Evaluation of the Canada Coal Transition Initiative (CCTI) and the CCTI - Infrastructure Fund

Evaluation and Advisory Services

Atlantic Canada Opportunities Agency

Final Report, April 18, 2024

About this publication

© His Majesty the King in Right of Canada, as represented by

the Minister of Rural Economic Development and Minister

responsible for the Atlantic Canada Opportunities Agency, 2024.

Catalogue No. AC5-57/2024E-PDF

ISBN 978-0-660-71402-8

Table of Contents

Acronyms

ACOA - Atlantic Canada Opportunities Agency

BDP - Business Development Program

CBDC - Community Business Development Corporation

CBRM - Cape Breton Regional Municipality

CCTI - Canada Coal Transition Initiative

CCTI-IF - Canada Coal Transition Initiative – Infrastructure Fund

DRF - Departmental Results Framework

ECCC - Environment and Climate Change Canada

GBA Plus - Gender-based analysis plus

GHG - green house gases

G&C - grants & contributions

ICF - Innovative Communities Fund

JTTF - Just Transition Task Force

OAGC - Office of the Auditor General of Canada

RDA - regional development agency

REGI - Regional Economic Growth through Innovation

SME - small and medium-sized enterprise

TBS - Treasury Board Secretariat

WD - Western Economic Diversification

Acknowledgements

This evaluation provides Canadians with an evidence-based, neutral assessment of the relevance and performance of the Atlantic Canada opportunities Agency’s (ACOA) delivery of the Canada Coal Transition Initiative and the Canada Coal Transition Initiative – Infrastructure Fund.

The evaluation team is grateful to the external key informants as well as the many ACOA employees from across Atlantic Canada who provided their time and knowledge in support of this evaluation.

Finally, under the exemplary leadership of Laura Kastronic and Deanna Slattery-Doiron, the evaluation team -- Lise Gallant, Nidhi Patel, Danie Landry, Chantal Saucier, Julie Noël, Gaétanne Kerry and Joelle Thériault -- provided great analysis under tight timelines. Thank you all for your dedication, professionalism and commitment to excellence.

Paul-Émile David

Director, Evaluation and Advisory Services

Executive Summary

This report presents the results of an evaluation of the relevance and performance of the Atlantic Canada Opportunities Agency’s (ACOA) delivery of the Canada Coal Transition Initiative (CCTI) and the Canada Coal Transition Initiative – Infrastructure Fund (CCTI-IF) from April 1, 2018 to March 31, 2023.

The study sought to answer the following four broad questions:

- To what extent do the initiatives address the distinct needs of affected communities related to diversifying and transitioning their economies away from coal-fired electricity generation?

- To what extent are the programs aligned with Government of Canada and ACOA/regional priorities?

- To what extent do the initiatives contribute to helping communities transition their economies away from coal-fired electricity generation?

- To what extent have the initiatives assisted impacted communities to diversify their economies?

- To what extent have the initiatives assisted impacted communities build capacity and create an enabling environment that reduces vulnerabilities to future economic shocks and supports sustainable economic growth?

- What factors facilitate or impede efficient program delivery?

Conclusions

By leveraging the deep knowledge of the local economy and robust stakeholder relationships established by Agency staff, ACOA is focusing its delivery of the CCTI and CCTI-IF on the unique needs of communities in New Brunswick and Nova Scotia as they prepare for the eventual phase-out of coal-fired electricity generation. These investments are contributing to the economic diversification and capacity of affected communities and align with Government of Canada priorities, including climate change mitigation, Indigenous reconciliation and regional priorities such as tourism. The integration of the CCTI and CCTI-IF into existing ACOA programs was generally considered efficient, and the vast majority of clients were satisfied with the service they received.

Lessons Learned:

- Timing matters: Closer alignment of the launch of the CCTI and CCTI-IF initiatives with the anticipated timing of the transition in Atlantic Canada would have contributed to greater relevance and effectiveness of the initiatives by ensuring adequate promotion and planning efforts at the outset. There are opportunities for greater advocacy of Atlantic Canadian interests in the development and implementation of these types of short-term, targeted programs to ensure that their design and timing are relevant to the realities in the region.

- Planning matters: The rapid implementation and lack of internal communication hindered the efficient allocation of resources and selection of projects and impacted the effectiveness of the initiatives. There is an opportunity for the Agency to improve planning around how resources are allocated and how performance will be measured at the outset of these types of short-term boutique initiatives and programs.

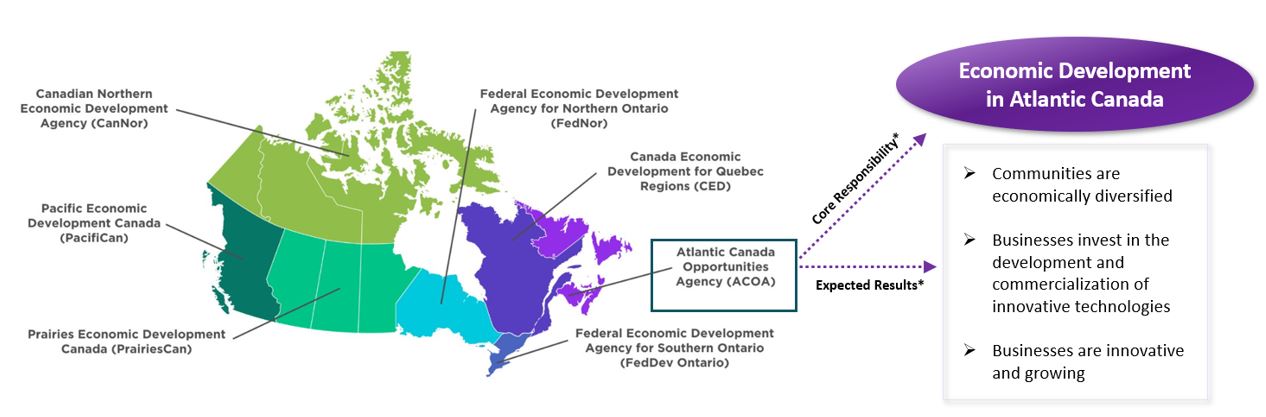

1.0 The Agency

ACOA is 1 of 7 federal regional development agencies (RDAs) in Canada that provide regionally tailored programs, services, knowledge and expertise with the aim to address economic challenges and opportunities.Footnote 1 ACOA’s mandate is "to increase opportunity for economic development in Atlantic Canada and, more particularly, to enhance the growth of earned incomes and employment opportunities in that region."Footnote 2

ACOA works with small and medium-sized businesses (SMEs), communities, organizations and regional stakeholders to strengthen the Atlantic economy through programs that focus on economic development, community development as well as policy, advocacy and coordination.Footnote 3

Figure 1: Canada's Regional Development Agencies

Long description: Map of Canada

This map of Canada indicates the geographic locations covered by each regional development agency. The Canadian Northern Economic Development Agency (CanNor) covers Yukon, Northwest Territories and Nunavut; the Federal Economic Development Agency for Northern Ontario (FedNor) covers Northern Ontario; the Canada Economic Development for Quebec Regions (CED) covers Quebec; the Federal Economic Development Agency for Southern Ontario (FedDev) covers Southern Ontario; Prairies Economic Development Canada (PrairiesCan) covers Alberta, Saskatchewan and Manitoba; Pacific Economic Development Canada (PacifiCan) covers British Columbia; and the Atlantic Canada Opportunities Agency (ACOA), covers New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador.

ACOA’s core responsibility is economic development in Atlantic Canada, and its expected results are ensuring that communities are economically diversified, businesses are investing in the development and commercialization of innovative technologies, and businesses are innovative and growing. For more information on ACOA’s core responsibility and expected results, see the Agency’s Departmental Results Framework.

2.0 The Program

Program description

Pan-Canadian Framework on Clean Growth and Climate Change

The international commitment to address climate change was significantly advanced at the 2015 United Nations’ Climate Change Conference in Paris. Canada, along with 194 other countries, adopted the Paris Agreement, marking a historic collaboration in reducing greenhouse gas (GHG) emissions.Footnote 4 This agreement highlighted the necessity of a just transition for the workforce, emphasizing the creation of decent work and quality jobs, aligned with national development priorities.

In response to this global initiative, in 2016 the Government of Canada announced its plan to phase-out coal-fired electricity by 2030. This decision was a key component of the Pan-Canadian Framework on Clean Growth and Climate Change, which laid out a comprehensive strategy encompassing four main pillars: pricing carbon pollution, complementary measures for further emission reductions across various economic sectors, initiatives for adapting to climate change impacts and building resilience, and promoting innovation, clean technology, and job creation.Footnote 5 This phase-out would significantly affect workers and communities in Alberta, Saskatchewan, New Brunswick and Nova Scotia.Footnote 6

Just Transition Task Force

Recognizing the adverse economic impacts this regulatory phase-out could have on communities and workers dependent on the coal sector, in 2018, Environment and Climate Change Canada (ECCC) established the Just Transition Task Force (JTTF) for Canadian Coal Power Workers and CommunitiesFootnote 7. The JTTF was tasked with:

- engaging workers and communities in the provinces affected by the coal phase-out

- providing options and recommendations to the Government of Canada, via the Minister, on what could be included in a just transition plan for coal power workers and communities

- how to structure a subsequent phase of consultation and analysis concerning a just transitionFootnote 8

The recommendations provided in the task force’s final report outlined measures to off-set the significant economic impacts expected in coal-affected communities, including the loss of jobs, reductions in industrial tax revenue, and skilled workers moving elsewhere to seek employment.

