Public Services and Procurement Canada

Assurance Report: Audit of Accrual Budgeting

Final Report

Office of the Chief Audit, Evaluation and Risk Executive

Introduction

Accrual budgeting is an approach to budgeting that can support effective long term capital investment planning. Budget 2019 announced Public Services and Procurement Canada (PSPC)’s transition to an accrual-based capital investment framework (in other words, an accrual budget) with an approved Capital Investment Fund. The Capital Investment Fund Management Instructions dated March 2021 indicated that transitioning capital-intensive organizations to accrual budgeting will help improve the government’s budgetary forecasting as Federal Budgets are prepared on an accrual basis, and will provide federal organizations with a predictable source of capital funding.

PSPC’s Finance Branch is leading the implementation of accrual budgeting within the department, and provides guidance to processes impacted by accrual budgeting. All branches and regions are implementing changes to their existing processes with the support of the Finance Branch.

Background

Accrual budgeting is based off the concept of accrual accounting. Under this approach, expenses are recorded as they are incurred as opposed to recording them when cash is disbursed. In the case of accrual budgeting, a typical expense would be an amortization expense, which consists of the capital investment costs spread across the useful life of the capital asset. The total accrued expenses, which would consist mostly of annual amortization of all PSPC’s existing, in progress, and planned capital assets, are benchmarked against the annual Baseline Accrual Space (or annual ceiling) to determine whether unused space is available under this ceiling, to invest in additional capital investment projects. On the contrary, if the budgeted expenses exceed the ceiling, certain projects that are under consideration or planned could be reprioritized or delayed.

The Capital Investment Fund is a dedicated source of capital funding earmarked for PSPC in the Government of Canada’s fiscal plan. Through budget 2019, PSPC was granted a $15.9 billion Capital Investment Fund on an accrual basis. The Capital Investment Fund establishes a ceiling over a 20-year period for capital investments. In addition, the fund sets an annual ceiling, called Baseline Accrual Space, which is the upper annual departmental amortization limit. The plan is for the Capital Investment Fund to be revised every 3 years via a Federal Budget Request to the Department of Finance, but PSPC is allowed to request additional funding for the Capital Investment Fund when deemed necessary In early 2022, PSPC submitted its revised request for funding through the Capital Investment Fund reset, and is awaiting a response.

In August 2020, the Accrual Budgeting Project headed by PSPC’s Finance Branch obtained approval from the PSPC Investment Management Board. An Accrual Budgeting Project Office was created in October 2020 to support the implementation of this project, which included the creation of both a Project Management Office and a Change Management Office. This project was originally expected to be completed by March 2023; however, Finance Branch anticipates that there will be some work past that point to maintain accrual budgeting activities in the department. The project is being delivered through a phased approach using a number of sub-projects.

The application of accrual budgeting is a shift in PSPC’s approach to managing capital assets, moving from a model of securing funds on a project-by-project basis to a holistic decision-making model organized by asset portfolios. As a result, it is expected that accrual budgeting will enable PSPC to base investment decisions on long-term strategic considerations, as opposed to short-term cost-minimization.

As Finance Branch is in charge of the implementation of accrual budgeting at PSPC, it provides support to the various stakeholders impacted by this change. Six Long Term Portfolio Plans were put in place within PSPC. The portfolio names and allocated amounts using the December 2019 data are summarized in a table in Appendix A: Portfolio, responsible branch and allocated amount based on the December 2019 data. The amounts include allocations in excess of PSPC’s 20 year Capital Investment Fund. The implementation of Accrual Budgeting Framework was identified as 1 of the top 3 risks for the department. Due to the complexity of the changes required for the implementation, there was a risk that the implementation of Accrual Budgeting would delay the start of a number of projects seeking governance approval. A risk mitigation strategy of over allocating funding was developed to increase the number of projects that were started. As a result, the aggregate amount shown in Appendix A is more than PSPC’s 20 year Capital Investment Fund of $15.9 billion by approximately $400 million. The Finance Branch indicated once PSPC receives new funding from the Capital Investment Fund reset, the current plan is to remove the over-allocation.

Focus of the audit

This internal audit was included in the Office of the Chief Audit, Evaluation and Risk Executive’s approved Risk-Based Audit Plan 2021 to 2024.

Importance

This audit is important because accrual budgeting is a new and different way of managing capital assets, which shifts emphasis from planning within annual expenditures limits to planning the expense profile of capital investments using a long term envelope of accrual space.

Accrual budgeting presents a significant, complex and wide reaching change for the department, and was identified as a high-risk area.

Objective

The objective of this assurance engagement was to provide assurance on the design, implementation and adequacy of the accrual budgeting project’s governance and change management practices, as well as the accrual budgeting initiative’s key processes, including accrual space allocation, within PSPC branches and regions. In addition, the objective was to provide assurance on the data integrity of the accrual budgeting project.

