Cost Recovery Guide for Impact Assessments by Review Panels Under the Impact Assessment Act

Our website is undergoing significant changes to provide updated guidance on the Impact Assessment Agency of Canada's practice on the application of the Impact Assessment Act and its regulations. This webpage and its contents may not reflect the Impact Assessment Agency of Canada's current practices. Proponents remain responsible for following applicable legislation and regulations. For more information, please contact guidancefeedback-retroactionorientation@iaac-aeic.gc.ca

A reference guide for project proponents

September 2022

Document Information

Disclaimer

The document Cost Recovery for Impact Assessments by Review Panels under the Impact Assessment Act is a Reference Guide for project proponents. It is for information purposes only and is not a substitute for the Impact Assessment Act or any of the relevant regulations. In the event of any inconsistency between this guide and Act(s) or regulations, the Act(s) or regulations would prevail. For the most up-to-date versions of the Act(s) and regulations, please consult the Department of Justice website.

Updates

This document may be reviewed and updated periodically. To ensure that you have the most up-to-date version, please consult the Policy and Guidance page of the Impact Assessment Agency of Canada’s website.

Copyright

© His Majesty the King in Right of Canada, as represented by the Minister of Environment and Climate Change, 2022.

This publication may be reproduced for personal or internal use without permission, provided the source is fully acknowledged. However, multiple copy reproduction of this publication in whole or in part for purposes of redistribution requires the prior written permission from the Impact Assessment Agency of Canada, Ottawa, Ontario K1A 0H3.

Catalogue Number: En106-237/2022E-PDF

ISBN: 978-0-660-43221-2

Ce document a été publié en français sous le titre: Recouvrement des coûts pour les évaluations d’impact par des commissions d’examen: guide de référence à l’intention des promoteurs de projets

Recouvrement des coûts pour les évaluations d’impact par les commissions d’examen en vertu de la Loi: Un guide de référence pour les promoteurs de projets Avril 2021

Alternative formats may be requested by contacting: iaac.information.aeic@canada.ca

Table of Contents

- 1.0 Introduction

- 2.0 Basis For Cost Recovery

- 3.0 Administrative Policy

- 4.0 Primary Agency Contacts

- Appendix 1: Timelines

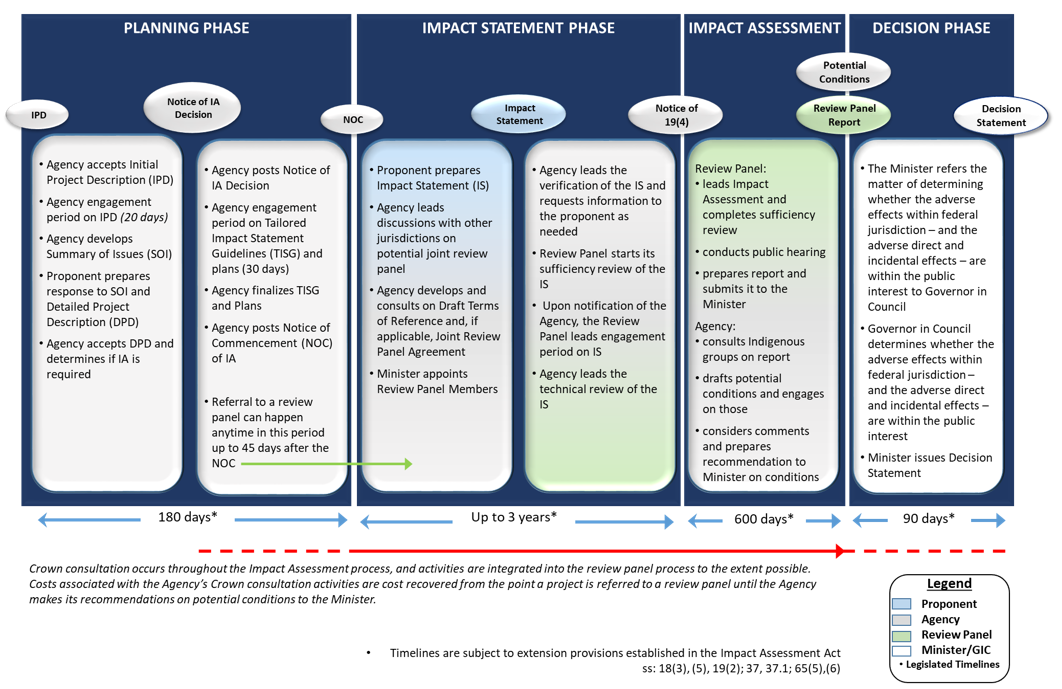

- Appendix 2: process chart of an ia by a review panel, indicating which steps are cost recoverable

- Appendix 3: roles and responsibilities of agency staff in ias by review panel; cost recoverable and non-cost recoverable activities

1.0 Introduction

This reference guide describes the Impact Assessment Agency of Canada’s (the Agency) administrative policy and approach for the recovery from proponents of costs incurred when impact assessments (IAs) are conducted by a review panel under the Impact Assessment Act (IAA; the Act), as per the Cost Recovery Regulations (SOR/2012-146).

The Agency’s Forward Regulatory Plan includes the development of new cost recovery regulations under the IAA. Consultations with stakeholders on the updated cost recovery regime will occur as part of the regulatory development process.

The existing Cost Recovery Regulations continue to apply to impact assessments by review panel under the IAA. When the new cost recovery regime is in place, it will contain details on whether and how designated projects under the existing cost recovery regime will be transitioned to the new regime. The purpose of this guide is to provide proponents of designated projects that are subject to an IA conducted by a review panel with a description of the services and amounts subject to cost recovery and the Agency’s approach for the implementation of cost recovery in relation to IAs by review panel, including Integrated Review Panels with lifecycle regulators and Joint Review Panels.

Proponents should refer to the "Cost recovery for environmental assessments by Review Panels under CEAA 2012" for assessments that are continuing under the Canadian Environmental Assessment Act, 2012.

This reference guide describes the:

- legislative, regulatory and policy basis for cost recovery;

- Agency’s administrative policy for cost recovery; and

- cost recoverable roles of the Agency and a review panel during an IA by panel review.

2.0 Basis For Cost Recovery

2.1 Legislative and regulatory basis for cost recovery

The Act provides the Agency with the authority to recover from the proponent of a designated project certain costs incurred during the course of an IA. The authority, as set out in sections 76-80 of the IAA provides that a proponent must pay to the Agency the costs incurred by the Agency or a review panel in relation to the exercise of its powers or the performance of its duties and functions in relation to a particular assessment. Under the IAA, and the Cost Recovery Regulations, until a new cost recovery regime is in place, three types of costs will be recovered:

- costs that the review panel and the Agency incur for prescribed services provided by a third party in the exercise of that power or the performance of that duty or function;

- prescribed amounts related to the exercise by the Agency of that power or the performance by it of that duty or function; and

- prescribed amounts related to the exercise by the members of a review panel of that power or the performance of that duty or function.

The services and amounts eligible to be recovered are prescribed in the Cost Recovery Regulations for a designated project referred to a review panel.

The Cost Recovery Regulations specify that cost recovery does not apply to a proponent who is:

- a federal authority;

- the Commissioner in Council of the Northwest Territories, the Legislature of the Yukon, an agency or body of those governments;

- the council of a band, as defined in subsection 2(1) of the Indian Act; or

- a provincial government, except in the case of a provincial Crown corporation.

2.2 Applicable federal instruments

The management of the Agency’s cost recovery regime is governed by a range of federal laws and policies, including the following:

- Cost Recovery Regulations set out the services and amounts for which the Agency can recover costs from the proponent of a project that undergoes an assessment by review panel.

- The Service Fees Act provides a legal framework within which departments are required to manage user fees, including the establishment and reporting of standards. This Act replaces the previous User Fees Act.

- The Treasury Board of Canada Secretariat’s Directive on Charging and Special Financial Authorities sets the requirements for service standards and monitoring of fee-related activities through audit and evaluation. It came into effect on April 2019 and replaces the Policy on Service Standards for External Fees.

- The Treasury Board of Canada Secretariat’s Policy on Service and Digital and the Directive on Service and Digital, in effect on April 1, 2020 provides general guidance on the use of service standards across the Government of Canada. These tools of oversight ensure effective management of service delivery.

- The Financial Administration Act which provides for the financial administration of the Government of Canada, the establishment and maintenance of the accounts of Canada and the control of Crown corporations

- The Treasury Board of Canada Secretariat’s Directive on Travel, Hospitality Conference and Event Expenditures.

- The National Joint Council’s Travel Directive; and

- Employee remuneration and benefits that are established by Treasury Board of Canada.

3.0 Administrative Policy

3.1 Service pledge and principles

The Agency is committed to providing timely, transparent and professional service in support of IAs referred by the Minister of Environment and Climate Change (the Minister) to review panels. This includes coordinating and managing the recovery of costs of IAs by review panel; ensuring that appropriate accounting, tracking, and reporting mechanisms are in place; and providing information and direction to proponents.

In supporting assessments by review panel, the Agency is committed to administering cost recovery in a manner that is efficient, transparent, and consistent. The following principles, applied in the cost recovery regime under CEAA 2012, continue to apply in implementing the current regulations under the IAA:

- Costs recovered by the Agency are reasonable and predictable, and the Agency and review panels will conduct their activities in an efficient manner. Tools such as an initial billing instrument and monthly invoices ensure timely provision of estimates and expenditures to the proponent;

- The provision of services is transparent and measurable, and aligned with the timelines established in the IAA for the conduct of IAs by review panels (Appendix 1 provides details regarding the timelines for an IA by review panel); and

- The management system for cost recovery is transparent and ensures accountability. It includes rigorous tracking of expenditures, third party auditing of costs, and periodic evaluation of the implementation of the administrative policy for the recovery of costs associated with an IA by review panel.

3.2 Application of Cost Recovery

The IAA provides for the recovery of costs in relation to all IAs of designated projects where the Agency is the responsible authority (i.e. IAs by the Agency and IAs by a review panel). However, the Cost Recovery Regulations, only prescribe the services and amounts eligible for cost recovery for a designated project that has been referred to a review panel. As a result, the Agency does not currently recover costs associated with IAs conducted by the Agency.

Under the IAA, the Agency has the authority to recover eligible costs incurred from the time the initial description of the designated project is received by the Agency until the day on which the follow-up program in respect of the project is complete. However, the existing Cost Recovery Regulations, only prescribe amounts to be recovered when the designated project is referred to a review panel. As a result, the cost recovery will occur from the date that the Notice of Referral of an IA to a review panel is posted on the Canadian Impact Assessment Registry (the Registry) until the Decision Statement is issued to the proponent.

The recovery of costs associated with an IA by review panel, including associated Indigenous consultations and engagements, includes all eligible costs associated with the following activities:

- Planning Phase: Eligible costs associated with activities by the Agency to conduct the Planning phase, from the date that the Notice of Referral of an IA to a review panel is posted on the Registry until the Notice of Commencement of the IA is posted on the Registry.

- Impact Statement Phase: Eligible costs associated with activities of the Agency and/or the Review Panel to review the Impact Statement, from the posting of the Notice of Commencement of the IA until the Agency issues a notice under subsection 19(4) of the IAA.

- Impact Assessment Phase: Eligible costs associated with activities by the Agency and the Review Panel to conduct the IA, from the time the Agency issues a notice under subsection 19(4) of the IAA until the Agency submits recommendations to assist the Minister in establishing conditions under section 55.1 of the IAA.

- Decision-Making Phase: Eligible costs associated with activities by the Agency in relation to Crown Consultation from the time the Agency posts its recommendations to assist the Minister in establishing conditions under section 55.1 of the IAA until the issuance of the Decision Statement to the proponent, for the designated project.

Should the project be approved and built, costs associated with compliance promotion and enforcement, incurred during the Post-Decision Phase, as well as any work required to consider revisions to a decision statement would not be recovered from a proponent.

A process diagram providing an overview of the phases of an IA by review panel, including associated Indigenous consultation, is provided in Appendix 2. The roles and responsibilities of Agency staff involved in an IA by review panel during these phases, and which of those roles are cost recoverable, are described in Appendix 3.

Any funds allocated by the Agency to support participation of public participants and Indigenous communities in an IA by review panel are not recovered.

When the Minister refers the IA of a designated project to a review panel, the Minister can enter into an agreement with another jurisdiction and a joint review panelFootnote1 can be established. In the case of joint review panels or integrated review panelsFootnote2, costs may be shared between the Agency and the other jurisdiction. Some provincial governments have bilateral agreements in place with the federal government that may provide details for sharing the costs between the two governments associated with the conduct of an IA by a joint review panel. Where no agreement between the federal and provincial government or other jurisdictions with powers, duties or functions in respect of the designated project is in place, cost sharing is addressed on a case-by-case basis.

The Minister may terminate an assessment by review panel of a designated project if the Minister is of the opinion that the review panel will not submit its report on time, or if the review panel fails to submit its report within the established time limits. If the Minister exercises this authority, the Agency will be required to complete the assessment and prepare a report in accordance with the Minister’s directives. The costs incurred by the Agency to complete the IA and prepare the report will be recovered from the proponent.

3.3 Services and Amounts

The Cost Recovery Regulations prescribe the services and amounts which the Agency can recover from the proponent of a designated project undergoing an IA by review panel. These include:

- costs incurred for services provided by a third party;

- amounts related to the exercise of the Agency’s responsibilities; and

- amounts related to the exercise of the responsibilities of the review panel members.

3.3.1 Third party services

The following categories of costs associated with third party services obtained by a review panel or by the Agency are subject to cost recovery:

- Travel:

- regular travel services

- chartered services

- Publication and printing (including professional desktop publishing, editing and English/French or French/English translation)

- Distribution services:

- regular mail

- courier

- Telecommunications (including telephone and line installation, Internet, long-distance, teleconference and video conference and webcasting services)

- Advertising and news wire services

- Public meeting, panel hearing and panel meeting facilities and equipment, including:

- hospitality

- simultaneous interpretation

- audio systems

- transcription services

- computer equipment

- equipment to support any virtual meeting or panel hearing, as required.

3.3.2 Amounts related to the exercise of the Agency’s responsibilities

Salary and travel expenses related to the exercise of the Agency’s responsibilities during the conduct of the IA by review panel, including Crown consultation with Indigenous communities to fulfill the Crown’s "duty to consult" requirements of section 35 of the Constitution Act, are subject to cost recovery. The amounts that can be cost recovered include:

- Direct and attributable federal government employees’ salaries and employee benefit plans (EBP), including overhead and overtime charges. Salary per diem rates are based on a productivity rate of 220 working days/year and an EBP of 20% of total chargeable salaries using:

- for employees represented by bargaining units, the rates of pay as established in collective agreements between Treasury Board and the bargaining units (the highest increment will be used for all classifications); or

- for excluded or unrepresented employees, the rates of pay established by Treasury Board under section 11.1 of the Financial Administration Act (the highest increment will be used for all classifications).

- Direct and attributable federal government employees’ travel expenses. Rates are provided within the National Joint Council’s Travel Directive.

3.3.3 Amounts related to the exercise of the responsibilities of members of a review panel

Remuneration costs and travel expenses related to the exercise of the responsibilities of members of a review panel are subject to cost recovery. The amounts that can be cost recovered include:

- Remuneration of review panel members:

- panel chairperson $650 per day

- panel member $500 per day

- Direct and attributable review panel members’ travel expenses. Rates are provided within the National Joint Council’s Travel Directive.

3.4 Financial Information

3.4.1 Billing Instrument

As soon as possible after the decision by the Minister to refer the IA of a designated project to a review panel, the Agency will provide the proponent with a billing instrument, which contains an initial budget estimate of the costs associated with the IA by review panel.

The initial estimate will be broken down into the three categories of recoverable costs, as set out in section 3.3 above and the Cost Recovery Regulations. The Agency may reallocate costs between these categories as the assessment proceeds. The amounts outlined in the billing instrument reflect the estimated costs prior to any applicable taxes. The initial budget estimate should not be considered to be the maximum expenses and is subject to revision, as it is not always possible to accurately predict all costs or services at the beginning of an IA, and unforeseen factors may change the initial estimates.

The Agency will inform the proponent as soon as possible if an update to the billing instrument is necessary due to an increase or decrease in expected costs. Amendments to the billing instrument budget estimate will be provided to the proponent.

The proponent is required to pay the actual costs eligible for recovery under the Cost Recovery Regulations even if these costs exceed those in the billing instrument, including any required taxes.

3.4.2 Invoicing

An invoice will be prepared and issued to the proponent on a monthly basis. Each invoice will specify the amount of applicable taxes. The Agency will pay recoverable costs up front, and subsequently invoice the proponent for these costs. Interest will begin to accrue 30 days following issuance of each monthly invoice to the proponent (see section 3.4.3 for full details in respect of payment).

Following the issuance of a decision statement, and once all bills related to the assessment by review panel have been paid by the Agency, the Agency will prepare and issue a final invoice to the proponent.

At any time during the IA, should the proponent decide not to proceed with the project and to terminate the requirement for an assessment by review panel, the Agency will consolidate all accrued costs up to the date of termination of the IA and prepare and issue a final invoice to the proponent.

Proponents are encouraged to raise any issues or concerns with the initial billing instrument, monthly invoices, any updated billing instrument or the final invoice with the Agency. A dispute resolution mechanism is available to proponent if any differences remain unresolved. This mechanism is described in section 3.4.5.

3.4.3 Payment Due and Debt

All invoices issued by the Agency to the proponent are payable within 30 calendar days after the day on which demand for payment is issued. Payments not received within 30 calendar days will be considered overdue and will incur interest.

All invoices identified as unpaid beyond the 30 calendar days are treated as a debt owing to Her Majesty.

Pursuant to section 80 of the IAA, a proponent has 90 daysFootnote3 to pay a fee, charge, levy, cost or amount that is owed, as referred to in section 76 of the Act. After this time, the Agency or review panel may be authorized to not exercise any of its powers or not perform any of its duties or functions in relation to an impact assessment until the debt to the Crown is recovered.

3.4.4 Audit

The Agency will keep records open to audit and inspection by an independent auditor that is deemed acceptable to the Agency and the proponent. Such records will include all invoices, receipts, vouchers, time sheets and documents used by the Agency, in full or in part, to calculate the recoverable costs of conducting the IA.

Should the Agency or the proponent exercise its option to audit, that party will be responsible for the cost of the audit.

Where an audit reveals discrepancies regarding the amount charged by the Agency, those discrepancies will be promptly rectified. An adjustment invoice or reimbursement cheque will be issued to the proponent by the Agency should any discrepancies be revealed as a result of an audit.

Audits will be conducted in accordance with a schedule agreed upon by the Agency and the proponent.

3.4.5 Dispute Resolution Mechanism

A dispute resolution mechanism is available to resolve disputes related to the billing instrument and any subsequent updates, or the amounts invoiced to the proponent, as provided by the IAA and the Cost Recovery Regulations, in the monthly invoices up to the final invoice.

As a first step, the proponent should seek to resolve disputes through discussions with the Panel Manager for the IA. Should the dispute remain unresolved after such discussions, the proponent may initiate the process of appeal detailed below.

The appeal must be based on existing information. Where new substantive information arises, the original decision should be revisited by all parties prior to proceeding with the appeal.

A proponent may appeal a decision with respect to:

- the billing instrument;

- amendments to a billing instrument resulting in a change in the estimate of the total amount to be recovered;

- the monthly invoices;

- the final invoice submitted to the proponent by the Agency.

Review Panels Dispute Resolution Mechanism Process after discussion(s) with Panel Manager

First Level of Appeal — Director, Review Panels Division and Director, Crown Consultation Operations Division

The proponent is required to submit a letter of Intent to Appeal to the Director, Review Panels Division and Director, Crown Consultation Operations Division, within 15 calendar days of when the billing instrument and any subsequent updates, or monthly invoice; or final invoice was received.

Within 15 calendar days of the date of the letter of Intent to Appeal, or a period that the Directors and proponent agree upon, the proponent must file a Detailed Statement indicating the specific reason for the appeal, the basis for the appeal and providing substantiating information.

The Directors will consider the letter of appeal, and the substantiating information, and determine the outcome of the appeal. The Directors will inform the proponent of the outcome of the appeal. A written response will be provided within 30 calendar days from the receipt of the substantiating information.

Second Level of Appeal — Vice-President, Operations Sector, IAAC

Within 15 calendar days of the date of the Directors’ decision made at the first level of appeal, the proponent must advise the Vice-President, Operations, in writing of their Intent to Appeal and identify the name and title of one person who is nominated to be on an appeal committee.

Within 15 days of the receipt of the proponent’s Intent to Appeal to the second level, the Vice-President of Operations will submit to the proponent, the names and titles of two people nominated to be members of an appeal committee.

An appeal committee will be formed with membership as follows:

- One member nominated by the Vice-President of Operations;

- One member nominated by the proponent; and

- One member agreed upon by both the Vice-President of Operations and the proponent, who will act as Chair of the appeal committee.

The recommendation made by the appeal committee will be based on the information submitted in the original notification and reviewed at the first level of appeal. The appeal committee may receive oral presentations as considered to be necessary by a committee member. The proponent will be given an opportunity to make an oral presentation.

The recommendation made to the Vice-President by the committee will be made on the basis of at least two of the three committee members concurring on the recommendation.

The Vice-President will consider the recommendation of the appeal committee and inform the proponent of his or her decision within 30 calendar days of the receipt of the appeal committee’s recommendation. The decision of the Vice-President of Operations is final.

4.0 Primary Agency Contacts

For more information pertaining to project-specific costs or procedures, proponents are encouraged to contact the Panel Manager assigned to their proposed designated project.

For more information on the Agency’s cost recovery policies or procedures, please contact:

Impact Assessment Agency of Canada

ATTN: Accounts Receivable

22nd Floor, Place Bell

160 Elgin Street

Ottawa ON K1A 0H3

Tel.: 613-957-0700

Fax: 613-957-0862

Toll free number: 1-866-582-1884

iaac.information.aeic@canada.ca

Appendix 1: Timelines

If the Minister refers the IA of a designated project to a review panel, the Agency will set project-specific timelines for the following phases of the IA.

- Planning Phase: The time limit for the planning phase is 180 days.

- Impact Statement Phase: A proponent has up to three (3) years from the date that the Notice of Commencement is posted on the Registry to submit an Impact Statement that contains, to the satisfaction of the Agency, all the required information and studies outlined in the final Tailored Impact Statement Guidelines (TISG). This phase concludes with the Agency posting a notice pursuant to subsection 19(4) of the IAA on the Registry.

- Impact Assessment Phase: The Agency must establish the time limit for this phase for an IA by review panel, including the time limit within which the Review Panel must submit its report, and the time limit within which the Agency must post its recommendations for any conditions that would apply to the designated project, if approved. Subject to subsection 37(2) of the Act, this time limit must not exceed 600 days, unless the Agency is of the opinion that more time is needed to coordinate with another jurisdiction, or to take into consideration other relevant project specific circumstances. For integrated assessments, as per subsection 37.1(2), the time limit for this phase will be not more than 300 days, unless the Agency is of the opinion that more time is needed. This Phase is complete when the Agency submits its recommendations for any conditions to the Minister, pursuant to section 55.1 of the IAA.

- Decision Phase: The time limit for the Governor in Council to determine whether the effects within federal jurisdiction, and the extent to which those are significant, are in the public interest, as well as the issuance of the Minister’s IA decision statement is no more than 90 days from the date the Agency posts on the Registry its recommendations to assist the Minister in establishing conditions, under subsection 55.1(2) of the IAA.

The Minister may extend the time limit for the submission of the IA Report by a review panel by a maximum of three months to enable cooperation with another jurisdiction or because of circumstances specific to the proposed project, pursuant to subsections 37(3) and 37(4) of IAA. The Minister may also extend the time limit for the issuance of the Decision Statement by a maximum of 90 days for any reason that the Minister considers necessary as per subsection 65(5) and 65(6) of IAA.

The Governor in Council may grant further extensions to the time limits for the issuance of the IA Report or the Decision Statement.

Appendix 2: Process chart of an ia by a review panel, indicating which steps are cost recoverable

The cost recovery period for an IA by review panel is indicated by the red arrow in the figure.

Cost recovery of eligible activities begins with the posting of the Minister’s decision to refer the IA to a review panel and ends with the issuance of the Decision Statement. Costs associated with Crown consultation activities during all of these stages are also cost recoverable.

In some cases, the referral of the assessment to a review panel may occur prior to the Notice of Commencement being posted. The Agency does not recover costs for activities undertaken prior to the submission of an Initial Project Description, or those activities typically completed during the first 80 days of the Planning Phase. This includes activities related to the review of the Initial Project Description, development of the Summary of Issues, review of the Detailed Project Description, Determination that an IA is required, and related initial consultations and engagements with Indigenous communities. However, the Minister may refer the assessment of a designated project to a review panel at any time following the determination that an IA is required, up to 45 days following the posting of the Notice of Commencement. Any activities after the referral to a review panel will be subject to cost recovery.

The Agency does not recover costs for activities undertaken following the issuance of Decision Statement, which includes follow-up, monitoring, and any enforcement related activities.

Appendix 3: Roles and responsibilities of agency staff in ias by review panel; cost recoverable and non-cost recoverable activities

Throughout the impact assessment process, Agency staff perform a number of different functions with respect to IAs by review panel. These functions include activities to support the Agency, including Crown consultation and whole-of-government coordination efforts, as well as supporting the review panel through a panel secretariat. The following describes the types of tasks or activities generally carried out by the Agency throughout the process, and those roles or activities that are specific to phases of the impact assessment. Where relevant, and for clarity, activities that are not cost-recovered are also described.

Panel Secretariat

Deliberative Privilege of the Review Panel and its Secretariat

During the conduct of an IA by a review panel, the Agency identifies staff members who will form a panel secretariat that supports the review panel by providing technical, analytical, procedural and administrative support. In the case of a joint review panel or integrated assessment, staff from the partnering jurisdiction may also be included in the panel secretariat. This secretariat functionally reports to the review panel members. In accordance with the principles of administrative law, upon appointment of a review panel, the panel secretariat operates within the deliberative privilege of the review panel. This means that the members of the secretariat do not discuss issues associated with the IA with any other Agency staff, nor any other individuals who are not part of the review panel or its secretariat.

Panel Secretariat

The following roles typically comprise a panel secretariat, however, additional roles may be required, depending on the context of the specific IA. The salaries of staff that support the review panel through the panel secretariat are cost-recoverable.

Panel Manager - Manages the panel secretariat and is responsible for the delivery and coordination of the general duties of the secretariat; provides the review panel with procedural, technical, analytical and administrative support throughout the IA; assists the review panel in preparing and distributing correspondence, hearing procedures, reports and other documents; and manages the review panel’s budget and expenditures. The Panel Manager works collaboratively with the partner jurisdiction, where applicable, to ensure the delivery and coordination of an efficient joint or coordinated process.

Panel Analyst(s) - Supports the Panel Manager in carrying out the above responsibilities.

Registry Coordinator - Ensures the timely posting of records to the Canadian Impact Assessment Registry.

Administrative Support Officer - Assists with administrative and logistical arrangements, including travel and accommodation arrangements, and contracting for third-party services.

Legal Counsel - Provides independent legal advice to the review panel throughout the IA of a designated project. This lawyer is not an employee of Justice Canada. The recovery of costs associated with any legal counsel to the review panel will be negotiated with proponents on a project-specific basis.

Communications Advisor - Provides communications advice and services to the review panel, including managing media relations, responding to media enquiries on behalf of the review panel, coordinating public announcements, preparing communications products as required, providing assistance during the public hearing and public information sessions, and/or messaging if required.

Other Agency Support

Outside of the panel secretariat, Agency staff also support the Agency and the Minister in fulfilling their responsibilities in the assessment process. These staff are not privy to the deliberations of the review panel. The salaries of these Agency support staff that are directly attributable to the assessment of the project are cost recoverable.

Activities that are Cost Recovered

The salaries of the Agency staff, whose roles and responsibilities are outlined below, would be cost-recovered.

Consultation Lead - Leads Agency staff in the development and implementation of a Crown consultation plan and where applicable, coordinates Crown consultation activities with those of another jurisdiction. The Consultation Lead represents the Crown during consultation activities, compiles the Crown consultation record, coordinates the evaluation of the scope, nature and sufficiency of the Crown’s consultation efforts, coordinates the response of Indigenous communities on how concerns were addressed during the IA review panel process, and documents activities relevant to the IA process. This may involve analyzing submissions prepared by Indigenous communities and participating in the process to identify issues of concern that the Crown may need to consider within its submissions to the review panel and in the subsequent development of conditions within the Decision Statement. This may also involve accommodation discussions with relevant parties throughout the IA process. The Consultation Lead will coordinate with relevant federal departments to ensure a whole of government approach to Indigenous consultation in the context of impact assessment.

Crown Consultation Analyst(s) - Supports the Consultation Lead in carrying out the above responsibilities.

Agency Review Manager – Leads the Agency’s review of the proponent’s Impact Statement to determine whether the required information or studies have been provided. Supports coordination during all phases of the assessment by review panel, including public hearing sessions, during decision-making and assisting in the identification of consistent federal approaches to issues arising in the impact assessment. Coordinates federal-provincial cooperation if required. Provides general procedural information with respect to the review panel process and acts as a liaison with the proponent and government departments.

Agency Review Analyst(s) - Supports the Agency Review Manager in carrying out the above responsibilities.

Finance Officer – Prepares invoices for recoverable expenses and provides financial and administrative services to the review panel.

Communications Advisor - Provides communications advice and services to the Agency, including managing media relations, responding to media enquiries on behalf of the Agency, coordinating public announcements, preparing communications products as required.

Activities that are not Cost Recovered

The salaries of the Agency staff, whose roles and responsibilities are outlined below, would not be cost-recovered.

The salary costs for the time spent by the Agency’s Senior Management during the assessment are not cost recovered.

The Agency’s Participant Funding Program provides grants and contribution agreements to Indigenous participants under an Indigenous funding program, and to public stakeholders under the public participant funding program. The salary costs for staff responsible to administer this program are not cost recovered. Likewise, any funds allocated by the Agency to support participation of individuals, groups, communities, entities through the funding provided during phases of the IA by review panel are also not cost recovered.

The Agency’s Executive Coordination and Briefing Unit and Intergovernmental Affairs Division support the decision-making processes for the Minister and the Governor in Council. The salary costs of these staff are not cost recovered.

Description of Recoverable and Non-recoverable costs by assessment phase

Planning Phase

Cost Recoverable Activities

Should the Minister decide to refer the assessment of a designated project to a review panel prior to the posting of a Notice of Commencement, Agency staff are involved in the follow cost-recoverable activities:

- Finalizing the Tailored Impact Statement Guidelines, Public Participation Plan, Indigenous Engagement and Participation Plan, Cooperation Plan, and Permitting Plans;

- Conducting any public engagement, including advertising;

- Conducting Indigenous consultation activities;

- Advertising related to public engagement or Indigenous consultations;

- Coordinating with other jurisdictions who may have responsibilities relating to the assessment of the designated project;

- Coordinating the involvement of federal departments and agencies in the impact assessment; and

- other tasks as required.

Activities that are not Cost Recovered

- Any work conducted by Agency staff prior to the referral of the IA of a designated project to a review panel are not cost recovered.

Impact Statement Phase

Cost Recoverable Activities

Cost recoverable activities by the Agency include:

- Supporting a proponent in developing its Impact Statement, including providing advice regarding the requirements included in the TISG and review of draft documents;

- Conducting any public engagement, including advertising;

- Conducting Indigenous Consultation activities;

- Developing the Review Panel Terms of Reference, and a Joint Review Panel Agreement, if required;

- Supporting the identification of Review Panel members for appointment; and

- Reviewing the Impact Statement to ensure it contains the required information or studies.

Once appointed, cost recoverable activities by the Review Panel and panel secretariat include:

- Conducting orientation sessions for the members of the Review Panel;

- Commencing the Review Panel’s sufficiency review of the Impact Statement; and

- Conducting any public engagement activities, including advertising.

Impact Assessment Phase

Cost Recoverable Activities

Once the Agency is satisfied that the proponent has provided all of the required information or studies, and posts a notice of that on the Registry, the Review Panel commences the Impact Assessment Phase. Cost recoverable activities by the Review Panel include:

- Completing the Review Panel’s sufficiency review of the Impact Statement;

- Organizing and conducting the public hearing;

- Developing draft conditions, where applicable;

- Conducting any public engagement;

- Indigenous Consultation activities; and

- Preparing the IA Report.

During the IA Phase, staff from the Agency, outside of the Review Panel Secretariat, will undertake the following cost-recoverable activities:

- Coordinating federal government participants in the process;

- Leading and coordinating Crown consultation activities with Indigenous communities; and

- Drafting and consulting on potential conditions that may be included in a Decision Statement, should the project be allowed to proceed.

The Impact Assessment Phase ends when the Agency submits its recommended list of conditions to the Minister.

Decision Phase

Cost Recoverable Activities

. Costs that may be recoverable during this phase include:

- Leading and coordinating Crown consultation activities with Indigenous communities.

Activities that are not Cost Recovered

The costs associated with the involvement of other Agency staff involved in the development of the Minister’s IA Decision Statement, as well as those from the Agency’s External Relations and Strategic Policy sector, such as the Cabinet Affairs and the Executive Coordination and Briefing Unit, in the development of Memoranda to the Minister and to Cabinet will not be cost recovered. These activities include:

- Coordinating federal government participants in the decision process;

- Preparing a government response to any recommendations from the review panel, if applicable; and

- Developing the Decision Statement, including finalizing potential conditions, should the designated project be allowed to proceed.

Post Decision Phase

Cost recovery currently ends with the issuance of a Decision Statement to the proponent. No further activities will be cost recovered after this stage of the IA.

Activities that are not Cost Recovered

- Costs associated with the Agency’s Compliance, Enforcement and Follow-up Programs, including the establishment of monitoring committees, or other activities as described within the conditions of the Decision Statement;

- The review of the compliance monitoring and reporting;

- Any enforcement activities and/or public notifications in respect of the project; and

- Costs associated with development and analysis of any Follow-up Programs required by the conditions of a Decision Statement.

Likewise, any activities undertaken in order to update or change any conditions of the Decision Statement issued by the Minister, are not cost recovered.