Canada-Yukon Labour Market Development Agreement

On this page

- 1.0 Interpretation

- 2.0 Purpose and scope

- 3.0 Yukon benefits and measures

- 4.0 Delegation of authority to Yukon with respect to the National Employment Service Function and Co-operation on Labour Market Information

- 5.0 Service to clients

- 6.0 Delivery arrangements

- 7.0 Transitional arrangements

- 8.0 Indicators for measuring results of Yukon benefits and measures and annual results targets and reporting

- 9.0 Year 2 review and evaluations

- 10.0 Information and data sharing

- 11.0 Monitoring and assessment report

- 12.0 Employment insurance program integrity

- 13.0 Transfer of federal employees to Yukon

- 14.0 Financial arrangements and contribution towards costs

- 15.0 Transfer of assets

- 16.0 Payment procedures

- 17.0 Annual annex

- 18.0 Financial accountability

- 19.0 Overpayment and lapsing funds

- 20.0 Public information

- 21.0 Designated officials

- 22.0 Joint Management Committee

- 23.0 Term of agreement

- 24.0 Termination

- 25.0 Amendment

- 26.0 Equality of treatment

- 27.0 General

- 28.0 Effective date

Annexes

- Annex 1 - Description of Yukon benefits and measures

- Annex 2 - National Employment Service function and co-operation on Labour Market Information

- Annex 3 - Delivery arrangements for Yukon benefits and measures

- Annex 4 - Indicators for measuring results of Yukon benefits and measures and annual results targets and reporting

- Annex 5 - Canada-Yukon exchange of information and data sharing arrangements (amended April 4, 2017)

This Agreement made this ___ day of _____, 2009.

Between

The Government of Canada (herein referred to as "Canada"), as represented by the Minister of Human Resources and Skills Development and the Canada Employment Insurance Commission

And

The Government of Yukon (herein referred to as "Yukon"), as represented by the Minister of Education

Recitals

Whereas Canada and Yukon agree on the importance of the development of a skilled workforce and to the rapid re-employment of unemployed Yukoners;

Whereas Canada and Yukon support the vision of a territorial labour market development system, based on predictable funding to support Yukon’s economic growth, the creation of employment opportunities and reduction in the “productivity gap” through responsive and appropriate labour market services that build on the skills, abilities and potential of Yukoners;

Whereas Canada and Yukon support the creation of a cohesive, made in Yukon system of services focused on addressing labour market challenges facing employers and employees across Yukon;

Whereas Canada and Yukon agree that they should to the extent possible, reduce unnecessary overlap and duplication in their labour market development programs;

Whereas, Canada, acting through the Canada Employment Insurance Commission, and with approval of Canada’s Minister of Human Resources and Skills Development, is authorized under section 63 of the Employment Insurance (EI) Act to enter into an agreement with Yukon to provide for payment of contributions towards

- (a) the costs of benefits and measures provided by Yukon that are similar to employment benefits and support measures under Part II of that Act and consistent with the purpose and guidelines of Part II of that Act; and

- (b) the administration costs that Yukon incurs in providing those benefits and measures;

Whereas Yukon will establish benefits and measures described in Annex 1 to this Agreement and Canada has determined that these benefits and measures meet the requirements of similarity to the employment benefits and support measures under Part II of the EI Act and are consistent with the purpose and guidelines of that Act;

Whereas with respect to the other areas of cooperation between Canada and Yukon covered by this Agreement, Canada, acting through its Minister of Human Resources and Skills Development, is authorized to enter into this Agreement under section 10 of the Department of Human Resources and Skills Development Act;

And whereas Yukon’s Minister of Education is authorized to enter into this Agreement on behalf of the Government of Yukon;

Now, therefore, the parties hereto agree as follows:

1.0 Interpretation

1.1 The terms "employment benefit" and "support measure" are used in the EI Act in reference to specific types of employment programs established by the Commission under sections 59 and 60(4), respectively, of the EI Act. The terms "benefit" and "measure" are used in section 63 of the EI Act in reference to employment programs established by other governments and organizations in Canada, towards the cost of which the Commission is authorized to make financial contributions, provided those programs are similar to the Commission’s employment benefits and support measures and are consistent with the purpose and guidelines of Part II of the EI Act.

1.2 In this Agreement, unless the context requires otherwise,

"Active EI claimant" means an individual for whom an employment insurance benefit period is established under the EI Act;

"Administration costs" means the costs of administration incurred by Yukon in providing the Yukon benefits and measures;

"Annual annex" means the annex referred to in Article 17;

"Commission" means the Canada Employment Insurance Commission;

"Costs of Yukon benefits and measures" means the following costs of financial assistance or other payments provided by Yukon under its Yukon benefits and measures to persons and organizations that are eligible for assistance under those benefits and measures:

- (a) under the Yukon benefits,

- (i) the costs of financial assistance provided under the benefits by Yukon directly to EI clients, and,

- (ii) the costs of financial assistance or other payments provided by Yukon under the benefits to persons or organizations as reimbursement for costs incurred by them, or as payment for services rendered by them, in relation to the provision of assistance to EI clients; and

- (b) under the Yukon measures, the costs of financial assistance or other payments provided by Yukon under its measures to persons and organizations that are eligible for assistance under those measures;

"Designated officials" means the officials designated by the parties under Article 21;

"EI Act" means the Employment Insurance Act, S.C. 1996, c. 23;

"EI client" means an unemployed person who, when requesting assistance under a Yukon benefit or Yukon measure,

- (a) is an active EI claimant; or

- (b) had a benefit period that ended within the previous 36 months; or

- (c) had a benefit period established for him or her within the previous 60 months, and

- (i) was paid parental or maternity benefits under the EI Act,

- (ii) subsequently withdrew from the labour force to care for one or more of their new-born children or one or more children placed with them for the purpose of adoption, and,

- (iii) is seeking to re-enter the labour force; or

- (d) received “territorial benefits” under a “territorial plan”, as those terms are defined in section 76.01 of the Employment Insurance Regulations, within the previous 60 months, and

- (i) if not for the territorial benefits paid under the territorial plan, would have been entitled to receive benefits under sections 22 or 23 of the EI Act, and would have had a benefit period established for that purpose within the 60 months period;

- (ii) subsequently withdrew from active participation in the labour force to care for one or more of their newborn children or one or more children placed with them for the purpose of adoption; and

- (iii) is seeking to re-enter the labour market;

"Fiscal year" means the period commencing on April 1 in one calendar year and ending on March 31 in the next calendar year;

“Joint Management Committee” means the committee established under Article 22;

“National Employment Service” means the national employment service maintained by the Commission under subsections 60(1) and (2) of the EI Act to provide information on employment opportunities across Canada to help workers find suitable employment and help employers find suitable workers;

“NES clients” means persons and organizations to whom the National Employment Service provides its services, namely: workers, whether insured or not or whether they are claiming employment insurance benefits or not; employers; workers’ organizations; and interested public and private organizations providing employment assistance services to workers;

“Service Canada” refers to a government service delivery initiative launched by the Government of Canada under the responsibility of the Minister of Human Resources and Skills Development;

“Transition committee” means the committee established under Article 7;

“Transition period” means the period between the date of the signing of this Agreement and the date referred to in Article 3.1 of this Agreement on which Yukon begins implementation of its Yukon benefits and measures;

“Yukon benefits and measures” means Yukon benefits and Yukon measures;

“Yukon benefit” means a labour market development program set out in Annex 1, as amended from time to time, that is provided by Yukon under Article 3 with funding transferred under this Agreement and that is designed to enable EI clients to obtain employment; and

"Yukon measure" means a labour market development program set out in Annex 1, as amended from time to time, that is provided by Yukon under Article 3 with funding transferred under this Agreement to support:

- (a) organizations that provide employment assistance services to unemployed persons;

- (b) employers, employee or employer associations, community groups and communities in developing and implementing strategies for dealing with labour force adjustments and meeting human resource requirements; or

- (c) research and innovation projects to identify better ways of helping persons prepare for, return to or keep employment, and be productive participants in the labour force.

2.0 Purpose and scope

2.1 The purpose of this Agreement is to:

- (a) implement, within the scope of Part II of the EI Act, new Canada-Yukon arrangements in the area of labour market development that will enable Yukon to assume an expanded role in the design and delivery of labour market development programs and services in Yukon, to benefit clients;

- (b) provide for cooperative arrangements between Canada and Yukon to reduce overlap and duplication in, and to harmonize and coordinate the delivery of, their respective employment programs and services, and

- (c) provide for the transfer of affected federal employees to Yukon.

2.2 Canada will retain responsibility for the delivery of insurance benefits under Part I of the EI Act and for the aspects of labour market development reflective of national interests, such as responding to national emergencies, activities in support of inter-provincial/territorial labour mobility, the promotion and support of national sectoral councils, the operation of national labour market information and national labour exchange systems, other labour market programming and the provision of support for labour market research and innovative projects designed to test new approaches to improving the functioning of the labour market in Canada.

2.3 To promote cooperation in the conduct of their respective activities and initiatives in support of labour market research and innovative projects, Canada and Yukon will keep each other informed of their planned activities and initiatives in this area.

2.4 This Agreement shall replace the Canada-Yukon Labour Market Development Agreement dated January 24, 1998 (the “Co-Management LMDA”) effective the date, as determined under Article 3.1 of this Agreement, on which Yukon begins providing its Yukon benefits and measures. As of that date, the Co-Management LMDA is hereby revoked.

3.0 Yukon benefits and measures

3.1 As of February 1, 2010, or at such later time as may be agreed to jointly by the designated officials, Yukon will provide the Yukon benefits and measures described in Annex 1.

3.2 Starting in 2010 to 2011, for each fiscal year during which Yukon provides its Yukon benefits and measures, Yukon will provide Canada’s designated officials with a plan which sets out:

- (a) the labour market issues which Yukon intends to address during the coming fiscal year;

- (b) the array of Yukon benefits and measures to be offered during the coming fiscal year; and

- (c) the projected expenditures under each of the Yukon benefits and measures for the coming fiscal year.

In the case of the plan for fiscal year 2010 to 2011, it will be submitted no later than three months prior to April 1, 2010 or such later date on which Yukon begins providing its Yukon benefits and measures as may be agreed to under Article 3.1. For each subsequent fiscal year, the plan will be submitted no later than three months prior to the beginning of the fiscal year to which it relates.

3.3 Subject to Article 3.4 and to adherence to the requirement of similarity and consistency with the purpose and guidelines of Part II of the EI Act, Yukon may make ongoing modifications to the design of its Yukon benefits and measures to ensure responsiveness to client need, labour market conditions, and evaluation findings. Any modifications to the design of a Yukon benefit or Yukon measure shall be set out in an amendment to Annex 1.

3.4 Where any question arises as to whether a proposed modification to a Yukon benefit or Yukon measure affects its consistency with the guidelines and purpose of Part II of the EI Act, or its similarity to the employment benefits and support measures established under Part II of the EI Act, it will be referred to the designated officials for a determination.

3.5 Yukon will not require any minimum period of residency in Yukon on the part of an individual as a condition of access by that individual to assistance under a Yukon benefit or Yukon measure supported by Canada under this Agreement.

3.6 To facilitate the co-ordination of the provision of assistance to EI claimants by Yukon under Yukon benefits and measures with the payment by Canada of insurance benefits to those claimants by virtue of section 25 of Part I of the EI Act, the Commission pursuant to subsection 28(3) of Canada’s Department of Human Resources and Skills Development Act, hereby authorizes Yukon's Minister of Education to exercise the Commission's power to designate authorities in Yukon who may, for the purposes of section 25 of Canada’s EI Act, refer active EI claimants to:

- (a) courses or programs of instruction or training which the claimant is attending at his or her own expense, or under Yukon benefits;

- (b) or any other employment activity for which assistance has been provided for the claimant under a Yukon benefit which is similar to the Commission's Job Creation Partnerships Benefit or Self-Employment Benefit.

3.7 Yukon will give thirty days advance notice to Canada of its intention to designate a referral authority for the purposes of section 25 of the EI Act in order that Canada may make the necessary administrative arrangements with the referral authority to ensure timely and proper payment of insurance benefits to the referred Active EI Claimants under section 25 of the EI Act.

3.8 Authorities designated by Yukon may include staff of its Department of Education, other Yukon government ministries or agencies, corporations of the Government of Yukon, as well as third parties in Yukon.

4.0 Delegation of authority to Yukon with respect to the National Employment Service Function and Co-operation on Labour Market Information

4.1 Canada hereby authorizes Yukon to carry out and perform the function of the National Employment Service described in section 2 of Annex 2 entitled "National Employment Service Function and Cooperation on Labour Market Information".

4.2 Canada and Yukon will cooperate in accordance with section 3 of Annex 2 in establishing formal links between the parties to facilitate and coordinate the operation of local, territorial and national labour exchange systems and the production and dissemination of local, territorial and national labour market information.

5.0 Service to clients

5.1 The parties agree that in the administration of Yukon benefits and measures and in carrying out the function of the National Employment Service, Yukon will be guided, subject to its service delivery model, by the following principles on service to clients:

- (a) citizen-centered services which facilitate ease of access for a broad range of client groups;

- (b) respectful and individual service;

- (c) provision of an array of integrated labour market services which are flexible, innovative and responsive to the changing labour market; and

- (d) measurable results within a well-defined framework of accountability.

5.2 Yukon agrees to:

- (a) provide access to assistance under its Yukon benefits and measures, and

- (b) carry out the function of the National Employment Service delegated to it under Article 4,

in either of Canada’s official languages where there is a significant demand for the provision of the assistance, or the performance of that function, in that language.

5.3 In determining the circumstances where there would be considered to be a "significant demand" for the provision of assistance or performance of the function referred to in Article 5.2 in either official language, Yukon agrees to use as a guideline the criteria for determining what constitutes ”significant demand“ for communications with, and services from, an office of a federal institution, as set out in the Official Languages (Communications with and Services to the Public) Regulations made pursuant to Canada's Official Languages Act.

5.4 Yukon agrees to consult with representatives of the official language minority communities in Yukon on the provision of its Yukon benefits and measures under this Agreement.

5.5 Canada and Yukon will establish mechanisms for dealing with representations or enquiries made by Members of Parliament or Members of the Legislative Assembly of Yukon on behalf of constituents who have sought their assistance in resolving a problem or obtaining information in relation to obtaining assistance under the Yukon benefits and measures, to ensure that the reply to the representations or enquiries is directed to the appropriate party and that the confidentiality and privacy requirements of the respective parties’ privacy legislation or policies are respected.

6.0 Delivery arrangements

6.1 Yukon will create and deliver a full range of locally-responsive, accessible, cost-effective, integrated and citizen-centered labour market programs and services to meet the needs of the people of Yukon.

6.2 Canada and Yukon agree that the only service delivery site in Yukon will be in Whitehorse, in accordance with the service delivery arrangements set out in Annex 3.

6.3 Canada and Yukon agree to work together to coordinate the delivery of their respective labour market programs and services, with the aim of providing an integrated approach that will improve service delivery for Yukoners.

7.0 Transitional arrangements

7.1 Immediately upon signing of this Agreement the parties will form a Transition Committee. The Transition Committee will remain in place for the Transition Period.

7.2 The Transition Committee will meet as required and be composed of an equal number of representatives of Canada and Yukon and include representatives for Canada from the Department of Human Resources and Skills Development and Service Canada and for Yukon from the Department of Education. The Transition Committee will be co-chaired by the Regional Executive Head for Service Canada responsible for Yukon, or his or her designate, or by such other representative of Canada as may be designated to serve as the Canada co-chair by the Minister of Human Resources and Skills Development, and the Assistant Deputy Minister of Advanced Education or his or her designate. Other members may be appointed by each co-chair, as appropriate.

7.3 The Transition Committee will undertake activities to ensure a smooth transition from Canada's delivery of its employment benefits and support measures to the delivery of the Yukon benefits and measures by Yukon. The Transition Committee will:

- (a) be a forum for keeping Yukon regularly informed about Canada’s plans for entering into financial commitments referred to in Article 7.4 during the Transition Period, for discussing those plans, and for Canada to consider the interests and views of Yukon regarding those plans;

- (b) establish an implementation plan including details regarding the transfer of financial, human and material resources; and

- (c) ensure that financial management and reporting systems and processes are in place to ensure that funding commitments made by Canada during the Transition period do not create funding pressures for Yukon once Yukon begins providing its Yukon benefits and measures.

7.4 Canada and Yukon are committed to maintaining continuity of service to individuals and organizations. In support of this commitment, both parties agree, from the date of the signing of this Agreement and up to and including January 31, 2010, that Canada may extend or renew financial assistance agreements under its employment benefits and support measures that terminate during this period, or enter into new agreements, for a period not to exceed three (3) years.

7.5 Yukon agrees to honour all financial assistance agreements referred to in Article 7.4 that Canada has signed with recipients which terminate after the date on which Yukon begins providing its Yukon benefits and measures, as determined under Article 3.1, by accepting an assignment of those agreements from Canada. Canada and Yukon agree to enter into an assignment agreement under which Yukon will assume all Canada’s rights and outstanding obligations under those agreements.

7.6 It is understood and agreed that Canada shall not provide any additional funding to Yukon to discharge any financial obligations accruing to recipients after the date on which Yukon begins providing its Yukon benefits and measures, as determined under Article 3.1, under funding agreements assigned to Yukon. Yukon shall utilize the funding provided by Canada referred to in Article 14.2 to discharge the financial commitments to recipients under such agreements.

7.7 The parties acknowledge that other arrangements to ensure continuity of client service during the transfer of responsibilities under this Agreement may be necessary and that other agreements to address transitional issues may be necessary.

8.0 Indicators for measuring results of Yukon benefits and measures and annual results targets and reporting

8.1 Canada and Yukon agree to:

- (a) use the results indicators set out in Annex 4, entitled "Indicators for measuring results of Yukon benefits and measures and annual results targets and reporting", for measuring the results of the Yukon benefits and measures,

- (b) set annual results targets for the results indicators in accordance with Annex 4, and

- (c) track and report on the annual results in accordance with Annex 4.

9.0 Year 2 review and evaluations

Year 2 review

9.1 Canada and Yukon agree to design and conduct a joint Year 2 Review of the implementation of this Agreement. The Year 2 Review will be conducted in fiscal year 2011 to 2012 and completed in 2012 to 2013. The purpose of the Year 2 Review will be to:

- (a) ensure that the Parties are properly implementing the provisions of this Agreement, including but not limited to:

- transition and implementation (progress towards full implementation and Employee Transfer Agreement);

- governance;

- priorities, plans, results, budgets;

- data collection and reporting (including administrative data systems and data sources);

- communications (both internal and external);

- provisions relating to funding;

- implementation of the performance measurement framework;

- development of an evaluation framework;

- other provisions of this Agreement, including monitoring and accountability;

and

- (b) inform potential improvements to this Agreement.

Evaluation

9.2 Canada and Yukon recognize the importance of evaluating the Yukon benefits and measures in order to determine their impacts and outcomes. Yukon agrees, therefore, to carry out periodic evaluations of the Yukon benefits and measures. The first impact evaluation will be conducted three to five years after implementation and subsequent evaluations will be conducted regularly, on a three-to-five year basis, as determined by the Joint Management Committee.

9.3 Yukon will advise Canada by notice in writing delivered on or before April 1, 2011, that Yukon has selected that either:

- (a) Articles 9.4 and 9.5 inclusive (“Option 1”), or

- (b) Articles 9.6, 9.7 and 9.8 inclusive (“Option 2”)

shall apply to, and form part of, this Agreement and upon delivery of such notice, those articles so selected shall apply to and form part of this Agreement.

Option 1

9.4 Yukon may carry out the periodic evaluations on its own. Where this option is selected, Yukon agrees that in carrying out each evaluation it will:

- a) develop an evaluation framework that adheres to commonly accepted evaluation practices and methodologies;

- b) submit the evaluation design or framework for review and recommendations by an independent third party external evaluator;

- c) before the evaluation is conducted, share the framework with Canada for review at the Joint Management Committee;

- d) after the findings are obtained, submit the evaluation report to an independent third party external evaluator for review before it is finalized; and

- e) provide a copy of the evaluation report to Canada for review at the Joint Management Committee.

9.5 Where this option is selected, the cost of the evaluations will be the sole responsibility of Yukon.

Option 2

9.6 Yukon may carry out the periodic evaluations jointly with Canada. Where this option is selected, the Joint Management Committee will establish a Joint Evaluation Sub-Committee comprised of equal representation from Canada and Yukon. One member from Canada and one member from Yukon will act as co-chairs.

9.7 For each evaluation, the Joint Evaluation Sub-Committee will:

- a) oversee the development of an evaluation framework that adheres to commonly accepted evaluation practices and methodologies;

- b) submit the evaluation design or framework for review and recommendations by an independent third party external evaluator;

- c) approve the evaluation framework;

- d) undertake joint assessment and approval of a Request for Proposals and the winning bid (HRSDC to sign contract for the evaluation);

- e) oversee the conduct of the evaluation according to the plan laid out in the framework;

- f) after the findings are obtained, submit the evaluation report to an independent third party external evaluator for review before it is finalized;

- g) approve the evaluation report; and

- h) provide a copy of the evaluation report to Canada and Yukon.

9.8 Where this option is selected, the costs for the joint impact evaluations will be borne by Canada.

10.0 Information and data sharing

10.1 For the purpose of implementing this Agreement, Canada and Yukon agree to exchange information in accordance with the arrangements specified in Annex 5 to this Agreement entitled, "Canada-Yukon exchange of information and data sharing arrangements".

10.2 Without limiting the generality of the foregoing, Canada and Yukon agree that the development and linking of electronic on-line systems that maintain client information data is an essential tool for effective and efficient case management for clients accessing Yukon benefits and measures.

11.0 Monitoring and assessment report

11.1 Canada will:

- (a) monitor and assess the effectiveness of the assistance provided by Yukon under the Yukon benefits and measures funded under this Agreement and of the assistance provided by other provinces and territories under benefits and measures provided by them with funding from Canada under similar Labour Market Development Agreements, and

- (b) prepare an annual monitoring and assessment report which the Minister of Human Resources and Skills Development shall make public by tabling it in Parliament each year

12.0 Employment insurance program integrity

12.1 As Canada may be providing insurance benefits under Part I of the EI Act to active EI claimants while they are participating under the Yukon benefits and measures, Canada and Yukon will cooperate with each other in developing measures for detecting and controlling abuse and in determining how and by whom these measures should be carried out.

13.0 Transfer of federal employees to Yukon

13.1 Yukon agrees to make offers of employment to those indeterminate employees of Canada who are affected by Canada’s withdrawal from the delivery of its employment benefits and support measures in Yukon and by Yukon's decision to expand its role in the design and delivery of labour market programs through the implementation of the Yukon benefits and measures.

13.2 Yukon undertakes that its offer to each indeterminate employee will meet the requirements of a Reasonable Job Offer (Type 2) within the meaning of Part VII of the Work Force Adjustment Directive (WFAD) that is applicable to the indeterminate employee, with the exception that each transferring employee will be granted an employment guarantee for a period of three years.

13.3 Details with respect to the conditions of employment to be offered to the affected indeterminate employees will be embodied in an Employee Transfer Agreement (ETA) to be entered into by the parties by July 15, 2009. Upon signing of the ETA, it will be appended as Annex 6 to this Agreement.

13.4 Yukon acknowledges and agrees that the amount of Canada's contributions referred to in Article 14 of this Agreement towards Yukon's administration costs is contingent upon offers of employment being made to those employees affected by this Agreement, and on the offers meeting the requirements of a “reasonable job offer” within the meaning of Part VII of Canada's WFADs applicable to the employees.

13.5 Canada agrees that every vacant position within Canada's affected employee group at such time as may be agreed upon by the parties in the Employee Transfer Agreement will be included in the calculation of the number of affected employees to whom Yukon will be considered to have made an offer of employment and who will be considered to have accepted the offer.

14.0 Financial arrangements and contribution towards costs

14.1 Canada and Yukon agree that, subject to the financial limitation set out in section 78 of the EI Act, the financial arrangements between them will be as set out in the provisions below.

Contribution towards the costs of Yukon benefits and measures

14.2 Canada, through the Commission, agrees to make annual contributions to Yukon pursuant to section 63 of the EI Act towards the costs of Yukon benefits and measures in accordance with Articles 14.3 to 14.5 below.

14.3 The amounts payable for fiscal year 2009 to 2010 and fiscal year 2010 to 2011 will be determined in accordance with the allocation methodology established by Canada for allocating among provinces or territories the funding approved each year by Canada’s Treasury Board for expenditures under Part II of the EI Act. The currently projected maximum amount of Canada's contribution towards the costs of Yukon benefits and measures for each of those fiscal years is estimated to be:

- Fiscal year 2009 to 2010: $3.635M (partial year funding), and

- Fiscal year 2010 to 2011: $3.564M

14.4 For greater certainty, the annual contribution amounts referred to in Article 14 do not include insurance benefits payable by the Commission to Active EI Claimants under Part I of the EI Act (by virtue of section 25 of the EI Act) while participating in training and other employment activities under Yukon Benefits.

14.5 For each fiscal year after fiscal year 2010 to 2011 during the term of this Agreement, the parties will review Canada’s contribution towards the costs of the Yukon benefits and measures. In conducting the annual reviews, Canada undertakes to provide Yukon with a three-year projection of Canada’s annual allocation which is based on current trends, but which is subject to change. The agreed amount of Canada's contribution towards the costs of the Yukon benefits and measures for each fiscal year will then be specified in the Annual annex for that fiscal year.

14.6 Notwithstanding anything in Article 14.3, in each of fiscal years 2009 to 2010 and 2010 to 2011, Canada agrees to increase the maximum contribution payable under Article 14 towards the costs of Yukon benefits and measures by an amount not exceeding the amount, rounded to the nearest thousand, determined by the formula

- C x (A/B)

- where

C is $500 million;

A is the average number of unemployed persons in Yukon calculated by averaging,

- (a) for fiscal year 2009 to 2010, the number of unemployed persons in Yukon each month during the months of August 2008 to, and including January 2009 as determined by Statistics Canada Labour Force Survey data for those months; and

- (b) for fiscal year 2010 to 2011, the number of unemployed persons in Yukon each month during the months of August 2009 to, and including January 2010, as determined by Statistics Canada Labour Force Survey data for those months; and

B is the average of the total number of unemployed persons in Canada calculated by averaging,

- (a) for fiscal year 2009 to 2010, the total number of unemployed persons in Canada in each month during the months of August 2008 to, and including, January 2009, as determined by Statistics Canada Labour Force Survey data for those months, and

- (b) for fiscal year 2010 to 2011, the total number of unemployed persons in Canada each month during the months of August 2009 to, and including, January 2010, as determined by Statistics Canada Labour Force Survey data for those months.

Contribution towards Yukon’s administration costs

14.7 In addition to the annual contribution towards the costs of the Yukon benefits and measures, Canada, through the Commission, agrees to make an annual contribution to Yukon towards the administration costs incurred by Yukon in each fiscal year during the Period of the Agreement.

14.8 Subject to Articles 14.10 and 14.11, the amount of the maximum annual contribution towards Yukon’s administration costs will be an amount determined in accordance with the methodology described in the letter of September 25, 1996 from Canada's Deputy Minister of Human Resources Development to Yukon’s Deputy Minister of Education.

14.9 The maximum amount payable by Canada in the annual contribution towards Yukon’s administration costs determined under Article 14.8 in each fiscal year is $389,000.

14.10 The maximum amount of the contribution in respect of Yukon’s administration costs, as determined under Article 14.8, that is payable in any fiscal year falling within the three-year period following the date of transfer of federal employees to Yukon shall be reduced if there is any reduction in the amount of the normal salary, as set out in the Employee Transfer Agreement, paid to those employees in that fiscal year. The amount of the reduction in the contribution for the fiscal year in question shall be an amount equal to the aggregate of the reduction in the agreed normal salaries payable to the transferred employees.

14.11 The maximum amount payable under Article 14.9 may be increased by an amount equal to savings in accommodation costs in relation to federal employees actually transferred to Yukon as federal leases become renewed following the transfer. Funds will be made available to Yukon as leases become renewed following a transfer or as otherwise jointly agreed to by the designated officials. The additional amount payable by Canada will not exceed $64,000 in each fiscal year.

15.0 Transfer of assets

15.1 Canada and Yukon will develop an inventory of assets to be transferred for no consideration to Yukon. The assets to be transferred to Yukon will be related to the extent of labour market development responsibilities assumed by Yukon and the number of Canada's employees transferred to Yukon.

15.2 The timetable for the transfer of assets will be established by the Transition Committee. No transfer will occur prior to the signing of the Employee Transfer Agreement referred to in Article 13.

16.0 Payment procedures

16.1 As of February 1, 2010, or on such later date as jointly agreed by the designated officials on which Yukon begins implementation of the Yukon benefits and measures, Canada will make advance payments of its annual contribution towards the costs of Yukon benefits and measures. The advances will be made on a monthly basis and will be based upon a forecast of cash flow requirements furnished by Yukon. Yukon agrees to update the forecast on a quarterly basis.

16.2 As of February 1, 2010, or on such later date as is jointly agreed by the designated officials on which Yukon begins implementation of its Yukon benefits and measures, Canada will make equal monthly installments of its annual contribution, towards the administration costs incurred by Yukon.

17.0 Annual annex

17.1 Prior to the commencement of the implementation by Yukon of its Yukon benefits and measures, and prior to the beginning of each fiscal year thereafter during the term of this Agreement, Canada and Yukon agree to set out in an Annual annex to this Agreement the following:

- (a) the agreed annual targets for the fiscal year for the results indicators referred to in Annex 4;

- (b) the three-year projection referred to in Article 14.5 of Canada's maximum annual contributions towards the costs of the Yukon benefits and measures; and

- (c) the actual amount of Canada’s contribution towards the costs of Yukon benefits and measures for the coming fiscal year.

17.2 The designated officials are authorized to sign the Annual annexes on behalf of their respective party.

18.0 Financial accountability

18.1 For fiscal year 2009 to 2010, and for each fiscal year thereafter during the term of this Agreement, Yukon will submit to Canada a report containing:

- (a) an audited financial statement prepared in accordance with generally accepted accounting principles and practices and in a form prescribed by Canada, and certified by an independent auditor selected by the Yukon Government, setting out the amount of the costs of Yukon benefits and measures that Yukon has actually incurred in that fiscal year in respect of each of the Yukon benefits and measures; and

- (b) a statement from an independent auditor selected by the Yukon Government certifying that all payments received from Canada in the fiscal year on account of Canada's contribution to its administration costs were paid in respect of administration costs actually incurred in that fiscal year.

18.2 Yukon will submit the report no later than three months after the end of the fiscal year to which it relates.

19.0 Overpayment and lapsing funds

19.1 If payments made to Yukon under this Agreement exceed the amounts to which Yukon is entitled, the amount of such excess is a debt owing to Canada and will be repaid to Canada upon receipt of notice to repay.

19.2 Any unutilized contribution for a given fiscal year will lapse.

20.0 Public information

20.1 Yukon and Canada agree on the importance of ensuring that the public is informed of their respective roles and, in particular, the financial contribution of Canada and the responsibility of Yukon with regard to the administration of Yukon benefits and measures under this Agreement.

20.2 Yukon agrees to acknowledge Canada’s support of the Yukon benefits and measures in signage, public announcements, program descriptions and correspondence, and public reports on the Yukon benefits and measures.

20.3 Canada and Yukon agree to cooperate to provide opportunities for announcements, ceremonies, celebrations, and releases of reports to allow representatives of Canada and Yukon to clearly articulate the role of each government in supporting the Yukon benefits and measures. Canada and Yukon will jointly prepare public information material and jointly organize and participate in any public announcement relating to the signing of this Agreement and of any agreements referred to in the annexes that are to be signed in the future.

20.4 Yukon will ensure that cheques or deposit statements for EI clients receiving assistance under its Yukon benefits and measures either directly from Yukon or through an organization receiving funding from Yukon, will include the Government of Canada word mark.

20.5 The parties agree to give each other reasonable advance notice of any major public relations initiatives to inform Canadians of activities being undertaken in the context of this Agreement.

21.0 Designated officials

21.1 Upon signing this Agreement, each party will provide to the other the name of its designated official. Either party may, from time to time, upon written notice to the other designate a new designated official in replacement of an existing designated official.

21.2 Designated officials, or their designates, will meet as required to resolve issues that emerge from the Agreement.

22.0 Joint Management Committee

22.1 Canada and Yukon agree to establish a Joint Management Committee for an indeterminate period when Yukon assumes responsibility for providing the Yukon benefits and measures set out in the Agreement.

22.2 The Joint Management Committee will meet at least twice annually or as agreed.

22.3 The Joint Management Committee will be composed of representatives of Yukon and Canada and will be co-chaired by both of the parties. Specific representation is to be determined by each of the parties. Decisions of the Joint Management Committee will be by consensus. If consensus cannot be reached, then the issue(s) will be referred to the appropriate Deputy Ministers for both of the parties. If the issue cannot be resolved by the Deputies, it shall be referred to the appropriate Ministers for both of the parties to be resolved.

22.4 The Joint Management Committee will meet as required and be responsible for:

- (a) providing direction to resolve issues arising from the management of the Agreement;

- (b) overseeing the preparation of the Annual annexes to the Agreement, including annual results targets as described in Article 8;

- (c) overseeing Year 2 Review and evaluation responsibilities outlined in Article 9.0;

- (d) discussing and reviewing Yukon’s annual plan;

- (e) maintaining linkages with the planning processes under any other Canada-Yukon Labour Market Agreement;

- (f) in accordance with Article 12 of the Agreement, developing measures for detecting and controlling abuse and determining how and by whom these measures should be carried out;

- (g) sharing views on labour market programs and policies as well as broader developments in the labour market; and

- (h) carrying out such other responsibilities as the designated officials may jointly assign to it.

23.0 Term of agreement

23.1 This Agreement will remain in force until terminated in accordance with Article 24.

24.0 Termination

24.1 After completion of the Year 2 Review under Article 9.1, either party can terminate the Agreement at any time by two fiscal years’ written notice of intention to terminate to the other party.

24.2 In the event of termination of this Agreement, Canada and Yukon agree that they will work together to ensure that services to clients will not be unduly affected or interrupted by the termination.

25.0 Amendment

25.1 This Agreement may be amended at any time with the mutual consent of the parties. To be valid, every amendment must be in writing and signed, in the case of Canada, by Canada's Minister of Human Resources and Skills Development and the Commission, and in the case of Yukon, by the Minister of Education, or by their authorized representatives.

25.2 Notwithstanding Article 25.1, an amendment to any annex to this Agreement may be signed by the designated officials of the parties.

26.0 Equality of treatment

26.1 During the term of this Agreement, if a province or territory other than Yukon negotiates an agreement (or any amendment to such an agreement) with Canada based on Canada’s May 30, 1996 proposal, and any provision of, or omission from, that agreement (or amendment) is more favourable to that province or territory than what was negotiated with Yukon, Canada agrees to amend this Agreement upon the request of Yukon in order to afford similar treatment to Yukon. The amendment shall be retroactive to the date on which the Agreement, or amendment to such an Agreement, with the other province or territory comes into force.

27.0 General

27.1 No member of the House of Commons or Member of the Legislative Assembly of Yukon will be admitted to any share or part of this Agreement or to any benefit arising therefrom.

28.0 Effective date

28.1 This Agreement will be effective when signed by both parties

Signed on behalf of Canada by the Minister of Human Resources and Skills Development and the Canada Employment Insurance Commission.

at Gatineau this 8th day of July, 2009

______________

Witness

______________

The Honourable Diane Finley

Minister of Human Resources and Skills Development

______________

Witness

______________

Janice Charette

Chairperson

Canada Employment Insurance Commission

Signed on behalf of Yukon by the Minister of Education, at Whitehorse this 23rd day of June, 2009

______________

Witness

______________

The Honourable Patrick Rouble, MLA

Minister of Education

Annex 1 - Description of Yukon benefits and measures

1.0 Purpose

1.1 The purpose of this Annex to the Canada-Yukon Labour Market Development Agreement (“LMDA”) is to describe the programs and services, also referred to as benefits and measures that will be provided by Yukon.

2.0 Objectives

2.1 The objective of Yukon benefits and measures is to assist individuals to prepare for, obtain, and maintain employment and to reduce their dependency on government forms of income support including EI benefits and social assistance.

2.2 In support of this objective and the objective of eliminating overlap and duplication, Yukon intends to incorporate the following design features:

- (a) harmonization with territorial employment initiatives to ensure that there is no unnecessary overlap or duplication;

- (b) flexible and broad array of client centred services, supports and benefits to participants;

- (c) reduction of dependency on unemployment benefits by helping individuals obtain or keep employment;

- (d) co-operation and partnership with other governments, employers, community-based organizations and other interested organizations;

- (e) flexibility to allow decisions to be made at a local level;

- (f) availability of assistance under the benefits and measures in either official language where there is significant demand for that assistance in that language;

- (g) commitment by persons receiving assistance under the benefits and measures to

- (i) achieving the goals of the assistance,

- (ii) taking primary responsibility for identifying their employment needs and locating services necessary to allow them to meet those needs, and

- (iii) if appropriate, sharing the cost of the assistance; and

- (h) implementation of the benefits and measures within a framework for evaluating their success in assisting persons to obtain or keep employment.

2.3 Yukon will be responsible for selecting priority clients for Yukon benefits and measures but only EI clients will be given access to Yukon Benefits funded under this Agreement.

3.0 Yukon benefits

Yukon will provide a broad range of services to enable EI clients to obtain employment.

3.1 Employment services

Employment services will be made available to encourage employers to hire to the fullest extent possible, EI clients who are at risk of extended periods of unemployment and/or provide participants with short-term work experience to help them acquire skills needed by local employers. Benefits will be used to provide:

Employment services – Wage subsidy component:

- (a) Support training on the job and work placement activities which could include targeted wage subsidies, work tools or equipment, short-term training and other employment related supports.

Employment services – Work experience component

- (b) Develop employment partnerships with employers and community groups that provide meaningful work experience opportunities for EI clients and may also help develop the community and local economy.

3.2 Self-employment assistance

Yukon will provide self-employment services to assist EI clients to start businesses and become self-employed. Services may include entrepreneurship training, individualized coaching and client supports.

3.3 Skills development

Yukon will implement a benefit for the education and training of EI clients so they can obtain the skills necessary for employment. This benefit will include the costs ordinarily paid by Yukon over and above the amounts recovered through tuition fees, with respect to each EI client receiving financial assistance under Skills Development and attending a publicly funded training institution.

3.4 Earnings supplement

Yukon will provide, or assist third party organizations with providing temporary earnings supplements to encourage clients to accept employment.

4.0 Yukon measures

4.1 Employment assistance services

Employment assistance services will be used to help clients to obtain employment. Services may include needs determination, employment counseling, job search training and provision of labour market information.

Yukon will provide services to meet the needs of specific client groups and local communities through a service delivery network that is further described in Annex 3.

Employment assistance services will be available to unemployed persons and job seekers.

4.2 Labour market partnerships

Through work with employer and employee groups, sectoral associations and other partners, Yukon will facilitate labour market activities that promote labour force development, workforce adjustment and effective human resources planning.

It is understood that Labour market partnerships may be used to provide assistance for employed persons who are facing becoming unemployed.

4.3 Research and innovation

Yukon will develop a territorial measure to support research, planning and innovative activities that address the needs of those in the Yukon labour market.

Annex 2 - National Employment Service Function and Co-operation on Labour Market Information

1.0 Purpose

The purpose of this Annex is to set out the National Employment Service (NES) function delegated to Yukon by the Canada Employment Insurance Commission.

2.0 Delegation of labour exchange function

2.1 Yukon shall maintain labour exchange in a manner that allows universal access by all clients and to the timely transfer of information to the national labour exchange system as the parties to the agreement agree to be appropriate.

3.0 Cooperation on Labour Market Information

3.1 Canada and Yukon agree to the preparation of a joint labour market information strategy which will set out how each party will cooperate in gathering, analyzing, producing, disseminating and using local, territorial and national labour market information to support economic progress.

3.2 In the joint Strategy, Canada and Yukon agree to clarify their respective roles and responsibilities, to encourage partnerships and ensure complementarity such that there is no unnecessary overlap and duplication.

3.3 Canada is responsible for the National Labour Market Information System, including the National Labour Market Information (LMI) System with which it will produce and disseminate labour market information and products connected with proper management of the Employment Insurance Account, entitlement to and continuation of EI benefits, and information for Employment Insurance users, as well as those required for the planning and delivery of HRSDC activities relating to this Agreement.

3.4 Yukon will be responsible for producing local, regional and territorial labour market information needed to assume the responsibilities conferred on it in this Agreement, as well as disseminating within Yukon, labour market information relating to the implementation of this Agreement and participating in and maintaining a link with the National Labour Market Information System.

3.5 Local, regional, territorial and national labour market information may include:

- a) occupational profiles and forecasts;

- b) community profiles;

- c) demographic and labour force profiles and forecasts;

- d) industrial/sectoral profiles and forecasts;

- e) wage and salary data;

- f) conditions of employment;

- g) vacancy and employment opportunities;

- h) labour market reviews and trends;

- i) occupational demand and skill shortage lists;

- j) potential employer lists;

- k) lists of training providers and available courses;

- l) major project updates;

- m) career resource planning tools; and

- n) work search tools.

Annex 3 - Delivery arrangements for Yukon benefits and measures

Service delivery principles

Yukon will be guided by the following principles on service to clients:

- a. Citizen centered services

- b. Respectful and individual service

- c. An array of integrated labour market services which are flexible, innovative and responsive to Yukon’s changing labour market

- d. Measurable results within a well-defined framework of accountability

Service delivery approach

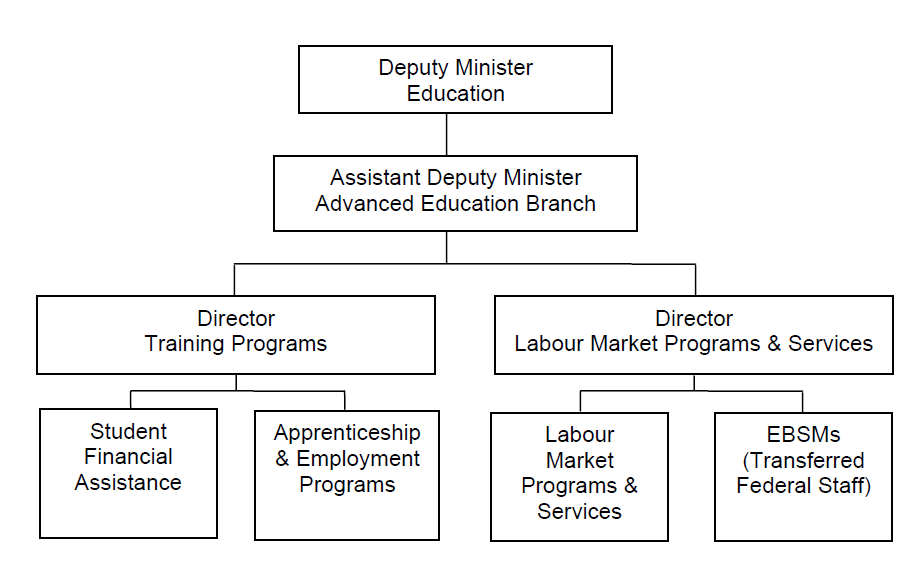

Upon the date of implementing the Labour Market Development Agreement, the Department of Education, Advanced Education branch will assume lead responsibility for delivery of EI Part II Programming and will incorporate transferring federal staff into the Department. Transferred staff will report to the Director, Labour Market Programs and Services. The following organizational chart explains the anticipated reporting relationship:

Service delivery of the employment benefits and support measures under the LDMA will be supported primarily through the Whitehorse-based office due to the small sizes, unique labour markets, geographic locations and limited need for services in rural Yukon communities. Travel to rural communities will occur on a regular and as needed basis to support rural community organizations and/or individuals. Information will also be maintained through printed materials and through the Government of Yukon’s website.

Employment benefits and support measures will be administered directly by program staff or through a third party where appropriate. The Yukon Government’s Financial Administration Act and General Administration Manual set the standards for review and approval processes for appropriation of funds by the Yukon Government.

Annex 4 - Indicators for measuring results of Yukon benefits and measures and annual results targets and reporting

1.0 Purpose

The purpose of this Annex is to set out the agreement of the parties on the indicators to be used for measuring the results of the Yukon benefits and measures, the annual results target-setting process, and annual results reporting.

2.0 Results measurement indicators

2.1 Canada and Yukon agree that the following indicators are to be used in measuring the results of the Yukon benefits and measures:

- (a) the number of active EI claimants who have accessed Yukon benefits and measures;

- (b) the number of EI clients returned to employment; and

- (c) savings to the Employment Insurance account.

3.0 Annual targets and target-setting

3.1 Canada and Yukon agree that the annual targets for the three results indicators will be mutually agreed to and be based upon historical data, socio-economic and labour market context, local or regional priorities, the characteristics or requirements of clients, and the funds available for the Yukon benefits and measures. Canada and Yukon agree that the results targets for the first fiscal year of implementation of the Yukon benefits and measures will be soft targets.

3.2 The results targets for each fiscal year will be set out in the Annual annex for that fiscal year.

4.0 Reporting of results

4.1 Canada and Yukon agree that the results indicators will be tracked and reported to Canada on a quarterly basis. Yukon will provide to the Regional Executive Head, Service Canada responsible for Yukon, the following Year-to-Date (YTD) information:

- (a) Percentage of EI clients involved in Yukon benefits who are active EI claimants;

- (b) Number of EI clients and the number of active EI claimants who are employed or self-employed, broken down by Yukon benefit and the average cost. EI clients, including active EI claimants, are considered as employed if they:

- (i) have drawn 25 percent or less of their Employment Insurance entitlement for twelve consecutive weeks (applies to active EI claimants who return to employment twelve weeks or more before the end of their benefit period); or,

- (ii) draw 25 percent or less of their Employment Insurance entitlement in all their remaining weeks on benefits (applies to active EI claimants who return to employment less than twelve weeks before the end of their benefit period); or,

- (iii) are recorded as employed at the completion of their intervention(s) (applies to EI clients who return to employment after the end of their benefit period or who were not active EI claimants); or,

- (iv) are employed when contacted twelve weeks after the completion of their intervention(s) (applies to insured participants who return to employment after the end of their benefit period or who were not active EI claimants);

- (c) Year-to-Date savings to the Employment Insurance Account as a result of active EI claimants becoming employed before making a full draw on their insurance entitlement (Part I insurance benefit entitlement minus actual Part I payout); and

- (d) the number of EI clients and the number of active EI claimants who have completed their intervention, broken down by type and average cost per intervention, as well as the number of active EI claimants who have yet to complete their intervention.

Annex 5 - Canada-Yukon exchange of information and data sharing arrangements

Amending Agreement #1 for Annex 5 of the Canada - Yukon Labour Market Development Agreement

Between

The Government of Canada (herein referred to as “Canada”), as represented by the Minister of Employment and Social Development, and the Canada Employment Insurance Commission

And

The Government of Yukon (herein referred to as “Yukon”), as represented by the Minister of Education

Whereas, Canada and Yukon entered into a Labour Market Development Agreement on July 8, 2009 (hereinafter referred to as the “LMDA”), in which Canada and Yukon agreed to certain arrangements relating to the provision of contributions by Canada pursuant to section 63 of the Employment Insurance Act to support the costs of benefits and measures (referred to in the LMDA as “Territorial Benefits and Measures”) provided by Yukon that are similar to Canada’s employment benefits and support measures and that are consistent with the purpose and guidelines of Part II of the Employment Insurance Act;

Whereas, Canada and Yukon wish to amend the information sharing arrangements provided for in section 10 and Annex 5 of the LMDA entitled “Canada-Yukon Exchange of Information and Data Sharing Arrangements”;

Whereas under section 25.2 of the LMDA, the designated officials of Canada and Yukon are authorized to sign amendments to any Annex to the LMDA;

Now, therefore, Canada and Yukon agree as follows:

- Annex 5 of the Canada-Yukon LMDA is hereby replaced in its entirety by the attached Annex 5, Canada-Yukon Exchange of Information and Data Sharing Arrangements, which shall be binding on the parties effective as of the date of signing of this Amending Agreement.

- The LMDA in all other respects shall remain the same.

Signed on behalf of Canada this ____ day of ___________, 2017.

______________

Witness

______________

Sylvie Bérubé

Assistant Deputy Minister

Western Canada and Territories Region

Service Canada

Signed on behalf of Yukon this ____ day of ___________, 2017.

______________

Witness

______________

Judy Arnold

Deputy Minister

Department of Education

1.0 Purpose

1.1 The purpose of this Annex to the Canada-Yukon Labour Market Development Agreement (LMDA) is to provide for the exchange of information, including “personal information” as defined in section 3 of Canada’s Privacy Act and section 3 of Yukon’s Access to Information and Protection of Privacy Act, and “information” as defined in subsection 30(1) of the Department of Employment and Social Development Act (DESD Act), between the parties. Personal information includes social insurance numbers.

2.0 Authorities

Canada’s authorities:

2.1 With respect to the information to be provided by Canada to Yukon under section 3 of this Annex, Canada confirms that it is authorized under subsection 34(1) of the DESD Act to provide such personal information to Yukon for the purposes set out in section 3. In this regard:

- (a) the personal information set out in section 3 consists of information obtained by the Canada Employment Insurance Commission or the Department of Employment and Social Development from persons under the Employment Insurance Act (EI Act), and of information prepared from such information;

- (b) subsection 34(1) of the DESD Act authorizes the disclosure of the aforementioned personal information to any person or body for the administration or enforcement of the program for which it was obtained or prepared; and

- (c) the personal information described in section 3 of this Annex will be disclosed to Yukon only for the purposes described herein.

2.2 With respect to the information to be collected by Canada from Yukon under section 4 of this Annex, Canada confirms that it is authorized under the EI Act to collect such personal information from Yukon for the purposes set out in section 4.

Yukon’s Authorities:

2.3 With respect to the personal information to be provided by Yukon to Canada under section 4 of this Annex, Yukon confirms that it is authorized under section 36 (b), (c), (d) and (f) of Yukon’s Access to Information and Protection of Privacy Act to provide such information to Canada for the purposes set out in section 4.

2.4 With respect to the information to be collected by Yukon from Canada under section 3 of this Annex, Yukon confirms that it is authorized under the FOIP Act to collect such personal information from Canada for the purposes set out in section 3.

3.0 Information to be provided by Canada to Yukon

3.1 Canada will provide to Yukon, when requested by Yukon, on a per individual basis, the following personal information under its control from an individual’s file for the purposes of:

- (a) assisting Yukon in establishing and verifying if the individual qualifies as an EI client who is not an active EI claimant (i.e. who qualifies as a former EI claimant) and is therefore eligible for, or entitled to, assistance under Yukon’s programs:

- name

- social insurance number

- address

- postal code

- telephone number

- date of birth

- federal office code – if available

- gender

- language (French or English)

- EI client status, with explanatory messages

- Provincial/Territorial Parental Benefits (P/TPB), if applicable, with explanatory messages

- identification if on an intervention, with explanatory messages; and

- (b) in respect of an individual, who has been determined to be an active EI claimant who is eligible for, or entitled to, assistance under Yukon’s programs, assisting Yukon in determining the nature and level of financial assistance to be provided to the EI client under Yukon’s programs:

- name

- social insurance number

- address

- postal code

- telephone number

- date of birth

- federal office code – if available

- gender

- language (French or English)

- EI client status, with explanatory messages

- P/TPB client status, if applicable, with explanatory messages

- identification if on an intervention, with explanatory messages

EI claim information:

- Benefit Period Commencement (BPC)

- type of EI benefit (claim type, e.g. regular, etc.)

- number of eligible weeks

- number of weeks paid (number of weeks paid in special benefits and number of weeks paid in regular benefits identified if on same claim)

- EI benefit rate – Part I

- federal tax deducted

- territorial tax deducted

- week of renewal

- latest renewable week

- last week processed

- expected end date of Part I

- apprenticeship (yes/no)

- apprenticeship waiting period waived (yes/no)

- stop payment – yes/no

- if yes – date of stop payment

- disentitlements, if applicable

- start date

- end date

- explanatory messages

- disqualifications, if applicable

- start date

- disqualification weeks remaining

- explanatory messages

- allocation of earnings

- start week

- end week

- allocation of earnings weekly amount

- amount of last week of allocation of earnings

Canada, may on its own initiative, provide to Yukon an update on all or any of the above information, for use by Yukon in reviewing, as needed, the purpose and amount of the financial assistance provided to the EI recipient by Yukon.

3.2 When Canada is unable to successfully process the information submitted by Yukon pursuant to section 4.2 of this Annex, regarding the referral by Yukon of an active EI claimant to a Yukon benefit, for purposes of sections 25 and 27 of the EI Act, Canada will provide to Yukon any or all of the following personal information under its control on the EI clients so referred, for use by Yukon in reviewing and/or modifying the information previously submitted to Canada:

- name

- social insurance number

- EI client status

- P/TPB client status

- federal office code – if available

- territorial office code – if available

- intervention type (e.g. training, job creation, self-employment)

- training ID (for training interventions)

- institution code (if available)

- apprentice indicator

- no claimant report code (for apprentices)

- start week(s)/date(s) of intervention

- end week(s)/date(s) of intervention

- intervention break start week/date

- intervention break end week/date

- agreement/file number

- rate (EI Part II)

- error code

- definition of error code

3.3 Canada will provide to Yukon on a monthly basis any or all of the following personal information under its control on all EI clients and non-EI clients who have received assistance from Yukon under Yukon programs, for use by Yukon for the review, analysis and verification of the data calculated/held by Canada for monitoring, assessment and reporting purposes. This information will be provided in a mutually agreed upon format.

3.3.1 Based on the monthly data files on EI clients and non-insured participants who are participating in Yukon programs funded with EI Part II monies, as provided by Yukon in section 4.3, the following personal information will be provided to Yukon by Canada in a return file to assist Yukon in reviewing and verifying Canada’s reporting of results on clients employed and unpaid benefits:

- social insurance number

- territorial office code

- EI client status

- Benefit Period Commencement (BPC)

- initial benefit entitlement weeks

- last week of entitlement

- benefit rate

- month code

- last week processed

- total weeks paid

- weeks paid sub-counter

- unpaid benefits

- training ID

- intervention code

- intervention start date

- intervention end date

- training/self-employment project start week

- training/self-employment project end week

- action plan ID

- action plan start date

- action plan result (case manager)action plan result week/date

- result week (calculated)

- apprenticeship client indicator

- group services type

- date of group session

- unit 143 – LMDA EI claimant who finds employment before the end of their entitlement period as a result of a Yukon program

- unit 144 – LMDA EI claimant who is recorded as employed after their entitlement period as a result of a Yukon program

- unit 145 – LMDA EI claimant who becomes employed before the end of their entitlement period as a result of a Yukon group service

- unit 146 – former LMDA EI claimant who becomes employed as a result of a Yukon program

- unit 152 – LMDA EI Part I unpaid benefits resulting from EI claimants employed before end of insurance entitlement period, as a result of a Yukon program (corresponds to unit 143 – non-TWS)

- unit 153 – LMDA EI Part I unpaid benefits resulting from EI claimants employed before end of insurance entitlement period as a result of a Yukon TWS intervention (wage subsidy - corresponds to unit 143 – TWS program)

- unit 154 – LMDA EI Part I unpaid benefits resulting from EI claimants employed before end of insurance entitlement period as a result of a Yukon group service (corresponds to unit 145)

3.4 Upon request, and based on the monthly data files on EI clients and non-insured participants who are participating in Yukon programs funded with EI Part II monies, as provided by Yukon in section 4.3, the following personal information will be provided to Yukon for the review and verification of Canada’s reporting of results. The personal information will be provided in two different data sets (by client and intervention):

- social insurance number

- age

- gender

- designated group indicators (persons with disabilities, members of visible minority groups, aboriginal peoples)

- territorial office code

- EI client type

- action plan ID

- action plan start date

- action plan end date

- action plan result

- action plan result date

- missing action plan indicator

- intervention code (type of intervention)

- intervention start date

- intervention end date

3.5 Canada will provide to Yukon, when requested by Yukon and based on the selection criteria identified by Yukon, on a per individual basis, any or all of the following personal information under Canada’s control from an individual’s file for the purpose of assisting Yukon in contacting EI applicants who may be interested in receiving assistance under the Yukon’s programs funded under this LMDA, in order to facilitate their return to work:

- name

- social insurance number

- address

- postal code

- telephone number

- email address (if available)

- gender

- date of birth

- official language of service (written)

- official language of service (spoken)

- federal office code associated with the client’s postal code

- territorial office/catchment code associated with the client’s postal code

- referral type (occupation in demand/job-ready or other)

- referral source (Appli-web, second referral)

- referral code and reason (i.e. the targeting criteria used to refer the client)

- National Occupational Classification (NOC) code for the most recent job

3.6 Upon request, Canada will provide to Yukon, the following personal information under its control, on all EI clients residing in Yukon who are active EI claimants and who are in receipt of regular or fishing benefits, to assist Yukon in the strategic planning of the delivery of its programs:

- postal code (first three digits)

- territorial office code, if available

- EI economic region

- age at benefit period commencement

- preferred official language (French or English)

- gender

- disability status (where available as self-identified information)

- visible minority (where available as self-identified information)

- aboriginal group (where available as self-identified information)

- education level (where available as self-identified information)

- EI claim status

- EI claim category (long-tenured worker, occasional claimant, frequent claimant)

- regular EI claimant without declared earnings – yes/no

- seasonal user

- weekly benefit rate

- number of entitlement weeks

- renewal week

- Benefit Period Commencement (BPC)

- first week of the last claimant’s report sent

- cut-off date (first insurable week)

- insured weeks/hours

- last week processed

- total number of weeks paid

- total benefits paid since the claim began

- last week worked

- insurable earnings

- National Occupational Classification (NOC) code of last job

- North American Industry Classification System (NAICS) code of last job

Any reports created by Yukon or Canada involving these data elements must be in cells of no less than 10.

3.7 Yukon understands that it cannot use any of the personal information received from Canada under this Annex for research or statistical purposes.

3.7.1 Should Yukon wish to receive from Canada personal information for research and/or statistical purposes, Canada will assess each request on a case-by-case basis. Canada may make personal information available to Yukon for research and/or statistical purposes upon being satisfied that the conditions set out in section 38 of the DESD Act are met. The information to be shared would be the subject of a separate information-sharing agreement.

3.8 For the purposes of detecting overpayments of financial assistance due to error, misrepresentation or fraud in relation to an individual or individuals receiving, or who have received, assistance from Yukon under Yukon programs funded under this LMDA, Canada will provide to Yukon where available and upon written request, on a per individual basis, any or all of the following personal information under its control about an individual:

- name

- social insurance number

- birth date

- address

- postal code

- telephone number

- type of benefits

- Benefit Period Commencement (BPC)

- waiting period weeks (in week code)

- gross weekly benefit rate (excluding the family supplement)

- net weekly benefit rate (excluding the family supplement)

- claim termination date

- number of entitlement weeks

- last week processed (in week code)

- weeks paid (in week code)

- payment indicator for each of the declarations referenced

- name and address of employer who issued the last record of employment used to establish the EI claim during which the client began participation in a Yukon intervention

- NOC code of last job

- number of insurable hours of last job

- explanatory messages

3.9 Canada may also, on its own initiative, provide to Yukon the information listed in section 3.8 about any individual who has received, or is receiving, assistance under Canada’s programs where it suspects that the individual was/is not entitled to that assistance, and/or may have received or be receiving insurance benefits under Part I of the EI Act to which the individual was/is not entitled.

3.10 Following amendments to Canada's EI Act, Canada will provide to Yukon, when requested by Yukon, on a per individual basis, any or all of the following personal information under its control in respect of each individual who has been determined to be an active EI claimant who is receiving or has recently received financial assistance while participating in a Yukon program, to assist Yukon in communicating with the client and/or in determining whether any revisions to Yukon’s financial assistance are required:

- name

- social insurance number

- address

- postal code

- telephone number

- language (English or French)

- federal office code – if available

- Part I benefit period commencement (BPC)

- Part I end date

- original EI entitlement (in weeks)

- amended EI entitlement (in weeks)

- total weeks paid to date

- last week processed

- intervention type

- training ID

- start week(s)/date(s) of intervention

- end week(s)/date(s) of intervention

- agreement/file number

- benefit rate

- last renewable week

4.0 Information to be provided by Yukon to Canada

4.1 Yukon will provide Canada, on a per individual basis, the following personal information under its control about each of its clients who has submitted an application under one of Yukon’s benefits and measures, for the purposes of establishing and verifying if the individual qualifies as an EI client:

- social insurance number

- name

- eligibility date