Evaluation of Mobile Devices and Fixed Lines

Table of contents

- Executive summary

- A. Introduction

- B. Methodology

- C. Findings related to enterprise objectives

- D. Findings related to service delivery

- E. Findings related to efficiency

- F. Conclusions and recommendations

- Appendix A: Service review recommendations

- Appendix B: Data collection methods and limitations

- Appendix C: Notional logic model for the evaluation of Mobile Devices and Fixed Lines

- Appendix D: Glossary of terms

- Appendix E: Glossary of acronyms

This publication is also available online on Shared Services Canada's website.

Permission to Reproduce

Except as otherwise specifically noted, the information in this publication may be reproduced, in part or in whole and by any means, without charge or further permission from Shared Services Canada, provided that due diligence is exercised to ensure the accuracy of the information reproduced is maintained; that the complete title of the publication is produced; that Shared Services Canada is identified as the source institution; and that the reproduction is not represented as an official version of the information reproduced, nor as having been made in affiliation with, or with the endorsement of the Government of Canada.

Commercial reproduction and distribution is prohibited except with written permission from Shared Services Canada. For more information, please contact Shared Services Canada at publication-publication@ssc-spc.gc.ca.

© His Majesty the King in Right of Canada, as represented by the Minister responsible for Shared Services Canada, 2023.

Shared Services Canada's Evaluation of Mobile Devices and Fixed Lines

ISBN 978-0-660-68879-4

Cat. No. P118-28/2024E-PDF

Publié aussi en français sous le titre :

Services Partagés Canada – Évaluation des services d'appareils mobiles et de téléphones fixes

ISBN 978-0-660-68880-0

No. de catalogue P118-28/2024F-PDF

Executive summary

Evaluation overview

The Office of Audit and Evaluation conducted an evaluation of Mobile Devices and Fixed Lines within the Telecommunications Program. The evaluation assessed the performance of Mobile Devices and Fixed Lines during the period of April 2019 to November 2022. The purpose of this evaluation was to inform decision making and identify potential implications for future operations. The evaluation assessed the alignment, responsiveness, effectiveness and efficiency of Mobile Devices and Fixed Lines.

Key findings

Mobile Devices and Fixed Lines were in alignment with enterprise objectives. SSC launched initiatives to modernize outdated telephony technologies, such as the Workplace Communications Project, and to reduce the device-to-user ratio, such as Fixed Line Rationalization. These initiatives supported the Policy on Service and Digital and were aimed at consolidating and standardizing telephony services. These efforts also demonstrated SSC's commitment to good stewardship of Government of Canada resources.

By introducing the Enterprise Service Model (ESM), SSC enhanced its governance to promote enterprise-level priorities. SSC also standardized its reporting on partner progress towards IT provisioning standards as specified in the Policy on Service and Digital.

Despite the many initiatives that aimed at achieving enterprise and stewardship outcomes, there was room for improvement in the effectiveness of Mobile Devices and Fixed Lines in delivering on enterprise objectives. SSC did not achieve its targets for eliminating non-essential fixed lines. At the same time, there was a significant increase in the number of mobile phones provisioned to federal employees. Since March 2021, there have been more mobile phones than public servants. In addition, actual reduction in fixed lines continued to fall behind projected levels, while mobile phones continued to increase at a rate exceeding projections. Based on partner projections for phone line usage contained in the Departmental Plans for Service and Digital, the overconsumption related to Mobile Devices and Fixed Lines will not be solved in the next 3 years.

The evaluation identified a number of factors that hindered SSC's ability to effectively deliver on enterprise objectives. Frequently changing interpretations of the IT provisioning standards set by Treasury Board Secretariat (TBS), ageing infrastructure and complex systems impacted SSC's ability to achieve goals set for modernization and phone line elimination targets. A lack of change management affected partner cooperation and understanding of these important initiatives, which, in turn, created delays and increased costs. External industry pressures such as supply chain and contract issues also hampered SSC's ability to reach its goals. Poor data quality interfered with SSC's ability to make progress towards its objectives as well.

From a service delivery perspective, Mobile Devices and Fixed Lines demonstrated a strong commitment to service excellence and made deliberate efforts to meet partners' needs as circumstances changed. However, there was room for improvement in responding to partners' information needs when it came to major change initiatives (e.g., ESM). Partners reported that they needed a clearer picture of the sequencing of service offerings and overarching roadmaps. This impacted partners' and SSC's ability to envision the end-state goal for modernizing and transforming telephony services.

Overall, Mobile Devices and Fixed Lines were effective. The services enabled partner departments and agencies to carry out their mandates by supporting communications, collaboration and enhancing remote and on‑site productivity. However, partners identified a number of challenges in SSC's recent performance in service delivery, including those related to ESM. These challenges impacted partners' confidence in SSC's ability to provide quality services.

The evaluation found that performance measurement throughout SSC was not robust enough to be effective in measuring outcomes. A key management tool for performance measurement is a logic model, which visually depicts the relationship between program activities, outputs and intended outcomes in the short, medium and long term. For telephony services, outcomes were vague and this made it difficult to identify the results that the program was trying to achieve. The logic models also failed to incorporate enterprise outcomes and desired results. Additionally, challenges with the accuracy of the Customer Satisfaction Feedback Initiative (CSFI) reporting appeared to have impacted its use as a reliable indicator to measure performance. This suggests that Telecommunications should consider ways to improve their measurement of and reporting on performance indicators.

Accessibility stakeholders identified barriers within Mobile Devices and Fixed Lines that made it difficult for persons with disabilities to access tools that could help them perform their jobs. The Accessible Canada Act (ACA) requires all federal organizations to prepare and publish accessibility plans every 3 years in consultation with persons with disabilities and their organizations. SSC's resulting Accessibility Plan described key barriers to accessibility that aligned with findings from this evaluation. For example, accessibility features were often not enabled on commonly available software and hardware, and accessibility tended to be an afterthought in some areas. Going forward, there is a need for Mobile Devices and Fixed Lines to align service offerings with relevant accessibility requirements as prescribed by the Accessible Canada Act, making services accessible by design and reducing the need for accommodation requests.

In terms of efficiency, the evaluation determined that costs per mobile device were competitive. However, overall telephony costs rose from 2020 to 2022 due to increased provisioning (e.g., pandemic and growing public service) and slower than anticipated fixed‑line reduction efforts. SSC made efforts to control rising costs by suspending and cancelling unused mobile phones, piloting softphones and addressing the timeliness of billing information to partners to help address overages.

Of concern, Telecommunications lacked visibility into reliable and detailed cost information for effective decision making and cost management. As SSC is now responsible for complete lifecycle costs for telephony, there is risk of increased cost pressures as Mobile Device and Fixed Line initiatives continue. Without relevant costing information and management tools, programs are unable to effectively model changes and efficiently conduct scenario analyses to predict financial impacts. Financial costing tools will be a key component for ensuring good stewardship over GC financial resources.

SSC also lacked end-to-end processes to manage the lifecycle of Mobile Devices and Fixed Lines. Other telephony processes, especially changes made to processes under ESM, were perceived as cumbersome and inefficient by both partner and SSC interviewees.

Recommendations

- Develop a standard operating procedure to support the launch of new Telecommunications service offerings or substantive modifications to an existing service offering to partners. This should include defining a communications and change management plan early in the process, and integrating stakeholder engagement and user centered design to help ensure partner telephony needs will be met.

- Develop a roadmap for all telephony services to support long-term strategic planning. This should include consultations with partners to identify and document their needs and concerns.

- Develop end-to-end processes for managing telephony services and devices. This should include a comprehensive information management system, documents detailing the roles and responsibilities of SSC and partners and processes for the safe disposal or repurposing of used devices. Partner input should be considered for processes that impact them. These processes should be widely communicated prior to implementation.

- Review telecommunication services to confirm compliance with accessibility requirements and to ensure services are disability inclusive.

- Establish and implement a process to develop logic models with specific immediate and intermediate outcomes and associated performance indicators for the Telecommunications Program in the Departmental Results Framework and Performance Information Profiles.

A. Introduction

This report presents the results of an evaluation of Shared Services Canada's (SSC) Mobile Devices and Fixed Lines, which are key components of the Telecommunications Program. In accordance with the Policy on Results, the evaluation assessed alignment with SSC 3.0, the responsiveness (relevance) and effectiveness of service delivery to partners, and the efficiency of Mobile Devices and Fixed Lines. The report is organized into 6 sections:

- Section A provides the description and context of Mobile Devices and Fixed Lines

- Section B describes the evaluation objectives, scope and methodology

- Section C presents the key findings related to achieving enterprise objectives, including the alignment of program activities with SSC objectives, the effectiveness of the program in achieving desired enterprise and stewardship outcomes, and the factors that affected achieving these outcomes

- Section D presents the key findings related to service delivery, including responsiveness to changing client needs and the achievement of service delivery outcomes for partners

- Section E presents the key findings related to efficiency

- Section F summarizes the study's conclusions and provides recommendations

1. Program description

1.1 The Telecommunications Program

During the period under review from April 2019 to November 2022, the Telecommunications Program provided voice, teleconferencing, contact centre services and the supporting telephony devices to enable communications in the Government of Canada (GC) workplace. The program was responsible for ensuring service continuity while modernizing telecommunication services for partner organizations and agencies, enabling mobilization of the workforce.

Under the 2016 Treasury Board Policy on Results, every department in the GC has established a Program Inventory that identifies all of the department's programs and describes how resources are organized to contribute to the department's Core Responsibilities and Results. According to SSC's 2022/23 Program Inventory, the Telecommunications Program included the following program components:

- Mobile Devices and Fixed-Lines

- Conferencing Services

- Videoconferencing

- Telecommunications Multi-Service Support

- Contact Centre Infrastructure Services

- Toll-Free Voice

The Telecommunications Program was delivered by the Digital Services Branch (DSB). Program components were managed under 2 directorates within the branch. The Telecommunications Directorate managed Mobile Devices and Fixed Lines. The Contact Centre and Conferencing Services Directorate managed the other 5 components.

1.2 Mobile Devices and Fixed Lines program component

Mobile Devices and Fixed Lines addressed the communication requirements of a wide variety of GC employees, which ranged from desk workers to highly mobile field workers. Telephony services were essential for employees who spent the majority of their day speaking on the phone and those who relied on the data-intensive capabilities of feature-rich mobile devices to do their work. These services were integral to the effective delivery of GC services to clients.

Specifically, the services provided under the Mobile Devices and Fixed-Line phones program component included:

Mobile device services

Mobile device services provisioned devices, accessories, and service plans for SSC partners and clients. Mobile device networks were managed by vendors, while service requests were managed by SSC. The mobile device services available were:

- Basic cell phones and voice and text plans

- Smartphones and voice, text and data plans

- Cellular-enabled tablets, Wi-Fi hubs and data-only plans

- Specialized devices and push-to-talk

- Subscriber Identity Modules (SIM) cards

Mobile device services were dependent on a vital enabling service, Enterprise Mobile Device Management (EMDM), which allowed mobile devices to securely connect to GC assets. SSC staff operated the EMDM service, which managed applications on smartphones. EMDM services included:

- Synchronization of enterprise email and calendar to phones

- Deployment of commercial and custom applications to phones

- Secure mobile access to GC extranet and partner intranets

Fixed line services

Fixed line services provisioned landline systems, services and devices using a combination of vendor-managed and SSC-managed services. Services included:

- Voice over Internet Protocol (VoIP)

- Central exchange (Centrex)

- Private branch exchange (PBX)

- Long distance telephone services (LDTS)

- Calling cards

1.3 Mobile Devices and Fixed Lines spending

Mobile Devices and Fixed Lines was the largest component of the Telecommunications Program. Total expenditures for Mobile Devices and Fixed Lines have increased from $250.7M in 2020/21 to $339.6M in 2022/23.

| 2020/21 | 2021/22 | 2022/23 | |

|---|---|---|---|

| Mobile Devices expenditures | $118.4M | $120.1M | $184.3M |

| Fixed Lines expenditures | $132.3M | $144.2M | $155.2M |

| Total Mobile Devices and Fixed Lines expenditures | $250.7M | $264.3M | $339.6M |

1.4 Program performance measurement

In accordance with the Treasury Board Policy on Results, departments across the GC developed Performance Information Profiles (PIPs) that identified the performance information for each program in their Program Inventory. At SSC, each branch has been responsible for establishing, implementing and maintaining their PIPs.

A logic model is an essential part of the PIP. Logic models visually depict the relationship between program activities, outputs and intended outcomes in the short, medium and long term. They also include the impact of a program and how a program links to related departmental core responsibilities.

Program logic models help determine what results a program should measure. A clear logic model should illustrate the purpose and context of the program. It also serves as guidance for developing meaningful evaluation questions and an effective evaluation methodology to assess program success in delivering the desired results.

The Telecommunications Program logic model from the 2022/23 PIP defined the following immediate, intermediate and ultimate outcomes for Mobile Devices and Fixed Lines:

- Immediate outcome: Voice services are well-managed and effectively procured

- Intermediate outcome: Voice services are available and enable collaboration and productivity

- Ultimate outcome: Government departments and agencies receive modern and reliable network services

Interestingly, these outcomes focused exclusively on service delivery outcomes to partners. The logic model did not include any outcomes that focused on achieving enterprise objectives or reflected the stewardship role that Shared Services Canada plays.

To assist with the identification of outcomes for the evaluation, a notional logic model was developed. The notional logic model was for evaluation purposes only and did not cover all components of the Telecommunications Program. The Notional Logic Model for the evaluation of Mobile Devices and Fixed Lines is in Appendix C.

2. Program context

2.1 Background

SSC was created in August 2011 to bring together IT infrastructure resources from 42 departments and agencies (SSC partners). The scale, scope and complexity of this type of merger was unparalleled in the GC.

One of SSC's responsibilities included managing and consolidating telephony infrastructure from SSC partners at sites across Canada. While SSC received some telephony employees from partners during its creation, some corporate memory loss of telephony infrastructure still occurred. Due to this corporate memory loss, information management for telephony infrastructure and services became disjointed. Over time, the number of phone lines also grew. Legacy networks became outdated, with many reaching end-of-support or end-of-life status.

To help address these challenges, SSC launched the Cost-Effective Telephone Services initiative in 2016, specifying that public servants should have a single telephony device. As part of that initiative, SSC shifted to a "mobile first" approach and encouraged partners to "cut the cord" to reduce the number of fixed-line phones. Accordingly, the number of mobile phone requests increased.

The Shared Services Canada Act was amended in 2017 to enable some partners to manage some services, including mobile devices, in-house. While this eased the pressure on SSC, it also resulted in a loss of control and knowledge of mobile device services.

2.2 Evolving context during the evaluation period

During the evaluation period from April 2019 to November 2022, Mobile Devices and Fixed Lines underwent a period of substantial change that impacted how the services were delivered, funded and governed. This included the launch of SSC 3.0, the new Policy on Service and Digital, and the introduction of the Enterprise Service Model.

2.2.1 SSC 3.0: An Enterprise Approach

In 2019, SSC launched its new strategy for service delivery. SSC 3.0 defined a whole‑of‑government approach to consolidate, modernize and standardize the GC IT infrastructure. It emphasized the transition from independent operations to common or enterprise approach.

Consistent with the enterprise approach, SSC's mandate for telecommunications was to transition the GC to a common, shared telecommunications infrastructure. As the common IT service provider, SSC was responsible for delivering modern and reliable telephony services. As the steward of GC resources, SSC was also responsible for delivering these services with a view to reduce costs, centralize their administration and rationalize service delivery. This was expected to achieve greater efficiencies, minimize risks, improve security and improve service quality.

2.2.2 Policy on Service and Digital

In April 2020, the new Treasury Board Policy on Service and Digital was published. The Policy articulated how GC organizations would manage service delivery, information and data, information technology and cyber security in the digital era. It established an enterprise-wide, integrated approach to governance, planning and management. Overall, the Policy advanced the delivery of services and the effectiveness of government operations. It also supported the Minister for Digital Government's mandate to lead Canada's digital transition. The management of these functions would be guided by the principles and practices outlined in GC Digital Standards. Under the Policy, SSC was responsible for providing related IT services in a consolidated and standardized manner to partners.

Of significance, the Standard on Information Technology Provisions (the Standard) in the Directive on Service and Digital provided concrete policy support for SSC's efforts to consolidate, modernize and standardize IT infrastructure. The Standard provided specifications for the provision of information technology to departments. According to the Standard, partners' consumption of IT services and provisions was subject to defined entitlement standards, accompanied by enhanced departmental service consumption reporting.

