Summary Report of Private Sector Perspectives on Enhanced Climate Related Financial Disclosures

Final Report

September 16, 2021

Table of Contents

- Executive Summary

- 1.0 Introduction

- 2.0 Domestic and International Momentum

- 3.0 Overview of Public Reports and Pre-Work Submissions

- 4.0 Market Readiness, Barriers and Impacts Associated with Enhanced Climate-Related Financial Disclosures

- 5.0 Conclusion

- Appendix A – Task Force on Climate Related Disclosures (TCFD) Framework

- Appendix B – Questions Guiding SFAC Pre-Work Submissions

- Appendix C – TCFD framework in various jurisdictions

Executive Summary

This report provides a baseline of information on the state of play on climate-related financial disclosures in Canada, drawing exclusively on publicly available reports and pre-work submissions prepared for the Sustainable Finance Action Council (SFAC) in advance of its inaugural meeting in June 2021. This summary is intended to assist the SFAC as it begins to execute the Disclosure aspects of its overall mandate.

There is considerable momentum both here in Canada and globally to provide investors, insurers and lenders with the enhanced climate-related financial disclosures they are increasingly seeking, in support of sound capital allocation decision making. To be of value, such disclosures must be comparable, credible, relevant and robust, based on sound information that is both historical and forward looking. No jurisdiction will suggest it has 'arrived' at an ideal state related to these criteria but most, including Canada, agree that we cannot and should not wait for the ideal. We need to enhance our disclosure commitments and capabilities over time, identifying a path forward that achieves ongoing progress to the ideal while adding true value along the way. At the same time, we must maintain a sense of urgency demanding considerable progress within reasonable timeframes.

Progress is being made. As this report outlines, two significant milestones have been met in Canada. First, there is now support within private financial services sectors (banking, insurance, pensions) for enhanced disclosure based on the Task Force on Climate-related Financial Disclosure Framework (TCFD). While it is not unanimous, the level of support is significant enough to suggest that the "whether or what" considerations related to disclosure are largely answered though the 'how' considerations are not. Second, there is also increasing effort by a growing number of organizations and institutions to incorporate some aspects of the TCFD framework in reporting processes. While much more is needed, it is encouraging to see how much genuine effort is being spent.

As this report also outlines, major challenges and uncertainties exist related to the 'how' of Canada's disclosure journey. Stakeholders have provided perspectives and feedback on Canada's overall readiness, barriers to overcome and potential impacts to be considered. Consensus suggests consideration for a phased-in approach allowing for flexibility, safeguards where required, the ability to enhance access and usability of required data, and assurance that genuine value is generated by the efforts required. Given Canada's economic dependence on our resource industries and our need to ensure we find and keep competitive advantage where critically important for a prosperous country, thoughtful transition considerations are also essential components of a successful path forward.

Finally, Canada's disclosure pathway may, in fact, be a series of pathways, recognizing the governance and regulatory relationships and accountabilities related to disclosure. While this report does not delve into such considerations, we recognize the importance of these considerations in the work SFAC will undertake.

As noted earlier, this report does not provide much new perspective. It did not commission new engagement or outreach but rather gathered together major historical viewpoints and analyses to provide a baseline for SFAC's future work. The challenges and barriers outlined in this report will require further analyses with recommended responses. In addition, a broader effort to engage multiple private sector perspectives, issuer and non-issuer, and public sector expectations will also be required.

1.0 Introduction

The Government of Canada formally launched the Sustainable Finance Action Council (SFAC) in May 2021, with a mandate to bring together public and private sector financial expertise to support the growth of a strong, well-functioning, sustainable finance market. One of the SFAC's early emphases is on enhancing climate-related financial disclosures in Canada's public and private sectors, aligned with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). Appendix A outlines the TCFD Framework.

The SFAC's inaugural meeting took place on June 11, 2021. In advance of this meeting council members were asked to provide feedback on the foundational market infrastructure needed to attract and scale sustainable finance in Canada:

- Climate-related Financial Disclosures: Building upon the Government of Canada's commitment to TCFD (Budget 2021) by enhancing disclosure to achieve as broad as possible coverage across the economy in the near term.

- Taxonomy: Defining economic activities eligible for investment that are green or would support high-emitting companies in their transition to lower/net zero emissions.

- Data: Improving climate data and analytics to support investors and corporate issuers.

The above three areas of focus were presented as initial priorities for the SFAC and a series of questions (see Appendix B) were prepared to guide SFAC representative responses.

This report focuses on the first of the above three priority areas – Climate-related financial disclosures. It is intended to summarize key findings of SFAC pre-work submissions and public materials, with a focus on:

- market readiness, including progress made in recent years on private sector climate-related disclosures and overall alignment with the TCFD Framework;

- key barriers to enhancing climate disclosures; and

- overall impact of moving towards broad adoption of climate-related financial disclosures in Canada.

The report is organized into three primary sections. Drawing in part on certain publicly available reports, section 2.0 provides background information on domestic and international momentum for context. The section includes insight on what has changed in recent years in terms of political will and market acceptance of the need to address climate change and increase climate-related financial disclosures. Information is provided on the rise in investor demand for these disclosures, and jurisdictional initiatives in support of TCFD-alignment.

Section 3.0 provides an overview of the public material and pre-work submissions. It includes information on the progress Canadian companies have made in recent years on climate-related financial disclosures aligned with the TCFD Framework and summarizes common themes emerging from the various reports.

Section 4.0 provides insight on market readiness, barriers and impacts associated with climate-related financial disclosures in Canada.

Given scope and timelines, the report is limited to a review of publicly available material and SFAC pre-work submissions. It offers a baseline, or foundation, of the state of play in Canada on climate-related financial disclosures, intended to assist the SFAC in defining its next steps. The report does not draw on any "new" consultations or engagement with interested and impacted stakeholder groups in Canada. Nor does it include new primary research comparing and contrasting the approaches to disclosure being contemplated in other jurisdictions, and among standard-setting bodies and decision-making authorities.

2.0 Domestic and International Momentum

Climate change poses risks to and provides opportunities for all sectors of the economy. These include physical risks related to more frequent or severe weather events and risks related to the transition to a low carbon economy. The risks associated with the transition can result in challenges to asset values due to any number of business pressures: higher costs of doing business, policy risks (e.g., increased regulatory burden), or technology risks (e.g., reduced demand for a certain product). While climate change will increasingly bring disruptions to industry, companies are recognizing the potential for prosperity in a low carbon economy. The Global Commission on the Economy and Climate estimates that by 2030, the global market for low-carbon solutions will be worth $26 trillion, creating strong growth and as many as 65 million jobs around the world.

In 2016, the global Financial Stability Board, under the leadership of Mark Carney, commissioned the Taskforce on Climate-related Financial Disclosures (TCFD) to develop recommendations on how financial and non-financial companies could put forward more consistent and comparable disclosures of the financial risks and opportunities related to climate change. The objective underlying this initiative was that a more robust bottom-up view of climate resiliency and systemic risks and opportunities would promote more informed credit, investment, and insurance underwriting decisions. The voluntary framework, published in 2017, was based on four pillars: governance, strategy, risk management, and metrics and targets.

Since then, investor demand for enhanced disclosure of climate-related financial risks suggests that voluntary reporting may no longer be adequate. Climate change is a systemic issue, and physical and transition risks will likely impact organizations regardless of their GHG emissions intensity. In this light, mandatory reporting may address the imbalance where the energy sector has seen a greater take-up of TCFD reporting, whereas other sectors that receive less attention on climate issues are less likely to produce this reporting.Footnote 1 The EU was first to act in January 2019, releasing Guidelines on Reporting Climate Related Information, which was a supplement to the broader Guidelines for Non-Financial Reporting. Other countries, such as New Zealand and the UK, have announced plans to make TCFD-aligned disclosures mandatory over the next few years. More recently, the U.S. has signalled momentum to enhance climate-related financial disclosures with the Securities and Exchange Commission preparing a proposal to revise public company disclosure requirements to cover a range of ESG issues. Additional details on developments in other jurisdictions can be found in Appendix C.

To date, the TCFD framework has been endorsed by approximately 2,400 organizations and companies globally, including some of Canada's largest financial institutions and the Government of Canada, in Budget 2019. 97 of the TCFD signatories are Canadian, including 61 from the financial sector (7 deposit-taking institutions, 6 insurance companies, and 11 pension plans). The number of Canadian signatories has grown from 17 in 2017 and 44 in 2019 to its current level. In November 2020, the CEOs of Canada's eight leading pension plan investment managers called on all companies to measure and disclose their performance on industry-relevant ESG factors by leveraging the TCFD framework and the Sustainability Accounting Standards Board (SASB) standards. Additionally, in June 2020, 15 Canadian universities signed a charter on investing to address climate change, in which they agreed to abide by certain principles and practices that acknowledge the challenges posed by climate change.Footnote 2

In Budget 2021, the Government of Canada further announced that federal crown corporations will demonstrate climate leadership by adopting TCFD standards as an element of their corporate reporting. The Government of Canada, alongside its G7 and G20 counterparts, has also committed to move toward mandatory TCFD-aligned disclosures, in line with domestic regulatory frameworks, and supports the IFRS Foundation's proposal to establish an International Sustainability Standards Board (ISSB). The proposed ISSB would develop sustainability reporting standards in relation to climate and other environmental, social, and governance factors. It would, as a first priority, develop a climate reporting standard in conformity with the TCFD Framework. Canada has notified the IFRS Foundation of its interest in hosting the ISSB.

The FSB Roadmap for Addressing Climate-Related Financial Risks was released on July 7, 2021. Related to the Roadmap's first objective – the establishment of a global minimum standard for disclosures on climate-related risks – the FSB is unequivocal in its support for the IFRS Foundation's proposal to establish the ISSB.

Material risks and opportunities associated with climate change must be recognized, priced and mitigated or companies risk losing access to national and international capital flows. International developments and domestic initiatives, such as the Expert Panel on Sustainable Finance, and more recently the SFAC, recognize that establishing critical market infrastructures for sustainable finance, such as enhanced climate-related financial disclosures, will enable the mobilization of private capital toward a low-carbon economy.

The TCFD Framework is the leading framework globally for climate-related financial disclosures, recognizing that other frameworks are also in use for broader ESG reporting:

- Millani's June 2021 report (TCFD Disclosure: A Canadian Perspective) notes that in a 2021 survey (Institutional Investor Survey 2021, Morrow Sodali) of 42 global institutional investors representing US$29 trillion of assets under management, 100% of the respondents said they are reviewing their portfolio companies' climate-related disclosures. Additionally, 75% of respondents nominated TCFD as their preferred ESG reporting framework.

- In Millani's 2021 ESG Sentiment Study of Canadian Institutional Investors, 75% of respondents indicated that they are currently aligning or planning to align their own reporting to TCFD.

- The Climate Action 100+ initiative, a global shareholder engagement program backed by 617 investors and targeting 167 high emitting companies, emphasizes its ask for companies to produce disclosure aligned with TCFD. There has been some momentum to establish a Canadian initiative with similar goals focusing on Canadian issuers.

- Investors are not alone – as of May 2021, over 2,000 organizations worldwide had expressed their support for the TCFD's recommendations, representing a market capitalization of almost US$20 trillion and financial institutions managing US$175 trillion worth of assets.

- Signatories of the UN Principles for Responsible Investment (PRI), which include over 4000 entities globally and 201 Canadian investment managers, asset owners, and service providers, have been required since 2021 to report to the PRI on and publicly disclose certain indicators modelled on the TCFD recommendations that are intended to complement organizations' overall TCFD reporting.

- Five organizations active in sustainability standard setting and reporting, (CDP, the Climate Disclosure Standards Board, the Global Reporting Initiative, the International Integrated Reporting Council, and the Sustainable Accounting Standards Board), have produced a prototype climate-related financial disclosure standard that demonstrates how TCFD recommendations can be implemented in companies' reporting. Numerous Canadian firms are supporters of these organizations.

3.0 Overview of Public Reports and Pre-Work Submissions

The material reviewed in preparing this report can be divided into two categories. The first includes publicly available reports that are more academic in nature, looking at the situation in Canada and abroad more or less objectively. They assess Canada's progress on climate-related financial disclosures (compared to other jurisdictions in some cases) and make observations that are reasonably dispassionate. The reports mainly provide high level analysis on the reporting in Canada (i.e., which firms report, which elements of reporting are most prevalent) rather than in depth assessments of its quality. In general, there appear to be few comprehensive studies of Canadian companies' experience with TCFD disclosures.

The second group of reports consists of a handful of publicly available responses recently provided to regulatory bodies, or decision-making authorities that have sought input on climate-related financial disclosures and how best to proceed. This group also includes the pre-work submissions provided in advance of the SFAC's inaugural meeting.

Despite the different perspectives, the views expressed in all of the above reports – the issues and trends, as well as challenges, opportunities and possible solutions – are quite similar. In general, there is overall agreement with regards to "what" needs to be done and "why" – a big picture consensus of sorts. "How" to proceed is where the uncertainty emerges, with alternatives and competing priorities, particularly with respect to implementation, clouding the way forward.

Drawing from the first group of (the more academic) public reports, section 3.1 assesses the state of play in Canada, i.e. the progress Canadian companies have made in recent years on climate-related financial disclosures and alignment with TCFD.

Section 3.2 provides a brief overview of the second group of reports, including a synopsis of some of the key themes that emerged from the comments these entities provided in response to calls for input.

The key points from all of the above material are further unpacked in section 4.0, focusing on market readiness, barriers and impacts associated with enhanced climate-related financial disclosures.

3.1 Progress in Canada on Climate-Related Financial Disclosures and Alignment with TCFD

The public reports assessing the progress of Canadian companies' climate-related disclosures yield a mix of more or less favourable results, depending on the lens used for the review, assessment criteria, the sector being reviewed, the size of the company, or other factors. Some of these public reports focus exclusively on GHG reporting, others focus on alignment with TCFD recommendations, while others look at (or at least comment on) ESG reporting more broadly.

EY, The Chartered Professional Accountants Canada (CPA), the Global Risk Institute in Financial Services, the Institute for Sustainable Finance (ISF) and Millani have all conducted relevant studies on Canadian companies' progress in enhancing their climate-related disclosures.

The above reports generally conclude that Canadian companies' climate-related financial disclosures have been improving in recent years, but more needs to be done to address various challenges and to ensure Canada is ready for a rapidly evolving landscape, with increasing demands by stakeholders. As well, the reports also raise the potential effect climate risks can have on access to capital.

The EY Global Climate Risk Disclosure Barometer assesses disclosures made by more than 1,100 companies in 42 countries, including 56 Canadian companies. The study found that Canadian companies, on average, disclosed information on 85% of the TCFD recommendations, comparable to Africa, the US, and western/northern Europe, but lagging Japan and the UK. By this metric, Canadian companies were ahead of the global average by 15%. The quality of Canadian disclosures, i.e., the extent to which they addressed every element of the TCFD recommendation, was measured at 51%, 9% higher than the global average but below the results for the US, UK, western/northern Europe. Canada's results for the quality metric had improved relative to the 2019 study, which EY attributed to increased investor interest, federal government support for TCFD, and a group of asset owners calling for better disclosure.

In reviewing 40 TSX companies across sectors in 2016 and 2019, CPA Canada notes that climate-related disclosures have improved in the intervening years, however, investor demands are not yet being satisfied. The 2019 CPA report notes that the TCFD recommendations are being "widely recognized and implemented", but that alignment is only partial. Almost all of the companies reviewed provided some TCFD aligned disclosures.

Based on a much larger review of 228 TSX companies, the results of the Millani study are less encouraging in terms of TCFD adoption and alignment. The report states that the majority of companies reviewed (54%) made no mention of TCFD in their reporting. Twenty-three percent indicated that they were aligned with the TCFD recommendations, with the balance planning to align or mentioning TCFD in some way. These results likely reflect the fact that much smaller companies were included in the larger sample size and these companies have lagged in terms of climate-related disclosures.

The Global Risk Institute looked more specifically at 58 Canadian financial firms over a 3-year period (2017-2019) and concluded that less than half (25) were publicly disclosing in alignment with the TCFD framework. These results were enough for the report to conclude that Canadian financial firms are early adopters relative to other Canadian firms and on par among their peers globally.

The Institute for Sustainable Finance reviewed a similar number of TSX companies as Millani but focused exclusively on GHG emissions reporting. GHG reporting (Scope 1, 2 and 3) is a key component of the TCFD framework and particularly important in the Canadian context. The ISF report notes that the S&P/TSX Composite Index, which includes 200 of the largest publicly listed companies in Canada, is approximately 25% higher (in relative terms) than the S&P 500 Index and 68% higher than the Dow Jones World Sustainability Index (Global Equities). The percentage of Canadian companies reporting their GHG emissions (67%) was found to be lagging behind Europe (79%) and the UK (99%), but approximately equal to the US. The percentage of large Canadian companies failing to report on GHG emissions and the fact that only 65 companies obtain third party verification of these reports underscore the extent to which institutional investors must estimate the carbon intensity of their portfolios, posing a challenge for the transition to net-zero. On the positive side, the authors estimate that a substantial proportion of total TSX GHG emissions would be eliminated if the 60 companies with emission reduction targets achieved their targets (-17.3% reduction over 2019 levels by 2030).

Based on their analyses of the current state in Canada, the above reports offer recommendations to financial sector participants as well as policy considerations. Millani states that "delaying alignment with TCFD recommendations will make it more challenging to meet investor and regulatory expectations". CPA Canada, in turn, suggests that companies improve their climate-related disclosures by engaging peers, investors and other stakeholders on best practices. The CPA report also emphasizes increasing "climate literacy" and understanding of the regulatory landscape as climate disclosures continue to evolve, and indicates the importance of executive support and increased board engagement on these issues moving forward.

The Global Risk Institute report recommendations share similar themes to the ones referenced above but also discusses a role for policymakers in improving on the current state. This report, focusing on the Canadian financial sector, suggests that firms should improve the internal consistency of their reporting, balance reporting on opportunities with information about climate risks and impacts, innovate to reflect the complex and interconnected layers of climate risk, set and report on targets, and emphasize engagement at the senior executive and Board levels. To drive change at the firm level, the report speaks to the value of investors' consistent engagement and communication of expectations. The Global Risk Institute also acknowledges that policymakers should clarify requirements for mandatory and voluntary disclosure and provide foundation elements needed by firms where necessary, such as guidance on scenario analysis.

While the EY report did not specifically focus on recommendations for Canadian companies, it offered broad recommendations for firms to focus on analyzing the extent of the risks and opportunities they are facing as a result of climate change, how this should be reflected in organization strategy and execution, and how these factors should be communicated to the market.

Overall, there is no shortage of advice on what needs to be done to improve the quality and quantity of climate-related disclosures. The details of implementation remain as key outstanding issues, with work being required to set reporting requirements, define materiality, and determine a consensus on what constitutes "decision useful" information.

These issues tend to be addressed more specifically in the second group of reports where various stakeholders have responded directly to calls for input from regulatory bodies or decision-making authorities attempting to make progress on the way forward.

3.2 Input to Regulatory Bodies / Decision-Making Authorities – Other Public Reports and Pre-Work Submissions

As mentioned above, there is some consensus related to what needs to be done but uncertainty regarding how. Timing, level of detail, accountability, alignment, authority and definitions are among the technical issues that need to be resolved.

Canadian Input to the Expert Panel on Sustainable Finance and Other Reporting Initiatives

With this in mind, various initiatives have been launched with a view to soliciting responses to key questions and issues on how best to proceed with enhanced climate-related reporting. For example:

- In April 2018, Canada's Minister of Environment and Climate Change and Minister of Finance jointly appointed the Expert Panel on Sustainable Finance to explore opportunities and challenges facing Canada in this field. Following extensive consultations, in June 2019, the Expert Panel published its recommendations, some of which focused specifically on climate-related disclosures and TCFD implementation among Canadian issuers.

- In August 2019, the Canadian Securities Administrators published a notice (CSA Staff Notice 51-358) clarifying existing legal requirements regarding the reporting of material climate change-related risks. This notice followed a period of research and consultation on issuers' disclosure of risks and financial impacts associated with climate change. The notice reinforces earlier guidance provided to issuers on existing continuous disclosure requirements relating to a broad range of environmental matters, including climate change. The CSA cited three key factors in publishing the notice: increased investor interest in climate change-related risks and concerns about receiving insufficient disclosure, the room for improvement in disclosure practices, and domestic and global momentum of voluntary disclosure frameworks (including TCFD and SASB).

- In September 2020, the IFRS Foundation published a "Consultation Paper on Sustainability Reporting" and proceeded to engage stakeholders (including investors, issuers, central banks, regulators, public policy makers, auditing firms and other service providers) to better understand what the Foundation could do in this area. Following the consultation, the IFRS Foundation's Feedback Statement indicated consensus on the growing demand to improve global consistency and comparability of sustainability reporting, recognition of an urgent need for action, and widespread support for the IFRS Foundation to play a role.

- In January 2021, the Ontario Capital Markets Modernization Taskforce recommended "mandating disclosure of material ESG information, specifically climate change-related disclosure that is compliant with the TCFD recommendations for issuers through regulatory filing requirements of the OSC". These requirements would apply to all reporting issuers (non-investment fund) and would include mandatory TCFD-aligned disclosure in the areas of governance, strategy, and risk management (subject to materiality), but not scenario analysis. Additionally, companies would be required to disclose Scope 1, Scope 2, and if appropriate, Scope 3 emissions on a "comply-or-explain" basis. The recommendations also set out a transition phase for compliance, varying from two to five years depending on the issuer's market cap.

- In March 2021, the U.S. Securities Exchange Commission requested input from investors, registrants, and other market participants onthe Commission's disclosure rules and guidance as they apply to climate change, and whether and how these should be modified.

SFAC Pre-Work Submissions

More recently, the SFAC requested input from its participating organizations on the foundational infrastructure needed to attract and scale sustainable finance in Canada.

The pre-work submissions were quite succinct and generally followed the line of questioning outlined in Appendix B. As such, the comments centred around the three initial priorities of the SFAC, including: (i) disclosure aligned with the TCFD recommendations; (ii) taxonomy considerations for Canada; and, (iii) better access to reliable and consistent data and analytics.

The feedback provided from SFAC organizations (19/25) is the latest in the Canadian context from stakeholders keenly interested and involved in shaping a uniquely Canadian response to the challenge of climate-related financial disclosures that will be accepted and respected at home and abroad.

Highlights from the Public Reports and Pre-Work Submissions

As mentioned above, many of the key themes (issues, challenges, recommendations) that emerged from the public reports and pre-work submissions were quite similar and tended to focus on implementation issues, given the nature of the consultations. Some of the key themes include:

- The public reports looking at Canadian progress on climate-related disclosures in recent years tended to conclude that the market appears to be "ready" (i.e. willing and able) to proceed with a "go slow approach". Most Canadian companies are reporting what they can, rather than waiting to be able to comply with all eleven of the TCFD recommendations. Investors are in agreement with this approach. Millani's semi-annual Canadian Institutional Investor Study in May/June 2021, notes that investors would like issuers to begin aligning their reports with the TCFD recommendations, even if they cannot completely align. It is accepted that if an issuer does not have sufficient information, it should focus on partial disclosures. The results of the 2019 CPA study confirmed that this is precisely what Canadian companies are doing.

- Virtually all of the material (public and pre-work submissions), acknowledged that there are multiple frameworks and approaches being used and that existing efforts, such as TCFD, should be coordinated going forward to reduce global fragmentation.

- In many of the reports, there was general agreement on the need for flexibility. In responding to the U.S. SEC consultation process, Canadian feedback suggested that issuers should be able to decide where and how they disclose relevant information, whether in annual, or voluntary reports at this time suggesting that it is too early to mandate inflexible approaches or requirements given the state of play internationally.

- The preference for flexibility in where and how to report is consistent with the need to reduce the risk of liability. Respondents tended to agree that climate-related disclosures should be furnished, as opposed to filed. This is a legal consideration in SEC filings whereby furnished information is excluded from certain liability provisions under the U.S. Exchange Act. The importance of safe harbour and comply or explain provisions was also stressed in order to encourage more disclosure to the best of a company's abilities. Further, some suggested that it is too early to mandate audit or certification requirements. Much of these concerns were based in part on the limited availability and quality of climate-related data. When Scope 1 and Scope 2 emissions data is available, they are generally strong. Scope 3 emissions data (e.g., on financed emissions from the financial sector and downstream emissions from the energy sector) may be of lower quality.

- Related to the above, many of the reports and submissions argued to be mindful of the compliance burden associated with climate-related disclosures. There was near unanimity on the need for a phased-in approach, suggesting that the TCFD journey could take as long as five years. Respondents made the point that definitions and methodologies are a work in progress and that standards should be principles-based, as opposed to overly prescriptive and that it is premature to treat climate-related information the same as financial data given that frameworks and standards are still evolving. This loops back to the points above regarding data quality, the preference for issuers to be able to choose where and how to report, and the hesitation in some camps about audit and certification requirements.

- Industry-specific metrics was a common theme, with many saying that companies are best positioned to determine the materiality of information. This is not arguing against the need to standardize metrics, but rather a recognition that in these early days, firms within sectors need to work together with investors to agree on what information is most decision-useful and how these metrics should be defined. The need for this interaction and feedback was highlighted in the pre-work submissions where it was noted that not all investors are requesting climate-related disclosures, and it is unclear how those that do are using them. The result is that companies are not getting any feedback on the usefulness of their disclosures.

4.0 Market Readiness, Barriers and Impacts Associated with Enhanced Climate-Related Financial Disclosures

Drawing from all of the public material and pre-work submissions, this section converts the main points summarized above into insights on market readiness, barriers and impacts associated with enhanced climate-related disclosures aligned with the TCFD Framework. The following chart provides a roadmap, with supporting rationale to guide further discussion related to these key themes.

Market Readiness

Issues affecting market readiness for enhanced climate-related disclosures

- Smaller Issuers Challenged

- Mandatory vs. Voluntary Disclosure

Examples of conditions or requirements that help achieve market readiness

- Phasing / Timing

- Flexibility

- Comply or Explain / Safe Harbour

(Intersection)

Examples of required sophistication in the market holding back market readiness; these represent a required maturation process as opposed to simple barriers to be overcome

- Maturity

- Data Integration / Inter-connections

- Scenario Analysis

- Scope 1,2,3 Emissions

- Materiality

- Governance

Barriers

Lack of agreement – consensus barriers to overcome

- Multiple Disclosure Approaches/Methodologies

- Taxonomy Issues

Organizational – clear (easily understood) structural barriers to overcome

- Regulatory Landscape

- Third Party Data Providers

- Centralized Data Hub

Key Points on Market Readiness

- Smaller Issuers – Small and medium sized companies have less capacity to comply with the evolving reporting landscape. These companies lack the resources in-house and there is insufficient sharing of expertise and data across companies and sectors. The Millani report notes that of the 228 TSX companies it reviewed, large-caps (>$10B market capitalization) made up 75% of issuers that are currently aligning to TCFD. A number of the pre-work submissions noted that enhanced climate-related financial disclosures are improving among large-cap companies but that disclosure rates drop off or are non-existent among smaller issuers and privately held companies. Smaller companies therefore, do not appear ready for any imminent adoption of enhanced climate-related disclosures, and would require substantial support to be able to comply with any rule changes. There is a potential role for industry associations to support smaller issuers in aggregating information for the purposes of producing disclosure and relevant analysis.

- Mandatory versus Voluntary Disclosure – The TCFD is currently a voluntary reporting framework. Some companies and sectors appear to be more ready than others to move towards full implementation. While there is broad consensus around the "go slow" approach mentioned above, in the pre-work submissions there was also widespread agreement that mandatory climate-related disclosures would eventually be adopted in Canada. All of this implies a level of comfort among SFAC respondents and other stakeholders, that the market is getting ready for a mandatory reporting regime.

To increase broader market acceptance of, and readiness for an enhanced, mandatory reporting regime, the public material and pre-work submissions outlined what would be required, for companies of all sizes, to be able to move towards compliance.

- A Phased Approach – The main point is that small- and mid-cap companies in particular require sufficient time to adopt a mandatory reporting regime, aligned with TCFD recommendations. Full adoption would be a multi-year journey. The time is required to allow for a common approach and standards to be implemented to ensure transparency and comparability. A mandatory regime would also ideally be national, requiring agreement among provincial regulators on how to proceed, which necessarily takes time.

- Flexibility – While the submissions were not unanimous on this point, there was some agreement that issuers should be provided with some flexibility in terms of disclosing in annual reports, in other periodic filings, or in dedicated climate-related disclosures. The discretion would allow disclosures outside of the annual reporting cycles reducing the compliance burden. The responses to the SEC and IFRS Foundation calls for input were more categorical in advocating for considerable flexibility.

- Comply-or-Explain and Safe Harbour – To increase market acceptance, it was noted that securities regulators should allow for the ability to "comply-or-explain" in the reporting framework. The framework should also include strong safe harbor protections to allow issuers to try to provide meaningful disclosure, despite the risks associated with uncertainty related to issues such as metrics, targets, scenario analyses and data quality.

Key Points on Barriers

There was broad agreement in the submissions on a number of barriers to be overcome to allow for the implementation of enhanced climate-related financial disclosures. These can be organized into two sub-groups: (i) consensus-related barriers, where agreement on how to proceed would help clear the path; and (ii) structural barriers, where changes (improvements) in the way companies are organized and do things would eliminate unnecessary friction on the path forward.

Consensus Barriers

- Multiple Disclosure Approaches / Methodologies – Nearly all of the public material and pre-work submissions acknowledge one way or another that companies are doing what they can to disclose meaningful climate-related information but there is little uniformity in reporting. Different frameworks, standards and methodologies are being used, inhibiting comparability and consistency. This is true even within sectors, making it difficult to identify and understand risks when there is no consistent understanding of definitions and terms. The Global Risk Institute notes that the lack of standardization and use of multiple reporting channels by the same firm makes individual assessments and sector wide comparisons cumbersome.

- Taxonomy Issues – The challenges in the area of taxonomy are linked to identifying and formalizing criteria or standards for "green" and "transition" assets. The taxonomy could then be used as an input in reporting, as firms would be able to indicate the extent to which their operations fall under the taxonomy through their disclosures.

While there is broad consensus that Canada should align with international efforts related to 'green' taxonomy, with specific reference to the significant work done by the EU, squaring this thinking with the notion of a "transition" taxonomy uniquely tailored to Canada's economic reality is more complicated, posing challenges for downstream reporting requirements.

Structural Barriers

Separate and distinct from the above consensus-related barriers are the following structural barriers.

- Regulatory Landscape – In implementing any enhanced climate-related reporting regime, Canada has the added complexity associated with its multi-jurisdictional securities regulation. In Canada, securities disclosure is regulated at the provincial level. A nation-wide mandatory securities disclosure regime aligned with the TCFD framework would require joint effort among provincial regulators through the Canadian Securities Administrators.

- Third Party Data Providers – There is broad consensus that climate data is generally difficult to obtain and requires working with third party service providers. The current supply of data is dominated by independent aggregators with varying proprietary methods to process and standardize their products. There is limited transparency with definitions, methodologies and overall approach. This makes access to data costly and creates barriers to entry and use, particularly for smaller financial sector participants. The general consensus is that companies would benefit from the availability of more accessible, transparent, reliable and validated data and tools.

- Centralized Data Hub – There is significant scope for collaboration on the collection, aggregation, and publication of climate-related data not deemed proprietary for competitive reasons. Public and private entities are identified as needing to do a better job in this regard to achieve a shared understanding and approach to developing data sets. The lack of an authoritative source of primary data and open-source tools and platforms is inhibiting consistent definitions, terms, understanding and interpretation of climate data. To overcome this barrier, a Canada-specific, standardized, centralized database is suggested, as opposed to multiple standards and proprietary ownership of data sets. Establishing sector-based subgroups to define and validate areas most in need of government support and collaboration has been identified as an initial priority.

Key Points Spanning Market Readiness and Barriers

The public material and pre-work submissions include a number of key points that could be understood as commentary on either the market's readiness to enhance climate-related disclosures or as barriers to moving forward. These issues tend to imply that the level of analytical sophistication in the market needs to increase to enable the provision of meaningful "decision-useful" climate-related disclosures. As such, they are barriers of sorts, but also acknowledge that the market can only move so fast towards full alignment with the TCFD Framework, given the evolving nature of some of the methodological challenges.

- Maturity – The CPA report notes that the companies it reviewed commonly disclosed throughout their regulatory and voluntary reporting that they had thoroughly examined climate-related risks but concluded that none of the reviewed risks would materially impact the company. The CPA report includes observations regarding the difficulty in assessing climate-related risks and opportunities, which is consistent with the idea that TCFD/ESG reporting is in its early days (a work in progress) and that companies' "climate literacy" (analytical sophistication) needs to improve.

- Data Integration/Inter-connections – Nearly all of the reports and submissions acknowledged in some way that data availability, quality and consistency, are challenges limiting the ability of issuers to provide meaningful climate-related disclosures. However, this is only part of the problem. Perhaps more important is ensuring that the data that is available is interpreted and used appropriately. Traditional risk metrics are often siloed and don't necessarily enable an integrated view. Climate risks need to be linked to other risks and overall climate literacy needs strengthening. One of the submissions pointed out that while there is a positive trend towards integrated reporting, it is a nascent practice with significant opportunity for improvement. For example, many organizations' "climate-related financial disclosures" are in fact climate disclosures, not financial disclosures. Further, other organizations are disclosing solely climate impacts while ignoring the systemic interconnections between financial performance, climate change, and the state of ecosystems. Some have called for the uptake of so-called "climate translators" to help organizations understand what climate science means (and does not mean) for their decision-making. Accounting for and disclosing the linkages will assist in adopting a more holistic view and manage growing systemic risks.

- Scenario Analysis – Related to the above, climate risk scenario analysis is still in its early days and additional sophistication is required. In the CPA study, only two of the 40 companies reviewed disclosed the results of their climate-related scenarios. An additional four disclosed that they conducted a scenario analysis but did not provide any results. Many firms lack the resources and expertise to conduct robust scenario analysis and detailed modelling. Policy makers need to be clear about what is expected and how scenario analysis should be conducted. One of the pre-work submissions noted that scenario analysis needs to be explained in the simplest of terms or an off-the-shelf model needs to be provided. Going forward, ongoing innovation is required to improve scenario analysis and other tools to assess the complex and interconnected layers of climate risk and opportunity, and how this will impact businesses over the short, medium and long term. Additionally, there should be alignment on scenarios to use (at least within sectors) and alignment on the disclosed output (e.g. qualitative or quantitative results, granularity) to improve comparability.

- The work of the Bank of Canada and OSFI on the climate risk scenarios pilot project is expected to help improve the current state of climate risk scenario analysis in the market. The project aims to build the climate scenario analysis capability of authorities and financial institutions, and support the financial sector in enhancing disclosure of climate-related risk. It also aims to increase understanding of the financial sector's potential exposure to transition risks and improve authorities' understanding of financial institutions' governance and risk management practices around climate-related risks and opportunities.

- Scope 3 GHG Emissions – The submissions note that there are significant gaps in disclosing Scope 3 emissions. There is a need for better standards and guiding methodologies for all emissions reporting, but particularly Scope 3 emissions. There is low disclosure of Scope 3 downstream disclosures from fossil fuel companies. The data needed to measure Scope 3 emissions may be of poor quality or unavailable. There is also the risk of double counting. The challenge becomes one of "full-cost-accounting", where everything is connected to everything else. The Millani report notes that some industries with less carbon intensive operations are not disclosing any climate-related information or demonstrating any TCFD alignment. This is telling as up-stream and down-stream impacts associated with these sectors exist.

- Materiality – The above points speak to the complexity of climate-related financial disclosures. Scoping these disclosures to ensure they remain material is also a work in progress. Different approaches, frameworks and methodologies are sometimes resulting in immaterial disclosures. They must be financially material, useful and cost-effective. It was pointed out that with various competing stakeholder priorities, there is a real risk of disclosing too much on topics of "interest" which leads to information overload that is not financially material. As one of the pre-work submissions noted, investors don't have time to read thousands of TCFD supplemental reports following different formats and including unlimited metrics.

- Governance – While leadership in the financial sector appears to be more advanced, senior executives and Boards in other sectors appear to be lagging, slowing broader adoption of TCFD aligned disclosures. While the Global Risk Institute report focusing on the Canadian financial sector suggests that the "top of the house" is engaged, the CPA Canada report notes that only half of the 40 companies reviewed disclosed climate-related governance in regulatory filings, making it the least disclosed regulatory category. By comparison, 80% included climate-related strategy disclosures, making it the most commonly disclosed category. CPA Canada and the Global Risk Institute both advise that increased Board engagement / involvement is required to improve climate-related disclosures.

5.0 Conclusion

Investors, insurers, and lenders are keen to enhance their understanding of and response to both the risks and opportunities of climate change and the world's march towards net-zero 2050. There is substantial global momentum on the need for climate-related financial disclosures that are comparable, credible, relevant and robust.

While it is not unanimous, the level of support in Canada is significant enough to suggest that the 'whether or what' considerations related to enhanced climate-related financial disclosure are largely answered though the 'how' considerations are not. More work is required to determine the impacts associated with enhanced climate-related financial disclosure requirements. The SFAC's Disclosure Technical Expert Group will work to collect perspectives on how Canadian financial sector participants and non-financial corporations can best move to adopt climate disclosure requirements, in Canada and internationally. Through this exercise, market participants and stakeholders will provide their views on the impacts of implementing enhanced climate disclosures that are either market driven (e.g., out of expectations from domestic or international investors) or spurred by actions from official sector bodies (e.g., changes to regulations or supervisory practices, international adoption of taxonomies or signals about cross-border carbon tariffs).

This report is intended to help the SFAC take stock of the state of play in Canada in support of its future work as it contributes to Canada's commitment to being a full participant on the road to a decarbonized future.

Appendix A – Task Force on Climate Related Disclosures (TCFD) Framework

To help identify the information needed by investors, lenders, and insurance underwriters to appropriately assess and price material climate-related risks and opportunities, the Financial Stability Board established an industry-led Task Force on Climate-related Financial Disclosures in 2017.

The TCFD recommendations were submitted to the G20, consisting of a set of voluntary disclosures focused on making climate change-related information consistent, comparable, reliable, clear, and decision-useful.

The TCFD Framework has become industry best practice for reporting on climate-related risks and opportunities. Other disclosure frameworks, including the Carbon Disclosure Project (CDP) and the Sustainability Accounting Standards Board (SASB), have also aligned with these recommendations.

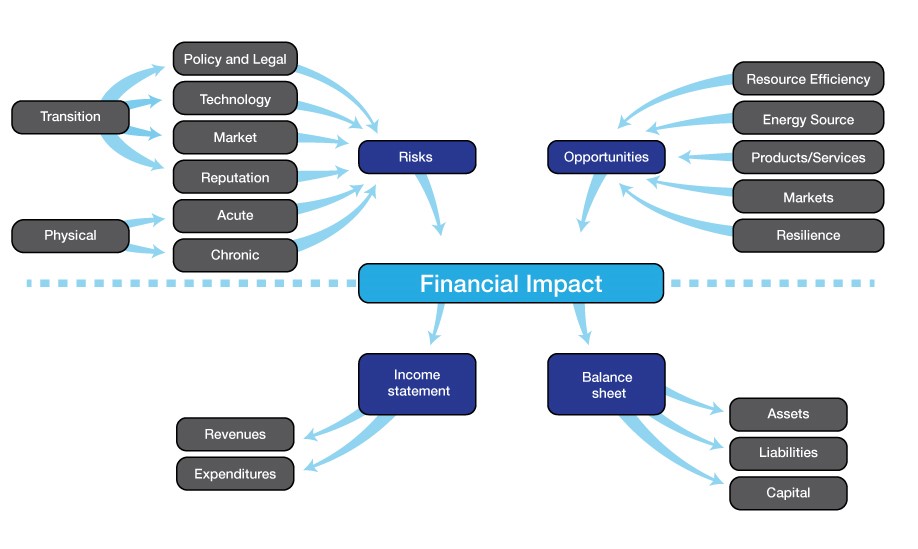

Climate-Related Risks, Opportunities and Financial Impacts

Risks – The TCFD divided climate-related risks into:

- risks related to the transition to a lower-carbon economy; and

- risks related to the physical impacts of climate change.

Transitioning to a lower-carbon economy entails extensive policy, legal, technology, and market changes to address mitigation and adaptation requirements related to climate change. Physical risks can be event driven (acute) or longer-term shifts (chronic) in climate patterns. Physical risks may have financial implications for organizations, such as direct damage to assets and indirect impacts from supply chain disruption.

Opportunities – Climate-related opportunities include efforts to mitigate and adapt through resource efficiency and cost savings, the adoption of low-emission energy sources, the development of new products and services, and building resilience along the supply chain. Climate-related opportunities will vary depending on the region, market, and industry in which an organization operates.

As outlined below, climate-related risks and opportunities can affect organizations' revenues and expenditures, estimates of future cash flows, as well as their assets and liabilities in a number of ways.

Climate-Related Risks, Opportunities and Financial Impacts

Recommended Disclosures

To fulfill its remit, the Task Force developed the following four widely adoptable recommendations on climate-related financial disclosures applicable to organizations across sectors and jurisdictions.

Governance

Disclose the organization's governance around climate-related risks and opportunities.

Recommended Disclosures

- Describe the board's oversight of climate-related risks and opportunities.

- Describe management's role in assessing and managing climate-related risks and opportunities.

Strategy

Disclose the actual and potential impacts of climate-related risks and opportunities on the organization's businesses, strategy, and financial planningwhere such information is material.

Recommended Disclosures

- Describe the climate-related risks and opportunities the organization has identified over the short, medium, and long term.

- Describe the impact of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning.

- Describe the resilience of the organization's strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario.

Risk Management

Disclose how the organization identifies, assesses, and manages climate-related risks.

Recommended Disclosures

- Describe the organization's processes for identifying and assessing climate-related risks.

- Describe the organization's processes for managing climate-related risks.

- Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organization's overall risk management.

Metrics and Targets

Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material.

Recommended Disclosures

- Disclose the metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management process.

- Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks.

- Describe the targets used by the organization to manage climate-related risks and opportunities and performance against targets.

Appendix B – Questions Guiding SFAC Pre-Work Submissions

-

The Sustainable Finance Action Council (SFAC) is mandated overall to provide financial sector input on the foundational market infrastructure needed to attract and scale sustainable finance in Canada, building on the current strengths and successes of our financial sector. Our mandate suggests three initial high priority areas of focus: disclosure aligned with the TCFD recommendations; taxonomy considerations for Canada; and better access to reliable and consistent data and analytics in support of sustainable finance efforts.

- Do these initial priorities adequately address the key requirements for Canada to strengthen its ability to align with global developments appropriately, while balancing the economic opportunities it is best positioned to embrace? Is there a need to further prioritize within these three areas of focus?

- Are we missing a critical additional area of focus that should be added to our work plan?

- How would you define success for the SFAC given this mandate? Can you share specific key success indicators we should adopt as we develop our work plan?

- Focusing on Disclosure:

- How would you define our current state of play in Canada? What are the top of mind or key barriers and concerns related to enhancing both coverage and quality of disclosure? How do approaches need to change to incorporate more inclusive considerations related to environmental, social and governance factors? How well does the TCFD framework address these considerations?

- Recognizing the global momentum related to mandatory disclosure aligned with the TCFD framework, what are the mechanisms you would need to see developed and the milestones achieved for you to advocate for a mandatory regime in Canada?

- Focusing on Taxonomy:

- Work has been underway for two years to define a transition taxonomy for Canada that reflects the need to address Canada's challenges and opportunities, while recognizing the need to align appropriately with global development and be viewed as credible. How do we get this initiative over the finish line?

- In addition to defining a Canadian transition taxonomy, how important is it to develop a made-in-Canada 'green' taxonomy or are our needs better served by aligning with global green taxonomy development efforts?

- Focusing on Data:

- Data access, quality and coverage is increasingly being highlighted as a barrier to implementing successful sustainable finance decision making and enhancing support for green investments. What do you see as a priority to ensure data is available to support integration of sustainability into the decision-making process? What is the one key ask you would have, the one key area of focus you would want to see on our work plan?

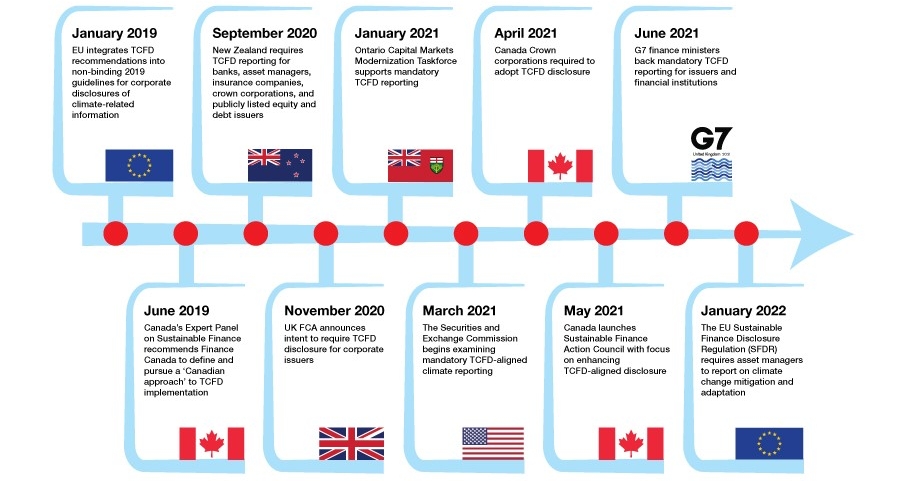

Appendix C – TCFD framework in various jurisdictions

The following chart from the Millani report illustrates how some jurisdictions are increasingly relying on the TCFD recommendations as a framework for climate-related disclosure for both issuers and financial institutions.

The rise of mandatory TCFD reporting

In addition to the above, a sampling of related international initiatives demonstrating ongoing momentum on climate-related disclosures and TCFD alignment include:

- EU – In January 2019, the EU released Guidelines on Reporting Climate Related Information, which was a supplement to the broader Guidelines for Non-Financial Reporting. The supplement is aligned with the TCFD recommendations but is non-binding. Companies may choose alternative approaches to the reporting of climate-related information, provided they meet legal requirements.

- United Kingdom – Consistent with the above "intent to require…" announced in November 2020, financial institutions supervised by the UK Prudential Regulation Authority (PRA) are now required to disclose climate-related risks in line with TCFD, including insurance and reinsurance firms, banks, building societies, and PRA-designated investment firms. The deadline for fully-embedded TCFD disclosure is December 31, 2021.

- The Financial Conduct Authority (FCA) has also published a final rule for UK premium listed companies, which requires them to disclose compliance with the TCFD recommendations on a comply-or-explain basis effective January 2021. Companies need to assess if their approach to managing climate-related risks is consistent with the TCFD and, if not, develop a programme for achieving compliance, including establishing board-level governance and risk management structures and processes for effectively managing and disclosing climate-related risks to TCFD standards. In 2022, mandatory disclosure will extend to UK-registered companies, a wider scope of listed companies, the largest UK-authorised asset managers, and FCA-regulated pension providers with greater than £1 billion in assets under management. (Source: Sarra, J., Canadian Climate Law Initiative)

- Further to this, the Department for Work and Pensions (DWP) published guidance on climate change governance and reporting for occupational pension schemes in alignment with TCFD in June 2021 following consultations conducted from January to March of the same year. The DWP guidance requires pension funds to have a system in place to prepare and publish annual TCFD reports by October 1, 2021 (if their assets total 5 billion GBP or more), October 1, 2022 (if their assets total 1 billion GBP or more), or a year later if assets are under the lower threshold.

- New Zealand – In April 2021, the New Zealand Government introduced the Financial Sector (Climate-related Disclosures and Other Matters) Amendment Bill. The Bill will make climate-related disclosures mandatory for approximately 200 organisations that meet a NZ $1 billion asset threshold, including most listed issuers, large registered banks, licensed insurers, and managers of investment schemes, which are designated as "climate reporting entities".

- The Bill amends the "Financial Markets Conduct Act" to require climate reporting entities to annually produce "climate statements" that are accessible to stakeholders and regulators, and require the signature of directors. It also amends the "Financial Reporting Act" to enable the External Reporting Board to prepare and issue climate-related reporting standards that align with the Financial Stability Board's Taskforce on Climate-related Financial Disclosures framework. The Bill passed first reading on in April 2021 and is now with the Select Committee on Economic Development, Science and Innovation Committee. Public consultation ended on May 28, 2021 and the Committee is scheduled to report to Parliament by August 16. The NZ Government has announced that it will publicly consult on possible wider private sector application after the legislation has been brought into force. (Source: Sarra, J., Canadian Climate Law Initiative)

- United States – In May 2021, President Biden signed an Executive Order (EO) entitled, "Climate-Related Financial Risk", which directs the federal government to develop a strategy to curb the risk of climate change on public and private financial assets and requires a government-wide plan to identify and disclose climate risk. The move is part of the Biden administration's longer-term agenda to cut U.S. Greenhouse Gas (GHG) emissions nearly in half by 2030, while curbing the damage climate change poses to all industries.

- The EO sets the stage for the US federal government, including its financial regulatory agencies, to begin to incorporate climate-risk and other ESG issues into financial regulation. It demonstrates the priority the Biden administration is giving to addressing climate change and will likely accelerate ongoing efforts by federal financial regulators to adopt new, climate risk-related regulations. The EO directs Treasury Secretary Janet Yellen to utilize the Financial Stability Oversight Council to coordinate the adoption of regulatory measures to address climate change on the part of the federal financial regulatory agencies. The US Securities and Exchange Commission (referenced in the chart above) is already actively preparing a proposal to revise public company disclosure requirements to cover a range of ESG issues, and the Federal Reserve Board has established two working committees to examine climate-related risks to financial stability and to the safety and soundness of financial institutions. (Source: Olmem, A., Mayer | Brown)

Bibliography

- AIMCo, BCi, CDPQ, CPP Investments, HOOPP, OMERS, Ontario Teachers' Pension Plan, PSP. (November 24, 2020) Companies and investors must put sustainability and inclusive growth at the centre of economic recovery.

- Bank of Canada and OSFI (November 16, 2020). News Release: Bank of Canada and OSFI launch pilot project on climate risk scenarios

- Canadian Association of Petroleum Producers. (February 27, 2019) Addendum to CAPP Submission to the Expert Panel on Sustainable Finance.

- Canadian Association of Petroleum Producers. (March, 2019) Canadian Association of Petroleum Producers Supplemental Submission to Expert Panel on Sustainable Finance.

- Canadian Bankers Association. (June 11, 2021) Comments on SEC's Public Statement: Public Input Welcomed on Climate Change Disclosures.

- Canadian Securities Administrators (August 2019). CSA Staff Notice 51-358 Reporting of Climate Change Related Risks

- Capital Markets Modernization Task Force (January 2021). Final Report

- CDP, CDSB, GRI, IIRC, and SASB. (December 2020) Reporting on enterprise value: Illustrated with a prototype climate-related financial disclosure standard

- Chartered Professional Accountants Canada. (2017) State of Play: Study of Climate-related Disclosures by Canadian Public Companies.

- Chartered Professional Accountants Canada. (2021) 2019 Study of Climate-Related Disclosures by Canadian Public Companies.

- Chartered Professional Accountants Canada. (2021) Summary Report: Study of Climate-related Disclosures by Canadian Public Companies (January 2020).

- Cleary, S. and Hakes, A. (April, 2021) Assessing Current Canadian Corporate Performance on GHG Emissions, Disclosures and Target Setting. Institute for Sustainable Finance.

- Climate Disclosure Standards Board. (2020) The State of EU Environmental Disclosure in 2020.

- Directorate-General for Financial Stability, Financial Services and Capital Markets Union. (2019) Guidelines on Reporting Climate-Related Information.

- Enbridge. (June 11, 2021) Request for Public Input Regarding Climate Change Disclosures.

- Enerplus. (June 11, 2021) Public Input Welcomed on Climate Change Disclosures.

- EY (June 2021). Global Climate Risk Disclosure Barometer

- Task Force on Climate Related Financial Disclosures. (June 15, 2017) Recommendations of the Task Force on Climate-related Financial Disclosures.

- Final Report of the Expert Panel on Sustainable Finance. (2019) Mobilizing Finance for Sustainable Growth. Environment and Climate Change Canada.

- Financial Stability Board (July 7, 2021) FSB Roadmap for Addressing Climate-Related Financial Risks.

- Herron Lee, A. (March 15, 2021) Public Input Welcomed on Climate Change Disclosures. U.S. Securities and Exchange Commission.

- IFRS Foundation. (April 2021) IFRS Foundation Trustees' Feedback Statement on the Consultation Paper on Sustainability Reporting.

- IFRS Foundation. (September, 2020) Consultation Paper on Sustainable Reporting.

- McGill University et. al. (June 2020) Investing to Address Climate Change: A Charter for Canadian Universities

- Millani (February 15, 2021). ESG Sentiment Study of Canadian Investors

- Millani. (June 14, 2021) TCFD Disclosure Study: A Canadian Perspective

- Olmem, A. and Forrester, J.P. (May 24, 2021) President Biden Signs Executive Order on Addressing Climate Change Risk through Financial Regulation. Mayer | Brown.

- Pension Investment Association of Canada. (June 14, 2021) Consultation Climate Change Disclosures.

- Sarra, J. (June 2, 2021) Following the Footpath to Mandatory TCFD Disclosure in the United Kingdom: Lessons for Canadian and Other Regulators. Canadian Climate Law Initiative.

- Sarra, J. (June 16, 2021) On the Horizon – Briefing note on TCFD-aligned mandatory disclosure in New Zealand. Canadian Climate Law Initiative.

- Slater, A. and Taylor, M. (November, 2020) Climate-related financial disclosure in the Canadian financial sector: A three-year Progress Report. Global Risk Institute in Financial Services.

- Smart Prosperity Initiative. (August, 2020) Bridging the Transparency Gap in Sustainable Finance.