Graphical Summary for Main Estimates, 2018–19

In these Estimates

Main Estimates - Text version

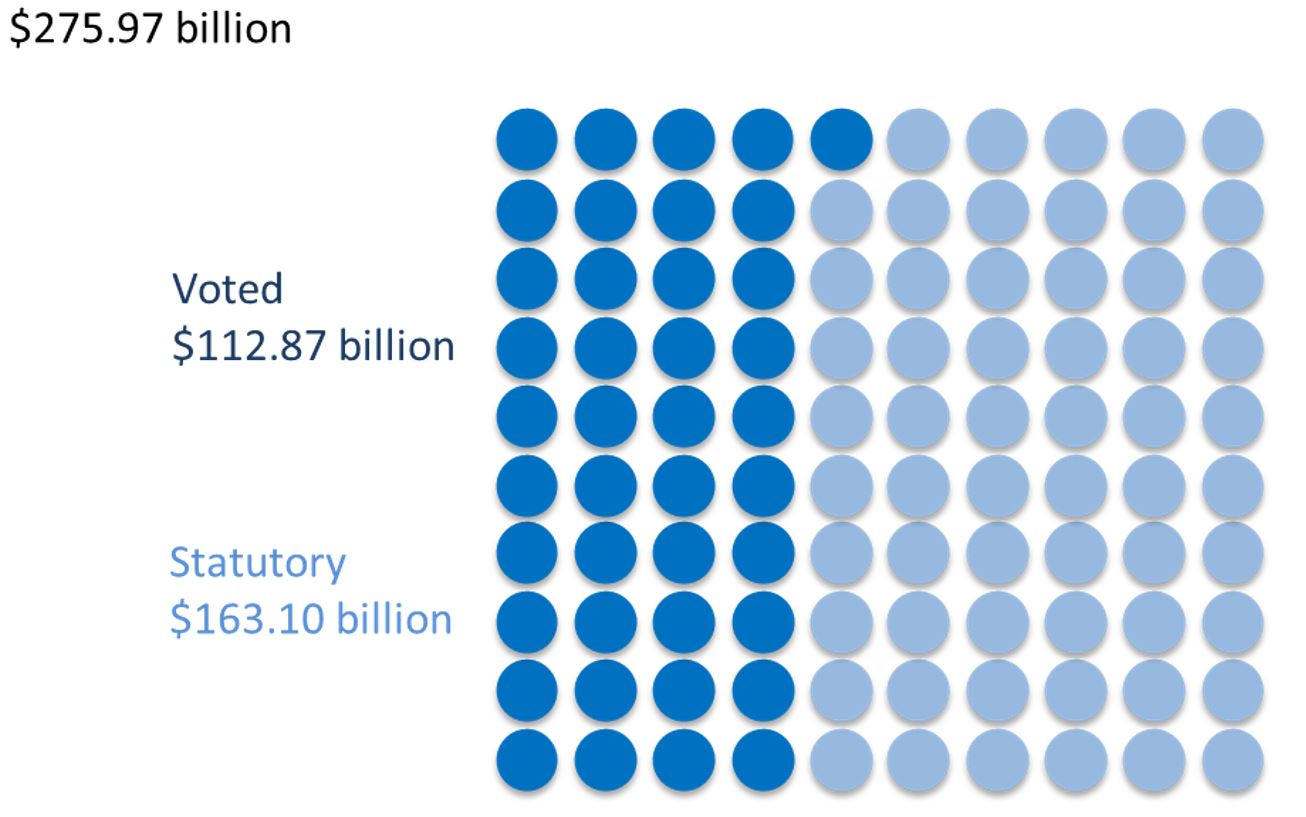

The Main Estimates comprise a total of $275.97 billion in new budgetary spending including statutory expenditures ($163.10 billion) and voted expenditures ($112.87 billion) that require Parliamentary approval. This represents a 7% increase over the 2017-18 Main Estimates ($257.92 billion).