Funding

To mitigate the potential adverse economic impacts of the transition, the Government of Canada allocated a total of $185 million to support affected workers and communities through the following investments (Table 1). The CCTI and the CCTI-IF were delivered to affected communities in Alberta and Saskatchewan through Prairies Economic Development Canada (PrairiesCan: formerly Western Economic Diversification (WD)), and through ACOA in New Brunswick and Nova Scotia.

Table 1: Overview of Total Investment from the Government of Canada in CCTI and CCTI-IF

| Program | Total Investment | Investment by region | Investment Source | Program Duration |

|---|---|---|---|---|

| CCTI | $35M | $10M (ACOA) $25M (WD) |

Budget 2018 | April 1, 2018 to March 31, 2023 |

| CCTI-IF | $150M | $45M (ACOA) $105M (PrairiesCan) |

Budget 2019 | August 20, 2020 to March 31, 2025 |

Canada Coal Transition Initiative

The CCTI is a key part of the commitments made under the Pan-Canadian Framework on Clean Growth and Climate Change. By investing in capacity-building, entrepreneurship, business start-up and expansion, and supply-chain development, the CCTI supports skills development and economic diversification activities to help workers and communities:

- transition their economies away from coal-fired electricity generation

- adapt to Canada's transition to a low-carbon economy

Canada Coal Transition Initiative – Infrastructure Fund

Following one of the recommendations of the JTTF, the CCTI-IF provides additional funding over five years (2020-2025) for infrastructure needs in impacted communities. The CCTI-IF aims to help affected communities move away from coal by investing in local infrastructureFootnote 9 projects that encourage economic diversification, bring in new sources of revenue and build adaptive capacity to reduce their vulnerability to future economic shocks. It will address immediate challenges and, to the extent possible, support the initial phases of longer-term community transition. Outcomes are focused on the creation of jobs, and diversification of the local and regional economies.

The Atlantic Canadian context

The full impact of the phase-out of coal-fired electricity generation varies in extent and timing across the country. For example, the transition has differed with Alberta and Saskatchewan displacing coal with natural gas, and Nova Scotia and New Brunswick actively looking for alternative energy sources to meet the 2030 target. In Alberta, coal transition began in 2015, and the province now relies on a mix of renewables and gas generation. Alberta will have fully phased-out coal generation by early 2024, and has been facing community impacts over this time. Saskatchewan is actively looking for alternative baseload energy options before committing to a timeline to phase-out coal. Changes in Nova Scotia and New Brunswick are expected to be gradual, and coal-industry job impacts may be mitigated through regular workforce adjustment and attrition.

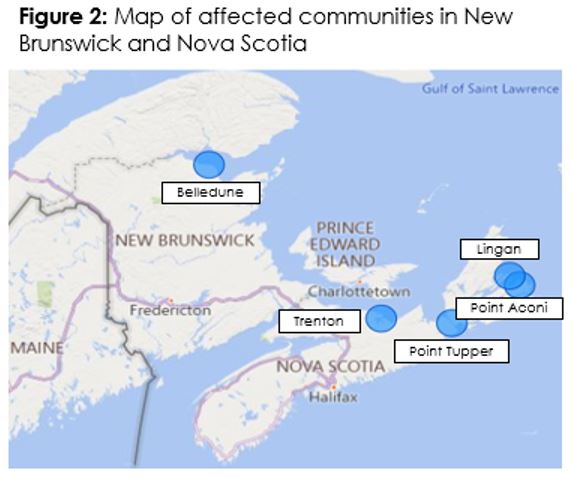

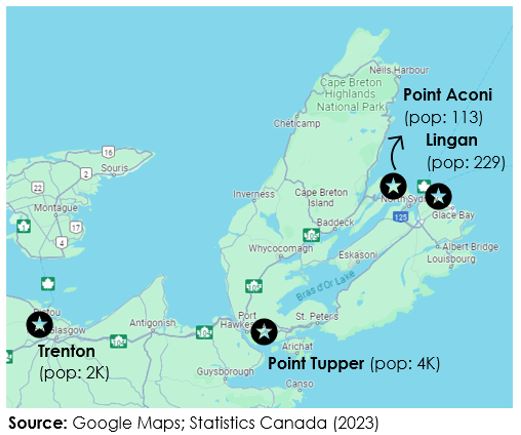

As there are currently no job losses as a result of the planned phase-out of coal in New Brunswick and Nova Scotia, ACOA has focused its efforts on broader community-based economic development initiatives to support affected workers and communities in New Brunswick (Belledune) and Nova Scotia (Lingan, Point Aconi, Point Tupper and Trenton) (See Figure 2). Affected communities in Nova Scotia are divided into two main regions throughout this report: mainland Nova Scotia and Cape Breton.

These areas are predominately rural and tend to underperform compared to provincial and national averages on various socio-economic indicators such as unemployment, median age and average household income. These areas struggle with outmigration, a shortage of skilled labour and the closure of key industries. As such, the potential loss of jobs and industries related to the phase-out of coal could have significant negative effects in these vulnerable communities.

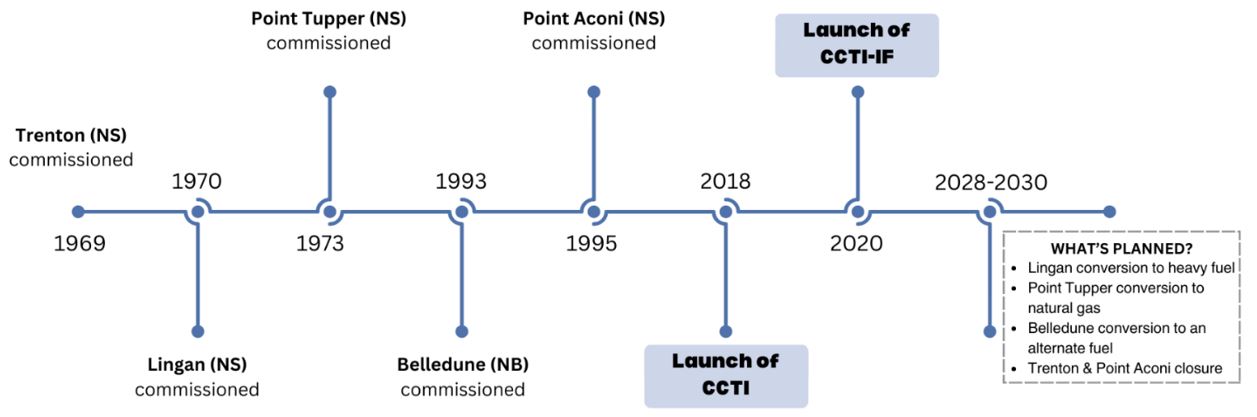

Long description: Timeline

* Trenton Station commissioned in 1969.

* Lingan Station commissioned in 1970.

* Point Tupper Station commissioned in 1973.

* Belledune Station commissioned in 1993.

* Point Aconi Station commissioned in 1995.

* Canada Coal Transition Initiative launched in 2018.

* Canada Coal Transition Initiative – Infrastructure Fund launched in 2020.

* Lingan will be converted to heavy fuel, Point Tupper will be converted to natural gas, Belledune will be converted to an alternate fuel and Trenton & Point Aconi are planned to close between 2028-2030.

For a more detailed overview of the socio-economic context in the affected communities, please refer to Annex A "Case Study: New Brunswick," and Annex B, "Case Study: Cape Breton Island and Mainland Nova Scotia."

Program delivery

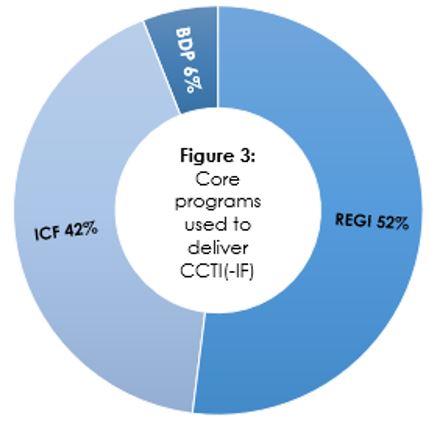

The initiatives combine grant and contribution (G&C) investments with non-financial supports. They are delivered through a continuous intake model, allowing proponents to submit project applications to ACOA at any point throughout the year. The types of assistance available include both repayable contributions (either conditional or unconditional) and non-repayable contributions. The CCTI and CCTI-IF are delivered using several of the Agency’s core programs: the Business Development Program (BDP), the Innovative Communities Fund (ICF) and the Regional Economic Growth through Innovation (REGI) program (Figure 3).

Eligible projects must be in one of the affected communities and surrounding areas in New Brunswick and Nova Scotia,Footnote 10 and must:

- be beneficial to the economic development of a community

- lead to sustainable economic activity

- be incremental in nature beyond any ongoing activities

- have a fixed duration with a time frame considered reasonable and necessary to complete the project

- meet existing BDP, ICF or REGI program eligibility criteria (contributions only, no grants)

Regional approach to program delivery

ACOA has taken a regional diversification lens focused on building economic development opportunities and taking into consideration that potential impacts are unique to each region and community. Flexibility is thus required to tailor approaches to best respond to the identified needs of communities and stakeholders. In New Brunswick and Nova Scotia, given the longer timelines for coal-fired electricity generation phase-out and the limited amount of federal funds allocated, the approach has taken the form of targeted and proactive support to lay the foundation for the economic transition to offset anticipated impacts.

The Agency’s continued commitment is to use funds to work closely with affected communities and stakeholders to identify economic development opportunities and projects and build inclusive solutions to minimize the negative effects of the phase-out of coal and assist with economic diversification activities. Flexibility to assist communities within a wide geographic footprint was considered in the design of the program.

Program officers located across Atlantic Canada provide advice and guidance to clients throughout the project process – from the development of strong plans to applying for funding to project completion. They troubleshoot along the way, helping to convene partners, pathfinding and leveraging additional sources of funding.

Program alignment and financial resources

All federal departments have a Departmental Results Framework (DRF) that outlines their core responsibilities, programs and expected results. The CCTI and its infrastructure fund have contributed to the Agency’s core responsibility - "Economic development in Atlantic Canada" - and to the departmental result - "Communities are economically diversified in Atlantic Canada." For more information on the Agency's DRF, the program inventory and performance indicators, see ACOA’s Reporting Framework as presented in the Agency's 2022-23 Departmental Plan.

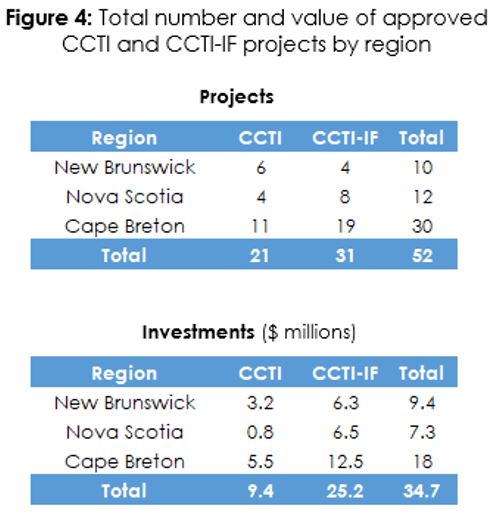

As shown in Figure 4, between April 1, 2018 and March 31, 2023, the Agency approved investments of almost $35 million across a total of 52 projects. Cape Breton is home to 3 of the 5 remaining coal-fired generating stations in Atlantic Canada, and as of 2022-23, projects in the Cape Breton region accounted for more than half of total investment (52%; 18M/34.4M) and of the total number of projects (58%; n= 30/52).

Long Description: CCTI and CCTI-IF projects by region

- New Brunswick had a total 10 projects, with 6 under CCTI and 4 under CCTI-IF

- Nova Scotia had a total 12 projects with 4 under CCTI and 8 under CCTI-IF

- Cape Breton had a total 30 projects with 11 under CCTI and 19 under CCTI-IF

- The combined total of 52 projects, with 21 under CCTI and 32 under CCTI-IF were approved across all three regions.

- In New Brunswick, the value of approved projects was $9.4 million, with $3.2 million under CCTI and $6.3 million under CCTI-IF

- In Nova Scotia, the value of approved projects was $7.3 million, with $0.8 million under CCTI and $6.5 million under CCTI-IF

- In Cape Breton, the value of approved projects was $18 million, with $5.5 million under CCTI and $12.5 million under CCTI-IF

- The total combined value of approved projects across all three regions was $34.7 million, with $9.4 million under CCTI and $25.2 million under CCTI-IF

3.0 Evaluation approach and methodology

Purpose

This evaluation responds to accountability requirements under the Policy on Results (2016) and the Financial Administration Act (1985) by assessing the relevance, effectiveness and efficiency of the delivery of the CCTI and CCTI-IF in Atlantic Canada. The evaluation also provides lessons learned to ACOA’s senior management on proposed actions that would contribute to the continuous improvement of the Agency’s policies, programs and operations.

Scope

The evaluation covers all contributions delivered through the CCTI and CCTI-IF between April 1, 2018 and March 31, 2023 in affected communities in New Brunswick and Nova Scotia. Of note, funding under the CCTI ended in 2022-23, and for the CCTI-IF, it will end in 2024-25. Therefore, the impacts may not be fully realized until the phase-out period ends. As a result, despite the requirement to evaluate the impact of the initiatives, this report is only able to provide interim conclusions on the extent to which any results can be attributed to them.Footnote 11 However, the evaluation accounts for the fact that some of the projects under both initiatives are still ongoing at the time of writing.

Format

The evaluation report provides a general overview of the CCTI and CCTI-IF, the methodology and the overall findings and lessons learned relating to the relevance, effectiveness and efficiency of the initiatives. An in-depth overview of additional evidence in support of these findings can be found in Annex A, "Case Study: New Brunswick," and Annex B, "Case Study: Cape Breton Island and Mainland Nova Scotia." These case studies aim to demonstrate how ACOA’s delivery of these initiatives is assisting impacted communities to diversify and transition their economies away from coal-fired electricity generation and build community capacity ahead of the shift.

Evaluation questions

Four evaluation questions were used to guide the collection of data and the analysis of results, with a focus on the Atlantic Canadian context.

Table 2: Evaluation questions

| Relevance |

|---|

| 1. To what extent do the initiatives address the distinct needs of affected communities related to diversifying and transitioning their economies away from coal-fired electricity generation? |

| 2. To what extent are the programs aligned with Government of Canada and ACOA/regional priorities? |

| Effectiveness |

| 3. To what extent do the initiatives contribute to helping communities transition their economies away from coal-fired electricity generation? |

| a) To what extent have the initiatives assisted impacted communities to diversify their economies? |

| b) To what extent have the initiatives assisted impacted communities build capacity and create an enabling environment that reduces vulnerabilities to future economic shocks and supports sustainable economic growth? |

| Efficiency |

| 4. What factors facilitate or impede efficient program delivery? |

Data collection methods

The evaluation used a mixed-methods approach, where qualitative data sources were prioritized to generate in-depth case studies, which provide a comprehensive overview of the effectiveness and relevance of the CCTI and CCTI-IF initiatives in the affected communities. Data were collected from a range of sources to ensure multiple lines of evidence when analyzing data and formulating findings (Table 3), and to mitigate any limitations associated with individual methods (Table 4). Field work was undertaken from September 2023 to January 2024. While specific examples are used for illustrative purposes, each finding was triangulated using evidence from a mix of quantitative and qualitative data.

Table 3: Data collection methods

| Method | Description |

|---|---|

| Case Studies and Internal/External Interviews | Two case studies targeting specific geographic locations surrounding the affected coal-fired electricity generation stations in New Brunswick and Nova Scotia. Semi-structured and written interviews with internal and external stakeholders were conducted as part of the case studies (N=41). |

| Document and Literature Review | Review of internal and external documents, for example:

|

| Performance and Financial Data Review | Data collected from internal administrative systems. All data were based on approved projects. |

Evaluation strengths and limitations

The evaluation was designed and implemented by an experienced evaluation team that focused efforts on questions of most importance to senior management. The study used a mixed-methods approach to identify useful findings to meet Treasury Board Secretariat (TBS) timelines and requirements. There was high stakeholder engagement throughout the project and the detailed case studies allowed for an in-depth exploration of needs and impacts of the programming.

The evaluation considered Gender-Based Analysis Plus (GBA Plus) in its design and implementation of data collection methods and the synthesis of findings. GBA Plus is an analytical process used to assess how different women, men and gender diverse people may experience policies, programs and initiatives.Footnote 12

Table 4: Evaluation limitations and mitigation strategies

| Limitation | Description | Mitigation strategies |

|---|---|---|

| Rapidly changing economic conditions |

|

|

| Performance measurement data |

|

|

| Measuring longer-term outcomes of a recent program |

|

|

4.0 Findings

Relevance

Question: To what extent do the initiatives address the distinct needs of affected communities related to diversifying and transitioning their economies away from coal-fired electricity generation?

Finding: Through its local presence, in-depth knowledge of the local economy and relationships with stakeholders, ACOA is delivering targeted CCTI and CCTI-IF investments that address the distinct needs of affected communities related to diversifying their economies and transitioning away from coal-fired electricity. Timing of initiatives was not aligned with the timing of the transition period in Atlantic Canada, which had an impact on the relevance of the initiatives in the region.

When the CCTI was launched in 2018, transitioning to alternative energy sources was not an immediate priority as the planned phase-out of coal-fired electricity generation was still more than a decade away in New Brunswick and Nova Scotia. At the time, the most pressing needs related to the eventual transition in both provinces were related to diversification of the economic landscape. Closer alignment with the actual transition period would have been beneficial as the requirement to apply uniform measures across diverse realities resulted in challenges applying those expected outcomes and criteria that were less relevant to the Atlantic Canadian context (e.g., GHG reductions, jobs).

Affected communities continue to experience persistent demographic challenges related to outmigration and a rapidly aging population, and the region has recently been impacted by supply-chain issues resulting from the COVID-19 pandemic and closures in traditional industries such as mining. ACOA is taking a targeted, place-based approach, working closely with stakeholders who have a vested interest in the transition and focusing on the unique circumstances of individual communities. Given the longer-term horizon for the transition, the Agency is focusing its efforts on identifying opportunities that would lay the foundation for offsetting future economic impacts. By leveraging established, productive working relationships with local industry, other levels of government as well as Indigenous communities, the Agency is supporting the longer-term economic diversification and sustainability of affected communities. The Agency does this by focusing on projects aimed at stimulating and attracting new investments and ensuring that emerging sectors are poised for high growth. To help make communities more livable and encourage retention and growth of population, the Agency also supports projects that focus on meeting the unique needs of communities related to capacity-building and offsetting loss of tax revenues.

In New Brunswick, the Belledune Generating Station, which is wholly owned by New Brunswick Power Corporation, is the only station still burning coal and is the second largest emitter of GHGs in the province. The closure of the NB Power Generating Station would have major socio-economic impacts in northern New Brunswick, which is largely rural and isolated from larger economic centres. A major employer for the area, the station provides both direct and indirect jobs that help sustain the population and drive economic growth in the surrounding areas. The station’s closure would also have a significant impact on the Port of Belledune, a major international marine cargo hub, as the importation of coal for the station represents roughly half of the port authority’s revenue stream. Given the importance of the port as an economic engine for the surrounding local economy, the station’s closure would also have significant impacts on an already strained supply-chain in the region.

There are four coal-fired electricity generating stations in operation in Nova Scotia: three on Cape Breton Island and one in Pictou County on the mainland. All four generating stations are wholly owned by Nova Scotia Power. While two of the stations are set to close, NS Power plans to convert the other two to alternative energy sources. With only one remaining coal mine in Cape Breton, the majority of coal is currently being sourced from international markets.

Nova Scotia has a long history of industry collapse due to closures in the mining sector, and the phase-out of coal-fired energy generation is expected to result in the loss of high-paying jobs, with impacts felt across the province. The transition is also expected to threaten the future viability of key transportation infrastructure (e.g., rail, marine ports) that were traditionally used to transport coal, which in turn would further strain supply-chains that support the province’s industrial economy. The Cape Breton economy, which is now largely driven by tourism, has a long history of closures in the coal and steel industries dating back to the 1980s and early 1990s.

Question: To what extent are the initiatives aligned with Government of Canada and ACOA/regional priorities?

Finding: ACOA CCTI and CCTI-IF investments are closely aligned with Government of Canada priorities related to protecting the environment and fighting climate change, Indigenous reconciliation, as well as regional priorities related to tourism and community economic development.

ACOA recognizes the importance of sustainable practices and is committed to the Government of Canada’s priority of protecting the environment and fighting climate change. Through initiatives such as the CCTI and CCTI-IF, the Agency leverages green technologies to drive economic growth and supports communities in transitioning away from coal-powered plants.Footnote 13 Greening the electricity grid is a priority for both the provincial and federal governments, and the two levels of government are working together with stakeholders to identify alternative sources of energy. Stakeholders recognize the vital role of economic greening in transition, emphasizing the need to reduce GHG emissions and invest in emerging sectors such as wind and hydrogen. Examples of projects with a clean growth aspect include solar farms and green energy capacity-building, alongside other infrastructure projects incorporating green elements related to environmental protection and leveraging community assets, such as parks.

Efforts to foster reconciliation and strengthen ties with Indigenous communities remain a pivotal focus for the Agency, and engagement and consultation was prioritized in its delivery of the initiatives. Projects contributed to relationship building, community involvement, and Indigenous economic growth. For example, in northern New Brunswick, ACOA invested in projects that fostered economic prosperity while honouring the reconciliation process between Indigenous and Acadian communities.

ACOA’s CCTI and CCTI-IF investments reflect the significance of the tourism industry in Nova Scotia. While investments in Cape Breton focused on increasing year-round attractions and initiatives that will help regain pre-pandemic visitor numbers, in Pictou County the focus was on community infrastructure necessary to boost local interest and tourism spending. These investments aim to attract more visitors, enrich their experience, foster sustainable local businesses and create jobs.

For additional information on how ACOA responds to the unique needs of affected communities in New Brunswick and Nova Scotia, please see Annex A, "Case Study: New Brunswick," and Annex B, "Case Study: Cape Breton Island and Mainland Nova Scotia."

Effectiveness

Question: To what extent do the initiatives contribute to helping communities transition their economies away from coal-fired electricity generation?

Finding: Through the CCTI and its related infrastructure fund (CCTI-IF), the Agency has assisted impacted communities in New Brunswick and Nova Scotia to diversify their economies and build community capacity and sustainability in advance of the future phase-out of coal-fired electricity generation.

ACOA delivered targeted and proactive support to help lay the groundwork for the eventual phase-out of coal-fired electricity. Efforts have prioritized transitioning communities over individual workers by funding projects that promote economic diversification and job creation in the surrounding regions to promote community development and long-term economic prosperity.

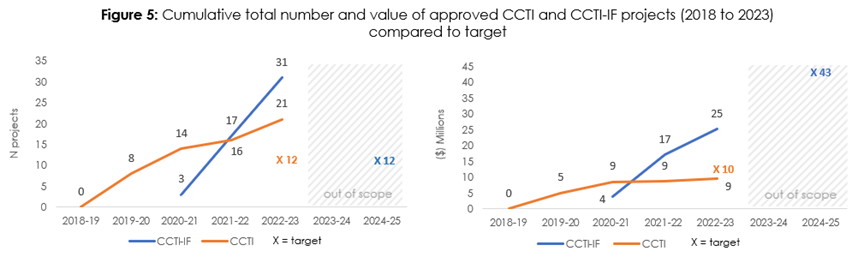

A total of $34.7 million has been invested to date in 52 projects across 17 communities,Footnote 14 as shown in Figures 5. The initial investment in CCTI (2018 to 2023) has yielded a total of 21 approved projects among 19 clients, with a total investment of $9.4 million throughout the program duration.Footnote 15

Long description: Approved CCTI and CCTI-IF projects compared to target

Two line graphs. The first graph shows progression of number of approved CCTI and CCTI-IF projects each year from 2018 to 2023. After the launch of CCTI, the program approved 8 projects in 2019-20, 14 in 2020-21, 16 in 2021-22 and 21 projects in 2022-23. After the launch of CCTI-IF, 3 projects were approved in 2020-21, 17 in 2021-22 and 31 projects were approved in 2023. The targets for number of projects have been surpassed. The target for CCTI was 12 projects by 2023 and for CCTI-IF was 12 projects by 2025.

The second graph shows the total amount of contribution for CCTI and CCTI-IF from 2018 to 2023. CCTI contributions went from $5 million in 2019-20 to $9 million in 2020-21 and remained consistent until the end of program duration. CCTI-IF contributions increased significantly from $4 million in 2020-21 to $25 million in 2022-23. Target for CCTI investments were not achieved. CCTI-IF investments are on track to achieve target. Target for CCTI was $10M by 2023 and for CCTI-IF it is $43M by 2025.

The additional investment through CCTI-IF (2020 to 2025) provided further support to help communities transition away from traditional coal-fired electricity and to mitigate the potential ensuing economic impacts. Although the initiative has not yet concluded, 31 projects among 28 unique clients have been approved, representing a cumulative investment of $25.2 million as of 2022-23 (Figure 5).

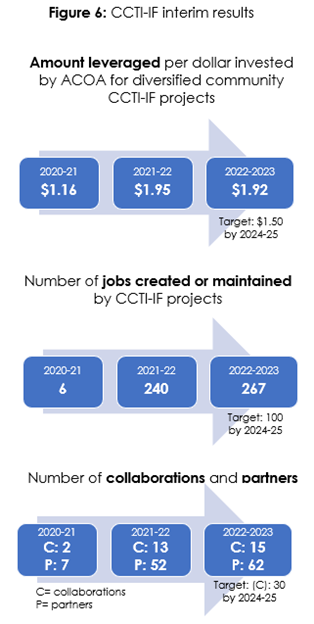

As shown in Figure 6, investments in CCTI-IF have already yielded positive economic impacts in the short-term through the creation of 267 jobs since the initiative was launched,Footnote 16 more than doubling the end-of-program target (n=100 by 2024-25). Additionally, the investment has produced a cumulative total of 62 partners/collaborators and 15 partnerships/collaborationsFootnote 17 since its introduction, and has contributed to the clients’ ability to leverage other types of support, which has resulted in ratio of $1.92 leveraged for every dollar invested by ACOA since inception.Footnote 18 Key project collaborators include other federal departments, provincial governments and municipalities, post-secondary institutions, First Nations and private organizations.

