2016 Annual Report

Archived Content

Information identified as archived is provided for reference, research or record-keeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Canadian Armed Forces photographic imagery sourced from

Department of National Defence’s Combat Camera

www.combatcamera.forces.gc.ca

Military Grievances External Review Committee

Cat. No. DG1-1

ISSN 2368-9978

3 January 2017

The Honourable Harjit Sajjan

Minister of National Defence

National Defence Headquarters

MGen Georges R. Pearkes Building

101 Colonel By Drive

Ottawa, Ontario

K1A 0K2

Dear Minister,

Pursuant to section 29.28(1) of the National Defence Act, I hereby submit the 2016 annual report on the activities of the Military Grievances External Review Committee for tabling in Parliament.

Yours truly,

Bruno Hamel

Chairperson and Chief Executive Officer

TABLE OF CONTENTS

- MESSAGE FROM THE CHAIRPERSON AND CHIEF EXECUTIVE

- ABOUT THE COMMITTEE

- IN FOCUS

- SYSTEMIC RECOMMENDATIONS

- OPERATIONAL STATISTICS

- CASE SUMMARIES

- ANNEXES

- COMMITTEE MEMBERS AND STAFF

- CONTACT US

For the purpose of this report, the acronyms most commonly used are:

CAF: Canadian Armed Forces

CDS: Chief of the Defence Staff

MGERC: Military Grievances External Review Committee

MESSAGE FROM THE CHAIRPERSON AND CHIEF EXECUTIVE OFFICER

I am pleased to submit the Military Grievances External Review Committee’s 2016 Annual Report. This report marks my last as the Chairperson and Chief Executive Officer of the Committee which I have had the privilege to lead for the last eight years.

In 2016, following the exceptional surge in case referrals experienced in 2015 due to Operation RESOLUTION, the volume of cases referred to the Committee continued to increase, reaching 224 cases as of 31 December 2016. Unfortunately, at the same time, the precarious and difficult situation I reported last year concerning the Committee’s membership did not change. Since February 2016, the Committee has been short the two Vice-Chairpersons that subsection 29.16(1) of the National Defence Act (NDA) establishes as the minimum necessary to carry out its functions. As well, my requests for additional Committee members were not answered.

The significance of the statutory requirement under subsection 29.16(1) of the NDA for the Governor in Council (GIC) to appoint the members required for the Committee to perform its functions cannot be overstated. The Committee’s ability to deliver on its mandate depends on it. No matter how many adjustments to staff and business processes are made, the Committee needs a sufficient number of members to review the grievances referred to it and issue findings and recommendations (F&R).

I find it disconcerting in the extremethat, notwithstanding my numerous requests and suggestions for interim solutions, the appointments essential for the Committee to fulfill its mandate have not been made. It is unfortunate that those who ultimately will be affected by the vacancies at the Committee are Canadian Armed Forces (CAF) members who have grievances, and their families. As well, this situation affects the Chief of the Defence Staff (CDS): if the Committee is delayed in hearing a grievance, the CDS’s ability to promptly remedy prejudice to a CAF member is compromised. Our men and women in uniform deserve better. I deeply regret that the Committee could not do more this year.

I am thankful for the team’s effort that made it possible to maintain the efficiency gains achieved in past years. However, the level of effort put forward in 2016 came at a price for our team and is not sustainable.

The Committee’s membership must be restored to the level mandated by law and to support its operational needs. While I acknowledge the two appointment processes currently underway, I am not convinced, given where the selection processes currently stand, that the situation will be remedied soon.

"No matter how many adjustments to staff and business processes are made, the Committee needs a sufficient number of members to review the grievances referred to it and issue findings and recommendations."

A significant part of the grievances reviewed last year were cases that do not belong to the types of grievances that must be referred to the Committee, according to regulations. These “discretionary”

referrals were made according to a model that has been under evaluation by the CAF since 2011. Under this model, which we consider fairer to all complainants, the Committee would review all grievances that reach the final authority (FA) level where the CAF are unable to resolve the matter to the satisfaction of the grievor. After five years of trial during which the Committee demonstrated its ability to deal with any type of grievances, it is my hope that this referral model will continue to be applied and that the CAF will eventually adopt it and make the necessary regulatory changes, so that all grievances benefit from an external review at the FA level.

I am particularly pleased to see that in 2016 the CAF leadership acknowledged and acted swiftly to temporarily correct a critical issue we highlighted the previous year. The problem dates back to 1 March 2007 and was caused by discrepancies between the amended Canadian Forces Superannuation Act and the Canadian Forces Superannuation Regulations, on one hand, and the CAF Terms of Service on the other hand. The discrepancies had the potential to compromise the eligibility to an immediate annuity of a vast majority of CAF members who would have retired after having completed a 25-year engagement. It was comforting to note that CAF leadership started acting to address the situation, while working on a permanent solution, even before a file related to this issue was adjudicated.

"In 2016, CAF leadership acted swiftly to temporarily correct a critical issue raised by the Committee, even before a related file was adjudicated. The issue had the potential to compromise the eligibility to an immediate annuity of a vast majority of CAF members who retire after completing a 25-year engagement."

You will find in this report detailed summaries of 10 F&R reports and a number of recommendations of a systemic nature issued by the Committee that we think are of particular interest. In the In Focus section we examine three Federal Court decisions that have clarified important questions related to the grievance process, for the benefit of all stakeholders. In one file, the Federal Court determined what it means to exercise discretion when considering whether it is in the interests of justice to consider the merits of a grievance submitted outside of the time limits. In a second case, the Federal Court dealt with the discretion that the CAF may exercise when a military member is granted leave in excess of his or her entitlement. Finally, in a third file, the Federal Court clarified the FA’s obligation to address all issues raised in a grievance, including claims for financial compensation.

Throughout 2016, the Committee’s program continued to receive outstanding support from its corporate services. They provided advice and solutions while responding to pressing demands related to changes in government processes that affected almost every sector. From the implementation of Phoenix, the new pay system, to MyGCHR, the new human resources information system, to the Web Renewal Initiative, there was no lack of challenges to keep up with government priorities. At the same time, a series of internal initiatives were launched with the aim of streamlining processes, increasing efficiency and reducing costs. Under the Lean Office initiative, the corporate services team looked for innovative solutions in service delivery and implemented a new organizational structure to better match the program’s needs. One major initiative was related to the updating of the Committee’s case management system in a way that ensures compliance with government requirements, while maintaining a customized version that better fits the Committee’s internal review process. The updated system is expected to be in place in 2017.

The Committee also continued to be engaged in Blueprint 2020, the government initiative launched in 2013 to modernize, renew and transform the public service. As such, we increased the use of mobile technologies (desktop virtualization, tablets and Wi-Fi) and updated our records management system, moving closer towards a paperless work environment that is, at the same time, flexible, productive and based on well-connected collaboration. An action plan was also developed to promote mental health in the workplace, another priority under Blueprint 2020 and for the Clerk of the Privy Council.

"There was no lack of challenges for corporate services. They continued to provide outstanding support to the Committee’s program while responding to pressing demands related to changes in government processes that affected almost every aspect of internal services."

Furthermore, the Committee has already completed the implementation of five out of six recommendations from the Core Control Audit of its management processes conducted in 2015. The remaining recommendation, which relates to putting in place an improved procurement framework, is expected to be completed by March 2017.

I am also pleased with the results of our five-year program review that was completed in 2016 and confirmed the Committee’s overall efficiency and objectivity, as well as the usefulness of the advice it provides to CAF decision_makers. Finally, the Committee has initiated a review of its Logic Model to ensure consistency with the new Treasury Board Policy on Results.Footnote 1

I have been at the Committee since 2 March 2009. During those eight years, I worked side by side with an outstanding team of public servants and Committee members. Their dedication to their work can only be surpassed by their commitment to a fair grievance process and to improving the working conditions of the men and women of Canada’s military. I am confident that they will continue on the same path. I have no doubt that they will provide my successor with unmatched support to ensure that what was accomplished so far is well preserved and constantly improved. I wish them all the best.

Bruno Hamel

ABOUT THE COMMITTEE

Mission

The Military Grievances External Review Committee provides an independent and external review of military grievances. In doing so, the Committee strengthens confidence in, and adds to the fairness of, the Canadian Armed Forces grievance process.

Mandate

The Military Grievances External Review Committee is an independent administrative tribunal reporting to Parliament through the Minister of National Defence.

The Committee reviews military grievances referred to it pursuant to section 29 of the National Defence Act and provides findings and recommendations to the Chief of the Defence Staff and the Canadian Armed Forces member who submitted the grievance.

The Grievance Context

Section 29 of the National Defence Act (NDA) provides a statutory right for an officer or a non-commissioned member who has been aggrieved to grieve a decision, an act or an omission in the administration of the affairs of the Canadian Armed Forces (CAF). The importance of this broad right cannot be overstated since it is, with certain narrow exceptions, the only formal complaint process available to CAF members.

Since it began operations in 2000, the Military Grievances External Review Committee (MGERC) has acted as the external and independent component of the CAF grievance process.

The Committee reviews all military grievances referred to it by the Chief of the Defence Staff (CDS), as stipulated in the NDA and article 7.21 of the Queen’s Regulations and Orders for the Canadian Forces. Following its review, the Committee submits its findings and recommendations to the CDS, at the same time forwarding a copy to the grievor; the CDS is the final decision-maker. The CDS is not bound by the Committee’s report, but must provide reasons, in writing, in any case where the Committee’s findings and recommendations are not accepted. The Committee also has the statutory obligation to deal with all matters as informally and expeditiously as the circumstances and the considerations of fairness permit.

The types of grievances that must be referred to the Committee are those involving administrative actions resulting in deductions from pay and allowances, reversion to a lower rank or release from the CAF; application or interpretation of certain CAF policies, including those relating to conflict of interest, harassment or racist conduct; pay, allowances and other financial benefits; and entitlement to medical care or dental treatment.

The CDS must also refer to the Committee grievances concerning a decision or an act of the CDS in respect of a particular officer or non-commissioned member. Furthermore, the CDS has discretion to refer any other grievance to the Committee.

Committee Structure

The Committee consists of Governor in CouncilFootnote 2 (GIC) appointees who, alone or in panel, are responsible for reviewing grievances and issuing findings and recommendations.

Under the NDA, the GIC must appoint a full-time Chairperson and at least two Vice-Chairpersons. In addition, the GIC may appoint any other members the Committee may require to carry out its functions. Appointments may be for up to four years and may be renewed.

Grievance officers, team leaders and legal counsel work directly with Committee members to provide analyses and legal opinions on a wide range of issues. The responsibilities of the Committee’s internal services include administrative services, strategic planning, performance evaluation and reporting, human resources, finance, information management, information technology, and communications.

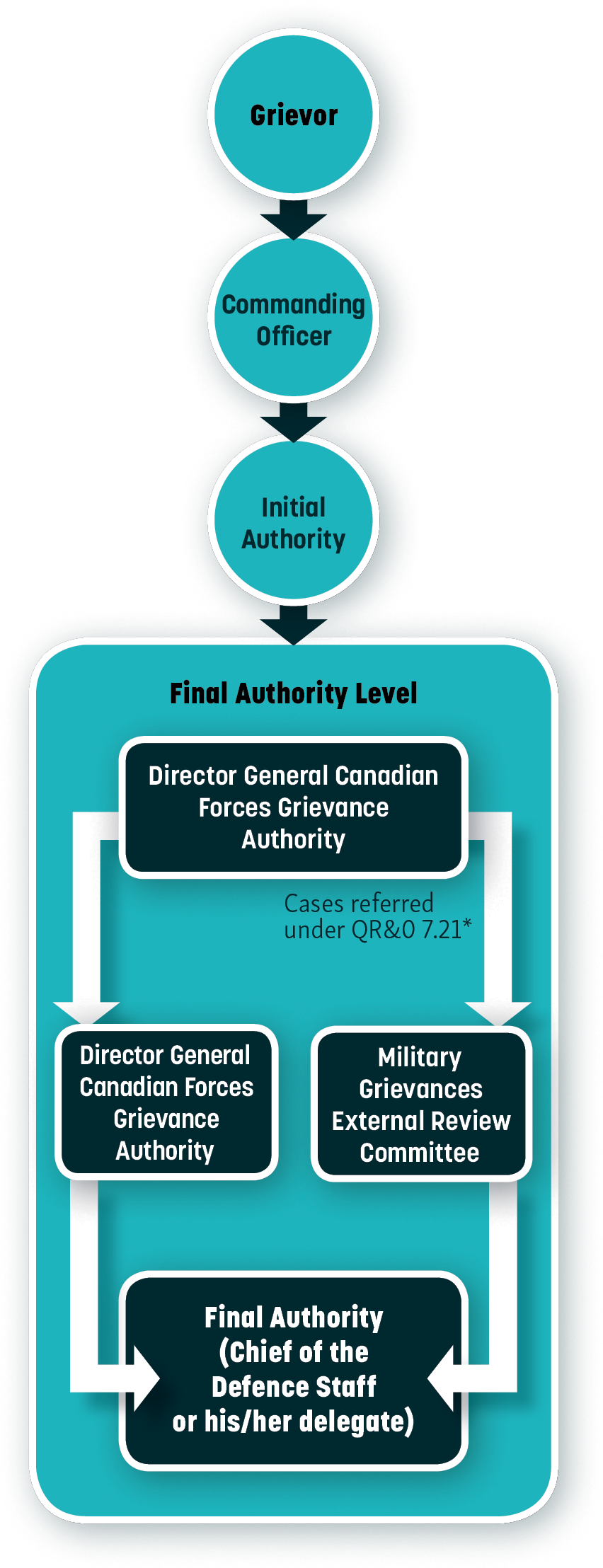

The Grievance Process

The CAF grievance process consists of two levels and begins with the grievor’s commanding officer (CO).

Level I: Review by the Initial Authority (IA)

Step 1: The grievor submits a grievance in writing to his or her CO.

Step 2: The CO acts as the IA if he or she can grant the redress sought. If not, the CO forwards the grievance to the senior officer responsible for dealing with the subject matter. Should the grievance relate to a personal action or decision of an officer who would otherwise be the IA, the grievance is forwarded directly to the next superior officer who is able to act as IA.

Step 3: The IA renders a decision and, if the grievor is satisfied, the grievance process ends.

Level II: Review by the Final Authority (FA)

Grievors who are dissatisfied with the IA’s decision are entitled to have their grievance reviewed by the FA, which is the CDS or his/her delegate.

Step 1: The grievor submits his or her grievance to the CDS for FA level consideration and determination.

Step 2: Depending on the subject matter of the grievance, the CDS may be obligated to, or may, in his or her discretion, refer it to the Committee. If the grievance is referred for consideration, the Committee conducts a review and provides its findings and recommendations to the CDS and the grievor. Ultimately, the FA makes the final decision on the grievance.

Text version : The Grievance Process

- Grievor

- Commanding Officer

- Initial Authority

- Final Authority Level

- Director General Candian Forces Grievance Authority

- Military Grievances External Review Committee

- Director General Canadian Forces Grievance Authority

- Final Authority (Chief of the Defence Staff or his/her delegate)

- Final Authority Level

- Initial Authority

- Commanding Officer

Cases referred under QR&0 7.21*

* Article 7.21 of the Queen’s Regulations and Orders for the Canadian Forces sets out the types of grievances that must be referred to the Committee for review once they reach the final authority level.

What Happens When the Committee Receives a Grievance?

The Committee’s internal review process consists of three steps: grievance reception, review, and the submission of findings and recommendations.

1. Grievance Reception

Upon receipt of a grievance, the grievor is contacted and invited to submit additional comments or other documents relevant to his/her case.

2. Review

The assigned Committee member holds a case conference where the grievance is reviewed and the issues are identified. The Committee member is assisted by a team leader, a grievance officer and legal counsel. If necessary, additional documentation is obtained and added to the file.

3. Findings and Recommendations

The Committee member issues findings and recommendations which are then sent simultaneously to both the CDS and the grievor. At this point, the Committee no longer retains jurisdiction over the grievance. The grievor receives a decision directly from the final authority, which is the CDS or his/her delegate.

IN FOCUS

In this section, the Committee discusses issues deemed of interest for our primary stakeholders either because they expand on certain aspects of the grievance process, or because they are cause for concern. This year, we discuss three Federal Court decisions that have clarified important questions related to the grievance process, for the benefit of all stakeholders: CAF discretion when considering whether it is in the interests of justice to consider the merits of a grievance submitted outside of the time limits; CAF discretion when a military member is granted leave in excess of his or her entitlement, and; the FA’s obligation to address all issues raised in a grievance, including claims for financial compensation.

Treatment of Grievances Submitted Outside the Time Limit

This year, the Committee has observed an increasing number of cases where the initial authorities (IA) have rejected grievances on the basis that they were submitted outside of the time limit provision of chapter 7 of the Queen’s Regulations and Orders for the Canadian Forces (QR&O), often concluding that the grievors’ reasons for delay were not “unforeseen, unexpected or beyond the grievor’s control.”

The QR&O provides:

7.06 - Time Limit to Submit Grievance

(2) A grievor who submits a grievance after the expiration of the time limit set out in paragraph (1) shall include in the grievance reasons for the delay.

(3) The initial authority … may consider a grievance that is submitted after the expiration of the time limit if satisfied it is in the interests of justice to do so. If not satisfied, the grievor shall be provided reasons in writing.

NOTE

If the delay is caused by a circumstance which is unforeseen, unexpected or beyond the grievor’s control, the initial authority or, in the case of a grievance to which Section 2 does not apply, the final authority should normally be satisfied that it is in the interests of justice to consider the grievance if it is submitted within a reasonable period of time after the circumstance occurs.

In fact, several IA appear to have generally focused on the example provided in the note to the QR&O rather than on the “interests of justice”

test as a reason not to accept grievances submitted late.

Recently, in Simms v. Canada (Attorney General) 2016 FC 770, this issue was reviewed by the Federal Court of Canada. In Simms, the grievor, who was contesting his Performance Evaluation Report, acknowledged the delay in his submission and sought adjudication “in the interests of justice.”

Both the IA and the final authority (FA) refused to examine the merits of the grievance on the basis that the grievor had not demonstrated that the delay was caused “by a circumstance which [was] unforeseen, unexpected or beyond the grievor’s control.”

The Federal Court allowed the grievor’s application for judicial review and remitted the matter to the FA for reconsideration. The Federal Court found that the IA and the FA should not have limited the exercise of their discretion on the basis of the content of the explanatory note. The Federal Court explained that:

[56] According to the Black’s Law Dictionary (10th ed. 2014), the phrase

“interests of justice”means“the proper view of what is fair and right in a matter in which the decision-maker has been granted discretion”[59] In my opinion, the explanatory note that follows subsection 7.06(3) of the QR&Os is analogous to marginal notes in other legislation. Such notes may aid in the interpretation of a statutory provision but do not have the force of law; see the decisions in R. v. Wigglesworth, [1987] 2 S.C.R. 541 at 556-557 and R. v. Boland (1995), CMAC-374.

[60] The exercise of discretion by the Director General was not limited to the circumstances set out in the note, that is where the delay was caused by a circumstance which is unforeseen, unexpected or beyond the grievor’s control and the grievance was submitted within a reasonable period of time after the circumstances occurs.

[61] In my opinion, the exercise of discretion

“in the interest of justice”requires the decision to be fair, particularly because of the importance to the Applicant personally, that is his career advancement by way of promotion. Factors to consider when assessing fairness include the prejudice suffered by both parties, the merits of the grievance and the cause for the delay; see decision in Hudon, supra and Brownlee v. Brownlee, [1986] B.C.J. No. 158 (B.C.C.A.).

Similarly, in previous files, the Committee looked at the jurisprudence and identified some of the relevant factors to be examined on a case-by-case basis when considering whether it is in the interests of justice to consider the merits of a grievance submitted outside of the time limits. While not exhaustive, the Committee took the view that the following factors should be considered:

- an intention from the grievor to pursue the action within the time limit;

- the existence of an arguable case;

- the cause and actual length of the delay; and

- whether there is or would be a prejudice caused by the delay.Footnote 3

In the Committee’s view, the Federal Court’s decision has clarified an important question regarding the use of discretion within the meaning of “interests of justice.”

This should ensure a more consistent treatment of grievances submitted outside the regulatory time frames within the CAF grievance process.

Special Leave as a Reasonable Redress Mechanism

Hamilton v. Canada (Attorney General) 2016 FC 930 is another interesting decision from the Federal Court issued this year in a judicial review application that dealt with the discretion that the CAF may exercise where a military member is granted leave in excess of his or her entitlement.

The applicant had been subject to an administrative error such that he received 30 days of annual leave, rather than the 25 days to which he was entitled each year, over a period of five years. When the error was discovered, he was informed that he had to pay back the 25 days of excess leave, which equated to $8,080.83. He submitted a grievance requesting that special or annual leave be approved in arrears.

The Committee recommended to the FA that, even though the grievor had not been entitled to 30 days of annual leave, the decision to recover the excess leave be cancelled by exercising the discretion found in QR&O 208.315(a)Footnote 4, or alternatively, that he be granted 25 days of special leave to offset the excess leave pursuant to QR&O 16.20Footnote 5.

The FA decided he could not grant the redress sought. He found that the excess leave in question was an overpayment. Interpreting QR&O 208.315(a) in the context of the prescriptions in QR&O 201.05 and 203.04 regarding overpaymentsFootnote 6, the FA found that recovery was mandatory. He also found that special leave could not be granted because, if it were, the grievor would receive a benefit not available to other CAF members who had been subjected to similar errors or who were only granted leave in accordance with their entitlements.

The Federal Court held that the FA’s decision was unreasonable in two respects. First, the Court looked at QR&O 208.315, which provides that designated officers “may direct that a forfeiture be imposed”

for excess annual leave granted. The Court held that the FA’s interpretation of article 208.315 ignored the discretion that is inherent in the words “may direct.”

Without deciding whether the excess leave received by the grievor could be characterized as an overpayment, the Court indicated that even if it could, the discretion to impose, or not impose, forfeitures would still exist pursuant to article 208.315. Given that the FA did not recognize the discretion to be exercised pursuant to article 208.315, the Court found the FA’s decision unreasonable.

Second, the Court found that it was unreasonable for the FA to reject the Committee’s recommendation that 25 days of special leave be granted because the FA’s reasons were based on conjecture or speculation. There was no evidence before the FA as to whether, if there were other members of the CAF in situations like that of the grievor, they would be denied a benefit available to him.

The Court quashed and set aside the FA decision and remitted the matter for re-determination in accordance with the reasons for the judgment. This case is interesting as it confirms the availability of special leave as a reasonable redress mechanism when appropriate. More importantly, it confirms that the CAF have discretion regarding the recovery of leave granted in error. Given the number of grievances the Committee sees where these types of errors occurred, the Committee is hopeful that the CAF will be less reticent to use that discretion to grant redress based on the Hamilton decision.

"Extremely thorough research… Even though I tried, I could never find as much supporting documentation for my grievance as the [Committee] member assigned to my file did. Really impressed and happy."

Authority to Award Financial Compensation

The jurisdiction of the CDS to award monetary compensation as the FA is a question that regularly resurfaces within the grievance process.

In its 2006 annual report, the Committee was already identifying a recurring problem: neither the IA nor the FA had the authority to award financial compensation to grievors as part of the grievance process. The authority to settle claims against the Crown or to give ex gratia payments to members of the CAF was delegated at the time solely to the Director Claims and Civil Litigation (DCCL) from the Legal Advisor to the Department of National Defence (DND) and the CAF.

In his National Defence Act Review and Recommendations of September 2003, the late Chief Justice Antonio Lamer recommended that the CDS should be given the authority to settle claims and to award ex gratia payments when he determined through the grievance process that the circumstances warranted such payments. DND accepted that recommendation and, in 2012, it was partially implemented. On 19 June 2012, by order of the Governor General in Council, the CDS was given the authority to award ex gratia payments. The Canadian Forces Grievance Process Ex Gratia Payments Order, PC 2012-0861 (the Order) indicates, among other things, that:

1. (1) The Chief of the Defence Staff may authorize an ex gratia payment to a person in respect of whom a final decision is made under the grievance process established under the National Defence Act.

(2) A payment under subsection (1) may only be authorized if the final decision is made on or after the day on which this Order comes into force.

2. The Chief of the Defence Staff may delegate the power to authorize a payment under subsection 1(1) to an officer who is directly responsible to the Chief of the Defence Staff.

3. The power to authorize a payment under subsection 1(1) is subject to any conditions imposed by the Treasury Board.

Since having this authority, the CDS has rarely used it. Indeed, in most cases where the Committee recommended that grievors should receive financial compensation as one of the redresses, they have been informed that their claim for compensation could not be settled through the CAF grievance process.

However, the issue of the CDS’ authority to award financial compensation was recently reviewed in a case before the Federal Court of Canada. In that case, Mr. Lafrenière (then Corporal Lafrenière) filed a grievance challenging a chain of command decision to relieve him from duty without informing him of the allegations against him or offering him the opportunity to defend himself.

As redress, Mr. Lafrenière sought financial compensation for harm to his health and his reputation. Although the FA expressed his agreement with the Committee that Mr. Lafrenière had been aggrieved, he rejected the Committee’s recommendation, which was to refer the grievor’s case to the DCCL for review. The FA concluded that the grievor had not demonstrated that the issue could give rise to a claim against the Crown.

On judicial review of the FA’s decision, the Federal Court found that the FA had not addressed the matter of the financial compensation requested by the grievor; rather, it had restricted its review to the Committee’s recommendation to refer the case to the DCCL. The judge noted that, under the Order, the CDS had, since 2012, held the authority to award some level of monetary compensation. According to the Court, the FA’s failure to speak to the claim for financial compensation rendered his decision unreasonable. The Court indicated as follows:

[Unofficial translation]

[67] Bernath, however, no longer reflects the state of the law on this issue, as confirmed by Mr. Justice Barnes in Chua v. Canada (Attorney General), 2014 FC 285 [Chua] in which he writes at para 13,

“The legislative landscape has changed since the decisions in Bernath, above. The CDS now has the authority to award financial relief of up to $100,000.00 and, until a grievor has exhausted all other forms of potential recovery, it is premature to consider a claim to civil damages even if it is based on allegations of Charter breaches.”That authority flows from the Order.[68] The Court will not speculate as to the FA’s reasons for not addressing the question of either his authority or whether or not to award financial compensation. Regardless of the reasons, the omission constitutes an error in and of itself, as the FA must address all of the issues raised by the grievance; his failure to do so renders his decision unreasonable (Bossé v. Canada (Attorney General), 2015 FC 1143 at para 47). Moreover, the impact of that omission is exacerbated here by the observation that the FA now has the authority to decide whether or not to award some level of financial compensation.

The Court therefore referred the grievance back to the FA for re-determination.

In the Committee’s view, this decision by the Federal Court clarifies the FA’s obligation to address all issues raised in a grievance, including claims for financial compensation. As indicated above, ex gratia payments are exceptional in and of themselves and are subject to a specific review process that includes obtaining a legal opinion as to the possibility of Crown liability.

Thus, if advised that there is a possibility of the Crown being held liable, the FA must conclude that it cannot offer an ex gratia payment. On the other hand, if the Crown’s liability does not appear to be at issue, the FA must then determine whether to award an ex gratia payment. Either way, financial compensation claims will now have to be dealt with by the FA within the grievance process.

In most cases where the Committee recommended that grievors should receive financial compensation as one of the redresses, they have been informed that their claim for compensation could not be settled through the CAF grievance process.

SYSTEMIC RECOMMENDATIONS

The grievance process is to some degree a barometer of current issues of concern to CAF members. Several grievances on the same issue may indicate a poor policy, the unfair application of a policy or a policy that is misunderstood. In some cases, the underlying law or regulation may be out of date or otherwise unfair.

The Committee feels a particular obligation to identify issues of widespread concern and, where appropriate, provides recommendations for remedial action to the CDS.

The following section presents a sample of systemic recommendations issued by the Committee in 2016. Full summaries of these cases, as well as all other systemic recommendations, are published online, as soon as they become available: www.canada.ca (under Departments and agencies).

MEANING OF “RESERVE FORCE SERVICE”

IN PENSION CALCULATIONS

Case 2015-187

Issue

Regular Force (Reg F) members are entitled to buy back prior pensionable service which had not counted towards an annuity, in order to increase the amount of their eventual pension. However, because the CAF include unpaid time spent on the Supplementary Reserve (Supp Res) and unpaid annuitant breaks in the calculation of 35 years of service, some CAF members who make a buy-back are considered to have accumulated 35 years before they have reached entitlement to a pension of 70%. The CAF then do not allow them to make further contributions to increase their eventual annuity percentage towards 70%. The CAF have interpreted the Canadian Forces Superannuation Act (CFSA) and its regulations as meaning that unpaid time on the Supp Res list and on annuitant breaks comes within the definition of “service.”

For this reason, the CAF consider that this time must also be bought back and counted towards the total years of pensionable service even though it does not count as pensionable service for increasing the percentage of the eventual annuity towards 70%.

If it was intended that time on the Supp Res list should be subject to being bought back in the same manner as the types of reserve service listed in the Queen’s Regulations and Orders for the Canadian Forces, it would logically be stated as such in the legislation or regulations. However, it is not. It is the Committee’s view that elective service does not include unpaid time spent in the Supp Res or on annuitant breaks. This issue has affected or will be affecting many CAF members who have elected to buy back Reserve Force service. Furthermore, it is the Committee’s view that the intent of the legislative scheme is to permit contributors to reach a 70% annuity. While CAF members must contribute at a reduced rate after reaching 35 years of service, the CFSA does not on its face prevent them from also making supplementary contributions until they reach the 70% maximum. The Committee considers that they should be allowed to do so.

Recommendations

The Committee recommended that:

- the files of CAF members who have been affected by the current CAF interpretation be audited;

- the audit use the Committee’s suggested interpretation to recalculate the affected annuities;

- affected CAF members be allowed to buy back further service if applicable;

- currently serving military members, when eligible, be allowed to continue contributions until they reach the maximum pension benefits of 70%; and

- a broad information campaign be conducted allowing CAF members in receipt of an annuity to identify themselves if affected.

ARTICLE IMPOSES AN UNREALISTIC AND UNFAIR DUTY ON CAF MEMBERS

Case 2015-228

Issue

Article 203.04 of the Queen’s Regulations and Orders for the Canadian Forces (QR&O) reads as follows:

203.04 - OVERPAYMENTS(1) It is the duty of every officer or non-commissioned member to be acquainted with the rates of pay, allowances and other financial benefits and reimbursable expenses to which that officer or non-commissioned member may be entitled, and the conditions governing their issue. (2) If an officer or non-commissioned member accepts a payment in excess of the entitlement due, the officer or non-commissioned member shall report and refund the amount of the overpayment to the accounting officer of the base or other unit or element where the officer or non-commissioned member is present.

The Committee found that QR&O 203.04(1) imposes on every CAF member the duty to be acquainted with an extremely large body of rules and practices governing compensation, benefits and their administration to which they may be entitled. Further, CAF authorities often rely on this regulation to hold military members accountable for errors made by those responsible for the administration of pay and benefits. The Committee found the duty placed upon CAF members in this regulation to be overly broad, uncertain and generally beyond the capacity of CAF members to fulfill. Furthermore, it does not reflect the reality of service life as personnel regularly rely on the expertise of those responsible for the administration of pay and benefits, due to the complexity of the regulations, policies and procedures surrounding such matters. The Committee also found that QR&O 203.04(2) is regarded in CAF administrative practice as the foundation for recovery of overpayments of pay and financial benefits. However, paragraph (2) prescribes no explicit requirement for a payee to know that a payment in excess of entitlement is received. In the Committee’s view, this paragraph cannot function without the element of knowledge being read in. With that in mind, paragraph (2) should be read as if the text stated: “If an officer or non-commissioned member knowingly accepts a payment in excess of the entitlement due… the officer or non-commissioned member shall report and refund the amount of the overpayment…”

In other words, a CAF member cannot be expected to report an overpayment, or be responsible for that overpayment, if he or she is not aware that they have received a payment in excess of their entitlements.

Recommendation

The Committee recommended that the CDS seek an amendment to QR&O 203.04 to clarify the intended application of paragraphs (1) and (2).

LEGAL REVIEW OF OVERPAYMENT CASES

Case 2015-228

Issue

The Committee found that the military overpayment provisions provide no explicit requirement to evaluate defences or counterclaims to an assertion that an overpayment is a debt due to the Crown. In the Committee’s view, whenever a CAF member is faced with the recovery of an overpayment, which is essentially a debt due to the Crown, there should be provisions for CAF members to put forth a defence to the claim, or a counterclaim to be considered in quantifying any amount in excess of entitlement. It is simply unfair of the CAF to unilaterally declare that a military member has received a payment in excess of their entitlements and then to initiate recovery action, without giving that CAF member an opportunity to challenge the debt.

Recommendation

The Committee recommended that the CDS consider an amendment to Military Pay Administrative Instruction (MPAI) 8.1 to add a requirement to seek a legal opinion as to whether an overpayment is a debt due to the Crown in cases where a significant sum is involved; where there is uncertainty concerning the applicable legal principles; or, where a CAF member has made representations challenging the basis for the intended recovery.

The Committee further recommended that the CDS consider whether the definition of claims in the Definitions paragraph of Defence Administrative Order and Directive (DAOD) 7004-1 (Claims and Ex Gratia Payments) should be amended to clarify that “claims”

includes a claim for loss and recovery of money.

DELEGATED AUTHORITY UNDER THE FINANCIAL ADMINISTRATION ACT

Case 2015-228

Issue

The Committee found that authority under subsection 155(1) of the Financial Administration Act (FAA), to authorize deductions and set-offs, has not been delegated to the CDS. This restricts his or her ability to act as final authority (FA) in the grievance process, in that he or she would be required to refer such matters to the Minister for approval prior to adjudicating on grievances where this authority is required.

Recommendation

The Committee recommended that the CDS request that authority under subsection 155(1) of the FAA be delegated to him for the purposes of his role as FA in the grievance process.

PROMOTION CYCLE FOR RESERVISTS AT NATIONAL DEFENCE HEADQUARTERS

Case 2015-297

Issue

Every fall, the Director Reserve Support Management (DRSM) sends the list of Primary Reserve List (PRL) members to the environmental commands and each environmental command proceeds to assess, via merit boards, their respective reservists. Then, each environmental command provides a selection list to the DRSM who, in turn, merges the different lists into the Combined Selection List (CSL). CAF members employed on the National Defence Headquarters/Military Personnel Command (NDHQ/MILPERSCOM) PRL must place high enough on the CSL (above the promotion forecast line) in order to receive a substantive promotion as of 1 April each year. Otherwise, Acting While so Employed (A/WSE) promotions are considered for those who perform duties at a higher rank. The establishment of the CSL is central to the promotion of reservists on the NDHQ/MILPERSCOM PRL and a firm timeline is associated with each step of the process. Furthermore, there is no mechanism to consider promotions of individuals joining the NDHQ/MILPERSCOM PRL after the environmental command selection lists are submitted. This leads to unfair results as deserving reservists may have to wait a complete year before being included in the promotion cycle and be considered for substantive promotion even though they met all promotion criteria and would have been granted a substantive promotion by their environmental command.

Recommendation

The Committee recommended that the promotion practice and policy applicable to members of the NDHQ/MILPERSCOM PRL be amended to allow for the use of discretion and include a process to formally address situations where reservists join the NDHQ/MILPERSCOM PRL once the promotion cycle has been initiated or the CSL established.

DELAYED ARMY COMMUNICATIONS AND INFORMATION SYSTEMS

SPECIALIST PAY REVIEW

Case 2016-013

Issue

On 30 June 2011, the CAF released a Military Employment Structure Implementation Plan (MES IP) announcing the amalgamation of three CAF occupations into one new occupation. On 1 October 2011, the legacy occupations of Land Communication and Information System Technician (LCIS TECH), Signal Operator and Lineman were grouped into a new single parent occupation named Army Communications and Information Systems Specialist (ACISS). In accordance with the MES IP, vested rights regarding rank, seniority, pay and terms of service were granted to all three former occupations. The MES IP noted that LCIS TECH was the only occupation of the three that was in the Specialist Trade 1 Pay Group at the time of amalgamation. The new ACISS occupation was allocated to the Standard Trade Pay Group pending completion of a pay evaluation by the Director Pay Policy and Development to determine the appropriate scale, and whether it would be entitled to specialist pay. The study was to be completed no later than 1 January 2013. To date, the study has not yet commenced.

The Committee acknowledged that the CAF have the right, if not the obligation, to restructure their occupations to be more efficient, but found that it must do so in a fair, thorough and transparent manner. The Committee found that the CAF prematurely set out to merge the occupations without having first completed the necessary pay evaluations. Only after a pay review has been completed and all aspects known and finalized should an occupation be restructured. Although the CAF achieved their primary goal of streamlining the occupation and its structural elements, it failed to address the resultant pay issues which were passed on to ACISS members. It is not acceptable to leave the pay aspect out of the equation or to delay it indefinitely. The Committee noted that this example of unacceptable delay was not an isolated case. It is unfair for CAF members to suffer the consequences of poor planning by waiting more than five years to learn whether they are entitled to specialist pay.

Finally, given the lack of certainty that any future decision to award specialist pay would be implemented retroactively, the Committee was also concerned that more potential harm may be done with every passing year.

Recommendation

The Committee recommended that the CDS direct the Chief of Military Personnel to personally oversee the completion of the ACISS pay review in an expedient manner, and to ensure that if the review results in one or more sub-occupations of the ACISS trade receiving specialist pay, that it be implemented effective the date of the amalgamation, 1 October 2011.

REVISION OF GEOGRAPHICAL BOUNDARIES GUIDELINES

Case 2016-031

Issue

On 31 July 2000, the Assistant Deputy Minister (Human Resources-Military) (ADM (HR-Mil)) issued guidelines to assist commanders in reviewing and defining their geographical boundaries for the purpose of qualifying for Post Living Differential benefits. The Committee noted that these guidelines were out of date and no longer fully aligned with more recent CDS grievance decisions addressing the question of what constitutes a reasonable daily commute. The Committee observed that the CAF have, in general, more recently been endorsing a 100-kilometer distance or a one-hour commuting time as being a reasonable daily commute whereas the 2000 guidelines suggested that 45 minutes represented a normal commuting time. The Committee therefore found that the guidelines should be amended to indicate that “a reasonable daily commute”

is generally considered to be 100 km or one hour of commuting time, linked to the CAF’s ability to recall the CAF member to base.

Recommendation

The Committee recommended that the CDS direct a review of the 31 July 2000 ADM (HR-Mil) guidelines issued to assist commanders in reviewing and defining their geographical boundaries. The Committee also recommended that the guidelines be amended to indicate that “a reasonable daily commute”

is generally considered to be 100 km or one hour of commuting time, linked to the CAF’s ability to recall the CAF member to base, and that this information be communicated in a timely manner to all CAF personnel responsible for defining geographical boundaries.

AMENDMENT TO THE CANADIAN FORCES SUPERANNUATION REGULATIONS

Case 2016-069

Issue

The Committee reviewed a grievance with regard to the impact of a previous CAF internal policy on the conversion of terms of service for re-enrollees. Changes enacted to CAF pension legislation in 2007 provided for transitional clauses whereby CAF members of the Regular Force (Reg F) could remain eligible for benefits under the previous version of the Canadian Forces Superannuation Act (CFSA), the so-called “grandfathering”

clauses. Under the previous version of the CFSA, pension entitlements were linked to the terms of service (TOS). This included the access to an immediate unreduced annuity after completing an intermediate engagement of 20 years (IE20). In the modernized CFSA, rather than completing his or her TOS, a CAF member must have completed 9,131 days of paid service, the equivalent of 25 years, referred to as an IE25. During the transition period, CAF members serving on an IE20 and those who would become eligible for an IE offer before 1 March 2007 were asked to select whether they wished to be or remain subject to an IE20 under the previous CFSA version or to accept an IE25 under the modernized CFSA version.

An internal policy regarding re-enrollees prevented certain CAF members from being offered an IE. They were instead offered either successive short engagements (SE) for officers or fixed periods of service (FPS) for non_commissioned members, to bring them to a combined 20 years of service, so as to entitle them to the same benefits as would have an IE20. The concerned CAF members had been assured that they would remain eligible for an immediate unreduced annuity after 20 years of service, as if they had completed an IE20 under the terms of the previous CFSA version. However, with regard to re-enrollees, the grandfathering clauses of the modernized CFSA legislation only provided this option to those who had accrued ten years or more of pensionable service as of 1 March 2007.

The Committee’s research determined that those who, like the grievor, re-enrolled in the Reg F between 2 March 1997 and 30 April 2005 and did not reach ten years of combined service by 1 March 2007, but had accepted other TOS than an IE, on the incorrect assumption and representations of CAF authorities, must now complete 9,131 days of paid service (25 years) in order to be eligible to an immediate unreduced annuity. CAF members who find themselves in this situation may be unaware that they are in fact required to serve another five years to receive an immediate unreduced annuity. The first of any CAF members affected by this could potentially complete 20 years of combined service and request release as early as 1 March 2017.

Recommendation

The Committee recommended that the CDS further investigate the issue and consider recommending an amendment to subsection 16.1 of the Canadian Forces Superannuation Regulations. The intent would be to provide the entitlement to an immediate unreduced annuity upon completion of 20 years of combined service under the former CFSA for re-enrollees who were offered, prior to 1 May 2005, successive non-IE terms of service totaling 20 years of combined service, and who had accrued less than ten years of pensionable service as of 1 March 2007.

NEW INTERIM DIRECTION — ACTING WHILE SO EMPLOYED PROMOTION

Case 2016-083

Issue

The Committee observed that the CAF promotion policy has been under review for several years with the expectation that a new Defence Administrative Orders and Directives (DAOD) on promotion will be the end result.

The Committee also noted that it may be several more months or even years before the DAOD is promulgated. Until that occurs, Canadian Forces General (CANFORGEN) message 060/00 continues to stand as the existing framework for Acting While so Employed (AWSE) promotions even though it no longer reflects the CAF’s position on AWSE promotion. The outdated CANFORGEN compels affected CAF members to submit grievances because only the CDS can waive promotion requirements.

Recommendation

The Committee recommended that, pending the promulgation of the new DAOD on promotion, the CDS direct the release of a new CANFORGEN providing interim guidance and direction on qualifying and obtaining approval of AWSE promotions.

RIGIDITY OF THE CANADIAN FORCES INTEGRATED RELOCATION PROGRAM DIRECTIVE

Case 2016-121

Issue

The purpose of the Canadian Forces Integrated Relocation Program (CF IRP) is to minimize the negative financial impact on CAF members by enabling them to relocate at a reasonable cost to the public. In its current form, the CF IRP directive is rigid and has undesirable effects. Simply put, the directive does not allow relocated military members to review or adjust their original decisions when necessary based on changes, difficulties or personal circumstances. This hinders their ability to divest themselves of their principal residence. The Committee believes that CAF members should have the opportunity to review their original decision and claim the allowances that are most compatible with their situation when divesting themselves of their primary residence in the context of relocation, without exceeding the amounts provided by the directive. The Committee therefore concluded that section 8.2 of the CF IRP would benefit from a significant overhaul in order to better meet the needs of members, the CAF and the general public.

Recommendation

The Committee recommended that the CDS order the review of section 8.2 of the CF IRP so that amendments be made to enable CAF members to review their original decision, including when they sell their principal residence as part of a relocation, without exceeding the amounts provided by the directive.

LAND DUTY ALLOWANCE — ATTACH POSTING TO A NON-DESIGNATED UNIT

Case 2016-125

Issue

While reviewing a grievance regarding the recovery of the land duty allowance (LDA), the Committee noted that the grievor’s home unit, designated as an operational unit for the purposes of chapter 205 of the Compensation and Benefits Instructions (CBI) governing LDA, attach posted personnel for lengthy periods of time to a non_designated unit to perform duties associated with positions established within its own unit establishment to provide support to that other unit on a permanent basis. This practice contravenes posting authorities and is contrary to the practice of another unit operating under the same circumstances.

This practice also resulted in barring the affected CAF members from receiving the LDA in accordance with paragraph 205.33 of the CBI. The Committee found that the circumstances surrounding the actual posting of these CAF members did meet the definition of an attach posting but was rather better described as a reassignment of position within the same unit. Further, the Committee noted that a reassignment of position would not disqualify the CAF members of the unit in questions from receiving the LDA.

Recommendation

The Committee recommended that the files of all CAF members of the grievor’s home unit in question, employed under the same circumstances since the inception of the LDA policy, be reassessed for eligibility to the LDA, in light of the particular circumstances of their posting.

PROVISION OF ACCURATE AND TIMELY INFORMATION ON RETURN MOVE FROM A POSTING ABROAD

Case 2015-301

Issue

The Canadian Forces Integrated Relocation Program (CF IRP) aims to allow CAF members to make informed decisions on the manner in which their moves from one location to another are conducted, domestically or internationally. One of these decisions is which, and the amount of, household goods and effects (HG&E) to place in long-term storage (LTS), to discard, or perhaps to acquire, and eventually to move within the scope of the weight entitlements prescribed in the CF IRP directive. The pre-move consultation is a key element to assist the military member and their family in making informed choices.

The Committee noted a major flaw with regard to the manner in which moves outside of Canada are performed, as well as how they are administered in accordance with the CF IRP directive. First, the pre-move consultation of HG&E at origin (overseas) is based on a volumetric weight assessment, whereas the weight at destination (in Canada) is actually scaled. Volume and weight are not really comparable units of measurement. A volume-based estimation of weight at origin can lead to a significant difference in comparison with the actual weight scaled at destination.

Second, CAF members are not necessarily made aware of the actual weight of their HG&E that was placed in LTS when the total weight on relocation to an overseas destination (shipped and in LTS) did not exceed the core entitlement of 20,000 lbs. The lack of such valuable information prevents CAF members and their family to make informed decisions on which/the amount of HG&E to discard, or perhaps to acquire, and eventually to move on return to Canada within the scope of the weight entitlements for an international move.

Recommendation

The Committee recommended that the CAF and their agents develop and implement a process whereby CAF members are provided accurate and timely information regarding the estimated weight of their HG&E on relocation, more so on out-of-Canada postings, and are always provided with the actual weight of their HG&E in LTS, regardless of the circumstances of their relocation. This will allow them to make informed decisions regarding the management of their HG&E with due consideration of the weight entitlement and funding envelopes of the CF IRP directive.

OPERATIONAL STATISTICS

This section contains an overview of the Committee’s operations, as related to the average time used to complete the review of a grievance, the types of grievances received, the annual workload, and the CDS responses to the Committee’s findings and recommendations (F&R). For comparison purposes and added perspective, the statistics in some cases cover the last few years, but their main focus is 2016 data.

A TIMELY REVIEW

In 2016, the Committee continued to maintain the average time for completing the review of grievances under its productivity standard of four months, slightly improving its efficiency despite a high level of referrals and vacancies in the Committee’s membership. As of 31 December 2016, the Committee received 230 cases and issued findings and recommendations reports for 250 cases.

Note: To simplify the reading of this section, we use CDS to refer to the final authority which includes the CDS and his/her delegate.

| 2012 | 2013 | 2014 | 2015 | 2016Figure 1 note * | |

|---|---|---|---|---|---|

| Average elapsed time in months | 2.6 | 3.5 | 4.3 | 3.9 | 3.9 |

AN INDEPENDENT REVIEW

As an administrative tribunal, the Committee has the obligation to review every case fairly and impartially. Each file is reviewed carefully and on its own merits while taking into consideration the issues raised by the complaint, the relevant evidence and the submissions of both the grievor and the CAF authorities.

Between 2012 and 2016, the Committee issued F&R on 1028 grievances, of which 53.2% (547 cases) found that the grievor had been aggrieved by a decision, act or omission in the administration of the affairs of the CAF. In the remaining 45.6% (469 cases), the Committee recommended that the grievance be denied.

Starting in 2014, the Committee made changes to the way it captures its statistics where it had determined that a CAF member has been aggrieved. In the 53.4% (400 cases) where the grievor had been aggrieved, the Committee had recommended to grant full or partial remedy in 94.3% (377 cases); in 4.0% (16 cases), the Committee recommended that a remedy be obtained outside of the grievance process, rather than be granted by the CDS; in 1.8% (7 cases) a remedy could no longer be recommended (i.e., the grievor was no longer a CAF member or the issue of the grievance was moot).

| 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|

| Aggrieved | 56% | 48% | 53% | 55% | 52% |

| Nor aggrieved | 41% | 49% | 47% | 44% | 48% |

| Cases closedFigure 2 note * | 3% | 3% | 0% | 1% | 0% |

Note: Totals may not add to 100% due to rounding.

KEY RESULTS

In the last five years, the CDS rendered decisions on 761 cases out of 1028 reviewed by the Committee. A total of 391 of these decisions addressed cases where the Committee found that the grievor had been aggrieved by a decision, act or omission in the administration of the affairs of the CAF. The remaining 370 decisions addressed cases where the Committee recommended that redress be denied.

In the 391 grievances where the Committee recommended redress be upheld or upheld partially, the CDS agreed in 73% of the cases (287 files).

“An extremely cogent document, I found the findings and recommendations to be sagacious and non-partisan. I was impressed with the clarity and forthrightness with which responsibility was attributed to the players in this grievance. If this sort of analysis and vision had been applied by those same individuals from the outset, then this grievance would not have come to pass.”

| Categories of grievances | Cases where the Committee found that the grievor had been aggrieved | Cases where the Committee found that the grievor had not been aggrieved |

|---|---|---|

| CDS agrees and partially agrees with the Committees F&R | 72% | 88% |

| CDS does not agree with the Committees F&R | 23% | 5% |

| Case withdrawn at CDS level | 1% | 6% |

ANNUAL WORKLOAD

Completed Grievance Reviews

The following table outlines the distribution by recommended outcomes of the 250 cases completed by the Committee in 2016.

| Careers | Harassment | Medical and Dental Care | Other | Pay and Benefits | Releases | Total | |

|---|---|---|---|---|---|---|---|

| Aggrieved | 64 | 8 | 5 | 3 | 41 | 8 | 129 |

|

Recommend No Remedy

|

1 | 0 | 0 | 0 | 1 | 0 | 2 |

|

Recommend Remedy

|

63 | 7 | 5 | 2 | 39 | 8 | 124 |

| Not Aggrieved | 38 | 4 | 4 | 11 | 53 | 9 | 119 |

| Not Grievable | 0 | 0 | 0 | 0 | 2 | 0 | 2 |

| Grand Total | 102 | 12 | 9 | 14 | 96 | 17 | 250 |

Categories of Grievances Received

| Number of Cases | 2014 | 2015 | 2016 |

|---|---|---|---|

| Releases | 10% | 6% | 8% |

| Pay and Benefits | 47% | 61% | 47% |

| Other | 7% | 6% | 6% |

| Medical and Dental Care | 1% | 2% | 1% |

| Harassment | 8% | 4% | 5% |

| Careers | 28% | 21% | 33% |

Note: Totals may not add to 100% due to rounding.

CDS Decisions Received in 2016

The Committee received CDS decisions in response to 241 grievances for the period between 1 January and 31 December 2016. The CDS:

- agreed with the Committee’s recommended outcome in 67% of these cases;

- partially agreed with the Committee’s recommended outcome in 10% of these cases; and

- did not agree with the Committee’s recommended outcome in 15% of these cases.

9% of the cases were resolved through the CAF informal resolution mechanism, after the Committee issued its F&R.

| CFGB F&Rs | CDS agrees | CDS disagrees | CDS partially agrees | Withdrawn at CDS level |

|---|---|---|---|---|

| 67% | 15% | 10% | 9% |

Note: Totals may not add to 100% due to rounding.

"…I was very impressed with the distillation of my case that the Committee did. Their recap was excellent and framed the salient points much better than I had originally stated. It is nice to feel supported through the process…"

CASE SUMMARIES

In 2016, the Committee issued 250 findings and recommendations (F&R) reports. For the purpose of this annual report, we are taking a closer look at ten cases of particular interest, with a summary of the issue (or issues) at stake, the Committee's position with regard to each case, and the F&R issued after their review by the Committee. When available, the final authority decision is also included. Summaries of select cases for which the Committee issued F&R reports in 2016 can be found online: www.canada.ca (under Departments and agencies).

RECOVERY OF TEMPORARY SERVICE ALLOWANCE

Case 2015-242

From April 2008 to March 2011, the grievor was offered six consecutive periods of Class B Reserve service, away from his permanent place of duty, totalling 1,093 straight days of service. He was paid temporary service allowances (free food and lodging, as well as incidental expenses) for the entire period. The chain of command claims that it made an informed decision to proceed in this way, having to address needs for essential duties that could not be met otherwise, while it was not able to offer any period of service of 365 days or more at a time, prohibiting his relocation. On being informed of this situation, the Director Compensation and Benefits (Administration) (DCBA) determined that the grievor was attached posted and not employed on temporary duty, thus entitled to temporary service allowances only for the first 364 days. The grievor was informed that the CAF would recover allowances paid as of the 365th day. The grievor claimed that if he had been informed at the time, he would assuredly have vacated his quarters before the end of the first period of service and secured accommodation in the community. He feels that the recovery has placed a heavy financial burden on him and is asking for the amounts due to be waived.

As initial authority (IA), the Director General Compensation and Benefits acknowledges that the current Canadian Forces Temporary Duty Travel Instruction (CFTDTI), effective 1 February 2011, did not cover the grievor’s situation. The IA supported DCBA’s decision that the recovery of any allowances paid beyond the 365th day was justified.

The Committee found that the situation was examined in the light of the CFTDTI which took effect only on 1 February 2011, and not of the CFTDTI which was in effect from 1 October 2002 to 31 January 2011. The Committee noted that confusion reigns as to the policies that applied in these circumstances during the period in question, especially with regard to reservists. It thus seems that before 1 February 2011, there were no policies providing for allowances to reservists in such circumstances. The Committee further noted that policies are formulated in a way that seems to assume that periods of service are determined in advance. The Committee found that no provision in either instruction allows for a change for “temporary duty”

to an attach posting and finally to a posting, or deals with transition among the various benefit packages to which military personnel are entitled in these circumstances.

The Committee observed that the DCBA and the IA have both treated the case as if the grievor had knowingly accepted a period of employment of more than a year and that, from the outset, the intent was to employ him for the entire period of 1,093 days, not that circumstances had evolved over time. The Committee did not subscribe to the conclusion that the recovery was justified.

The grievor’s situation should normally have been reviewed under the applicable policies at the time to determine the allowances to which he would have been entitled during each of his new periods of service. However, the Committee agreed that the grievor’s situation was special and that it would be difficult to proceed in this way. The Committee concluded that it would be reasonable and fair to recommend that the CDS exercise the discretion he is granted and remit charges for quarters and rations from 1 April 2008 to 31 March 2011, and recalculate the amounts due.

CDS Decision: Pending

REIMBURSMENT FOR TRAVEL TO MEDICAL APPOINTMENTS

Case 2015-299

After being seriously injured in a training accident, the grievor spent the better part of three years on extended sick leave. During this time, he was required to attend numerous medical appointments both within and outside of the local area of his normal place of duty. In the first year, the grievor was reimbursed, or partially reimbursed for travel to his medical appointments outside of the local area, but then, due to an apparent change in policy, he was no longer reimbursed.

The Director Compensation and Benefits Administration (DCBA) had advised the unit involved that because the grievor was on sick leave, he could not be considered to be “on duty.”

Therefore, travel expenses were not reimbursable under the Canadian Forces Temporary Duty Travel Instructions. The initial authority (IA) stated that, based on the DCBA direction, he was unable to grant redress. However, the IA opined that the grievor was being treated unfairly and supported the grievor in submitting his grievance to the final authority.

The Committee determined that the grievance hinged on the question of whether or not the grievor, who was on sick leave, could be considered to be “on duty”

when attending medical appointments. The Committee reviewed the Associate Deputy Minister (Human Resources – Military) Instruction 08/05- instead of, Health-Related Travel, and found that it clearly states that CAF members “travelling on health-related matters are considered on ‘temporary duty’ status.”

The Committee also noted that the Canadian Forces Health Services Group Instruction 3100-21 - Sick Leave states that CAF members who are on sick leave are considered to be “on duty”

when they attend an appointment to be medically reassessed for the purposes of sick leave.

The Committee then considered the facts of the grievor’s case:

- he was seriously injured while participating in a training exercise, while on duty;

- the medical appointments were all planned, scheduled and organized by the CAF;

- the appointments were an integral part of the CAF medical care provided to the grievor;

- the grievor had an obligation to follow and comply with the medical care plan put in place by CAF medical authorities; and

- failure to attend the appointments could have led to administrative or disciplinary action against the grievor.

Based on the above, the Committee found that the grievor should be deemed to be “on duty”

while attending the CAF-directed medical appointments. The Committee therefore recommended that the grievor be reimbursed for his travel expenses for those appointments which were outside of his local duty area.

CDS Decision: Pending

ACCOMMODATIONS FOR BREASTFEEDING

Case 2015-310

Shortly after her return to work following a maternity leave, the grievor was notified that she was to take part in an exercise. She asked the base medical staff to obtain employment limitations that would allow her to be deployed to an environment favourable to her decision to breastfeed her child. The medical staff informed her that her request was administrative in nature and should be addressed through the chain of command.

The grievor sent her chain of command a list of her needs, including access to a private room, electricity, running water, a freezer and the approval of regular break periods. The chain of command indicated that it would support the grievor’s requests when possible and in accordance with the operational needs of the exercise, adding however that it would take place in austere conditions and that the high operational tempo would not guarantee that her needs would always be met. The chain of command cautioned the grievor that she should be resourceful in finding solutions to her specific needs.

When she returned from the exercise, dissatisfied with the treatment she had received, the grievor submitted a grievance asking that the CAF adopt a policy in support of breastfeeding and reimburse her the costs of renting a breast pump for the duration of the exercise. She submitted that despite the support from her chain of command and its efforts to put in place favorable conditions, the exercise was incompatible with breastfeeding and represented a risk to her health due to hygiene reasons, the schedule and lack of privacy.

The initial authority (IA) denied the grievance, indicating that breastfeeding is a personal choice and that medical limitations should not be issued to allow a mother to breastfeed her child. He explained that it was up to the chain of command to accommodate the needs of a breastfeeding mother, which seemed to have been done for the grievor, to the extent possible. As for reimbursement of the breast pump, the IA concluded that this was not included in the range of CAF health services, so an exception to accommodate the grievor was not justified.

The Committee found that the grievor had not established a prima facie case of discrimination against her, based on sex or family situation. Although she had a legal obligation to feed her child, she did not demonstrate that the child had a medical condition necessitating breast milk or that there was no other accessible or available alternative in providing care for her child.

Moreover, the Committee found that the chain of command’s efforts to accommodate the grievor during the exercise, although it was not obligated to do so, were reasonable.

As for reimbursement of the breast pump, the Committee agreed that this was not included in the range of CAF health care services that are comparable to health care services provided for Canadians under provincial health care plans, which do not include this either. Given the absence of a specific medical condition, the Committee determined that the grievor’s situation did not justify that an exception be made and recommended that the breast pump not be reimbursed.

Lastly, although the grievor required that the CAF adopt a clear policy on breastfeeding, the Committee determined that the Canadian legislation to which the CAF are subject already very clearly frames the needs in the grievor’s request.

The Committee recommended that the grievance be denied.

CDS Decision: The final authority agreed with the Committee's findings and recommendation.

The Initial Authority explained that it was up to the chain of command to accommodate the needs of a breastfeeding mother, which seemed to have been done for the grievor, to the extent possible.

HOME EQUITY ASSISTANCE

Case 2016-007

While in the process of selling his condominium upon posting, the grievor’s condominium corporation unexpectedly levied a special assessment of $17,000 against each of the condominium units. In order to conclude the sale with a prospective buyer, the grievor reduced his sale price to compensate for the special assessment and then applied for the Home Equity Assistance (HEA) benefit to make up for the loss he suffered. His application for HEA was denied as it was found that it was his personal choice to lower the price of his home. The grievor argued that the financial loss he suffered on the sale of his home was not due to a personal decision, but rather to unforeseen factors beyond his control and that his loss met the intent of the HEA benefit criteria.

The Director General Compensation and Benefits, acting as the initial authority (IA), determined that the reduction in the sale price of the grievor’s house was based on the requirement for deferred maintenance as detailed in the special assessment levied by the condominium corporation. The IA pointed out that, as per the Canadian Forces Integrated Relocation Program (CF IRP) directive, any reduction in the sale price based on deferred maintenance cannot be included when calculating HEA.

The Committee observed that the CF IRP does not define or provide examples as to what is, or would be, considered deferred maintenance. The Committee referenced the Royal Canadian Mounted Police IRP directive which provides an example of deferred maintenance and found that the special assessment was not levied due to what could be considered deferred maintenance, but rather it was levied to ensure sufficient funds would be available for future planned maintenance. As such, the Committee found that the reduction in the grievor’s listing price was not due to deferred maintenance.

The Committee therefore recommended that the grievor be granted HEA based on the loss he suffered on the sale of his home.

CDS Decision: Pending

VOCATIONAL REHABILITATION PROGRAM FOR SERVING MEMBERS

Case 2016-044

The grievor contended that his commanding officer (CO) twice denied his request to participate in the Vocational Rehabilitation Program for Serving Members (VRPSM) merely out of spite for having caused a summary trial to be reviewed and quashed. The grievor submitted that the denial was a form of extrajudicial punishment based upon an alleged service offence that he had succeeded in getting dismissed.

The initial authority (IA), the Commander 1 Canadian Air Division Headquarters, found that although the CO may have had valid concerns, he should have tempered those concerns with due consideration for the intent of the VRPSM. The IA found that the grievor was unfairly denied access to the VRPSM. Regrettably, since the grievor was no longer serving in the CAF, approving his VRPSM request was no longer possible. Following receipt of the IA decision, the grievor sought five months pay as compensation for denying his VRPSM.

The Committee noted that the intent of the VRPSM, as set out in Canadian Forces General Message 151/07 and in the Aide Memoire for the VRPSM, is to ensure to the extent possible that releasing CAF members are given the support they need to successfully transition to a civilian career. The Committee concluded that the CO denied the request because of the conduct of the grievor, and found that although the decision was not overtly contrary to CAF policy, it failed to respect the intent of the policy and was unreasonable and overly restrictive.

The Committee reiterated that the aim of the grievance process is to provide a CAF member with a rights-based mechanism capable of repairing a situation or restoring a grievor to where he/she should have been in the first place had that injustice not occurred. The Committee confirmed with the Servicemen’s Income Security Insurance Plan (SISIP) that the grievor had full access to all of SISIP’s programs and benefits, and that he had availed himself of SISIP’s vocational training benefit by upgrading his educational qualifications. Consequently, the Committee recommended that the grievor’s request for five months pay be denied.

CDS Decision: The final authority (FA) agreed with the Committee’s findings and recommendation that the grievance be denied. Like the Committee, given the evidence on file, the FA found that denying the grievor’s request for VRPSM was unreasonable and unwarranted given the circumstances. However, while the FA regrets that the grievor was not afforded that program, he was pleased to note that the grievor took advantage of the vocational training offered to medically releasing CAF members through the SISIP.

ANNUAL LEAVE DURING RETIREMENT LEAVE

Case 2016-089