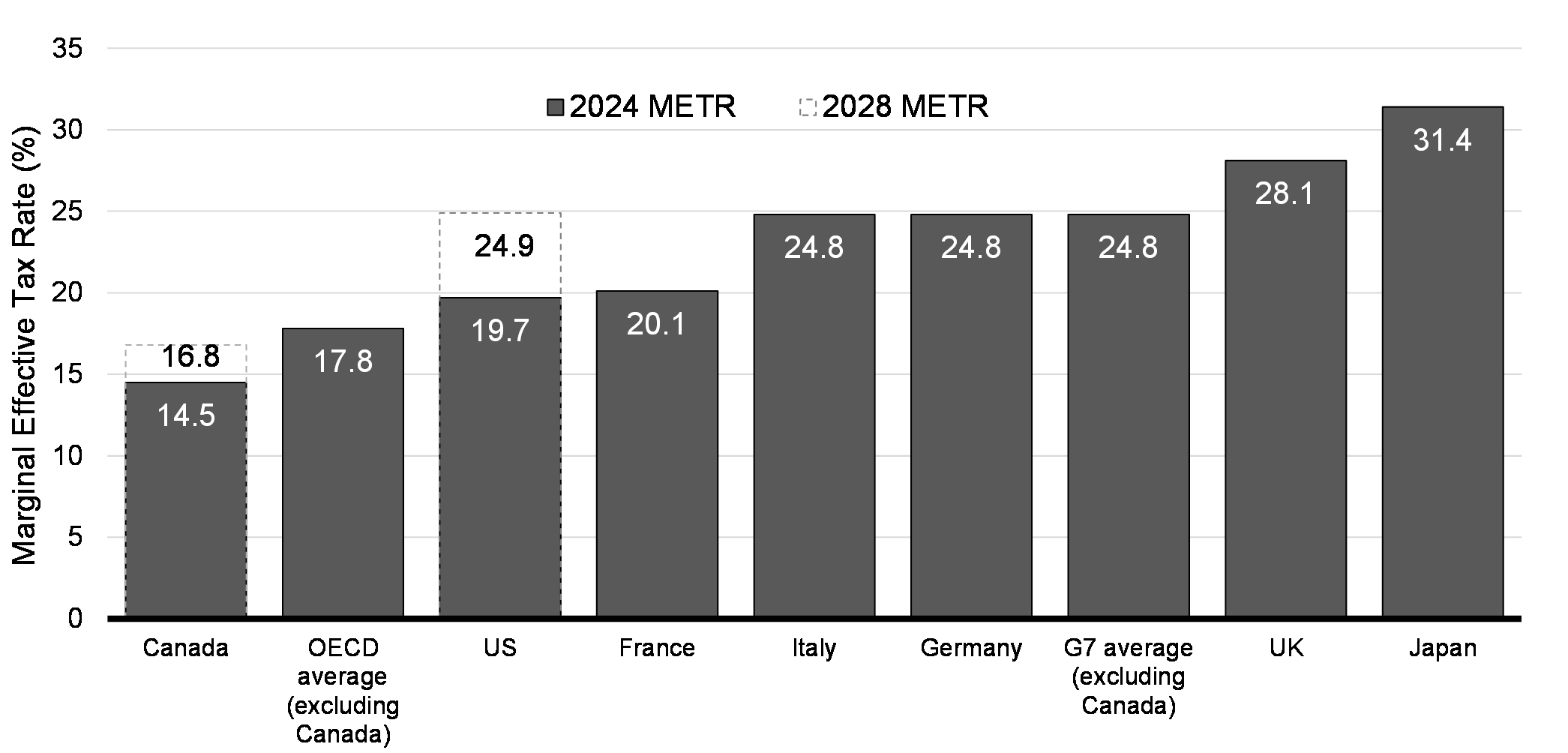

Second, the Marginal Effective Tax Rate (METR) is an estimate of the level of taxation on a new business investment, accounting for all levels of taxation, as well as investment tax credits, and capital cost allowances. It is one of the main metrics for comparing the level of taxation on new business investment between countries. Maintaining a competitive METR is important for Canada's attractiveness as an investment destination.

Canada's average METR is the best in the G7, and far more advantageous than in the U.S. and other OECD countries. Increasing the fairness of capital gains taxation will not impact Canada's METR score.