Top Organizations - Text version

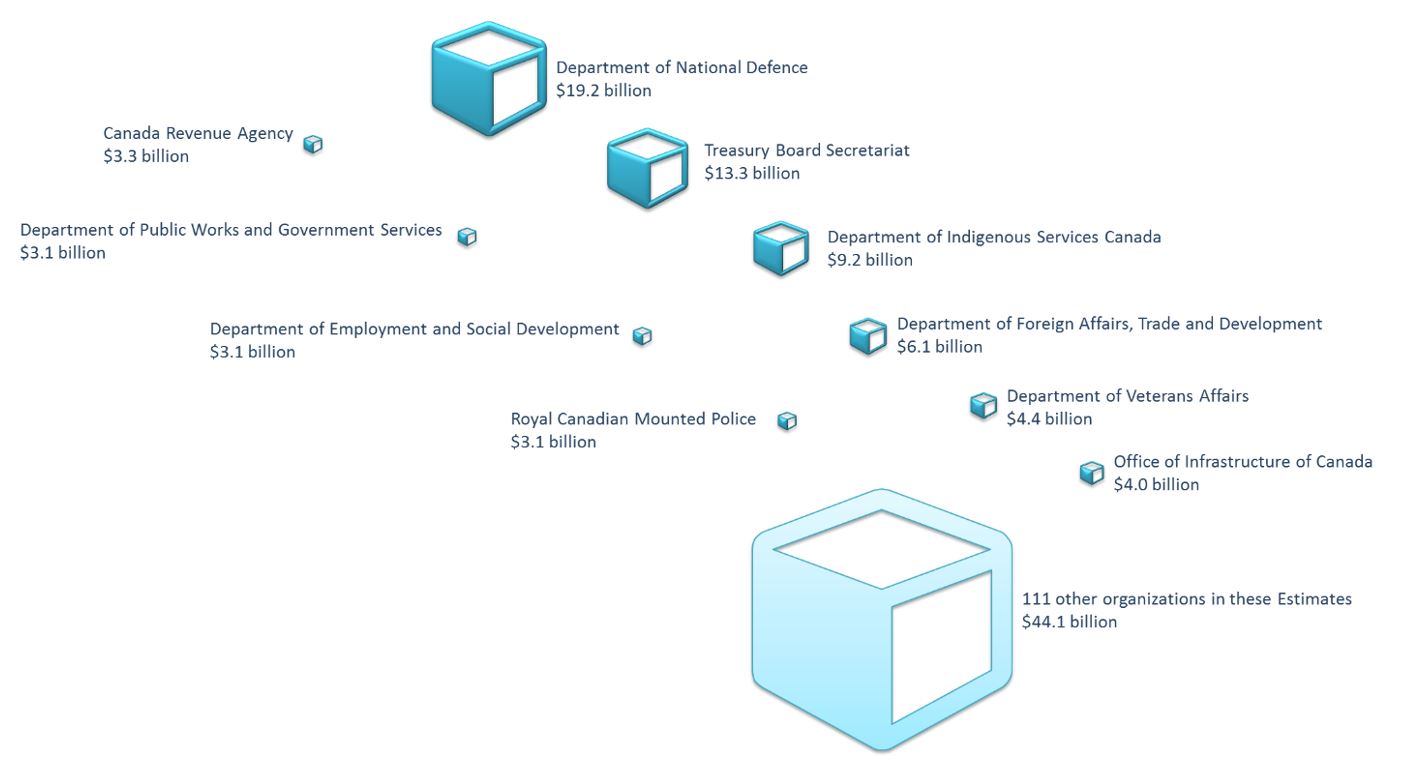

Ten departments account for $68.8 billion (61%) of the voted budgetary appropriations presented in the Main Estimates.

