Evaluation of the Classification Program

Note to readers

This report contains information severed in accordance to the Access to Information Act.

This document presents the results of an evaluation of the Classification Program (the program), which is managed by the Workforce, Organization and Classification (WOC) Directorate within the Office of the Chief Human Resources Officer (OCHRO) at the Treasury Board of Canada Secretariat (TBS). The evaluation was carried out by the TBS Internal Audit and Evaluation Bureau (IAEB), with the assistance of Goss Gilroy Inc.

The evaluation was conducted in accordance with the Treasury Board Policy on Results. It assessed the relevance and performance of the program, with an emphasis on implementation and the assessment of the achievement of the immediate outcomes of the program. The evaluation also assessed the efficiency of the program, and the extent to which it is likely to contribute to government efficiency overall.

The evaluation was conducted between January and and covered the period beginning fiscal year 2010 to 2011 and ending fiscal year 2016 to 2017. It examined the use of funds assigned in 2010 and 2013 to administer the program.

On this page

- Results at a glance

- Role of the Classification Program and its context

- Program background

- Evaluation methodology and scope

- Limitation of the evaluation

- Relevance

- Performance

- Efficiency

- Alternatives to the current program design

- Suggestions for further research

- Recommendations

- Appendix A: Links between the Workforce Organization and Classification Directorate and other OCHRO areas

- Appendix B: Classification Program logic model

- Appendix C: evaluation methodology

- Appendix D: management response and action plan

Results at a glance

- The evidence demonstrates that there is an ongoing need for the program and that it is aligned with federal government and TBS priorities, roles and responsibilities. The program’s relevance is likely to increase owing to various contextual factors, including the upcoming changes to pay equity legislation and policies.

- The program is making progress toward achieving its immediate outcomes, but the pace has been slowed by work that was neither anticipated nor funded and by a lack of capacity both internally and government-wide. The current funding does not meet the needs of the program and does not appear to be aligned with the program design. The review of the occupational group structure (OGS) (planned in 2013) was delayed but is ongoing. The program could play a stronger role in encouraging departments and agencies (DAs) to update their job descriptions and to develop standardized job descriptions, given the impact these have on the work of the Pay Equity and Labour Relations units within OCHRO. A majority of DAs feel supported by the program although many also have reservations about whether the program has the necessary capacity. New qualification standards were also reviewed for several occupational groups.

- The program largely focuses its oversight on monitoring. However, oversight requirements exceed the program’s capacity, in particular the ability to carry out audits.

- It is unclear whether the B-base funding model is still appropriate, as it was based on specific, shorter-term timelines that have since been significantly extended. This model increases the administrative burden (additional reporting), creates staffing challenges (recruiting and retaining the required expertise), and makes planning difficult for what is essentially an ongoing function.

- Outdated job evaluation standards and job descriptions, as well as limited resources devoted to government-wide oversight, may have contributed, among other factors, to “upward trending”Footnote 1 in classification.

- The delays in the OGS review, the complexity of the classification system, and the changing and challenging environment to which the program is subject indicate the need for a stronger governance structure to provide the program with vision and direction within TBS and across government.

Role of the Classification Program and its context

In this section

In the federal public service, classification is the cornerstone of human resources management. The complexity of the classification system (see Appendix A), and the context in which it exists, have a direct impact on the ability of the program to achieve its expected outcomes. This section describes the elements that influence the program’s performance.

Program role

Classification involves allocating a job to an occupational group and level. This is done using a job evaluation standard to ensure that the relative value of work is recognized and compensated appropriately across the core public administration (CPA).

The program provides a policy framework, direction and tools to foster the prudent management of the government payroll. The program is expected to support appropriate classification decisions and ensure classification relativity across the CPA. While collective bargaining is often seen as a key driver of compensation, classification standards also play a key role by ensuring that there is a proper match between each position in the CPA and the classification levels.

The program allows the Government of Canada to determine and manage fair and competitive compensation through a system that ensures internal relativity (within the CPA) and external relativity (in comparison with the external labour market). A sound, updated classification system helps an organization attract, retain and motivate skilled employees. Without it, the Government of Canada would be vulnerable to the risk of costly pay equity complaints and grievances.

Program context

The program leads and supports government-wide classification in a legislative and financial environment that is politically sensitive and that must consider factors such as labour relations and pay equity.

The program’s internal environment includes:

- 29 occupational groups

- 73 job evaluation standards

- 90,000 positions that DAs must convert by 2020 (according to 2016 data)

- a payroll of about $14 billion

- 15 bargaining agents (plus 2 unrepresented groups)

- over 70 DAs

- about 200,000 employees

In addition, other considerations contribute to its complexity:

- Classification conversion can only take place between rounds of collective bargaining

- Communications and change management activities must be able to reach large numbers of managers and employees Canada-wide

- Changes within the classification system are inherently time- and resource-intensive

- There is inadequate capacity for implementation

- Priorities frequently change, creating unfunded work pressures

- Classification conversions require strong, continued stakeholder support and management effort over several years to design and implement. For example:

- it can take two years for a single group to be converted in a department

- it takes 18 to 36 months for a classification standard to be developed

- all new occupational groups and standards must be approved by Treasury Board ministers

- It is difficult to maintain capacity in a labour-intensive program that has operated in an environment of resource constraints

Program background

In this section

Program description

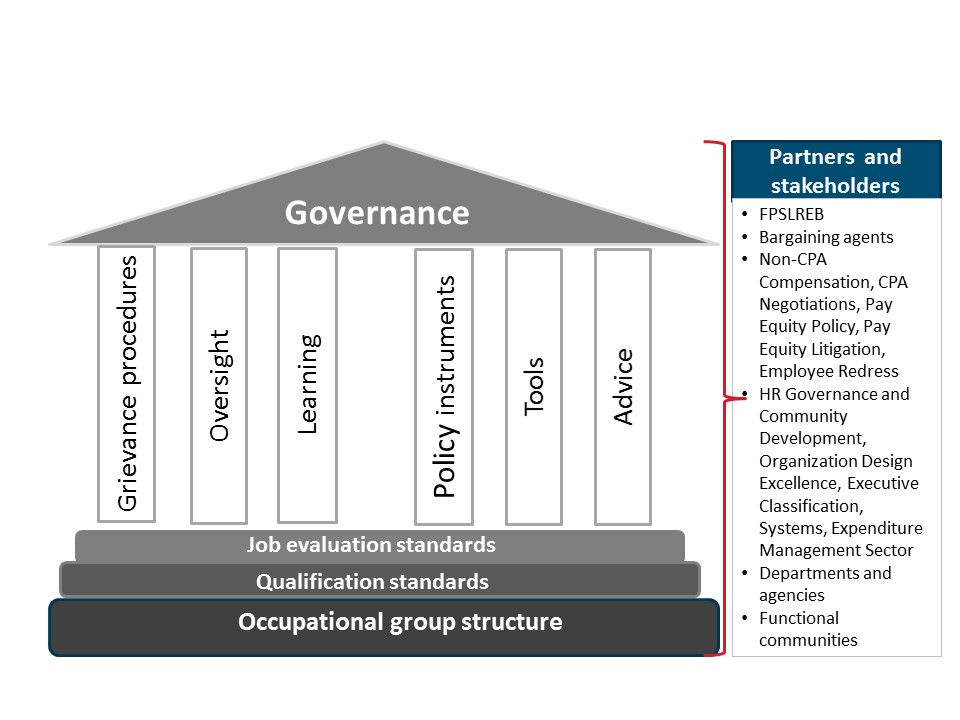

According to the Treasury Board Policy on Classification, OCHRO is responsible for developing and maintaining the Classification Program, including the OGS,Footnote 2 policy instruments, the classification grievance procedure and requirements, job evaluation standards, tools, learning and oversight (see Figure 1).

