Canada Health Act Annual Report 2023-2024

Table of contents

- Acknowledgements

- Canada Health Act 2023-2024 year in review infographic

- Road to the Canada Health Act

- Chapter 1 - Canada Health Act overview

- Chapter 2 - Administration and compliance

- Chapter 3 – Provincial and territorial health care insurance plans in 2023-2024

- Annex A - Canada Health Act and Extra-Billing and User Charges Information Regulations

- Annex B - Policy interpretation letters

- Annex C - Financial statements of actual amounts of extra-billing and user charges for the period April 1, 2021 to March 31, 2022

- Annex D - Reimbursement action plans and progress reports

- Contact information

- Endnotes

Acknowledgements

Health Canada would like to acknowledge the work and effort that went into producing this Annual Report. It is through the dedication and timely commitment of the following departments of health and their staff that we are able to bring you this report on the administration and operation of the Canada Health Act:

- Newfoundland and Labrador Department of Health and Community Services

- Prince Edward Island Department of Health and Wellness

- Nova Scotia Department of Health and Wellness

- New Brunswick Department of Health

- Quebec Ministry of Health and Social Services

- Ontario Ministry of Health

- Manitoba Health, Seniors, and Long-Term Care

- Saskatchewan Ministry of Health

- Alberta Ministry of Health

- British Columbia Ministry of Health

- Yukon Department of Health and Social Services

- Northwest Territories Department of Health and Social Services

- Nunavut Department of Health

We also greatly appreciate the extensive work effort that was put into this report by our production team, including desktop publishers, translators, editors and concordance experts, printers and staff of Health Canada.

Canada Health Act 2023-2024 year in review infographic

Figure 1 - Text description

- 2024 marked the 40th anniversary of the passage of the Canada Health Act, which received royal assent on April 17, 1984.

- To ensure the Act keeps pace with evolutions in health care delivery, interpretation letters have been issued on several occasions. Most recently, on January 9, 2025, the new Canada Health Act Services Policy was announced and confirms that patients should not be charged for medically necessary physician-equivalent services when provided by other regulated health professionals, such as nurse practitioners, pharmacists, or midwives. The policy comes into effect on April 1, 2026.

- In 2023-2024, the federal government transferred over $49.4 billion to provinces and territories through the Canada Health Transfer, to support them in delivering publicly funded care.

- In 2023–2024, approximately $1 billion was reciprocally billed for insured hospital and physician services provided to residents outside their home jurisdiction, through reciprocal billing agreements in place between the provinces and territories.

- In March 2024, $79.4 million in Canada Health Transfer deductions were levied, including:

- $72.4 million under the Diagnostic Services Policy to NS, NB, QC, MB, SK, AB, and BC for patient charges for medically necessary diagnostic services.

- $6.99 million to NL, NB, ON, and BC for patient charges for other medically necessary surgical services such as abortions, cataract and other day-surgery procedures.

- Based on actions taken to ensure patients do not face charges for medically necessary services, in March 2024, more than $90 million was reimbursed to provinces. More than $175 million has been reimbursed to provinces since

Road to the Canada Health Act

“I came to believe that health services ought not to have a price tag on them, and that people should be able to get whatever health services they required irrespective of their individual capacity to pay.”

- Tommy Douglas, Premier of Saskatchewan 1944-1961, who introduced North America’s first single-payor universal health care program.

Canada's public health insurance system has developed over more than 60 years, shaped by key legislative changes and shifting public expectations. The roots trace back to the introduction of the Hospital Insurance and Diagnostic Services Act (HIDSA) in 1957, which built on the work of Tommy Douglas, widely known as the father of Medicare in Canada, who established universal hospital coverage in Saskatchewan in 1947. The HIDSA created a 50-50 cost-sharing model to encourage provinces and territories (PTs) to establish comprehensive and universal coverage for hospital services. This was followed by the Medical Care Act (MCA) in 1966, which followed a similar approach, encouraging PTs to provide universal coverage for physician services. Under the HIDSA, patient user charges were deducted from payments made by the federal government; however, under the MCA, there was no equivalent reduction for extra-billing by physicians. These cost-sharing agreements helped fund hospital and physician services until the late 1970s.

In 1977, the Federal-Provincial Fiscal Arrangements and Established Programs Financing Act (EPF) changed the way the federal government provided health care funding to the PTs. Under the EPF, the former 50-50 cost-sharing agreements were replaced with a fixed federal per capita contribution. The move to block funding removed the federal government's capacity to withhold partial sums from transfer amounts to PTs that allowed user charges. As a result, the federal government could only transfer the full amount of the block funding or withhold it all, making it harder to enforce compliance and prevent patient charges.

During this time, many provinces started introducing hospital user fees, justifying the charges by claiming that health care funding had been reduced. Some provinces also cited the income from extra-billing during physician payment negotiations to rationalise lower settlements. Consequently, extra-billing was occurring in most provinces during this time, with hospital user charges occurring in six provinces.

In 1979, Justice Emmett Hall, who had previously reviewed Canada's health care system in 1964, was once again tasked by the federal government to assess the state of Canada's publicly funded health insurance programs. His final report, released in 1980, called for a renewed commitment to the principles of Medicare, and warned that extra-billing by doctors and hospital user fees were creating a two-tiered system, undermining universal access to care.

“As a society, we are aware that the trauma of illness, the pain of surgery, the slow decline to death, are burdens enough for the human being to bear without the added burden of medical or hospital bills penalizing the patient at the moment of vulnerability. The Canadian people determined that they should band together to pay medical bills and hospital bills when they were well and income earning. Health services were no longer items to be bought off the shelf and paid for at the checkout stand. Nor was their price to be bargained for at the time they are sought. They were a fundamental need, like education, which Canadians could meet collectively and pay for through taxes.”

- Justice Emmett Hall, excerpted from “Canada’s National-Provincial Health Program for the 1980’s: A Commitment for Renewal”.

Building on Justice Hall's conclusions, a Parliamentary task force on the Federal-Provincial Fiscal Arrangements recommended in 1981 that the federal government combine the HIDSA and MCA into a single program supported by clear criteria that could be monitored and enforced. The task force also recommended that the Minister of National Health and Welfare report annually to Parliament on whether these criteria were being met, including details of any penalties levied against PTs that failed to fully comply. These recommendations were later implemented with the passage of the Canada Health Act.

At the May 1982 meeting of federal, provincial and territorial health ministers, Monique Bégin, the Minister of National Health and Welfare, announced the government's plan to replace the HIDSA and MCA with the Canada Health Act. In her introductory remarks, Minister Bégin stated the proposals put forward as components of the Canada Health Act were meant "to protect, renew and improve our excellent system of health care. They are based on the fundamental principles that the cost of adequate health care should be borne by all Canadians rather than by the sick and that the best possible health care system can only be achieved by all of us working cooperatively to solve problems before they become insoluble and to protect a program at a time when it is vulnerable."

The new Act would combine the four key principles from the previous legislation (public administration, universality, comprehensiveness, portability) and add a fifth condition, accessibility, distinguishing the concept of "universality" from "accessibility", while adding measures to ensure these principles were respected. In her opening statement from the meeting, she emphasized the ministers' pride in Canada's health care system and their commitment to ensuring access for all, recognizing the importance of controlling patient charges to ensure that accessibility.

In order to gain public support for the new legislation and counter negative media campaigns and statements from some medical groups and provincial officials, who saw extra-billing and user charges as legitimate revenue streams, the federal government distributed more than 300,000 copies of "Preserving Universal Medicare: A Government of Canada Position Paper" in July 1983. The paper explained the government's position on Medicare's future, stressing that extra-billing and user charges were a serious threat to the universal access that Medicare was meant to guarantee. The release of the paper sparked significant public engagement, with over 100 meetings held across the country to discuss its contents.

“It is apparent that unless a concerted effort is made to commit ourselves once more to the principles of universal health insurance, the gaps in insurance cover will continue to grow. A choice must now be made. Do we as a nation wish to allow an increasing number of out fellow Canadians to fall through the widening cracks in our health insurance program? Or do we wish in stead to preserve and improve Medicare?”

- Excerpted from “Preserving Universal Medicare – A Government of Canada Position Paper.”

On December 12, 1983, Bill C-3, an Act relating to cash contributions by Canada in respect of insured health services provided under provincial health care insurance plans and amounts payable by Canada in respect of extended health care services and to amend and repeal certain Acts in consequence thereof, which would later be more commonly known as the Canada Health Act, was given first reading in the House of Commons.

“Thanks to Medicare, no one need worry about any financial burden resulting from an unforeseen illness. Since health insurance is a collective program, all Canadians share the cost of medical care for which they could not pay individually…This program is not only for the young, the wealthy and the healthy. It is designed also to help the poor, the old and the chronically ill. The latter group is the one most affected by the charging of direct fees.”

- Senator Jacques Hébert, excerpted from the debate on the enactment of the Canada Health Act, April 11, 1984.

After the Bill's second reading, it was sent to the Standing Committee on Health, Welfare, and Social Affairs for review. Over 130 witnesses appeared before the Committee, which met 17 times between January and March 1984. The Committee submitted its report to the House of Commons on March 21, 1984, and, after several more days of debate, Bill C-3 passed unanimously on April 9, 1984. The Bill was then sent to the Senate and received royal assent on April 17, 1984.

Chapter 1 - Canada Health Act overview

This chapter describes the evolution of Medicare in Canada, as well as the Canada Health Act, its key definitions, requirements, regulations, penalty provisions, and excluded persons and services under the Act. It also outlines interpretation letters from former federal Ministers of Health sent to their provincial and territorial counterparts, all of which followed months of consultation:

- the Honourable Jake Epp provided guidance on the interpretation and implementation of the Act;

- the Honourable Diane Marleau announced the Federal Policy on Private Clinics;

- the Honourable Ginette Petitpas Taylor announced three new Canada Health Act initiatives - the Diagnostic Services Policy, the Reimbursement Policy, and strengthened Canada Health Act reporting; and

- the Honourable Mark Holland announced the Canada Health Act Services Policy.

The evolution of Medicare in Canada

Canada's single-payor public health care insurance system, "Medicare", is financed through a progressive tax system, which allows risks to be pooled and costs to be shared by all Canadians. Our health care insurance system evolved into its present form over more than six decades. Saskatchewan was the first province to establish universal, public hospital insurance in 1947 and, 10 years later, the Government of Canada passed the Hospital Insurance and Diagnostic Services Act (HIDSA), to encourage provinces and territories to provide universal coverage for these services by sharing in their costs. Its unanimous adoption by the federal Parliament launched the largest single program ever undertaken in peace-time Canada and, by 1961, all the provinces and territories had public insurance plans that provided universal access to hospital services. Saskatchewan again pioneered by providing insurance for physician services, beginning in 1962. The Government of Canada enacted the Medical Care Act in 1966, to encourage provinces and territories to provide universal coverage for physician services by sharing in their costs. By 1972, all provincial and territorial insurance plans had been expanded to include physician services.

In 1979, at the request of the federal government, Justice Emmett Hall undertook a review of the state of health services in Canada. In his report, he affirmed that health care services in Canada ranked among the best in the world but warned that extra-billing by doctors and user charges levied by hospitals were creating a two-tiered system that threatened the universal accessibility of care. This report, and the national debate it generated, led to the enactment of the Canada Health Act.

Did You Know?

The Canada Health Act was enacted expressly to protect patients from charges when they access medically necessary physician and hospital services. While the Act has remained largely unchanged over the last four decades, the federal government has issued several policy interpretation letters to ensure the Act's application keeps pace with new circumstances as health care delivery evolves. A description of the four policy interpretation letters issued to date, with the most recent being issued in January 2025, can be found later in this chapter. Copies of these letters can also be found in Annex B of this report.

Passed unanimously in the House of Commons in 1984, the Canada Health Act, Canada's federal health care insurance legislation, codified the national principles which underpin federal funding for hospital and physician services and added prohibitions on the patient charges which threatened to undermine universal access to care.

In Canada, the roles and responsibilities for health are shared between the federal, provincial and territorial governments. The provincial and territorial governments have primary jurisdiction in health care administration and delivery. This includes setting their own priorities, administering their health care budgets and managing their own resources. The federal government, under the Canada Health Act, defines the national principles that are to be reflected in provincial and territorial health care insurance plans.

What is the Canada Health Act?

The Act establishes criteria and conditions related to insured health services and extended health care services that the provinces and territories must fulfill to receive the full federal cash contribution under the Canada Health Transfer (CHT). In fiscal year 2023–2024, the federal government transferred $49,421,000,000 to provinces and territories to support their health care systems. Additional information on federal, provincial and territorial funding arrangements is available by visiting the Department of Finance's website. The aim of the Act is to ensure that all eligible residents of Canadian provinces and territories have reasonable access to medically necessary hospital, physician, and surgical-dental services that require a hospital setting, on a prepaid basis, without charges related to the provision of insured health services.

A copy of the Act is provided in Annex A.

Budget 2024 re-confirmed the federal government's plan, Working Together to Improve Health Care for Canadians, to invest $200 billion to support the health and well-being of Canadians, which includes $25 billion over 10 years in targeted funding through bilateral agreements with provinces and territories to improve access to family health and mental health and substance use services, support the health workforce and modernize health systems. The bilateral agreements also include $9.5 billion for addressing home care, mental health, personal support workers and long-term care.

By March 2024, all provinces and territories had signed their bilateral agreements with the federal government, anchored in fundamental principles, including a mutual commitment to upholding the Canada Health Act. These agreements marked a significant investment in ensuring equitable access to health care services across Canada, fostering collaboration between federal and provincial and territorial authorities to address systemic challenges and enhance health care delivery.

Key definitions under the Canada Health Act (Section 2)

Insured health services are medically necessary hospital, physician and surgical-dental services (performed by a dentist in a hospital, where a hospital is required for the proper performance of the procedures) provided to insured persons, unless those services are provided under another Act of Parliament, or provincial or territorial workers' compensation legislation.

Extended health care services are certain aspects of long-term residential care (nursing home intermediate care and adult residential care services), and the health aspects of home care and ambulatory care services.

Insured persons are eligible residents of a province or territory. A resident of a province is defined in the Act as "… a person lawfully entitled to be or to remain in Canada who makes his home and is ordinarily present in the province, but does not include a tourist, a transient or a visitor to the province…"

Insured hospital services include medically necessary in-patient and out-patient services such as accommodation and meals at the standard or public ward level and preferred accommodation if medically required; nursing services; laboratory, radiological and other diagnostic procedures, together with the necessary interpretations; drugs, biologicals and related preparations when administered in the hospital; use of operating room, case room and anesthetic facilities, including necessary equipment and supplies; medical and surgical equipment and supplies; use of radiotherapy facilities; use of physiotherapy facilities; and services provided by persons who receive remuneration therefor from the hospital.

Insured physician services are medically required services rendered by medical practitioners. Medically required physician services are generally determined by the provincial or territorial health care insurance plan, in consultation with the medical profession.

Insured surgical-dental services are services provided by a dentist in a hospital, where a hospital setting is required for the proper performance of the procedure.

Health care practitioner is a person lawfully entitled under the law of a province to provide health services in the place in which the services are provided by that person.

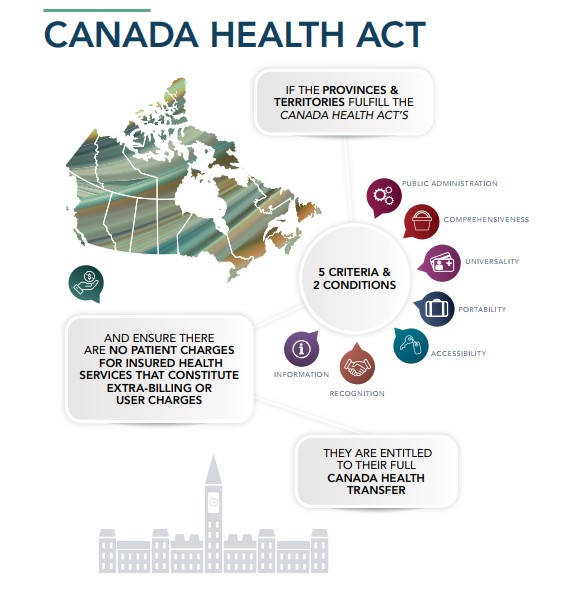

The Canada Health Act infographic

Figure 2 - Text description

If the provinces and territories fulfil the Canada Health Act's 5 criteria and 2 conditions:

- Public administration

- Comprehensiveness

- Universality

- Portability

- Accessibility

- Recognition

- Information

And ensure there are no patient charges for insured health services that constitute extra-billing or user charges they are entitled to their full Canada Health Transfer.

Requirements of the Canada Health Act

The Canada Health Act contains nine requirements that the provinces and territories must fulfill in order to qualify for the full amount of their cash entitlement under the CHT.

They are:

- five program criteria that apply only to insured health services;

- two conditions that apply to insured health services and extended health care services; and

- two provisions, with respect to extra-billing and user charges, that apply only to insured health

The criteria

1.0 Public administration (Section 8)

The public administration criterion of the Canada Health Act requires provincial and territorial health care insurance plans to be administered and operated on a non-profit basis by a public authority, which is accountable to the provincial or territorial government for decision-making on benefit levels and services, and whose records and accounts are publicly audited. However, the criterion does not prevent the public authority from contracting out the services necessary for the administration of the provincial and territorial health care insurance plans, such as the processing of payments to medical practitioners for insured health services.

The public administration criterion pertains only to the administration of provincial and territorial health care insurance plans and does not preclude private facilities or providers from supplying insured health services as long as no insured person is charged in relation to the provision of these insured health services.

2.0 Comprehensiveness (Section 9)

The comprehensiveness criterion requires that the health care insurance plan of a province or territory must cover all insured health services provided by hospitals, physicians or dentists (i.e., surgical-dental services that require a hospital setting).

3.0 Universality (Section 10)

Under the universality criterion, all insured residents of a province or territory must be entitled to the insured health services provided by the provincial or territorial health care insurance plan on uniform terms and conditions. Provinces and territories generally require that residents register with the plan to establish entitlement.

4.0 Portability (Section 11)

Residents moving from one province or territory to another must continue to be covered for health care services insured by the home jurisdiction during any waiting period imposed by the new province or territory of residence (up to three months), before coverage is established in the new jurisdiction. It is the responsibility of residents to inform their province or territory's health care insurance plan that they are leaving and to register with the health care insurance plan of their new province or territory, in order to avoid any gaps in coverage.

Residents who are temporarily absent from their home province or territory, or from Canada, must continue to be covered for insured health services by their home province or territory. If insured persons are temporarily absent in another province or territory, the portability criterion requires that insured health services be paid at the host province's rate. Refer to the Interprovincial Health Insurance Agreement Coordinating Committee section in Chater 2 for additional information on how in-Canada portability is facilitated by the provinces and territories. If insured persons are temporarily out of the country, insured health services are to be paid at the home province's rate. Insured residents must apply to their home provincial or territorial health care insurance plan in order to obtain reimbursement for any insured health services outside Canada.

The portability criterion is intended to permit a person to receive medically necessary services in relation to an urgent or emergent need, when absent on a temporary basis (e.g., business or vacation) but does not entitle residents to seek services or shorter waits for non-urgent or emergent services.

Prior approval by the health care insurance plan in a person's home province or territory may be required before coverage is extended for elective (non-emergency) services to a resident while temporarily absent from their province or territory.

5.0 Accessibility (Section 12)

The intent of the accessibility criterion is to ensure that insured persons in a province or territory have reasonable access to insured hospital, physician, and surgical-dental services that require a hospital setting, on uniform terms and conditions. Access to insured health services should be unimpeded, either directly or indirectly, by charges (extra-billing or user charges) or other means (e.g., discrimination on the basis of age, race, health status, or financial circumstances).

In addition, the health care insurance plan of the province or territory must provide:

- reasonable compensation to physicians and dentists for all the insured health services they provide; and

- payment to hospitals to cover the cost of insured health services.

The conditions

1.0 Information (Section 13[A])

Provincial and territorial governments are required to provide information to the federal Minister of Health as prescribed by regulations under the Act.

2.0 Recognition (Section 13[B])

Provincial and territorial governments are required to recognize the federal financial contributions toward both insured and extended health care services.

The provisions

Extra-Billing and User Charges

The provisions of the Canada Health Act pertaining to extra-billing and user charges for insured health services in a province or territory are outlined in sections 18 to 21. If it can be confirmed that either extra-billing or user charges exist in a province or territory, a mandatory dollar-for-dollar deduction from the CHT payments to that province or territory is required under the Act.

Extra-Billing (Section 18)

Under the Act, extra-billing is defined as a charge by an enrolled medical practitioner or dentist (i.e., a dentist providing insured surgical-dental services when a hospital setting is medically required) to an insured person for an insured health service, which is charged in addition to the amount paid by the provincial or territorial health care insurance plan. For example, if an enrolled physician were to charge a patient any amount for an office visit that is insured by the provincial or territorial health care insurance plan, the amount charged would constitute extra-billing. Extra-billing is seen as a barrier for people seeking medical care, and is contrary to the accessibility criterion.

User Charges (Section 19)

A user charge is defined as any charge for an insured health service, other than extra-billing. This includes any charge levied for insured hospital services, or any non-physician related services provided in conjunction with an insured physician service at a non-hospital facility (e.g., private practice). In other words, if patients were charged a fee as a condition of receiving insured health services, that fee would be considered a user charge. User charges are not permitted under the Act because, as is the case with extra-billing, they constitute a barrier to access.

What is a patient charge?

- If an enrolled medical practitioner or dentist…

- Charges an insured resident…

- For an insured health service…

- An amount in addition to the amount paid by the provincial or territorial health care insurance plan that…is extra-billing.

- Other charges (e.g., for supplies) related to the provision of insured health services…are user charges.

Other elements of the Act

Regulations (Section 22)

Section 22 of the Canada Health Act enables the federal government to make regulations for administering the Act in the following areas:

- defining the services included in the Act's definition of "extended health care services," e.g., nursing home care or home care;

- prescribing which services are excluded from hospital services;

- prescribing the types of information that the federal Minister of Health may reasonably require, as well as the format and submission deadline for the information; and

- prescribing how provinces and territories are required to recognize the CHT in their documents, advertising or promotional materials.

To date, the only regulations in force under the Act are the Extra-billing and User Charges Information Regulations. These Regulations require the provinces and territories to report annually to Health Canada on the amounts of extra-billing and user charges levied. A copy of these Regulations is provided in Annex A.

Penalty provisions of the Canada Health Act

Mandatory Penalty Provisions

Under the Act, provinces and territories that allow extra-billing and user charges are subject to mandatory dollar-for-dollar deductions from the federal transfer payments under the CHT. For example, if it is determined that any amount of extra-billing by physicians has occurred in a province or territory, the federal cash contribution to that province or territory will be reduced by that same amount. Although deductions are usually based on information provided by the province or territory in accordance with the Extra-billing and User Charges Information Regulations, where information is not provided, or is incomplete, Health Canada will make an estimate of the amount of extra-billing and user charges. This process requires consultation with the province or territory concerned. Deductions based on estimates have been made on numerous occasions.

Provincial and territorial financial statements of extra-billing and user charges received during the reporting period are provided in Annex C.

Discretionary Penalty Provisions

Non-compliance with one of the five criteria or two conditions of the Act is subject to a discretionary penalty. The amount of any deduction from CHT payments is based on the magnitude of the non- compliance, and is approved by Cabinet.

The Canada Health Act sets out a consultation process that must be undertaken with the province or territory before discretionary penalties can be levied. To date, the discretionary penalty provisions of the Act have not been used.

Excluded services and persons

Although the Canada Health Act requires that insured health services be provided to insured persons in a manner that is consistent with the criteria and conditions set out in the Act, not all health care services or Canadian residents fall under the scope of the Act.

Excluded services

A number of services provided by hospitals and physicians are not considered medically necessary, and, thus, are not insured under provincial and territorial health care insurance legislation. Uninsured hospital services for which patients may be charged include preferred hospital accommodation (unless prescribed by a physician or when standard ward level accommodation is unavailable), private duty nursing services, parking, and the provision of telephones and televisions. Uninsured physician services for which patients may be charged include telephone advice (unless it is insured by the provincial or territorial health care insurance plan); the provision of medical certificates (e.g., for work, school, insurance purposes); the transfer of medical records; testimony in court; and cosmetic services. Amounts for these services are governed by provincial and territorial Colleges of Physicians, which generally require that charges be reasonable and reflect the cost of services provided.

The definition of "insured health services" excludes services provided to persons under any other Act of Parliament (e.g., certain services provided to veterans) or under the workers' compensation legislation of a province or territory.

In addition to the medically necessary hospital and physician services covered by the Canada Health Act, provinces and territories also provide a wide range of other programs and services, such as prescription drug coverage, non-surgical dental care, ambulance services and optometric services, at their discretion and on their own terms and conditions. These services are often targeted to specific population groups (e.g., seniors, children, and those receiving social assistance), with levels of funding and scope of coverage varying from one province or territory to another.

Excluded persons

The Canada Health Act definition of "insured person" excludes members of the Canadian Armed Forces and persons serving a term of imprisonment within a federal penitentiary. The Government of Canada provides coverage to these groups through separate federal programs.

The exclusion of these persons from insured health service coverage predates the adoption of the Act and is not intended to constitute differences in access to publicly insured health care.

Policy interpretation letters

There are four key policy statements that clarify the federal position on the Canada Health Act. These statements were made in the form of ministerial letters from former federal Ministers of Health to their provincial and territorial counterparts, following months of consultation. Copies of the letters are provided in Annex B of this report.

Epp Letter

In June 1985, approximately one year following the passage of the Canada Health Act in Parliament, former federal Minister of Health and Welfare Jake Epp wrote to his provincial and territorial counterparts to set out and confirm the federal position on the interpretation and implementation of the Act. The letter sets forth statements of federal policy intent that clarify the Act's criteria, conditions and regulatory provisions. The letter highlighted the fundamental change signified by the Canada Health Act, which was the prohibition of all patient charges for insured health services provided to insured residents. The Epp letter remains an important reference for assessing and interpreting compliance with the Act.

Marleau Letter—Federal Policy on Private Clinics

Between February and December of 1994, a series of seven federal, provincial and territorial meetings dealing wholly, or in part, with private clinics took place. At issue was the growth of private clinics providing medically necessary services funded partially by the public system and partially by patients, and their impact on Canada's universal, publicly funded health care system.

At the September 1994 federal, provincial and territorial meeting of Health Ministers in Halifax, all Ministers of Health present, with the exception of Alberta's Health Minister, agreed to "…take whatever steps were required to regulate the development of private clinics in Canada."

Diane Marleau, the federal Minister of Health at the time, wrote to all provincial and territorial Ministers of Health on January 6, 1995, to announce the new Federal Policy on Private Clinics. The Minister's letter provided the federal interpretation of the Canada Health Act as it relates to the issue of facility fees charged directly to patients receiving medically necessary services at private clinics. The letter stated that the definition of hospital contained in the Act includes any facility that provides acute, rehabilitative or chronic care. Thus, when a provincial or territorial health care insurance plan pays the physician fee for a medically necessary service delivered at a private clinic, it must also pay the facility fee or face a deduction from federal transfer payments.

Petitpas Taylor Letter

On August 8, 2018, the former federal Minister of Health, Ginette Petitpas Taylor, wrote to her provincial and territorial counterparts formalizing three new Canada Health Act initiatives – the Diagnostic Services Policy, the Reimbursement Policy, and strengthened Canada Health Act reporting. These initiatives were the subject of discussions between federal, provincial and territorial officials and adjustments were made to the requirements of these initiatives based on feedback received from the provinces and territories.

Diagnostic Services Policy

The Diagnostic Services Policy came into effect on April 1, 2020. This policy is a formalization of the application of the Canada Health Act to diagnostic services. It confirms the longstanding federal position that medically necessary services, including diagnostic services, are insured regardless of the venue where the services are delivered. Under this policy, provinces and territories first reported on patient charges for medically necessary diagnostic services in December 2022 (for any patient charges which occurred during 2020–2021), and these reports were published in the 2022-2023 Canada Health Act Annual Report.

Did You Know?

Since April 1, 2020, any patient charges for medically necessary diagnostic imaging services, such as MRI or CT scans, regardless of where these services are provided (i.e., hospital or private facility), have been considered contrary to the Canada Health Act. If you believe you have been charged inappropriately, you may report these charges to your provincial or territorial health ministry, using the phone numbers provided inside the back cover of this report. You may also contact the Canada Health Act Division of Health Canada at the following coordinates:

Reimbursement Policy

Should a province or territory be subject to a mandatory deduction, the federal Minister of Health has the discretion to provide a reimbursement if the province or territory eliminates the patient charges that led to the deductions within a specified timeframe. The first deductions eligible for reimbursement under the policy were those taken in March 2018.

Strengthened Canada Health Act Reporting

The aim of strengthened Canada Health Act reporting is to ensure Health Canada has the information required to accurately assess compliance with the Act, as well as to increase transparency for Parliament and Canadians on the administration of the Act, and the state of the publicly funded health care insurance system.

Holland Letter - Canada Health Act Services Policy

Following over two years of engagement with provinces and territories, on January 9, 2025, former federal Minister of Health, Mark Holland wrote to his provincial and territorial counterparts, outlining the new Canada Health Act Services Policy, reaffirming the federal government's commitment to protecting the publicly funded health care system and ensuring that all Canadians benefit from innovations in health care delivery without being burdened by patient charges to access these services.

The Canada Health Act Services Policy clarifies the federal position that anyone with a valid health card should not pay for medically necessary services which would be covered by their provincial or territorial health care plan, if provided by a physician. The intention of the policy is to ensure that the hospital and physician services that were insured when the Canada Health Act was enacted in 1984, remain insured in the future, as the health care system evolves.

To give provinces and territories time to consider how best to integrate these services into their health care insurance plans, the policy will come into effect on April 1, 2026.

Once implemented, the provinces and territories will be required to report patient charges related to physician-equivalent services for the first time in December 2028, and if any deductions are required, the first deductions under the policy will be taken in March 2029. These deductions will be eligible for reimbursement under the Canada Health Act Reimbursement Policy provided the province or territory implicated takes steps to eliminate the patient charges and the circumstances that led to them within two years after the deduction occurred.

Did You Know?

Nurse practitioners (NPs) are advanced practice nurses who integrate clinical skills associated with nursing and medicine to independently assess, diagnose, treat and manage a wide range of health conditions in a variety of health care settings, including hospitals, community and continuing care settings. While NP scopes of practice vary across Canada, many provinces and territories are increasingly integrating nurse practitioners into their health care systems as a means of improving access to primary care services overall.

Canada Health Act mythbusters

Myth: All health care in Canada must be publicly delivered.

Fact: The Canada Health Act doesn't forbid the provision of health services by private companies, as long as residents are not charged for insured health services. In fact, many aspects of health care in Canada are delivered privately. Family physicians mostly bill the provincial or territorial health care insurance plan as private contractors. Hospitals are often incorporated private foundations, and many aspects of hospital care (e.g., lab services, housekeeping, and linens) are carried out privately. Lastly, in many provinces and territories, private facilities are contracted to provide services under the health care insurance plan.

Myth: Health care in Canada is free.

Fact: While you may not have to pay upfront when you receive medically necessary services, health care in Canada is not free. Health care in Canada is funded through tax revenues at the provincial, territorial, and federal levels. By spreading the cost of health care across the entire population, everyone is assured of the care they need, without the great financial burden that medical expenses could pose to a family or individual.

If you believe you have been subject to inappropriate patient charges for insured health services please contact your respective province or territory using the information contained in the Contact Information section of the report, or by contacting the Canada Health Act Division at medicare.spb.chad-dlcs.dgps.assurance.maladie@hc-sc.gc.ca.

Myth: I can use my health insurance card to find a shorter waitlist in another province or territory.

Fact: Your health insurance card does not entitle you to seek out shorter waitlists in other provinces or territories. Although you are covered for insured health services during temporary absences from your home province or territory, prior approval may be required before coverage can be used for non-emergency services in another province or territory.

Myth: I'm a Canadian so I am automatically entitled to health care coverage.

Fact: Having Canadian citizenship does not entitle you to health care coverage, rather you must be an eligible resident within a province or territory. Canadians have their part to play in establishing and maintaining their health care coverage. In all provinces and territories, you are required to register for coverage, and then maintain your eligibility by renewing your coverage, and remaining in your home province or territory for a prescribed number of days each year. Although allowance is often made if you leave your home province or territory for school, work, or other reasons, it is important to inform your provincial or territorial health care insurance plan when you will be away for extended periods, and to understand what your responsibilities are in maintaining your coverage.

Myth: My specific medical condition is covered under the Canada Health Act.

Fact: The Canada Health Act is quite a short piece of legislation and lays out standards at a very high level. Specific medical conditions are not named under the Act; rather, it requires provincial and territorial health care insurance plans to cover medically necessary hospital and physician services. Given their role in health care delivery, the decision over which services to cover is made by the province or territory, in consultation with the medical profession.

Myth: I don't need travel insurance within Canada because I'm covered under Medicare.

Fact: This is a very common misconception, and one that could be quite costly under certain circumstances. Medicare ensures that if you leave your province or territory for a few hours, days or weeks, you will still have coverage for emergency medical services. The same is true during moves to other provinces or territories. However, the hospital and physician services covered under the Canada Health Act are not the only services you might need while outside your usual province or territory. Some services that are not covered by the Act (e.g., prescription drug coverage or ambulance services) are highly subsidized for residents, but not for visitors, which is why you should ensure you have adequate coverage whenever you travel or move within the country.

Chapter 2 - Administration and compliance

Administration

In administering the Canada Health Act, the federal Minister of Health (the Minister) is assisted by Health Canada staff and by the Department of Justice.

The Canada Health Act Division

The Canada Health Act Division of Health Canada is responsible for supporting the Minister in the administration of the Canada Health Act. Members of the Division fulfill the following ongoing functions:

- monitoring and analysing provincial and territorial health care insurance plans for compliance with the criteria, conditions, and extra-billing and user charges provisions of the Act;

- conducting issue analysis and policy research to provide strategic advice;

- asking provincial and territorial health ministries to investigate and provide information and clarification when possible compliance issues arise, and, when necessary, recommending corrective action to them in order to ensure the criteria, conditions, and extra-billing and user charges provisions of the Act are upheld;

- informing the federal Minister of Health of possible non-compliance and recommending appropriate action to resolve the issue;

- managing the annual extra-billing and user charges and reimbursement reporting processes;

- disseminating information on the Act and its administration;

- responding to enquiries about the Act and health care insurance issues received by telephone, mail and the Internet, from the public, members of Parliament, federal government departments, other governments, stakeholder organizations and the media;

- developing and maintaining relationships, with health officials in provincial and territorial governments, for information sharing;

- collaborating with provincial and territorial health department representatives through the Interprovincial Health Insurance Agreements Coordinating Committee;

- working with Health Canada Legal Services and Justice Canada on litigation issues that implicate the Act; and

- producing the Canada Health Act Annual Report on the administration and operation of the Act.

Canada Health Act compliance

The Canada Health Act Division monitors the operations of provincial and territorial health care insurance plans in order to provide advice to the Minister on possible non-compliance with the Canada Health Act. Sources for this information include: provincial and territorial government officials and publications; nongovernmental organizations; media reports; and correspondence received from the public.

Staff in the Canada Health Act Division assess issues of concern and complaints on a case-by-case basis. The assessment process involves compiling all facts and information related to the issue and taking appropriate action. Verifying the facts with provincial and territorial health officials sometimes reveals issues that are not directly related to the Act, while others may pertain to the Act but are a result of misunderstanding or miscommunication, such as eligibility for health care insurance coverage and portability of insured health services within and outside Canada. In these instances, matters are generally resolved quickly with provincial or territorial assistance.

In instances where a Canada Health Act issue has been identified and remains after initial enquiries, Division officials ask the jurisdiction in question to investigate the matter and report back. Division staff discuss the issue and its possible resolution with provincial or territorial officials. Only if the issue is not resolved to the satisfaction of the Division after following the aforementioned steps, is it brought to the attention of the federal Minister of Health.

Deductions and reimbursements under the Act

For the most part, provincial and territorial health care insurance plans meet, and often exceed, the requirements of the Canada Health Act. However, some issues and concerns remain. The most prominent of these relate to accessibility issues, and specifically patient charges for medically necessary health and diagnostic services at private clinics.

Diagnostic Services Policy

On April 1, 2020, the Canada Health Act Diagnostic Services Policy (DSP) came into effect. The policy formalized the federal government's longstanding position that all medically necessary physician and hospital services, including diagnostic services, must be covered by provincial and territorial health care insurance plans, regardless of the venue in which they are delivered. The first deductions under the DSP were taken in March 2023. This was the second year provinces and territories were expected to report on these charges, with associated deductions taken in March 2024. These reports, which were submitted to Health Canada in December 2023, pertained to patient charges for diagnostic services that occurred in fiscal year 2021-2022, and can be found in Annex B.

Both Manitoba and British Columbia reported patient charge amounts to Health Canada. In instances where provinces did not report on these charges, estimates of their magnitude were developed using data from the Canadian Agency for Drugs and Technologies in Health's report on private imaging facilities. These estimates were shared with provinces before deductions were taken to give them an opportunity to provide province-specific data. Saskatchewan subsequently provided province-specific data, which was used to inform Health Canada's estimate.

In March 2024, Nova Scotia, New Brunswick, Quebec, Saskatchewan, Manitoba, Alberta and British Columbia, were subject to mandatory dollar-for-dollar deductions, totalling approximately $72.4 million as a result of patient charges for medically necessary diagnostic services. Mandatory deductions under the DSP will continue as long as patients continue to face charges for these services.

Under the Canada Health Act Reimbursement Policy, mandatory Canada Health Transfer (CHT) deductions may be reimbursed to provinces or territories if they implement a Reimbursement Action Plan (RAP) to eliminate the patient charges in question and rectify the circumstances that led to them, within two years of the date of the deduction. Through this process, reimbursements totalling $83,208,629 were provided to Quebec, Manitoba, Alberta and British Columbia as a result of implementing elements in their respective RAPs to improve access and eliminate patient charges for medically necessary diagnostic services.

Quebec, Alberta, and British Columbia received partial reimbursements of past deductions, in recognition of progress made in eliminating patient charges, whereas Manitoba received full reimbursement for successfully implementing their RAP to eliminate these charges. A copy of these RAPs, as well as the current RAP status updates on their implementation, are presented in Annex D of this report.

| Deduction | Reimbursement | |

|---|---|---|

| Nova Scotia | $1,794,635 | - |

| New Brunswick | $1,794,635 | - |

| Quebec | $36,014,132 | $46,728,814Footnote 1 |

| Manitoba | $650 | $354,477Footnote 2 |

| Saskatchewan | $1,084,513 | - |

| Alberta | $20,450,175 | $20,537,796Footnote 3 |

| British Columbia | $11,270,216 | $15,587,542Footnote 4 |

| TOTALS | $72,408,956 | $83,208,629 |

|

||

Other patient charges for medically necessary health services

Newfoundland and Labrador

Based on amounts reported by Newfoundland and Labrador to Health Canada, a deduction of $1,255 was levied against the province's CHT payment in March 2024 in respect of patient charges for insured cataract surgery that occurred in fiscal year 2021–2022. Since 2018, when this issue was first identified, the province has implemented regulatory and policy measures, detailed in its RAP and subsequent status updates, that strengthen its prohibitions against patient charges for insured cataract procedures. Due to the retrospective nature of reporting under the Canada Health Act, and Newfoundland and Labrador's ongoing investigation of patient complaints, the province has continued to identify and report instances of patient charges to Health Canada when they occur. In recognition of the successful implementation of its RAP, and ongoing compliance with the reporting requirements under the Reimbursement Policy, Newfoundland and Labrador qualified for an immediate full reimbursement of $1,255 to offset its March 2024 CHT deduction. Health Canada continues to monitor this issue to ensure continued compliance. A copy of Newfoundland and Labrador's RAP as well the January 2025 status update on its implementation are presented in Annex D of this report.

New Brunswick

During the reporting period, surgical abortion services in New Brunswick were insured under the provincial health care insurance plan but only covered if performed in hospital; procedures provided in a private clinic in Fredericton, which closed in February 2024, were not covered. Prior to the clinic's closing, Health Canada had raised this issue with New Brunswick at the officials' level and Ministerial levels.

Although the province's financial statement of extra-billing and user charges for 2021-2022 indicated a nil amount, there was evidence of ongoing patient charges and Health Canada used data published by the Canadian Institute for Health Information to estimate patient charges for medically necessary surgical abortion services in the amount of $109,275. Since 2020, deductions totalling $444,041 have been levied against New Brunswick's CHT payments in respect of patient charges to access to abortion services. Though the private clinic in New Brunswick is now closed, the retrospective nature of reporting under the Canada Health Act means New Brunswick will face additional CHT deductions for patient charges for medically necessary surgical abortion services levied in 2022-2023 and 2023-2024.

As described in New Brunswick's Reimbursement Action Plan, which can be found in Annex D of this report, this issue has now been resolved and will be reported on in more detail in next year's report.

Ontario

While the Ontario Health Insurance Plan provides coverage for physicians' fees related to abortion services in all settings, including private clinics, during the 2021-2022 reporting period the province only covered facility fees in the four private abortion clinics licensed as Independent Health Facilities (IHF) under the Independent Health Facilities Act (IHFA). In some instances, this led to other clinics charging patients out-of-pocket to access abortion services. Based on amounts reported by Ontario to Health Canada, a deduction of $32,800 was levied against the province's CHT payment in March 2024 in respect of patient charges to access insured abortion services that occurred in fiscal year 2021–2022. At the same time, in recognition of actions taken to eliminate these patient charges, including the introduction of new legislation in 2023, as discussed below, Ontario received partial reimbursement of its March 2022 ($6,560), March 2023 ($32,800), and March 2024 ($32,800) deductions, for a total reimbursement of $43,296.

As reported in its February 2024 Reimbursement Action Plan update, on September 25, 2023, Ontario proclaimed the Integrated Community Health Services Centre Act (ICHSCA), which replaces the IHFA and provides a new framework for the delivery of insured health services in private clinics. The IHSCA maintains the previous legislation's prohibitions on charging facility fees related to the provision of insured health services, while adding prohibitions on refusing access to insured services, or providing preferential access to insured services, based on an insured resident's choice to pay or not pay for an uninsured service. Health Canada continues to engage with Ontario to encourage the province to fulfil the commitment made in its RAP as work is on-going to establish regulations under the new legislation, which is expected to eliminate these patient charges. A copy of Ontario's RAP as well the February 2024 status update on its implementation are presented in Annex D of this report.

British Columbia

Based on amounts reported by British Columbia to Health Canada, a deduction of $6,848,505 was levied against the province's CHT payment in March 2024 for patient charges levied for medically necessary surgical services in fiscal year 2021–2022.

In recognition of the significant strides British Columbia has made in successfully implementing elements of its RAP, to greatly reduce patient charges for medically necessary surgical services, Health Canada authorized a reimbursement of $6,818,207 in March 2024. This represents a partial reimbursement of British Columbia's March 2022, 2023, and 2024 deductions. A copy of British Columbia's RAP and January 2025 status update on its implementation are presented in Annex D of this report.

| Province | Deductions for Diagnostic Services | Deductions for Surgical Services | Deduction Total | Reimbursement Total |

|---|---|---|---|---|

| NL | - | $1,255 | $1,255 | $1,255 |

| NS | $1,794,635 | - | $1,794,635 | - |

| NB | $1,794,635 | $109,275 | $1,903,910 | - |

| QC | $36,014,132 | - | $36,014,132 | $46,728,814 |

| ON | - | $32,800 | $32,800 | $43,296 |

| MB | $650 | - | $650 | $354,477 |

| SK | $1,084,513 | - | $1,084,513 | - |

| AB | $20,450,175 | - | $20,450,175 | $20,538,796 |

| BC | $11,270,216 | $6,848,505 | $18,118,721 | $22,405,749Footnote * |

| Total | $72,408,956 | $6,991,835 | $79,400,791 | $90,072,387 |

Footnotes

|

||||

Additional compliance issues

Enrollment and membership fees at private primary care clinics

Private primary care clinics that charge patients annual membership fees continue to be an issue of concern under the Canada Health Act. In many cases, these clinics provide their members with access to a mix of insured primary care services and uninsured health services (e.g., massage therapy and nutritional services). Typically, the clinics claim that the fees cover a basket of non-insured health services; however, in some cases these fees are also mandatory to access insured health services at the clinic.

When Health Canada becomes aware of such charges, the Department recommends the provinces and territories work with the clinics in question to make clear to insured residents that access to insured health services is not contingent or preferential based on the payment of annual fees for uninsured health services, which may also involve an investigation or audit of the billing practices of the clinic. When investigations or audits occur, Health Canada requests information about the findings and next steps to ensure any inappropriate patients charges have been eliminated. Health Canada also advises that these provinces and territories develop legislation that is clear about patients' access to insured health services and which prohibits out-of-pocket charges to patients.

In 2023, Health Canada reached out to Alberta following media reports of a primary care clinic that appeared to be charging patients for expedited access to insured physician services. Alberta responded that they were in the process of investigating all clinics that had a membership component to their services, including the clinic identified by Health Canada. The province subsequently identified 41 primary care clinics that advertise membership fees to access a mix of insured and uninsured services, and undertook an analysis of seven randomly selected clinics to gain an understanding of their business models and how they operate. While preliminary results of this review found that the membership fees were only to access uninsured services, Alberta informed Health Canada that an audit would be required to ensure these clinics are not operating in contravention of the Canada Health Act. Alberta is currently evaluating next steps concerning all identified membership clinics and Health Canada continues to monitor this issue.

Since 2023, British Columbia has pursued injunctions against two membership-based primary care providers for operating in non-compliance with British Columbia's legislation. Following prolonged consultations, the providers in question changed their business models to come into compliance, prompting British Columbia to drop the respective injunctions. British Columbia continues to monitor the activities of membership-based primary care providers in the province and provides regular updates to Health Canada.

Portability

Physician services received by Quebec residents when out-of-province are not reimbursed at host province rates, which is a requirement of the portability criterion of the Canada Health Act.

For all jurisdictions, except Prince Edward Island and the three territories, the per diem rates for out-of-country hospital services appear lower than home province or territory rates, which is contrary to the requirement of the portability criterion of the Act. These concerns have been raised with the implicated provinces, and Health Canada continues to monitor the issue.

History of deductions, refunds, and reimbursements under the Canada Health Act

The Canada Health Act, which came into force April 17, 1984, reaffirmed the national commitment to the original principles of the Canadian health care system, as embodied in the previous legislation, the Medical Care Act and the Hospital Insurance and Diagnostic Services Act. By putting into place mandatory dollar-for-dollar penalties for extra-billing and user charges, the federal government took steps to eliminate the proliferation of direct charges for hospital and physician services, judged to be restricting the access of many Canadians to health care services due to financial considerations.

Canada Health Act compliance from 1984–1987

During the period 1984 to 1987, subsection 20(5) of the Act provided for deductions in respect of these charges to be refunded to the province if the charges were eliminated before April 1, 1987.

By March 31, 1987, it was determined that all provinces in which patients had been subject to extra-billing and user charges had taken appropriate steps to eliminate them. Accordingly, by June 1987, a total of $244,732,000 in deductions was refunded to New Brunswick, Quebec, Ontario, Manitoba, Saskatchewan, Alberta, and British Columbia.

| PTs | 1984-1985 | 1985-1986 | 1986-1987 | Total |

|---|---|---|---|---|

| NB | $3,078,000 | $3,306,000 | $502,000 | $6,886,000 |

| QC | $7,893,000 | $6,139,000 | - | $14,032,000 |

| ON | $39,996,000 | $53,328,000 | $13,332,000 | $106,656,000 |

| MB | $810,000 | $460,000 | - | $1,270,000 |

| SK | $1,451,000 | $656,000 | - | $2,107,000 |

| AB | $9,936,000 | $11,856,000 | $7,240,000 | $29,032,000 |

| BC | $22,797,000 | $30,620,000 | $31,332,000 | $84,749,000 |

| TOTAL | $85,961,000 | $106,365,000 | $52,406,000 | $244,732,000 |

In the first three years after the enactment of the Canada Health Act, almost $245 million in deductions were taken against federal health transfers to provinces; these deductions were refunded when the provinces effectively eliminated the patient charges that led to them.

Canada Health Act compliance from 1987–2018, by province

Following the Act's initial three-year transition period, during which refunds to provinces and territories for deductions were possible, penalties under the Act did not reoccur until fiscal year 1994–1995. See the chart later in this chapter for penalties occurring from fiscal years 1994–1995 to 2016-2017.

Federal policy on private clinics

In January 1995, federal Minister of Health, the Honourable Diane Marleau, expressed concerns to her provincial and territorial colleagues about the development of two-tiered health care and the emergence of private clinics charging facility fees for medically necessary surgical services. As part of her communication with the provinces and territories, Minister Marleau announced that the provinces and territories would be given more than nine months to eliminate these user charges, but that any province that did not, would face financial penalties under the Act. Accordingly, beginning in November 1995, deductions have been applied to the cash contributions of provinces for noncompliance with the Federal Policy on Private Clinics, which has implicated Newfoundland and Labrador, Nova Scotia, Manitoba, Alberta, and British Columbia, as described below. In addition to deductions taken under the Federal Policy on Private Clinics, Newfoundland and Labrador, Nova Scotia, Quebec, and British Columbia have also taken deductions with respect to physician extra-billing, which is also described below.

Under the Canada Health Act, the term "hospital" includes more than just buildings with a big "H" on them.

Under the 1995 Federal Policy on Private Clinics, the Honourable Diane Marleau, the federal Minister of Health at the time, clarified that the definition of "hospital" set out in the Canada Health Act includes any facility that provides acute, rehabilitative, or chronic care. As such, a hospital also covers health care facilities, such as clinics.

Newfoundland and Labrador

A total of $280,430 was deducted from Newfoundland and Labrador's cash contribution due to facility fees in a private abortion clinic, before these fees were eliminated, effective January 1, 1998.

A deduction of $1,100 was taken from the March 2005 CHT payment to Newfoundland and Labrador as a result of patient charges for an MRI scan in a hospital which occurred during 2002–2003.

From March 2011 to March 2013, deductions totaling $102,249 were taken from CHT payments to Newfoundland and Labrador for extra-billing and user charges, based on charges reported by the province to Health Canada. These charges resulted from services provided by an opted-out dental surgeon who has since left the province.

Nova Scotia

Before it closed in November 2003, deductions totaling $372,135 were made to Nova Scotia's Canada Health and Social Transfer cash contribution for its failure to cover facility charges to patients, while paying the physician fee, at a Halifax clinic. A final deduction of $5,463 was taken from the March 2005 CHT payment to Nova Scotia as a reconciliation of deductions that had already been taken for 2002–2003. A one-time positive adjustment in the amount of $8,121 was made to Nova Scotia's March 2006 CHT payment to reconcile amounts actually charged in respect of extra-billing and user charges with the penalties that had already been levied based on provincial estimates reported for fiscal 2003–2004.

The March 2007 CHT payment to Nova Scotia was reduced by $9,460 in respect of extra-billing during fiscal year 2004–2005. This amount was reported to Health Canada by the province based on the findings of an audit, concluded in 2006, of the billing practices of a Nova Scotia physician.

Quebec

In March 2017, on the basis of amounts of extra-billing and user charges reported by the Quebec Auditor General with respect to accessory fees charged in 2014–2015, the federal Minister estimated a deduction amount of $9,907,229. In light of corrective action the provincial government had already taken to eliminate accessory fees in January 2017, that amount was subsequently returned to Quebec by the Government of Canada.

In March 2018, using the amount of extra-billing and user charges reported by the Quebec Auditor General with respect to accessory fees charged in 2014–2015 as a proxy, the federal Minister estimated a deduction amount of $9,907,229. In light of the legislative changes the provincial government had already implemented to eliminate and prohibit the continuation of accessory fees in January 2017, this amount was subsequently returned to Quebec by the Government of Canada. This reimbursement pre-dated the Reimbursement Policy. Quebec's March 2017 and March 2018 deductions, which, due to reporting timelines under the Act, were taken after patient charges had already been eliminated by the provincial government, served as the inspiration for the Reimbursement Policy.

Manitoba

From November 1995 to December 1998, deductions totaling $2,055,000 were taken due to user charges anticipated by the province at surgical and ophthalmology clinics. However, during fiscal year 2001–2002, a monthly deduction (from October 2001 to March 2002, inclusively) in the amount of $50,033.50 was levied against Manitoba's Canada Health Social Transfer cash contribution on the basis of a financial statement provided by the province. The statement showed that actual amounts charged with respect to user charges for insured health services in fiscal years 1997–1998 and 1998–1999 were greater than the deductions levied on the basis of estimates. This brought total deductions levied against Manitoba to $2,355,201.

Alberta

Deductions of $3,585,000 were made, from November 1995 until June 1996, to Alberta's cash contribution in respect of facility fees charged at clinics providing surgical, ophthalmological and abortion services. On October 1, 1996, Alberta prohibited private surgical clinics from charging patients a facility fee for medically necessary services for which the physician fee was billed to the provincial health care insurance plan.

British Columbia

In the early 1990s, as a result of a dispute between the British Columbia Medical Association and the British Columbia government over compensation, several doctors opted out of the provincial health care insurance plan and began billing their patients directly. Some of these doctors billed their patients at a rate greater than the amount the patients could recover from the provincial health care insurance plan.

This higher amount constituted extra-billing under the Act. Deductions began in May 1994, relating to fiscal year 1992–1993, and continued until extra-billing by physicians was banned when changes to British Columbia's Medicare Protection Act came into effect in September 1995. In total, $2,025,000 was deducted from British Columbia's cash contribution for extra-billing that occurred in the province between 1992–1993 and 1995–1996.

In January 2003, British Columbia provided a financial statement in accordance with the Canada Health Act Extra-billing and User Charges Information Regulations indicating aggregate amounts actually charged with respect to extra-billing and user charges in private surgical clinics during fiscal year 2000–2001, totaling $4,610. Accordingly, a deduction of $4,610 was made to the March 2003 CHST cash contribution.

In 2004, British Columbia did not report to Health Canada the amounts of extra-billing and user charges actually charged during fiscal year 2001–2002. As a result of reports that British Columbia was investigating 55 cases of user charges, a $126,775 deduction was taken from British Columbia's March 2004 CHST payment, based on the amount the federal Minister estimated to have been charged during fiscal year 2001–2002.

Between 2002 and 2017, deductions totaling $1,773,183 were taken from British Columbia's Canada Health Transfer payments in light of patient charges reported by the province to Health Canada. The deduction taken to British Columbia's federal health transfers in March 2013, in respect of fiscal year 2010–2011, was estimated by the federal Minister of Health and represents the aggregate of the amounts reported to Health Canada by British Columbia and those reported publicly as the result of an audit performed by the Medical Services Commission of British Columbia. This methodology was used until fiscal year 2016–2017.

Following collaborative work with Health Canada on an audit project to determine the extent and scope of patient charges in the province, a deduction of $15,861,818 was taken in March 2018 in respect of patient charges during fiscal year 2015–2016. This deduction reflected British Columbia's private clinic audit results, patient complaints, and publicly available evidence of $4.7 million of patient charges to insured residents by enrolled physicians at the Cambie Surgery Centre.

Since the passage of the Act, from April 1984 to March 2024, deductions totaling $276,868,026 have been taken from transfer payments in respect of the extra-billing and user charges provisions of the Act. This amount excludes deductions totaling $244,732,000 that were made between 1984 and 1987, and subsequently refunded to the provinces when extra-billing and user charges were eliminated.

| NL | PE | NS | NB | QC | ON | MB | SK | AB | BC | YT | NT | NU | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1994/95 | - | - | - | - | - | - | - | - | - | $1,982,000 | - | - | - | $1,982,000 |

| 1995/96 | $46,000 | - | $32,000 | - | - | - | $269,000 | - | $2,319,000 | $43,000 | - | - | - | $2,709,000 |

| 1996/97 | $96,000 | - | $72,000 | - | - | - | $588,000 | - | $1,266,000 | - | - | - | - | $2,022,000 |

| 1997/98 | $128,000 | - | $57,000 | - | - | - | $586,000 | - | - | - | - | - | - | $771,000 |

| 1998/99 | $53,000 | - | $38,950 | - | - | - | $612,000 | - | - | - | - | - | - | $703,950 |

| 1999/00 | ($42,570) | - | $61,110 | - | - | - | - | - | - | - | - | - | - | $18,540 |

| 2000/01 | - | - | $57,804 | - | - | - | - | - | - | - | - | - | - | $57,804 |

| 2001/02 | - | - | $35,100 | - | - | - | $300,201 | - | - | - | - | - | - | $335,301 |

| 2002/03 | - | - | $11,052 | - | - | - | - | - | - | $4,610 | - | - | - | $15,662 |

| 2003/04 | - | - | $7,119 | - | - | - | - | - | - | $126,775 | - | - | - | $133,894 |

| 2004/05 | $1,100 | - | $5,463 | - | - | - | - | - | - | $72,464 | - | - | - | $79,027 |

| 2005/06 | - | - | ($8,121) | - | - | - | - | - | - | $29,019 | - | - | - | $20,898 |

| 2006/07 | - | - | $9,460 | - | - | - | - | - | - | $114,850 | - | - | - | $124,310 |

| 2007/08 | - | - | - | - | - | - | - | - | - | $42,113 | - | - | - | $42,113 |

| 2008/09 | - | - | - | - | - | - | - | - | - | $66,195 | - | - | - | $66,195 |

| 2009/10 | - | - | - | - | - | - | - | - | - | $73,925 | - | - | - | $73,925 |

| 2010/11 | $3,577 | - | - | - | - | - | - | - | - | $75,136 | - | - | - | $78,713 |

| 2011/12 | $58,679 | - | - | - | - | - | - | - | - | $33,219 | - | - | - | $91,898 |

| 2012/13 | $50,758 | - | - | - | - | - | - | - | - | $280,019 | - | - | - | $330,777 |

| 2013/14 | ($10,765) | - | - | - | - | - | - | - | - | $224,568 | - | - | - | $213,803 |

| 2014/15 | - | - | - | - | - | - | - | - | - | $241,637 | - | - | - | $241,637 |

| 2015/16 | - | - | - | - | - | - | - | - | - | $204,145 | - | - | - | $204,145 |

| 2016/17 | - | - | - | - | $9,907,229Footnote 1 | - | - | - | - | $184,508 | - | - | - | $10,091,737 |

| 2017/18 | - | - | - | - | $9,907,229Footnote 1 | - | - | - | - | $15,861,818 | - | - | - | $25,769,047 |

| TOTAL: | $383,779 | - | $378,937 | - | $19,814,458Footnote 1 | - | $2,355,201 | - | $3,585,000 | $19,660,001 | - | - | - | 46,177,376 |

Footnotes

|

||||||||||||||

Understanding this chart

The first deductions under the Act were taken during the first three years after the Act's passage and were subsequently refunded. They are described earlier in this chapter and listed in a chart. There were no deductions taken between fiscal year 1987–1988 and 1993–1994.

To date, most deductions have been based on statements of actual extra-billing and user charges, meaning they are made two years after the extra-billing and user charges occurred (for example, deductions taken in fiscal year 2016–2017 would be in respect of patient charges levied in 2014–2015).

In instances where provinces and territories estimate anticipated amounts of extra-billing and user charges for the upcoming year, a deduction was taken in respect of those charges in the fiscal year for which they are estimated.

In addition to forming the basis for most deductions under the Act, the statements of actual extra-billing and user charges provide an opportunity to reconcile any estimated charges with those that actually occurred. These reconciliations form the basis for further modifications to provincial and territorial cash transfers.

Canada Health Act compliance from 2019−present, by province

Reimbursement Policy and Diagnostic Services Policy

As described earlier, two policies were announced in the Petitpas Taylor interpretation letter: the Canada Health Act Reimbursement Policy and the Diagnostic Services Policy (DSP).