Archived - Canada at the European Bank for Reconstruction and Development 2015

Canada is a founding member and major shareholder of the European Bank for Reconstruction and Development (EBRD), and a strong supporter of the Bank’s mandate to support transitions towards democracy, pluralism and market-based economies in its countries of operations. The EBRD also works to promote general principles of good governance, accountability and institutional effectiveness in its investments and technical assistance activities. This report details progress in advancing Canada’s key objectives at the EBRD in 2015, and presents our forward-looking objectives for 2016:

- Encourage the EBRD to prioritize resources to areas with the greatest need, notably Ukraine and countries in the Southern and Eastern Mediterranean region, while emphasizing the importance of continued domestic-led political and economic reform as a condition for support.

- Support the EBRD’s Green Economy Transition approach, including its efforts to catalyze private sector investments in infrastructure that supports regional integration, energy security and green growth.

As Canada’s new Governor at the EBRD, I look forward to working with the Bank to achieve these objectives. Canada is strongly committed to promoting democratic, market-oriented economies in the context of freedom, the rule of law and human rights, both at home and abroad. Our shareholding in the EBRD allows us to advance these goals, in cooperation with other shareholders. It is in this spirit that I am pleased to present to Members of Parliament and all Canadians, Canada at the European Bank for Reconstruction and Development 2015: Report on Operations Under the European Bank for Reconstruction and Development Agreement Act.

Going forward, I will encourage the EBRD to explore innovative ways to increase development lending based on need and potential impact, catalyze new development resources from the private sector, and foster innovative partnerships which will enable the EBRD to achieve its transition mandate.

The Honourable Bill Morneau

Minister of Finance

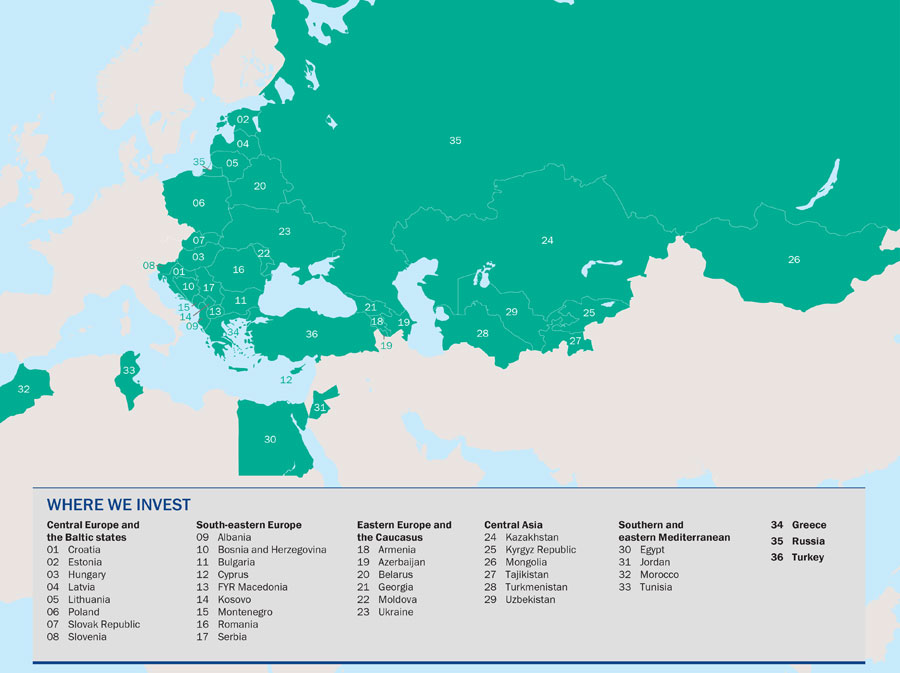

The European Bank for Reconstruction and Development (the EBRD or the Bank) is a project-oriented international financial institution created in 1991 to foster transition towards democratic, market-oriented economies and to promote private and entrepreneurial initiatives in Central and Eastern Europe, in Mongolia and in the Southern and Eastern Mediterranean region. In pursuing this mission, the EBRD operates in countries that demonstrate a commitment to the fundamental principles of multiparty democracy, pluralism and market economics.[1]

The Bank’s 67 shareholders include 65 countries and two intergovernmental organizations (the European Union and the European Investment Bank). As at December 31, 2015, the Bank’s total assets reached €55 billion, while liabilities amounted to €40 billion. A robust capital position has helped the Bank to maintain relatively stable investment levels in recent years, with annual lending around €9 billion.[2]

Three core operating principles guide the Bank’s activities: transition impact, additionality and sound banking practices. Delivering on transition impact requires the Bank to ensure that its projects are aligned with its mandate to foster transitions towards democracy, pluralism and market-based economies. Upholding the principles of additionality and sound banking involves catalyzing additional flows of private sector financing, as well as ensuring good financial governance practices and the effective use of capital in its operations. In accordance with the Agreement Establishing the EBRD, the Bank is also committed to promoting environmentally and socially sustainable development practices. For more information on the EBRD’s mandate and activities, see Annex 1.

As a founding member and the eighth largest shareholder in the Bank, Canada actively contributes to the development of EBRD policies while providing oversight of the Bank’s financial activities. This is primarily achieved through Canada’s seats on the Board of Governors and Board of Directors. At the Board of Directors, Canada is part of a constituency that also includes Jordan, Morocco and Tunisia. The EBRD’s Annual Meeting also provides Canada with an opportunity to meaningfully engage in dialogue with Bank management and like-minded shareholders. For more information on Canada’s role at the EBRD, see Annex 2.

Key objectives guide Canada’s engagement with the Bank. Renewed annually, these objectives are informed by the Government of Canada’s policy goals, a dedication to the EBRD’s underlying transition mandate, and the general principles of good governance, accountability and institutional effectiveness. A discussion of the progress made on Canada’s 2015 objectives, as well as Canada’s forward-looking objectives for 2016, can be found in the section entitled “Canada’s Objectives at the EBRD.”

As one of the largest investors in its regions of operations, the EBRD actively works to enhance the effectiveness of its activities. By investing billions annually in its recipient countries, catalyzing additional resources from the private sector and delivering on its expanded regional mandate, the EBRD is able to enhance its transition impact each year.[3]

In 2015, the EBRD significantly increased its support for political and economic transitions in its countries of operations, despite a challenging economic and political environment. The Bank’s total annual investment rose to almost €9.4 billion, a €525 million increase from €8.9 billion in 2014. These investments were made in 381 projects across 35 countries. In addition to investing its own funds, the EBRD mobilized an additional €22.2 billion in private capital in 2015, using shareholders’ capital to crowd in additional funds for development and transition. In 2015, the EBRD significantly increased the amount of private funds mobilized, due to an increased focus on co-financing projects with partners and the impact of the EBRD’s largest syndicated loan transaction to date, which involved a Canadian company in Mongolia.

Chart 1: EBRD Funds Mobilized and Investments 2011–2015 (€ millions)

In March 2015, the EBRD Board of Governors approved Greece’s request to become a country of operations of the Bank for a time-limited period until 2020. The Bank began making investments in Greece in support of structural and economic reforms, including a €250 million equity investment as part of a bank recapitalization program.

During the Bank’s Annual Meeting in Tbilisi, Georgia in May 2015, shareholders approved the Bank’s Strategic and Capital Framework, which established a high-level strategic framework for the Bank’s operations in 2016-2020.

In October 2015, the EBRD approved the Green Economy Transition approach, which seeks to raise the level of environmental investment to 40% of total EBRD financing by 2020. The EBRD participated in the 2015 United Nations Climate Change Conference (COP21) climate conference in December, and announced steps to scale up green financing to approximately €18 billion by 2020.

In November 2015, the EBRD approved its first gender strategy. The Strategy for the Promotion of Gender Equality adds to a suite of other social and environmental safeguard policies already in place at the EBRD, and ensures that the Bank includes gender equality considerations when making investments in countries of operations.

At the EBRD’s 2016 Annual Meeting in London, United Kingdom, Governors will elect a Bank President. Canada has a long-standing position to advocate for fair, open and transparent election processes for the heads of multilateral development banks and has emphasized this priority to other shareholders in the lead-up to the Presidential election.

Canada has actively worked at the EBRD’s Board of Directors to oppose lending to new Russian projects, including the halting of all new Russian projects in 2014.This moratorium continued in 2015, and the Bank did not make any new investments in Russia, while continuing to receive interest and principal payments from its existing loan portfolio there. Small disbursements to Russia were made for EBRD projects approved before the moratorium came into effect.

The EBRD has continued to support political and economic transition in Ukraine, and provided approximately €1 billion in lending to new public and private sector projects in Ukraine in 2015. The Bank’s investments were targeted towards supporting Ukraine through very challenging economic conditions, funding investments in energy security infrastructure and trade financing, and reinforcing Ukraine’s reforms to move towards an open and more inclusive, market-oriented economy.

EBRD Support to Ukraine

In 2015, the EBRD committed approximately €1 billion to 29 projects in Ukraine, as well as engaging in technical assistance efforts and an extensive policy dialogue with Ukrainian businesses and the government.

The EBRD’s largest investment in Ukraine was a €276 million loan to Naftogaz, the Ukrainian national oil and gas company, to support the purchase of gas for heating over the 2015-2016 winter. The Bank also made extensive investments in the financial sector (€386 million), agribusiness (€185 million) and municipal transport infrastructure (€100 million) in 2015.

In addition to its investments, the EBRD has provided extensive technical assistance to establish the Business Ombudsman Council for Ukraine, which was created to fight corruption by investigating wrongdoing by state entities and defend businesses and entrepreneurs against state entities infringing their rights. The EBRD also provided support to the National Reform Council, an organization established to help prioritize and build political consensus around Ukraine’s economic reform agenda. Anti-corruption and economic reform efforts in Ukraine have been bolstered by the Bank’s technical assistance to both of these organizations.

