Joint Audit and Evaluation of Budgetary Controls – Vote 1

Office of the Chief Audit Executive and Evaluation Services Directorate

March 2017

Cette publication est également disponible en français.

© Her Majesty the Queen in Right of Canada, 2017.

Catalogue No. CH6-57/2017E-PDF

ISBN: 978-0-660-08344-5

Table of contents

Executive summary

Budgeting and forecasting are key organizational controls that support the stewardship of funds and the achievement of organizational objectives. These controls are increasingly important for the Department of Canadian Heritage (PCH or “the Department”) in the context of planning and implementing the various transformation and innovation initiatives, as rigorous budgeting and forecasting allows for more informed senior management decision-making.

A joint audit and evaluation of budgetary controls was carried out with the goal of providing a comprehensive assessment of PCH budgetary and forecasting framework for vote 1 (operations and maintenance, and salary). This joint engagement was a first for the Office of the Chief Audit Executive and the Evaluation Services Directorate and was an innovative initiative to reduce the impact on the client, while providing value-added for management.

The objective of this engagement was to provide assurance with respect to: the effectiveness of governance; the efficiency and effectiveness of budgetary and financial forecasting processes and controls; and the relevance, reliability and timeliness of financial data for resource allocation and reallocation and decision-making. The scope was from April 1, 2013 to January 13, 2017 for processes associated with vote 1. Given the different nature of processes, vote 5 (grants and contributions) was excluded from the current engagement.

Audit and evaluation opinion and conclusion

Based on the joint engagement findings, it is the opinion of the Chief Audit Executive and the Director, Evaluation Services Directorate that PCH has an established process for the yearly allocation and reallocation of budgets for vote 1 and forecasts are updated on a monthly basis. The Executive and Finance Committees provide oversight on budgets and forecasts. Directors, Directors General and Assistant Deputy Ministers are accountable for budgets and the accuracy of forecast.

There are opportunities to optimize vote 1 budgeting and forecasting processes, to better enable Deputy Minister and Senior Management decision-making and increase the maturity of the financial management framework. The recommended improvements relate to:

- Strengthening the effectiveness of the oversight committees by having in-depth budgeting and forecasting discussions at the Finance Committee, reviewing the committee membership; and ensuring that committee discussions are based on integrated financial and non-financial information and covering multi-year plans.

- Increasing the empowerment and objectivity of the financial management and the challenge function by streamlining the forecasting process and reviewing roles and responsibilities.

- Bringing a greater focus on responsibility centre managers at all levels of the organization to align the budgeting and forecasting process with delegated financial authorities.

Statement of conformance

In my professional judgment as Chief Audit Executive, the audit components of this joint engagement were conducted in conformance with the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing and with the Internal Auditing Standards for the Government of Canada, as supported by the results of the quality assurance and improvement program. Sufficient and appropriate audit procedures were conducted, and evidence gathered, to support the accuracy of the findings and conclusion in this report. The findings and conclusion are based on a comparison of the conditions, as they existed at the time, against pre-established review elements that were agreed with management and are only applicable to the entity examined and for the scope and time period covered by the joint engagement.

The evaluation components of this project have been conducted in compliance with the Policy on Results and related Standard on Evaluation.

Original signed by

Natalie M. Lalonde

Chief Audit Executive

Department of Canadian Heritage

Marie-Josée Dionne

Director, Evaluation Services Directorate

Department of Canadian Heritage

Joint Audit and Evaluation Team:

- Sophie Frenette, Audit Manager

- Kossi Agbogbe, Team Leader

- Chrystianne Pilon, Senior Auditor

- Gurkiran Jassy, Auditor

- Trisha Laul, Auditor

- Silviya Dragolova, Manager, Evaluation, Professional Practice Unit

- Rose Magdala Coriolan, Evaluation Officer

With the assistance of external resources

1.0 Background and context

Budgeting is the identification and allocation of resource at a global level based on strategic and operational planning exercises conducted previously. Forecasting is the consolidation, validation and analysis of commitments, expenditures, actuals and budgets. Both budgeting and forecasting are essential to the management of the Department of Canadian Heritage (PCH or “the Department”) activities. A budget, combined with accurate and timely forecast data and relevant non-financial information (e.g. plans, risks and priorities), enables sound senior-management decision-making. It also allows the Department to track its overall financial position, assess performance and strengthen the capacity to deliver programs and services. At PCH, forecasts are updated monthly.

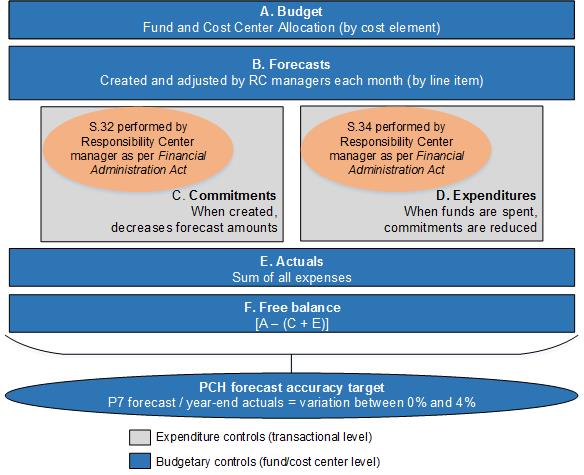

Figure 1. Budgeting and forecasting process

Figure 1. Budgeting and forecasting process - text version

The main financial components of the budgeting and forecasting process are outlined sequentially below:

A - Budget (with budgetary controls at the fund or cost center level)

- Fund and Cost Center Allocation (by cost element)

B - Forecasts (with budgetary controls at the fund or cost center level)

- Created and adjusted by Responsibility Centre managers each month (by line item)

C - Commitments (with expenditure controls at the transactional level)

- When created, decreases forecast amounts

- Section 32 performed by Responsibility Center manager as per Financial Administration Act

D - Expenditures (with expenditure controls at the transactional level)

- When funds are spent, commitments are reduced

- Section 34 performed by Responsibility Center manager as per Financial Administration Act

E – Actuals (with budgetary controls at the fund or cost center level)

- Sum of all expenses

F - Free balance (with budgetary controls at the fund or cost center level)

- Budget minus the sum of Commitments and Expenditures

The various budgeting and forecasting components form part of the Canadian Heritage forecast accuracy target:

- The Period 7 forecast divided by the year end actuals should equal a variation between zero and four percent

The Deputy Minister provides leadership by demonstrating financial responsibility, transparency, accountability, and ethical conduct in financial and resources management. He is supported by the Chief Financial Officer, the lead departmental executive for all aspects of financial management, as well as Financial Management Advisors. He is also supported by two senior committees involved in budgeting and forecasting activities, namely the Executive Committee (EXCOM) and Finance Committee (FINCOM).

Assistant Deputy Ministers (sector heads) and Direct Reports (Directors General, Executive Directors and other corporate responsibilities such as the Chief Audit Executive) are responsible for exercising financial management authorities, responsibilities, and accountabilities, managing financial resources demonstrating prudent stewardship of public funds. Assistant Deputy Ministers and Direct Reports receive various administrative corporate services from Resource Management Directorates, including financial support.

PCH’s vote 1 reference levels were approximately $220 Million in 2016-2017 and the accuracy of the October (P7) forecasts has been within 4% of year end expenditures (three year average). The management of salary have been at the forefront of senior management attention, including the absorption of salary increases within existing reference levels and the impacts of delays in staffing processes. The budgeting and forecasting process is therefore key for sound stewardship and the prudent and efficient use of public funds.

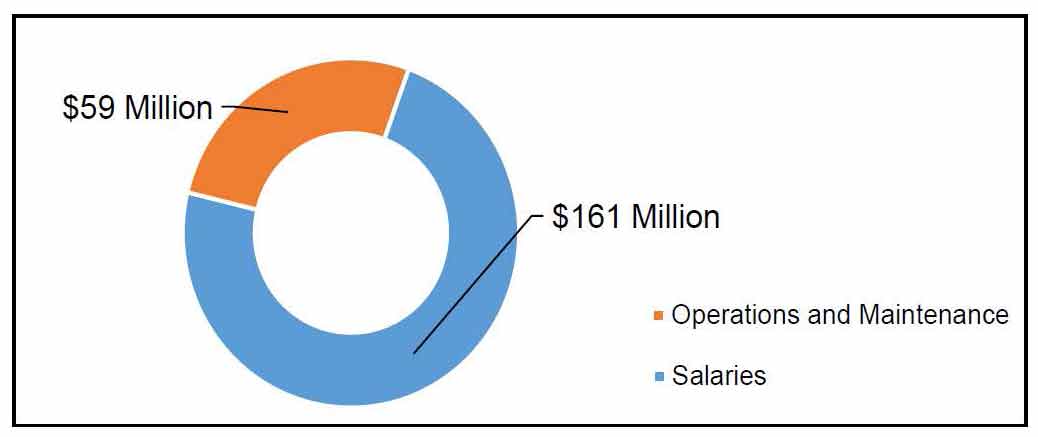

Figure 2. PCH vote 1 reference levels (2016-2017)

Figure 2. Canadian Heritage vote 1 reference levels (2016-2017) – Text version

The graph contains a pie chart showcasing the Canadian Heritage Vote 1 Reference Levels (2016-2017)

- Operations and maintenance reference levels total $59 Million

- Salaries reference levels total $161 Million

The Government of Canada financial management model is evolving, placing a greater emphasis on the integration of budgets, operations and plans. At the core of this evolution is a financial management community that collaborates with program branches to embrace a more results-oriented culture. This evolution will also support PCH in the delivery of its mandate and priorities, and pursue a modern, nimble, agile and resilient organization.

2.0 About the joint engagement

2.1 Project authority

In accordance with the 2016–2017 to 2018–2019 Risk-Based Audit Plan and the 2016–2017 to 2020–2021 Departmental Evaluation Plan, the Office of the Chief Audit Executive and the Evaluation Services Directorate carried out a joint audit and evaluation of budgetary controls. The goal of this joint engagement – a first for these two directorates – was to provide a comprehensive view of PCH budgetary controls. Moreover, this joint project helped increase the effectiveness of the assessment, thus maximizing the value for the Department.

2.2 Objective and scope

The objective was to provide assurance with respect to:

- the effectiveness of governance;

- the efficiency and effectiveness of budgetary and financial forecasting processes and controls; and

- the relevance, reliability and timeliness of financial data for resource allocation/reallocation and decision-making.

The engagement covered the period from April 1, 2013 to January 13, 2017 for processes associated with vote 1 (Operations and maintenance and salary).

Given their different nature, the processes associated with Vote 5 (Grants and contributions) were excluded from the current engagement. Even though the materiality of Vote 5 is considerable, the operational environment is very different. However, some of the recommendations in this report will also have a positive impact on the vote 5 budgetary controls.

2.3 Approach and methodology

The joint engagement allowed for an integration of the respective approaches, practices and methodologies specific to audit and to evaluation.

This engagement was conducted in accordance with the requirements of the Treasury Board Internal Audit policy suite, the Treasury Board Policy on Evaluation (2009) and the Treasury Board Policy on Results (2016). It was carried out in a manner that ensures the team's neutrality and objectivity, as per respective professional requirements and standards, and ensures that observations and conclusions are evidence-based.

An overview of the joint methodology is presented in Appendix A.

3.0 Findings and recommendations

The following section provides an overview of the findings of the joint audit and evaluation, as well as recommendations for PCH management. A summary of conclusions for each of the review element is also presented in Appendix B. Findings of lesser materiality, risk or impact have been communicated with the auditee verbally and in a management letter.

3.1 Governance, information and monitoring

Oversight for budgets and forecasts

Departmental governance mechanisms are in place, however forecasting discussions were not in-depth enough for effective oversight.

Deputy Heads are accountable for establishing adequate governance and oversight for financial management. Departments have the flexibility to establish governance committee models in support of sound financial management and in accordance with their needs. At PCH, the oversight model for financial management includes two senior committees.

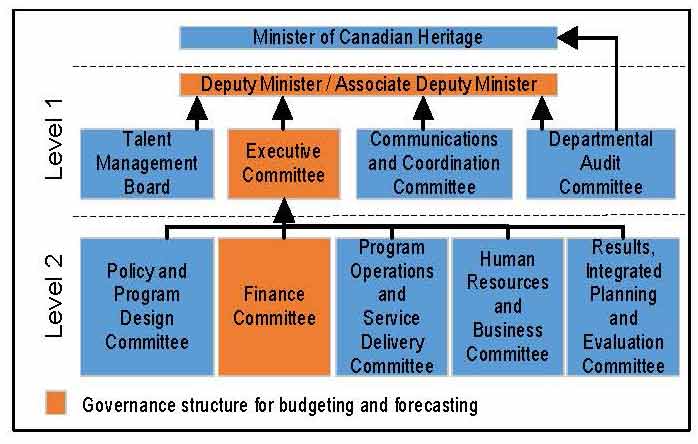

Figure 3. PCH Governance model

Figure 3. Canadian Heritage Governance model – Text version

This graph depicts the Canadian Heritage governance model including various level one and two committees.

A - Minister of Canadian Heritage

B - Deputy Minister and/or Associate Deputy Minister (involved in the Canadian Heritage budgeting and forecasting process)

C - Level 1:

- Talent management board

- Executive committee (involved in the Canadian Heritage budgeting and forecasting process)

- Communications and coordination committee

- Departmental audit committee

D - Level 2:

- Policy and program design committee

- Finance committee (involved in the Canadian Heritage budgeting and forecasting process)

- Program operations and service delivery committee

- Human resources and business committee

- Results, integrated planning and evaluation committee

EXCOM: The decision-making body for all significant financial and other matters affecting the Department. Members include Assistant Deputy Ministers and Direct Reports to the Deputy Minister of PCH. EXCOM is chaired by the Deputy Minister.

FINCOM: An advisory and decision-making body reporting to EXCOM, responsible for the planning, management and providing advice on the allocation of financial resources (among other financial-related roles) with a core agenda item of reviewing the departmental long term financial strategy, financial plans, forecasts, trends, and risks. Membership is at the Director or Director General levels. The Chair is at the Assistant Deputy Minister level and the Chief Financial Officer plays a functional lead role.

Departmental governance mechanisms are established. Mandates for both committees are reviewed, approved and communicated on a yearly basis. FINCOM endorses the information it receives, which is then forwarded to EXCOM for approval.

Evidence gathered through interviews, surveys and focus groups indicate that, although oversight committees are well established, FINCOM could be more effective by having substantial discussions on aspects of budgeting, forecasting and long term financial planning at key periods of time. Based on the review of records of decisions, there was little evidence of a challenge function or discussions on financial risks, impacts, mitigation strategies, and long term planning at FINCOM are taking place. In addition, some interviewees noted a difference between FINCOM’s formal mandate and its current functioning, noting that it may be viewed as a forum for sharing information. FINCOM is not entirely fulfilling its role of oversight related to budgeting and forecasting as described in its mandate.

According to interviews, FINCOM members are, at least in part, determined by the Talent Management Board. Best practices recommend to consider the membership of finance committees from the perspective of having a sufficient number of members with appropriate financial background and knowledge. Therefore, it is not clear that the current membership selection criteria allows FINCOM to play an enhanced oversight role and provide value-added advice to EXCOM.

The Chief Financial Officer as functional lead for FINCOM holds the key responsibility for integrating financial and non-financial information to be tabled at the governance committees. Although FINCOM’s mandate defines its role, authority, agenda items, and expected outcomes, the specific distinction between roles and responsibilities of functional leads and of committee members is unclear.

With respect to EXCOM, the findings were similar, as the committee documentation that was reviewed did not allow the team to validate if the committee was having substantial discussions on financial plans, forecasts, trends and risks. Interviews indicated that the essence of EXCOM discussions are not communicated effectively to FINCOM members. Overall, the monthly financial discussions did not appear to yield the strategic oversight, risk identification, and early detection of financial issues that were expected from such an oversight body.

Quality of information for decision-making

The information tabled at FINCOM and EXCOM is timely and accurately reflects SAP data. However, relevance and reliability should be improved by including more non-financial information and linking resource allocations to multi-year plans and priorities.

FINCOM receives a considerable volume of financial information, including financial forecasts on a monthly basis. The majority of stakeholders viewed the information as sufficient, complete, timely and accurate. Testing confirmed that monthly forecasting presentations included financial information which accurately reflected the financial data in the departmental financial system (SAP) for September (P6), October (P7) and December (P9); limited discrepancies were noted, however relevant explanations were included in the presentations. Forecasting discussions were also held based on timely financial information.

To support the in-depth discussions in line with their mandates and respective oversight roles, the information provided to FINCOM and EXCOM should include relevant non-financial information on context, operations, plans, priorities, risks, impact, and performance. This would lead to more informed and effective decision-making. While this information may exist and be available to senior management outside of the committee structure, governance documentation suggests that discussions are not based on integrated financial and non-financial information. This would help improve the relevance and reliability of information for decision-making.

Resource allocations and reallocations

Document review suggests that FINCOM and EXCOM discussions about resource allocations at the beginning of the fiscal year did not include in-depth discussions on underlying options, benefits, risks, multi-year planning and mitigation strategies. Interviewees also expressed a concern that budgets were based on historical allocations more than expenditures or needs/priorities. The review of documents supported this observation, while this may be due to records of decisions being very high-level.

Interviewees were satisfied with the quality of information and discussion for in-year reallocation and pressures exercises, however the process was perceived as somewhat ad-hoc. Quantitative analysis demonstrated a consistent approach to pressures management.

In summary, improving the quality of the information provided to FINCOM and EXCOM, and reviewing FINCOM’s membership as well as clarifying responsibilities of functional leads, will allow the committees to systematically and effectively play their oversight roles as outlined in their respective mandates. A more in-depth challenge function and discussions of budget allocations would also strengthen the oversight role of committees.

Recommendations

To strengthen the effectiveness of the existing governance structure’s oversight and to support evidence-based decision making:

- The Chief Financial Officer, in collaboration with the Chair of the Finance Committee, should ensure that Finance and Executive Committees receive financial and non-financial information and that there are in-depth discussions at both committees at the beginning of the fiscal year on long term financial strategy as well as on forecasting at key periods of the year, including ongoing discussions on risk management and the allocation of resources based on multi-year plans and priorities.

- The Corporate Secretary, in collaboration with the Director General of Human Resources, should clarify roles and responsibilities of functional leads and review the membership of the Finance Committee for a balanced approach between talent management and managers with financial experience.

Supporting sound budgeting and forecasting

Efficient financial management includes roles and responsibilities that are clear, aligned with operational needs, and support the stewardship of funds. Responsibility Centre Managers are delegated with spending authority as per Financial Administration Act and have the responsibility for budget management. In addition, the Treasury Board Policy on Financial Management Governance sets the tone by assigning key responsibilities to the Deputy Minister and the Chief Financial Officer.

The Deputy Minister is responsible for assuming overall stewardship responsibilities and for the integrity of the department's financial management. The Deputy Minister in consultation with the Comptroller General appoints the Chief Financial Officer to support him through his mandate.

The Chief Financial Officer leads financial management at PCH and confirms having unfettered access to the Deputy Minister. He is a functional lead on FINCOM and a member of EXCOM. The Chief Financial Officer relies on the challenge and advisory function of Financial Management Advisors, to raise issues and financial risks as required to senior management.

There is opportunity to clarify the Financial Management Advisor role to support and challenge Responsibility Centre Manager forecasts from a departmental perspective.

The following three groups have financial responsibilities in PCH:

- Resource Management Directorates provide administrative services and report to Assistant Deputy Ministers and Direct Reports. Across PCH, there are 44 employees in AS (Administrative Services) and CR (Clerical and Regulatory) positions who provide various financial services at the sector level. Resource Management Directorates are also the main point of contact for financial advice for Responsibility Centre Managers.

- Regional Financial Advisors provide the same kind of support as Resource Management Directorates in the PCH regional offices and have a functional reporting relationship to the Chief Financial Officer. There are eleven regional financial advisors in FI (Financial Management) positions, reporting to Regional Directors General. The majority of these positions have a minimum qualification standard of eligibility for recognized professional accounting designations (except at the entry level).The Citizenship, Heritage and Regions Sector’s Resource Management Directorate (responsible for Regions) consolidates regional forecasts with the ones from its national headquarters branches, for a complete Sector forecast.

- Financial Management Advisors report to the Chief Financial Officer and provide budget and forecasting expertise to Assistant Deputy Ministers and Direct Reports. There are five Financial Management Advisors in FI positions responsible for budgeting, forecasting and other activities (e.g. Treasury Board Submissions), in addition to a manager and a director who perform a challenge function at the aggregate level. These positions have a minimum qualification standard of eligibility for recognized professional accounting designations (there are no entry-level positions). These advisors have limited time to engage with Responsibility Centre Managers directly and limited access to non-financial (e.g. operational) information. The Financial Management Advisor challenge of forecasts is therefore limited to the level of Assistant Deputy Ministers and Direct Reports.

When combining the three financial functions, there are approximately 60 departmental officials who support budgets and forecasts at various levels, among other financial management responsibilities. There is an opportunity to better define the role for challenging budgets and forecasts from a departmental perspective, which would be more appropriate for positions which require accounting designations, namely Financial Management Advisors. It is understood that this change would require a clarification of the financial role and responsibilities of Resource Management Directorates with regard to sector budgets and forecasts.

A direct participation of the Financial Management Advisors in the monthly forecasting process with Responsibility Centre Managers will give them regular access to operational (i.e. non-financial) information. This will enable Financial Management Advisors to systematically challenge key financial assumptions underlying plans, multi-year impacts and proactively support budgets and forecasts based on departmental priorities, at all levels of the organization.

Ultimately, a greater participation of the Financial Management Advisors will support the Chief Financial Officer’s capacity to provide strategic and objective financial advice as per the upcoming Policy on Financial Management. It will also contribute to enterprise-wide financial management that will allow the Department to deliver on its modernization and innovation agendas.

Recommendation

- The Chief Financial Officer should facilitate a greater participation of the Financial Management Advisors in the financial management process, so they may provide a more informed, robust and standard support, advice and challenge of budgets and forecasts.

3.2 Processes and controls

Enabling budget and forecast accuracy

A budgeting and forecasting process is in place but would be strengthened by formalizing a departmental policy.

Budgeting and forecasting are key processes to enable stewardship for public funds. Through monitoring and forecasting, risks and funding pressures can be brought forward to senior management. This leads to the development of mitigation strategies, updates to plans, internal budget reallocations, or external requests for departmental funding.

General expectations for budgeting and forecasting roles and responsibilities are outlined in the Treasury Board Secretariat financial management policy suite. There is also a Common Business Process with the “should be” model of budget and forecast management. Forecasting should be completed quarterly as a minimum and at the centre of this process is the Responsibility Centre Manager with delegated financial responsibilities as per the Financial Administration Act.

The PCH budgeting and forecasting process was mapped (see Appendix C), including the activities of all relevant stakeholders. PCH has a two-level budget allocation structure comprised of 65 fund centres and 557 cost centres. Financial Management Advisors are mostly involved with the establishment of budget allocations and the challenge of financial information at the fund centre level, whereas Resource Management Directorates are more present at the cost centre level.

PCH issues a budget management guideline each year which includes principles and outlines the roles of the Financial Management Branch, Assistant Deputy Ministers, Directors General and Directors. A more complete guideline should include the roles and responsibilities of all stakeholders (such as Resource Management Directorates and Regional Financial Advisors), reflect the two-level allocation structure (fund and cost centre), and include Responsibility Centre Managers at all levels.

Timeliness of budget allocations

As part of the Treasury Board Directive on Results, there is a mandatory indicator on the number of days elapsed before managers at the lowest levels of the organization obtain access to their budgets. This indicator is a measure of operational planning where the earlier access to the budget allows managers to plan their activities more effectively. PCH has good practices for the timeliness of budgeting, as Financial Management Advisors completed fund centre allocations prior to the start of the fiscal year. However, there is an opportunity to improve the process for budget allocations at the lowest levels of the organization (i.e. cost centre).

The majority of cost centre budgets were allocated by April 30 for the past three fiscal years. Cost centre allocations are left to the discretion of Assistant Deputy Ministers or Direct Reports and entered in SAP by Resource Management Directorates. As a result, practices vary as illustrated in Table A. It is not possible to measure performance for the indicator outlined above as there is no single allocation. PCH should strive to reduce the number of cost centre allocation transactions and set a date by which all Assistant Deputy Ministers or Direct Reports allocate their budgets. This would support financial planning by Responsibility Centre Managers across the organization.

| Sector (excluding Minister’s offices) | 2013-2014 | 2014-2015 | 2015-2016 | |||

|---|---|---|---|---|---|---|

| Total number of allocation transactions | Budget allocated by April 30 | Total number of allocation transactions | Budget allocated by April 30 | Total number of allocation transactions | Budget allocated by April 30 | |

| Strategic Policy, Planning and Corporate Affairs | 1089 | 18% | 1581 | 75% | 1611 | 62% |

| Sport, Major Events and Commemorations | 831 | 69% | 950 | 105% | 886 | 79% |

| Citizenship, Heritage and Regions | 3143 | 70% | 3022 | 68% | 2856 | 34% |

| Cultural Affairs | 443 | 106% | 419 | 106% | 445 | 107% |

| Direct Reports | 1342 | 87% | 1262 | 79% | 2377 | 89% |

| PCH (Total) | 6848 | 67% | 7234 | 84% | 8175 | 72% |

Note: The total number of allocation transactions exceeds the number of cost centres, as there were multiple transactions per cost centres.

Overall, consultations with Responsibility Centre Managers and other stakeholders indicated a desire for greater consistency and predictability in the budgeting and forecasting process. These opportunities for systematic improvements, in addition with a greater standardization to promote efficiencies, could be addressed with a departmental policy. As part of the new Policy on Financial Management, departments have been instructed to avoid re-creating rules internally that are already outlined in Treasury Board policy instruments. The departmental policy could focus on PCH-specific responsibilities and include a target date for cost centre allocations, which would allow to report on results of the mandatory timeliness indicator.

Recommendation

- The Chief Financial Officer should develop and implement a policy instrument for budgeting and forecasting which includes PCH-specific controls and processes, and a target date for cost centre resource allocations.

Measuring forecasting accuracy

As part of the Treasury Board Directive on Results, PCH will be expected to report on the variance between the department’s September (P6) and December (P9) lapse forecasts and Public Account lapses. This is to encourage increased discipline and forecasting accuracy, and guide effective and timely expenditure management decisions.

PCH measures the forecasting accuracy of Assistant Deputy Ministers and Direct Reports based on October (P7) forecasts, with a 4% target. Results are reported to FINCOM and EXCOM. In 2015-2016, most Assistant Deputy Ministers and Direct Reports met the target and global results were also positive for June (P6, 4% accuracy) and September (P9, 2%). A granular analysis of PCH forecasting identified the following relevant trends:

- Salary forecasting is accurate (within a 2% range) in part due to the use of a standard Salary Forecasting Tool. Salaries account for a larger proportion of Vote 1 expenditures overall, and as a result has a large impact on the accuracy of global forecasts.

- Forecasting accuracy for goods and services varied between 9% and 12% and year-end expenditures were high, indicating an opportunity for better planning.

- Forecasting accuracy for travel, hospitality and conferences varied between 10% and 24%.

PCH has a corporate forecasting accuracy indicator in executive performance management agreements; this good practice was introduced in 2015-2016. A review of a sample of 25 agreements confirmed the indicator was included in a majority of agreements (96% in 2015-2016 and 92% in 2016-2017). Half of the sampled agreements measured forecasting accuracy in accordance with the indicator. Of those, 67% reported on results accurately. A potential cause of inaccurate reporting would be the absence of an independent validation of results by the Financial Management Branch.

Overall, forecasting accuracy targets are set and reported on at level of Assistant Deputy Ministers and Direct Reports. Efforts have been made to complement organizational targets with indicators to hold executives accountable for forecasting accuracy. However the executive performance management process was not applied consistently and excluded 272 non-executives, which represents approximately 75% of the Responsibility Centre Managers population. There is an opportunity for PCH to extend the good practice and include a mandatory indicator for forecasting accuracy at the lowest levels of the organization. Understanding that a transition will be beneficial for these new measures, it will help support the Deputy Minister’s accountability related to accuracy of financial information.

Recommendation

- The Chief Financial Officer in collaboration with the Director General of Human Resources, should develop indicators to measure forecasting accuracy that are aligned to expectations, included in performance management agreements of all Responsibility Centre Managers and report on results.

Tools to support Responsibility centre manager forecasting and accountability

Resource Management Directorates extract financial information from SAP and format it in excel worksheets for greater ease of use by Responsibility Centre Managers. These tools have evolved over time as a result of SAP reports not being user friendly, and in an effort to provide customized forecasting support. The variety of tools increases the risk of errors due to the manipulation of data.

There is no standard requirement to have Responsibility Centre Managers attest to their monthly forecasts, which would help reinforce delegated financial authorities. Templates with a more formal validation of the accuracy of forecasts, would also clarify any potential confusion between the accuracy of forecasts and the responsibilities for data entry.

There is a Business Intelligence system in place at PCH which has the potential for more user-friendly and standard reporting to support the monthly forecasting process. However consultations revealed very little use of this tool as a result of low awareness, training and support. In order to capitalize on the use of this existing tool, a successful implementation of this system will require user-friendly templates and training prior to implementation; this can be developed in collaboration Resource Management Directorates. A standard template will also increase the efficiency of monthly forecasting.

Recommendation

- The Chief Financial Officer should continue to develop standard reporting templates for forecasting which should include Responsibility Centre Manager attestation and provide training on the use of the Business Intelligence tool.

4.0 Conclusion

PCH has established a number of good practices for budgets, including a governance structure, annual budget allocations, pressures exercises, monthly forecasting and a financial management challenge function. This joint audit and evaluation identified optimizations that will help strengthen the governance and accountabilities, the effectiveness and efficiency of processes, and the relevance and reliability of information for decision-making.

Overall, the culture of financial management in PCH places emphasis at the level of Assistant Deputy Ministers and Direct Reports to the Deputy Minister, which is a good practice. However, it should be complemented with effective tools to support Responsibility Centre Managers who exercise financial management authorities, responsibilities and accountabilities at all levels of the organization. Being more strategic regarding the placement of controls should also alleviate the frequency of the involvement of governance committees, and allow them to play a more strategic role focused on risk, multi-year planning, and corporate advice.

There is also an opportunity, supported by the upcoming changes to the Treasury Board policy suite on financial management, to strengthen the financial management function. This includes placing a greater emphasis on the empowerment and objectivity of the challenge function for budgets and forecasts, clarifying roles and responsibilities, and combining financial and non-financial information for more informed decision-making.

Ultimately, the recommendations of this report will contribute to a stronger organizational culture of stewardship for resources by improving budgets and forecasts. This will support the continuing maturity of PCH’s financial management function. It will also support the modernization and innovation agendas of the Department by enabling better information for decision-making at all levels of the organization.

Appendix A – Audit and evaluation methodology

The methodology of the joint audit and evaluation of budgetary controls included:

- A review of the organization’s documentation, directives and procedures, as well as relevant policies and legislation.

- Consultations with personnel, including:

- 26 interviews;

- focus groups with Financial Management Advisors (4) and representatives from Resource Management Directorates (7); and,

- surveys of Responsibility Centre Managers (sample of 118 managers with delegated financial authorities, 25% response rate) and of Finance Committee members (sample of 22 members from the past three fiscal years, 50% response rate).

- An analysis of financial (e.g. budget, forecast and expenditures) and human resources data.

- A review of forecasting accuracy commitments in performance management agreements. PCH has a population of 357 managers with delegated financial authority (272 non-EX and 85 EX), however only EX agreements were tested as there is no central repository of non-EX agreements. Of the 85 EX agreements, 25 were selected via judgmental stratified sampling based on sectoral representation.

- Process mapping of key controls and procedures.

- A comparison of the key roles, controls and procedures in place at PCH and the requirements of the applicable Treasury Board policy instruments, including:

- the new Policy and Directive on results which include mandatory indicators for financial management outcomes;

- selected instruments from the financial management policy suite applicable during the scope of the engagement, namely the Policy on Financial Resource Management Information and Reporting (2010), the Policy on Financial Management Governance (2009), the Policy and Directive on financial management systems (2010) and the Guideline on the Common Financial Management Business Process 1.2 – Manage Forecasting and Budget Review; and

- the draft Financial Management Policy expected to be in place for April 1st, 2017 which will replace the instruments above (draft version published December 20, 2016).

Appendix B – Review elements and results

Because this innovative project integrated the methodologies of internal audit and of evaluation, the terms “audit criteria” and “evaluation questions” have been replaced by “review elements,” which are grouped under areas of interest.

| Area of interest | Review element | ResultFootnote 1 |

|---|---|---|

| Governance |

1.1 Are governance methods effective in terms of monitoring budgets and forecasts? |

2 |

|

1.2 Are the roles and responsibilities appropriate in terms of supporting the sound management of budgets and forecasts? |

3 |

|

| Processes and controls |

2.1 Do the enabling elements support cost centre managers in assuming their responsibilities with respect to budgets and forecasts? |

3 |

|

2.2 Are there mechanisms in place to ensure that financial resources are allocated to PCH strategic priorities? |

3 |

|

| Information and monitoring |

3.1 Is the financial information communicated to senior managers accurate, reliable, relevant and timely in terms of supporting their monitoring role and decision-making? |

2 |

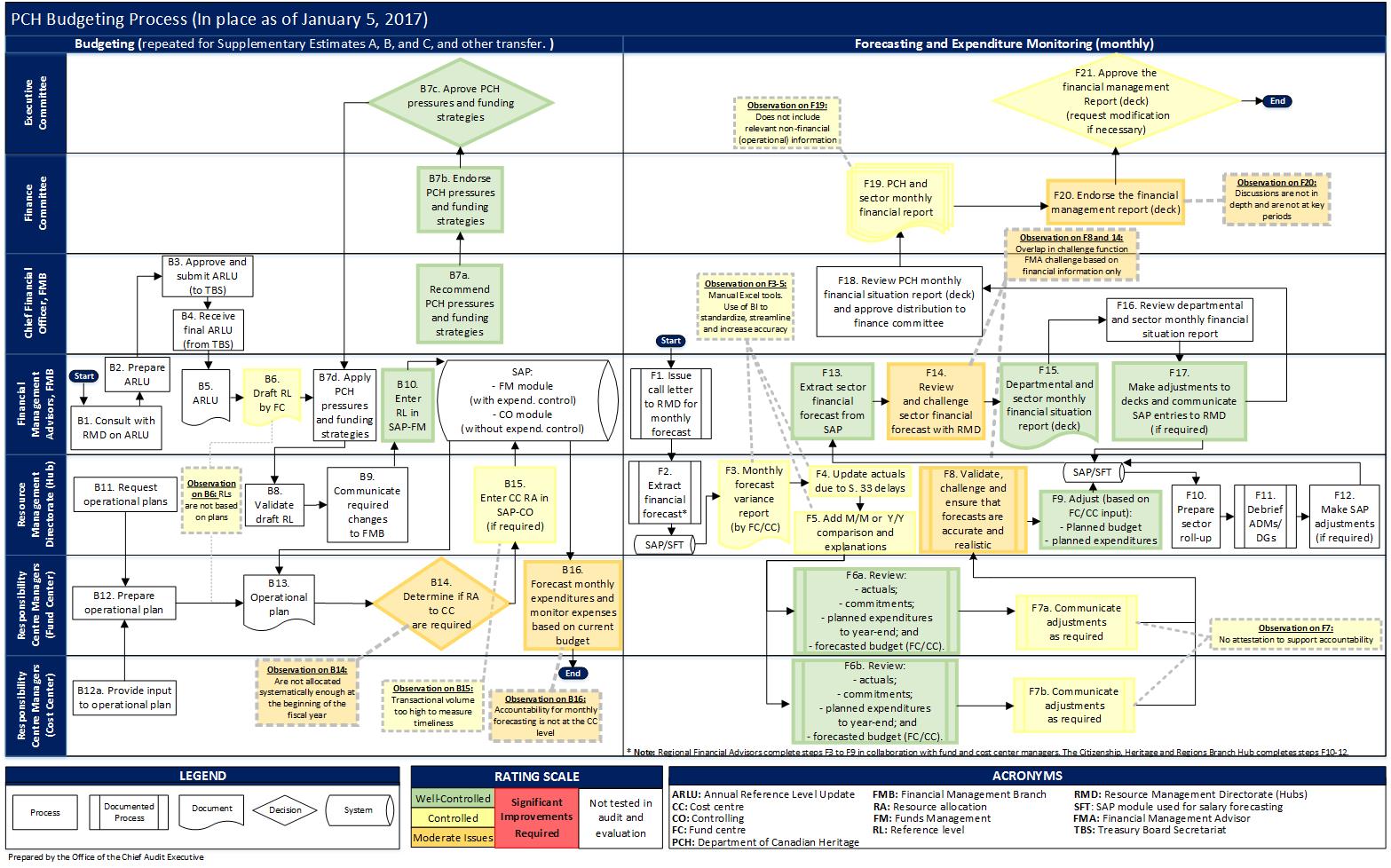

Appendix C – PCH budgeting and forecasting process

Appendix C. PCH budgeting and forecasting process - Text version

The appendix contains a process chart which depicts the budgeting and forecasting processes in place at Canadian Heritage. The process chart identifies the main responsibilities, activities (processes and decisions), systems and documents. The process is divided in two sub processes: Budgeting; and Forecasting and Expenditure Monitoring.

The Budgeting process is repeated for Supplementary Estimates A, B, and C, and other transfer and is comprised of the following steps:

A - Executive Committee:

- Decision: Approve Canadian Heritage pressures and funding strategies

B - Finance Committee:

- Process: Endorse Canadian Heritage pressures and funding strategies

C - Chief Financial Officer, Financial Management Branch:

- Process: Approve and submit Annual Reference Level Update (to the Treasury Board Secretariat)

- Process: Receive final Annual Reference Level Update (from the Treasury Board Secretariat)

- Process: Recommend Canadian Heritage pressures and funding strategies

D - Financial Management Advisors, Financial Management Branch:

- Process: They start the budgeting process by consulting with Resource Management Directorates on the Annual Reference Level Update

- Process: Prepare Annual Reference Level Update

- Document: Annual Reference Level Update

- Document: Draft Reference Level by Fund Centre

- Observation: Reference levels are not based on plans

- Process: Apply Canadian Heritage pressures and funding strategies

- Process: Enter Reference Level in SAP-FM

- System: The financial system called SAP has the following two modules: Funds Management module (with expenditure control) and Controlling module (without expenditure control)

E - Resource Management Directorate (Hub)

- Process: Request operational plans

- Process: Validate draft Reference Levels

- Process: Communicate required changes to Financial Management Branch

- Process: Enter Cost Centre Resource Allocation in SAP-CO(if required)

- Observation: Transactional volume too high to measure timeliness

F - Responsibility Centre Managers (Fund Centre)

- Process: Prepare operational plan

- Document: Operational plan

- Decision: Determine if Resource Allocations to Cost Centre are required

- Observation: Are not allocated systematically enough at the beginning of the fiscal year

- Process: Forecast monthly expenditures and monitor expenses based on current budget

- Observation: Accountability for monthly forecasting is not at the Cost Center level

G - Responsibility Centre Managers (Cost Centre)

- Process: Provide input to operational plan

The Forecasting and Expenditure Monitoring process is comprised of the following steps:

A - Executive Committee:

- Decision: Approve the financial management Report (deck) (request modification if necessary)

B - Finance Committee:

- Document: Canadian Heritage and sector monthly financial report

- Process: Endorse the financial management report (deck)

- Observation: Discussions are not in depth and are not at key periods

C - Chief Financial Officer, Financial Management Branch:

- Process: Review PCH monthly financial situation report (deck) and approve distribution to finance committee

- Process: Review departmental and sector monthly financial situation report

D - Financial Management Advisors, Financial Management Branch:

- Documented Process: They start by issuing a call letter to Resource Management Directorates (Hubs) for monthly forecasts

- Process: Extract sector financial forecast from SAP

- Process: Review and challenge sector financial forecast with Resource Management Directorates (Hubs)

- Document: Departmental and sector monthly financial situation report (deck)

- Process: Make adjustments to decks and communicate SAP entries to Resource Management Directorates (Hubs) (if required)

E - Resource Management Directorate (Hub)

- Documented Process: Extract financial forecast*

- Note for regions: Regional Financial Advisors complete these steps in collaboration with fund and cost center managers.

- System: SAP or SFT (which is a SAP module used for salary forecasting)

- Document: Monthly forecast variance report (by Fund Centre and Cost Centre)

- Process: Update actuals due to Section 33 delays

- Process: Add month to month, or year to year comparison and explanations

- Documented Process: Validate, challenge, and ensure that forecasts are accurate and realistic

- Process: Adjust planned budget and planned expenditures (based on Fund Center and Cost Center input)

- System: SAP or SFT (which is a SAPmodule used for salary forecasting)

- Note for regions The Citizenship, Heritage and Regions Branch Hub completes these steps.

- Process: Prepare for sector roll up

- Documented Process: Debrief Associate Deputy Ministers and/or Director Generals

- Process: Make SAP adjustments (if required)

F - Responsibility Centre Managers (Fund Centre)

- Documented Process: Review of actuals, commitments, planned expenditures to year-end and forecasted budget (Fund Centre and Cost Center)

- Process: Communicate adjustments as required

- Observation: No attestation to support accountability

G - Responsibility Centre Managers (Cost Centre)

- Documented Process: Review of actuals, commitments, planned expenditures to year-end and forecasted budget (Fund Centre and Cost Center)

- Process: Communicate adjustments as required

Appendix D – Management action plan

| Recommendations | Management assessment and actions | Responsibility | Target date |

|---|---|---|---|

|

Governance, information and monitoring To strengthen the effectiveness of the existing governance structure oversight and to support evidence-based decision making:

|

Agree. Starting in 2017-18 and to be further developed based on the needs of the Finance Committee, the Financial Situation Report will include non-financial information for decision-making such as:

Funding strategies on investment opportunities that present options will also be part of the Yearly Budget Review exercise. |

Director, Financial Planning and Resource Management |

September 30, 2017 |

|

Agree. The terms of reference for all level 2 committees are reviewed annually. At the next round of reviews (first quarter of 2017-18), the roles and responsibilities of all functional leads will be revised to ensure a clearer mandate and expectations. Talent Management Board, under the leadership of the Director General, Human Resources, will use the new terms of reference to determine the membership and ensure that there is a good balance between experienced and new executives with both financial and non-financial management experience. |

Corporate Secretary |

June 30, 2017 |

|

Processes and controls

|

Agree. The Chief Financial Officer will ensure a greater integration of Financial Management Advisors in the Sectors and Direct reports by providing them the opportunity to participate at management discussions and allowing them to communicate directly with the DGs and directors if needed. Financial roles and responsibilities between financial planning and Hubs will be further defined. |

Director, Financial Planning and Resource Management |

April 30, 2018 |

|

Agree. For 2017-18, the Budget Management Guidelines issued by Financial Planning and Resource Management Directorate will include processes and timelines on cost centre resource allocations. |

Director, Financial Planning and Resource Management |

April 1, 2017 |

|

A policy for the Department will be developed for the 2018-19 fiscal year, in the context of the broader implementation of the new Treasury Board Policy on Financial Management. |

Director, Accounting Operations, Financial Policy & Systems |

April 30, 2018 |

|

|

Agree. Yes, in collaboration with the Director General of Human Resources, accuracy targets for forecasting for all Cost Centre managers, including non-executives, will be included in performance management agreement. The Financial Management Branch will provide Human Resources with financial information to help measure the achievement of this target. |

Director, Financial Planning and Resource Management |

April 30, 2018 |

|

Agree. Forecast attestation of Responsibility Centre Managers will be required for the September, October and December monthly forecasts (P6, P7 and P9). |

Director, Financial Planning and Resource Management |

September 30, 2017 |

|

Standard Business Intelligence reporting templates will be developed to support forecasting. Training for the Business Intelligence tool will be given. |

Director, Accounting Operations, Financial Policy & Systems |

April 1, 2018 |

Page details

- Date modified: