Quarterly Financial Report

For the quarter ended December 31, 2016

Introduction

This quarterly financial report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. It should be read in conjunction with the 2016-17 Main Estimates. This quarterly report has not been the subject of an external audit or review.

Polar Knowledge Canada (POLAR) was created pursuant to the Canadian High Arctic Research Act and came into force on June 1, 2015. The purpose of POLAR is to advance knowledge of the Canadian Arctic to improve economic opportunities, environmental stewardship and the quality of life of its residents and all other Canadians; promote the development and dissemination of knowledge of the other circumpolar regions, including the Antarctic; strengthen Canada’s leadership on Arctic issues, and establish a hub for scientific research in the Canadian Arctic.

Further information on the organization appears on its website at https://www.canada.ca/en/polar-knowledge.html.

Basis of Presentation

This quarterly report has been prepared according to expense-based accounting. The accompanying Statement of Authorities includes the department's spending authorities granted by Parliament and those used by the department consistent with the Main Estimates and Supplementary Estimates for the 2016-2017 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

POLAR uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament still follow an expense-based accounting model.

Highlights of Fiscal Quarter and Fiscal Year-to-date (YTD) Results

POLAR’s financial structure is composed of voted program authorities and statutory authorities for contributions to employee benefit plans.

The variances between fiscal years 2015-2016 and 2016-2017 are explained by the fact that POLAR was established in June 2015 and was in its first year of operations. For this reason, statutory authorities and expenditures for 2015-2016 cannot be compared with those for 2016-2017.

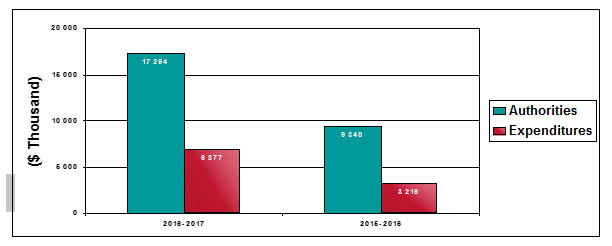

For the period ending December 31, 2016, POLAR had total authorities of $17.3 million while expenses were $6.9 million. The budgetary authorities and expenditures for the first three quarters of 2016-17 and 2015-16 appear in Chart 1 below. For more details, refer to the Statement of Authorities.

Chart 1: Third Quarter Expenditures compared to Annual Authorities

POLAR incurred a total of $6.9 million in expenditures in the first three quarters, representing approximately 40% of the total available authorities. The expenses of $6.9 million were allocated mostly to personnel expenditures and transfers for the amounts of $2.8 million and $1.7 million respectively, accounting for 65% of the total. The remaining 35% primarily consists of expenses for transport and communications and professional and special services. Refer to the Departmental Budgetary Expenditures by Standard Object for more details.

Risks and Uncertainties

POLAR has identified five key risks and responses for 2016-17.

Technologies that are tested may not be suitable to the extreme northern environments and may therefore be abandoned as viable options. POLAR will pay particular attention to project planning and risk assessment, perform periodic re-evaluations of projects, consult with technology leaders, test multiple technologies, and build on previous work and lessons learned.

Northern communities may not be receptive to certain technology solutions. This risk will be mitigated through the establishment of community outreach and engagement, community involvement in projects and the development of local capacity.

The success of some demonstration/pilot projects will hinge on technical capacity at the community level. As a result, POLAR is considering planning for community involvement in projects, providing training/internship support, and ensuring ongoing community outreach and communications.

There is no interest in partnering if there is insufficient market potential for technologies. POLAR contribution programs will be used as an incentive to attract the interest of the private sector. Other response measures will include market assessments as well as scaling projects to market potential.

Lastly, POLAR may not be able to attract and retain staff with the required competencies in a timely manner, given the remote location and climate of Cambridge Bay. Measures will be implemented to manage this risk such as collective and anticipatory staffing, fast-track staffing processes, partnerships with educational institutions, human resources planning, competency profiling, and innovative human resources programs to attract and retain staff.

Significant Changes in Relation to Operations, Personnel and Programs

There have been no significant changes to the programs or structure since POLAR was established on June 1, 2015.

Approved by:

David J. Scott, Ph.D.

President

Julie Brunet

Executive Director of Corporate Services and Chief Financial Officer

Ottawa, Canada

February 17, 2017

Polar Knowledge Canada

Quarterly Financial Report

For the quarter ended December 31, 2016

Statement of authorities(unaudited)

(in dollars)

| Fiscal year 2016-2017 | |||

|---|---|---|---|

| Total available for use for the year ending March 31, 2017 * | Used during the quarter ended December 31, 2016 | Year to date used at quarter-end | |

| Vote 1 – Program Expenditures | 16,672,324 | 3,264,295 | 6,410,177 |

| Statutory authorities | 622,077 | 155,519 | 466,558 |

| Total authorities | 17,294,401 | 3,419,814 | 6,876,735 |

| Fiscal year 2015-2016 | |||

|---|---|---|---|

| Total available for use for the year ending March 31, 2016 * | Used during the quarter ended December 31, 2015 | Year to date used at quarter-end | |

| Vote 1 – Program Expenditures | 9,223,340 | 2,864,668 | 3,128,372 |

| Statutory authorities | 116,623 | 29,156 | 87,467 |

| Total authorities | 9,339,963 | 2,893,824 | 3,215,839 |

* Includes only Authorities available for use and granted by Parliament at quarter-end

Departmental budgetary expenditures by Standard Object (unaudited)

(in dollars)

| Fiscal year 2016-2017 | |||

|---|---|---|---|

| Planned expenditures for the year ending March 31, 2017 | Expended during the quarter ended December 31, 2016 | Year to date used at quarter-end | |

| Expenditures: | |||

Personnel |

4,238,802 | 967,615 | 2,764,284 |

Transportation and communications |

1,981,970 | 228,683 | 894,131 |

Information |

330,328 | 102,204 | 145,348 |

Professional and special services |

1,644,642 | 228,580 | 694,490 |

Rentals |

550,547 | 157,202 | 354,990 |

Repair and maintenance |

55,055 | 5,500 | 5,619 |

Utilities, materials and supplies |

440,438 | 16,998 | 47,892 |

Acquisition of land, buildings and works |

362,645 | 20,280 | 264,279 |

Acquisition of machinery and equipment |

495,492 | 17,843 | 30,793 |

Transfer payments |

7,194,482 | 1,674,909 | 1,674,909 |

| Total net budgetary expenditures | 17,294,401 | 3,419,814 | 6,876,735 |

| Fiscal year 2015-2016 | |||

|---|---|---|---|

| Planned expenditures for the year ending March 31, 2016 | Expended during the quarter ended December 31, 2015 | Year to date used at quarter-end | |

| Expenditures: | |||

| Personnel | 2,860,996 | 1,142,696 | 1,202,611 |

| Transportation and communications | 1,287,495 | 307,477 | 456,762 |

| Information | 258,196 | 21,889 | 51,556 |

| Professional and special services | 1,840,964 | 183,888 | 227,825 |

| Rentals | 358,287 | 28,402 | 31,606 |

| Repair and maintenance | 101,583 | 109 | 316 |

| Utilities, materials and supplies | 221,180 | 37,578 | 44,165 |

| Acquisition of machinery and equipment | 468,386 | 64,334 | 93,526 |

| Transfer payments | 1,892,972 | 1,097,507 | 1,097,507 |

| Other subsidies and payments | 49,905 | 9,944 | 9,965 |

| Total net budgetary expenditures | 9,339,963 | 2,893,824 | 3,215,839 |