Market Intelligence Report: Combination Inhalers for Asthma, 2018

April 2020

ISSN 2371-5154

Cat. No.: H79-10E-PDF

Table of Contents

Acknowledgements

This report was prepared by the Patented Medicine Prices Review Board (PMPRB) as part of the National Prescription Drug Utilization Information System (NPDUIS) initiative.

The PMPRB wishes to acknowledge and thank the members of the NPDUIS Advisory Committee for their expert oversight and guidance in the preparation of this report. Please note that the statements, findings, and conclusions do not necessarily reflect those of the members or their organizations.

Appreciation goes to Brian O’Shea for leading this project and to Jeffrey Menzies, Tanya Potashnik, and Elena Lungu for their oversight in the development of the report. The PMPRB also wishes to acknowledge the contribution of the analytical staff Nevzeta Bosnic, Jared Berger, Jihong Yang, Blake Wladyka, and Jun Yu; and editorial staff Carol McKinley, Sarah Parker, and Shirin Paynter.

Disclaimer

NPDUIS operates independently of the regulatory activities of the Board of the PMPRB. The research priorities, data, statements, and opinions expressed or reflected in NPDUIS reports do not represent the position of the PMPRB with respect to any regulatory matter. NPDUIS reports do not contain information that is confidential or privileged under sections 87 and 88 of the Patent Act, and the mention of a medicine in a NPDUIS report is not and should not be understood as an admission or denial that the medicine is subject to filings under sections 80, 81, or 82 of the Patent Act or that its price is or is not excessive under section 85 of the Patent Act.

Although this information is based in part on data obtained from the NPDUIS Database of the Canadian Institute for Health Information (CIHI) and under license from IQVIA’s MIDAS® Database, Payer Insights database, and Private Pay Direct Drug Plan database, the statements, findings, conclusions, views, and opinions expressed in this report are exclusively those of the PMPRB and are not attributable to CIHI or IQVIA.

Contact Information

Patented Medicine Prices Review Board

Standard Life Centre

Box L40

333 Laurier Avenue West

Suite 1400

Ottawa, ON K1P 1C1

Tel.: 1-877-861-2350

TTY 613-288-9654

Email: PMPRB.Information-Renseignements.CEPMB@pmprb-cepmb.gc.ca

Executive Summary

The PMPRB Market Intelligence Report series provides detailed information on specific therapeutic market segments of importance to Canadians. These targeted analyses are designed to inform policy discussions, aid in evidence-based decision making, and provide Canadians with insight into issues pertaining to pharmaceutical pricing and utilization in Canada and internationally.

This edition of the report analyzes the market for inhaled corticosteroid (ICS) and long-acting beta agonist (LABA) combination inhalers used in the treatment of asthma. These medicines generate annual sales of over half a billion dollars in Canada and represent close to half of the total sales for obstructive airway disease medicines. Canadian list prices for combination inhalers for asthma far exceed the levels prevailing in many other countries, and in fact, this sub-class tops the list of therapeutic areas with the greatest cost implications due to higher prices in Canada.

Asthma is the most common chronic respiratory disease in Canada, affecting over three million Canadians and imposing substantial costs in terms of drug spending as well as lost productivityFootnote 1. This report examines four combination inhalers available in Canada that are used to maintain control over asthma symptoms as part of a continuum of treatmentFootnote i:

- Advair (fluticasone/salmeterol): launched in 1999

- Symbicort (budesonide/formoterol): launched in 2002

- Zenhale (mometasone/formoterol): launched in 2011

- Breo Ellipta (fluticasone/vilanterol): launched in 2013

The analysis provides insight into the use of these medicines, as well as their market shares, pricing, and annual treatment costs. It explores Canadian markets from the national as well as public and private payer perspectives, positioning them within an international context. The findings are centred on the 2018 calendar year, with a retrospective look at trends in recent years.

International markets examined include the Organisation for Economic Co-operation and Development (OECD) members, with a focus on the seven countries the PMPRB currently considers in reviewing the prices of patented medicines (PMPRB7): France, Germany, Italy, Sweden, Switzerland, the United Kingdom (UK), and the United States (US).

The results of this study will inform policy discussions and aid in evidence-based decision making on the price and reimbursement of these medicines at the public and private payer levels in Canada.

Key Findings

Canadian per capita sales of combination inhalers for asthma are among the highest in the OECD

- In 2018, sales of combination inhalers for asthma in Canada totalled $577 million, accounting for 2.3% of the total pharmaceutical market, the fifth highest share in the OECD and well above the median of 1.2%.

- Canadian per capita sales for combination inhalers for asthma were more than double the OECD median in 2018, placing Canada second among the OECD countries, while per capita consumption ranked 10th.

Combination inhalers for asthma have not benefitted from the same level of generic competition as oral solid medicines

- In Canada, the first competitor inhaler delivering the same combination of medicines as Advair was approved in 2018; two other same-combination competitors were approved in 2019 and 2020, including the first generic version of Advair. None of these medicines had recorded sales data at the time of analysis.

- Same-combination competitors of Advair and Symbicort were approved much earlier in all of the PMPRB7 comparator countries, except Switzerland, although their uptake has been relatively low.

- Prices discounts for same-combination competitors varied across the PMPRB7: while European countries offered prices up to 29% lower than the top-selling strengths of the originator brands in Canada in 2018, in the US the discounts for a newly-launched generic were deeper, at up to 66% less than the originator brand price.

Despite relatively modest per patient treatment costs, the widespread use of combination inhalers for asthma makes them a strong contributor to Canadian drug plan spending

- In 2018, combination inhalers for asthma made up 2.7% of the total drug costs for Canadian public plans and 2.3% of private drug plan costs.

- Canadian public drug plans, which provide coverage to specific population groups including seniors, reimbursed slightly over half of all retail sales of combination inhalers for asthma in 2018, with 5.2% of the beneficiaries being treated with at least one of these medicines.

- The average annual drug costs per patient were between 31% and 53% higher for each combination inhaler in public plans than in private plans, mainly due to a higher rate of consumption by the beneficiary population in the public plans.

When comparing brand prices for combination inhalers in Canada to foreign markets, Canadian prices are consistently higher, with important cost implications for both public and private payers

- Canadian average list prices for combination inhalers for asthma were the second highest among the PMPRB7 in Q4-2018, trailing only the US, and are substantially higher than the OECD median.

- Compared to Canadian levels, median PMPRB7 prices were 59% lower for Advair, 36% lower for Symbicort, and 54% lower for Breo Ellipta in Q4-2018.

- Compared to the OECD countries, the differentials between Canadian and foreign prices were even greater, with median OECD average prices 64% lower for Advair, 50% lower for Symbicort, and 56% lower for Breo Ellipta.

- The cost implications of paying higher prices for combination inhalers for asthma in Canada are substantial, estimated at $264 million nationally in 2018 when compared to median PMPRB7 levels.

Data sources: The main data sources for international, Canadian national, and Canadian public and private drug plans are the IQVIA MIDAS® Database (all rights reserved); IQVIA’s Private Drug Plan Database; and the Canadian Institute for Health Information’s NPDUIS Database.

Limitations: As the available data does not distinguish between indications, the drug use and costs reported here are associated with all disease therapies including asthma and COPD. Foreign and Canadian national sales and prices are based on manufacturer list prices, while drug plan costs are based on the amounts accepted for reimbursement. None of the values reported capture off-invoice price rebates, managed entry agreements (also known as product listing agreements), or patient access schemes.

Introduction

The PMPRB Market Intelligence Report series examines therapeutic classes of drugs with high sales in Canada and large price differentials between Canadian and international levels. Previous editions focused on biologic disease-modifying antirheumatic drugs and anti-vascular endothelial growth factor drugs used for retinal conditions. This third edition analyzes the market for combination inhaled corticosteroid (ICS) and long-acting beta agonist (LABA) medicines indicated for the treatment of asthma.

Asthma is a debilitating chronic lung disease affecting over three million Canadians.Footnote 1 This analysis examines Canadian and international markets for the four ICS/LABA combination inhalers with recorded sales in Canada: Advair, Symbicort, Zenhale, and Breo Ellipta. Throughout the report, these medicines are referred to as combination inhalers for asthma.

The results of this study will inform policy discussions and aid in evidence-based decision making on the price and reimbursement of these medicines at the public and private payer levels, while providing Canadians with insight into their pricing and utilization in Canada and internationally.

Asthma: Prevalence and Treatment

The prevalence of asthma in Canada, which is estimated at 7.8% for people aged 12 and older,Footnote 2 falls within the range of the PMPRB7 countries. In the US, the estimated rate of prevalence is 7.7%Footnote 3 for adults; while asthma prevalence for persons aged 15 and older is 9.4% in the UK, 8.8% in France, 7.6% in Sweden, and 6.1% in Germany.Footnote 4

In Canada, asthma is usually treated using a stepwise approach based on a patient’s level of disease control. As part of the continuum of treatment, the Canadian Thoracic Society 2012 Guidelines recommend adding a long-acting beta agonist (LABA), ideally in the form of a combination inhaler, to maintenance inhaled corticosteroid (ICS) therapy for patients 12 years and older if the ICS alone is not enough to maintain control of asthma symptoms.Footnote ii If the ICS/LABA combination is insufficient, then either increasing the ICS dose, or the addition of a leukotriene receptor antagonist (LTRA), are recommended as third-line therapeutic options.Footnote 5

Methods

Drug Selection

Drug selection was based on the Anatomical Therapeutic Chemical (ATC) fourth-level class “adrenergics in combination with corticosteroids or other drugs, excluding anticholinergics.” In 2017, the differences between Canadian and international price levels had the largest net impact on this class of drugs.Footnote 6

There are 12 different combinations of medicinal ingredients in this therapeutic class; however, only four had recorded sales in Canada at the time of the analysis: Advair (fluticasone/salmeterol); Symbicort (budesonide/formoterol); Zenhale (mometasone/formoterol); and Breo Ellipta (fluticasone/vilanterol). Arbesda RespiClick, another fluticasone/salmeterol combination, received market approval in Canada in 2018. This was followed by an additional fluticasone/salmeterol inhaler in 2019 and the entry of Wixela Inhub, the first generic version of Advair, in 2020. None of these newer medicines impacted the market during the study period.

Approach

International markets examined include the Organisation for Economic Co-operation and Development (OECD) members, with a focus on the seven countries the PMPRB currently considers in reviewing the prices of patented medicines (PMPRB7): France, Germany, Italy, Sweden, Switzerland, the United Kingdom (UK), and the United States (US). Public plan results are based on data from all jurisdictions participating in the NPDUIS initiative: all Canadian provincial public plans with the exception of Quebec, as well as Yukon and the Non-Insured Health Benefits Program.

Canadian and international rates of drug consumption per capita were determined by converting the physical quantity of drugs sold into daily treatment doses per patient and expressing the result on a per capita basis. Daily treatment doses were based on the World Health Organization’s list of defined daily doses for combination products,Footnote 7 where applicable, or recommended maintenance doses from product monographs.

Average foreign-to-Canadian price ratios for the selected drugs were calculated for a variety of bilateral and multilateral measures. Bilateral price ratios compare the price levels for an individual country to those in Canada, while multilateral ratios compare the prices across all countries (PMPRB7 or OECD) to those in Canada. The resulting ratios reflect how much more or less Canadians would have paid for combination inhalers for asthma if they had paid average international prices (multilateral measures) or the prices in a specific country (bilateral measures). For more details on how foreign-to-Canadian price ratios are calculated, see the Reference Documents section of the Analytical Studies page.

Data Sources

The findings presented in this report are based on the analysis of a number of databases. Canadian national and international drug sales, prices, and utilization were based on data captured in the IQVIA MIDAS® Database (all rights reserved). The NPDUIS Database from the Canadian Institute for Health Information (CIHI) was used in the analyses of the public drug plan market, while the IQVIA Private Drug Plan database was used in the analyses of the private drug plan market. The IQVIA Payer Insights databases provided information on the market breakdown by payer type, and the IQVIA Canadian Drugstore and Hospital Purchases Audit was used for the provincial distribution of sales. For more information on these data sources, see the Reference Documents section of the Analytical Studies page.

Limitations

As the available data does not distinguish between indications, the drug use and costs reported here are associated with all disease therapies. For example, the results for Advair, Symbicort, and Breo Ellipta do not distinguish between their use for the treatment of asthma and their use for chronic obstructive pulmonary disease (COPD). For Breo Ellipta and the strengths of Advair indicated for COPD, the recommended daily maintenance doses in the respective Health Canada product monographs are identical to the asthma maintenance doses. For Symbicort, the recommended COPD maintenance daily dose is equal to the maximum recommended asthma maintenance dose.

Foreign and Canadian national sales and prices are based on manufacturer list prices, while drug plan costs are based on amounts accepted for reimbursement. None of the values reported capture off-invoice price rebates, managed entry agreements (also known as product listing agreements), or patient access schemes.

Depending on the country, combination inhalers for asthma may be dispensed through the retail or hospital sectors, or a combination of both. The prices reported here may vary depending on the differences between the procurement processes in these sectors.

Payer Insights data, used to provide a breakdown of the Canadian market, reports payments at the transaction level, which reflects the first payer.

While the results suggest that Canada has one of the highest rates of sales per capita of combination inhalers for asthma, this report makes no assessment as to the appropriateness of these levels.

1. Drug Status in Canada

Combination inhalers for asthma have been available in Canada for at least two decades and are listed on almost all Canadian public drug formularies.

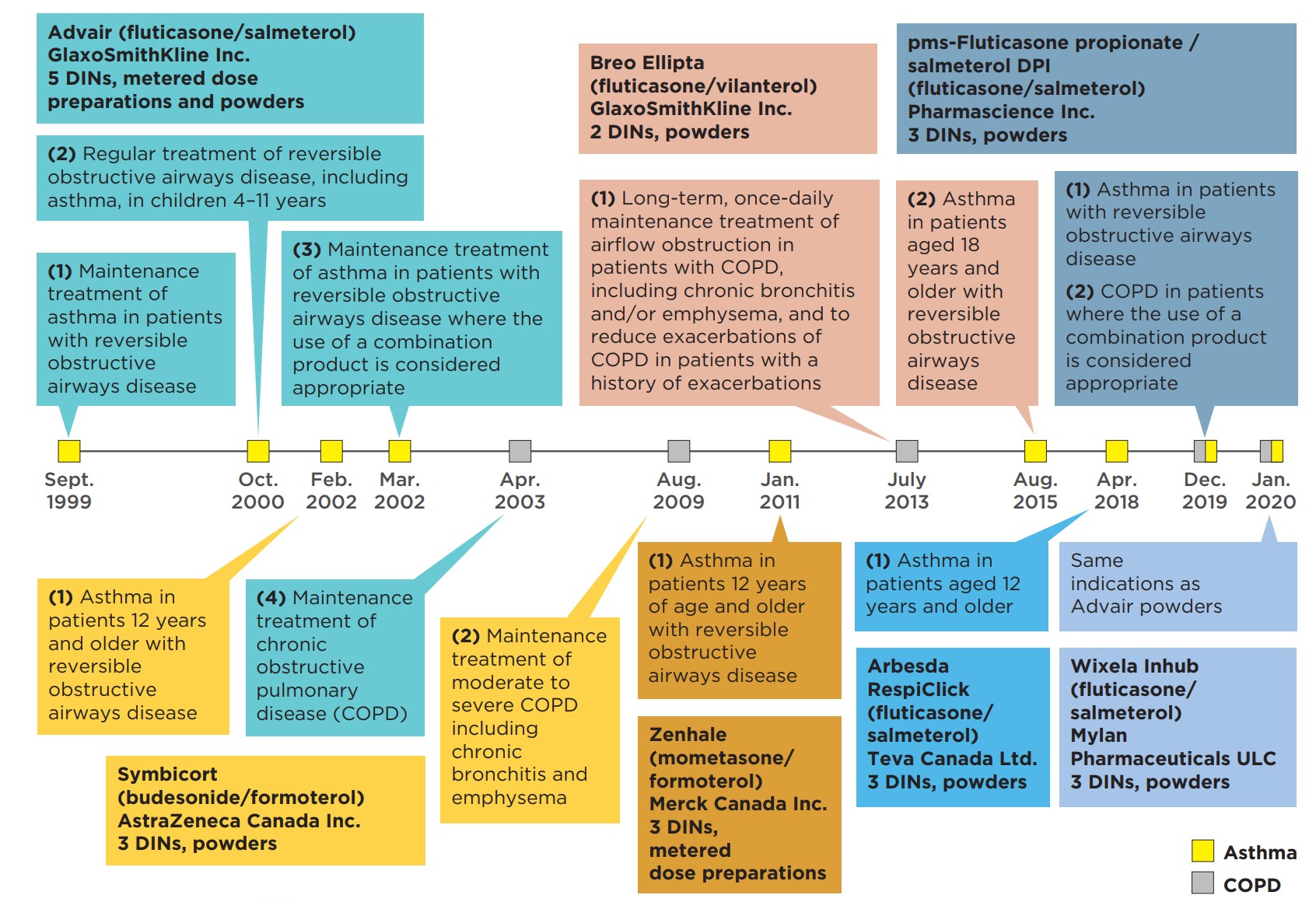

Inhaled corticosteroids and long-acting beta-agonist (ICS/LABA) combination inhalers are indicated for the treatment of respiratory conditions such as asthma, as well as chronic obstructive pulmonary disease (COPD). The timeline of Canadian launches and subsequent approvals for these drugs is presented in Figure 1.1.

Figure description

This figure shows a timeline of the market approvals for Advair, Symbicort, Zenhale, Breo Ellipta, Arbesda Respiclick, pms-Fluticasone propionate / salmeterol DPI, and Wixela Inhub.

| Advair (fluticasone/salmeterol) GlaxoSmithKline Inc. 5 DINs, metered dose preparations and powders | Symbicort (budesonide/formoterol) AstraZeneca Canada Inc. 3 DINs, powders | Zenhale (mometasone/formoterol) Merck Canada Inc. 3 DINs, metered dose preparations | Breo Ellipta (fluticasone/vilanterol) GlaxoSmithKline Inc. 2 DINs, powders | Arbesda RespiClick (fluticasone/ salmeterol) Teva Canada Ltd. 3 DINs, powders | pms-Fluticasone propionate / salmeterol DPI (fluticasone/salmeterol) Pharmasciene Inc. 3 DINs, powders | Wixela Inhub (fluticasone/ salmeterol) Mylan Pharmaceuticals ULC 3 DINs, powders |

|---|---|---|---|---|---|---|

| September 1999: (1) Maintenance treatment of asthma in patients with reversible obstructive airways disease |

February 2002: (1) Asthma in patients 12 years and older with reversible obstructive airways disease |

January 2011: (1) Asthma in patients 12 years of age and older with reversible obstructive airways disease |

July 2013: (1) Long-term, once-daily maintenance treatment of airflow obstruction in patients with COPD, including chronic bronchitis and/or emphysema, and to reduce exacerbations of COPD in patients with a history of exacerbations |

April 2018: (1) Asthma in patients aged 12 years and older |

December 2019: (1) Asthma in patients with reversible obstructive airways disease (2) COPD in patients where the use of a combination product is considered appropriate |

January 2020: Same indications as Advair powders |

| October 2000: (2) Regular treatment of reversible obstructive airways disease, including asthma, in children 4–11 years |

August 2009: (2) Maintenance treatment of moderate to severe COPD including chronic bronchitis and emphysema |

August 2015: (2) Asthma in patients aged 18 years and older with reversible obstructive airways disease |

||||

| March 2002: (3) Maintenance treatment of asthma in patients with reversible obstructive airways disease where the use of a combination product is considered appropriate |

||||||

| April 2003: (4) Maintenance treatment of chronic obstructive pulmonary disease (COPD) |

Data source: Health Canada Drug Product Database and Notice of Compliance Database.

Background

Health Canada

Health Canada provides market authorization to drug products that have been assessed for safety, efficacy, and quality.

PMPRB – HDAP

All new patented medicines reported to the PMPRB are subject to a scientific evaluation as part of the price review process. This is conducted by the Human Drug Advisory Panel (HDAP), which makes recommendations on the level of therapeutic improvement, the primary use (where required), the selection of medicines to be used for comparison purposes, and the comparable dosage regimens.

CADTH – CDR

Through the Common Drug Review (CDR) process, the Canadian Agency for Drugs and Technologies in Health (CADTH) conducts evaluations of the clinical, economic, and patient evidence on drugs. These evaluations are used to provide reimbursement recommendations and advice to Canada’s federal, provincial, and territorial public drug plans, with the exception of Quebec, where the Institut national d’excellence en santé et en services sociaux (INESSS) performs a similar function.

pCPA

The pan-Canadian Pharmaceutical Alliance (pCPA) conducts joint provincial/territorial /federal negotiations for brand-name and generic drugs in Canada to achieve greater value for publicly funded drug programs and patients. All brand-name drugs coming forward for funding through the CDR or pan-Canadian Oncology Drug Review (pCODR) processes are considered for negotiation.

Advair (fluticasone/salmeterol) was launched in 1999, followed by Symbicort (budesonide/formoterol) in 2002. More recent entrants include Zenhale (mometasone/formoterol) in 2011 and Breo Ellipta (fluticasone/vilanterol) in 2013. Three other fluticasone/salmeterol inhalers were approved between 2018 and 2020, including the first generic version of Advair, but none had recorded sales data at the time of analysis.

Combination inhalers for asthma are broadly covered by most public drug plans, usually with criteria for use or requiring special authorization.

The PMPRB’s Human Drug Advisory Panel (HDAP) classified Advair and Symbicort as providing “moderate, little, or no improvement” over their component medicinal ingredients, which were already marketed as separate products. Zenhale was reviewed after the implementation of the 2010 revised PMPRB Guidelines as “offering slight or no improvement” over Advair and Symbicort, which were chosen as its therapeutic class comparators for the treatment of asthma. When Breo Ellipta was reviewed by HDAP in 2013, its only approved indication was for COPD, and it was assessed as providing “a slight or no improvement” over comparators Advair and Symbicort. None of the recently approved fluticasone/salmeterol competitor inhalers have been reviewed by HDAP.

Advair and Symbicort were not reviewed by CADTH as they entered the market prior to the implementation of the Common Drug Review (CDR) in 2003. The CDR recommended that both Zenhale and Breo Ellipta be listed in a manner similar to other ICS/LABA combination inhalers for the treatment of asthma. Arbesda RespiClick, a combination of the same medicinal ingredients as Advair, was reviewed by CADTH as a new combination product since it was approved by Health Canada as a new drug submission. The CDR recommended that Arbesda RespiClick be listed for the treatment of asthma, with the condition that it provide cost savings over the lowest priced ICS/LABA available.

Both Advair and Breo Ellipta were the subject of negotiations through the pan-Canadian Pharmaceutical Alliance (pCPA). The pCPA completed one negotiation in 2015 for Advair for both its asthma and COPD indications. Breo Ellipta’s indications were negotiated separately, with agreements reached for COPD in 2015 and asthma in 2016.

In Canada, each public drug plan reimburses beneficiaries based on their own specific eligibility criteria, cost-sharing structures, and formulary listing decisions. All provincial public drug plans, as well as Yukon and the NIHB, reimburse Advair, Symbicort, and Breo Ellipta for asthma, while Zenhale is listed in all public formularies except for Alberta. At the time of this analysis, reimbursement decisions had not been announced for any of the newer fluticasone/salmeterol competitor inhalers.

Table 1.1 reports on the Canadian approvals, assessments, recommendations, negotiation status, and reimbursement decisions for combination inhalers for asthma through to the end of January 2020.

| Trade name (medicinal ingredients) Manufacturer |

Notice of Compliance dates | PMPRB HDAP assessment | CADTH recommendations | pCPA negotiation status | Public drug plan reimbursement | |

|---|---|---|---|---|---|---|

| Asthma | COPD | |||||

| Advair (fluticasone/salmeterol) GlaxoSmithKline |

Asthma: Sept. 1999 COPD: Apr. 2003 |

Category 3* – Moderate, Little, or No Improvement | NA† | One complete: for both COPD and asthma | All provinces, YT, and the NIHB | All provinces (except ON), YT, and the NIHB |

| Symbicort (budesonide/formoterol) AstraZeneca |

Asthma: Feb. 2002 COPD: Aug. 2009 |

Category 3* –Moderate, Little, or No Improvement | NA† | – | All provinces, YT, and the NIHB | All provinces (except BC and ON), YT, and the NIHB |

| Zenhale (mometasone/formoterol) Merck |

Asthma: Jan. 2011 | Slight/No Improvement | Sept. 2011 Asthma: do not list‡ Dec. 2012 Asthma: list with criteria or conditions |

– | All provinces (except AB), YT, and the NIHB | NA |

| Breo Ellipta (fluticasone/vilanterol) GlaxoSmithKline |

COPD: July 2013 Asthma: Aug. 2015 |

Slight/No Improvement | Aug. 2014 COPD: list with criteria or conditions Feb. 2016 Asthma: list with criteria or conditions |

Two complete: one for COPD and one for asthma | All provinces, YT, and the NIHB | All provinces, YT, and the NIHB |

| Arbesda RespiClick (fluticasone/salmeterol) Teva |

Asthma: Apr. 2018 | NA | Dec. 2018 Asthma: list with criteria or conditions | Negotiations closed without agreement | NA | NA |

| pms-Fluticasone propionate / salmeterol DPI (fluticasone/salmeterol) Pharmascience Inc. |

Asthma and COPD: Dec. 2019 | NA | NA | – | NA | NA |

| Wixela Inhub (fluticasone/salmeterol) Mylan Pharmaceuticals ULC |

Asthma and COPD: Jan. 2020 | NA | NA | – | NA | NA |

Note: Information in the table is valid as of January 31, 2020.

* The HDAP review was completed prior to the implementation of the 2010 PMPRB Guidelines. Category recommendations are detailed in the previous PMPRB Guidelines.

† Introduced prior to the 2003 implementation of CADTH’s Common Drug Review (CDR).

‡ CADTH recommendation was based on uncertain clinical benefit and lack of trials versus ICS monotherapy.

2. International Market Overview

Combination inhalers for asthma are over a half billion dollar market in Canada, with a modest steady growth over the past five years. These drugs account for a larger share of pharmaceutical sales in Canada than in most other countries. Canadian per capita spending and consumption of combination inhalers for asthma are among the highest in the OECD.

While Advair and Symbicort entered the Canadian market close to two decades ago, these medicines have not experienced the same level of generic competition as oral solid medicines.

The first competitor inhaler delivering the same combination of medicines as Advair was approved in Canada in 2018; this was followed by another two same-combination competitors in 2019 and 2020, the latter of which was the first generic version of Advair to enter the Canadian market. None of these medicines had recorded sales data during the study period. Internationally, numerous same-combination competitors to Advair and Symbicort have been approved, with price discounts of up to 29% off the originator brands in the European PMPRB7 countries and up to 66% in the US. Nevertheless, the originator brands still account for the majority of sales revenue.

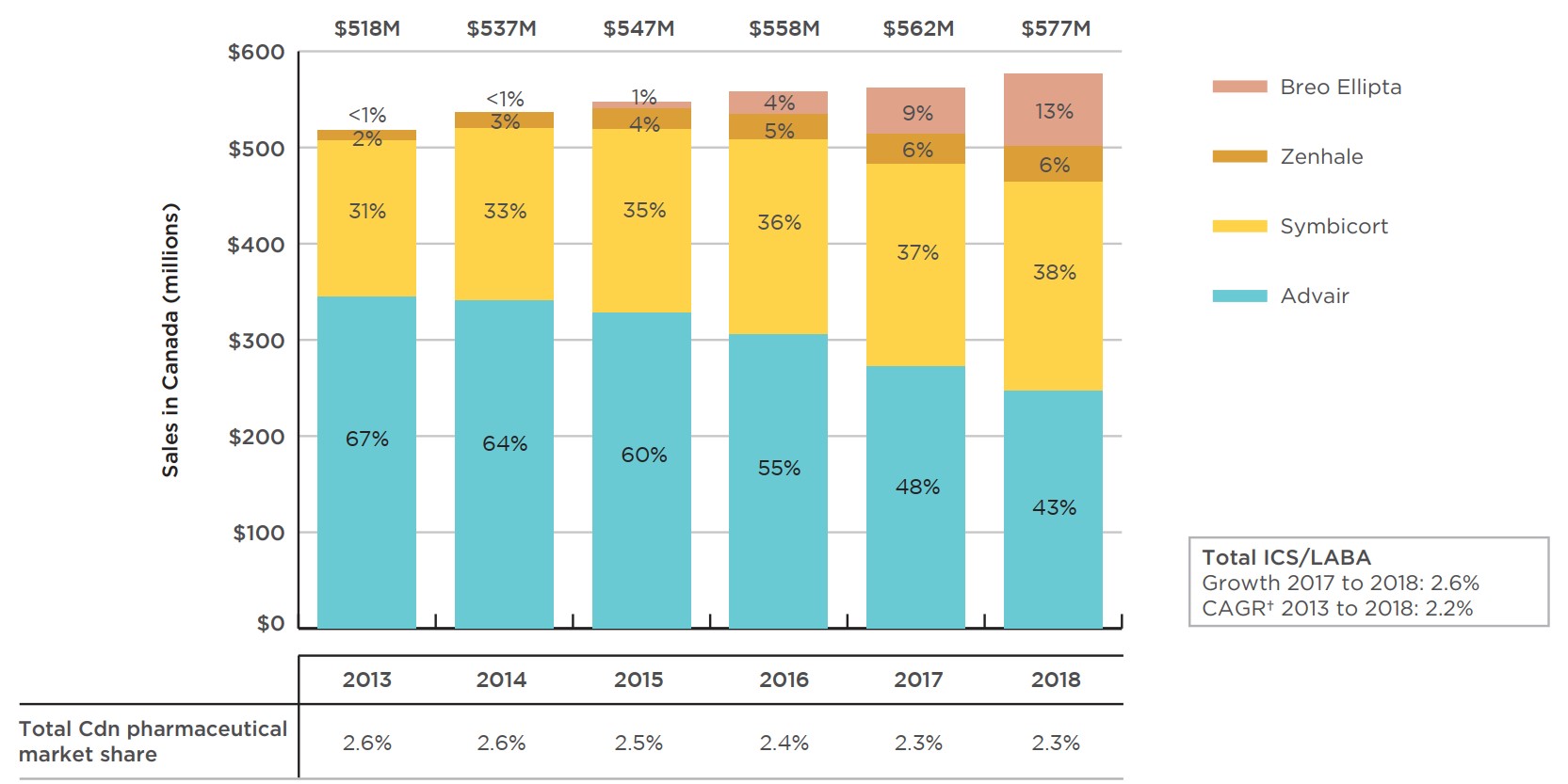

In 2018, sales of combination inhalers for asthma totaled $577 million, or 2.3% of the total Canadian prescription pharmaceutical market. Sales of these drugs have grown steadily since 2013, at a compound annual growth rate (CAGR) of 2.2% per year. This is somewhat lower than the CAGR of 5.4% observed for the pharmaceutical market as a whole, although the overall growth rate was influenced by the introduction of higher-cost medicines including direct-acting antivirals for hepatitis C.

Although Advair was still the top-selling medicine in this class in 2018, accounting for 43% of the Canadian sales for combination inhalers for asthma, its share has gradually decreased from 67% in 2013. While Symbicort and Zenhale have increased their market share over the same period, much of Advair’s loss has been taken up by the recent entrant Breo Ellipta. Figure 2.1 illustrates these trends, showing the sales revenue share for Advair decreasing while combined sales for the other combination inhalers for asthma continue to grow.

Figure description

This column graph gives the trends in Canadian sales revenues for Advair, Symbicort, Zenhale, and Breo Ellipta from 2013 to 2018. Over this period, the compound annual growth rate for sales of this class of medicines was 2.2%, with a growth rate of 2.6% from 2017 to 2018.

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|---|

| Advair | $344 million (67%) | $341 million (64%) | $328 million (60%) | $306 million (55%) | $272 million (48%) | $247 million (43%) |

| Symbicort | $163 million (31%) |

$179 million (33%) | $191 million (35%) | $203 million (36%) | $210 million (37%) | $218 million (38%) |

| Zenhale | $10 million (2%) | $16 million (3%) | $21 million (4%) | $27 million (5%) | $32 million (6%) | $36 million (6%) |

| Breo Ellipta | <$1 million (<1%) |

$1 million (<1%) | $7 million (1%) | $23 million (4%) | $48 million (9%) | $75 million (13%) |

| Total sales | $518 million | $537 million | $547 million | $558 million | $562 million | $577 million |

| Total Canadian pharmaceutical market share | 2.6% | 2.6% | 2.5% | 2.4% | 2.3% | 2.3% |

* At manufacturer price levels.

† Compound annual growth rate.

Data source: IQVIA MIDAS® Database, prescription retail and hospital markets, 2013 to 2018. All rights reserved.

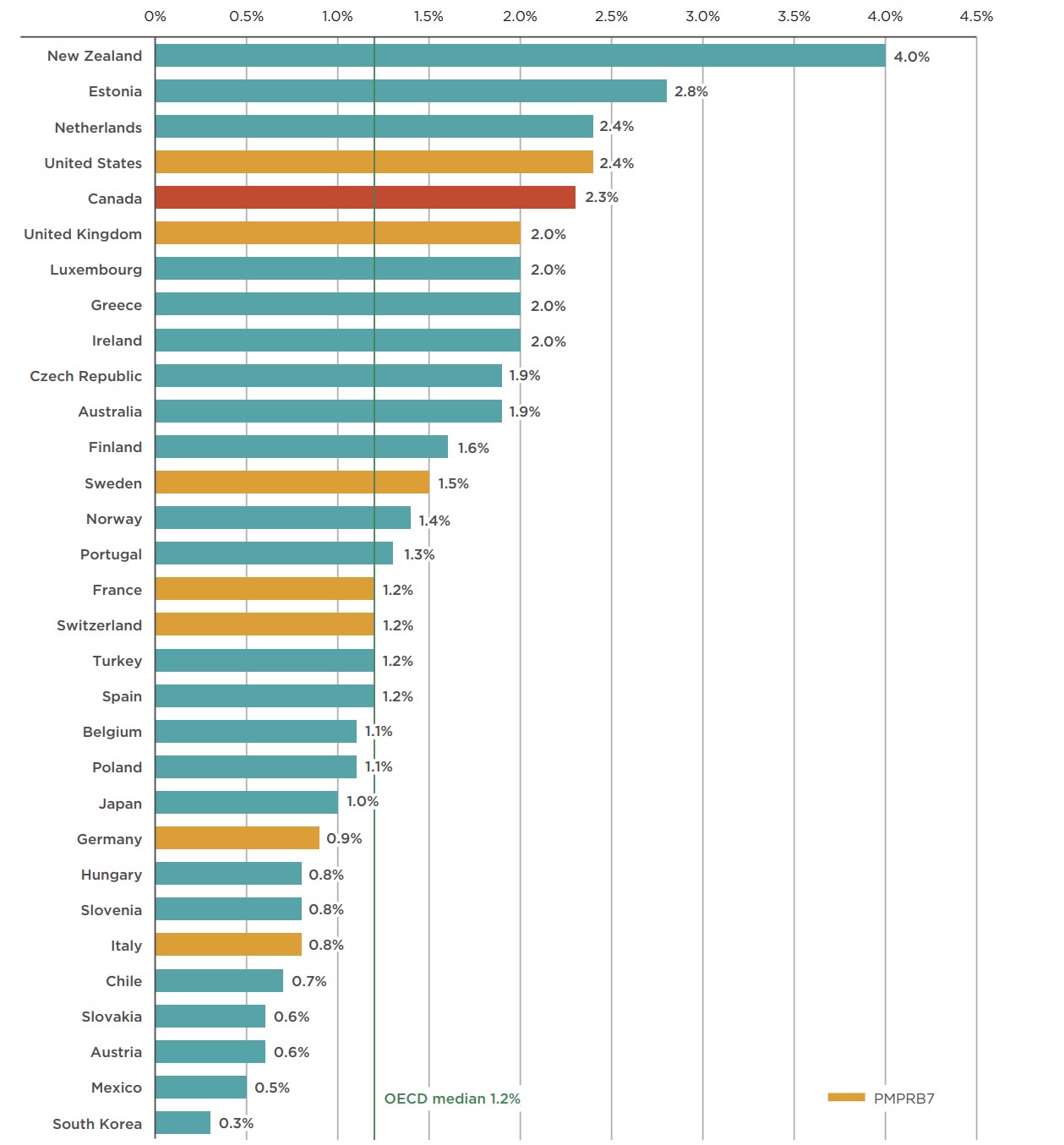

Due to a slower rate of sales growth relative to the overall pharmaceutical market, the revenue share of total pharmaceutical spending for combination inhalers for asthma declined slightly, from 2.6% in 2013 to 2.3% in 2018. However, the 2.3% market share in 2018 places Canada fifth in the OECD, well above the median of 1.2%. Of the PMPRB7 countries, only the US had a higher market share at 2.4%.

Market shares for all OECD countries are given in Figure 2.2. Although a higher comparative market share may point towards a higher rate of consumption, higher prices, or a combination of both factors, it is also affected by the relative sales of the rest of the pharmaceutical market in each country.

Figure description

This bar graph gives the combination inhalers for asthma share of total pharmaceutical sales for each country in the Organisation for Economic Co-operation and Development (OECD) in 2018. The OECD median is 1.2%.

| Country | Share of total pharmaceutical sales revenues in 2018 |

|---|---|

| South Korea | 0.3% |

| Mexico | 0.5% |

| Austria | 0.6% |

| Slovakia | 0.6% |

| Chile | 0.7% |

| Italy | 0.8% |

| Slovenia | 0.8% |

| Hungary | 0.8% |

| Germany | 0.9% |

| Japan | 1.0% |

| Poland | 1.1% |

| Belgium | 1.1% |

| Spain | 1.2% |

| Turkey | 1.2% |

| Switzerland | 1.2% |

| France | 1.2% |

| Portugal | 1.3% |

| Norway | 1.4% |

| Sweden | 1.5% |

| Finland | 1.6% |

| Australia | 1.9% |

| Czech Republic | 1.9% |

| Ireland | 2.0% |

| Greece | 2.0% |

| Luxembourg | 2.0% |

| United Kingdom | 2.0% |

| Canada | 2.3% |

| United States | 2.4% |

| Netherlands | 2.4% |

| Estonia | 2.8% |

| New Zealand | 4.0% |

*At manufacturer price levels.

Data source: IQVIA MIDAS® Database, prescription retail and hospital markets, 2018. All rights reserved.

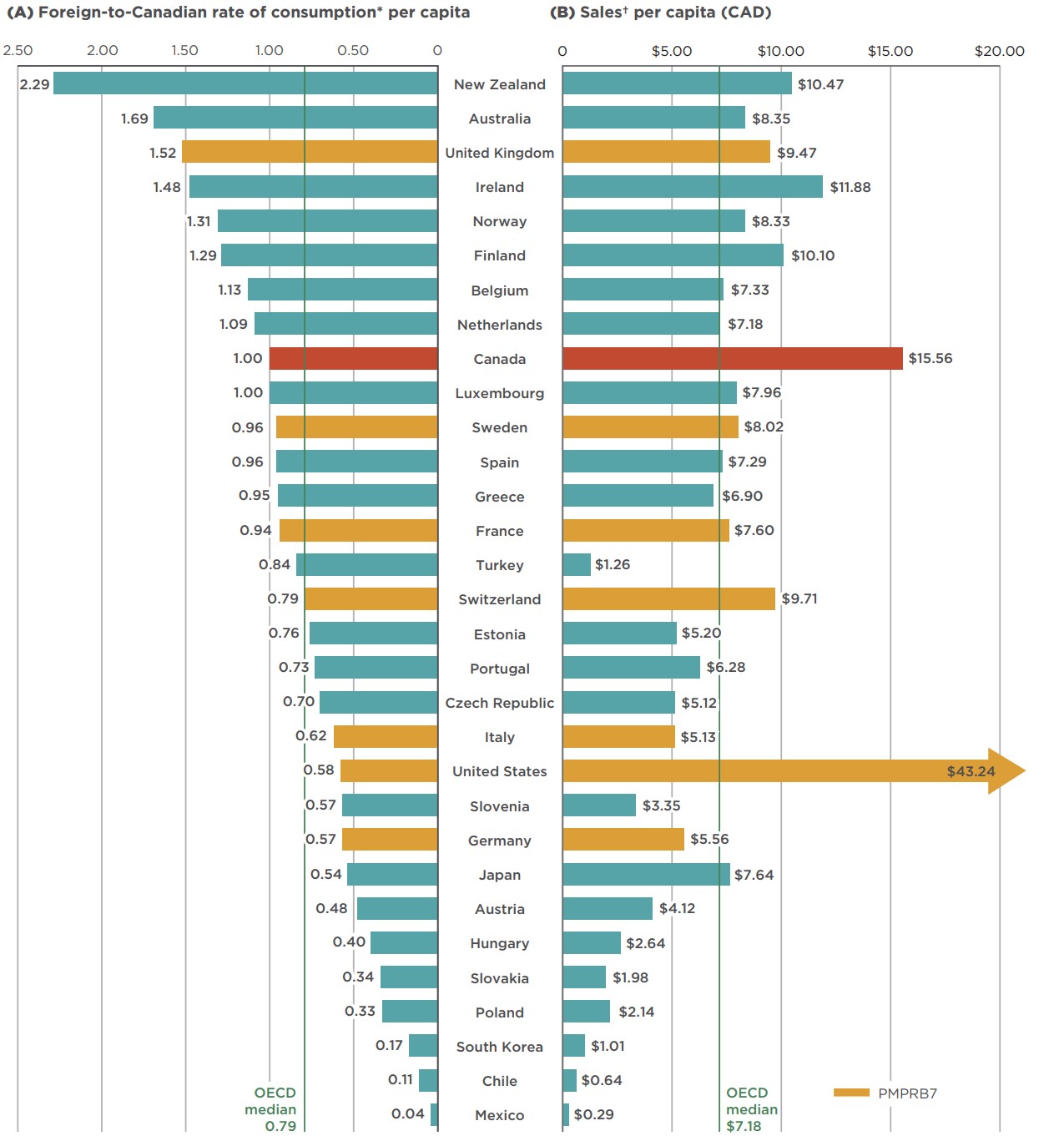

Per capita consumption and sales of combination inhalers for asthma are also higher in Canada than in international markets. Canadian per capita consumption was 10th highest in the OECD in 2018, ranking higher than all PMPRB7 countries except the US, with median OECD rates 21% lower than in Canada. Canada ranked even higher in terms of sales, with the second highest per capita rate in the OECD, following the US, at more than double the OECD median.

Figure 2.3 gives the 2018 (a) per capita consumption and (b) per capita sales of combination inhalers for asthma in each OECD country. The rate of consumption was calculated by converting the number of doses sold into daily maintenance treatment doses per capita. The results are presented as an index, with the per capita consumption rate in Canada set to one, and the rates in other countries determined relative to this measure. Daily maintenance doses were taken from the WHO list of defined daily doses for combination products,Footnote 7 as well as individual product monographs.

The variation among countries may be influenced by many factors including differences in the prevalence and treatment of asthma and other relevant indications, the demographic and disease profiles of the population, the reimbursement policies in each country, and the affordability of treatments. Considerations such as these are outside the scope of this analysis.

Figure description

This split bar graph gives the combined per capita consumption and sales of combination inhalers for asthma for each country in the Organisation for Economic Co-operation and Development (OECD) in 2018. The median OECD values are 0.79 and $7.18, respectively.

| Country | Foreign-to Canadian rate of consumption* per capita | Sales† revenue per capita in Canadian dollars |

|---|---|---|

| Mexico | 0.04 | $0.29 |

| Chile | 0.11 | $0.64 |

| South Korea | 0.17 | $1.01 |

| Poland | 0.33 | $2.14 |

| Slovakia | 0.34 | $1.98 |

| Hungary | 0.40 | $2.64 |

| Austria | 0.48 | $4.12 |

| Japan | 0.54 | $7.64 |

| Germany | 0.57 | $5.56 |

| Slovenia | 0.57 | $3.35 |

| United States | 0.58 | $43.24 |

| Italy | 0.62 | $5.13 |

| Czech Republic | 0.70 | $5.12 |

| Portugal | 0.73 | $6.28 |

| Estonia | 0.76 | $5.20 |

| Switzerland | 0.79 | $9.71 |

| Turkey | 0.84 | $1.26 |

| France | 0.94 | $7.60 |

| Greece | 0.95 | $6.90 |

| Spain | 0.96 | $7.29 |

| Sweden | 0.96 | $8.02 |

| Luxembourg | 1.00 | $7.96 |

| Canada | 1.00 | $15.56 |

| Netherlands | 1.09 | $7.18 |

| Belgium | 1.13 | $7.33 |

| Finland | 1.29 | $10.10 |

| Norway | 1.31 | $8.33 |

| Ireland | 1.48 | $11.88 |

| United Kingdom | 1.52 | $9.47 |

| Australia | 1.69 | $8.35 |

| New Zealand | 2.29 | $10.47 |

* Based on World Health Organization Defined Daily Doses (DDD) for combination products where listed, and regular maintenance dosing in product monographs otherwise.

† At manufacturer price levels.

Data source: IQVIA MIDAS® Database, prescription retail and hospital markets, 2018. All rights reserved.

Although both Advair and Symbicort have been on the market for nearly two decades, they have faced limited generic competition. Instead, competitor products with the same combination of medicinal ingredients often launch under a proprietary market name and are not considered to be generic versions of the originator brand.

This trend can be seen in the recent Canadian market approvals of fluticasone/salmeterol competitor inhalers. Arbesda RespiClick was approved by Health Canada as a new drug submission (NDS), not through the abbreviated new drug submission (ANDS) process used for generic products. It gained marketing authorization in 2018 and was reviewed by the CDR as a new product. Arbesda RespiClick was made available at lower strengths and uses a RespiClick delivery device for inhalation, which differentiated it from the existing Advair strengths.Footnote 8 The following year, another fluticasone/salmeterol inhaler was approved, featuring the same strengths as the three Advair Diskus inhalers already available.Footnote 9 This product was also approved by Health Canada as an NDS rather than a generic. It was not until early 2020 that a true generic version of Advair, Wixela Inhub, was approved for market in Canada.

Regulatory challenges for generic combination inhalers

Combination inhalers for asthma are a complex market space, with special regulatory requirements for proving bioequivalence that may complicate generic entry. There is no international consensus with regard to regulating the design, method, and evaluation of bioequivalence studies for inhaled medicines.

In Canada, guidelines for demonstrating the therapeutic equivalence of "subsequent entry inhaled corticosteroid products used for the treatment of asthma" were published in 2018, but do not apply to combination products.Footnote 10 While two same-combination competitor inhalers to Advair were approved in 2018 and 2019, neither was submitted to Health Canada as an Abbreviated New Drug Submission (ANDS), and they are not considered to be generic versions of Advair. In early 2020, a third same-combination competitor inhaler was approved. Unlike the other two, this medicine was submitted as an ANDS and is considered to be a true generic version of Advair.Footnote 11

In a 2019 press release following the approval of the first generic of Advair Diskus, the US Food and Drug Administration acknowledged that the development of complex generics “can be more challenging than, for instance, solid oral dosage forms, like tablets, and the FDA regularly takes steps to help guide industry through the process.” The FDA noted it had provided bioequivalence recommendations and other considerations in a 2013 draft product specific guidance for companies seeking to develop a generic form of Advair Diskus.Footnote 12

The European Medicines Agency classifies same-combination competitor inhalers as “hybrid medicines”, which are required to demonstrate bioequivalence to a reference medicine, but are delivered using a different inhaler, at slightly different strengths or with a different indication. DuoResp Spiromax is an example of a hybrid medicine, using Symbicort as its reference.Footnote 13

Same-combination competitors to Advair or Symbicort had recorded sales in all OECD countries in 2018 with the exception of Canada, Japan, and Switzerland. Based on international sales data, the first appearance of same-combination competition to Advair or Symbicort in the PMPRB7 is detailed in Table 2.1. As they entered the market more recently, Zenhale and Breo Ellipta do not appear to have any same-combination competitors.

| Country | Fluticasone/salmeterol (Advair) | Budesonide/formoterol (Symbicort) |

|---|---|---|

| Canada | NA | NA |

| France | Q4-2015 | Q1-2016 |

| Germany | Q3-2012 | Q2-2014 |

| Italy | Q3-2013 | Q3-2015 |

| Sweden | Q3-2010 | Q2-2014 |

| Switzerland | NA | NA |

| UK | Q2-2015 | Q3-2014 |

| US | Q2-2017 | NA |

Data source: IQVIA MIDAS® Database, prescription retail and hospital markets, 2019. All rights reserved.

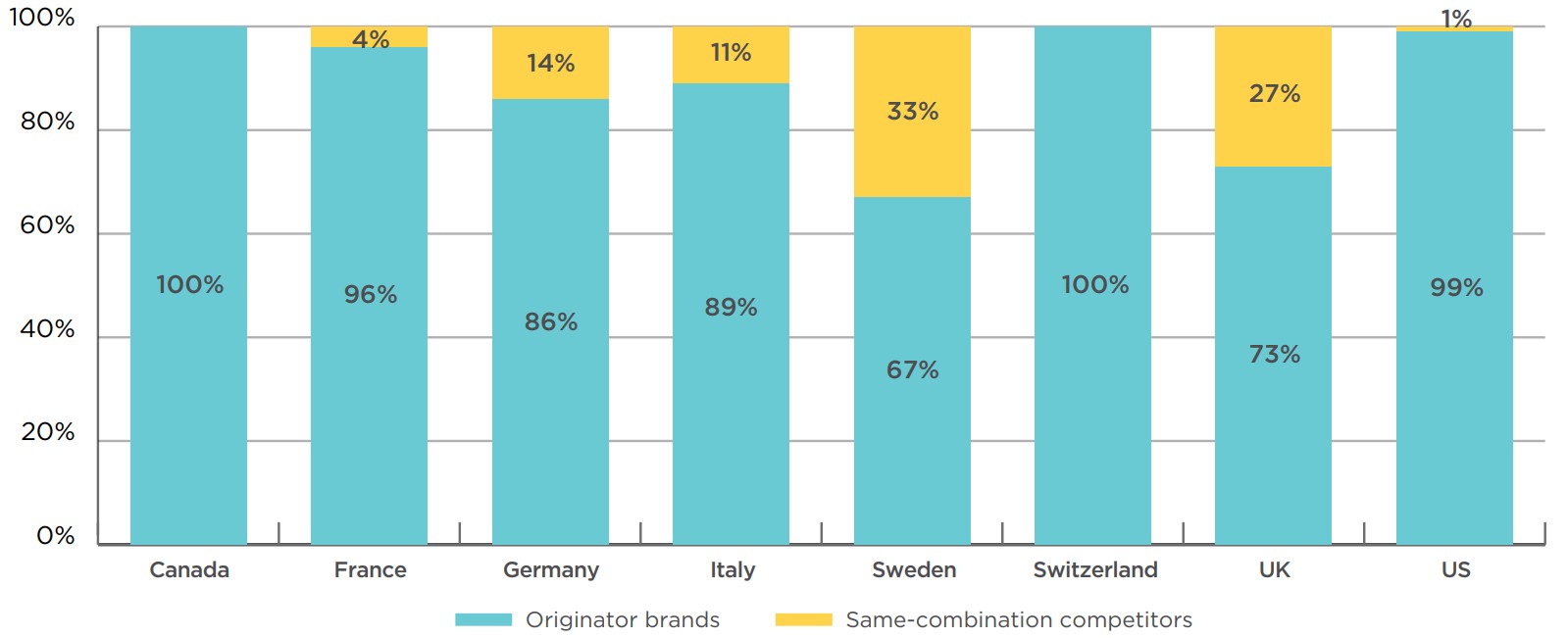

The level of market penetration by same-combination competition for Advair and Symbicort is illustrated in Figure 2.4. This graph displays the share of sales revenue for the originator fluticasone/salmeterol and budesonide/formoterol brands versus all same-combination competitors, both generic and non-generic, for the PMPRB7 in 2018. Apart from Canada and Switzerland, the US had the lowest level of competitor uptake, with only 1% of sales in 2018. The UK and Sweden had the largest average sales shares at 27% and 33%, respectively. This is a very different distribution than would be expected for an oral solid medicine after two decades.

Figure description

This column graph gives the combined revenue share of the originator brands Advair and Symbicort versus same-combination competitors for Canada and the PMPRB comparator countries in 2018. Same-combination competitors include both generics and subsequent brand-name competitors for the same combination of medicinal ingredients.

| Originator brands | Same-combination competitors | |

|---|---|---|

| Canada | 100% | 0% |

| Germany | 86% | 14% |

| France | 96% | 4% |

| Italy | 89% | 11% |

| Sweden | 67% | 33% |

| Switzerland | 100% | 0% |

| United Kingdom | 73% | 27% |

| United States | 99% | 1% |

* Includes both generics and subsequent brand-name competitors for the same combination of medicinal ingredients.

Data source: IQVIA MIDAS® Database, prescription retail and hospital markets, 2018. All rights reserved.

Even where alternatives to the originator brand combination inhalers for asthma exist, the cost savings offered are often quite moderate. Average unit prices for select same-combination competitor strengths of Advair and Symbicort in the European PMPRB7 countries ranged from a discount of 1% to 29% off the originator brand price in 2018, as shown in Table 2.2. Conversely, the first approved generic version of Advair in the US had an average unit price that was 66% lower than the corresponding originator brand strengths and captured a substantial market share (based on first recorded sales in the MIDAS® Database in 2019).

The Canadian market approvals of three fluticasone/salmeterol competitor inhalers between 2018 and 2020 may put downward pressure on per capita spending, however, based on international experience, it is difficult to predict the extent of the potential savings.

| Country | Fluticasone/salmeterol 250 mcg/25 mcg (Advair) | Budesonide/formoterol 200 mcg/6 mcg (Symbicort) |

|---|---|---|

| Canada | NA | NA |

| France | NA | -14% |

| Germany | -8% | -5% |

| Italy | -21% | -20% |

| Sweden | -10% | -29% |

| Switzerland | NA | NA |

| UK | -22% | <-1% |

| US | NA | NA |

Note: Based on the top-selling strength of the originator brand in Canada in 2018.

Data source: IQVIA MIDAS® Database, prescription retail and hospital markets, 2018. All rights reserved.

3. Canadian Market Overview: Payer Markets

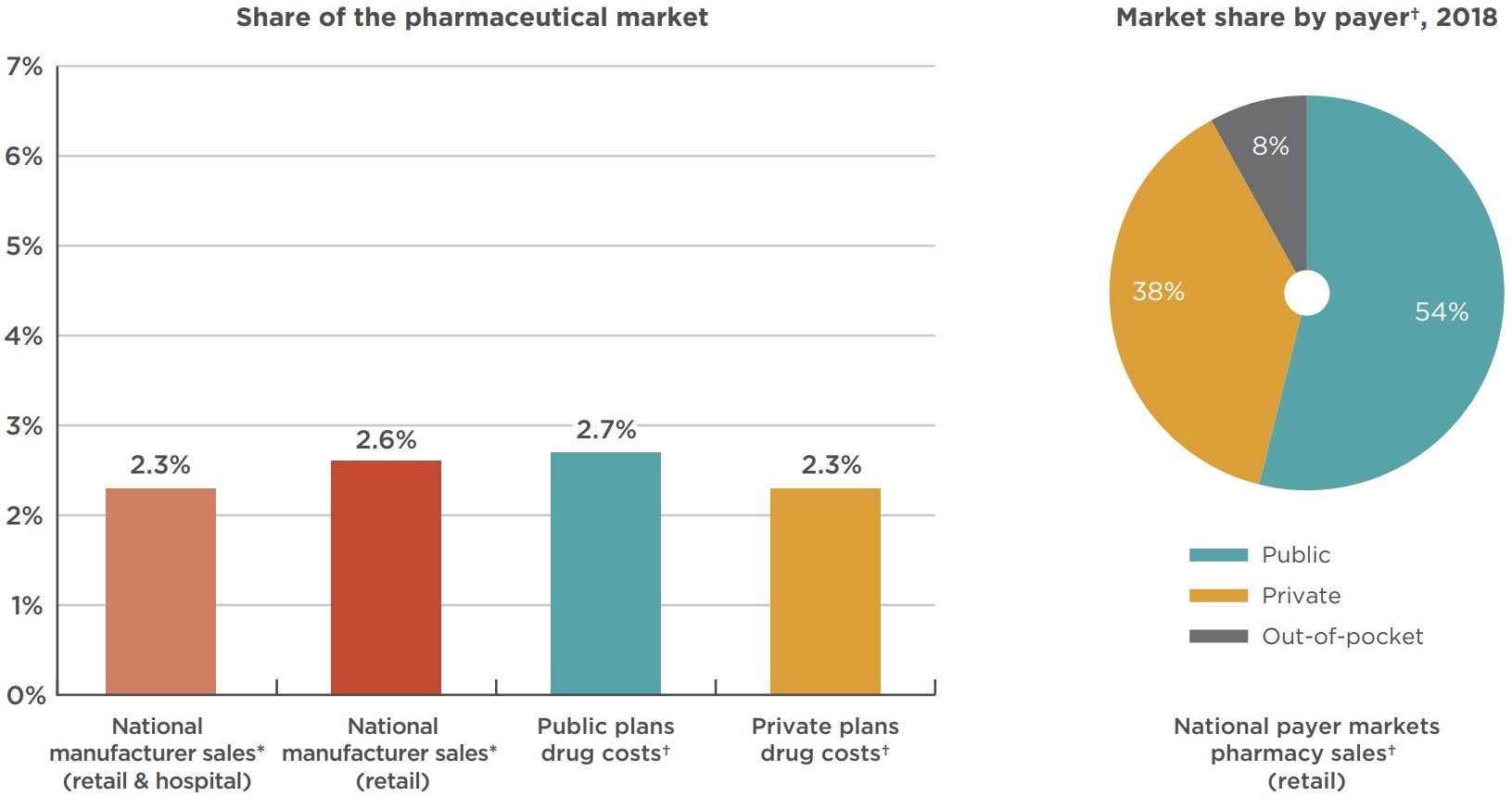

Despite relatively modest per patient treatment costs, widespread use of combination inhalers for asthma makes them a strong contributor to both public and private plan costs. In 2018, these medicines made up 2.7% of the total drug costs for Canadian public plans and 2.3% of private drug plan costs.

Public drug plans reimbursed slightly over half of all retail sales of combination inhalers for asthma in 2018, with 5.2% of beneficiaries being treated with at least one of these medicines. The private plan beneficiary population is generally younger than the population covered by the public plans and has a lower average consumption of these medicines.

Public drug plans reimbursed 54% of the national retail sales of combination inhalers for asthma in 2018, while private payers covered 38% of retail sales, and 8% was paid in cash.

Figure 3.1 shows that combination inhalers for asthma made up a slightly larger share of drug costs in public plans (2.7%) than private plans (2.3%) in 2018. Individual public plan shares ranged from a low of 1.4% for the NIHB to a high of 3.8% for Alberta. In private plans, the lowest share is observed in Quebec at 1.6%, with Saskatchewan and Manitoba setting the upper bound at 4.0%. Note that both public and private rates can be influenced by many factors including the plan designs and the demographics of each jurisdiction.

Figure description

This column graph gives the combination inhalers for asthma share of the national, public, and private markets in Canada in 2018. An associated pie graph gives the national combination inhalers for asthma market share of retail sales by payer.

| Market segment | Share of the pharmaceutical market |

|---|---|

| National manufacturer sales* (retail and hospital) | 2.3% |

| National manufacturer sales* (retail) | 2.6% |

| Public plans drug costs† | 2.7% |

| Private plans drug costs† | 2.3% |

| Payer | Share of national retail sales revenues |

|---|---|

| Public plans | 54% |

| Private plans | 38% |

| Out-of-pocket | 8% |

* At manufacturer price levels.

† Drug costs include markups but exclude dispensing costs.

Data source:

National: IQVIA MIDAS® Database, prescription markets, 2018. All rights reserved.

Public plans: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information, 2018. Plans included: British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, Yukon, and the Non-Insured Health Benefits Program.

Private plans: IQVIA Private Pay Direct Drug Plan Database, 2018.

National payer markets: IQVIA Payer Insights Database, 2018.

The provincial distribution of retail and hospital sales of combination inhalers for asthma in the IQVIA Canadian Drug Store and Hospital Purchases Audit (CDH) is in line with the distribution for the overall pharmaceutical market in 2018. Ontario and Quebec are the two largest contributors, together accounting for 63% of the national sales.

Although the average annual cost per beneficiary for combination inhalers for asthma is less than $1,000, the large patient population results in hundreds of millions of dollars in costs for Canadians. Over 406,000 individuals covered by the NPDUIS public plans, or 5.2% of all beneficiaries, had at least one claim for a combination inhaler for asthma in 2018, making it the largest beneficiary population out of the top 10 therapeutic classes with the highest public drug plan costs.

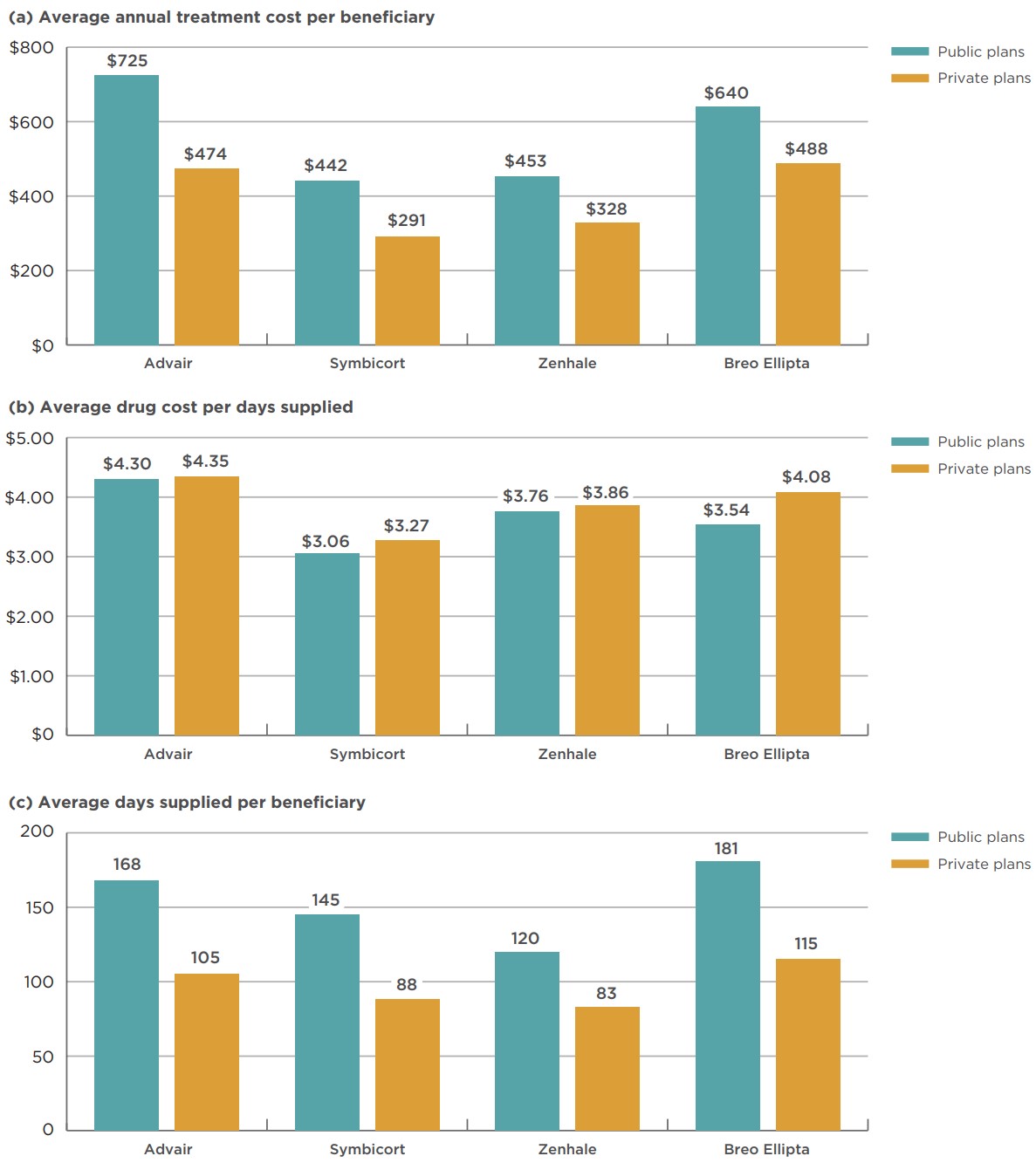

The average annual treatment cost for each combination inhaler for asthma was substantially higher in public drug plans than in private plans, as shown in Figure 3.2a. Advair had the highest treatment cost in public plans, at $725 per beneficiary, followed by Breo Ellipta at $640. These two medicines also had the highest average costs in private plans. The average public plan costs for Advair and Symbicort were over 50% higher than in private plans, while Breo Ellipta had the smallest differential, with a 31% higher cost in public plans.

The average annual treatment cost differential appears to be driven by a higher level of consumption in public plans. The average drug cost per days supplied for each combination inhaler for asthma claimed by public drug plan beneficiaries is actually slightly lower than in private plans, as detailed in Figure 3.2b, whereas the average annual days supplied for each combination inhaler for asthma was between 45% and 63% higher in public plans than in private plans for the same medicine, as shown in Figure 3.2c.

The difference in consumption may be driven by general demographic differences between the public and private drug plans, as well as the disease profiles of the beneficiaries. Public plans generally cover an older demographic, while private drug plans mainly cover working-age beneficiaries and their dependants. In 2018, 71% of patients making a public plan claim for a combination inhaler for asthma were at least 65 years old, compared to just 7% of private plan claimants.

Figure description

This series of three column graphs compares the average annual treatment cost per beneficiary, average drug cost per day supplied, and average days supplied per beneficiary for combination inhalers for asthma for Canadian public versus private payers in 2018.

| Average annual treatment cost per beneficiary | Average drug cost per days supplied | Average days supplied per beneficiary | ||||

|---|---|---|---|---|---|---|

| Public | Private | Public | Private | Public | Private | |

| Advair | $725 | $474 | $4.30 | $4.35 | 168 | 105 |

| Symbicort | $442 | $291 | $3.06 | $3.27 | 145 | 88 |

| Zenhale | $453 | $328 | $3.76 | $3.86 | 120 | 83 |

| Breo Ellipta | $640 | $488 | $3.54 | $4.08 | 181 | 115 |

Note: Public and private data includes markups and excludes dispensing costs.

Data source:

Public plans: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information, 2018. Plans included: British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, Yukon, and the Non-Insured Health Benefits Program.

Private plans: IQVIA Private Pay Direct Drug Plan Database, 2018.

4. International Price Comparison

Price levels for the brand combination inhalers for asthma available in Canada are consistently higher than corresponding brand prices in foreign markets, second only to the US among the PMPRB7, and substantially higher than the OECD median. These price discrepancies have important implications on costs for Canadian public and private payers.

This section reports the average foreign-to-Canadian price ratios for each brand combination inhaler for asthma, weighted according to the 2018 sales revenue share of each strength of the drug sold in Canada, as shown in Table 4.1. For each ratio, the weighted average price level in Canada is set to one and the corresponding foreign prices are determined to be either higher than (above) or lower than (below) this level.Footnote iii

Table 4.1 Share of Canadian sales revenue by strength, combination inhalers for asthma, 2018

| Strength | Brand revenue share |

|---|---|

| Advair 125 | 10.8% |

| Advair 250 | 38.3% |

| Advair DISKUS 100 | 1.1% |

| Advair DISKUS 250 | 27.0% |

| Advair DISKUS 500 | 22.8% |

| Symbicort 100 Turbuhaler | 3.1% |

| Symbicort 200 Turbuhaler | 96.9% |

| Zenhale 100 mcg/5 mcg | 30.6% |

| Zenhale 200 mcg/5 mcg | 69.4% |

| Breo Ellipta 100 mcg/25 mcg | 51.8% |

| Breo Ellipta 200 mcg/25 mcg | 48.2% |

Data source: IQVIA MIDAS® Database, prescription retail and hospital markets, 2018. All rights reserved.

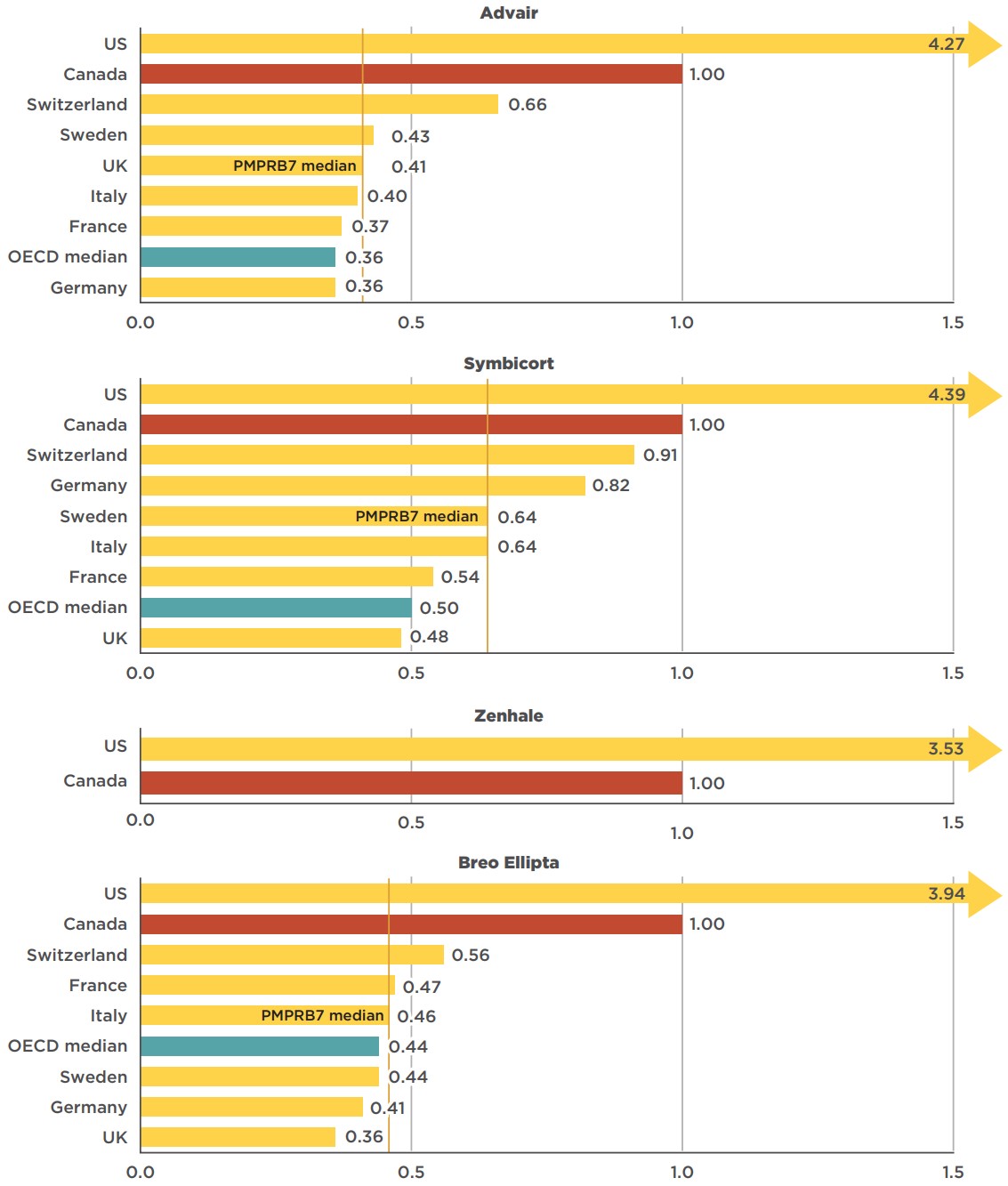

The average prices of originator brand combination inhalers for asthma were consistently higher in Canada than in all of the PMPBR7 countries except the US (Figure 4.1), whose levels were significantly greater. PMPRB7 median prices were 36%, 54%, and 59% lower than Canadian levels for Symbicort, Breo Ellipta, and Advair, respectively. For Zenhale, PMPRB7 data was only available for the US, at a price that was over three and a half times higher than the Canadian level.

Note that these results are based on manufacturer list prices and do not reflect managed entry agreements in Canada or the PMPRB7 countries. The use of these agreements is widespread internationally, and significant discounts off list prices are commonplace, according to a confidential survey of public health authorities in Canada, the US, Germany, England, and other developed countries.Footnote 14 The use of these agreements, referred to as product listing agreements in Canada, likely results in rebated prices for Advair, Symbicort, Zenhale, and Breo Ellipta that are lower than the list prices analyzed in Figure 4.1. Thus, the price differentials and the cost implications presented here may be overestimated or underestimated depending on the actual rebated prices in Canada and foreign markets.

Figure description

This figure consists of four bar graphs depicting the foreign-to-Canadian price ratios for Advair, Symbicort, Zenhale, and Breo Ellipta in 2018. Bilateral price ratios are given for each of the seven PMPRB comparator countries, as well as the median price ratio for the Organisation for Economic Co-operation and Development (OECD) countries.

Advair

| Germany | 0.36 |

| OECD median | 0.36 |

| France | 0.37 |

| Italy | 0.40 |

| United Kingdom (PMPRB7 median) | 0.41 |

| Sweden | 0.43 |

| Switzerland | 0.66 |

| Canada | 1.00 |

| United States | 4.27 |

Symbicort

| United Kingdom | 0.48 |

| OECD median | 0.50 |

| France | 0.54 |

| Italy | 0.64 |

| Sweden (PMPRB7 median) | 0.64 |

| Germany | 0.82 |

| Switzerland | 0.91 |

| Canada | 1.00 |

| United States | 4.39 |

Zenhale

| Canada | 1.00 |

| United States | 3.53 |

Breo Ellipta

| United Kingdom | 0.36 |

| Germany | 0.41 |

| Sweden | 0.44 |

| OECD median | 0.44 |

| Italy (PMPRB7 median) | 0.46 |

| France | 0.47 |

| Switzerland | 0.56 |

| Canada | 1.00 |

| United States | 3.94 |

Note: For Zenhale, the price in Canada represents the OECD median, since the US, Canada, and Mexico were the only countries with available pricing information.

* At manufacturer price levels.

Data source: IQVIA MIDAS® Database, prescription retail and hospital markets, 2018. All rights reserved.

An analysis of the foreign-to-Canadian price ratios over time shows mixed results. Figure 4.2 gives the annual bilateral foreign-to-Canadian price ratios for the top-selling strengths of Advair, Symbicort, Zenhale, and Breo Ellipta for the PMPRB7 from 2011—the year Zenhale entered the Canadian market—to 2018. Median PMPRB7 and OECD price ratios are also given for the start and end years. For presentation purposes, the scale of each graph has not been extended to include the US price ratio, which is the highest in the PMPRB7; the starting and ending price ratios are reported in the legend table, as well as the percent price change in local currency.

The Advair 250 mcg/25 mcg price was consistently higher in Canada than in all of the PMPRB7 countries except the US. The median price in the PMPRB7 markets dropped from 38% below the Canadian price level in 2011 to 50% below in 2018, widening the gap between Canadian and median PMPRB7 prices.

The Canadian price of Symbicort 200 mcg/6 mcg was fifth highest among the PMPRB7 in 2011, after the US, Sweden, Switzerland, and Germany. Over the next seven years, the price levels for all countries except the US decreased, leaving the Canadian price second highest by 2018. Sweden had the largest relative price decrease, dropping from 4% higher than the Canadian price level in 2011 to 35% lower in 2018.

Since Zenhale 200 mcg/5 mcg entered the Canadian market in 2011, the US price has steadily increased, from 151% of the Canadian price to 325% in 2018. No other PMPRB7 countries have data available for this medicine.

Unlike the other medicines, the gap between Canadian and median PMPRB7 price levels for Breo Ellipta 100 mcg/25 mcg has narrowed over time: from 63% lower than the Canadian level in 2014 to 44% lower in 2018. Despite this, the highest European PMPRB7 price level, set by Switzerland, was still 39% lower than the Canadian price.

Figure description

These four line graphs depict the trends in annual foreign-to-Canadian price ratios for the top-selling strengths Advair, Symbicort, Zenhale, and Breo Ellipta from 2011 to 2018 for each of the seven PMPRB comparator countries, as well as the median price ratios for the Organisation for Economic Co-operation and Development (OECD) and PMPRB7 countries.

Advair 250 mcg/25 mcg

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | Change in the average price per unit, local currency, 2011–2018 | |

|---|---|---|---|---|---|---|---|---|---|

| Canada | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0% |

| France | 0.56 | 0.51 | 0.52 | 0.52 | 0.46 | 0.44 | 0.43 | 0.37 | -40% |

| Germany | 0.59 | 0.47 | 0.51 | 0.53 | 0.50 | 0.45 | 0.41 | 0.40 | -40% |

| Italy | 0.48 | 0.46 | 0.50 | 0.53 | 0.50 | 0.47 | 0.47 | 0.40 | -26% |

| Sweden | 0.71 | 0.69 | 0.76 | 0.77 | 0.60 | 0.61 | 0.59 | 0.50 | -28% |

| Switzerland | 0.86 | 0.83 | 0.84 | 0.67 | 0.73 | 0.74 | 0.71 | 0.71 | -30% |

| United Kingdom | 0.62 | 0.62 | 0.65 | 0.73 | 0.78 | 0.71 | 0.65 | 0.60 | -11% |

| United States | 1.89 | 2.07 | 2.46 | 2.84 | 3.42 | 3.81 | 3.91 | 4.14 | 68% |

| PMPRB7 median | 0.62 | 0.62 | 0.65 | 0.67 | 0.60 | 0.61 | 0.59 | 0.50 | |

| OECD median | 0.52 | 0.48 | 0.51 | 0.51 | 0.47 | 0.44 | 0.40 | 0.38 |

Symbicort 200 mcg/6 mcg

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | Change in the average price per unit, local currency, 2011–2018 | |

|---|---|---|---|---|---|---|---|---|---|

| Canada | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 9% |

| France | 0.71 | 0.62 | 0.61 | 0.61 | 0.56 | 0.55 | 0.53 | 0.55 | -25% |

| Germany | 1.00 | 0.88 | 0.92 | 0.94 | 0.84 | 0.86 | 0.85 | 0.86 | -16% |

| Italy | 0.67 | 0.61 | 0.65 | 0.69 | 0.66 | 0.64 | 0.63 | 0.65 | -5% |

| Sweden | 1.04 | 0.99 | 1.05 | 1.04 | 0.68 | 0.69 | 0.67 | 0.65 | -31% |

| Switzerland | 1.04 | 0.98 | 1.01 | 1.06 | 0.99 | 0.99 | 0.93 | 0.91 | -20% |

| United Kingdom | 0.65 | 0.64 | 0.64 | 0.72 | 0.77 | 0.70 | 0.63 | 0.48 | -26% |

| United States | 2.13 | 2.31 | 2.59 | 3.06 | 3.76 | 4.04 | 4.10 | 4.30 | 67% |

| PMPRB7 median | 1.00 | 0.88 | 0.92 | 0.94 | 0.77 | 0.70 | 0.67 | 0.65 | |

| OECD median | 0.69 | 0.62 | 0.64 | 0.66 | 0.59 | 0.55 | 0.53 | 0.50 |

Zenhale 200 mcg/5 mcg

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | Change in the average price per unit, local currency, 2011–2018 | |

|---|---|---|---|---|---|---|---|---|---|

| Canada | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 3% |

| United States | 1.51 | 1.79 | 1.98 | 2.30 | 2.84 | 3.09 | 3.13 | 3.25 | 69% |

| PMPRB7 median | 1.51 | 1.79 | 1.98 | 2.30 | 2.84 | 3.09 | 3.13 | 3.25 | |

| OECD median | 1.26 | 1.40 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

Breo Ellipta 100 mcg/25 mcg

| 2014 | 2015 | 2016 | 2017 | 2018 | Change in the average price per unit, local currency, 2014–2018 | |

|---|---|---|---|---|---|---|

| Canada | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | -30% |

| France‡ | 0.37 | 0.46 | 0.55 | 0.57 | 0% | |

| Germany | 0.34 | 0.30 | 0.37 | 0.44 | 0.45 | -12% |

| Italy‡ | 0.34 | 0.43 | 0.54 | 0.56 | 5% | |

| Sweden | 0.37 | 0.34 | 0.43 | 0.50 | 0.48 | 0% |

| Switzerland | 0.46 | 0.47 | 0.52 | 0.61 | 0.61 | -16% |

| United Kingdom | 0.36 | 0.39 | 0.37 | 0.38 | 0.39 | -21% |

| United States | 2.24 | 2.68 | 3.53 | 4.44 | 4.64 | 23% |

| PMPRB7 median | 0.37 | 0.37 | 0.43 | 0.54 | 0.56 | |

| OECD median | 0.41 | 0.38 | 0.43 | 0.51 | 0.51 |

Note: US values are too high to be included in the scale of the graphs for Advair, Symbicort, and Breo Ellipta.

* At manufacturer price levels.

† In local currency.

‡ Earliest available price ratios (2015) were used.

Data source: IQVIA MIDAS® Database, prescription retail and hospital markets, 2011 to 2018. All rights reserved.

Given the widespread use of combination inhalers for asthma, higher Canadian list prices for these medicines suggest that there may be important implications for Canadian payers. Using the median PMPRB7 foreign-to-Canadian price ratios calculated in Figure 4.1, the cost implications of these price differentials are estimated in Table 4.2, both at the national level and for the NPDUIS public drug plans.Footnote iv The results may be overestimated or underestimated depending on the extent to which confidential prices and rebates in Canada compare to foreign markets.

Canadian sales of all strengths of Advair totalled $246.6 million in 2018. Given that the PMPRB7 median list price of Advair was 59% lower than the Canadian price, this difference equates to $144.8 million in sales nationally in 2018, and $71.0 million in costs for the Canadian public drug plans. For Symbicort, which has a narrower 36% gap between the Canadian and median PMPRB7 price levels, the difference equates to $78.2 million at the national level and $28.6 million in public plan costs. Breo Ellipta’s smaller market share translates into $41.0 million at the national level and $21.7 million for public drug plans, based on a 54% differential between the Canadian and median PMPRB7 price levels. Cost implications for Zenhale were not calculated due to a lack of data.

The combined cost implications of paying higher list prices for Advair, Symbicort, and Breo Ellipta in Canada are substantial, estimated at $264.0 million or 1.03% of the total Canadian market in 2018. For the public plans, the cost implications are estimated to be $121.3 million or 1.27% of total public plan drug costs for 2018.

Table 4.2 Estimated cost implications of higher Canadian list prices for Advair, Symbicort, and Breo Ellipta compared to the PMPRB7 median, 2018

| Total Canadian market, 2018* (all payers) | Public plan cost implications†, 2018 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BC | AB | SK | MB | ON | NB | NS | PE | NL | YT | NIHB | Total public | |||

| Advair | Total costs | $246.6M | $12.4M | $14.4M | $3.9M | $5.2M | $72.2M | $3.9M | $2.7M | $0.2M | $1.5M | $0.2M | $4.3M | $120.9M |

| Cost implication |

$144.8M | $7.3M | $8.5M | $2.3M | $3.0M | $42.4M | $2.3M | $1.6M | $0.1M | $0.9M | $0.1M | $2.5M | $71.0M | |

| Symbicort | Total costs | $218.1M | $6.9M | $10.9M | $2.6M | $2.2M | $51.3M | $1.2M | $2.0M | $0.2M | $0.7M | $0.1M | $1.7M | $79.8M |

| Cost implication |

$78.2M | $2.5M | $3.9M | $0.9M | $0.8M | $18.4M | $0.4M | $0.7M | $0.1M | $0.2M | $0.0M | $0.6M | $28.6M | |

| Breo Ellipta | Total costs | $75.4M | $4.0M | $4.1M | $1.7M | $1.4M | $25.7M | $0.9M | $0.8M | $0.1M | $0.3M | $0.0M | $0.7M | $39.9M |

| Cost implication |

$41.0M | $2.2M | $2.3M | $0.9M | $0.7M | $14.0M | $0.5M | $0.4M | $0.1M | $0.2M | $0.0M | $0.4M | $21.7M | |

| Total | Total costs | $540.1M | $23.3M | $29.5M | $8.2M | $8.8M | $149.3M | $6.1M | $5.5M | $0.5M | $2.5M | $0.3M | $6.7M | $240.7M |

| Cost implication | $264.0M (1.03% of Cdn mkt) | $11.9M | $14.6M | $4.2M | $4.6M | $74.8M | $3.2M | $2.7M | $0.3M | $1.3M | $0.2M | $3.5M | $121.3M (1.27% of public plans) | |

Note: Median foreign-to-Canadian price ratios used to calculate cost implications are based on the fourth quarter of the 2018 calendar year.

* At manufacturer price levels. Discounts from managed entry agreements are not included.

† Includes markups and excludes dispensing costs. Discounts from managed entry agreements are not included.

Data sources:

National: IQVIA MIDAS® Database, prescription markets, 2018. All rights reserved.

Public plans: National Prescription Drug Utilization Information System Database, Canadian Institute for Health Information, 2018. Plans include: British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, Yukon, and the Non-Insured Health Benefits Program.