Seniors infographic – 2021

From: Employment and Social Development Canada

Alternate formats

Figure 1: Text Version

Seniors

As Canada's population is aging…

- 18% of the Canadian population were aged 65 and older in 2020.

- The senior population is expected to grow to 24% by the end of the 2030s.

- The average life expectancy is 79.8 years for men and 83.9 years for women.

Source: Statistics Canada.

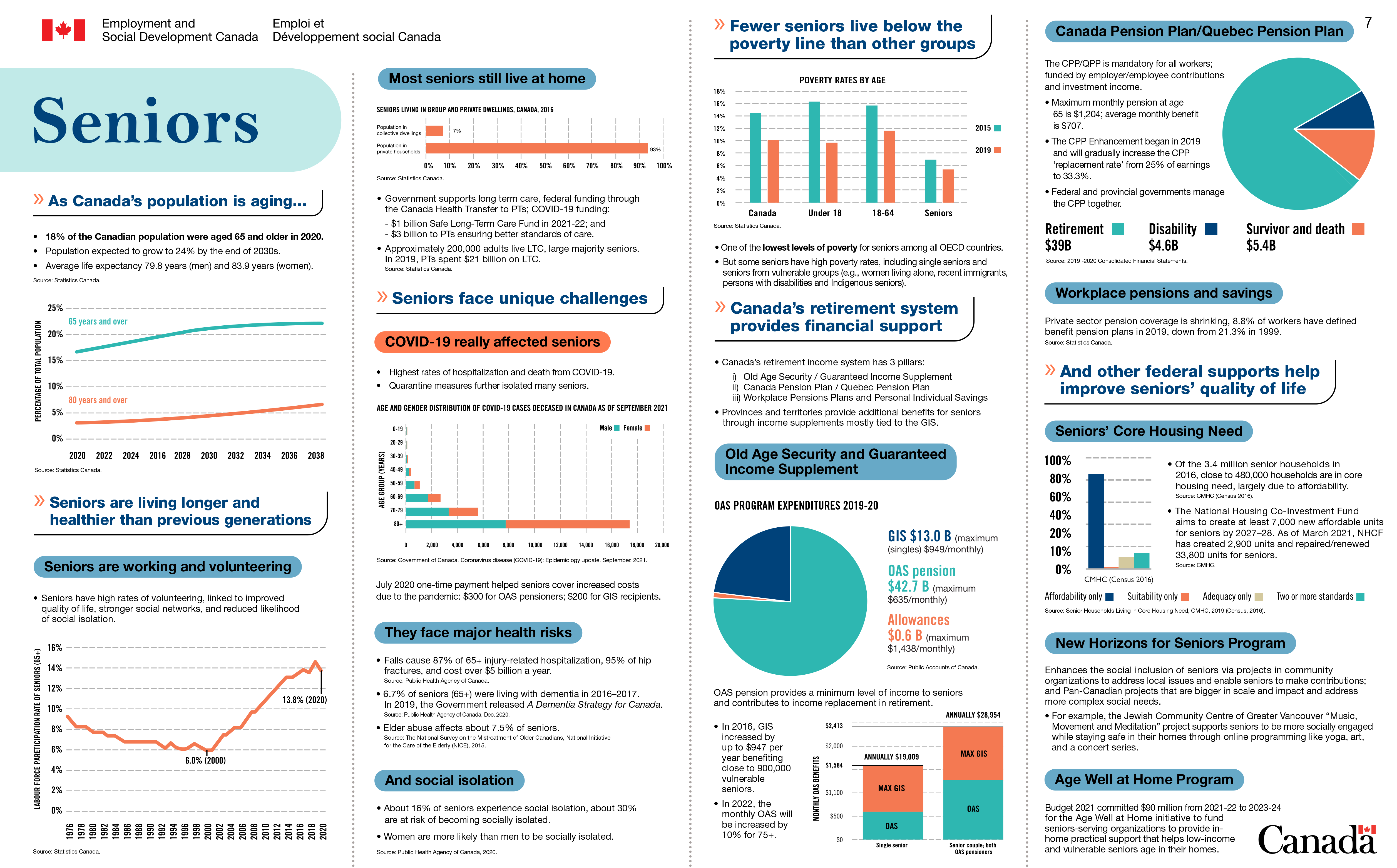

Based on a medium-growth projection, Canada's population proportion aged 65 and older is expected to grow from 18% in 2020 to 22.5% in 2030 and 23.6% in 2040. Based on the same projection, Canada's population proportion aged 80 and older is expected to grow from 4.4% in 2020 to 6.1% in 2030 and 8.4% in 2040.

Source: Statistics Canada.

Seniors are living longer and healthier than previous generations

Seniors are working and volunteering

- Seniors have high rates of volunteering, linked to improved quality of life, stronger social networks, and reduced likelihood of social isolation.

The labour force participation rate of seniors aged 65 and older has more than doubled from 6% in 2000 to 13.8% in 2020.

Source: Statistics Canada.

Most seniors still live at home

In 2016, 93% of Canadian seniors were living in private households, while 7% were living in collective dwellings.

Source: Statistics Canada.

- Government supports long term care with federal funding through the Canada Health Transfer to provinces and territories and COVID-19 funding, including:

- $1 billion through the Safe Long-Term Care Fund in 2021 to 2022, and

- $3 billion to provinces and territories ensuring better standards of care

- Approximately 200,000 adults live in long-term care, with a large majority being seniors. In 2019, provinces and territories spent 21 billion dollars on long-term care.

Source: Statistics Canada.

Seniors face unique challenges

COVID-19 really affected seniors

- Seniors have the highest rates of hospitalization and death from COVID-19.

- Quarantine measures further isolated many seniors.

As of September 2021, 27,400 Canadians who have contracted COVID-19 have died. Of these deaths:

- 16 individuals or 0.1% were aged 0 to 19

- with 6 of them being male and 10 of them being female

- 70 individuals or 0.3% were aged 20 to 29

- with 44 of them being male and 26 of them being female

- 164 individuals or 0.6% were aged 30 to 39

- with 103 of them being male and 61 of them being female

- 379 individuals or 1.4% were aged 40 to 49

- with 246 of them being male and 133 of them being female

- 1,067 individuals or 3.9% were aged 50 to 59

- with 661 of them being male and 406 of them being female

- 2,708 individuals or 9.9% were aged 60-69

- with 1,724 of them being male and 984 being female

- 5,603 individuals or 20.4% were aged 70 to 79

- with 3,336 of them being male and 2,267 being female and

- 17,393 individuals or 63.5% were aged 80 and older

- with 7,741 being male and 9,652 being female

Source: Government of Canada. Coronavirus disease (COVID-19): Epidemiology Update. September 2021.

The July 2020 1-time payment helped seniors cover increased costs due to the pandemic and provided $300 for Old Age Security pensioners and $200 for Guaranteed Income Supplement recipients.

They face major health risks

- For seniors aged 65 and older, falls cause 87% of injury-related hospitalizations, 95% of hip fractures, and cost over $5 billion a year.

Source: Public Health Agency of Canada.

- 6.7% of seniors aged 65 and older were living with dementia in 2016 to 2017. In 2019, the Government released A Dementia Strategy for Canada.

Source: Public Health Agency of Canada, December 2020.

- Elder abuse affects about 7.5% of seniors.

Source: The National Survey on the Mistreatment of Older Canadians, National Initiative for the Care of the Elderly, 2015.

And social isolation

- About 16% of seniors experience social isolation and about 30 % are at risk of becoming socially isolated.

- Women are more likely than men to be socially isolated.

Source: Public Health Agency of Canada, 2020.

Fewer seniors live below the poverty line than other groups

Canada's poverty rate saw a decline from 14.5% of the population in 2015 to 10.1% of the population in 2019. This included:

- a decline from 16.4% in 2015 to 9.7% in 2019 for Canadians aged 18 and under,

- a decline from 15.7% in 2015 to 11.6% in 2019 for Canadians aged 18 to 64, and

- a decline from 7% in 2015 to 5.4% in 2019 for Canadians aged 65 and older

Source: Statistics Canada.

Canada has one of the lowest levels of poverty for seniors among all Organisation for Economic Co-operation and Development countries.

But some seniors have high poverty rates, including single seniors and seniors from vulnerable groups such as women living alone, recent immigrants, persons with disabilities and Indigenous seniors.

Canada's retirement system provides financial support

Canada's retirement income system has 3 pillars:

- Old Age Security / Guaranteed Income Supplement

- Canada Pension Plan / Quebec Pension Plan

- Workplace Pensions Plans and Personal Individual Savings

Provinces and territories provide additional benefits for seniors through income supplements mostly tied to the Guaranteed Income Supplement.

Old Age Security and Guaranteed Income Supplement

Old Age Security Program Expenditures for 2019 to 2020

- In 2019 to 2020, the Government paid $56.3 billion in Old Age Security benefits. This included $42.7 billion in Old Age Security pension benefits, $13 billion in Guaranteed Income Supplement benefits, and $600 million dollars in Allowance benefits.

- The maximum monthly Old Age Security pension is approximately $635. The maximum monthly Guaranteed Income Supplement for singles is approximately $949. The maximum monthly Allowance for the Survivor is approximately $1,438.

Source: Public Accounts of Canada.

The Old Age Security pension provides a minimum level of income to seniors and contributes to income replacement in retirement.

- In 2016, the Guaranteed Income Supplement increased by up to $947 per year benefiting close to 900,000 vulnerable seniors.

- In 2022, the monthly Old Age Security pension will be increased by 10% for those aged 75 and older.

Old Age Security and Guaranteed Income Support Rates

- A single senior can receive a maximum of approximately $1,584 each month in Old Age Security pension and Guaranteed Income supplement. This equates to approximately $19,009 annually.

- A senior couple who are both Old Age Security pensioners can receive a maximum of approximately $2,413 each month in Old Age Security pension and Guaranteed Income supplement. This equates to approximately $28,954 annually.

Canada Pension Plan/Quebec Pension Plan

The Canada Pension Plan/Quebec Pension Plan is mandatory for all workers and is funded by employer/employee contributions and investment income.

- Maximum monthly pension at age 65 is $1,204 and the average monthly benefit is $707.

- The Canada Pension Plan Enhancement began in 2019 and will gradually increase the Canada Pension Plan 'replacement rate' from 25% of earnings to 33.3%.

- Federal and provincial governments manage the Canada Pension Plan together.

In the 2019 to 2020 Fiscal Year, the Canada Pension Plan paid a total of $39 billion in retirement benefits, $5.4 billion in survivor's benefits, and $4.6 billion in disability benefits.

Source: 2019 to 2020 Consolidated Financial Statements.

Workplace pensions and savings

Private sector pension coverage is shrinking. 8.8% of workers have defined benefit pension plans in 2019, down from 21.3% in 1999.

Source: Statistics Canada

And other federal supports help improve seniors' quality of life

Seniors' Core Housing Need

In 2016, Census data indicated that 85.6% of senior households in core housing need lived in housing that failed to meet the affordability criteria. In addition:

- 1.3% lived in housing that failed to meet the suitability criteria,

- 5.7% lived in housing that failed to meet the adequacy criteria, and

- 7.4% lived in housing that failed to meet two or more of the criteria.

Source: Senior Households Living in Core Housing Need, published by the Canada Mortgage and Housing Corporation in 2019 using Census 2016 data.

- Of the 3.4 million senior households in 2016, close to 480,000 households are in core housing need, largely due to affordability.

Source: Canada Mortgage and Housing Corporation using 2016 Census data

- The National Housing Co-Investment Fund aims to create at least 7,000 new affordable units for seniors by 2027 to 2028. As of March 2021, the National Housing Co-Investment Fund has created 2,900 units and repaired/renewed 33,800 units for seniors.

Source: Canada Mortgage and Housing Corporation

New Horizons for Seniors Program

Enhances the social inclusion of seniors via projects in community organizations to address local issues and enable seniors to make contributions; and Pan-Canadian projects that are bigger in scale and impact and address more complex social needs.

- For example, the Jewish Community Centre of Greater Vancouver's "Music, Movement and Meditation” project supports seniors to be more socially engaged while staying safe in their homes through online programming aimed at increasing both physical and mental wellbeing. Activities include yoga, art and a concert series.

Age Well at Home Program

Budget 2021 committed 90 million dollars from 2021 to 2022 and from 2023 to 2024 for the Age Well at Home initiative to fund seniors-serving organizations to provide in-home practical support that helps low-income and vulnerable seniors age in their homes.