Evaluation of the funding provided by the Department of Canadian Heritage TV5 Program 2017-18 to 2023-24

Evaluation Services Directorate

May 12, 2025

On this page

- List of tables

- List of figures

- List of acronyms and abbreviations

- Summary

- 1. Introduction

- 2. Program profile

- 3. Evaluation approach and methodology

- 4. Findings

- 5. Conclusions

- 6. Recommendations, management response and action plan

- Appendix A: History of the TV5 partnership

- Appendix B: Role of the Program in TV5 governance

- Appendix C: Data collection methods, limitations and mitigation strategies of the evaluation

- Appendix D: Evaluation matrix

- Appendix E: Bibliography

List of tables

- Table 1: Objectives of the TV5 Program

- Table 2: Expected outcomes of the TV5 Program

- Table 3: Planned expenditures of the TV5 Program (in dollars), 2017-18 to 2023-24

- Table 4: Actual expenditures of the TV5 Program (in dollars), 2017-18 to 2023-24

- Table 5: Evaluation questions by issue

- Table 6: Proportion of programs broadcast on TV5MONDE by region of origin per fiscal year (in percentage), 2017 to 2023 (Excluding France)

- Table 7: Distribution of hours of content available on TV5MONDEplus (in number and percentage), 2021 to 2023

- Table 8: Proportion of programs broadcast by TV5QC from the international Francophonie (in percentage), 2017-18 to 2022-23

- Table 9: Program full-time equivalents, 2017-18 to 2023-24

- Table 10: Recommendation 1 — Action plan

- Table 11: Recommendation 2 — Action plan

List of figures

- Figure 1: Evolution of subscriptions by Canadian households to television and subscription-based video on demand services (by percentage), 2013 and 2023

- Figure 2: Subscriptions to television and subscription-based video on demand services (by percentage), 2023-24

- Figure 3: Advertising spending in Canada: digital and television (in billion dollars), 2015 and 2023

- Figure 4: Number of visits and unique users on TV5MONDEplus, in millions, 2020-21 and 2022-23

List of acronyms and abbreviations

- CRTC

- Canadian Radio-television and Telecommunications Commission

- SVOD

- Subscription video on demand

- TV5 Program

- The Program

- TV5QC

- TV5 Québec Canada

- UNESCO

- United Nations Educational, Scientific and Cultural Organization

Summary

The evaluation examined the Department of Canadian Heritage’s (PCH) TV5 Program, a grants and contributions program that ensures the financial and diplomatic participation of the Government of Canada in the TV5 multilateral partnership which includes France, the Wallonia-Brussels Federation, Switzerland, the Principality of Monaco, Canada and Quebec.

The TV5 Program supports:

- TV5MONDE is a traditional general-interest French-language television channel headquartered in France and available world-wide, with the exception of Canada. It offers a wide range of content, mostly from partner governments.

- TV5MONDEplus is the TV5MONDE French-language video-on-demand platform. It is also available worldwide, except in Canada.

- TV5 Québec Canada (TV5QC) is a traditional general-interest French-language television channel that manages the distribution of the TV5 signal in Canada. Its programming consists mainly of content from TV5MONDE.

The evaluation examined program relevance and efficiency for 2017-18 to 2023-24 and its effectiveness for 2017-18 to 2022-23. A combination of qualitative and quantitative methods was used to answer the evaluation questions, including:

- a literature review;

- a review of program documents and administrative data; and

- interviews with key internal and external informants.

Key Findings

Relevance

The audiovisual sector is undergoing rapid change, creating considerable challenges for the business models of traditional television networks. The TV5 Program funding has:

- supported TV5MONDE and TV5QC operations and activities;

- facilitated the digital transition of TV5MONDE with the creation of TV5MONDEplus; and

- promoted official languages.

Despite these advances, several challenges remain.

- TV5MONDE faces challenges in diversifying its revenue and content offering.

- TV5MONDEplus is struggling to stand out in a competitive market.

- TV5QC is facing financial difficulties, declining subscriptions, and an aging audience.

The TV5 Program is aligned with the Government of Canada roles, responsibilities and priorities. It is closely tied to the mandate of PCH. It supports the audiovisual industry and promotes Canada’s official languages. However, more can be done to measure the diversity of Canadian content, particularly from equity groups and Indigenous peoples.

Effectiveness

The TV5 Program met its commitments in the TV5 partnership and increased its influence within the multilateral partnership. It facilitated access to Canadian French-language audiovisual content internationally, and to content from abroad within Canada. However, challenges remain, particularly in terms of the ability of TV5QC and TV5MONDEplus digital platform to remain attractive and competitive in the current digital landscape.

Efficiency

Overall, the TV5 Program was delivered efficiently, with flexible funding and relatively stable operating costs. Senior management has been stable during most of the evaluation period. However, turnover at the program level and changes in governance within the Department have posed challenges in maintaining relationships with partners.

While the program has a performance measurement strategy, there are shortcomings, including data management, coverage of funded activities and data standardization, limiting evidence-based decision-making.

Recommendations

Recommendation 1

The evaluation recommends that the Senior Assistant Deputy Minister, Cultural Affairs, continues to encourage TV5QC and TV5MONDE to adapt their business models to remain relevant and viable.

Recommendation 2

The evaluation recommends that the Senior Assistant Deputy Minister, Cultural Affairs, updates the Program’s performance measurement strategy to better assess diversity of Canadian content, facilitate the monitoring and communication of results, and strengthen the use of performance data in decision-making.

1. Introduction

This report presents:

- the findings;

- the conclusions; and

- the recommendations of the evaluation of the funding allocated by the Department of Canadian Heritage TV5 Program to the TV5 partnership.

The evaluation was conducted in accordance with the requirements set out in the Treasury Board Secretariat Policy on Results (2016) and the Financial Administration Act.

It was carried out in accordance with the Departmental Evaluation Plan 2024-25 to 2028-29 and examines:

- the relevance and efficiency of the Program over a period of 7 years, from April 1, 2017, to March 31, 2024; and

- its effectiveness over a period of 6 years, from April 1, 2017, to March 31, 2023.

2. Program profile

The Canadian Heritage TV5 Program (hereinafter the Program) supports Canada’s financial and diplomatic participation in the TV5 partnership. The Program contributes:

- to the funding of TV5MONDE, its digital platform TV5MONDEplus, and TV5 Québec Canada (TV5QC); and

- to the governance structure and strategic directions of these channels.

As a partner or funding government, the Program follows the principles and commitments defined by the TV5 Charter.

TV5 CHARTER

The Charter defines the principles, values, and roles and responsibilities of TV5 partners. It sets out the partnership structure, operator activities and expectations for donor governments.

The TV5 partnership is currently made up of six partner governments, including:

- France;

- the Wallonia-Brussels Federation;

- Switzerland;

- Canada;

- Quebec; and

- the Principality of Monaco.

Each government is responsible for selecting a public broadcaster to produce and deliver content reflecting French cultural diversity. These broadcasters work closely with TV5MONDE, TV5QC and other partner broadcasters to ensure that programming is coherent and diverse, while participating in the governanceFootnote 1 of TV5.

A brief history of the TV5 partnership is presented in Appendix A.

2.1. Overview of recipients and activities funded by the Program

TV5MONDE

Created in 1984, TV5MONDE is a French company based in Paris. This traditional television channel offers a wide range of French-language programming, mainly from partner countries, and includes eight general interest channels and two special interest channels.Footnote 2 It is broadcast worldwide, with the exception of Canada, where TV5QC is responsible for broadcasting the TV5 signal.

Its mission includes:

- serve as a showcase for the entire French-speaking world and promote its cultural diversity;

- promote program exchanges and the international export of French-language programs;

- be a forum for cooperation between public broadcasters of partner governments; and

- promote French language learning.

The TV5MONDE business model is structured as follows:

- 90% of its income comes from public funding from partner governments.

- 10% of its income comes from advertising, subscriptions and other sources.

For the period under review, funding from the governments of Canada, through the TV5 Program, and Quebec represented an average of 9% of the public funding, of which 5.5% came from Canada and 3.5% from Quebec.

Program funding to TV5MONDE is provided in the form of an annual grant paid in euros (€). Its amount cannot exceed $8 million; in 2023, the funding was just below that level.

This funding covers the following activities:

- Common expenses (€4,920,000): costs shared among partner governments for activities related to general operations of the channel.

- Journalistic collaboration project (€100,000): exclusive TV5 Program funding to cover the salary of a Radio-Canada journalist assigned to TV5MONDE newscasts.

TV5MONDEplus

TV5MONDEplus is a TV5MONDE video on demand platform, accessible worldwide with the exception of a few countries, including CanadaFootnote 3. It offers a general interest catalogue from TV5MONDE.

In October 2018, at the Francophonie Summit in Yerevan, Canada’s Prime Minister Justin Trudeau announced his support for the creation of a Francophone digital platform via TV5MONDE. This project, which was also supported by France, aimed to promote the French language online. Although this joint initiative was officially confirmed in the Summit Declaration, the Government of Canada was the main contributor to the project through the TV5 Program.

The subsidiary TV5Numérique, associated with TV5QC, was created in 2019 to administer the Canadian investment granted to TV5MONDEplus for a period of 5 years. Program funding of $14.6 million was provided through a multi-year contribution in Canadian dollars to support activities related to the creation, launch and development of the platform.

TV5QC

Created in 1988, TV5QC is a general interest, non-profit channel based in Montreal. This traditional television channel is responsible for broadcasting the TV5 signal throughout Canada. It broadcasts French-language content, mainly from TV5MONDE.

Its mission is to:

- promote and showcase the cultural, social and linguistic diversity of the Quebec, Canadian and international Francophonie; and

- provide Canadians with access to content from across the French-speaking world, including original Canadian productions.

The TV5QC business model for the period evaluated is distributed as follows:

- 83% of its income came from subscription fees paid by Broadcasting Distribution UndertakingsFootnote 4;

- 10% came from advertising and other sources; and

- 7% came from public funding provided by the governments of Canada (4%) and Quebec (3%).

During the evaluation period, Program funding was provided in Canadian dollars in the form of two annual contributions for each of the following activities:

- Distribution ($1,610,000): to release the rights of Canadian programs broadcast in areas managed by TV5MONDE; and

- Operation ($1,380,000): to support the ongoing operation of the channel.

2.2. Objectives and expected outcomes

The TV5 Program has three objectives focused on accessibility, visibility and Canadian leadership within the international Francophonie (Table 1).

| Accessibility | Visibility | International Francophonie |

|---|---|---|

| Give Canadians access to the diversity of Canadian and international French-language content. | Ensure the visibility of creators, artists, and artisans in the Canadian French-language television, cinema and multimedia industry in Canada and around the world. | Maintain Canada’s leadership within the Francophonie. |

Source: TV5 Program original documents

The expected outcomes focus on governance, Canadian content broadcast on TV5MONDE and available on TV5MONDEPlus, and content from the international Francophonie broadcast on TV5QC (Table 2).

| Focus | Expected outcomes |

|---|---|

| Governance |

|

| Canadian content broadcast on TV5MONDE |

|

| Canadian content broadcast on TV5MONDEplus |

|

| Content from the international Francophonie broadcast on TV5QC |

|

Source: TV5 Program original documents

2.3. Management and governance

The TV5 Program falls under the responsibility of the Audiovisual Branch of the Cultural Affairs sector of Canadian Heritage. As a partner government, the Program participates in the governance of TV5 and collaborates with various bodies on the international Francophonie. See Appendix B for more information on the Program’s role in the governance of TV5.

2.4. Resources

Table 3 presents the Program’s planned expenditures from 2017-18 to 2023-24. The total planned expenditures were $88.5 million.

| Fiscal year | Operations and maintenanceFootnote 5 | Grants and contributions | Total |

|---|---|---|---|

| 2017-18 | 354,050 | 10,960,900 | 11,314,950 |

| 2018-19 | 350,639 | 10,960,900 | 11,311,539 |

| 2019-20 | 614,572 | 10,960,900 | 11,575,472 |

| 2020-21 | 691,981 | 12,960,900 | 13,652,881 |

| 2021-22 | 624,954 | 12,960,900 | 13,585,854 |

| 2022-23 | 452,763 | 12,960,900 | 13,413,663 |

| 2023-24 | 636,721 | 12,960,900 | 13,597,621 |

| TOTAL | 3,725,680 | 84,726,300 | 88,451,980 |

Source: Chief Financial Officer Branch, Canadian Heritage

Table 4 presents the Program’s actual expenditures from 2017-18 to 2023-24, which amounted to $94.5 million. The difference between planned and actual expenditures is mainly due to the funding of the digital platform in 2019 and additional funding from the COVID-19 Emergency Support Fund in 2020 (see the Efficiency section of this report for more information).

| Fiscal year | Operations and maintenance | Grants and contributions | Total |

|---|---|---|---|

| 2017-18 | 530,247 | 10,954,000 | 11,484,247 |

| 2018-19 | 698,362 | 10,750,817 | 11,449,179 |

| 2019-20 | 799,656 | 16,436,003 | 17,235,659 |

| 2020-21 | 735,113 | 13,067,195 | 13,802,308 |

| 2021-22 | 631,512 | 12,216,841 | 12,848,353 |

| 2022-23 | 681,296 | 12,948,089 | 13,629,385 |

| 2023-24 | 1,097,944 | 12,960,900 | 14,058,844 |

| TOTAL | 5,174,130 | 89,333,845 | 94,507,975 |

Source: Chief Financial Officer Branch, Canadian Heritage

3. Evaluation approach and methodology

The Department of Canadian Heritage’s Evaluation Services Directorate conducted the evaluation. This section describes the evaluation approach and methodology, including scope, timing, calibration, evaluation questions, data collection methods, limitations and mitigation strategies.

3.1. Scope, calibration and quality control

Exploratory interviews were held with Program officials, including senior management, to identify specific information needs and refine the scope of the evaluation. The key information needs related to:

- the relevance of certain Program components;

- program operation and potential efficiency improvements; and

- the achievement of expected outcomes.

The analysis of the Program’s relevance and efficiency covers the period from 2017-18 to 2023-24. Though the restructuring of the TV5 Program coincided with the beginning of this evaluation in 2023-24, this period was selected to address certain issues and provide relevant, useful and timely findings. However, the analysis of Program effectiveness is limited to 2017-18 to 2022-23, as the outcomes data for 2023-24 were not available at the time of the data collection.

This evaluation has also been calibrated in terms of effort and time by:

- reducing the number of evaluation questions;

- focusing on existing data sources whenever possible;

- conducting targeted data collection; and

- simplifying the report.

The following measures have been implemented to ensure the quality of the evaluation:

- use of professional and experienced evaluators;

- collection of data from various primary and secondary sources to guarantee reliable results;

- validation of findings through rigorous analysis and appropriate triangulation; and

- review of preliminary results with representatives of the Program and the Evaluation Services Directorate to ensure clarity of the analysis, conclusions, and recommendations.

3.2. Evaluation questions

Table 5 presents the issues and their corresponding evaluation questions. The evaluation matrix is presented in Appendix D.

| Issue | Evaluation questions |

|---|---|

| Relevance |

|

| Effectiveness |

|

| Efficiency |

|

3.3. Data collection methods

The evaluation approach includes the collection and analysis of qualitative and quantitative data to answer the evaluation questions. It drew on a variety of information sources, both primary and secondary, using the following methodologies:

- document and administrative review;

- literature review; and

- key informant interviews.

For more details on the methodology, see Appendix C, Table C-1.

3.4. Limitations and mitigation strategies of the evaluation

The evaluation encountered certain limitations, particularly with regard to the TV5 Program’s performance measurement data. However, strategies were implemented to address limitations.

For more details on the limitations and mitigation strategies, see Appendix C, Table C-2.

4. Findings

4.1. Relevance

4.1.1. Continued need

Evaluation question #1: To what extent is the TV5 program financial participation in the TV5 partnership still relevant?

Key findings

Evolution of the audiovisual sector

- The evolution of the audiovisual sector is creating significant challenges for the business model of traditional television channels.

Continued and changing needs

- TV5 Program funding was important in terms of:

- supporting the activities of TV5QC and TV5MONDE;

- bringing TV5MONDE into the digital age with the creation of its digital platform;

- strengthening Canada’s influence within the international Francophonie.

- However, challenges remain:

- TV5QC is facing financial problems, a lack of appeal, and an aging audience.

- TV5MONDE is experiencing difficulties in diversifying revenue sources and content.

- TV5MONDEplus has issues with its competitiveness on the international market.

4.1.1.1 Evolution of the audiovisual sector

Public consumption of audiovisual content has evolved faster than regulatory frameworks

The viewing habits for audiovisual content have evolved in recent years, moving from more traditional modes, such as television and cinema, to digital modes, such as Netflix, Amazon Prime Video and TikTok. These digital options are often cheaper and more flexible. They allow viewers to select and consume audiovisual content on demand and on a wide range of mobile devices. The way audiences interact with the content has also changed, moving from being mostly passive viewers to becoming more active participants, who even create their own content.

Regulations for the audiovisual sector have evolved more slowly than the technology and the modes of consumption. This has meant that streaming platforms have been established and gained market share without the same constraints or obligations as traditional television. Traditional television is highly regulated, as is the case in Canada with the Canadian Radio-television and Telecommunications CommissionFootnote 6 (CRTC).

In response to these new digital realities, Canada adopted the Online Streaming Act in 2023Footnote 7. Although the framework for its implementation is currently being developed, it is expected that this law will rebalance the obligations imposed on all modes of audiovisual content consumption.

There is now an overabundance of audiovisual content

The lack of regulation combined with technological progress has enabled digital platforms to develop and grow rapidly. This accelerated growth has facilitated content production and led to an overabundance of audiovisual products on the market. This overabundance has also supported the rapid expansion of new distribution channels and the diversification of formats, including:

- video on demand;

- subscription-based video on demand;

- free television with ads; and

- social media.

In this increasingly competitive environment, the major streaming platforms are making huge investments in purchasing and developing new content, particularly exclusive content,Footnote 8 to stand out from the competition and build customer loyalty.

The number of traditional television subscriptions has decreased in favour of streaming platforms

