Archived - Canada at the European Bank for Reconstruction and Development 2016

Openness, inclusion and cooperation are essential for a strong and stable global economy, and Canada looks to multilateral partners such as the European Bank for Reconstruction and Development (EBRD) to help advance these objectives. In particular, we believe the EBRD can help promote an agenda in its countries of operations that complements Canada’s own efforts at home to foster inclusive growth, strengthen the middle class and help those working hard to join it.

It is in this spirit that I am pleased to present to Members of Parliament and all Canadians, Canada at the European Bank for Reconstruction and Development 2016: Report on Operations Under the European Bank for Reconstruction and Development Agreement Act.

This report details progress in advancing Canada’s key objectives at the EBRD in 2016, and presents our forward-looking objectives for 2017. As Canada’s Governor at the EBRD, I look forward to working with the Bank to achieve these objectives:

- Prioritize resources to areas with the greatest need, notably Ukraine and countries in the Southern and Eastern Mediterranean region, while emphasizing the importance of continued domestic-led political, economic and institutional reforms as a condition for support.

- Support the Bank’s updated transition mandate to build strong, inclusive and sustainable market economies in its countries of operations, promoting the effective and efficient use of investment and policy instruments to deliver results.

Canada is strongly committed to promoting democratic, market-oriented economies in the context of freedom, the rule of law and human rights. Our shareholding in the EBRD allows us to advance these goals, in cooperation with other shareholders. As we work towards furthering these objectives, I encourage the EBRD to use its existing balance sheet to the greatest extent possible, catalyze additional development resources from the private sector, and expand gender and climate considerations in its operations, to enable the EBRD to most effectively achieve its transition mandate.

The Honourable Bill Morneau

Minister of Finance

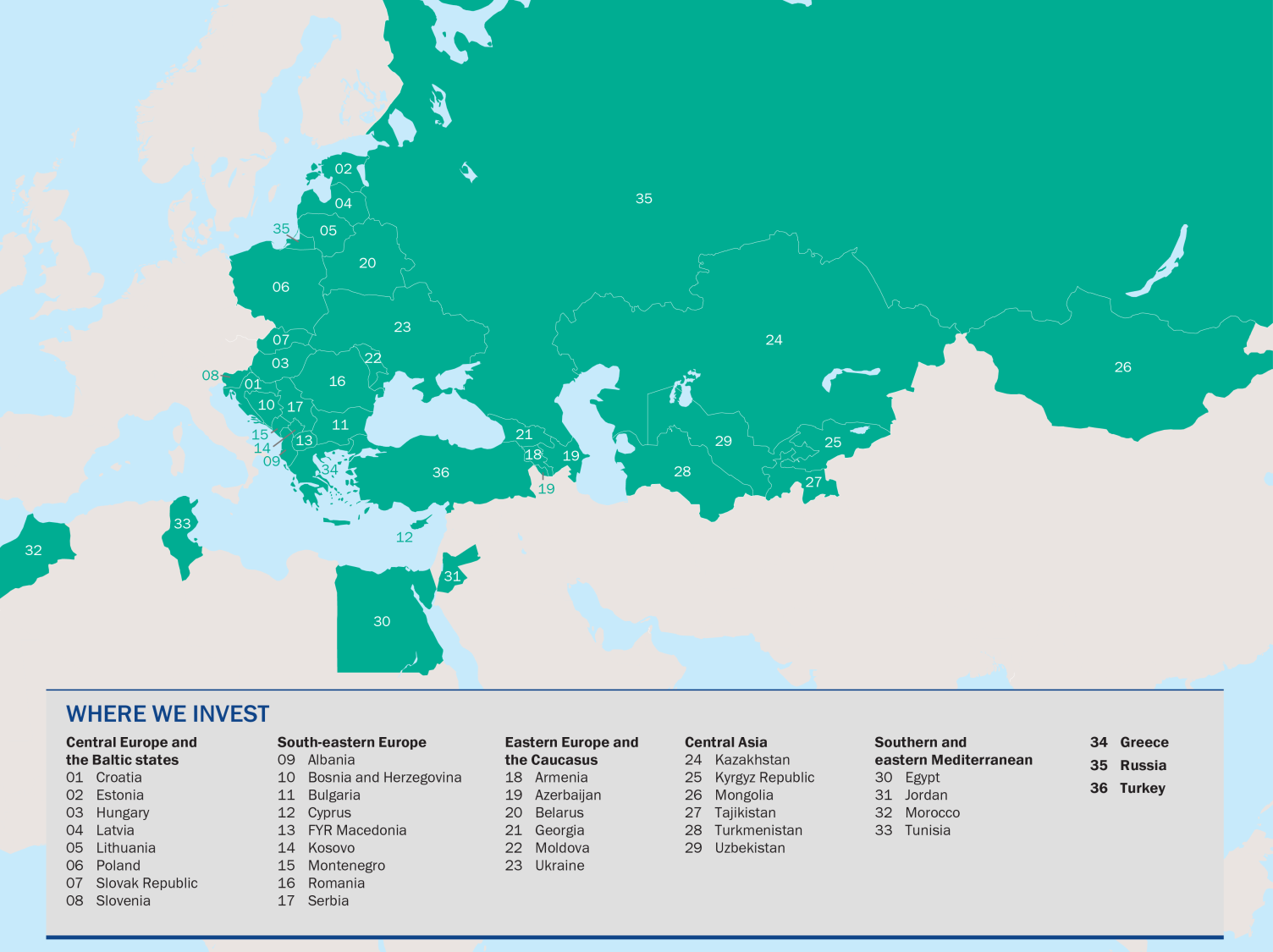

The European Bank for Reconstruction and Development (the EBRD or the Bank) is a project-oriented international financial institution created in 1991 to foster transition towards democratic, market-oriented economies and to promote private and entrepreneurial initiatives in Central and Eastern Europe, in Mongolia and in the Southern and Eastern Mediterranean (SEMED) region. In pursuing this mission, the EBRD operates in countries that demonstrate a commitment to the fundamental principles of multiparty democracy, pluralism and market economics.[1]