2.2.3 Enterprise Service Model

The Enterprise Service Model (ESM) was announced as a budget decision in 2021 and implemented in April 2022. ESM worked within the framework provided by the Directive on Service and Digital to consolidate SSC services, including Mobile Devices and Fixed Lines. It represented a whole-of-government enterprise shift, where every organization would use common IT infrastructure and each user would have common tools. It was expected that ESM would allow for faster turnarounds, enhanced collaboration, increased reliability and reduced risk.

Specifically, ESM was intended to:

- provide stable funding to enable longer term planning

- support the management of demand while ensuring service capacity

- be simple and cost effective to deliver

- be transparent to partners

- support an enterprise approach to service delivery

Prior to ESM, funding for SSC services was overly complex, inconsistent and costly to administer. Funding consisted of a patchwork of cost recovery and appropriations. In some cases, SSC billed partners for some or all of the service, while in other cases SSC was responsible for paying for the full service. The introduction of ESM eliminated the need to bill each partner for enterprise services. It was intended to provide SSC with better control to streamline common services and promote good stewardship of GC resources.

In order to fund ESM, a one-time appropriation was made from partner budgets in April 2022. Appropriations for most services, including Fixed Lines, were estimated from partners' actual usage of services in fiscal year 2019/20. For Mobile Devices, the appropriation was estimated based on each partner's usage in September 2020. This funding was intended to cover services now provided by SSC, including cost and volume protection. Going forward, cost recovery would only be used if warranted for a limited number of services, such as specific one-time business requests.

While ESM created benefits, the new model was not without risks. Rising costs and changing partner demands created a new need for SSC to carefully monitor available funding versus costs to ensure fiscal responsibility.

B. Methodology

This section describes the objective and scope of the evaluation, the specific evaluation issues and questions that were addressed, data collection methods and data limitations.

1. Objective and scope

The purpose of the evaluation was to inform decision making by providing a neutral assessment of the alignment, responsiveness, effectiveness and efficiency of Mobile Devices and Fixed Lines. After the completion of the initial evaluation report, additional data collection was conducted to assess SSC's performance in achieving its enterprise and stewardship objectives regarding Mobile Devices and Fixed Lines. This report presents findings on the responsiveness, effectiveness and efficiency of SSC's delivery of telephony services. It also presents findings from the additional data collection, which focused on SSC's enterprise alignment and stewardship role.

The evaluation addressed the following key questions:

- To what extent have Mobile Devices and Fixed Lines been aligned to SSC 3.0?

- How responsive have Mobile Devices and Fixed Lines been to changing client needs?

- How effective have Mobile Devices and Fixed Lines been in achieving the intended outcomes?

- What are the opportunities to improve efficiency?

The evaluation covered the period from April 2019 to November 2022. Data collection began in January 2022 and initially concluded in November 2022. In response to arising requirements, additional data collection took place from December 2022 to March 2023 and again from April to May 2023. The additional data collection focused on the degree to which the program had aligned its actions to the enterprise approach.

The evaluation was managed and conducted internally by the Office of Audit and Evaluation in accordance with the Treasury Board Policy on Results. The evaluation team was supported by external expertise to conduct the literature review and the partner survey.

2. Data collection methods

The evaluation used a mixed-method approach. Multiple lines of evidence, along with the triangulation of data, were used where possible to address all evaluation questions. Specifically, the evaluation used literature reviews, document reviews (including SSC Service Reviews), key informant interviews, observations, administrative data analysis and a client survey. There were a number of limitations, including the difficulty of disentangling the beginning of ESM from systemic issues, data gaps for line counts and the reality that partner perspectives findings reflect their perspectives at a specific point in time. Given that ESM was implemented in April 2022, it was too soon to determine whether ESM had achieved its intended impacts.

More information on the lines of evidence and the limitations appear in Appendix B.

C. Findings related to enterprise objectives

This section describes evaluation findings related to enterprise and stewardship objectives. It looks at the extent to which Mobile Devices and Fixed Lines sought to foster and support the enterprise approach. It also assesses whether the services were successful in achieving the desired enterprise outcomes. Finally, it identifies the factors that hindered the achievement of these outcomes.

1. Alignment with enterprise objectives

The evaluation examined the alignment of Mobile Devices and Fixed Lines with the enterprise approach. Overall, the evaluation found that SSC's actions were aligned with the enterprise approach and supported the Policy on Service and Digital.

Key Finding

Mobile Devices and Fixed Lines launched initiatives that were aligned with the enterprise approach and supported the Policy on Service and Digital. These initiatives also supported SSC’s role as the steward of GC resources.

1.1 SSC supported Treasury Board policy updates

The Policy on Service and Digital introduced the Standard on Information Technology Provisions in April 2020. The Standard specified a limit of one cellular device along with the lowest-tier cellular plan for GC IT Users and Call Centre Users.

During the implementation process of the Standard, technology and user requirements changed; telephony services also evolved and converged. Based on lessons learned from ESM and the early implementation stage of the Standard, SSC continuously revisited targets for modernization. SSC also collaborated with Treasury Board Secretariat and the GC Enterprise Architecture Review Board (GC EARB) to propose updates to the Standard.

Telecommunication's latest interpretation of the telephony provisioning standard was proposed in February 2023, specifying a one‑user‑to‑one‑telephony‑device ratio, whereby a user would be allocated one telephony device that was the most conducive for their workplace technology requirement. This interpretation had evolved from the previously proposed target of 1.2 devices per full-time employee (FTE). At the same time, interpretations of the Standard were subject to the needs of partners, recognizing that some job functions would have unique requirements.

1.2 SSC enhanced its enterprise governance and reporting

Prior to the introduction of ESM, governance and funding was structured around individual partners with differing preferences that did not always align with enterprise-level priorities. One of the expected results of ESM was stronger enterprise governance and priority setting. This, in turn, could allow SSC to deliver on enterprise objectives and meet partner enterprise IT needs within existing reference levels.

SSC standardized its reporting on partner progress towards IT provisioning standards using Departmental Plans for Service and Digital (DPSDs). SSC Client Executives and the Telecommunications Directorate collaborated with partners to build achievable plans and record these plans in DPSDs. These reports helped to forecast the rate at which departments would become compliant with the Standard established in Treasury Board policy.

Compliance status would then be reported to the GC Enterprise Architecture Review Board. Service consumption beyond entitlement standards required special approval from GC EARB. When exceptions were submitted for approval, partners were required to provide a rationale for the exceptions, and SSC was required to provide the associated cost and schedule implications. This approval process helped to ensure that exceptions to policy standards were sufficiently justified.

1.3 SSC modernized outdated telephony technologies

Traditional landline telephony systems were based on legacy technologies that were no longer reliable or cost effective. At the time of data collection, many partners still relied on legacy fixed‑line infrastructure. Some of these networks had reached end-of-support or end-of-life status. Telecommunications vendors informed SSC they would soon stop offering some legacy services. It was becoming increasingly difficult to locate necessary expertise and equipment to address service outages related to these systems.

In alignment with the Treasury Board standard for service provisioning, SSC focused on transitioning users from traditional desktop phones to mobile phones that supported modern GC work environments. For users who continued to require fixed lines (for example, users who had accommodation requirements or worked in security zones), legacy voice services were modernized and transitioned to enterprise Voice over Internet Protocol (VoIP) services. VoIP services were administered centrally from enterprise data centres, helped reduce support costs and improved security and service delivery.

To mitigate challenges with VoIP implementation at sites that did not have local area networks (LANs) or upgraded facilities, SSC implemented ‘VoIP-basic' solutions instead of full VoIP services. VoIP-basic delivered modern voice services on legacy LANs. Minimal upgrades (e.g., power, heating ventilation and cooling), which were a partner's responsibility, were required to support these solutions, thereby alleviating funding issues for partners. VoIP-basic solutions mitigated risks associated with end-of-life legacy voice infrastructure and offered a reliable service to meet business requirements for many years.

Modernization work was also ongoing under the Workplace Communication Services (WCS) Project. The WCS Project modernized legacy phone lines for the Department of National Defence and a small number of other government departments. Specifically, WCS aimed to modernize 170K legacy Private Branch Exchange(PBX) to enterprise VoIP services. As of December 2022, 27.2K PBX lines had been migrated to VoIP.

SSC also modernized legacy infrastructure through Real Property Projects. These projects ensured modern enterprise solutions were the default for new infrastructure requirements and existing workplace fit-ups. SSC worked with partners to determine the optimal telephony solution for their voice service requirements. Enterprise VoIP and cellular solutions were recommended for real property projects whenever possible.

For mobile phones, SSC developed a mobile device refresh plan to ensure that GC mobile devices remained up to date. Under this plan, GC mobile phones followed a "3 + 1" year refresh model and provided users with a new device after 3 years. This approach balanced cost efficiency with GC security requirements and the functionality needs of users.

1.4 SSC implemented initiatives to reduce device-to-user ratio

In alignment with Treasury Board Standards for service provisioning, SSC implemented initiatives to eliminate superfluous and unused telephone lines.

SSC introduced the Fixed Line Rationalization (FLR) initiative to eliminate non-essential fixed line phones. The goal of FLR was to improve the efficiency of telephony services across government and ensure judicious use of public funds. SSC also implemented the zero usage initiative to reduce the number of unused mobile phone plans across the GC. A more detailed discussion of these initiatives is contained in section E – Findings Related to Efficiency.

2. Effectiveness – Enterprise and stewardship outcomes

The evaluation examined SSC’s effectiveness in achieving enterprise and stewardship outcomes. Overall, SSC made some progress towards achieving enterprise and stewardship outcomes, but there was room for improvement. The evaluation also identified a number of factors that hindered SSC’s progress towards achieving enterprise and stewardship outcomes.

Key Finding

Despite the many Telecommunications initiatives aimed at achieving enterprise and stewardship outcomes, SSC’s progress was slow. In fact, the number of mobile devices in circulation exceeded the number of federal employees since March 2021. According to partner projections in the 2022-2023 DPSDs, overconsumption will not be solved in the next 3 years.

2.1 SSC made some progress in eliminating phone lines, but the pace was slow

In February 2020, SSC developed an integrated service strategy for Mobile Devices and Fixed Lines. According to this strategy, SSC aimed to eliminate superfluous fixed lines at an average rate of at least 10% per year.

In March 2020, shortly before the introduction of the Policy on Service and Digital, there were 556,120 fixed lines across partner organizations (source: Enterprise Data Repository, extracted June 5, 2023). The number of fixed lines was reduced to 548,650 in March 2021, and further to 514,003 in December 2022, representing an average annual reduction rate of 2.8%. This was significantly below the 10% target.

Unfortunately, SSC did not achieve its target elimination rate for fixed lines.

| Date | Fixed Line Count | Annual Percent Reduction |

|---|---|---|

| March 2020 | 556,120 | N/A |

| March 2021 | 548,650 | 1.3% |

| December 2022 | 514,003 | 6.3% |

| Annualized (7.6% total reduction over 33 months) | 2.8% | |

SSC worked closely with the Office of the Chief Information Officer (OCIO) of the GC to manage the number of GC phone lines. This was mainly managed according to the provisioning standards established in the Directive on Service and Digital, which took effect in April 2020.

In the GC, a "workpoint" was any space where employees could perform their work. Each workpoint was equipped with furnishings and digital tools that supported a variety of tasks and varying degrees of interaction or concentration.

The Directive on Digital and Service defined 9 IT user and workpoint profiles. The most common profile was the "GC IT User." A GC IT user was defined as a general IT user equipped to work at and away from a workpoint, outside GC offices, or in telework or remote work situations. Under the Standard on Information Technology Provisions, GC IT Users were entitled to one cellular device and one lowest-tier cellular plan. Exceptions could be made for secure or classified information or communications, where a second cellular device and second cellular plan could be provided.

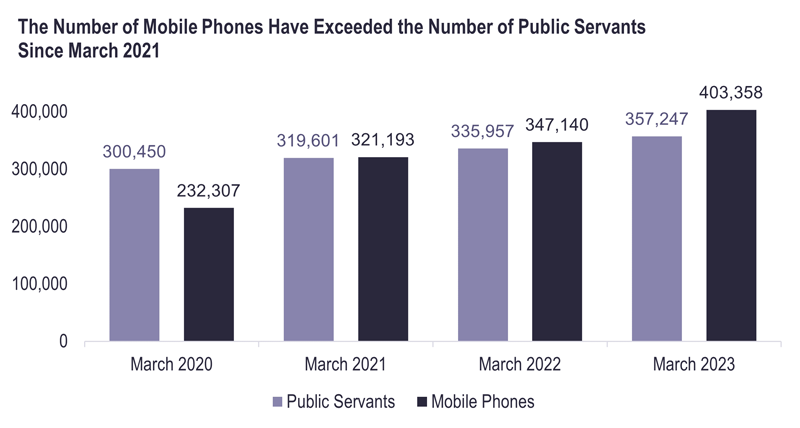

From March 31, 2020, to March 31, 2023, the number of indeterminate employees, term employees, casuals and students in the federal public service (i.e., the core public administration and separate agencies) grew from 300,450 to 357,247, representing an 18.9% increase.

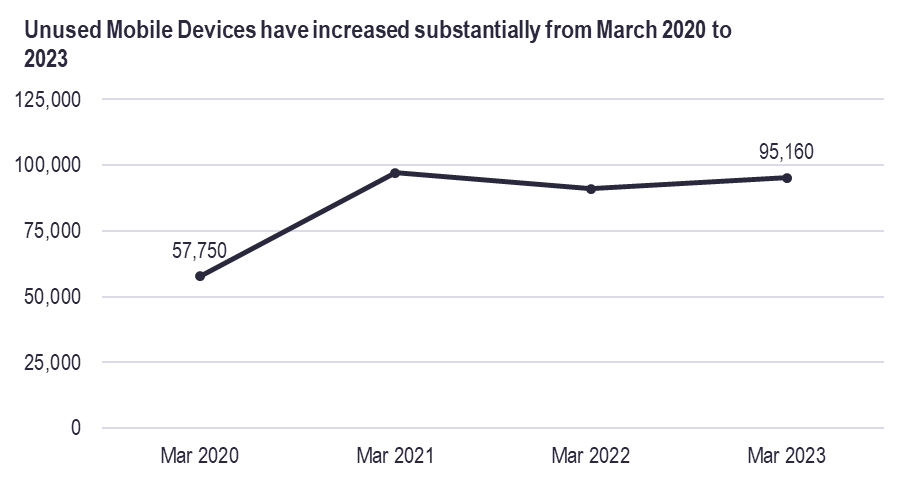

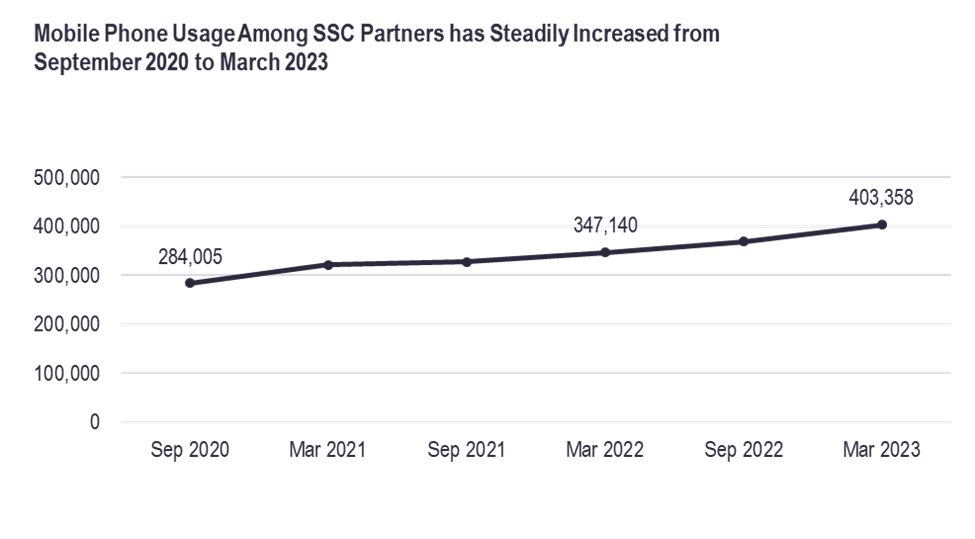

During the same period, the number of mobile phones provided to this population increased at a considerably higher rate. Specifically, the number of mobile phones (including suspended devices) increased from 232,307 in March 2020 to 403,358 in March 2023. These 171,051 new phones represented a 74% increase over 3 years.

While some public servants (such as classified users) may have had valid reasons for having additional devices, there were more mobile phones than public servants. Specifically, the ratio of mobile phones (including suspended devices) to public servants increased from 0.77 in March 2020 to 1.13 by March 2023.

Long description

The graph shows that the number of Mobile Phones have exceeded the number of public servants since March 2021.

| Year | Number of Public Servants | Number of Mobile Phones |

|---|---|---|

| March 2020 | 300,450 | 232,307 |

| March 2021 | 319,601 | 321,193 |

| March 2022 | 335,957 | 347,140 |

| March 2023 | 357,247 | 403,358 |

Sources: TBS Population of the federal public service and Canada (Population of the federal public service - Canada.ca); data from SSC (Enterprise Data Repository (EDR), accessed May 2023).

2.2 While SSC made progress towards achieving GC standards, projected levels of phone usage could not be sustained

Together, FLR and the enhanced reporting required under ESM were working to bring SSC partners closer to the standard of one telephony device per user profile. The DPSDs) contained partner projections of their phone needs for the next 3 years. SSC compiled this information into reports to track partner progress on reducing over consumption. According to the 2022-2023 Consumption by Partner report, partners projected they would increase their mobile devices by 33,843 and decrease their fixed lines by 130,185 in fiscal year 2022/23. Comparing these DPSD projections with the actual change in partner phone line usage demonstrates that the number of fixed lines did not decrease as much as projected by partners. At the same time, it shows that the number of mobile devices increased more than partner projections.

Long description

The graph shows that in fiscal year 2022-23, the number of mobile devices increased more than projected by SSC partners and the number of fixed lines did not decrease as much as projected by partners.

| Type of Phone | Projected Change | Actual Change |

|---|---|---|

| Mobile Devices | + 33,843 | + 56,218 |

| Fixed Lines | - 130,185 | - 54,976 |

Sources: Based on data from SSC (2022-23 Consumption by Partner report; EDR, accessed May 2023).

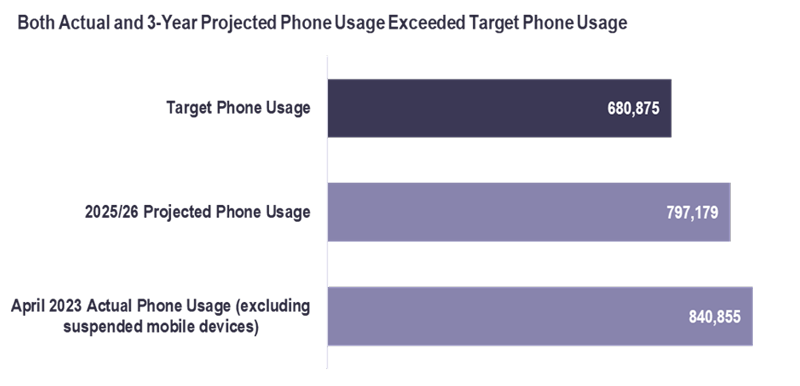

As reported in the Quarter 4 2022-2023 Consumption by Partner report, as of April 2023, there were 840,855 total phone lines (excluding suspended mobile devices), but only 680,875 user profiles and workpoints. This represented an overconsumption of 159,980 phone lines. Furthermore, partner projections for their expected 3-year demand for Mobile Devices and Fixed Lines was 797,179 phone lines. These projections indicate that there would still be an overconsumption of 116,304 phone lines in fiscal year 2025/26. According to the DPSD report, "in aggregate, across the GC, SSC does not have sufficient appropriations to sustain actuals at these levels."

Based on these projections from the 2022-2023 DPSDs, there was no evidence that this overconsumption issue would be resolved in the next 3 years.

Long description

The graph shows that both actual phone usage among SSC partners in April 2023 and partners’ projected phone usage in fiscal year 2025/26 exceeded SSC’s target phone usage. This illustrates that as of April 2023, there was no evidence that the issue of phone overconsumption in the GC would be resolved in the next three years.

| Target Phone Usage | Projected Phone Usage in FY 2025-26 | Actual Phone Usage in April 2023 (excluding suspended mobile devices) |

|---|---|---|

| 680,875 | 797,179 | 840,855 |

Source: Based on data from SSC (Q4 2022-23 Consumption by Partner report)

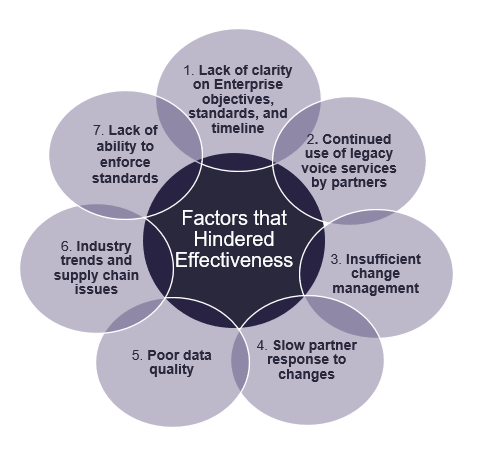

3. Analysis of hindering factors

The evaluation identified 7 factors that have hindered SSC’s effectiveness in achieving desired enterprise and stewardship outcomes :

Long description

There were seven factors that hindered SSC’s effectiveness in achieving outcomes:

- Lack of clarity on Enterprise objectives, standards, and timelines

- Continued use of legacy voice services by partners

- Insufficient change management

- Slow partner response to changes

- Poor data quality

- Industry trends and supply chain issues

- Lack of ability to enforce standards

3.1 There was a lack of clarity on enterprise objectives, standards and timeline

The evaluation team observed some confusion over the enterprise approach and its objectives among employees in the Telecommunications Program and elsewhere in SSC. It was unclear the extent to which this lack of clarity impacted SSC's ability to make progress on its objectives.

There was also confusion over the Telecommunication Program's various interpretations of the IT provisioning standards set by TBS. From 2019/20 to 2022/23, there were 5 different interpretations of the IT provisioning standards. The initial interpretation in June 2021 set a ratio of 1.4 telephony devices per FTE, shifting to 1.2 devices per employee in February 2022. The proposed interpretation in early 2023 was 1 telephony device per user profile plus non-human lines (e.g., elevators, security lines, etc.) as required. While most of these interpretations were not officially ratified, partners were aware of some of them. This presented a moving target to partners, which may have made it difficult for some partners to align their telecommunication plans to SSC's interpretation of the IT provisioning standards.

According to the program document review, the Telecommunications Program identified timelines to achieve telephony service consumption targets within some strategy updates and proposals. These timelines had been communicated in an inconsistent way. For example, in fiscal year 2019/20, the telecommunications integrated service strategy specified a target to reduce Centrex and PBX lines by 10% per quarter. In fiscal year 2021/22, Telecommunications identified a target to achieve 1.2 phone lines per FTE by fiscal year 2024/25. This inconsistency in communicating timelines, coupled with the different interpretations of the IT provisioning standards, could have made it difficult for SSC to define and achieve phone line elimination targets.

It is important to note that by fiscal year 2022/23, timelines to comply with the IT provisioning standards set by TBS were developed by partners during the digital planning process.

3.2 The continued use of legacy voice services by partners created challenges for SSC for modernization and consolidation

The legacy environment that many partners still relied upon for voice services caused complications and delays for modernization. In particular, ageing IT infrastructure and complex systems were problematic.

One of SSC's goals was to consolidate partner voice services. This was a significant and onerous task that was hampered by a complex patchwork of different partner systems and approaches. At the time of data collection, SSC was still working through vendor invoices to identify and rectify billing errors and over-billing that originated before SSC's creation.

Furthermore, according to internal interviewees, telephony architecture was too complex. This complex infrastructure could introduce several points of failure when migrating partners from legacy to modern services. This could create delays when something went wrong, since SSC would have to "follow the breadcrumbs" to determine what happened. There were also a lot of standalone fixed‑line sites that required time-consuming individual visits for software patches and updates. SSC was working on consolidating these sites to a central core with a goal to centralize administration.

Ageing partner infrastructure also hampered efforts to modernize telephony infrastructure. According to interviewees, some of the back-end technology partners relied upon was over 30 years old. In many cases, this legacy infrastructure had to be replaced before a partner could be onboarded to modern service solutions. Sometimes it could cost millions of dollars to replace or upgrade legacy infrastructure.

3.3 There was insufficient organizational change management

Change management is a collective term for approaches to prepare, support and help individuals, teams and organizations in making organizational changes. Telephony services had undergone a period of substantial changes before and during the evaluation. These changes significantly impacted how the services were delivered, funded and regulated. These changes continuously brought risks and opportunities to both SSC and its partners. In order to successfully manage the changes that affected partners, SSC needed an effective change management strategy.

SSC had a number of internal supporting functions available such as Change Management, Behavioural Insights, and Service Design. These functions were designed to provide certain in‑house expertise to help programs design and manage changes to services. External expertise was also available to support SSC in navigating critical organizational change processes.

The evaluation did not find evidence that SSC had leveraged appropriate change management expertise. As a result, many issues occurred, which impacted SSC's ability to deliver effective telephony services to partners and meet enterprise objectives.

Section D takes a closer look at SSC's responsiveness to partners' information needs.

3.4 Some partners were slow to respond to changing requirements

Due to the lack of organizational change management, partners did not always have sufficient understanding of the reasons behind the changes. For example, since partners had not paid for fixed line services since SSC's creation in 2011, they did not have visibility on the cost of non‑essential phone lines. Furthermore, many partners did not understand that the initial appropriation amounts to SSC in 2011 had been eroded due to increased costs and demands for the services. In the words of one SSC interviewee, "In general, one of the challenges right now is that partners don't appreciate that the function of SSC is to save the GC money. They don't see the savings, and often the changes SSC makes are seen as increasing costs on their end."

The Fixed Lines Service Review and interviews for this evaluation identified 3 additional factors that contributed to the slow response by partners. Some partners had competing priorities and lacked financial incentives to complete the work. Others lacked staff to complete the work while maintaining essential operations. Finally, some partners did not believe they had a reliable replacement for fixed lines. Due to these factors, the planned reduction in fixed lines did not occur on schedule. As of October 2022, 43% of partners had not completed the line validations needed before SSC could eliminate a fixed line.

Section D takes a closer look at the sequencing of service offerings and roadmaps.

3.5 Poor data quality was a barrier to making progress towards enterprise objectives

Poor data quality was another barrier for SSC's progress towards achieving its goals. This included both data that SSC was responsible for maintaining and other data sources that SSC relied upon for decision making.

There was a need for SSC to improve the information management of its assets within Mobile Devices and Fixed Lines. It was well‑known that prior to FLR line validation exercises, SSC did not have complete knowledge of which partners owned which fixed lines and where the fixed lines were located. There were 2 main reasons for this. First, SSC received incomplete information about partner telephony assets upon its creation in 2011. Second, there was no clear process to inform SSC of changes to fixed‑line ownership when partners stopped using offices. As a result, SSC had to rely upon partners to validate which lines they owned and where they were located. This was a lengthy process that had to be completed before partners could inform SSC which fixed lines could safely be disconnected. According to internal interviewees, SSC also did not have complete knowledge of some mobile devices. This related mainly to partners who had taken over provisioning of their own mobile devices, as per Bill C-44 from 2017. In some cases, differences between SSC's and partners' records for mobile devices had to be reconciled when reference levels for ESM were calculated.

There were also challenges with external data that SSC relied upon to set telephony targets for partners. Initially, partner phone line elimination targets were calculated using FTE data from each partner. However, it was later identified that partner FTE data did not provide an accurate representation of the number of public servants who required a phone line. This led to revisions to the proposed target ratio of phones to public servants.

3.6 Some industry trends impacted SSC's modernization efforts

There were some factors that SSC had limited control over. These external pressures included influences from the telecommunications industry and supply chain issues.

Some of SSC's Fixed Lines and most of its Mobile Devices (EMDM services as the only exception) were managed by vendors. This meant that vendors and industry trends impacted the services. For example, vendors were phasing out their Centrex service offerings, but some partners still relied on Centrex lines. SSC was able to negotiate a contract extension for Centrex services but at a significant increase in cost.

Another way in which vendors impacted SSC's progress towards its goals was through their performance in relation to contracts. For example, the Workplace Communication Services project to modernize fixed lines was contracted out to an external vendor. The contract was deeply affected by severe delays that finally resulted in SSC redefining the scope of the work.

During the evaluation, global supply chain issues also impacted SSC. There was a chipset shortage that had wide-reaching impacts across the IT industry. This resulted in order backlogs and sometimes impacted which phones partners could obtain. Internal interviewees identified that careful planning and bulk phone orders could help offset supply chain issues.

3.7 SSC lacked the ability to enforce standards

While entitlement standards for telephony were an important policy tool to assist SSC to rationalize usage of phone lines, they were not enough on their own to meet line reduction targets for fiscal year 2022/23. According to internal interviewees, SSC lacked the ability to force partners to cut fixed lines. SSC also lacked the ability to say "no" when partners requested mobile devices, regardless of whether a request exceeded a partner's DPSD projections or entitlement standards. While this was an appropriate approach to ensure that partners had unimpeded access to needed services, it meant that SSC was not applying enforcement mechanisms to ensure partner compliance with standards. As a result, SSC relied heavily on partner cooperation to bring Mobile Device and Fixed Line usage in line with GC standards.

D. Findings related to service delivery

This section describes evaluation findings related to responsiveness and effectiveness for service delivery outcomes. Relevance is the extent to which a program addresses a demonstrable need. Responsiveness is a dimension of relevance and it focuses on the extent to which a program’s objectives and design respond to beneficiary or partner needs and continue to do so as circumstances change.

1. Responsiveness to changing client needs

The evaluation examined how responsive Mobile Devices and Fixed Lines had been to changing client needs. Overall, the evaluation found that while SSC was committed to providing client-centric services, there was room for improvement in meeting partners’ needs.

Key Finding

While SSC was committed to service excellence, there was room for improvement in its responsiveness to changing partners’ needs. Only 39% of partners believed that SSC understood their operational requirements for voice services.

1.1 While staff were committed to service excellence, SSC was not successful in responding to partners’ information needs

During interviews and in CSFI comments, partners consistently reported that Telecommunications staff were committed to providing good service and were great to work with. When surveyed in Q3 2022/23, 71% of partners agreed that SSC worked quickly to resolve serious issues with voice services. This was further supported by CSFI results from October 2020 to April 2022, which indicated that Mobile Devices and Fixed Lines met or exceeded target customer satisfaction scores.

Quotes from interviewees from partner organizations:

"When called on for an emergency, SSC is always right there."

"A lot of good people working there."

"The team is fantastic."

"The challenges we have, they react."

"We have a good relationship with the service lines."

"The people are great."

"I love the people on the service lines, they are open to suggestions."

"We appreciate the people and what they do for us."

"I see the hard work everyday."

However, SSC was not seen as successful in responding to partners' information needs on a number of initiatives.

According to external interviews, while the introduction of ESM was communicated widely, communication was not timely and did not trickle down efficiently to all relevant levels of staff. Interviewees reported that only high-level details were shared before ESM started. Only 33% of partner respondents believed that SSC had provided enough details about changes to voice services under ESM for them to make the changes in time for ESM's implementation.

At the time of the interviews in summer 2022, partners reported that many operational-level details were still missing 3 months after ESM was implemented. For example, partners lacked details on processes for device evergreening, processes for reconfiguring phones when users changed departments and whether there was a cap on ordering new mobile devices. According to interviewees, late communication about ESM impeded partners' abilities to complete their budgets and IT plans. Partners had been given details on ESM in February 2022 and this was after they had completed their planning for 2022/23. According to survey results in Q3 2022/23, only 39% of partners believed that SSC provided enough details for them to plan accordingly.

SSC's challenges in responding to partners' information needs led to perceptions that SSC did not understand partners' operational needs. In the survey in Q3 2022/23, only 39% of partners believed that SSC understood their operational requirements for voice services.

Long description

Results from four questions in the survey administered by the evaluation team in quarter three of fiscal year 2022-23.

- 71 percent of partners agreed that SSC worked quickly to resolve serious issues with voice services.

- Only 33 percent of partners reported that SSC provided enough details about changes to voice services under ESM for them to make the changes in time for ESM's implementation.

- Only 39 percent of partners believed that SSC provided enough details about ESM for them to plan accordingly.

- Only 39 percent of partners believed that SSC understood their operational requirements for voice services.

1.2 The sequencing of service offerings needed improvement

In summer 2022, some partners indicated there was misalignment between voice service standards, SSC initiatives and service offerings and partner needs. In particular, the sequencing of service offerings was problematic.

The Directive on Service and Digital stipulated that most public servants were entitled to a mobile phone for their work. However, at the time, many GC buildings had insufficient cellular signals. The upgrades required to boost cell phone signals were expensive and not within the budget of some partners.

Despite pressure from SSC to eliminate fixed lines, some partners believed that they did not have a viable alternative. These partners believed SSC was attempting to shut down one capability before another was enabled. This perception impacted partner progress on FLR. According to the survey in Q3 2022/23, while 78% of partners believed FLR was aligned with their needs, only 57% believed that SSC provided a realistic deadline for their organization to complete FLR activities.

While SSC had created roadmaps for some initiatives, such as FLR, the softphone pilot and EMDM activities, multiple lines of evidence suggested that an overarching plan for all telephony was missing. According to interviewees, this made it difficult for partners to visualize the future of telephony services. This was echoed in the survey in Q3 2022/23. Only 47% of survey respondents said that SSC had shared a clear roadmap for the future direction of voice services.

During the evaluation period, there had been several recent changes to telephony services with more changes planned. At the time of data collection, large departments reported that they were struggling to keep up with the changes. A comprehensive voice services roadmap would better enable partners and SSC to envision the end-state goal for the transformation of telephony services and plan accordingly.

As of June 2023, there was a Telephony roadmap that was being planned to be shared with partners.

2. Effectiveness – Service delivery outcomes

In evaluation, the core issue of effectiveness focuses on the impacts of a program and the extent to which the program is achieving its expected outcomes. Outcomes are the changes or consequences attributable to program outputs.

In terms of effectiveness in service delivery to partners, the evaluation considered telephony devices and services, client service and the quality of those services. It also examined how effectively services were monitored and measured through internal tools such as performance indicators and the CSFI.

Overall, Mobile Devices and Fixed Lines were effective. The program supported the ability of partners to carry out their mandates and serve Canadians; however, partners expressed concerns about the deteriorating quality of service. This was partially due to cumbersome SSC processes. The evaluation also identified some organization-wide challenges at SSC with performance measurement.

Key Finding

While SSC was effective overall in delivering telephony services to its partners, there was limited partner confidence in SSC’s ability to provide quality services.

2.1 Mobile Devices and Fixed Lines enabled partners to carry out their mandates

During the evaluation period, federal employees relied on voice services, such as Mobile Devices and Fixed Lines, to enable their work in serving Canadian citizens. Multiple lines of evidence showed that SSC’s telephony services were effective. When interviewed, partners independently and frequently indicated that SSC’s telephony solutions were critical services that enabled their workforce to stay connected to each other and to Canadians wherever they were. SSC telephony services enabled collaboration and increased the productivity of public servants.

SSC’s Departmental Results Report for 2021/22 indicated that the cellular network was available more than 99.5% of the time. Additionally, in the Q3 2022/23 survey, 69% of partners reported that SSC’s mobile phone services supported their organization’s delivery on its mandate. For fixed lines this was 84%.

Long description

Results from two questions in the survey administered by the evaluation team in quarter three of fiscal year 2022-23.

- Overall, 69 percent of partners reported that SSC’s mobile phone services adequately supported their organization’s delivery on its mandate.

- For fixed lines, 84 percent of partners reported that the services adequately supported their organization’s delivery on its mandate.

Interviewees provided many specific examples of how Mobile Devices and Fixed Lines supported, enabled and enhanced effective tasks. They helped safety organizations protect national security and uphold the safety of Canadians, and helped science organizations facilitate the collection of data. EMDM-enabled applications permitted public servants to enter data in real-time during inspections or other field work, saving time and boosting productivity.

The tethering feature on smartphones allowed public servants to connect a GC tablet or laptop to the Internet so they could continue working when they did not have reliable Wi-Fi. Cell phones kept public servants connected to their teams and emergency services at events and while doing field work. SSC’s deployment of cell phones during the COVID-19 pandemic enabled public servants across Canada to continue working and serving Canadians from home.

2.2 Partners expressed concerns about the deteriorating quality of service in 2022

While SSC's commitment to supporting partners was notable, interviewees in summer 2022 indicated that SSC had suffered damage to its reputation during the evaluation period due to recent performance. This reputational damage led some partners to believe that SSC was not capable of providing the level of service they required.

Partners' internal telephony teams reported that they were often blamed by end-users for poor service and indicated it was now outside their control to help these users directly. In Q3 of 2022/23, only 6% of survey respondents working in partner departments believed that SSC's performance in fulfilling voice service requests under ESM had a positive impact on their reputation with their clients.

Furthermore, only 44% of partners surveyed in Q3 2022/23 were confident about SSC's ability to meet their voice services needs under ESM. As a result of this lack of confidence, some interviewees and survey respondents expressed a desire to take back management of some or all aspects of Mobile Devices.

According to partner interviewees, there were several challenges that impacted Mobile Devices and Fixed Lines that contributed to a decrease in partner confidence in SSC's ability to deliver voice services. These included:

- ESM challenges, including its rushed implementation and lack of clarity

- asset and information management gaps

- insufficient consultation with partners prior to implementing service changes

- training gaps and software errors related to Onyx (the IT Service Management tool)

- lengthy delays in fulfilling partner requests

- cumbersome processes (including service desk processes and EMDM processes)

- unmet partner needs related to international telephony and service sequencing

These service issues likely contributed to the drop in Mobile Devices' CSFI rating. Prior to the implementation of ESM, the average rating peaked at 4.12 out of 5. By October 2022 this average rating was 3.02 out of 5, below the 3.60 target rating. It was also not clear why a 3.60 rating would be sufficient. This is lower than what many organizations set as their target.

Long description

Line graph demonstrating partner ratings of mobile devices and fixed lines services in the Customer Satisfaction Feedback Initiative questionnaire on services from October 2018 to April 2023. In general, mobile devices and fixed lines met or exceeded SSC’s target rating of 3.60 (out of 5.0) since October 2020. However, ESM-related challenges impacted partner ratings for mobile devices in October 2022.

| Date | Mobile Devices Score | Fixed Lines Score |

|---|---|---|

| October 2018 | 2.74 | 3.74 |

| April 2019 | 3.32 | 3.66 |

| October 2019 | 3.52 | 3.58 |

| October 2020 | 3.90 | 3.60 |

| April 2021 | 4.02 | 3.81 |

| October 2021 | 4.12 | 3.93 |

| April 2022 | 3.79 | 3.86 |

| October 2022 | 3.02 | 3.88 |

| April 2023 | 3.72 | 3.95 |

Source: Based on data from SSC (CSFI Service Questionnaire results)

2.3 There were organization-wide challenges at SSC with performance measurement

According to the Treasury Board Policy on Results, outputs are direct products and services that come from the activities of an organization, program or initiative. Outputs are usually within the control of the organization itself. By contrast, program outcomes are changes or consequences that are attributable to the direct products or services of the program.

The 2021/22 PIP performance indicators for Mobile Devices and Fixed Lines were:

- Indicator 1: Percent of time the fixed-line voice infrastructure is available

- Indicator 2: Customer satisfaction with telecommunications services

These indicators were not robust enough to sufficiently measure identified outcomes. Of specific concern, infrastructure availability directly stems from the activity of the program. This would be an output, not an outcome.

From a conceptual level, using customer satisfaction to measure outcomes arising from SSC performance for partner organizations was problematic. Specifically, customer satisfaction was a proxy for measuring the achievement of outcomes. Customer satisfaction could be vague, based on perceptions and affected by expectations. It could reflect satisfaction with outputs (for example, what was within the control of the program). This meant that customer satisfaction did not directly capture the real impacts of excellent or poor SSC performance and the ways in which SSC supported partners in delivering on their mandates.

There was room for improvement in the identification of immediate service delivery outcomes for the Telecommunications Program. The outcomes developed in the 2021/22 Performance Information Profile (PIP) for Mobile Devices and Fixed Lines were:

- Immediate outcome: Voice services are well-managed and effectively procured

- Intermediate outcome: Voice services are available and enable collaboration and productivity

These outcomes were vague and this made it difficult to identify the results that the program was trying to achieve or assess the bang-for-buck for investments in these services.

It should be noted these types of performance measurement challenges were observed across all of SSC's PIPs, and the Departmental Results Framework (DRF).

To address this gap, the evaluation team conducted a survey and asked partners whether Mobile Devices and Fixed Lines had adequately supported their organization's ability to deliver on its mandate.

Looking forward, partners provided several suggestions on the best ways to measure the business impact of SSC performance from a service delivery perspective. The top 3 suggestions that partners felt were the best way to measure the impacts of poor or excellent performance by SSC on end users were:

- track and report on time to fulfill requests from partners and resolve issues

- obtain feedback from end-users about their experience, including whether the service meets user needs

- track and report on the accuracy of request fulfillments from partners

Other suggestions for performance measurement from partners included:

- determine ease of use, availability, and quality of self-support information and technical support

- develop and track SSC performance on service-level standards and report results

- compare the cost of GC services to public offerings

- track the number of times a client must follow up on a request

- track the number of escalations required for requests or issues to be resolved

When it came to how partners measured the performance of their own teams, 94% of partner respondents tracked request fulfillment time within their department or agency, while 71% tracked client satisfaction and 34% tracked provisioning errors.

2.4 Partners and SSC employees raised issues with the CSFI that had implications for it's accuracy in measuring SSC performance

The purpose of the CSFI was to provide quarterly measurements of partner satisfaction with SSC services in general, as well as with specific services, such as Telecommunications. Several challenges with this measurement tool surfaced independently and consistently during partner interviews, and this was further supported by evaluation survey results.

In Q3 2022/23, only 33% of respondents believed that the mechanisms SSC used to receive feedback from partner organizations enabled clients to clearly communicate concerns. These challenges had implications for the CSFI's use as a robust and reliable indicator for measuring service line performance.

Some partners had multiple telephony teams that all provided responses to the CSFI. Interviewees reported that their responses were averaged before submission to SSC. This created situations where, if one area received excellent service and another received poor service within the same partner organization, this level of detail was lost. This impacted the accuracy of SSC's understanding of partner satisfaction.

Additionally, some partners submitted their CSFI responses with an awareness of their audience, which impacted their ratings and comments. Of specific concern, some partners reported that they had moderated their critical ratings and comments on the CSFI due to a perception that their Client Executive's performance bonus was linked to CSFI survey results. Partners viewed Client Executives as their champions within SSC for resolving their issues with service delivery.

This finding suggests that Telecommunications should consider ways to improve their measurement of and reporting on performance indicators.

2.5 There were barriers within Mobile Devices and Fixed Lines services that made it difficult for Persons with Disabilities to access tools that could help them perform their jobs

The Accessible Canada Act is a federal law that came into force in 2019, which aims to make Canada barrier-free by 2040. Part of the focus of the ACA is to identify, remove and prevent barriers in employment for persons with disabilities. It requires all federal organizations to prepare and publish accessibility plans in consultation with persons with disabilities and their organizations.

Accessible Canada Act

The Accessible Canada Act (ACA) aims to realize a barrier-free Canada by 2040.

Barriers are things that prevent people with disabilities from fully and equally participating in society. Barriers can exist in physical spaces, in communication technologies, in policies, programs and services, and in attitudes.

ACA aims to identify, remove and prevent barriers in the federal jurisdiction in the following priority areas:

- employment

- buildings and public spaces

- information and communication technologies

- use of sign languages

- procurement of goods and services

- design and delivery of programs and services

- Transportation

SSC 3.0 recognizes that "Federal employees need modern digital tools that are accessible by design; enhance their productivity and allow them to collaborate across departments to deliver the essential services Canadians rely on."

At the time of data collection, there was no document outlining service line responsibilities to ensure information and communication technology was accessible by design. Inclusion requirements were often not proactively considered when telephony systems or services were procured. For example, when VoIP devices were launched, they were not evaluated for accessibility. This meant that public servants who required accessibility features on fixed lines had to use legacy devices and technology. This was not in line with the ACA's goals.

Adaptive technology in smartphones could assist the GC in meeting its accessibility goals; however, SSC's configuration of smartphones made accessibility features difficult or impossible to use. This resulted in a lack of options for public servants with disabilities. In the words of one interviewee, when SSC made changes to its configuration of smartphones, "my phone went from being partially usable to not usable at all. It is not the device but the GC layer, policies, lack of software available in the workspace." According to the interviewee, smartphones configured by SSC were difficult to even unlock for some persons with disabilities. Other examples of accessibility features that were difficult to obtain at the time of data collection included Siri (which is a critical enabling feature for people with visual impairments) and document readers. In contrast, some departments that did not use SSC's Mobile Device services did not have the same challenges to make accessibility options available on smartphones when needed.

The lack of accessibility options in GC Mobile Devices and Fixed Lines at the time of data collection contributed to a need for public servants with disabilities to submit accommodations requests to SSC’s Accessibility, Accommodation and Adaptive Computer Technology program. While accommodation requests were a critical service, ad-hoc solutions were often time consuming and costly compared to an accessible-by-design approach, and they often could not fully meet the needs of public servants with disabilities. Building accessibility features into Mobile Devices and Fixed Lines services at the onset would reduce the need for accommodations requests, saving resources and promoting inclusion.

It is important to note that SSC released an Accessibility Plan in December 2022 that had been developed in consultation with persons with disabilities. The Accessibility Plan described key barriers to accessibility that aligned with findings from this evaluation. For example, accessibility features were often not enabled on commonly available software and hardware, and accessibility tended to be an afterthought in some areas. The Plan also developed goals to address accessibility shortcomings. Going forward, there is a need for Mobile Devices and Fixed Lines to build accessibility into their services at the onset to align with accessibility goals.

E. Findings related to efficiency

The evaluation examined whether the services were delivered in a cost-effective and timely manner, and whether there were opportunities to improve operational efficiency.

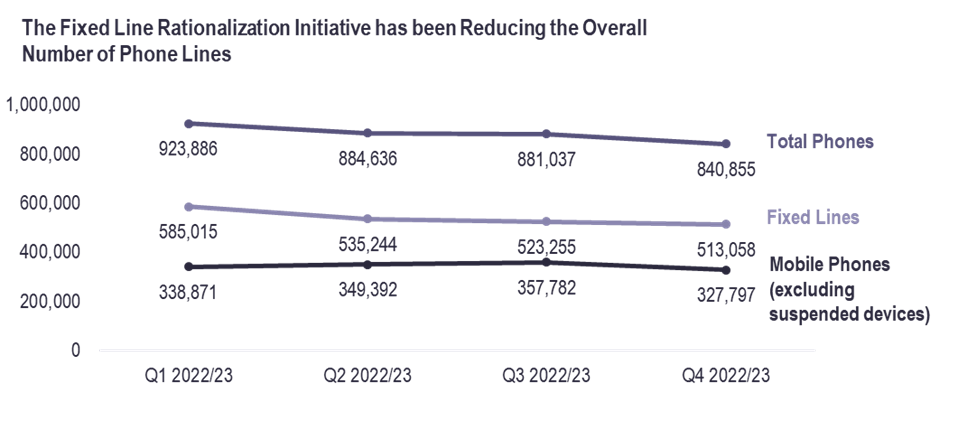

Overall, SSC's telephony expenses had risen since the start of the pandemic because of significant increases in the number of mobile phones provided to public servants. During the evaluation period, the program tried to reduce costs by reducing the number of fixed lines. It also made considerable efforts to contain costs by identifying and cancelling unused mobile phones; introducing softphones; and providing billing information to partners in a more timely manner.

Under the new ESM, SSC carried all of the risk for any uncontrolled spending. To ensure the successful delivery of the new strategic roadmaps for services and identify opportunities for efficiency improvements, SSC needed improved costing information for decision making. Specifically, there was a need for complete cost information for services (including benchmarks and disaggregated data), better lifecycle cost information, and new scenario planning tools.

Furthermore, the evaluation also found a number of areas in telephony processes where efficiency could be improved.

1. SSC’s telephony costs were increasing

Key Finding

While costs per mobile device were competitive, overall telephony costs rose because of increases in the number of mobile devices provisioned.

While it is difficult to find relevant benchmarks for commercially confidential information, a review of industry trends suggested that SSC had negotiated excellent rates for voice, text and data cell phone plans. GC rates were significantly lower than retail rates. SSC also took advantage of bulk purchases of devices to receive price discounts.

Despite these competitive rates, SSC expenditures on telephony services increased from $196.7 million in 2019/20 to $264.3 million in 2021/22. This represented a 34% increase over 2 years. When SSC assumed responsibility for all Mobile Devices and Fixed Lines costs under ESM in 2022/23, total expenditures jumped to $339.6 million, representing a 73% increase since 2019/20. This was 12% higher than the initial budget allocation of $303.5 million.

Long description

Graph illustrating expenditures for fixed lines, mobile devices, and their combined total for fiscal years 2019-20 to 2021-22. Total combined expenditures for mobile devices and fixed lines increased by 34 percent since 2019-20.

| Fiscal Year | Mobile Devices Expenditures | Fixed Lines Expenditures | Total Expenditures |

|---|---|---|---|

| 2019-20 | $59.8 M | $136.9 M | $196.7 M |

| 2020-21 | $118.4 M | $132.3 M | $250.7 M |

| 2021-22 | $120.1 M | $144.2 M | $264.3 M |

Source: Based on data from SSC (obtained from the Telecommunications FMA)

The main driver for increased expenditures was the rise in the number of devices provided to public servants across the GC.

Key Finding