Prairies Economic Development Canada’s Quarterly Financial Report for the quarter ended June 30, 2024

View the print-friendly version: PDF (443 kB)

ISSN 2817-2558

Statement Outlining Results, Risks and Significant Changes in Operations, Personnel and Programs

Introduction

This quarterly financial report should be read in conjunction with the Main Estimates. It has been prepared by management as required by section 65.1 of the Financial Administration Act (FAA) and in the form and manner prescribed by the Treasury Board. This quarterly report has not been subject to an external audit or review.

Authority, mandate and program activities

Prairies Economic Development Canada’s (PrairiesCan) mandate is to grow and diversify the economy of the prairie provinces and advance its interests of the region in national economic policy, programs, and projects. The department will achieve this mandate by working with clients and partners in our four roles as investor, advisor, pathfinder, and convenor.

PrairiesCan operates under the provision of the Western Economic Diversification Act, which came into force on June 28, 1988. As a federal department, PrairiesCan is headed by a Minister and a Deputy Head (President).

The Departmental Plan and Main Estimates provide further information on PrairiesCan’s authority, mandate and program activities.

Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the department’s spending authorities granted by Parliament and those used by the department, consistent with the Main Estimates for the 2024–2025 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

The Department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Financial structure

PrairiesCan manages its expenditures under 2 votes:

- Vote 1 – Net operating expenditures include salary, and other operating costs (e.g., transportation and communications; professional and special services).

- Vote 5 – Grants and contributions include all transfer payments.

Budgetary statutory authorities represent payments made under legislation approved by Parliament, and include items such as the Government of Canada’s share of employee benefit plans and other minor items.

Highlights of fiscal quarter and fiscal year-to-date (YTD) results

The following section highlights significant changes to fiscal quarter results as of June 30, 2024.

Statement of authorities: Vote 1 – net operating expenditures

Total authorities available for use for fiscal year 2024–2025 are $41.5 million, a net decrease of $0.8 million, or -2%, compared to the $42.3 million for 2023–2024. The net decrease is explained by:

- $2.4 million increase for collective bargaining agreement adjustments;

- $0.3 million increase in funding to support Budget 2023 Tourism Growth Program;

- $2.5 million decrease from various Budget 2021 program re-profiles;

- $0.9 million decrease in funding due to Refocused Government Spending in Travel and Professional Services; and

- $0.1 million decrease in funding for various other minor adjustments.

Total authorities used has slightly increased to $10.6 million for the quarter ended June 30, 2024, compared to $10.5 million used at June 30, 2023.

Graph 1 illustrates total authorities available for use for the fiscal year, and authorities used at quarter-end.

(in thousands of dollars)

Text version: Total available for use and used for Vote 1 (in thousands of dollars)

This bar graph breaks down total authorities available for use for fiscal year 2024–2025 and the authorities used at quarter end and then compares them to fiscal year 2023–2024.

2024–2025

- $41,478 represents total available for use for the year ending March 31

- $10,585 represents total authorities used for the quarter ending June 30

2023–2024

- $42,306 represents total available for use for the year ending March 31

- $10,492 represents total authorities used for the quarter ending June 30

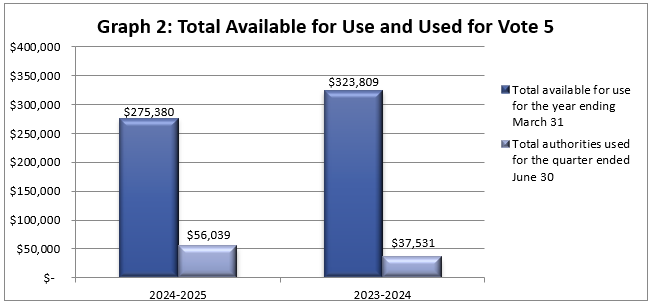

Statement of authorities: Vote 5 – grants and contributions

Total authorities available for use for fiscal year 2024–2025 are $275.4 million, a net decrease of $48.4 million, or -15%, compared to the $323.8 million for 2023–2024. The net decrease is explained by:

- $18.7 million increase for Vaccine and Infectious Disease Organization project announced in Budget 2018;

- $12.9 million increase in funding related to Repayable Contributions;

- $7.4 million increase for the Tourism Growth Program Relief Fund announced in Budget 2021;

- $7.2 million increase in funds for the Canada Coal Transition Initiative announced in Budget 2018;

- $1.6 million increase for other minor transfers and cashflow adjustments;

- $38.7 million decrease for the conclusion of the Jobs and Growth Initiative;

- $18.0 million decrease for the conclusion of the Canada Community Revitalization Fund;

- $15.4 million decrease for concluding the initiative supporting the Canadian aerospace sector;

- $12.5 million decrease for the conclusion of the Tourism Relief Fund, and

- $11.6 million decrease in funding for the Canadian Critical Drug Initiative.

Total authorities used for the quarter-ended June 30, 2024 increased to $56.0 million, compared to $37.5 million at June 30, 2023. The $18.5 million increase, or 49% is explained by:

- $14.2 million increase in payments for the Canadian Critical Drug Initiative;

- $4.2 million increase for payments restoring rail service to Churchill, Manitoba;

- $2.2 million increase in Western Diversification Program payments, investing in a diverse and growing economy;

- $1.1 million decrease in payments for the completion of the Innovation and Skills Plan announced in Budget 2018;

- $0.5 million decrease for payment timing differences made to network partners;

- $0.4 million decrease in Regional Economic Growth through Innovation payments to deliver various other initiatives; and

- $0.1 million decrease in payments supporting the Canada Coal Transition Initiative.

Graph 2 illustrates total authorities available for use for the fiscal year, and authorities used at quarter-end.

(in thousands of dollars)

Text version: Total available for use and used for Vote 5 (in thousands of dollars)

This bar graph breaks down total authorities available for use for fiscal year 2024–2025 and the authorities used at quarter end and then compares them to fiscal year 2023–2024.

2024–2025

- $275,380 represents total available for use for the year ending March 31

- $56,039 represents total authorities used for the quarter ending June 30

2023–2024

- $323,809 represents total available for use for the year ending March 31

- $37,531 represents total authorities used for the quarter ending June 30

Statement of authorities: budgetary statutory authorities

Budgetary statutory authorities available for use for fiscal year 2024–2025 are $4.5 million, a decrease of $0.1 million when compared to the $4.6 million in 2023–2024. The variance is due to minor net adjustments in funding.

Budgetary statutory authorities used for fiscal year 2024–2025 are $1.1 million, a decrease of $0.1 million when compared to the $1.2 million in 2023–2024.

Graph 3 illustrates total authorities available for use for the fiscal year, and authorities used at quarter-end.

(in thousands of dollars)

Text version: Total available for use and used for budgetary statutory authorities (in thousands of dollars)

This bar graph breaks down total authorities available for use for fiscal year 2024–2025 and the authorities used at quarter end and then compares them to fiscal year 2023–2024.

2024–2025

- $4,478 represents total available for use for the year ending March 31

- $1,120 represents year-to-date authorities used for the quarter ending June 30

2023–2024

- $4,625 represents total available for use for the year ending March 31

- $1,156 represents year-to-date authorities used for the quarter ending June 30

Statement of the departmental budgetary expenditures by standard object

Expenditures by standard object for the quarter ended June 30, 2024, were $67.7 million, which reflects an increase of $18.5 million, or 38% from the $49.2 million at June 30, 2023.

The variance is largely due to:

- $14.2 million increase in payments for the Canadian Critical Drug Initiative;

- $4.2 million increase for payments restoring rail service to Churchill, Manitoba;

- $2.2 million increase in Western Diversification Program payments, investing in a diverse and growing economy;

- $1.1 million decrease in payments for the completion of the Innovation and Skills Plan announced in Budget 2018;

- $0.5 million decrease for payment timing differences made to network partners;

- $0.4 million decrease in Regional Economic Growth through Innovation payments to deliver various other initiatives; and

- $0.1 million decrease in payments supporting the Canada Coal Transition Initiative.

Additional information can be found in the Statement of Authorities, Vote 1 and Vote 5 sections above.

Graphs 4 and 5 illustrate actual expenditures for the quarter-end.

(in thousands of dollars)

Text version: actual expenditures quarter ended June 30, 2024 (in thousands of dollars)

This pie chart breaks down actual expenditures for quarter ended June 30, 2024.

- $56,039 represents actual spending on Transfer Payments, which accounts for 83% of Actual Expenditures quarter ended June 30, 2024

- $9,958 represents actual spending on Personnel, which accounts for 15% of Actual Expenditures quarter ended June 30, 2024

- $1,747 represents actual spending on Other operating costs, which accounts for 2% of Actual Expenditures quarter ended June 30, 2024

Text version: actual expenditures quarter ended June 30, 2023 (in thousands of dollars)

This pie chart breaks down actual expenditures for quarter ended June 30, 2023.

- $37,531 represents actual spending on Transfer Payments, which accounts for 76% of Actual Expenditures quarter ended June 30, 2023

- $9,989 represents actual spending on Personnel, which accounts for 20% of Actual Expenditures quarter ended June 30, 2023

- $1,659 represents actual spending on Other operating costs, which accounts for 4% of Actual Expenditures quarter ended June 30, 2023

Risks and uncertainties

PrairiesCan allocates departmental funding and resources within a well-defined framework of accountabilities, policies, and procedures. This includes a system of budgets, reporting, and internal controls to manage within available resources and Parliamentary authorities.

