Improving Access

Improving Access:

Improving access along the housing continuum

Product of the Northern Housing Forum

Yellowknife, NT, May 2018

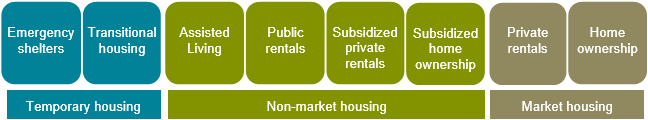

HOUSING CONTINUUM |

The housing continuum, represents a range of housing options based on varying needs. Elements of the housing continuum are lacking in the North, such as sufficient transitional housing options, supportive housing/assisted living, cooperative housing, and private rentals.1 Additionally, lack of financial literacy and market housing reduces options in northern communities. Understanding this continuum is important when considering the needs of a community and where to focus efforts and resources.

RECOMMENDATIONS |

- Identify Needs. Determine which elements of the housing continuum are most relevant to the community or region. These priorities may shift over time as demographic changes occur.

- Increase financial literacy through training programs that build practical skills. Increased literacy improves the ability of individuals and families to access credit and market housing. Sharing rental payment history with banks / financial institutions is another way to obtain credit.

- Establish partnerships with private landowners / companies to increase the availability of options along the housing continuum, such as subsidized private rentals.

- Provide information on co-ops and co-housing to support uptake.

- – In a co-operative housing model a co-op owns real estate and occupants are members or ‘shareholders’ of the co-op. Members decide how it is operated. Housing co-ops are more affordable because monthly housing fees are set to cover costs (not-for-profit). Co-ops also provide housing security and a sense of community.2

- – Co-housing is a model in which residents typically own their individual homes or units that are clustered around a common house or area with shared amenities, such as the kitchen. Multiple parties put forward initial equity to build or purchase the co-housing units and then contribute to the maintenance of the property.3

- Consider alternative financing options:

- – Habitat for Humanity, offers a ‘hand-up’ model whereby homes are sold at cost and future occupants are required to contribute at least 500 volunteer hours. Repaid loans provide capital for the building of additional homes.4

- – Establish a purchase support program which can provide homeownership assistance to potential home buyers who cannot obtain financing through a bank.

- – Social Impact Bonds, also known as a “Pay for Success Bonds”, may be established at the territorial or provincial level. Social Impact Bonds generate funds from investors who purchase government bonds. Instead of a fixed rate of return, repayment to investors depends on the specified social outcomes being achieved (e.g. social housing units being built).5

- – Connect with private capital providers. Share the governance and decision-making framework for the region, and data costs for building and maintenance to demonstrate true costs and conditions. Organizations like the National Aboriginal Capital Corporations Association should be consulted to increase available capital.

CONDITIONS FOR SUCCESS |

- Understand the needs: Target funding to the most needed housing options along the housing continuum for each particular community.

- Learn from others: Sharing best practices and integrating the successes and lessons learnt from others can improve the likelihood of success for future projects.

- Obtain community endorsement: Many of the above options require community support. For example, Habitat for Humanity requires volunteers to help build the houses.

- Form partnerships: Building partnerships with private companies, non-governmental organizations (NGOs), and government agencies fosters the development of the most suitable housing options for the community.

SUCCESS STORIES |

The Inukshuk Housing Co-operative, located in the City of Yellowknife, offers affordable, safe and social community housing. The vision of the co-op is to meet the common need and potential of affordable housing for all its members. The co-op maintains 50 units (2-4 bedrooms) and has a community centre with a meeting space.6

The NWT Housing Corporation PATH program (Providing Assistance for Territorial Homeownership) provides homeownership assistance. The program offers potential home buyers an alternative to bank financing, based on income, where they live, and family size. Those in remote areas are eligible for more assistance.7

Alaska Housing Finance Corporation offers interest rate reductions to promote the energy efficiency of existing and newly constructed homes meeting energy-efficient criteria.8

__________________________

- IISD. 2016. Best Practices in Sustainable Housing Delivery in Inuit Nunangat. Prepared for Inuit Tapiriit Kanatami. URL: https://www.itk.ca/wp-content/uploads/2016/11/Best-Practices-in-Sustainable-Housing-Delivery.pdf

- CMHC. 2018. Co-operative Housing Guide. URL: https://www.cmhc-schl.gc.ca/en/maintaining-and-managing/co-operative-housing-guide

- Canadian Cohousing Network. 2018. About Cohousing. URL: http://www.cohousing.ca/about-cohousing/what-is-cohousing/

- Habitat for Humanity. 2018. Build and homeownership process. URL: https://www.habitat.ca/en/how-we-help/building-and-ownership-process

- https://en.wikipedia.org/wiki/Social_impact_bond

- Inukshuk Coop. http://www.ykinukshukcoop.ca/About/HousingCoop101/tabid/67/Default.aspx

- NWT Housing Corporation. 2014. Purchase Support: PATH. URL: http://nwthc.gov.nt.ca/node/47

- Alaska Housing Finance Corporation, n.d., Energy Efficiency Interest Rate Reduction (EEIRR). URL: https://www.ahfc.us/efficiency/energy-programs/energy-efficiency-rate-reduction