Regional Development Agencies Internal Audit of Recipient Selection – Phase II

Final Report

Office of the Comptroller General, Internal Audit Sector

On this page

- What the purpose was, what was audited

- Why it was audited

- Background: RDAs audited

- Background: transfer payment programs

- Overall findings, conclusion and conformity statement

- Conclusion

- Recommendations by RDA

- Appendix A: best practices

- Appendix B: applicable legislation, policies and directives

- Appendix C: audit criteria

- Appendix D: definitions

- Appendix E: transfer payments

- Appendix F: transfer payment programs included in the audit

What the purpose was, what was audited

In this section

What the purpose was

The objective of this audit was to assess the design and implementation of the management control frameworks over the process for selecting recipients in Regional Development Agencies (RDAs).

To accomplish this objective, the audit determined whether the following were in place in the RDAs during the period under review:

- governance

- application assessments

- funding agreements

Governance

Governance processes for selecting recipients are:

- citizen- and recipient-focused

- aligned with:

Application assessments

Applications are consistently assessed against:

- approved terms and conditions (Ts&Cs)

- overall program objectives

- RDA guidelines and expectations

Funding agreements

The development of funding agreements consider the following:

- risk

- program Ts&Cs

- the Policy and the Directive

- applicable legislation

What was audited

The audit scope included management control frameworks for the process of selecting recipients for the following RDAs:

- Atlantic Canada Opportunities Agency (ACOA)

- Federal Economic Development Agency for Southern Ontario (FedDev Ontario)

Activities examined

- Application assessments and funding decisions

- Funding agreements

- Promotion, engagement and performance measurement strategies

Sample of application assessments examined

- Project application files approved or rejected between April 1, 2015, and March 31, 2017.

- A judgmental sample of transfer payment projects was selected to review their related application assessments.

Confirmation of compliance and alignment

The audit confirmed compliance and alignment with the following:

- the Financial Administration Act

- the Policy and the Directive

- program Ts&Cs

Documents and processes

- The audit examined documents and processes in place as at April 1, 2017.

- Also considered were initiatives undertaken subsequently and observed during fieldwork.

Why it was audited

In this section

Government agenda and delivering results for Canadians

Transfer payments are a large part of the Government of Canada’s spending and are one of the key instruments it uses to achieve policy objectives and priorities. RDAs use these instruments to contribute to successful, diversified and participative local economies by providing regionally tailored programs, services, knowledge and expertise for the benefit of all Canadians.

Public trust and confidence

Transfer payment programs must be designed, delivered and managed in a way that is fair, accessible and effective for all involved, including departments, applicants and recipients.

Program management

Management control frameworks over programs:

- help ensure that funds are spent prudently, equitably and according to policies and legislation

- help avoid concerns about program performance and accountability

RDA resources

Each RDA is mandated to promote economic development for its region. Such development is primarily done through transfer payment programs. As such, the majority of RDAs’ human and financial resources are dedicated to funding, delivering and managing transfer payment programs.

RDA mandate and program objectives

Once a project is funded, RDAs have limited control over the realization of a project’s results or ultimate outcomes. As such, a robust process for selecting recipients is one of the most effective ways through which RDAs can increase the likelihood that:

- project outcomes are realized

- program objectives are achieved

- the mandates of RDAs are fulfilled

As a result of these considerations, this audit was identified as an area of high inherent risk for RDAs during consultations for the Office of the Comptroller General’s 2016-2020 RDA Risk-Based Audit Plan.

Background: RDAs audited

In this section

As a result of the risk-based audit planning process and consultations with RDAs, the following were selected for this audit:

- Atlantic Canada Opportunities Agency (ACOA)

- Federal Economic Development Agency for Southern Ontario (FedDev Ontario)

Atlantic Canada Opportunities Agency (ACOA)

Figure 1: map of ACOA’s operating area - Text version

The image is a map of the provinces in which ACOA operates: New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador.

ACOA’s core mandate is to create opportunities for economic growth in Atlantic Canada by:

- helping businesses become more competitive, innovative and productive

- working with diverse communities to develop and diversify local economies

- championing the strengths of Atlantic Canada

ACOA is headquartered in Moncton, New Brunswick, with regional headquarters in each Atlantic provincial capital city.

For more information regarding the Agency, please visit ACOA’s website.

