Help guide for the Business Scale-up and Productivity expression of interest form

View the print-friendly version: PDF (433 kB)

This help guide is a companion for Prairies Economic Development Canada (PrairiesCan) Business Scale-up and Productivity program.

Preparation

Before beginning your expression of interest (EOI), carefully review the guidelines for this program, to ensure your organization is eligible to apply for funding and your proposed activities meet the program’s objectives and criteria.

- Delivered by Canada’s regional development agencies (RDAs), in this case PrairiesCan, this expression of interest will be used to determine whether you will be invited to submit a full Business Scale-up and Productivity (BSP) application.

- Businesses will be limited to 1 successful application per year.

- Fields marked with an asterisk (*) are mandatory, and you will be unable to submit your EOI if such fields are left incomplete.

- Incomplete EOIs cannot be assessed and may be deemed ineligible.

- Contact PrairiesCan should you have any questions or wish to discuss your proposed project or other relevant government programs that may be applicable to your project.

Completing the form

Refer to the guidance below for explanations of how to complete the expression of interest form.

Organization information

- Legal name of applicant organization *

- The legal name as shown on the certificate of incorporation or registration.

- Operating name (if different than legal name)

- Provide the name you are operating under if different from the full legal name.

- Mailing address (Including suite, unit, apt #)

- The mailing address of the applicant organization.

- Email address

- Include the general email address of your organization.

- Website

- Your organization’s website address (if available).

- Corporate Status *

- Indicate if your organization is a for-profit or not-for-profit.

- Organization Type (select best fit) *

- Select from the drop down menu what most accurately reflects your organization type.

- Provide your Canada Revenue Agency (CRA) Business number or Goods and Services Tax (GST) number (first 9 digits only)

- The unique business number or GST number assigned to the applicant organization by the CRA. A business number or GST number must be obtained through the CRA. For information on obtaining a business number visit the CRA’s Business Number Registration page.

- Jurisdiction of Incorporation *

- Select from the drop down menu your organization’s jurisdiction of incorporation.

- Incorporation Number

- As shown on your Certification of Incorporation.

- In the province of

- Indicate in which province the organization was incorporated.

- Date of incorporation

- Indicate the date the organization was incorporated.

- Alternative number type

- Please enter if you do not have a CRA Business Number or Incorporation Number, so your organization can be identified (e.g. band number, education number).

- Number of employees working for your organization (full time equivalents)

- Indicate the number of Full-Time Equivalent employees (FTEs) working for your organization (and if applicable, any affiliated companies). Part-time employees should be calculated based on their equivalent to a FTE (i.e., 1 part time employee working approx. 20 hrs/week should be represented as 0.5 FTE).

- Provide a brief summary of your organization and mandate (Maximum of 500 characters)

- The description of the applicant organization and an explanation of the organization’s mandate and priorities.

Include the date your organization established business in Canada.

Project primary contact

This person will be contacted for any follow-up on this application.

- Title *

- Provide the contact person’s job title (e.g., President, Executive Director).

- Email address *

- The email at which the primary contact may be reached.

Project secondary contact

- Title

- Provide the contact person’s job title (e.g., President, Executive Director).

- Email address

- The email at which the secondary contact may be reached.

Project information

- Project title (maximum of 90 characters) *

- Provide a project title that accurately reflects the activities and results of the project. Should your project be approved, this description will be disclosed on the Open Government Portal website as part of its proactive disclosure guidelines. A project title can be a maximum of 90 characters including spaces.

- Project address is the same as Mailing address on the account?

- Yes / No

Select “Yes” if the address at which the project will be undertaken is the same as the organization’s mailing address. If checked, the mailing address will be automatically entered. - Project address / location (Including suite, unit, apt #): *

- If the project address is different from the mailing address, enter the location at which the project will take place.

- Describe your project activities in plain language. The description should include the objectives of the project, as well as, key activities of the project and how these activities will achieve the intended objectives of the project. (Maximum of 1,000 characters including spaces) *

- Briefly describe your project in plain language. This is important as this section will be used in summary documents to describe your project at various review stages. The description should provide the department with a high-level overview of the project and outline the main elements of the project. It should provide an understanding of why you are seeking financial assistance, how you will use the funds, and how the funds will support the objectives of your project. Do not use technical language in this section.

Eligible projects will focus on accelerating and supporting business growth through productivity improvement, business scale-up and/or technology commercialization. Identify the primary project activity and outline your planned activities to scale-up, introduce a productivity improvement, or commercialize a technology.

Describe how your project addresses market demand. - Briefly describe the economic benefits associated with this project. (1,000 characters including spaces) *

- Provide numerical values measured year over year from the project funding start date typically to 1 year following the project completion date.

Provide an explanation as to how these economic outcomes will be achieved. Ensure to identify and detail all assumptions to support the reasonableness of your economic outcomes. All projects will be screened for significance of outcomes and the likelihood of them being achieved.

If your project supports the Government of Canada’s commitment to inclusive growth (under-represented groups) you may include this in your explanation. Note: recipients will be encouraged to track inclusiveness indicators (i.e., women, Indigenous Peoples, and youth).

Describe the economic benefits associated with the proposed project including sales and job creation (e.g. number of highly qualified personnel). - Which regional development agency (RDA) Priority does this project best support?

- Choose 1 priority that best aligns with your project’s objectives, activities, and outcomes. Your project may be compared to similar projects of a chosen priority area.

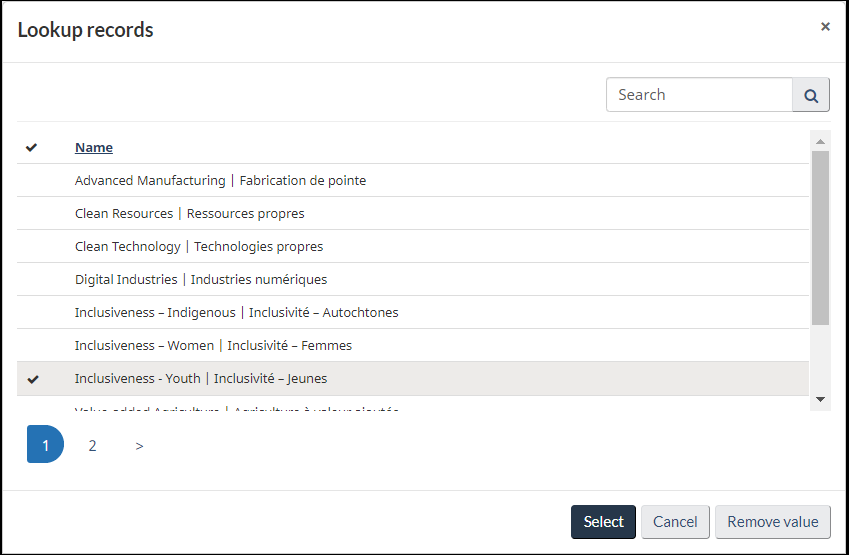

To select 1 of the RDA’s priorities, click on the magnifying glass icon and the “Lookup records” window will appear where you can then select a priority from.

- Explain how this project supports the indicated priority. (Maximum of 2,000 characters).

- Explain in detail how the project’s objectives, activities, and outcomes align with the selected RDA priority.

Indicate whether your project addresses one of the RDA’s additional areas of focus (i.e. Critical Minerals; Food and Ingredients Processing; or Zero Emission Heavy Equipment Vehicles).

Project timelines

- Proposed project start date *

- This is the proposed date the agreement between the Recipient and PrairiesCan comes into effect. The date entered in this field should be in the future. Any costs incurred prior to this date are not eligible for reimbursement under the terms of the agreement and are outside of the scope of the project. This can be thought of as the start date for the project.

- Proposed project end date *

- This is the anticipated date the project activity will cease.

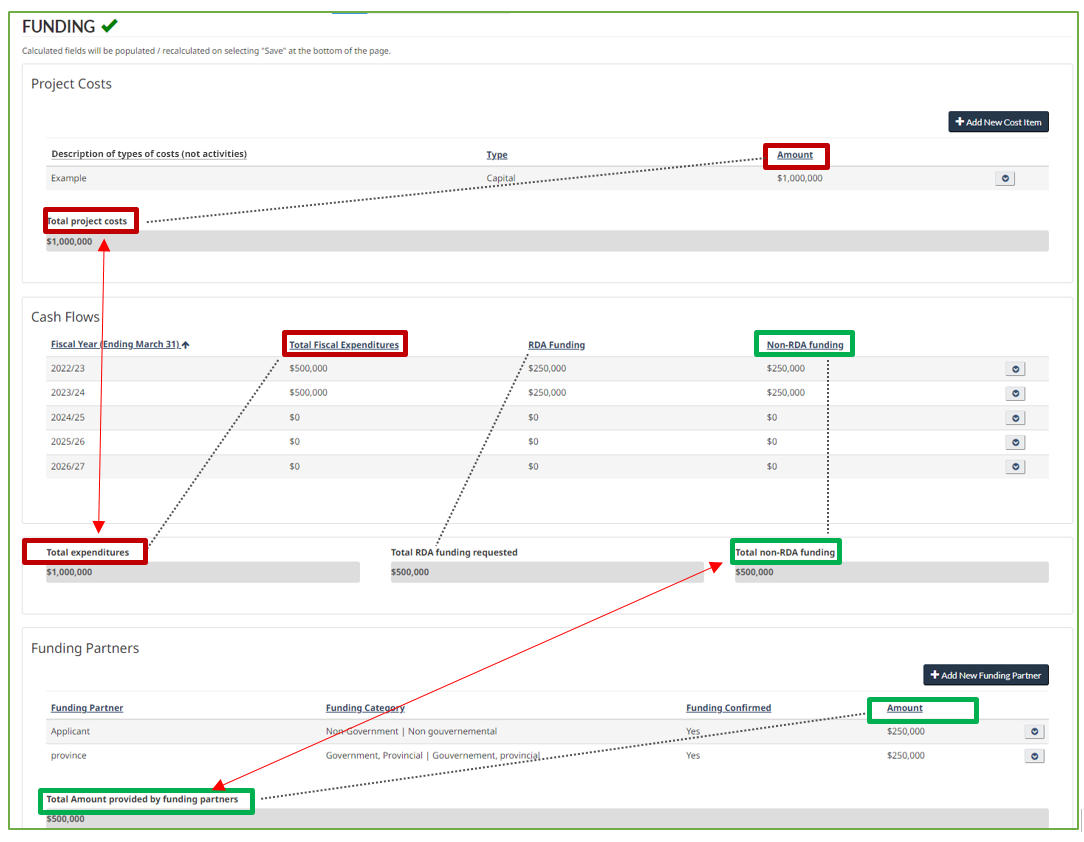

Project costs

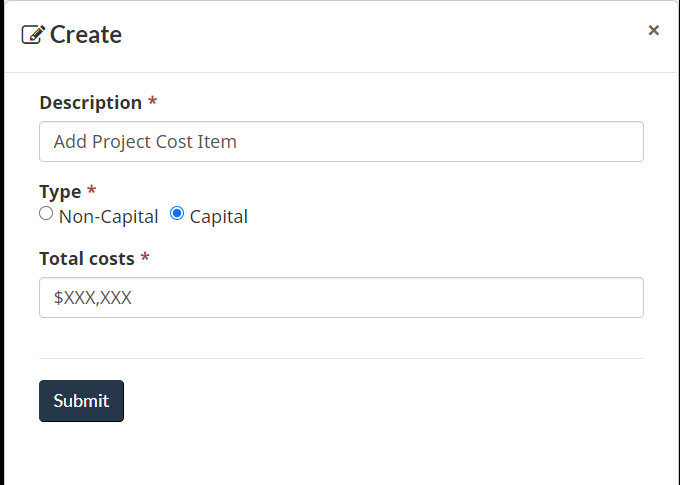

- Description *

- List the various cost items you anticipate incurring in the implementation of the project. Each cost item should have its own line (see instructions below).

Recipients must ensure all project cost items are clearly verifiable.

Examples of eligible costs and ineligible costs under the BSP program can be found on the program’s web page. - Type *

- Indicate if the cost is capital (e.g. purchase of equipment and associated costs such as installation) or non-capital (e.g. salaries, professional fees).

- Amount *

- The anticipated amount of the cost item.

- Total Project Costs

- Automatically sums the cost items listed above.

Note: This total must equal the Total expenditures from the Cash Flows section below.

To add a project cost item, click on the ![]() button and the following window will appear for you to provide the information. Click the Submit button once complete. You will still have the ability to edit the project cost item after hitting this Submit button.

button and the following window will appear for you to provide the information. Click the Submit button once complete. You will still have the ability to edit the project cost item after hitting this Submit button.

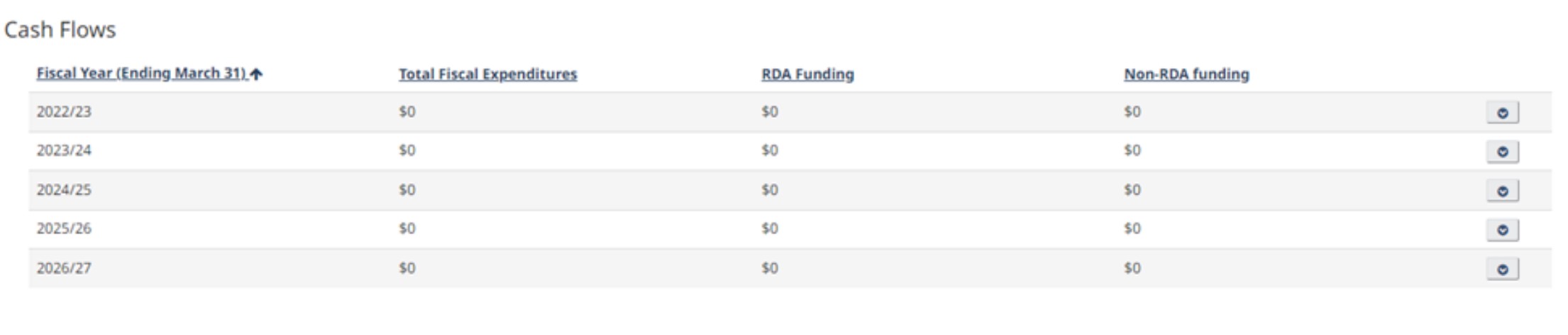

Cash flows

Fiscal Year (Ending March 31): Year 1

- Total Fiscal Expenditures

- Anticipated total project costs incurred in Year 1.

- RDA Funding

- The amount of RDA funding being requested to support Year 1 expenses.

- Non-RDA Funding

- Automatically generated: the expenditures not covered by RDA funding.

Fiscal Year (Ending March 31): Year 2

- Total Fiscal Expenditures

- Anticipated total project costs incurred in Year 2.

- RDA Funding

- The amount of RDA funding being requested to support Year 2 expenses.

- Non-RDA Funding

- Automatically generated: the expenditures not covered by RDA funding.

Fiscal Year (Ending March 31): Year 3

- Total Fiscal Expenditures

- Anticipated total project costs incurred in Year 3.

- RDA Funding

- The amount of RDA funding being requested to support Year 3 expenses.

- Non-RDA Funding

- Automatically generated: the expenditures not covered by RDA funding.

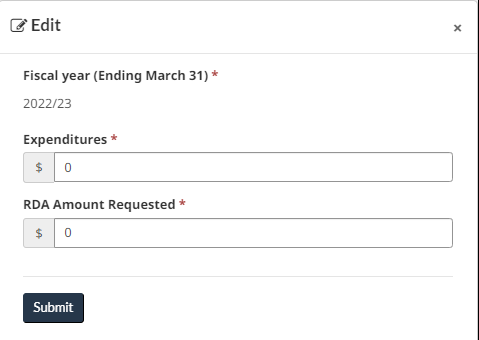

- To enter cash flow information, click the down arrow on the far right for the fiscal year you are interested in. Click the Edit option that appears. Note: fiscal years shown below are for illustrative purposes only.

- Enter the “Expenditures” and “RDA Amount Requested” information and then hit Submit. You will still have the ability to edit the project cost item after hitting this Submit button. Note: fiscal years shown below are for illustrative purposes only.

- RDA funding requested *

- This is the sum of the RDA Funding column in the Cash Flows section. It is automatically calculated.

- Total expenditures *

- This is the sum of the Total Fiscal Expenditures column in the Cash Flows section. It is automatically calculated.

Note: This total must equal the Total project costs from the Project Costs section above. - Total non-RDA funding *

- This is the sum of the Non-RDA Funding column in the Cash Flows section. It is automatically calculated.

Note: This total must equal the Amount provided by funding partners from the Funding Partners section below.

The solid arrows point to the fields that must balance and the dotted lines indicate what column is being summed to produce those totals. Note: fiscal years shown above are for illustrative purposes only.

Funding partners

- Funding Partner

- Please note that the first entry in the list of funding partners is reserved for your own organization (the “Applicant”). Add other funding partners or contributors, if any, in subsequent rows.

Identify all potential project contributors that will provide funding as a monetary contribution or in-kind contribution.

Note: recipients must ensure all contributions (including in-kind contributions) are clearly verifiable. - Funding Category

- Select from the drop down menu the description that best reflects the funding source.

- Funding Confirmed

- Indicate if the funding has been confirmed.

In the case where your organization (Applicant) is a source of funding, indicate yes if you have cash on hand. - Amount

- The anticipated amount of funding this partner will provide.

- Amount provided by funding partners

- Automatically sums the funding amounts listed above.

Note: This total must equal the Total non-RDA funding from the Cash Flows section above.

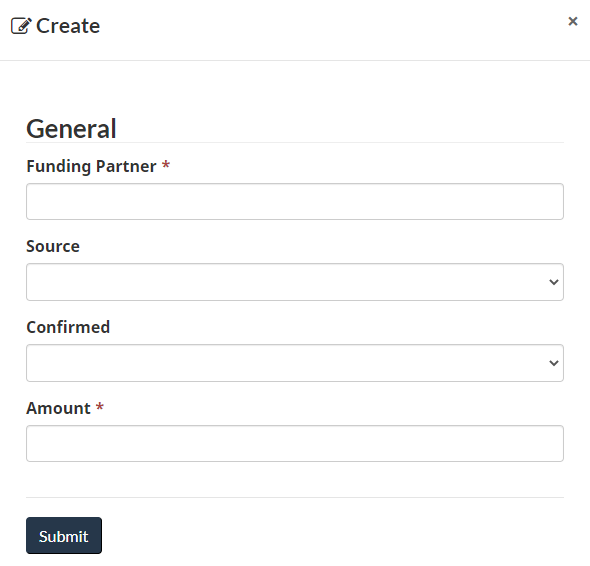

- To add a funding partner, click on the

button and the following window will appear for you to input the information. Click the Submit button once complete. You will still have the ability to edit the project cost item after hitting this Submit button.

button and the following window will appear for you to input the information. Click the Submit button once complete. You will still have the ability to edit the project cost item after hitting this Submit button.

- To edit what your organization will be contributing towards this project, click the down arrow on the far right for the fiscal year you are interested in. Click the Edit option that appears and a similar pop-up window as shown above will appear.

- Briefly describe any partnerships (non-financial and financial) for this project (maximum of 1200 characters including space): *

- Describe your management team (including board or directors, advisors) and/or partnerships that would be important to the success of the proposed project.

Signing authority

Indicate here the individual within your organization who has signing power / the authority to enter into an agreement. This person may be different from the contact person.

- Title *

- Provide the contact person’s job title (e.g., President, Executive Director).

- Email address *

- The email at which the primary contact may be reached.

Documents

Upload here the supporting documents to be provided with your EOI.

Upload the following mandatory documents:

- Financial statements for the past 2 years, as well as interim financial statements for at least the last 6-month period;

- Confirmation of other funding sources (e.g. bank statements, unused portion of lines of credit, official letters of intent, funding agreements, signed term sheets);

- Other supporting documentation (e.g. business plan, pitch deck) detailing your organization, how it meets the high-growth definition, and details about the proposed project.

Validation

For this step, any errors or omissions in the form will be brought to your attention, and you will be given the opportunity to review them, and make any necessary corrections.

Attestation

Before you can complete and submit your expression of interest, it is necessary in this final step for you to affirm that you are aware of certain statutory obligations, and that your organization meets the eligibility requirements for the BSP program. The attestation must be completed by a member of your organization with signing power/authority to enter into a legal agreement. For your reference, the complete text of this attestation is given below.

Please select “I agree” to affirm, and then submit using the “Submit” button.

On behalf of the Applicant Organization, I hereby acknowledge and agree that:

- This expression of interest does not constitute a commitment from Prairies Economic Development Canada (PrairiesCan) for financial assistance.

- Any person who has been lobbying on behalf of the Applicant Organization to obtain a contribution as a result of this expression of interest is registered pursuant to the Lobbying Act and was registered pursuant to that Act at the time the lobbying occurred.

- The Applicant Organization is under no obligation or prohibition, nor is it subject to, or threatened by any actions, suits or proceedings, which could or would affect its ability to implement this proposed project.

- The Applicant Organization has not, nor has any other person, corporation or organization, directly or indirectly paid or agreed to pay any person to solicit a contribution arising as a result of this expression of interest for a commission, contingency fee or any other consideration dependent on the execution of an Agreement or the payment of any contribution arising as a result of this expression of interest.

- Prairies Economic Development Canada (PrairiesCan) and Pacific Economic Development Canada (PacifiCan) are government institutions as defined under the Access to Information (ATI) Act. Records in the custody and care of the institution are subject to disclosures under Part 1 and Part 2 of the ATI Act with limited exceptions and exclusions.

- Personal information collected by PrairiesCan is collected in accordance with section 4 of the Privacy Act (R.S.C., 1985, c. P-21). This information will be used to determine eligibility, administer grants and contributions, and evaluate program effectiveness. Personal information collected is described in the Personal Information Bank entitled “Grants and Contributions”, number PrairiesCan-PPU-055. Questions regarding the collection and use of your personal information may be directed to the ATIP Coordinator, PrairiesCan, Canada Place, 1500-9700 Jasper Avenue NW, Edmonton, Alberta T5J 4H7, by telephone at 780-495-0162, or by email to atip-aiprp@prairiescan.gc.ca.

If you choose not to provide the personal information, your application may not be processed.

You have a right under section 12 of the Privacy Act to access to your personal information under the control of PrairiesCan as well as a right to request correction of personal information where there is an error or omission. You have the right to make a complaint to the Office of the Privacy Commissioner under section 29(1) of the Privacy Act regarding PrairiesCan’s collection, use, and disclosure of your personal information, processing of your request for correction of personal information or processing of your access to personal information request.

I authorize PrairiesCan, its officials, employees, agents and contractors to make credit checks and enquiries of such persons, firms, corporations, federal, provincial and municipal government departments/ agencies, and non-profit, economic development or other organizations as may be appropriate, and to collect and share information with them, as PrairiesCan deems necessary in order to assess this expression of interest, to administer and monitor the implementation of the subject project, and to evaluate the results of the project and related programs.