Audit of the Canadian Audio-Visual Certification Office (CAVCO) Program

Office of the Chief Audit Executive

February 2022

On this page

- Executive summary

- 1.0 Background

- 2.0 About the audit

- 3.0 Findings and recommendations

- 4.0 Conclusion

- Appendix A — Assessment scale and results summary

- Appendix B — Management action plan

List of figures

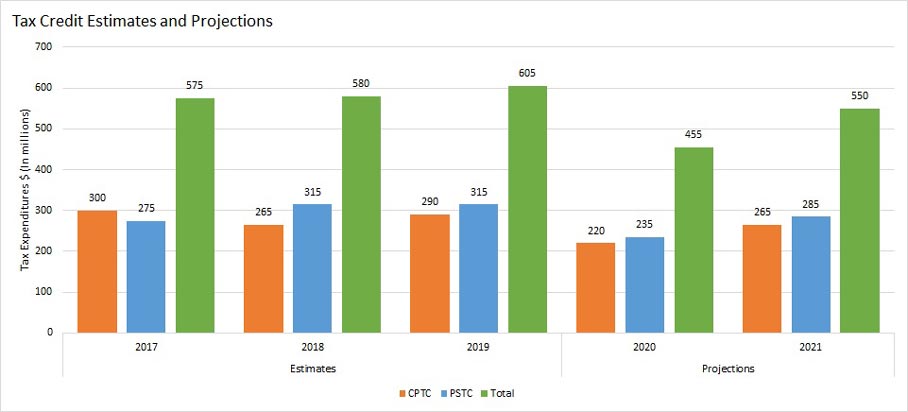

- Figure 1: Tax Credit Estimates and Projections

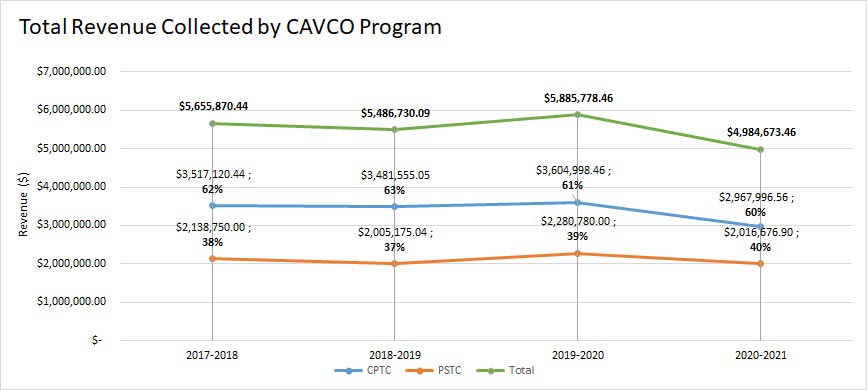

- Figure 2: Annual Revenues Collected by CAVCO

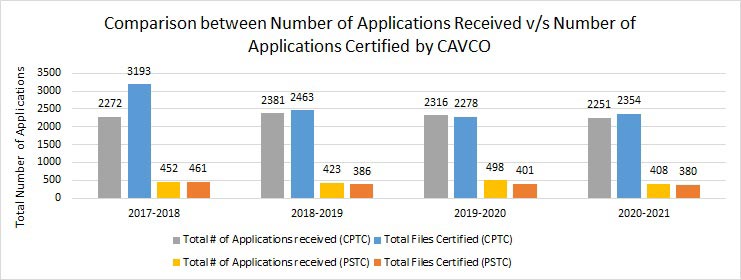

- Figure 3: Applications Received and Certified by CAVCO

Alternate format

Audit of the Canadian Audio-Visual Certification Office (CAVCO) Program [PDF version - 750 KB]

List of acronyms and abbreviation

- CAVCO

- Canadian Audio-Visual Certification Office

- CCPERB

- Canadian Cultural Property Export Review Board

- CIB

- Cultural Industries Branch

- CIOB

- Chief Information Officer Branch

- CPTC

- Canadian Film or Video Production Tax Credit

- DG

- Director General

- EXCOM

- Executive Committee

- GCBO

- Grants and Contributions Business Online

- GoC

- Government of Canada

- HR

- Human resource

- JPO

- Junior Program Officer

- OCAE

- Office of the Chief Audit Executive

- OTJ

- On-The-Job

- PCH

- Canadian Heritage

- PIA

- Privacy Impact Assessment

- POSDC

- Program Operations and Service Delivery Committee

- PSPMA

- Public Service Performance Management Application

- PSTC

- Film or Video Production Services Tax Credit

- QAO

- Quality Assurance Officer

- RMD

- Department’s Resource Management Directorate

- SFA

- Service Fees Act

- SA&A

- Security Assessment and Authorization

- TCO

- Tax Credit Officer

- TRA

- Threat and Risk Assessment

Executive summary

The Canadian Audio-Visual Certification Office (CAVCO or the Office) of the Department of Canadian Heritage (PCH or the Department) co-administers two tax credits with the Canada Revenue Agency. The Canadian Film or Video Production Tax Credit (CPTC) supports the creation of Canadian-content audiovisual productions, while the Film or Video Production Services Tax Credit (PSTC) encourages the employment of Canadians on audiovisual productions shot in Canada. Both are refundable income tax credits for the film and video production industry and were introduced in the mid-1990s to replace previous tax shelter mechanisms. PCH issues certificates confirming that productions meet eligibility requirements as per the Income Tax Act and Regulations, and as defined further in program guidelines. Eligibility requirements relate to, but are not limited to: application and certification deadlines, production genres, copyright ownership, production costs, etc. The Canada Revenue Agency then administers the credits, via the corporation income tax return process.