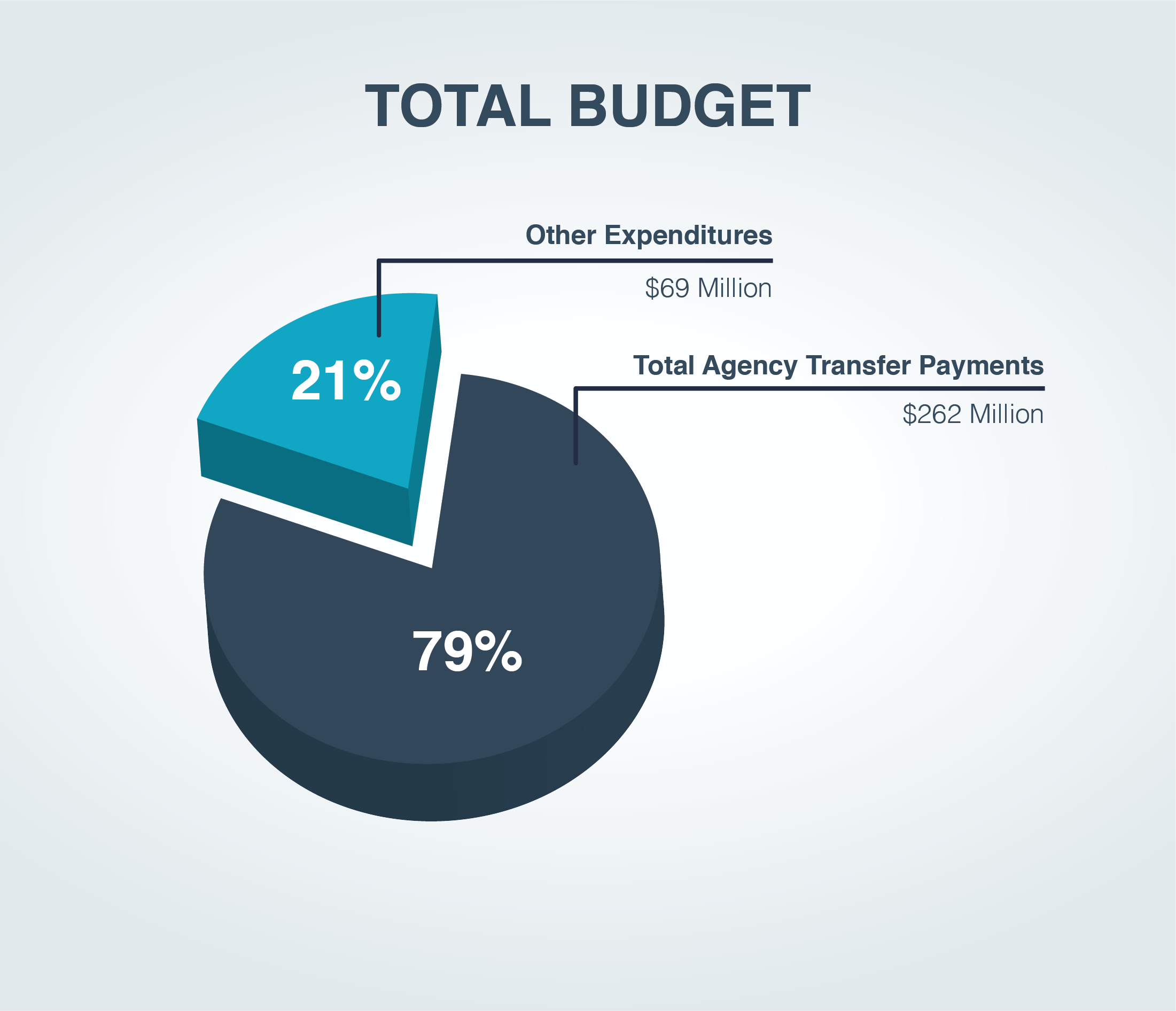

Figure 2: ACOA’s total budget for the 2016-2017 fiscal year - Text version

This image is a pie chart that represents ACOA’s budget separated into two groups: Total Agency Transfer Payments $262 Million (79% of the Agency’s budget); and Other $69 Million (21% of the Agency’s budget).

For more information regarding ACOA’s total budget for 2016-2017 fiscal year, please refer to the Public Accounts of Canada 2016-2017: Expenditures.

Federal Economic Development Agency for Southern Ontario (FedDev Ontario)

Figure 3: map of FedDev Ontario’s operating area - Text version

The image is a map of the province of Ontario with a circle around southern Ontario depicting the area in which FedDev Ontario operates.

FedDev Ontario’s core mandate is to:

- strengthen southern Ontario’s economic capacity for innovation, entrepreneurship and collaboration

- promote the development of a strong and diversified southern Ontario economy

FedDev Ontario is headquartered in Waterloo, Ontario, with additional offices in Ottawa, Toronto and Peterborough.

For more information regarding the Agency, please visit FedDev Ontario’s website.

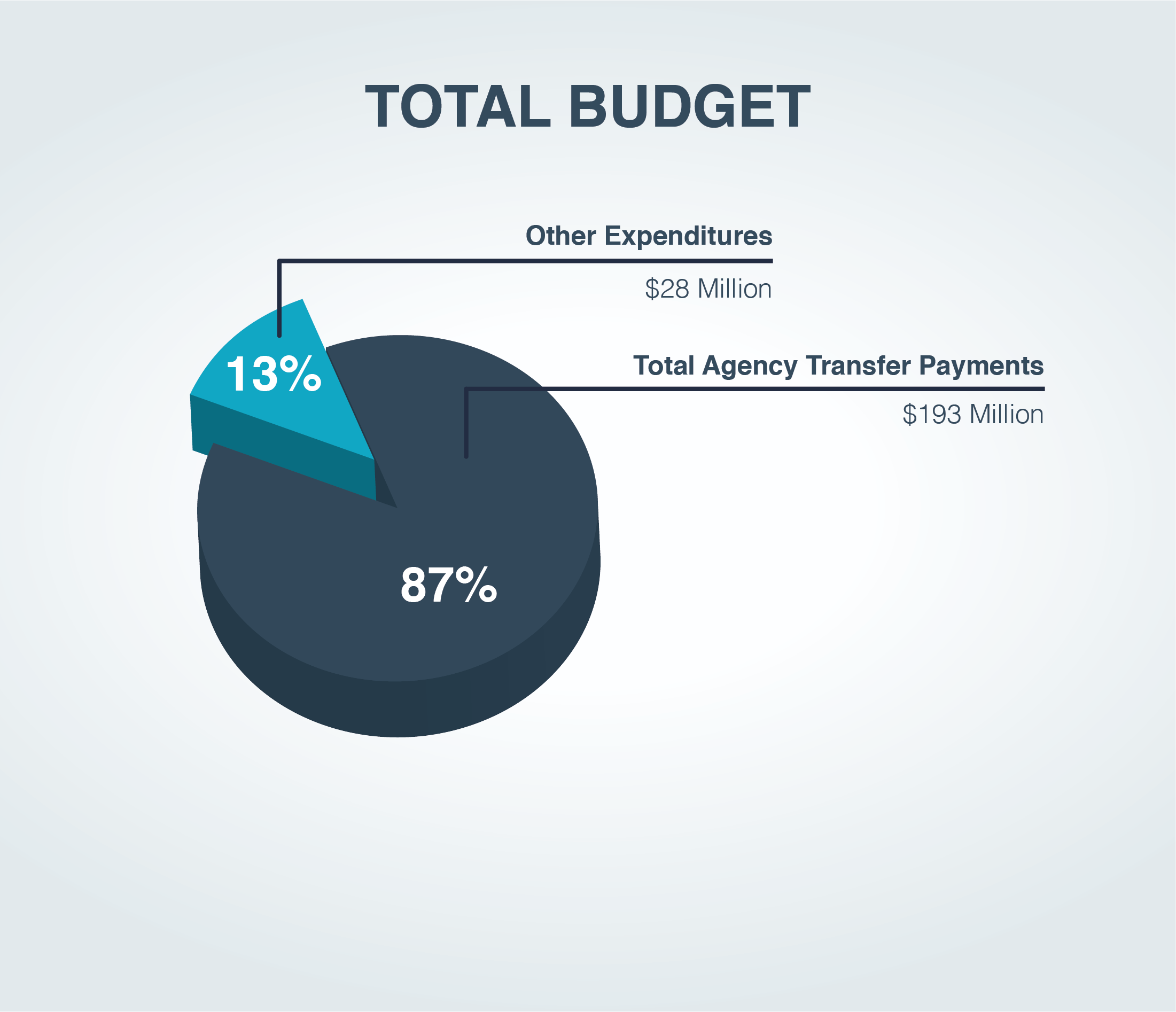

Figure 4: FedDev Ontario’s total budget for the 2016-2017 fiscal year - Text version

This image is a pie chart that represents FedDev Ontario’s budget separated into two groups: Total Agency Transfer Payments $193 Million (87% of the Agency’s budget); and Other $28 Million (13% of the Agency’s budget).

For more information regarding FedDev Ontario’s total budget for 2016-2017 fiscal year, please refer to the Public Accounts of Canada 2016-2017: Expenditures.

Background: transfer payment programs

In this section

Transfer payments:

- are monetary payments or transfers of goods, services or assets to third parties

- represent a large part of the Government of Canada’s spending

The tangible results of transfer payments touch the lives of Canadians and others every day and involve all sectors of society. Transfer payments include grants, contributions and other transfer payments. Refer to Appendix E for additional information on transfer payments.

Transfer payment programs included

Transfer payment programs were selected in consultation with each RDA. The selection criteria included the value to the RDAs of including each program, programs managed in regional offices, and programs that were ongoing and were on a direct delivery basis. For details on the programs audited, refer to Appendix F.

ACOA

- Atlantic Innovation Fund

- Business Development Program

- Innovative Communities Fund

FedDev Ontario

- Advanced Manufacturing Fund

- Economic Development Initiative

- Investing in Business Innovation

- Investing in Commercialization Partnerships

- Investing in Business Growth and Productivity

- Investing in Regional Diversification

Overall findings, conclusion and conformity statement

In this section

- Governance

- Application assessments

- Funding agreements

- Conformity statement

- Governance findings 1: citizen- and recipient-focused processes

- Governance findings 2: program design, guidance and roles and responsibilities

- Governance findings 3: performance measurement

- Governance findings 4: assessment tools

- Application assessment findings

- Funding agreement findings

Governance

- The RDAs implemented processes that generally support citizen- and recipient-focused selection processes.

- The transfer payment programs, policies, roles and responsibilities generally support alignment with the Policy and the Directive.

- Although the RDAs have strategies to measure program-level performance, strategies to measure performance of the process to select recipients varied between the RDAs.

- Both RDAs developed and implemented tools to assess applications.

- Opportunities for improvements in governance were noted for both RDAs.

Application assessments

- Assessing a funding application generally considers whether projects support the achievement of program objectives and outcomes. The extent of such consideration varied between the RDAs and between programs.

- Funding applications were generally assessed consistently against:

- program Ts&Cs

- established guidance and expectations

- Some opportunities for improvement were identified for both RDAs.

Funding agreements

- Both RDAs used standard funding agreement templates that aligned with the Ts&Cs of the applicable program.

- The extent to which standard funding agreements aligned with the Directive varied between the RDAs.

- The funding agreements used for the projects sampled aligned with their respective templates. The impact of risk considerations on funding agreements varied between the RDAs.

Although the design and implementation of the management control frameworks varied between the two RDAs, they are generally aligned with and support the achievement of the expectations and objectives outlined in the Policy on Transfer Payments.

Conformity statement

This audit engagement was conducted in conformance with the International Standards for the Professional Practice of Internal Auditing.

Mike Milito, MBA, CIA, CRMA

Assistant Comptroller General and Chief Audit Executive

Office of the Comptroller General

Governance findings 1: citizen- and recipient-focused processes

What was expected

- There are established service standards that are monitored.

- Program and application information is publicly available.

- Communications plans exist.

- Stakeholder feedback mechanisms exist.

Key takeaway

Although the RDAs have implemented processes to support citizen- and recipient-focused selection processes, some of the processes could be improved to help enhance program accessibility and RDA accountability.

Why this is important

By developing service standards, communications plans, feedback mechanisms, and consistent communication of program information, RDAs are held accountable and help ensure their programs are:

- accessible

- understandable

- continuously improved upon

What was found

| Service standards | Program and application information | Communications plans | Feedback | |

|---|---|---|---|---|

| Strengths |

|

|

|

|

| Opportunities |

|

|

|

|

| Impacts of findings | Recommendations |

|---|---|

Service standards:

|

FedDev Ontario management should formally adopt service standards for communicating an application funding decision. Once adopted, management should:

(See Recommendation 4) |

Consistent program information:

|

ACOA management should develop and implement a formal Agency-wide plan for communicating program information to potential applicants and the public, including changes to program websites. (See Recommendation 1) |

| Agency-wide communications plans allow for all programs to be promoted to different target audiences, across regions, which help diversify the types of applicants and projects. | |

| Formal feedback mechanisms allow for problem areas in the assessment process to be identified and corrected to improve stakeholder experiences. | Management of both RDAs should develop and implement a formal process for collecting, analyzing, reporting, and using stakeholder feedback to improve the recipient selection process. (See Recommendation 6) |

| Service standards, publicly available program information, communications plans, and feedback mechanisms would help ensure RDAs comply with Policy and Directive requirements and that their programs are citizen- and recipient-focused. |

Governance findings 2: program design, guidance and roles and responsibilities

What was expected

- Program Ts&Cs and guidance align with the requirements of the Policy and the Directive.

- Roles, responsibilities and accountabilities are clear.

- Employees have training and guidance.

Key takeaway

The RDAs’ program design, guidance, and roles and responsibilities generally align with the Policy, the Directive and legislative mandates. However, there are opportunities to further enhance the RDAs’ already comprehensive guidance materials.

Why this is important

Having established program design, policies, roles, responsibilities and accountabilities helps RDAs ensure their transfer payment programs are managed with integrity, transparency and accountability. These elements also allow for further alignment with the Policy and the Directive.

What was found

| Program Ts&Cs | Roles, responsibilities, accountabilities, training and guidance | |

|---|---|---|

| Strengths |

|

|

| Opportunities |

|

|

| Impacts of findings | Recommendations |

|---|---|

| Ts&Cs set out the parameters under which transfer payments may be made for a given program. Within Ts&Cs are standard expectations for recipient reporting requirements, which need to be identified to ensure they are consistently included in funding agreements. The required information can be used to support monitoring and reporting on program performance. | ACOA management should ensure that recipient reporting requirements are included in program Terms and Conditions. (See Recommendation 2) |

Standardized onboarding/training processes and material would:

|

Management of both RDAs should design and implement a standardized training/onboarding process and material for new employees to help ensure consistent training and guidance across programs and regions (See Recommendation 7) |

| Individuals with specified roles, responsibilities, and accountabilities for program delivery support could help ensure that service standards, stakeholder feedback, recipient selection process performance, and communications plans are implemented, and that continuous and formal process improvements occur. | Management of both RDAs should draft and implement a document that outlines the overall roles and responsibilities for the recipient selection process. (See Recommendation 8) |

| The audit findings regarding the application assessments related to eligibility, feasibility/viability, program objectives, separation of duties, and risks are partially the result of the guidance-related opportunities identified. | FedDev Ontario management should ensure its guides and tools provide direction on what is required in application assessments once an application is deemed Eligible Not-Recommended. (See Recommendation 5) |

ACOA management should revise its guidance and tools to ensure that:

(See Recommendation 3) |

Governance findings 3: performance measurement

What was expected

- Program performance measurement strategies exist.

- Performance measurement strategies include process-related activities to select recipients.

- Performance of recipient selection activities is monitored and reported on.

- Application assessments consider project contributions to program objectives.

Key takeaways

- Both RDAs have strategies to measure program performance that, to varying degrees, include process-related activities to select recipients. The comprehensiveness of monitoring and reporting on the performance of the process to select recipients varied between the RDAs.

- Application assessments generally included consideration of projects’ support of program objectives.

Why this is important

Performance measurement strategies:

- help measure the effectiveness of the recipient selection process

- strengthen accountabilities for all involved

Ensuring that all applications are assessed for project contributions to program objectives:

- harmonizes and standardizes the assessment process across all programs

- helps ensure that projects selected will increase the likelihood of achieving program objectives

What was found

Recipient selection process performance

- ACOA identified, tracked, monitored and reported to senior management on performance targets for processes to select recipients.

- FedDev Ontario tracked certain statistics related to the process to select recipients.

Figure 5: Percentage of applications assessed that identified project results, program objectives, how projects contribute to achieving program objectives, and how project results align with program objectives - Text version

These bar graphs identify the percentage of applications assessed that:

- Identified expected project results:

- Both Agencies had 100% in this area.

- Identified program objectives to which the project aims to contribute:

- ACOA had 85% in this area, while FedDev Ontario had 100% in the same area.

- Analyzed how projects contribute to the achievement of program objectives:

- ACOA had 70% in this area, while FedDev Ontario had 100% in the same area.

- Expected project results are aligned with program objectives:

- Both Agencies had 100% in this area.

| Impacts of findings | Recommendations |

|---|---|

Selecting, monitoring and reporting on recipient selection performance targets:

|

FedDev Ontario management should formally identify performance targets for the recipient selection process. Once adopted, management should:

(See Recommendation 4) |

Assessing applications for their contribution to program objectives helps contribute to balanced assessments that result in approving projects that:

|

Findings for individual application assessments regarding program objectives are linked to those identified in this audit’s governance-related section on guidance and tools. As such, no additional recommendations have been included. |

Governance findings 4: assessment tools

What was expected

- Tools are developed to help ensure the consistent assessment of applications.

- Tools are aligned with established assessment criteria, including program Ts&Cs.

Key takeaway

- Both RDAs have developed tools to help consistently assess applications against established criteria and program Ts&Cs. However, opportunities exist to enhance consistency in application assessments and the harmonization of program assessment activities.

Why this is important

Tools that help ensure the consistent assessment of applications:

- ensure that program Ts&Cs are respected

- help create harmonization and standardization across programs

- increase timeliness

- contribute to ensuring that appropriate levels of due diligence are exercised

What was found

The tools generally assist with the consistent assessment of these key areas:

- Eligibility

- Stacking limits

- Contribution type

- Program objectives

- Risks

- Project feasibility and viability

- Ability to repay

However, there were opportunities identified for both Agencies:

- ACOA’s assessment tools and guidance (i.e. Project Summary Form, Project Approval Form, and Manual) provided limited direction on all the elements of eligibility that need to be assessed for each program. These forms are also inconsistent, between programs, with respect to how program objectives are to be considered.

- FedDev Ontario’s workbooks include areas of assessment and consideration that are common to all programs (e.g. risk assessments and eligibility checklists). Inconsistencies between the workbooks were noted in some of these common areas.

| Impacts of findings | Recommendations |

|---|---|

| Consistent direction within application assessment tools (including for risk assessments) across programs contributes to uniform and harmonized assessment activities, which is one of the Policy’s objectives. | ACOA management should revise its guidance and tools to ensure eligibility requirements and project contributions to program objective considerations are consistently assessed across programs. (See Recommendation 3) |

| Tools that support consistent assessment and consideration of these key areas, across programs, ensure that the opportunities related to eligibility, risks and program objectives noted in the individual application assessments can be addressed. | FedDev Ontario management should ensure its tools are consistent in key areas, where appropriate, between programs. (See Recommendation 5) |

Application assessment findings

What was expected

- Applications were consistently assessed against program Ts&Cs in key areas.

- Application assessments consistently considered key areas in accordance with RDA guidance and expectations.

- Application assessments followed RDA guidance and expectations in key areas.

Key takeaway

The assessment of applications against program Ts&Cs, established guidance and expectations was generally completed.

Why this is important

Consistent assessments provide management and Canadians with assurances that transfer payment programs are designed and delivered in a manner that is prudent, equitable and in accordance with applicable guidance, policies, directives and expectations.

What was found

Figure 6 below depicts the overall findings for the application assessments sampled and examined. The examination covered the areas below in terms of consistency of assessments and alignment with guidance and expectations (that is, program Ts&Cs, the Policy and Directive, and RDA guidance and expectations):

| RDA | Eligibilityfigure 6 note * | Stacking Limits | Contribution Type | Program Objectives | Risksfigure 6 note * | Project Feasibility and Viability | Ability to Repay | Service Standards | Separation of Dutiesfigure 6 note * | Communication | Delegated Authority – Section 32 | Proactive Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

||||||||||||

Figure 6 Notes

|

||||||||||||

| ACOA | ||||||||||||

| FedDev Ontario | ||||||||||||

| Impacts of findings | Recommendation |

|---|---|

Separation of duties:

|

Findings for the individual application assessments are directly linked to those identified in the governance-related sections on Guidance, Program Objectives, and Tools (refer to Findings – Governance). As such, no additional recommendations have been included. |

| Ensuring that all eligibility requirements are consistently assessed and guidance is adhered to helps ensure that only those applicants and projects that are aligned with program Ts&Cs are the ones that receive funding. | |

Assessing applications for their contribution to program objectives helps contribute to balanced assessments that:

|

|

Completed risk and viability assessments ensure that:

|

Funding agreement findings

What was expected

- Standard funding agreements:

- were used

- were aligned with program Ts&Cs

- complied with key requirements of the Policy and the Directive

- Reporting and monitoring requirements considered risk.

Key takeaways

- The two RDAs used standard funding agreements (templates) that aligned with applicable program Ts&Cs but varied in their alignment with requirements of the Directive and in their consideration of risk.

- Project funding agreements were aligned with RDA templates.

Why this is important

Funding agreements set out the obligations for all parties involved in a transfer payment project. Standard funding agreements are used to ensure that obligations are consistent across all programs and projects, including key requirements and reporting requirements that consider risk.

Standard funding agreements help hold the RDAs and their recipients accountable so as to increase the likelihood that projects will:

- achieve their desired results and outcomes

- contribute to program objectives as desired

- collectively help the RDAs fulfill their mandates

What was found

Standard funding agreement template findings:

- ACOA’s funding agreement templates for non-commercial and commercial clients under the Atlantic Innovation Fund contain key requirements. However, those funding agreement templates for ACOA’s other programs, non-repayable, repayable as well as conditionally repayable contributions, are missing the start date and duration of the agreements, and note the identification of project activity details and costs as “optional”.

- FedDev Ontario has funding agreement templates for non-repayable and repayable contributions under all programs. These templates contain key requirements.

- The funding agreements for the projects sampled were aligned with their respective RDA templates.

- As ACOA’s project funding agreements used the templates provided, those opportunities identified in the templates were carried through into some of the individual project funding agreements reviewed.

- While the Agency’s monitoring requirements are risk based, reporting requirements in ACOA’s funding agreements were standardized and not considerate of risk.

| Impacts of findings | Recommendation |

|---|---|

Defined cost categories and activities increase recipients’ understanding of eligible costs and of what is expected for project delivery, leading to fewer erroneous claims and increased likelihood of project success. They also:

|

ACOA management should revise its funding agreement templates to ensure that:

(See Recommendation 3) |

Including the effective dates and durations of defined funding agreements:

This inclusion also brings the funding agreement templates in alignment with the other RDAs not included in the audit. |

|

| The administrative burden on recipients could be reduced by implementing risk-based reporting requirements in funding agreements. |

Conclusion

| Strengths | Opportunities | Conclusion |

|---|---|---|

| A number of good practices were identified with respect to governance, application assessments and funding agreements in both RDAs. | Targeted opportunities for improvement with respect to processes for governance, application assessments and funding agreements were identified. | Although the design and implementation of management control frameworks varied between the two RDAs and opportunities for improvement were identified, these frameworks were comprehensive and were generally aligned with and support the achievement of the expectations and objectives of the Policy on Transfer Payments. |

Governance-related strengths included:

|

ACOA’s processes can be improved with respect to:

|

|

| Application assessments generally included key considerations and assessments in accordance with program Ts&Cs and expectations. | FedDev Ontario’s processes can be improved with respect to:

|

|

Both RDAs used standard funding agreement templates that aligned with:

|

Both RDAs can improve their processes for:

|

Recommendations by RDA

In this section

The following recommendations are intended as targeted enhancements to operations and to correct specific opportunities for improvement.

Recommendations for ACOA

| Recommendation number | Recommendation | Priority | Target beneficiary |

|---|---|---|---|

| Recommendation 1 | ACOA management should develop and implement a formal Agency-wide plan for communicating program information to potential applicants and the public, including changes to program websites. | Low-Medium | Potential applicants and the public |

| Recommendation 2 | ACOA management should ensure that recipient reporting requirements are included in program Terms and Conditions. | High | The RDA |

| Recommendation 3 | ACOA management should revise its guidance, tools and funding agreement templates to ensure that:

|

High | The RDA and recipients |

Recommendations for FedDev Ontario

| Recommendation number | Recommendation | Priority | Target beneficiary |

|---|---|---|---|

| Recommendation 4 | FedDev Ontario management should formally adopt service standards for communicating an application funding decision, and identify performance targets for the recipient selection process. Once adopted, management should communicate the service standards and targets, as well as track, monitor, and report on related performance. | Medium-High | The RDA and applicants |

| Recommendation 5 | FedDev Ontario management should ensure its guides and tools provide direction on what is required in application assessments once an application is deemed Eligible Not-Recommended, and that these tools are consistent in key areas, where appropriate, between programs. | Medium | The RDA |

Priority ratings

Priority ratings were established for the purpose of ranking recommendations relative to one another and are not meant to reflect overall risks for the RDAs.

Recommendations for both RDAs

| Recommendation number | Recommendation | Priority | Target beneficiary |

|---|---|---|---|

| Recommendation 6 | Management of both RDAs should develop and implement a formal process for collecting, analyzing, reporting, and using stakeholder feedback to improve the recipient selection process. | Low-Medium | Potential applicants, applicants, recipients and the RDAs |

| Recommendation 7 | Management of both RDAs should design and implement a standardized training/onboarding process and material for new employees to help ensure consistent training and guidance across programs and regions. | Medium | RDA employees |

| Recommendation 8 | Management of both RDAs should draft and implement a document that outlines the overall roles and responsibilities for the recipient selection process, which could include roles and responsibilities for monitoring and reporting on recipient selection activities performance, support to program delivery, communications, quality assurance, and finance. | Medium | The RDAs |

Priority ratings

Priority ratings were established for the purpose of ranking recommendations relative to one another and are not meant to reflect overall risks for the RDAs.

Acknowledgement

The audit team gratefully acknowledges ACOA and FedDev Ontario staff at their head offices and at the regional offices. Their contributions were essential to the completion of this audit.

The findings and recommendations of this audit were presented to ACOA and FedDev Ontario management.

Management has agreed with the findings in this report and will take action to address the recommendations that apply to their RDA.

Appendix A: best practices

In this section

ACOA’s best practices

- ACOA presents dashboard updates to its Executive Committee on progress made against targets for its process to select recipients.

- ACOA’s Newfoundland and Labrador region has presented programming information to local accounting firms to help them support their clients in managing ACOA funding agreement expectations.

- ACOA uses one document to support an assessment decision to:

- fund or reject a project

- approve funding decisions

FedDev Ontario’s best practices

- FedDev Ontario uses program-specific eligibility checklists to ensure that all eligibility requirements are assessed to justify further project assessment or statutory rejection.

- FedDev Ontario’s reporting requirements are based on the results of the risk assessment for the client and project.

- Across programs, FedDev Ontario’s websites:

- contain similar key information

- are constructed in a similar fashion to facilitate accessibility and understanding of program information

Appendix B: applicable legislation, policies and directives

In this section

Financial Administration Act

The Financial Administration Act provides for:

- the financial administration of the Government of Canada

- the establishment and maintenance of the accounts of Canada

- the control of Crown corporations

Policy on Transfer Payments

The Policy on Transfer Payments sets out roles, responsibilities and mandatory requirements to ensure that transfer payment programs are managed with integrity, transparency and accountability in a manner that is:

- sensitive to risks

- citizen- and recipient-focused

- designed and delivered to address government priorities in achieving results for Canadians

Directive on Transfer Payments

The Directive on Transfer Payments supports the objectives of the Policy on Transfer Payments by providing operational requirements for departmental managers who have been assigned responsibilities for the management of transfer payments. It also provides for the tailoring of certain general requirements to reflect relationships with specific categories of recipients.

Appendix C: audit criteria

In this section

Governance

1.1. The Terms and Conditions of the programs are aligned with the Treasury Board Submissions, the requirements of the Treasury Board Policy and Directive on Transfer Payments and applicable legislation.

1.2. There are appropriate policies, procedures and practices, and clear roles and responsibilities including proper separation of duties that govern the recipient selection process.

1.3. There is a promotional strategy that clearly communicates program information to potential applicants.

1.4. There is a strategy to engage applicants and recipients in support of innovation, continuous improvement and the establishment of positive relations.

1.5. There is a performance measurement strategy in place for the oversight of the recipient selection process and reporting of performance of program objective.

Program applications

2.1. Eligibility of applications is consistently assessed against established criteria, which are based on the program’s Terms and Conditions.

2.2. Funding decisions are made in accordance with approved Terms and Conditions and are prioritized based on the recipient’s ability to contribute to program objectives.

Program funding agreements

3.1. Standard funding agreements are used, and they are aligned with the approved Terms and Conditions and comply with the Treasury Board Policy and Directive on Transfer Payments.

3.2. Funding agreements address recipient risk in accordance with the program’s risk management strategy.

3.3. Funding agreements are approved under section 32 of the Financial Administration Act prior to signing.

Appendix D: definitions

- Applicant Footnote 1

- An individual or entity that has applied for a transfer payment.

- Funding agreement Footnote 1

- A written agreement or documentation constituting an agreement between the Government of Canada and an applicant or a recipient setting out the obligations or understandings of both with respect to one or more transfer payments.

- Harmonization of transfer payment programs Footnote 1

- The alignment and/or integration of two or more transfer payment programs that contribute to similar objectives or serve the same recipients.

- Performance measurement strategy Footnote 1

- The selection, development and ongoing use of performance measures for program management or decision-making.

- Recipient Footnote 1

- An individual or entity that either has been authorized to receive a transfer payment or that has received that transfer payment.

- Service standard Footnote 2

- Public commitment to a measurable level of performance that clients can expect under normal circumstances.

- Stacking limit Footnote 1

- The maximum level of total Canadian government funding authorized by the terms and conditions for a transfer payment program for any one activity, initiative or project of a recipient.

- Standardization Footnote 1

- The establishment of common processes, systems or procedures for the management and delivery of transfer payments.

- Terms and conditions Footnote 1

- A document, approved by Treasury Board or a minister, which sets out the parameters under which transfer payments may be made for a given program.

- Transfer payment program Footnote 1

- A program or a component of a program supported by transfer payments.

Appendix E: transfer payments

In this section

Transfer payments

Transfer payments are monetary payments, or transfers of goods, services or assets to third parties. They represent a large part of the Government of Canada’s spending. Their tangible results touch the lives of Canadians and others every day, and cover all sectors of society. Transfer payments include grants, contributions, and other transfer payments.

The transfer payment life cycle

The transfer payment life cycle consists of:

- program design

- promotion and communication

- assessment and selection

- funding agreements

- payment

- monitoring

- evaluation and reporting

The process for selecting recipients

The process for selecting recipients consists of:

- promoting, communicating and raising awareness of program objectives, criteria and administrative requirements

- assessing applications received and selecting recipients

- drafting, negotiating and signing funding agreements

Objective of the Policy

The objective of the Policy on Transfer Payments is to ensure that transfer payment programs are:

- managed with integrity, transparency and accountability

- sensitive to risks

- citizen- and recipient-focused

- designed and delivered to address government priorities in achieving results for Canadians

Expected results of the Policy

The expected results of transfer payment programs are that they:

- are supported by clearly defined and understood roles, responsibilities and accountabilities

- are designed, delivered and managed in a manner that takes account of risk and demonstrates value for money

- are supported by cost-effective oversight and control systems at both departmental and government-wide levels

- are accessible, understandable and useable by applicants and recipients to ensure effective control, transparency and accountability

Appendix F: transfer payment programs included in the audit

Programs were selected in consultation with each RDA. The selection criteria included:

- the value to the RDAs of including each program

- programs managed in regional offices

- programs that were ongoing and were on a direct delivery basis

Note: The programs included were in place at the time of the audit. However, in December 2018, the RDA programs were consolidated into two nationally consistent streams. These streams are focused on business scale-up, productivity, and market expansion, as well as business accelerators and incubators.

| ACOA | Atlantic Innovation Fund (AIF) | AIF helps Atlantic Canadians develop and bring to market new products and services that:

|

|---|---|---|

| Business Development Program (BDP) | BDP helps small and medium-sized enterprises become more competitive, innovative and productive by:

|

|

| Innovative Communities Fund (ICF) | ICF invests in strategic projects that build the economies of Atlantic Canada’s communities. Working in partnership with Atlantic communities and stakeholders, ICF:

|

|

| FedDev Ontario | Advanced Manufacturing Fund (AMF) | AMF promotes continued growth and increased productivity of Ontario’s advanced manufacturing sector by:

|

| Economic Development Initiative (EDI) | EDI supports business and economic development activities that encourage:

|

|

| Investing in Business Innovation (IBI) | IBI fosters a more competitive southern Ontario economy by encouraging the development of partnerships between entrepreneurs and investors to support early-stage, globally oriented businesses with the ability to become world-leading innovators. | |

| Investing in Commercialization Partnerships (ICP) | ICP addresses innovation and commercialization, and encourages collaboration to improve Ontario’s productivity performance so that the region can compete on an international platform. | |

| Investing in Business Growth and Productivity (IBGP) | IBGP assists existing southern Ontario businesses to adopt new technologies that have the potential to improve productivity and expand their operations. | |

| Investing in Regional Diversification (IRD) | IRD is designed to build stronger, more diverse economies in southern Ontario in the long term by:

|