Scope

A risk-based approach was used to establish the scope and approach for this audit engagement. This engagement assessed key activities taken by teams within the Finance Branch associated with defining and implementing the governance structure, and the development and implementation of processes related to this departmental-wide transformation. The audit also reviewed:

- the change management strategy in regards to stakeholder (branches and regions) engagement in the project

- the adequacy of the key processes of the accrual budgeting initiative, specifically with regards to the allocation of the accrual space across, and within portfolios

- data integrity of the accrual budgeting project

In order to carry out this engagement, we validated findings through an examination supporting documentation and conducted interviews with key employees within the branches and the regions. We did not do compliance testing of the implementation of the change management strategy and processes being applied.

The period covered in this audit was from October 1, 2020 to March 31, 2022. The scope period start date was determined based on the date that the Accrual Budgeting Project Management Office was officially created. Relevant information obtained before and subsequent to the audit scope period was also considered, as deemed necessary by the audit team.

Audit criteria and methodology

The audit criteria and methodology can be found in Appendix B: Audit criteria and methodology.

The examination phase of the audit took place from June 2022 to August 2022. Relevant information obtained subsequent to our examination phase was considered.

The internal audit was conducted in accordance with the International Standards for the Professional Practice of Internal Auditing, as supported by the results of the quality assurance and improvement program.

High level observations and findings

We found that project governance, change management activities and key processes existed and enabled the department to transition to, and function under the accrual budgeting framework. However, improvement is required in the areas of change management, processes and data integrity.

Governance

Adequate governance was in place to ensure oversight of the delivery of the accrual budgeting project. Committees were established with appropriate membership and timely information was provided to and discussed at committee meetings. For the project level committees, we noted and advised Finance Branch of opportunities to update and approve the Terms of References to ensure that they reflect current expectations.

Change management

A change management strategy was in place and being executed. As well, tools and training were in place to assist accrual budgeting implementation. PSPC is the first department to apply accrual budgeting to all its asset portfolios, necessitating the department to design and implement significant changes to the entrenched government processes. In addition, the department had to make these significant changes while simultaneously operating under the accrual budgeting framework. Such a large-scale change proved difficult for some employees to adopt. The challenge in implementing this change is evidenced by mediocre scores received by the change management activities based on assessments conducted by Finance Branch’s Change Management Office. Change management is important as it drives the successful adoption and usage of change within an organization. It allows employees to understand and commit to the shift and work effectively during it. Without effective change management, organization transitions can be rocky and expensive in terms of both time and resources.

Processes

Overall, we found that processes to allocate accrual space across and within portfolios existed. However, the audit team noted that relevant guidance documents existed in different forms and they were spread across different branches. This made it difficult for employees to understand the full accrual budgeting process and what components applied to their context. It would be beneficial for Finance Branch to establish a summary document listing the key activities in accrual budgeting, linking the relevant guidance, as well as clearly delineating roles and responsibilities associated with these activities. This will help stakeholders in the branches and regions to better understand the inter-connectivity of different accrual budgeting related activities and processes, potentially increasing efficiency in these processes.

We found that cash expenditures forecasting needs improvement as the June 2021 cash forecast for the fiscal year 2021 to 2022 was $1.8 billion, while the actual spending for that fiscal year was $1.2 billion (a forecast variance of $600 million). As the cash forecast is the basis for accrual budgeting, over-forecasting may lead to excessive or unnecessary accrual space being tied up for certain projects, which may prevent other priority projects from accessing the accrual funding needed.

Data Integrity

Data integrity management processes were not defined and implemented. However, Finance Branch implemented data quality checks in the interim. A Data Integrity and Stewardship sub-project, which should be completed by March 2023, is currently underway to establish appropriate data quality requirements.

Findings, recommendations, and management action in response to the recommendation

The recommendations presented in this report address issues of high significance.

Finance Branch has validated the findings of the internal audit, agreed with the recommendations in this report and developed related action plans. The Office of the Chief Audit, Evaluation and Risk Executive has determined that they appear reasonable to address the recommendations.

Governance and oversight

Overall, we found that adequate governance was in place to ensure oversight of the delivery of the accrual budgeting project. Governance is important as it can improve the performance of the organization, and help it become more stable and productive, and unlock new opportunities. It can also reduce risks and enable faster, safer growth.

We expected governance committees to be in place to oversee the accrual budgeting project, and include members from branches and regions. We also expected the governance bodies to provide leadership and oversight over the accrual budgeting project. This would include receiving regular information on performance and progress for discussion and approval.

