Archived - The Fiscal Monitor - October 2020

Highlights

October 2020

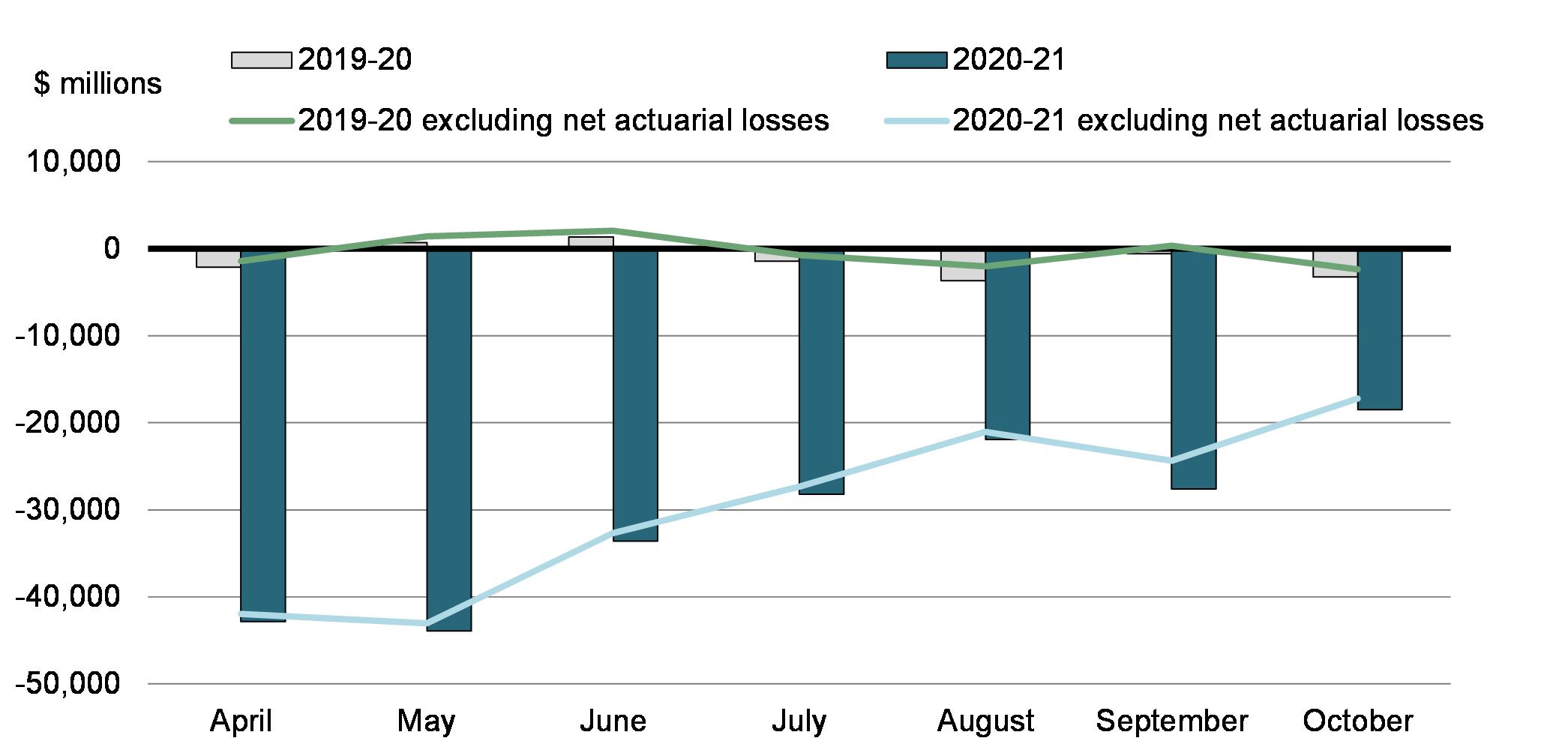

There was a budgetary deficit of $18.5 billion in October 2020, compared to a deficit of $3.3 billion in October 2019. The budgetary deficit before net actuarial losses was $17.2 billion, compared to a deficit of $2.4 billion in October 2019. The budgetary balance before net actuarial losses is a new measure introduced to supplement the traditional budgetary balance and improve the transparency of the government's financial reporting by isolating the impact of the amortization of net actuarial losses arising from the revaluation of the government's pension and other employee future benefit plans.

The government's 2020–21 financial results reflect the economic downturn and temporary measures implemented through the government's Economic Response Plan to support Canadians and businesses facing hardship as a result of the COVID-19 outbreak.

Monthly Budgetary Balance and Budgetary Balance Excluding Net Actuarial Losses

Compared to October 2019:

- Revenues decreased by $1.4 billion, or 5.5 per cent, reflecting decreases in tax revenues and other revenues.

- Program expenses excluding net actuarial losses were up $13.7 billion, or 52.5 per cent, driven by increased transfers to businesses and individuals as part of the government's COVID-19 response measures.

- Public debt charges were down $0.2 billion, or 11.6 per cent, largely reflecting lower interest on Government of Canada treasury bills and on the government's pension and other employee future benefit obligations.

- Net actuarial losses were up $0.4 billion, or 43.0 per cent, reflecting changes in the actuarial valuations for pensions and benefits, which have increased in large part due to declines in year-end interest rates used in valuing these obligations, as well as increased costs associated with the utilization of disability and other future benefits provided to veterans.

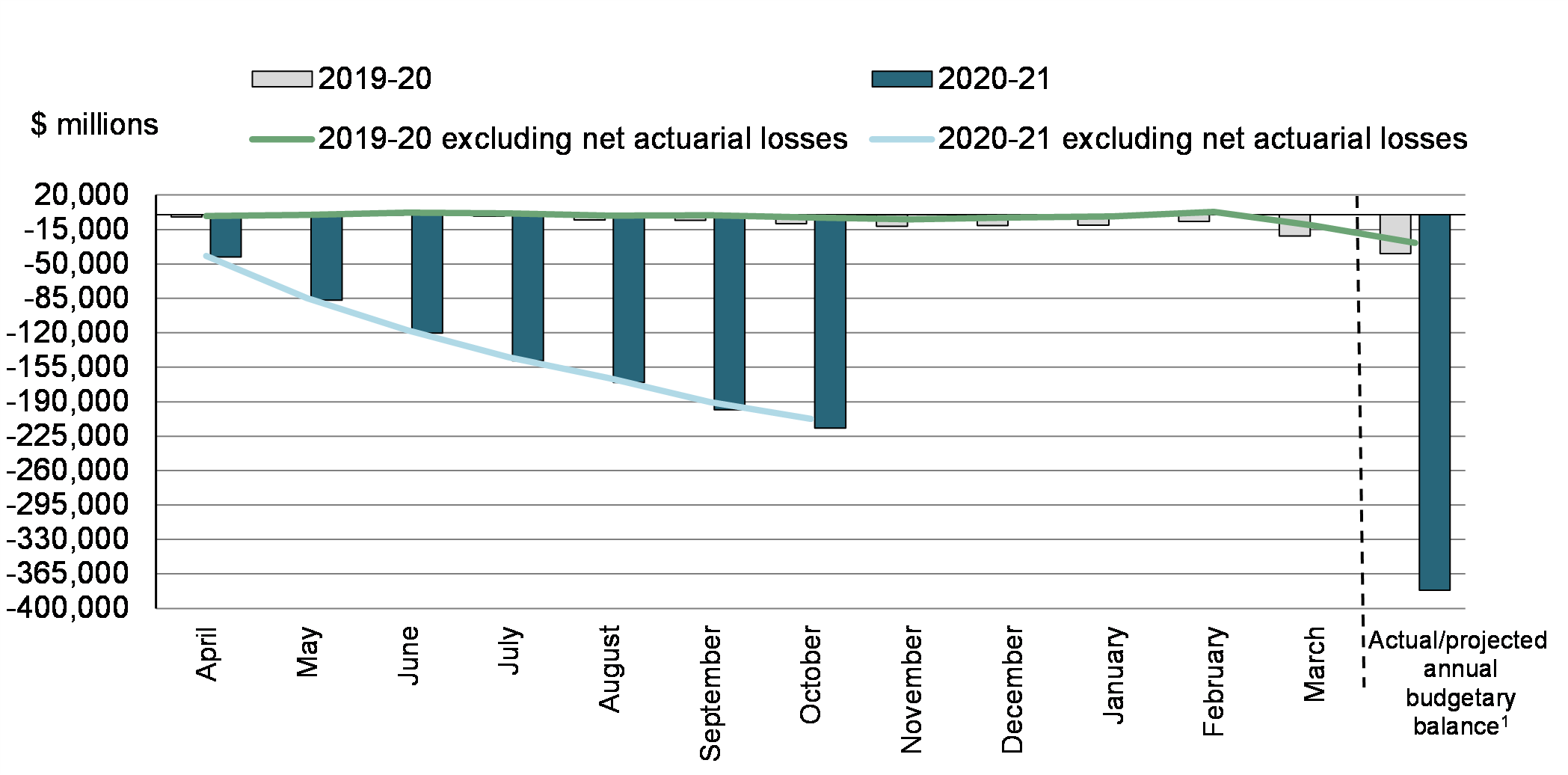

April to October 2020

For the April to October period of the 2020–21 fiscal year, the government posted a budgetary deficit of $216.6 billion, compared to a deficit of $9.1 billion reported for the same period of 2019–20. The budgetary deficit before net actuarial losses was $207.6 billion, compared to a deficit of $2.8 billion for the same period of 2019–20.

The unprecedented shift in the government's financial results reflects the severe deterioration in the economic situation and temporary measures implemented through the government's Economic Response Plan to support Canadians and businesses facing hardship as a result of the COVID-19 outbreak during this period.

Compared to fiscal year 2019–20:

- Revenues were down $36.6 billion, or 19.3 per cent, reflecting a broad-based reduction in revenues, including lower tax revenues and other revenues.

- Program expenses excluding net actuarial losses were up $171.0 billion, or 96.3 per cent, largely reflecting transfers to individuals, businesses, and other levels of government under the Economic Response Plan, including the Canada Emergency Response Benefit (CERB), the Canada Emergency Wage Subsidy (CEWS), the 25 per cent incentive for the Canada Emergency Business Account (CEBA), and transfers under the Safe Restart Agreement.

- Public debt charges decreased by $2.8 billion, or 18.9 per cent, largely reflecting lower Consumer Price Index adjustments on Real Return Bonds, lower interest on the government's pension and benefit obligations, and lower interest on treasury bills.

- Net actuarial losses were up $2.7 billion, or 43.1 per cent, reflecting increases in the value of the government's obligations for pensions and other employee future benefits based on actuarial valuations prepared for the Public Accounts of Canada 2020. The increase in net actuarial losses is due in large part to declines in year-end interest rates used in valuing these obligations, as well as increased costs associated with the utilization of disability and other future benefits provided to veterans.

Year-to-Date Budgetary Balance and Budgetary Balance Excluding Net Actuarial Losses

| October | April to October | |||

|---|---|---|---|---|

| 2019 | 2020 | 2019–20 | 2020–21 | |

| Budgetary transactions | ||||

Revenues |

25,465 | 24,067 | 189,532 | 152,915 |

Expenses |

||||

Program expenses, excluding net actuarial losses1 |

-26,040 | -39,714 | -177,552 | -348,582 |

Public debt charges |

-1,782 | -1,576 | -14,757 | -11,966 |

Budgetary balance, excluding net actuarial losses1 |

-2,357 | -17,223 | -2,777 | -207,633 |

Net actuarial losses1 |

-897 | -1,283 | -6,277 | -8,983 |

Budgetary balance (deficit/surplus) |

-3,254 | -18,506 | -9,054 | -216,616 |

| Non-budgetary transactions | 2,003 | 13,351 | -5,681 | -41,062 |

| Financial source/requirement | -1,251 | -5,155 | -14,735 | -257,678 |

| Net change in financing activities | 14,108 | 28,736 | 24,701 | 324,799 |

| Net change in cash balances | 12,857 | 23,581 | 9,966 | 67,121 |

| Cash balance at end of period | 49,969 | 111,801 | ||

| Note: Positive numbers indicate net source of funds. Negative numbers indicate net requirement for funds. 1Comparative figures and figures for April to August 2020 have been reclassified to conform to the presentation used in the Annual Financial Report of the Government of Canada 2019–2020. Information regarding this reclassification can be found in Note 8 at the end of this document. |

||||

Revenues

Revenues in 2020–21 have been affected by the economic impacts of the COVID-19 crisis and by measures introduced under the government's Economic Response Plan, such as tax deferrals and the one-time Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit payment. However, due to challenges in isolating these impacts from underlying economic activity, it is not possible to provide an accurate measure of the impact of COVID-19 on federal revenues.

Revenues in October 2020 totalled $24.1 billion, down $1.4 billion, or 5.5 per cent, from October 2019.

- Tax revenues decreased by $0.4 billion, or 1.7 per cent, reflecting a broad-based decline across most of the major categories of tax revenues. This decline was partially offset by an increase in corporate income tax revenue, primarily due to the end of the tax deferral period on September 30.

- Employment Insurance (EI) premium revenues were up $28 million, or 2.4 per cent.

- Assessed fuel charge proceeds under the federal carbon pollution pricing system were up $0.1 billion, or 39.0 per cent.

- Other revenues, consisting of enterprise Crown corporations' net profits, sales of goods and services, returns on investments and net foreign exchange revenues, were down $1.1 billion, or 50.2 per cent. This decrease largely reflects lower profits from enterprise Crown corporations, particularly the Bank of Canada. The decrease in Bank of Canada profits is attributable to the Bank's secondary market purchases of Government of Canada securities to support liquidity in financial markets. Under the public sector accounting standards, premiums paid on these bond purchases are expensed immediately, which more than offsets interest earned on the securities during the month.

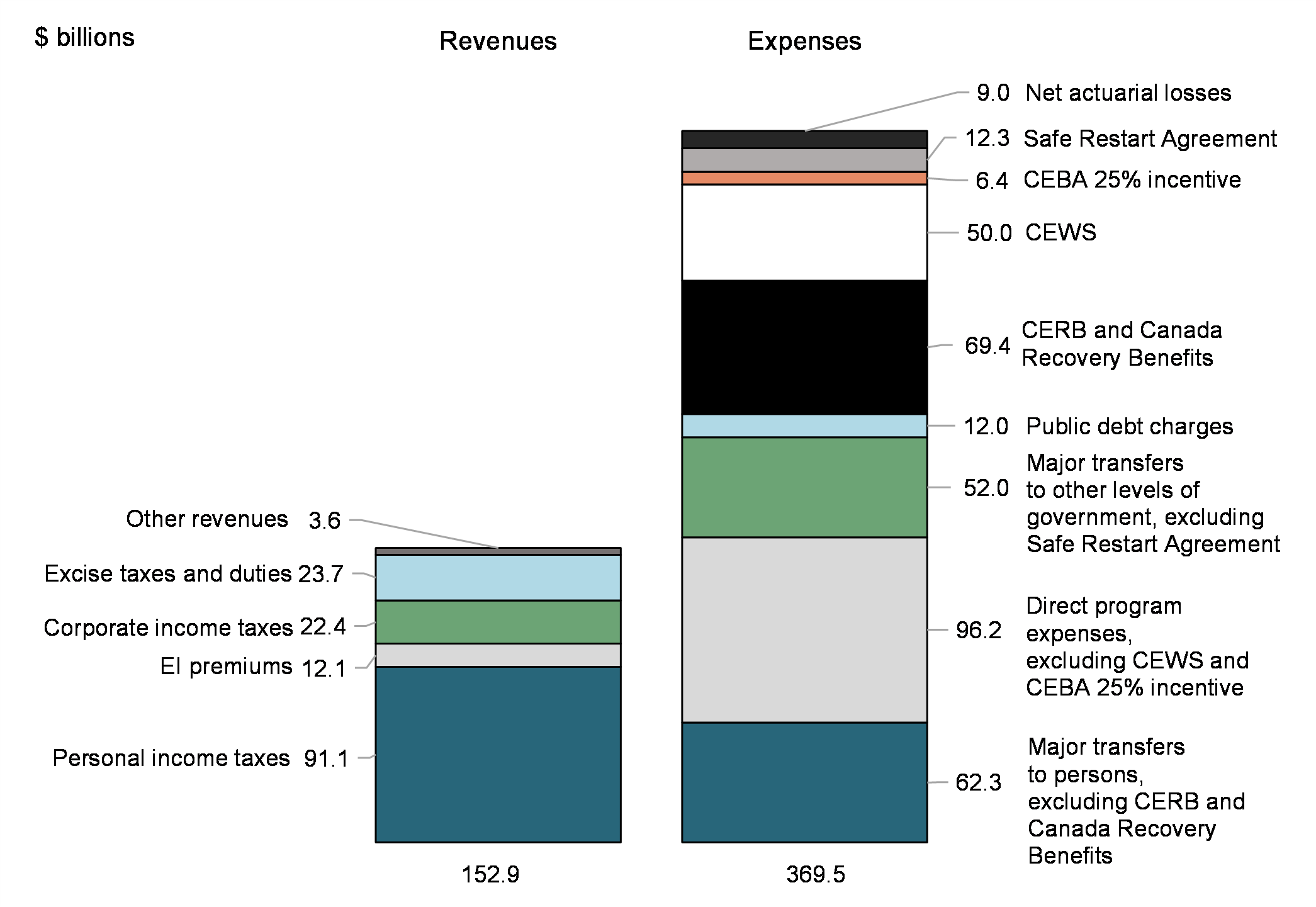

For the April to October period of 2020–21, revenues were $152.9 billion, down $36.6 billion, or 19.3 per cent, from the same period the previous year.

- Tax revenues decreased by $17.7 billion, or 11.1 per cent, driven largely by declines in GST and corporate income tax revenues, reflecting COVID-19 impacts and related measures such as the one-time additional GST/HST credit payment. For its part, the federal portion of assessed cannabis excise duties increased by $25 million to $48 million over the April to October period.

- EI premium revenues were down $0.4 billion, or 2.8 per cent.

- Assessed fuel charge proceeds were up $1.4 billion, or 195.8 per cent.

- Other revenues were down $20.0 billion, or 117.7 per cent, largely reflecting the up-front expensing of premiums paid by the Bank of Canada on its secondary market purchases of Government of Canada securities, as well as lower profits from other enterprise Crown corporations and lower revenues from interest and penalties.

| October | April to October | |||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | Change | 2019–20 | 2020–21 | Change | |

| ($ millions) | (%) | ($ millions) | (%) | |||

| Tax revenues | ||||||

Income taxes |

||||||

Personal |

12,601 | 12,313 | -2.3 | 92,102 | 91,136 | -1.0 |

Corporate |

2,862 | 3,860 | 34.9 | 26,868 | 22,425 | -16.5 |

Non-resident |

1,170 | 674 | -42.4 | 5,216 | 4,409 | -15.5 |

Total income tax revenues |

16,633 | 16,847 | 1.3 | 124,186 | 117,970 | -5.0 |

Other taxes and duties |

||||||

Goods and Services Tax |

3,860 | 3,453 | -10.5 | 24,628 | 15,188 | -38.3 |

Energy taxes |

506 | 465 | -8.1 | 3,381 | 2,827 | -16.4 |

Customs import duties |

413 | 418 | 1.2 | 3,222 | 2,310 | -28.3 |

Other excise taxes and duties |

492 | 346 | -29.7 | 3,938 | 3,328 | -15.5 |

Total other taxes and duties |

5,271 | 4,682 | -11.2 | 35,169 | 23,653 | -32.7 |

Total tax revenues |

21,904 | 21,529 | -1.7 | 159,355 | 141,623 | -11.1 |

| Fuel charge proceeds | 159 | 221 | 39.0 | 731 | 2,162 | 195.8 |

| Employment Insurance premiums | 1,186 | 1,214 | 2.4 | 12,489 | 12,138 | -2.8 |

| Other revenues | 2,216 | 1,103 | -50.2 | 16,957 | -3,008 | -117.7 |

| Total revenues | 25,465 | 24,067 | -5.5 | 189,532 | 152,915 | -19.3 |

| Note: Totals may not add due to rounding. | ||||||

Expenses

Program expenses in 2020–21 have been significantly impacted by spending measures under the Economic Response Plan, including the CERB, the CEWS, the Safe Restart Agreement, the 25 per cent incentive under the CEBA, the Canada Emergency Student Benefit (CESB), the Canada Emergency Commercial Rent Assistance (CECRA) program, and the Canada Recovery Benefits. Further information regarding these measures is provided below.

Program expenses excluding net actuarial losses in October 2020 were $39.7 billion, up $13.7 billion, or 52.5 per cent, from October 2019.

- Major transfers to persons, consisting of elderly benefits, EI benefits, the CERB and Canada Recovery Benefits, and children's benefits, were up $5.1 billion or 64.3 per cent.

- Elderly benefits increased by $0.2 billion, or 3.2 per cent, due to an increase in the average benefit and growth in the number of recipients.

- EI benefits increased by $2.9 billion, or 255.1 per cent, reflecting higher unemployment from the crisis, temporary changes to the EI program to improve access, and $1.0 billion in CERB benefits to individuals eligible for EI.

- CERB benefits to those individuals not eligible for EI and Canada Recovery Benefits payments totalled $2.0 billion. Canada Recovery Benefits include the Canada Recovery Benefit, the Canada Recovery Sickness Benefit, and the Canada Recovery Caregiving Benefit, which are income support programs introduced under Canada's COVID-19 Economic Response Plan.

- Children's benefits were up $0.1 billion, or 3.1 per cent.

- Major transfers to other levels of government were down $0.1 billion, or 0.9 per cent, largely due to a timing difference in Gas Tax Fund payments, as payments for 2020-21 were made earlier this fiscal year. This decrease more than offset legislated growth in the Canada Health Transfer, the Canada Social Transfer, Equalization transfers and transfers to the territories.

- Direct program expenses were up $8.6 billion, or 73.4 per cent. Within direct program expenses:

- Fuel charge proceeds returned increased by $44 million, or 440.0 per cent, largely reflecting the maturity of the program and an increase in the rate of the Climate Action Incentive payments for tax year 2019.

- The CEWS reflects $5.9 billion in payments to eligible employers under Canada's COVID-19 Economic Response Plan.

- Other transfer payments increased by $3.2 billion, or 83.3 per cent, reflecting a number of COVID-19 response measures, including additional funding and the accelerated timing of payments under Workforce Development Agreements with provinces and territories; one-time payments to help Canadians with disabilities with extraordinary expenses they have incurred during the COVID-19 pandemic; and relief provided under the CECRA program.

- Operating expenses of the government's departments, agencies and consolidated Crown corporations and other entities decreased by $0.5 billion, or 5.6 per cent, reflecting a number of factors, including adjustments to provisions for contingent liabilities in the prior year, timing factors, and costs associated with the general election held in October 2019.

Public debt charges decreased by $0.2 billion, or 11.6 per cent, reflecting lower interest on Government of Canada treasury bills, as well as lower interest on the government's pension and other employee future benefit obligations due to decreases in the discount rates used to value these obligations.

Net actuarial losses, which represent the amortization of changes in the value of the government's obligations for pensions and other employee future benefits accrued in previous fiscal years, increased by $0.4 billion, or 43.0 per cent, in large part due to declines in year-end interest rates used in valuing these obligations, as well as increased costs associated with the utilization of disability and other future benefits provided to veterans.

For the April to October period of 2020–21, program expenses excluding net actuarial losses were $348.6 billion, up $171.0 billion, or 96.3 per cent, from the same period the previous year.

- Major transfers to persons, consisting of elderly benefits, EI benefits, the CERB and Canada Recovery Benefits, and children's benefits, were up $75.0 billion or 132.5 per cent.

- Elderly benefits increased by $1.8 billion, or 5.5 per cent, reflecting growth in the number of recipients and an increase in the average benefit.

- EI benefits increased by $29.3 billion, or 287.2 per cent, due to higher unemployment resulting from the crisis and temporary changes to the EI program to improve access. EI benefits included $27.6 billion in CERB benefits paid to individuals eligible for EI.

- CERB payments to those individuals not eligible for EI and Canada Recovery Benefits totalled $41.8 billion.

- Children's benefits were up $2.2 billion, or 15.5 per cent, largely reflecting the one-time increase to the May 2020 Canada Child Benefit payment.

- Major transfers to other levels of government were up $17.5 billion, or 37.4 per cent, largely reflecting transfers under the Safe Restart Agreement and the Essential Workers Wage Top-Up; legislated growth in 2020–21 in the Canada Health Transfer, the Canada Social Transfer, Equalization transfers and transfers to the territories; the accelerated timing of federal funding delivered through the Gas Tax Fund; transfers through the Safe Return to Class Fund; and, funding to clean up orphan and inactive oil and gas wells. These increases were offset in part by a $1.9‑billion expense recorded in April 2019 resulting from the Hibernia Dividend Backed Annuity Agreement between Canada and Newfoundland and Labrador, which did not recur in 2020–21.

- Direct program expenses were up $78.5 billion, or 105.9 per cent. Within direct program expenses:

- Fuel charge proceeds returned increased by $1.5 billion, or 114.4 per cent, largely reflecting the continued administration of Climate Action Incentive payments, at an increased rate, for the 2019 tax year.

- The CEWS accounted for $50.0 billion in payments.

- Other transfer payments increased by $24.1 billion, or 102.8 per cent, largely reflecting a number of COVID-19 response measures, including the 25 per cent incentive under the CEBA, transfers to students under the CESB, support for seniors to cover increased costs as a result of COVID-19, and payments under the CECRA.

- Operating expenses of the government's departments, agencies and consolidated Crown corporations and other entities increased by $3.0 billion, or 6.0 per cent, reflecting in large part purchases of medical and personal protective equipment in response to the COVID-19 crisis and increased current service costs for pensions and other employee future benefits based on updated actuarial valuations.

Public debt charges decreased by $2.8 billion, or 18.9 per cent, largely reflecting lower Consumer Price Index adjustments on Real Return Bonds, lower interest on pension and benefit obligations, and lower interest on Government of Canada treasury bills.

Net actuarial losses increased by $2.7 billion, or 43.1 per cent, reflecting increases in the measurement of the government's obligations for pensions and other employee future benefits accrued in previous fiscal years. The increase in net actuarial losses is due in large part to declines in year-end interest rates used in valuing these obligations and increased costs associated with the utilization of disability and other future benefits provided to veterans.

| October | April to October | |||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | Change | 2019–20 | 2020–21 | Change | |

| ($ millions) | (%) | ($ millions) | (%) | |||

| Major transfers to persons | ||||||

Elderly benefits |

4,759 | 4,912 | 3.2 | 32,340 | 34,115 | 5.5 |

Employment Insurance benefits1 |

1,146 | 4,069 | 255.1 | 10,189 | 39,453 | 287.2 |

Canada Emergency Response Benefit and Canada Recovery Benefits1 |

- | 1,958 | n/a | - | 41,818 | n/a |

Children's benefits |

2,025 | 2,087 | 3.1 | 14,118 | 16,310 | 15.5 |

Total major transfers to persons |

7,930 | 13,026 | 64.3 | 56,647 | 131,696 | 132.5 |

| Major transfers to other levels of government | ||||||

Canada Health Transfer |

3,364 | 3,489 | 3.7 | 23,551 | 24,424 | 3.7 |

Canada Social Transfer |

1,215 | 1,252 | 3.0 | 8,508 | 8,764 | 3.0 |

Equalization |

1,653 | 1,714 | 3.7 | 11,575 | 12,001 | 3.7 |

Territorial Formula Financing |

268 | 284 | 6.0 | 2,606 | 2,759 | 5.9 |

Gas Tax Fund |

324 | - | -100.0 | 1,408 | 2,170 | 54.1 |

Home care and mental health |

- | - | n/a | 550 | 625 | 13.6 |

Other fiscal arrangements2 |

-481 | -452 | 6.0 | -1,432 | 13,523 | 844.3 |

Total major transfers to other levels of government |

6,343 | 6,287 | -0.9 | 46,766 | 64,266 | 37.4 |

| Direct program expenses3 | ||||||

Fuel charge proceeds returned |

10 | 54 | 440.0 | 1,267 | 2,717 | 114.4 |

Canada Emergency Wage Subsidy |

- | 5,886 | n/a | - | 50,023 | n/a |

Other transfer payments |

3,785 | 6,939 | 83.3 | 23,397 | 47,450 | 102.8 |

Operating expenses |

7,972 | 7,522 | -5.6 | 49,475 | 52,430 | 6.0 |

Total direct program expenses |

11,767 | 20,401 | 73.4 | 74,139 | 152,620 | 105.9 |

| Total program expenses, excluding net actuarial losses3 | 26,040 | 39,714 | 52.5 | 177,552 | 348,582 | 96.3 |

| Public debt charges | 1,782 | 1,576 | -11.6 | 14,757 | 11,966 | -18.9 |

| Total expenses, excluding net actuarial losses3 | 27,822 | 41,290 | 48.4 | 192,309 | 360,548 | 87.5 |

Net actuarial losses3 |

897 | 1,283 | 43.0 | 6,277 | 8,983 | 43.1 |

| Total expenses | 28,719 | 42,573 | 48.2 | 198,586 | 369,531 | 86.1 |

| Notes: Totals may not add due to rounding. 1 Figures for April to August 2020 have been reclassified to conform to the presentation used in the Annual Financial Report of the Government of Canada 2019–2020. Information regarding this reclassification can be found in Note 8 at the end of this document. 2 Other fiscal arrangements include the Youth Allowances Recovery and Alternative Payments for Standing Programs, which represent a recovery from Quebec of a tax point transfer; statutory subsidies; payments under the 2005 Offshore Accords; payments to provinces in respect of common securities regulation; transfers under the new Hibernia Dividend Backed Annuity Agreement with Newfoundland and Labrador; the Essential Workers Wage Top-Up; transfers under the Safe Restart Framework; and, other items. 3 Comparative figures and figures for April to August 2020 have been reclassified to conform to the presentation used in the Annual Financial Report of the Government of Canada 2019–2020. Information regarding this reclassification can be found in Note 8 at the end of this document. |

||||||

The following table presents total expenses by main object of expense.

| October | April to October | |||||

|---|---|---|---|---|---|---|

| 2019 | 2020 | Change | 2019–20 | 2020–21 | Change | |

| ($ millions) | (%) | ($ millions) | (%) | |||

| Transfer payments | 18,068 | 32,192 | 78.2 | 128,077 | 296,152 | 131.2 |

| Other expenses | ||||||

Personnel, excluding net actuarial losses1 |

4,506 | 4,534 | 0.6 | 28,876 | 31,205 | 8.1 |

Transportation and communications |

268 | 172 | -35.8 | 1,520 | 977 | -35.7 |

Information |

28 | 23 | -17.9 | 165 | 189 | 14.5 |

Professional and special services |

1,067 | 1,070 | 0.3 | 5,778 | 5,682 | -1.7 |

Rentals |

317 | 276 | -12.9 | 1,850 | 1,931 | 4.4 |

Repair and maintenance |

302 | 281 | -7.0 | 1,661 | 1,455 | -12.4 |

Utilities, materials and supplies |

221 | 478 | 116.3 | 1,390 | 3,088 | 122.2 |

Other subsidies and expenses |

813 | 203 | -75.0 | 5,153 | 4,701 | -8.8 |

Amortization of tangible capital assets |

427 | 477 | 11.7 | 2,989 | 3,146 | 5.3 |

Net loss on disposal of assets |

23 | 8 | -65.2 | 93 | 56 | -39.8 |

Total other expenses |

7,972 | 7,522 | -5.6 | 49,475 | 52,430 | 6.0 |

| Total program expenses, excluding net actuarial losses1 | 26,040 | 39,714 | 52.5 | 177,552 | 348,582 | 96.3 |

| Public debt charges | 1,782 | 1,576 | -11.6 | 14,757 | 11,966 | -18.9 |

| Total expenses, excluding net actuarial losses1 | 27,822 | 41,290 | 48.4 | 192,309 | 360,548 | 87.5 |

Net actuarial losses1 |

897 | 1,283 | 43.0 | 6,277 | 8,983 | 43.1 |

| Total expenses | 28,719 | 42,573 | 48.2 | 198,586 | 369,531 | 86.1 |

| Note: Totals may not add due to rounding. 1 Comparative figures and figures for April to August 2020 have been reclassified to conform to the presentation used in the Annual Financial Report of the Government of Canada 2019–2020. Information regarding this reclassification can be found in Note 8 at the end of this document. |

||||||

Revenues and expenses (April to October 2020)

Financial requirement of $257.7 billion for April to October 2020

The budgetary balance is presented on an accrual basis of accounting, recording government revenues and expenses when they are earned or incurred, regardless of when the cash is received or paid. In contrast, the financial source/requirement measures the difference between cash coming in to the government and cash going out. This measure is affected not only by changes in the budgetary balance but also by the cash source/requirement resulting from the government's investing activities through its acquisition of capital assets and its loans, financial investments and advances, as well as from other activities, including payment of accounts payable and collection of accounts receivable, foreign exchange activities, and the amortization of its tangible capital assets. The difference between the budgetary balance and financial source/requirement is recorded in non-budgetary transactions.

With a budgetary deficit of $216.6 billion and a requirement of $41.1 billion from non-budgetary transactions, there was a financial requirement of $257.7 billion for the April to October 2020 period, compared to a financial requirement of $14.7 billion for the same period of the previous year.

The increased financial requirement for non-budgetary transactions for the April to October 2020 period was mainly driven by changes in accounts payable, accrued liabilities and accounts receivable; and loans, investments and advances. Changes to accounts payable, accrued liabilities and accounts receivable reflect a number of factors, including year-over-year changes in the balances of taxes receivable and amounts payable related to tax, while changes to loans, investments and advances largely reflect loans advanced under the CEBA program during this period.

| October | April to October | |||

|---|---|---|---|---|

| 2019 | 2020 | 2019–20 | 2020–21 | |

| Budgetary balance (deficit/surplus) | -3,254 | -18,506 | -9,054 | -216,616 |

| Non-budgetary transactions | ||||

Accounts payable, accrued liabilities and accounts receivable |

2,704 | 16,168 | -3,017 | -23,975 |

Pensions, other future benefits, and other liabilities |

844 | 1,155 | 6,240 | 9,181 |

Foreign exchange accounts |

119 | -1,395 | 305 | -1,070 |

Loans, investments and advances |

-1,387 | -2,235 | -8,741 | -23,267 |

Non-financial assets |

-277 | -342 | -468 | -1,931 |

Total non-budgetary transactions |

2,003 | 13,351 | -5,681 | -41,062 |

| Financial source/requirement | -1,251 | -5,155 | -14,735 | -257,678 |

| Note: Totals may not add due to rounding. | ||||

Net financing activities up $324.8 billion

The government financed this financial requirement of $257.7 billion and increased cash balances by $67.1 billion by increasing unmatured debt by $324.8 billion. The increase in unmatured debt was achieved primarily through the issuance of treasury bills and marketable bonds.

Cash balances at the end of October 2020 stood at $111.8 billion, up $67.1 billion from their level at the end of March 2020. The significant increase in the cash balance largely reflects borrowings undertaken to meet the government's projected financial requirements under the COVID-19 Economic Response Plan.

| October | April to October | |||

|---|---|---|---|---|

| 2019 | 2020 | 2019–20 | 2020–21 | |

| Financial source/requirement | -1,251 | -5,155 | -14,735 | -257,678 |

| Net increase (+)/decrease (-) in financing activities | ||||

Unmatured debt transactions |

||||

Canadian currency borrowings |

||||

Marketable bonds |

11,150 | 54,906 | 25,214 | 192,159 |

Treasury bills |

2,800 | -26,800 | 2,700 | 125,433 |

Retail debt |

-11 | -4 | -126 | -29 |

Total Canadian currency borrowings |

13,939 | 28,102 | 27,788 | 317,563 |

Foreign currency borrowings |

-35 | 281 | -782 | 4,571 |

Total market debt transactions |

13,904 | 28,383 | 27,006 | 322,134 |

Cross-currency swap revaluation |

290 | -63 | -1,627 | -4,833 |

Unamortized discounts and premiums on market debt |

-65 | 434 | 157 | 7,650 |

Obligations related to capital leases and other unmatured debt |

-21 | -18 | -835 | -152 |

| Net change in financing activities | 14,108 | 28,736 | 24,701 | 324,799 |

| Change in cash balance | 12,857 | 23,581 | 9,966 | 67,121 |

| Cash balance at end of period | 49,969 | 111,801 | ||

| Note: Totals may not add due to rounding. | ||||

Federal debt

The federal debt, or accumulated deficit, is the difference between the government's total liabilities and total assets. The year-over-year change in the accumulated deficit reflects the year-to-date budgetary balance plus other comprehensive income or loss. Other comprehensive income or loss represents certain unrealized gains and losses on financial instruments and certain actuarial gains and losses related to pensions and other employee future benefits reported by enterprise Crown corporations and other government business enterprises.

The accumulated deficit increased by $221.0 billion over the April to October 2020 period, reflecting the $216.6-billion budgetary deficit and $4.4 billion in other comprehensive losses.

| March 31, 2020 |

October 31, 2020 |

Change | |

|---|---|---|---|

| Liabilities | |||

Accounts payable and accrued liabilities |

163,833 | 192,312 | 28,479 |

Interest-bearing debt |

|||

Unmatured debt |

|||

Payable in Canadian currency |

|||

Marketable bonds |

596,864 | 789,023 | 192,159 |

Treasury bills |

151,867 | 277,300 | 125,433 |

Retail debt |

497 | 468 | -29 |

Subtotal |

749,228 | 1,066,791 | 317,563 |

Payable in foreign currencies |

15,941 | 20,512 | 4,571 |

Cross-currency swap revaluation |

10,592 | 5,759 | -4,833 |

Unamortized discounts and premiums on market debt |

2,487 | 10,137 | 7,650 |

Obligations related to capital leases and other unmatured debt |

5,503 | 5,351 | -152 |

Total unmatured debt |

783,751 | 1,108,550 | 324,799 |

Pension and other liabilities |

|||

Public sector pensions |

168,596 | 168,050 | -546 |

Other employee and veteran future benefits |

126,378 | 136,179 | 9,801 |

Other liabilities |

6,051 | 5,977 | -74 |

Total pension and other liabilities |

301,025 | 310,206 | 9,181 |

Total interest-bearing debt |

1,084,776 | 1,418,756 | 333,980 |

Total liabilities |

1,248,609 | 1,611,068 | 362,459 |

| Financial assets | |||

Cash and accounts receivable |

173,715 | 293,290 | 119,575 |

Foreign exchange accounts |

104,903 | 105,973 | 1,070 |

Loans, investments, and advances (net of allowances)1 |

152,502 | 171,392 | 18,890 |

Public sector pension assets |

4,598 | 4,598 | 0 |

Total financial assets |

435,718 | 575,253 | 139,535 |

| Net debt | 812,891 | 1,035,815 | 222,924 |

| Non-financial assets | 91,531 | 93,462 | 1,931 |

| Federal debt (accumulated deficit) | 721,360 | 942,353 | 220,993 |

| Note: Totals may not add due to rounding.

1 October 31, 2020 amount includes $4.4 billion in other comprehensive losses from enterprise Crown corporations and other government business enterprises for the April to October 2020 period. |

|||

Notes

- The Fiscal Monitor is a report on the consolidated financial results of the Government of Canada, prepared monthly by the Department of Finance Canada. The government is committed to releasing The Fiscal Monitor on a timely basis in accordance with the International Monetary Fund's Special Data Dissemination Standards Plus, which are designed to promote member countries' data transparency and promote the development of sound statistical systems.

- The financial results reported in The Fiscal Monitor are drawn from the accounts of Canada, which are maintained by the Receiver General and used to prepare the annual Public Accounts of Canada.

- The Fiscal Monitor is generally prepared in accordance with the same accounting policies as used to prepare the government's annual consolidated financial statements, which are summarized in Section 2 of Volume I of the Public Accounts of Canada, available through the Public Services and Procurement Canada website.

- The financial results presented in The Fiscal Monitor have not been audited or reviewed by an external auditor.

- There can be substantial volatility in monthly results due to the timing of revenue receipts and expense recognition. For instance, a large share of government spending is typically reported in the March Fiscal Monitor.

- The April to March results reported in The Fiscal Monitor are not the final results for the fiscal year as a whole. The final results are published in the annual Public Accounts of Canada and incorporate post-March end-of-year adjustments made once further information becomes available, including the accrual of tax revenues reflecting assessments of tax returns and valuation adjustments for assets and liabilities. Post-March adjustments may also include the accrual of measures announced in the budget that are recorded upon receipt of Royal Assent of enabling legislation.

- Table 7, Condensed Statement of Assets and Liabilities, is included in the monthly Fiscal Monitor following the finalization and publication of the government's financial results for the preceding fiscal year, typically in the fall.

- The Department of Finance Canada has changed the presentation of the financial results in The Fiscal Monitor to: (a) separately present the recognition of actuarial gains and losses related to public sector pensions and other employee and veteran future benefits; and, (b) reflect CERB benefits paid to individuals eligible for EI within EI benefits. This new format is aligned with the presentation adopted in the Condensed Consolidated Statement of Operations and Accumulated Deficit in the Annual Financial Report of the Government of Canada 2019–2020.

- Actuarial gains and losses were previously reported as part of direct program expenses, but are now presented in a new line item titled "Net actuarial losses". A new subtotal line titled "Budgetary balance, excluding net actuarial losses" has also been added. The purpose of this revised presentation is to enhance financial reporting and decision making for users by isolating the impacts of re-measurements of public sector pension and other employee and veteran future benefit obligations, which are often significant and can potentially mask underlying events and trends in current government spending. Results for April to August 2020 and comparative figures for the prior year have been reclassified to conform to this new presentation. Further details regarding this change in presentation can be found in the Annual Financial Report of the Government of Canada 2019–2020, available on the Department of Finance Canada website.

- CERB payments to individuals eligible for EI were previously reported in The Fiscal Monitor within the line item titled "Canada Emergency Response Benefit", but have been reclassified to the line item "Employment Insurance benefits". CERB payments to individuals eligible for EI are charged to the EI Operating Account.

Note: Unless otherwise noted, changes in financial results are presented on a year-over-year basis.

For inquiries about this publication, contact Bradley Recker at 613-369-5667.

December 2020

© Her Majesty the Queen in Right of Canada (2020)

All rights reserved

All requests for permission to reproduce this document or any part thereof shall be addressed to the Department of Finance Canada.

Cette publication est également disponible en français.

Cat. No.: F12-4E-PDF

ISSN: 1487-0134