Deposit Insurance Review: Consultation Paper

Table of contents

1. Introduction

Canada has one of the strongest and most resilient banking systems in the world. It remains strong and well-capitalized with a robust regulatory framework and contingency tools to support financial stability.

The deposit insurance framework for federally regulated financial institutions is an integral feature of the financial system safety net, along with effective regulation, supervision, the resolution framework, and liquidity support. Deposit insurance contributes to public confidence in the financial system by protecting depositors' savings in the unlikely event that a deposit-taking institution fails (that is, experiences severe financial difficulties so that it cannot meet its financial obligations and becomes non-viable). There has not been a deposit insurance payout in almost 30 years.

While deposit insurance primarily aims to support stability and protect depositors in the event of a financial institution's failure, the framework also plays a role in fostering a more competitive financial sector. By leveling the playing field between institutions of different sizes, deposit insurance can enhance competition. Since all insured deposits are equally protected, regardless of an institution's size or risk profile, smaller and medium-sized institutions can compete more easily for deposits and customers.

The government undertakes regular reviews of financial safety net frameworks to ensure they remain effective, responsive to evolving risks, and continue to promote high levels of public confidence. The last review of the deposit insurance framework began in 2014 and led to legislative changes in 2018. These included extending coverage to foreign currency deposits, treating all registered products in the same manner by creating new categories, and improving the rules for trust deposit accounts. Annex A provides a more detailed list of past adjustments.

In March 2023, the global banking system experienced volatility, which included the failure of three regional banks in the United States and Credit Suisse, a global systemically important bank. While the Canadian financial sector was not materially impacted and performed well during both the pandemic and the March 2023 events, these events reminded global policy makers that large banks can experience runs that can quickly contribute to their failure. Lessons from these events have pointed to the important role deposit insurance can play in promoting stability.

Maintaining effectiveness of the federal deposit insurance framework requires ongoing assessment to adapt to the evolving financial system and marketplace. Given significant changes in Canada's economic environment and financial services sector, a review of the deposit insurance framework is timely.

In this context, Budget 2024 announced the government's intention to undertake a review of the federal deposit insurance framework to be led by the Department of Finance Canada, to ensure it continues to support the evolving needs of Canadians and to uphold financial stability.

Through this consultation paper, the department is seeking views on possible improvements to the deposit insurance framework based on the specific proposals identified. The department welcomes views with respect to these and other potential enhancements to the framework.

2. Background

2.1 International Guidance

Deposit insurance protects depositors' savings in the unlikely event that a financial institution fails. This contributes to maintaining public confidence in the financial system, reduces the likelihood of bank runs, and promotes financial stability.

Bank runs can occur if customers of a financial institution are concerned about the financial institution's soundness (financial health) and withdraw their deposits over fears the financial institution may not be able to honour their future withdrawal requests. If more and more customers get concerned and withdraw their funds, this may strain the financial health of the institution further and in some cases, could lead to its failure.

The International Association of Deposit Insurers has established Core Principles of Effective Deposit Insurance Systems (see link at the end of this document). These guidelines state that the level and scope of deposit insurance coverage should be credible but limited.

Specifically, most depositors across insured institutions should be fully protected, in order to minimize the risk of bank runs. With the protection offered by deposit insurance, depositors are less likely to withdraw their funds in times of perceived or real stress, thus reducing the risk of bank runs and potential contagion across the financial system.

At the same time, a substantial proportion of the value of deposits should be left unprotected and therefore exposed to market discipline. Market discipline refers to the fact that uninsured depositors are exposed to the risk of loss in the event of a bank failure. Therefore, depositors who have funds not covered by deposit insurance have an incentive to monitor the performance and risk management practices of the member institution and to keep their funds in a member institution they consider to be safe.

Depositors holding large value deposits are generally viewed as best positioned to monitor risk-taking by financial institutions and exert this market discipline, given they are considered to have the financial sophistication needed to judge the soundness of a financial institution.

2.2 The Canadian Deposit Insurance Framework

Framework Structure

The federal deposit insurance framework is established under the Canada Deposit Insurance Corporation Act and administered by the Canada Deposit Insurance Corporation (CDIC), a federal Crown corporation under the purview of the Minister of Finance. (Please note, each of Canada's ten provinces has a provincial deposit insurance framework and a provincial deposit insurer responsible for deposit insurance protection at provincial credit unions and caisses populaires.)

CDIC's legislative objects include providing insurance against the loss of deposits held at its member institutions, promoting financial stability, and acting as the resolution authority for its members.

CDIC membership is comprised of deposit-taking institutions such as banks, federally incorporated trust and loan companies, and federal credit unions. CDIC currently has 84 members. CDIC is funded by premiums paid by member institutions and does not receive public funds to operate. Deposit insurance provided by CDIC is free and automatic for depositors.

The coverage provided by Canada's deposit insurance framework consists of three main elements:

- The categories of eligible deposits;

- The coverage limit; and

- The scope of eligible deposits.

| The CDIC Coverage Limit is $100,000. | |

|---|---|

| Coverage extends to Eligible Deposits held in CDIC member institutions in each of the following nine categories up to the limit: | Eligible Deposits are deposits in Canadian or foreign currency, payable in Canada, in the form of: |

|

|

The deposit insurance limit of $100,000 applies to eligible deposits in each of the nine categories listed above (for deposits held at CDIC member institutions). To calculate the insured deposits a depositor has for each deposit category, one needs to combine all the deposits of that depositor falling within a category that are held at a member institution and apply the limit of $100,000 per category. Please see Example 1 in Annex B.

Depositors have access to total coverage above $100,000 when they have multiple accounts:

- Across deposit insurance categories: by holding deposits in more than one category at the same member institution, depositors are able to access coverage above $100,000. To calculate the total insured deposits a depositor has at a particular member institution, one needs to add the insured deposits that the depositor holds in each deposit category at the member institution. Please see Example 2 in Annex B.

- Across member institutions: by holding deposits with more than one CDIC member institution, depositors are able to access coverage above $100,000 and diversify the location of their deposits. To calculate the total insured deposits a depositor has across member institutions, one needs to add the depositor's insured deposits at various member institutions.

- Across affiliated member institutions within a banking group: By placing deposits in the same deposit category at affiliated CDIC members within a banking group, depositors are able to access coverage above $100,000. CDIC member institutions consolidate to 54 member groups on the basis of affiliation with a parent. Please see Example 3 in Annex B.

In order for deposit insurance coverage to apply, deposits must be eligible deposits (which can be held in any currency). Please see Example 4 in Annex B.

This means that deposit insurance coverage does not apply to the following:

- Foreign deposits: deposits payable in other countries are ineligible and so are not covered by CDIC deposit insurance (these deposits may however be insured by the host jurisdiction's deposit insurance scheme).

- Financial products such as investment products (for example, mutual funds, stocks and bonds, exchange traded funds, etc.) and cryptocurrencies: these products do not fall within the definition of deposits and so are not covered by deposit insurance.

In the unlikely event of a bank failure in which CDIC undertakes a reimbursement of insured deposits, if a depositor had deposits that exceeded the limit, the depositor would need to contact the court-appointed liquidator handling the failed bank to file a claim for the amount above the deposit insurance limit.

The Canadian deposit insurance framework does not differentiate between types of depositors (for example, between personal and corporate depositors), so the framework applies equally to personal and corporate deposits. Throughout this paper, depositors have been categorized as either retail depositors or non-retail depositors:

- Retail depositors include individuals and sole proprietorships (that is, accounts held by natural persons).

- Non-retail depositors include corporations (large and small-medium enterprises), municipalities/universities/schools/hospitals, and not-for-profit organizations (that is, accounts held by legal persons).

Framework Coverage

When assessing the protection offered by the deposit insurance framework, all of the elements of the framework should be taken into account, as outlined above: the categories of eligible deposits; the coverage limit; and the scope of eligible deposits.

While the limit was not increased as part of the last deposit insurance review in 2014, changes were made that clarified the framework and improved overall depositor protection.

For example, the scope of eligible deposits was broadened as part of the last review, to reflect the changing marketplace.

- Deposits held in foreign currency became eligible for deposit insurance.

- Products with terms greater than five years were made eligible for deposit insurance.

In addition, a new deposit insurance category (First Home Savings Account) was added when this new registered plan was announced in Budget 2022 and came into effect in 2023. This new category provides an additional $100,000 of protection to eligible depositors who take advantage of this new financial product. These changes together have resulted in a sizeable increase in depositor protection.

In line with international best practices, Canada's deposit insurance framework is a limited coverage framework. It covers the vast majority of depositors but leaves a substantial proportion of the value of deposits exposed to the possibility of loss in the event of a bank failure.

- Recent analysis undertaken by CDIC shows that approximately 95 per cent of all eligible deposit accountsFootnote 1 are fully covered under the current framework.

- At the same time, in terms of total dollars deposited, approximately 37 per cent of the total value of eligible deposits held by CDIC member institutions is covered.

These numbers show that despite the changes in deposit dynamics and the growth in uninsured eligible deposits outlined below, depositor protection under the current deposit insurance framework remains strong.

3. The Deposit Insurance and Financial Services Landscape

3.1 Trends

There have been significant changes in the economic, social, and technological environment since the last review was launched in 2014, and the financial and economic conditions in Canada have evolved. For example:

- Since January, the unpredictability of US trade policy has caused a sharp increase in uncertainty and market volatility. Despite this, Canadian banks remain well positioned to support the financial system and the broader economy, even through a period of financial stress.

- Changes in savings patterns and wealth transfers (in part due to changing demographics) and increasing digitalization and innovation in the financial sector have all impacted depositor protection needs.

- Digitalization and innovation are changing depositor behaviour and the way that banking services are provided. For example, more Canadians are engaging with their financial service providers through online banking/financial services platforms.

There have also been significant changes to the deposit landscape since the last review, including sustained growth in uninsured eligible deposits driven by trends in savings patterns and wealth transfers.

In February 2023, CDIC launched a study that included comprehensive analysis of detailed data from its member institutions to assess deposit trends and savings behaviour. It analyzed detailed member data to generate insights on the size and nature of different types of deposits held at each institution. This data provides a deeper understanding of the deposit sector. Highlights of the findings are outlined in Section 4.

Analysis shows that the composition of deposits held at CDIC member institutions has changed significantly since the 2014 review. Of note, Chart 1: Deposit Growth Across CDIC's Membership (2005-2024), shows that the growth of uninsured eligible deposits (i.e., eligible deposits in excess of $100,000) has significantly outpaced the growth of insured deposits. These uninsured eligible deposits grew by 594 per cent from $315 billion in 2005 to $2,183 billion in 2024, while insured deposits grew by 183 per cent from $438 billion to $1,241 billion over the same time period. Consequently, the proportion of deposits that are insured as a percentage of total eligible deposits across CDIC's membership has declined from 58 per cent in 2005 to 36 per cent in 2024, a trend that accelerated during the pandemic.

Deposit Growth Across CDIC's Membership (2005-2024)

$ Billion

Considerations

The policy objectives of depositor protection and financial stability will guide the review of the deposit insurance framework. The government will take the following considerations into account when deciding what changes to the deposit insurance framework, if any, are necessary.

- Depositor Protection: Increasing the scope and level of coverage would increase depositor protection and help reflect changing protection needs of depositors. Any increase in the scope or level of coverage would result in a proportionate increase in CDIC exposure that would generally need to be offset through additional premiums paid by CDIC member institutions, thereby potentially affecting the cost of financial services to consumers. In finalizing its position, the government will aim to balance meeting depositor needs and the cost of doing so.

- Financial Stability: Deposit insurance protects depositors' savings in the unlikely event that a deposit-taking institution fails, which increases depositor confidence and reduces the likelihood of bank runs, thereby promoting financial stability. Increasing deposit insurance coverage thus generally contributes to financial stability. However, as outlined above, a substantial proportion of deposits should be left uncovered (that is, exposed to market discipline), to ensure depositors have an interest in the risk management practices of the member institution. Changes to the deposit insurance framework should therefore balance the financial stability benefits of increased coverage against the potential increase in risk-taking in the banking system.

While the Canadian deposit insurance framework is mature and depositors at CDIC member institutions remain well protected, ensuring that the framework remains relevant requires ongoing assessment in light of the evolving financial sector, marketplace, saving patterns of Canadians and the current economic environment.

4. Policy Questions and Proposals

The department is seeking views on a range of issues and potential enhancements to the deposit insurance framework that merit consideration. Questions have been posed to facilitate discussion.

As noted above, depositor protection under the current deposit insurance framework remains strong.

There may be areas, however, where changes could be made to improve depositor protection, depositor comprehension, and the deposit insurance framework's support of financial stability.

4.1 Increasing the Deposit Insurance Limit

The department is considering increasing the deposit insurance limit to $150,000 per category.

The current deposit insurance limit of $100,000 per deposit category was increased from $60,000 in 2005. The adequacy of the limit was last assessed during the last review. It was determined at that time that the limit remained appropriate, and that raising the limit would not have materially enhanced depositor protection.

Since then, there has been a deterioration of the real value of available coverage due to inflation. To maintain the real value of deposit protection as it was set in 2005 (i.e., $100,000 in 2005 dollars), the adjusted limit today would need to be set at approximately $150,000.

Further, there has been an increase in deposits that exceed the $100,000 limit at CDIC member institutions, due to evolving trends in Canadians' savings patterns and changing demographics. For example, approximately 95 per cent of all eligible deposit accounts are currently fully covered as compared to 97 per cent in 2014.

While the Canadian financial sector was not materially impacted by the March 2023 banking turmoil, the bank failures in the United States resulted in public focus on deposit insurance in Canada. The episode led to media coverage and questions from the public about the deposit protection offered in Canada, in particular, comparing the Canadian limit to that in other jurisdictions.Footnote 2

We should consider all elements of a framework (deposit categories, coverage limit, and scope of eligible deposits) when assessing the protection offered by a deposit insurance framework. While the Canadian deposit insurance limit of $100,000 appears to be lower than comparable G7 countries, all of these countries, with the exception of the United States, apply their limit on a per institution basis. In Canada, the United States, and many Canadian provinces, the limit applies to each category at each institution, which provides substantially more protection for depositors.

| Deposit Insurance Limits of G7 CountriesFootnote 3 | |

|---|---|

| Country | Coverage/Limit |

| Canada | 9 Categories each at $100,000 CAD |

| United States | 14 Categories each at US$250,000 ($349,225.00 CAD) |

| United Kingdom | £85,000 ($157,547.50 CAD) |

| France, Germany, Italy | €100,000 ($156,200CAD) |

| Japan | ¥10,000,000 ($95,220 CAD) |

| Deposit Insurance Limits of Canada and Canadian Provinces | |

|---|---|

| Jurisdiction | Coverage/Limit |

| Canada, Quebec | 9 Categories each at $100,000 |

| New Brunswick, Newfoundland and Labrador | 9 Categories each at $250,000 |

| Nova Scotia | 8 Categories each at $250,000 |

| Ontario | 3 Categories each at $250,000 for deposits in non-registered accounts Unlimited for deposits in registered and tax-free accounts |

| Prince Edward Island | 3 Categories each at $125,000 for deposits in non-registered accounts Unlimited for deposits in registered and tax-free accounts |

| Manitoba, British Columbia, Saskatchewan, Alberta | Unlimited |

The limit (per deposit category) could be set at different levels.

- $150,000 limit: A limit set at $150,000 per deposit category would offset inflationary effects (as it represents the current $100,000 limit adjusted for inflation).

- $250,000 limit: A limit set at $250,000 per deposit category would align with that of the United States and some Canadian provinces, and may provide better protection for non-retail depositors.

Table 3 below shows the varying levels of protection by type of depositor if the limit were increased to $150,000 and to $250,000. It is important to note that this table shows the results of potential increases to the deposit limit with the deposit insurance framework as it is currently structured. If changes were made to the structure of the framework by, for example, providing a higher limit to non-retail depositors (please see the discussion in section 4.2 below), these numbers would have to be updated.

| Percentage of Eligible Deposit Accounts Fully Protected | |||

|---|---|---|---|

| Depositor Type | $100,000 limit | $150,000 limit | $250,000 limit |

| Retail | 96.33% | 97.97% | 98.97% |

| Non-retail | 91.32% | 94.87% | 96.67% |

| All | 95.48% | 97.44% | 98.58% |

| Data source: Data and System Requirements data collected by CDIC as part of the 2023 Deposit Insurance Study. | |||

For purposes of the table, depositors have been categorized as either retail depositors (eligible deposit accounts held by natural persons) or non-retail depositors (eligible deposit accounts held by legal persons, such as corporations, municipalities or not-for-profit organizations).

- If the limit were increased to $150,000, the level of protection for retail depositors would increase to approximately 98 per cent (from the current 96 per cent) of eligible deposit accounts fully protected, while protection for non-retail depositors would increase to approximately 95 per cent (from the current 91 per cent).

- If the limit were increased to $250,000, this would increase protection to approximately 99 per cent for retail depositors and 97 per cent for non-retail depositors.

Issues for Consultation

The deposit insurance limit has not been increased since 2005 and since then there has been a deterioration of the real value of deposit protection such that the adjusted limit today would be approximately $150,000. Further, evolving trends in Canadians' savings patterns and changing demographics have increased the number of deposits that exceed the $100,000 limit and decreased the proportion of fully protected depositors.

The department is considering increasing the deposit insurance limit to $150,000 per category. Such an increase to the limit would offset the effect of inflation on the limit and would increase the proportion of fully protected depositors.

In addition, the department is considering other enhancements to the deposit insurance framework (see sections below). Taken together, all these enhancements would increase coverage appreciably.

What are your views on the department considering increasing the deposit insurance limit to $150,000 per category?

Should there be a mechanism for periodic revisions to the limit?

Further, periodic reviews of the limit outside of regular reviews e.g., every five years, could be considered to ensure the limit remains relevant to depositors and adapts to emerging trends.Footnote 4 CDIC could provide a recommendation on the deposit insurance limit to the Minister of Finance at regular intervals. This would require member institutions to provide more detailed data at regular intervals to support CDIC's recommendations.

4.2 Providing a Higher Deposit Insurance Limit to Non-Retail Depositors

The department is considering providing a deposit insurance limit of $500,000 per category to non-retail depositors.

Currently, the Canadian deposit insurance framework does not differentiate between types of depositors. For purposes of this discussion, depositors have been categorized as either retail depositors (natural persons) or non-retail depositors (legal persons). Non-retail depositors include corporations, municipalities/universities/schools/hospitals, and not-for-profit organizations.

While the framework currently applies equally to all depositors, the way it has evolved, including how new deposit categories have been added over time, has been focused primarily on the savings habits and needs of retail (individual) depositors.

The current structure of the framework, with its various deposit insurance categories, is best aligned with the deposit holdings of retail depositors. For example, some categories of deposits, such as the various registered/tax-free categories (e.g., RRSP, RRIF, FHSA, etc.), are not available to corporate depositors.

As a result, non-retail depositors are not able to benefit as extensively from stacking across deposit insurance categories to access coverage above $100,000. To do this, non-retail depositors would typically need to hold deposits with more than one CDIC member institution (stacking across member institutions) or with affiliated member institutions (stacking across a banking group).Footnote 5

The needs of retail and non-retail depositors are also different. Many non-retail depositors hold deposit accounts specifically for operational purposes, to fund their ongoing operations (e.g., transactional accounts to cover payroll, pay suppliers, etc.). Any delay or cessation in access to the funds in these accounts could be highly disruptive. If these entities were unable to access the funds in the accounts they use to fund their daily operations, this could threaten their ability to continue to carry out business. For example, these entities may not be able to make payroll or pay their suppliers. This would in turn impact their employees and vendors, which could potentially harm the economy.

Further, these accounts can often be subject to large fluctuations through a monthly business/operational cycle. Depending on the size of the non-retail depositor, the balances held in these accounts can significantly exceed the current $100,000 limit per deposit category.

There may be additional policy considerations associated with certain types of non-retail depositors that could argue for greater protection.

- Small and medium-sized enterprises: The holdings, needs, and level of sophistication of small business depositors and large corporate depositors can be vastly different given relative access to resources and different banking practices. For example, many small businesses hold all their funds at a single CDIC member institution (where they maintain their business relationship), making the stacking of deposits across multiple member institutions more challenging. Given these smaller businesses are more vulnerable, it may be appropriate to provide them with greater coverage.

- Municipalities, universities, schools, and hospitals: In addition to paying employees and suppliers with their operational accounts, the activities of these entities serve a public purpose and impact the lives of Canadians. The loss of these deposits could have broader societal impacts, so providing these entities with greater coverage would help mitigate the impact of the loss of deposits for those who would benefit from these deposits.

- Not for profit organizations: Similarly, deposits held for charitable purposes serve a social purpose and could argue for greater coverage of these deposits.

Consideration could be given to adjusting the framework to better meet the needs of non-retail depositors by increasing the deposit insurance limit for those depositors. Given non-retail depositors generally have higher and more variable balances than most retail depositors, the limit increases considered in section 4.1 above may not be sufficient to meet their specific needs.

A higher limit for non-retail depositors would also recognize the fact that these depositors do not have access to stacking within a member institution, as many deposit categories are not available to them.

| Percentage of Non-Retail Eligible Deposit Accounts Fully Protected | |||

|---|---|---|---|

| Depositor Type | $100,000 limit | $500,000 limit | $1,000,000 limit |

| Non-retail | 91.32% | 98.20% | 99.06% |

| Data source: Data and System Requirements data collected from CDIC as part of the 2023 Deposit Insurance Study. | |||

In Table 4 above, non-retail depositors include small and medium-sized enterprises; large corporations; and other non-retail depositors (municipalities, universities, hospitals, schools, not for profit organizations, and governments).

As discussed above, the deposit insurance framework has been designed to leave a substantial amount of deposits unprotected in order to encourage large depositors to monitor the performance and risk management practices of financial institutions and exert market discipline. Large value depositors (and in particular large corporate depositors) are generally viewed as sophisticated and best able to play this role. Given the need to preserve this market discipline, care would have to be taken when increasing the limit for non-retail depositors (and in particular for large corporate depositors).

| Percentage of Non-Retail Deposits Protected | |||

|---|---|---|---|

| Depositor Type | $100,000 limit | $500,000 limit | $1,000,000 limit |

| Non-retail | 10.74% | 17.42% | 20.66% |

| Data source: Data and System Requirements data collected from CDIC as part of the 2023 Deposit Insurance Study. | |||

For example, a deposit limit of $500,000 for non-retail depositors would still leave 83 per cent of the total value of deposits held by CDIC member institutions uncovered (in terms of total dollars deposited). This amount could generally be viewed as sufficient to continue to exert market discipline.

Consideration could also be given to providing further targeted increases to different types of non-retail depositors, for example different limits could be set for corporations, municipalities, hospitals, schools, not-for-profit organizations, and governments. This would introduce significant complexity into the framework, which may not be warranted as all types of non-retail depositors losing access to their funds could result in significant downstream economic impacts.

Any option considered will need to balance the financial stability benefits of increased coverage against the potential increase in risk-taking in the banking system, leaving a substantial amount of deposits unprotected in order to preserve market discipline.

Issues for Consultation

Currently, the Canadian deposit insurance framework does not differentiate between retail and non-retail depositors. While the framework applies equally, its evolution has focused primarily on retail depositors with the addition of many categories that are not available to corporate depositors. The needs of retail and non-retail depositors are also different, with many non-retail depositors holding operational deposit accounts (e.g., transactional accounts to cover payroll, pay suppliers, etc.) that are subject to large fluctuations exceeding the current limit. Loss of access to these operational deposits could have significant downstream economic impacts.

Given the above, the department is considering providing a deposit insurance limit of $500,000 per category to all non-retail depositors. Such an increase would recognize the fact that non-retail depositors have less access to stacking, and that loss of access to their operational deposits could have significant downstream economic impacts.

What are your views on the department considering increasing the deposit insurance limit to $500,000 per category for non-retail depositors?

4.3 Temporary High Balances

The department is considering extending coverage for temporary high balances for depositors experiencing significant life events, with the following features:

- Coverage would be provided for an enumerated list of life events such as real estate transactions; inheritance; divorce settlements; insurance payout; and damage settlements;

- Extended coverage would be for a period of six months; and

- The limit would be set at $1 million (although consideration could be given to unlimited for certain life events).

A temporary high balance is a large, transactional balance that is typically held by depositors for a limited amount of time and for a specific reason. Temporary high balances could include large lump sum payments such as those received from an inheritance, an insurance payout, a divorce settlement, or the proceeds from the sale of a home.

The Canadian deposit insurance framework does not currently provide for additional coverage of these temporary high balances. However, Canada's aging population may result in an increased number of the life events leading to temporary high balances, such as real estate sales or inheritance.

While still uncommon internationally, the last decade has seen an increase in the number of jurisdictions offering this type of coverage, in particular in Europe. European Union member states are required to incorporate some form of temporary high balance coverage into their deposit insurance frameworks.Footnote 6

The design of temporary high balance coverage is very flexible, but there are certain features that are consistently highlighted across jurisdictions.

Eligible Depositors

The intent of temporary high balance deposit coverage is to protect depositors from a bank failure occurring as they transition through major life events. Accordingly, it usually applies to natural persons only.

Eligible Life Events

Temporary high balance coverage can be designed to apply to significant life events generally, or an enumerated list of life events. General application results in flexibility, while an enumerated list provides clarity and certainty. Some examples of life events that are covered internationally are:

- the sale or purchase of a home;

- payments received in connection with marriage, divorce, retirement, dismissal, disability, or death; or

- payments for insurance compensation or compensation resulting from a criminal offence or miscarriage of justice.

Limit for Temporary High Balances

Approaches to setting limits on temporary high balance coverage range from relatively small, fixed amounts to unlimited coverage. Some European jurisdictions have different limits for each type of life event covered under their framework (i.e., the limit for real estate transactions could be based on the average home price, but certain other life events could lead to substantially higher temporary high balances and given their extraordinary nature, could be covered entirely, for example, damage settlements for a personal injury). Calculation of the coverage can also aggregate amounts in the case of multiple life events or consider each event separately.

Duration of Temporary High Balance Coverage

Temporary high balance coverage is intended to protect deposits for a limited amount of time, giving depositors enough time to organize their financial affairs and obtain protection under the regular coverage framework. Internationally, timeframes vary between three months to a year.

Issues for Consultation

The Canadian deposit insurance framework does not currently provide for additional coverage of temporary high balances.

Given the above, the department is considering extending coverage for temporary high balances for depositors experiencing significant life events where coverage would be provided for an enumerated list of life events such as real estate transactions, inheritance, divorce settlements, insurance payout and damage settlements; for a period of six months from the date of the high balance deposit; with a deposit insurance limit of $1 million (although consideration could be given to unlimited for certain life events). Such an extension would significantly increase coverage for depositors transitioning through major life events when they may temporarily need greater protection.

What are your views on the department considering extending coverage for temporary high balances for depositors experiencing significant life events as proposed above?

Should consideration be given to an unlimited deposit insurance limit for certain life events?

4.4 Framework Simplification

The department is considering streamlining deposit insurance categories to four categories by merging the registered and tax-free categories.

The department is considering making deposit insurance coverage for the merged registered and tax-free category unlimited (i.e., no limit).

The structure and composition of the deposit insurance framework has evolved considerably over time. The framework put in place at the inception of Canada's deposit insurance regime in 1967 covered one category of deposits, with a limit of $20,000. Two additional categories (joint deposits and deposits held in trust) were added in 1977.

The framework has developed since then to reflect the evolution of the marketplace, and new deposit categories have been added over time as new financial products were offered. The addition of new deposit insurance categories in the registered space (registered and tax-free products) has mirrored changes made to the tax rules in the Income Tax Act. Today's framework covers the nine deposit categories, outlined above in section 2.2.

While the addition of new categories over time has increased depositor protection overall, it has also introduced a level of complexity to the deposit insurance framework. This complexity may not be conducive to promoting depositors' understanding of the framework and the coverage it provides.

Research shows that one of the best ways to reinforce trust in deposit insurance is to ensure depositors are aware of it and understand how it works. There could therefore be value in considering framework simplification, in order to improve depositor comprehension, while maintaining the overall protection benefits offered under the current framework structure.

This could be achieved by merging certain categories that share key characteristics. Such a restructuring would reduce the number of categories that depositors would need to consider when placing their deposits. This may also help improve depositor understanding of how coverage applies.

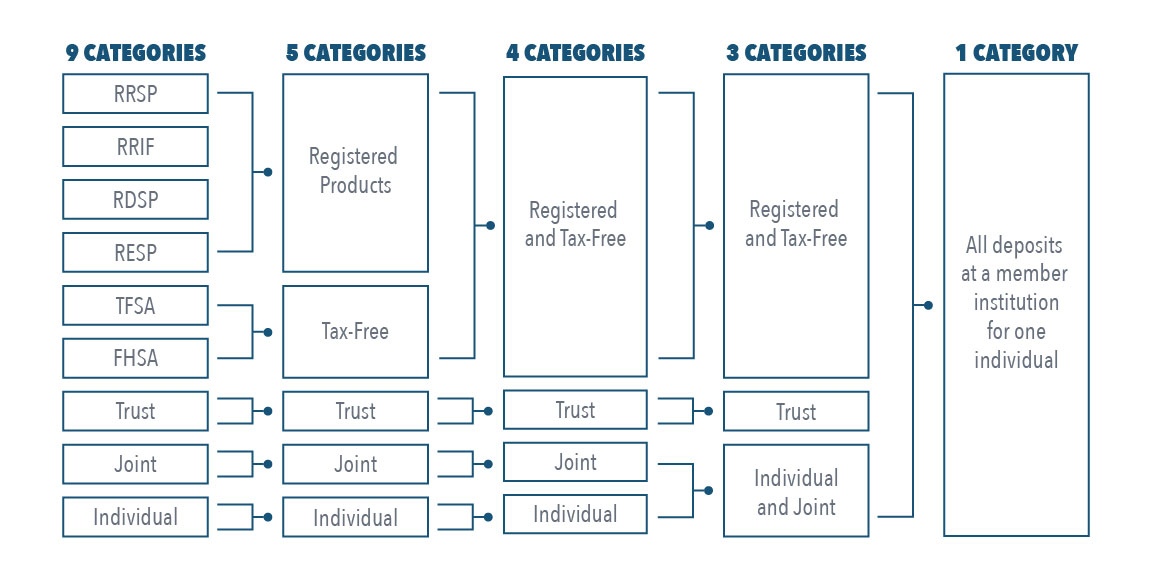

Various options for streamlining the deposit insurance framework by merging some categories of deposits could be considered (Figure 2). Should the deposit insurance framework be streamlined, the intent would not be to reduce the protection offered by the framework. This could be achieved by applying a higher limit to any streamlined category. As noted above in section 4.1, the vast majority of international jurisdictions apply their limit on a per institution basis which is depicted as 1 category below.

Options for Streamlining Deposit Insurance Categories

Streamlining deposit insurance categories may also have unintended consequences and could lead to confusion among some depositors who are familiar with the current deposit categories/acronyms used to sell deposit products. Applying different limits to different deposit insurance categories would increase the complexity of the framework, which could lead to reduced depositor understanding.

Measures could be taken to avoid multiple limits. For example, if the deposit insurance categories for registered and tax-free products were merged (see the option of four categories in Figure 2 above), deposit insurance coverage could be made unlimited (i.e., no limit). Amounts held in registered and tax-free categories are otherwise limited by tax rules set under the Income Tax Act. This could streamline the framework while still maintaining an effective limit through the tax rules. Such an approach is not unlike the approach taken by the provinces of Ontario and Prince Edward Island, where registered accounts (e.g., RRSP, RRIF, TFSA) have unlimited coverage.

Issues for Consultation

Most international jurisdictions apply their deposit insurance limit on a per institution basis. In contrast, most North American jurisdictions apply their limit to each deposit insurance category at each institution. The structure of the Canadian deposit insurance framework has evolved over time to include nine deposit categories.

On balance, the department is of the view that simplifying the deposit insurance framework by streamlining some categories is worth considering in order to improve depositor understanding. As a result, the department is considering streamlining deposit insurance categories to four categories by merging the registered and tax-free categories (please see Figure 3 below).

Figure 3 Proposal for Streamlining Deposit Insurance Categories

Proposal for Streamlining Deposit Insurance Categories

The department is also considering further simplification by making deposit insurance coverage for the merged registered and tax-free category unlimited (i.e., no limit). Given the intent to not reduce the protection offered by the framework, a new higher limit would need to be applied to the streamlined category. This could simplify the framework while still maintaining an effective limit mirroring the tax rules.

What are your views on the department considering streamlining deposit insurance categories to four categories by merging the registered and tax-free categories?

What are your views on providing unlimited deposit insurance coverage for that merged category?

4.5 Enhancing Depositor Comprehension Through Improved Disclosure

The department is considering strengthening disclosure requirements to require that a member institution provide its customers with tailored information explaining the amount of insured deposits that are held at that member institution for that customer.

Recent financial market turbulence in the United States highlighted the impact that social media can have during a financial crisis. The speed with which negative information (whether true or false) about a financial institution and deposit insurance can reach depositors is faster than ever before. This concern is even more relevant given the current economic environment.

In times of financial uncertainty, depositors will seek to validate the information they are receiving from social media and try to understand whether the deposits they hold with their financial institution(s) are protected by deposit insurance. They will most often seek this information from trusted resources, such as their financial institution or advisors.

Currently, CDIC member institutions are required to provide general information to depositors about the deposit insurance framework (e.g., via brochures) and about CDIC itself (e.g., via the posting of a CDIC logo). However, institutions are not required to inform their depositors about the actual deposit insurance coverage applicable to the funds they hold at that institution.

Disclosure requirements could be strengthened to require that member institutions provide their customers with tailored information explaining the amount of insured deposits that are held at that member institution for that customer.

Issues for Consultation

To further strengthen depositor confidence, the department is considering strengthening disclosure requirements by requiring that a member institution provide its customer with tailored information explaining the amount of insured deposits that are held at that member institution for that customer.

This could be provided upon request or on an ongoing basis through customer support lines, banking statements, or on-line banking platforms. This would enhance depositor comprehension and confidence, which would in turn support financial stability.

What are your views on the department considering strengthening disclosure requirements to require that member institutions provide their customers with tailored information explaining the amount of insured deposits that are held at that member institution for that customer?

Annex A – Recent Changes to the Canadian Deposit Insurance Framework

Budget 2023

Temporary Authority

- In force from June 22, 2023 to April 30, 2024.

- Temporarily authorized the Minister of Finance, upon the Governor in Council's approval, to increase the deposit insurance limit.

- The Minister must be of the opinion that it is necessary to promote the stability or maintain the efficiency of the financial system in Canada.

- The Minister must consult the heads of the financial sector agencies.

- This temporary authority was not used and the deposit insurance limit remained unchanged.

April 2022

2014 Review Phase 2 Measures

- Came into force April 30, 2022.

- Measures to modernize the scope of deposit insurance coverage, simplify and streamline requirements, and better reflect products currently offered in the market by:

- Treating all registered products in the same manner by adding new deposit categories for registered education savings plans (RESPs) and registered disability savings plans (RDSPs), so that every registered product is covered up to the same $100,000 limit.

- Removing separate coverage for mortgage tax accounts (funds held in mortgage tax accounts will still receive coverage under other coverage categories as long as the funds are held as an eligible deposit, e.g. as an individual or joint deposit).

- Improving the rules for trust deposit accounts, by clarifying record-keeping requirements and facilitating more timely payouts in the event that a bank fails.

Budget 2021

Targeted Amendments

- The Budget Implementation Act, 2021, No. 1 amended the CDIC Act to provide CDIC with a targeted expansion of its authorities to improve timeliness and efficiency of the deposit insurance payout process. These provisions came into force, on April 30, 2022 alongside the Phase 2 measures they amended.

- The Budget Implementation Act, 2021, No. 1 also introduced a two year transitional rule, where a failure to meet a requirement of the schedule to the CDIC Act could be remedied within 90 days of the failure of an institution. The transitional rule expired on April 30, 2024.

May 2020

Regulatory Relief

- The coming into force of the 2014 Review Phase 2 measures was delayed from April 30, 2021 to April 30, 2022 (Order in Council P.C. 2020-0337).

- The delay allowed financial institutions to focus on managing the uncertainties related to the COVID-19 pandemic, providing them with additional time to meet the new requirements.

April 2020

2014 Review Phase 1 Measures

- Came into force April 30, 2020.

- Measures to modernize the scope of deposit insurance coverage, simplify and streamline requirements, and better reflect products currently offered in the market by:

- Removing travellers' cheques, which are no longer issued by member institutions, as an eligible deposit.

- Eliminating the five-year term limit on guaranteed investment certificates (GICs), as longer-term products are now available.

- Extending coverage to foreign currency deposits, which are widely used by Canadians.

March 2020

Temporary Authority

- In force from March 25, 2020 to Sept 30, 2020.

- Temporarily authorized the Minister of Finance to increase the deposit insurance limit.

- This temporary authority was not used and the deposit insurance limit remained unchanged.

2005

Deposit Limit Increase

- The limit was increased from $60,000 to the current $100,000.

Annex B – Deposit Insurance Framework Primer

The deposit insurance limit of $100,000 applies to eligible deposits in each of the nine categories listed above (for deposits held at CDIC member institutions).

To calculate the insured deposits a depositor has for each deposit category, we need to combine all the deposits of that depositor falling within a category that are held at a member institution and apply the limit of $100,000 per category. Please see Example 1 below.

Example 1

Calculating Insured Deposits Per Category

Insured Deposits Per Deposit Category

Julie does all her banking at SafeBank (a CDIC Member Institution). She has the following accounts (deposits) in her own name:

| Chequing account (in one name) | $40,000 |

|---|---|

| Savings account (in one name) | $90,000 |

| Total (in one name) | $130,000 |

Both of those accounts fall in the category of "deposit held in one name". In order to calculate Julie's insured deposits for that category, we have to add the amounts held in both of those accounts ($130,000), and then apply the deposit insurance coverage limit ($100,000) to the category.

| Total (deposit in one name category) | $130,000 |

|---|---|

| Deposit insurance limit (per category) | $100,000 |

| Insured Deposits for that category | $100,000 |

This means that if SafeBank were to fail, Julie would receive deposit insurance of $100,000 for that deposit category (that is, the deposit accounts (chequing and savings) held in her name).

By holding deposits in more than one category at the same member institution, depositors are able to access coverage above $100,000. This is referred to as "stacking".

To calculate the total insured deposits a depositor has at a particular member institution, one needs to add the insured deposits that the depositor holds in each deposit category at the member institution. Please see Example 2 below.

Example 2

Calculating a Depositor's Total Insured Deposits at a Single CDIC Member Institution

Insured Deposits Per Deposit Category

In addition to the accounts outlined in Example 1 above, Julie also has a joint account with her spouse at SafeBank:

| Chequing account (joint) | $80,000 |

|---|---|

| Total (joint) | $80,000 |

This account falls in the category of "deposits held in more than one name" (joint), which is a different category than "deposits held in one name". This means that Julie would benefit from deposit insurance for that category as well.

In order to calculate Julie's insured deposits for that category, we have to apply the deposit insurance coverage limit ($100,000) to this new category.

| Total (deposits in more than one name) | $80,000 |

|---|---|

| Deposit insurance limit (per category) | $100,000 |

| Insured Deposits for that category | $80,000 |

This means that if SafeBank were to fail, Julie (and her spouse) would receive deposit insurance of $80,000 for that deposit category (deposits held in more than one name).

Total Deposit Insurance at SafeBank

Let's assume that Julie has no other accounts at SafeBank.

In order to calculate Julie's total insured deposits at SafeBank, we have to add the insured deposits for each category of deposits that Julie holds at SafeBank.

| Insured Deposits (deposits in one name) | $100,000 |

|---|---|

| Insured Deposits (deposits in more than one name) | $80,000 |

| Total insured deposits (at SafeBank) | $180,000 |

Similarly, by holding deposits with more than one CDIC member institution, depositors are able to access coverage above $100,000 (stacking across member institutions).

To calculate the total insured deposits a depositor has across member institutions, we need to add the depositor's insured deposits at various member institutions.

It is also possible to stack within a banking group, by placing deposits in the same deposit category at affiliated CDIC members. CDIC member institutions consolidate to 54 member groups on the basis of affiliation with a parent. Please see Example 3 below.

Example 3

Calculating a Depositor's Total Insured Deposits Across a Banking Group

Insured Deposits at SafeBank

As shown in Example 2 above, Julie has total insured deposits of $180,000 at SafeBank:

| Total insured deposits (at SafeBank) | $180,000 |

|---|

Insured Deposits at SafeBankTrust (Affiliated with SafeBank)

Julie also has a savings account at SafeBankTrust, which is affiliated with SafeBank (i.e., it is part of the same banking group). SafeBankTrust is also a CDIC member institution.

| Savings account (deposits in one name) | $40,000 |

|---|

Given Julie has only one account at SafeBankTrust, and the amount in the account is under the deposit insurance coverage limit of $100,000, Julie has $40,000 of insured deposits at SafeBankTrust:

| Total insured deposits (at SafeBankTrust) | $40,000 |

|---|

Total Insured Deposits Across the Banking Group

In order to calculate Julie's total insured deposits across the banking group, we have to add the insured deposits that Julie holds at SafeBank with the insured deposits that she holds at SafeBankTrust.

| Insured Deposits at SafeBank | $180,000 |

|---|---|

| Insured Deposits at SafeBankTrust | $40,000 |

| Total insured deposits (across the banking group) | $220,000 |

In order for deposit insurance coverage to apply, deposits must be eligible deposits, payable in Canada. Please see Example 4 below. This means that deposit insurance coverage does not apply to the following:

- Foreign deposits: deposits payable in other countries are ineligible and so are not covered by CDIC deposit insurance (these deposits may however be insured by the host jurisdiction's deposit insurance scheme).

- Financial products such as investment products (for example, mutual funds, stocks and bonds, exchange traded funds, etc.) and cryptocurrencies: these products do not fall within the definition of deposits and so are not covered by deposit insurance.

Example 4

Determining Deposits Eligible for Deposit Insurance

Robert has opened a Registered Retirement Savings Plan (RRSP) at BankSolid. His RRSP holds the following:

| Cash | $10,000 |

|---|---|

| Term deposit | $30,000 |

| Mutual funds | $70,000 |

| Total RRSP | $110,000 |

In order to calculate Robert's insured deposits for that category, we have to determine which deposits are eligible for deposit insurance. Only the cash and term deposit are eligible for deposit insurance (as they fall within the definition of deposit under the CDIC framework). Investment products such as mutual funds do not fall within the definition of deposits and so are not eligible deposits.

We then have to add the amounts held in the RRSP that are eligible for deposit insurance.

Eligible Deposits

| Cash | $10,000 |

|---|---|

| Term deposit | $30,000 |

| Total eligible deposits in RRSP | $40,000 |

We then need to apply the deposit insurance coverage limit ($100,000) to the category.

| Total (deposits in RRSP) | $40,000 |

|---|---|

| Deposit insurance limit (per category) | $100,000 |

| Insured Deposits for that category | $40,000 |

This means that if BankSolid were to fail, Robert would receive deposit insurance of $40,000 for that deposit category (deposits in an RRSP).

Glossary

- Deposit

- Refers to the balance of money received by a member institution from a customer, that the member institution is obliged to repay. Normally this takes the form of a credit in an account.

- Retail depositors

- Refers to natural persons (i.e., individuals) and sole proprietors (i.e., individuals who own and operate an unincorporated business).

- Personal deposits

- Refers to accounts held by natural persons (individuals) kept for purposes other than carrying on business.

- Eligible deposit account

- Refers to an account held at a CDIC member institution, containing a non-zero volume of deposits that are eligible to receive CDIC deposit insurance. Accounts held by the same individual across more than one deposit insurance category and/or member institution are considered separate eligible deposit accounts. An individual's accounts held within one deposit insurance category at a single member institution (e.g., a savings account held in one name and a chequing account held in one name for the same individual) are combined for the purposes of calculating deposit insurance coverage and are presented as a single eligible deposit account in this paper.

- Sole proprietorship deposits

- Refers to accounts held by an unincorporated business owned and operated by one individual.

- Corporate depositors

- Refers to privately and publicly owned corporations, as well as unincorporated enterprises that function as if they were corporations such as partnerships.

- Small and medium-sized enterprises

- Refers to a subset of corporate depositors. For purposes of data shown in this paper, "small and medium-sized enterprises" refers to privately and publicly owned corporations (as well as unincorporated enterprises that function as if they were corporations) with annual revenues of up to $750 million.Footnote 7

- MUSH depositors

- Refers to municipalities, universities (and colleges), schools, and hospitals.

- Not for profit depositors

- Refers to not-for-profit organizations such as charitable organizations and clubs.

- Public purpose depositors

- Refers to both MUSH depositors and not for profit depositors.

- Public purpose deposits

- Refers to deposits held for a public and/or social purpose, held by either MUSH depositors or not for profit depositors.