Archived - Debt Management Report 2021–2022

Table of Contents

Foreword by the Deputy Prime Minister and Minister of Finance

Introduction

Highlights for 2021-22

Part I 2021-22 Debt Management Context

Composition of Federal Debt

Sources of Borrowings and Uses of Borrowings

Borrowing Authorities

Government of Canada Credit Rating Profile

Part II Report on Objectives, Strategic Direction and Principles

Objectives, Strategic Direction and Principles

Raising Stable and Low-Cost Funding, and Strategic Direction

Maintaining a Well-Functioning Government Securities Market

Part III Report on the 2021-22 Debt Program

Domestic Marketable Bonds

Treasury Bills and Cash Management Bills

Foreign Currency Debt

Retail Debt

Cash Management

Investment of Receiver General Cash Balances

Annex 1 Completed Treasury Evaluation Reports

Annex 2 Debt Management Policy Measures Taken Since 1997

Foreword by the Deputy Prime Minister and Minister of Finance

Canadians and the Canadian economy have faced nearly three years of historic challenges. When COVID-19 first reached our shores, our government introduced unprecedented emergency measures to keep Canadians safe, protect their jobs, and keep the Canadian economy afloat. It was a muscular plan—and it worked.

Our economy is now 103 per cent the size it was before the pandemic, and so far this year, our economic growth has been the strongest in the G7. In November, our unemployment rate fell to just 5.1 per cent. We have recovered 117 per cent of the jobs lost to COVID, compared to just 105 per cent in the United States. That means 523,000 more Canadians are working today than before COVID first hit.

As we contend with the pandemic's economic aftershocks, this remarkable economic recovery has allowed us to reinforce Canada's social safety net and provide important relief to those who need it most—without pouring fuel on the fire of inflation. And critically, it means that Canada faces the global economic slowdown from a position of fundamental economic strength.

Every year, the federal government provides a report to Parliament and Canadians that details the government's domestic debt program. This report reflects the main activities of the government's borrowing program, as set out in the 2021-22 Debt Management Strategy, and is guided by the key principles of transparency, regularity, prudence, and liquidity. As in the past, the government has consulted dealers and investors as part of the process for developing the debt management strategy.

This report demonstrates that Canada's debt management operations continue to support the effective execution of the debt management program, contributing to the objectives of raising stable and low-cost funding and maintaining a well-functioning market for Government of Canada securities. That market now includes green bonds after the successful issuance of an inaugural $5 billion green bond in March 2022, which received strong demand from investors. This report also shows that there remains strong demand for Government of Canada debt securities, contributing to the stability of Canada's debt.

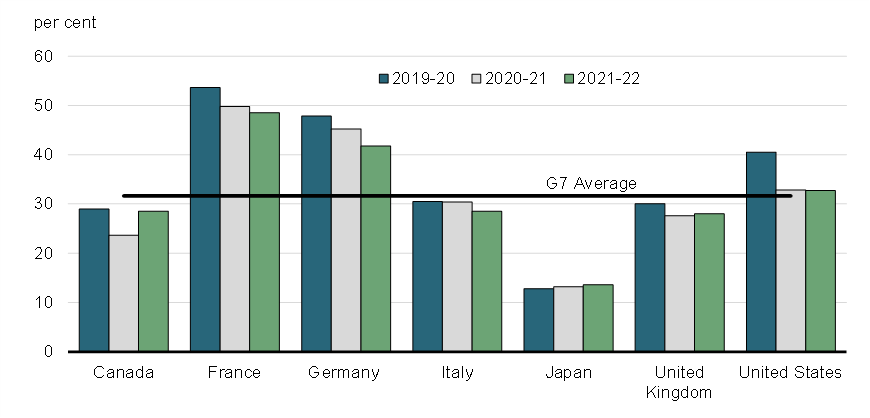

Our government remains committed to the fiscal anchor that we reiterated in the Fall Economic Statement: the unwinding of COVID-19-related deficits and reducing the federal debt-to-GDP ratio. The federal debt-to-GDP ratio is projected to continuously decline and is on a steeper downward track than projected in Budget 2022. Canada already has the lowest net debt and deficit-to-GDP ratio in the G7, and in early November, Moody's reaffirmed our AAA rating with a stable outlook.

Canada has a proud tradition of fiscal responsibility—a tradition that must and will be maintained.

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

Ottawa, 2022

Purpose of This Publication

This edition of the Debt Management Report provides a detailed account of the Government of Canada's borrowing and debt management activities for the fiscal year ending March 31, 2022.

As required under Part IV (Public Debt) of the Financial Administration Act (the "FAA"), this publication provides transparency and accountability regarding these activities. It reports on actual borrowing and uses of funds compared to those forecast in the Debt Management Strategy for 2021-22, published on April 19, 2021, in Budget 2021. It also discusses the environment in which the debt was managed, the composition of the debt, changes in the debt during the year, strategic policy initiatives and performance outcomes.

Other Information

The Public Accounts of Canada is tabled annually in Parliament and is available on the Public Services and Procurement Canada website. The Debt Management Strategy and the Report on the Management of Canada's Official International Reserves, which are also tabled annually in Parliament, are available on the Department of Finance Canada website Additionally, monthly updates on cash balances and foreign exchange assets are available through The Fiscal Monitor, which is also available on the Department of Finance Canada website. Under the Borrowing Authority Act (the "BAA"), the Minister of Finance (the "Minister") is required to table a report to Parliament generally every three years on amounts borrowed by the Minister on behalf of Her Majesty in right of Canada and by agent Crown corporations. The most recent report was tabled in Parliament on November 23, 2020 and is available on the Department of Finance Canada website.

The Extraordinary Borrowing Report to Parliament tabled in Parliament on October 22, 2020, provides a detailed account of amounts borrowed in extraordinary circumstances under section 47 of the FAA (as enacted by the COVID-19 Emergency Response Act).Footnote 1 This report provides details on extraordinary borrowings that were undertaken between April 1, 2020 and September 30, 2020, and is available on the Department of Finance Canada website Furthermore, the 2021-22 Extraordinary Borrowing Report to Parliament was tabled in Parliament on May 25, 2021. This report provides details on extraordinary borrowings that were undertaken between March 23, 2021 to May 6, 2021, and is available on the Department of Finance Canada website.

Executive Summary

Introduction

This publication reports on two major activities: (i) the management of federal market debt (the portion of the debt that is borrowed in financial markets); and (ii) the investment of cash balances in liquid assets for operational purposes and contingency planning.

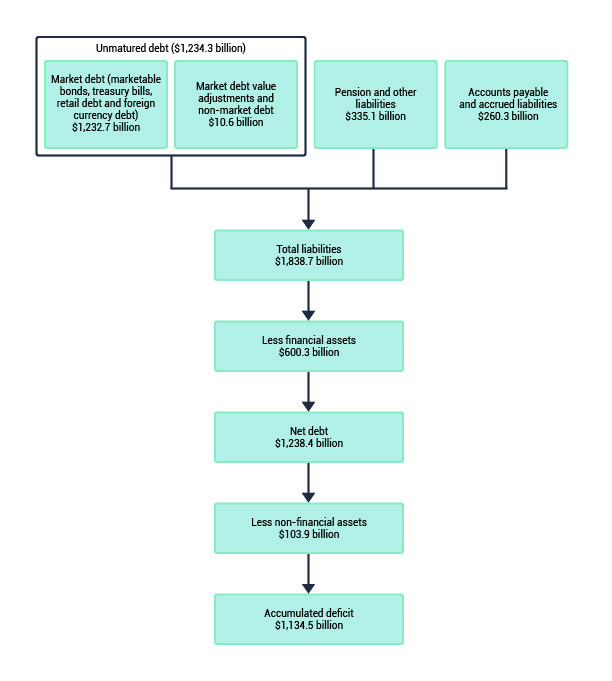

The government's market debt, including marketable bonds, treasury bills, retail debt and foreign currency debt, stood at $1,232.7 billion at the end of fiscal year 2021-22 (see boxed area of Chart 1). In addition to market and other types of unmatured debt, other liabilities brought the total liabilities of the Government of Canada to $1,838.7 billion at that time. When financial and non-financial assetsFootnote 2 are subtracted from total liabilities, the federal debt or accumulated deficit of the Government of Canada was $1,134.5 billion as at March 31, 2022 (see Chart 1).

In the Debt Management Strategy for 2021-22 published in Budget 2021, the government outlined its plan to issue its first ever green bond to support the environment and climate change plan. The Government of Canada successfully issued its inaugural 7.5-year, $5 billion green bond in March 2022, receiving strong demand from domestic and international investors in green bonds.

Domestic funding is conducted through the issuance of marketable securities, which consist of nominal bonds, Real Return Bonds, green bonds and treasury bills, including cash management bills. These securities are generally sold through competitive auctions (occasionally through a syndication process at the government's discretion, such as for the inaugural green bond) to government securities distributors, a group of banks and investment dealers in the Canadian market. These government securities distributors then resell these securities to their wholesale and retail clients in the secondary market.

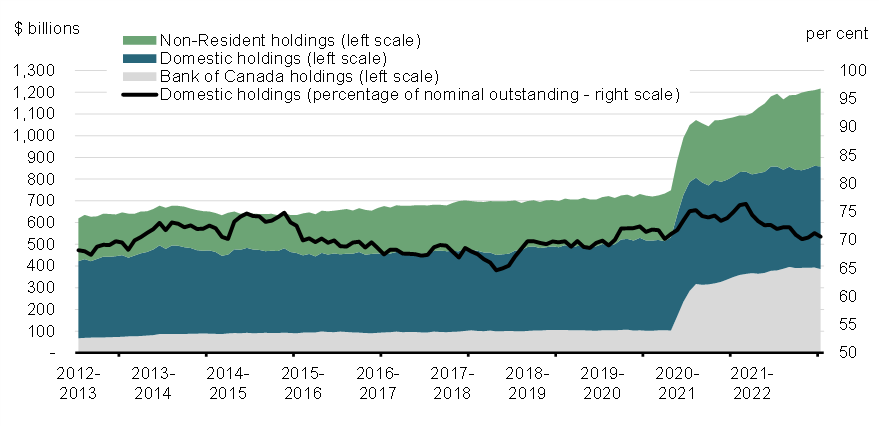

Government of Canada marketable securities are widely held and can be found in retail and institutional investment portfolios, insurance companies and pension funds, central banks (including the Bank of Canada), as well as a variety of other investment vehicles. Overall, about 71 per cent of Government of Canada market debt was held by Canadian investors, including the Bank of Canada, as well as insurance companies and pension funds, and financial institutions and provincial and municipal governments. The participation of international investors in Government of Canada securities markets is of benefit to Canadians, as they serve to increase competition, increase the diversity of the government's investor base, and ultimately reduce borrowing costs for Canadian taxpayers.

Cross-currency swaps of domestic obligations and issuance of foreign currency debt are used to fund foreign reserve assets held in the Exchange Fund Account (see the section entitled "Foreign Currency Debt").

Federal Balance Sheet, as at March 31, 2022

Highlights for 2021-22

The Debt Management Report consists of three parts covering the main aspects of the Government of Canada's debt program. "Part I – 2021-22 Debt Management Context" focuses on the state of the accumulated deficit (i.e., federal debt), the year's financial requirements and the sources of borrowings used to raise funds, the federal government's credit ratings, and the authorities required to borrow. "Part II – Report on Objectives, Strategic Direction and Principles" reports on debt management objectives to implement the government's strategic direction to maximize the financing of the COVID-19-related debt through long-term issuance, to raise stable and low-cost funding to meet the financial needs of the Government of Canada, and to maintain a well-functioning market for Government of Canada securities. "Part III – Report on the 2021-22 Debt Program" reports on the operational aspects of the market debt program.

This year's debt management operations continue to support the effective execution of the debt management program. The main highlights are as follows:

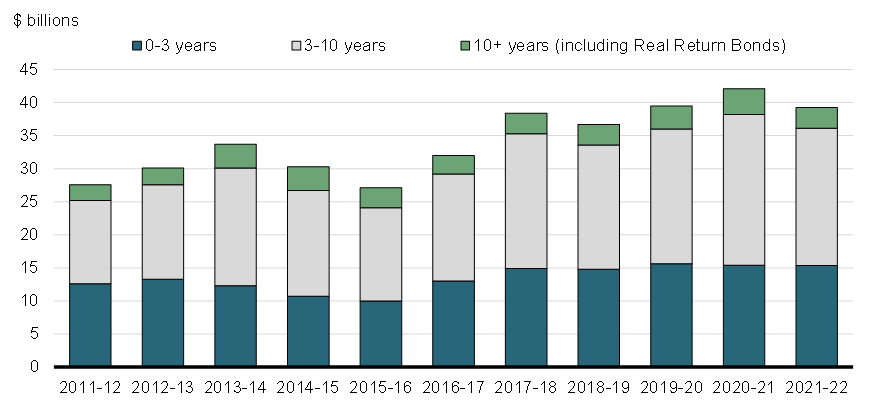

COVID-19 and Debt Management

The Debt Management Strategy sets out the objectives, strategy, and borrowing plans for the government's domestic debt program. In 2021-22, the government continued to maximize the financing of COVID-19-related debt through long-term issuance. The shift towards long-term issuance began in 2020-21 as a result of the significant increase in borrowing in response to the COVID-19 crisis. The objective was to provide security and stability to the government balance sheet by lowering debt rollover and providing more predictability in the cost of servicing debt. During 2021-22, the government issued a combined $107.0 billion in 10-year and 30-year bonds compared to $105.5 billion in 2020-21 and $19.0 billion in 2019-20 (pre-pandemic).

In response to the extraordinary circumstances caused by the COVID-19 crisis, on March 23, 2021, the Administrator of the Government of Canada in Council authorized the Minister to borrow money under paragraph 46.1(c) of the FAA. The authority was invoked to fund COVID-19 response programs that received prior approval from Parliament such as the Canada Emergency Wage Subsidy and the Canada Recovery Benefit. During the 2021-22 fiscal year, $1.6 billion was borrowed under paragraph 46.1(c) of the FAA between April 1, 2021 and May 6, 2021. When added to extraordinary borrowings of $6.6 billion from March 23, 2021 to March 31, 2021 of the prior fiscal year (2020-21), outstanding borrowings under that extraordinary borrowing authority increased to $8.2 billion.

Federal Green Bond Program

To support the growth of the sustainable finance market in Canada, in March 2022, the government published a green bond framework and issued its inaugural federal green bond, delivering on commitments made in Budget 2021.

The inaugural issuance of $5 billion, the largest Canadian-dollar green bond offering in Canadian history, received strong demand from green and socially minded investors, who represented 72 per cent of buyers. There was also strong demand from international investors, reflecting their confidence in the green bond program meeting global standards for sustainable finance.

Stock of Domestic Market Debt

The stock of domestic market debt increased by $122.9 billion in 2021-22, bringing the total debt stock to $1,232.7 billion. The change in the stock was comprised of a $155.6 billion increase in marketable bonds payable in Canadian dollars, a $31.4 billion decrease in treasury and cash management bills, a decrease of $0.3 billion in retail debt, and a $1.0 billion decrease in marketable debt payable in foreign currencies. Notwithstanding the increase in debt stock, Canada's general government net debt-to-GDP (gross domestic product) ratio remains the lowest among the Group of Seven (G7) nations according to the International Monetary Fund (IMF).

In 2021-22 as interest rates rose from a very low level in the previous fiscal year, the weighted average rate of interest on market debt increased to 1.37 per cent compared to 1.35 per cent in 2020-21.

Strong Demand for Government of Canada Debt Securities

In 2021-22, the relative strength of the Canadian economy and its capital markets continued to support demand for Government of Canada securities in primary and secondary markets. Accordingly, treasury bill and bond auctions remained well-covered and competitively bid, providing an efficient manner for the government to raise funding. The publication of the Quarterly Bond Schedule before each quarter and the Call for Tenders before each auction helped maintain transparency. This promoted well-functioning markets for the government's securities to the benefit of a wide array of domestic market participants, contributing to the objective of raising stable and low-cost funding.

Part I

2021-22 Debt Management Context

Composition of Federal Debt

In 2021-22, total market debt increased by $122.9 billion (or about 11 per cent) to $1,232.7 billion (see Table 1). For additional information on the financial position of the government, see the 2021-22 Annual Financial Report of the Government of Canada.

| 2022 | 2021 | Change | |

|---|---|---|---|

| Payable in Canadian currency | |||

| Marketable bonds | 1,030.9 | 875.3 | 155.6 |

| Treasury and cash management bills | 187.4 | 218.8 | -31.4 |

| Retail debt | 0.0 | 0.3 | -0.3 |

| Total payable in Canadian currency | 1,218.3 | 1,094.4 | 123.9 |

| Payable in foreign currencies | 14.5 | 15.4 | -1.0 |

| Total market debt | 1,232.7 | 1,109.8 | 122.9 |

| Market debt value adjustment, capital lease obligations and other unmatured debt | 10.6 | 15.4 | -4.8 |

| Total unmatured debt | 1,243.3 | 1,125.2 | 118.1 |

| Pension and other accounts | 335.1 | 319.7 | 15.4 |

| Total interest-bearing debt | 1,578.4 | 1,444.8 | 133.5 |

| Accounts payable, accruals and allowances | 260.3 | 207.4 | 52.9 |

| Total liabilities | 1,838.7 | 1,652.2 | 186.4 |

| Total financial assets | 600.3 | 502.4 | 97.9 |

| Total non-financial assets | 103.9 | 101.1 | 2.8 |

| Federal debt (accumulated deficit) | 1,134.5 | 1,048.7 | 85.7 |

|

Note: Numbers may not add due to rounding. |

|||

Sources of Borrowings and Uses of Borrowings

The key reference point for debt management is the financial requirement or financial source, which represents the net cash outflow or inflow for the fiscal year. This measure differs from the budgetary balance (i.e., the deficit or surplus on an accrual basis) by the amount of non-budgetary transactions and the timing of payments on a cash basis, which can be significant. Non-budgetary transactions include changes in federal employee pension liabilities; changes in non-financial assets; investing activities through loans, investments and advances; and changes in other financial assets and liabilities, including foreign exchange activities. Anticipated borrowing and planned uses of borrowings are set out in the debt management strategy, while actual borrowing and uses of borrowings compared to those forecast are reported in this publication (see Table 2).

There was a financial requirement of $81.4 billion in 2021-22, reflecting $90.2 billion in cash outflows due to a budgetary deficit and a cash inflow of $8.8 billion due to non-budgetary transactions. The financial requirement was $109.6 billion lower than the projection in the Debt Management Strategy for 2021-22. Lower financial requirements were primarily a result of higher than expected budgetary revenue. For comparison, the financial requirement in 2020-21 was $314.6 billion.

In 2021-22, loans to the Business Development Bank of Canada, Canada Mortgage and Housing Corporation and Farm Credit Canada under the Crown Borrowing Program increased by $7.0 billion, where no increase was planned as reported in the Debt Management Strategy for 2021-22.

| Planned1 | Actual | Difference | |

|---|---|---|---|

| Sources of borrowings | |||

| Payable in Canadian currency | |||

Treasury bills |

226 | 187 | -39 |

Bonds |

286 | 257 | -29 |

Retail debt |

0 | 0 | 0 |

| Total payable in Canadian currency | 512 | 445 | -67 |

| Payable in foreign currencies | 10 | 7 | -3 |

| Total cash raised through borrowing activities | 523 | 452 | -71 |

| Uses of borrowings2 | |||

| Refinancing needs | |||

Payable in Canadian currency |

|||

Treasury bills |

219 | 219 | 0 |

Bonds |

105 | 105 | 0 |

Of which: |

|||

Bonds that mature |

105 | 105 | 0 |

Switch bond buybacks |

0 | 0 | 0 |

Cash management bond buybacks |

0 | 0 | 0 |

Retail debt |

0 | 0 | 0 |

Total payable in Canadian currency |

324 | 324 | 0 |

Payable in foreign currencies |

8 | 8 | 0 |

| Total refinancing needs | 332 | 332 | 0 |

| Financial source/requirement | |||

Budgetary balance |

155 | 90 | -65 |

Non-budgetary transactions |

|||

Pension and other accounts |

-11 | -13 | -2 |

Non-financial assets |

3 | 3 | 0 |

Loans, investments and advances |

11 | 23 | 12 |

Of which: |

|||

Loans to enterprise Crown corporations3 |

0 | 7 | 7 |

Other |

11 | 16 | 5 |

Other transactions4 |

33 | -22 | -55 |

Total non-budgetary transactions |

36 | -9 | -45 |

| Total financial source/requirement | 191 | 81 | -110 |

| Total uses of borrowings | 523 | 414 | -109 |

| Change in other unmatured debt transactions5 | 0 | 5 | 5 |

| Net increase or decrease (-) in cash | 0 | 37 | 37 |

|

Note: Numbers may not add due to rounding. 1 Planned numbers are from the Debt Management Strategy for 2021–22. 2 A negative sign denotes a financial source. 3 Loans to enterprise Crown corporations represent corporations under the Crown Borrowing Program. 4 Primarily includes the conversion of accrual adjustments into cash, such as tax and other account receivables; provincial and territorial tax collection agreements; and tax payables and other liabilities. 5 Includes cross-currency swap revaluation, unamortized discounts on debt issues, obligations related to capital leases and other unmatured debt, where this refers to in the table. |

|||

Borrowing Authorities

In order to undertake market borrowing activities, the Minister needs authority from Parliament as well as the Governor in Council (the "GIC").

Under the Parliamentary borrowing authority framework enacted on November 23, 2017, Parliamentary authority is granted through the BAA and Part IV of the FAA, which together allow the Minister to borrow money up to a maximum overall amount as approved by Parliament. The FAA also authorizes the Minister to borrow in excess of the approved maximum amount under limited circumstances for the specific purposes of refinancing outstanding debt, extinguishing or reducing liabilities, and making payments in extraordinary circumstances, such as natural disasters.

Subject to the noted limited exceptions, the maximum stock of borrowings approved by Parliament in effect from April 1, 2020 to May 5, 2021 was $1,168 billion, which also includes amounts borrowed by agent Crown corporations, and Canada Mortgage Bonds guaranteed by Canada Mortgage and Housing Corporation. On May 6, 2021, the maximum amount of borrowing was amended to $1,831 billion when the Economic Statement Implementation Act, 2020 received Royal Assent. As at March 31, 2022, the outstanding borrowings subject to the maximum amount was $1,529 billion ($1,133 billion as at March 31, 2021).

Part IV of the FAA also requires the Minister to receive annual approval from the GIC to carry out borrowing for the Government of Canada for each fiscal year, including issuing securities in financial markets and undertaking related activities subject to a maximum aggregate amount. On the recommendation of the Minister, the GIC approved $635 billion to be the maximum aggregate principal amount of money that may be borrowed by the Minister in 2021-22.Footnote 3 The maximum aggregate principal amount is the sum of the following sub-components: (i) the maximum stock of treasury bills anticipated to be outstanding during the year; (ii) the total value of refinanced and anticipated new issuances of marketable bonds; and (iii) amounts to facilitate intra-year management of the debt and foreign exchange accounts.

During 2021-22, $452 billion of the GIC-approved borrowing authority was used, $183 billion below the authorized borrowing authority limit (see Table 2).

Government of Canada Credit Rating Profile

Throughout 2021-22, the Government of Canada continued to receive high credit ratings from rating agencies, with a stable outlook, on Canadian-dollar and foreign-currency-denominated short- and long-term debt (see Table 3).

The rating agencies focusing on general government net debt-to-GDP have indicated that Canada's sound macroeconomic policy framework and financial system, as well as Canada's economic resilience and diversity and the strength of monetary and fiscal flexibility, are all reflected in Canada's strong current credit ratings: Moody's (Aaa), Fitch (AA+), S&P (AAA), DBRS (AAA) and JCRA (AAA).

Rating agency |

Term | Domestic currency |

Foreign currency |

Outlook | Previous rating action |

|---|---|---|---|---|---|

| Moody's Investors Service | Long-term Short-term |

Aaa - |

Aaa - |

Stable | Nov 2003 |

| Standard & Poor's | Long-term Short-term |

AAA A-1+ |

AAA A-1+ |

Stable | July 2002 |

| Fitch Ratings | Long-term Short-term |

AA+ F1+ |

AA+ F1+ |

Stable | June 2020 |

| Dominion Bond Rating Service | Long-term Short-term |

AAA R-1 (High) |

AAA R-1 (High) |

Stable | n/a |

| Japan Credit Rating Agency | Long-term | AAA | AAA | Stable | n/a |

Part II

Report on Objectives, Strategic Direction and Principles

Objectives, Strategic Direction and Principles

Objectives

The debt management objectives in 2021-22 were to raise stable and low-cost funding to meet the financial needs of the Government of Canada and to maintain a well-functioning market for Government of Canada securities.

Strategic Direction

In its Debt Management Strategy for 2021-22, the government continued to maximize its financing of COVID-19-related debt through long-term issuance. This prudent approach aimed to provide security by lowering debt rollover and providing more predictability in the cost of servicing debt. Maintaining the shift towards long-term debt issuance, which began in 2020-21, also involved the re-opening of the ultra-long 50-year bond.

Principles

In support of the objectives and strategic direction, the design and implementation of the domestic debt program are guided by the key principles of transparency, regularity, prudence and liquidity. Towards this end, the government publishes strategies and plans, and consults regularly with market participants to ensure the integrity and attractiveness of the market for dealers and investors. The structure of the market debt is managed conservatively in a cost-risk framework, preserving access to diversified sources of funding and supporting a broad investor base.

Raising Stable and Low-Cost Funding, and Strategic Direction

In general, achieving stable and low-cost funding involves striking a balance between debt costs and various risks in the debt structure. This selected balance between cost and risk is mostly achieved through the deliberate allocation of issuance among various debt instruments and terms.

Market Debt Issuance in 2021-22

In 2021-22, total bond issuance was $257.4 billion, down from $369.9 billion in 2020-21 reflecting lower financial requirements. The total bond issuance included an inaugural 7.5-year, $5.0 billion green bond.

Shorter-term debt instruments experienced a decrease in issuance from all-time highs, with 2-, 3- and 5-year maturities seeing the largest decrease on a percentage basis. In particular, 2-year issuance decreased to

$67.0 billion from $129.0 billion, 3-year issuance decreased to $29.0 billion from $56.5 billion, and the 5-year issuance decreased to $44.0 billion from $77.5 billion in 2021-22 compared to 2020-21 (see Table 4.1). Overall, $140.0 billion in short-term bonds were issued, down from $263.0 billion in 2020-21 (see Table 4.2).

The allocation of long bond issuance (i.e., 10-year maturities and longer) was 44 per cent in 2021-22, 15 percentage points higher than the previous fiscal year, when it was 29 per cent (see Table 4.2) and 2 percentage points higher than the plan set out in the Debt Management Strategy for 2021-22 (see Table 4.3).While issuanceacross all tenors was lower than expected as the financial requirement came in $109.6 billion lower than projected, a higher allocation of long issuance was maintained in support of the strategic direction adopted by the government.

| 2020-21 Previous Year | 2021-22 Planned | 2021-22 Actual | Difference between Actual and Planned | 2021-22 Actual vs 2020-21 % change | |

|---|---|---|---|---|---|

| Treasury bills | 219 | 226 | 187 | -39 | -14% |

| 2-year | 129 | 76 | 67 | -9 | -48% |

| 3-year | 57 | 36 | 29 | -7 | -49% |

| 5-year | 78 | 48 | 44 | -4 | -43% |

| 10-year | 74 | 84 | 79 | -5 | 7% |

| 30-year | 32 | 32 | 28 | -4 | -13% |

| Real Return Bonds | 1 | 1 | 1 | 0 | 0% |

| Ultra-long | 0 | 4 | 4 | 0 | |

| Green bonds | 0 | 5 | 5 | 0 | |

| Total bonds | 370 | 286 | 257 | -29 | -31% |

| Total gross issuance1 | 589 | 512 | 445 | -68 | -24% |

1 Issuance is estimated from Bank of Canada data, using issuance date to determine the amount issued in each sector and fiscal year, consistent with Bank of Canada methodology. The use of issuance date instead of auction date results in slight differences in some sectors. |

|||||

| 2020-21 Previous Year | 2021-22 Actual | |||

|---|---|---|---|---|

| Issuance ($ billions) |

Share of Bond Issuance | Issuance ($ billions) |

Share of Bond Issuance | |

| Short (2, 3, 5-year sectors) | 263 | 71% | 140 | 54% |

| Long (10-year+) | 107 | 29% | 112 | 44% |

| Green bonds | - | 5 | 2% | |

| Gross bond issuance | 370 | 100% | 257 | 100% |

| 2021-22 Planned | 2021-22 Actual | |||

|---|---|---|---|---|

| Issuance ($ billions) | Share of Bond Issuance | Issuance ($ billions) | Share of Bond Issuance | |

| Short (2, 3, 5-year sectors) | 160 | 56% | 140 | 54% |

| Long (10-year+) | 121 | 42% | 112 | 44% |

| Green bonds | 5 | 2% | 5 | 2% |

| Gross bond issuance | 286 | 100% | 257 | 100% |

Market Debt Composition

The composition of the stock of market debt is a reflection of past debt issuance choices (e.g., over the last 30 years for the 30-year sector). The effects of changes in issuance patterns of short-term debt instruments become visible relatively quickly, while the full effect of issuance changes in longer-term debt instruments takes the entire maturity period to be fully appreciated. A well-distributed maturity profile helps maintain a prudent risk exposure to changes in interest rates over time at an affordable cost, while promoting well-functioning markets by providing liquidity across different maturity sectors.

Composition of Market Debt by Remaining Term to Maturity

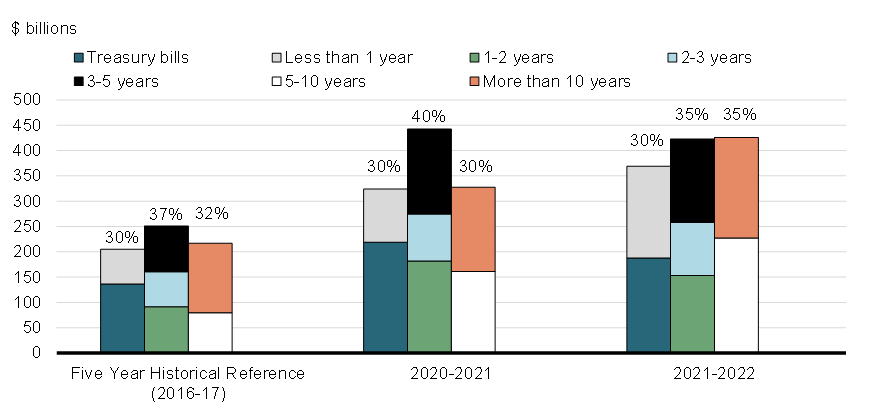

As a result of the significant increase in long-term bond issuance during 2020-21 and 2021-22, the composition of market debt made up by long-term debt stock grew in 2021-22. Correspondingly, the proportion of short-term bonds declined. The cumulative effect of the increased short-term issuance in 2020-21 and increased long-term issuance in 2020-21 and 2021-22 on the composition of the debt will become further pronounced in the coming years as the shorter-term bonds issued in 2020-21 mature (see Chart 2).

Composition of Market Debt by Remaining Term to Maturity, as at March 31

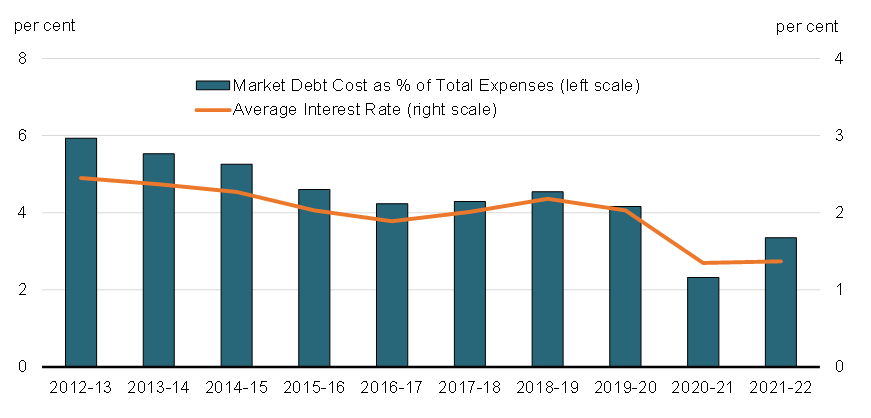

Cost of Market Debt

Annual interest rate costs on market debt are the largest component of public debt charges (which also include interest expenses on non-market liabilities).Footnote 4 The weighted average rate of interest on the stock of market debt was 1.37 per cent in 2021-22, slightly up from 1.35 per cent in 2020-21. Interest on market debt as a share of total government expenses increased from 2.33 per cent in 2020-21 to 3.35 per cent in 2021-22 (see Chart 3). This was primarily due to the larger stock of market debt following a significant increase in debt in 2020-21.

Market Debt Costs and Average Effective Interest Rate

Market Debt: Average Term to Maturity and Debt Rollover

Prudent management of debt refinancing needs, which promotes investor confidence, involves Government of Canada actions that strive to minimize the impact of market volatility or disruptions to the funding program. According to a number of common measures of market debt refinancing risks, including average term to maturity (ATM) and debt rollover, the Government of Canada's market debt remained prudent through 2021-22 when compared to historical averages.

