The Administrative Tribunals Support Service of Canada’s 2025-26 Departmental Plan

On this page

From the Chief Administrator

Orlando Da Silva, LSM

Chief Administrator

I am proud to present the 2025-2026 Departmental Plan for the Administrative Tribunals Support Service of Canada (ATSSC).

This plan reflects our unwavering commitment to delivering excellent support services to the 121 federal administrative tribunals we serve. In November 2024, we celebrated our 10th year of facilitating access to justice by providing services to these tribunals and adapting our practices to meet their shifting needs. Recently, some tribunals have seen their mandates expand, faced heavier workloads, more complex cases and the appointment of additional tribunal members.

In response, we will carefully manage the ATSSC’s resources to support the unique and evolving needs of each tribunal. This includes optimizing our organizational structure to deliver support services more efficiently and to build our organizational capacity.

We continue to seek opportunities to improve efficiency by adopting innovative tools and processes. Recent upgrades to our case management systems have already shown benefits, and we continue to explore the use of artificial intelligence to deliver services—such as translation—more quickly and at lower cost.

We will continue to support the tribunals we serve in holding hearings and resolving disputes in environments that are accessible for all—whether in person or virtually—by continuing to modernize audiovisual equipment in hearing rooms.

Fostering an inclusive and supportive work environment for our employees remains a key priority. We are investing in activities to raise awareness of equity, diversity, inclusion and accessibility, and we regularly share mental health resources with staff. We will continue to review our processes, tools and services to ensure they are inclusive and barrier-free for everyone who interacts with our organization.

As you will read in the ATSSC’s 2025-2026 Departmental Plan, we are committed to ensuring all necessary elements are in place to continue providing exceptional support to the tribunals we serve, and ultimately, to members of the Canadian population seeking access to justice.

Orlando Da Silva, LSM

Chief Administrator

1 As per the Administrative Tribunals Support Service of Canada Act, the ATSSC provides facilities and administrative support to 11 federal administrative tribunals. The ATSSC also supports the Environmental Protection Tribunal of Canada through a memorandum of understanding with Environment and Climate Change Canada.

Plans to deliver on core responsibilities and internal services

Core responsibilities and internal services

Support services and facilities to federal administrative tribunals and their members

Description

The ATSSC is responsible for providing support services required by each tribunal by way of a single, integrated organization.

Quality of life impacts

The activities outlined in the ATSSC’s core responsibility description contribute to the “Good Governance” domain of the Quality of Life Framework for Canada and, more specifically, to the “Democracy and institutions” subdomain and the “Confidence in institutions” indicator.

Indicators, results and targets

This section presents details on the department’s indicators, the actual results from the three most recently reported fiscal years, the targets and target dates approved in 2025-26 for support services and facilities to federal administrative tribunals and their members. Details are presented by departmental result.

Table 1: Tribunal members receive the specialized support services they need to hear matters, to resolve files, or to render decisions.

Table 1 provides a summary of the target and actual results for each indicator associated with the results under support services and facilities to federal administrative tribunals and their members.

Departmental Result Indicators |

Actual Results |

Target |

Date to achieve |

|---|---|---|---|

Percentage of files examined where the preparatory information was deemed complete and provided within the timeframes established by Chairpersons‡ |

85% |

March 31, 2026 |

|

Level of satisfaction of tribunal members with the quality of the specialized services offered by their assigned secretariats |

85% |

March 31, 2026 |

‡ – Established timeframes are set for each individual tribunal as the timing for the receipt of preparatory information varies by tribunal. Timeframes are established by Chairpersons in collaboration with the relevant secretariat and, if applicable, in accordance with legislative or regulatory requirements.

1 – Percentage is based on the average results of 10 out of 12 tribunals. Of the 2 remaining tribunals, one had no cases to report, and the other had not finalized their methodology by the end of the fiscal year 2021-22.

2 – Percentage is based on the average results of 11 out of 12 tribunals. One tribunal had not finalized their methodology by the end of the fiscal year 2022-23.

3 – Percentage is based on the average results of 10 out of 12 tribunals. Of the 2 remaining tribunals, one had no cases to report, and the other had not finalized their methodology by the end of the fiscal year 2023-24.

4 – Percentage is based on the average of the results for the 3 ATSSC programs. For 2023-24, the ATSCC implemented the client satisfaction score (CSAT) to calculate members’ level of satisfaction. Previous years’ results were not recalculated.

Additional information on the detailed results and performance information for the ATSSC’s program inventory is available on GC InfoBase.

Plans to achieve results

The following section describes the planned results for support services and facilities to federal administrative tribunals and their members in 2025-26.

Tribunal members receive the specialized support services they require to hear matters, to resolve files, or to render decisions.

Results we plan to achieve:

- Optimize our organizational structure: Share resources across secretariats, adopt new service standards where possible, refine workflows and improve processes to deliver efficient and flexible services that meet the demanding and dynamic workloads of the tribunals

- Modernize operations and technology: Leverage digital tools, modernize audiovisual equipment, and explore the use of artificial intelligence to enhance operational efficiency

- Adapt support services to tribunals: Support tribunals as they adapt to legislative changes that impact their mandates and operations, and which may result in more complex cases and increased workload for the tribunals and the ATSSC

- Foster an inclusive and supportive work environment: Review processes and address potential barriers to ensure that all individuals can fully participate and thrive in the workplace

Key risks

We may lack the resources to provide the level of support services required by the tribunals we serve as the number of tribunal members, cases and associated costs increase. To mitigate this risk, we will continue to invest in training and streamlining processes to help staff work more efficiently and explore cost-effective solutions to meet the varied and complex needs of the tribunals while maintaining fiscal responsibility.

Planned resources to achieve results

Table 2: Planned resources to achieve results for support services and facilities to federal administrative tribunals and their members

Table 2 provides a summary of the planned spending and full-time equivalents required to achieve results.

Resource |

Planned |

|---|---|

Spending |

$58,991,644 |

Full-time equivalents |

570 |

Complete financial and human resources information for the ATSSC’s program inventory is available on GC InfoBase.

Program inventory

Support services and facilities to federal administrative tribunals and its members is supported by the following programs:

- Program 1.1: Registry Services

- Program 1.2: Legal Services

- Program 1.3: Mandate and Member Services

Additional information related to the program inventory for support services and facilities to federal administrative tribunals and their members is available on the Results page on GC InfoBase.

Internal services

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Plans to achieve results

This section presents details on how the department plans to achieve results and meet targets for internal services.

- Enhance corporate services processes

- Take inventory, assess, review, and refine corporate services processes to ensure they are client-centric, effective, efficient, accessible, and inclusive

- Provide access to secure communication infrastructure

- Provide access to the necessary infrastructure to enable secure communication services

- Develop a holistic people management strategy

- Create an integrated approach to people management that is anchored in the core values of the public service

- Support sustainable progress on various government-wide priorities such as mental health and well-being, diversity, inclusion, official languages, accessibility, and values and ethics

- Ensure that programs and services are barrier-free in their design and delivery

Planned resources to achieve results

Table 3: Planned resources to achieve results for internal services this year

Table 3 provides a summary of the planned spending and full-time equivalents required to achieve results.

Resource |

Planned |

|---|---|

Spending |

$23,478,629 |

Full-time equivalents |

150 |

Complete financial and human resources information for the ATSSC’s program inventory is available on GC InfoBase.

Planning for contracts awarded to Indigenous businesses

Government of Canada departments are to meet a target of awarding at least 5% of the total value of contracts to Indigenous businesses each year. This commitment is to be fully implemented by the end of 2025-26.

The ATSSC has identified opportunities to consider qualified Indigenous suppliers for procurement therefore ensuring that Indigenous businesses are included where capacity exists.

We have taken the following actions to support the government’s commitment:

- Integrated Indigenous procurement with annual planning

- Continued to incorporate Indigenous procurement targets into our Annual Procurement Plan, monitored contracting activities and adjusted as needed to meet the 5% target

- Identified opportunities for Indigenous suppliers

- Determined the market capacity for various goods and services of Indigenous businesses and ensured that clients were aware of qualified Indigenous suppliers

- Enhanced procurement training

- Required new procurement officers to complete Indigenous procurement training courses within 6 months of arriving at the ATSSC

- Collaborated across government

- Actively participated in intergovernmental working groups and training sessions on Indigenous procurement and collaborated with government departments and central agencies on various Indigenous procurement initiatives

Table 4: Percentage of contracts planned and awarded to Indigenous businesses

Table 4 presents the current, actual results with forecasted and planned results for the total percentage of contracts the department awarded to Indigenous businesses.

5% Reporting Field |

2023-24 Actual Result |

2024-25 Forecasted Result |

2025-26 Planned Result |

|---|---|---|---|

Total percentage of contracts with Indigenous businesses |

44.88% |

5% |

>5% |

Planned spending and human resources

This section provides an overview of the ATSSC’s planned spending and human resources for the next three fiscal years and compares planned spending for 2025-26 with actual spending from previous years.

Spending

This section presents an overview of the department's planned expenditures from 2022-23 to 2027-28.

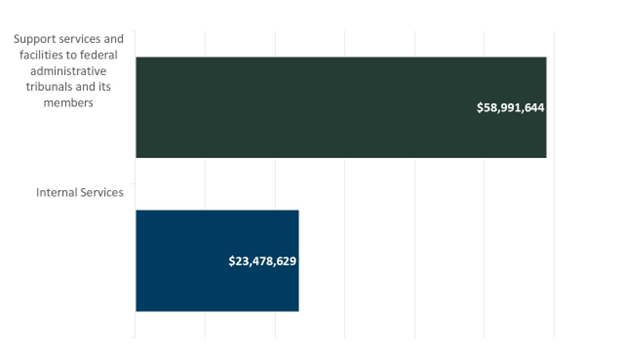

Graph 1 presents how much the department plans to spend in 2025-26 to carry out core responsibilities and internal services.

Text description of figure 1

Core responsibilities and internal services |

2025-26 planned spending |

|---|---|

Support services and facilities to federal administrative tribunals and its members |

$58,991,644 |

Internal services |

$23,478,629 |

Analysis of planned spending by core responsibility

This table summarizes the ATSSC’s planned spending for its core responsibility and internal services for the upcoming fiscal year. In fiscal year 2025-26, planned spending for support services and facilities to federal administrative tribunals and their members is $58,991,644, corresponding to 71.53% of planned spending. Planned spending for internal services is $23,478,629, corresponding to 28.47% of planned spending. All numbers presented are net of vote-netted revenue.

Budgetary performance summary

Table 5: Three-year spending summary for core responsibilities and internal services (dollars)

Table 5 presents how much money the ATSSC spent over the past three years to carry out its core responsibilities and for internal services. Amounts for the current fiscal year are forecasted based on spending to date.

Core responsibilities and Internal services |

2022-23 Actual Expenditures |

2023-24 Actual Expenditures |

2024-25 Forecast Spending |

|---|---|---|---|

Support services and facilities to federal administrative tribunals and its members |

$59,592,353 |

$62,893,574 |

$59,877,172 |

Subtotal(s) |

$59,592,353 |

$62,893,574 |

$59,877,172 |

Internal services |

$23,003,073 |

$25,798,987 |

$25,804,187 |

Total(s) |

$82,595,426 |

$88,692,561 |

$85,681,359 |

Analysis of the past three years of spending

Spending increased from 2022-23 to 2023-24 ($6.1 million) due to continued efforts to add more capacity across the organization, to address the continued implementation of new or modified legislative mandates for tribunals combined with an increased volume of cases in certain tribunals as well as an increase in personnel expenditures related to the growth in salary rates resulting from the signing of collective agreements.

Forecasted spending in 2024-25 is lower than 2023-24 actual expenditures by $3.0 million, primarily due to activities related to tribunal caseloads, the Refocusing Government Spending to Deliver for Canadians initiative and decreased expenditures related to personnel and employee compensation as a result of new collective agreements.

All numbers presented are net of vote-netted revenue.

More financial information from previous years is available on the Finances section of GC Infobase.

Table 6: Planned three-year spending on core responsibilities and internal services (dollars)

Table 6 presents how much money the ATSSC’s plans to spend over the next three years to carry out its core responsibilities and for internal services.

Core responsibilities and Internal services |

2025-26 Planned Spending |

2026-27 Planned Spending |

2027-28 Planned Spending |

|---|---|---|---|

Support services and facilities to federal administrative tribunals and its members |

$58,991,644 |

$58,429,983 |

$57,915,449 |

Subtotal |

$58,991,644 |

$58,429,983 |

$57,915,449 |

Internal services |

$23,478,629 |

$23,255,089 |

$23,050,305 |

Total(s) |

$82,470,273 |

$81,685,072 |

$80,965,754 |

Analysis of the past three years of spending

Spending is expected to decrease slightly in 2026-27 and subsequent years due to the continued implementation of the Refocusing Government Spending to Deliver for Canadians initiative.

All numbers presented are net of vote-netted revenue.

More detailed financial information on planned spending is available on the Finances section of GC Infobase.

Table 7: Budgetary gross and net planned spending summary (dollars)

Table 7 reconciles gross planned spending with net spending for 2025-26.

Core responsibilities and Internal services |

2025-26 Gross planned spending (dollars) |

2025-26 Planned revenues netted against spending (dollars) |

2025-26 Planned net spending (authorities used) |

|---|---|---|---|

Support services and facilities to federal administrative tribunals and its members |

$95,837,972 |

$36,846,328 |

$58,991,644 |

Subtotal |

$95,837,972 |

$36,846,328 |

$58,991,644 |

Internal services |

$26,457,952 |

$2,979,323 |

$23,478,629 |

Total |

$122,295,924 |

$39,825,651 |

$82,470,273 |

Analysis of budgetary gross and net planned spending summary

The ATSSC is partially funded by vote-netted revenue (a cost recovery mechanism), for the operation of the Secretariat to the Social Security Tribunal of Canada. As the expenses of this Secretariat increase, the revenue increases proportionately, which decreases the net cost of its operations. The planned expenses result from the authority to make recoverable expenditures on behalf of the Canada Pension Plan and the Employment Insurance Operating Account.

Information on the alignment of the ATSSC’s spending with Government of Canada’s spending and activities is available on GC InfoBase.

Funding

This section provides an overview of the department's voted and statutory funding for its core responsibilities and for internal services. For further information on funding authorities, consult the Government of Canada budgets and expenditures.

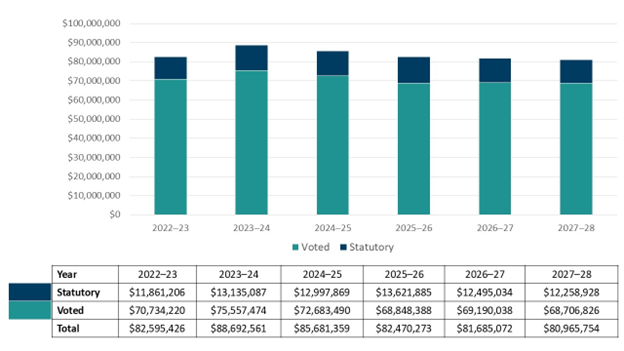

Graph 2 summarizes the department's approved voted and statutory funding from 2022-23 to 2027-28.

Text description of graph 2

This graph illustrates the ATSSC’s actual and planned spending over a 6-year period starting in 2022-23 and ending in 2027-28. In fiscal year 2022-23, statutory spending was $11,861,206 and voted spending was $70,734,220, for a total of $82,595,426. In fiscal year 2023-24, statutory spending was $13,135,087 and voted spending was $75,557,474, for a total of $88,692,561. In fiscal year 2024-25, forecasted statutory spending is $12,997,869 and voted spending is $72,683,490, for a total of $85,681,359. In fiscal year 2025-26, planned statutory spending is $13,621,885 and voted spending is $68,848,388, for a total of $82,470,273. In fiscal year 2026-27, planned statutory spending is $12,495,034 and voted spending is $69,190,038, for a total of $81,685,072. In fiscal year 2027-28, planned statutory spending is $12,258,928 and voted spending is $68,706,826, for a total of $80,965,754.

Fiscal year |

Total |

Voted |

Statutory |

|---|---|---|---|

2022-23 |

$82,595,426 |

$70,734,220 |

$11,861,206 |

2023-24 |

$88,692,561 |

$75,557,474 |

$13,135,087 |

2024-25 |

$85,681,359 |

$72,683,490 |

$12,997,869 |

2025-26 |

$82,470,273 |

$68,848,388 |

$13,621,885 |

2026-27 |

$81,685,072 |

$69,190,038 |

$12,495,034 |

2027-28 |

$80,965,754 |

$68,706,826 |

$12,258,928 |

Analysis of statutory and voted funding over a six-year period

This graph illustrates the ATSSC’s actual and planned spending over a 6-year period.

Fiscal years 2022-23 and 2023-24 show actual expenditures as reported in the Public Accounts, while 2024-25 presents the forecast for the current fiscal year.

Forecasted spending in 2024-25 is lower than 2023-24 actual expenditures by $3.0 million, primarily due to activities related to tribunal caseloads, the Refocusing Government Spending to Deliver for Canadians initiative and decreased expenditures related to personnel and employee compensation as a result of new collective agreements.

Spending is projected to decrease between 2024-25 and 2025-26 by $3.2 million due to the implementation of the Refocusing Government Spending to Deliver for Canadians initiative and the sunsetting of program integrity funding.

Spending is expected to decrease by $0.8 million in 2026-27 and subsequent years due to the continued implementation of the Refocusing Government Spending to Deliver for Canadians initiative.

All numbers presented are net of vote-netted revenue.

For further information on the ATSSC’s departmental appropriations, consult the 2025-26 Main Estimates.

Future-oriented condensed statement of operations

The future-oriented condensed statement of operations provides an overview of the ATSSC’s operations for 2024-25 to 2025-26.

Table 8: Future-oriented condensed statement of operations for the year ended March 31, 2026 (dollars)

Table 8 summarizes the expenses and revenues which net to the cost of operations before government funding and transfers for 2024-25 to 2025-26. The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

Financial information |

2024-25 Forecast results |

2025-26 Planned results |

Difference (Planned results minus forecasted) |

|---|---|---|---|

Total expenses |

$126,841,180 |

$131,707,317 |

$4,866,137 |

Total revenues |

$31,753,508 |

$39,825,651 |

$8,072,143 |

Net cost of operations before government funding and transfers |

$95,087,672 |

$91,881,666 |

- $3,206,006 |

Analysis of forecasted and planned results

For the 2025-26 fiscal year, the net cost of operations before government funding and transfers is forecasted to be $3.2 million lower than the forecasted 2024-25 results. This reduction is primarily due to the implementation of Refocusing Government Spending to Deliver for Canadians and the sunsetting of program integrity funding. In addition, total revenue is expected to increase in 2025-26 to support preparations for the transfer of Employment Insurance (EI) cases from the Social Security Tribunal to the EI Board of Appeal. This increase reflects the anticipated need to adjudicate a higher number of cases.

A more detailed Future-Oriented Statement of Operations and associated Notes for 2025-26, including a reconciliation of the net cost of operations with the requested authorities, is available on the ATSSC’s website.

Human resources

This section presents an overview of the department’s actual and planned human resources from 2022-23 to 2027-28.

Table 9: Actual human resources for core responsibilities and internal services

Table 9 shows a summary of human resources, in full-time equivalents, for the ATSSC’s core responsibilities and for its internal services for the previous three fiscal years. Human resources for the current fiscal year are forecasted based on year to date.

Core responsibilities and internal services |

2022-23 actual full-time equivalents |

2023-24 actual full-time equivalents |

2024-25 forecasted full-time equivalents |

|---|---|---|---|

Support services and facilities to federal administrative tribunals and its members |

576 |

586 |

563 |

Subtotal |

576 |

586 |

563 |

Internal services |

155 |

157 |

155 |

Total |

731 |

743 |

718 |

Analysis of human resources over the last three years

Explanations for changes in full-time equivalents by year are in line with the explanations provided for variances in the departmental spending section.

Table 10: Human resources planning summary for core responsibilities and internal services

Table 10 shows information on human resources, in full-time equivalents, for each of the ATSSC’s core responsibilities and for its internal services planned for the next three years.

Core responsibilities and internal services |

2025-26 planned full-time equivalents |

2026-27 planned full-time equivalents |

2027-28 planned full-time equivalents |

|---|---|---|---|

Support services and facilities to federal administrative tribunals and its members |

570 |

533 |

536 |

Subtotal |

570 |

533 |

536 |

Internal services |

150 |

145 |

146 |

Total |

720 |

678 |

682 |

Analysis of human resources for the next three years

Explanations for changes in full-time equivalents by year are in line with the explanations provided for variances in the departmental spending section.

Corporate information

Departmental profile

Departmental contact information

Supplementary information tables

The following supplementary information tables are available on the ATSSC’s website:

Information on the ATSSC’s departmental sustainable development strategy can be found on the ATSSC’s website.

Federal tax expenditures

The ATSSC’s Departmental Plan does not include information on tax expenditures.

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures.

This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA Plus of tax expenditures.

Definitions

List of terms

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, departments or individuals; and payments to Crown corporations.

- core responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A report on the plans and expected performance of an appropriated department over a 3-year period. Departmental Plans are usually tabled in Parliament each spring.

- departmental result (résultat ministériel)

- A consequence or outcome that a department seeks to achieve. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

- A quantitative measure of progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

- A framework that connects the department’s core responsibilities to its departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

- A report on a department’s actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

- full-time equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full person-year charge against a departmental budget. For a particular position, the full-time equivalent figure is the ratio of number of hours the person actually works divided by the standard number of hours set out in the person’s collective agreement.

- gender-based analysis plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

Is an analytical tool used to support the development of responsive and inclusive policies, programs, and other initiatives. GBA Plus is a process for understanding who is impacted by the issue or opportunity being addressed by the initiative; identifying how the initiative could be tailored to meet diverse needs of the people most impacted; and anticipating and mitigating any barriers to accessing or benefitting from the initiative. GBA Plus is an intersectional analysis that goes beyond biological (sex) and socio-cultural (gender) differences to consider other factors, such as age, disability, education, ethnicity, economic status, geography (including rurality), language, race, religion, and sexual orientation.

Using GBA Plus involves taking a gender- and diversity-sensitive approach to our work. Considering all intersecting identity factors as part of GBA Plus, not only sex and gender, is a Government of Canada commitment.

- government priorities (priorités gouvernementales)

For the purpose of the 2025-26 Departmental Plan, government priorities are the high-level themes outlining the government’s agenda in the most recent Speech from the Throne.

- horizontal initiative (initiative horizontale)

- An initiative where two or more federal departments are given funding to pursue a shared outcome, often linked to a government priority.

- Indigenous business (entreprise autochtones)

- For the purpose of the Directive on the Management of Procurement Appendix E: Mandatory Procedures for Contracts Awarded to Indigenous Businesses and the Government of Canada’s commitment that a mandatory minimum target of 5% of the total value of contracts is awarded to Indigenous businesses, a department that meets the definition and requirements as defined by the Indigenous Business Directory.

- non budgetary expenditures (non budgetary expenditure)

- Non-budgetary authorities that comprise assets and liabilities transactions for loans, investments and advances, or specified purpose accounts, that have been established under specific statutes or under non-statutory authorities in the Estimates and elsewhere. Non-budgetary transactions are those expenditures and receipts related to the government's financial claims on, and obligations to, outside parties. These consist of transactions in loans, investments and advances; in cash and accounts receivable; in public money received or collected for specified purposes; and in all other assets and liabilities. Other assets and liabilities, not specifically defined in G to P authority codes are to be recorded to an R authority code, which is the residual authority code for all other assets and liabilities.

- performance (rendement)

- What a department did with its resources to achieve its results, how well those results compare to what the department intended to achieve, and how well lessons learned have been identified.

- performance indicator (indicateur de rendement)

- A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an department, program, policy or initiative respecting expected results.

- plan (plan)

- The articulation of strategic choices, which provides information on how a department intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead to the expected result.

- planned spending (dépenses prévues)

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

- program (programme)

- Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

- Identifies all the department’s programs and describes how resources are organized to contribute to the department’s core responsibilities and results.

- result (résultat)

- A consequence attributed, in part, to a department, policy, program or initiative. Results are not within the control of a single department, policy, program or initiative; instead they are within the area of the department’s influence.

- statutory expenditures (dépenses législatives)

- Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- target (cible)

- A measurable performance or success level that a department, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

- Expenditures that Parliament approves annually through an appropriation act. The vote wording becomes the governing conditions under which these expenditures may be made.