Impact Assessment Agency of Canada’s Quarterly Financial Report for Quarter ended December 31, 2022

Statement outlining results, risks and significant changes in operations, personnel and programs

Introduction

The Impact Assessment Agency of Canada’s (the Agency) third quarterly financial statement for the period ended December 31, 2022 has been prepared by management as required by section 65.1 of the Financial Administration Act, and in the form and manner prescribed by Treasury Board under the Directive on Accounting Standards. It should be read in conjunction with the Main Estimates and Supplementary Estimates for the current year.

This report has not been subject to an external audit or review.

The Agency, led by a President who reports directly to the Minister of Environment and Climate Change, has its headquarters in Ottawa and regional offices in St. John’s, Halifax, Quebec City, Toronto, Edmonton, and Vancouver. The Agency’s activities are carried out under two core responsibilities: 1) Impact Assessments and 2) Internal Services.

1. Impact Assessments

The Agency delivers high-quality impact assessments that contribute to the informed decision making on major projects, in support of sustainable development. Through its delivery of Impact Assessment (IA), the Agency serves Canadians by looking at both positive and negative environmental, economic, social and health impacts of potential projects. The Agency:

- Leads and manages the impact assessment process for all federally designated major projects;

- Leads Crown engagement and serves as the single point of contact for consultation and engagement with Indigenous peoples during impact assessments for designated projects;

- Provides opportunities and funding to support public participation in impact assessments;

- Works to ensure that mitigation measures are applied and are working as intended;

- Promotes uniformity and coordination of impact assessment practices across Canada through research, guidance and ongoing discussion with stakeholders and partners; and

- Works with a range of international jurisdictions and organizations to exchange best practices in impact assessment.

In delivering on its core responsibilities for designated projects, the Agency collaborates with federal departments and agencies with specific expertise to provide information and advice that support the conduct of impact assessments. Where projects are associated with lifecycle regulators such as the Canada Energy Regulator, the Canadian Nuclear Safety Commission and the Offshore Petroleum Boards, the Agency works collaboratively with these partners to draw upon their expert knowledge and ensures that safety, licensing requirements, international obligations, and other key regulatory factors are considered as part of a single, integrated assessment. In accordance with the transitional provisions of Impact Assessment Act (IAA 2019), the Agency is also responsible to continue managing the environmental assessment (EA) of most projects required under the former Canadian Environmental Assessment Act (CEAA 2012).

In addition, the Agency advises and assists the Minister of Environment and Climate Change in establishing review panels and supports panels in their work. It also supports the Minister in fulfilling responsibilities under IAA 2019, including the development and issuance of enforceable impact assessment (IA) decision statements.

2. Internal Services

Internal Services are resources that are required to enable Program delivery and are activities provided to meet corporate obligations of the Agency. Internal Services include:

- Management and oversight services

- Communications services

- Legal services

- Human Resource management services

- Financial management services

- Information Management and Technology services

- Accommodation and Security management services

- Material management services; and

- Procurement management services.

Under IAA 2019, the Agency has an expanded mandate to administer four Grants and Contribution funding programs (Funding Programs):

- Participant Funding Program - to facilitate the participation of the public and Indigenous Peoples in preparing for possible IAs of designated projects, for the IA of projects by the Agency or a review panel, for the design and implementation of follow-up programs for projects, and for regional and strategic assessments.

- Policy Dialogue Program - to promote uniformity and harmonization in relation to the assessment of effects across Canada and all levels of government; promote and monitor the quality of impact assessments under the Act; develop policy related to the Act; and to engage with Indigenous Peoples on policy issues related to the Act.

- Research Program - to promote or conduct research on matters related to IAs that focuses on policy-relevant research on impact assessment, and enabling research partnership opportunities.

- Indigenous Capacity Support Program - to promote communication and cooperation with Indigenous peoples ensuring respect for the rights of Indigenous peoples and ensuring the consideration of Indigenous knowledge.

The Agency also has responsibilities for reviewing projects of a federal nature under the environmental and social protection regimes set out in sections 22 and 23 of the 1975 James Bay and Northern Quebec Agreement. The President of the Agency is designated by Order-in-Council as the federal administrator of these processes.

The Cabinet Directive on the Environmental Assessment of Policy, Plan and Program Proposals establishes a self-assessment process for conducting a strategic IA of a policy, plan or program proposal. The Agency supports the Minister of Environment and Climate Change in promoting the application of the Cabinet Directive and provides training and guidance for federal authorities.

Basis of Presentation

This quarterly report has been prepared by management using the expenditure basis of accounting. The accompanying Statement of Authorities includes the Agency’s spending authorities granted by Parliament and those used by the Agency consistent with the Main Estimates and Supplementary Estimates (as applicable) for the 2022–2023 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before funds can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The Agency uses the full accrual method of accounting to prepare and present its annual financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of fiscal quarter and fiscal year-to-date (YTD) results

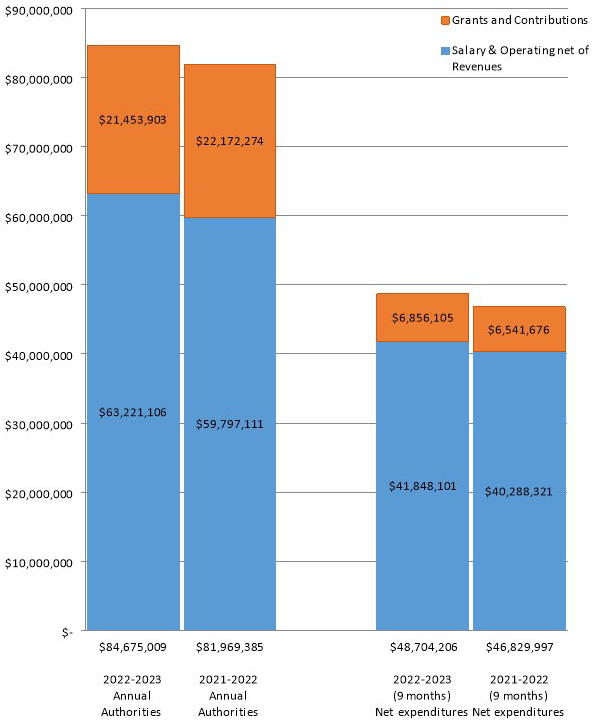

Figure 1 outlines the net budgetary authorities ($84.68M in 2022–2023 and $81.97M in 2021–2022), which represents the resources available for the year as of December 31, 2022, net of the revenue that is forecasted to be collected. The Agency’s available authorities, net of revenues, currently represent an increase of $2.71M (3.30%) from the previous year. The variance is due to additional authorities granted by the Treasury Board for the settlement of collective agreements as well as a re-profile of funds from the previous year to address a legal settlement.

Figure 1 also outlines the Agency’s third quarter year-to-date budgetary expenditures net of revenues that have increased by $1.87M (4%) from the previous year ($48.70M in 2022–2023 and $46.83M in 2021–2022). This increase is explained by the following:

- Expenditures in Other Expenses represent an increase of $372K ($376K in 2022–2023 and $3.5K in 2021–2022). This change is a result of a court payment related to a contingent liability.

- Expenditures in Transportation and Telecommunications represent an increase of $487K ($627K in 2022–2023 and $140K in 2021–2022). Although travel remains limited due to COVID-19 concerns, this change is a result of a significant increase in travel expenses largely due to easing restrictions.

- Expenditures in Acquisition of Machinery & Equipment represent an increase of $289K ($418K in 2022–2023 and $129K in 2021–2022). This change is a result of easing restrictions pertaining to COVID-19 and the continuing preparation of office equipment and software for the Return to the Workplace hybrid model.

- Expenditures in Information represent an increase of $139K ($350K in 2022–2023 and $212K in 2021–2022). This change is a result of the resumption of assessments that were previously paused due to COVID-19.

- All other budgetary expenditures increased by a total of $587K ($46.93M in 2022-2023 and $46.35M in 2021-2022) for the following: personnel, professional services, rentals, purchased repair and maintenance, utilities, materials and supplies, transfer payments and revenue.

Risks and Uncertainties

The Agency’s expenditures and revenues are influenced by the number of assessments underway during a given fiscal year, and are affected by the economic conditions that are outside the control of the Agency. To offset a portion of its expenditures, the Agency has vote-netted revenue authority to recover certain incurred costs from proponents in the conduct of assessments by review panels. The timing of revenue collection is uncertain and may impact the Agency’s overall financial results.

In addition, the timing of requests for grants or contributions participant funding under the four funding programs varies and is unpredictable. A contribution commitment to participant funding may be planned in one year but could be realized across multiple fiscal years depending on the progression of the impact assessment. Unused contribution commitments are carried forward from one year to another and are honored by the Agency as they materialize.

The Agency is also subject to litigation, the extent and costs of which are uncertain. If applicable, these are normally covered by the Agency’s annual appropriations.

Approval by Senior Officials

Approved by:

___________________________________

Terence Hubbard

President

___________________________________

Joelle Raffoul

Acting Vice-President Corporate Services and Chief Financial Officer

Ottawa, Canada

March 1, 2023

Statement of Authorities (unaudited)

Total available for use for the year ending |

Used during the quarter ended |

Year to date used at quarter-end |

|

|---|---|---|---|

VOTE 1 - Net Operating Expenditures |

$ 57,192,392 |

$ 13,218,609 |

$ 37,326,566 |

VOTE 5 - Grants and Contributions |

$ 21,453,903 |

$ 3,535,123 |

$ 6,856,105 |

Statutory Authorities - Employee Benefits |

$ 6,028,714 |

$ 1,507,178 |

$ 4,521,535 |

Total Authorities |

$ 84,675,009 |

$ 18,260,910 |

$ 48,704,206 |

Total available for use for the year ending |

Used during the quarter ended |

Year to date used at quarter-end |

|

|---|---|---|---|

VOTE 1 - Net Operating Expenditures |

$ 53,910,006 |

$ 12,178,345 |

$ 35,872,992 |

VOTE 5 - Grants and Contributions |

$ 22,172,274 |

$ 2,958,891 |

$ 6,541,676 |

Statutory Authorities - Employee Benefits |

$ 5,887,105 |

$ 1,471,776 |

$ 4,415,329 |

Total Authorities |

$ 81,969,385 |

$ 16,609,012 |

$ 46,829,997 |

Agency Budgetary Expenditures by Standard Object (unaudited)

Planned Expenditures for the year ending March 31, 2023 |

Expended during the quarter ended December 31, 2022 |

Year to date used at quarter-end |

|

|---|---|---|---|

Expenditures |

|||

Personnel |

$ 48,157,882 |

$ 12,110,385 |

$ 36,138,150 |

Transportation and Telecommunications |

$ 2,823,061 |

$ 257,301 |

$ 627,088 |

Information |

$ 934,101 |

$ 86,216 |

$ 350,376 |

Professional Services |

$ 8,853,679 |

$ 1,983,884 |

$ 5,068,196 |

Rentals |

$ 3,754,856 |

$ 44,477 |

$ 62,046 |

Purchased Repair and Maintenance |

$ 11,532 |

$ 1,545 |

$ 9,240 |

Utilities, materials and supplies |

$ 281,384 |

$ 31,418 |

$ 61,177 |

Acquisition of Machinery & Equipment |

$ 1,314,661 |

$ 306,042 |

$ 417,928 |

Transfer Payments |

$ 21,453,903 |

$ 3,535,123 |

$ 6,856,105 |

Other expenses |

$ 89,950 |

$ 1,516 |

$ 375,752 |

Total Gross Budgetary Expenditures |

$ 87,675,009 |

$ 18,357,907 |

$ 49,966,058 |

Less Revenues netted against Expenditures |

|||

Panel Reviews |

$ 3,000,000 |

$ 96,997 |

$ 1,261,852 |

Total Revenue netted against expenditures |

$ 3,000,000 |

$ 96,997 |

$ 1,261,852 |

Total net budgetary expenditures |

$ 84,675,009 |

$ 18,260,910 |

$ 48,704,206 |

Planned Expenditures for the year ending March 31, 2022 |

Expended during the quarter ended December 31, 2021 |

Year to date used at quarter-end |

|

|---|---|---|---|

Expenditures |

|||

Personnel |

$ 46,512,225 |

$ 11,628,585 |

$ 36,252,244 |

Transportation and Telecommunications |

$ 2,605,392 |

$ 68,490 |

$ 139,642 |

Information |

$ 862,078 |

$ 45,104 |

$ 211,581 |

Professional Services |

$ 7,785,432 |

$ 2,138,676 |

$ 5,076,676 |

Rentals |

$ 3,465,342 |

$ 17,739 |

$ 49,666 |

Purchased Repair and Maintenance |

$ 10,643 |

$ 1,306 |

$ 1,385 |

Utilities, materials and supplies |

$ 259,688 |

$ 23,757 |

$ 53,247 |

Acquisition of Machinery & Equipment |

$ 1,213,296 |

$ 115,821 |

$ 128,958 |

Transfer Payments |

$ 22,172,274 |

$ 2,958,891 |

$ 6,541,676 |

Other expenses |

$ 83,015 |

$ 3,461 |

$ 3,488 |

Total Gross Budgetary Expenditures |

$ 84,969,385 |

$ 17,001,830 |

$ 48,458,563 |

Less Revenues netted against Expenditures |

|||

Panel Reviews |

$ 3,000,000 |

$ 392,818 |

$ 1,628,566 |

Total Revenue netted against expenditures |

$ 3,000,000 |

$ 392,818 |

$ 1,628,566 |

Total net budgetary expenditures |

$ 81,869,385 |

$ 16,609,012 |

$ 46,829,997 |

Note 1: The Agency has authority to collect up to $8,001,000 in vote-netted revenue