CAVCO received over 2,600 certification applications and issued over 2,700 certificates in 2020-21 with a projected value of $550 million to the Canadian film and video production companies and those employed in the film and video industry in Canada. CAVCO is funded through fees charged to applicants for the processing of tax credit applications. The revenue collected by CAVCO has remained relatively stable with a noticeable reduction in 2020-21 assumed to be a result of the COVID-19 pandemic restrictions placed on audio-visual productions in Canada.

Since 2017, CAVCO has implemented numerous changes to address a significant backlog of application assessments, workplace wellbeing, and to improve the program’s operational performance. These changes have included, but not been limited to, streamlining of its application assessment processes and migration to a new web-based platform for application processing with improved user interface and enhanced reliability and functionality.

In accordance with the Department’s approved Risk-Based Audit Plan 2020-2023, the Office of the Chief Audit Executive conducted the Audit of CAVCO.

What we examined

The objective of the audit was to provide assurance on the effectiveness of CAVCO’s governance (including monitoring), risk management and control processes. The audit assessed whether:

- Governance bodies are in place and provide oversight of CAVCO’s direction, plans and priorities.

- Governance bodies receive timely and relevant information on program operations and key changes to program design and delivery.

- Processes and practices are in place to help ensure adherence to relevant legislation and regulations.

- Changes to program design and delivery are effectively managed and reported.

- Processes and practices are in place to support the management of program and client information.

- The development and implementation of program plans and approaches consider the need to identify, attract and retain sufficient qualified human resources to meet the current and future needs of the organization.

- Performance and progress against program plans and objectives are regularly measured and reported.

- Performance standards are developed, communicated, and monitored to provide staff with clear information and feedback on expectations.

- Service standards are developed, communicated, and monitored in support of the timely assessment of the applications.

- CAVCO adheres to the requirements of the Service Fees Act (SFA).

Audit opinion and conclusion

Based on the audit findings, the Department of Canadian Heritage, in particular CAVCO, has put in place processes and controls to support the processing of tax credit applications in adherence with relevant legislation and regulations, with these processes continuing to be improved. Performance standards have been established for the processing of applications for the benefit of both staff and applicants, although in the case of applicants these services standards need to be reviewed. Processes and practices are also in place to support the management of program and client information, with some improvements required. In addition, initiatives have been identified and are being implemented to improve the efficiency and effectiveness of application processing and to improve operational performance. The audit identified key opportunities for improvements with respect to the following activities:

- Develop a more structured approach to the setting of plans and priorities, with increased reporting to and oversight by branch/sector management;

- Update and enhance the policies, procedures and practices that support adherence to legislation and regulations;

- Enhance planning and implementation processes in support of major change initiatives;

- Improve safeguarding of client and program information; and

- Review the appropriateness of service standards for the processing of CPTC and PSTC tax credit applications.

Statement of conformance

In my professional judgment as Chief Audit Executive, this audit was conducted in conformance with the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing and with the Policy and Directive on Internal Audit of the Government of Canada, as supported by the results of the quality assurance and improvement program. Sufficient and appropriate audit procedures were conducted, and evidence gathered, to support the accuracy of the findings and conclusion in this report. The findings and conclusion are based on a comparison of the conditions, as they existed at the time, against pre-established audit criteria that were agreed with management and are only applicable to the entity examined and for the scope and time period covered by the audit.

Original signed by

Bimal Sandhu

Chief Audit Executive

Department of Canadian Heritage

Audit Team Members

Dylan Edgar

Director of Internal Audit

Trisha Laul

Auditor

With the assistance of external resources.

1.0 Background

The Canadian Audio-Visual Certification Office (CAVCO or the Office) of the Department of Canadian Heritage (PCH or the Department) co-administers two tax credits with the Canada Revenue Agency. The Canadian Film or Video Production Tax Credit (CPTC) supports the creation of Canadian-content audiovisual productions, while the Film or Video Production Services Tax Credit (PSTC) encourages the employment of Canadians on audiovisual productions shot in Canada. Both are refundable income tax credits for the film and video production industry and were introduced in the mid-1990s to replace previous tax shelter mechanisms. PCH issues certificates confirming that productions meet eligibility requirements as per the Income Tax Act and Regulations, and as defined further in program guidelines. Eligibility requirements relate to, but are not limited to, application and certification deadlines, production genres, copyright ownership, production costs, etc. The Canada Revenue Agency then administers the credits, via the corporation income tax return process.

Significance of CAVCO operations

CAVCO operations are significant to the Department and to the Canadian film and video industry. As noted in the chart below, the Canadian film and video industry is projected to benefit from approximately $550 million in tax credits in 2021, with estimated and projected tax credits having been on the increase prior to a projected reduction in 2020 assumed to be the result of the COVID-19 pandemic restrictions placed on audio-visual productions in Canada.

Source: Report on Federal Tax Expenditure - Canada.caFootnote 1

Figure 1: Tax Credit Estimates and Projection – text version

| - | Estimates Tax Expenditures ($) | Projections Tax Expenditures ($) | |||

|---|---|---|---|---|---|

| 2017 | 2018 | 2019 | 2020 | 2021 | |

| Canadian Film or Video Production Tax Credit (CPTC) | 300,000 000 | 265,000,000 | 290,000,000 | 220,000,000 | 265,000,000 |

| Film or Video Production Services Tax Credit (PSTC) | 275,000,000 | 315,000,000 | 315,000,000 | 235,000,000 | 285,000,000 |

| Total ($) | 575,000,000 | 580,000,000 | 605,000,000 | 455,000,000 | 550,000,000 |

CAVCO is funded through fees charged to applicants for the processing of tax credit applications. The graph below illustrates annual revenue collected by CAVCO in relation to these application fees, which averaged approximately $5.5M per year since 2017. While the revenue collected by CAVCO was relatively stable over this period, there was a noticeable reduction in 2020-21 as a result of the COVID-19 pandemic restrictions.

Source: Data provided by CAVCO on revenue collected (for CPTC, PSTC & total).

Figure 2: Annual Revenues Collected by CAVCO – text version

| - | Revenue ($) | ||||

|---|---|---|---|---|---|

| 2017-2018 | 2018-2019 | 2019-2020 | 2020-2021 | ||

| Canadian Film or Video Production Tax Credit (CPTC) |

3,517,120.44 (62%) |

3,481,555.05 (63%) |

3,604,998.46 (61%) |

2,967,996.56 (60%) |

|

| Film or Video Production Services Tax Credit (PSTC) |

2,138,750.00 (38%) |

2,005,175.04 (37%) |

2,280,780.00 (39%) |

2,016,676.90 (40%) |

|

| Total ($) | 5,655,870.44 | 5,486,730.09 | 5,885,778.46 | 4,984,673.46 | |

Staffing and application processing

CAVCO resides within the Cultural Industries Branch of the Cultural Affair Sector. Led by a Director, the Office operates with three managers and a total of 56 classified positions. As noted, CAVCO’s primary responsibility includes the processing of tax credit applications under the CPTC and PSTC. The chart below highlights the significant number of applications received and the number certificatesFootnote 2 issued each year.

Source: GoC website - CAVCO Performance Results – Film and Video Tax Credits.

Figure 3: Applications Received and Certified by CAVCO – text version

| - | Total Files Certified | Total Number of Applications received | ||||||

|---|---|---|---|---|---|---|---|---|

| 2017-2018 | 2018-2019 | 2019-2020 | 2020-2021 | 2017-2018 | 2018-2019 | 2019-2020 | 2020-2021 | |

| Canadian Film or Video Production Tax Credit (CPTC) | 3193 | 2463 | 2278 | 2354 | 2272 | 2381 | 2316 | 2251 |

| Film or Video Production Services Tax Credit (PSTC) | 461 | 386 | 401 | 380 | 452 | 423 | 498 | 408 |

CAVCO uses the Grants & Contributions Business Online (GCBO) system to manage the client interface and back-office phases of the application receipt and review process. This system also supports the Canadian Cultural Property Export Review Board (CCPERB) program within PCH. The user interface of GCBO has recently been replaced as described under subsection that follows.

The application review process involves three key staff positions within CAVCO. These positions and their role in the application review process are summarized below.

- Junior Program Officers – JPOs review tax credit applications received by CAVCO for completeness. In the case of less-complex files (i.e., track A and B files), once an application is deemed complete by a JPO it is sent directly for recommendation and approval. In the case of more complex files (i.e., track C, D and E files), an application deemed complete by a JPO is submitted to the queue for analysis by a TCO.

- Tax Credit Officers (and Senior Tax Credits Officers) – TCOs complete a detailed analysis of those tax credit applications identified as more complex files (i.e., track C, D and E files). In completing their assessment, TCOs may seek assistance and/or advise from Quality Assurance Officers and/or present files to CAVCO’s advisory or compliance committee for eligibility consideration.

- Quality Assurance Officers – QAOs are typically the most experienced staff in the assessment of tax credit applications. Until recently, QAOs conducted an evaluation of all complex files after they had been analyzed by a TCO. Once evaluated, the file would be recommended for approval (or denial). More recently, the application review process has been revised, with QAOs now reviewing only a sample of tax certificates after issuance.

Changes to the application review process are summarized below and detailed more fully, as necessary, in the Findings section of this report.

Recent operational improvements

CAVCO has made significant changes to its operations since 2017 to address a significant backlog of application assessments, improve program operations, and address staff workplace issues. Key changes over this period have included:

- 2018-2019: A new risk-based approach to the processing of tax credit applications was introduced to streamline the process and to help eliminate the extensive backlog of files that had developed. Under the ‘tracks approach’, applications are triaged based on complexity. While more complex files were still subject to analysis by a TCO and then evaluated by a QAOs), less-complex files were reviewed for completeness by a JPO and then sent directly for recommendation and approval.

- 2019-2020: The propriety case management system (GCBO) developed in the mid-2000s to process tax credit applications was migrated to a new web-based platform, known as Maestro. The new platform provides a significantly improved user interface and enhanced reliability and functionality. In addition, during this year, the program also discontinued the Canadian Content Certification Audit Program (CRA Audits) and updated the CPTC guidelines.

- 2020-2021: Further revisions were made to the tax credit application review process in 2020. Rather than have all track C, D and E files evaluated by a QAO prior to certification issuance (or denial), it was decided that only a sample of these files would be reviewed by QAOs and that these reviews would take place after application certification. The process is now referred to “post certification audits”.

- 2021-2022: The program is continuing the transition to “independent Officers” and enhancing Maestro.

- A variety of changes were made to address staff workplace issues. Annual wellness surveys conducted with CAVCO staff between 2016 and 2019 revealed a marked improvement in CAVCO’s workplace wellbeing (e.g., how staff felt about their work, working environment, the climate at work and the CAVCO organization as a whole).

2.0 About the audit

2.1 Project authority

The authority for this audit is derived from the Department’s Risk-Based Audit Plan 2020-2023, which was approved by the Deputy Minister in October 2020.

2.2 Objective and scope

The objective of the audit was to provide assurance on the effectiveness of CAVCO’s governance (including monitoring), risk management and control processes. The scope of the audit covered the operations of CAVCO, including program design changes, from March 1, 2017, to the substantial completion of the audit.

The audit criteria, presented in Appendix A, were developed based on a risk assessment and analysis conducted in the planning phase and cover the following:

- Line of Enquiry 1: Governance

- Line of Enquiry 2: Program Design and Delivery

- Line of Enquiry 3: Performance Measurement

- Line of Enquiry 4: Service Fees Act

2.3 Approach and methodology

The audit was carried out in accordance with the Government of Canada internal audit policy suite, and the Institute of Internal Auditors’ International Standards for the Professional Practice of Internal Auditing.

This audit assessed the controls that were in place for CAVCO as well as any potential gaps. The methodology included:

- A review of CAVCO documentation including but not limited to:

- Laws, regulation, policies, procedures and guidance/training materials;

- Plans, reports and corporate documentation (e.g., system releases, Public Notices);

- Governance documentation including committee records and relevant service agreements; and

- Results of internal quality assurance and monitoring processes.

- A flowcharting exercise to identify the CAVCO certification process, accountabilities and relevant controls, including a process walkthrough with CAVCO personnel;

- Interviews with representatives from CAVCO and Canadian Heritage corporate; and

- A summary analysis of financial, human resources and operational data.

3.0 Findings and recommendations

Findings are based on the evidence gathered through the interviews conducted, analyses performed, and documentation reviewed for each assessment criteria. Appendix A provides a summary level conclusion for each of the assessment criteria. Findings of lesser materiality, risk or impact have been communicated with the auditee verbally at debrief sessions.

3.1 Governance

CAVCO would benefit from more structured governance for the approval of CAVCO plans and priorities and the monitoring/oversight of progress toward their achievement.

Governance and oversight serve to ensure that management’s direction, plans, and actions are appropriate and responsible. Separating governance and management promotes accountability at all levels. It also provides a mechanism for good organizational governance that focuses on stakeholder value by balancing performance and conformance. The audit team expected to see a governance structure established and operating for CAVCO that would extend beyond the operational activities of the program and would include evidence of review and oversight of CAVCO’s direction, plans and priorities by departmental and branch senior management commensurate with the importance and magnitude of the program.

The audit team noted that over the past several years, CAVCO management has established extensive program priorities and implemented several significant change initiatives. Reporting on these plans and objectives has primarily involved regular bilateral meetings between the Director of CAVCO and the Director General (DG) of the Cultural Industries Branch (CIB) who also has the delegated authority to approve tax credit certificates. The audit team also noted that CAVCO voluntarily presented its planned move to a risk-based approach to application processing (i.e., the ‘tracks-based approach’) to both Executive Committee (EXCOM) and the now defunct Program Operations and Service Delivery Committee (POSDC) in 2018 and 2019.

Considering the significance of CAVCO operations to the Department and to the Canadian film and video industry, as well as management’s significant efforts to identify and implement operational improvements, the Office would benefit from a more structured approach to the setting and approving of plans and priorities and the monitoring/oversight of progress toward their achievement. Establishing a more structured approach to planning and oversight would help ensure that branch and sector management had a clear understanding of CAVCO priorities and performance expectations and help ensure that priorities were recognized and supported.

Recommendation

- The Director General, Cultural Industries, should establish a formal process for the setting of annual priorities for CAVCO, including those related to significant change initiatives, and which includes regular reporting of progress to branch/sector management.

3.2 Program design and delivery

In examining program design and delivery, the audit team considered processes and practices in place to support the processing of tax credit applications in adherence to relevant legislation and regulations; the implementation of recent changes initiatives; processes and practices in place to support the management of program and client information; and program plans and approaches for identifying, attracting, and retaining qualified human resources to meet operational needs.

Processes and practices to support adherence to legislation and regulations

Program guidelines, processes and practices are in place to support the processing of tax credit applications; however further effort is required to update operational policies and procedures and ensure all supporting information is easy to access.

Well defined and easily accessible policies, processes, tools, and practices help ensure that tax credit applications are processed in adherence to the Income Tax Act and Regulations. The principal source of information for TCOs in assessing tax credit applications consistent with legislative and regulatory requirements is the program guidelines that have been established by CAVCO. The CPTC guidelines were updated in March 2020. However, the PSTC guidelines have not been updated since 2012. As per CAVCO’s Policy Manager, sections of these guidelines would benefit from a clearer, more comprehensive explanation of requirements.

While program guidelines represent the primary source of information for program staff (and applicants), the audit team noted that CAVCO has established processes, procedures, systems, and tools to supplement the guidelines and in turn support TCOs in the assessment of tax credit applications. However, it was noted that information existed in multiple locations (across the CAVCO shared drive) and that it is not always clear that the information that exists is current or relevant. It was also noted that information on past decisions/interpretations can challenging to locate and search.

The audit team also noted that tools are being developed in MS Teams to support TCOs in obtaining timely advised and direction from QAOs as applications are processed. Further, with the development of Maestro, CAVCO is looking to create links in the system to provide TCOs with easy access to current guidelines, process, and procedures (rather than requiring them to search multiple information sources in an effort to obtain direction). In addition, CAVCO is documenting operational policies and procedures in key areas where direction is currently lacking/outdated. However, these efforts to provide TCOs with up-to-date information and tools to support the assessment of tax credit applications remain “in development”.

The importance of organized, complete and easy to access information and tools is of particular importance given that CAVCO is moving toward ‘independent officers’ (i.e. the elimination of the evaluation phase of application review) and as such the work of TCOs will no longer be reviewed by a QAO prior to application approval. It also helps to ensure consistent messaging to applicants, and in turn more complete applications.

Recommendation

- The Director General, Cultural Industries, should ensure that an approach is established, and monitored, for the coordination of efforts to organize, update and easily access policies, processes, tools, and practices in support of application assessment in adherence to legislation and regulations.

Implementation of changes initiatives

While significant efforts are underway to improve the efficiency and effectiveness of the processing of tax credit applications, planning and implementation processes in support major change initiatives need to be enhanced.

The effective management of change initiatives is critical to help ensure their successful implementation, to help management have a full understanding of the implications, and to ultimately ensure that risks can be more effectively managed. In this regard, the audit team expected to find that CAVCO employed appropriate change and project management methodologies and principles in the implementation of change initiatives. The audit team considered two recent change initiatives: the move to post certification audits and migration to the new web-based platform for application processing referred to as ‘Maestro’.

Post certification audits

Since 2017, CAVCO has been working to identify and adopt risk-based approaches to the processing of tax credit applications and improve processing times. In 2020-21, CAVCO eliminated the evaluation phase of the application review process and introduced post certification audits. Previously to this change, all tax credit applications falling within the ‘C’, ‘D’ and ‘E’ tracks were subject to two reviews prior to recommendation of an application for approval/rejection. Applications were first subject to a detailed review by a TCO, and then a subsequent ‘evaluated’ by a QAO. While the evaluation by QAOs helped to identify shortcomings (if any) in the review conducted by the TCO, it increased application processing times and rarely identified eligibility issues missed by TCOs. With the move to post certification audits, applications are now sent directly for approval/rejection after TCO review, with only a sample of issued tax certificates subsequently selected for post-evaluation (audit) by a QAO.

The audit team noted that no formal ‘project plan’ was established in support of this change initiative. This was due in part to the fact that the move to post certification audits, already being considered by CAVCO management, was expedited as a result of the COVID 19 pandemic and the system access issues it initially created. However, the team found that the change initiative was complex and would have benefited from a more fulsome and structured planning and implementation process, including additional consultation with affected staff.

It was noted that further work is required to ensure that post certification audits are successfully implemented and adequately support the integrity of the application review process, including:

- The identification of the criteria to be used to select files for post certification audit and the quantity or percentage of files to be audited;

- The establishment of performance standards and targets for QAOs to ensure sufficient files were subject to audit and that file review occurred in a timely manner;

- The determination of clear expectations and procedures to support QAOs in the completion of post certification audits and the documenting of observations;

- A clear means for rolling up observations (in relation to non-eligibility issue) in Maestro to support trend analysis and training; and

- The clarification of roles and responsibilities for the monitoring of audit results by management and an approach/plan for reviewing progress and results and making adjustments as needed, etc.

Maestro

In 2019, based on a recommendation from the Chief Information Officer Branch (CIOB) Applications Development team, the Grants and Contributions Business Online (GCBO) application used by CAVCO to support tax credit application assessment was migrated to a new web-based platform. A systems committee was established to support transition to the new platform, referred to as Maestro, which includes representatives from the CIOB development team, CAVCO, Super Users and Augmented Super Users. The project, which is ongoing, is led by a longstanding and experienced CAVCO manager.

The audit team found that the approach used by the systems team to gather user feedback during and after Maestro implementation to be effective. It was also noted that CAVCO staff were generally pleased with the new user interface and the enhanced reliability and functionality of the platform. However, the team found that due in part to the project having been developed and managed under CAVCO’s existing Service Level Agreement with CIOB, no formal project governance, structure and standard project discipline and oversight was established. As such, it was observed that:

- Fundamental system documentation is missing or out of date (e.g., data dictionary); and

- Certain stakeholders had not been consulted, including IT Security which noted the need for updated system assessments including:

- The Privacy Impact Assessment (PIA), due to data flows changes;

- The Threat and Risk Assessment (TRA), due to potential changes in threat exposure; and

- Security Assessment and Authorization (SA&A), due to the new context.

Missing system documentation hampers system development, maintenance and knowledge transfer to other developers and system users. Further, the absence of a Security Assessment and Authorization benefiting from a current Privacy Impact and Threat and Risk Assessment increases the risk that management has not explicitly accepted the residual risk of an agreed set of controls, and the results of a security assessment over the Maestro user interface.

Recommendations

- The Director General, Cultural Industries, should ensure that clear parameters and criteria are established to address noted implementation gaps associated with the move to post certification audits.

- The Director General, Cultural Industries, should ensure that necessary revisions are made to Maestro’s PIA, TRA and SA&A with the support of departmental IT Security.

Management of program and client information

Controls are in place over the collection and management of information within the Grants and Contributions Business Online application; however, the safeguarding of information outside of the application requires improvement.

In processing tax credit applications, CAVCO receives and stores detailed and confidential financial and proprietary information on production companies and personal information on industry professionals. The audit team expected to find that processes and practices were in place to support the management of this client and program information, including to support the safeguarding of information collected on corporations and individuals, the gathering of accurate and complete information to support operational enhancements and policy direction, and the sharing of information, where authorized, to support needed/requested changes to legislation and regulations.

The audit team found that CAVCO staff are keenly aware of the requirements of the Income Tax Act and the need to safeguard taxpayer information at the Protected B level. In this regard, it was noted that the GCBO application is on a segregated Protected B server environment; that communication with applicants is primarily through the GCBO application and Secure Channel; and that information that is shared with organizations outside of CAVCO does not identify individual taxpayers. However, the team noted that certain taxpayer information (i.e. cheque images) is stored on the CAVCO shared drive, which is not certified Protected B, along with production information captured within the minutes of advisory and compliance committee minutes maintained by CAVCO.

The audit team found that information on productions and individuals is entered directly into the system by CAVCO clients, primarily through the CAVCO on-line portal. The direct input of this information eliminates the risk of transcription errors by CAVCO employees. Further, applications are reviewed for completeness by JPOs and for accuracy and completeness by TCOs. Notwithstanding, CAVCO data staff conduct a major data cleanup at mid-year. Further, the team noted some anomalies in the data extracts that were provided to them. As such, while the quality of the information in the GCBO database cannot be described as ‘perfect,’ the audit team found that CAVCO makes concerted effort to address accuracy and completeness issues before provides information to external bodies and/or inputting it to the annual Profile, Economic Report on the Screen-based Media Production Industry report.

Finally, the audit team found that the information managed by CAVCO is shared, as allowed under the Income Tax Act. However, it was noted that changes to legislation and regulations are required to support the broader sharing of taxpayer information with the film and video policy group within the department and permit more detailed analysis of the evolution of Canada’s film and video industry.

Recommendation

- The Director General, Cultural Industries, should ensure that taxpayer information that resides on the CAVCO shared drive be moved to a Protected B environment.

Identifying, attracting, and retaining qualified human resource

Plans and approaches are in place for identifying, attracting, and retaining qualified resources to meet current and future operational needs, although limited progress had been made in establishing a system and data group to support CAVCO’s data development and maintenance requirements.

Human resource (HR) planning is a critical process which helps to ensure organizations recruit, retain, and optimize the deployment of the people they require to meet their strategic objectives and to respond to changes in the market and the general environment. Accordingly, the audit team expected to find that plans and initiatives are established by CAVCO management to ensure the Office is able to identify, attract, and retain sufficient HR capacity to support its operations and activities.

The team noted that formal departmental HR plans are developed annually by the CAVCO Director, in consultation with CAVCO managers, taking into consideration positions required to deliver on program objectives. These plans are submitted to the Department’s Resource Management Directorate (RMD) with whom CAVCO conducts regular progress meetings.

Furthermore, the audit team found that HR related plans were discussed during monthly all-staff meetings. In addition, CAVCO management prepared and presented an annual “HR and Staffing” deck to staff for both 2019-20 and 2020-21. These presentations provided important information on planned staffing activities and challenges by position (e.g., JPO, TCO, QAO) and/or division (e.g. Policy Team).

Overall, the team found the HR and staffing information presented to staff to be informative and insightful. Further, it was apparent that much of the planned activities were in progress or completed. However, it was noted that limited progress had been made in terms of management’s plan to establish a system and data group to address and manage issues related to system and data maintenance, development and leveraging, as well as to provide in-house GCBO support and training. Management acknowledged that while they have been able to “make do” with the current staff and teams, it recognizes that a dedicated system and data group is currently “more important than ever.”

3.3 Performance measurement

The audit team examined processes and practices in place for establishing operational plans and objectives and measuring and reporting against them; for developing and communicating performance standards for staff; and for setting, and reporting against, service standards for the processing of tax credit applications.

Program plans and objectives

Program priorities are established and communicated each year, however CAVCO would benefit from a more structured/formal approach for setting plans and priorities and measuring and reporting against them.

The practice of setting priorities, supported by well articulated plans, serves to focus time and resources towards work, projects, and tasks that impact high-value projects, and long-term goals. The audit team expected to find that clear, well-defined priorities were established for CAVCO, with associated annual and project plans, with regular reporting on progress toward their achievement.

The team found that CAVCO management establishes priorities on an annual basis and that it communicates these priorities to staff. While the number of the priorities identified each year tended to fluctuate (e.g. four in 2019-20, 18 in 2021-22), certain reoccurring priorities were identified each year (e.g. maintaining a healthy workplace). For the most part, the audit team found these priorities to be broadly stated, with limited information on supporting targets or performance indicators. The team found that the use of terms like ‘improve,’ ‘better’ and ‘increase’ limited the value of the stated priorities and the ability to measure and report on their achievement. It was observed that plans and activities were documented in support of some of the listed priorities and some performance indicators were available. In terms of reporting, as noted earlier in section 3.1 of this report (Governance), progress toward the achievement of priorities was primarily reported through regular bilateral meetings between the Director of CAVCO and the DG of Cultural Industries.

As noted previously in this report, considering the significance of CAVCO operations to the Department and to the Canadian film and video industry, as well as management’s significant efforts to identify and implement operational improvements, a more structured approach should be in place for establishing plans and priorities and reporting on progress. This would in turn be integrated into the branch’s governance model.

Recommendation

See recommendation 1.

Performance standards for staff

Performance standards are developed and communicated to relevant CAVCO staff, providing clear information on performance expectations, with performance against these standards monitored and communicated.

Establishing performance expectations for applicable staff is considered crucial given the nature of CAVCO operations and the fact that it has an obligation to process tax credit applications in a timely manner. Accordingly, the audit team expected to find performance expectations/standards established for JPOs, TCOs and QAOs on a regular basis. It further expected to find that the performance of these employees against these expectations/standards was being monitored and that results were being communicated to them.

The audit team found that work objectives are formally established and communicated to JPOs, TCOs and QAOs. For the most part, the objectives are established by CAVCO management and then presented and explained to the employees by group (i.e., JPO, TCO, and QAO). Objectives are primarily divided into three categories for each position. JPO and TCO objectives are separated in the categories of: Quality, Quantity and Customer Service. QAO objectives are separated in the categories of: Quality, Quantity and Coaching. More recently, QAO objectives were categorized in relation to Mentoring and Training, Advisory Committee and related responsibilities, and Audits.

It was noted that after the objectives are discussed with the employee groups, they are added into each employee’s Public Service Performance Management Application (PSPMA). A review of these objectives takes place between the employee and their manager at the beginning of the year, at mid-year, and at year-end.

The audit team noted management is well invested in their employees, providing timely feedback as they execute their roles and responsibilities through regular bilateral meetings with their supervisor, system generated employee specific operational status information, and a recent client survey. Additionally, while still under development, it is intended that the results from post-certification audits will be rolled up and used to support TCO learning and training.

Service standards for application processing

Service standards are in place for the processing of tax credit applications and CAVCO regularly reports against them; however, these service standards have been in place for many years and should be reviewed and updated as appropriate.

The Cabinet Directive on Regulation requires that departments develop, publish, and review service standards for high-volume regulatory transactions that promote timely decision-making and provide Canadians with clear information on expectations for interactions and service. This directive, along with the Treasury Board Policy on Service and Digital and its corresponding guideline, make it clear that service standards are also expected to be sufficiently challenging to service providers and drive service excellence. The audit team expected to find that CAVCO service standards were developed, communicated, and monitored to support timely application processing, consistent with Government of Canada (GoC) policy expectation.

CAVCO has a service standard of 120 days for the processing of both CPTC and PSTC applications and it reports monthly on the number of applications processed and its adherence to this standard. The information is posted on the section of the department’s website specific to CAVCO operations. The processing period commences after a JPO has reviewed the application and deemed it to be complete (referred to by CAVCO as the ‘registration phase’) and is completed once the application has been reviewed by a TCO and the Director General (with delegated authority) has approved the tax certificate for issuance. The audit team examined the time period used by CAVCO to calculate application processing time (against the 120-service standard) and found it to be appropriate. However, it was noted that neither the PCH website nor the CPTC or PTSC guidelines provided sufficient explanation to applicants that the registration phase (i.e. JPO review time) was not part of the time period considered against the service standard. Making this information more transparent to applicants would help to ensure they understand the importance of submitting an application that includes all necessary documentation and information.

Finally, the audit team found that the existing service standard of 120 days for both CPTC and PSTC applications requires a review by CAVCO to ensure it meets GoC policy expectations. The audit team was advised that the 120-day service standard has been in place for many years, having originally been established based on a Canada Revenue Agency standard. GoC policy documentation on service standards advises that in addition to providing clients (i.e. applicants) with a defined level of performance (for planning and awareness purposes), service standards are expected to represent an appropriate performance goal for a department. While significant changes have occurred in the CPTC and PSTC application review process (i.e. implementation of the tracks approach and more recently the elimination of the evaluation phase), service standards have not been reviewed to ensure they meet all GoC criteria. At a minimum, it seemed apparent that different service standards should exist for the processing of CPTC and PSTC applications as processing times are clearly different for these two streams.

Recommendations

- The Director General, Cultural Industries, should ensure that an examination is conducted of the appropriateness of CAVCO service standards for the processing of PSTC and CPTC applications, and that information on how service days are calculated is clearly communicated in guidelines and the Department’s website.

3.4 Service fees act

CAVCO is in adherence with the requirements of the Service Fees Act; however, its planned efforts to initiate preparatory work to put policies and processes in place to facilitate fee remission, should the Act be amended, have not occurred.

The Service Fees Act (SFA or ‘the Act’) came into effect in April 2018, replacing the previous User Fees Act. The Act introduced a modern legislative framework to enable cost-effective delivery of services and, through enhanced reporting to Parliament, improved transparency, and oversight. In examining CAVCO compliance with SFA requirementsFootnote 3, the audit team conducted interviews and examined documentation in support of CAVCO’s position, including senior management’s concurrence, that the fees it charges are further to a regulatory regime and that annual CPI adjustments should not apply to those CAVCO fees calculated based on applicant production costs (as this would represent the ‘doubling-counting’ of inflation). The audit team also considered CAVCO progress on establishing policies and processes to facilitate fee remission. It should be noted that the Office of the Chief Audit Executive (OCAE) will be conducting an audit of the implementation of the Service Fees Act and the work completed during this audit will be taken into consideration.

Based on the information gathered and reviewed, the audit team found CAVCO to be in compliance with the requirements of the SFA. Of note, on the matter of fee remission, the Act requires that fees be refunded to fee payers if/when service standards in relation to a service are not met. CAVCO had intended to initiate preparatory work to establish the necessary policies and processes to facilitate fee remission should the Act be amended, and its activities be deemed a service. However, the audit team was informed by CAVCO management that this work has not yet commenced as it has not been deemed a priority.

4.0 Conclusion

The Department of Canadian Heritage has put in place processes and controls to support the processing of tax credit applications in adherence with relevant legislation and regulations, with these processes continuing to be improved. Performance standards have been established for the processing of applications for the benefit of both staff and applicants, although in the case of applicants these services standards need to be reviewed. Processes and practices are also in place to support the management of program and client information, with some improvements required. In addition, initiatives have been identified and are being implemented to improve the efficiency and effectiveness of application processing and to improve operational performance. The audit identified key opportunities for improvements with respect to the following activities:

- Develop a more structured approach to the setting of plans and priorities, with increased reporting to and oversight by sector/branch management;

- Update and enhance the policies, procedures and practices that support adherence to legislation and regulations;

- Enhance planning and implementation processes in support of major change initiatives;

- Improve safeguarding of client and program information; and

- Review the appropriateness of service standards for the processing of CPTC and PSTC tax credit applications.

Appendix A — Assessment scale and results summary

| Conclusion | Definition |

|---|---|

| Well controlled | Well managed, no material weaknesses noted; and effective. |

| Controlled | Well managed and effective. Minor improvements are needed. |

| Moderate issues |

Requires management focus (at least one of the following criteria is met):

|

| Significant improvements required |

Requires immediate management focus: At least one of the following three criteria is met:

|

The conclusions reached for each of the criteria used in the assessment were developed according to the following definitions.

| Audit criteria | Results summary |

|---|---|

| 1.1 Governance bodies are in place and provide oversight of CAVCO’s direction, plans and priorities. | Moderate Issues |

| 1.2 Governance bodies receive timely and relevant information on program operations and key changes to program design and delivery. | Moderate Issues |

| 2.1 Processes and practices are in place to help ensure adherence to relevant legislation and regulations. | Controlled |

| 2.2 Changes to program design and delivery are effectively managed and reported. | Moderate Issues |

| 2.3 Processes and practices are in place to support the management of program and client information. | Moderate Issues |

| 2.4 The development and implementation of program plans and approaches consider the need to identify, attract and retain sufficient qualified human resources to meet the current and future needs of the organization. | Well Controlled |

| 3.1 Performance and progress against program plans and objectives are regularly measured and reported. | Moderate issues |

| 3.2 Performance standards are developed, communicated, and monitored to provide staff with clear information and feedback on expectations. | Well controlled |

| 3.3 Service standards are developed, communicated, and monitored in support of the timely assessment of the applications. | Moderate issues |

| 4.1 CAVCO adheres to the requirements of the Service Fees Act. | Controlled |

Appendix B — Management action plan

| Recommendations | Management assessment and actions | Responsibility | Target date |

|---|---|---|---|

|

Agreed CAVCO will prepare an annual report for the DG, Cultural Industries, that will review progress made on the previous year’s priorities, and outline objectives and priorities for the upcoming year. |

DG, Cultural Industries | June 2022 |

|

Agreed This recommendation is being implemented. Maestro, CAVCO’s online case management system where all file analysis takes place, has been made the central repository for all CAVCO policies, tools and procedures. This new feature is called the Toolbox. Work remains to be done on a process for updating the contents of the Toolbox, adding new material, and monitoring results. |

DG, Cultural Industries | October 2022 |

|

Agreed Building on the plan for post-certification audits, which are an integral part of the risk-based approach, CAVCO will consolidate and refine existing parameters and procedures related to:

|

DG, Cultural Industries | October 2022 |

|

Agreed CAVCO will work with CIOB and departmental IT Security, and allocate resources, as necessary, to update the PIA, TRA, and SA&A for Maestro. |

DG, Cultural Industries | March 2023 |

|

Agreed CAVCO acknowledges that it has been storing a relatively small amount of taxpayer information that is contained in working documents on a Protected A network while awaiting a departmental solution for Protected B documents, and accepts this risk. CAVCO will work with CIOB to move this taxpayer information to SharePoint, which is a Protected B environment. |

DG, Cultural Industries | October 2022 |

|

Agreed CAVCO will review the service standards for the CPTC and PSTC programs. |

DG, Cultural Industries | October 2023 |

|

Agreed CAVCO will better communicate how service days are calculated in guidelines and the website. |

DG, Cultural Industries | June 2022 |

©Her Majesty the Queen in Right of Canada, 2022

Catalogue Number: CH6-47/2022E-PDF

ISBN: 978-0-660-43436-0

Page details

- Date modified: