Audit of the Treasury Board of Canada Secretariat's Work Force Adjustment Processes for Budget 2012

Internal Audit and Evaluation Bureau

Final Report

Approved:

Table of Contents

Statement of Conformance

The Internal Audit and Evaluation Bureau (the Bureau) has completed the audit of the Treasury Board of Canada Secretariat’s work force adjustment processes stemming from Budget 2012. This audit conforms with the Internal Auditing Standards for the Government of Canada, as supported by the results of the Bureau’s quality assurance and improvement program.

Executive Summary

Background

The Work Force Adjustment Directive defines work force adjustment as follows:

a situation that occurs when a deputy head decides that the services of one or more indeterminate employees will no longer be required beyond a specified date because of a lack of work, the discontinuance of a function, a relocation in which the employee does not wish to relocate or an alternative delivery initiative.Footnote 1

Budget 2012 resulted in a high volume of work force adjustment cases across the federal government, including in the Treasury Board of Canada Secretariat (the Secretariat).

As with past work force adjustments in the Secretariat, various internal and external stakeholders were involved, and numerous compliance requirements had to be met. What differed about this round of work force adjustments was their high volume in a short time and the use of expanded processes because of the magnitude and cross‑governmental reach of the exercise.Footnote 2 As a result, an adequate and effective management control framework was critical to ensure that Budget 2012 work force adjustment processes in the Secretariat respected the spirit and intent of the applicable authorities and treated employees fairly and equitably.

Objectives and Scope

The audit objectives were as follows:

- To assess the adequacy and effectiveness of the management of work force adjustment processes in the Secretariat; and

- To assess the compliance of work force adjustment processes in the Secretariat with the applicable legislation, policies, directives and collective agreements.

The scope included activities undertaken to manage work force adjustment cases in the Secretariat stemming from Budget 2012. The audit covered transactions from —the date that Budget 2012 work force adjustments were announced in the Secretariat—to , with the exception of work force adjustment payments, which were examined until .

Key Findings and Conclusion

The audit concluded, with a reasonable level of assurance, that the Secretariat’s management control framework over Budget 2012 work force adjustment processes was adequate and effective, and that its internal processes complied with applicable authorities.

The key findings were as follows.

- A management control framework was in place to ensure that work force adjustment decisions were implemented as intended:

- Work force adjustment decisions were documented and supported by analysis and adequate information;

- Controls were in place to ensure that once decisions were made to eliminate positions, the integrity of those decisions was respected;

- Accountabilities, roles and responsibilities were clearly defined and communicated effectively; and

- Oversight, monitoring, reporting and risk management were in place and working effectively to track and consider the progress of work force adjustment cases.

- Processes were established that complied with applicable work force adjustment authorities:

- Processes and procedures were outlined and aligned with applicable work force adjustment authorities; and

- Management carried out work force adjustment processes in compliance with the applicable authorities.

Although financially immaterial, an exception was identified in the consistent application of the education allowance, specifically, the treatment of certain fees and whether they constitute tuition and mandatory equipment.

After the Human Resources Division (HRD) was informed of this exception, it started re‑examining the applicable cases to rectify inconsistencies. In light of the current lack of guidance in this area and to ensure the consistent and equitable treatment of employees, it is recommended that HRD develop guidance on the reimbursement of the fees in connection with the education allowance to ensure the following:

- Consistent and equitable treatment for employees impacted by work force adjustments stemming from Budget 2012, and that claims that have already been processed are revised where necessary; and

- That, in future, this guidance is applied to all employees who select this option.

Management Response

The Secretariat has developed a management response, which is presented in Appendix D.

1.0 Introduction

1.1 Overview

Work force adjustment is defined as follows:

a situation that occurs when a deputy head decides that the services of one or more indeterminate employees will no longer be required beyond a specified date because of a lack of work, the discontinuance of a function, a relocation in which the employee does not wish to relocate or an alternative delivery initiative.Footnote 3

Work force adjustment can impact both executive and non-executive indeterminate employees in the core public administration.

The National Joint Council Work Force Adjustment Directive, developed by the employer and bargaining agents, and work force adjustment provisions from applicable collective agreements, are the authorities that govern work force adjustment for represented employees and for employees appointed on an indeterminate basis who are excluded or unrepresented.

The Directive on Career Transition for Executives is the authority governing work force adjustment for executive-level employees.

1.2 Work Force Adjustment Processes

Refer to Appendix A for detailed flowcharts and descriptions of work force adjustment processes for executive and non-executive indeterminate employees, as outlined in the applicable authorities.

1.3 Impact on the Secretariat

The Treasury Board of Canada Secretariat (the Secretariat) has undertaken a number of measures to increase its operational efficiency and to reduce costs. These measures include spending reviews (e.g., Administrative Services Review, department-level strategic reviews), cost containment (e.g., operating budget freeze), and service centralization (e.g., support for Shared Services Canada).Footnote 4

Budget 2012 set the Secretariat’s savings target at $23.6 million to be achieved by fiscal year 2014–15. That target was to be achieved through measures including the elimination of positions. Work force adjustment cases stemming from Budget 2012 are, therefore, all cases that occurred during the Budget 2012 time frame, including reductions resulting from the Strategic and Operating Review,Footnote 5 as well as from certain reorganizations and strategic reviews.

Budget 2012 resulted in 116Footnote 6 work force adjustment cases in the Secretariat. The resulting personnel reductions will contribute to the expected decline in the Secretariat’s work force, as indicated in the table below.

| 2012–13 | 2013–14 | 2014–15 | |

|---|---|---|---|

| Total | $275.2 million | $241.9 million | $230.5 million |

| Full-Time Equivalents | 2,097 | 1,872 | 1,786 |

1.4 Roles and Responsibilities

Given the breadth of work force adjustment processes in the Secretariat that stemmed from Budget 2012, various stakeholders and functions were involved because of their functional responsibilities. This section outlines the roles and responsibilities of these stakeholders.

The Secretary, as deputy head, was responsible for determining that the services of an employee were no longer required and for initiating work force adjustment. This responsibility was supported by various functions across the Secretariat, as described below.

The Human Resources Division (HRD) exercised the main coordination role for work force adjustment cases. It was responsible for providing advice and guidance to senior management on the work force adjustment process (e.g., strategic work force planning to mitigate impacts on people), as well as for managing, tracking and monitoring all work force adjustment processes in the Secretariat. It also produced reports for various stakeholders.Footnote 8

HRD collaborated with the following:

- Sectors dealing with work force adjustment cases;

- The Financial Management Directorate (FMD), Corporate Services Sector;

- The Strategic Communications and Ministerial Affairs Sector;

- The Departmental Resourcing Committee; and

- The Office of the Chief Human Resources Officer (OCHRO).

Sectors were responsible for identifying the human resources reductions required under Budget 2012. However, they consulted with HRD to identify vacant positions, plan staffing requirements and determine the approach to take to implement work force adjustment. Because of those consultations and the way in which vacancies were managed in the Secretariat, the majority of positions cut as a result of the Budget 2012 spending review were vacant. Sectors were also responsible for managing their own selection of employees for retention or lay-off (SERLO) processes and for ensuring that the appropriate delegations of authority were respected, in consultation with HRD.

FMD provided advice on the affordability of decisions made in relation to spending reviews and work force adjustments stemming from Budget 2012 before they were finalized. It then monitored and reported on the financial aspects of those decisions. As part of its monitoring and reporting efforts, FMD coordinated with the Expenditure Management Sector to track the costs of work force adjustments and the overall costs of implementing Budget 2012 savings measures. It also collaborated regularly with HRD to ensure the consistency of work force adjustment information.

The Strategic Communications and Ministerial Affairs Sector provided strategic advice and support for communication activities in the Secretariat. This included providing communications to support the rollout of Budget 2012 and subsequent impacts on the Secretariat’s work force.

The Departmental Resourcing Committee was created in early 2012 and met bi-weekly or as needed to review all proposed staffing actions—executive and non-executive—in the Secretariat. The purpose of this committee was to ensure that affected, surplus and opting employees, particularly those impacted by the spending review reductions, were given first consideration for job opportunities in the Secretariat in order to allow for continuous employment in the federal public service. This committee was renamed the Treasury Board Secretariat Departmental Human Resources Committee in , and its mandate was expanded to include additional responsibilities for human resources management and for initiatives that have department-wide implications.

The Secretariat holds other key responsibilities related to work force adjustments stemming from Budget 2012 in its role as a central agency. Although they are not covered in the scope of this audit, these responsibilities are worth mentioning.

The Strategic Communications and Ministerial Affairs Sector supports OCHRO in government-wide communications relating to Budget 2012. As part of the coordination of communications on the work force impacts of Budget 2012, the Privy Council Office reviewed the communication strategies of participating departments and agencies to ensure their readiness before notifications to bargaining agents, employees, other stakeholders and Canadians.Footnote 9 The Strategic Communications and Ministerial Affairs Sector coordinated communications on the Strategic and Operating Review and acted as a communications interface between the Privy Council Office and participating departments and agencies.

OCHRO supported the Chief Human Resources Officer in ensuring that departments and agencies involved in work force adjustments stemming from Budget 2012 spending reviews were informed, equipped and engaged. In this effort, OCHRO led various initiatives, including weekly conference calls with heads of human resources to provide guidance and share experiences.

2.0 Audit Details

2.1 Authority

The Audit of the Treasury Board of Canada Secretariat’s Work force Adjustment Processes for Budget 2012 is part of the Secretariat’s approved Risk-Based Audit Plan 2012-15.

2.2 Objectives and Scope

The audit objectives were as follows:

- To assess the adequacy and effectiveness of the management of work force adjustment processes in the Secretariat; and

- To assess the compliance of work force adjustment processes in the Secretariat with the applicable legislation, policies, directives and collective agreements.

The scope covered activities undertaken to manage work force adjustment in the Secretariat. Specifically, these activities consisted of the following:

Work force adjustment cases stemming from Budget 2012: The audit examined reductions that occurred during the Budget 2012 time frame,Footnote 10 specifically those stemming from the Strategic and Operating Review, and certain reorganization and strategic review cases. The high volume of cases in a relatively short time created a sense of urgency, which resulted in higher inherent risks that employees may not have been treated equitably, consistently and transparently, which are key principles of the work force adjustment authorities.

Decision support: The audit examined processes supporting work force adjustment decisions, including processes related to the identification of affected and surplus employees, the selection of employees for retention or lay-off and the determination of guarantees of reasonable job offers. These processes were examined to assess whether decisions were properly supported.

Employee entitlements: Employees were entitled to various options and support mechanisms accorded to them through applicable authorities. Options that had a financial implication and for which payments were made as of , were examined for their accuracy and supporting documentation.

Management control framework elements: As previously described, various parties in the Secretariat supported work force adjustment. The audit examined the clarity of the accountabilities, roles and responsibilities of these parties, including training and communication. Processes for oversight, monitoring, reporting and risk management were also assessed to ensure adequacy and effectiveness.

Scope Exclusions

The audit did not examine the following:

- The Secretariat’s role as a central agency;

- Work force adjustment cases arising for reasons outside of Budget 2012;

- The merits of the specific work force adjustment decisions resulting from Budget 2012; and

- The approach for recording transactions relating to work force adjustment reductions in the departmental financial system and their subsequent impact on the Secretariat’s financial statements.

Audit Period

The audit covered transactions for the period between —the date that work force adjustments stemming from Budget 2012 were announced in the Secretariat—and . An exception was made to extend the audit to include the examination of work force adjustment payment transactions to , to provide assurance over a larger portion of these transactions. The audit also took into consideration any significant events and relevant information up to the drafting of the audit report ().

2.3 Lines of Enquiry

The audit had the following two lines of enquiry:

- A management control framework is in place to ensure that work force adjustment decisions are implemented as intended.

- Processes and procedures are established and comply with applicable work force adjustment authorities.

The audit criteria were derived from the Office of the Comptroller General’s Audit Criteria Related to the Management Accountability Framework: A Tool for Internal Auditors.

Detailed audit criteria for each of these lines of enquiry are presented in Appendix C.

2.4 Approach and Methodology

The audit approach and methodology was risk-based and conformed with the Internal Auditing Standards for the Government of Canada. These standards require that the audit be planned and performed in a way to obtain reasonable assurance that the audit objectives were achieved.

The examination phase of this audit was conducted from to . The work carried out during this phase consisted of the following:

- Interviews with key stakeholders;

- Documentation review;

- Walk-throughs;Footnote 11 and

- Sample testing.

Additional details on the audit approach and methodology can be found below in Section 3.0, “Audit Results.”

3.0 Audit Results

The audit results are presented below by line of enquiry.

3.1 Management of Work Force Adjustment Processes

An adequate and effective management control framework was in place to ensure that work force adjustment decisions were implemented as intended.

Because of the need to ramp up quickly to administer a high volume of work force adjustment activities in a short time and because of the complexity of the activities associated with the number of parties involved, it was expected that the Secretariat would have in place a management control framework to ensure that work force adjustment decisions were implemented as intended. Specifically, the following elements were examined:

- Support for work force adjustment decisions;

- Accountabilities, roles and responsibilities; and

- Oversight, monitoring, reporting and risk management mechanisms.

The audit findings against each of these elements are described below.

Support for Work force Adjustment Decisions

The audit team expected work force adjustment cases to be aligned with positions identified in approved personnel reduction targets and for work force adjustment decisions to be properly supported. It also expected processes to be in place in order to ensure that the integrity of the workforce adjustment decisions was respected.

The audit found that work force adjustment cases were aligned with personnel reduction targets and were properly supported. Planned position reductions stemming from Budget 2012 were identified in the following:

- The Secretariat’s Strategic and Operating Review proposals approved by the Treasury Board;

- Information submitted to the Privy Council Office for approval before the announcement of work force adjustments stemming from Budget 2012; and

- The Secretary of the Treasury Board’s Budget 2012 announcement to Secretariat employees.

Decisions that followed the deputy head’s decision to initiate work force adjustment were also properly supported. For example, the Secretary had to determine whether a guarantee of a reasonable job offer would be provided to affected non-executive employees. This guarantee is provided to affected employees for whom the deputy head can predict employment availability in the core public administration. The Secretary’s decision not to issue a guarantee of a reasonable job offer to any of the affected Secretariat employees was supported by information, analysis and recommendations prepared by HRD for all positions identified in employee reduction targets. The supporting information was developed in compliance with Work Force Adjustment Directive requirements and in alignment with Canada School of Public Service management training materials.

To ensure the integrity of work force adjustment decisions stemming from Budget 2012, processes were put in place to ensure that eliminated positions are not recreated in the future. At the time of the audit, a process to abolishFootnote 12 from the PeopleSoft system all positions eliminated through work force adjustment was well underway. Also, the Departmental Resourcing Committee reviewed and approved all staffing actions during the audit period.

Accountabilities, Roles and Responsibilities

It was expected that accountabilities, roles and responsibilities related to work force adjustment processes would be clearly defined and communicated.

The audit found that lines of communication were open and effective between HRD, FMD and sectors that were managing work force adjustment cases. The audit team reviewed documentation and conducted interviews with managers responsible for all of the SERLO processes completed in the Secretariat and who were involved in implementing work force adjustment measures. To help minimize anxiety on the part of employees, management completed the SERLO processes, including notifying employees of their results, in a timely manner. Of the nine SERLO processes conducted, eight were completed by the end of , and the last one was completed in , within four months of the announcements. The audit found that:

- Accountabilities, roles, and responsibilities were clearly defined and communicated effectively; and

- Lines of communication were open and effective. Specifically, feedback indicated the following:

- Frequent communication with the HRD team, which provided strong support on SERLO and work force adjustment; and

- The weekly Managers’ Forum that was run by HRD and was often attended by representatives from OCHRO gave all managers with impacted employees a platform to ask questions and was effective at enabling managers across the Secretariat to share information.

Sufficient training, tools and information resources were available to guide managers and employees in fulfilling their roles and responsibilities. Specifically, the following resources were employed:

- Although it was not mandatory, managers and supervisors were encouraged to participate in work force management training. Attendance was tracked, and representatives from each sector attended the in-house training.

- A comprehensive set of documents, training materials, links and tools were communicated to managers and supervisors in the form of in-house training materials and a Manager Toolkit binder for senior managers.

- HRD managers attended work force management courses offered by the Canada School of Public Service in collaboration with OCHRO and the Public Service Commission.

A key control existed, whereby HRD actively participated, supported and guided all sectors that were running SERLO processes. This control mitigated the risk that managers and supervisors did not attend the available training or were not prepared to carry out their responsibilities independently.

Oversight, Monitoring, Reporting and Risk Management Mechanisms

It was expected that oversight, monitoring, reporting and risk management mechanisms would be in place to track and consider the progress of work force adjustment cases and changing risks to ensure that work force adjustment was being implemented as intended.

The audit found that oversight, monitoring, reporting and risk management mechanisms were in place to ensure that Budget 2012 work force adjustment cases were being implemented as intended, as described below.

Oversight

Effective governance structures were in place to oversee Budget 2012 work force adjustment in the Secretariat. The following two committees, in combination, provided oversight over work force adjustment:

- The HRD Work Force Management Committee; and

- The Secretariat Departmental Resourcing Committee.

The HRD Work Force Management Committee consisted of managers from HRD. That committee’s mandate was to ensure that work force adjustment was properly managed. The full committee met weekly, and a subcommittee met for daily “stand-up” meetings to discuss specific work force adjustment issues. Although no terms of reference were developed, the Executive Director and other managers in HRD clearly and consistently described its roles and responsibilities. Agendas were prepared, and records of discussion were written when significant issues were discussed. The audit team’s examination of agendas and records of discussion determined that the topics discussed aligned with the committee’s described mandate.

The mandate of the Secretariat Departmental Resourcing Committee, as defined in its terms of reference, was to review and approve all proposed staffing actions (executive and non‑executive) and to ensure that surplus Secretariat employees were considered before approval was granted to staff any vacant position. The audit team examined a stratified sample of staffing actionsFootnote 13 carried out during the audit period and determined that appropriate approvals were obtained from the Committee.

Also, although they were not directly involved in the oversight of work force adjustment, the following committees were important stakeholders in the governance structure:

- Senior Executive Committee – Strategic and Operating Review (SEC-SOR): This Secretariat senior executive committee was set up to oversee the Strategic and Operating Review, which was the impetus for most Budget 2012 work force adjustment cases. Decisions about personnel reductions resulting from work force adjustment were shared and discussed with SEC-SOR before the Budget 2012 announcements.

- Labour Management Consultation Committee: This consultative committee of management and union representatives is an information-sharing forum on workplace issues in the Secretariat. Decisions about personnel reductions resulting from work force adjustment were also shared and discussed with this committee before the Budget 2012 announcements.

Monitoring and Reporting

Work force adjustment progress was tracked, and results were reported. HRD maintained a spreadsheet that tracked the status of all impacted employees, and FMD maintained spreadsheets that tracked financial implications. The audit found evidence that HRD and FMD collaborated regularly to ensure consistent and complete tracking and reporting of Budget 2012 work force adjustment information.

The following regular progress reporting and notification activities were completed:

- HRD reported regularly to OCHRO sectors on the status of impacted employees and complied with the various requirements set out in the call letter,Footnote 14 including the frequency of reporting (weekly, bi‑weekly, monthly and quarterly).

- FMD reported regularly to the Expenditure Management Sector on work force adjustment cost tracking and on the implementation of Budget 2012 savings measures. FMD complied with call-letter requirements, including the frequency of reporting (semi‑annually).

- The Executive Director, HRD, provided updates to the Secretary of the Treasury Board during regular bilateral meetings.

- Implementation and status updates on work force adjustment reductions and savings were also provided to the Labour Management Consultation Committee, the Executive Committee and to the President of the Treasury Board.

The reports to key stakeholders were reviewed and properly supported.

Risk Management

Although no formal risk management process was developed to specifically identify and assess work force adjustment risks, the risk management approach taken was found to be adequate. There was evidence that HRD’s experience with work force adjustment cases, the Secretariat’s committees and governance mechanisms, as well as the operational measures in place, allowed management to identify and respond to risks during the period of intense work force adjustment activity. Specifically, the measures included the following:

- Development of a project plan that mapped out work force adjustment activities and the related timelines to ensure consistent and timely implementation across the Secretariat;

- Assignment of a dedicated senior human resources planning advisor who tracked and monitored cases and who was the key point of contact in HRD on work force management issues in her role on the HRD Work Force Management Committee and its subcommittee, conference calls with OCHRO, and sector SOR preparation meetings; and

- Other control mechanisms put in place such as oversight bodies, monitoring, frequent reporting, and communications.

In summary, the Secretariat put in place an adequate and effective management control framework to ensure that work force adjustment decisions were implemented as intended.

3.2 Compliance With Work Force Adjustment Authorities

Processes and procedures were established and complied with applicable work force adjustment authorities.

It was expected that the Secretariat would put in place work force adjustment processes in compliance with the applicable authorities.

The audit found that adequate and effective processes and procedures were defined and that they aligned and complied with the applicable authorities. Specifically, management put in place processes and procedures that outlined the requirements for the department as it related to work force adjustment for non-executive employees and career transition for executives. These were aligned with the following authorities:

- National Joint Council’s Work Force Adjustment Directive;

- Treasury Board’s Directive on Career Transition for Executives;

- Three collective agreements where the bargaining agents have opted to include work force adjustment clauses in their agreements rather than fall under the National Joint Council’s directive;Footnote 15 and

- The Public Service Commission of Canada’s Guide on the Selection of Employees for Retention or Lay-Off and Guide on the Selection of Executives for Retention or Lay-Off.

As part of its testing, the audit team examined a stratified sample of compensation and staffing files. Budget 2012 work force adjustment cases were stratified based on the various work force adjustment sub-processes (i.e., SERLO, non-SERLO, opting, and alternation) to ensure that there was appropriate coverage of sample data. Within each of the strata, a random sample was selected. In total, the audit team tested the following:

- 19 executive work force adjustment cases, which represented 59 per cent of executive cases in the Secretariat; and

- 42 non-executive work force adjustment cases, which represented 50 per cent of non‑executive cases in the Secretariat.

The audit team also tested eight non-executive cases (35 per cent) that involved Secretariat employees who volunteered to alternate into positions that were to be eliminated in other government departments.Footnote 16 Audit testing achieved 100 per cent coverage of work force adjustment payments related to Budget 2012 as of .Footnote 17

Based on its testing, the audit team found evidence that management adequately carried out the processes that it put in place in compliance with the applicable authorities. Specifically, the team found the following:

- Bargaining agents and OCHRO were appropriately notified;

- Impacted employees and executives were appropriately notified and received all the required information related to their work force adjustment status;

- All key information was appropriately communicated to executives and employees involved in SERLO processes;

- For SERLO processes, candidates were assessed based on the merit criteria, and the evaluation of candidates and the resulting decisions were documented;

- When applicable, files included the appropriate documentation to support options selected by employees and executives, and any resulting cash entitlements to these employees and executives were accurately calculated and paid; and

- All affected and opting letters for executives and employees were reviewed and approved by the Secretary, as the deputy head.

An exception was noted in relation to the education allowance—one of the options available to impacted non-executive employees. As of , six opting employees had received reimbursements from the Secretariat in connection with the education allowance. The total value of those reimbursements represented one per cent of the Secretariat’s total work force adjustment payments stemming from Budget 2012. Of the cases tested, 95 per cent of education reimbursements claimed were accepted and paid. However, for three opting employees, the decisions on the eligibility for the reimbursement of fees were not consistent for certain fees such as incidental, technology and other general associated fees.

The Work Force Adjustment Directive is silent on the reimbursement of such fees, and no formalized guidance exists on how departments should establish eligibility for reimbursement of these fees.

From a financial perspective, the impact of the exception was immaterial when compared with the total amount of the Secretariat’s work force adjustment payments. From a people perspective, however, the impact was important. Consistent treatment helps ensure that employees are treated equitably. After HRD was informed of the inconsistencies in this area, it started to re-examine the applicable cases to make any necessary adjustments and to discuss where clarity over the eligibility of fees is required.

Notwithstanding the above observation, work force adjustment processes were established and complied with the applicable authorities.

3.3 Overall Conclusion

We conclude, with a reasonable level of assurance, that the Secretariat’s management control framework over work force adjustment processes for Budget 2012 was adequate and effective, and specifically that:

- A management control framework was in place to ensure that work force adjustment decisions were implemented as intended; and

- Processes were established and complied with applicable work force adjustment authorities.

Recommendation

It is recommended that management develop guidance for the reimbursement of education fees to ensure the following:

- Consistent and equitable treatment of employees impacted by work force adjustments stemming from Budget 2012, and that claims that have already been processed are revised where necessary; and

- That, in future, this guidance is applied to all employees who select this option.

Appendix A: Flowcharts and Descriptions of Key Work Force Adjustment Processes

Flowchart: Key Elements of the Work Force Adjustment Directive

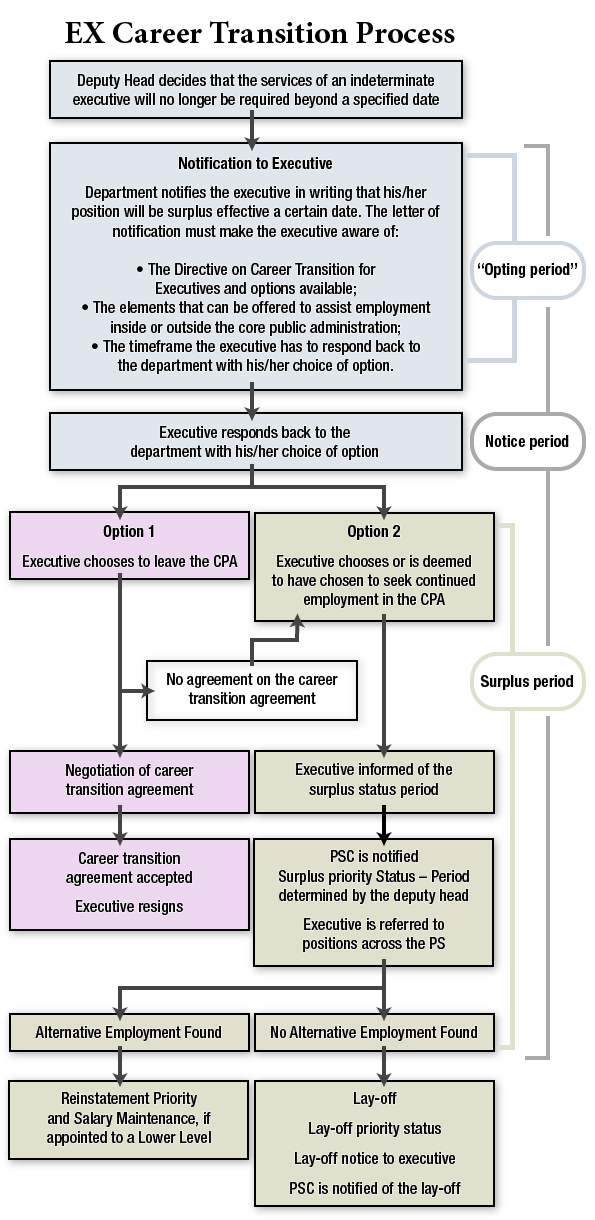

Flowchart: EX Career Transition Process - Text version

EX Career Transition Process

Deputy head decides that the services of an indeterminate executives will no longer be required beyond a specified date.

Notification to Executive

Department notifies the executive in writing that his or her position will be surplus effective a certain date. The letter of notification must make the executive aware of the following:

- The Directive on Career Transition for Executives and options available;

- The elements that can be offered to assist employment inside or outside the core public administration; and

- The time frame in which the executive has to respond to the department with his or her choice of option.

Options

Executive provide the department with his or her choice of option. (Considered the “Opting Period”)

Option 1 - Executive chooses to leave the core public administration

The deputy head and the executive negotiate a career transition agreement.

The career transition agreement is accepted and the executive resigns.

If there is no agreement on the career transition agreement, the executive is deemed to have chosen to option 2 (seek continued employment in the core public administration).

Option 2 - Executive chooses or is deemed to have chosen to seek continued employment in the core public administration

Executive is informed of the surplus the surplus priority entitlement period.

The Public Service Commission (PSC) is notified.

The period of the surplus priority status is determined by the deputy head.

The executive is referred for positions across the core public administration.

If alternative employment is found, the executive is entitled to a reinstatement priority and salary maintenance, if appointed to a lower level.

If no alternative employment is found, the executive is laid-off. Executive has a lay-off priority status.

Descriptions of Key Work force Adjustment Processes

The work force adjustment processes outlined in the above flowcharts are summarized below.

Decision

Along with a deputy head’s decision to initiate work force adjustment, decisions are also made to determine whether employees will be declared surplus or affected and whether the positions are unique or similar.

In cases where employees occupy similar positions in an affected part of an organization and some but not all of them are to be laid off, a process for selection of employees for retention or lay-off is followed. This process is used to select, on the basis of merit, those employees who are to be retained to carry on the continuing work of the affected part of the organization, and those who are to be laid off.Footnote 18

For non-executive employees, a deputy head must also determine whether a guarantee of a reasonable job offer will be provided. This guarantee provides the affected employee with an offer of indeterminate employment in the core public administration. Executives are not entitled to such a guarantee.

Where no guarantee of a reasonable job offer is provided, employees who are declared surplus or are selected for lay-off are considered to be “opting employees” and are given the opportunity to select from the options described below under “Options.”

Notification

The deputy head must provide employees who are selected for lay‑off with official written notification that their services will no longer be required. Before that notification is provided to non-executive employees, the Office of the Chief Human Resources Officer and the bargaining agents must be advised within the time frame prescribed in the applicable authorities. In the case of work force adjustments arising from recent government-wide spending reviews, the Privy Council Office approves all work force adjustment notifications before they are issued.

Options

While different options apply to executive and non-executive employees, common principles apply to both parties. Intrinsic in their respective work force adjustment directives are the concepts of treating employees in an equitable, consistent and transparent manner, and giving them every reasonable opportunity to continue their careers as public service employees.

Non-executive employees have 120-days from the date they receive a notification letter to select among the following three options:

- Option A: A 12-month surplus priority period in which to secure a reasonable job offer.

- Option B: A transition support measure where the employee receives a cash payment based on years of service in the public service. Employees who choose this option must resign.

- Option C: An education allowance where the employee receives a transition support measure (see Option B), plus an amount for reimbursement of allowable expenses. Under this option, the employee may either resign or delay his or her departure by going on a leave without pay.

All opting non-executive employees are also entitled to up to $600 toward counselling services in respect of their potential re-employment or retirement.

Executive-level employees have the following two options:

- Option 1: Leave the core public administration and seek employment elsewhere.

- Option 2: Seek continuing employment in the core public administration.

Another support mechanism available to all employees impacted by work force adjustment is the alternation process. This process facilitates the retention of impacted employees by placing them in an alternate position, that of an employee who wants to leave the core public administration, where their skills can be used and where they can continue their careers in the public service.

Appendix B: List of TermsFootnote 19

- Affected employee

- An indeterminate employee who has been informed in writing that his or her services may no longer be required because of a work force adjustment situation.

- Alternation

- A process that occurs when an opting employee (not a surplus employee) who wishes to remain in the core public administration exchanges positions with a non-affected employee (the alternate) willing to leave the core public administration with a transition support measure or with an education allowance.

- Core public administration

- That part in or under any department or organization, or other portion of the federal public administration specified in Schedules I and IV of the Financial Administration Act for which the Public Service Commission has the sole authority to appoint.

- Guarantee of a reasonable job offer

- A guarantee of an offer of indeterminate employment within the core public administration provided by the deputy head to an indeterminate employee who is affected by work force adjustment. Deputy heads will be expected to provide a guarantee of a reasonable job offer to those affected employees for whom they know or can predict employment availability in the core public administration.

- Impacted employee

- For the purposes of this audit, an indeterminate employee who was notified that his or her services may no longer be required or will no longer be required because of a work force adjustment. This includes affected, opting and surplus employees.

- Opting employee

- An indeterminate employee whose services will no longer be required because of a work force adjustment situation and who has not received a guarantee of a reasonable job offer from the deputy head and who has 120 days to consider the options set out in Section 6.3 of the Work Force Adjustment Directive. (Refer to Appendix A for a description of options A, B and C).

- Selection of employees for retention or lay-off (SERLO)

- A process to select, on the basis of merit, those employees who are to be retained to carry on the continuing work of the affected part of the organization, and those who are to be laid off. This process must be implemented when some but not all of the employees in any part of the deputy head’s organization are to be laid off. These employees are employed in similar positions or performing similar duties in the same occupational group and level within the affected part of the organization.

- Surplus employee

- An indeterminate employee who has been informed in writing by his or her deputy head that he or she will be laid off and has either been formally declared surplus, or has selected the time-limited surplus status option as provided by the applicable work force adjustment authorities.

- Work force adjustment case

- For the purposes of this audit, a situation where a Secretariat employee was notified that he or she was impacted by work force adjustments stemming from Budget 2012.

Appendix C: Audit Criteria

The audit criteria were derived from the Office of the Comptroller General’s Audit Criteria Related to the Management Accountability Framework: A Tool for Internal Auditors.

Line of Enquiry 1: Management of Work Force Adjustment Processes

A management control framework is in place to ensure that work force adjustment decisions are implemented as intended.

1.1 Work force adjustment decisions are aligned with reduction targets and are properly supported.

1.2 Accountabilities, roles and responsibilities are clearly defined and communicated.

1.3 Oversight, monitoring, reporting and risk management mechanisms are in place to support decision making.

Line of Enquiry 2: Compliance With Work Force Adjustment Authorities

Processes are established and comply with applicable work force adjustment authorities.

2.1 Processes and procedures are defined and aligned with applicable work force adjustment authorities.

2.2 Processes comply with applicable work force adjustment authorities.

Appendix D: Management Response

Recommendation

It is recommended that management develop guidance for the reimbursement of the education allowance to ensure the following:

- Consistent and equitable treatment for employees impacted by work force adjustments stemming from Budget 2012, and that claims that have already been processed are revised where necessary; and

- That, in future, this guidance is applied to all employees who select this option.

Priority Ranking: High

We agree with the recommendation.

| Actions | Completion Date | Office of Primary Interest |

|---|---|---|

1. Seek the Secretary’s approval on a departmental approach relating to the eligibility of expenses for reimbursement of education fees under the Work Force Adjustment Directive for employees who choose Option C:

|

Executive Director, HRD |

|

2. A departmental application guide on the education allowance will be developed and implemented. It will contain the following:

|

Executive Director, HRD |

|

3. Apply the departmental application guide to previous and pending cases, and identify corrective measures when applicable. |

Executive Director, HRD |

|

4. Develop a formal process to track, monitor and evaluate the effectiveness of the departmental application guide on the treatment process of future reimbursement requests. |

Executive Director, HRD |

© Her Majesty the Queen in Right of Canada, represented by the President of the Treasury Board, [2014],

[ISBN: 978-0-660-25674-0]