Consultation paper: Proposed Changes to Reporting of Gains and Losses in the Government’s Financial Results

Consultation Approach

Closing date: June 12, 2020

The Government is seeking public feedback on changing the way that actuarial gains and losses are reported in the Government's financial results, including the merits of incorporating the operating balance measurement concept in the federal financial reporting framework.

Written comments should be sent to:

Director General

Fiscal Policy Division

Economic and Fiscal Policy Branch

Department of Finance Canada

James Michael Flaherty Building

90 Elgin Street

Ottawa ON K1A 0G5

Email: fin.fc-cf.fin@canada.ca

The Department of Finance may make public some or all of the comments received or may provide summaries in its public documents. Stakeholders providing comments are asked to indicate clearly the name of the individual or the organization that should be identified as having made the submission.

In order to respect privacy and confidentiality, please advise when providing your comments whether you:

- consent to the disclosure of your comments in whole or in part;

- request that your identity and any personal identifiers be removed prior to publication; or

- wish that any portions of your comments be kept confidential (if so, clearly identify the confidential portions).

Information received through this comment process is subject to the Access to Information Act and the Privacy Act. Should you express an intention that your comments, or any portions thereof, be considered confidential, the Department of Finance will make all reasonable efforts to protect this information.

Introduction

The Government of Canada prepares its annual consolidated financial statements and fiscal projections in accordance with the highest accounting standards in the world—on a full accrual basis—and has received 21 consecutive unmodified audit opinions on its financial statements from the Auditor General of Canada dating back to 1998–99.

Full accrual accounting is recognized globally as the most sophisticated and comprehensive basis of financial measurement, as it records expenses when they are incurred, regardless of when the cash payment is made, and records revenues when earned, regardless of when the cash is received. At the same time, to value various assets and liabilities, this accounting basis requires the extensive use of estimates and assumptions about future events and circumstances, such as interest rates, inflation and mortality. These estimates and assumptions are reviewed and updated on an annual basis, which can result in significant changes, both upward and downward, in the previously recorded values of the Government's assets and liabilities.

One area that is most subject to uncertainty and volatility relates to the valuation of public sector pensions and other future benefits owed to veterans and government employees. This volatility has increased in recent years, with the introduction of a new discount rate methodology in the 2018 Public Accounts of Canada for valuing unfunded pension and other future benefit obligations. Prior to the change in methodology, unfunded pension obligations were discounted using a 20-year moving average of Government of Canada long-term bond rates, which resulted in a relatively stable discount rate. Under the new methodology, unfunded benefit obligations are discounted based on the spot rates of Government of Canada bonds at fiscal year-end (March 31), which can fluctuate significantly from one year to the next.

While these adjustments and revaluations are an important part of providing an accurate picture of the Government's balance sheet (i.e. Statement of Financial Position) at any given time, they can also result in large swings in the budgetary balance, which have the potential to obscure underlying trends in government spending—including the true contribution government spending is making to economic growth—and can make fiscal management more challenging.

While interest rate volatility (and economists' ability to forecast that volatility) are not new challenges, in an environment of heightened economic uncertainty, which is often reflected in fluctuations in government bond yields, it is important to consider new ways to communicate the impact of these economic forces on the Government's financial results.

This paper discusses this dynamic and explores a potential option to improve the presentation of the Government's budget and financial reporting.

The Government of Canada moved to full accrual accounting in 2002–03. This represented a significant undertaking for the Government, and resulted in the recording of tens of billions of dollars in additional assets and liabilities in its financial statements, including liabilities related to employee future benefits. Since that time, the Government has kept pace with developments in generally accepted accounting practice, implementing new and updated standards as issued by the Public Sector Accounting Board and adopting new best practices, as was done in 2017–18 with the implementation of the new discount rate methodology for the accounting for unfunded pension benefits. As such, Canada is one of only a few Organisation for Economic Co‑operation and Development member countries to record and report unfunded pension obligations.

Impact of Changes in Actuarial Assumptions on the Budgetary Balance

The Government sponsors a number of defined benefit pension plans that collectively cover nearly all the employees of the federal public service, members of the Canadian Forces (including the Reserve Force), members of the Royal Canadian Mounted Police (RCMP), federally appointed judges, and Members of Parliament, including Senators. In addition, some of the Government's consolidated Crown corporations and other entities maintain their own defined benefit pension plans covering substantially all of their employees.

In addition to pension plans, the Government and consolidated Crown corporations and other entities sponsor different types of other future benefit plans, with varying terms and conditions. The benefits are available to employees during or after employment or upon retirement. Other future benefits include disability and associated benefits available to war veterans, current and retired members of the Canadian Forces and the RCMP, their survivors and dependants; health care and dental benefits available to retired employees and their dependants; accumulated sick leave entitlements; severance benefits; and workers' compensation benefits.

The Government's liabilities for both employee pensions and other future benefits totalled $282.6 billion as of March 31, 2019.

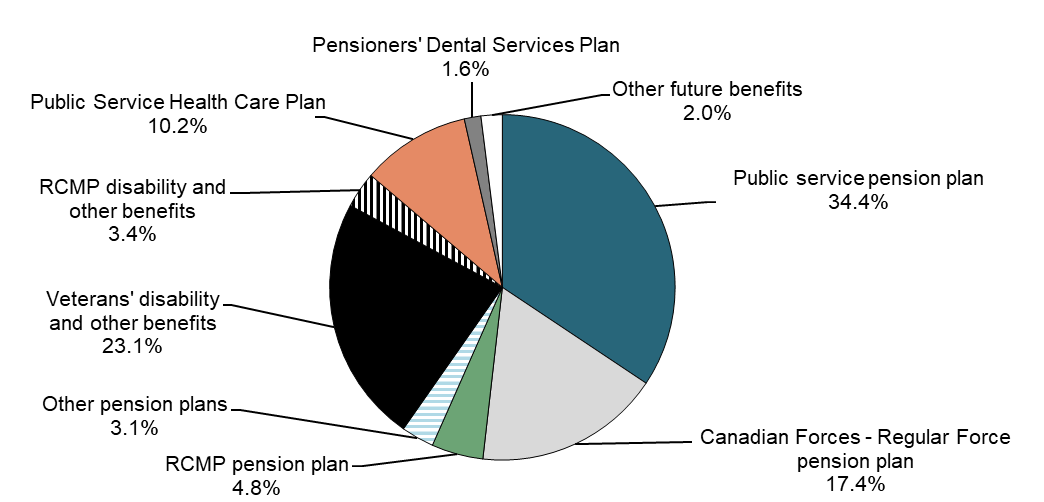

Chart 1

Pensions and Other Future Benefit Liabilities by Category for 2018–19

The value of the Government's benefit obligations is calculated annually by the Office of the Chief Actuary, and represents the present value, or discounted value, of estimated future benefit payments. Future payments are projected based on a number of actuarial assumptions that include, for example, assumptions about future inflation, interest rates, general wage increases, workforce composition, retirement rates and mortality rates.

One of the key assumptions used in valuing the Government's benefit obligations is the discount rate. This rate is applied to the stream of expected future benefit payments to estimate their value in today's dollars. The discount rates used in calculating the present value of unfunded pension and other future benefit obligations are based on the actual yields on Government of Canada bonds at fiscal year-end. The discount rate used to value funded pension benefits is based on the expected rates of return on invested funds. Funded pension benefits include post-March 2000 service under the Government's four main pension plans: the public service, Canadian Forces–Regular Force, Royal Canadian Mounted Police, and Canadian Forces–Reserve Force pension plans.

The Government's future benefit obligations are revalued at each year-end to reflect actual experience—such as the incidence of disability claims and retirement rates—and changes in assumptions about the future. Relatively small changes in assumptions can have significant impacts on the estimated value of future benefit obligations. In particular, the valuation of the Government's obligations for unfunded pensions and other future benefits is sensitive to changes in year-end interest rates, which are used in estimating their present value. While year-over-year changes in interest rates do not affect the benefits ultimately payable to recipients (see box below), they can result in a significant change in the Government's obligations. For example, based on current interest rates, a decrease of 1 per cent in discount rates would increase the Government's benefit obligations by $106.8 billion.

Impact of Discount Rates on the Valuation of the Government's Long-Term Liabilities

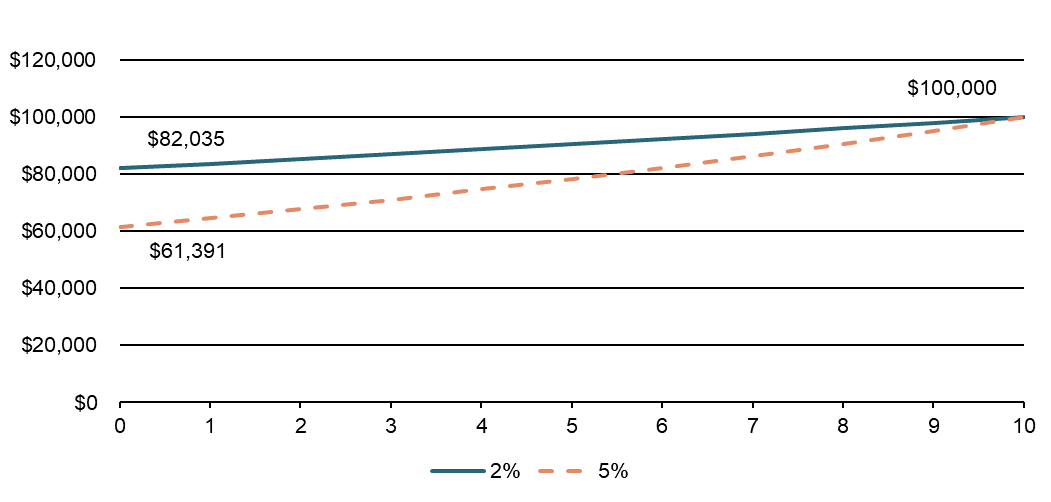

The following chart illustrates the difference in the accounting for a payment of $100,000 due in 10 years under a 2 per cent discount rate and a 5 per cent discount rate scenario. Using a 2 per cent rate, the initial obligation is higher (at $82,035) but remaining expenses recognized over the life of the obligation are lower ($17,965, representing the difference between the initial obligation and the $100,000 to be paid). Using a 5 per cent discount rate, the initial obligation is lower (at $61,391), but remaining expenses over the life of the obligation are higher (at $38,609). The total expense recorded under either scenario is the same—$100,000. The choice of discount rate affects only the timing of the accounting.

Illustration of Alternate Discount Rates

Increases or decreases in the estimated value of the obligations resulting from annual revaluations are referred to as actuarial gains and losses. Under Canadian public sector accounting standards, actuarial gains and losses resulting from annual re-measurements are not recognized in the Government's expenses immediately due to their tentative nature and because further adjustments may be required in the future. Instead, these gains and losses amounts are amortized to expenses and included in the Government's liabilities over time, on average about 13 years.

The cumulative impact of prior years' gains and losses amortized in a given fiscal year can be significant and can vary considerably from one year to the next. For example, expenses associated with the recognition of actuarial losses totalled $8.4 billion in 2018–19, compared to a total deficit of $14.0 billion for the fiscal year. This expense is expected to increase to $10.8 billion in 2019–20 (versus a forecast deficit of $26.6 billion for the year), driven in large part by the amortization of actuarial losses on the Government's main pension and benefit plans as a consequence of a decrease in year-end interest rates.

Conversely, looking forward, as interest rates are expected to rise over the forecast horizon, these interest rate losses will be reversed, leading to improvements in the budgetary balance. While this is seemingly a favourable outcome, it is also one that is entirely beyond the Government's control—and when the impact of actuarial gains and losses on the budgetary balance is volatile and unpredictable, tracking the Government's liabilities and forecasting the Government's spending plans is also made more difficult.

Potential Adjustments to the Government's Financial Reporting Framework

There is concern that re-measurement adjustments may impair the usefulness and understandability of the Government's financial statements and fiscal projections, including as a measurement of the short-term impact of government spending and taxation choices on the economy. Further, given the magnitude and the volatility associated with these amounts, there is a risk that swings in the gains/losses associated with the obligations will distort prudent fiscal planning.

Operating Balance Concept

As the Department of Finance Canada and the Office of the Comptroller General of Canada consider ways to make the Government's financial reporting more transparent, one option being considered is to introduce a new financial measurement concept—the operating balance—in the Government's financial reporting framework. The operating balance would represent a gross measure of the Government's deficit/surplus that excludes impacts of actuarial gains and losses on employee pensions and other future benefit plans. In effect, this means showing actuarial gains or losses as their own line item, rather than as part of overall program expenses.

The operating balance would not be a substitute for the traditional measure of the deficit. The Government would continue to present the traditional budgetary balance, or annual deficit/surplus, in its budget and financial reporting as the most comprehensive measure of financial performance. However, the operating balance could act as a useful supplementary measure that would make it easier to see the effects of gains and losses during a specific accounting period, separate from the Government's planned spending on programs (which includes transfers to persons, transfers to other levels of government and direct program expenses).

In this context, the operating balance could be a more practical instrument to hold the Government to account for the fundamental underlying changes in program spending. It could evolve as an anchor metric for the Government's fiscal planning and reporting framework, which may be more easily understood by Canadians, as it would better reflect the impact of spending decisions by governments.

Operating Balance in Application

Actuarial gains and losses—while an essential part of responsible accounting—have the potential to mask underlying trends in government spending, are subject to revision or reversal in subsequent periods, and can make the resulting presentation of financial results more difficult to understand. By isolating the impact of re-measurements of previously-recorded pension and other employee future benefit obligations, the operating balance could provide users of the Government's financial plans and reports with a clearer view of its planned and actual operating activities in an accounting period, enhancing transparency and accountability.

Further, by excluding the amortization of actuarial gains and losses the operating balance could serve as an improved basis over the traditional budgetary balance for measuring the fiscal impulse and the Government's structural fiscal position. These two concepts are key in developing and implementing effective and sustainable economic policies and programs.

- In particular, by excluding the amortization of actuarial gains and losses, which does not have an immediate impact on economic activity, the operating balance would provide a clearer indication of whether the Government's fiscal position is providing more or less stimulus to the economy.

- Similarly, the structural fiscal position—the budgetary balance that can be expected in the absence of economic cycles and other transitory factors—is crucial for assessing long-term fiscal sustainability. Excluding the amortization of actuarial gains and losses, which are temporary and largely unrelated to the current economic position, from its calculation would provide a more accurate view of the structural fiscal position.

Large actuarial gains and losses can also make fiscal management more challenging for governments, encouraging economically inefficient and potentially fiscally imprudent pro-cyclical behaviour. For example, when the economy is strong and interest rates are rising, governments should not be using (potentially temporary) windfalls created by actuarial gains to sponsor new program spending; similarly, governments should also be careful to avoid reflexive cuts to program spending when facing an increase in (potentially temporary) expenses related to actuarial losses.

International Examples

Other national governments have moved toward similar financial reporting concepts that isolate the impact of actuarial gains and losses for financial reporting and fiscal planning purposes. New Zealand and Australia, for example, which also use full accrual accounting, base their budgeting decisions on financial reporting that separately identifies the impact of significant revaluations on their financial results—an approach that provides a clearer accounting and better understanding of government financial performance during a fiscal year. An illustration of this dual bottom line concept can be found in the Financial Statements of the Government of New Zealand, available on the New Zealand Treasury website.

The practice of separately reporting revaluation gains and losses is also used in the Canadian private sector, under International Financial Reporting Standards, whereby all actuarial gains and losses flow directly to other comprehensive income, outside of net income. It is also in line with International Public Sector Accounting Standards, which require that actuarial gains and losses on post-employment benefits flow directly to the accumulated deficit/surplus (i.e., the prevailing public sector "debt" metric), with no direct impact on the annual deficit/surplus.

Further, a new Canadian Public Sector Accounting Standard on financial statement presentation which is set to come into effect in fiscal year 2021–22 will allow for certain re-measurement gains and losses to be reported outside of the annual deficit/surplus. Items to be excluded from the annual deficit/surplus will be identified by the Public Sector Accounting Board (PSAB), which establishes generally accepted accounting standards for the Canadian public sector, through accounting standards for specific financial statement items. According to PSAB, this presentation will help improve accountability by distinguishing financial performance arising from operating activities from the greater uncertainty associated with unrealized performance. However, it is expected that it will take several years before new standards are developed that will identify which elements should be reported outside of the deficit/surplus.

Illustration of Fiscal Projections

Table 1 below provides an illustration of the fiscal projections set out in the 2019 Economic and Fiscal Update, incorporating a new operating balance concept.

| Projection | |||||||

|---|---|---|---|---|---|---|---|

| 2018–2019 | 2019–2020 | 2020–2021 | 2021–2022 | 2022–2023 | 2023–2024 | 2024–2025 | |

| Budgetary revenues | 332.2 | 340.1 | 352.3 | 367.2 | 381.8 | 395.9 | 411.9 |

| Program expenses | 314.6 | 330.0 | 343.7 | 354.2 | 366.2 | 376.9 | 389.4 |

| Public debt charges | 23.3 | 24.4 | 23.7 | 25.3 | 27.3 | 29.5 | 31.5 |

| Expenses, excluding actuarial losses/gains | 337.8 | 354.5 | 367.5 | 379.5 | 393.5 | 406.3 | 420.8 |

| Adjustment for risk | -1.5 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | |

| Operating balance | -5.6 | -15.9 | -18.2 | -15.3 | -14.7 | -13.4 | -11.9 |

| Actuarial (losses) gains | -8.4 | -10.8 | -9.9 | -6.8 | -3.7 | -2.9 | 0.3 |

| Budgetary balance (with risk adjustment) | -14.0 | -26.6 | -28.1 | -22.1 | -18.4 | -16.3 | -11.6 |

| Federal debt | 685.5 | 713.2 | 741.4 | 763.4 | 781.8 | 798.1 | 809.7 |

Additionally, Table 2 below provides an overview of the economic and fiscal developments since Budget 2019 and their impact on the operating balance:

- Line 1 shows the budgetary balance as presented in Budget 2019. Lines 1.1 and 1.2 remove the impacts of the adjustment for risk and actuarial losses (gains), respectively, included in Budget 2019 projections to arrive at the operating balance underlying Budget 2019 (line 2).

- Lines 2.1, 2.2 and 2.3 show the impact on the operating balance of economic and fiscal developments and policy actions since Budget 2019, as well as the adjustment for risk.

- Line 3 shows the operating balance projected in the 2019 Economic and Fiscal Update. Line 3.1 adds/deducts from the operating balance the current projection of actuarial losses and gains from employee future benefit plans to calculate the final budgetary balance, shown in line 4.

- Line 3.1 presents all actuarial losses and gains expected to be recognized in a given fiscal year. The Government will explore further whether all or a subset of losses and gains should be reported outside of the operating balance. For example, the operating balance could exclude only those losses and gains due to changes in discount rates. Alternatively, the operating balance could include losses and gains arising from actual experience different from that previously assumed, and exclude losses and gains due to changes in assumptions about the future.

| Projection | |||||||

|---|---|---|---|---|---|---|---|

| 2018–2019 | 2019–2020 | 2020–2021 | 2021–2022 | 2022–2023 | 2023–2024 | 2024–2025 | |

| 1. Budget 2019 budgetary balance1 | -14.9 | -19.8 | -19.7 | -14.8 | -12.1 | -9.8 | |

| 1.1 Adjustment for risk from Budget 2019 | 0.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | |

| 1.2 Losses (gains) from employee future benefit plans | 8.6 | 6.9 | 3.4 | 1.6 | 0.0 | -0.4 | |

| 2. Budget 2019 operating balance | -6.3 | -10.0 | -13.3 | -10.2 | -9.1 | -7.1 | |

| 2.1 Economic and fiscal developments since Budget 2019, excluding losses/gains from employee future benefit plans | 0.7 | -0.3 | 0.6 | 1.1 | 1.5 | 1.8 | |

| 2.2 Policy actions since Budget 2019 | -4.1 | -2.5 | -3.2 | -4.1 | -5.0 | -5.0 | |

| 2.3 Adjustment for risk | -1.5 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | |

| 3. Operating balance | -5.6 | -15.9 | -18.2 | -15.3 | -14.7 | -13.4 | -11.9 |

| 3.1 Losses (gains) from employee future benefit plans | -8.4 | -10.8 | -9.9 | -6.8 | -3.7 | -2.9 | 0.3 |

| 4. Final budgetary balance | -14.0 | -26.6 | -28.1 | -22.1 | -18.4 | -16.3 | -11.6 |

| Note: Totals may not add due to rounding. 1 A negative number implies a deterioration in the budgetary balance (lower revenues or higher spending). A positive number implies an improvement in the budgetary balance (higher revenues or lower spending). |

|||||||

| 2008–2009 | 2009–2010 | 2010–2011 | 2011–2012 | 2012–2013 | 2013–2014 | 2014–2015 | 2015–2016 | 2016–2017 | 2017–2018 | 2018–2019 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Budgetary revenues | 237.3 | 220.6 | 239.3 | 246.7 | 254.4 | 270.0 | 279.9 | 292.6 | 290.9 | 311.2 | 332.2 |

| Program expenses | 209.7 | 242.3 | 238.4 | 238.0 | 237.9 | 233.7 | 248.7 | 263.6 | 278.7 | 297.9 | 314.6 |

| Public debt charges | 28.3 | 26.6 | 28.6 | 29.0 | 25.5 | 24.7 | 24.2 | 21.8 | 21.2 | 21.9 | 23.3 |

| Expenses, excluding actuarial losses/gains |

237.9 | 268.8 | 267.0 | 267.0 | 263.4 | 258.4 | 272.9 | 285.4 | 299.9 | 319.8 | 337.8 |

| Operating balance | -0.6 | -48.2 | -27.8 | -20.3 | -9.0 | 11.6 | 7.0 | 7.2 | -9.1 | -8.6 | -5.6 |

| Actuarial (losses) gains | -8.5 | -8.2 | -7.2 | -7.7 | -12.3 | -19.7 | -7.6 | -10.1 | -9.9 | -10.4 | -8.4 |

| Budgetary balance | -9.1 | -56.4 | -35.0 | -28.0 | -21.3 | -8.1 | -0.6 | -2.9 | -19.0 | -19.0 | -14.0 |