PrairiesCan assesses risk in all areas of departmental decision making. Executive governance committees provide departmental risk oversight for these decisions. The department also provides bi-annual risk input to the Treasury Board Secretariat (TBS) Office of the Comptroller General to inform the Regional Development Agency (RDA) Risk-Based Internal Audit Plan.

The department continues to identify and mitigate enterprise-wide risks such as employee physical and mental health, cyber vulnerabilities, loan repayment, and funding programs risk.

To minimize risk, PrairiesCan employs risk-based mitigation such as:

- business continuity planning;

- occupational health and safety planning;

- people management strategies;

- Public Service Employee Survey (PSES) results and recommendations;

- a robust system of network controls including encrypted signature, electronic security protocols, and mobile equipment to employ remote connectivity; and

- when implementing and assessing funding programs and projects, the department uses risk assessments, governance processes, process mapping, and separation of duties.

PrairiesCan will continue to apply risk management practices and principles at all levels of the organization to support strategic priority setting, resource allocation, informed decisions, and improved results.

Significant changes in relation to operations, personnel and programs

There are no significant changes in relation to operations, personnel and programs for this reporting period.

Approval by senior officials

Approved by:

Original signed by:

________________________

Diane Gray

President

Edmonton, Canada

Date: August 22, 2024

Original signed by:

________________________

Wolf Findling

A/Chief Financial Officer

Statement of authorities (unaudited)

| Authorities | Total available for use for the year ending March 31, 2025* | Used during the quarter ended June 30, 2024 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 - Net operating expenditures | $41,478 | $10,585 | $10,585 |

| Vote 5 - Grants and contributions | 275,380 | 56,039 | 56,039 |

| Budgetary statutory authorities: Employee benefit plans |

4,478 | 1,120 | 1,120 |

| Total authorities | $321,336 | $67,744 | $67,744 |

| Authorities | Total available for use for the year ending March 31, 2024* | Used during the quarter ended June 30, 2023 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 - Net operating expenditures | $42,306 | $10,492 | $10,492 |

| Vote 5 - Grants and contributions | 323,809 | 37,531 | 37,531 |

| Budgetary statutory authorities: Employee benefit plans |

4,625 | 1,156 | 1,156 |

| Total authorities | $370,740 | $49,179 | $49,179 |

| *Includes only Authorities available for use and granted by Parliament at quarter-end. | |||

Departmental budgetary expenditures by standard object (unaudited)

| Expenditures | Planned expenditures for the year ending March 31, 2025* | Expended during the quarter ended June 30, 2024 | Year-to-date used at quarter-end |

|---|---|---|---|

| Personnel | $36,929 | $9,958 | $9,958 |

| Transportation and communications | 1,026 | 189 | 189 |

| Information | 1,451 | 34 | 34 |

| Professional and special services | 5,772 | 818 | 818 |

| Rentals | 1,704 | 492 | 492 |

| Repair and maintenance | 759 | 0 | 0 |

| Utilities, materials and supplies | 148 | 14 | 14 |

| Acquisition of machinery and equipment | 1,967 | 2 | 2 |

| Transfer payments | 275,380 | 56,039 | 56,039 |

| Other subsidies and payments | 0 | 198 | 198 |

| Total gross budgetary expenditures | $325,136 | $67,744 | $67,744 |

| Less revenues netted against expenditures: | |||

| Vote netted revenue | (3,800) | 0 | 0 |

| Total net budgetary expenditures | $321,336 | $67,744 | $67,744 |

| Expenditures | Planned expenditures for the year ending March 31, 2024* | Expended during the quarter ended June 30, 2023 | Year-to-date used at quarter-end |

|---|---|---|---|

| Personnel | $35,054 | $9,989 | $9,989 |

| Transportation and communications | 1,295 | 258 | 258 |

| Information | 717 | 24 | 24 |

| Professional and special services | 8,425 | 655 | 655 |

| Rentals | 992 | 262 | 262 |

| Repair and maintenance | 1,082 | 0 | 0 |

| Utilities, materials and supplies | 258 | 19 | 19 |

| Acquisition of machinery and equipment | 1,107 | 89 | 89 |

| Transfer payments | 323,809 | 37,531 | 37,531 |

| Other subsidies and payments | 0 | 352 | 352 |

| Total gross budgetary expenditures | $372,740 | $49,179 | $49,179 |

| Less revenues netted against expenditures: | |||

| Vote netted revenue | (2,000) | 0 | 0 |

| Total net budgetary expenditures | $370,740 | $49,179 | $49,179 |

| *Includes only Authorities available for use and granted by Parliament at quarter-end. | |||