In 2011, the EBRD’s geographic reach was expanded to include the Southern and Eastern Mediterranean (SEMED) region. Jordan, Morocco and Tunisia were granted country of operation status in 2013 by the EBRD’s Board of Governors. In October 2015, Egypt became a country of operations, allowing operations in the country to access the EBRD’s ordinary capital resources for new lending. Lebanon was also approved for membership in the Bank in December 2015.[4]

In 2015, the EBRD invested €1.5 billion in 37 operations across the SEMED region’s four recipient countries, a 36% increase compared to the funding provided in 2014. EBRD lending in Egypt increased to €780 million from €593 million in 2014. EBRD lending in Morocco also increased strongly to €431 million in 2015 from €225 million in 2014. EBRD lending to SEMED operations are focused on developing municipal infrastructure, supporting domestic financial institutions and private businesses, and promoting sustainable and renewable energy sources.

The ongoing refugee crisis in Syria and neighbouring countries has put enormous pressure on local governments and communities, including on domestic infrastructure. The EBRD has increased its support for projects that can support displaced people and the communities hosting refugees. For example, the EBRD has made significant investments in Jordanian municipal infrastructure, including a €17.5 million investment to the Water Authority of Jordan to upgrade wastewater treatment facilities. The EBRD’s investment in the Water Authority of Jordan is important to providing facilities to support refugee communities and their Jordanian hosts. In 2016, the EBRD will provide further support for the region, both through its ordinary capital resources and accompanying grant and technical cooperation assistance.

The EBRD invested €1.2 billion in 20 projects in the electrical power sector, of which 15 projects supported low-carbon energy sources such as wind, solar or hydropower. One of the EBRD’s largest energy infrastructure investments was a €101 million loan to Tajikistan’s national electricity company to support the development of additional hydropower generation capacity in the Central Asian country. The EBRD financing will also support investments in high voltage transmission lines to help export the power to neighbouring countries, creating a new source of foreign exchange earnings.

In 2015, the EBRD became a member of the Global Infrastructure Facility (GIF). The GIF is a World Bank led facility to support the development, preparation and structuring of complex infrastructure projects through public-private partnerships. The EBRD also provided €40 million to create the Infrastructure Project Preparation Facility, with a similar goal of increasing the number of bankable infrastructure projects.

Chernobyl Shelter Fund

The EBRD manages the Chernobyl Shelter Fund, a cooperative effort with G7 donors to construct a new protective structure over the destroyed Chernobyl nuclear reactor and the aging containment sarcophagus built following the 1986 nuclear accident. When completed, the structure will have an estimated life of 100 years and will protect against the continued release of radioactive material from the reactor. The shelter is expected to be completed in late 2017 and will cost an estimated €1.5 billion, of which the EBRD will have provided approximately €500 million. In addition to other G7 donors, Canada has provided a total of $117 million in support of Chernobyl nuclear safety projects.

The EBRD operates across a diverse geographic area stretching from Central Asia through Central and South-eastern Europe to the SEMED region. Regional investment levels are affected by various factors, including the business climate in individual recipient countries and domestic political developments that may hinder the EBRD’s operations.

Turkey received the most support in 2015, with lending growing by €510 million or 36% compared to 2014 levels. The SEMED region also saw strong investment growth, with Egypt and Morocco receiving significantly more support. Greece became an EBRD recipient country on a temporary basis in 2015, and lending in Central Asia and Central Europe and the Baltic States also increased. Due to Russia’s destabilizing actions in eastern Ukraine and subsequent guidance from the Board of Directors, the EBRD did not undertake any new financing operations in Russia in 2015; however, some disbursements associated with existing programs did occur. Support to South-eastern Europe and Eastern Europe and the Caucasus decreased. The charts below illustrate the regional changes in the EBRD’s investment flows from 2014 to 2015.

Chart 2: EBRD Investments in 20151 (€ millions)

Chart 3: EBRD Investments in 20141 (€ millions)

Bank commitments totalled almost €9.4 billion in 2015, while disbursements remained stable at €6.5 billion, the same level as in 2014. The EBRD’s projects attracted some €22.2 billion in external financing, with the EBRD directly mobilizing €1.6 billion in syndicated loans (compared to €0.9 billion in 2014). The Bank maintained a solid balance sheet in 2015, with a robust capital position and high levels of liquidity. In 2015, the EBRD realized profits of €949 million (€927 million in 2014) before impairment.

The EBRD’s operational and financial highlights are summarized below.