The Bank’s 67 shareholders include 65 countries and two intergovernmental organizations (the European Union and the European Investment Bank). As at December 31, 2016, the Bank’s total assets reached €56 billion, while liabilities amounted to €41 billion. A robust capital position has helped the Bank to maintain relatively stable investment levels in recent years, with annual lending around €9 billion.[2]

Three core operating principles guide the Bank’s activities: transition impact, additionality and sound banking practices. Delivering on transition impact requires the Bank to ensure that its projects are aligned with its mandate to foster transitions towards democracy, pluralism and market-based economies. Upholding the principles of additionality and sound banking involves catalyzing additional flows of private sector financing, as well as ensuring good financial governance practices and the effective use of capital in its operations. In accordance with the Agreement Establishing the EBRD, the Bank is also committed to promoting environmentally and socially sustainable development practices. For more information on the EBRD’s mandate and activities, see Annex 1.

As a founding member and the eighth largest shareholder in the Bank, Canada actively contributes to the development of EBRD policies while providing oversight of the Bank’s financial activities. This is primarily achieved through Canada’s seats on the Board of Governors and Board of Directors. At the Board of Directors, Canada leads a constituency that includes Morocco, Jordan and Tunisia. The EBRD’s Annual Meeting also provides Canada with an opportunity to meaningfully engage in dialogue at the level of Governors with Bank management and other shareholders. For more information on Canada’s role at the EBRD, see Annex 2.

Key objectives guide Canada’s engagement with the Bank. Renewed annually, these objectives are informed by the Government of Canada’s policy goals, a dedication to the EBRD’s underlying transition mandate, and the general principles of good governance, accountability and institutional effectiveness. A discussion of the progress made on Canada’s 2016 objectives, as well as Canada’s forward-looking objectives for 2017, can be found in the section entitled “Canada’s Objectives at the EBRD.”

As one of the largest investors in its regions of operations, the EBRD actively works to enhance the effectiveness of its activities. By investing billions annually in its recipient countries, catalyzing additional resources from the private sector and delivering on its expanded regional mandate, the EBRD is able to enhance its transition impact each year.[3]

This year marked the 25th anniversary of the EBRD. Created in response to the collapse of communism in Eastern Europe, the Bank has been a strong source of transition support in this region, and the expansion to the SEMED region is a demonstration of the organization’s sustained relevance as it supports the transition challenges these countries face. In a challenging low growth environment globally, the EBRD invested €9.4 billion in 35 countries in 2016, facilitating 378 projects, a strong performance matching the previous record set in 2015.

As one of the Bank’s founding members, Canada is pleased to have been an important partner of the EBRD. It continues to strongly support the work of the Bank as it assists its recipient countries in adopting crucial reforms to create sustainable democratic institutions and to build well-functioning market economies.

At its inception, the Bank’s focus was to develop market-oriented economies. Since that time, there has been an evolution in the EBRD’s thinking around the elements of a successful market economy and, accordingly, the Bank has refined the transition concept underpinning the design and evaluation of investments and technical assistance projects. Originally developed in 1997, the Bank’s approach to transition was updated in 2016 to reflect that a “well-functioning market economy should be more than just competitive; it should also be inclusive, well-governed, environmentally friendly, resilient and integrated.”[4] Implementation of the revised transition concept, including innovative approaches to assess the expected impact of projects, will take place in 2017.

The EBRD opened its first Representative Office for North America in Washington, D.C., in April 2016. Aimed at supporting EBRD partnerships and business development in Canada, Mexico and the United States, this office should help increase opportunities for Canadian engagement with the Bank.

In October 2016, the EBRD hosted a business forum in Toronto, in collaboration with Global Affairs Canada, Canadian Manufacturers & Exporters, Export Development Canada and the Ontario Ministry of International Trade. Co-chaired by then Minister of International Trade Chrystia Freeland and EBRD President Suma Chakrabarti, the forum presented an opportunity for Canadian firms to explore the products and services of the Bank and discuss potential co-investment opportunities. The forum also highlighted the experiences of Canadian businesses that have invested alongside the EBRD, including in a project approved in 2016, undertaken by Centerra Gold Inc. With a strong commitment to create sustainable development in the mining sector, Centerra Gold has undertaken work to develop a gold mine in Turkey to the highest international standards while enhancing social inclusion and transparency.

In 2016, the Board of Governors met at the Annual Meeting in May to elect the EBRD’s next President for the 2016 to 2020 term. Incumbent Sir Suma Chakrabarti had served as President of the EBRD since 2012, and was nominated for re-election by the United Kingdom. Marek Belka, President of the National Bank of Poland and former Prime Minister of Poland, was also put forth by the Polish government as a candidate for the election. At the EBRD Annual Meeting, Sir Suma Chakrabarti was elected for a second four-year term. Canada looks forward to our continued collaboration under President Chakrabarti’s leadership to address the challenges facing the EBRD’s countries of operations.

