Annual Financial Report of the Government of Canada Fiscal Year 2018–2019

Note to Readers

The financial results in this report are based on the audited consolidated financial statements of the Government of Canada for the fiscal year ended March 31, 2019, the condensed form of which is included in this report.

For the 21st consecutive year, the Government has received an unmodified audit opinion from the Auditor General of Canada on the consolidated financial statements. The complete consolidated financial statements are available on the Public Services and Procurement Canada website.

The Fiscal Reference Tables have been updated to incorporate the results for 2018–19 as well as historical revisions to the National Economic and Financial Accounts published by Statistics Canada.

Report Highlights

- The Government posted a budgetary deficit of $billion for the fiscal year ended March 31, 2019, compared to an estimated deficit of $billion in the March 2019 budget.

- Revenues increased by $billion, or per cent, from 2017–Program expenses increased by $14.6 billion, or per cent, reflecting increases in all major categories of expenses. Public debt charges were up $billion, or 6.3 per cent.

- The federal debt (the difference between total liabilities and total assets) stood at $685.5 billion at March 31, The federal debt-to-GDP (gross domestic product) ratio was per cent, down from per cent in the previous year.

- Public debt charges amounted to per cent of expenses in 2018–This is down from a peak of nearly 30 per cent in the mid-1990s.

- For the 21st consecutive year, the Government has received an unmodified audit opinion from the Auditor General of Canada on the consolidated financial statements.

| 2018–19 | 2017–18 Restated1 |

|

|---|---|---|

| Budgetary transactions | ||

| Revenues | 332.2 | 311.2 |

| Expenses | ||

| Program expenses | 322.9 | 308.3 |

| Public debt charges | 23.3 | 21.9 |

| Total expenses | 346.2 | 330.2 |

| Budgetary balance | (14.0) | (19.0) |

| Non-budgetary transactions | 1.2 | 9.5 |

| Financial source/requirement | (12.7) | (9.4) |

| Net change in financing activities | 15.7 | 7.6 |

| Net change in cash balances | 3.0 | (1.9) |

| Cash balance at end of period | 37.6 | 34.6 |

| Financial position | ||

| Total liabilities | 1,185.2 | 1,150.4 |

| Total financial assets | 413.0 | 397.5 |

| Net debt | (772.1) | (752.9) |

| Non-financial assets | 86.7 | 81.6 |

| Federal debt (accumulated deficit) | (685.5) | (671.3) |

| Financial results (% of GDP) | ||

| Revenues | 15.0 | 14.5 |

| Program expenses | 14.6 | 14.4 |

| Public debt charges | 1.0 | 1.0 |

| Budgetary balance | (0.6) | (0.9) |

| Federal debt (accumulated deficit) | 30.9 | 31.3 |

| Note: Numbers may not add due to rounding. 1 Certain comparative figures have been restated. Information regarding this restatement can be found in Note 3 of the condensed consolidated financial statements. |

||

Economic DevelopmentsFootnote 1

The global economic expansion moderated in 2018 after two years of strong growth, which was broad-based across most regions of the world. Towards the end of the year increased trade tensions, notably between the U.S. and China, and lower expectations for growth translated into increased financial market volatility, lower commodity prices, and a decline in government bond yields.

Against the backdrop of easing global growth, the Canadian economy moderated to a more sustainable pace in line with underlying fundamentals. Real GDP grew 1.9 per cent in 2018 after the strong growth of 2017 (3.0 per cent). Throughout the year, the labour market continued to be strong. Since the fall of 2015, the economy has generated close to 1 million jobs with the unemployment rate reaching its lowest level in more than 40 years.

Supported by accommodative monetary and fiscal policy, consumer spending and business investment led Canadian economic growth in 2018, while lower global oil prices over the second half of the year and slower housing market activity weighed on the economy.

There was continued volatility in commodity markets over the year with the price of West Texas Intermediate crude oil increasing to nearly US$70 per barrel in October, its highest level since before the oil shock, before retreating again to below US$50 per barrel toward the end of 2018.

Canada's nominal GDP, the broadest measure of the tax base, grew 3.6 per cent in 2018, down from 5.6 per cent in 2017. Lower nominal growth was due to more moderate real GDP growth as well as lower GDP inflation, the latter reflecting a decrease in global and Canadian oil prices at the end of the year. Both real and nominal GDP growth in 2018 were in line with the Budget 2019 forecast.

Both short- and long-term interest rates in Canada continued to increase over most of 2018 as a result of increases in the Bank of Canada's policy target rate. However, interest rates across the yield curve remained historically low in 2018, and long-term interest rates began to subside towards the end of the year in response to expectations for easing monetary policy in the U.S., and overall economic uncertainty.

Going forward, there remain important uncertainties and risks in the global and domestic economies. The Government regularly surveys private sector economists on their views on the economy to assess and manage risk. The survey of private sector economists has been used as the basis for economic and fiscal planning since 1994 and introduces an element of independence into the Government's forecasts. This practice has been supported by international organizations, such as the International Monetary Fund (IMF).

| 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|

| Real GDP growth | ||||

| Budget 2018 | 3.0 | 2.1 | 1.6 | 1.7 |

| Budget 2019 | 3.0 | 1.9 | 1.8 | 1.6 |

| Actual | 3.0 | 1.9 | – | – |

| Nominal GDP growth | ||||

| Budget 2018 | 5.6 | 4.1 | 3.5 | 3.8 |

| Budget 2019 | 5.6 | 3.8 | 3.4 | 3.5 |

| Actual | 5.6 | 3.6 | – | – |

| 3-month treasury bill rate | ||||

| Budget 2018 | 0.7 | 1.4 | 2.0 | 2.3 |

| Budget 2019 | 0.7 | 1.4 | 1.9 | 2.2 |

| Actual | 0.7 | 1.4 | – | – |

| 10-year government bond rate | ||||

| Budget 2018 | 1.8 | 2.3 | 2.8 | 3.1 |

| Budget 2019 | 1.8 | 2.3 | 2.4 | 2.7 |

| Actual | 1.8 | 2.3 | – | – |

| Unemployment rate | ||||

| Budget 2018 | 6.4 | 6.0 | 6.0 | 6.1 |

| Budget 2019 | 6.3 | 5.8 | 5.7 | 5.9 |

| Actual | 6.3 | 5.8 | – | – |

| Consumer Price Index inflation | ||||

| Budget 2018 | 1.6 | 1.9 | 2.0 | 1.9 |

| Budget 2019 | 1.6 | 2.3 | 1.9 | 2.0 |

| Actual | 1.6 | 2.3 | – | – |

| Note: Figures have been restated to reflect the historical revisions in the Canadian System of National Accounts as of the first quarter of 2019 released on May 31, 2019. | ||||

The Budgetary Balance

The Government posted a budgetary deficit of $14.0 billion in 2018–19, compared to a deficit of $19.0 billion in 2017–18.

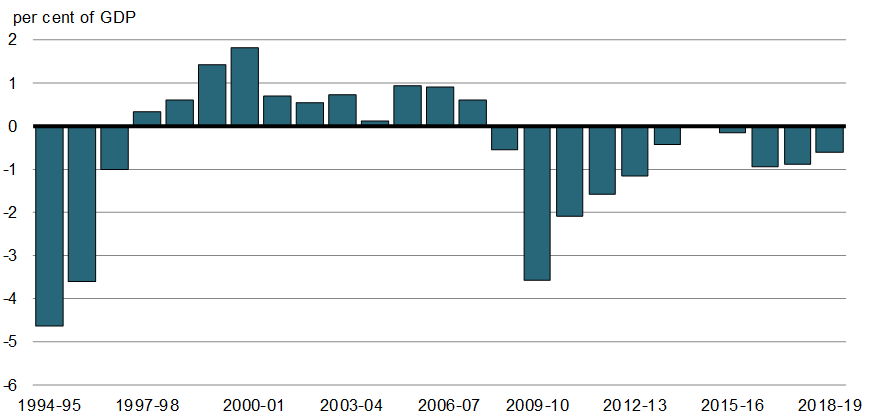

The following graph shows the Government’s budgetary balance since 1994–95. To enhance the comparability of results over time and across jurisdictions, the budgetary balance and its components are presented as a percentage of GDP. In 2018–19, the budgetary deficit was 0.6 per cent of GDP, compared to a deficit of 0.9 per cent of GDP a year earlier.

Budgetary Balance

Revenues were up $21.0 billion, or 6.7 per cent, from the prior year, reflecting increases in all streams, driven primarily by income tax revenues, other taxes and duties and other revenues.

Expenses were up $16.0 billion, or 4.8 per cent, from the prior year. Program expenses increased by $14.6 billion, or 4.7 per cent, primarily reflecting an increase in transfer payments. Public debt charges increased by $1.4 billion, or 6.3 per cent, from the prior year.

Comparison of Actual Budgetary Outcomes to Projected Results

The $14.0-billion deficit recorded in 2018–19 represents a $0.9-billion improvement over the $14.9-billion deficit projected in the March 2019 budget.

Overall, revenues were about equal to the March 2019 budget projections. However, actual results did vary from projections in certain streams. Income tax revenue was $0.7 billion lower than projected in Budget 2019 due to slightly weaker-than-expected corporate earnings, partially offset by stronger-than expected personal income tax revenue. Other taxes and duties, primarily Goods and Services Tax (GST) revenue, were lower by $1.3 billion, or 2.3 per cent, while other revenues and Employment Insurance (EI) premium revenues increased by $1.2 billion and $0.9 billion, respectively, relative to budget projections.

Program expenses were $0.6 billion lower than expected. Major transfers to persons and major transfers to other levels of government were broadly in line with projections while direct program expenses across federal departments and agencies were $0.6 billion lower than projected, reflecting a 0.4-per-cent forecast variance.

Public debt charges were $0.3 billion lower than forecast, reflecting a lower-than-expected average effective interest rate on the stock of interest-bearing debt.

| Difference | ||||

|---|---|---|---|---|

| Actual ($ billions) |

March 2019 budget ($ billions) |

($ billions) | (%) | |

| Revenues | ||||

| Income tax | ||||

| Personal | 163.9 | 162.8 | 1.1 | 0.7 |

| Corporate | 50.4 | 52.0 | (1.6) | (3.2) |

| Non-resident | 9.4 | 9.6 | (0.2) | (2.1) |

| Total | 223.6 | 224.3 | (0.7) | (0.3) |

| Other taxes and duties | ||||

| Goods and Services Tax | 38.2 | 39.6 | (1.4) | (3.7) |

| Energy taxes | 5.8 | 5.8 | 0.0 | 0.3 |

| Customs import duties | 6.9 | 6.9 | 0.0 | 0.0 |

| Other excise taxes and duties | 6.3 | 6.2 | 0.1 | 1.2 |

| Total | 57.2 | 58.5 | (1.3) | (2.3) |

| Employment Insurance premiums | 22.3 | 21.4 | 0.9 | 4.0 |

| Other revenues | 29.1 | 27.9 | 1.2 | 4.0 |

| Total revenues | 332.2 | 332.2 | 0.0 | 0.0 |

| Program expenses | ||||

| Major transfers to persons | ||||

| Elderly benefits | 53.4 | 53.3 | 0.1 | 0.2 |

| Employment Insurance | 18.9 | 18.8 | 0.1 | 0.5 |

| Children's benefits | 23.9 | 23.9 | (0.0) | (0.2) |

| Total | 96.1 | 96.0 | 0.1 | 0.1 |

| Major transfers to other levels of government | ||||

| Support for health and other social programs | 52.7 | 52.7 | 0.0 | 0.0 |

| Fiscal arrangements | 18.0 | 18.1 | (0.1) | (0.4) |

| Gas Tax Fund | 4.3 | 4.3 | 0.0 | 0.0 |

| Home care and mental health | 0.8 | 0.9 | (0.0) | (1.4) |

| Total | 75.9 | 76.0 | (0.1) | (0.1) |

| Direct program expenses | 150.9 | 151.5 | (0.6) | (0.4) |

| Total program expenses | 322.9 | 323.5 | (0.6) | (0.2) |

| Public debt charges | 23.3 | 23.6 | (0.3) | (1.3) |

| Budgetary outcome/estimate | (14.0) | (14.9) | 0.9 | |

| Note: Numbers may not add due to rounding. | ||||

Revenues

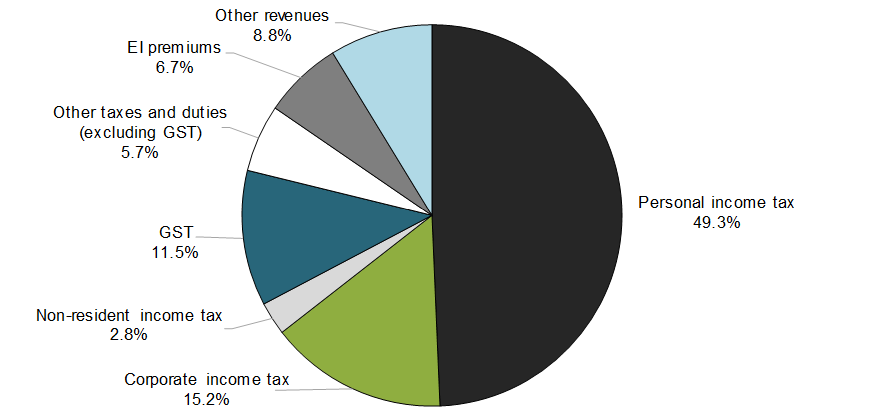

Federal revenues can be broken down into four main categories: income tax revenues, other taxes and duties, EI premium revenues and other revenues.

Within the income tax category, personal income tax revenues are the largest source of federal revenues, and accounted for 49.3 per cent of total revenues in 2018–19 (down from 49.4 per cent in 2017–18). Corporate income tax revenues are the second largest source of revenues, and accounted for 15.2 per cent of total revenues in 2018–19 (down from 15.4 per cent in 2017–18). Non-resident income tax revenues are a comparatively smaller source of revenues, accounting for only 2.8 per cent of total revenues in 2018–19 (up from 2.5 per cent in 2017–18).

Other taxes and duties consist of revenues from the GST, energy taxes, customs import duties and other excise taxes and duties. The largest component of this category—GST revenues—accounted for 11.5 per cent of all federal revenues in 2018–19 (down from 11.8 per cent in 2017–18). The share of the remaining components of other taxes and duties stood at 5.7 per cent of total federal revenues (up from 5.5 per cent in 2017–18).

EI premium revenues accounted for 6.7 per cent of total federal revenues in 2018–19 (down slightly from 2017–18).

Other revenues are made up of three broad components: net income from enterprise Crown corporations and other government business enterprises; other program revenues from returns on investments, proceeds from the sales of goods and services, and other miscellaneous revenues; and foreign exchange revenues. Other revenues accounted for 8.8 per cent of total federal revenues in 2018–19 (up slightly from 2017–18).

Composition of Revenues for 2018–19

Revenues Compared to 2017–18

Total revenues amounted to $332.2 billion in 2018–19, up $21.0 billion, or 6.7 per cent, from 2017–18. The following table compares revenues for 2018–19 to 2017–18.

| 2018–19 ($ millions) |

2017–18 Restated1 ($ millions) |

Net change | ||

|---|---|---|---|---|

| ($ millions) | (%) | |||

| Tax revenues | ||||

| Income tax | ||||

| Personal | 163,881 | 153,619 | 10,262 | 6.7 |

| Corporate | 50,368 | 47,805 | 2,563 | 5.4 |

| Non-resident | 9,370 | 7,845 | 1,525 | 19.4 |

| Total | 223,619 | 209,269 | 14,350 | 6.9 |

| Other taxes and duties | ||||

| Goods and Services Tax | 38,221 | 36,751 | 1,470 | 4.0 |

| Energy taxes | 5,802 | 5,739 | 63 | 1.1 |

| Customs import duties | 6,881 | 5,416 | 1,465 | 27.0 |

| Other excise taxes and duties | 6,323 | 5,913 | 410 | 6.9 |

| Total | 57,227 | 53,819 | 3,408 | 6.3 |

| Total tax revenues | 280,846 | 263,088 | 17,758 | 6.7 |

| Employment Insurance premiums | 22,295 | 21,140 | 1,155 | 5.5 |

| Other revenues | 29,077 | 26,988 | 2,089 | 7.7 |

| Total revenues | 332,218 | 311,216 | 21,002 | 6.7 |

| 1 Certain comparative figures have been restated. Information regarding this restatement can be found in Note 3 of the condensed consolidated financial statements. | ||||

- Personal income tax revenues increased by $billion in 2018–19, or per cent, driven by high employment and a strong labour market.

- Corporate income tax revenues increased by $billion, or per cent, reflecting growth in corporate earnings in a number of sectors including finance, manufacturing and wholesale trade.

- Non-resident income tax revenues are paid by non-residents on Canadian-sourced income. These revenues increased by $billion, or per cent, largely reflecting growth in corporate earnings and dividends.

- Other taxes and duties increased by $billion, or per cent. GST revenues grew by $billion in 2018–19, or per cent, reflecting growth in retail sales. Energy taxes grew by $billion, or per cent, primarily due to higher aviation fuel consumption in 2018–Customs import duties increased by $billion, or per cent, largely due to the application of steel and aluminum retaliatory tariffs. Excluding the retaliatory tariffs, customs import duties grew by per cent. Other excise taxes and duties were up $billion, or per cent, driven primarily by an increase in tobacco excise duties.

- EI premium revenues increased by $billion, or per cent. This was due to an increase in insurable earnings and in the premium rate for 2018.

- Other revenues increased by $billion, or per cent, largely reflecting an increase in interest and penalties revenues and a greater return on investments, both largely due to higher interest rates.

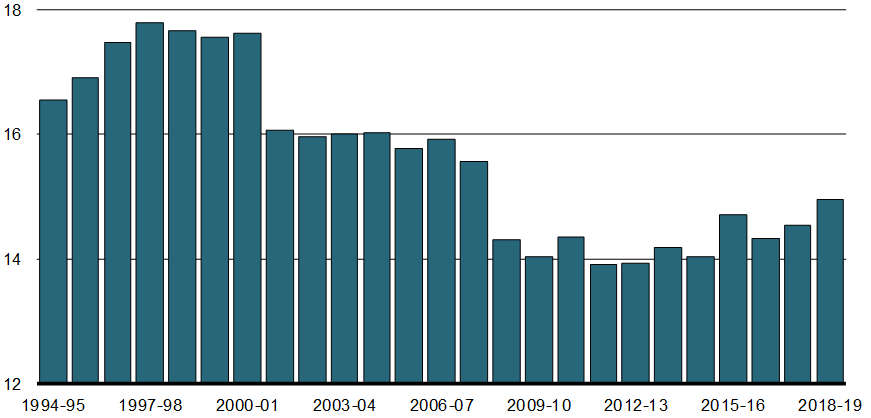

The revenue ratio—revenues as a percentage of GDP—compares the total of all federal revenues to the size of the economy. This ratio is influenced by changes in statutory tax rates and by economic developments. The ratio stood at 15.0 per cent in 2018–19 (up from 14.5 per cent in 2017–18). This increase primarily reflects growth in personal and corporate income tax revenues and other taxes and duties.

Revenue Ratio

revenues as a per cent of GDP

Expenses

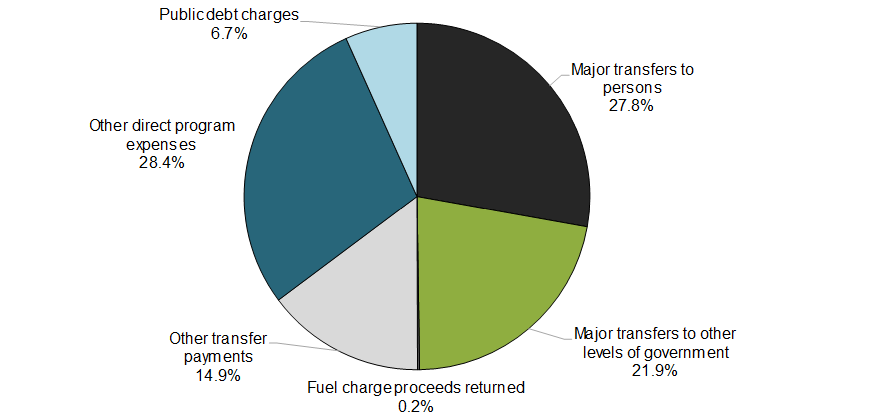

Federal expenses can be broken down into three main categories: transfer payments, which account for roughly two-thirds of all federal spending, other expenses and public debt charges.

Transfer payments are classified under four categories:

- Major transfers to persons, which made up per cent of total expenses (down from per cent in 2017–18). This category consists of elderly, EI and children’s benefits.

- Major transfers to other levels of government—which include the Canada Health Transfer, the Canada Social Transfer, home care and mental health transfers, fiscal arrangements (Equalization, transfers to the territories, a number of smaller transfer programs and the Quebec Abatement), and Gas Tax Fund transfers—made up 21.9 per cent of total expenses in 2018–19 (up from per cent in 2017–18).

- Fuel charge proceeds returned, consisting of payments under the new federal carbon pollution pricing system, made up per cent of expenses.

- Other transfer payments, which include transfers to Aboriginal peoples, assistance to farmers, students and businesses, support for research and development, and international assistance, made up per cent of expenses (up from per cent in 2017–18).

Other direct program expenses, which represent the operating expenses of the Government’s 130 departments, agencies, and consolidated Crown corporations and other entities, accounted for 28.4 per cent of total expenses in 2018–19 (down from 29.3 per cent in 2017–18).

Public debt charges made up the remaining 6.7 per cent of total expenses in 2018–19 (up slightly from 2017–18).

Composition of Expenses for 2018–19

Pricing Carbon Pollution While Delivering Climate Action Incentive Payments

The federal carbon pollution pricing system is composed of a fuel charge and an output-based pricing system. All direct proceeds from the federal fuel charge are returned to the jurisdiction of origin. In Ontario, New Brunswick, Manitoba and Saskatchewan, the bulk of proceeds are returned through Climate Action Incentive payments. Eligible individuals residing in these provinces can claim the payments through their personal income tax returns. A number of individuals have claimed the Climate Action Incentive payment before the fuel charge came into effect on April 1, 2019 by filing their tax returns before the end of the fiscal year (March 31, 2019). These payments, totalling $0.7 billion, are expensed in the 2018–19 fiscal year. The corresponding proceeds will be collected in the 2019-20 fiscal year, offsetting this expense.

Expenses Compared to 2017–18

Total expenses amounted to $346.2 billion in 2018–19, up $16.0 billion, or 4.8 per cent, from 2017–18. The following table compares total expenses for 2018–19 to 2017–18.

| 2018–19 ($ millions) |

2017–18 Restated1 ($ millions) |

Net change | ||

|---|---|---|---|---|

| ($ millions) | (%) | |||

| Major transfers to persons | ||||

| Elderly benefits | 53,366 | 50,644 | 2,722 | 5.4 |

| Employment Insurance | 18,888 | 19,715 | (827) | (4.2) |

| Children's benefits | 23,882 | 23,432 | 450 | 1.9 |

| Total | 96,136 | 93,791 | 2,345 | 2.5 |

| Major transfers to other levels of government | ||||

| Federal transfer support for health and other social programs | 52,729 | 50,872 | 1,857 | 3.7 |

| Fiscal arrangements and other transfers | 23,196 | 19,647 | 3,549 | 18.1 |

| Total | 75,925 | 70,519 | 5,406 | 7.7 |

| Direct program expenses | ||||

| Fuel charge proceeds returned | 664 | - | 664 | n/a |

| Other transfer payments | 51,753 | 47,138 | 4,615 | 9.8 |

| Other direct program expenses | 98,438 | 96,840 | 1,598 | 1.7 |

| Total direct program expenses | 150,855 | 143,978 | 6,877 | 4.8 |

| Total program expenses | 322,916 | 308,288 | 14,628 | 4.7 |

| Public debt charges | 23,266 | 21,889 | 1,377 | 6.3 |

| Total expenses | 346,182 | 330,177 | 16,005 | 4.8 |

| 1 Certain comparative figures have been restated. Information regarding this restatement can be found in Note 3 of the condensed consolidated financial statements. | ||||

- Major transfers to persons increased by $billion in 2018–19, reflecting increases in elderly and children’s benefits. Elderly benefits increased by $billion, or per cent, reflecting growth in the elderly population and changes in consumer prices, to which benefits are fully indexed. EI benefits decreased by $billion, or per cent, reflecting stronger labour market conditions. Children’s benefits increased by $billion, or per cent, reflecting the indexation of the Canada Child Benefit, which took effect in July 2018.

- Major transfers to other levels of government increased by $billion in 2018–19, primarily reflecting $2.7 billion in legislated growth in the Canada Health Transfer, the Canada Social Transfer, Equalization transfers and transfers to the territories, as well as a one-time $2.2-billion increase in transfers under the Gas Tax Fund.

- Direct program expenses increased by $billion in 2018–19, or per cent:

- Fuel charge proceeds returned began in 2018–19 and amounted to $billion.

- Other transfer payments increased by $billion, or per cent, in 2018–19, reflecting increases across a number of departments and agencies, including higher transfers relating to infrastructure, $billion in funding for the Green Municipal Fund announced in Budget 2019, and increased transfers to First Nations and assistance for students.

- Other direct program expenses of departments, agencies, and consolidated Crown corporations and other entities increased by $billion, or per cent.

- Public debt charges increased by $billion, or per cent, reflecting a higher average effective interest rate on the stock of interest-bearing debt in 2018–19.

There has been a large shift in the composition of total expenses since the mid-1990s. Public debt charges were the largest component for most of the 1990s, given the large and increasing stock of interest-bearing debt and high average effective interest rates on that stock of debt. Since reaching a high of nearly 30 per cent of total expenses in 1996–97, the share of public debt charges in total expenses has fallen by more than three-quarters.

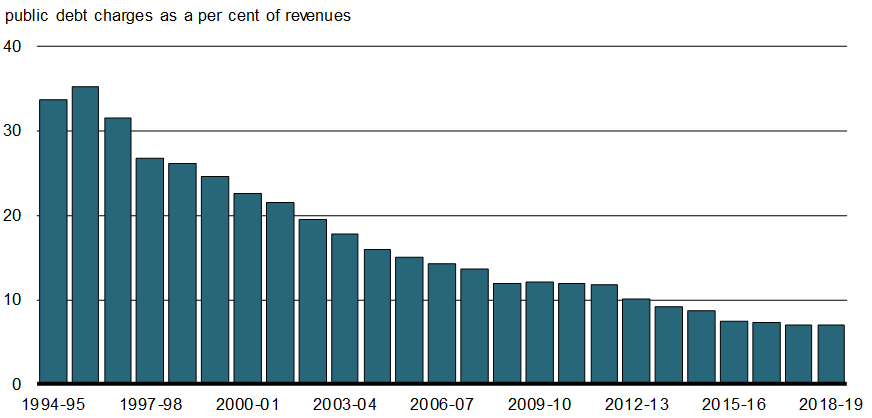

The interest ratio (public debt charges as a percentage of revenues) shows the proportion of every dollar of revenue that is needed to pay interest and is therefore not available to pay for program initiatives. The lower the ratio, the more flexibility the Government has to address the key priorities of Canadians. The interest ratio has been decreasing in recent years, falling from a peak of 37.6 per cent in 1990–91 to 7.0 per cent in 2018–19. This means that, in 2018–19, the Government spent approximately 7 cents of every revenue dollar on interest on public debt.

Interest Ratio

Federal Debt

The federal debt (accumulated deficit) is the difference between the Government’s total liabilities and its total assets. With total liabilities of $1.2 trillion, financial assets of $413.0 billion and non-financial assets of $86.7 billion, the federal debt stood at $685.5 billion at March 31, 2019, up $14.2 billion from March 31, 2018.

The $14.2-billion increase in the federal debt reflects the 2018–19 budgetary deficit of $14.0 billion and a $0.2billion other comprehensive loss.

| 2018–19 | 2017–18 | Net change | |

|---|---|---|---|

| Federal debt at beginning of year | (671,254) | (651,540) | (19,714) |

| Annual deficit | (13,964) | (18,961) | 4,997 |

| Other comprehensive loss | (232) | (753) | 521 |

| Federal debt at end of year | (685,450) | (671,254) | (14,196) |

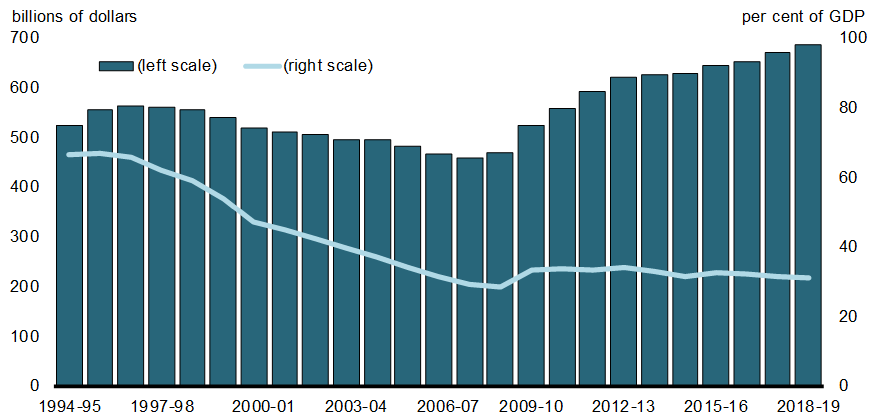

The following chart shows the federal debt since 1994–95. The federal debt stood at 30.9 per cent of GDP in 2018–19, down from 31.3 per cent in 2017–18.

Federal Debt (Accumulated Deficit)

| 2018–19 | 2017–18 Restated1 |

|

|---|---|---|

| Liabilities | ||

| Accounts payable and accrued liabilities | 159.7 | 147.8 |

| Interest-bearing debt | ||

| Unmatured debt | 736.9 | 721.2 |

| Pensions and other employee future benefits | 282.6 | 275.7 |

| Other liabilities | 5.9 | 5.7 |

| Total interest-bearing debt | 1,025.5 | 1,002.6 |

| Total liabilities | 1,185.2 | 1,150.4 |

| Financial assets | ||

| Cash and other accounts receivable | 49.5 | 49.0 |

| Taxes receivable | 127.6 | 123.0 |

| Foreign exchange accounts | 99.7 | 96.9 |

| Loans, investments and advances | 133.9 | 126.4 |

| Public sector pension assets | 2.4 | 2.1 |

| Total financial assets | 413.0 | 397.5 |

| Net debt | (772.1) | (752.9) |

| Non-financial assets | ||

| Tangible capital assets | 78.9 | 73.8 |

| Inventories | 6.6 | 6.7 |

| Prepaid expenses and other | 1.1 | 1.1 |

| Total non-financial assets | 86.7 | 81.6 |

| Federal debt (accumulated deficit) | (685.5) | (671.3) |

| Note: Numbers may not add due to rounding. 1 Certain comparative figures have been restated. Information regarding this restatement can be found in Note 3 of the condensed consolidated financial statements. |

||

Assets

The Government’s assets consist of financial assets (cash and other accounts receivable, taxes receivable, foreign exchange accounts, loans, investments and advances, and public sector pension assets) and non-financial assets (tangible capital assets, inventories, and prepaid expenses and other).

At March 31, 2019, financial assets amounted to $413.0 billion, up $15.6 billion from March 31, 2018. The increase in financial assets reflects increases in cash and other accounts receivable, taxes receivable, foreign exchange accounts, loans, investments and advances, and public sector pension assets.

- At March 31, 2019, cash and other accounts receivable totalled $billion, up $billion from March 31, Within this component, cash and cash equivalents increased by $billion. The balance of cash and cash equivalents includes $20 billion that has been designated as a deposit held with respect to prudential liquidity management. The Government’s overall liquidity is maintained at a level sufficient to cover at least one month of net projected cash flows, including coupon payments and debt refinancing needs. Other accounts receivable decreased by $billion, largely due to a $1.6-billion decrease in cash collateral under International Swaps and Derivatives Association agreements in respect of outstanding cross-currency swap agreements and a $1.0-billion decrease in dividends receivable from Canada Mortgage and Housing Corporation at year-end.

- Taxes receivable increased by $billion during 2018–19 to $billion, reflecting growth in tax revenues and higher disputed arrears.

- Foreign exchange accounts increased by $billion in 2018–19, totalling $billion at March 31, The increase in foreign exchange accounts largely reflects a $1.8-billion increase in foreign exchange reserves held in the Exchange Fund Account, due mainly to net revenues earned on investments in the Fund during the year, and a $1.3-billion decrease in notes payable to the IMF.

- Loans, investments and advances increased by $billion in 2018–19.

- Loans, investments and advances in enterprise Crown corporations and other government business enterprises increased by $billion. Investments in enterprise Crown corporations and other government business enterprises decreased by $billion, as the $billion in net profits recorded by these entities during 2018–19 were more than offset by $billion in other comprehensive losses and $billion in dividends paid to the Government. Net loans and advances were up $billion, primarily reflecting a $3.2billion increase in loans to Crown corporations under the consolidated borrowing framework, and $4.8-billion in financing to the Canada Development Investment Corporation (CDEV) from the Canada Account to fund the acquisition of the Trans Mountain entities, to finance construction activities for the Expansion Project, and to fund other corporate purposes.

- Other loans, investments and advances increased by $billion.

- Public sector pension assets increased by $billion.

Details of the Trans Mountain Pipeline Acquisition

On August 31, 2018, the Government of Canada purchased the entities that control the existing Trans Mountain Pipeline, its Expansion Project and related assets for $4.4 billion.

The Trans Mountain entities are controlled by the Trans Mountain Corporation (TMC), which is a subsidiary of CDEV, an enterprise Crown corporation reporting to Parliament through the Minister of Finance. The consolidated equity of CDEV, which includes the Trans Mountain entities under TMC, is recorded as a government asset and reported under Loans, investments and advances on the Condensed Consolidated Statement of Financial Position.

The purchase of the Trans Mountain entities was financed through a loan to CDEV from the Canada Account, which is also reported under Loans, investments and advances. The balance of this loan amounted to $4.8 billion as at March 31, 2019. Funding for this loan was provided through an increase in Government of Canada unmatured debt.

The Trans Mountain entities currently provide transportation and logistical services to shippers from the Western Canadian sedimentary basin and generate cash flows from tolls charged to these shippers. The Expansion Project is a capital project, which will significantly increase the capacity of the Trans Mountain pipeline system.

The Trans Mountain entities have significant commercial value and generate returns from existing operational assets. The net results attributable to Canada’s holdings in the Trans Mountain entities are consolidated in CDEV’s net income, which is included in Other revenues on the Condensed Consolidated Statement of Operations and Accumulated Deficit.

Construction and other associated expenditures related to the construction of the Expansion Project prior to its in-service date will be recorded as additions to the book value of the Project.

It is not the intention of the Government of Canada to be a long-term owner of the Trans Mountain entities.

At March 31, 2019, non-financial assets stood at $86.7 billion, up $5.0 billion from a year earlier. Of this growth, $5.1 billion relates to an increase in tangible capital assets, offset in part by a $0.1-billion decrease in inventories.

Liabilities

The Government’s liabilities consist of accounts payable and accrued liabilities and interest-bearing debt.

At March 31, 2019, accounts payable and accrued liabilities totalled $159.7 billion, up $11.9 billion from March 31, 2018. This increase reflects growth in amounts payable related to tax, other accounts payable and accrued liabilities, provisions for contingent liabilities, environmental liabilities and asset retirement obligations, and interest and matured debt, partially offset by a decrease in deferred revenue.

- Amounts payable related to tax increased by $billion in 2018–19, from $billion at March 31, 2018 to $65.2 billion at March 31, This increase reflects in part the Climate Action Incentive payments that were accrued at the end of the year.

- Other accounts payable and accrued liabilities increased by $billion in 2018–Within this component, accounts payable increased by $billion. This increase was attributable in large part to the accrual of $billion in spending measures announced in Budget 2019, including a one-time $2.2-billion top-up to the Gas Tax Fund and $bilion in funding for the Green Municipal Fund. Miscellaneous paylist deductions and other accounts payable increased by $billion and $21 million, respectively. Accrued salaries and benefits increased by $0.1 billion, due mainly to an increase in allowances for vacation pay. These increases were somewhat offset by a $0.4-billion decrease in liabilities under tax collection agreements, reflecting timing differences in payments to provinces, territories and Aboriginal governments, and a $44-million decrease in notes payable to international organizations.

- Provisions for contingent liabilities increased by $billion, largely reflecting an increase in the Government’s estimates of amounts required to settle various specific claims and pending and threatened litigation.

- Environmental liabilities and asset retirement obligations increased by $billion in 2018–19, reflecting revisions to previously estimated provisions, net of remediation activities undertaken.

- Deferred revenue decreased by $billion in 2018–19, primarily reflecting the recognition of previously deferred revenue related to spectrum licence auctions.

- Liabilities for interest and matured debt increased by $4 million from the prior year.

Interest-bearing debt includes unmatured debt, or debt issued on the credit markets, pension and other future benefit liabilities, and other liabilities. At March 31, 2019, interest-bearing debt totalled $1,025.5 billion, up $22.9 billion from March 31, 2018. Within interest-bearing debt, unmatured debt increased by $15.7 billion, liabilities for pensions decreased by $2.1 billion, liabilities for other employee and veteran future benefits increased by $9.1 billion, and other liabilities increased by $0.2 billion.

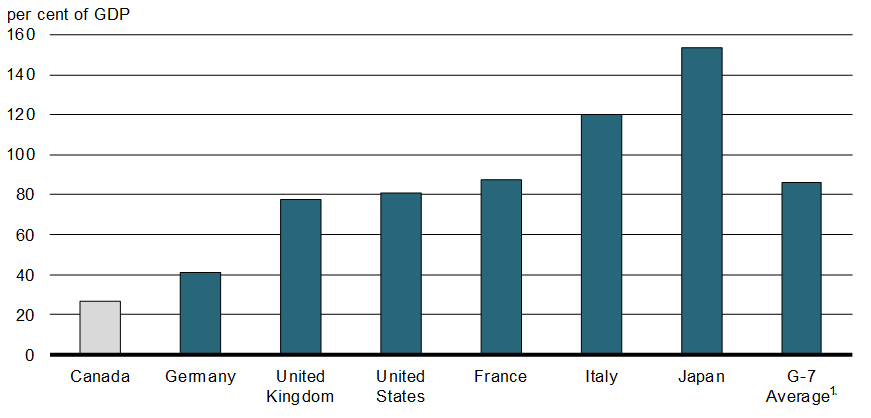

International Comparisons of Government Debt

Jurisdictional responsibility (between central, state and local governments) for government programs differs among countries. As a result, international comparisons of government fiscal positions are made on a total government, National Accounts basis. For Canada, total government net debt includes that of the federal, provincial/territorial and local governments, as well as the net assets held in the Canada Pension Plan and Québec Pension Plan.

G7 Total Government Net Debt, 2018

Canada’s total government net debt-to-GDP ratio stood at 26.8 per cent in 2018, according to the IMF. This is the lowest level among G7 countries, which the IMF estimates will record an average net debt of 86.0 per cent of GDP in that same year.

The following table provides a reconciliation between the Government of Canada’s federal debt-to-GDP ratio and Canada’s total government net debt-to-GDP ratio used for international debt comparison purposes. Importantly, Canada’s total government net debt-to-GDP ratio includes the net debt of the federal, provincial, territorial and local governments as well as the net assets held by the Canada Pension Plan (CPP) and Québec Pension Plan (QPP), and excludes liabilities for public sector pensions and other employee future benefits.

| (per cent of GDP) | ||

|---|---|---|

| Federal debt | 30.9 | |

| Add: Non-financial assets | 3.9 | |

| Net debt (Public Accounts basis) | 34.8 | |

| Less: | Liabilities for public sector pensions | (7.6) |

| Liabilities for other future benefits | (5.1) | |

| National Accounts/Public Accounts methodological differences and timing adjustments1 | (2.8) | |

| Total federal net debt (National Accounts basis) | 19.3 | |

| Add: Net debt of provincial/territorial and local governments | 20.6 | |

| Less: Net assets of the CPP/QPP | (13.1) | |

| Total government net debt | 26.8 | |

| Note: Numbers may not add due to rounding. 1 Includes timing differences (National Accounts data are as of December 31), differences in the universe covered by each accounting system, and differences in accounting treatments of various transactions such as capital gains. Sources: Statistics Canada and Public Accounts of Canada. |

||

Financial Source/Requirement

The budgetary balance is the most comprehensive measure of the federal government’s fiscal results. It is presented on an accrual basis of accounting, recording government expenses when they are incurred, regardless of when the cash payment is made, and recording tax revenues when earned, regardless of when the cash is received.

In contrast, the financial source/requirement measures the difference between cash coming in to the Government and cash going out. It differs from the budgetary balance in that it includes cash transactions in loans, investments and advances, public sector pensions, other specified purpose accounts, foreign exchange activities, and changes in other financial assets, liabilities and non-financial assets. These activities are included as part of non-budgetary transactions.

Non-budgetary transactions also include adjustments for the effects of non-cash items included in the budgetary balance and for any accruals of past or future cash receipts or payments. Examples of non-cash items include amortization of tangible capital assets, pension expenses not funded in the period, and the recognition of previously deferred revenue.

Non-budgetary transactions resulted in a net source of funds amounting to $1.2 billion in 2018–19, compared to a net source of funds of $9.5 billion in 2017–18. The year-over-year decrease in the financial source from non-budgetary transactions was due in large part to an increase in the financial requirement related to loans, investments and advances, primarily reflecting the $4.8-billion loan to CDEV to finance the acquisition of the Trans Mountain Pipeline.

With a budgetary deficit of $14.0 billion and a financial source from non-budgetary transactions of $1.2 billion, there was a total financial requirement of $12.7 billion in 2018–19, compared to a financial requirement of $9.4 billion in 2017–18 (Table 9).

The Government financed this financial requirement of $12.7 billion and increased its cash balances by $3.0 billion by increasing unmatured debt by $15.7 billion. Cash balances at the end of March 2019 stood at $37.6 billion, up from $34.6 billion at the end of March 2018.

| 2018–19 | 2017–18 Restated1 |

|

|---|---|---|

| Deficit for the year | (14.0) | (19.0) |

| Non-budgetary transactions | ||

| Pensions and other accounts | ||

| Public sector pension liabilities | (2.1) | (0.5) |

| Other employee and veteran future benefits liabilities | 9.1 | 11.2 |

| Other liabilities | 0.2 | (0.0) |

| Public sector pension assets | (0.3) | (0.2) |

| Total | 6.9 | 10.4 |

| Non-financial assets | (5.0) | (3.9) |

| Loans, investments and advances | (7.8) | (3.1) |

| Other transactions | ||

| Accounts payable, receivable, accruals and allowances | 9.9 | 4.3 |

| Foreign exchange activities | (2.8) | 1.9 |

| Total | 7.2 | 6.1 |

| Total non-budgetary transactions | 1.2 | 9.5 |

| Financial requirement | (12.7) | (9.4) |

| Net change in financing activities | ||

| Marketable bonds (Canadian currency) | (5.4) | 38.7 |

| Treasury bills | 23.6 | (26.0) |

| Retail debt | (1.3) | (1.9) |

| Other | (1.1) | (3.2) |

| Total | 15.7 | 7.6 |

| Change in cash balances | 3.0 | (1.9) |

| Cash at end of year | 37.6 | 34.6 |

| Note: Numbers may not add due to rounding. 1 Certain comparative figures have been restated. Information regarding this restatement can be found in Note 3 of the condensed consolidated financial statements. |

||

Condensed Consolidated Financial Statements of the Government of Canada

The fundamental purpose of these condensed consolidated financial statements is to provide an overview of the financial affairs and resources for which the Government is responsible under authority granted by Parliament. Responsibility for the integrity and objectivity of these statements rests with the Government.

| 2019 Budget (Note 4) |

2019 Actual | 2018 Actual Restated (Note 3) |

|

|---|---|---|---|

| Revenues | |||

| Income tax revenues | 216,966 | 223,619 | 209,269 |

| Other taxes and duties | 55,366 | 57,227 | 53,819 |

| Employment insurance premiums | 21,716 | 22,295 | 21,140 |

| Other revenues | 26,711 | 29,077 | 26,988 |

| Total revenues | 320,759 | 332,218 | 311,216 |

| Expenses | |||

| Transfer payments | |||

| Old age security benefits and related payments | 53,637 | 53,366 | 50,644 |

| Major transfer payments to other levels of government | 73,616 | 75,925 | 70,519 |

| Employment insurance | 20,714 | 18,888 | 19,715 |

| Children's benefits | 23,708 | 23,882 | 23,432 |

| Fuel charge proceeds returned | - | 664 | - |

| Other transfer payments | 47,462 | 51,753 | 47,138 |

| Total transfer payments | 219,137 | 224,478 | 211,448 |

| Other expenses | 92,714 | 98,438 | 96,840 |

| Total program expenses | 311,851 | 322,916 | 308,288 |

| Public debt charges | 24,707 | 23,266 | 21,889 |

| Total expenses | 336,558 | 346,182 | 330,177 |

| Annual deficit | (15,799) | (13,964) | (18,961) |

| Accumulated deficit at beginning of year | (671,254) | (671,254) | (651,540) |

| Other comprehensive loss | - | (232) | (753) |

| Accumulated deficit at end of year | (687,053) | (685,450) | (671,254) |

| The accompanying notes are an integral part of these condensed consolidated financial statements. | |||

| 2019 | 2018 Restated (Note 3) |

|

|---|---|---|

| Liabilities | ||

| Accounts payable and accrued liabilities | 159,707 | 147,799 |

| Interest-bearing debt | ||

| Unmatured debt | 736,915 | 721,201 |

| Pensions and other future benefits | 282,644 | 275,707 |

| Other liabilities | 5,905 | 5,670 |

| Total interest-bearing debt | 1,025,464 | 1,002,578 |

| Total liabilities | 1,185,171 | 1,150,377 |

| Financial assets | ||

| Cash and accounts receivable | 177,041 | 172,057 |

| Foreign exchange accounts | 99,688 | 96,938 |

| Loans, investments and advances | 133,912 | 126,371 |

| Public sector pension assets | 2,406 | 2,124 |

| Total financial assets | 413,047 | 397,490 |

| Net debt | (772,124) | (752,887) |

| Non-financial assets | ||

| Tangible capital assets | 78,942 | 73,835 |

| Other | 7,732 | 7,798 |

| Total non-financial assets | 86,674 | 81,633 |

| Accumulated deficit | (685,450) | (671,254) |

| Contractual obligations and contractual rights (Note 5) | ||

| Contingent liabilities (Note 6) | ||

| The accompanying notes are an integral part of these condensed consolidated financial statements. | ||

| 2019 Budget (Note 4) |

2019 Actual | 2018 Actual Restated (Note 3) |

|

|---|---|---|---|

| Net debt at beginning of year | (752,887) | (752,887) | (729,254) |

| Change in net debt during the year | |||

| Annual deficit | (15,799) | (13,964) | (18,961) |

| Acquisition of tangible capital assets | (9,045) | (11,134) | (9,793) |

| Amortization of tangible capital assets | 5,599 | 5,643 | 5,261 |

| Other | 449 | 450 | 613 |

| Net increase in net debt due to operations | (18,796) | (19,005) | (22,880) |

| Other comprehensive loss | - | (232) | (753) |

| Net increase in net debt | (18,796) | (19,237) | (23,633) |

| Net debt at end of year | (771,683) | (772,124) | (752,887) |

| The accompanying notes are an integral part of these condensed consolidated financial statements | |||

| 2019 | 2018 | |

|---|---|---|

| Cash provided (used) by operating activities | ||

| Annual deficit | (13,964) | (18,961) |

| Adjustments to reconcile annual deficit to cash used by operating activities | 18,093 | 15,184 |

| 4,129 | (3,777) | |

| Cash used by capital investment activities | (9,545) | (8,954) |

| Cash (used) provided by investing activities | (3,693) | 4,978 |

| Cash provided by financing activities | 12,102 | 5,895 |

| Net increase (decrease) in cash and cash equivalents | 2,993 | (1,858) |

| Cash and cash equivalents at beginning of year | 34,642 | 36,500 |

| Cash and cash equivalents at end of year | 37,635 | 34,642 |

| Supplementary information | ||

| Cash used for interest | 14,747 | 13,411 |

| The accompanying notes are an integral part of these condensed consolidated financial statements. | ||

Notes to the Condensed Consolidated Financial Statements of the Government of Canada

1. Applied Criteria in the Preparation of the Condensed Consolidated Financial Statements

The criteria applied by the Government in the preparation of these condensed consolidated financial statements are as follows:

- These condensed consolidated financial statements are extracted from the audited consolidated financial statements available from the Public Services and Procurement Canada website.

- The condensed consolidated financial statements are in agreement with the related information in the audited consolidated financial statements and contain the information necessary to avoid distorting or obscuring matters disclosed in the related complete audited consolidated financial statements, including the notes thereto.

- As these condensed consolidated financial statements are, by their nature, summarized, they do not include all disclosures required by Canadian public sector accounting standards.

- Readers interested in the disclosure of more detailed data should refer to the audited consolidated financial statements available from the Public Services and Procurement Canada website.

2. Summary of Significant Accounting Policies

The reporting entity of the Government of Canada includes all of the government organizations which comprise the legal entity of the Government as well as other government organizations, including Crown corporations, which are separate legal entities but are controlled by the Government. The financial activities of all of these entities, except for enterprise Crown corporations and other government business enterprises, are consolidated in these financial statements on a line-by-line and uniform basis of accounting after eliminating significant inter-governmental balances and transactions. Enterprise Crown corporations and other government business enterprises, which are not dependent on the Government for financing their activities, are recorded under the modified equity method. The Canada Pension Plan (CPP), which includes the assets of the CPP under the administration of the Canada Pension Plan Investment Board, is excluded from the reporting entity because changes to the CPP require the agreement of two thirds of participating provinces and it is therefore not controlled by the Government.

The Government accounts for transactions on an accrual basis, using the Government’s accounting policies that are described in Note 1 to its audited consolidated financial statements, which are based on Canadian public sector accounting standards. The presentation and results using the stated accounting policies do not result in any significant differences from Canadian public sector accounting standards.

Financial assets presented on the Condensed Consolidated Statement of Financial Position can provide resources to discharge liabilities or finance future operations and are recorded at the lower of cost or net realizable value. Non-financial assets cannot normally be converted into cash to finance future operations without disrupting government operations; they are recorded at cost less accumulated amortization. Liabilities are recorded at the estimated amount ultimately payable, adjusted for the passage of time, as required. Obligations for pensions and other future benefits are measured on an actuarial basis. Allowances for valuation are established for loans, investments and advances, as well as for loan guarantees and other obligations.

Some amounts in these condensed consolidated financial statements are based on estimates and assumptions made by the Government. They are based on facts and circumstances, historical experience, general economic conditions and reflect the Government’s best estimate of the related amount at the end of the reporting period. Estimates and underlying assumptions are reviewed annually at March 31. Revisions to accounting estimates are recognized in the period in which estimates are revised if revisions affect only that period or in the period of revision and future periods if revisions affect both current and future periods.

A material measurement uncertainty exists when it is reasonably possible that a material variance could occur in the reported or disclosed amount in the near term. Near term is defined as a period of time not to exceed one year from March 31. The Government has determined that a material measurement uncertainty exists with respect to the reported amounts for public sector pensions and other employee and veteran future benefits. Measurement uncertainty due to estimates and assumptions also exists in the provision for contingent liabilities; the accrual of tax revenues and the related amounts receivable and payable and the allowance for doubtful accounts; environmental liabilities and asset retirement obligations; enterprise Crown corporations and other government business enterprises; other loans, investments and advances; the expected useful life of tangible capital assets; and, contractual rights. It is reasonably possible that the Government’s reassessments of these estimates and assumptions could require a material change in reported amounts or disclosures in the condensed consolidated financial statements.

3. Accounting Change and Restatement

Change in revenue recognition criteria for Crown corporations

As the result of the introduction of a new standard, the Government reviewed its accounting policy, which required a reassessment of how the consolidated Crown corporations recognize revenue. This new standard established comprehensive guidance to determine if transactions should be accounted for as an agent or a principal.

This had a significant impact on the Canadian Commercial Corporation for its commercial contracting activities. Based on a review of the new standard, it was concluded that, given that the Canadian Commercial Corporation’s contracting activities involve arranging for goods or services to be transferred to foreign buyers, it does not control the underlying goods or services provided by Canadian exporters. Therefore, the method in which these activities are reported was changed from the Corporation acting as a principal to an agent as it results in a more appropriate presentation of these transactions in the condensed consolidated financial statements.

As an agent, the Canadian Commercial Corporation recognizes revenue for the services it provides to Canadian exporters. However, with respect to the commercial trading transactions, it no longer recognizes gross revenue from foreign buyers and related costs in the Condensed Consolidated Statement of Operations and Accumulated Deficit. Associated accounts payable, deferred revenue, accounts receivable and prepaid expenses related with these transactions are also no longer recognized in the Condensed Consolidated Statement of Financial Position.

The Government applied this change on a retroactive basis with a restatement of prior year balances. There were no changes to the accumulated deficit.

The effects of the restatement are as follows:

| 2018 | |||

|---|---|---|---|

| As previously reported |

Effect of change in accounting policy |

As restated |

|

| Condensed Consolidated Statement of Operations and Accumulated Deficit | |||

| Other revenues | 29,378 | (2,390) | 26,988 |

| Total revenues | 313,606 | (2,390) | 311,216 |

| Other expenses | 99,230 | (2,390) | 96,840 |

| Total expenses | 332,567 | (2,390) | 330,177 |

| Condensed Consolidated Statement of Financial Position | |||

| Accounts payable and accrued liabilities | 154,824 | (7,025) | 147,799 |

| Total liabilities | 1,157,402 | (7,025) | 1,150,377 |

| Cash and accounts receivable | 173,206 | (1,149) | 172,057 |

| Total financial assets | 398,639 | (1,149) | 397,490 |

| Net debt | (758,763) | 5,876 | (752,887) |

| Non-financial assets - Other | 13,674 | (5,876) | 7,798 |

| Total non-financial assets | 87,509 | (5,876) | 81,633 |

| Condensed Consolidated Statement of Change in Net Debt | |||

| Net debt at beginning of year | (734,098) | 4,844 | (729,254) |

| Change in net debt during the year - Other | (419) | 1,032 | 613 |

| Net increase in net debt due to operations | (23,912) | 1,032 | (22,880) |

| Net increase in net debt | (24,665) | 1,032 | (23,633) |

| Net debt at end of year | (758,763) | 5,876 | (752,887) |

4. Source of Budget Amounts

The budget amounts included in the Condensed Consolidated Statement of Operations and Accumulated Deficit and the Condensed Consolidated Statement of Change in Net Debt are derived from the amounts that were budgeted for 2019 in the February 2018 Budget Plan (Budget 2018). To enhance comparability with actual 2019 results, Budget 2018 amounts have been adjusted to reflect the change in the discount rate methodology used in determining the present value of the Government’s unfunded pension obligations introduced in the Public Accounts of Canada 2018. This adjustment has resulted in a $2,311-million increase in projected other expenses, a $1,615-million decrease in projected public debt charges, and a $696-million net increase in the projected 2019 annual deficit. Budget 2018 amounts have also been adjusted to reflect a change in the accounting for commercial trading transactions by the Canadian Commercial Corporation in 2019. This adjustment has resulted in a $2,655-million decrease in projected other expenses and a $2,655-million decrease in projected other revenues, with no net impact on the projected 2019 annual deficit.

Since actual opening balances of the accumulated deficit and net debt were not available at the time of preparation of Budget 2018, the corresponding amounts in the budget column have been adjusted to the actual closing balances of the previous year.

5. Contractual Obligations and Contractual Rights

The nature of Government activities results in large multi-year contracts and agreements, including international treaties, protocols and agreements of various size and importance. Any financial obligations resulting from these contracts and agreements are recorded as a liability when the terms for the acquisition of goods and services or the provision of transfer payments are met.

Contractual obligations that will materially affect the level of future expenditures include transfer payment agreements, agreements for the acquisition of goods and services, operating leases and funding of international organizations. At March 31, 2019, contractual obligations amount to $162,497 million ($137,921 million in 2018), of which $45,663 million pertains to fiscal year 2020.

The activities of Government can also involve the negotiation of contracts or agreements with third parties that result in the Government having rights to both assets and revenues in the future. These arrangements typically relate to sales of goods and services, leases of property, and royalties and profit-sharing arrangements. The terms of these contracts and agreements may not always allow for a reasonable estimate of revenues in the future. For contracts and agreements that do allow for a reasonable estimate, total revenues to be received in the future under major contractual rights are estimated at $40,448 million at March 31, 2019 ($54,646 million in 2018), of which $3,237 million pertains to fiscal year 2020.

6. Contingent Liabilities

Contingent liabilities arise in the normal course of operations and their ultimate disposition is unknown. A provision is recorded when the potential liabilities are assessed as likely to become an actual liability and a reasonable estimate of the loss can be made. The Government’s contingent liabilities include claims comprising pending and threatened litigation, specific claims and comprehensive land claims, guarantees provided by the Government, assessed taxes under appeal, callable share capital in international organizations, and insurance programs of agent enterprise Crown corporations.

- There are thousands of claims, including pending and threatened litigation, specific claims and comprehensive land claims, outstanding against the Government. While the total amount claimed in these actions is significant, their outcomes are not determinable in all cases. The Government has recorded an allowance for claims where it is likely that there will be a future payment and a reasonable estimate of the loss can be made. Significant exposure to a liability could exist in excess of what has been accrued. Claims and litigation for which the outcome is not determinable and for which an amount has not been accrued are estimated at approximately $8,528 million ($10,053 million in 2018).

- Guarantees provided by the Government include guarantees on the borrowings of enterprise Crown corporations and other government business enterprises, loan guarantees, insurance programs managed by the Government, and other explicit guarantees. At March 31, 2019, the principal amount outstanding for guarantees provided by the Government amounts to $551,336 million ($553,133 million in 2018) for which an allowance of $277 million ($278 million in 2018) has been recorded. Of the total amount guaranteed, $294,734 million ($291,469 million in 2018) relates to guarantees on the borrowings of agent enterprise Crown corporations.

- Contingent liabilities include previously assessed federal taxes where amounts are being appealed to the Tax Court of Canada, the Federal Court of Canada, or the Supreme Court of Canada. As of March 31, 2019, $4,467 million ($5,404 million in 2018) was being appealed to the courts. The Government has recorded, in accounts payable and accrued liabilities or in reduction of cash and accounts receivable, as applicable, the estimated amount of appeals that are considered likely to be lost and that can be reasonably estimated.

- The Government has callable share capital in certain international organizations that could require payments to those agencies. At March 31, 2019, callable share capital amounts to $34,750 million ($32,030 million in 2018).

- At March 31, 2019, insurance in force relating to self-sustaining insurance programs operated by four agent enterprise Crown corporations amounts to $1,772,785 million ($1,754,457 million in 2018). The Government expects that all four corporations will cover the cost of both current claims and possible future claims.