EBRD Operational and Financial Indicators, 2010-2015

(€ millions, except for number of projects)

| 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | |

|---|---|---|---|---|---|---|

| Number of projects | 381 | 377 | 392 | 393 | 380 | 386 |

| EBRD investment | 9,378 | 8,853 | 8,498 | 8,920 | 9,051 | 9,009 |

| Resources mobilized | 22,202 | 13,867 | 13,488 | 17,372 | 20,802 | 13,174 |

| Total project value | 30,738 | 20,769 | 20,527 | 24,871 | 29,479 | 22,039 |

| Gross disbursement | 6,500 | 6,500 | 5,900 | 6,000 | 6,700 | 6,000 |

| Realized profit before impairment | 949 | 927 | 1,169 | 1,007 | 866 | 927 |

| Net profit/loss for the year before transfers of net income | 802 | (568) | 1,012 | 1,021 | 173 | 1,377 |

| Paid-in capital | 6,202 | 6,202 | 6,202 | 6,202 | 6,199 | 6,197 |

| Reserves and retained earnings | 8,384 | 7,978 | 8,674 | 7,748 | 6,974 | 6,780 |

| Total members’ equity | 14,586 | 14,180 | 14,876 | 13,950 | 13,173 | 12,977 |

Overall, the Bank’s strong capitalization, high levels of liquidity and relatively low levels of non-performing loans reaffirm that the EBRD continues to be in a strong position to carry out its mandate in the medium term. The Bank continues to be rated AAA or equivalent with a stable outlook by all three major credit rating agencies (Standard & Poor’s, Moody’s Investors Service and Fitch Ratings). EBRD year-end financial statements are available on its website.

Canada actively contributes to the development of the EBRD’s policies and provides oversight of the Bank’s financial activities through its seats on the Board of Governors and the Board of Directors. Canada is also involved in the work of various committees, and has the opportunity to meaningfully engage in dialogue with the Bank’s other shareholders during the EBRD Annual Meeting.

As a major shareholder in the EBRD, Canada supports the Bank in accomplishing its mandate to foster effective political and economic transitions in its countries of operations. In doing so, Canada works to ensure the EBRD also maintains prudent risk management systems and a healthy financial profile. In order to provide strategic direction for its engagement with the EBRD, Canada develops key objectives on an annual basis. These objectives are informed by Canada’s commitment to the EBRD’s underlying mandate, the Government’s foreign policy and development agenda, and general principles of good governance, accountability and institutional effectiveness.

In 2015, Canada’s objectives were targeted to encourage the EBRD to prioritize its operations in countries with the greatest transition needs, notably in Ukraine and the SEMED region. Further, Canada actively contributed to the Strategic and Capital Framework process through 2015, helping to set a forward direction for the EBRD that is aligned with Canadian priorities. Canada’s 2015 objectives at the EBRD are presented below along with an overview of progress made in achieving these objectives.

Objective 1: Encourage the EBRD to prioritize resources to countries with the greatest need, notably Ukraine and the Southern and Eastern Mediterranean region, and ensure the EBRD emphasizes the importance of continued domestic-led political and economic liberalization reforms as a condition for support.

Canada is a strong advocate for EBRD resources to be deployed in countries and regions where they can have the greatest transition impact. In this regard, the SEMED region presents a strong case for EBRD support. Although SEMED countries have made meaningful progress in developing more inclusive political and economic institutions, the region’s transition process is still nascent and requires ongoing support.

Canada was encouraged to see continued growth in the Bank’s investments in the SEMED region, with Egypt, Jordan and Morocco all receiving more support compared to 2014. Morocco received almost twice as much funding, with investment increasing to €431 million in 2015 from €225 million in 2014. The Bank also opened an office in Morocco in early 2015. Egypt became a full recipient country in 2015, reflecting its transition progress. Recipient country status allows the EBRD to use its ordinary capital resources for financing and technical assistance programming. Previously, Egypt had received support through the Shareholder Special Fund, a trust fund funded through net income allocations by the Bank. Using ordinary capital resources will allow the EBRD to use its full balance sheet to scale up operations in Egypt that support the country’s continued transition.

Efforts are underway for Lebanon to become a member and recipient country of the EBRD in 2016. Work is also underway to have Libya become an EBRD member and country of operations, although this effort remained stalled through 2015 due to continued instability in the country. In the SEMED region, the EBRD increased its focus on addressing the impacts of the refugee crisis. Given the ongoing crisis and the scale of development needs in the region, Canada looks forward to the EBRD continuing to play an important role in providing investments and technical assistance. Support for transition in the SEMED region is especially important as Canada shares a constituency with Morocco, Tunisia and Jordan at the EBRD Board of Directors. Canadian representatives at the EBRD Board work closely with the EBRD and representatives of these countries to facilitate EBRD investment opportunities there.

Throughout 2015, Canada emphasized that a clear commitment to undertake domestic-led reforms should be a condition for all ongoing support from the Bank. On this basis, at the Board of Directors, Canada has opposed or abstained from voting on projects that could result in direct benefits to the Belarusian government due to the continued lack of political and economic reform in the country.

Objective 2: Engage in the upcoming Strategic and Capital Framework process, to promote a forward direction for the EBRD that is aligned with Canada’s foreign policy and development priorities.

Canada played an active role in the discussion around the Strategic and Capital Framework, which established a high-level framework to guide the Bank’s operations over the 2016–2020 period. The Strategic and Capital Framework was voted on and approved by EBRD Governors at the 2015 Annual Meeting in Tbilisi, Georgia.