In January 2016, the Asian Infrastructure Investment Bank (AIIB) became operational, with strong ambitions to address the $8 trillion infrastructure gap in Asia. As it begins this challenging work, the AIIB has been working in cooperation with established institutions. In May 2016, the AIIB and EBRD established a key partnership by signing a Memorandum of Understanding to set a framework for strategic and operational collaboration in support of economic development and investment across countries where both are actively involved. This was followed by the signing of the first joint project between the EBRD and the AIIB in June 2016, which will improve regional connectivity through the upgrade of a key section of the motorway connecting Tajikistan’s capital, Dushanbe, with neighbouring Uzbekistan. Canada is a strong advocate of collaboration between multilateral development banks, and is pleased to see strong cooperation between these two organizations.

Canada and the EBRD have both assisted in addressing the challenges in transforming Chernobyl into a safe and secure site. The EBRD manages this project on behalf of international donors, which include the Group of Seven (G7) countries and the European Union. Canada has advocated for the importance of maintaining a high level of nuclear safety and improved safety and performance of nuclear and fuel cycle facilities at all stages of the lifecycle—including life extensions and decommissions. Efforts to secure the Chernobyl nuclear power plant include initiatives such as the Interim Spent Fuel Storage Facility (ISF-2), which processes the spent fuel assemblies from the plant. To address a shortfall in funding for the ISF-2, the EBRD provided €40 million from its allocation of 2015 net income. Canada has demonstrated its continued support, by providing $3.6 million as part of the G7 pledge of €45 million at the Chernobyl Pledging Conference in April 2016.

Chernobyl Shelter Fund

The EBRD manages the Chernobyl Shelter Fund, a cooperative effort with G7 donors to construct a new protective structure over the destroyed Chernobyl nuclear reactor and the aging containment sarcophagus built following the 1986 nuclear accident. This past year, the destroyed reactor was contained, when the largest moveable land-based structure ever built was moved into place in November 2016, replacing a hastily assembled shelter built after the 1986 accident. This structure will have an estimated life of 100 years and will protect against the continued release of radioactive material from the reactor. The shelter costs an estimated €1.5 billion, of which the EBRD has provided approximately €500 million. In total, Canada has provided $117 million in support of Chernobyl nuclear safety projects.

In 2016, the EBRD continued to provide significant support for sustainable economic transition in its countries of operations, despite a challenging economic and political environment. The Bank maintained a record level of financing in 2016, with its commitments remaining stable at roughly €9.4 billion, the same level as 2015. These investments were made in 378 projects across 35 countries. In addition to investing its own funds, the EBRD mobilized an additional €1.7 billion in private capital in 2016 for development and transition projects. Overall, the EBRD’s total project financing has trended upwards over a five-year period.

In 2016, total disbursements reached €7.8 billion, compared to €6.5 billion in 2015. The EBRD realized profits of €642 million before impairment, compared to €949 million in 2015, driven by lower profits from divestments in the equity portfolio. However, the Bank’s net profit rose to €985 million from €802 million in 2015 due to improved financial performance in project investments, and treasury activities such as raising debt finance and asset management.

EBRD Operational and Financial Highlights 2012–2016

(€ millions, except for number of projects and where otherwise indicated)

| 2016 | 2015 | 2014 | 2013 | 2012 | |

|---|---|---|---|---|---|

| Number of projects | 378 | 381 | 377 | 392 | 393 |

| EBRD commitments1 | 9,390 | 9,378 | 8,853 | 8,498 | 8,920 |

| Mobilized investment2 | 1,693 | 2,336 | 1,177 | 862 | 1,063 |

| Total project financing3 | 25,470 | 30,303 | 20,769 | 20,527 | 24,871 |

| Gross disbursement | 7,800 | 6,500 | 6,500 | 5,900 | 6,000 |

| Realized profit before impairment | 642 | 949 | 927 | 1,169 | 1,007 |

| Net profit/loss for the year before transfers of net income | 985 | 802 | (568) | 1,012 | 1,021 |

| Paid-in capital | 6,207 | 6,202 | 6,202 | 6,202 | 6,202 |

| Reserves and retained earnings | 9,224 | 8,384 | 7,947 | 8,674 | 7,748 |

| Total members’ equity | 15,431 | 14,586 | 14,149 | 14,876 | 13,950 |

| Non-performing loans ratio | 5.5% | 5.9% | 5.6% | 3.3% | 3.4% |

| Liquid assets/undisbursed investments4 | 93.5% | 92.5% | 103.1% | 93.5% | 85.0% |

| 1 EBRD commitments include new and restructured commitments, and amounts issued under the Trade Facilitation Programme. 2 Mobilized investment is the volume of commitments from entities other than the Bank made available to the client due to the Bank’s direct involvement in mobilizing external financing during the year. These figures have been revised to reflect a change in reporting at the EBRD. In 2016, multilateral development banks (MDBs) established a task force to develop a joint framework and methodology to measure MDB private investment on a consistent basis. MDBs were tasked with reporting mobilization by distinguishing between private direct mobilization—private financing provided on commercial terms due to the active and direct involvement of the MDB—and other external financing. The EBRD’s new reporting is aligned with this joint MDB methodology. 3 Total project financing is the total amount provided to a project, including both EBRD and non-EBRD finance, and is reported in the year in which the project first signs. 4 Treasury liquid assets divided by total Banking undrawn commitments (undisbursed but committed investments), plus one year’s debt service, which comprises debt due for redemption within one year and one year’s estimated interest expense. From 2016, debt redemptions have been based on expected rather than contractual maturity. Note that the Bank’s Liquidity Policy dictates that liquid assets should represent at least 75% of the projected total of undrawn commitments plus one year’s debt service. Source: EBRD, Annual Report 2016. |

|||||

Finally, the Bank’s strong capitalization, high levels of liquidity and relatively low levels of non-performing loans reaffirm that the EBRD continues to be in a strong position to carry out its mandate in the medium term. The Bank continues to be rated AAA or equivalent with a stable outlook by all three major credit rating agencies (Standard & Poor’s, Moody’s Investors Service and Fitch Ratings).

The EBRD operates across a diverse geographic area stretching from Central Asia through Central and South-eastern Europe to the SEMED region. Regional investment levels are affected by various factors, including the business climate in individual recipient countries and domestic political developments that may hinder the EBRD’s operations.

Turkey continued to receive the most support in 2016, with lending totalling €1.9 billion, accounting for roughly 20% of total investments. In 2015, Greece became an EBRD recipient country on a temporary basis until 2020 and saw 52% growth in investment from €320 million in 2015 to €485 million in 2016. Bulgaria, Kazakhstan and Jordan also received significantly more support, with lending growing by €539 million, €342 million and €240 million respectively. Due to Russia’s destabilizing actions in eastern Ukraine and subsequent guidance from shareholders, the EBRD did not undertake any new financing operations in Russia in 2015 and 2016; however, some disbursements associated with existing programs did occur. Support to Eastern Europe and the Caucasus decreased. The charts below illustrate the regional changes in the EBRD’s investment flows from 2015 to 2016.

Chart 1: EBRD Investments in 20161

Chart 2: EBRD Investments in 2015

Canada actively contributes to the development of the EBRD’s policies and provides oversight of the Bank’s financial activities through its seats on the Board of Governors and the Board of Directors. Canada is also involved in the work of various committees, and has the opportunity to meaningfully engage in dialogue with the Bank’s other shareholders during the EBRD Annual Meeting.

As a major shareholder in the EBRD, Canada supports the Bank in accomplishing its mandate to foster effective political and economic transitions in its countries of operations. In doing so, Canada works to ensure the EBRD also maintains prudent risk management systems and a healthy financial profile. In order to provide strategic direction for its engagement with the EBRD, Canada develops key objectives on an annual basis. These objectives are informed by Canada’s commitment to the EBRD’s underlying mandate, the Government’s foreign policy and development agenda, and general principles of good governance, accountability and institutional effectiveness.

In 2016, Canada’s objectives were targeted to encourage the EBRD to prioritize its operations in countries with the greatest transition needs, notably in Ukraine and the SEMED region, and to support the Bank’s Green Economy Transition. Canada’s 2016 objectives at the EBRD are presented below along with an overview of progress made in achieving these objectives.

1. Encourage the EBRD to prioritize resources to areas with the greatest need, notably Ukraine and countries in the Southern and Eastern Mediterranean region, while emphasizing the importance of continued domestic-led political and economic reform as a condition for support.

The EBRD has provided a strong response to the crisis in Ukraine that started in late 2013. In 2016, the EBRD’s support for political and economic transition in Ukraine directed €581 million in lending to new projects targeted towards investments in banking sector stabilization and restructuring, energy security and energy sector reforms, and reinforcing Ukraine’s efforts to move towards an open and more inclusive, market-oriented economy. While the level of investment has decreased compared to past years, the EBRD remains a major investor and champion of reform in Ukraine at a time of ongoing severe difficulties. Canada continues to be a strong advocate for this region and to support Ukraine by providing dedicated resources to the Chernobyl Shelter Fund and encouraging EBRD investments that facilitate political and economic transition in Ukraine.

In response to Russia’s annexation of Crimea and subsequent role in destabilizing eastern and southern Ukraine, Canada and other key shareholders have actively opposed EBRD lending to new Russian projects since 2014. As a result, the Bank has not made new investments in Russia for almost three years; however, it receives interest and principal payments from its existing loan portfolio, and maintains resident offices in Russia. Since the start of the Ukraine crisis, Canada and the international community have recognized that Belarus has played a constructive role in the region, by facilitating negotiations toward a ceasefire and peace agreement in Ukraine, known as the Minsk agreements, in September 2014 and February 2015. In recent years, Canada has opposed or abstained from voting on Belarusian projects, due to the lack of political and economic reform in the country. However, Belarus has moved towards increased international openness, encouraging discussions on democracy and human rights in the country, conducting peaceful Presidential elections, and demonstrating goodwill in a long-sought and welcomed move to release political prisoners.

In light of these developments, in May 2016, the Government of Canada signalled its commitment to diplomatically re-engage by removing Belarus from the Area Control List, lifting sanctions that have been in place since December 2006. With the introduction of the Country Strategy for Belarus in 2016, which will shape the Bank’s engagement, priorities and projects in the next few years, Canada will assess each Belarusian project on its merits.

EBRD Support to Strengthen the Ukraine Banking Sector

Banking sector stabilization is a main priority for the EBRD in Ukraine. In collaboration with other international financial institutions, the EBRD is working with authorities to develop reforms for state-owned financial institutions, and strengthen the role of private capital in the banking sector.

The EBRD has developed a strategic partnership with the country’s largest state-owned bank, PJSC Savings Bank of Ukraine (Oschadbank), to prepare and implement a comprehensive program to commercialize and partially privatize its operation by 2018. To meet these goals, the EBRD will work with Oschadbank through its Trade Facilitation Programme (TFP), which promotes international trade in the EBRD’s countries of operations by providing guarantees to banks, and assuming political and commercial payment risk related to international trade transactions. Specifically, through the TFP, the EBRD will provide guarantees of up to €50 million to Ukrainian exporters and importers. The EBRD will also provide assistance through tangible measures designed to improve corporate governance and the transfer of banking knowledge.

The EBRD has also advised the Ukrainian government and the National Bank of Ukraine on a number of policy and regulatory issues relating to banking system reform, including legislation on related party lending. In the case of Privatbank, the largest bank in Ukraine, the EBRD was strongly supportive of the decision of the Ukrainian government in 2016 to nationalize the bank and to protect its depositors, both individuals and businesses, and the EBRD will be advising the Ukrainian authorities on the bank’s management and transformation.

The EBRD expanded its reach to the SEMED region in 2011. Since then, Canada has been a strong supporter of deepening investments in this region. However, the region’s transition process is still nascent and requires ongoing support to ensure meaningful progress in developing more inclusive political and economic institutions. With expertise in providing investments and technical assistance in key areas such as municipal infrastructure, renewable energy, and education and training, the EBRD continues to play an important role in this region.

Canada supported the Bank’s investments in the SEMED region (Egypt, Jordan, Morocco and Tunisia) for a total investment of nearly €1.4 billion in 2016 in 40 projects in the financial sector, energy, industry, commerce, agribusiness and infrastructure. The Bank’s investments in these countries focused on supporting the growth of small and medium-sized enterprises, boosting agribusiness, improving banking services, creating local capital markets, and supporting renewable energy and energy efficiency.

At the same time, the EBRD continues its focus on addressing the impacts of the refugee crisis. As the Syrian refugee crisis deepened in 2016, the Bank prepared a financing package that could be worth €900 million to support private sector and infrastructure projects in some of the worst affected countries, including Jordan and Turkey. At the 2016 Annual Meeting, shareholders approved setting aside €35 million of the Bank’s net income in 2016 for this package in support of refugee-hosting countries in the SEMED region. This commitment was an outcome of United Kingdom-led efforts and broad support from others, including Canada, to secure funding for this critical issue. In 2016 alone, the EBRD committed to over €70 million in new transactions alongside €50 million of grants to help alleviate the refugee crisis.

Canada supports multilateral efforts to address development needs in the SEMED region, and welcomes the Bank’s continued program of investments that help modernize economies across the region and make them more robust and resilient. The following projects, as supported by shareholders, convey the Bank’s continued support in addressing the critical challenges of hosting refugees, scaling up climate finance, and ensuring that women are a key contributor in the business community:

- In Jordan, the EBRD provided a loan of €50 million to the Greater Amman Municipality to finance solid waste infrastructure urgently needed in the country’s capital. Infrastructure improvements were required to respond to the increased population, which includes 1.3 million Syrian refugees.

- In Morocco, the Bank provided a €24 million loan to Éléphant Vert, a local producer of bio-fertilizers, bio-pesticides and bio-stimulants. With the aim of increasing use of sustainable climate-friendly agricultural inputs rather than chemical fertilizers, this investment is expected to lead to significant greenhouse gas emission savings.

- In Tunisia, women’s economic empowerment is one focus of the Bank’s support for small businesses. The EBRD provided a €1.6 million loan to the local microfinance institution Microcred Tunisie S.A. for on-lending to micro, small and medium-sized enterprises, poorer regions and women-led businesses, with the goal of creating jobs.

2. Support the EBRD’s Green Economy Transition approach, including its efforts to catalyze private sector investments in infrastructure that supports regional integration, energy security and green growth.

The Green Economy Transition (GET) was implemented this past year, and is the key mechanism for the Bank to scale up its climate financing with the goal of reaching 40% green investments as a share of total annual Bank investment by 2020. With the aim of assisting EBRD countries of operations to meet ambitious development milestones pledged at the 21st Conference of the Parties (COP21) climate conference in December 2015, the GET expanded the scope of EBRD climate finance, tackling activities such as water and materials efficiency, energy efficiency, renewable energy and climate resilience.

In 2016, Canada worked closely with the EBRD and other multilateral development banks to expand efforts to catalyze private investment in sustainable infrastructure. Green infrastructure with a private sector investment focus is a crucial element of meeting COP21 goals. With its expertise in crowding in the private sector, the EBRD is well placed to play a catalytic role by expanding the pipeline of bankable infrastructure projects, using guarantee instruments to reduce the risk profile of private infrastructure investments, and developing new financing vehicles to crowd in private funds. In the first year of GET implementation, the EBRD invested €2.9 billion in 151 projects, accounting for 33% of total annual Bank investment.

With investments in three renewable energy projects, Jordan is on the leading edge of private capital mobilization in the Middle East. These projects provide an opportunity for the country to reduce its energy costs and ‎hydrocarbon dependence without burdening the government’s balance sheet. EBRD investment of US$131 million supported these three projects with total project costs in excess of US$350 million, increasing Jordan’s electricity generation capacity from clean, renewable sources and reducing its reliance on hydrocarbon imports. As the Bank continues to deepen its investment, it expects to more than triple the volume of renewable energy financed in Jordan in the near future.

Creating Capacity for Solar Power in Jordan

Currently, Jordan relies heavily on thermal power generation and faces serious challenges to meet increased demand for electricity in a manner that is sustainable, reliable and affordable. To support Jordan’s ability to increase its renewable energy capacity, the EBRD provided a senior secured loan of up to US$27 million to finance the construction of a 50 megawatt solar photovoltaic plant near Amman. The project will be implemented in a region facing considerable challenges from an influx of refugees, and will serve to stimulate the local economy, providing skills training and employment. With a total cost of US$72 million, the project will be the first utility-scale solar plant of this size, and a key element of the strategy of the Jordanian Ministry of Energy and Mineral Resources to generate 10% of the country’s electricity demand from renewables by 2020, compared to just 1% in 2014. This project can serve as a demonstration of how private sector capital and expertise can be effectively mobilized, deliver much-needed generating capacity, and lower the carbon intensity of the power sector.

Canada is an active shareholder with a strong interest in the EBRD. As such, Canada’s objectives are meant to help ensure that the EBRD remains an effective, efficient and modern institution for the clients and countries it serves. These objectives will be reported on in next year’s Canada at the European Bank for Reconstruction and Development report to Parliament.

1. Prioritize resources to areas with the greatest need, notably Ukraine and countries in the Southern and Eastern Mediterranean region, while emphasizing the importance of continued domestic-led political, economic and institutional reforms as a condition for support.

In 2017, Canada will strongly advocate that the EBRD continue to play an important role in both Ukraine and the SEMED region by making investments which foster political and economic transitions, prioritized based on the greatest need and potential impact. Ukraine and the SEMED region continue to face significant pressures, and the current political and economic context in both regions demonstrates a clear case for transition support from the EBRD.

Alongside the EBRD and its international partners, Canada will continue to work towards transforming Chernobyl into a safe and secure site, including the completion and the formal handover of the New Safe Confinement project to Ukraine by the end of November 2017. Canada will continue to encourage EBRD investments in Ukraine and the facilitation of a comprehensive package of reforms to support the stabilization of the country.

Canada is committed to addressing the Syrian refugee crisis and is also counting on its development partners, including the EBRD, to implement measures to address this challenge. Canada recognizes the enormous pressure this has put on local governments and host communities and welcomes the work that the EBRD has undertaken in Turkey and the SEMED region, in particular Jordan, to address the ongoing refugee crisis. Increased EBRD support for countries that host significant populations of refugees can provide much-needed support in areas such as domestic infrastructure. Canada will continue to support projects in these regions that demonstrate additionality, and effectively crowd in private sector investment. Support for transition in the SEMED region is particularly important to Canada given our shared constituency with Morocco, Jordan and Tunisia at the EBRD Board of Directors. Canadian representatives at the Board work closely with Bank management and representatives of these countries to facilitate EBRD investment opportunities in these countries.

The Bank plans to extend its reach in the SEMED region by welcoming Lebanon as a member. In 2015, Canada, along with the support of the EBRD’s shareholders, voted in favour of Lebanon’s membership at the Bank. Efforts are underway for Lebanon to ratify its membership and become a country of operations at the EBRD in 2017. With a population of 4.5 million and hosting as many as 1 million Syrian refugees—the highest per capita concentration of refugees in the world—Lebanon has borne a significant share of the burden of the refugee crisis. Once Lebanon joins, Canada will support the Bank as it applies its transition expertise to address critical needs in this country.

2. Support the Bank’s updated transition mandate to build strong, inclusive and sustainable market economies in its countries of operations, promoting the effective and efficient use of investment and policy instruments to deliver results.

The revised transition concept, approved in 2016, updates the Bank’s understanding of what constitutes a sustainable, well-functioning market economy. It notes that a well-functioning market economy should be more than just competitive; it should also be inclusive, well-governed, environmentally friendly, resilient and integrated. Two initiatives which explicitly promote these outcomes—the Green Economy Transition approach and the Strategy for the Promotion of Gender Equality—were already rolled out in 2016 and will be integrated into the operations of the Bank in 2017.

In a comprehensive assessment of Canada’s international assistance policy and funding framework, consultations to inform an International Assistance Review outlined key priorities with strong linkages to the Bank’s updated transition concept, including empowering women and girls and addressing climate change as fundamental principles of inclusive and environmentally friendly economies.

In 2017, Canada will continue to work closely with the EBRD to expand efforts to catalyze private investment in sustainable infrastructure, as the Bank scales up climate financing towards the 40% target. Green infrastructure with a private sector investment focus is a crucial element of meeting COP21 goals, and will allow for a much greater impact than could be achieved with EBRD resources alone.

Canada will also reinforce the Bank’s work to mainstream its Strategy for the Promotion of Gender Equality to increase women’s economic empowerment and equality of opportunities in the countries where the Bank invests. Effectively addressing systemic gaps means building incentives into the Bank’s instruments to ensure that a meaningful gender component is included in the project structure. To support this approach, Canada will work closely with the EBRD to implement and measure this Strategy across Bank operations.

The EBRD began operations in 1991. Its aims are to foster the transition towards open, market-oriented economies in Central and Eastern Europe, the successor states of the former Soviet Union, Mongolia and member countries in the Southern and Eastern Mediterranean region, and to promote private and entrepreneurial initiative in those countries that are committed to the fundamental principles of multiparty democracy, pluralism and market economics.[5] Where countries are not committed to these principles, the Bank develops a strategy for limited involvement. To deliver on its mandate, the Bank focuses its activities on assisting its 35 recipient countries in implementing economic reforms, taking into account the particular needs of countries at different stages in the transition process.

The Bank’s overriding focus is the private sector, with a strong operational emphasis on enterprise restructuring, including the strengthening of financial institutions, and the development of the infrastructure needed to support the private sector. The EBRD’s charter stipulates that not less than 60% of its financing commitments should be directed either to private sector enterprises or to state-owned enterprises implementing a program to achieve private ownership and control. All of its financing projects have to demonstrate environmental sustainability, as per the Bank’s Articles of Agreement. The Environmental and Social Policy is reviewed every three years to help ensure the Bank adopts best practices in all projects.

In promoting economic transition, the Bank acts as a catalyst for increased flows of financing to the private sector, as the external capital requirements of these countries cannot be fully met by official multilateral or bilateral sources of financing, and many foreign private investors remain hesitant to invest in the region.

The EBRD differs from other regional development banks in several ways. Firstly, the Bank’s overriding focus is on the private sector. Further, the EBRD’s mandate gives it an explicit focus on the promotion of democratic institutions in its countries of operations. The EBRD is the only international financial institution with this charter requirement. Finally, the EBRD does not have a dedicated concessional financing facility and poverty reduction is not part of its mandate. Nonetheless, the Bank’s focus on private sector-led growth has a clear link to employment and poverty reduction.

The EBRD’s operations to advance the transition to a market economy are guided by three principles: transition impact, additionality and sound banking. Financing is provided for projects that expand and improve markets, help to build the institutions that underpin a market economy, and demonstrate and promote market-oriented skills and sound business practices. EBRD financing must also mobilize additional sources of financing and not displace them. Bank projects must be sound from a banking perspective, thus demonstrating to private investors that the region offers attractive returns. Adherence to sound banking principles also ensures the financial viability of the EBRD and hence its attractiveness as a co-investment partner for the private sector. Integrity is another important aspect of the Bank’s due diligence in selecting projects.

The Bank’s medium term operational priorities are premised on: the central importance of creating and strengthening institutions that ensure markets work well; the fundamental role that small businesses can play in creating dynamic, competitive and more equitable economies; and the key role the transition process plays in supporting the principles of multiparty democracy and pluralism.

To achieve these priorities the Bank focuses on:

- Developing market-based and commercially oriented infrastructure.

- Developing sound financial sectors linked to the needs of enterprises and households.

- Providing leadership for the development of lending to micro, small and medium-sized enterprises.

- Demonstrating, through selected examples, effective approaches to restructuring viable large enterprises.

- Diversifying the economic base and developing knowledge-based industries.

- Taking an active approach in its equity investments to improve corporate governance.

- Engaging governments in policy dialogue to strengthen institutions and improve the investment climate.

- Tackling energy efficiency, climate change and energy security.

- Promoting transparency and accountability in public sector management.

- Taking a regional approach where appropriate.

- Promoting sustainable development and environmental due diligence.

The EBRD offers a full array of financial products and services, including:

- Longer term loans.

- Equity investments.

- Quasi-equity instruments (subordinated loans, preferred stock, income notes).

- Guarantees and standby financing.

- Working capital and trade finance facilities.

- Risk management (intermediation of currency and interest rate swaps, provision of hedging facilities).

Eligible projects must be supported by a strong business case, benefit the economy and the transition process of the host country, and comply with the EBRD’s environmental guidelines. Projects in all industries are eligible for EBRD financing, except those producing military equipment, tobacco and distilled alcohol. Although it is primarily a financier of private sector projects, the Bank may provide financing to state-owned companies, provided they are operating competitively and, in particular, that financing facilitates or enhances the participation of private and/or foreign capital. The EBRD can finance private companies that are locally or foreign owned, as well as joint ventures between foreign and local shareholders.

In order to ensure the participation of investors and lenders from the private sector, the EBRD generally limits its total amount of debt and equity financing for any single project to 30% of total estimated project costs. In rare cases, such as when a project is in corporate recovery, the Bank may become the largest shareholder in order to protect the EBRD’s investment.

Smaller projects are financed both directly by the EBRD and through local financial intermediaries. By supporting local commercial banks, micro-finance organizations, equity funds and leasing facilities, the EBRD has helped finance a multitude of smaller projects.

The EBRD charges market rates for its private sector financing and provides uniform loan pricing for sovereigns at 6-month LIBOR (London Interbank Offered Rate) +100 basis points. In addition, fees vary according to the nature of the project and the amount and complexity of the work required of the EBRD.

The Bank uses its close relationship with governments in the region to promote policies that bolster the business environment. The EBRD advises governments on promoting a sound investment climate and stronger institutional framework, which are important for the functioning of the private sector. This dialogue is typically supportive of projects in which the Bank invests. Specifically, the EBRD works with government officials to promote sound corporate governance, anti-corruption practices, fair and predictable taxation policies, and transparent accounting standards. In addition, a dedicated legal team advocates for an effective legal and regulatory framework which is not directly tied to a project.

Technical cooperation improves the preparation and implementation of the EBRD’s investment projects and provides advisory services to private and public sector clients. It increases the impact of EBRD projects on the transition process by supporting structural and institutional changes, and it assists legal and regulatory reform, institution building, company management and training.

Technical cooperation is important to the Bank as it enhances investment effectiveness by ensuring thorough preparations and enables the EBRD to take on investment opportunities in higher-risk environments. Technical cooperation projects are managed by the EBRD and funded by the Bank’s profits, governments and international institutions.

The highest authority in the Bank is the Board of Governors. The Board meets annually and approves the EBRD’s Annual Report, net income allocation and financial statements, the independent auditor’s report, the election of the Chair and Vice-Chair for the next Annual Meeting, as well as other items requiring Governors’ approval. A Governor and an Alternate Governor represent each of the 67 shareholders.

The Board of Directors is responsible for the general operations of the Bank. It is composed of 23 members, with each representing either one member or a constituency of member countries. The Board helps to set the strategic and financial course for the Bank, in consultation with the Bank’s management.

The Board of Directors has established four committees that are responsible for overseeing the activities of the Bank: the Board Steering Group, the Audit Committee, the Budget and Administrative Affairs Committee, and the Financial and Operations Policies Committee. This division of labour is consistent with good corporate governance practices and provides an appropriate system of checks, balances and incentives. In addition, the structure ensures a more effective discussion by the Board, once initiatives are ready for approval.

The Board Steering Group is responsible for the coordination of the Committees’ work programs to avoid overlap and ensure timely completion. In addition to some administrative duties, the Chair of the Group is the main liaison between the Board and management. The Group is currently chaired by the Director for France.

The Audit Committee’s primary objective is to ensure that the financial information reported by the Bank is complete, accurate, relevant and timely. The Committee oversees the integrity of the Bank’s financial statements and the compliance of its accounting and reporting policies with the requirements set out in the International Financial Reporting System. It also reviews the EBRD’s system of internal controls and its implementation, as well as the functions of the internal audit, evaluation and risk management teams. The Committee is currently chaired by the Director for Turkey/Romania/Azerbaijan/Kyrgyz Republic.

The Budget and Administrative Affairs Committee is responsible for ensuring that the Bank’s budgetary, staff and administrative resources are aligned with its strategic priorities. To this end, the Committee reviews the medium term resource framework, annual budgets and the business plan. It also oversees the Bank’s human resources policies, including ethics and the Code of Conduct. The Committee is currently chaired by the Director for Germany.

The Financial and Operations Policies Committee oversees the Bank’s financial and operational policies, including the annual borrowing plan prepared by the Treasury Department. The Committee is responsible for the transparency and accountability of the Bank’s operations, as laid out in the 2006 Public Information Policy. Since 2007, the Committee has also been charged with overseeing the net income allocation process. As well, it is responsible for the Bank’s Environmental and Social Policy and EBRD sector strategies. The Committee is currently chaired by the Director for Poland/Bulgaria/Albania.

For More Information on the EBRD

The Bank releases considerable information on its various activities. Bank publications include information guides (such as Guide to EBRD Financing), evaluation reports, special reports (such as the Annual Report and Transition Report), country strategies and assorted fact sheets.

Information can also be obtained on the Bank’s website.

Requests for information can be addressed to:

Publications Desk

European Bank for Reconstruction and Development

One Exchange Square

London, EC2A 2JN

United Kingdom

Or to: Office of the Director for Canada, Jordan, Morocco and Tunisia

canadaoffice@ebrd.com

The EBRD’s share capital is provided by member countries, with proportional voting rights. The chart below provides shareholdings as at December 31, 2016.

Shareholding as a Percentage of Authorized Capital Stock

The EBRD has 67 shareholders: 65 countries, as well as the European Union and the European Investment Bank. China joined the Bank in January 2016. In 2016, the EBRD invested in 35 countries, including Egypt and Greece, which became countries of operations in 2015. Overall, the Bank holds investments in 36 countries; however, no investment took place in Russia in 2015 and 2016.

Source: EBRD, About the EBRD: We Invest in Changing Lives.

Canada’s relationship with the EBRD is governed by the European Bank for Reconstruction and Development Agreement Act, which outlines Canada’s responsibilities with respect to the EBRD. In particular, it requires the Minister of Finance to table in Parliament an annual report of operations at the EBRD for the previous calendar year by March 31 (or, if the House is not sitting, on any of the 30 days thereafter that it is sitting).

Canada is the eighth largest shareholder of the EBRD, with its shares representing 3.4% of the institution’s capital. This amounts to €1.02 billion of the Bank’s capital, €213 million of which is paid-in capital, with the remaining shares being callable capital.

The principal responsibility for oversight of the EBRD’s key activities resides with the Department of Finance Canada. The Department of Finance Canada coordinates Canadian policy advice and manages Canada’s strategic interests at the EBRD in consultation with Global Affairs Canada.

Canada’s representation at the EBRD—The Honourable Bill Morneau, Minister of Finance, is the Canadian Governor and Ian Shugart, Deputy Minister of Foreign Affairs, is the Alternate Governor. Since November 2016, Canada has been represented on the EBRD Board of Directors by Douglas Nevison.

Canada’s constituency at the EBRD—The Director for Canada also represents Morocco, Jordan and Tunisia at the EBRD Board of Directors.

Canadian staff at the EBRD—Canadians are well represented on EBRD staff. At the end of 2016, there were 42 Canadians on the staff of the EBRD, representing 1.8% of total positions.

Canada’s membership in the EBRD, and its active participation in the discussion of policy and operational issues, is an important means to help shape economic and social development in the EBRD’s countries of operations. Canada strongly supports the overriding objective of developing a strong private sector in its countries of operations by mobilizing financing for projects with a high transition impact and by providing advice and technical assistance to businesses and governments. The Bank provides Canada with a vehicle to contribute to development in transition countries that are not currently part of our bilateral development assistance programs. Canada’s engagement helps to raise awareness among Canadian companies of opportunities presented by the EBRD.

Canadian companies can seek financing for projects undertaken in the Bank’s countries of operations. The Bank often relies on the procurement of goods and services from the private sector to implement transition projects. Canadian consultants were awarded 44 contracts valued at €1.4 million in 2016. Further, three EBRD investments were signed with Canadian companies in 2016, totalling approximately €180 million in EBRD finance. Finally, Canadian financial institutions provided approximately €807 million in co-financing in support of four EBRD projects.

1 Article 1 of the Agreement Establishing the European Bank for Reconstruction and Development. Where countries do not demonstrate a commitment to these principles, the Bank limits its activities accordingly.

2 Annual investment refers to the amount of financing committed under signed agreements during the calendar year.

3 Recipient countries include: (1) official countries of operations, which receive assistance through the Bank’s traditional channels (Governors must pass an affirmative vote for a country to attain this status); and (2) potential countries of operations, which receive support through other EBRD mechanisms, such as Shareholder Special Funds.

4 See http://www.ebrd.com/news/2016/ebrd-updates-transition-concept-.html

5 Article 1 of the Agreement Establishing the European Bank for Reconstruction and Development.