Canada’s Stablecoin Framework

1. Introduction

A stablecoin is a digital asset designed to maintain a stable value relative to an underlying asset. A fiat-backed stablecoin is a particular type of stablecoin that is pegged to one fiat currency of reference (e.g., CAD or USD).

There is currently no comprehensive regulation of the issuance of fiat-backed stablecoins in Canada, and that is the focus of the new federal framework. This framework, proposed through Budget 2025 with the legislation introduced in Bill C-15, will make stablecoins safer to hold and use in Canada, ensuring that issuers maintain proper reserves, offer redemption at par in the referenced fiat currency, maintain appropriate data security practices, and have sound corporate and financial governance.

The framework will complement existing federal and provincial regimes, including the Retail Payment Activities Act.

1.1 What will Canada's Stablecoin Framework do?

The goal of the proposed stablecoin framework is to promote safe innovation and competition in the financial sector through regulations for Canadian financial technology companies to innovate and issue stablecoins, while ensuring that consumers are protected. The framework will apply to domestic and foreign issuers.

The proposed framework follows recent developments of legislative and regulatory frameworks for stablecoins in other jurisdictions, such as the United States and European Union. In August 2025, the United States enacted the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, following the full adoption of the Markets in Crypto Assets regulations in the European Union in 2024. Canada's stablecoin framework is designed to be compatible with these frameworks, with key elements consistent with recommendations of the Financial Stability Board.

| Individuals | Issuers |

|---|---|

| Confidence that fiat-backed stablecoin issued to Canadians are safe and subject to comprehensive oversight by the Bank of Canada | Consistent and appropriate regulatory framework that applies across the country |

| Redemption at par in the underlying fiat currency, with transparency in published redemption policies | International recognition and potential for interoperability/reciprocity agreements |

| Disclosures from issuers | Unlocking new business opportunities |

Canadians currently primarily use fiat-backed stablecoins as a store of value when trading other cryptocurrencies, and as a bridge between the traditional fiat currency/financial system and the digital asset space. However, with Canada's stablecoin framework, Canadians will be able to feel more confident in using fiat-backed stablecoins for payment purposes, such as for sending money abroad.

1.2 Policy Objectives for Canada's Stablecoin Framework

Competition is central to productivity, innovation, and affordability. Developing regulations for fiat-backed stablecoins will respond to the government's commitment to increase innovation and competition in the financial sector by helping to provide Canadians with options for digital payments, international money transfers, and more.

The development of Canada's stablecoin framework was guided by four public policy objectives:

- Enabling innovation and competition: Creating a regulated, safe, and predictable environment for issuers of stablecoins to operate in Canada.

- Consumer protection: Ensuring timely redemption, appropriate management of reserve assets, and requiring disclosure of information so Canadian consumers can feel confident holding and using stablecoins.

- International alignment: Ensuring that Canada's framework is consistent with the Financial Stability Board recommendations for stablecoin regulation, and preparing for potential future interoperability with the United States, European Union, and other jurisdictions.

- Safeguarding financial stability: Ensuring that stablecoins retain their peg to the referenced fiat currency and maintain sufficient reserve assets, and in sufficient composition, to enable timely redemption.

2. Course of Action

The government has introduced legislation through the 2025 Budget Implementation Act that will require issuers to, among other requirements:

- register with the Bank of Canada, provide necessary information on an ongoing basis and as requested, and be subject to prudential requirements overseen by the Bank of Canada;

- maintain a 1:1 reserve of high-quality liquid assets, in the reference currency of the stablecoins;

- create and adhere to a redemption policy for stablecoin holders, and offer at-par redemption; and,

- create and adhere to policies around corporate governance, risk management, data security, and recovery and resolution.

The Department of Finance Canada, working closely with the Bank of Canada, will begin regulatory development once the legislation has received Royal Assent. Once completed, draft regulations will be published in the Canada Gazette for consultations before being finalized. It is expected that this work will continue over 12-18 months from early 2026, with the stablecoin framework coming into force in 2027.

2.1 Governance

The Bank of Canada will administer the framework and supervise stablecoin issuers, building on their expertise in payment service provider supervision under the Retail Payment Activities Act and their responsibility for supervising financial market infrastructure, including systemically important and prominent payment systems under the Payment, Clearing and Settlement Act. The Department of Finance will continue its role in respect of policy and legislative/regulatory development.

Canada's stablecoin framework includes safeguards to protect the public interest and national security. The Stablecoin Act provides the Minister of Finance with the authority to address risks related to national security. The Minister's exercise of the national security authorities will be supported by security and intelligence agencies.

2.2 Scope

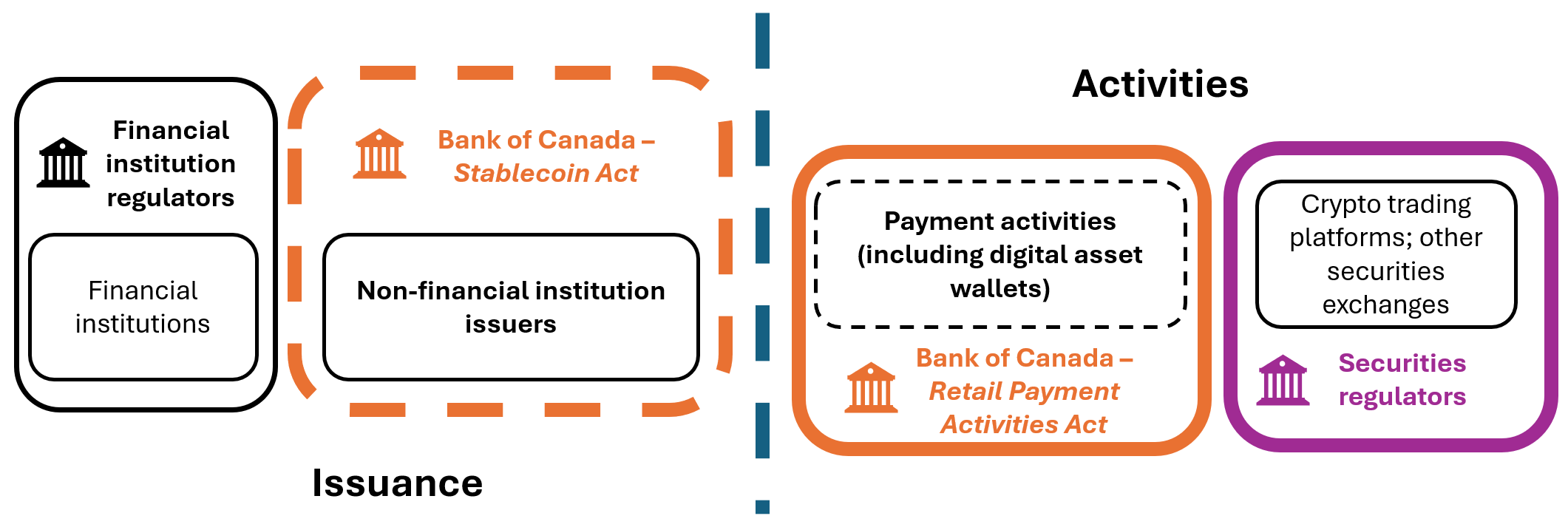

Visual overlay of the stablecoin regulatory landscape in Canada

Canada's stablecoin framework will only regulate the issuance of fiat-backed stablecoins by non-financial institutions. All non-financial institution issuers of fiat-backed stablecoins in Canada will be subject to the framework and supervision by the Bank of Canada. Federal, provincial and foreign financial institutions that are prudentially regulated, such as banks or credit unions, are already subject to comprehensive regulation of their business activities. Other types of stablecoins (non-fiat-backed) will continue to be regulated by their respective provincial or territorial securities regulator.

The framework will apply to domestic and foreign issuers who make fiat-backed stablecoins available to Canadians, directly or indirectly. It does not distinguish between CAD-denominated vs foreign-currency-denominated stablecoins.

The use and exchange of fiat-backed stablecoins will continue to be regulated according to how they are used. Securities regulators will regulate the exchange and trading of fiat-backed stablecoins on securities exchanges and crypto-trading platforms. The Bank of Canada, under the Retail Payment Activities Act, will supervise payment service providers that perform payment functions in a fiat-backed stablecoin, subject to that stablecoin being prescribed in regulation.

2.3 Registration

Non-financial institution issuers will need to apply for registration with the Bank of Canada. As part of this application, issuers will need to provide:

- information on corporate ownership, structure and financial health;

- technology information related to the stablecoin that is planned to be issued; and,

- compliance information related to the Stablecoin Act (the Act).

Registration will be an ongoing obligation, with various requirements for issuers to provide updated information to the Bank of Canada within the time and in the manner to be specified in the regulations and when significant changes occur. Issuers will also need to provide to the Bank of Canada reports containing compliance-related information certified by a chartered accountant and supported by an opinion from a legal practitioner.

2.4 Reserves

Issuers will need to maintain a reserve of assets of equal or greater value than the value of stablecoins that have been minted. The assets must be held in cash or high-quality cash-like assets at a qualified custodian and must be segregated from the other assets of the issuer and the qualified custodian. Issuers must ensure that, in the event of their insolvency, the reserve assets are not accessible to creditors other than the holders of the outstanding stablecoins.

2.5 Redemption

Issuers will need to establish, publish, and follow a redemption policy that spells out how a stablecoin holder can redeem their stablecoin in the referenced currency. This will include the timing and manner of redemption, any fees that may be charged, and a description of the role of third parties.

2.6 Other provisions

Issuers will need to:

- establish, publish, and follow policies on corporate governance, data security, risk management, and recovery and resolution;

- not offer interest or yield to stablecoin holders;

- not represent that their stablecoin is legal tender, a deposit, or insured under a public deposit insurance system;

- not communicate or provide false or misleading information, by the use of such terms, expressions, logos, symbols, or illustrations to be specified in the regulations; and,

- provide the Bank of Canada or the Minister of Finance with any information requested.

Issuers of stablecoins will also be subject to anti-money laundering and anti-terrorist financing (AML/ATF) requirements established under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act as they are considered money services businesses (MSBs) that are dealing in virtual currencies.

2.7 Enforcement

Canada's stablecoin framework includes key protections to ensure that issuers respect their obligations under the Act. Non-compliance can be addressed by the Bank of Canada through compliance agreements and administrative monetary penalties.

The proposed framework provides authorities to the Minister of Finance that align with existing financial sector statutes, including the Retail Payment Activities Act and the Consumer-Driven Banking Act, to refuse access to the framework for national security-related reasons.The Minister can also prohibit an issuer from taking any measures related to issuing stablecoins to people in Canada if it serves the public interest or for reasons related to national security. Consistent with the federal legislation of financial institutions, the Act provides the Minister with the power to impose conditions or require undertakings, if the Minister is of the opinion that it is necessary for national security reasons.

3. Next Steps

Once the legislation has received Royal Assent, the Department of Finance will begin the development of supporting regulations for the Stablecoin Act. Once completed, draft regulations will be published in the Canada Gazette.

The Department will continue to work with the Bank of Canada and other key partners to monitor ongoing domestic and international developments in this evolving market and ensure that Canada's stablecoin framework provides a safe environment for innovation and competition while protecting consumers and the stability of Canada's financial system.