One of Canada’s 2016 objectives continues from the previous year, while a second new objective has been added to reflect our evolving priorities at the EBRD. Canada is a motivated shareholder with a strong interest in the instution. As such, its objectives are meant to help ensure that the EBRD remains an efficient, effective and modern institution for the clients and countries that the Bank serves. Canada’s 2016 objectives are listed below, and will be reported on in next year’s Canada at the European Bank for Reconstruction and Development report to Parliament.

- Encourage the EBRD to prioritize resources to areas with the greatest need, notably Ukraine and countries in the Southern and Eastern Mediterranean region, while emphasizing the importance of continued domestic-led political and economic reform as a condition for support.

Given the trade-offs required in the allocation of EBRD resources, Canada will continue to advocate that the Bank prioritize investments based on the greatest need and potential impact. Ukraine and countries in the SEMED region are facing significant pressures, and the current political and economic context in both regions demonstrates a clear case for transition support from the EBRD. In particular, the EBRD should continue to support SEMED countries and communities hosting large refugee populations. In 2016, Canada will strongly advocate that the EBRD continue to play an important role in both regions by making investments which foster political and economic transitions.

- Support the EBRD’s Green Economy Transition approach, including its efforts to catalyze private sector investments in infrastructure that supports regional integration, energy security and green growth.

2015 was an important year for global development, with the Addis Ababa Financing for Development conference in July, the release of the Sustainable Development Goals in September, and the COP21 climate conference in December. Meeting these ambitious development milestones will require significant new resources from all development actors, including the private sector. Given its private sector investment focus and transition mandate, the EBRD is well placed to play an instrumental role in crowding in new resources for sustainable development. The private sector is particularly well suited to scaling up investments in infrastructure. Multilateral development banks, including the EBRD, can play a catalytic role by taking steps to expand the pipeline of bankable infrastructure projects, use guarantee instruments to reduce the risk profile of private infrastructure investments, and develop new financing vehicles to crowd in private funds. In 2016, Canada will work closely with the EBRD, and the multilateral development banking system more broadly, to expand efforts to catalyze private investment in infrastructure that is sustainably designed and built and regionally integrated.

The EBRD began operations in 1991. Its aims are to foster the transition towards open, market-oriented economies in Central and Eastern Europe, the successor states of the former Soviet Union, Mongolia and member countries in the Southern and Eastern Mediterranean region, and to promote private and entrepreneurial initiative in those countries that are committed to the fundamental principles of multiparty democracy, pluralism and market economics.[5] Where countries are not committed to these principles, the Bank develops a strategy for limited involvement. To deliver on its mandate, the Bank focuses its activities on assisting its 35 recipient countries in implementing economic reforms, taking into account the particular needs of countries at different stages in the transition process.

The Bank’s overriding focus is the private sector, with a strong operational emphasis on enterprise restructuring, including the strengthening of financial institutions, and the development of the infrastructure needed to support the private sector. The EBRD’s charter stipulates that not less than 60% of its financing commitments should be directed either to private sector enterprises or to state-owned enterprises implementing a program to achieve private ownership and control. All of its financing projects have to demonstrate environmental sustainability, as per the Bank’s Articles of Agreement. The Environmental and Social Policy is reviewed every three years to help ensure the Bank adopts best practices in all projects.

In promoting economic transition, the Bank acts as a catalyst for increased flows of financing to the private sector, as the capital requirements of these countries cannot be fully met by official multilateral or bilateral sources of financing, and many foreign private investors remain hesitant to invest in the region.

The EBRD differs from other regional development banks in several ways. Firstly, the Bank’s overriding focus is on the private sector. Further, the EBRD’s mandate gives it an explicit focus on the promotion of democratic institutions in its countries of operations. The EBRD is the only international financial institution with this charter requirement. Finally, the EBRD does not provide concessional financing and poverty reduction is not specifically part of its mandate. However, development of the private sector in its countries of operations should lead to increased employment and thus help reduce poverty.

The EBRD’s operations to advance the transition to a market economy are guided by three principles: transition impact, additionality and sound banking. Financing is provided for projects that expand and improve markets, help to build the institutions that underpin a market economy, and demonstrate and promote market-oriented skills and sound business practices. EBRD financing must also mobilize additional sources of financing and not displace them. Bank projects must be sound from a banking perspective, thus demonstrating to private investors that the region offers attractive returns. Adherence to sound banking principles also ensures the financial viability of the EBRD and hence its attractiveness as a co-investment partner for the private sector. Integrity is another important aspect of the Bank’s due diligence in selecting projects.

The Bank’s medium term operational priorities are premised on: the central importance of creating and strengthening institutions that ensure markets work well; the fundamental role that small businesses can play in creating dynamic, competitive and more equitable economies; and the key role the transition process plays in supporting the principles of multiparty democracy and pluralism.

To achieve these priorities the Bank focuses on:

- Developing market-based and commercially oriented infrastructure.

- Developing sound financial sectors linked to the needs of enterprises and households.

- Providing leadership for the development of lending to micro, small and medium-sized enterprises.

- Demonstrating, through selected examples, effective approaches to restructuring viable large enterprises.

- Diversifying the economic base and developing knowledge-based industries.

- Taking an active approach in its equity investments to improve corporate governance.

- Engaging governments in policy dialogue to strengthen institutions and improve the investment climate.

- Tackling energy efficiency, climate change and energy security.

- Promoting transparency and accountability in public sector management.

- Taking a regional approach where appropriate.

- Promoting sustainable development and environmental due diligence.

The EBRD offers a full array of financial products and services, including:

- Longer term loans.

- Equity investments.

- Quasi-equity instruments (subordinated loans, preferred stock, income notes).

- Guarantees and standby financing.

- Working capital and trade finance facilities.

- Risk management (intermediation of currency and interest rate swaps, provision of hedging facilities).

Eligible projects must be supported by a strong business case, benefit the economy and the transition process of the host country, and comply with the EBRD’s environmental guidelines. Projects in all industries are eligible for EBRD financing, except those producing military equipment, tobacco and distilled alcohol. Although it is primarily a financier of private sector projects, the Bank may provide financing to state-owned companies, provided they are operating competitively and, in particular, that such financing facilitates or enhances the participation of private and/or foreign capital in such enterprises. The EBRD can finance private companies that are wholly locally owned or foreign owned, as well as joint ventures between foreign and local shareholders.

In order to ensure the participation of investors and lenders from the private sector, the EBRD generally limits the total amount of debt and equity financing for any single project to 30% of total estimated project costs. In rare cases, such as when a project is in corporate recovery, the Bank may become the largest shareholder in order to protect the EBRD’s investment.

Smaller projects are financed both directly by the EBRD and through local financial intermediaries. By supporting local commercial banks, micro-finance organizations, equity funds and leasing facilities, the EBRD has helped finance a multitude of smaller projects.

The EBRD charges market rates for its private sector financing and provides uniform loan pricing for sovereigns at 6-month LIBOR (London Interbank Offered Rate) +100 basis points. In addition, fees vary according to the nature of the project and the amount and complexity of the work required of the EBRD.

The Bank uses its close relationship with governments in the region to promote policies that bolster the business environment. The EBRD advises governments on promoting a sound investment climate and stronger institutional framework, which are important for the functioning of the private sector. This dialogue is typically supportive of projects in which the Bank invests. Specifically, the EBRD works with government officials to promote sound corporate governance, anti-corruption practices, fair and predictable taxation policies, and transparent accounting standards. In addition, a dedicated legal team advocates for an effective legal and regulatory framework which is not directly tied to a project.

Technical cooperation improves the preparation and implementation of the EBRD’s investment projects and provides advisory services to private and public sector clients. It increases the impact of EBRD projects on the transition process by supporting structural and institutional changes, and it assists legal and regulatory reform, institution building, company management and training.

Technical cooperation is important to the Bank as it enhances investment effectiveness by ensuring thorough preparations and enables the EBRD to take on investment opportunities in higher-risk environments. Technical cooperation projects are managed by the EBRD and funded by the Bank’s profits, governments and international institutions.

The highest authority in the Bank is the Board of Governors. The Board meets annually and approves the EBRD’s annual report, net income allocation and financial statements, the independent auditor’s report, the election of the Chair and Vice-Chair for the next Annual Meeting, as well as other items requiring Governors’ approval. A Governor and an Alternate Governor represent each of the 66 shareholders.

The Board of Directors is responsible for the general operations of the Bank. It is composed of 23 members, with each representing either one member or a constituency of member countries. The Board helps to set the strategic and financial course for the Bank, in consultation with the Bank’s management.

The Board of Directors has established four committees that are responsible for overseeing the activities of the Bank: the Board Steering Group, the Audit Committee, the Budget and Administrative Affairs Committee, and the Financial and Operations Policies Committee. This division of labour is consistent with good corporate governance practices and provides an appropriate system of checks, balances and incentives. In addition, the structure ensures a more effective discussion by the Board, once initiatives are ready for approval.

The Board Steering Group is responsible for the coordination of the Committees’ work programs to avoid overlap and ensure timely completion. In addition to some administrative duties, the Chair of the Group is the main liaison between the Board and management. The Group is currently chaired by the Belgian Director.

The Audit Committee’s primary objective is to ensure that the financial information reported by the Bank is complete, accurate, relevant and timely. The Committee oversees the integrity of the Bank’s financial statements and the compliance of its accounting and reporting policies with the requirements set out in the International Financial Reporting System. It also reviews the EBRD’s system of internal controls and its implementation, as well as the functions of the internal audit, evaluation and risk management teams. The Committee is currently chaired by the Greek Director.

The Budget and Administrative Affairs Committee is responsible for ensuring that the Bank’s budgetary, staff and administrative resources are aligned with its strategic priorities. To this end, the Committee reviews the medium term resource framework, annual budgets and the business plan. It also oversees the Bank’s human resources policies, including ethics and the Code of Conduct. The Committee is currently chaired by the Spanish Director.

The Financial and Operations Policies Committee oversees the Bank’s financial and operational policies, including the annual borrowing plan prepared by the Treasury Department. The Committee is responsible for the transparency and accountability of the Bank’s operations, as laid out in the 2006 Public Information Policy. Since 2007, the Committee has also been charged with overseeing the net income allocation process. As well, it is responsible for the Bank’s Environmental and Social Policy and EBRD sector strategies. The Committee is currently chaired by the Norwegian Director.

For More Information on the EBRD

The Bank releases considerable information on its various activities. Bank publications include information guides (such as Guide to EBRD Financing), evaluation reports, special reports (such as the Annual Report and Transition Report), country strategies and assorted fact sheets.

Information can also be obtained on the Bank’s website.

Requests for information can be addressed to:

Publications Desk

European Bank for Reconstruction and Development

One Exchange Square

London, EC2A 2JN

United Kingdom

Or to: Office of the Director for Canada, Jordan, Morocco and Tunisia

canadaoffice@ebrd.com

The EBRD’s share capital is provided by member countries, with proportional voting rights.

The chart below provides shareholdings as at December 31, 2015.

Shareholding as a Percentage of Authorized Capital Stock

The EBRD has 67 shareholders: 65 countries, as well as the European Union and the European Investment Bank. In 2015, the EBRD invested in 36 countries, including Egypt and Greece, which became countries of operations in 2015.

Source: EBRD, About the EBRD: We Invest in Changing Lives.

Canada’s relationship with the EBRD is governed by the European Bank for Reconstruction and Development Agreement Act, which outlines Canada’s responsibilities with respect to the EBRD. In particular, it requires the Minister of Finance to table in Parliament an annual report of operations at the EBRD for the previous calendar year by March 31 (or, if the House is not sitting, on any of the 30 days thereafter that it is sitting).

Canada is the eighth largest shareholder of the EBRD, with its shares representing 3.4% of the institution’s capital. This amounts to €1.02 billion of the Bank’s capital, €213 million of which is paid-in capital, with the remaining shares being callable capital.

The principal responsibility for oversight of the EBRD’s key activities resides with the Department of Finance. The Department of Finance coordinates Canadian policy advice and manages Canada’s strategic interests at the EBRD in consultation with Global Affairs Canada.

Canada’s representation at the EBRD–The Honourable Bill Morneau, Minister of Finance, is the Canadian Governor and Daniel Jean, Deputy Minister of Foreign Affairs, is the Alternate Governor. Since January 2013, Canada has been represented on the EBRD Board of Directors by Claire Dansereau. Jean-François Perreault, former Assistant Deputy Minister of International Trade and Finance at the Department of Finance, represented Canada as the Temporary Alternate Governor at the 2015 EBRD Annual Meeting in May in Tbilisi, Georgia.

Canada’s constituency at the EBRD–The Director for Canada also represents Morocco, Jordan and Tunisia at the EBRD Board of Directors.

Canadian staff at the EBRD–Canadians are well represented on EBRD staff. At the end of 2015, there were 39 Canadians on the staff of the EBRD, representing 1.8% of total positions.

Canada’s membership in the EBRD, and its active participation in the discussion of policy and operational issues, is an important means to help shape economic and social development in the EBRD’s countries of operations. Canada strongly supports the overriding objective of developing a strong private sector in its countries of operations by mobilizing financing for projects with a high transition impact and by providing advice and technical assistance to businesses and governments. The Bank provides Canada with a vehicle to contribute to development in transition countries that are not currently part of our bilateral development assistance programs. Canada’s engagement helps to raise awareness among Canadian companies of opportunities presented by the EBRD.

Canadian companies can seek financing for projects undertaken in the Bank’s countries of operations. The Bank often relies on the procurement of goods and services from the private sector to implement transition projects. Canadian consultants were awarded contracts valued at €856,641 in 2015. Further, four EBRD investments were signed with Canadian companies in 2015, totalling approximately €400 million in EBRD finance. Finally, Canadian financial firms provided approximately €93 million in co-financing in support of two EBRD projects.

Ukraine–Canada is a leading supporter of Ukraine’s reform efforts in a number of key sectors including fiscal and monetary policy, macro-economic stabilization, the judicial sector, law enforcement, agriculture, stability and security, decentralization and deregulation. Canada is also responding to the humanitarian needs of conflict-affected people in eastern Ukraine.

Since the onset of the crisis, Canada has expedited and increased support to Ukraine, including $400 million in loans to help the Ukrainian government stabilize the economy; over $240 million in new bilateral development assistance projects to strengthen democracy, the rule of law and sustainable economic growth; over $45 million in security and stabilization projects, including support for the Organization for Security and Co-operation in Europe Special Monitoring Mission; and over $19 million in humanitarian assistance funding to address the basic needs of conflict-affected people.

Jordan–Jordan is a development country of focus. In 2014–15, Canada provided approximately $30 million in development assistance to Jordan to support its long term development goals and national efforts to manage the influx of over a million Syrians. This included programming in education and sustainable economic growth, for example through support for education sector reform, teacher training, skills development and renewable energy. Support was also provided to build the capacity of municipalities most impacted by the influx of Syrian refugees and local infrastructure needed to deliver essential services.

Building on this foundation of programming, in February 2016, Canada committed a total of $270 million of development assistance over three years (2016–2019) for Jordan, Iraq, Syria and Lebanon. This assistance will aim to build the resilience of individuals, host communities and countries to withstand and recover from the impact of conflicts in the region. It will also aim to build local capacity to provide basic social services, maintain and rehabilitate public infrastructure, foster inclusive growth and employment, and advance inclusive and accountable governance.

Egypt–Egypt is one of Canada’s development partner countries. In 2015, Canada operationalized $35.6 million in new programming over five years to continue to promote sustainable economic growth by supporting small and medium-sized businesses and improving the employability of marginalized people through technical vocational education and training aligned with labour market needs.

Canada’s new programming is also improving the ability of the Government of Egypt and host communities to mitigate the impact of the Syrian crisis in the primary education sector with support for school feeding initiatives as well as programs aimed at improving access to and the quality of formal education.

Morocco–Morocco is also one of Canada’s development partner countries. Since 2009–10, Canada has contributed over $41 million in bilateral development assistance to Morocco. In 2014–15, the Department of Foreign Affairs, Trade and Development’s Morocco Development Program disbursed $8.2 million. The Program’s main objective is to support the implementation of Moroccan reforms in priority sectors, including strengthening the government’s capacity to provide high-quality education for young women and men and reinforcing its ability to respond to challenges related to youth employability. Programming results include strengthening educational reforms, such as the decentralization of the education system; defining a vocational training management framework based on the Canadian skills-based approach; and reinforcing the institutionalization of systemic gender equality approaches.

Other EBRD recipient countries benefit from the Government’s support to multilateral organizations, such as the Global Fund to Fight AIDS, Tuberculosis and Malaria, Gavi, the Vaccine Alliance, the Global Environment Facility, the World Health Organization and the International Development Association, as well as from contributions to Canadian and international civil society partners.

In 2014–15, the development portfolio of the Department of Foreign Affairs, Trade and Development provided approximately $39.6 million to 31 Canadian civil society organizations, implementing 44 projects in 11 EBRD recipient countries: Armenia, Azerbaijan, Egypt, Georgia, Jordan, the Kyrgyz Republic, Mongolia, Morocco, Tajikistan, Turkey and Ukraine. The most active Canadian partners, by number of projects and expenditure volumes, included Save the Children Canada, World Vision Canada, Aga Khan Foundation Canada and Oxfam-Québec. The majority of the funding was provided as humanitarian assistance to help Syrian refugees in neighbouring countries. The main sectors of programming in the EBRD’s recipient countries where these civil society organizations are active include humanitarian aid, democratic governance and education.

Programming is also delivered through the Canada Fund for Local Initiatives (CFLI) and the Global Peace and Security Fund (GPSF).

The CFLI assists in financing small local projects in countries appearing on the Organisation for Economic Co-operation and Development’s Development Assistance Committee List of Official Development Assistance Recipients, including 17 of the EBRD’s countries of operations. CFLI projects are designed and implemented, for the most part, by local civil society organizations. In 2014–15, the CFLI funded 103 projects in the EBRD’s countries of operations for a total value of $2.12 million. Project themes included: protecting human rights, including those of lesbian, gay, bisexual and transgender communities; preventing sexual violence and child, early and forced marriage; supporting democratic transition; entrenching the rule of law; and strengthening economic governance.

Through the GPSF, over $12.9 million was provided to 6 EBRD countries of operations in 2014–15. Initiatives supported a variety of areas, including security in Jordan, regional cooperation across Central Asia, independent media in Belarus, election observation in Ukraine, Tunisian constitutional reform, women’s political participation in Tunisia and Jordan, and a rule of law project in Kosovo. In Jordan, for example, $48 million was provided in security and stabilization assistance, including material support such as vehicles and equipment, to the Jordanian Gendarmerie Forces, the Public Security Directorate and Civil Defence to effectively secure the Za’atari and Azraq refugee camps. In addition, Canada provided support to the Jordanian Armed Forces with equipment to assist their operations on the northern border.

1 Article 1 of the Agreement Establishing the European Bank for Reconstruction and Development. Where countries do not demonstrate a commitment to these principles, the Bank limits its activities accordingly.

2 Annual investment refers to the amount of financing committed under signed agreements during the calendar year.

3 Recipient countries include: (1) official countries of operations, which receive assistance through the Bank’s traditional channels (Governors must pass an affirmative vote for a country to attain this status); and (2) potential countries of operations, which receive support through other EBRD mechanisms, such as Shareholder Special Funds.

4 Lebanon will officially become a member country once it purchases its shares at the EBRD.

5 Article 1 of the Agreement Establishing the European Bank for Reconstruction and Development.