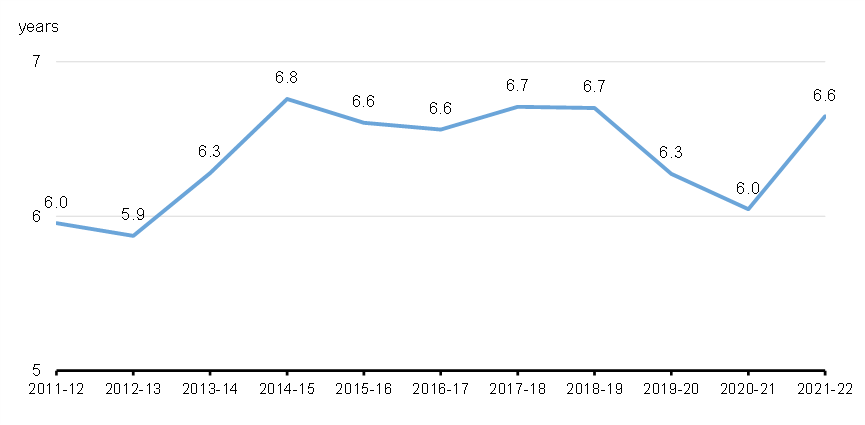

Average Term to Maturity

The ATM of market debt tends to rise and fall mostly with the stock of treasury bills. This is evident in the decline of the ATM from 6.7 years in 2018-19 to 6.3 years in 2019-20, which resulted from increased issuance of treasury bills to support a liquid and well-functioning market for Government of Canada treasury bills.

In 2021-22, the ATM increased to 6.6 years, up from 6.0 years in 2020-21, reflecting the decline in the stock of treasury bills during the year and the continuation of the Government of Canada's strategic direction to maximize long-term issuance (see Chart 4.1).

Average Term to Maturity of Government of Canada Market Debt

The weighted ATM is measured by weighting the remaining term to maturity of issued debt by its proportion to the overall debt stock.Footnote 5

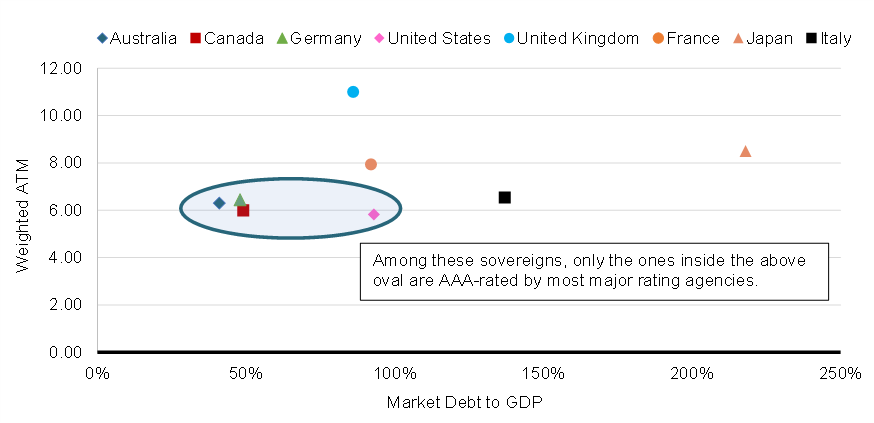

Canada has successfully built a prudent debt structure relative to GDP over the last 30 years. In general, low debt-to-GDP countries can choose a higher risk level (i.e., lower ATM) in exchange for lower interest rate costs. Overall, Canada is in line with other AAA-rated countries (see Chart 4.2).

Weighted ATM vs Market Debt-to-GDP

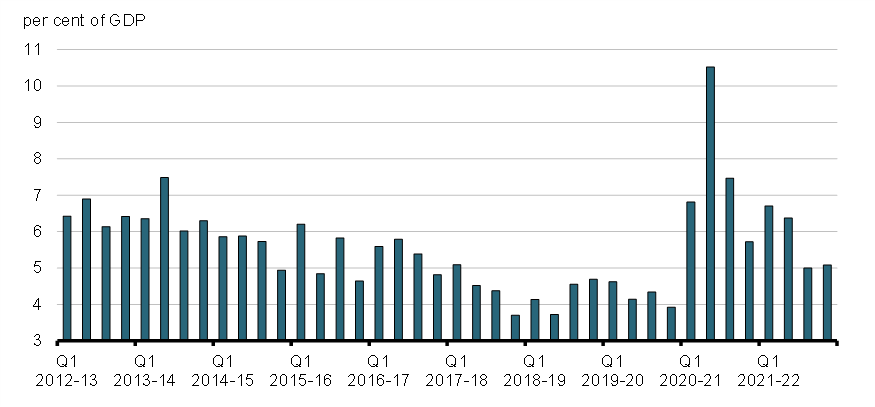

Debt Rollover: Quarterly Maturities to GDP

Debt rollover, measured as the amount of debt maturing per quarter as a percentage of GDP, decreased to an average of 5.8 per cent in 2021-22 from an average of 7.6 per cent in 2020-21. This decrease reflects the large amount of treasury bills that matured in 2020-21 to fund government actions at the height of the COVID-19 pandemic, as well as the government's approach of maximizing the financing of COVID-19-related debt through long-term issuance (see Chart 5). The average annual debt rollover in 2021-22 is in line with the average over the previous decade of 5.6 per cent.

Quarterly Maturities of Domestic Market Debt as a Percentage of GDP

Debt Rollover: Single-Day Maturities

The government maintained 10 maturity dates in 2021-22, which was the same as in 2020-21. Following the significant increase in debt which began in 2020-21, single-day maturities remain high relative to historical averages. The government monitors the level of single-day maturities and may implement programs to effectively manage Government of Canada cash flows ahead of large debt maturities.

The benchmark maturity date profile is as follows:

- 2-year bonds: February 1, May 1, August 1, November 1

- 3-year bonds: April 1, October 1

- 5-year bonds: March 1, September 1

- 10-year bonds: June 1, December 1

- 30-year bonds: December 1 – although Real Return Bonds and nominal 30-year bonds mature on December 1, they do not mature in the same year.

Maintaining a Well-Functioning Government Securities Market

A well-functioning market in Government of Canada securities benefits the government as a borrower as it directly supports the fundamental objective of raising stable, low-cost funding, while also benefiting a wide range of market participants.

A well-functioning market helps the government to have more certain access to funding markets over time, contributes to lower and less volatile interest rate costs for the government, and provides flexibility to meet changing financial requirements. For market participants, a liquid and transparent secondary market in government debt instruments provides risk-free assets for investment portfolios, stability to other domestic fixed-income markets for which Government of Canada securities serve as benchmarks (e.g., provinces, municipalities and corporations), and a useful tool for hedging interest rate risk.

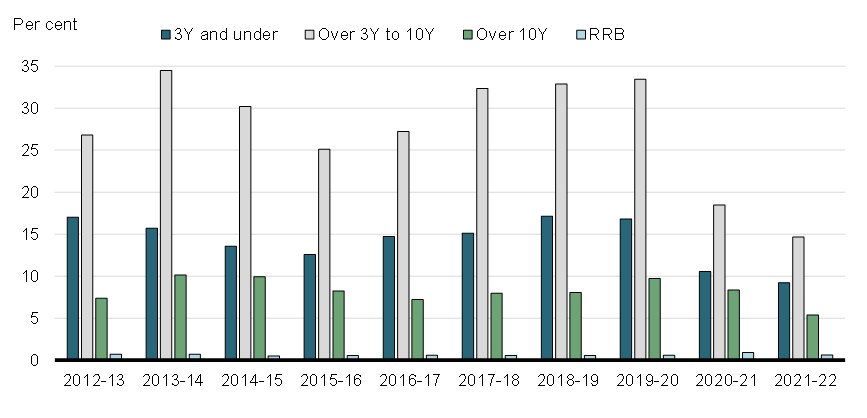

Providing Regular and Transparent Issuance

During 2021-22, the Government of Canada continued announcing bond auction schedules prior to the start of each quarter, and provided details for each operation in a Call for Tender in the week leading up to an auction.Footnote 6 In 2021-22, there were regular auctions for 2-, 3-, 5-, 10- and 30-year bonds, as well as Real Return Bonds. Bond issuance schedules were communicated through the Bank of Canada website on a timely basis.

To bring additional transparency to the market for Government of Canada securities, effective September 2021, the Bank of Canada began publishing benchmark details ahead of each fiscal quarter within its Quarterly Bond Schedule publications.

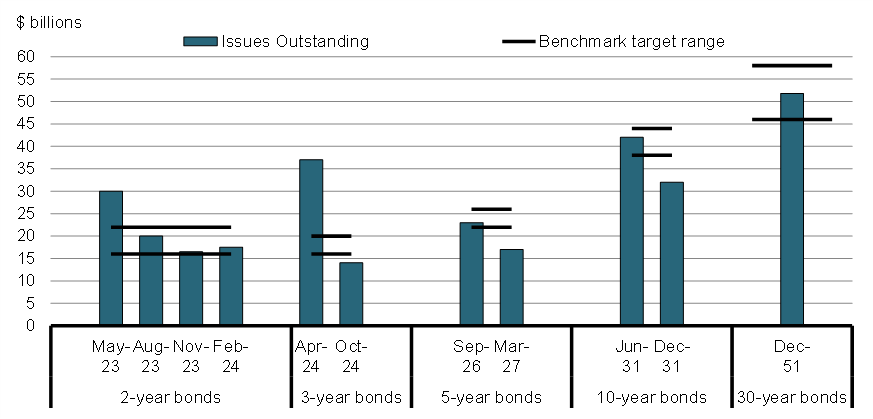

Concentrating on Key Benchmarks

The bond benchmark ranges for 2021-22 were narrower compared to the previous fiscal year given less uncertainty following the peak of the COVID-19 pandemic (see Chart 6).Footnote 7 Compared to 2020-21, the upper limit was considerably lower for all maturities, while the lower bound was higher for all maturities except the 3-year and 5-year bonds. Although the ranges narrowed, benchmark sizes remained higher in 2021-22 compared to 2019-20 (pre-pandemic) for all maturities.

- 2-year bonds: $16 billion to $22 billion

- 3-year bonds: $16 billion to $20 billion

- 5-year bonds: $22 billion to $26 billion

- 10-year bonds: $38 billion to $44 billion

- 30-year nominal bonds: $46 billion to $58 billion

Size of Gross Bond Benchmarks in 2021-22

Ensuring a Broad Investor Base in Government of Canada Securities

A diversified investor base supports an active secondary market for Government of Canada securities, thereby helping to keep funding costs low and stable. Diversification of the investor base is pursued by maintaining a domestic debt program that issues securities in a wide range of maturity sectors, which meet the needs of different types of investors types.

During 2021-22, domestic investors (including the Bank of Canada) held about 71 per cent of Government of Canada securities (see Chart 7). Among domestic investors, the Bank of Canada held the largest share of Government of Canada securities (32 per cent), followed by insurance companies and pension funds (15 per cent). Taken together, these top two categories accounted for just under half of outstanding Government of Canada securities.

In 2021-22, non-resident investors held 29 per cent of Government of Canada securities,Footnote 8 up five percentage points from 2020-21. This share of non-resident holdings of government securities remains below the average G7 holdings by non-resident investors (see Chart 8).

Distribution of Government of Canada Securities

Percentage of Total Marketable Debt of G7 Countries Held by Non-Residents

Consulting With Market Participants

Formal consultations with market participants are held at least once a year, in order to obtain their views on the design of the borrowing program and on the liquidity and efficiency of the Government of Canada's securities markets. These consultations helped to inform the Debt Strategy Management Strategy for 2021-22.

During the consultations held in September and October of 2020, the Department of Finance and the Bank of Canada conducted over 30 bilateral virtual meetings with dealers, investors and other relevant market participants. These consultations sought the views of market participants on issues related to the design and operation of the Government of Canada's domestic debt program.

During the fall 2020 consultations, a broad concensus supported continued issuance in the 10- and 30-year sectors, a direction that continued into 2021-22. Market participants also expressed strong support for the issuance of a green bond, the first of which was issued in 2021-22. The Fall 2020 Debt Management Strategy Consultations Summary was published in conjunction with the Fall Economic Statement 2020 on November 30, 2020.Footnote 9

Securities Distribution System

As the government's fiscal agent, the Bank of Canada distributes Government of Canada marketable bills and bonds by auction to government securities distributors (GSDs) and customers. GSDs that maintain a certain threshold of activity in the primary and secondary markets for Government of Canada securities may become primary dealers, which form a select core group of distributors for Government of Canada securities. To maintain a well-functioning securities distribution system, government securities auctions are monitored to ensure that GSDs abide by the terms and conditions.Footnote 10

Quick turnaround times enhance the efficiency of auctions, and reduce market risk for participants. In 2021-22, the turnaround time for treasury bill and bond auctions averaged 1 minute 58 seconds, while there were no buyback operations conducted. This compares to an average turnaround time in 2020-21 of 1 minute 57 seconds.Footnote 11

Monitoring Secondary Market Trading in Government of Canada Securities

Two important measures of liquidity and efficiency in the secondary market for Government of Canada securities are trading volume and turnover ratio.

Trading volume represents the amount of securities traded during a specific period (e.g., daily). Large trading volumes typically indicate that participants can buy or sell in the marketplace without a substantial impact on the price of the securities and generally imply lower bid-offer spreads.

Turnover ratio, which is the ratio of securities traded relative to the amount of securities outstanding, measures market depth. High turnover implies that a large amount of securities change hands over a given period of time, which is an indication of a liquid market.

The average daily trading volume in the secondary market for Government of Canada's bonds during 2021-22 was $39.4 billion, down $2.7 billion from 2020-21 (see Chart 9). This brought trading volume closer to its

pre-pandemic level.

Government of Canada Bond Average Daily Trading Volumes

In 2021-22, the annual debt stock turnover ratio in the Government of Canada secondary bond market, calculated as trading volume divided by average debt stock, decreased to 10.9x from 14.0x in 2020-21 due to a higher debt stock. The sectors with the highest monthly turnover during the fiscal year were medium-term bonds with maturities between 3 and 10 years at 14.6x, while Real Return Bonds had the lowest turnover at 0.6x (see Chart 10).

Government of Canada Bond Turnover Ratio by Term to Maturity Annualized Monthly Trading Volume / Total Bond Stock

Supporting Secondary Market Liquidity

During 2020-21, the Bank of Canada introduced measures to support efficient financial markets and provide liquidity to the financial system. Some of these measures include the Government of Canada Bond Purchase Program (GBPP), as well as securities repo operations (SROs) which replaced the securities lending program.Footnote 12 As financial markets recovered, the GBPP, a program to purchase Government of Canada securities in the secondary market, was wound down with the last auction held on April 21, 2022. The Bank of Canada's purchases through the GBPP totaled $92.8 billion between April 1, 2021 and March 31, 2022.

Securities repo operations, in which the Bank of Canada makes a portion of its holdings of Government of Canada securities available through daily repurchase operations, remain in place. This provides a temporary source of Government of Canada nominal bonds and treasury bills to primary dealers to support liquidity in the securities financing market. The Bank of Canada conducted 10,900 SROs in 2021-22, compared to 3,148 operations in 2020-21 when it was first introduced.

Part III

Report on the 2021-22 Debt Program

Treasury bill and bond auctions performed well and demand for Government of Canada securities remained strong throughout the fiscal year as a result of persistent demand for high-quality sovereign debt securities, Canada's strong fiscal and economic position, and support measures implemented by the Bank of Canada.

Domestic Marketable Bonds

Bond Program

In 2021-22, gross bond issuance was $257.4 billion, $112.5 billion lower than the $369.9 billion issued in 2020-21. Gross issuance consisted of $256.0 billion in nominal bonds, of which $5 billion was the inaugural green bond issuance, and $1.4 billion in Real Return Bonds (see Table 5).

| 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | |

|---|---|---|---|---|---|

| Nominal (auction) | 134.21 | 96.7 | 122.4 | 368.5 | 256.02 |

| Nominal (switch) | 0.8 | 0.8 | 2.8 | 0.0 | 0.0 |

| Real Return Bonds | 2.2 | 2.2 | 1.8 | 1.4 | 1.4 |

| Total gross issuance | 137.2 | 99.7 | 127.0 | 369.9 | 257.4 |

| Cash buyback | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Switch buyback | -0.8 | -0.8 | -2.8 | 0.0 | 0.0 |

| Total buyback | -0.8 | -0.8 | -2.8 | 0.0 | 0.0 |

| Net issuance | 136.4 | 98.9 | 124.2 | 369.9 | 257.4 |

Note: Numbers may not add due to rounding. |

|||||

Auction Result Indicators for Domestic Bonds

A total of 66 nominal bond auctions were conducted in 2021-22, compared to 76 auctions in 2020-21. This decrease in nominal bond auctions was largely due to lower financial requirements compared to 2020-21.

Auction coverage is defined as the total amount of bids received, including bids from the Bank of Canada, divided by the amount auctioned. All else being equal, a higher auction coverage level typically reflects strong demand and therefore should result in a lower average auction yield. Bond auction coverage was lower than the 5-year average for all maturities except Real Return Bonds (see Table 6).

The auction tail represents the number of basis points between the highest yield accepted and the average yield of an auction. A small auction tail is preferable as it is generally indicative of better transparency in the pricing of securities. Average auction tails were higher than the 5-year average across all maturities.Footnote 13

| Nominal Bonds | Real Return Bonds |

||||||

|---|---|---|---|---|---|---|---|

| 2-year | 3-year | 5-year | 10-year | 30-year | 30-year | ||

| Tail (basis points) | 2021-22 | 0.19 | 0.37 | 0.34 | 0.69 | 0.45 | n/a |

| 5-year average | 0.17 | 0.26 | 0.29 | 0.52 | 0.41 | n/a | |

| Coverage | 2021-22 | 2.46 | 2.40 | 2.55 | 2.32 | 2.51 | 2.54 |

| 5-year average | 2.67 | 2.58 | 2.59 | 2.35 | 2.53 | 2.42 | |

Notes: Tail represents the number of basis points between the highest yield accepted and the average yield of an auction. Coverage is defined as the total amount of bids received, including bids from the Bank of Canada, divided by the amount auctioned. |

|||||||

Participation at Domestic Bond Auctions

In 2021-22, primary dealers' (PDs) allotments for nominal bonds decreased from 64 per cent in 2020-21 to 63 per cent, with customer allocations increasing from 36 per cent to 38 per cent (see Table 7),Footnote 14 excluding the Bank of Canada's allotment.Footnote 15 In aggregate, the 10 most active participants were in total allotted 75 per cent of nominal bonds auctioned in 2021-22. For Real Return Bonds, primary dealers' share of allotments decreased from 45 per cent in 2020-21 to 43 per cent in 2021-22, with customer allocations increasing from 55 per cent to 57 per cent.

| Participant type | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | |

| PDs | 94 | 70 | 61 | 63 | 75 | 61 | 237 | 64 | 140 | 63 |

| Customers | 40 | 30 | 36 | 37 | 47 | 39 | 135 | 36 | 84 | 38 |

| Top 5 participants | 75 | 56 | 46 | 48 | 68 | 55 | 207 | 56 | 112 | 50 |

| Top 10 participants | 114 | 85 | 74 | 77 | 98 | 80 | 299 | 80 | 168 | 75 |

| Total nominal bonds issued | 134 | 97 | 122 | 373 | 223 | |||||

Note: Numbers may not add due to rounding. |

||||||||||

| Participant type | 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | |

| PDs | 94 | 70 | 61 | 63 | 75 | 61 | 237 | 64 | 140 | 63 |

| Customers | 40 | 30 | 36 | 37 | 47 | 39 | 135 | 36 | 84 | 38 |

| Top 5 participants | 75 | 56 | 46 | 48 | 68 | 55 | 207 | 56 | 112 | 50 |

| Top 10 participants | 114 | 85 | 74 | 77 | 98 | 80 | 299 | 80 | 168 | 75 |

| Total nominal bonds issued | 134 | 97 | 122 | 373 | 223 | |||||

Note: Numbers may not add due to rounding. |

||||||||||

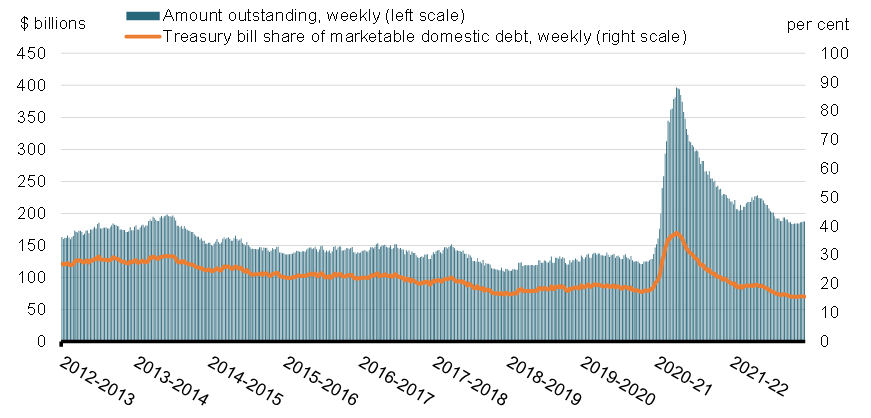

Treasury Bills and Cash Management Bills

During 2021-22, $439.0 billion in 3-, 6- and 12-month treasury bills were issued, a decrease of $207 billion from the previous year. There were two cash management bill operations for a total issuance amount of $8.0 billion in 2021-22 compared to five operations for a total of $25.5 billion in 2020-21. Together, treasury bill and cash management bill issuance totaled $447.0 billion. As at March 31, 2022, the combined treasury bill and cash management bill stock totaled $187.4 billion, a decrease of $31.4 billion from the end of 2020-21 (see Chart 11).

Treasury Bills Outstanding and as a Share of Marketable Domestic Debt

In 2021-22, all treasury bill and cash management bill auctions were fully covered. Excluding 12-month treasury bills, auction tails were smaller than the 5-year average across treasury bill maturity sectors. Coverage ratios for treasury bill auctions in 2021-22 were lower than the 5-year average for all treasury bill maturity sectors (see Table 8).

| 3-month | 6-month | 12-month | Cash management bills |

||

|---|---|---|---|---|---|

| Tail | 2021-22 | 0.58 | 0.62 | 0.77 | 1.12 |

| 5-year average | 0.64 | 0.70 | 0.67 | 2.51 | |

| Coverage | 2020-21 | 1.98 | 2.13 | 2.07 | 2.01 |

| 5-year average | 2.17 | 2.37 | 2.39 | 2.59 | |

|

Notes: Tail represents the number of basis points between the highest yield accepted and the average yield of an auction. Coverage is defined as the total amount of bids received, including bids from the Bank of Canada, divided by the amount auctioned. Tail and coverage ratio were calculated as the weighted averages, where the weight assigned to each auction equals the percentage total allotment in the auction's issuance sector. |

|||||

Participation at Treasury Bill Auctions

In 2021-22, the share of treasury bills allotted to primary dealers declined by 10 percentage points to 74 per cent from 84 per cent in 2020-21, and the share allotted to customers increased to 26 per cent from 16 per cent (see Table 9). The 10 most active participants were in total allotted 86 per cent of these securities.

Participant type |

2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | ($ billions) | (%) | |

| PDs | 230 | 91 | 239 | 88 | 246 | 84 | 543 | 84 | 324 | 74 |

| Customers | 23 | 9 | 33 | 12 | 45 | 16 | 103 | 16 | 115 | 26 |

| Top 5 participants | 174 | 69 | 190 | 70 | 190 | 65 | 431 | 67 | 260 | 59 |

| Top 10 participants | 235 | 93 | 242 | 89 | 246 | 85 | 577 | 89 | 379 | 86 |

| Total treasury bills issued | 253 | 272 | 291 | 646 | 439 | |||||

|

Note: Numbers may not add due to rounding. |

||||||||||

Foreign Currency Debt

Foreign currency debt is used to fund the Exchange Fund Account (EFA), which represents the largest component of the official international reserves. The primary objectives of the international reserves are to aid in the control and protection of the external value of the Canadian dollar and provide a source of liquidity to the Government of Canada.

The EFA is primarily made up of liquid foreign currency securities and special drawing rights (SDRs). Liquid foreign currency securities are composed primarily of debt securities of highly rated sovereigns, their agencies that borrow in public markets and are supported by a comprehensive government guarantee, and highly rated supranational organizations. SDRs are international reserve assets created by the IMF, the value of which is based on a basket of international currencies. The official international reserves also include Canada's reserve position at the IMF. This position, which represents Canada's investment in the activities of the IMF, fluctuates according to drawdowns and repayments from the IMF. The Report on the Management of Canada's Official International Reserves provides information on the objectives, composition and performance of the reserves portfolio.

The market value of Canada's official international reserves as at March 31, 2022 increased to US$103.8 billion from US$83.4 billion as at March 31, 2021. EFA assets, which totaled US$99.4 billion as at March 31, 2022, up from US$78.9 billion as at March 31, 2021, were held at a level that is consistent with the government's commitment to maintain holdings of liquid foreign currency securities at or above 3 per cent of nominal GDP.

The EFA is funded by liabilities of the Government of Canada denominated in, or converted to, foreign currencies. Funding requirements are primarily met through an ongoing program of cross-currency swaps funded by domestic issuances. As at March 31, 2022, Government of Canada cross-currency swaps outstanding stood at US$64.8 billion (par value).

In addition to cross-currency swaps funded by domestic issuances, the EFA is funded through a short-term US-dollar paper program (Canada bills), a global bond program, and a medium-term note (MTN) program (Canada notes and euro medium-term notes) which had a value of zero at year end. The funding method of choice depends on funding needs, costs, market conditions and funding diversification objectives (see Table 10).

| March 31, 2022 | March 31, 2021 | Change | ||

|---|---|---|---|---|

| Swapped domestic issues | 64,754 | 55,175 | 9,579 | |

| Global bonds | 9,500 | 9,000 | 500 | |

| Canada bills | 2,060 | 3,226 | -1,166 | |

| Medium-term notes | ||||

Euro medium-term notes |

0 | 0 | 0 | |

Canada notes |

0 | 50 | -50 | |

| Total | 76,314 | 67,451 | 8,863 | |

|

Note: Liabilities are stated at the exchange rates prevailing on March 31, 2021. |

||||

As at March 31, 2022, the Government of Canada had three global bonds outstanding (see Table 11). The government had no medium-term notes outstanding as of March 31, 2022.

Year of issuance |

Market | Amount in original currency | Yield (%) |

Term to maturity (years) |

Coupon (%) |

Benchmark interest rate—government bonds |

Spread from benchmark at issuance (basis points) |

Spread over swap curve in relevant currency on issuance date (basis points) |

|---|---|---|---|---|---|---|---|---|

| 2017 | Global | US$3 billion | 2.066 | 5 | 2.000 | US | 9.0 | LIBOR + 1.5 |

| 2020 | Global | US$3 billion | 1.690 | 5 | 1.625 | US | 6.0 | LIBOR - 6.5 |

| 2021 | Global | US$3.5 billion | 0.854 | 5 | 0.750 | US | 6.0 | LIBOR - 2 |

|

Note: LIBOR = London Interbank Offered Rate. |

||||||||

Retail Debt

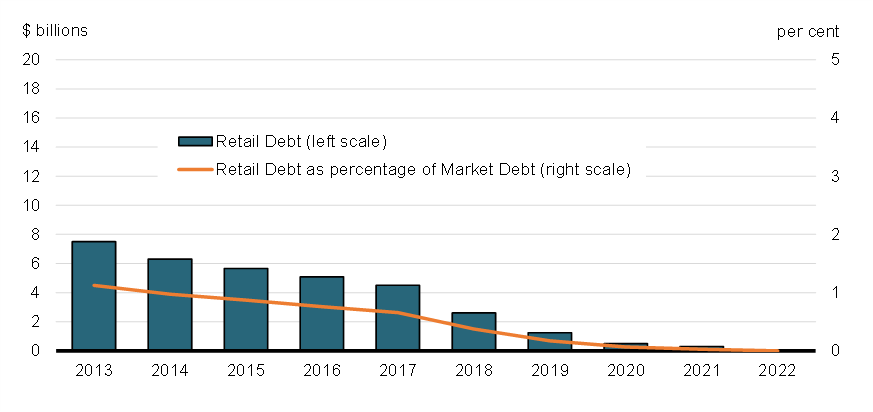

In Budget 2017, the Government of Canada announced the discontinuation of the Canada Savings Bonds and Canada Premium Bonds programs, given that retail debt is no longer a cost-effective source of funds or a preferred investment by Canadians. Following the announcement, Canadians were reassured that all remaining funds in the Payroll Savings Program, the Canada Retirement Savings Plan and the Canada Retirement Income Fund, along with any unredeemed certificated bonds, remain safe and guaranteed by the Government of Canada. The last maturity date was December 1, 2021 and therefore all outstanding bonds have now matured.

In 2021-22, the stock of Canada Savings Bonds and Canada Premium Bonds held by retail investors decreased from $0.3 billion to zero (see Chart 12).

Evolution of Retail Debt Stock, as at March 31

In 2021-22, the stock of retail debt declined by $0.2 billion (see Table 12).

| Gross sales | Redemptions | Net change | |

|---|---|---|---|

| Payroll | 0.0 | 0.1 | -0.1 |

| Cash | 0.0 | 0.1 | -0.1 |

| Total | 0.0 | 0.2 | -0.2 |

|

Note: Numbers may not add due to rounding. |

|||

Cash Management

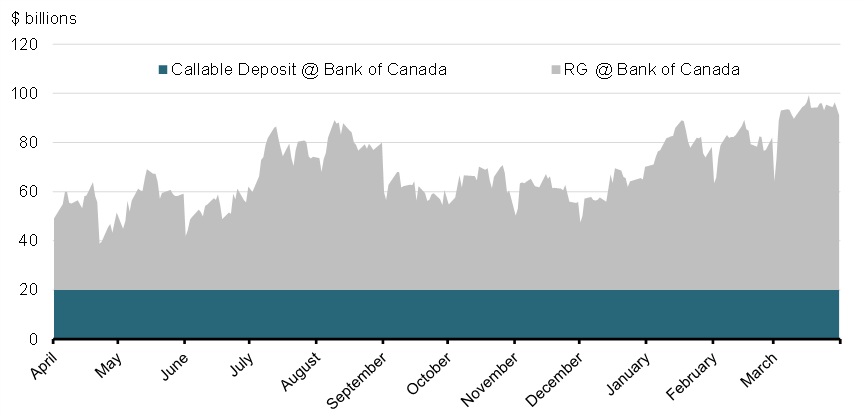

The Bank of Canada, as the government's fiscal agent, manages the Receiver General (RG) Consolidated Revenue Fund, from which the balances required for the government's day-to-day operations are drawn. The core objective of cash management is to ensure that the government has sufficient cash available, at all times, to meet its operating requirements.

Cash consists of money on deposit to the credit of the RG for Canada with the Bank of Canada. Cash with the Bank of Canada includes RG operating balances and a $20 billion callable demand deposit held for the prudential liquidity plan (PLP).

During the COVID-19 crisis, the federal government built up its cash position in order to ensure that funds were available for contingency purposes. By the end of the 2021-22 fiscal year, the cash balance had grown further from its level in 2020-21. The year-end daily liquidity position increased by $33.4 billion to $91.0 billion by the end of 2021-22 (see Chart 13 and Table 13).

Daily Liquidity Position for 2021-22

| March 31, 2021 | March 31, 2022 | Annual average | Net change | |

|---|---|---|---|---|

| Callable deposits with the Bank of Canada | 20.0 | 20.0 | 20.0 | 0.0 |

| RG balances with the Bank of Canada | 37.6 | 71.0 | 48.6 | 33.4 |

| Total | 57.6 | 91.0 | 68.6 | 33.4 |

|

Note: Numbers may not add due to rounding. |

||||

Prudential Liquidity Management

The government holds liquid financial assets in the form of domestic cash deposits and foreign exchange reservesFootnote 16 to promote investor confidence and safeguard its ability to meet payment obligations in situations where normal access to funding markets may be disrupted or delayed. The government's overall liquidity levels are managed to normally cover at least one month (i.e., 23 business days) of net projected cash flows, including coupon payments and debt refinancing needs. The 23-day PLP requirement is a forward-looking measure that changes daily due to daily actual cash balances and new projected cash requirements.

Investment of Receiver General Cash Balances

There were no RG auctions of cash to financial institutions conducted in 2021-22. RG auctions ceased in the previous fiscal year since financial system liquidity was high and participants did not need additional funds. These auctions did not resume in 2021-22 as financial system liquidity remained high.

Annex 1

Completed Treasury Evaluation Reports

In order to inform future decision making and to support transparency and accountability, different aspects of the Government of Canada's treasury activities are reviewed periodically under the Treasury Evaluation Program. The program's purpose is to obtain periodic external assessments of the frameworks and processes used in the management of wholesale and retail market debt, cash and reserves as well as the treasury activities of other entities under the authority of the Minister.

Reports on the findings of these evaluations and the government's response to each evaluation are tabled with the House of Commons Standing Committee on Public Accounts by the Minister. Copies are also sent to the Auditor General of Canada. The reports are posted on the Department of Finance Canada website.

| Area | Year |

|---|---|

| Debt Management Objectives | 1992 |

| Debt Structure—Fixed/Floating Mix | 1992 |

| Internal Review Process | 1992 |

| External Review Process | 1992 |

| Benchmarks and Performance Measures | 1994 |

| Foreign Currency Borrowing—Canada Bills Program | 1994 |

| Developing Well-Functioning Bond and Bill Markets | 1994 |

| Liability Portfolio Performance Measurement | 1994 |

| Retail Debt Program | 1994 |

| Guidelines for Dealing With Auction Difficulties | 1995 |

| Foreign Currency Borrowing—Standby Line of Credit and FRN | 1995 |

| Treasury Bill Program Design | 1995 |

| Real Return Bond Program | 1998 |

| Foreign Currency Borrowing Programs | 1998 |

| Initiatives to Support a Well-Functioning Wholesale Market | 2001 |

| Debt Structure Target/Modelling | 2001 |

| Reserves Management Framework1 | 2002 |

| Bond Buybacks1 | 2003 |

| Funds Management Governance Framework1 | 2004 |

| Retail Debt Program1 | 2004 |

| Borrowing Framework of Major Federal Government-Backed Entities1 | 2005 |

| Receiver General Cash Management Program1 | 2006 |

| Exchange Fund Account Evaluation1 | 2006 |

| Risk Management Report1 | 2007 |

| Evaluation of the Debt Auction Process1 | 2010 |

| Evaluation of the Asset Allocation Framework of the Exchange Fund Account1 | 2012 |

| Report of the Auditor General of Canada on Interest-Bearing Debt2 | 2012 |

| Crown Borrowing Program Evaluation1 | 2013 |

| Retail Debt Evaluation1 | 2015 |

|

1 Available on the Department of Finance Canada website. |

|

Annex 2

Debt Management Policy Measures Taken Since 1997

The fundamental objectives of debt management are to raise stable and low-cost funding to meet the financial needs of the Government of Canada and to maintain a well-functioning market for Government of Canada securities. For the government as a debt issuer, a well-functioning market attracts investors and contributes to keeping funding costs low and stable over time. For market participants, a liquid and transparent secondary market in government debt provides risk-free assets for investment portfolios, a pricing benchmark for other debt issues and derivatives, and a primary tool for hedging interest rate risk. The following table lists significant policy measures that have been taken to achieve stable, low-cost funding and ensure a well-functioning Government of Canada securities market.

| Measure | Year |

|---|---|

| Discontinued the 3-year bond benchmark | 1997 |

| Moved from weekly to bi-weekly treasury bill auctions | 1998 |

| Introduced a cash-based bond buyback program | 1999 |

| Introduced standardized benchmarks (fixed maturities and increased size) | 1999 |

| Started regular cross-currency swap-based funding of foreign assets | 1999 |

| Introduced a switch-based bond buyback program | 2001 |

| Allowed the reconstitution of bonds beyond the size of the original amount issued | 2001 |

| Introduced the cash management bond buyback program | 2001 |

| Reduced targeted turnaround times for auctions and buyback operations | 2001 |

| Advanced the timing of treasury bill auctions from 12:30 p.m. to 10:30 a.m. | 2004 |

| Advanced the timing of bond auctions from 12:30 p.m. to 12:00 p.m. | 2005 |

| Reduced the timing between bond auctions and cash buybacks to 20 minutes | 2005 |

| Dropped one quarterly 2-year auction | 2006 |

| Announced the maintenance of benchmark targets through fungibility (common dates) | 2006 |

| Consolidated the borrowings of three Crown corporations | 2007 |

| Changed the maturity of the 5-year benchmark and dropped one quarterly 5-year auction | 2007 |

| Reintroduced the 3-year bond benchmark | 2009 |

| Increased the frequency of cash management bond buyback operations from bi-weekly to weekly | 2010 |

| Announced a new framework for the medium-term debt management strategy | 2011 |

| Announced plans to increase the level of prudential liquidity by $35 billion over 3 years | 2011 |

| Added four new maturity dates—February 1, May 1, August 1 and November 1 | 2011 |

| Increased benchmark target range sizes in the 2-, 3- and 5-year sectors | 2011 |

| Announced a temporary increase in longer-term debt issuance | 2012 |

| Announced changes to the Terms and Conditions Governing the Morning Auction of Receiver General Cash Balances | 2013 |

| Introduced ultra-long bond issuance | 2014 |

| Discontinued 3-year issuance | 2015 |

| Increased benchmark target range sizes in the 2- and 5-year sectors | 2015 |

| Increased benchmark target range sizes in the 2-, 5- and 10-year sectors | 2016 |

| Reintroduced the 3-year bond benchmark | 2016 |

| Introduced a pilot program to increase flexibility in the maximum repurchase amount at CMBB operations | 2017 |

| Discountinued the sales of new Canada Savings Bonds | 2017 |

| Pilot program to increase flexibility of CMBB operations made permanent | 2018 |

| Ceased all buyback operations and RG auctions | 2020 |

| Added a second 10-year benchmark bond per year—December 1 | 2020 |

| Increased the frequency of treasury bills auctions from bi-weekly to weekly (i.e., first half of the fiscal year) | 2020 |

| Reduced the frequency of treasury bills auctions from weekly to bi-weekly (i.e., second half of the fiscal year) | 2020 |

| Introduced federal green bond program | 2022 |

Annex 3

Glossary

asset-liability management: An investment decision-making framework that is used to concurrently manage a portfolio of assets and liabilities.

average term to maturity: The weighted average amount of time until the securities in the debt portfolio mature.

benchmark bond: A bond that is considered by the market to be the standard against which all other bonds in that term area are evaluated against. It is typically a bond issued by a sovereign, since sovereign debt is usually the most creditworthy within a domestic market. Usually it is the most liquid bond within each range of maturities and is therefore priced accurately.

budgetary deficit: The shortfall between government annual revenues and annual budgetary expenses.

buyback on a cash basis: The repurchase of bonds for cash. Buybacks on a cash basis are used to maintain the size of bond auctions and new issuances.

buyback on a switch basis: The exchange of outstanding bonds for new bonds in the current building benchmark bond.

Canada bill: A promissory note denominated in US dollars, issued for terms of up to 270 days. Canada bills are issued for foreign exchange reserves funding purposes only.

Canada Investment Bond: A non-marketable fixed-term security instrument issued by the Government of Canada.

Canada note: A promissory note usually denominated in US dollars, and available in book-entry form. Canada notes can be issued for terms of nine months or longer, and can be issued at a fixed or a floating rate. Canada notes are issued for foreign exchange reserves funding purposes only.

Canada Premium Bond: A non-marketable security instrument issued by the Government of Canada, which is redeemable once a year on the anniversary date or during the 30 days thereafter without penalty.

Canada Savings Bond: A non-marketable security instrument issued by the Government of Canada, which is redeemable on demand by the registered owner(s), and which, after the first three months, pays interest up to the end of the month prior to cashing.

cross-currency swap: An agreement that exchanges one type of debt obligation for another involving different currencies and the exchange of the principal amounts and interest payments.

duration: Measures the sensitivity of the price of a bond or portfolio to fluctuations in interest rates. It is a measure of volatility and is expressed in years. The higher the duration number, the greater the interest rate risk for bond or portfolio prices.

electronic trading system: An electronic system that provides real-time information about securities and enables the user to execute financial trades.

Exchange Fund Account (EFA): An account that aids in the control and protection of the external value of the Canadian dollar and which provides a source of liquidity for the Government of Canada. Assets held in the EFA are managed to provide liquidity to the government and to promote orderly conditions for the Canadian dollar in the foreign exchange markets, if required.

financial source/requirement: The difference between the cash inflows and outflows of the government's Receiver General account. In the case of a financial requirement, it is the amount of new borrowing required from outside lenders to meet financing needs in any given year.

fixed-rate share of market debt: The proportion of market debt that does not mature or need to be repriced within one year (i.e. the inverse of the refixing share of market debt).

foreign exchange reserves: The foreign currency assets (e.g. interest-earning bonds) held to support the value of the domestic currency. Canada's foreign exchange reserves are held in the Exchange Fund Account.

Government of Canada securities auction: A process used for selling Government of Canada debt securities (mostly marketable bonds and treasury bills) in which issues are sold by public tender to government securities distributors and approved clients.

government securities distributor: An investment dealer or bank that is authorized to bid at Government of Canada auctions and through which the government distributes Government of Canada treasury bills and marketable bonds.

interest-bearing debt: Debt consisting of unmatured debt, or debt issued on the credit markets, liabilities for pensions and other future benefits, and other liabilities.

Large Value Transfer System: An electronic funds transfer system introduced in February 1999 and operated by the Canadian Payments Association. It facilitates the electronic transfer of Canadian-dollar payments across the country virtually instantaneously.

marketable bond: An interest-bearing certificate of indebtedness issued by the Government of Canada, having the following characteristics: bought and sold on the open market; payable in Canadian or foreign currency; having a fixed date of maturity; interest payable either in coupon or registered form; face value guaranteed at maturity.

marketable debt: Market debt that is issued by the Government of Canada and sold via public tender or syndication. These issues can be traded between investors while outstanding.

money market: The market in which short-term capital is raised, invested and traded using financial instruments such as treasury bills, bankers' acceptances, commercial paper, and bonds maturing in one year or less.

non-market debt: The government's internal debt, which is, for the most part, federal public sector pension liabilities and the government's current liabilities (such as accounts payable, accrued liabilities, interest payments and payments of matured debt).

overnight rate; overnight financing rate; overnight money market rate; overnight lending rate: An interest rate at which participants with a temporary surplus or shortage of funds are able to lend or borrow until the next business day. It is the shortest term to maturity in the money market.

primary dealer: A member of the core group of government securities distributors that maintain a certain threshold of activity in the market for Government of Canada securities. The primary dealer classification can be attained in either treasury bills or marketable bonds, or both.

primary market: The market in which issues of securities are first offered to the public.

Real Return Bond: A bond whose interest payments are based on real interest rates. Unlike standard fixed-coupon marketable bonds, the semi-annual interest payments on Government of Canada Real Return Bonds are determined by adjusting the principal by the change in the Consumer Price Index.

refixing share of market debt: The proportion of market debt that matures or needs to be repriced within one year (i.e., the inverse of the fixed-rate share of market debt).

refixing share of market debt to gross domestic product (GDP): The amount of market debt that matures or needs to be repriced within one year relative to nominal GDP for that year.

secondary market: The market where existing securities trade after they have been sold to the public in the primary market.

sovereign market: The market for debt issued by a government.

treasury bill: A short-term obligation sold by public tender. Treasury bills, with terms to maturity of 3, 6 or 12 months, are currently auctioned on a bi-weekly basis.

ultra-long bond: A bond with a maturity of 40 years or longer.

yield curve: The conceptual or graphic representation of the term structure of interest rates. A "normal" yield curve is upward sloping, with short-term rates lower than long-term rates. An "inverted" yield curve is downward sloping, with short-term rates higher than long-term rates. A "flat" yield curve occurs when short-term rates are the same as long-term rates.

Annex 4

Contact Information

Consultations and Communications Branch

Department of Finance Canada

14th floor

90 Elgin Street

Ottawa, Ontario K1A 0G5

Phone: 613-369-3710

Facsimile: 613-369-4065

TTY: 613-369-3230

E-mail: financepublic-financepublique@fin.gc.ca

Media Enquiries:

613-369-4000

Reference Tables

I - Total Liabilities, Outstanding Market Debt and Debt Charges, as at March 31

II - Government of Canada Outstanding Market Debt, as at March 31

III - Issuance of Government of Canada Domestic Bonds

IV - Outstanding Government of Canada Domestic Bonds, as at March 31, 2022

V - Government of Canada Cross-Currency Swaps Outstanding, as at March 31, 2022

VI - Crown Corporation Borrowings, as at March 31

| Liabilities | |||||

|---|---|---|---|---|---|

| Year | Market debt | Market debt value adjustments | Accounts payable and accrued liabilities | Pension and other liabilities | Total liabilities |

| 1986 | 201.2 | -0.4 | 39.4 | 79.1 | 319.4 |

| 1987 | 228.6 | -0.4 | 42.1 | 84.7 | 355.0 |

| 1988 | 250.8 | -0.9 | 47.2 | 90.9 | 388.0 |

| 1989 | 276.3 | -2.2 | 50.2 | 97.1 | 421.4 |

| 1990 | 294.6 | -2.9 | 53.2 | 104.5 | 449.3 |

| 1991 | 323.9 | -3.2 | 54.9 | 112.1 | 487.7 |

| 1992 | 351.9 | -2.2 | 56.1 | 118.5 | 524.2 |

| 1993 | 382.7 | -3.0 | 58.4 | 125.1 | 563.2 |

| 1994 | 414.0 | -1.8 | 63.7 | 131.4 | 607.3 |

| 1995 | 441.0 | -3.4 | 71.3 | 139.8 | 648.7 |

| 1996 | 469.5 | -1.7 | 74.9 | 148.5 | 691.3 |

| 1997 | 476.9 | 0.3 | 75.9 | 156.3 | 709.4 |

| 1998 | 466.8 | 1.4 | 81.7 | 160.9 | 710.8 |

| 1999 | 457.7 | 2.6 | 83.7 | 168.2 | 712.2 |

| 2000 | 454.2 | -0.2 | 83.9 | 175.8 | 713.6 |

| 2001 | 444.9 | 1.3 | 88.5 | 179.0 | 713.6 |

| 2002 | 440.9 | 0.9 | 83.2 | 177.9 | 703.0 |

| 2003 | 438.6 | -1.1 | 83.2 | 178.3 | 699.0 |

| 2004 | 436.5 | -2.5 | 85.2 | 180.9 | 700.1 |

| 2005 | 431.8 | -4.3 | 97.7 | 179.8 | 705.0 |

| 2006 | 427.3 | -6.1 | 101.4 | 179.9 | 702.5 |

| 2007 | 418.8 | -4.7 | 106.5 | 185.1 | 705.8 |

| 2008 | 394.1 | -3.4 | 110.5 | 191.2 | 692.3 |

| 2009 | 510.9 | 3.1 | 114.0 | 200.4 | 828.4 |

| 2010 | 564.4 | -5.3 | 120.5 | 208.7 | 888.3 |

| 2011 | 596.8 | -5.7 | 119.1 | 217.2 | 927.5 |

| 2012 | 631.0 | -4.7 | 125.0 | 226.1 | 977.5 |

| 2013 | 668.0 | 4.4 | 118.7 | 236.2 | 1,027.4 |

| 2014 | 648.7 | 10.3 | 111.4 | 245.2 | 1,015.8 |

| 2015 | 649.5 | 15.7 | 123.6 | 251.4 | 1,040.2 |

| 2016 | 669.7 | 18.5 | 127.9 | 262.0 | 1,078.0 |

| 2017 | 695.1 | 18.5 | 132.5 | 270.7 | 1,116.9 |

| 2018 | 704.3 | 16.9 | 154.8 | 281.4 | 1,157.4 |

| 2019 | 721.1 | 15.8 | 159.7 | 282.6 | 1,185.2 |

| 2020 | 765.2 | 18.6 | 163.8 | 301.0 | 1,248.6 |

| 2021 | 1,109.8 | 15.4 | 207.4 | 319.7 | 1,652.2 |

| 2022 | 1,232.7 | 10.6 | 260.3 | 335.1 | 1,838.7 |

| Accumulated deficit and debt charges | ||||||

|---|---|---|---|---|---|---|

| Year | Total liabilities | Financial assets | Net debt | Non-financial assets | Accumulated deficit | Gross public debt charges |

| 1986 | 319.4 | 70.1 | 249.2 | 21.4 | 227.8 | 27.7 |

| 1987 | 355.0 | 73.2 | 281.8 | 24.2 | 257.7 | 28.7 |

| 1988 | 388.0 | 75.0 | 313.0 | 26.3 | 286.7 | 31.2 |

| 1989 | 421.4 | 77.9 | 343.6 | 29.0 | 314.6 | 35.5 |

| 1990 | 449.3 | 74.5 | 374.8 | 31.0 | 343.8 | 41.2 |

| 1991 | 487.7 | 76.6 | 411.1 | 33.4 | 377.7 | 45.0 |

| 1992 | 524.2 | 78.5 | 445.7 | 35.8 | 410.0 | 43.9 |

| 1993 | 563.2 | 76.0 | 487.2 | 38.2 | 449.0 | 41.3 |

| 1994 | 607.3 | 79.3 | 527.9 | 40.4 | 487.5 | 40.1 |

| 1995 | 648.7 | 81.2 | 567.5 | 43.3 | 524.2 | 44.2 |

| 1996 | 691.3 | 92.7 | 598.6 | 44.4 | 554.2 | 49.4 |

| 1997 | 709.4 | 100.4 | 609.0 | 46.1 | 562.9 | 47.3 |

| 1998 | 710.8 | 103.6 | 607.2 | 47.2 | 559.9 | 43.1 |

| 1999 | 712.2 | 109.3 | 602.9 | 48.7 | 554.1 | 43.3 |

| 2000 | 713.6 | 123.5 | 590.1 | 50.2 | 539.9 | 43.4 |

| 2001 | 713.6 | 141.9 | 571.7 | 51.7 | 520.0 | 43.9 |

| 2002 | 703.0 | 137.7 | 565.3 | 53.4 | 511.9 | 39.7 |

| 2003 | 699.0 | 139.5 | 559.6 | 54.2 | 505.3 | 37.3 |

| 2004 | 700.1 | 149.1 | 551.0 | 54.8 | 496.2 | 35.8 |

| 2005 | 705.0 | 155.4 | 549.6 | 54.9 | 494.7 | 34.1 |

| 2006 | 702.5 | 165.6 | 536.9 | 55.4 | 481.5 | 33.8 |

| 2007 | 705.8 | 181.9 | 523.9 | 56.6 | 467.3 | 33.9 |

| 2008 | 692.3 | 176.0 | 516.3 | 58.6 | 457.6 | 33.3 |

| 2009 | 828.4 | 298.9 | 529.4 | 61.5 | 467.9 | 28.3 |

| 2010 | 888.3 | 300.8 | 587.5 | 63.4 | 524.1 | 26.6 |

| 2011 | 927.5 | 304.0 | 623.5 | 66.6 | 556.9 | 28.6 |

| 2012 | 977.5 | 317.6 | 659.9 | 68.0 | 591.9 | 29.0 |

| 2013 | 1,027.4 | 337.8 | 689.5 | 68.9 | 620.6 | 25.5 |

| 2014 | 1,015.8 | 318.5 | 696.4 | 70.4 | 626.0 | 24.7 |

| 2015 | 1,040.2 | 336.7 | 703.5 | 74.6 | 628.9 | 24.2 |

| 2016 | 1,078.0 | 365.8 | 712.2 | 77.8 | 634.4 | 21.8 |

| 2017 | 1,116.9 | 382.8 | 734.1 | 82.6 | 651.5 | 21.2 |

| 2018 | 1,157.4 | 397.5 | 752.9 | 81.6 | 671.3 | 21.9 |

| 2019 | 1,185.2 | 413.0 | 772.1 | 86.7 | 685.5 | 23.3 |

| 2020 | 1,248.6 | 435.7 | 812.9 | 91.5 | 721.4 | 24.5 |

| 2021 | 1,652.2 | 502.4 | 1,149.8 | 101.1 | 1,048.8 | 20.4 |

| 2022 | 1,838.7 | 600.3 | 1,238.4 | 103.9 | 1,134.5 | 24.5 |

| Payable in Canadian dollars | |||||

|---|---|---|---|---|---|

| Year | Treasury bills | Marketable bonds1 | Retail debt | Canada Pension Plan bonds |

Total |

| 1986 | 62.0 | 81.1 | 44.2 | 0.4 | 187.7 |

| 1987 | 77.0 | 94.4 | 44.3 | 1.8 | 217.5 |

| 1988 | 81.1 | 103.9 | 53.3 | 2.5 | 240.8 |

| 1989 | 102.7 | 115.7 | 47.8 | 3.0 | 269.2 |

| 1990 | 118.6 | 127.7 | 40.9 | 3.1 | 290.2 |

| 1991 | 139.2 | 143.6 | 34.4 | 3.5 | 320.7 |

| 1992 | 152.3 | 158.1 | 35.6 | 3.5 | 349.5 |

| 1993 | 162.1 | 178.5 | 34.4 | 3.5 | 378.4 |

| 1994 | 166.0 | 203.4 | 31.3 | 3.5 | 404.3 |

| 1995 | 164.5 | 225.7 | 31.4 | 3.5 | 425.1 |

| 1996 | 166.1 | 252.8 | 31.4 | 3.5 | 453.8 |

| 1997 | 135.4 | 282.6 | 33.5 | 3.5 | 454.9 |

| 1998 | 112.3 | 294.6 | 30.5 | 3.5 | 440.8 |

| 1999 | 97.0 | 295.8 | 28.2 | 4.1 | 425.0 |

| 2000 | 99.9 | 294.4 | 26.9 | 3.6 | 424.7 |

| 2001 | 88.7 | 295.5 | 26.4 | 3.5 | 414.1 |

| 2002 | 94.2 | 294.9 | 24.0 | 3.4 | 416.5 |

| 2003 | 104.6 | 289.2 | 22.6 | 3.4 | 419.8 |

| 2004 | 113.4 | 279.0 | 21.3 | 3.4 | 417.1 |

| 2005 | 127.2 | 266.7 | 19.1 | 3.4 | 416.3 |

| 2006 | 131.6 | 261.9 | 17.3 | 3.1 | 413.9 |

| 2007 | 134.1 | 257.9 | 15.2 | 1.7 | 408.9 |

| 2008 | 117.0 | 253.8 | 13.1 | 1.0 | 384.9 |

| 2009 | 192.5 | 295.3 | 12.5 | 0.5 | 500.8 |

| 2010 | 175.9 | 367.9 | 11.8 | 0.5 | 556.1 |

| 2011 | 163.0 | 416.1 | 10.1 | 0.0 | 589.2 |

| 2012 | 163.2 | 448.1 | 8.9 | 0.0 | 620.3 |

| 2013 | 180.7 | 469.0 | 7.5 | 0.0 | 657.2 |

| 2014 | 153.0 | 473.3 | 6.3 | 0.0 | 632.6 |