Funded projects were regionally tailored and supported diversification and community-building activities in a variety of sectors. More than two thirds of projects supported (67%) targeted manufacturing and processing, tourism and community asset and infrastructure, while others focused on areas related to agri-food, biosciences, building and construction, clean tech, forestry, information communication technologies and telecommunications, mining and ocean tech.

The CCTI and CCTI-IF investments include projects aiming to develop new or emerging industries, attract new businesses, investments and workers, expand existing businesses and organizations, enhance community-based assets and infrastructure, increase tourism, and foster engagement and reconciliation efforts with Indigenous communities. A detailed overview of how ACOA’s investments responded to the unique needs of the affected regions, along with some interim results, can be found in Annex A, "Case Study: New Brunswick," and Annex B, "Case Study: Cape Breton Island and Mainland Nova Scotia."

Long-term impacts

Only two thirds of approved projects were complete as of March 31, 2023,Footnote 19 and in many cases, impacts will not be apparent in the immediate future. With two years remaining, CCTI-IF funds are over 50% allocated. However, most internal and external key informants expect that project results will be sustained and are confident that conditions for long-term success are in place, despite uncertainties around the timing and impact of the transition and other challenges related to the economic landscape (e.g., inflation, supply-chain issues, unforeseen disruptions). The Agency’s early investments aimed at community engagement and planning helped to set the stage for more tangible projects in support of the future transition. While some more recent projects are outside the scope of this study, these infrastructure investments support the realization of the initial vision and will ultimately support the transition away from coal toward alternative fuel sources and ensure that affected communities are poised for continued growth.Barriers and facilitators

When asked which challenges or obstacles could impact the achievement of project results, internal stakeholders and clients expressed how the COVID-19 pandemic, supply-chain issues and inflation caused delays and unexpected cost increases. Difficulties in recruiting specialized professionals was also identified as a leading barrier by key informants.

Internal and external stakeholders identified several facilitators contributing to the achievement of results. For example, some ACOA staff mentioned that focusing on high-growth firms, community-based assets as well as investing in projects that filled gaps in the community were key. Furthermore, proper planning and using a client-focused approach were essential. At the project level, clients and internal stakeholders mentioned having the right partners at the table, good leadership and management, as well as having the buy-in of the community. Key informants emphasized the importance of understanding community needs and ongoing project monitoring as contributors to long-term success.

Long description: Amount leveraged per $ invested by ACOA, no. of jobs created and no. of partners through CCTI-IF projects

Three vertical arrows. First arrow showing CCTI-IF leveraged $1.16 in 2020-21 which increased to 1.92 in 2022-2023. Second arrow showing 6 jobs created or maintained through CCTI-IF projects in 2020-21 and it increased to 267 in 2022-23. Third arrow showing 2 collaborators and 7 involved in CCTI-IF projects in 2020-21 which increased to 15 collaborators and 62 partners in 2022-2023.

Efficiency

Question: What factors facilitate or impede efficient program delivery?

Finding: ACOA’s approach of delivering the CCTI and CCTI-IF through existing programs and processes contributed to the efficient delivery of the initiatives, and clients are generally satisfied with the service they received. The rapid implementation impeded efficient delivery and targeted selection of projects, however. Opportunities exist to improve planning and performance measurement structures to better capture outcomes.

ACOA delivered the initiatives through existing programs, such as the BDP, the ICF and REGI. While the majority of internal key informants reported that delivering the initiatives using existing programs and processes was an efficient approach, some reported challenges aligning the CCTI projects with existing program criteria. For example, in Cape Breton, many CCTI projects had longer timelines, and many were already in the planning stages when the initiatives were launched. Very few projects were developed specifically for the CCTI or CCTI-IF due to short timelines for delivery of initiatives, and the vast majority of projects were with existing ACOA clients (NB: 8/10; CB + mainland NS: 39/42).

ACOA staff pointed out that the recent trend toward delivering more one-off, boutique programs has added levels of complexity and reduced overall efficiency of program delivery. ACOA staff also reported a general lack of internal communication surrounding the initiatives, including a lack of clarity around eligibility criteria, which resulted in staff trying to fit existing project proposals to the CCTI and its infrastructure fund.

The rapid delivery of the initiatives (especially during a global pandemic) was identified as a barrier to success as insufficient time for planning and promotion impeded targeted selection of projects and resulted in missed opportunities for clients. Additional time at the outset would have allowed the Agency to ensure clients were aware of the goals of the initiatives and to focus efforts on the identification and development of alternatives. Internal key informants suggested that greater preparation and planning would have also supported increased leveraging of private-sector investments.

ACOA staff and managers suggested that challenges continue to persist with the Agency’s performance measurement structures, specifically related to tracking longer-term outcomes with these types of initiatives. They suggested that clearly identifying and communicating outcomes that are tailored to these shorter-term initiatives at the outset would improve the Agency’s ability to accurately measure and report on results.

Overall, clients were very satisfied with the service they received from ACOA staff and indicated that this support and advice were crucial to the success of their projects. ACOA’s ability to convene stakeholders and partners was also perceived as being very positive and contributed to both the success of current projects and facilitated new connections in support of future transition projects.

5.0 Conclusions

By leveraging the deep knowledge of the local economy and robust stakeholder relationships established by Agency staff, ACOA is focusing its delivery of the CCTI and CCTI-IF on the unique needs of communities in New Brunswick and Nova Scotia as they prepare for the eventual phase-out of coal-fired electricity generation. These investments are contributing to the economic diversification and capacity of affected communities and align with Government of Canada priorities, including climate change mitigation, Indigenous reconciliation and regional priorities such as tourism. The integration of the CCTI and CCTI-IF into existing ACOA programs was generally considered efficient, and the vast majority of clients were satisfied with the service they received.

Lessons Learned:

- Timing matters: Closer alignment of the launch of the CCTI and CCTI-IF initiatives with the anticipated timing of the transition in Atlantic Canada would have contributed to greater relevance and effectiveness of the initiatives by ensuring adequate promotion and planning efforts at the outset. There are opportunities for greater advocacy of Atlantic Canadian interests in the development and implementation of these types of short-term initiatives to ensure that their design and timing are relevant to the realities that exist in the region.

- Planning matters: The rapid implementation and lack of internal communication hindered the efficient allocation of resources and selection of projects and impacted the effectiveness of the initiatives. There is an opportunity for the Agency to improve planning around the allocation of resources and defining how performance will be measured at the outset of these types of short-term boutique initiatives and programs.

Appendix A Case Study: New Brunswick

This case study provides additional evidence in support of the findings of the Atlantic Canada Opportunities Agency’s (ACOA) Evaluation of the Canada Coal Transition Initiative (CCTI) and its related Infrastructure Fund (CCTI-IF). By focusing on the unique needs of the Village of Belledune and its surrounding communities, this case study aims to illustrate how ACOA’s delivery of these initiatives is helping to diversify and transition their economies away from coal-fired electricity generation.

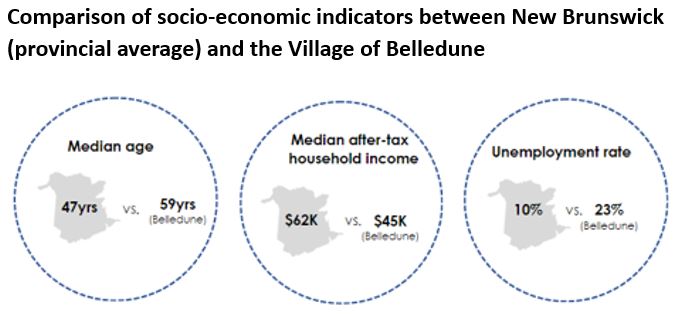

ContextCompared to the rest of the province, the Belledune region has higher unemployment, lower household income and a population that is aging more rapidly.Footnote 22 Educated youth tend to leave the region for better opportunities in other provinces or countries which exacerbates the shortage of skilled workers. According to a recent study based on Statistics Canada data, as the population continues to decline in and around Belledune, basic services are expected to become increasingly difficult to maintain and the closure of the station would negatively impact residents’ overall quality of life.

Long description: Comparison of socio-economic indicators

The diagram of three circles, each showing comparison between provincial average and Belledune community average for three socioeconomic indicator as follows:

* Median age: 47 years (New Brunswick) vs. 59 years (Belledune)

* Median after-tax household income: $62,000 (New Brunswick) vs. $45,000 (Belledune)

* Unemployment rate: 10% (New Brunswick) vs. 23% (Belledune)

Belledune coal-fired electricity generation station

Following decades of transition, the Belledune electricity generating station is the only facility still burning coal in New Brunswick. Commissioned in 1993 and owned by the New Brunswick Electric Power Corporation (NB Power), the station provides approximately 15% of the province’s electricity needs. It burns close to 1 million tonnes of coal per year that is mostly shipped from the United States and South America through the Port of Belledune. The generating station is New Brunswick’s second largest emitter of greenhouse gases (GHGs) and produces one third of all GHGs emitted in the province. NB Power is currently exploring options to convert the station to another fuel source as the plant is essential to the production of electricity in the province and has an expected end-of-life date of 2040.

The generating station constitutes a major economic asset in the area, and the Village of Belledune derives approximately one half of its municipal tax revenue from it. The station is also an important employer in the region and supports approximately 375 direct and indirect full-time, relatively high-paying jobs. It also supports a chain of approximately 20 small and medium-sized suppliers from surrounding communities in sectors such as heavy equipment, fabrication and trucking.

The closure of the station would create economic uncertainty and may have negative impacts throughout northern New Brunswick due to the significant loss of well-paying jobs and tax revenue. With an economy currently dominated by resource-based industries such as forestry, agriculture and fisheries, a diversified economic base is necessary to provide more options for workers impacted by the potential closure of the Belledune Generating Station. However, availability of jobs in sectors with more transferrable skills such as construction or manufacturing may be limited compared to larger urban centres according to a recent study.

Port of Belledune

The Belledune Generating Station is located in close proximity to the Port of Belledune, a marine terminal and a critical enabler of economic activity in northern New Brunswick. Over the years, the port has steadily broadened its activities, resulting in a more globally diversified clientele and greater volumes of transiting cargo.Footnote 23 It currently derives approximately half of its revenue from the import of coal being burned at the generating station. The port supports approximately 3,000 direct and indirect jobs and the closure of the generating station would likely have a major negative impact.

The port places significant importance on its relationship with local Indigenous communities. In 2018, the Port Authority signed a Relationship, Engagement and Consultation Protocol with local Indigenous communities laying out the terms of relationship building, consultation and accommodation and proponent engagement with the Mi’gmaq First Nations. It constitutes a historic agreement and the first of its kind in Canada.Footnote 24

Recent and planned investments at the Port of Belledune may lead to new economic opportunities for the region; but there will continue to be global competition for more traditional sectors (e.g., manufacturing, primary resources), leading to increased vulnerability and potential for negative outcomes, specifically regarding population and employment trends.

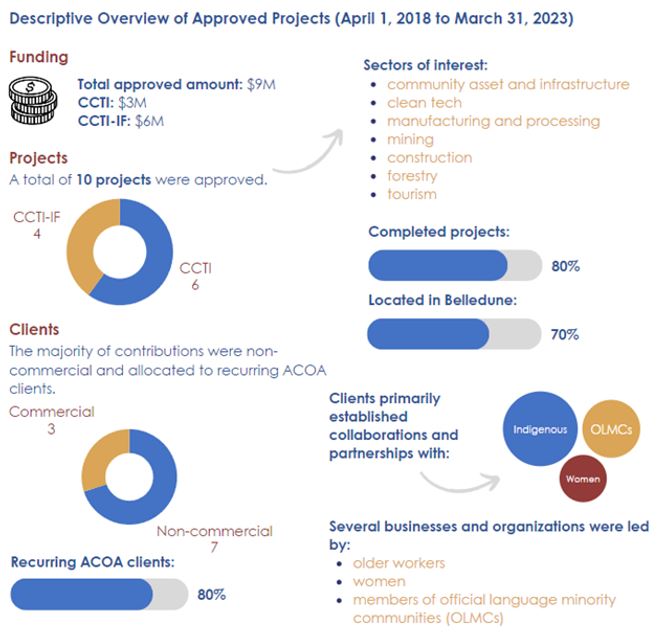

Long description: Overview of approved projects in New Brunswick

The infographic contains detailed information about approved projects under CCTI and CCTI-IF in New Brunswick between April 1, 2018 to March 31, 2023:

* The total funding amount for both streams was $9M which includes $3M by CCTI and $6M by CCTI-IF.

* Total number of approved projects was 10 which includes 6 under CCTI and 4 under CCTI-IF. These projects cover the following sectors: community and infrastructure, clean technology, manufacturing and processing, mining, construction, forestry & tourism.

* 7 of these projects are non-commercial and 3 are commercial.

* 80% of the contributions were allocated to recurring ACOA clients.

* 80% of these projects are completed.

* 70% of the projects are located in Belledune.

* Clients primarily established collaborations and partnerships with Indigenous peoples, members of official language minority communities (OLMCs), and women.

* Several businesses and organizations were led by older workers, women and OLMCs.

Identifying and addressing the needs of affected communities

According to internal key informants, when the CCTI was launched in 2018, there was no immediate sense of urgency in the community related to the phase-out of coal-fired electricity generation. As the transition was more than a decade away, any impacts on jobs at the station were expected to be mitigated through redeployment within the organization and attrition. As such, communities have yet to feel the full impact of the transition. Although most projects funded through the CCTI/CCTI-IF in New Brunswick during the evaluation period have concluded, longer-term impacts will likely only be realized in years to come as the transition away from coal-fired electricity generation unfolds.

Need: Diversification of economic activities

Diversifying and expanding the Port of Belledune infrastructure to drive regional economic activity and international market expansion was identified by internal key informants and community stakeholdersFootnote 25,Footnote 26 as a key need due to its significant economic generation capabilities and dependence on the generating station supply-chain. Furthermore, a need for the development of new industries in non-coal related sectors that would encourage further growth and diversification in Belledune and surrounding communities was expressed as necessary. Internal key informants also pointed out the imminence of economic impacts from the closure of the Glencore smelter in Belledune, precipitating the need for economic diversification. Both internal key informants and community stakeholders identified diversification of economic activities in priority areas such as clean growth and Indigenous economic development as a major need to strengthen the economy ahead of the transition.

How ACOA is addressing the need:

In preparation for the upcoming phase-out of coal-fired electricity, the CCTI/CCTI-IF projects in New Brunswick aimed to increase economic diversification and develop non-coal-related sectors. For example, ACOA invested in a supply-chain diversification initiative led by the Chaleur Community Development Business Corporation (CBDC) for existing small and medium-sized enterprises (SMEs) affected by the closure of the Glencore smelter and Trevali mine. The project helped 22 companies to acquire new skills, identify new fabrication and manufacturing opportunities, improve productivity and generate new revenues. Internal stakeholders indicated that all participating SMEs have remained in operation following the project and many of these companies have been able to diversify into new markets abroad. As a result, these SMEs are expected to continue to grow and create employment opportunities in the region.

Two ACOA assisted projects (CCTI) were linked directly to the Port of Belledune. To ensure that the Port continues to drive economic prosperity in northern New Brunswick, the Belledune Port Authority undertook a series of studies aimed at enhancing the Port’s capacity to strategically manage new growth, attract new industries, increase the flow of trade, and expand the scope of its services and client base. As a result, a master development plan was created and launched that outlines recommendations that establish the framework for a highly diverse long-term development plan at the Port. One key element of this plan includes the planning and marketing of a Green Hub initiative supporting renewable energy and green manufacturing.

Planning efforts for the Green Energy Hub have been completed as part of the CCTI and have helped profile the Port of Belledune and the region internationally. Development options are currently being pursued by the port and this includes establishing a clear pathway to create, in partnership with Indigenous stakeholders, a subsidiary company able to undertake commercial opportunities. This would include the development of an industrial park, which would house a green hydrogen production facility. Site preparedness studies to establish the Green Energy Hub are currently underway as part of a recent CCTI-IF investment.

In addition, several projects aimed to create and develop new industries such as a feasibility study assessing the potential for a large-scale mining project in the Dalhousie region. Work completed by Carboniq through the CCTI-IF helped prove that a natural pozzolan deposit is present in sufficient quantities to justify a potential large-scale mining project in the area.

The Chaleur Regional Service Commission worked with the Pabineau Mi'gmaq First Nation in the planning of a tourism initiative with the goal of raising the profile of the Chaleur region as a tourist destination and generating economic benefits for the area. Central to this planning exercise was a focus on understanding and appreciating the relationship of reconciliation and mutual respect between the region’s Indigenous and Acadian communities. Should this tourism initiative be implemented, it could generate new employment opportunities in the Chaleur region as well as increase the growth of small businesses such as restaurants and accommodations.

Need: Transitioning the Belledune Generating Station

To further mitigate impacts that would result from the closure of the Belledune Generating Station, internal stakeholders, clients and other community members that participated in a previous consultation processFootnote 27 expressed a need to prioritize the maintenance of operations. This includes efforts to secure a new fuel source and undertake the retrofits necessary to keep the station open.

How ACOA is addressing the need:

Three projects totalling just over $3 million, or one third of the overall approved funding in the province, were directly linked to the maintenance of operations at the Belledune electricity generating station. Projects were aimed at creating knowledge and building capacity for an eventual green fuel conversion.