Figure 1 - Text version

The title of Figure 1 is “elements of the Classification Program.”

The figure shows a structure whose foundation consists of three horizontal bars. The bottom bar is labelled “Occupational group structure,” the middle bar is labelled “Qualification standards,” and the top bar is labelled “Job evaluation standards.” Above the horizontal bars are six vertical bars that show the main activities of the Program. The bars are labelled “Grievance procedures,” “Oversight,” “Learning,” “Policy instruments,” “Tools” and “Advice.” Above the columns is a triangle labelled “Governance.”

To the right of the structure, the partners and stakeholders of the program are listed. They are:

- Federal Public Sector Labour Relations and Employment Board

- Bargaining agents

- Non-CPA Compensation, CPA Negotiations, Pay Equity Policy, Pay Equity Litigation, Employee Redress

- Human Resources Governance and Community Development, Organization Design Excellence, Executive Classification, Systems, Expenditure Management Sector

- Departments and agencies

- Functional communities

The program as a whole relies on a mix of project and program funding. This information has been severed

Roles and responsibilities

The Workforce Organization and Classification Directorate in OCHRO is responsible for the design and functional management of the program. It is also responsible for supporting DAs and overseeing classification decisions and activities in the CPA.

Authority to conduct organizational design, write and update job descriptions, and create and classify positions is sub-delegated by the Treasury Board to deputy heads on their appointment. Deputy heads exercise this authority in conformity with established policies and guidelines.

During various periods since 2010, the Public Service Management Advisory Committee and its former sub-committee on OGS have served as governance committees for the program. The program’s current governance body is the Occupational Group Structure Assistant Deputy Minister Steering Committee. The steering committee has a mandate to assess issues concerning the organization of work and to provide advice to OCHRO, including guidance on setting and aligning priorities, making recommendations on major decisions on the pace and direction of initiatives, and reviewing progress and impacts.

In addition, TBS and the federal government have various governance committees and councils that the program consults and makes presentations to on various aspects of classification.

The Classification Program Renewal Initiative

In addition to its ongoing activities to maintain and oversee the classification system, the program is also responsible for overseeing classification reform. Periodically, a structure such as the OGS and the standards require review and redesign. The 2003 May Status Report of the Auditor General of Canada, as well as an internal review initiated in 2011, highlighted the following weaknesses and challenges in the classification system:

- no clear vision of the overall expected results

- obsolete tools and policies

- outdated or inadequate standards and job descriptions

- inefficient use of resources

- deficiencies in organizational capacity

The Classification Program Renewal Initiative was established to modernize all aspects of classification (the infrastructure) This information has been severed. Like other forms of infrastructure, classification infrastructure is often unseen. If not maintained, renovated or repaired on an ongoing basis, the systems it supports will deteriorate.

Specifically, the Classification Program Renewal Initiative addresses the pressing need to update the OGS and qualificationFootnote 3 and job evaluation standards,Footnote 4 in light of legislation (for example, the Canadian Human RightsAct, the Federal Public Sector Labour Relations Act, and the Public Service Employment Act), new negotiated collective agreements, and new imperatives for efficiency and improved people management in the public service.

As shown in Table 1, the Classification Program Renewal Initiative has five work streams, each with a distinct goal.

| # | Work stream | Goal |

|---|---|---|

| 1. | Policy, learning and oversight | Reduce financial and legal liabilities |

| 2. | Program implementation | Control costs |

| 3. | The OGS project | Modernize and streamline This information has been severed |

| 4. | Research, data and analytics | Robust data and analysis |

| 5. | Overall management and administration | Sound program management and administration |

As of 2013, the OGS review (work stream 3) was to be conducted in two phases.

Phase I was to encompass the review and modernization of occupational groups and job evaluation standards prioritized in memoranda of agreements with bargaining agents. The Program and Administrative Services (PA) Group and the Computer Systems (CS) Group are the main occupational groups considered under these agreements and make up nearly 50% of the positions in the CPA.

Phase II of the plan was to address the remaining groups of the OGS (46% of the CPA in 2013).

Expected outcomes

The expected outcomes of the Classification Program, as shown in its logic model (see Appendix B), are as follows:

Immediate

- Classification expertise informs collective bargaining negotiations, grievances and complaint resolution

- Classification considerations inform enterprise-wide initiatives

- DAs are supported and have the expertise to deliver classification program activities

- TBS actively monitors the classification program in DAs and proposes the necessary corrective measures

- Occupational group structure, group definitions and job evaluation standards are relevant and equitable

- Updated qualification standards are relevant, clear and practical

Intermediate

- Ensure Treasury Board’s exclusive authority to organize and classify work in its role as the employer

- Contribute to enterprise-wide administrative efficiency

- Ensure accurate and consistent classification and evaluation of work

- Enable equitable, fair and appropriate compensation management

- Recruitment supports service delivery

Long-term

- Enable financial and legal risk management

- Strengthen people management in the public service

- Support government program and service delivery

Evaluation methodology and scope

The evaluation assessed the program’s relevance and performance using multiple lines of evidence in proportion to their risk and materiality. It focused on the achievement of immediate outcomes of the program as shown in the logic model in Appendix B. The evaluation assessed efficiency in terms of governance effectiveness in support of program efficiency, and the program’s use of resources. The methodology is described in Appendix C.

The lines of evidence were:

- an analysis of administrative data

- a document review

- a literature review (selected review of other jurisdictions)

- interviews

- an online survey of DAs

As the evaluation was formative, it did not assess the appropriateness of the program model. It also did not assess the appropriateness of DAs’ classification decisions (allocation of a job to an occupational group and level).

Limitation of the evaluation

The evaluation assessed the program’s progress in achieving its immediate outcomes. It could not, however, assess whether job evaluation standards are relevant and equitable since the program is in an early stage of the OGS review.

The program’s design assumes a specific level of resources in order to be effective. Clarity on the intended level of funding would be needed to fully assess the program model in a summative evaluation.

Relevance

In this section

Conclusion

The evidence demonstrates that there is an ongoing need for the program and that it is aligned with federal government and TBS priorities, roles and responsibilities.

The program’s relevance is likely to increase owing to various contextual factors, including the upcoming changes to pay equity legislation and policies.

Ongoing need for the program

All lines of evidence confirm that there continues to be a need for the program. Most important, the program has an obligation to fulfill its stewardship role for classification in the CPA, as mandated by legislation. In addition, no other program allows the Government of Canada to determine and manage fair and competitive compensation for employees of the CPA.

As part of this foundational role, there is a pressing need to review the OGS and classification standards, and where warranted, to streamline and update the qualification and job evaluation standards, some of which are more than 50 years old.

Most survey respondents agreed that there continues to be a need for the program to provide DAs with support to implement policy and with expertise to inform grievances and complaint resolution. There is also a need for monitoring compliance with policy and for accrediting classification specialists. A few interviewees also highlighted the need for the OGS review to support priorities such as horizontal initiatives, an agile and mobile workforce, and flexible structures.

The document review confirmed that the program is required to meet commitments made to bargaining agents. Specifically, TBS entered into an agreement with the Public Service Alliance of Canada to review the occupational group structure for the Program and Administration Services (PA) Group, which is to be completed by the end of 2017 This information has been severed. TBS has also committed to the Professional Institute of the Public Service of Canada to undertake a review of the Computer Systems (CS) Group. And in the most recent round of collective bargaining, TBS committed to the Public Service Alliance of Canada to conduct a review of the classification standards for the Technical Services (TC) Group by the end of 2019.

Alignment with priorities, roles and responsibilities

All lines of evidence show a strong alignment between the program and federal government priorities and roles and responsibilities.

The program is well aligned with the role of TBS. Section 7(1) of the Financial Administration Act establishes the responsibility of the Treasury Board to act on “all matters relating to a) general administrative policy in the federal public administration; [and] b) the organization of the federal public administration or any portion thereof, and the determination and control of establishments therein….” Similarly, section 11.1(1), “Powers of the Treasury Board,” states that in the exercise of its human resources management responsibilities, the Treasury Board may “a) determine the human resources requirements of the public service and provide for the allocation and effective utilization of human resources in the public service; [and] b) provide for the classification of positions and persons employed in the public service.” The Public Service Employment Act provides Treasury Board with the authority to establish qualification standards. While deputy heads have accountability for their DAs, TBS is responsible for establishing policies, standards and associated guidance to ensure internal and external relativity.

Performance

In this section

-

Conclusion

-

Immediate outcomes

- Expected outcome: classification expertise informs collective bargaining negotiations, grievances and complaint resolution

- Expected outcome: classification considerations inform enterprise-wide initiatives

- Expected outcome: DAs are supported and have the expertise to deliver classification program activities

- Expected outcome: occupational group structure, group definitions and job evaluation standards are relevant and equitable

- Expected outcome: updated qualification standards are relevant, clear and practical

- Expected Outcome: TBS actively monitors the classification program in DAs and proposes the necessary corrective measures

-

Immediate outcomes

Conclusion

The program is making progress toward achieving its immediate outcomes although there were delays in the OGS review and the program was not able to conduct audits as part of its oversight role. There were several factors that hampered progress, including unanticipated and unfunded demands and a lack of capacity both internally and government-wide.

Given the magnitude of the work to be accomplished, the changing environment (for example, collective bargaining, pay equity), and the complexity and sensitivity of the issues and system, it is unclear whether there are sufficient resources to meet operational demands. This poses a risk to the Classification Program’s ability to achieve its immediate and long-term outcomes, and impacts the Classification Program throughout the CPA.

Immediate outcomes

Expected outcome: classification expertise informs collective bargaining negotiations, grievances and complaint resolution

Conclusion

The program is achieving this expected outcome. However there appears to be a need for greater support.

The document review showed that the program provides expertise to various groups within TBS, including collective bargaining, grievances, pay equity and other OCHRO units. This finding was confirmed by most interviewees who indicated that the support and tools provided by the program are useful.

Job descriptions are key components of the classification system and are the responsibility of DAs. Although some positions can benefit from a tailored job description, standardized job descriptions are also used; both contribute to consistency across the CPA.

According to program documentation, the Workforce Organization and Classification Directorate in OCHRO is responsible for developing tools to help DAs develop standardized job descriptions and for working with them to ensure that the tools are used for this purpose. However, several job descriptions in the system are outdated, significantly limiting the ability of other users within OCHRO (such as collective bargaining and pay equity) to achieve their mandates. New and updated standardized job descriptions would facilitate their work. Some interviewees mentioned that the work on these job descriptions has generally been useful for their information needs.

Some respondents mentioned that they would like more information on the rationale for and progress on changes made to the OGS. Interviewees said that the program could be more engaged with pay equity and the Policy Committee, and could be more involved in the Organizational Design Excellence initiative (which focuses on Executive levels).

Expected outcome: classification considerations inform enterprise-wide initiatives

Conclusion

The program is achieving this expected outcome. However the evidence showed a need for greater support.

According to the interviews and documentation, the program supports other initiatives being led by TBS, including My GCHR (the Government of Canada’s people management system), Common Human Resources Business Processes (CHRBP), Blueprint 2020, and functional communities developing standardized job descriptions (see Table 2).

The documentation indicates that an enterprise-wide approach to developing and maintaining standardized content for job descriptions has been developed and that work is ongoing to meet the need. Respondents said that standardized job descriptions would facilitate the work of the Compensation and Labour Relations Sector, as well as managers and classification advisors in DAs.

The program supports enterprise-wide initiatives through participation at meetings, the review of draft documents, and advice. However, some interviewees indicated that the program has limited resources to provide support, which creates delays in their work.

| Enterprise-wide initiatives | Program role |

|---|---|

| My GCHR, Phoenix | Ensures that tools, such as Position and Classification Information System+ (PCIS+), meet classification business needs across the CPA. |

| CHRBP | Contributes to the development of new or revised processes under CHRBP. Collaborates to introduce improvements to components such as developing, amending or updating job descriptions; classifying job descriptions; and undertaking organizational design. |

| Blueprint 2020 | Collaborates on the integration of the Classification Policy Suite into the proposed People Management Policy Framework under the Policy Suite Reset Initiative, which responds to the need for the public service to streamline internal rules. |

| Functional communities | Produces tools for departments to develop standardized job descriptions, and ensures that they are used. Validates new or amended standardized job descriptions and related products such as application parameters for enterprise-wide functional communities, notably the Human Resources community (Personnel Administration [PE generics]) and the Information Technology community (CS generics). |

Expected outcome: DAs are supported and have the expertise to deliver classification program activities

Conclusion

The program is achieving this expected outcome to some extent. A lack of capacity appears to prevent the program from fully achieving this outcome. A significant proportion of DAs do not believe they have adequate expertise in their organizations.

The evidence on support to DAs from the online survey and key informant interviews is mixed. A slight majority of survey respondents responded positively about the program’s capacity to support DAs, whereas interviewees responded more negatively.

While 52% of survey respondents agreed that the program has the necessary capacity to support their organization in delivering classification activities, 21% disagreed with this statement and 27% were neutral. This finding was also supported by interview data.

Most interviewees said that the program appears to have limited resources to support DAs. Many activities conducted by the program required reassignment of resources (for example, work on special requests from DAs, support to implement unplanned proposals for updating occupational group definitions and standards, and support to the Pay Equity policy team). Some interviewees mentioned that this lack of resources prevents the program from being strategic.

Despite capacity challenges, the document review showed that the program has developed a series of tools to support DAs. These tools include:

- dashboard

- job evaluation plans

- learning curriculum for accreditation purposes

- information and reporting systems such as the Position and Classification Information System (PCIS) Query Tool and PCIS+ tools

- Job Title Abbreviation Tool

- Reclassification Proactive Disclosure on the Open Government Portal

A few respondents indicated that more work is needed to develop oversight tools, and tools for chief financial officers to help them to understand the financial implications of classification decisions.

Overall, evidence from interviews and the survey confirmed that most DAs believe they have adequate classification expertise (64% of survey respondents); however, another 33% disagreed with this statement.Footnote 5 This finding is also reflected in the 2016 Classification Monitoring Aggregate Report. Program documentation also indicates that DA capacity in classification expertise (including accredited advisors) varies across DAs.

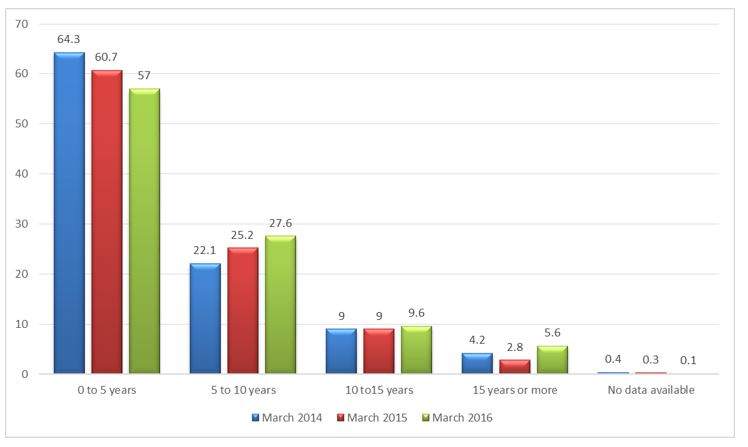

Data from the 2016 classification dashboards indicate that 43% of all occupied positions in the CPA have job descriptions that are more than 5 years old, an increase of 3.7% since 2015. The Directive on Classification recommends that job descriptions be reviewed every 5 years. As shown in Figure 2, the number of outdated job descriptions has been steadily increasing.

The reported lack of capacity in approximately one-third of DAs may explain the lack of progress on standardized and updated job descriptions in DAs. While it was beyond the scope of this evaluation to measure the impacts of outdated job descriptions, there are risks associated with them. Outdated job descriptions could indicate that they do not match the actual content of the work, which can provide distorted information to human resources functions such as collective bargaining, pay, performance management and recruitment.

Figure 2 - Text version

The title of Figure 2 is “percentage of job descriptions in the CPA by age, to .”

This figure is a historical illustration of the age of job descriptions in the CPA from 2014 to 2016. The figure is a 2‑D column graph. Categories are on the horizontal axis (x‑axis), and values are on the vertical axis (y‑axis). The horizontal axis shows the age of the job descriptions for 2014, 2015 and 2016 in 5 categories (0 to 5 years, 5 to 10 years, 10 to 15 years, 15 years or more, and no data available). The vertical axis shows the percentage of job descriptions for each category. The vertical axis starts at 0 and ends at 70, with ticks every 10 points.

The percentage of job descriptions between 0 to 5 years was 64.3% for 2014, 60.7% for 2015, and 57% for 2016.

The percentage of job descriptions between 5 to 10 years was 22.1% for 2014, 25.2% for 2015, and 27.6% for 2016.

The percentage of job descriptions between 10 to 15 years was 9% for 2014, 9% for 2015, and 9.6% for 2016.

The percentage of job descriptions for 15 years or more was 4.2% for 2014, 2.8% for 2015, and 5.6% for 2016.

The percentage of job descriptions for which no data are available is 0.4% for 2014, 0.3% for 2015, and 0.1% for 2016.

Training and development: The document review indicated that training activities have been designed and delivered for the classification community since 2016, namely for the accreditation of human resources advisors and the training of managers with human resources responsibilities. A new learning curriculum has been developed in partnership with the Canada School of Public Service. The new curriculum consists of four courses, and over 15,000 managers have received training. According to the survey findings, 68% of respondents agreed that course materials for classification-related training are effective for training managers and human resources advisors. Respondents from smaller DAs were more likely to agree (81% versus 60% for those from larger DAs).

Expected outcome: occupational group structure, group definitions and job evaluation standards are relevant and equitable

Conclusion

Progress has been made toward this outcome; however, the pace of progress in the early years was hampered by a lack of resources for the OGS review.

The evaluation did not assess the relevance and equitability of group structures, definitions and job evaluation standards, given the implementation focus of the evaluation and the stage of the activities related to this outcome.

Changes to the OGS structure were a major component of the planned results for the program. In 2010, the program was expected to complete changes to the standards for the Program and Administrative Services (PA) Group This information has been severed and the Computer Systems (CS) Group by 2012. However, the timeline was revised in 2013 because of a lack of resources. Today, the work on the PA and CS groups continues [This information has been severed].

Other additions were made to the OGS priorities, including the creation of a new Police Operations Support (PO) Group. Some technical changes were proposed or implemented, including for the Financial Management (FI) Group and the Economics and Social Science Services (EC) Group. New job evaluation standards were implemented for the Law Management (LC) Group and the Law Practitioner (LP) Group.

Since the review of the OGS is an ongoing, long-term process requiring broad consultation and alignment between numerous stakeholders, it was expected to continue at least until 2020. However, the recent repeal of Bill C-525Footnote 6 may affect the process. Another uncertainty relates to the impact of the pending pay equity legislation, which may cause further delays.

Expected outcome: updated qualification standards are relevant, clear and practical

Conclusion

Qualification standards have been updated for some groups, and there is evidence of improved clarity, relevance and practicality.

The document review confirmed that new qualification standards have been developed for the CS, LP and LC groups. Amendments have been made to This information has been severed the LC Qualification Standard. The document review showed that these standards are in the process of being approved. This information has been severed.

More specifically, the document review showed evidence of improvements to the clarity, relevance and practicality of the qualification standards. The updates to the LC Qualification Standard reflected changes to the Key Leadership Competencies This information has been severed.

Expected Outcome: TBS actively monitors the classification program in DAs and proposes the necessary corrective measures

Conclusion

With the exception of audits, which have not been undertaken to date, the program is achieving this expected outcome.

The evidence shows that the program’s oversight activities focus on monitoring and reporting, for example:

- the implementation of a CPA-wide dashboard that provides various statistics by DA and classification group

- the implementation of a biannual classification monitoring template completed by DAs

- an aggregate monitoring report

The 2016 Classification Monitoring Survey has become a recurring biannual oversight activity. In addition, an oversight guide was developed. Most interviewees and survey respondents said that the dashboard is useful and allows DAs to make broad comparisons. Some interviewees commented that the dashboard does not provide indicators of efficiency and that the interface could be modernized.

According to the online survey, 53% of the respondents said that feedback from the program to DAs on oversight is useful (45% of respondents from large departments agreed, versus 64% of respondents from small departments).

TBS interviewees indicated that there are insufficient resources within the program to conduct audits. This finding is important in light of interview evidence that identified inconsistent application of the various classification standards.

Efficiency

In this section

Conclusion

The program is not operating as efficiently as it could because of ongoing staffing challenges, excessive reporting burden, and unfunded priorities that divert resources.

Previous calls for improvements to the classification system, combined with ongoing delays in program activities, point to a need for stronger governance and leadership that goes beyond oversight of the OGS review.

Governance effectiveness in support of program efficiency

The Workforce Organization and Classification Directorate is responsible for designing and delivering the program, as well as for supporting DAs and monitoring classification decisions. The OGS Assistant Deputy Minister Steering Committee provides oversight and guidance for classification initiatives. The steering committee has a mandate to assess issues on the organization of work and to provide advice to OCHRO.

Most current and former committee members interviewed for the evaluation were satisfied with the steering committee’s mandate and activities. However, a few mentioned that the meetings are too short and not frequent enough. Some said that documentation stemming from the meetings was limited.

The evidence suggests that the program could benefit from a governance structure that goes beyond the OGS. A few interviewees suggested that more senior-level committees would be useful to establish links with other OCHRO units. A committee with membership both internal and external to the Compensation and Labour Relations Sector could help set priorities. The document review also supported this finding.

A key informant mentioned that major obstacles to overall progress are the lack of consensus on the objectives for OGS reform, and the need for more work to establish long-term objectives that consider operational, legislative and labour relations constraints. Some said that the OGS needs to be more directly connected to other government-wide human resources initiatives.

The 2003 May Status Report of the Auditor General of Canada and successive program documents have called for the revision and modernization of the classification system. The evidence suggests that stronger governance could provide the vision, direction and support needed to address the backlog of work in a timelier manner. This governance could also encompass new commitments and provide direction, taking into account both the complexity of the issues and the changing environment in which the program operates.

Program use of resources

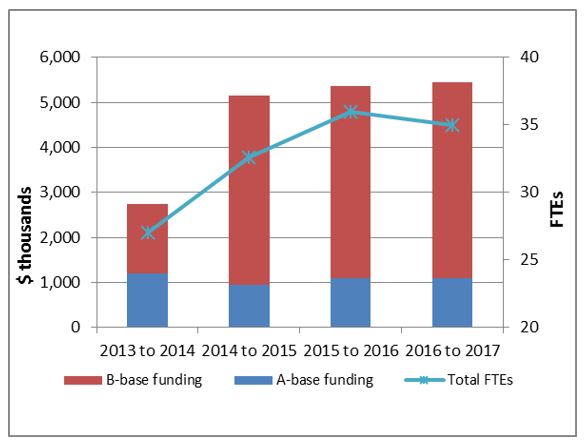

According to documentation, the program’s budgeted resources in fiscal year 2013 to 2014 included 27 full-time equivalents (FTEs) through B-base funding, in addition to 11 FTEs through A‑base funding, for a total of 38 FTEs. However the actual FTEs used in the past 4 fiscal years have fallen below this level (see Figure 3). Both program documentation and interviewees indicated that the program does not have sufficient human resources to produce the expected program outputs.

Figure 3 - Text version

The title for Figure 3 is “program resources by type of program funding, 2013 to 2014 fiscal year to 2016 to 2017 fiscal year.”

This figure is a historical illustration of the program resources from the 2013 to 2014 fiscal year to the 2016 to 2017 fiscal year. Categories are on the horizontal axis (x‑axis), and values are on the vertical axes (y‑axis on the left and z‑axis on the right).

This figure has stacked columns that show the sources of funding (A‑base and B‑base funding) in thousands of dollars, and a trend line that shows the actual number of full-time employees (FTEs).

The horizontal axis shows the fiscal years from 2013 to 2014 to 2016 to 2017. The first vertical axis (y‑axis) shows A‑base and B‑base funding. This axis starts at 0 and ends at 6,000, with ticks every 1,000 points. The second vertical axis (z‑axis) shows the number of actual FTEs. This axis starts at 20 and ends at 40, with ticks every 5 points.

From 2013 to 2014, A‑base funding was $1,208,000, B‑base funding was $1,541,000, and there were 27 FTEs.

From 2014 to 2015, A‑base funding was $941,000, B‑base funding was $4,215,000, and there were 32.6 FTEs.

From 2015 to 2016, A‑base funding was $1,099,000, B‑base funding was $4,263,000, and there were 36 FTEs.

From 2016 to 2017, A‑base funding was $1,095,000, B‑base funding was $4,354,000, and there were 35 FTEs.

Source: Classification Program administrative data

According to interviews and documentation, the program’s ability to produce the expected outputs (both in terms of quality and quantity) was hampered by four factors:

- Understaffing: In 2015, securing qualified staff for the program was recognized as a key challenge in program reports (the program had 32.6 FTEs rather than the 38 approved FTEs). In 2016, staffing was again recognized as a challenge although the actual FTE count increased (36 actual FTEs). Similar challenges were noted for recruiting external resources. Some interviewees said that the program needs twice the resources it currently has.

- Turnover among staff, including among senior management: Key informants mentioned that turnover put additional pressures on staffing. Many OCHRO senior managers had changed positions since 2011, resulting in delays in some ongoing projects, especially the OGS changes.

-

B‑base funding model: Most interviewees agreed that the program is ongoing in nature and should receive continuous funding. The program is mandated by legislation, and there are activities, such as oversight, which should be ongoing and funded permanently to prevent misclassification and upward trending in the classification structure. As well, many respondents agreed that by the time the OGS and job evaluation standards are updated in the current cycle, revisions will likely be required to the earlier work done by the Workforce Organization and Classification Directorate, given that the OGS structure (and related job evaluation standards) should be reviewed on a regular basis.

B‑base funding is usually applied to short-term projects. The document review showed that the timelines for the Classification Program Renewal Initiative have extended beyond what was originally planned. This finding suggests that without additional resources, the modernization of the classification system may take longer than originally estimated.

A majority of key informants interviewed stated that the program should be completely A‑base funded. They believe that the use of B‑base funding has led to inefficiencies. For example, staffing and retaining qualified personnel can become challenging since the short-term arrangement implied by B‑base funding can create uncertainty about job stability for some employees. In addition, a number of interviewees mentioned that producing the biannual progress reports for Treasury Board, which is a requirement for B-base funding, presented an excessive administrative burden.

-

Unexpected and unfunded tasks: Such work prevents the program from producing its expected immediate outcomes. This information has been severed:

- Policy development: After the planned overhaul of the Classification Policy Suite, completed in 2015, the Workforce, Organization and Classification Directorate also redesigned its Policy Suite in 2016 to align with the new approach of the Policy Reset Initiative (Policy on People Management).

- Learning and capacity building:In 2016, the Canada School of Public Service changed its delivery model. As a result, the program is now responsible for all new and updated course content, the identification and training of new facilitators, the correction of exams, and classification accreditation that involves extensive documentation reviews.

- Machinery of government changes: The government’s decision to transfer certain organizational components of the Royal Canadian Mounted Police (RCMP) to the CPA required analysis to determine how to integrate staff in non-CPA job classifications into the OGS. This led to the analysis and determination of acquired rights for RCMP civilian members and the design of the Police Operations Support (PO) Group. Similarly, in the 2012 to 2013 fiscal year, the consolidation of CS staff into the newly created Shared Services Canada required the provision of policy guidance for staff transfers.

- Pay equity complaint litigation:Between 2012 and 2017, the program provided support for several major pay equity litigation cases that exceeded the resources allocated for litigation management. For example, the program developed a customized classification standard and methodology for a pay equity case to be able to compare and evaluate the FI‑01 and FI‑02. For this case, 152 groups and levels were evaluated This information has been severed. Program resources were required to support the Public Sector Equitable Compensation Act policy and legislation efforts

-

Enterprise-wide initiatives: The following initiatives were supported by the Workforce, Organization and Classification Directorate over the period under evaluation:

- The program’s contribution to the redesign of the Organization and Job Classification component of the Common Human Resources Business Process, and support for its implementation across the CPA.

- The shift to the new Canada.ca website, which involved migrating existing web content and TBS intranet pages, sunsetting the former Position Reclassification Data Capture tool used for Proactive Disclosure, and helping departments migrate to the new Open Data Portal to disclose their reclassifications.

- Expanded work on the PCIS+ system: Initially, the plan was to build just a Work Description Repository. However, the PCIS Query Tool was an aging legacy system that needed to be upgraded and both systems would use very similar data. In line with the Clerk of the Privy Council’s priority to “streamline the back office,” it was decided to combine the two tools. The program was identified as the pilot sector for building a new master database, with PCIS data to be used by all TBS applications in the future.

-

Other OGS work:Priorities for the OGS review project were changed twice at senior management direction to:

- modify the Foreign Service (FS) Group definition This information has been severed

- review all job evaluation standards to reflect the government’s approach to its relationship with Indigenous Peoples, and revise six standards to align with the reconciliation initiative

Impact on government-wide efficiency

To date, work on the OGS is ongoing but has not yet resulted in a measureable government-wide efficiency This information has been severed. Changes are not cost-neutral and normally take time to produce cost savings. In fact, OGS changes frequently lead to cost increases for government in the short term, while benefits are indirect and longer term.

For example, a new job evaluation standard means new rating factors for valuing jobs. Job evaluation using new factors usually means that some jobs will be worth more than under previous standards and some will be worth less. Where jobs are worth a higher salary level, the incumbents will be compensated; where the jobs are worth a lower salary level, the incumbents have access to salary protection and do not experience a reduction in pay. In the longer term, classification reform provides important benefits to creating an agile, mobile workforce, but it requires updated classification standards and an updated OGS.

Upward trending in classification

Upward trending in classification happens when the average working level of positions within an occupational group moves toward the higher levels over time. This can lead to a higher salary envelope that goes beyond the increases from collective bargaining. According to the documentation review, the average salary across the CPA increased by 8.5% (net of inflation) between 1999 and 2014 (from $68,509 to $74,350), or to about a 0.5 level increase in the classification levels. Given that the salary increases resulting from collective bargaining have been close to inflation, this net increase can be at least partially explained by upward trending.

The document review indicated that competition for staff among DAs can cause misclassification and lead to upward trending. However it can also be explained by organizational changes within government, recruitment and retention issues, budgetary reductions and deficit reduction initiatives, and internal departmental initiatives to improve effectiveness and increase efficiency.

For example, the EC Group grew significantly between 1999 and 2014, going from 6 thousand to 12 thousand staff members across the CPA. While the average EC salary level in 1999 was Level 4, by 2014 it was Level 5. The average salary increased by 11% (net of inflation). Key informant respondents explained that a high demand for these individuals among DAs competing for these resources contributed to an increase in the average classification levels. The document review indicated that other organizational changes within government (for example, machinery of government changes) help explain this trend. The lowest level (EC‑01) has practically disappeared from the EC landscape, going from 14% of the group in 1999, to 3% in 2014.

There was general agreement among key informants that several factors have prevented TBS from acting on upward trending in classification:

- outdated classification standards

- poor classification and staffing decisions

- misuse or inaccurate use of standards

- limited resources devoted to oversight

Although the program has implemented mechanisms to monitor classification decisions in key categories (including the EC), key informants were unanimous in saying that more resources are needed for oversight and for work with DAs to develop interdepartmental standardized job descriptions.

Interviewees identified risks if the program did not achieve its objectives, including:

- DAs competing for resources, leading to over-classifications of recruits

- collective bargaining conducted without reliable information about the nature of the work associated with each classification level, preventing valid wage comparisons with the private sector and other DAs (although key informants indicated that they are able to obtain this information through outsourcing);

- overpayment and undesired turnover, owing to the lack of funding for an ongoing program, whose activities, such as oversight, may be key to preventing misclassification and upward trending in the classification structure

- the classification system remaining overly complex and costly to administer, creating inefficiencies in other program

Alternatives to the current program design

The interviews and literature review indicated that there are other ways to deliver the program, although an assessment of appropriateness was outside the scope of the evaluation.

One option is to use off-the-shelf products,Footnote 7 a solution identified by a few interview respondents. There is evidence that the program explored this option in 2014. While it could be considered in a group-by-group examination, a complete review of the OGS based on one product would likely not be feasible, given the scope and complexity of the task (for example, converting the groups of the existing system) and the program’s resources.

Another option is to either further decentralize or centralize classification activities. Program representatives had mixed opinions about the centralization or decentralization of classification services. Currently, Treasury Board as the employer sets policy, directives and standards, while each DA manages and classifies positions in accordance with the Treasury Board framework. Most DAs in the CPA have in-house accredited classification advisors who provide services to managers, or have a shared services arrangement for access to these services with another department (although the capacity in DAs may not be adequate).

Some program representatives argued that the classification advisors could be relocated to a central service to protect their independence, while others saw this option as contradictory to deputy head accountability. The example of Department of Justice Canada (JUS) lawyers is relevant. JUS has Departmental Legal Services Units in other DAs. These units employ JUS lawyers who provide client DAs with legal advice and assistance to facilitate their operations. Departmental Legal Service Units are generally located in the same building as the client’s senior management team, and a close relationship typically develops between Departmental Legal Service Units and their clients. At the same time, the Departmental Legal Service Unit is to ensure consistency in legal interpretations by maintaining the connection to the centralized authority.

The literature indicated that variations exist among member countries of the Organisation for Economic Co‑operation and Development regarding centralization or decentralization of public service classification systems. Some jurisdictions, such as Australia and the United Kingdom, have opted for a decentralized model where departments and ministries have a high level of independence. Other countries, such as France and the United States, have a more centralized approach, using a common classification standards system. One of the lessons learned is that the lack of common standards can lead to inconsistencies in classification categories and levels of pay between departments.

Suggestions for further research

Through the evaluation process, the team found that there are areas that could benefit from further research:

- The main reasons for upward trending in classification across the CPA are not clear. Research on this topic could help the program develop a targeted strategy for addressing the issue and inform further decision-making.

- The key factors that prevent DAs from reviewing and updating job descriptions every five years, as recommended by the Directive on Classification, would benefit from research. Research would help the program identify whether it can play a stronger enabling role within its authorities. It may also enable the Workforce, Organization and Classification Directorate to better understand the risk posed to areas such as collective bargaining.

Recommendations

- It is recommended that the Classification Program complete a review (ideally by a neutral third‑party expert) of the assumptions and risks on which the program is based. The review should determine the level of capacity and resources needed for:

- its foundational role in the classification system and for its ongoing activities (policy management, interpretations and advice)

- the completion of the remaining work under the OGS review within a reasonable time frame, including its implementation

- the more recently expanded core business activities (for example, oversight, learning and accreditation, and interdepartmental standardized job descriptions), as well as upcoming commitments such as pay equity and any ensuing responses needed

- It is recommended that the program strengthen its governance structure, based on an assessment (ideally by a neutral third party), so that it has the rigour, vision, direction and support to achieve its expected outcomes.

- It is recommended that the program’s funding model and reporting requirements be reviewed to determine whether the current approach is appropriate, and to assess the balance between information needs and the resources invested in reporting.

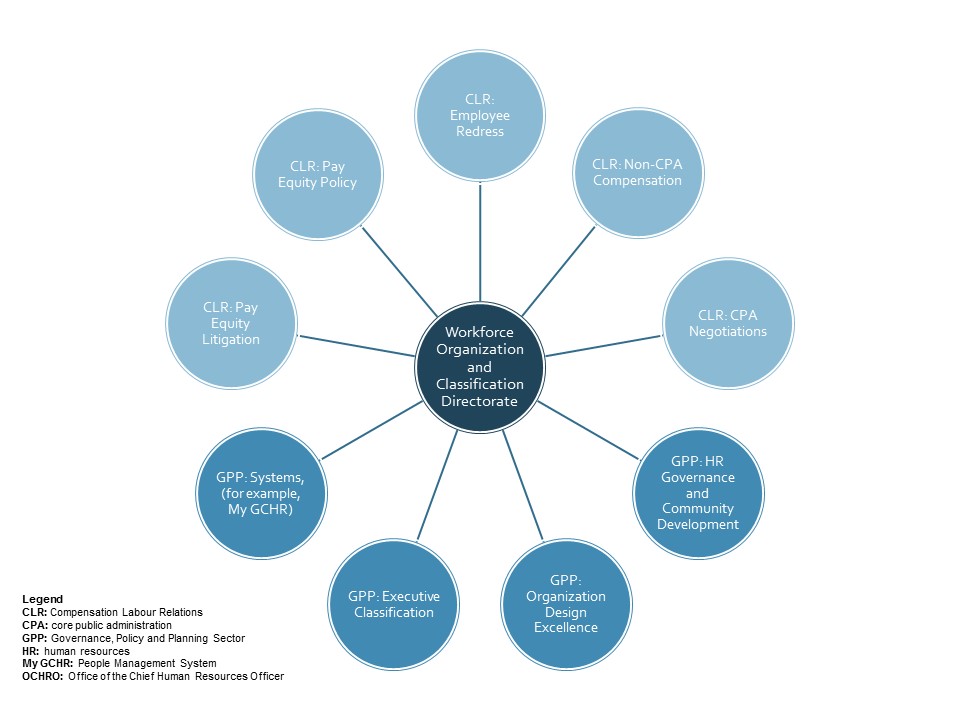

Appendix A: Links between the Workforce Organization and Classification Directorate and other OCHRO areas

Figure 4 - Text version

The title of Appendix A is “Links between the Workforce Organization and Classification Directorate and other areas in the Office of the Chief Human Resources Officer.”

This figure is a radial diagram that shows nine outer circles connected with lines to a circle in the centre of the diagram. The centre circle is labelled “Workforce Organization and Classification.” The nine outer circles are labelled as follows:

- Compensation Labour Relations: Pay Equity Litigation

- Compensation Labour Relations: Pay Equity Policy

- Compensation Labour Relations: Employee Redress

- Compensation Labour Relations: Non-CPA Compensation

- Compensation Labour Relations: CPA Negotiations

- Governance Policy and Planning Sector: Human Resources Governance and Community

- Governance Policy and Planning Sector: Organization Design Excellence

- Governance Policy and Planning Sector: Executive Classification

- Governance Policy and Planning Sector: Systems (for example, MY GCHR)

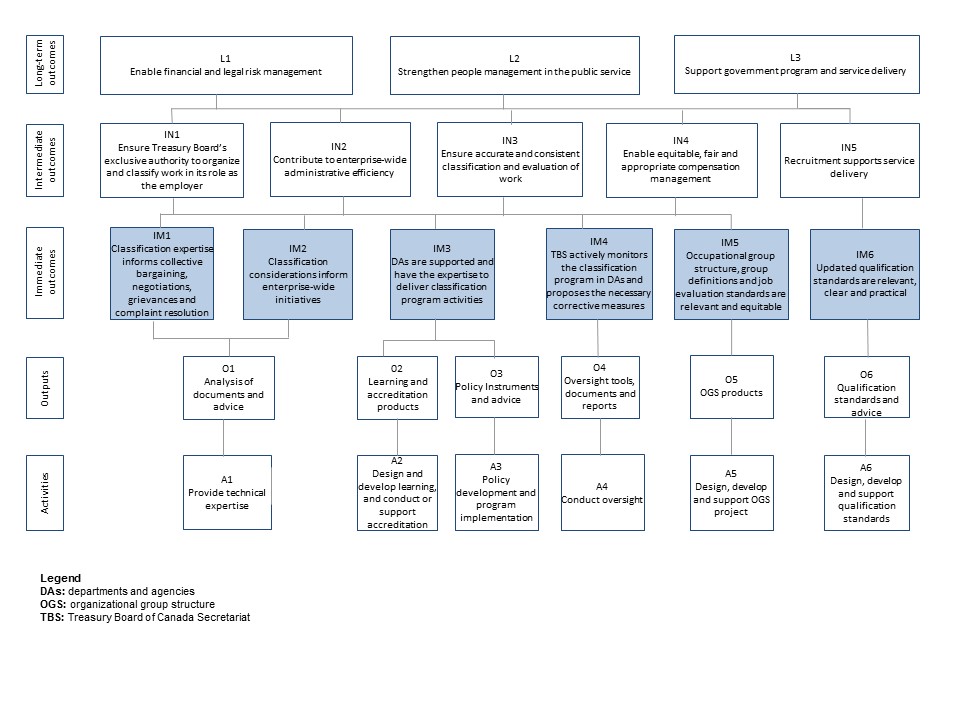

Appendix B: Classification Program logic model

Figure 5 - Text version

The title of Appendix B is “Classification Program logic model.”

The logic model shows the activities, outputs, immediate outcomes, intermediate outcomes and long-term outcomes for the Classification Program as follows:

Activities

- Provide technical expertise

- Design and develop learning and to conduct or support accreditation

- Policy development and program implementation

- Conduct oversight

- Design, develop and support OGS project

- Design, develop and support qualification standards

Outputs

- Analysis of documents and advice

- Learning and accreditation products

- Policy instruments and advice

- Oversight tools, documents and reports

- OGS products

- Qualification standards and advice

Immediate outcomes

- Classification expertise informs collective bargaining negotiations, grievances and complaint resolution

- Classification considerations inform enterprise-wide initiatives

- DAs are supported and have the expertise to deliver classification program activities

- TBS actively monitors the classification program in DAs and proposes the necessary corrective measures

- Occupational group structure, group definitions and job evaluation standards are relevant and equitable

- Updated qualification standards are relevant, clear and practical

Intermediate outcomes

- Ensure Treasury Board’s exclusive authority to organize and classify work in its role as the employer

- Contribute to enterprise-wide administrative efficiency

- Ensure accurate and consistent classification and evaluation of work

- Enable equitable, fair and appropriate compensation management

- Recruitment supports service delivery

Long-term outcomes

- Enable financial and legal risk management

- Strengthen people management in the public service

- Support government program and service delivery

Appendix C: evaluation methodology

In this section

The evaluation was guided by an approved evaluation framework, which was a detailed plan of the evaluation activities, questions and indicators.

Evaluation questions

Relevance

- How has the Classification Program (the program) adapted to its changing context over the last five years, and what are the implications for the program?

- How does the program align with the roles and responsibilities of the Treasury Board of Canada Secretariat (TBS)?

- To what extent does the initiative continue to address a demonstrable need?

Performance

- To what extent has the program achieved its immediate outcomes?

- What are the factors that help or hinder the achievement of outcomes?

- Is the right governance model in place to oversee and manage the program?

- How effective is the program oversight model?

- How effective is the current classification model in the Government of Canada (that is, building capacity within TBS and departments and agencies (DAs) to address occupational group structure (OGS) changes, learning and accreditation)?

Efficiency

- How could the program be more cost-efficient?

- To what extent is the program able to achieve outcomes within its current level of resourcing?

- Are there delivery alternatives that could decrease costs while delivering similar results?

Alternatives

- What lessons have been learned to date, or what best practices have been applied?

- Are there any barriers or unintended outcomes that have been observed?

Methodology

Consistent with best practices, the evaluation of the Classification Program used multiple lines of evidence to ensure that reliable and sufficient information is produced from both quantitative and qualitative analysis. The methods, summarized below, are:

- an analysis of administrative data

- a document review

- a literature review (a review of practices and structures of other jurisdictions)

- interviews

- an online survey of DAs

Analysis of administrative data

The analysis of program administrative data that is maintained by the Classification Program managers includes the analysis of the data collected for regular reports prepared for the Public Service Management Advisory Committee and other core public service audiences, and for the day-to-day management of the program. Data from the Position and Classification Information System (PCIS) was also analyzed. Finally, data maintained by the Canada School of Public Service on participation in, and completion of, classification classes was analyzed.

Document review

The document review provided evaluation evidence to supplement and expand on the analysis of the administrative data. The documents included plans and frameworks, progress reports, dashboard reports, third-party assessments, memoranda of understanding, lessons learned documents, research reports, monitoring reports and results, audit reports and results, agendas and minutes from governance bodies, applicable regulations and policy instruments, the Status Report of the Auditor General of Canada, information on the program published on GCPedia and Canada.ca, and briefings and presentations to various audiences.

Literature review (review of practices and structures of other jurisdictions)

The evaluation team also conducted a review of the practices and structures of other jurisdictions, including Ontario, Quebec and Australia. The team also reviewed practices in another service sector in the federal government (legal advisory services) as alternative approaches to delivering the program.

Key informant interviews

Twenty-five in-depth key informant interview sessions were conducted using open-ended questions. Key informant interviews are a qualitative method used in evaluation to address most evaluation issues and questions. They gather views and factual information from key informants selected from within the federal government and the core public administration.

Interviews were conducted with representatives of:

- the Classification Program, including the Director, managers and other key staff members with relevant information to inform the evaluation questions (n=6)

- the OGS Assistant Deputy Minister Steering Committee that guides the work of the Classification Program (n=5)

- the Human Resources Council and other applicable communities, including functional communities such as the Organization and Classification Community of practice (n=6)

- the Public Service Commission of Canada or departmental heads of staffing (n=2)

- representatives from other sectors at TBS

- Government Operations Sector (n=2)

- Expenditure Management Sector, Compensation Management (n=2)

- Corporate Services Sector (n=2)

When invited to participate in an interview, respondents were invited to organize group interviews, if they wished to do so. Each interview was weighted equally regardless of the number of interviewees in each interview.

Online survey of DAs

Evidence from DAs was gathered via an online survey conducted in April and March 2017. The survey was sent to 112 heads of classification representing DAs of the core public administration. A total of 69 individuals responded to the survey, for an overall response rate of 62%. Several email reminders were sent to the potential respondents, and follow‑up phone calls were made to those who did not respond.

The following scale was used to summarize the survey results:

- few: less than 20%

- some: 20% to 39%

- many: 40% to 49%

- half: 50%

- most: 51% and more

Appendix D: management response and action plan

The Treasury Board of Canada Secretariat’s Labour Relations and Compensation Sector (CLR) has reviewed the evaluation and agrees with the report’s recommendations, as indicated below.

| IAEB recommendations | CLR proposed action | Start date | Targeted completion date | Office of Primary Interest |

|---|---|---|---|---|

|

Recommendation 1 It is recommended that the Classification Program complete a review (ideally by a neutral third-party expert) of the assumptions and risks on which the program is based. The review should determine the level of capacity and resources needed for:

|

Management response It is agreed that a review should be conducted to determine the level of capacity and resources needed, both for:

Action plan CLR will fund a review (ideally by a neutral third party expert) to determine the level of capacity and resources needed This information has been severed. |

Workforce Organization and Classification (WOC) |

||

|

Recommendation 2 It is recommended that the program strengthen its governance structure, based on an assessment (ideally by a neutral third party), so that it has the rigour, vision, direction and support to achieve its expected outcomes. |

Management response It is agreed that the governance structure of the Classification Program should be strengthened so that the program has access to enterprise-wide, executive-level guidance and support on an ongoing basis. Action plan CLR will fund a review (ideally by a neutral third party) to assess the current governance structure and to recommend a structure that would best provide the program with the vision, direction and support it needs to meet the expected outcomes. As part of the review, the current governance bodies, including the Occupational Group Structure Assistant Deputy Minister Steering Committee, will be consulted about potential changes to governance. As a short-term measure, the Assistant Secretary, Government Operations Sector will be invited to sit on the steering committee, to ensure better integration of program initiatives with the broader management agenda. |

WOC | ||

|

Recommendation 3 It is recommended that the program’s funding model and reporting requirements be reviewed to determine whether the current approach is appropriate, and to assess the balance between information needs and the resources invested in reporting. |

Management Response It is agreed that the program’s funding model and reporting requirements should be reviewed. Action Plan There will be a review of the program’s funding model, based on the results of the review in response to Recommendation 1 This information has been severed. This information has been severed CLR will submit a proposal, based on the proposed funding model, to reflect a better balance between information needs and the resources invested in reporting. |

WOC |

© Her Majesty the Queen in Right of Canada, represented by the President of the Treasury Board, 2018,

ISBN: 978-0-660-26036-5