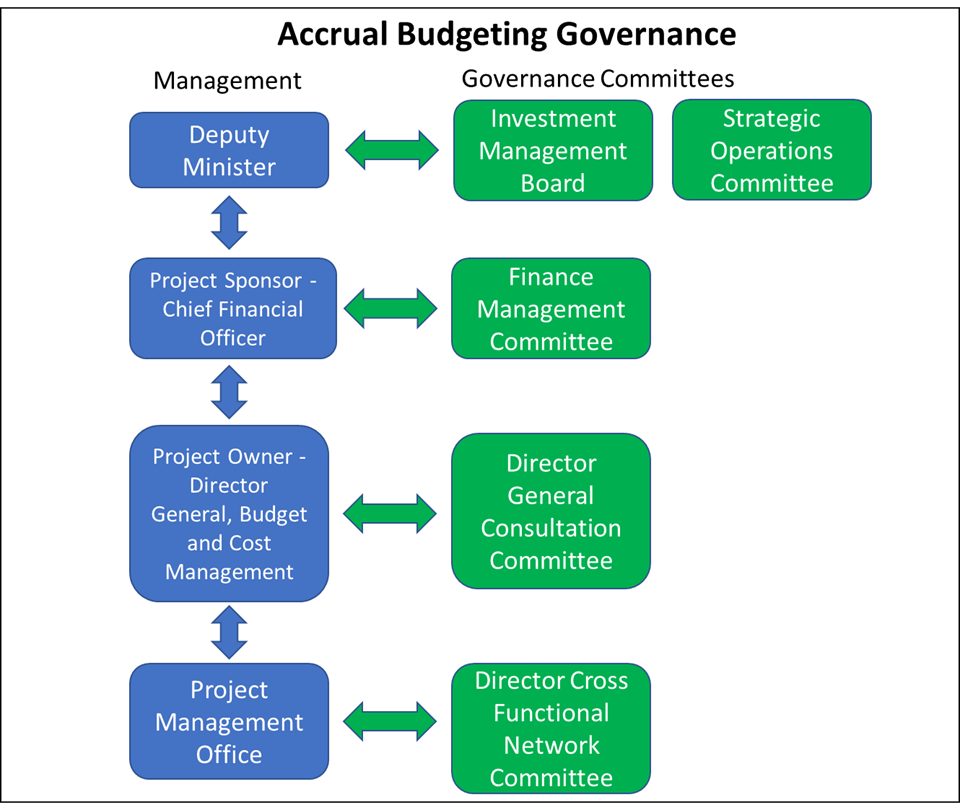

We found this to be the case. 2 project level governance committees (Director General Consultation Committee, and Director Cross Functional Network Committee) and 3 sponsor group governance committees (Investment Management Board, Finance Management Committee, and Strategic Operations Committee) were in place to oversee the delivery of the accrual budgeting project. The committees had members from various branches and regions involved in accrual budgeting. For example, the Director Cross Functional Network Committee was made up of members in key positions in branches such as Finance Branch, Real Property Services and Digital Services Branch, as well as regions such as Pacific, Ontario and Quebec. See Appendix C: Governance structures’ mandate, and membership for details of the mandates and membership of each governance committee.

The 5 governance committees do not directly report to one another. However, information is communicated through committee members such as the Project Owner who are members of various committees. For example, the link between the Project Group Committees and Sponsor Group Committees is the Project Owner (Director General, Budget and Cost Management), who is the chair of the Director General Consultation Committee. The Project Owner reports to the Chief Financial Officer, who chairs the Finance Management Committee, and is a member of the Investment Management Board and Strategic Operations Committee. See Appendix D: Accrual budgeting governance for a diagram of the governance structure and committee members who communicate information on the accrual budgeting project. It should be noted that the 3 sponsor group governance committees are not accrual budgeting specific and discuss other PSPC topics. All of the committees had developed Terms of References that covered mandate, scope, membership and meeting frequency. However, for the project level committees (Director General Consultation Committee, and Director Cross Functional Network Committee), we noted and advised Finance Branch of opportunities to update and approve the Terms of References to ensure that they reflect current expectations.

The 2 project level committees served as consultative committees to support the work of the accrual budgeting project, and the Investment Management Board served as the decision making authority. Timely information was provided to these committees via the project owner and project management office staff. A review of the committees’ agendas records of decision during the audit period (October 2020 to March 2022) indicated that accrual budgeting related information was presented to and discussed at all 5 governance committee meetings. The committees received dashboards, presentations, and updates, and made decisions when required. These dashboards included information on Risk Indicators and Mitigation Strategies, Issue Indicators and Mitigation Strategies, Project Status and Health, Key Milestones and Scope of Work, and Financial Indicators.

Change management

Overall, a change management strategy was in place and being executed. In addition, tools and training were in place to assist accrual budgeting implementation. However, the change management activities did not achieve adequate scores based on assessments conducted by Finance Branch’s Change Management Office. Change management is important as it drives the successful adoption and usage of change within an organization.

We expected a change management strategy to be in place and executed for the accrual budgeting project. We also expected tools and training to be in place to allow stakeholders to implement the project and apply the accrual budgeting requirements. Finally, we expected that change management activities would achieve adequate scores based on assessments conducted.

In March 2020, a Change Management Strategy for the accrual budgeting project was developed and approved. The audit confirmed that an Accrual Budgeting Project Change Management Plan included in the strategy was developed and approved in June 2021. This plan was based on principles of Prosci, which is the change management methodology formally adopted enterprise-wide by PSPC. The plan outlined key change management activities to prepare for, manage and reinforce changes.

The audit verified that certain change-management activities were undertaken such as defining roles and responsibilities of Accrual Budgeting Project team members, the development of change management operational plans, creation of a training plan framework, and the development of a communications and stakeholder engagement plan. Based on our review of the Accrual Budgeting project charter, and the communications and stakeholder engagement plan, we noted that key Accrual Budgeting Project stakeholders were identified as well as the roles and responsibilities of project members.

A Change Management Office was also established in October 2020, demonstrating a commitment to support employees’ buy-in of the change to accrual budgeting. Communication channels including an Accrual Budgeting Project intranet page, a Microsoft Teams site and a Change Agent Network were established to communicate key developments of the accrual budgeting project, and address stakeholders’ questions and concerns. In addition, the audit confirmed that change management activities and milestones were tracked in project dashboards and presented to the 2 project level governance committees (Director General Consultation Committee, and Director Cross Functional Network Committee) on a timely basis.

Although change management activities were taking place, the scores obtained on 2 assessments conducted fell below the threshold for an adequate ratings. The Change Management Office conducted 2 Awareness Desire Knowledge Ability and Reinforcement assessments (December 2021 and March 2022), and 2 Prosci Change Triangle assessments (March 2021 and March 2022). These assessments requested survey responses from various stakeholders and, as such, fostered stakeholder engagement to support individuals in the changes that were taking place. The Awareness Desire Knowledge Ability and Reinforcement assessments were used to identify barriers to change, and the Prosci Change Triangle assessments were used to assess project health across critical aspects (such as Leadership/Sponsorship, Project Management, Change Management). See Appendix E: Change management assessments for details of the dates and respondents of the above mentioned assessments.

We reviewed documentation for the Awareness Desire Knowledge Ability and Reinforcement assessment performed in December 2021 which noted that there were no perceived barrier points to adopting change.

We also examined the documentation for the 2 Prosci Change Triangle assessments that were conducted. For the purposes of this audit, we focused on the scores pertaining to the change management segment of the assessments. The scores achieved fell below the threshold for an adequate rating in both Prosci Change Triangle assessments.

Of note, the Prosci Change Triangle assessment conducted in March 2021 identified that processes were not well understood. We noted the same issue during our interviews with some stakeholders, which is discussed in the Processes section. Some employees we interviewed between February 2022 and June 2022 noted confusion or lack of clarity in regards to roles and responsibilities or accrual budgeting impacted processes. Subsequent to the 2021 assessment, Finance Branch identified actions to address the assessment results, and the audit team obtained and reviewed evidence in relation to various actions. For instance, the audit team observed that a website and awareness video were created, and briefing toolkits were created, such as a Talking Points document for senior leaders and an Introducing the Accrual Budgeting Project presentation deck. The Project Leader acknowledged that more work could be done on analyzing results of assessments.

We noted that training material and tools on accrual budgeting were developed, and training sessions were delivered. Guidance material was in the form of PowerPoint decks, management instructions, and other types of documentation. Training was primarily in the form of awareness sessions also known as Accrual Budgeting 101 sessions. This training covered basics of accrual budgeting, the Capital Investment Fund and the associated baseline accrual space, some historical background information, some example scenarios, and frequently asked questions.

Finance Branch provided the audit team with a spreadsheet, which listed various awareness sessions organized and delivered to stakeholders across PSPC in the past few months. The May 2022 spreadsheet showed that almost 20 sessions were held, which were presented to a wide variety of stakeholders such as staff in the Pay Solutions Branch, Science and Parliamentary Infrastructure Branch, and Finance Branch and to groups such as the Accommodation, Infrastructure, Portfolio and Financial Management Committee and the Comité de gestion de la région du Québec.

A tool was developed for the department to report data on accrual profiles of PSPC’s asset portfolios. This tool was developed to help stakeholders understand the current status of the accrual budget on a monthly basis. Another tool was also in use to enable stakeholders to visualize the impacts of different scenarios such as adjustments to existing projects on accrual space allocation. Finally, in March 2022, Finance Branch prepared a flowchart of steps involved in the monthly consolidation and reporting of departmental accrual budgeting information.

Although we noted that there are many change-management activities that have been completed, such as training and awareness sessions, based on our review of the results of the assessments conducted as well as our interviews with some employees, there remains some work to be done in clarifying the accrual budgeting processes. We also expect that clarification of processes would help to improve the results of the assessments, so that the resulting scores would be above the threshold for an adequate rating as identified by the Prosci change management methodology that is being used. Clarifying the process would allow employees to understand and commit to the shift to accrual budgeting, and work effectively during it.

Recommendation 1

The Assistant Deputy Minister, Finance Branch, should take measures to improve the results of change management activities, which may include information sessions on relevant accrual budgeting topics.

Action plan 1

Accrual Budgeting Project Office will conduct an Awareness Desire Knowledge Ability and Reinforcement assessment as well as a Prosci Change Triangle (PCT) Assessment in November 2022 to evaluate the results of change management. The target completion date for this action plan is November 2022.

Based on the analysis of the results, Accrual Budgeting Project Office will work with various sub-project leads to determine which, if any, topics would require information sessions to be developed and delivered. Appropriate documentation would be maintained for such analysis and determination. The target completion date for this action plan is January 2023.

Processes

Overall, we found that processes to allocate accrual space across and within portfolios existed. However, relevant guidance documents existed in different forms, and they were spread across different branches. It would be beneficial for Finance Branch to establish a summary document listing the key activities in accrual budgeting, linking the relevant guidance, as well as clearly delineating roles and responsibilities associated with these activities. This will help stakeholders in the branches and regions to better understand the inter-connectivity of different accrual budgeting related activities and processes, potentially increasing efficiency in these processes.

Prioritization processes existed but could be clarified.

We expected key processes of the accrual budgeting initiative to be established with clear objectives, defined accountabilities, roles and responsibilities, as well as clearly described steps to perform accrual budgeting related activities.

During our review, we found that each of the 6 portfolios was allocated a portion of the overall Capital Investment Fund for their own portfolio-level investment planning in March 2020, which was called the initial notional allocation. The audit team obtained and reviewed the evidence including Investment Management Board’s Record of Decisions and a supporting spreadsheet showing notional space by portfolio, to verify that the initial notional allocation process was completed. While Finance Branch was able to describe the process followed in the initial notional allocation, they recognized that the process was not formally defined, documented and adequately communicated during implementation, as it was the first time for PSPC to allocate accrual space across portfolios.

We selected 2 out of 6 portfolios (Office and Digital) to review their prioritization processes for adequacy. We examined relevant supporting documentation and conducted interviews with key employees involved in the processes to allocate accrual space across and within these portfolios. However, we did not independently re-perform the processes to verify that they are operating effectively.

At the onset of our examination phase, we expected that all of the portfolios would use the same prioritization criteria, which would be similar to the departmental prioritization model. We were advised that after the initial notional allocation, each portfolio had the flexibility to develop their own processes to rearrange capital projects and reallocate corresponding accrual space within their respective allocated portion. As a result, Office portfolio set up their own prioritization criteria, and Digital portfolio used the same departmental prioritization criteria with different weightings. Both portfolios developed their processes to prioritize capital projects and reallocate accrual space within their portfolios, as there was no requirement for portfolios to all have the same allocation process.

We reviewed the Office and Digital prioritization processes, which included key steps and criteria for prioritization. The existing guidance documents that impact accrual budgeting currently take various forms, including but not limited to instruction documents, departmental policies and directives, various slides decks, email communication, records of decisions and flowcharts. Since these documents and related tools are stored in different locations and maintained by different teams across PSPC, it may be challenging for employees to understand the whole picture of accrual budgeting, its impact to existing business processes as well as the interconnectivity of existing processes to support accrual budgeting transition. Some employees in both the Quebec and Ontario regions informed us that they experienced confusion and potential duplication of efforts in the 2021 prioritization exercises.

We reviewed the Real Property - Services Funding Confirmation Process (Office portfolio) and noted that roles and responsibilities for the process owner and teams completing activities within the funding process were clearly identified and defined. The Digital Investment Playbook (Digital portfolio) outlined at a high level the roles and responsibilities of the Digital Service Branch as well as Finance Branch related to investment management. High-level roles and responsibilities were clear in both documents, but they did not articulate the entire accrual budgeting process. Although Finance Branch is not responsible for all these processes, there were many process documents, and Finance Branch is in charge of the implementation of accrual budgeting at PSPC. As such, it would be beneficial for Finance Branch to develop a summary document explaining key linkages of accrual budgeting to existing departmental and portfolio level activities, as well as clearly delineating roles and responsibilities. Confusion around process requirements or roles and responsibilities could lead to increased errors, overlooked process steps or potential duplication of efforts.

In addition to the above, Finance Branch has been working on a Departmental Prioritization Model and a repeatable process to prioritize capital projects across all portfolios. The model was presented and approved by the Finance Management Committee in June 2022 and was in the process of being implemented. The concept of the model and high-level prioritization criteria outlined link portfolio prioritization (look within) and departmental prioritization (look across) to the PSPC’s Investment Plan. A Departmental Prioritization Tool was also developed to support the implementation of the departmental prioritization process. Once the model and the tool are implemented, the current portfolio processes are expected to be adjusted to align with the new approach. Based on our review of the presentation of the model, if it is successfully implemented, it could promote portfolio-level investment planning decisions that support enterprise-wide priorities.

Recommendation 2

The Assistant Deputy Minister, Finance Branch, should ensure that a summary document highlighting key accrual budgeting activities is developed and communicated to relevant stakeholders. This document should reference accrual budgeting activities to existing departmental processes which have roles and responsibilities within them.

Action plan 2

Finance Branch has created an Accrual and Investment Management101 slides deck, as well as the Investment Management Handbook.

The objective of the PSPC Investment Management (IM) Handbook is to provide information on investment management processes and procedures required to ensure PSPC has the necessary assets and services in place to support the Government of Canada’s program delivery to Canadians. Key Investment Management, associated accrual budgeting and Project Navigator activities are described as well as the key linkages between them. The target completion date for this action plan is December 2022.

Cash expenditures forecasting needs improvement.

During the engagement, it was brought to our attention that PSPC was over-forecasting cash expenditures needed for scheduled capital projects. The audit team then reviewed relevant documentation and noted that the June 2021 cash forecast for the fiscal year 2021 to 2022 was $1.8 billion, while the actual spending for that fiscal year was $1.2 billion (a forecast variance of $600 million). This confirmed the assertion that over-forecasting of cash expenditures occurred around the beginning of a fiscal year, leaving large amounts of cash unused at year end. As a cash forecast is the basis for accrual forecast, this practice may lead to excessive or unnecessary accrual space being tied up for certain projects, which will prevent other priority projects from accessing the accrual funding needed.

We reviewed the Records of Decisions of the Finance Management Committee (June 27, 2022) and the Executive Committee (July 7, 2022), and noted that Finance Branch presented the 2021-to-2022 Year-End Departmental Management Report to both committees and poor forecasting was discussed.

Also, Finance Branch proposed forecast related commitment and performance measures to be included in executive’s performance management agreement. Accurate forecasting is important as it will help PSPC to set reasonable and measurable goals based on current and historical data, which will have an impact on the department’s accrual budgeting allocation and space. Having accurate data and statistics to analyze will help PSPC to decide what amount of change, growth or improvements will be determined as a success.

Recommendation 3

In order to improve forecasting in the portfolios, the Assistant Deputy Minister, Finance Branch, should explore options in collaboration with PSPC’s senior management and relevant stakeholders to raise awareness on the impacts of inaccurate forecasting and to strengthen relevant governance committee’s oversight roles.

Action plan 3

Finance Branch will continue to work with senior level committees such as the Investment Management Board (IMB), the Strategic Operations Committee (Strat OPS) and the Finance Management Committee (FMC) to raise awareness on the accrual consequences of inaccurate forecasting. Actions taken will be supported by appropriate documentation. The target completion date for this action plan is March 2023.

Data integrity

Data integrity management processes have not yet been completely defined and implemented. In the interim, Finance Branch implemented data quality checks. A Data Integrity and Stewardship sub-project, which should be completed by March 2023 is currently underway to establish appropriate data quality requirements.

We expected the data integrity management processes to be clearly defined and implemented. The processes were also expected to define data quality requirements to ensure accuracy, completeness and consistency of data required to support accrual budgeting activities.

Although a data integrity management process has yet to be defined, in the interim, some data integrity activities such as data quality checks to improve the completeness and adequacy of critical fields data were implemented by Finance Branch. Manual inputting of data in spreadsheets was part of the monthly forecasting process. Thus there was a risk of human errors as spreadsheets were used in process. In order to mitigate this risk, Finance Branch established some data quality checks on the data extracted from SIGMA, as well as the data manually prepared and submitted by portfolios. These data-quality checks on completeness and adequacy of critical fields data enabled the Finance Branch to carry out the monthly forecasting and other related activities that relied on the data.

We reviewed documentation on a sample basis that supported various data quality checks performed by Finance Branch. These included completeness and adequacy checks on critical fields such as project status, estimated useful life, total project cost and total approval amount. Based on our review of data quality checks performed and documents from governance committee meetings, we found that these checks were appropriately in place as we did not find any evidence to support that there have been issues with the data used in accrual budgeting.

It should be noted that our scope did not include any project management testing in the branches and regions. Hence we did not verify the accuracy of project information inputted into SIGMA. Also, we did not examine the controls at the portfolio level to ensure that the data transferred to Finance Branch had appropriate supporting documentation and was reviewed.

In order to reach a more robust future state, a Data Integrity and Stewardship sub-project is currently underway to establish a Data Stewardship model and related data integrity management processes to address the data required to support accrual budget related business functions. This sub-project plans to assess existing capabilities, design and implement new capabilities that enhance data management to enable long-term asset performance, as well as address data required to support accrual budget related business functions. Detailed objectives include the following:

- identifying the data required for management to make investment decisions

- designing the Data Stewardship model and processes to monitor data standardization and to address integrity issues

- driving data standardization and sustain data quality practices, allowing data to be collected, stored, used and monitored efficiently across project planning, portfolio planning, investment planning and prioritization and treasury management under an accrual budgeting approach

- implementing consistent, repeatable, and transparent data management processes and procedures to support investment decisions

- assessing the impact of changes on stakeholders, establish stakeholder expectations and monitor the adoption changes

The sub-project is still in design phase. Thus the data integrity management processes have not yet been designed, implemented and communicated to branches and regions. We were advised that this sub-project should be completed by March 2023.

Based on our review of the sub-project’s documentation, the sub-project objectives noted above appear reasonable and would help to ensure that relevant data quality requirements to support accrual budgeting related activities are implemented. Data integrity management processes should be a high priority in order to ensure that foundational data information used for accrual budgeting is accurate and complete. Without the data integrity management processes and the data quality requirements being finalized and implemented, the data required to manage the Capital Investment Fund may not be complete or accurate, and investment decisions may be made based on unreliable project data, leading to investment decisions not being aligned with the departmental objectives. In the interim, Finance Branch implemented some data integrity activities such as data-quality checks to improve the completeness and adequacy of critical fields data.

Recommendation 4

The Assistant Deputy Minister, Finance Branch, should ensure that data integrity management processes, which establish data quality requirements, be developed and implemented to ensure the completeness, accuracy and consistency of the data required to support accrual budgeting related business functions.

Action Plan 4

Accrual Budgeting Project Office will complete the scheduled work to establish the data quality requirements in accordance with the Data sub-project Charter. The target completion date for this action plan is June 2023.

Conclusion

We found that governance, change management activities and key processes existed and enabled the department to transition to, and function under, the accrual budgeting framework. However, improvement is required in the areas of change management, processes and data integrity.

Acknowledgement

In closing, we would like to acknowledge, recognize, and thank the Finance Branch for the time dedicated, and the information provided during the course of this engagement.

Audit team

Director, Procurement Audit: Marina Leigertwood-Joseph

Internal Audit Project Leader: Matt Xu

Senior Internal Auditor: Richard Mayer

Appendices

Below there are 5 appendices relating to allocated amounts by portfolio and branch, audit criteria and methodology, governance structure including mandate and membership, accrual budgeting governance, and change management assessments over the last 3 years.

Appendix A: Portfolio, responsible branch and allocated amount based on the December 2019 data

| Portfolio | Responsible Branch | Amount allocated in millions |

|---|---|---|

| Office | Real Property Services Branch | $9,480 |

| Parliamentary | Science and Parliamentary Infrastructure Branch | $4,039 |

| Engineering | Real Property Services Branch | $1,307 |

| Digital | Digital Services Branch | $991 |

| Sciences | Science and Parliamentary Infrastructure Branch | $511 |

| Fleet | Real Property Services Branch | $14 |

| Total | $16,342 | |

The amounts were provided by the Finance Branch.

Appendix B: Audit criteria and methodology

Based on the Office of the Chief Audit, Evaluation and Risk Executive risk assessment, the following lines of enquiry were identified:

Criteria

| Lines of enquiry | Criteria |

|---|---|

1. Governance: There is adequate governance in place to ensure oversight of the delivery of the accrual budgeting project. |

1.1 Design: Governance structures are in place and have adequate composition and representativity of stakeholders involved. |

| 1.2 Implementation: Governance bodies provide direction to the accrual budgeting project. | |

| 1.3 Adequacy: Monitoring and reporting mechanisms are in place and provide senior management and governance bodies with timely and accurate information required for oversight and decision-making. | |

2. Change management: There is a change management strategy in place, which includes stakeholder engagement. |

2.1 Design: A change management strategy is in place, specifically in regards to stakeholder engagement and involvement. Key stakeholders have been identified, roles and responsibilities have been defined, and adequate communication and training plans have been put in place with milestones, deadlines and dedicated resources. |

| 2.2 Implementation: The change management strategy has been executed, and tools and training are in place to allow stakeholders to implement the project, and apply the accrual budgeting requirements. | |

| 2.3 Adequacy: Change management activities achieve adequate results. | |

3. Processes: The key processes of the accrual budgeting initiative have been designed, have been implemented and are adequate. |

3.1 Design: There is a clearly defined process in place to allocate accrual space across portfolios, and within portfolios that is communicated to all stakeholders involved, including the regions. |

| 3.2 Implementation: The process, procedures and tools to allocate accrual space have been implemented, and consistently applied. | |

| 3.3 Adequacy: Processes are established with clear objectives, defined accountabilities, and roles and responsibilities as well as clearly described steps to perform accrual budgeting related activities. | |

4. Data Integrity: Data integrity management processes are in place that establish data quality requirements, including relevant data to be used to support accrual budgeting related business functions. |

4.1 Design: There is a clearly defined process in place to establish data quality requirements including relevant data required to support accrual budgeting activities across and within portfolios. The process and requirements are communicated to all stakeholders involved, including the regions. |

| 4.2 Implementation: The process to manage data quality requirements for accrual budgeting has been implemented and communicated to relevant stakeholders. | |

| 4.3 Adequacy: The data integrity management process defines what data should be used, the source of the data, and other data quality requirements to ensure accuracy, completeness, and consistency of data required to support accrual budgeting activities. |

Methodology

The methodology for examination includes the following:

- the planning phase will include document collection and review, as well as interviews with key stakeholders in the Finance Branch, Real Property Branch, Digital Services Branch, the Ontario and the Quebec regions, involved in the accrual budgeting

- the examination phase will include in-depth interviews with key departmental personnel along with additional documentation review

- at the end of the examination phase, the audited organizations will be requested to provide validation of the findings

- during the reporting phase, the audit team will document the audit findings, conclusions and recommendations in a Director's Draft Report

- this report will be internally cleared through the Office of the Chief Audit, Evaluation and Risk Executive quality assessment function

- the audited organization will be provided with the Director’s Draft Report and will be requested to review and comment on the report

- comments will be assessed and incorporated in the Chief Audit, Evaluation and Risk Executive's Draft Report

- this report will be sent to the audited organization for final acceptance

- a management response to the report, and a Management Action Plan in response to the audit recommendations, will be requested if applicable

- the Draft Final Report, management response, and Management Action Plan if applicable will be tabled at the Departmental Audit Committee meeting for final approval

Appendix C: Governance structures’ mandate, and membership

| Committee | Mandate | Membership |

|---|---|---|

| Director General Consultation Committee | Acts as an advisory group and consultation forum that provides stakeholders input, advice and consultation services with regards to the development and implementation of the Accrual Budgeting Project. |

Key positions from the following areas: Branches:

Regions: Pacific, Western, Ontario, Québec, Atlantic |

| Director Cross Functional Network Committee | Acts in an advisory and consultation manner providing stakeholders input, advice and consultation services with regards to the development and implementation of the Accrual Budgeting project. Advises and provides recommendations to the Finance Branch’s project team and the Project Management Office. |

Key positions from the following areas: Branches:

Regions: Pacific, Western, Ontario, Québec, Atlantic |

| Investment Management Board | Provides strategic direction in support of the management of the Capital Investment Fund, informs the Minister of sensitive issues related to the Investment Plan, and addresses areas of greatest risks in achieving departmental objectives. |

Personnel:

Branches:

|

| Finance Management Committee | Advises and provides recommendations to the Deputy Minister and Associate Deputy Minister on financial management issues. |

Branches:

Regions:

|

| Strategic Operations Committee | Provides strategic performance oversight, health monitoring, advice and recommendations related to project implementation, program and service delivery regardless of funding source. |

|

Appendix D: Accrual budgeting governance

Image description

This diagram presents the governance structure and committee members who communicate information on the accrual budgeting project. The Deputy Minister, who communicates information to the Investment Management Board and the Strategic Operations Committee, has a bilateral communication relationship with the Project Sponsor – Chief Financial Officer. The Project Sponsor – Chief Financial Officer, who communicates information to the Finance Management Committee, has a bilateral communication relationship with both the Deputy Minister and the Project Owner – Director General, Budget and Cost Management. The Project Owner – Director General, Budget and Cost Management, who communicates information to the Director General Consultation Committee, has a bilateral communication relationship with both the Project Sponsor – Chief Financial Officer, and the Project Management Office. The Project Management Office, who communicates information to the Director Cross Functional Network Committee, has a bilateral communication relationship with the Project Owner – Director General, Budget and Cost Management.

Appendix E: Change management assessments

| Name of assessment | Date | Respondents |

|---|---|---|

| Prosci Change Triangle | March 2021 | Assistant Deputy Ministers, Regional Directors General and Director Generals |

| Prioritization - Awareness Desire Knowledge Ability and Reinforcement | December 2021 | Members of the Director General Consultation Committee and the Director Cross Functional Network Committee |

| Sponsor Coalition - Awareness Desire Knowledge Ability and Reinforcement | March 2022 | Assistant Deputy Ministers, Regional Directors General and Director Generals |

| Prosci Change Triangle | March 2022 | Members of the Director General Consultation Committee and Director Cross Functional Network Committee, and financial management advisors |