Steering Committee meeting 1 – December 7, 2022

An Open Banking Canada Steering Committee meeting was held on December 7, with all working group members to provide an update and examine issues that have not been discussed yet, including governance and technical standards.

For questions or comments, please contact obbo@fin.gc.ca.

On this page:

Meeting presentation

Ground rules

- Members are welcome to communicate in the official language of their choice.

- Use the "Reaction/Raise hand" function during the designated discussion periods to intervene.

- Introduce yourself before speaking by stating your name and organization.

- Limit speaking time to two minutes.

- Use the "Mute" function when you are not talking, so we can clearly hear whoever is speaking.

- No more than one participant per organization.

- Meeting materials will be posted online on the open banking implementation site.

Progress to date

Introduction

As per the Open Banking Canada Steering Committee Terms of Reference:

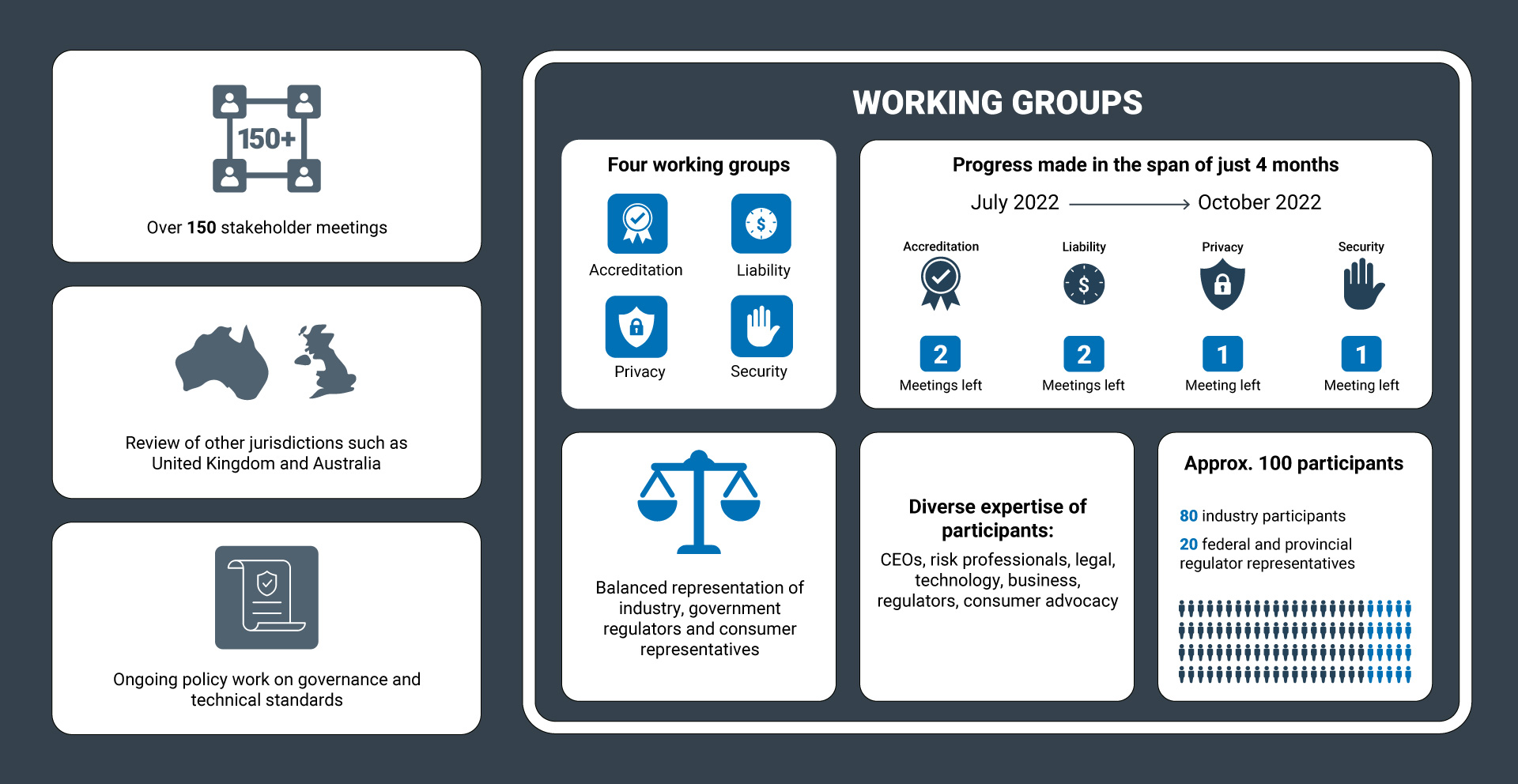

The scope of the Steering Committee differs from the working groups established by the Open Banking Lead.

Whereas the working groups are forums for select members to support the Open Banking Lead in the development of accreditation and common rules requirements, the Steering Committee is a venue for broader discussion with all stakeholders on points such as general updates, progress made in a given working group or any other topic the Open Banking Lead deems fit.

Steering Committee members can also:

- Raise novel issues with cross disciplinary implications that may not be properly addressed in existing working groups; and,

- Introduce proposals for resolving concerns.

The Steering Committee is a consultative, rather than a decision-making, body.

Agenda

| 11:00 – 11:05 am | Welcome and ground rules |

|---|---|

| 11:05 – 11:10 am | Introduction |

| 11:10 – 11:20 am | Accreditation |

| 11:20 – 11:30 am | Discussion |

| 11:30 – 11:50 am | Technical standards |

| 11:50 am – noon | Discussion |

| Noon – 12:45 pm | Lunch break |

| 12:45 – 12:55 pm | Remarks by Hon. Randy Boissonnault |

| 12:55 – 1:15 pm | Governance considerations |

| 1:15 – 1:30 pm | Discussion |

| 1:30 – 1:40 pm | Key governance functions |

| 1:40 – 1:55 pm | Discussion |

| 1:55 – 2:00 pm | Overview of five jurisdictions |

| 2:00 – 2:15 pm | Discussion |

| 2:15 – 2:30 pm | Closing remarks and questions |

Accreditation process

- Accreditation provides confidence in participants by giving transparency into entities' business

- Any entity wishing to participate in open banking would need to seek accreditation, other than banks and credit unions

- Accreditation would need to be renewed and could be revoked

- Accrediting entity would review information on an applicant's business and verify they meet certain criteria

Possible accreditation requirements

These requirements have been prepared based on preliminary input from accreditation and other working groups.

- Risk-management processes and governance to address principal security risks

- Internal dispute mechanism and membership in an external complaints body

- Certification demonstrating conformance to technical requirements

- Traceability framework to trace consumer data

- Adoption of standard consumer consent flows and implementation of consent management dashboard

- Processes in place to meet reporting obligations

- Information on the organization's services, structure, management and their experience

- Insurance or comparable financial guarantee

The above lists are not final, non-exhaustive and subject to change.

Technical standards

The Advisory Committee on Open Banking's report advised the Government to:

- Consider a more comprehensive set of qualities when discussing standards. This includes, security, competitiveness, consumer experience, stability, international compatibility and safety and soundness of the financial sector.

- Have the Open Banking lead engage and work alongside industry as well as leverage market developments that are underway.

- Mandate a standards development approach based on the recommendation of the open banking lead.

Any decision will need to be grounded in the public policy principles.

Public policy principles

- Accessible and inclusive for all credited system participants without requiring additional arrangement.

- Enable a positive consumer experience without overly onerous steps that the consumer must follow to realize the benefits of open banking.

- Enable the safe and efficient transfer of data among system participants.

- Capable of evolving with technological change to keep pace with the rapidly evolving sector.

- Sufficiently flexible to enable the development of new and innovative products.

- Compatible and interoperable with international approaches.

Considerations

- Various global standards are appropriate for an open banking system and assessing their individual merits is critical before implementing an open banking system.

- While we are aware of local standards in other jurisdictions including the Berlin Group, the French STET standards as well as the Czech and Polish standards, more extensive review and consideration is under way for those from:

- The OpenID Foundation; and,

- The Financial Data Exchange.

- Deliberations of options regarding what approach the government should take towards standards development are necessary (for instance, single standard vs market standards).

Governance

The Advisory Committee on Open Banking's report recommended that:

- Governance of an Open Banking system be impartial, transparent, and representative and commensurate with the risks posed to the system;

- A "purpose-built governance entity" (PBGE) be established, to provide ongoing administration under government oversight; and,

- Elements of open banking should be codified in legislation or regulation, with a view to expanding to additional products or functions over time.

Considerations

With the Committee's recommendations as guiding principles, many considerations are being taken into account in the development of system governance, such as:

- Federal/provincial jurisdictions

- Existing government frameworks

- Alignment with other government initiatives

- Flexibility and scalability

- Timing

- Robustness

- Competition and utility to consumers

Key governance functions

Administration

- Managing the scope of the system (data fields, read vs write)

- Maintain tech standards, including updating specifications and certification requirements

- Update accreditation criteria, approve of accreditation (internally or through third party)

- Maintain consumer experience guidelines

- Manage a public registry of accredited participants

Supervision

- Monitor tech performance to ensure the system and its participants works as intended

- Monitor and supervise compliance with common rules

- Monitor and supervise conflict resolution processes

- Promote consumer education and financial literacy

Resolution

- Resolve conflicts between participants and direct liability

- Resolve conflicts between consumers and participants

- Promote the privacy of individuals

Overview of five jurisdictions

| Jurisdiction | Approach/System | Status |

|---|---|---|

| United Kingdom | The Open Banking Implementation Entity (OBIE), is overseen by the Competition and Markets Authority (CMA). The Financial Conduct Authority (FCA) authorizes organizations to join the open banking system. | The UK leads the way in OB implementation. OBIE has undergone a series of governance reforms, and the government has begun work to create a new entity that would oversee a broader scope of data. |

| European Union | Each EU country has a designated National Competent Authority (NCA) (typically a central bank or financial services regulator) responsible for overseeing the respective country's OB framework. | The EU has not signaled changes in approach to governance but is examining the potential to move to a single technical standard across the EU. |

| Australia | Implementation under the purview of the Australian Competition and Consumer Commission (ACCC), data standards managed by a data standards body; privacy overseen by the Australian privacy regulator. | Australia is now looking at creating a dedicated entity to oversee its Consumer Data Right and related rules. |

| Brazil | Open banking initiated and overseen by Brazil's central bank with implementation being managed by industry, with balanced representations | Brazil is set to move to Open Finance. The initial structure will be replaced with a definitive structure when the last stage of implementation begins. |

| United States | Initially industry-led; with guidance from Consumer Financial Protections Bureau (CFPB). | CFPB is now moving to a more regulated approach. Draft rules to be released early 2023; final rules in place by early 2024. |

Closing remarks

- Working groups to resume in the New Year

- Next Steering Committee meeting date to be confirmed

- Meeting material will be published on the open banking implementation page