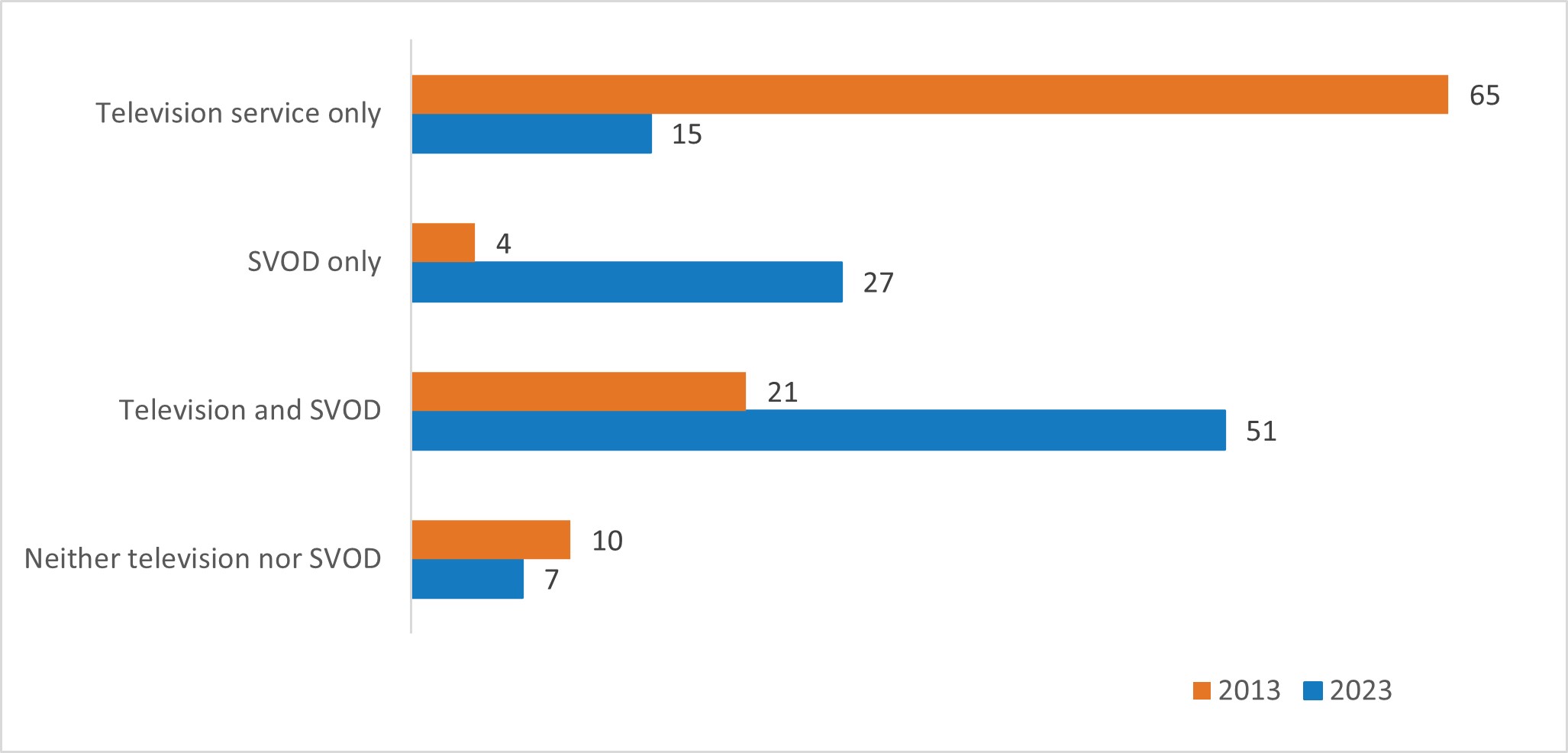

Between 2013 and 2023, there has been a large decline in the number of subscriptions to traditional television services in Canada in favour of online streaming platforms (Figure 1):

- The percentage of households that had only a traditional television subscription dropped from 65% to 15%.

- The percentage of households subscribed to both traditional television and a video on demand service increased from 21% to 51%.

- The percentage of households subscribed solely to a video on demand service increased from 4% to 27%.

Source: Media Technology Monitor, 2024. The Best of Both Worlds. Why subscribe to both TV and SVODs?

Figure 1: Evolution of subscriptions by Canadian households to television and subscription-based video on demand services (by percentage), 2013 and 2023 – alternative text

| 2013 | 2023 | |

|---|---|---|

| Television service only | 65 | 15 |

| SVOD only | 4 | 27 |

| Television and SVOD | 21 | 51 |

| Neither television nor SVOD | 10 | 7 |

Although traditional television still exists, its long-term future is uncertain because fewer people are watching. In Canada, for example, more and more young people are either cancelling their subscriptions or not subscribing at all to traditional television services.

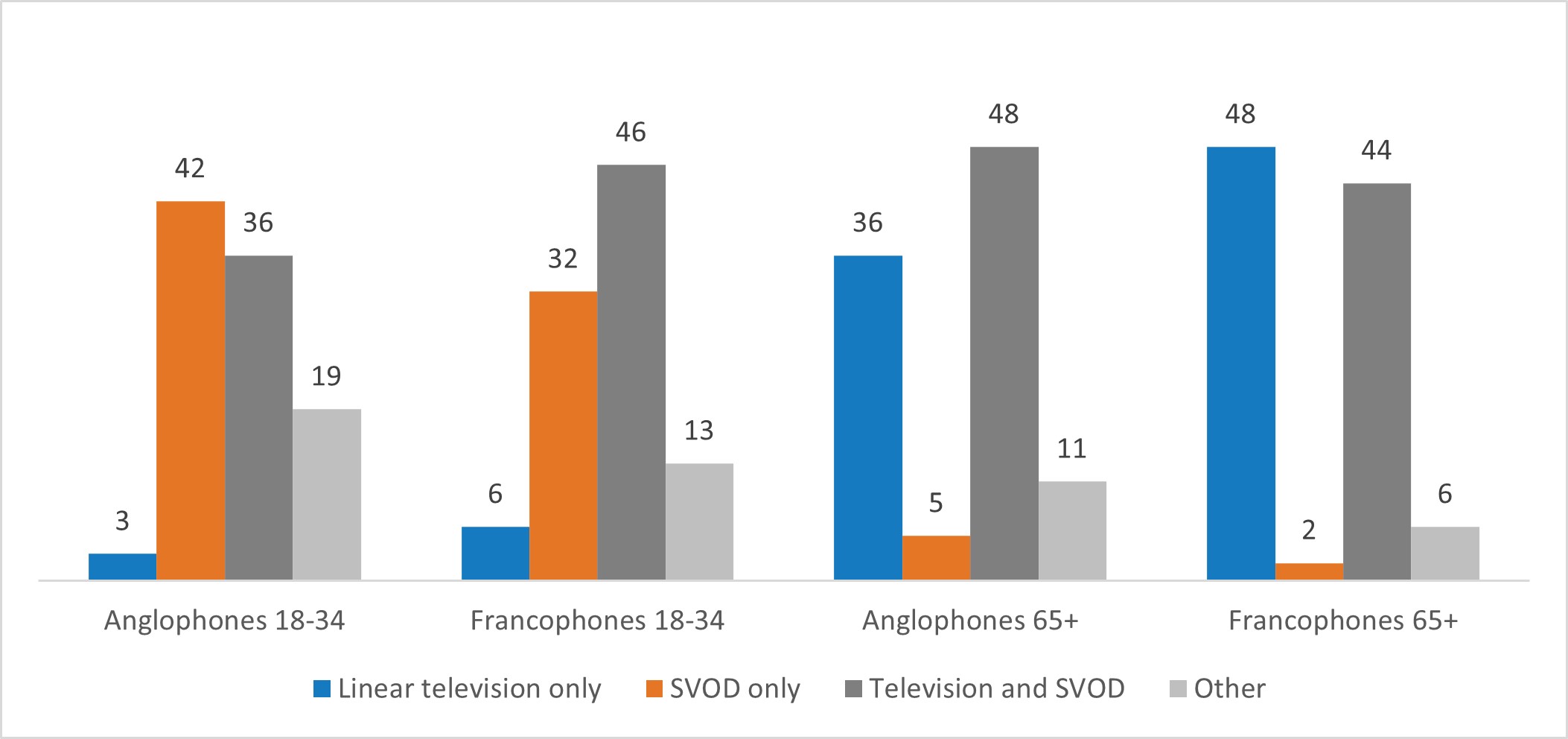

According to a 2024 report by the Media Technology Monitor, young people aged 18 to 34, and particularly Anglophones, are increasingly replacing traditional television with subscription-based video on demand services (Figure 2):

- 42% of young Anglophones, 18 to 34 years old, subscribe only to a subscription-based video on demand service, compared to 32% of Francophones.

- In contrast, only 5% of Anglophones and 2% of Francophones aged 65 and over choose to subscribe solely to this type of service.

Source: Media Technology Monitor, 2024. Gauging demand for On-Demand: the SVOD Landscape (among French- and English-speaking Canadians)

Figure 2: Subscriptions to television and subscription-based video on demand services (by percentage), 2023-24 – alternative text

| Linear television only | SVOD only | Television and SVOD | Other | |

|---|---|---|---|---|

| Anglophones 18-34 | 3 | 42 | 36 | 19 |

| Francophones 18-34 | 6 | 32 | 46 | 13 |

| Anglophones 65+ | 36 | 5 | 48 | 11 |

| Francophones 65+ | 48 | 2 | 44 | 6 |

Furthermore, a study by the Canada Media FundFootnote 9 shows that in 2023, young people aged 16 to 24 spent an average of 95 minutes a day watching traditional television, and 234 minutes a day on their mobile phones. In comparison, people aged 55 to 64 spent almost twice as much time watching traditional television (171 minutes) and less time on their mobile phones (104 minutes).

Advertising revenue is moving to streaming platforms

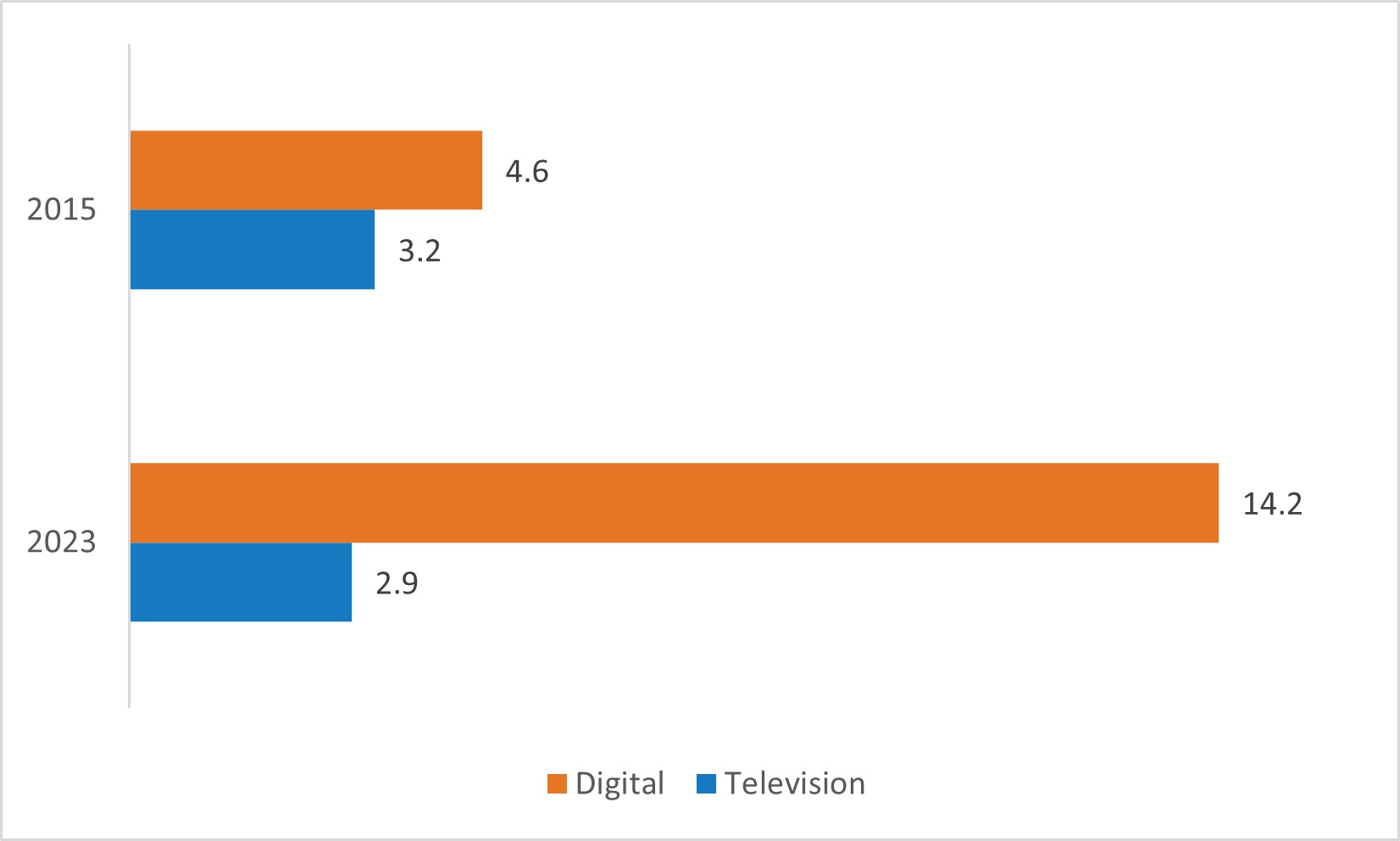

Advertising revenue has followed the conventional television audience in its migration to streaming platforms.

Advertising spending on traditional television in Canada has dropped from $3.2 billion in 2015 to $2.9 billion in 2023. This decline was particularly pronounced during the COVID-19 pandemic, when television advertising spending dropped to $2.5 billion in 2020.

In contrast, in Canada digital advertising spending kept growing during the same period, increasing from $4.6 billion in 2015 to $14.2 billion in 2023. This growth shows a shift in advertiser preferences toward more flexible and better-targeted formats (Figure 3).

Source: TV5QC 2022-23 Business Plan

Figure 3: Advertising spending in Canada: digital and television (in billion dollars), 2015 and 2023 – alternative text

| 2015 | 2023 | |

|---|---|---|

| Television | 3.2 | 2.9 |

| Digital | 4.6 | 14.2 |

4.1.1.2 TV5QC continued and changing needs

TV5QC experienced a decrease in revenue during the period evaluated

From 2017-18 to 2022-23, TV5QC experienced an ongoing decline in the number of subscribers and the amount of revenue from subscriptions, which dropped from $31.4 million in 2017 to $27.8 million in 2023Footnote 10. This decline is mainly attributable to the ongoing decrease in the number of subscribers to broadcasting distribution services, as well as to the fixed monthly subscriber rates set by the CRTC, which have remained unchanged since 2013.

Overall, TV5QC’s advertising revenue grew slightly, from $2.7 million in 2017 to $2.9 million in 2023, an increase of 7.9%. However, this increase remains modest compared with the rapid rise in the consumer price index over the same period, which increased by 26.7%. Despite the general decline in advertising revenue in the industry during COVID-19, TV5QC does not appear to have been particularly affected by this trend. However, the channel recorded a 14.9% drop in advertising revenue in 2023 compared to the previous year, a loss of just over half a million dollars.

Additional funding from the Program helped TV5QC face certain challenges

The TV5 Program funding for TV5QC activities and operations have remained stable over the years, respecting the Program’s financial commitments.Footnote 11 However, since 2019-20, the financial surpluses generated by exchange rate fluctuations in the TV5MONDE grant have been transferred to TV5QC.Footnote 12 These surplus transfers have helped to overcome financial challenges faced by TV5QC, including the decline in subscription revenue. TV5QC also received additional funding in the amount of $345,000 from the Canadian Heritage COVID-19 Emergency Support Fund to support its activities during the 2020-21 fiscal year.

Challenges remain regarding TV5QC’s appeal

Market share data raise questions about the channel’s relevance and appeal. In Quebec, TV5QC had an average market share of 1.3% of the Francophone market during the period evaluated, well below that of Radio-Canada (14%) and Télé-Québec (3.3%).Footnote 13 Despite its accessibility to all households subscribing to a conventional television service, this market share is below Radio-Canada’s and Télé-Québec’s both of whom have much larger programming budgets. Moreover, in 2023-24, the TV5QC audience was an average of 62 years old, compared to the average of 56Footnote 14 for traditional television. In light of the sharp decline in traditional television viewing among young people, the aging audience profile poses significant challenges for the channel’s future.

4.1.1.3 TV5MONDE continued and changing needs

The TV5 Program has contributed to maintaining TV5MONDE operations and activities

Support from the TV5 Program has helped to maintain the channel’s operations and activities. Public funding from partner governments makes up about 90% of TV5MONDE’s income, helping the organization to remain more resilient in a constantly changing audiovisual landscape. The combined funding from the governments of Canada and Quebec represented an average of 9% of the total public funding for TV5MONDE over the period evaluated, which is slightly higher than that of the other partners, with the exception of France.Footnote 15 The funding distribution between the governments of Canada (60%) and Quebec (40%) is in line with the commitments set out in the TV5 Charter.

TV5MONDE’s reach has expanded

The number of households connected to a service that provides access to one of the TV5MONDE general interest channels went from 354 million in 2017 to 431 million in 2023. Although television audience data are only measured for 24 countries, the expansion of the channel’s audience on the African continent is partly responsible for this increase.

To expand its content and funding sources, TV5MONDE relies on the TV5 partnership to attract new partner governments. To that end, the Principality of Monaco was added to the partnership in 2021. TV5MONDE is continuing its efforts to establish new partnerships, particularly with African governments, to strengthen the representation of the cultural diversity of the international Francophonie within the TV5 partnership.

4.1.1.4 TV5MONDEplus continued and changing needs

The TV5 Program has been a leader in TV5MONDE’s digital shift

The Program played an important role in TV5MONDE’s digital shift by funding the creation of the TV5MONDEplus platform in 2019. Although several partner governments approved the initiative, Canada was the only one to provide substantial financial support, with an investment of $14.6 million from 2019 to 2024. The investment included:

- $5.8 million for technological development;

- $6.2 million for Canadian content acquisition; and

- $600,000 for the administration of the Canadian Heritage TV5 Program.

The Program supported the discoverability of Francophone content on the Internet

In general, technological advances have reinforced the predominance of English-language audiovisual content on streaming platforms. This situation has created an imbalance, with French-language productions struggling to make themselves known on a global scale, limiting their reach and undermining the cultural and linguistic diversity of the content available online.

The dominant position of the English-language in content production and distribution makes it more accessible and visible on streaming platforms. This phenomenon feeds a vicious cycle, where greater consumption of English-language content generates more interactions (views, likes, shares and comments), prompting platforms to promote it more in their recommendations, to the detriment of French-language productions.

The TV5MONDEplus platform enabled TV5MONDE to adapt to new consumption habits, while also increasing the visibility and discoverability of French-language content and its cultural diversity on the Internet. By offering a large selection of movies, series and documentaries in French, the platform expanded access to Francophone content on a global scale. This move has strengthened the presence of French on the Internet, while highlighting the continuing challenges of ensuring equitable access to French-language content.

In this context, in 2019, TV5QC and UNIS TV launched their own common digital platform: TV5UNIS. Though the platform is not funded by the TV5 Program, it benefits from free access to some of the programming broadcast on TV5MONDE.

TV5MONDEplus reach grows, but user engagement remains low

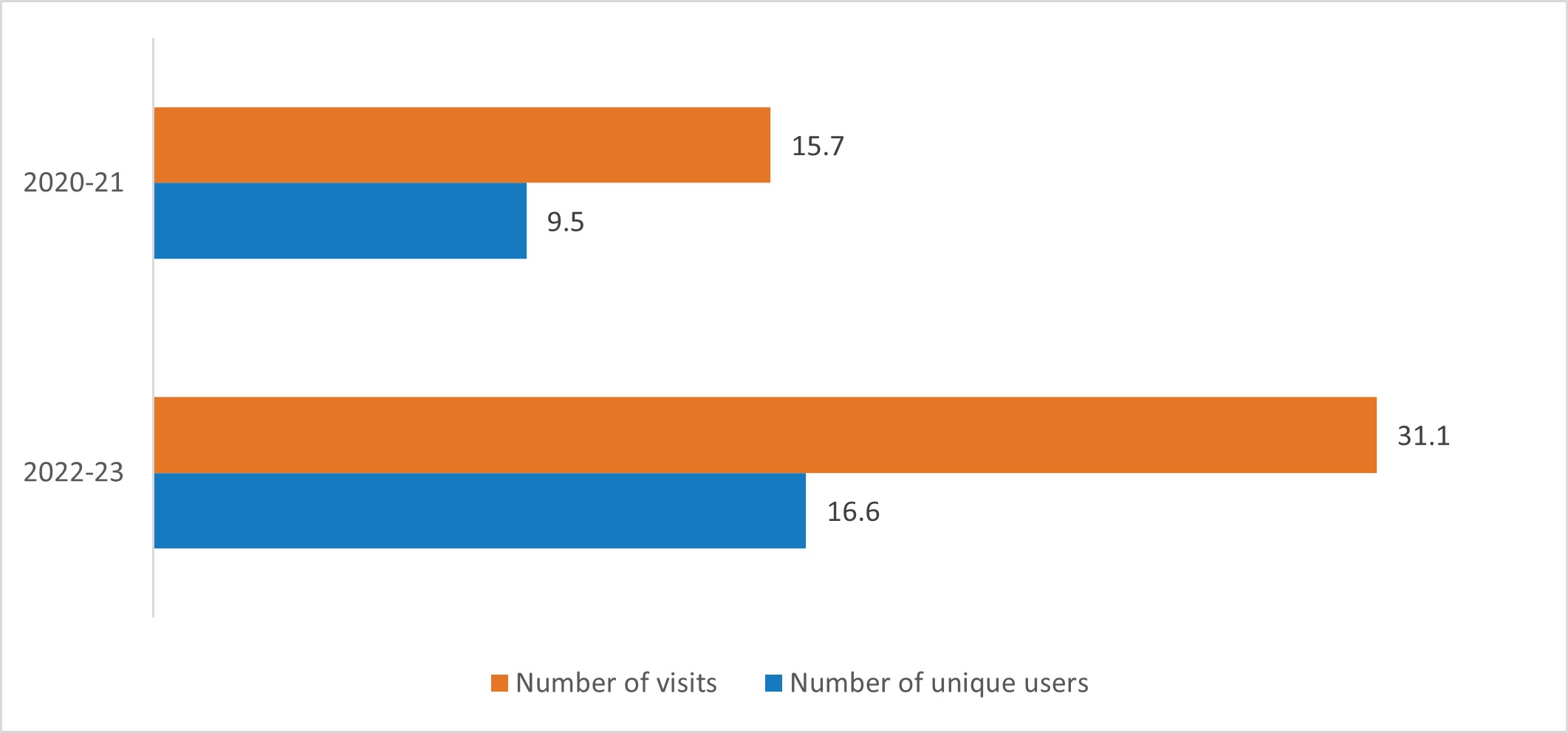

Although TV5MONDEplus has recorded growth in the number of visits and unique users, additional efforts are required to increase user engagement. The number of unique users went from 9.5 million in 2020-21 to 16.6 million in 2022-23, and the number of visits went from 15.7 million to 31.1 million in the same period (Figure 4).

Source: TV5 Program data

Figure 4: Number of visits and unique users on TV5MONDEplus, in millions, 2020-21 and 2022-23 – alternative text

| 2020-21 | 2022-23 | |

|---|---|---|

| Number of visits | 15.7 | 31.1 |

| Number of unique users | 9.5 | 16.6 |

However, average engagement per user remains low. The data show that unique users consult the platform on average twice a year, suggesting low recurrence of visits and limited interaction with the content. As such, efforts are needed to make the platform more appealing and encourage more interactions.

Platform content is growing, but challenges remain in the face of digital giants

Since its launch, the number of hours of content available on TV5MONDEplus has continued to grow, going from 6,491 hours in 2021 to 6,991 hours in 2023. This increase reflects the efforts made to enrich the platform content through various initiatives, including:

- Creation of the Francophonie Fund: This Fund was established in 2020 by the Government of Canada, TV5MONDE and the International Organization of La Francophonie to support the production and distribution of French-language audiovisual content on the platform. It helped increase the diversity of content, mainly by including content from countries in the global South.

- A partnership with UNESCO: In 2021, UNESCO helped enrich TV5MONDEplus programming by adding approximately 15 hours of free programming.

- Cultural partnerships: TV5MONDEplus now has new cultural partners to help diversify the platform’s cultural content.

While content diversity is an important asset, challenges remain in ensuring that the content is unique, innovative and distinctive enough to keep users loyal. Because of its limited budget, TV5MONDE often has to purchase the rights to non-exclusive content, reducing its capacity to offer distinctive content and limiting its competitiveness on the digital market. The marketing budget for TV5MONDEplus is also limited, hindering its ability to effectively promote its content.

Technological constraints present both opportunities and challenges

TV5MONDEplus faces challenges in personalizing user experience, mainly because signing in to the platform is optional. This limits the platform’s ability to collect data on its audience. On platforms like Netflix, where sign-in is required, artificial intelligence analyzes user behaviour and preferences to personalize content and ads. This makes the experience more engaging and helps build user loyalty. Despite the benefits of having users sign in, by making that step optional, TV5MONDEplus allows users to enjoy the content while also protecting their privacy. This approach is particularly important for users living in vulnerable environments where sharing personal information may involve risks such as surveillance or discrimination.

The cost of equipment and lack of infrastructure, particularly in rural or less developed areas where access to high-speed Internet is limited, restrict access to streaming platforms. These obstacles slow the transition to digital, while providing opportunities for conventional television, which remains a more accessible alternative for these populations.

4.1.2. Alignment with government roles, responsibilities and priorities

Evaluation question #2: To what extent is the TV5 Program financial participation in the TV5 partnership aligned with the roles, responsibilities and priorities of the Government of Canada, including those of the Department of Canadian Heritage?

Key findings:

Alignment with the Government of Canada roles, responsibilities and priorities

- The TV5 Program is aligned with the priorities of the Government of Canada and the roles, responsibilities and priorities of the Department of Canadian Heritage. The Program supports the audiovisual industry, the promotion of official languages and the strengthening of Canada’s influence internationally.

Possible improvements

- However, efforts are still required to better measure the diversity of Canadian content purchased, particularly from equity groups and Indigenous peoples.

TV5 Program is aligned with the roles, responsibilities and priorities of the Government of Canada

The Program falls within the areas of responsibility defined by the Act to establish the Department of Canadian Heritage, which include cultural industries and heritage, as well as the performing and audiovisual arts. It contributes to the department’s core responsibility of “creativity, arts, and culture,” ensuring that “a wide range of Canadian artistic and cultural content is accessible at home and abroad.”

The grant to TV5MONDE and the contributions to TV5QC and TV5MONDEplus support several key strategic outcomes for Canadian Heritage, including:

- promote the success of creative industries in the digital economy;

- enable Canadians to consume Canadian content on various platforms; and

- help creative industries stand out in world markets.

TV5 Program supports the French-language Canadian audiovisual industry

In a context where Francophone productions face limited economic prospects, the TV5 Program is boosting the French-language Canadian audiovisual industry by creating collaboration opportunities for artists and producers, both in Canada and abroad. In doing so, the Program is also contributing to government commitments to official languages, promoting French-language audiovisual content and ensuring its broadcasting, both on traditional and digital television.

According to the Charte de la Francophonie, TV5 is designated as one of the direct and recognized operators of the Francophonie Summit. As such, TV5 works closely with other Francophone institutions to achieve the objectives set out at the Francophonie Summit.

TV5 Program contributes to the Canadian Government’s diplomatic and economic priorities

Through its funding, the Program increases Canada’s visibility and influence on the international stage; it also supports the objectives of Global Affairs Canada. Through multi-party meetings, it strengthens Canada’s diplomatic relations with Francophone partner governments, contributing to the promotion of Canadian interests abroad. As the Honourable Mélanie Joly former Minister of Canadian Heritage, stated in 2017 in a news release regarding the Canadian presidency of TV5: “Promoting the richness, vitality and values of the Francophonie is a priority for the Government of Canada. This partnership allows us to continue to collaborate to promote the Canadian and international Francophonie, as well as to advance its foreign and development policy priorities.”

The Program supports other government priorities that showcase Canada, its landscapes, its traditions and its values through funded audiovisual content and journalistic activities. According to some key stakeholders, this visibility has generated economic benefits that could not be documented in this evaluation, particularly in the tourism and Francophone immigration sectors.

More efforts are needed to document alignment with priorities in terms of equity groups and reconciliation with Indigenous peoples

Though progress has been made in measuring the origin of broadcast rights purchased, both in and outside Quebec, more efforts are needed to better report on the diversity of Canadian French-language content purchased from equity groups or on actions taken to support reconciliation. At the time of this evaluation, Program monitoring systems did not provide data on its alignment with government priorities in terms of inclusion, diversity, equity and accessibility beyond official languages, which limits its ability to measure the representation of these voices and perspectives. A more rigorous monitoring of purchased broadcast rights would help ensure that the Program fully captures Canada’s cultural richness.

4.2. Effectiveness

4.2.1. Achievement of expected outcomes

Evaluation question #3: To what extent is the TV5 Program achieving expected outcomes?

Key findings

TV5 governance

- The TV5 Program has fulfilled its commitments to the TV5 partnership and strengthened its influence within the international Francophonie.

International availability of Canadian content

- The TV5 Program has promoted international access, distribution and consumption of French-language Canadian audiovisual content through TV5MONDE and TV5MONDEplus.

Availability of content from the international Francophonie in Canada

- The TV5 Program has facilitated access to and consumption of content from the international Francophonie in Canada.

Facilitators and challenges encountered in achieving outcomes

- Though the TV5 partnership is a key asset in achieving Program outcomes, there are several challenges that threaten its success, particularly the ability of TV5QC and the TV5MONDEplus to remain competitive in a constantly changing environment.

TV5 Program remains influential within the TV5 partnership

The TV5 Program has contributed to the strategic directions and guiding principles of TV5MONDE and TV5QC in line with the TV5 Charter. It met its governance commitments by:

- actively participating in the required formal meetings, both with TV5MONDE and TV5QC; and

- assuming the presidency of TV5MONDE meetings in 2018 and 2019 and organizing in-person meetings in Moncton (2018) and Banff (2019), strengthening the collaboration between partners.

By maintaining an active involvement in the TV5 governance and supporting various international Francophone initiatives, the TV5 Program has remained influential within the TV5 partnership. The majority of people interviewed noted that Canada is recognized for its positive leadership within the TV5 partnership and is considered a solid partner that brings a forward thinking and non-European perspective.

However, some partners noted a weaker affirmation of the program at working-level meetings. This may be attributed to personnel turnover during the period evaluated, sometimes causing participants to be less likely to make decisions.

Canadian content is available internationally via TV5MONDE

Nearly 11% of the content broadcast by TV5MONDE is Canadian, slightly exceeding the proportion of content from other regions, excluding France (Table 6). This contributes to the international promotion of Canadian content and provides a special showcase for French-language Canadian artists and producers abroad, one of Canada’s objectives in participating in the TV5 partnership.

| Fiscal year | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Total average |

|---|---|---|---|---|---|---|---|---|

| Canada & Quebec | N/A | 11 | 11 | 10 | 10 | 11 | 11,5 | 11 |

| Switzerland | N/A | 9 | 10 | 10 | 10 | 10 | 10 | 10 |

| Wallonia-Brussels Federation | N/A | 8 | 8 | 7.5 | 6 | 7 | 6.5 | 7 |

| Africa and South | N/A | 4 | 4 | 5 | 4 | 4 | 4 | 4 |

| Total | N/A | 32 | 33 | 32.5 | 30 | 32 | 32 | 32 |

Source: TV5 Program data

There are opportunities to strengthen the presence of Canadian content in certain geographical areas. For example, the distribution of Canadian content in Africa does not always reach the Program’s annual target of 7%.

TV5 Program funding supports the staffing of a Canadian journalist and columnist at TV5MONDE giving audiences a uniquely Canadian perspective, different from that of other partners.

Canadian content is available internationally via TV5MONDEplus

Canadian content is well represented on the TV5MONDEplus platform, accounting for 28.5% of total content, with a total of 5,745 hours of Canadian content broadcast since the platform’s launch, exceeding that of other partner governments (Table 7). Canada was one of the few governments to fund the purchase of content on the platform for the period evaluated, which could explain this high proportion.

| Content origin | 2021 number |

2021 % |

2022 number |

2022 % |

2023 number |

2023 % |

Total number |

Total % |

|---|---|---|---|---|---|---|---|---|

|

TV5QC, Télé-Québec, Radio-Canada, etc. (Canada and Quebec) |

1,910 | 29 | 1,990 | 30 | 1,845 | 27 | 5,745 | 28.5 |

| Radio-télévision belge de la Communauté française (Wallonia-Brussels Federation) | 659 | 10 | 631 | 10 | 720 | 10 | 2,010 | 10 |

| Radio-télévision Suisse (Switzerland) | 1,341 | 21 | 1,395 | 21 | 1,421 | 20 | 4,157 | 21 |

| RFI (France) | 204 | 3 | 204 | 3 | 64 | 1 | 472 | 2 |

| France TV (France) | 368 | 6 | 475 | 7 | 511 | 7 | 1,354 | 7 |

| TV5MONDE and other partners | 2,009 | 31 | 1,921 | 29 | 2,430 | 35 | 6,360 | 31.5 |

| Total | 6,491 | 100 | 6,616 | 100 | 6,991 | 100 | 20,098 | 100 |

Source: TV5 Program data

While 254 Canadian titles were purchased between 2020 and 2023, for an average of 63 titles per year, the Program's threshold of 50 titles per year was not achieved in 2021 and 2023.

Based on TV5 documents, Canadian videos were viewed 6.6 million times between 2020 and 2023, with an increase of approximately 30% between 2021 and 2023. Canadian titles represented 20% of the videos viewed on the platform for that same period. In 2023, 3 Canadian titles were among the 10 most popular in the world, demonstrating the quality of Canadian content.

Content from the Canadian and international Francophonie is available in Canada via TV5QC

The Program’s participation in TV5 gives Canada access to a vast bank of programs from the international Francophonie. This is in line with the Program’s second objective within the TV5 partnership, which is to offer Canadians with enriching audiovisual content and programming that diversifies the Francophone television landscape available in the country and reflects the cultural vitality and diversity of the Canadian and international Francophonie. To that end, TV5QC has benefited from the TV5MONDE’s program bank to feed its own programming.

Between 2018-19 and 2021-22, TV5QC exceeded its annual target of 75% of broadcasts from the international Francophonie, with an average of 84% (Table 8). Nearly 40% of that content came from France. Furthermore, between 2017-18 and 2021-22, approximately 16% of TV5QC programming was Canadian, fulfilling the obligation to broadcast a minimum of 15% of Canadian content.

| Content origin | 2017-2018 | 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 | 2022-2023 | Average |

|---|---|---|---|---|---|---|---|

| Canada | 17 | 15 | 22 | 15 | 13 | N/A | 16 |

| France | N/A | 38 | 41 | 43 | 39 | N/A | 40 |

| TV5MONDE | N/A | 19 | 15 | 15 | 16 | N/A | 16 |

| AcquisitionsFootnote 16 | N/A | 16 | 15 | 15 | 16 | N/A | 16 |

| Switzerland | N/A | 6 | 6 | 5 | 7 | N/A | 6 |

| Wallonia-Brussels Federation | N/A | 5 | 5 | 5 | 5 | N/A | 5 |

| Subtotal for the international Francophonie (excluding Canada) | 83 | 85 | 78 | 85 | 87 | N/A | 84 |

Source: TV5 Program data

It is important to note that some of the content from TV5MONDE is also broadcast on the TV5UNIS platform, which is not funded by the TV5 Program and the Radio-Canada streaming platform called ICI.TOU.TV.

There are various facilitators and challenges in achieving TV5 Program outcomes

In terms of elements facilitating the achievement of results, the evaluation notes the positive impact of collaboration between TV5 delivery partners and partner governments. This dynamic is reinforced by the stability of the leadership within the partners, which fosters a collaborative working environment, strengthens expertise and makes exchanges more fluid and productive.

Though TV5QC is accessible in every Canadian household subscribing to a broadcasting distribution service, its programming is not widely watched by Canadians, which limits the TV5 Program’s impact. Aware of this challenge, the channel included the intention to win back active adults aged 35 to 60 to rejuvenate its audience and increase its reach in its 2022-23 management plan. In addition, the low recurrence of TV5MONDEplus user visits limits the visibility of its content and reduces the impact of the expected outcomes of the TV5 Program.

TV5QC and TV5MONDE operate in a constantly changing media environment, while relying on relatively diminishing sources of revenue. They both broadcast their content on traditional platforms, such as television, as well as on digital platforms, such as websites and applications. This multi-platform distribution requires a reconciliation of different delivery models to ensure content relevance and reach a more diversified audience.

Internet access is still uneven in different regions, slowing the expansion of TV5MONDEplus. However, this does provide opportunities for traditional television channels such as TV5MONDE to better retain audiences that do not have access to streaming platforms.

The geopolitical and cultural context also plays an important role. In some countries, access to some content may be limited if it does not align with local values. Furthermore, there is a reluctance of certain users to sign in to TV5MONDEplus, limiting their experience and access to all the platform’s functionalities.

4.3. Efficiency

4.3.1. Efficient delivery

Evaluation question #4: To what extent is the TV5 Program delivered efficiently?

Key findings:

In general, the TV5 Program is delivered efficiently

- The Program has demonstrated flexibility in its funding method.

- Operating costs are relatively stable.

Challenges have nevertheless been identified

- Although senior management remained stable for most of the period, staff turnover and changes in governance posed challenges in maintaining relationships with partners.

Flexible funding is one of the Program’s strengths

The TV5 Program allows for any surplus funds from the TV5MONDE grant, generated by exchange rate fluctuations, to be reallocated to areas requiring resources, such as TV5QC. Program staff consider this approach to be a good practice because it offers financial flexibility, allowing funds to be adjusted based on changing needs. This helps ensure efficient and responsive management, by directing resources to where they can have the greatest impact.

Service standards have been met

The Program met its service standards during the period evaluated. However, it has a limited number of recipients and there is no deadline for submitting applications. Furthermore, funding applications are initiated directly by Program staff, and not by the recipients themselves. As a result, compliance with service standards is a less relevant indicator for evaluating the efficiency of the TV5 Program.

The Program adapted well to the COVID-19 pandemic

During the COVID-19 pandemic, the Program delivered $345,000 in additional funding from the COVID-19 Emergency Support Fund to TV5QC. However, TV5QC had difficulty spending due to disruptions in audiovisual production caused by the pandemic. To remedy the situation, several amendments were made to the TV5QC contribution agreements to extend the spending period for the funding. These adjustments allowed for optimal use of the available resources despite the challenges and interruptions involved in audiovisual projects during this unusual period.

TV5 governance meetings were also adapted to being held exclusively in virtual format during COVID-19 due to travel restrictions and social distancing measures. This transition to virtual formats enabled the Program to maintain continuity in governance activities while also respecting safety protocols.

According to key stakeholders, the frequency of exchanges between Program staff, Global Affairs Canada and the Canadian Heritage international relations team dropped during the pandemic. This trend seems to have continued after the pandemic, with staff indicating that the level of communication has not returned to its previous pace.

Program operating costs remained stable

The administrative ratio of the TV5 Program remained within a range of 4.6% to 7.8%, with an average of 5.5% of the overall budget allocated to its operations. The Canadian presidency of the TV5 partnership in 2018 and 2019 did not have a major impact on the Program’s administrative ratio for those years. Furthermore, given its low number of contribution agreements, the Program’s administrative ratio is expected to be low.

The number of full-time equivalents and the Program’s salary costs almost doubled in 2023-24 compared to the previous year (Table 9). According to the Program’s senior management, this increase is due to the temporary inclusion of the salaries of the public media research group in the budget. The financial data are expected to be readjusted from 2024-25 to represent the number of full-time equivalents actually working on the TV5 Program, which should help stabilize its administrative ratio in the future.

| Fiscal year | Expected | Actual |

|---|---|---|

| 2017-18 | 3.6 | 4.6 |

| 2018-19 | 4.1 | 6.0 |

| 2019-20 | 6.1 | 6.8 |

| 2020-21 | 7.1 | 5.8 |

| 2021-22 | 6.0 | 5.0 |

| 2022-23 | 5.2 | 5.5 |

| 2023-24 | 4.5 | 7.4 |

Source: Chief Financial Officer Branch, Canadian Heritage

Staff turnover has created challenges in relationships with partners

The stability of senior management throughout most of the evaluation period helped to ensure the program's strategic continuity and the maintenance of strong partnerships at a decision-making level. This consistent leadership played a key role in preserving a shared vision and strengthening long-term relationships.

However, Program staff turnover made it difficult to maintain strong working relationships with partners, especially in a diplomatic setting, where mutual trust is essential for sharing sensitive information. Changing staff representatives meant that these relationships had to be rebuilt, which takes time and can slow communication and project progress. Furthermore, integrating new members requires a period of adaptation so that everyone fully understands their roles and responsibilities, highlighting the importance of stability in preserving the Program’s knowledge and corporate memory.

TV5 Program governance changed several times

The TV5 Program underwent several governance changes within the department during the evaluation period, reflecting shifts in alignment and direction while remaining under the responsibility of the Assistant Deputy Minister of the Cultural Affairs sector. Below is an overview of the changes:

- From 2017 to May 2021: The Program was under the Strategic Policy Branch, falling directly under the responsibility of the Assistant Deputy Minister of Cultural Affairs. This period coincides with the Canadian presidency work.

- From May 2021 to March 2023: The Program was attached to the International Trade Branch of the Cultural Affairs Sector.

- From April to May 2023: The Program was under the Arts Branch of the Cultural Affairs Sector.

- From May 2023: The Program is under the new Audiovisual Branch, which includes supports to several public broadcasters, such as CBC/Radio-Canada, as well as all the federal tools supporting the audiovisual sector, such as the Canada Media Fund and the Indigenous Screen Office. This change is designed to improve collaboration, effectiveness and resource management, while promoting a better understanding of the challenges faced by Canadian broadcasters.

For the TV5QC component, the new Program governance is considered positive, because it fosters better coordination with other audiovisual programs in Canada and allows for better sharing of resources and experience. However, the reorganization appears less suited to the TV5MONDE component, which also deals with issues of international diplomacy unique to this program. The dual domestic and international nature of the Program limits its ability to fit completely into a single departmental structure.

Cyclical and frequent activities present opportunities for efficiency gains

TV5 Program funding activities are predictable and cyclical, with a limited number of agreements being managed every year: one grant agreement for TV5MONDE and two contribution agreements for TV5QC for the period evaluated. The agreements signed for TV5MONDEplus cover multiple years.

In interviews, some key informants expressed their wish to harmonize the periods of coverage of these agreements, particularly for TV5QC, to facilitate accountability.

Due to the consistency of the amounts of these agreements, some partners also suggested the implementation of multi-year agreements with TV5MONDE to make the process more predictable and efficient. However, this option remains unlikely as long as the TV5 Charter goes unamended, since such an approach could conflict with its current provisions.

Stakeholders interviewed also emphasized that direct access to PCH senior management would facilitate the effective management of ad hoc issues. Greater access would for quicker communication of Canada's position on pressing or strategic issues to partners. It would also facilitate faster decision-making, enabling the program to keep pace with interactions with other partners and adapt to the sometimes rapid dynamics of the partnership.

When this evaluation report was being prepared, work was ongoing to evaluate opportunities to improve the alignment of the Program’s contribution agreements.

4.3.2. Performance measurement insufficient to monitor and communicate results

Evaluation question #5: To what extent are the TV5 Program performance measurement data useful and enable effective reporting and communication of results?

Key findings:

Shortcomings in the Program’s performance measurement strategy

- Although the Program has a performance measurement strategy, it has several shortcomings that limit its effectiveness in supporting evidence-based decision-making:

- complexity of data management;

- coverage of certain funded activities; and

- availability and standardization of data.

Performance measurement involves several challenges

Although the Program has a performance measurement strategy, it is complex and has several shortcomings. The evaluation encountered certain challenges that complicated the analysis of the Program’s performance, including:

- a high number of results and indicators;

- missing data on short-, medium- or long-term results achieved;

- unambitious targets that are surpassed year after year; and

- indicators that are not within the scope of the Program’s funding or that are part of the Program’s activities and commitments within the TV5 partnership itself.

In addition, the Program’s performance measurement does not appear to cover all the activities funded by the Program. Although several indicators measure the availability of Canadian content, there are still gaps in areas such as:

- the origin of the Canadian content purchased to better reflect government priorities;

- potential economic benefits for creators and producers in Canada;

- special projects funded (such as the TV5MONDE journalistic project); and

- consumption of this content on TV5MONDE.Footnote 17

Though TV5MONDE and TV5QC collect a great deal of relevant data, a lack of standardization with respect to how certain data are reported complicates the comparison of certain results over time and makes it difficult to evaluate the Program’s performance. In addition, the lack of systematic data compilation makes it difficult to use the data to support decision-making.

5. Conclusions

The evaluation confirms the overall relevance, effectiveness and efficiency of the TV5 Program between 2017-18 and 2023-24. The Program meets the needs of the Francophone audiovisual sector and aligns with the priorities of the federal government with respect to official languages. The Program’s support for the creation of the TV5MONDEplus digital platform is a testament to its crucial role in the modernization of TV5. In general, it achieved its expected outcomes and was delivered efficiently. However, efforts are still required to better demonstrate the Program’s impact in terms of inclusion, diversity, equity, accessibility and reconciliation.

The rapid evolution of the audiovisual sector, changes in how audiovisual content is consumed, increased competition, and the emergence of new technologies pose challenges for the business models of traditional channels such as TV5QC and TV5MONDE, requiring their ongoing adaptation. Key challenges include the long-term viability of TV5QC, the appeal of TV5MONDEplus on the international market and the diversification of sources of income and content for TV5MONDE.

While the Program has maintained stable funding and provided extra support to TV5QC, several factors, such as the increase in the consumer price index, the loss of advertising revenue, the loss of subscription revenue and the update of the CRTC regulatory framework continue to pose challenges for TV5, particularly for TV5QC.

Observation 1: Reflection on the future of the TV5 Program is essential to continue navigating the challenges and developments in the audiovisual sector. Building on its reputation and good relationships with partner governments, the Program should continue to play a leading role in guiding change and innovation for TV5. In this regard, though it is outside the scope of this evaluation, the government announced the following in 2024-25 for a two-year period:

- $15 million in temporary support to help public service media, including TV5QC, to maintain their levels of programming and services, pending the finalization of the new CRTC regulatory framework; and

- $4 million in funding to enrich the TV5MONDEplus catalogue and maintain competitive levels of programming.

Observation 2: In addition, the Program also needs to strengthen its performance measurement capabilities. This would enable it to monitor its progress more accurately, highlight its strengths and correct its weaknesses. To date, the lack of reliable data has limited the effectiveness of communicating successes and making decisions based on solid information.

6. Recommendations, management response and action plan

Based on the findings and conclusions presented in this report, the evaluation offers the following two recommendations:

Recommendation 1

The evaluation recommends that the Assistant Deputy Minister of Cultural Affairs continue to encourage TV5QC and TV5MONDE to adapt their business models to remain relevant and viable.

Management response

The Cultural Affairs Sector accepts this recommendation. In order to adapt the TV5QC and TV5MONDE business models to make them more relevant and viable, the Sector is investing $4 million over 2 years, beginning in 2024-25, to enrich the TV5MONDEplus catalogue and maintain competitive levels of programming, including $400 000 over 2 years, beginning in 2024-25, to promote Canadian Francophone artists and content on the platform internationally.

With the announcement of the 2024 budget, the Sector will support TV5QC in maintaining its levels of programming and services pending the finalization of the new CRTC regulatory framework.

The Sector is also focused on creating new partnerships with TV5MONDE. This action is in line with the implementation of its 2025-28 Strategic Plan which, with a view to modernization, targets a younger audience in French-speaking Africa.

The Sector monitors the progress of the results of these investments and influences the updating of the TV5QC and TV5MONDE business models.

| Action plan item | Deliverable | Timeline | Responsible party |

|---|---|---|---|

| 1.1. TV5QC will be considered in 2025-26 for financial support aiming to help public service media maintain their levels of programming and services, pending the finalization of the new CRTC regulatory framework. During that time, the Sector will influence the TV5QC business plan so that it specifies how it intends to strengthen its financial foundation. | 1.1.1. Funding disbursed for TV5QC in 2025-26 for assistance to public service media | March 2026 | Director General, AVB |

| 1.1.2. Summary of discussions on strengthening the TV5QC financial foundation | January 2028 | Director, AVB | |

| 1.2. The Sector will participate in the drafting of the Charters and intergovernmental agreements with partner governments and TV5Monde operators, and in collaboration with Global Affairs Canada, encourage TV5Monde to find new partnership opportunities. | 1.2.1. Draft Charters and intergovernmental agreements reviewed at the director general level | January 2028 | Director General, AVB |

| 1.2.2. Summary of discussions on partnership opportunities with TV5Monde | January 2028 | Director, AVB |

Full implementation date: January 2028

Recommendation 2

The evaluation recommends that the Senior Assistant Deputy Minister, Cultural Affairs, updates the Program’s performance measurement strategy to better assess the diversity of Canadian content, facilitate the monitoring and communication of results, and strengthen the use of performance data in decision-making.

Management response

The Cultural Affairs Sector accepts this recommendation. During the Performance Information Profile (PIP) review in spring 2025, success indicators will be adapted to take government priorities into account and facilitate decision-making. To that end, the review will be conducted with the TV5QC management team. The exercise will also help improve the communication of results and facilitate their monitoring, thereby ensuring better accountability. The new performance measurement will be reflected in the TV5QC contribution agreement.

| Action plan item | Deliverable | Timeline | Responsible party |

|---|---|---|---|

| 2.1 Collaborate with the Strategic Planning Directorate to update the TV5 Program performance measurement strategy. | 2.1.1 A summary of meetings with the Strategic Planning Directorate is available | December 2025 | Director, AVB |

| 2.2 Revise the TV5 Program performance measurement strategy in the PIP, with a particular focus on enabling data collection and improving the comprehensiveness of the measurement of consumption and promotion of Canadian content on the TV5MONDEplus platform and TV5QC channels, including content from equity groups in Canada. | 2.2.1 A revised PIP is approved by the Director General | December 2025 | Director General, AVB |

| 2.3. In collaboration with the TV5QC management team, update the performance indicators and expected outcomes in the TV5QC contribution agreement to reflect the new TV5 Program performance management framework. This will include a selection of indicators from TV5MONDE. | 2.3.1. The modified contribution agreement includes updated indicators and results | March 2026 | Director General, AVB |

| 2.4. The TV5 Program will compile and analyze the performance data provided by TV5QC every year in accordance with the requirements of their contribution agreement. | 2.4.1 The report is submitted to the TV5 Program director | July 2026 | Director, AVB |

Full implementation date: July 2026

Appendix A: History of the TV5 partnership

This section presents a brief history of the highlights of the TV5 partnership, both in terms of the governance of TV5 and of aspects associated with TV5MONDE and TV5QC.

| Year | Organization | Highlight |

|---|---|---|

| 1984 | TV5MONDE | The TV5 partnership was launched with the creation of TV5MONDE, an undertaking dedicated to broadcasting international Francophone programming.Footnote 18 |

| 1986 | TV5QC | The governments of Canada and Quebec joined the TV5 partnership, with the Consortium de télévision Québec. |

| 1988 | TV5QC | TV5QC was launched and was operated by the Consortium de télévision du Québec, with headquarters located in Montreal. The TV5QC signal was broadcast across Canada. |

| Since then, the partnership has evolved and the TV5’s management structures have been modified a number of times | ||

| 2001 | TV5MONDE & TV5QC | The management of all TV5 signals was consolidated under TV5MONDE, except for that broadcast in Canada, which remained under TV5QC. |

| 2009 |

TV5QC TV5MONDE |

The TV5.ca website was redesigned. The TV5MONDE mobile website was launched, as well as the Tivi5MONDE channel. This channel was aimed at young Francophones aged 3 to 12. It is broadcast in non-French-speaking Europe, Africa, Latin America, Asia and the Arab world and offers cartoons, entertainment, educational programs and information provided by TV5 Monde partner channels. |

| 2013 | TV5QC | The TV5QC licence was modified with the addition of a new signal called Unis. The Unis TV channel was launched the following year, and both channels benefitted from mandatory distribution on basic service. |

| 2015 | TV5MONDE | Inauguration of the new TV5MONDE Style HD channel, available in the Middle East, Asia, Africa and the United States. The channel broadcasts programs on fashion, luxury, the hotel industry, jewelry, gastronomy, oenology, design, the art of gardening, architecture, and cultural and historical heritage. |

| Period covered by the evaluation | ||

| 2018 | TV5 | The TV5 Program assumed the presidency of TV5 from 2018 to 2019. |

| 2019 | TV5QC | The digital platform was redesigned to combine the offerings of TV5QC and UnisTV. |

| 2020 | TV5MONDE | Launch of the TV5MONDE digital platform, TV5MONDEplus. |

| 2021 | TV5 | The Government of the Principality of Monaco and its Monacan channel Monte-Carlo Riviera joined the TV5 partnership. |

| 2023 | TV5QC | TV5Unis was launched on Roku. |

Appendix B: Role of the Program in TV5 governance

| TV5MONDE and TV5MONDEplus | TV5Numérique | TV5QC |

|---|---|---|

|

Act as president in association with partner governments (rotating role) WHO: TV5 Program Participate in the Conference of Ministers Responsible WHO: Minister of Canadian Heritage Participate in the meeting of the senior officials WHO: ADM, Cultural Affairs Sector Remain informed about the board of directors and program committee discussions WHO: Radio-Canada (public broadcasting partner of the TV5 Program responsible for feeding TV5 programming through TV5 Program funding) |

Appoint three administrators and remain informed about discussions during meetings of the TV5Numérique board of directors WHO: Administrators appointed by the Program to the board of directors |

Participate in the annual members’ meeting WHO: Minister of Canadian Heritage Participate in the coordination meeting WHO: TV5 Program Appoint two administrators and remain informed about discussions during meetings of the board of directors OBJECTIVE: Supervise the implementation of strategic directions |

Appendix C: Data collection methods, limitations and mitigation strategies of the evaluation

Except for the literature review, which was conducted by the Canadian Heritage Policy Research Group, all data collection was carried out by the evaluation team.

Table C-1 briefly describes the methods used.

| Data collection method | Description |

|---|---|

| Literature review | Analysis of research and academic publications and public data from Statistics Canada. |

| Document review | Analysis and compilation of key documents from the Program, including recipients, and from the Government of Canada. |

| Administrative review |

Analysis of administrative data from different sources:

|

| Interviews with key informants | 15 interviews with key Program stakeholders, both internal and external. |

Table C-2 describes the main limitations of the evaluation, and the mitigation strategies used to minimize their impact.

| Limitations | Mitigation strategies |

|---|---|

| The periods covered by the data reported by TV5MONDE and TV5QC are not aligned with one another or with the Canadian Heritage fiscal year. | Where relevant, the different time periods have been specified in the report. |

| Shortcomings in performance measurement have limited the ability to fully evaluate Program results. |

Several meetings and follow-ups were organized with the Program to clarify questions regarding performance measurement. In addition, due to limitations in the availability and quality of certain indicators, some have not been reported as part of this evaluation. The use of several data collection methods enriched the analysis by integrating other data sources to answer some of the questions. |

| There is a limited number of respondents who could answer certain interview questions. |

Because of the respondents’ profiles and their specific expertise on certain aspects of TV5, the interview questions were adapted to their knowledge. As a result, some questions were answered by a limited number of participants. Whenever possible, different data sources were used to formulate key findings. |

Appendix D: Evaluation matrix

| Indicator | Document and administrative review | Literature review | Interviews |

|---|---|---|---|

| 1.1 Perceptions, trends and challenges faced by TV5Monde (global trends and issues in the audiovisual industry, including technological and commercial issues). | Yes | Yes | Yes |

| 1.2 Perceptions and evidence on the specificity of TV5 Québec Canada in the Canadian Francophone television market, including technological and commercial issues and the impact of the CRTC on TV5 Québec Canada. | Yes | Yes | Yes |

| 1.3 Perceptions and evidence on the extent to which the financial participation of the TV5 Program meets continued and changing needs, including those related to changes resulting from the COVID-19 pandemic. | Yes | Yes | Yes |

| Indicator | Document and administrative review | Literature review | Interviews |

|---|---|---|---|

| 2.1 Perceptions and evidence on the extent to which the financial participation of the TV5 Program in the TV5 partnership is aligned with the roles, responsibilities and priorities of the Government of Canada and PCH, including those associated with IDEA and reconciliation. | Yes | No | Yes |

| Indicator | Document and administrative review | Literature review | Interviews |

|---|---|---|---|

| 3.1 Perceptions and evidence demonstrating that the TV5 Program has achieved its expected outcomes in the short term. | Yes | No | Yes |

| 3.2 Perceptions and evidence demonstrating that the TV5 Program has achieved its expected outcomes in the medium term. | Yes | No | Yes |

| 3.3 Perceptions and evidence demonstrating that the TV5 Program has achieved its expected outcomes in the long term. | Yes | No | Yes |

| 3.4 Perceptions and evidence on the factors that facilitate or hinder the achievement of expected outcomes. | Yes | No | Yes |

| Indicator | Document and administrative review | Literature review | Interviews |

|---|---|---|---|

| 4.1 Perceptions and evidence on the presence of practices and mechanisms for the efficient delivery of the TV5 Program, including service standards and best practices from other PCH programs, countries or governments in the multilateral partnership. | Yes | Yes | Yes |

| 4.2 Perceptions and evidence on the efficient delivery of funding during the COVID-19 pandemic. | Yes | No | Yes |

| Indicator | Document and administrative review | Literature review | Interviews |

|---|---|---|---|

| 5.1 Perceptions and evidence on the extent to which performance data collected accurately reflect the achievements and results of the TV5 Program and support decision-making and the demands of the department’s responsibilities. | Yes | No | Yes |

| 5.2 Perceptions and evidence on potential improvements to the performance measurement strategy. | Yes | No | Yes |

Appendix E: Bibliography

- Canada Media Fund, Perspectives: A Publication of the CMF's Foresight & Innovation Team - Embracing Change, spring 2024.

- Canadian Heritage, News Release. Canada Will Assume Presidency of TV5 in 2018 and 2019, November 24, 2017.

- Justice Canada, Department of Canadian Heritage Act, 1995.

- Justice Canada, Online Streaming Act, 2023.

- Media Technology Monitor. Gauging demand for On-Demand: the SVOD Landscape (among French- and English-speaking Canadians), 2024

- Media Technology Monitor. The Best of Both Worlds. Why subscribe to both TV and SVODs?, 2024

- Numeris, Market Share: Data for Quebec Franco, Monday to Sunday, 2 a.m. to 2 a.m., WAvAge, 2 years and up, from 2017-18 to 2022-23.

- Numeris, Demographic Profile: Data for Quebec Franco, Monday to Sunday, 2 a.m. to 2 a.m., WAvAge, 2 years and up, from 2018-19 to 2023-24.

© His Majesty the King in Right of Canada, represented by the Minister of Canadian Heritage, 2025.

Cat. No. CH7-64/1-2025E-PDF

ISBN 978-0-660-77843-3