- Department of National Defence: $19.2 billion

- Treasury Board Secretariat: $13.3 billion

- Department of Indigenous Services Canada: $9.2 billion

- Department of Foreign Affairs, Trade and Development: $6.1 billion

- Department of Veterans Affairs: $4.4 billion

- Office of Infrastructure of Canada: $4.0 billion

- Canada Revenue Agency: $3.3 billion

- Department of Public Works and Government Services: $3.1 billion

- Department of Employment and Social Development: $3.1 billion

- Royal Canadian Mounted Police: $3.1 billion

- 111 other organizations in these Estimates: $44.1 billion

Long-term comparison of Main Estimates - Text version

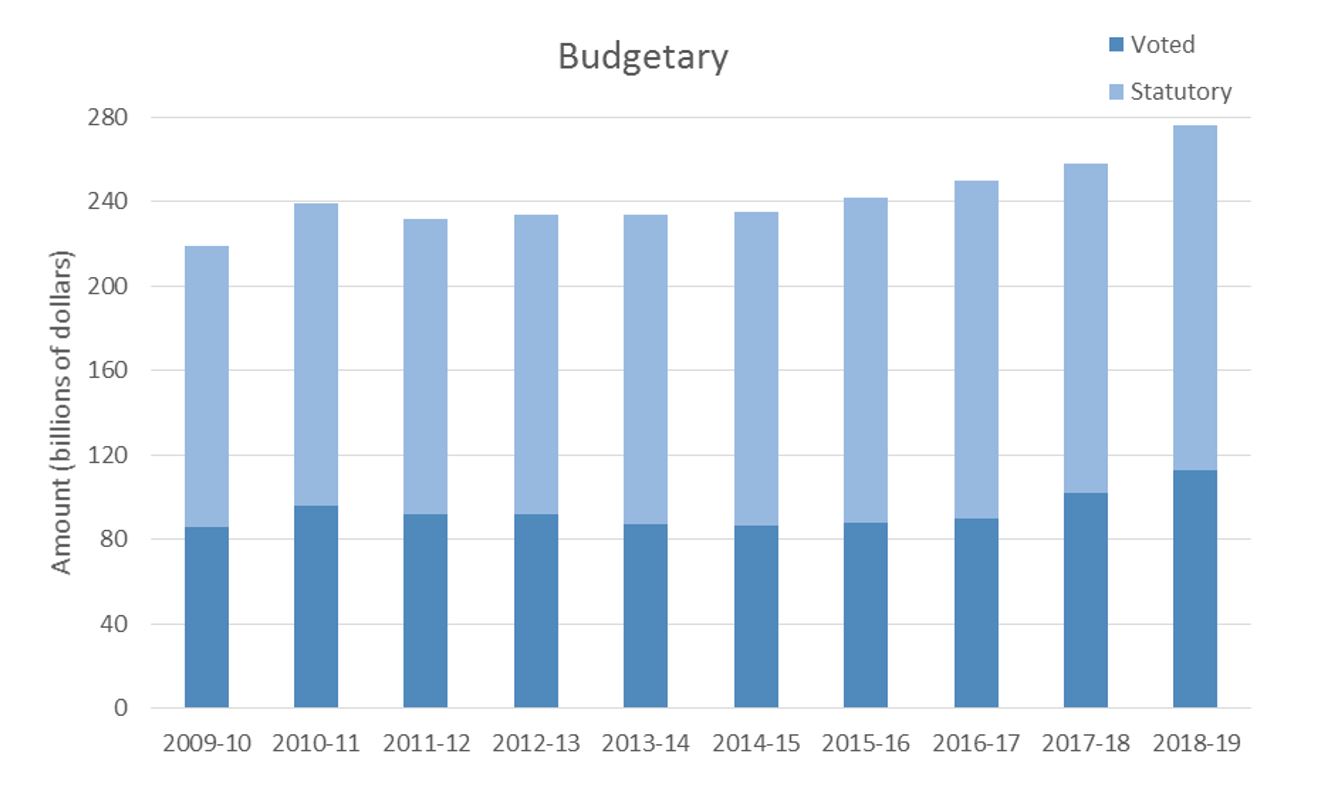

The Main Estimates have increased by 26% over the past 10 years. Voted expenditures have increased by 32% while statutory expenditures have increased by 22%. Amounts below are in billions of dollars.

- 2009-10

- Voted Expenditures: $85.63

- Statutory Expenditures: $133.58

- 2010-11

- Voted Expenditures: $96.17

- Statutory Expenditures: $142.98

- 2011-12

- Voted Expenditures: $91.80

- Statutory Expenditures: $139.58

- 2012-13

- Voted Expenditures: $91.95

- Statutory Expenditures: $141.45

- 2013-14

- Voted Expenditures: $87.06

- Statutory Expenditures: $146.58

- 2014-15

- Voted Expenditures: $86.28

- Statutory Expenditures: $149.05

- 2015-16

- Voted Expenditures: $88.18

- Statutory Expenditures: $153.39

- 2016-17

- Voted Expenditures: $89.85

- Statutory Expenditures: $160.29

- 2017-18

- Voted Expenditures: $102.14

- Statutory Expenditures: $155.78

- 2018-19

- Voted Expenditures: $112.87

- Statutory Expenditures: $163.1

Composition of Estimates and Expenditures - Text version

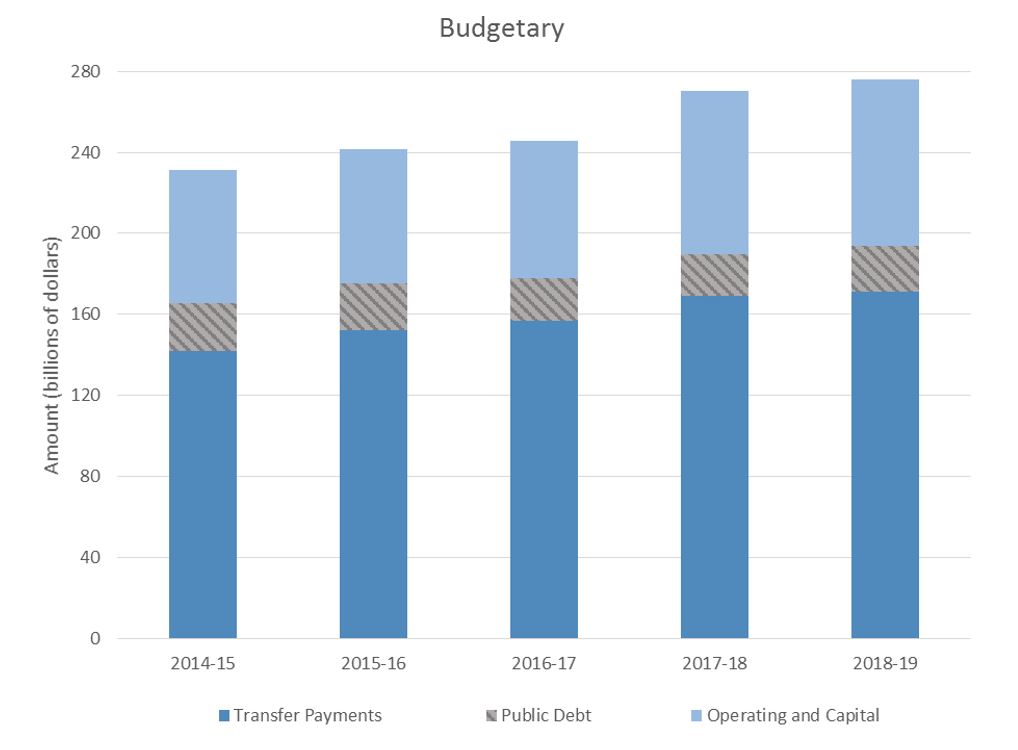

The majority of the government's expenditures consist of transfer payments to other levels of government, individuals and other organizations. Other expenditures include public debt charges as well as operating and capital expenditures. The following information represents the actual expenditures and/or latest planned expenditures for the most recent 5 years (billions of dollars).

- 2014-15 (Actual Expenditures)

- Transfer Payments: $142.13

- Operating and capital: $65.5

- Public Debt: $23.49

- 2015-16 (Actual Expenditures)

- Transfer Payments: $152.4

- Operating and capital: $66.34

- Public Debt: $22.64

- 2016-17 (Actual Expenditures)

- Transfer Payments: $156.64

- Operating and capital: $68.12

- Public Debt: $21.17

- 2017-18 (Estimates to date)

- Transfer Payments: $168.92

- Operating and capital: $80.52

- Public Debt: $20.83

- 2018-19 (Main Estimates)

- Transfer Payments: $170.84

- Operating and capital: $82.29

- Public Debt: $22.84

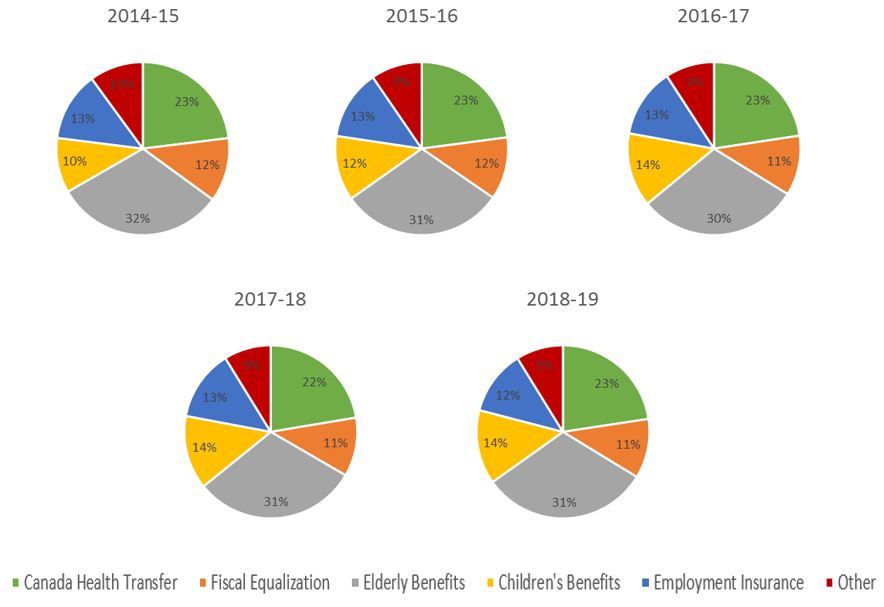

Major Transfer Payments - Text version

Major Transfer Payments account for a large proportion of the government's total expenditure framework. The following information represents the actual expenditures and/or latest planned expenditures for the most recent 5 years (billions of dollars).

- 2014-15 (Actual Expenditures)

- Canada Health Transfer: $32.11 (23%)

- Fiscal Equalization: $16.67 (12%)

- Elderly Benefits: $44.13 (32%)

- Children's Benefits: $14.3 (10%)

- Employment Insurance: $18.05 (13%)

- Other: $14 (10%)

- 2015-16 (Actual Expenditures)

- Canada Health Transfer: $34.02 (23%)

- Fiscal Equalization: $17.34 (12%)

- Elderly Benefits: $45.48 (31%)

- Children's Benefits: $18.03 (12%)

- Employment Insurance: $19.42 (13%)

- Other: $14.2 (9%)

- 2016-17 (Actual Expenditures)

- Canada Health Transfer: $36.06 (23%)

- Fiscal Equalization: $17.88 (11%)

- Elderly Benefits: $48.2 (30%)

- Children's Benefits: $22.07 (14%)

- Employment Insurance: $20.71 (13%)

- Other: $14.64 (9%)

- 2017-18 (Estimates to date)

- Canada Health Transfer: $37.15 (22%)

- Fiscal Equalization: $18.25 (11%)

- Elderly Benefits: $51.06 (31%)

- Children's Benefits: $22.88 (14%)

- Employment Insurance: $22.00 (13%)

- Other: $15.05 (9%)

- 2018-19 (Main Estimates)

- Canada Health Transfer: $38.58 (23%)

- Fiscal Equalization: $18.96 (11%)

- Elderly Benefits: $53.67 (31%)

- Children's Benefits: $23.7 (14%)

- Employment Insurance: $20.7 (12%)

- Other: $15.9 (9%)

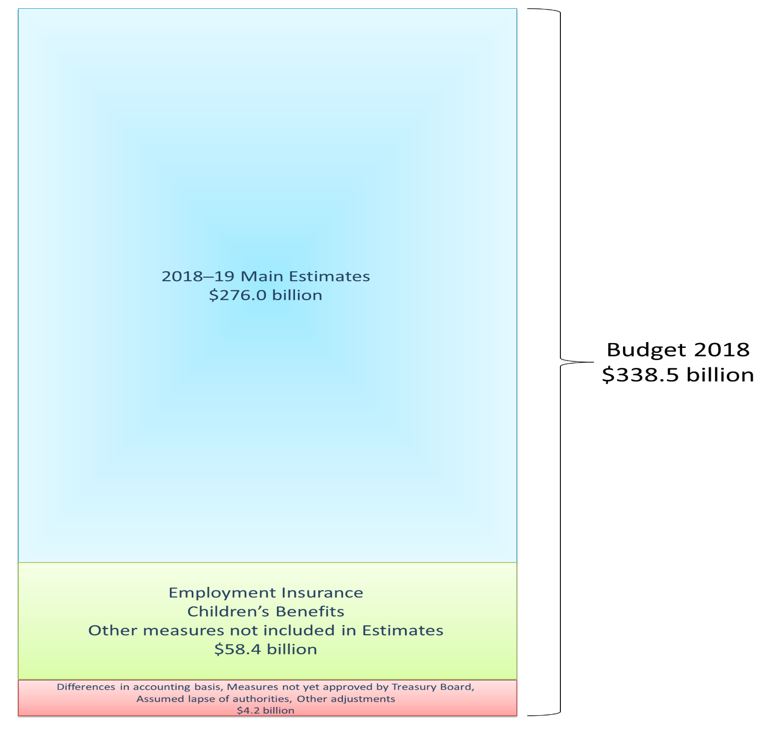

Comparing the Budget and Estimates - Text version

Funding announced in this year's federal budget is compared with that requested through the Main Estimates. Budget 2018 presents a total spending framework of $338.5 billion. Of that amount, $276.0 billion are represented in the 2018-19 Main Estimates.

Two other components are:

- $58.4 billion for Employment Insurance and Children's Benefits, and other measures not included in Estimates; and

- $4.2 billion to account for differences in accounting basis, measures not yet approved by Treasury Board, assumed lapse of authorities, and other adjustments.

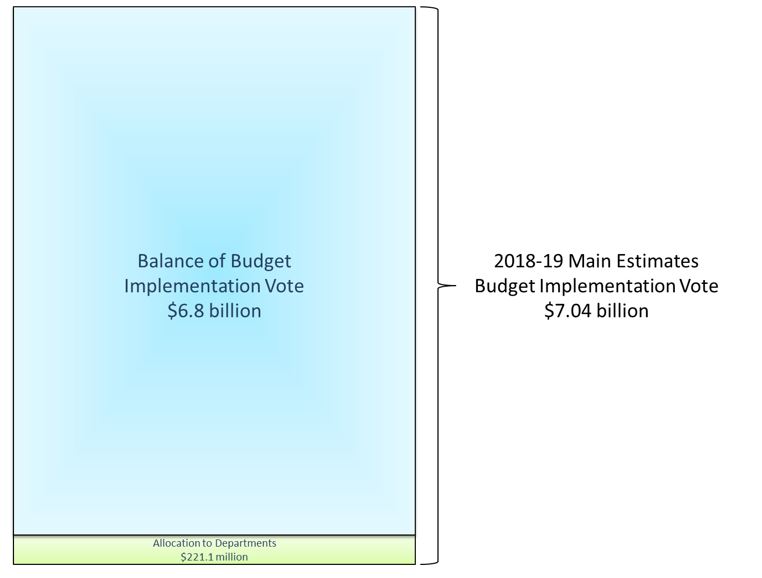

Budget 2018 Implementation - Text version

The 2018-19 Main Estimates includes a Budget Implementation Vote of $7.04 billion. $221.1 million will be allocated to departments immediately following approval of the 2018-19 Main Estimates. The balance of the Budget Implementation Vote will be $6.8 billion.