Canada – Ontario Canada-wide Early Learning and Child Care Agreement - 2021 to 2026

Official title: Canada – Ontario Canada-wide Early Learning and Child Care Agreement

On this page

- List of abbreviations

- Canada – Ontario Canada-wide Early Learning and Child Care Agreement

- Preamble

- 1.0 Definitions

- 1.1 Vision for Canada-wide early learning and child care

- 2.0 Canada-wide early learning and child care objectives and areas of investment

- 3.0 Period of agreement

- 4.0 Financial provisions

- 5.0 Accountability

- 6.0 Long-term collaboration

- 7.0 Communications

- 8.0 Dispute resolution

- 9.0 Amendments to the agreement

- 10.0 Termination

- 11.0 Notice

- 12.0 General

- Annex 1: Multilateral early learning and child care framework

- Annex 2: Ontario's action plan for fiscal year 2022 to 2023 to fiscal year 2023 to 2024

List of abbreviations

- AODA

- Accessibility for Ontarians with Disabilities Act

- CARE Tax Credit

- Childcare Access and Relief from Expenses Tax Credit

- CCEYA

- Child Care and Early Years Act

- CCLS

- Child Care Licensing System

- CMSMs/DSSABs

- Consolidated Municipal Service Managers/ District Social Services Administration Boards

- CWELCC

- Canada-wide early learning and child care

- DESDA

- Department of Employment and Social Development Act

- ECE

- Early childhood educators

- ECEA

- Early Childhood Educators Act

- EDI

- Early Development Instrument

- EFIS

- Education Finance Information System

- ELCC

- Early learning and child care

- FDK

- Full-day kindergarten

- FPT

- Federal-Provincial-Territorial

- HDLH

- How Does Learning Happen?

- OCAAT

- Ontario College of Applied Arts and Technology

- O. Reg.

- Ontario Regulation

- PL

- Professional Learning

- POS

- Purchase of Service

- RECEs

- Registered early childhood educators

- SNR

- Special Needs Resourcing

Canada – Ontario Canada-wide Early Learning and Child Care Agreement

Between:

- Her Majesty the Queen in Right of Canada (hereinafter referred to as "Canada" or "Government of Canada") as represented by the Minister of Employment and Social Development ("Canada") and as represented by the Minister of Families, Children and Social Development (herein referred to as "the federal Minister"); and

- The Government of Ontario (hereinafter referred to as "Ontario") as represented by the Minister of Education herein referred to as "the Ontario Minister")

Referred to collectively as the "Parties".

Preamble

Whereas, Canada and Ontario agreed to a Multilateral Early Learning and Child Care Framework on June 12, 2017 which articulated their shared vision for early learning and child care and describes their approach to achieve this vision.

Whereas, Canada and Ontario will work together to build a community-based system of quality, licensed early learning and child care, aiming for all families to have access to high-quality, affordable, flexible and inclusive early learning and child care no matter where they live.

Whereas, Canada confirmed in Budget 2021 almost $30 billion over 5 years and provides permanent ongoing funding to work with provincial and territorial, and Indigenous partners to support quality not-for-profit licensed child care, and ensure early childhood educators are at the heart of the system. Combined with previous investments announced since 2015, approximately $9.2 billion per year ongoing will be invested in child care, including Indigenous Early Learning and Child Care, starting in fiscal year 2025 to 2026.

Whereas, Canada confirms its commitment to continuing its investment in early learning and child care (ELCC) past fiscal year 2025 to 2026, as indicated in Budget 2021.

Whereas, it is Canada's intention to continue this investment, subject to appropriations, by renewing the Canada-wide early learning and child care agreements signed with all provinces and territories prior to their expiration in fiscal year 2025 to 2026 and to begin discussions with jurisdictions on renewal in fiscal year 2024 to 2025.

Whereas, subject to the renewal of the Ontario Canada-wide Early Learning and Child Care Agreement and the annual population adjustment, Ontario's estimated share for fiscal year 2026 to 2027 would be no less than the annual allocation for fiscal year 2025 to 2026, reaching approximately $2.9 billion. From fiscal year 2021 to 2022 to fiscal year 2026 to 2027, Ontario's estimated allocation would total $13.2 billion.

Whereas, Canada confirms the federal intention to support the continuity of federal child care funding.

Whereas, Canada's spending in ELCC is intended to increase until it is roughly shared with provinces and territories by fiscal year 2025 to 2026.

Whereas, to further support a lasting federal commitment, Canada is committed to tabling Early Learning and Child Care Legislation, following consultations with stakeholders, provincial, territorial, and Indigenous partners—to enshrine the principles of a Canada-wide ELCC system into law.

Whereas, the Department of Employment and Social Development Act (DESDA) authorizes the federal Minister to enter into agreements with the provinces and territories, for the purpose of facilitating the formulation, coordination and implementation of any program or policy falling within DESDA.

Whereas, the Government of Ontario may enter into agreements with the Government of Canada under which Canada undertakes to provide funding toward costs incurred by the Government of Ontario for the provision of ELCC.

Whereas, Canada has, pursuant to its Policy on Transfer Payments, established a transfer payment program to provide funds to the provincial and territorial governments for the development and delivery of licensed child care programs and services.

Whereas, as part of implementation of this Agreement, municipal partners will enrol child care operators that apply to enrol and meet provincial requirements in the Canada-wide ELCC child care system and enrolment will be subject to operator agreement funding terms and conditions.

Whereas, the Truth and Reconciliation Commission of Canada has called "upon the federal, provincial, territorial, and Indigenous governments to develop culturally appropriate early childhood education programs for Aboriginal families."

Whereas, Canada and the Assembly of First Nations, Inuit Tapiriit Kanatami, the Métis National Council jointly released the co-developed Indigenous ELCC Framework in September 2018, which establishes overarching principles and sets a vision for happy and safe Indigenous children and families, strong cultural identity, and a comprehensive and coordinated system that is anchored in self-determination and centered on children and grounded in culture, and can be used as a guide for all actors involved in Indigenous ELCC.

Whereas, Ontario invests in ELCC for Indigenous children and Canada and Ontario agree to work collaboratively with Indigenous governing bodies and organizations to achieve a Canada-wide ELCC system.

Now therefore, Canada and Ontario agree as follows.

1.0 Definitions

1.0.1 In this Agreement, the following words and expressions will have the following meanings.

1.0.2 "Licensed child care" has the same meaning as set out in the definition in subsection 2(1) of the Child Care and Early Years Act, 2014. This is consistent with Canada's definition of regulated programs and services, which are those that meet standards that are established and/or monitored by provincial/territorial governments and Indigenous governments and authorities.

1.0.3 "Not-for-profit providers/operations", as it pertains to licensed child care, child care spaces, and early learning and child care programs means such services to a community for a purpose other than generating a profit, including publicly-delivered child care operations. Providers/operations may generate a profit, but the surplus earnings, or other resources, are directed towards improving child care services (for example, improving family or child well-being or development) rather than distributed for the personal benefit of owners, members, investors or to enhance asset growth. For the purposes of this Agreement, all home child care agency licensees (as defined under the Child Care and Early Years Act, 2014) are deemed to be not-for-profit licensed child care, regardless of auspice.

1.0.4 "Fiscal year" means the period commencing on April 1 of one calendar year up to and including March 31 of the following calendar year.

1.0.5 "Parent fees" means the fee a parent is required to pay a licensee for child care.

1.1 Vision for Canada-wide early learning and child care

1.2 Canada and Ontario agree that the long-term vision and objectives for Canada-wide ELCC set out in the Multilateral Framework will guide the investment of funds provided under this Agreement. This includes the vision that all families in Canada have access to high-quality, affordable, flexible and inclusive ELCC no matter where they live.

1.3 Canada and Ontario aspire to the following objectives:

- providing a 50% reduction in average parent fees for licensed ELCC by the end of 2022 and reaching an average of $10 a day by the end of fiscal year 2025 to 2026 for licensed child care enrolled in the Canada-wide ELCC system

- creating more high-quality, affordable licensed child care spaces, predominately through not-for-profit licensed child care providers as outlined in section 2.1.1

- addressing barriers to provide inclusive and flexible child care

- valuing the early childhood workforce and providing them with training and development opportunities

1.4 Canada and Ontario agree that progress toward this vision will be undertaken by prioritizing federal investments in support of licensed child care for children under age 6.

2.0 Canada-wide early learning and child care objectives and areas of investment

2.1 Objectives

2.1.1 Canada and Ontario commit to the following Ontario objectives:

- affordability:

- Ontario commits to using federal funding to reduce parent fees as defined in section 1.0.5 for ELCC spaces for children under age 6 by an average of 50% from 2020 levels by the end of December 2022

- Ontario commits to using federal funding to reduce parent fees for full-time ELCC spaces for children under age 6 to an average of $10 per day by the end of fiscal year 2025 to 2026

- access:

- Ontario commits to using federal funding to increase the net number of licensed child care spaces for children under age 6 by flowing funds by the end of fiscal year 2025 to 2026 to support the creation of 76,700 spaces (from 2019 levels) by March 31, 2026, and 86,000 child care spaces (from 2019 levels) by December 31, 2026

- in creating these child care spaces, Ontario commits that:

- federal funding will be exclusively used to support licensed child care

- federal funding will be used predominantly to support the creation of not-for-profit child care spaces to ensure that the existing proportion of not-for-profit licensed child care spaces for children age 0 to 5 will be maintained or increased by the end of this Agreement. For further clarity, at the end of this Agreement, the proportion of not-for-profit licensed child care spaces for children age 0 to 5 compared to the total number of licensed child care spaces for children age 0 to 5 will be 70% or higher

- quality:

- Ontario commits to use federal funds to sustain and improve quality, including:

- maintaining and improving evidence based quality frameworks, standards, and tools for ELCC

- developing a wage framework for Early Childhood Educators (ECEs) and committing to its implementation, by setting a wage floor and instituting wage improvements

- increasing the percentage of child care workers providing licensed child care in the province for children age 0 to 5 who fully meet Ontario's requirements for qualified employees in regulation under the CCEYA to at least 60% by fiscal year 2025 to 2026

- Ontario commits to use federal funds to sustain and improve quality, including:

- inclusive:

- Ontario commits to develop and fund a plan that supports access to licensed child care spaces for vulnerable children and children from diverse populations, including, but not limited to, children living in low income families, children with disabilities and children needing enhanced or individual supports, Indigenous children, Black and other racialized children, children of newcomers to Canada, and official language minorities. Ontario will engage with a broad range of partners to develop a plan

- in supporting inclusive child care, Ontario commits:

- where possible, to report the annual public expenditures on child care programming dedicated to children from diverse and/or vulnerable families

- to maintain or increase the current level of licensed child care spaces offering French-language programs and licensed spaces offering bilingual programs for children age 0 to 5 by fiscal year 2025 to 2026 and continue to meet or exceed the number of French child care spaces for children age 0 to 5 proportional to the population of French speaking people in Ontario by fiscal year 2025 to 2026

- to working with Canada on monitoring quality and inclusion goals with statistical data. Ontario will work with partners to gather data and conduct assessments on barriers to access

- data sharing and reporting:

- Ontario commits to share financial and administrative data (including micro data) needed to monitor progress in establishing the Canada-wide system

2.1.2 Ontario's policy and approach to achieving these objectives is set out in its action plan attached as Annex 2.

2.2 Eligible areas of investment

2.2.1 Ontario agrees to use funds provided by Canada under this Agreement to support the expansion of licensed child care, as defined under section 1.0.2, and predominately not-for-profit ELCC programs and services as outlined in section 2.1.1, for children under the age of 6.

2.2.2 In developing and delivering its ELCC programs and services, Ontario agrees to take into account the needs of official language minority communities in its jurisdiction.

2.2.3 Acceptable investments under this Agreement may include, but are not limited to: capital and operating funding for licensed ELCC; fee subsidies; training, professional development and support for the early childhood workforce; quality assurance; parent information and referrals; and certain administration costs incurred by Ontario to support the growth, expansion, implementation and administration of this Agreement.

2.2.4 Canada and Ontario also agree to promote, define, and deliver innovative approaches to enhance the quality, access, affordability, flexibility, and inclusivity of ELCC systems, with consideration for those more in need.

2.2.5 Canada and Ontario agree that funding will be targeted toward licensed programs and activities, as described above, for children under age 6, that will have an impact on families, including families more in need such as lower-income families, Indigenous families, lone-parent families, and families in underserved communities, including Black and racialized families; families of children with disabilities and children needing enhanced or individual supports; and families with caregivers who are working non-standard hours. Families more in need also includes those with limited or no access to ELCC programs and services in the children's first official language.

3.0 Period of agreement

3.1 This Agreement shall come into effect upon the last signature being affixed and will remain in effect until March 31, 2026, unless earlier terminated in writing by Canada or Ontario in accordance with the terms hereof in section 10. Funding provided under this Agreement, in accordance with section 4, will cover the period from April 1, 2021 to March 31, 2026.

3.2 Canada-wide early learning and child care bilateral agreements

3.2.1 Extension of this Agreement beyond March 31, 2026 will provide Ontario and Canada the opportunity to review and course correct, if required, and realign new priorities in future agreements based on joint reviews of progress made to date. Section 6 outlines the program review process.

3.2.2 In the event this Agreement is extended in accordance with the terms of section 3.2.1 and section 9.0, Ontario may continue to use funding provided thereunder to cover the same eligible areas of investment as those covered through funding received for the period fiscal year 2021 to 2022 to fiscal year 2025 to 2026 subject to the terms and conditions of that extended agreement.

4.0 Financial provisions

4.1 Canada's contributions under this Agreement are in addition to, and not in lieu of, those that Canada currently pays to Ontario through the Canada Social Transfer in order to support early childhood development and ELCC within Ontario.

4.2 Ontario has an existing robust accountability framework in place as outlined in Annex 2. Ontario intends to maintain and build upon its existing robust accountability framework by introducing a further control mechanism. Ontario proposes to implement a cost control framework following the signing of the agreement that will be in place for all providers that opt into the Canada-wide ELCC system. The Parties are interested in approaches to ensure the sound and reasonable use of public funds, ensuring that costs and earnings of child care licensees that opt-in to the Canada-wide ELCC system are reasonable and that surplus earnings beyond reasonable earnings are directed towards improving child care services.

4.3 For existing licensed child care spaces, Ontario intends to propose a regulation to set a fee maximum for those that opt-in to the Canada-wide ELCC system and freeze fees as of the date the signatures from both Parties are affixed to the agreement. For new spaces, where the licensee opts-in to the Canada-wide ELCC system, the same controls will be in place as for existing child care spaces with a further restriction that fees can be no higher than the average fee for the Consolidated Municipal Services Manager/District Social Services Administration Board (CMSM/DSSAB). If a corporate licensee that was enrolled in the Canada-wide ELCC system sells its shares, it remains enrolled and the purchaser is bound by the fee structure of the seller (this is the same for a merger). If a corporate licensee sells its assets, the new licensee must apply to enrol in the Canada-wide ELCC system and once enrolled its fees must be set at or below the Consolidated Municipal Services Manager/District Social Services Administration Board maximum.

4.4 A proportion of Ontario's annual allocation will be conditional upon confirmation of the continued implementation of a cost control framework. Canada may withhold payment of 30% of the access funding set out in Annex 2 in the amounts of:

- $53 million in fiscal year 2022 to 2023

- $218 million in fiscal year 2023 to 2024

- $442 million in fiscal year 2024 to 2025

- $725 million in fiscal year 2025 to 2026

The Parties will work together to ensure that the cost control framework is in accordance with the sound and reasonable use of public funding and is supportive of the objectives of this Agreement, as set out in section 2.1.1. Following the conclusion of this work and mutual agreement by the Parties, Ontario shall provide written notice of the implementation of the cost control framework, following which Canada will release the withheld funding.

4.5 Beginning fiscal year 2023 to 2024 and on an annual basis, Ontario shall provide written notice in accordance with section 4.4 of the continued implementation of Ontario's cost control framework by April of each subsequent year, following which Canada will release the withheld funding in respect of that year.

4.6 Wages will be subject to the minimum floor for Registered Early Childhood Educators (RECE) and supervisors, which will be a requirement in Ontario's funding guidelines.

4.7 Allocation to Ontario

4.7.1 Subject to Parliamentary approval of appropriations, Canada has designated the following maximum amounts to be transferred in total to all provinces and territories under this initiative with a fixed base rate of $2 million per year for each province and territory and the balance of the funding on a per child (0 to 12) basis for the period starting on April 1, 2021 and ending on March 31, 2026. This funding includes financial commitments made as part of the 2021 to 2026 Canada-wide early learning and child care agreements.

- $2,948,082,433 for the fiscal year beginning on April 1, 2021

- $4,489,349,839 for the fiscal year beginning on April 1, 2022

- $5,538,345,183 for the fiscal year beginning on April 1, 2023

- $6,492,201,954 for the fiscal year beginning on April 1, 2024

- $7,718,943,823 for the fiscal year beginning on April 1, 2025

4.7.2 Subject to annual adjustment based on the formula described in section 4.7.3, Ontario's estimated projected share of the amounts described in section 4.7.1 will be:

| Fiscal year | Estimated amount to be paid to Ontario* (subject to annual adjustment) |

|---|---|

| 2021 to 2022 | $1,099,118,364 |

| 2022 to 2023 | $1,681,475,235 |

| 2023 to 2024 | $2,081,462,593 |

| 2024 to 2025 | $2,449,269,375 |

| 2025 to 2026 | $2,923,564,331 |

- * The notional allocations for fiscal year 2021 to 2022 use Statistics Canada's population estimates as at July 1st, 2020. Notional allocations for fiscal year 2022 to 2023 to fiscal year 2025 to 2026 are calculated based on Statistics Canada's longer-term population growth models using the Medium Growth M1 Population Growth Scenario from the previous fiscal year.

4.7.3 The final amount to be paid to Ontario for the fiscal year will be calculated using the formula F x K/L plus $2 million, where:

- F is the annual total funding amount transferred to provinces and territories for the fiscal year minus the base funding from all provinces and territories

- K is the total population of children aged 0 to 12 in Ontario on July 1 of that fiscal year, as determined using population estimates from Statistics Canada

- L is the total population of children aged 0 to 12 on July 1 of that fiscal year, as determined using population estimates from Statistics Canada

4.7.4 For the purposes of the formula in section 4.7.3, the population of children aged 0 to 12 for Ontario for each fiscal year and the total population of children aged 0 to 12 in all provinces and territories for that fiscal year are the respective populations as determined on the basis of the quarterly preliminary estimates of the respective populations on July 1 of that fiscal year. These estimates are released by Statistics Canada in September of each fiscal year.

4.8 Payment

4.8.1 Subject to Parliamentary approval of appropriations, Canada's contribution will be paid in approximately equal semi-annual installments as follows:

- the full payment of the designated amount set out in section 4.7.2 for fiscal year 2021 to 2022 will be made within 30 days after the signatures from both Parties are affixed to the agreement

- beginning in fiscal year 2022 to 2023, the first installment will be paid on or about June 15 of each fiscal year. The second installment will be paid on or about November 15 of each fiscal year once conditions in section 5.2 are satisfied

4.8.2 Beginning in fiscal year 2022 to 2023, the amount of the first installment will be an amount equal to 50% of the total amount of Canada's maximum contribution to Ontario for the fiscal year, which will be calculated using Statistics Canada 0 to 12 population estimates from the previous year.

4.8.3 Beginning in fiscal year 2022 to 2023, the amount of the second installment will be an amount equal to the balance of Canada's contribution to Ontario for the fiscal year based on the actual amount of the contribution determined under sections 4.7.3 and 4.7.4 for the fiscal year.

4.8.4 Canada will notify Ontario at the beginning of the fiscal year of their notional amount. The actual amount under sections 4.7.3 and 4.7.4 will be based on the Statistics Canada quarterly preliminary children (0 to 12) population estimates on July 1 of the preceding fiscal year.

4.8.5 In fiscal year 2024 to 2025, Canada shall withhold payment of its first installment if Canada has not received from Ontario its planned action plan for fiscal year 2024 to 2025, in accordance with requirements outlined in section 5.1. In fiscal year 2025 to 2026, Canada shall withhold payment of its first installment if Canada has not received from Ontario its planned action plan for fiscal year 2025 to 2026, in accordance with requirements outlined in section 5.1.

4.8.6 Starting in fiscal year 2023 to 2024, Canada shall withhold payment of its first installment for a fiscal year if Canada has not received from Ontario all information requested under section 4.8.8 for the payment of its second installment from the previous fiscal year.

4.8.7 Starting in fiscal year 2022 to 2023, Canada may withhold amounts payable in respect of fiscal year if Ontario is unable to meet the objectives of the agreement, in accordance with section 2.1.1.

4.8.8 Starting in fiscal year 2022 to 2023, Canada shall withhold payment of its second installment for that fiscal year until Ontario provides an annual progress report outlining data and results achieved from the previous fiscal year and its annual audited financial statement of the previous fiscal year in accordance with section 5.2.

4.8.9 In such an event that payment is being withheld, Canada will provide Ontario with a minimum 60 days written notice of its intention to withhold payment amounts, and the procedures for dispute resolution will be followed in accordance with section 8.

4.8.10 The sum of both semi-annual installments constitutes a final payment and is not subject to any further adjustment once the second installment of that fiscal year has been paid, unless there is a debt due to Canada, which requires repayment in accordance with section 4.11.

4.8.11 Payment of Canada's funding for each fiscal year of this Agreement is subject to an annual appropriation by the Parliament of Canada for this purpose. Likewise, use of the funding by Ontario is subject to an annual appropriation by Ontario's Legislature.

4.9 Maximum annual contribution in respect of administration costs

4.9.1 Canada's contribution in respect of Ontario's administration costs referred to in section 2.2.3 shall not exceed:

- in the fiscal years covered under this Agreement an amount up to 10% of the maximum amount payable for those fiscal years

4.10 Carry forward

4.10.1 For fiscal year 2021 to 2022, at the request of Ontario, and subject to the approval of Canada's Treasury Board, Ontario may retain and carry forward to the following fiscal year any unexpended funds remaining from Ontario's annual contribution payable under section 4.7 up to a maximum of 100% of the contribution payable.

4.10.2 In fiscal year 2022 to 2023, at the request of Ontario, and subject to the approval of Canada's Treasury Board, Ontario may retain and carry forward to the following fiscal year unexpended funds remaining from Ontario's annual contribution payable under section 4.7, up to a maximum of 95% of the contribution payable. Any unexpended funds in excess of 95% of the contribution payable represents an overpayment subject to section 4.11.

4.10.3 In fiscal year 2023 to 2024, at the request of Ontario, and subject to approval of Canada's Treasury Board, Ontario may retain and carry forward to the following fiscal year any unexpended funds remaining from Ontario's annual contribution payable under section 4.7, up to a maximum of 75% of the total contribution payable. Any unexpended funds in excess of 75% of the contribution payable represents an overpayment subject to section 4.11.

4.10.4 In fiscal year 2024 to 2025 at the request of Ontario, and subject to approval of Canada's Treasury Board, Ontario may retain and carry forward to the following fiscal year any unexpended funds remaining from Ontario's annual contribution payable under section 4.7, up to a maximum of 50% of the total contribution payable. Any unexpended funds in excess of 50% of the contribution payable represents an overpayment subject to section 4.11.

4.10.5 In fiscal year 2025 to 2026 at the request of Ontario, and subject to approval of Canada's Treasury Board, Ontario may retain and carry forward to the following fiscal year any unexpended funds remaining from Ontario's annual contribution payable under section 4.7, up to a maximum of 10% of the total contribution payable. Any unexpended funds in excess of 10% of the contribution payable represents an overpayment subject to section 4.11.

4.10.6 Ontario may only use the amount carried forward to the following fiscal year for expenditures on eligible areas of investment made under section 2.2 incurred that fiscal year.

4.10.7 For greater certainty, any amount carried forward under sections 4.10.1 and 4.10.5 is supplementary to the maximum amount payable to Ontario under section 4.7 of this Agreement during the fiscal year in which the funding is carried forward.

4.10.8 All amounts carried forward to the next fiscal year, pursuant to sections 4.10.1 to 4.10.5 must be spent by the end of that fiscal year. Ontario is not entitled to retain any such carried forward amounts that remain unexpended after the end of that fiscal year, nor is it entitled to retain any balance of Canada's contribution payable pursuant to section 4.7 that remains unexpended at the end of that fiscal year and is not carried forward in accordance with sections 4.10.1 to 4.10.5. Such amounts are considered debts due to Canada and shall be repaid in accordance with section 4.11.

4.11 Repayment of overpayment

4.11.1 In the event payments made to Ontario exceed the amount to which Ontario is entitled under the agreement and/or unexpended funding is in excess of the carry forward allowance, the amount of the excess is a debt due to Canada and shall be repaid to Canada upon receipt of notice to do so and within the period specified in the notice.

4.11.2 Canada shall, in addition to any other remedies available, have the right to recover the debt by deducting or setting-off the amount of the debt from any future contribution payable to Ontario under this Agreement.

4.11.3 Use of funds

4.11.4 Canada and Ontario agree that funds provided under this Agreement will only be used by Ontario in accordance with the areas for investment outlined in section 2.2 of this Agreement.

4.11.5 Canada and Ontario agree that, within each fiscal year of the period of this Agreement, Ontario may move funding between the individual programming categories outlined in its action plan in Annex 2 to ensure the maximum use of funding. Ontario agrees to notify Canada in writing of any such change in funding allocation, including the rationale for the change. The change will be implemented upon agreement between Canada and Ontario.

4.11.6 Canada and Ontario agree that funds provided under this Agreement will be used to ensure improvements in ELCC as outlined in section 2.1.1 and will not displace existing provincial or municipal spending in place on or before March 31, 2021.

5.0 Accountability

5.1 Action plan

- Ontario has completed and shared its action plan for fiscal year 2022 to 2023 and fiscal year 2023 to 2024 (Annex 2). Subsequently, Ontario will provide an action plan for fiscal year 2024 to 2025 by the beginning of fiscal year 2024 to 2025. Subsequently, with the completion of the program review conducted during the fiscal year 2024 to 2025 by the Implementation Committee pursuant to section 6.4, Ontario will provide an action plan for fiscal year 2025 to 2026 by the beginning of fiscal year 2025 to 2026. Ontario will publicly release their action plan which:

- outlines an implementation plan towards achieving objectives set out in section 2, including priority areas for investment, and targets by indicator, within the framework's parameters

- identifies specific targets for each indicator that will be reported on annually for tracking progress in relation to the objectives set out under section 2.1.1, and as outlined in its action plan in Annex 2, which may include the following:

- total number of ELCC spaces available during the fiscal year, broken down by age groups of child and type of setting (for example, for-profit/not-for-profit/public licensed child care centres, licensed family child care homes, etc.)

- the number of net new spaces created during the fiscal year, broken down by age groups of child and type of setting (for example, for-profit/not-for-profit/public licensed child care centres, licensed family child care homes, etc.)

- total number of inclusive (as defined in section 2.1.1) spaces created/converted, broken down by age group of child and type of setting

- average daily parental fee for licensed child care spaces at the end of each fiscal year, including at the beginning of fiscal year 2021 to 2022 and at the end of 2022

- number of children under age 6 and 6 to 12 years receiving fee subsidies, broken down by families receiving partial and full subsidies

- number and proportion of children under age 6 and 6 to 12 years in flexible licensed ELCC arrangements and number and proportion of centers/providers that provide flexible arrangements (for example, non-traditional arrangements such as flexible/irregular hours, weekend and emergency services); and geographic distribution of spaces

- number of children under age 6 and 6 to 12 years with disabilities and children needing enhanced or individual supports that are in licensed ELCC spaces

- number or proportion of child care service providers who provide services that are adapted to the needs of children with disabilities and children needing enhanced or individual supports

- number of Indigenous children under age 6 years in licensed child care spaces, distinction-based (First Nations, Inuit, Metis) through statistical methods where possible

- number of racialized Canadian children, including Black Canadian children under age 6 in licensed child care spaces through statistical methods where possible

- number and percentage of staff working in licensed child care programs in Ontario who fully meet the Ontario's certification/educational requirements

- annual public expenditure on training and professional development of the early childhood workforce

- wages of the early childhood workforce according to the categories of certification, including any wage enhancements, top-ups and/or supplements

- identifies additional jurisdiction-specific indicators for tracking progress in relation to the objectives of the agreement

- describes how Ontario plans to address the ELCC needs of its children/families more in need, as described in section 2.2.5

- if available, number and proportion of children under age 6 and 6 to 12 years from families more in need that are in licensed child care spaces through statistical methods where possible

- outline any additional available information to be reported annually that would be useful to assess progress, including:

- information about waiting lists to access licensed child care spaces, where possible

- total child care subsidies provided by parents' income level

- average child-to-staff ratio among licensed child care service providers

- total annual investment in ELCC

- a description of consultation processes referred to in section 5.1.2, the type of groups consulted and annual priorities related to stakeholder feedback

5.1.2 Ontario will consult with parents, child care providers, experts, Indigenous peoples, official language minority communities and other interested Parties as an important step in finalizing its fiscal year 2024 to 2025 action plan. Ontario will outline the results of consultations in its fiscal year 2024 to 2025 action plan as well as through its annual reporting.

5.1.3 By the beginning of fiscal year 2024 to 2025, Ontario commits to share with Canada its fiscal year 2024 to 2025 action plan. With the program review under section 6.4 complete, Ontario will provide an action plan for fiscal year 2025 to 2026 by the beginning of fiscal year 2025 to 2026. The action plan shall include the elements described in section 5.1 (i) a) to f). Once the Parties agree that the action plan is final, the action plan may be published by one or both of the Parties and Canada will be able to provide Ontario with its first payment for the first fiscal year in the action plan according to section 4.8.

5.2 Reporting

5.2.1 Ontario agrees to provide baseline data on indicators set out in their action plan as soon as possible after the Parties sign this Agreement.

5.2.2 By no later than October 1 starting in fiscal year 2023 to 2024, unless otherwise stated, and continuing during the period of this Agreement, Ontario agrees to:

- provide to Canada an annual report in the format and manner decided jointly by Canada and Ontario. The report shall show separately the results attributable to the funding provided by Canada under this Agreement and shall include:

- description of the activities, expenditures and results of the agreement as set out in Annex 2

- results achieved in working towards the vision for Canada-wide ELCC set out in this Agreement, including average child care fees and progress toward the average 50% reduction in fees by the end of 2022 and reaching an average fee of $10 per day by fiscal year 2025 to 2026

- results achieved according to the indicators and targets referred to in Annex 2

- the impact on families more in need, as described in section 2.2.5, including progress toward specific Ontario targets as described in Annex 2

- additional available information to be reported annually that would be useful to assess progress

- description of any relevant consultation processes, the type of groups consulted and annual priorities related to stakeholder feedback referred to in Annex 2

- any additional results of Ontario's annual child care data collection as per section 5.2.2 (f) and any evaluation activities undertaken in the fiscal year, as available

- continue to provide to Canada additional data required for the publication of the annual National Progress Report

- by no later than October 1 starting in fiscal year 2022 to 2023, provide to Canada an audited financial statement of revenues received from Canada under this Agreement during each fiscal year

- the revenue section of the statement shall show the amount received from Canada under this Agreement during the fiscal year

- the total amount of funding used for ELCC programs and services under section 2.2

- the administration costs incurred by Ontario in developing and administering ELCC programs under section 2.2.3

- if applicable, the amount of any amount carried forward by Ontario under section 4.10

- if applicable, the amount of any surplus funds that are to be repaid to Canada under section 4.11

- provide financial and administrative information, as required, to demonstrate progress in meeting the requirements in this Agreement

- Canada and Ontario recognize the importance of reporting to the public on results achieved under this Agreement. Within 365 days of the end of each fiscal year starting in fiscal year 2023 to 2024, Ontario agrees to report to the people of Ontario and Canada on the results and expenditures of ELCC programs and services. The report shall show separately the results attributable to the funding provided by Canada under this Agreement and be consistent with the annual report outlined under section 5.2.2 (a)

- to inform reporting on results related to Ontario's action plan, Ontario agrees to continue, and share results with Canada from, an annual data collection of child care providers and other participants in the sector in Ontario to collect information, including: number of children enrolled, capacity (number of spaces), number of ECEs, ECE wages and qualifications, fee charged to parents, subsidies, and auspice. Costs of undertaking the data collection would be eligible expenses under this Agreement, to the maximum set out in section 4.9.1. Ontario agrees to provide the financial and administrative information, as required, to demonstrate progress in meeting the conditions outlined in this section

5.2.3 Canada, with prior notice to Ontario, may incorporate all or any part or parts of the annual report described under section 5.2.2 (a) into any public report that Canada may prepare for its own purposes, including any reports to the Parliament of Canada or reports that may be made public.

5.3 Audit

5.3.1 Ontario will ensure that expenditure information presented in the annual report is, in accordance with Ontario's standard accounting practices, complete and accurate.

5.4 Evaluation

5.4.1 As per established policies and processes with respect to program effectiveness, Ontario will evaluate programs and services receiving funds provided under this Agreement and make public the results of any such evaluations.

5.4.2 Ontario may be asked to participate in the evaluation by Canada of the initiatives under this Agreement and agrees to provide information as requested by Canada during and following the agreement in order for Canada to evaluate relevant initiatives under this Agreement. Evaluation results will be made available to the public.

6.0 Long-term collaboration

6.1 Understanding that expanding and building a new social program is complex, and that both governments are committed to achieving an average of $10 a day for licensed child care spaces for eligible children, Canada and Ontario will create an officials-level Implementation Committee. This committee will monitor progress towards this goal in consultation with stakeholders. Ontario and Canada will provide data to support the work of the Implementation Committee.

6.2 Canada and Ontario, through the Implementation Committee and/or designated officials, agree to meet at least twice annually, timed to coincide with the planning and reporting cycles, or as agreed to by the Parties, to discuss and exchange information on issues related to this Agreement, including:

- administration and management of the agreement, including providing a forum for the exchange of information on annual planning priorities and reporting

- exchanging information on local challenges and priorities and the results of engagement with other relevant stakeholders, including official language minority communities

- discussing access to affordable high-quality and culturally appropriate ELCC for Indigenous children in Ontario with both Ontario and Canada providing updates and information

- providing a forum to exchange information on best practices and have discussions related to the implementation of the agreement, for example, status of data collection and results as well as discussing what indicators may be included in subsequent action plan(s) under this Agreement

- improving data collection and dissemination on key ELCC information, including culturally oriented ELCC information for indigenous children, Black and other racialized children, newcomer to Canada children, and other groups of children that may require additional consideration for accessing programs and services

- review and provide direction to resolve any issues arising from the implementation and management of this Agreement, and from the evaluation of provincial programs supported under this Agreement

- monitor progress towards the shared goal of an average of $10 per day, in consultation with stakeholders, including sharing information on space creation in the for-profit and not-for-profit sector

- through mutual agreement, stakeholders may be invited to attend a meeting of the Implementation Committee

- report to the Government of Canada and Ontario on progress towards Canada's and Ontario's shared goals to date and how the remainder of the shared goals may be achieved before the expiry of the agreement

- in December 2022, the governments of Canada and Ontario to report on progress towards Canada and Ontario's shared goals to date based on data available at that time

6.3 Canada and Ontario agree to share and release data as available, and share knowledge, research and information on effective and innovative practices in ELCC, to further support the development of and reporting on quality and outcomes. Canada and Ontario agree to work together, and with stakeholders, towards the development of additional measures and indicators that could be included in bilateral agreements in the future that could reinforce the vision for Canada-wide ELCC.

6.4 Program review

6.4.1 To ensure the long-term sustainability of the agreement and to provide some certainty to Ontario's child care sector and partners, Canada and Ontario agree to have a program review ("program review") conducted during the term of this Agreement by the Implementation Committee. The program review will be conducted during the fiscal year 2024 to 2025.

6.4.2 Canada and Ontario agree that the purpose of the program review is to communicate progress and share information on the committed objectives outlined in section 2.1.1 of this Agreement. This includes a review of indicators and targets under section 2.1.1 of this Agreement as well as an analysis of costs (including operator deficits if any) and cost drivers.

6.4.3 The program review will be completed by June 30, 2024. This timeframe recognizes Ontario's need to release its funding allocations to partners for their subsequent fiscal year in a timely manner. This timing also considers Ontario's municipal partners operate on a calendar year basis with a January 1 start to their fiscal year.

6.4.4 Ontario will provide the Implementation Committee with the financial model for the purpose set out in section 6.4.2.

6.4.5 A summary of findings will be provided to Canada and Ontario with conclusions and recommendations.

7.0 Communications

7.1 Canada and Ontario agree on the importance of communicating with citizens about the objectives of this Agreement in an open, transparent, effective and proactive manner through appropriate public information activities.

7.2 Canada and Ontario recognize the importance of ensuring that the public is informed of Canada's financial contributions to Ontario's ELCC programs and services, funded under this Agreement.

7.3 Ontario agrees to acknowledge Canada's contribution by including federal identification in all public communications and marketing products, promotional material and advertising. Canada agrees to acknowledge Ontario's contribution in public communications and marketing products, promotional material and advertising where specifically related to or associated with Ontario.

7.4 Canada reserves the right to conduct public communications, announcements, events, outreach and promotional activities about the framework and bilateral agreements. Canada agrees to give Ontario 10 days advance notice of public communications related to the framework, bilateral agreements, and results of the investments of this Agreement.

7.5 Ontario reserves the right to conduct public communications, announcements, events, outreach and promotional activities about the framework and bilateral agreements. Ontario agrees to give Canada 10 days advance notice of public communications related to the framework, bilateral agreements, and results of the investments of this Agreement.

7.6 Canada and Ontario agree to participate in a joint announcement upon signing of this Agreement.

7.7 Canada and Ontario agree to work together to identify opportunities for joint announcements relating to programs funded under this Agreement.

7.8 Ontario will make best efforts to require service providers, funded under this Agreement to display federal identification to recognize that the programs and services provided receive Canada's financial assistance.

7.9 Ontario agrees that promotional communications to all groups receiving funding through this Agreement (for example, licensed child care providers, home child care licensees, and municipal partners, colleges, and career colleges) will include federal identification and recognize Canada's financial assistance.

7.10 Canada will provide a mutually agreed upon standard letter to Ontario for use in notifying all recipients of funding from this Agreement, to include federal and Ontario identification and recognize Canada's financial assistance. Parties may collectively agree on an alternate version that appropriately identifies and recognizes both Parties.

8.0 Dispute resolution

8.1 Canada and Ontario are committed to working together and avoiding disputes through government-to-government information exchange, advance notice, early consultation, and discussion, clarification, and resolution of issues, as they arise.

8.2 The Parties acknowledge that the current forecast provided by Ontario is accurate, and through the use of funds carried forward in accordance with section 4.10, is forecast to cover costs of achieving the objectives of the agreement up to the end of the fiscal year 2025 to 2026. This forecast includes funding provided by Canada under section 4 of this Agreement, and the $267 million net new investment committed by Ontario. Nothing in this Agreement would require either Canada or Ontario to contribute additional funding during the term of this Agreement beyond the funding committed by both Parties as referred to in the previous sentence.

8.3 As the Parties take stock of progress as outlined in section 6, should there be challenges, Canada and Ontario agree to work together to explore workable solutions, including proportional adjustments to targets. The responsible Ministers for Canada and Ontario agree to consider all reasonable approaches put forward by officials to address challenges.

8.4 If at any time either Canada or Ontario is of the opinion that the other Party has failed to comply with any of its obligations or undertakings under this Agreement or is in breach of any term or condition of the agreement, Canada or Ontario, as the case may be, may notify the other Party in writing of the failure or breach. Upon such notice, Canada and Ontario will endeavour to resolve the issue in dispute bilaterally through their designated officials.

8.5 If a dispute cannot be resolved by designated officials, then the dispute will be referred to the Deputy Ministers most responsible for ELCC, and if it cannot be resolved by them, then the federal Minister and Ontario Minister shall endeavour to resolve the dispute.

8.6 If Ontario has failed to comply with its obligations or undertakings and where the Ontario Minister and federal Minister are unable to resolve related disputes, a termination of the agreement may be pursued in accordance with section 10.

9.0 Amendments to the agreement

9.1 This Agreement, including all attached annexes, except Annex 1, may be amended at any time by mutual consent of the Parties. To be valid, any amendments shall be in writing and signed by the Parties.

9.2 Waiver

9.3 Failure by any Party to exercise any of its rights, powers, or remedies under this Agreement or its delay to do so does not constitute a waiver of those rights, powers, or remedies. Any waiver by either Party of any of its rights, powers, or remedies under this Agreement must be in writing; and, such a waiver does not constitute a continuing waiver unless it is so explicitly stated.

10.0 Termination

10.1 Canada may terminate this Agreement at any time if the terms of this Agreement are breached by Ontario by giving at least 6 months written notice of Canada's intention to terminate the agreement. Ontario may terminate this Agreement at any time if the terms of this Agreement are breached by Canada by giving at least 6 months written notice of Ontario's intention to terminate the agreement.

10.2 After the date of termination of this Agreement under section 10.1, Canada shall have no obligation to make any further payments to Ontario after the date of effective termination.

11.0 Notice

11.1 Any notice, information or document provided under this Agreement will be effectively delivered or sent by email or mail, with postage or other charges prepaid. Any notice that is delivered will have been received when delivered; and, except in periods of postal disruption, any notice mailed will be deemed to have been received 8 calendar days after being mailed. Any notice emailed will be deemed to have been received the following business day. The Parties agree that sending any notice, information or document by email is the preferred method of transmittal. However, if any notice, information or document must be mailed:

- Canada will advise Ontario's Assistant Deputy Minister, Early Years and Child Care Division by email at the time of mailing

- Ontario will advise the Director General of the Federal Child Care Secretariat by email at the time of mailing

The address for notice or communication to Canada shall be as follows, or as Canada later designates to Ontario by notice in writing:

- Federal Child Care Secretariat

140 Promenade du Portage

Gatineau, QC K1A 0J9

NC-SSP-ELCC-GD@hrsdc-rhdcc.gc.ca

The address for notice or communication to Ontario shall be as follows, or as Ontario later designates to Canada by notice in writing:

- Ministry of Education

Attention: Assistant Deputy Minister, Early Years and Child Care Division

315 Front Street, 11th floor

Toronto, ON M7A 0B8

holly.moran@ontario.ca

12.0 General

12.1 This Agreement, including Annexes 1 and 2, comprises the entire agreement entered into by the Parties with respect to the subject matter hereof.

12.2 This Agreement does not displace federal investments in ELCC, based on the Multilateral Early Learning and Child Care Framework, Annex 1, concluded on June 12, 2017.

12.3 This Agreement shall be interpreted according to the laws of Canada and Ontario.

12.4 No member of the House of Commons or of the Senate of Canada or of the Legislature of Ontario shall be admitted to any share or part of this Agreement, or to any benefit arising therefrom.

12.5 If for any reason a provision of this Agreement that is not a fundamental term is found by a court of competent jurisdiction to be or to have become invalid or unenforceable, in whole or in part, it will be deemed to be severable and will be deleted from this Agreement, but all the other provisions of this Agreement will continue to be valid and enforceable.

12.6 This Agreement is drafted in English at the request of the Parties.

- Signed on behalf of Canada by the Minister Families Children and Social Development in Ottawa this 27th day of March, 2022.

- [Signed by] The Honourable Karina Gould, Minister of Families, Children and Social Development.

- Signed on behalf of Ontario by the Minister of Education at Vaughan this 27th day of March, 2022.

- [Signed by] The Honourable Stephen Lecce, Minister of Education.

Annex 1: Multilateral Early Learning and Child Care Framework

Federal, Provincial and Territorial Ministers most responsible for early learning and child care (ELCC) agree on the importance of supporting parents, families and communities in their efforts to ensure the best possible future for their children. For more details, please consult the Multilateral Early Learning and Child Care Framework.

Annex 2: Ontario's action plan for fiscal year 2022 to 2023 and fiscal year 2023 to 2024

1.0 Introduction

The purpose of this action plan is to outline Ontario's key principles and priorities for this funding as well as the actions to be taken in fiscal year 2022 to 2023 and fiscal year 2023 to 2024 to work towards the goal of implementing a Canada-wide Early Learning and Child Care (CWELCC) system. The fiscal year 2024 to 2025 action plan would be provided by the beginning of fiscal year 2024 to 2025, and the fiscal year 2025 to 2026 action plan would be provided by the beginning of fiscal year 2025 to 2026.

Under the CWELCC agreement between Ontario and the Government of Canada, Canada will provide funding to Ontario to support the implementation of a CWELCC system. Ontario will use the investment to build on and leverage the success of existing child care funding and associated initiatives while working with system partners to achieve the goals of a CWELCC system.

The goals for a CWELCC system include:

- providing a 50% reduction in average child care fees for licensed child care for children under the age of 6 by the end of calendar year 2022 and reaching an average of $10 per day for child care fees by the end of fiscal year 2025 to 2026

- creating more high-quality, affordable licensed child care spaces

- addressing barriers to provide inclusive and flexible licensed child care

- strengthening the early childhood workforce through enhanced compensation, training, and professional learning opportunities

Federal investments and support in Indigenous early learning and child care

The Indigenous Early Learning and Child Care Framework, co-developed with Indigenous partners in 2018, sees children and families supported by a comprehensive and coordinated system of ELCC policies, programs and services that are led by Indigenous peoples, rooted in Indigenous knowledge, cultures and languages and supported by strong partnerships. Building on this strong foundation and in addition to investments announced in the 2020 Fall Economic Statement, Canada's Budget 2021 included $2.5 billion over 5 years, starting in fiscal year 2021 to 2022, and $542 million ongoing, to advance First Nations, Inuit and Métis Nation specific early learning and child care priorities that meet the unique needs of Indigenous families. Approximately $54 million in Indigenous ELCC funding is reaching Ontario in fiscal year 2021 to 2022.

2.0 Background: Ontario's system of early learning and child care

2.1 Highlights: Ontario's child care system

Child care is foundational to supporting early childhood development and student success. It is also a key enabler of workforce participation, particularly for women, both as parents and providers.

Ontario is home to almost 2 million children age 0 to 12, representing approximately 38% of Canada's child care age population. Ontario has approximately 860,000 children age 0 to 5 and 1,090,000 children age 6 to 12. These children are supported by a system of early learning and child care that is fully integrated with publicly funded schools to support access and seamless experiences for all Ontario families.

Ontario's child care system has a broad range of care options for families. There are more than 464,500 high quality licensed child care spaces in centres for children age 0 to 12 in the province. About 288,000 of these spaces are available for children age 0 to 5. Ontario's child care system also includes an estimated 10,000 spaces for children age 0 to 5 in licensed home child care, for an estimated total capacity of 298,000 spaces for this age group.

Quality and safety in child care programs are a priority for Ontario and are supported by a strong quality-focused licensing and enforcement regime.

Ontario shares with Canada the goals of a CWELCC system, including improved affordability, access, quality, and inclusion. Ontario has been working to advance these goals on many fronts, including:

- full-day kindergarten: Ontario invests $3.6 billion in universal full-day kindergarten, providing a full-day of free high-quality programming for all children age 4 to 5 in the publicly funded school system across the province. Ontario is the first Canadian jurisdiction to provide full-day kindergarten to both 4- and 5-year-old children and 90% of Ontario children age 4 and 5 attend full-day kindergarten

- fee subsidy for low-income families: Ontario's child care fee subsidy system provides $880 million annually to support low-income families to access child care. In 2019, the most recent year for which there is data available, fee subsidies supported 150,500 children in Ontario to access child care; 57,900 of these children attended child care free with full subsidy

- operator subsidies: Ontario invests approximately $700 million in operator subsidies to help offset costs that would otherwise result in higher child care fees. Support is provided for general operating costs, as well as wage enhancements for qualified staff

- Ontario childcare access and relief from expense (CARE) tax credit: introduced in 2019, this tax credit helps an estimated 300,000 families each year with up to 75% of their eligible child care expenses so they can work, run a business or study to acquire new skills

- child care spaces in schools: Ontario has committed up to $1 billion over 5 years (beginning in 2019) to create up to 30,000 new child care spaces in schools. As of March 31, 2021, 54% of licensed child care centres and 64% of licensed child care spaces were in publicly funded schools. 70% of primary schools have a child care centre

- wage enhancement grant/home child care enhancement grants: Ontario values the important role of child care and early years professionals. Since 2015, Ontario has supported recruitment and retention of RECEs in child care through the Ontario Wage Enhancement Grant. In 2021, Ontario invested $203 million to help attract and retain RECEs within Ontario's child care system and support access to stable, high quality child care programs

- Ontario's college of early childhood educators: Ontario values the important role of child care and early years professionals. The College is the self-regulatory body for the early childhood education profession in the province and is the only regulatory college for early childhood educators in Canada. As a result, Ontario is the only jurisdiction in Canada with title protection for the profession

- modern legislative framework and quality standards: the Child Care and Early Years Act, 2014 (CCEYA) is the legislation that governs child care in Ontario. The legislation requires that programming in licensed spaces is aligned with the provincial pedagogy, How Does Learning Happen?, which sets out a vision, values, foundations and approaches to guide practice for high quality experiences in licensed child care and early years settings

- licensing and enforcement: Ontario has a modern regulatory framework. The Ministry of Education issues child care licences under the CCEYA and is responsible for enforcement of that legislation

- annual data collection: Ontario has conducted an annual data collection of child care program operations from licensed child care centres and home child care agencies since 2012 and has been reporting on the Early Development Instrument (EDI) indicators since 2003

- EarlyON child and family programs: in addition to Ontario's robust child care system, Ontario also has 419 main sites and 664 mobile/satellite locations offering EarlyON child and family programs to provide key supports to caregivers and children

Note: Ontario's investment of $2 billion in child care includes $146.7 million from the federal government in fiscal year 2021 to 2022 under the Canada-Ontario early learning and child care agreement.

2.2 Overview: Ontario's child care system

Ontario sets overall policy, legislation, and regulations for the early years and child care sector (for-profit and not-for-profit) across the province. Ontario also issues licences, conducts inspections, and investigates complaints about licensed and unlicensed child care across the province.

There are 2 types of licensed child care in Ontario:

- child care centres are licensed by the Ministry of Education and include nursery schools, full-day and before- and after-school programs. Child care centres operate in a variety of locations including schools, workplaces, community centres and places of worship. The Ministry inspects child care centres at least annually to ensure they meet health, safety and programming requirements under the CCEYA

- home child care agencies are licensed by the Ministry of Education. Agencies enter into agreements with individual home child care providers and work with families to find the right provider for their child. Providers are screened, approved and regularly monitored by the licensed home child care agency. The Ministry also inspects home child care agencies and a sample of home child care providers annually to ensure licensing requirements are met and maintained

Ontario works with a broad and diverse range of partners to support the child care and early years system, including but not limited to Consolidated Municipal Service Managers (CMSMs), District Social Services Administration Boards (DSSABs), Child Care Licensees, the College of Early Childhood Educators, District School Boards, EarlyON Child and Family Centre Providers, First Nation communities, Indigenous and Francophone organizations, and Ontario Colleges of Applied Arts and Technology.

CMSMs/DSSABs are designated under the CCEYA as service system managers and are responsible and accountable for planning, implementing, monitoring, and reporting outcomes for child care and early years investments in their service area. CMSMs/DSSABs possess critical knowledge about community needs, maintain close connections with community partners, and are well positioned to plan and implement growth in the local child care system where it is needed the most.

Child Care and Early Years Act, 2014

The Child Care and Early Years Act (CCEYA) governs child care in Ontario. The CCEYA sets out what types of programs are considered child care and what types of child care do not require a licence in order to support informed decision-making for parents about their child care options. It sets out protective measures as well as licensing, inspection, and enforcement provisions. The CCEYA states that it is a matter of provincial interest that there be a system of child care and early years programs and services that:

- is focused on Ontario's children and families

- promotes the health, safety and well-being of children

- provides high quality experiences and positive outcomes for children with a provincial framework to guide pedagogy

- includes knowledgeable, self-reflective and qualified professionals and staff, including members of the College of Early Childhood Educators

- respects equity, inclusiveness and diversity in communities and the qualities of Aboriginal, First Nation, Métis and Inuit communities, children with disabilities, Francophone communities and urban, rural, remote and northern communities

The above items are just a few of the enumerated items of provincial interest regarding child care and early years system set out in the CCEYA and is not an exhaustive list.

The CCEYA has 2 associated regulations:

- Ontario Regulation 137/15 (General) provides licensing standards, additional clarity and accountability on a broad range of specific issues

- Ontario Regulation 138/15 (Funding, Cost Sharing and Financial Assistance), sets out rules regarding the use of provincial funding

Funding

Funding to support child care and child and family programs is flowed to 47 CMSMs/DSSABs, 96 First Nation communities and 3 Transfer Payment Agencies for child care and child and family programs on reserves.

CMSMs and DSSABs operate on a calendar year (January to December). Ontario typically provides their annual allocation information each fall, prior to the beginning of the calendar year.

In fiscal year 2021 to 2022, Ontario is investing over $2 billion in early years and child care:

- $1.6 billion to CMSMs/DSSABS for child care to support

- $880 million in fee subsidies for low-income parents

- $700 million in operator subsidies (including $203 million for the Wage Enhancement Grant)

- $25.5 million to support Indigenous-led child care and early years programming off reserve

- $49.5 million for child care and child and family programs in First Nation communities

- $141.5 million for EarlyON child and family programs

- $445 million for the Ontario CARE Tax Credit

As part of its plan to expand access to child care, the government is also investing up to $1 billion over 5 years to create up to 30,000 new child care spaces in schools.

On top of these investments, Ontario invests $3.6 billion annually in full-day kindergarten which guarantees full-day learning and education to all children age 4 to 5 in publicly funded schools across the province.

2.3 Affordability supports for families

Child care fees have historically been market-driven, with higher fees associated with regions with a higher cost of living. Parent fees also vary by age group, with higher fees for younger age groups. Based on data as of March 31, 2021, estimated average daily child care fees for the 0 to 5 age group are over $46 per day. Average daily fees for the 6 to 12 age group are approximately $24 per day.

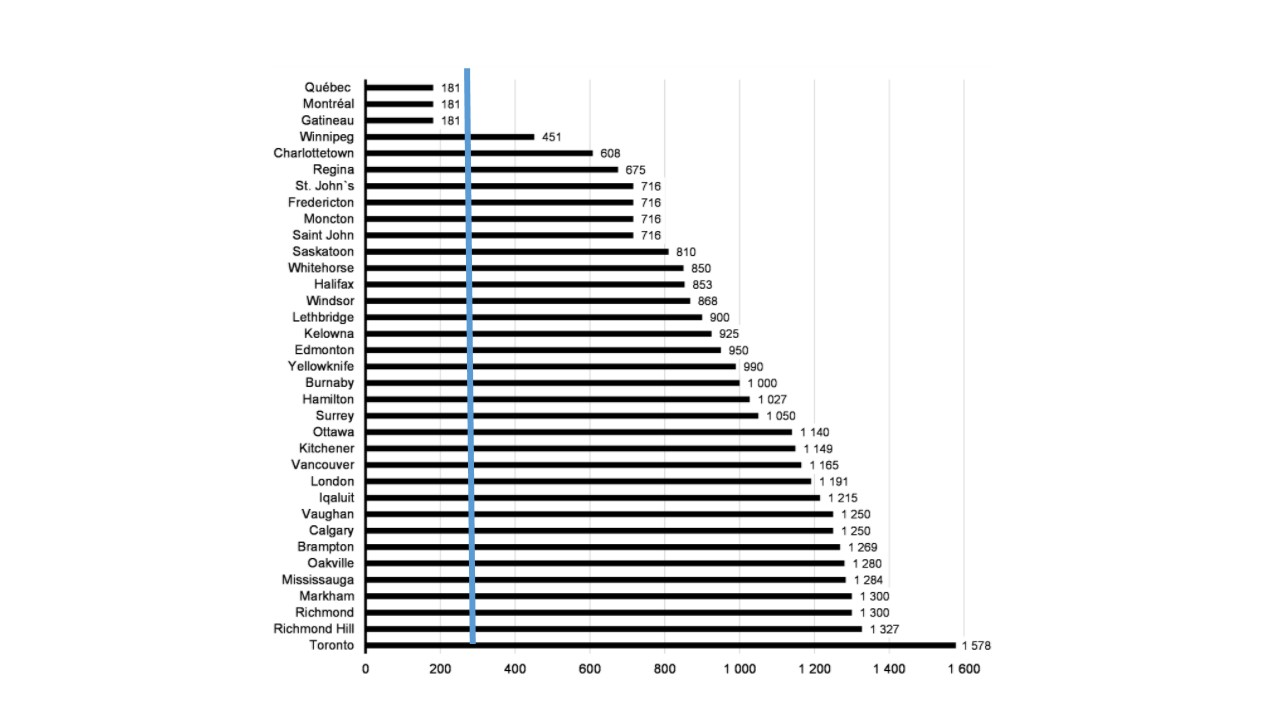

Below is a chart that shows the average daily fees in licensed child care as of March 31, 2021:

Table 2: Daily fees in licensed child care for 2021

Note: the tables below were modified for accessibility reasons.

| Age group | Weighted average daily fees |

|---|---|

| Infant | $73.20 |

| Toddler | $60.86 |

| Preschool | $53.27 |

| Kindergarten | $47.64 |

| Kindergarten before and after school | $25.79 |

| School age before and after school | $23.08 |

| Age group | Weighted average daily fees |

|---|---|

| Less than 2 years | $47.56 |

| 2 to 3 years | $45.59 |

| 4 to 5 years | $41.19 |

| 4 to 5 years before and after school | $25.90 |

| 6 to 12 years before and after school | $26.36 |

Ontario has some of the highest child care fees in Canada. For example, of the 10 regions across the country with the highest monthly toddler fees, 7 of these are in Ontario.

Note: the figure below was modified for accessibility reasons.

- Note: The blue line represents Ontario's estimates of monthly fees of an average of $10 per day.

- Source: Canadian Centre for Policy Alternatives, 2021, as cited in the Federal Budget 2021.

Figure 1 – Text version

| Canadian cities | Monthly toddler fees |

|---|---|

| Québec city | $181 |

| Montréal | $181 |

| Gatineau | $181 |

| Winnipeg | $451 |

| Charlottetown | $608 |

| Regina | $675 |

| St. John's | $716 |

| Fredericton | $716 |

| Moncton | $716 |

| Saint John | $716 |

| Saskatoon | $810 |

| Whitehorse | $850 |

| Halifax | $853 |

| Windsor | $868 |

| Lethbridge | $900 |

| Kelowna | $925 |

| Edmonton | $950 |

| Yellowknife | $990 |

| Burnaby | $1,000 |

| Hamilton | $1,027 |

| Surrey | $1,050 |

| Ottawa | $1,140 |

| Kitchener | $1,149 |

| Vancouver | $1,165 |

| London | $1,191 |

| Iqaluit | $1,215 |

| Vaughan | $1,250 |

| Calgary | $1,250 |

| Brampton | $1,269 |

| Oakville | $1,280 |

| Mississauga | $1,284 |

| Markham | $1,300 |

| Richmond | $1,300 |

| Richmond Hill | $1,327 |

| Toronto | $1,578 |

- Source: Canadian Centre for Policy Alternatives, 2021, as cited in the Federal Budget 2021.

Ontario invests in several initiatives to make child care more affordable for parents across the province but achieving the $10 per day target will be more challenging for Ontario given the higher costs.

Full-day kindergarten

Ontario invests $3.6 billion annually to guarantee full school day learning to all children age 4 to 5 in publicly funded schools across the province. The program is universal and fully funded, providing high quality learning experiences co-led by teachers and Registered Early Childhood Educators (RECE) in the school system. Kindergarten supports children's well-being and learning before they begin school at age 6.

The transition from a half-day kindergarten program to a full-day program began in the 2010 to 2011 school year and was fully implemented by the 2014 to 2015 school year. Implementation of the program included more than $1.5 billion investment in capital funding to support school boards to build/renovate classrooms. This investment supported the creation of approximately 3,500 kindergarten classrooms.

Since it was fully implemented, about 99% of primary schools in Ontario provide full-day kindergarten, with 267,000 children currently enrolled.

Childcare access and relief from expenses tax credit

In 2019, Ontario introduced the Childcare access and relief from expenses (CARE) tax credit to enable families to access a broad range of child care options. In fiscal year 2021 to 2022, the credit will provide an estimated $445 million to approximately 300,000 families to support their eligible child care expenses, including those for child care in centres, home‐based care and other settings. As announced in the 2021 Ontario Budget, this includes a top‑up of 20% of the credit entitlement for the 2021 taxation year.

Families can receive up to:

- $6,000 per child under the age of 7 (plus a top‑up of up to $1,200 for 2021)

- $3,750 per child between the ages of 7 and 16 (plus a top‑up of up to $750 for 2021)

- $8,250 per child with a severe disability (plus a top‑up of up to $1,650 for 2021)

The CARE tax credit is provided in addition to the Child Care Expenses Deduction and focuses on lower- and moderate-income families. The CARE tax credit enables families to choose child care options that best meet their needs, including care outside of traditional hours and on weekends. The CARE tax credit is based on a tax filer's:

- family income, based on the income used in determining the tax filer's Child Care Expenses Deduction

- eligible child care expenses, defined as the tax filer's total entitlement under the Child Care Expenses Deduction

Support for general operating costs to support affordability

Ontario provides approximately $700 million in operator subsidies to help offset costs that would otherwise result in higher child care fees. This funding supports the general operating costs of licensed child care programs in order to reduce and stabilize fees for services, sustain service levels, and where funds allow, improve access to high quality affordable early learning and child care services for children and their families. General operating funding may be used for ongoing costs, including staff wages and benefits, lease and occupancy costs, utilities, administration, transportation for children, resources, nutrition, supplies, and maintenance.

Note: Ontario allocates fee subsidy funding and general operating funding to CMSMs/DSSABs and CMSMs/DSSABs have purchase of service (POS) agreements with child care operators in their region to support them in these areas. Currently, CMSMs/DSSABs as service system managers have discretion to decide which operators they will enter into POS agreements with based on available funding and service planning priorities (for example, gaps in service). An estimated 700 to 800 of the approximately 5,500 child care centres in Ontario do not have a POS agreement with a service system manager.

Child care fee subsidies

In Ontario, a child care fee subsidy is available for financially eligible families using a standardized assessment of family income and is determined on a sliding scale in order to increase access to the licensed child care system. Ontario's child care fee subsidy provides $880 million in direct support annually for low-income families to access child care. In 2019, the most recent year for which there is data available, 150,500 children in Ontario were supported with a full or partial fee subsidy.

The amount of subsidy a family may be eligible for is based on factors set out in the provincial Policy Statement: Access to Subsidized Child Care. These factors include parents' employment/education activities or the special needs of the child. CMSMs/DSSABs may weight the factors differently depending on the needs of their community. For example, 2 parents who both work full-time could receive subsidy for full-time child care if they qualify financially. If one of the parents works on a part-time basis, the family could be eligible for subsidy for the time the parent is working plus reasonable travel time.

Through the standardized income test assessment, the family contribution to the cost of child care is calculated as follows:

- no cost if family net income is $20,000 or under (full subsidy)

- 10% of net income over $20,000 but under $40,000, plus

- 30% of net income over $40,000

Access to fee subsidies is based on availability of subsidy funds within the budget of the local CMSM/DSSAB, as well as child care space availability. Service system managers have reported fee subsidy waitlists in some communities.

Fee subsidy eligibility includes children under 13 years or up to 18 years with special needs who were already in the child care system or entered the child care system before August 31, 2017.

The table below shows a breakdown of fee subsidies provided by family income level:

| Family income | Percentage* | Number of subsidy children |

|---|---|---|

| $20,000 and below | 38% | 57,913 |

| $20,001 to $40,000 | 34% | 51,280 |

| $40,001 to $60,000 | 18% | 27,251 |

| $60,001 and above | 9% | 14,030 |

| Total | 100% | 150,474 |

- *Numbers may not add up due to rounding.

2.4 Family choice and access to child care spaces