Through the assistance of ACOA’s CCTI initiative, NB Power commissioned various studies aimed at validating alternative fuel sources that have provided critical information to better assess the technical details around a potential conversion away from coal, as well as viable options to continue operating the station. Modelling and testing of biomass (e.g., torrefied wood pellets) as an alternate fuel source is scheduled to occur in the spring of 2024 with a recent CCTI-IF investment and, if successful, it could provide the necessary fuel to continue operating the Belledune Generating Station. Stakeholders suggest that this would likely help mitigate power cost increases resulting from the plant closure as well as benefit local supply-chains that are producing wood pellets.

Furthermore, FP Innovations led field trials to assess the biomass harvesting systems currently in operation in New Brunswick with the assistance of ACOA’s CCTI funding. These trials have helped detail the incremental cost of harvesting and forwarding forest biomass from logging to roadside as well as producing a benchmark that will help decision makers and stakeholders evaluate the feasibility of future biomass utilization projects, such as the one proposed by NB Power at the Belledune electricity generating station.

Finally, with CCTI-IF funding, the Quebec Stevedoring Company completed the construction of a new wood pellet warehouse as well as technology upgrades to an existing wood pellet shipping conveyor system at the Port of Belledune. It has enabled local companies to expand and increase biomass production, including the maintenance and creation of new direct and indirect jobs. Stakeholders suggest this new infrastructure will assist in the further development of the biomass industry, which could enhance the competitiveness of northern New Brunswick as a local, national and international supplier of wood pellets. An increase in production could also help fuel the local power plant should a transition to torrefied wood pellets be implemented, and an increase in exports could directly benefit the Port of Belledune through an increase in cargo volumes.

A conversion of the Belledune Generating Station would help maintain employment at the station and potentially create hundreds of jobs across the supply-chain in sectors such biomass harvesting, collection, transport and handling.

Conclusion

ACOA delivered targeted and proactive support in New Brunswick to lay the foundation for an eventual economic transition. Given the longer timelines for the phase-out of coal-fired electricity generation, the Agency focused its efforts on long term economic diversification activities that leverage regional economic assets, stimulate new opportunities and investments and consider the unique needs of impacted communities. This includes ongoing relationship-building with Indigenous communities and efforts toward decarbonization of the energy grid.

Funded projects have contributed to identifying potential sectors of diversification as well as laying the foundation for community resilience, well-being and competitiveness. A lot of planning and groundwork has been done in anticipation of future funding opportunities and a large focus was placed on asset-based development such as the projects developed in and around the Port of Belledune. Interviewed internal stakeholders noted that the strong focus placed on the Port of Belledune allowed the region to build on the strength of existing assets and utilize its potential to drive further economic development opportunities.

Projects were mainly focused on mitigating the impact of a potential shutdown such as maintaining employment and preventing further industry closures, thus supporting local economic growth. Assisted SMEs have been successful in acquiring new skills, in increasing productivity and in generating new revenue. New employment opportunities were created, and local supply-chains have been developed and expanded. The CCTI/CCTI-IF investments are expected to generate additional business and community growth, enabling northern New Brunswick communities to build resilience and ensure the longer-term prosperity of the region.

Appendix B Case Study: Cape Breton Island and Mainland Nova Scotia

This case study provides additional evidence in support of the findings of ACOA’s Evaluation of the Canada Coal Transition Initiative (CCTI) and its related Infrastructure Fund (CCTI-IF). By focusing on the unique needs of impacted communities on Cape Breton Island and mainland Nova Scotia, it aims to illustrate how ACOA’s delivery of these initiatives is assisting impacted communities to diversify and transition their economies away from coal-fired electricity generation.

Context

There are four coal-fired electricity generating stations in operation in Nova Scotia: three on Cape Breton Island and one in Pictou County. Under federal and provincial regulations, and as part of commitments made under the Pan-Canadian Framework on Clean Growth and Climate Change, all stations are set to cease operations by 2030. These shutdowns are expected to impact not only the communities where the coal plants are located (i.e., Lingan, Point Aconi, Point Tupper and Trenton), but surrounding areas as well. All of Nova Scotia’s coal units are owned and operated by NS Power, a private company owned by Emera, and regulated by the provincial government through the Nova Scotia Utility and Review Board.

Long description: Nova Scotia map

The map points out four communities along with their respective population sizes located across the eastern part of Nova Scotia as follows:

- Trenton (population of 2,000)

- Point Tupper (population of 4,000)

- Point Aconi (population of 113)

- Lingan (population of 229)

The Cape Breton Regional Municipality (CBRM), known as the industrial and economic heart of Cape Breton and home to 95% of its population, is the second largest municipality in Nova Scotia (population: approximately 94,000).Footnote 28 Two coal-fired electricity generating stations are located within the CBRM, in the communities of Lingan and Point Aconi. These small communities are located on the shores of the Cabot Strait. The Donkin coal mine, which is the only remaining coal mine on the island, is also located in the CBRM.

Southwestern Cape Breton, near the Canso Strait, is home to the Point Tupper Generating Station. This station is located in the County of Richmond, which has a population of 9,000Footnote 29 and is in close proximity to Port Hawkesbury.

The fourth generating station is in the northeastern corner of mainland Nova Scotia, in Trenton, Pictou County (population: 44,000Footnote 30). The small town of Trenton is situated near the town of Stellarton, which historically supplied coal from its surface mine to the Trenton plant until mining operations ended in 2019.

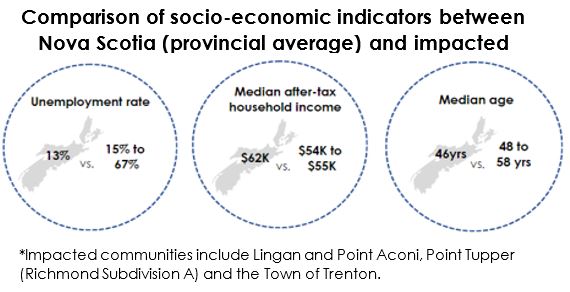

Socio-economic context

The coal mining industry has long been a source of pride and heritage in rural Nova Scotia as it helped drive economic activity in Cape Breton and mainland Nova Scotia for decades. However, a decline in the coal industry and other key sectors such as mining, manufacturing and pulp and paper in recent years has led to long-term regional economic impacts. For example, the Sydney Steel Corporation, a major employer in Cape Breton closed its plant in 2001 after more than a century in operation, marking the end of an important industrial era. More recently, the 2020 closure of the Northern Pulp paper mill in Pictou County resulted in the loss of almost 3,000 well-paying jobs at the mill and in the broader forestry sector, as well as a significant decrease in tax revenues for the municipality.Footnote 31

Long description: Socio-economic indicators

The diagram is of three circles, each showing comparison between provincial average and three impacted communities'** average for three socioeconomic indicators as follows:

* Unemployment rate: 13% (Nova Scotia) vs. 15% to 67%

* Median after-tax household income: $62,000 (Nova Scotia) vs. $54,000 to $55,000

* Median age: 46 years (Nova Scotia) vs. 48 to 58 years

**Impacted communities include Lingan and Point Aconi, Point Tupper (Richmond Subdivision A) and the Town of Trenton.

While these rural communities have adapted to these challenges, they continue to face persistent demographic difficulties, including negative population growth and out-migration,Footnote 32 which makes it hard for them to attract and retain young families.Footnote 33 Their elevated vulnerability and economic challenges, compared to the provincial norm, could make them more likely to experience outsized negative effects from the potential loss of jobs and industries relating to the phase-out of coal. In Cape Breton, labour market fluctuations are more pronounced due to the predominance of seasonal sectors such as primary industries and tourism. Despite overall population growth in Nova Scotia in recent years, driven by immigration and interprovincial migration, communities impacted by the coal transition are still underperforming on various socio-economic indicators. Compared to the rest of the province, these communities have higher unemployment, lower household income, and a population that is aging more rapidly.Footnote 34

Potential Impacts of Coal Phase-Out

As part of the transition away from coal, the Point Aconi and Trenton stations are set to close while the Point Tupper and Lingan stations are expected to be converted to other fuel sources. These generating stations currently provide an important baseload amount of power for the province, accounting for 41% of its electricity needs in 2022.Footnote 35 The stations are also important employers, providing nearly 1,000 direct and indirect jobs across Nova Scotia.

Communities have yet to feel the full impact of the transition since most employees will not be affected until the transition begins in 2028. According to NS Power, given that approximately 40% of affected employees are age 50 or older and may be eligible for retirement by the start of the phase-out, any reductions are expected to be gradual, and impacts may be mitigated through regular workforce adjustments and attrition. However, some job losses are anticipated at stations converting to other fuel sources. For example, it is estimated that natural gas conversions could lead to a 60% to 70% labour force reduction.Footnote 36

NS Power has established several supports in advance of the coal phase-out,Footnote 37 and various provincial programs and services supporting career guidance and skills development/training are in place. Nevertheless, it is anticipated that the loss of direct and indirect jobs as well as a significant reduction of tax revenue and local economic activity from the phase-out will lead to economic uncertainty and negative impacts throughout Cape Breton and Pictou County.

Economic impacts are likely to be felt at local ports, particularly the Port of Sydney and the Point Tupper marine terminal, through which most of the coal used for electricity generation is imported. These imports generate economic activity and employment in and around the marine terminals and support local industry and businesses all along the supply- chain. For example, the transportation sector, which is vital to the region’s economy, could be impacted as rail and trucking are the primary means of transporting coal to the stations.

Long description: Overview of approved projects in Nova Scotia

Long description:

The infographic contains detailed information about approved projects under CCTI and CCTI-IF in Nova Scotia between April 1, 2018 to March 31, 2023:

* The total funding amount for both streams was $25M which includes $6M by CCTI and $19M by CCTI-IF.

* Total number of approved projects was 42, which includes 15 under CCTI and 27 under CCTI-IF. These projects cover the following sectors: manufacturing/processing, tourism, community/infrastructure, biosciences, ocean, food, clean technology and information/communication.

* 28 of these projects are non-commercial and 14 are commercial.

* 93% of the contributions were allocated to recurring ACOA clients.

* Several businesses and organizations were led by women, older workers, youth (<40), newcomers and Indigenous peoples.

* 67% of these projects are completed.

* 71% of the projects are located in Cape Breton and 29% are located in mainland.

* Clients primarily established collaborations and partnerships with Indigenous peoples, newcomers, persons with disabilities and older workers.

ACOA clients, staff and community stakeholders have indicated that job creation, job retraining programs and opportunities for skills acquisition will be an essential part of the economic recovery in the region as advanced skills and techniques may be needed for new jobs.

Identifying and addressing the needs of affected communities

Clients and internal stakeholders, as well as previous community consultationsFootnote 38,Footnote 39 identified the following needs as priorities for the phase-out of coal-fired electricity generation.

Need: economic stimulation and diversification

Clients and internal key informants identified the need for long-term economic diversification activities in non-coal-related sectors as a way to mitigate anticipated financial impacts, such as the loss of jobs and tax revenue. They emphasized the importance of developing new industries, attracting new investments, and growing existing businesses and organizations to encourage further growth and diversification in Cape Breton and Pictou County.

Two priority areas for diversification activities were identified: clean growth and tourism.

Clean growth: Stakeholders identified greening the economy as a key priority related to this transition. They viewed the reduction of GHG emissions and decarbonization as well as the development of emerging sectors such as wind and hydrogen as areas that should be further explored and invested in. Staff and clients also highlighted the importance of protecting the environment and natural resources while exploring these new opportunities. Furthermore, clients expressed the importance of also focusing on natural community assets that don’t utilize energy sources, such as parks and outdoor spaces.

Tourism: Tourism is the foundation of Cape Breton’s economy, and many clients highlighted the need for supports in year-round tourism opportunities. They also expressed the need for more efforts and programs that support the return of visitation numbers to pre-COVID levels. This need is aligned with the areas of focus identified in Cape Breton’s Destinations Development Strategy,Footnote 40 such as accommodation, culture and heritage preservation, cruise and marine tourism and destination marketing. In Pictou County, clients and internal stakeholders voiced a need for enhanced community infrastructure that would generate exposure and interest in the area and encourage local tourism spending.

How ACOA is addressing the need:

ACOA contributions through the CCTI and CCTI-IF supported economic diversification and infrastructure in both existing and emerging sectors. Most projects (67%) were with non-commercial clients and focused on tourism and community-based assets and infrastructure, while most commercial projects were related to advanced manufacturing.

Several projects were aimed at developing new or emerging industries. For example, ACOA provided support to Cape Breton’s Verschuren Centre for Sustainability in Energy and the Environment for several projects related to biosciences and clean growth (see "Spotlight on the Verschuren Centre"). In Pictou County, CCTI funds helped Ignite Labs Atlantic Inc. develop an incubator space to support new and early-stage technology companies and to further the adoption of innovative processes in local industries. During its first two years of operation, Ignite Pictou doubled its target for number of companies supported.

ACOA also invested in projects that are directly linked to the attraction of new investments, such as the development of an investment and growth strategy looking at increasing foreign direct investment and the relocation of new industries to the Strait of Canso region. By establishing a culture of collaboration and information sharing among development partners, this strategy created a seamless and comprehensive experience for potential investors. According to stakeholders, it is also expected to contribute to business retention and growth as well as enhanced competitiveness for Atlantic SMEs.

Furthermore, many projects focused on the expansion of existing businesses and organizations to promote economic growth and diversification. Funds were used to purchase and install new equipment or machinery, expand or upgrade existing facilities and construct new buildings with the goal of creating employment, increasing production capacity, accessing new markets and stimulating further economic development in the area.

By working with existing clients, ACOA was able to build on community assets as well as amplify emerging industries in the area while advancing government priorities such as job creation, productivity improvements through automation, and a shift to green industries. The support provided to emerging industries, like bioprocessing, further enhances the development of this budding cluster and serves to diversify Cape Breton’s economy while using by-products of traditional industries such as forestry and seafood processing. In many areas, the objectives of the CCTI and CCTI-IF aligned with ACOA priorities related to capacity building and tech adoption. For example, working with existing clients in tourism to increase their offerings and extend into the shoulder season builds on long-term efforts by ACOA and others to support the tourism industry and provide more full-time, permanent jobs.

Clean growth: While ACOA’s approach to the transition was not primarily focused on clean growth, the Agency invested a little over $3 million in 7 projects with this focus. Projects included the establishment of a solar farm, capacity building in green energy (e.g., onshore/offshore wind and hydrogen), and the acquisition of technology that supports clean and sustainable industries. Several other infrastructure-related projects had green components such as energy-efficient equipment and buildings.

Tourism: ACOA’s CCTI and CCTI-IF investments in tourism reflect the importance of this sector for Nova Scotia. In fact, in the year leading into the COVID-19 pandemic, tourism activity in the province generated approximately $3 billion in tourism spending, while preliminary estimates for 2020 and 2021 indicate a drop to $1 million in economic return from that industry.Footnote 41 Since 2018, ACOA has contributed to the growth of the tourism industry by supporting 17 projects totalling just over $10 million. Approximately 70% of that funding was allocated in Cape Breton. Investments on the island were made in a variety of projects, ranging from enhancements to wharf and port infrastructure to better accommodate marine travellers, to the acquisition of a snow-making machine at a year-round destination for outdoor enthusiasts, to enhancements to several local museums. This includes the Cape Breton miner’s museum, which features exhibits that showcase the region's long and rich history of coal mining.

Investments in tourism are likely to help attract and increase visitors, enhance their experience and provide opportunities for year-round and value-added tourism according to stakeholders. This will contribute to supporting the sustainability of local businesses and the creation of new jobs in the community. In the longer term, it is expected to contribute to advancing Atlantic Canada tourism's competitiveness and productive capacity.

Spotlight on the Verschuren Centre

Established in 2011 and located at Cape Breton University, the Verschuren Centre for Sustainability in Energy and the Environment is a commercially focused research and development and deployment service provider that develops and delivers sustainable technology solutions in energy, food and resource management to businesses, governments and communities.

The centre is one of only a few places in Canada that has developed this type of expertise and infrastructure in biotechnology and is comprised of a cluster of companies from other provinces and countries that have set up a physical presence in Cape Breton. The centre helps businesses achieve industrial scale production at a faster rate than anywhere else in the world while retaining their intellectual property. A number of these companies have already created new well-paid high-tech jobs in Cape Breton, and more are expected.

The emergence of this cluster is the result of purposeful coordination among many stakeholders in Nova Scotia, including ACOA.

ACOA invested almost $5 million (20% of the total allocated funds through the CCTI and CCTI-IF in NS) in 3 projects, demonstrating a strategic move to grow the bioprocessing sector and help the region move toward a low-carbon economy.

Need: Building community capacity and sustainability

Clients as well as internal and community stakeholders voiced a need for community capacity building and strengthening as a way to foster community resiliency and sustainability in preparation for the transition. They emphasized the need to improve community-based assets and infrastructure, including transportation infrastructure, as well as the necessity of building strong, economically stable communities that attract residents, workers, businesses and tourists. Clients and internal stakeholders also expressed the importance of acknowledging the social and communal aspects of the transition, including community support, collaboration and leadership. Furthermore, clients and community stakeholders pointed out population growth, including international student retention, as a means of growing the economy and ensuring the vitality of communities. Opportunities to increase affordability, such as keeping electricity costs low, were also voiced by stakeholders.

Inclusive growth: Stakeholders underscored the importance of maintaining ongoing reconciliation efforts and continuing to strengthen relationships with Indigenous communities. Clients also expressed the need to consider how evolving economic conditions, such as inflation and job scarcity are disproportionately impacting under-represented groups, including newcomers. Furthermore, they highlighted the value of accessible and inclusive spaces that foster a sense of belonging within the community.

How ACOA is addressing the need: