The ABC Method: a risk management approach to the preservation of cultural heritage

This manual offers a comprehensive understanding of risk management applied to the preservation of heritage assets, whether collections, buildings or sites. It provides a step-by-step procedure and a variety of tools to guide the heritage professional in applying the ABC method to their own context. The method can be applied to a range of situations, from analysis of a single risk to a comprehensive risk assessment of the entire heritage asset.

[PDF version, 2.45 MB]

Table of contents

- Overview

- Step 1: Establish the context

- Tasks for the establish the context step

- Explanations for the establish the context step

- Task scope and time horizon

- Mandate, policies, and procedures of the organization

- Legal context

- Financial context

- Governance context

- Stakeholders

- The value pie: Introduction

- The value pie: Setting up the table

- The value pie: Using value categories

- The value pie: When items aren’t so easily defined

- The value pie: Using values directly as intangible items

- The value pie: Multiple contributing values to each item

- Items with multiple values: A worked example

- The value pie: Capturing ensemble value

- The value pie: Applying it to only some parts of the heritage asset

- The value pie affects risk assessment

- Step 2: Identify risks

- Tasks for the identify risks step

- Explanations for the identify step

- Identify specific risks

- Write the risk summary sentences

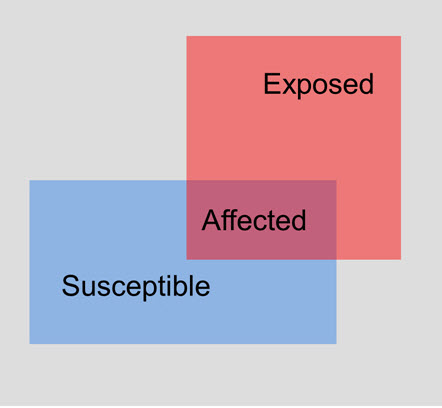

- Susceptible and exposed = affected

- Checklists

- Frameworks and their purpose

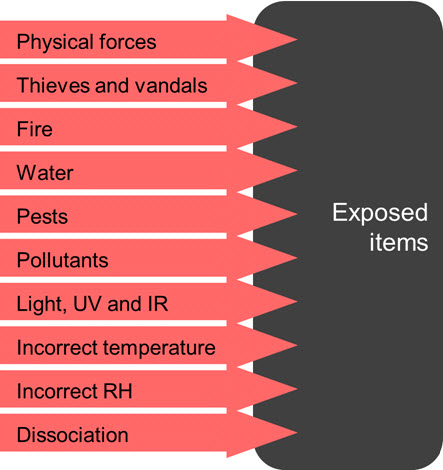

- The 10 “Agents” of deterioration

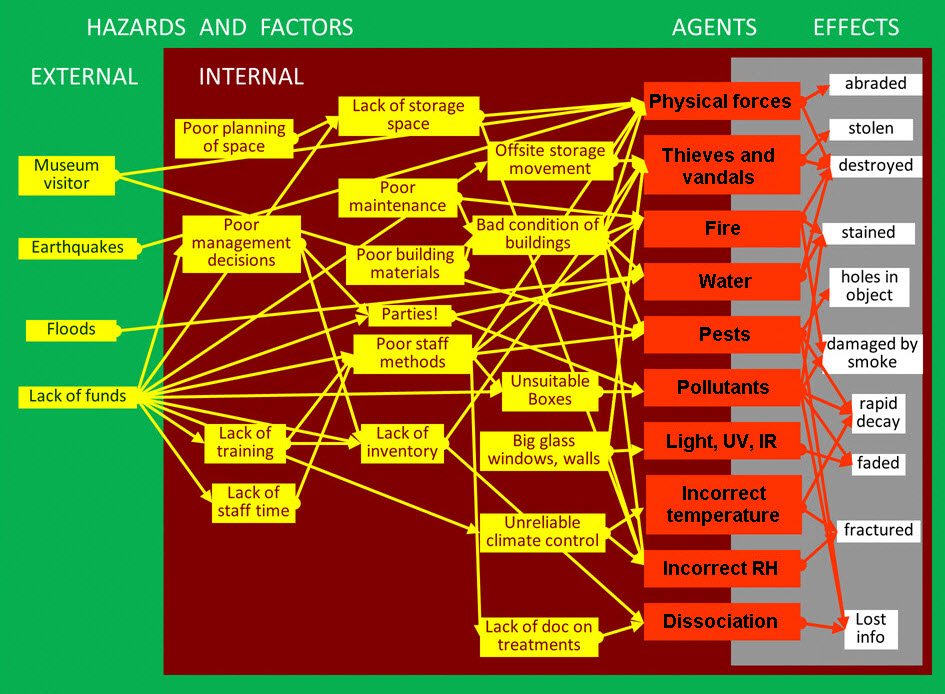

- The causal chain from hazard to adverse effect, via the 10 agents

- The three “Types” of risk occurrence

- “Rare” as a rigorously defined term

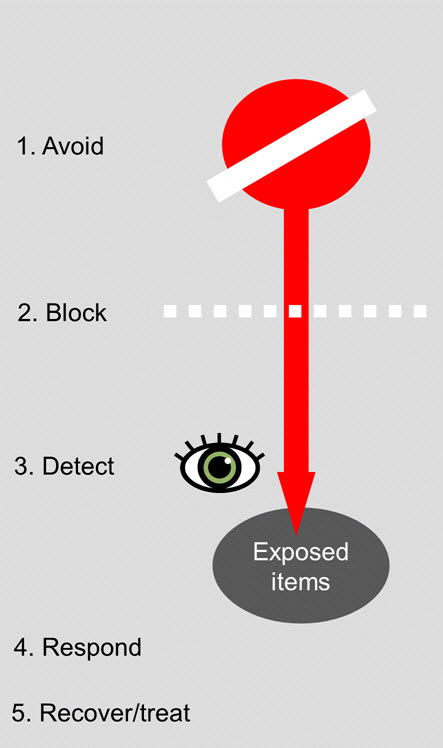

- The five “Stages” of control

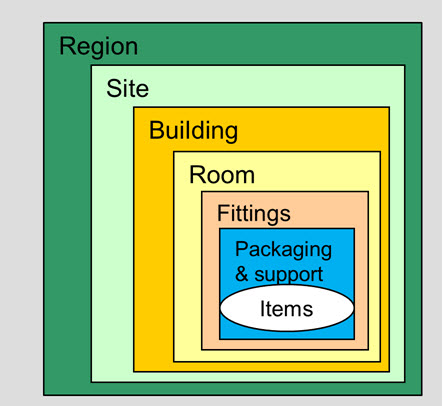

- The six “Layers” around the heritage asset

- The three sources of knowledge

- Comprehensive risk identification: The Ten Agents and Three Types of Occurrence Table

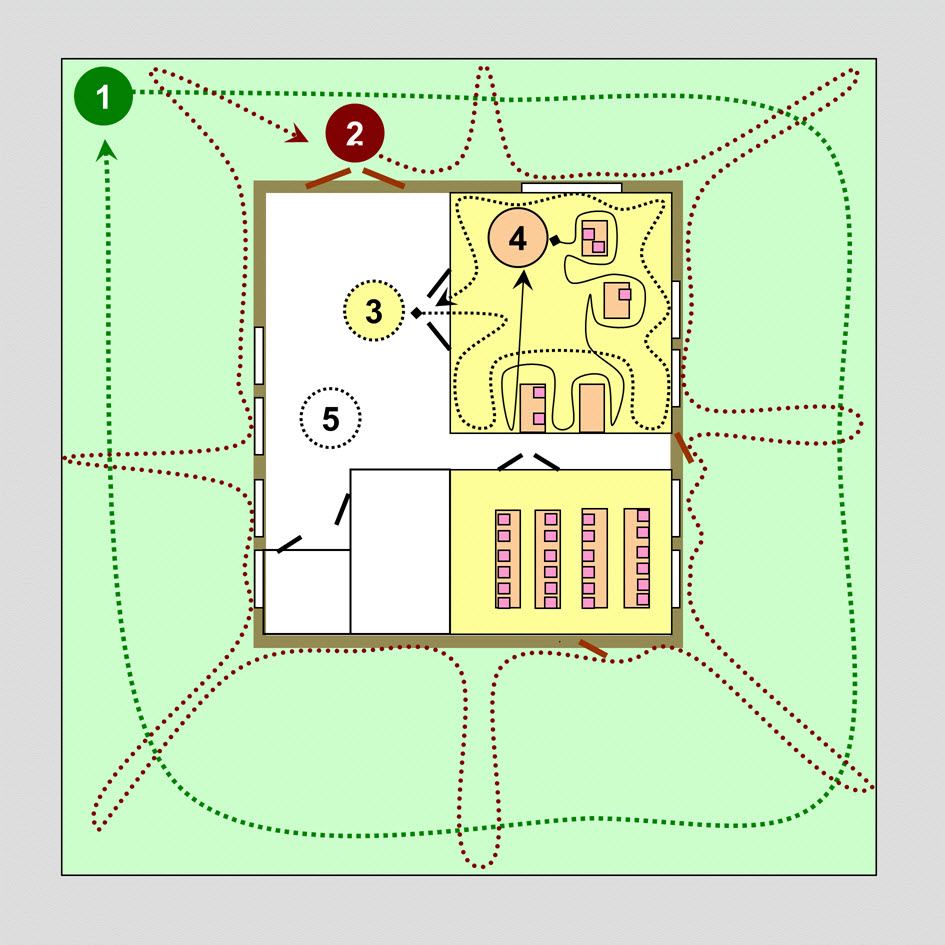

- Comprehensive risk identification: Use efficient paths for surveys

- Rare events and regional data

- Collecting local knowledge

- Identifying risks by causes other than the 10 agents

- Step 3: Analyze risks

- Tasks for the analyze step

- Explanations for the analyze step

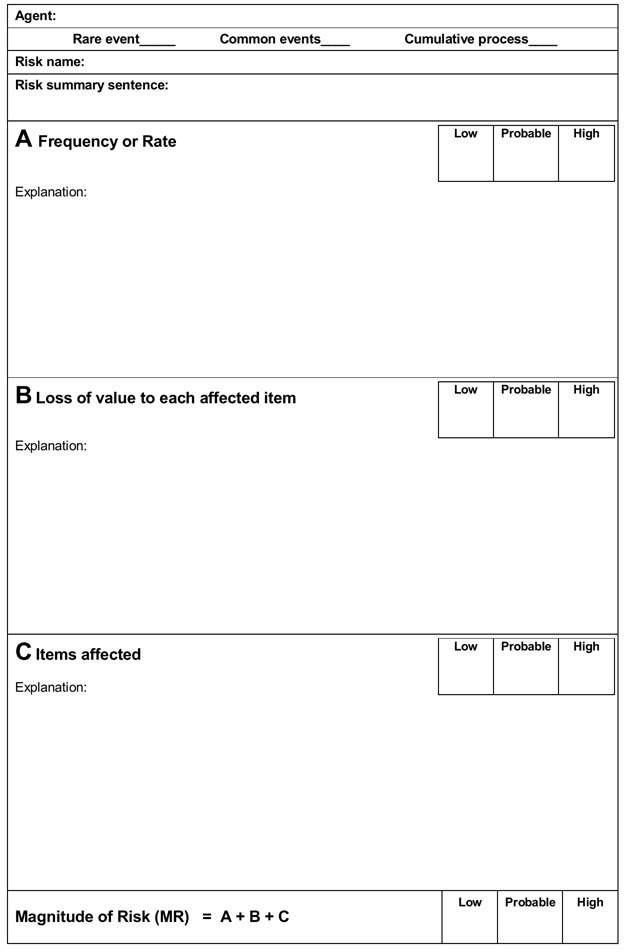

- The three ABC components for quantification of risk

- The ABC scales

- A scale: Frequency or rate

- B scale: Loss of value to each affected item

- C scale: Items affected

- Do you want paper or electronic?

- The risk scenario

- Analyzing A for rare events

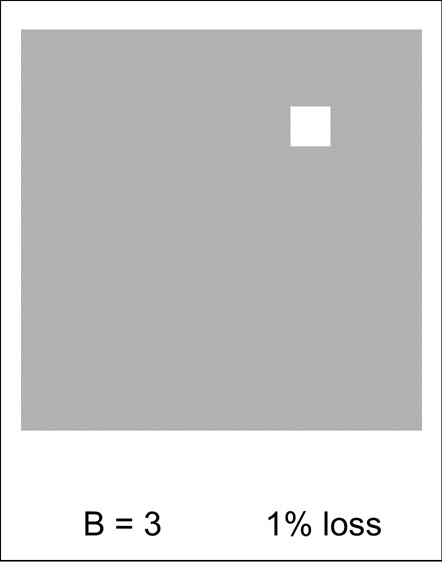

- Analyzing A for common events

- Analyzing A for cumulative processes

- Analyzing A using a time horizon

- Analyzing which items to include: Check the value pie for guidance

- Analyzing B when loss is total

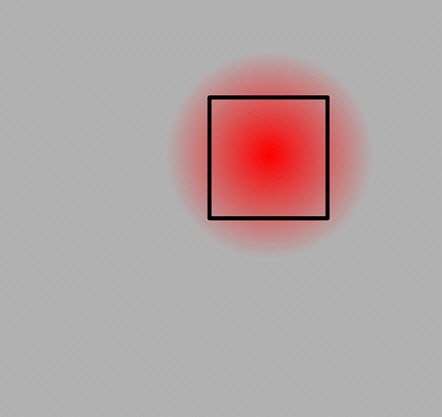

- When loss is partial: Analysis of the deterioration

- When loss is partial: From deterioration to loss of value

- When loss is partial: Using fractions

- When loss is partial: Using diagrams

- When loss is partial: Using words

- When loss is partial: Using equivalence to total loss

- When loss is partial: Equivalence chains

- When loss is partial: Value judgements may not be necessary

- Analyzing C if all items have equal value

- Analyzing C when items vary in value

- Analyzing a risk by using the probable institutional response

- Review for coherence in the analysis of the three components

- Finding knowledge

- Knowledge phases during risk analysis

- Aggregating and disaggregating specific risks

- Facts plus theories: The general method for analyzing scenarios

- Theory: Exposure to events

- Theory: Exposure to cumulative processes

- Analyzing risks by control levels

- Can we predict the future?

- Making deductions from the evidence of past adverse effects

- Separating the technical issues from the subjective issues during the analyze step

- The arithmetic behind the ABC scores

- Step 4: Evaluate Risks

- Step 5: Treat Risks

- Conclusion

Overview

Introduction

The main lesson from these experiences has been that scientific expertise, rational decision making, and public values can be reconciled if there is a serious attempt to integrate them. The transformation of the risk arena into a cooperative risk discourse seems to be an essential and ultimately inevitable step to improve risk policies and risk management.

No one is distressed by failing to see very subtle points that require specialized knowledge. We are distressed, however, if we overlook the obvious.

Welcome to heritage risk management

Why use it?

If you have ever wondered what to do when facing a pressing and difficult preservation decision, then this method can help.

If you have ever wondered how to balance preservation with sustainability, shrinking resources, user demands, and public accountability, then this method can help. Finally, if you have ever wondered how to present all this succinctly to decision makers, with transparent priorities, then this method can help.

The goal of heritage risk management

In simple language, our goal is the best preservation of the value of the heritage asset with the available resources.

In more technical terms, our goal is to assess the risks and deterioration processes affecting our heritage asset, and then to act to reduce them as effectively as possible, given the available resources.

What is risk-based decision making?

Risk-based decision making is the application of risk assessments to a decision. The distinction with risk management is only a matter of degree. Many useful preservation decisions can be made using very focused assessments of one or two risks. If, on the other hand, one wants to “manage” risks of a heritage asset, one needs assessments of most, if not all, of the risks.

Structure of the manual

Overview section

The Overview section summarizes the who, what, why, and how of the method. Several examples of its use are provided. It opens the door to thinking about not only comprehensive risk management, but also smaller decisions within heritage preservation, i.e. risk-based decision making.

The five steps

The core of the manual is built around the five steps of a management cycle. These are:

- Establish the context

- Identify risks

- Analyze risks

- Evaluate risks

- Treat risks

Within each of the steps, the manual provides a subsection on tasks and a subsection of explanations.

Tasks

For each of the five steps, three or more tasks have been outlined. The sections on each step begin with these tasks. Each task is explained by a list of detailed activities.

Who can do this?

Anyone responsible for heritage preservation

This manual outlines the ideas behind risk management of heritage assets, such as collections, buildings, and sites, and provides a step-by-step procedure for doing it. Once you begin to view preservation decisions from this perspective, you will be “doing” heritage risk management.

A participatory process

Risk management involves many players inside and outside the organization. This manual can be used to inform all participants.

Just want the big picture?

For those just curious about the method, or who have been asked to participate in the process, please read the Overview section.

First-time user?

This manual was developed as a resource for a course in the method. The best way to use it is in the context of mentoring or training.

If you are trying to apply the full method for the first time, without the benefit of a teacher, we suggest that you begin by reading the entire manual. Then locate one of the many individuals around the world who have taken the ICCROM course called “Reducing Risks to Collections” (see the ICCROM website for lists of participants) and who are passionate about sharing and building the method. Canadians can contact CCI for assistance; others, please contact the organization ICCROM.

Paper method or database?

Paper

This method can be applied using only paper forms. Some calculations and graphing will be necessary. This can be managed with a calculator or by using spreadsheet software such as Microsoft Excel® or OpenOffice.

Database

The most convenient tool is the CCI Risk Management Database, developed specifically for the method. It automates all the calculations necessary for comprehensive assessments and the evaluation of risk reduction options. It generates reports based on your data and text entries. For information on the database, contact CCI.

Origins of the Manual

Partner Institutions

From 2006 until 2012, ICCROM, the Canadian Conservation Institute (CCI), and the Netherlands Cultural Heritage Agency (RCE; formerly the Institute for Cultural Heritage, ICN) established a collaboration framework “to create an international shift in attitude from traditional preventive conservation practice to risk management within the heritage profession.” Among the activities of this collaboration were research, training and dissemination, and the production of resource materials, which CCI was to lead.

Manual background

This manual was conceived in the framework of that collaboration. Since then, the text has been substantially revised based on the experience of CCI in applying the ABC method to Canadian institutions and that of ICCROM in projects carried out in Latin America, Asia, and Europe.

Acknowledgements

The training initiatives were coordinated by ICCROM in the framework of the partnership. Content was developed and delivered by staff of ICCROM (Catherine Antomarchi, José Luiz Pedersoli, and Isabelle Verger); staff of CCI (Stefan Michalski, Irene Karsten, Julie Stevenson, Jean Tétreault, Tom Strang, Paul Marcon); staff of ICN (Agnes Brokerhof, Bart Ankersmit, Frank Ligterink). Early development of these courses benefited from the ideas and experience of Robert Waller while he was head of the conservation section at the Canadian Museum of Nature. Other contributors included: Veerle Meul, while with Monumentenwacht Vlaanderen, Belgium; and Jonathan Ashley-Smith, United Kingdom. A special thanks to Vesna Zivkovic, head of the preventive conservation section at the Central Institute of Conservation of Serbia, who developed the course glossary, many course resources, and tools.

A final thanks to Catherine Antomarchi for her careful review and many improvements of both the English and French versions.

Authors

The lead author of this manual was Stefan Michalski at CCI. Co-author was José Luiz Pedersoli Jr. for ICCROM.

Examples of risk-based decision making

Introduction

These examples illustrate the variable scope of risk-based decision making, from small to large. Some come from the participants’ case work during the ICCROM-CCI-ICN courses “Reducing Risks to Collections.” The rest were created by considering how common preservation decisions can be considered from a risk-based approach. It is our hope that these examples inspire users to consider many preservation decisions from the risk perspective, not necessarily with the full methodology of the manual, but at least with the fundamental ideas.

Decisions about a single risk

Documents in “bad” boxes

The staff of an archive in a small museum know that standard “best practice advice” states that they must replace all ordinary cardboard boxes with “archival quality” boxes. Given the cost of archival boxes, and the labour of making the change, the archive asks: What risk exactly are we reducing if we replace existing boxes?

A risk analysis, based on best available knowledge, concludes that the risk will be the browning of the sheets in direct contact with the box. This is 2 sheets out of perhaps 200–400 sheets in each box. Maximum browning is estimated to take at least several decades to occur. The archivist considers that the loss of value due to maximum browning of these two sheets is very small, since no information is jeopardized.

When the risk is analyzed and scored, the expected magnitude of risk is found to be negligible.

Humidity fluctuations and a permanent collection of furniture

The permanent collection of furniture in a small museum has been in the museum building for at least 30 years. The director is considering upgrading climate control, since it has always been considered desirable for furniture, but is well aware that “museum quality climate control” means large capital expenditures for equipment, ongoing maintenance costs, and growing energy costs. The municipality is pressing sustainability as a major decision-making issue for any new funding.

A careful visual examination of the 19th-century furniture pieces in the museum displays shows no damage that can be ascribed to humidity fluctuations of the last few decades. (There are signs of physical damage from the moves of the last two decades, however, and from visitor abrasion.)

A risk analysis based on this local knowledge, supported by current theory, concludes that if the building is left unchanged, the risk due to relative humidity (RH) fluctuations is very small, but that several new risks will be created by a mechanical system due to the inevitability of mechanical failures.

Decisions comparing two options

Climate control specifications for a mixed collection

A museum located in a temperate continental climate zone with a mixed historic collection, primarily furniture and oil paintings, has two proposals for climate control systems for its new building:

- A low-cost system with moderate fluctuations, seasonal setbacks, and no true summer dehumidification.

- A more expensive system, more energy consuming, and less easily repaired, but with true summer dehumidification.

Both systems have winter humidification. The conservation department has been asked to report on the implications of the different ranges of RH fluctuations and temperature fluctuations on the collection.

The risk from both RH fluctuations and temperature fluctuations is cracking of the furniture and the paintings. The assessment considers the risk from daily fluctuations, the risk from seasonal setbacks, and the risk from a complete failure of the system during winter or summer operation. Although there was considerable uncertainty in the analyses, the risk assessment suggests that overall, the greatest risk from either system, when looking into the future, is the chance of humidification failure in winter. The simpler system has much shorter repair times estimated for the humidifier, since the local maintenance firms could repair this system, but the other system would require consultants from outside the city.

Furthermore, it became apparent during analysis of this greatest risk that it could be reduced dramatically by designing the humidification system with two humidifiers, rather than one, each of which could handle the average load if one failed. This emerged as the best proposal for improving the simpler system.

Decisions comparing several risks

Climate control decisions for mixed collections

A museum wants to “improve” its climate control. They carry out a risk assessment of the current climate conditions. The issue of “incorrect RH” is a complex one, with four subtypes of incorrect RH. Each of these subtypes has different forms of damage, e.g. high RH causes mould, which causes local staining and disintegration, typically of flexible organic materials such as textiles, paper, and leather. RH fluctuations, on the other hand, cause fractures of rigid items such as furniture and oil paintings. Increasing RH above 0% causes increasing chemical decay of archival material and increasing corrosion of metals.

The museum discovers that the risks were not in the priority that they expected. The risk of further deterioration of the furniture due to continued fluctuations is low. The deterioration from rapid chemical decay of parts of the photographic archives in the current temperature conditions is high. The chance of a mould event in the archives is also high, given the likelihood of a small flood in its current location and the total lack of resources or planning to clean up the water quickly.

Decisions comparing risks in an asset of buildings plus collections

Historic house museum

A museum is in a historic house; the collection and house form an ensemble (around a nationally famous person). There is pressure to improve human comfort inside for the visitors, so a full scale “improvement” in climate control is proposed.

A comparative risk assessment of the current climate control situation (none) and of the proposed improvements (extensive) demonstrates that the risks to the ensemble will escalate considerably with the “improvements.” This is because the predicted deterioration of the collection due to RH and temperature fluctuations, assuming they continue to follow the pattern of the last 30 years, is small, but the likely damage to the building of the proposed climate control system is large, due to two distinct issues:

- immediate damage to the building fabric due to system installation, which will result in an endless loss of historic authenticity for visitors, and

- mould and decay of the wall fabric due to moisture damage to the building over the next 10–30 years.

There is also a public health risk and the probable loss of museum operation if these moulds are dangerous to occupants. (In a hot climate, the equivalent issue would be condensation during summer air conditioning.)

The counter argument is that visitors will continue to complain and may ask for refunds. Further examination of the complaints shows that the issue is one of summer discomfort, aggravated by the security policy of closed windows. Risk analysis clarifies that although closed windows reduce theft during closed hours, they cannot reduce theft during opening hours. The museum decides to experiment with natural ventilation in the upper floors, augmented by fans in some rooms, and to ask the engineering consultants to reconsider low-energy, sustainable options further.

Decisions based on a comprehensive risk assessment

Planning the next 10 years in a historic village: Assessment

A municipality asks its historic village museum for a long-term plan, with annual budget implications. The museum decides that part of the planning process will include a comprehensive risk assessment of the collections and buildings.

Unlike the previous example, where pre-selected risks were compared, the museum makes a conscious effort to identify all possible risks, including a few “exotic” risks, such as airplane crashes (it is near a major airport).

One of the unexpected risks that emerges is the imminent retirement (and expected death within 20 years) of a particular staff member. He is the only person who knows all the details about the historic buildings that were moved to the site in the last 30 years. He never had the time, or inclination, to write it down. If this information is not captured before the loss of this individual, much of the value of the buildings will be lost, or at the least, expensive to recover.

Planning the next 10 years in a historic village

The museum in the above example has been asked for a plan. After receipt of the comprehensive assessment, they begin to explore options for reducing the largest, unacceptable risks. They also explore options that address several risks at once. This is now comprehensive risk management.

Integrated risk management

Planning the next 10 years in a historic village: Integration

The director realizes that the organization must develop risk management plans not only for the site and all its heritage assets, but also to meet new fire safety codes, to address public safety and liability issues, to consider the emergency preparedness plan, and to make it all fit with the museum’s insurance policies.

Currently these are all disconnected planning documents and even disconnected branches of the municipality’s layers of bureaucracy. The director begins to draft a museum master plan for the next 10 years. A diagram is assembled of all the various risk management programs already in place for liability etc., and those now considered for the risks to the heritage asset itself. In meetings with senior staff, and with their insurance advisor, the organization begins to see where these different risk management plans support each other and where they need to be coordinated better.

Methods of risk-based decision making

Defining and measuring risk

What is risk?

In everyday language, risk is “the possibility of loss.” (Merriam-Webster online dictionary) The ISO recently defined risk as “the effect of uncertainty on objectives.” (ISO 31000:2009 / ISO 73:2009) The Society for Risk Analysis in the USA has abandoned attempts at a universal short definition and adopted six variations that serve different industries. Its first definition, however, states that “Risk is the possibility of an unfortunate occurrence.” (Society for Risk Analysis, 2015a) For the ABC method, we define risk as “the possibility of a loss of value to the heritage asset.”

How to measure risk

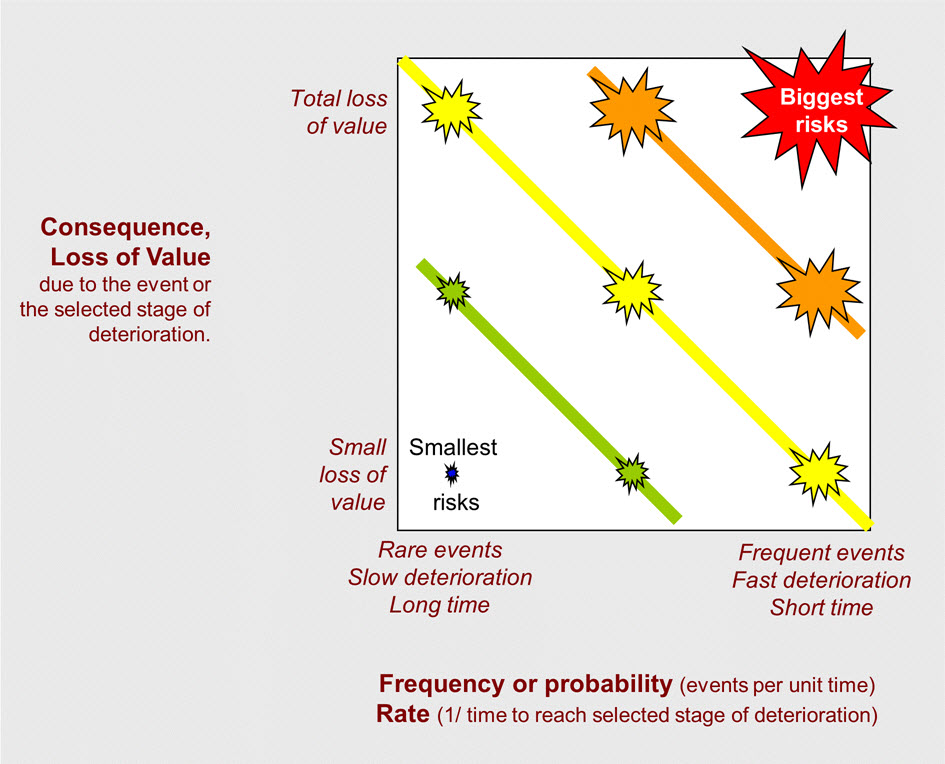

Metrics are the tool for determining whether a risk is bigger or smaller than another risk. In its list of risk metrics from various fields, the first noted by the Society for Risk Analysis (2015a) is: “The combination of probability and magnitude/severity of consequences.” Figure 1 is the map of such combinations.

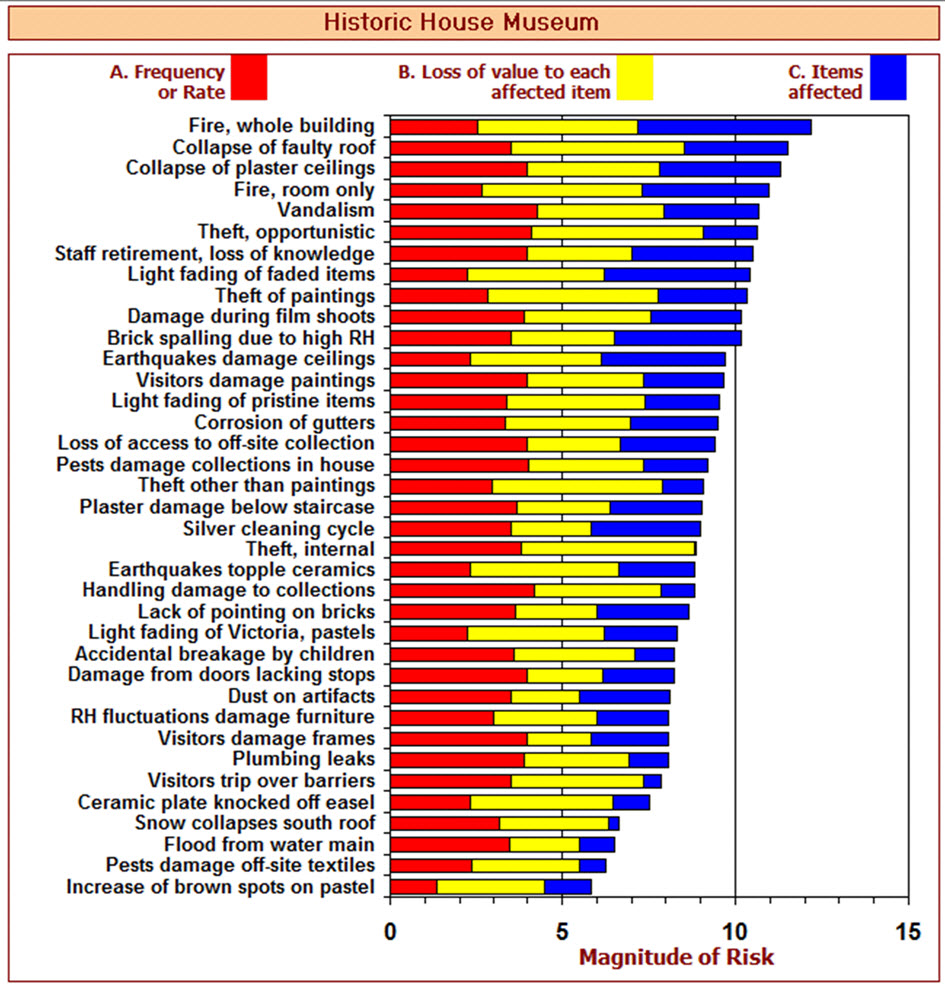

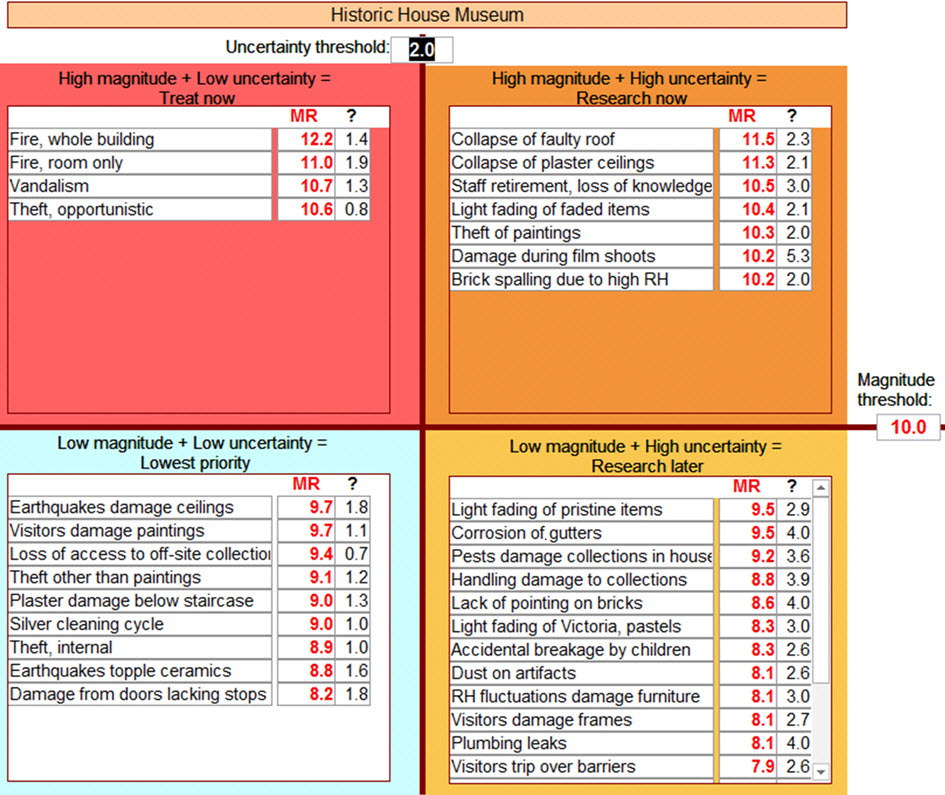

For risk to heritage assets, risk is defined as “the expected fractional loss of value to the heritage asset per unit time,” e.g. % loss of value per century. In the ABC method, the risk is expressed on a 15-point logarithmic scale (analogous to the magnitude scale for earthquakes) and measurements on this scale are called the “magnitude of risk,” abbreviated MR.

Placing events and cumulative processes side by side

Although examples of risk tend to focus on rare events, risk includes frequent events and even cumulative processes. As the other risks, cumulative processes are also measured in terms of consequence, i.e. loss of value, but one must select a particular stage of deterioration or a particular time in the future to assess a combination of consequence and the time it took to get there. Thus a high rate process is comparable to a frequent event whereas a slow rate process is comparable to a rare event.

When risk is intangible

It is easy to slip into thinking that risk only measures tangible phenomena, e.g. the gradual erosion of a wall or the chance that the wall will collapse during an earthquake, but in heritage as in public health, tangible phenomena are only half of the analysis. The consequences depend on intangible phenomena, such as loss of value.

Mapping risks

The standard diagram for comparing risks

In all fields of risk assessment, the basic diagram for comparing risks uses two axes, shown in Figure 1. One axis measures how bad the event will be and is often called “Consequence” or “Impact.” In the ABC method, it is called the “Loss of Value.” The other axis measures how often the event is expected to occur and is often called the “Likelihood” or “Probability” of the event. In the ABC method, it is called “Frequency” for events and “Rate” for cumulative processes.

© Government of Canada, Canadian Conservation Institute. CCI 96638-0001

Figure 1. Map of loss of value versus frequency or rate.

Description of Figure 1.

The graph shows a three-by-three grid of star shapes representing risks. The stars increase in size from the bottom left corner to the top right corner.

Technical notes to the risk map

In semi-quantitative risk assessment, this diagram is often presented as a simple table with three rows and three columns, labelled low, medium, and high. The top right corner (High+High) and the lower left corner (Low+Low) are unambiguous as the highest and lowest risks, but determining the relative size of mixtures in between is not so obvious and becomes the goal of more precise risk analysis such as the ABC method.

The diagonal lines of different colours that connect equal size risks will only be straight if the X and Y axes are geometric or logarithmic, e.g. 1, 5, 25 or 1, 10, 100, rather than linear, e.g. 1, 2, 3. Simple risk maps in most fields do imply big multiplicative jumps between steps, not just uniform increments.

The risk management cycle

A cycle

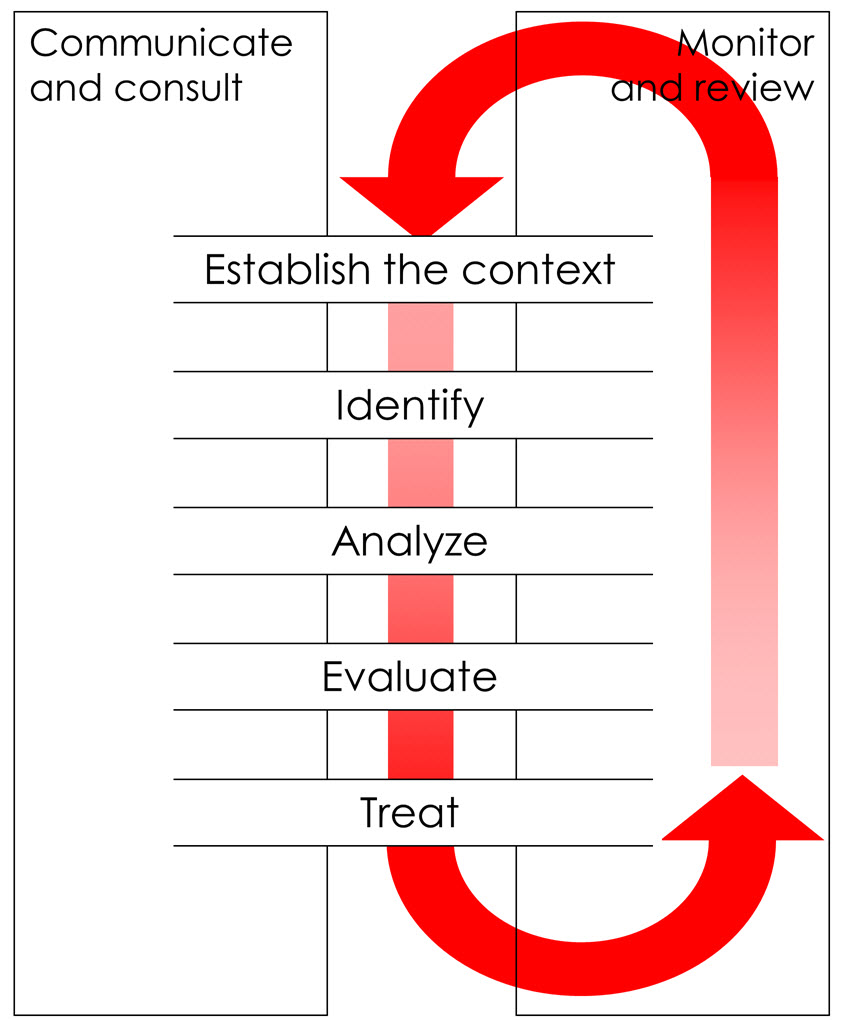

This manual is structured around a risk management cycle that was found originally in the Australian / New Zealand Standard for Risk Management (AS/NZS 4360:2004) and that is now part of the ISO 31000:2009, Standard for Risk Management. The process has five sequential steps and two ongoing activities, shown in Figure 2.

© Government of Canada, Canadian Conservation Institute. CCI 96638-0021

Figure 2. The risk management cycle.

Description of Figure 2.

A large red arrow shaped like an oval racetrack follows a path through the five steps then loops back to the top. Steps: establish the context; identify; analyze; evaluate and treat (causes). Ongoing activities: communicate and consult; monitor and review.

A starting point

All risk management methods emphasize the cyclic nature of management, but one does need to start somewhere. The first step is to establish the context — especially the scope of the initial assessment and its goals for the organization.

Assessment: The core process

The three central steps — identify, analyze, and evaluate — are the core of the process. Together, they are referred to as risk assessment.

Treat risk causes, not effects

Normally in conservation we think of the word “treat” in terms of the heritage items themselves. Here we think in terms of the risks, their causes, and their reduction.

Normal good management

We can recognize the two ongoing activities (communicate and consult, monitor and review) as standard elements of all good management, especially when acting in public trust. This manual focuses on the five sequential steps that are peculiar to risk management:

- Establish the context

- Identify

- Analyze

- Evaluate

- Treat (causes)

Analysis of a single risk

What is analysis?

Analysis is the fundamental step within any risk-based method: it is the quantification of the risk. It is the most technical part of risk-based decision making, but it is not necessarily just science. This manual emphasizes common sense, framing the questions well, and knowing where to look for technical answers.

What is analysis of a single risk?

Analysis of a single risk is an answer to a question like: What is the risk due to the “bad” boxes used to house the paper archives? Or what is the risk of theft due to the poor locks on the door? Or, what is the risk to the façade of a historic building or to the rock art in an archaeological site from outdoor weathering?

Using the manual for a single risk analysis

A single-risk analysis presumes that you already have a sense of context for the question you are asking and that you already have the risk identified, e.g. the “bad” boxes housing the paper archives will cause browning and weakening of the contents in a certain period of time.

In this case, proceed directly to step 3 of the manual, Analyze Risks. You may find, however, that you need to subdivide the risk into several parts in order to analyze it well.

Assessing risks of the same kind

What is assessment?

Risk assessment is the fundamental institutional process. It adds a step before analysis — identify the risks — and it adds a step after analysis — evaluate the risks. In terms of the five steps, assessment is steps 2 to 4:

- Identify

- Analyze

- Evaluate

What is assessment of risks of the same kind?

For example, an assessment of the risk due to lighting throughout a collection would consider many specific light-fading situations — different parts of the collection in different rooms.

As will become apparent as you do various forms of risk analyses, an assessment of the same kind of risks has the large advantage of permitting one to use the same damage criterion for all the risks.

For example, in the lighting risk assessment, this could be “a just noticeable fade anywhere on each item.” For the risk of loss of tooling detail in many stone sculptures in many locations of a site, this damage criterion could be “total loss of current remaining tool marks.” In the two examples, each risk then differs from one situation to another only in terms of the time to reach the criterion.

Using the manual for assessment of risks of the same kind

You will use the first four steps of the risk management cycle:

- Establish the context

- Identify

- Analyze

- Evaluate

Comparative risk assessment

What is it?

Comparative risk: “Comparison of two or more risks with respect to a common scale.” BusinessDictionary.com

Although the term “comparative” can be applied when the risks measured are of the same kind, e.g. comparing the weathering of one part of a site with weathering of another part of the site, we adopt the sense used in its origins — the comparison of very different kinds of risks, e.g. comparing radiation to pollution to car accidents. (Kates and Kasperson 1983) If we compare risks from earthquakes, theft, vandalism, pollution, etc., in order to decide which best to act on to preserve the asset, then we are doing comparative risk assessment.

The difficulty of comparative risk assessment

Comparing risks with different kinds of deterioration requires the adoption of a common scale to convert the predicted deterioration into predicted loss of value. This is the hard part of comparative risk assessment and the essential part. It links material science to cultural values. This conversion is described in the Analyze step.

Discovering the small magnitude of some risks

One of the primary purposes of comparative risk assessment is the recognition of greatly exaggerated risks. These are issues that “everyone knows are important” but which fail to gain significance in the cold light of comparative assessment. Some examples include the assumption that “acids” from ordinary paper boxes will somehow cause major loss to everything inside them or that the deterioration due to humidity fluctuations identical to those of the last 30 years will somehow add dramatic new damage. The exaggeration of such risks comes about from a combination of two factors: the lack of perspective in most preservation guidelines, followed by the ease and clarity with which one can identify well-known solutions — in the previous example, the purchase of acid-free boxes and the purchase of HVAC climate control. The fact that these may be extremely expensive solutions to a marginal risk or deterioration, and that perhaps the organization has bigger risks with lower cost solutions, never gets assessed.

Using the manual for comparative risk assessment

The same four steps as used in assessing risks of the same kind will be followed:

- Establish the context

- Identify

- Analyze

- Evaluate

A comparative risk assessment is not necessarily comprehensive (see next subsection). There are many reasons for limiting the identification of risks to a particular checklist, rather than a comprehensive checklist. One may be asked, for example, to assess only the risks that fall within the conservation department’s traditional responsibilities, or only the risks related to a particular design issue, such as climate control systems, or only the (many) risks due to visitors to a site.

Comprehensive risk assessment

What is it?

“(The) objective of a comprehensive risk assessment is to ensure that all pertinent knowledge, both qualitative and quantitative, is recorded, evaluated, and presented in a fashion that is understandable to decision makers." (Tardiff and Rodricks 1988)

“Comprehensive” and “pertinent” are relative — they depend on the goals of the assessment. In terms of this manual, “comprehensive” refers to the goal of minimizing all forms of loss to the entire heritage asset, whatever the causes.

Why comprehensive assessment?

To achieve the goal of minimizing all forms of loss of value to the heritage asset, we have to manage all risks and deterioration processes. We have to be comprehensive in the identification step. We have to do our best to analyze and evaluate these risks despite many uncertainties. Then we must focus on treating the largest risks.

Discovering big unknown risks

Comprehensive risk assessment will have achieved most of its value if it uncovers large risks that were not being addressed. Such risks tend to have been unaddressed because they were outside conventional areas of responsibility. Common examples include internal theft, the loss of institutional memory (staff retirement), pest risks due to careless staff behavior, etc.

How to be comprehensive

Two types of tools occur throughout risk management to aid comprehensive identification: checklists and conceptual frameworks. These are all described in the Identify step.

Using the manual for comprehensive risk assessment

The same steps will be followed as before:

- Establish the context

- Identify

- Analyze

- Evaluate

The difference is that one uses the tools of the identify step to explore as widely as possible all the risks, even those outside one’s “comfort zone.”

The communicate and consult activity becomes essential in comprehensive risk assessment because one is guaranteed to be outside one’s area of technical competence, and often outside one’s area of responsibilities. It is an institutional-wide process, and it relies on information from as many outside sources as one can obtain.

Comprehensive risk management

What is it?

Comprehensive risk management is the linkage of a comprehensive risk assessment with a risk treatment plan. It is the enactment of the full management cycle of Figure 1.

Using the manual for comprehensive risk management

The same steps as for comprehensive risk assessment will be followed, with the addition of the treat step.

- Establish the context

- Identify

- Analyze

- Evaluate

- Treat (causes)

Integrated risk management

What is integrated risk management?

There are several systems of risk management already active in organizations: disaster preparedness, public risk management, liability insurance, fire and security management, collection management, business resumption plans, etc. Integrated risk management is the effective coordination of all these systems in order to meet the institution’s goals.

Wider systems of risk management

For senior managers, risk management will already mean the framework and processes in place to deal with risks to the organization, business resumption plans, public safety, etc. Even for small organizations, risk management will already mean their approach to insurance and various forms of liability.

Heritage risk management will be integrated within the organization’s risk management systems, which encompass its legal, financial, and governance obligations. Fire management, for example, is first and foremost a life safety issue, with legal codes in place. Fire risk management for heritage assets cannot supersede life safety, e.g. single storey public buildings with easy egress may not require sprinklers to save lives, but they are a good idea to save the building.

For the very largest system, our planet, risk management has meant the implementation of sustainability as a global criterion for all contributing subsystems.

Integrating horizontally and vertically

The hierarchy of risk management systems comes about because of a hierarchy within an organization and between organizations. Each layer has its goals, responsibilities, and span of authorities. Within each layer, such as heritage management, this manual suggests that one manage all the risks that affect one’s goals (and responsibilities) in a comprehensive manner. This is one type of integration — horizontal.

On the other hand, risks due to longstanding hazards such as fire, criminals, pests, and natural disasters, or those within the jurisdiction of a particular building function, such as climate control, have well-established offices, experts, and authorities to serve them. Integration along new pathways, whether vertical or horizontal, is never easy. It will vary from informal exchange of information to formal linkages, all the way to restructuring of the organization.

Everyone is doing it

One of the advantages of adopting a risk management approach to heritage is that increasingly, all the layers above your layer (especially government) are adopting this conceptual framework. Communication will be easier and credibility more likely.

Background ideas of risk-based decision making

Rethinking disaster risk management and emergency preparedness

The old, narrow concept of heritage “risks”

In organizations, as in everyday life, we tend to think of risk in terms of fires, floods, earthquakes, war, etc. One does not plan on how to prevent such hazards, one can only plan on how to reduce losses during and after the event. This is only one type of risk — rare and catastrophic — and only one type of risk treatment — emergency preparedness.

The new, wider concept of heritage risks

Let’s take an example from the health field: the risks from cigarette smoke. We mean a range of processes, from cumulative deterioration of lung capacity that starts on the first day one inhales tars to the growing burden of carcinogens that eventually tip the body into rapid deterioration. When we think of risks to our health, we mean not only risks from smoke, but risks from earthquakes, risks from crossing the street, risks from UV, etc. In the same way that we try to balance our management of all these different risks, we must do the same for our heritage.

Integrating the rare with everything else

Emergency preparedness for heritage is usually the responsibility of the same staff that will initiate heritage risk management…you. For you, the integration is not a matter of separate responsibilities or authorities, it is a matter of linking concepts and planning that share the same goal — preservation of the heritage asset. Emergency preparedness for heritage assets will always be distinct in some of its techniques and sources of expertise — catastrophes do bring distinct problems of scale and urgency — but they are just a particular set of risks within the larger set of all risks to the asset. Doing triage or writing manuals on what to do with wet collections uses exactly the same knowledge, the same individuals, as risk management of small events.

As a planning and management element, it makes sense to integrate emergency preparedness within a system of comprehensive heritage risk management. And it may well emerge that in the light of a single measurable goal, the balance of resources currently directed to “routine” risks such as climate control, as compared to resources directed to flood mitigation, needs revision.

Integrating collections with sites and buildings

Integrating approaches

The professions specializing in heritage sites and buildings have developed their own methods and terminologies for risk management. Much of their focus has been on emergency preparedness, also called disaster planning. It is not the intent of this manual to displace those methods, nor to pretend to provide a substantive introduction to those methods.

Sites and buildings have also developed methods of estimating or ranking relative value and have encountered the same dilemmas and disputes that arise when one attempts such measures.

Although this ABC method originated with a collections perspective, we have incorporated ideas and methods borrowed from many areas of risk management, including the sites and buildings literature.

We hope that the two areas of specialization, movable and immovable heritage, both struggling to find practical and effective methodologies for wise decision making, can continue to share concepts and, perhaps, begin to build coherent integrated approaches.

The example of the historic house museum

There is one classic dilemma of heritage risk management that already integrates collections and buildings: the problem of climate control for a collection in a historic house museum. Humidification in cold climates and air conditioning in hot climates both lead to wall condensation, then mould and building decay. There can be problems of staff health, public health, and litigation.

Although not framed until recently in a risk management perspective, there is a considerable literature available on the problem and numerous museum renovations that have foundered on the dilemma.

In an innovative series of meetings sponsored by organizations for conservators of collections (American Institute for Conservation) and conservators of buildings (Association for Preservation Technology International) in the 1990s, a series of ethical guidelines were developed for decision making in such situations, called the New Orleans Charter for Joint Preservation of Historic Structures and Artifacts. (Stovel and Taylor 1996) In effect, however, these guidelines only stipulate that the decision makers consider both the collection and the building, and that they balance preservation of the two, but they do not offer a method. Risk assessment is a suitable method.

Uncertainty and anxiety

Anxiety about all the uncertainty

Everyone who applies the method experiences moments of anxiety over the uncertainty inherent in it. Uncertainty enters many parts of the risk management approach, not just uncertainty in the sense that we cannot know exactly when chance events will strike, but also uncertainty about the future context, uncertainty about the rate of cumulative processes, uncertainty about which items are affected, uncertainty about value judgements, etc.

Some anxiety is just due to the newness of the method in our field and will diminish as more of us share experiences and as experts in preservation begin to adapt to its demands.

Risk experts in other fields have developed many ways to deal with uncertainty — some of which we have adapted for this manual.

At some point, one will also wonder whether spending even longer at gathering information, or waiting for the experts to give better answers, will yield a significantly better analysis, a significantly better decision. This is the problem of “bounded rationalism,” which means simply that we make decisions as best as we can, with the best information available. We cannot wait for the perfect decision — it never comes.

The method only informs decisions, it does not automate them

In the midst of writing up difficult assessments, it will be important to remember that the purpose of this method is not to automate the decisions, but to inform the decision makers as clearly and usefully as possible. If an assessment is difficult and uncertain, then the reasons for that uncertainty become a useful part of the report. One of the decisions may well be to devote more resources towards reducing that uncertainty, so that a better decision can be made later. In any case, it is essential that risk assessment explicitly addresses the existing uncertainty and clearly communicates it to the decision makers.

Why bother?

The alternative methods — making decisions based on generalized rules, or habits, or visible improvements in facilities — while much less anxiety-provoking, provide no clear connection to the preservation goal. If the generalized rules are indeed based on sound knowledge, then that knowledge can be used much more effectively within a risk management approach. If visible improvements are known indicators of meeting the preservation goal, then that same knowledge can be put to even better use by risk management. As much as possible, the Analyze section of this manual attempts to recast established preservation knowledge within the risk management framework.

The goal of heritage risk management

The goal of conservation

Traditionally, our goal can be stated as: Preserving our heritage assets as well as possible, at the same time as providing access as well as possible, given limited resources.

Developing a measurable goal

Risk-based decision making is built on the idea that one can use some notion of value to define the goal, and that one can make some kind of rational computation to quantify all the phenomena that jeopardize that goal.

The positive perspective

Risk management can be considered a special form of cost-benefit management. From the perspective of cost-benefit analysis, and taking the example of any resource, the goal is:

- To maximize the benefits of the resource over time, as measured at some specified point in the future, and for a given cost.

A similar though not identical goal states:

- To maximize the value of the resource, as measured at some specified point in the future, and for a given cost.

The negative perspective

From the negative perspective of risk management, we can restate the goal as:

- To minimize the loss of value to the resource, as measured at some specified point in the future, and for a given cost.

The practical goal of this manual

In practical terms, and in terms of a heritage asset, we can rephrase the goal as:

- To assess the risks to the heritage, and to act to reduce them as effectively as possible, given the available resources.

Although there are subtle differences between these four stated goals, (Michalski 2008) for the purposes of the ABC method, the last two will be our guides.

Limitations of any method

“Independent of the tool, there is always a need for a managerial evaluation and review, which sees beyond the results of the analysis and adds considerations linked to the knowledge and lack of knowledge that the assessments are based on, as well as issues not captured by the analysis.”

All management tools such as the ABC method are called decision-support tools rather than decision-making tools because they assist rather than automate decisions. On the other hand, consider this statement by an author who has studied extensively which risk assessment methods have or have not worked well for public health management:

“Only a few voices want to restrict scientific input to risk management…even participants from the lay public were not only willing to accept, but furthermore demanded that the best technical estimate of the risks under discussion should be employed for the decision-making process.”

Time horizon and the social discount rate

A measurable goal requires us to specify a particular future

- To minimize the loss of value to the asset, as measured at some specified point in the future, and for a given cost.

For risks due to very rare events or very slow cumulative processes, it does not matter which point in the future we use for measuring our goal — 3 years, 10 years, 100 years — we will measure the same magnitude of risk. For risks that are frequent or fast and which reach a point of maximum damage quickly, however, it does matter — the point in time we choose for measuring the goal will change the magnitude of the risk. This means that priorities might change between different types of risk.

For example, if some pristine coloured item is subject to complete fading in 10 years by the lighting in a new exhibit, then from the perspective of the viewers of the next 10 years, this fading may be the highest risk to the asset and a priority to treat, more than the risk from theft or fire. From the perspective of viewers 30 years or 100 years in the future, however, that fading damage will have stopped long ago, whereas the chance that the item is stolen or burns increases proportionally to time. They may want us to give priority to the fire and theft issues.

Modelling the total value over time

The qualifying phrase “at some specified point in the future” in all the goals is important. Measuring the goal at different points in the future can give different priorities of risk, leading to different decisions.

In mathematical formulations of the goal, the benefits or value are accrued not at a precise point in the future, but by using a diminishing weight over time, expressed through a curve known as the social discount rate. This curve models the balance between concern for the benefits of the current generation and a slowly diminishing concern for the benefits of future generations. In this manual, social discount rate will be kept in the background, but the methods presented in the analyze step and evaluate step do take it into account, and it will be brought forward when it influences the risk-based decisions. We will, however, tend to speak of the more recognizable concept of “time horizon” or “short-term goals versus long-term goals,” rather than “the influence of variable social discount rate.”

For further discussion of social discount rate see Michalski, 2008.

The equivalence of fractional loss with the chance of total loss

Definite fractional loss versus the chance of total loss

Consider two extremes in uncertainty — the chance of total loss due to a rare event versus a completely certain loss that is only partial.

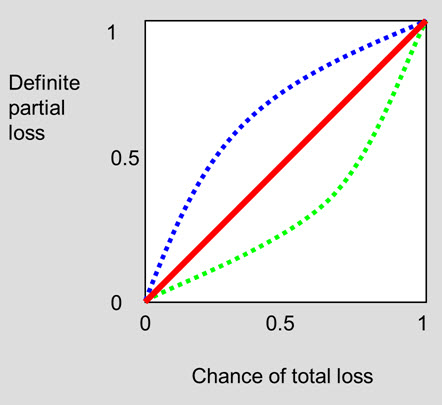

In Figure 3, one can plot the decision maker’s equivalence between definite partial loss and the chance of total loss. For example, what if one is offered a choice between a) a 50–50 chance of the heritage asset burning down in the next 75 years, and b) definite damage that will cause a loss of half the value of the heritage asset in 75 years. From the perspective of risk assessment, these two scenarios have the same magnitude of risk; they are equivalent. In Figure 3, the red line plots such equivalence. Someone who is “risk-averse” has an equivalence plot shown by the blue line: they prefer taking a definite 50% loss, rather than a 50% chance of losing everything. Someone who is risk-seeking (the green line) prefers to take a 50–50 chance of losing the whole heritage asset, rather than commit to definitely losing half of it.

© Government of Canada, Canadian Conservation Institute. CCI 96638-0023

Figure 3. Equivalence between definite partial loss and the chance of total loss. Red line: risk equivalence. Blue line: risk-averse judgements. Green line: risk-seeking judgements.

Description of Figure 3.

The X axis is chance of total loss from 0 to 1; the Y axis is definite partial loss also from 0 to 1. The line for equivalence is a diagonal straight line from the lower left corner (0,0) to the upper right corner (1,1). A blue line for risk-averse judgements starts at 0,0 and finishes at 1,1 but is curved above the diagonal, indicating that one perceives a 50-50 chance of total loss as equivalent to a 75% definite partial loss. Conversely, the green line for risk-seeking is curved below the diagonal, indicating that one perceives a 50-50 chance of total loss as equivalent to a 25% definite partial loss.

Are heritage organizations risk-blind or risk-seeking?

Part of our motivation for encouraging risk assessment in heritage organizations is our experience that they appear “blind” to risks such as fire and disasters when doing preventive conservation as compared to their full attention on slow cumulative processes, such as boxes that may be emitting acids (or not.) One might argue that this risk-blindness is a case of risk-seeking. This seems unlikely. It is more likely the general blindness problem Dörner (1996) has shown in his book The Logic of Failure, when people try to make decisions in complex systems that have either very slow feedback (in our case, very slow deterioration) or very infrequent feedback (in our case, rare disasters).

When rare events become cumulative processes

The whole notion of rare begins to diminish when one looks from the perspective of national and international agencies who advise thousands of heritage organizations. From this perspective, one sees fires, floods, major thefts, severe pest incidents, “freak” accidents, etc., on a routine basis, many events per decade, or even per year. Our obligation to provide the wisest advice to individual heritage organizations is coloured by our obligation to provide the wisest advice to all heritage organizations as a collective holding the heritage of all of us.

Summary list of tasks

1. Establish the context

- Task 1: Consult with decision makers. Define the scope, goals and criteria.

- Task 2: Collect and understand the relevant information.

- Task 3: Build the value pie.

2. Identify risks

- Task 1: Assemble the appropriate tools and strategies.

- Task 2: Survey the heritage asset and make a photographic record.

- Task 3: Identify specific risks, name them, and write their summary sentences.

3. Analyze risks

- Task 1: Quantify each specific risk.

- Task 2: Split or combine specific risks, as needed.

- Task 3: Review and refine the analyses.

4. Evaluate risks

- Task 1: Compare risks to each other, to criteria, to expectations.

- Task 2: Evaluate the sensitivity of prioritization to changes in the value pie.

- Task 3: Evaluate uncertainty, constraints, opportunities.

The risk assessment is now completed. The task may end here.

5. Treat risks

- Task 1: Identify risk treatment options.

- Task 2: Quantify risk reduction options.

- Task 3: Evaluate risk reduction options. An external consultant’s task may end here.

- Task 4: Plan and implement selected options.

One cycle of risk management is now completed.

Communicate and Consult

These activities are ongoing through all five consecutive steps above.

- Explain the risk-based approach if it is novel.

- Consult with experts and stakeholders, as well as colleagues.

- Make clear reports, clear graphs. Document the process thoroughly.

Monitor and Review

These activities are also ongoing through all five consecutive steps above.

- At each step, be prepared to go back and review a previous step.

- Review the risk reductions achieved by previous risk treatments.

- Coordinate future cycles within the existing cycles of the institution’s management.

Step 1: Establish the context

The three tasks for this step are:

- Consult with decision makers. Define the scope, goals and criteria.

- Collect and understand the relevant information.

- Build the value pie.

Tasks for the establish the context step

Task 1: Consult with decision makers. Define the scope, goals and criteria

Establish management support

This is an essential step in any organizational project, but especially for risk assessment because the method is unfamiliar, it asks difficult questions, and it involves many parts of the organization.

Communicate the method

Explain the risk management approach. Provide examples, resource materials, and presentations. Use graphs and tables from case studies as illustrations. Expect to do so throughout the assessment process.

Establish support for consultation with staff

Risk assessment requires access to staff knowledge. Some of this knowledge will be sensitive since it concerns security (such as discussions of anti-theft procedures) and some of it will be sensitive since it concerns failure of the organization to preserve its assets. It is essential to have clear management support for consultation within the organization. Different organizations can have very different cultures and very different agendas for the risk assessment.

Communicate before a site visit

External consultants can use correspondence prior to the actual site visit to establish many of these points. Use a written questionnaire.

Define the scope

In consultation with decision makers, establish the kind of risks that are within scope: a single risk, a fixed list of risks, or a comprehensive assessment of all risks.

Establish the target assets, which may include collections, historic buildings, and site components.

Define the goals of the project

Establish the organization’s goals for the risk assessment. Provide proposals for those unsure of what goals are possible.

Establish the time horizon

For most situations, a time horizon of 30 years is appropriate. If the scope of your task has other targets, such as a 100-year preservation mandate, or a 10-year management plan, establish which will be used to evaluate risks and to evaluate options.

Establish criteria for risk evaluation

After one has identified and analyzed risks, one will need to decide whether to do something about each one. Aside from obvious criteria such as regulations and costs, one will need guidance on what magnitude of risk is “acceptable.” It is helpful to know from the beginning of an assessment how the organization will balance use of the asset with risks due to that use.

Task 2: Collect and understand the relevant information

Key documents of the organization

These are essential to have in-hand:

- The organization's mission statement (may be called “Purpose,” “Goals,” “Mandate,” etc.)

- Statements of significance (or equivalent documentation) about the items within the scope of the assessment.

- Documentation about any value-based categorization that applies to the heritage asset being assessed.

When key documents do not exist

Build them during the risk assessment. It is common for the assessment process to uncover, and to make explicit, ideas about the heritage asset value that were previously unspecified.

Other policy documents

These are useful to have in-hand:

- Description of governance

- Policies concerning the target public

- Policies concerning use of the heritage asset

- Policies concerning preservation of the material heritage.

Operation and facility documents

These are useful to have in-hand:

- Organizational chart

- Financial documents

- Building plans

- Disaster plans

- Loan forms

- Incident registers

- Climate control records

- External suppliers of services and products that impinge on the material heritage

- Results of previous consultations.

External documents

These are useful to know about:

- National and international laws and other legal instruments regulating the use, protection, ownership, and control of cultural heritage

- Government policies and orientations concerning cultural heritage and risk management.

Communicate before a site visit

The questionnaire sent prior to the site visit should contain a request for all key documents listed above.

Task 3: Build the value pie

Communicate and consult extensively

Building the value pie requires extensive communication of the idea and goals behind it and extensive consultation to quantify the relative value of the groups and subgroups of items within the heritage asset.

Establish the boundaries of the heritage asset being assessed

Clarify which part of the heritage asset of the organization is within the scope of the risk management plan or of this particular assessment.

Identify the main "groups" within the asset

Make a list of the main categories or groups of items that constitute the heritage asset, e.g. Site, Building, and Collection. Groups often reflect organizational structure. For a small assessment, there may be only one group, e.g. Collections or Site.

Identify the “value subgroups” within each group

Divide each group of items into subgroups of similar value for the organization and its mandate, e.g. building elements A, building elements B, etc. If the organization already has established categories of value which apply to the heritage asset, use these as value subgroups, e.g. treasures, above average items, and average value items.

Make a draft of the value pie table

Make a first draft of the table containing the identified groups and their value subgroups. Account for all items in the heritage asset.

Define items and count them

Define clearly the individual items in each value subgroup, in whatever form makes sense for communication and for analysis. Count the number of items in each value subgroup.

Determine the relative values

Quantify the relative value of groups and value subgroups. The goal is to derive the fractional value of each item relative to the whole asset, e.g. each average painting holds 0.1% of the asset value.

Generate the value pie graphics

Create pie charts from the value pie tables (as shown in Figures 4 and 5). Discuss with stakeholders whether the relative size of segments in the value pies appear correct, and adjust the tables if necessary.

Besides the CCI Risk Management Database, spreadsheet software such as Microsoft Excel® or OpenOffice Calc can be used to automate calculations and to generate the corresponding pie chart(s).

Document the process

Document the entire process of building the value pie, in particular all justifications and arguments used to establish the relative values of the groups and subgroups.

Explanations for the establish the context step

Task scope and time horizon

Identify the purpose of your task

Your task might be a single risk analysis to support a specific conservation decision, or it might be comprehensive risk management to develop and implement cost-effective measures to treat the largest risks to your heritage asset over a number of years.

What is the scope?

Scope refers to the boundaries within which you will analyze, assess, or manage risks. The widest scope includes all possible risks to all items of the heritage asset, irrespective of their location or situation — on site, on exhibition, on-site and off-site storage, on loans, during transport, cataloged or not, etc. It will probably require the expertise of many professionals and the responsibilities and authorities of all layers of the organization. In many cases, however, the scope will be limited to a certain set of risks and/or to a specific portion of the heritage asset, e.g. the management of theft and mechanical damage risks during a travelling exhibition of ceramic items, or the risks to an archaeological site from flooding during the next year.

Tasks with narrower scope will likely be less demanding in terms of expertise, degree of organizational involvement, time, and resources. In any case, it is necessary to discuss and define the roles and responsibilities of the different people and parts of your organization participating in the task and to agree upon what will be its deliverables or products.

Which time horizon do you consider?

Consider the time horizon in relation to the risks which will be analyzed, assessed, and managed. Using different time horizons (for instance, 3, 10, 100, or 300 years into the future) will change the magnitudes of some risks and possibly the priorities in treating them. Selecting a given time horizon means that you have decided to measure risks from the perspective of that moment in time when the asset is “handed over” to future owners.

Mandate, policies, and procedures of the organization

What is the organization’s mandate?

The organization’s mandate (or mission statement) contains the official instructions about the purpose and core responsibilities of the organization, including clear statements about what to preserve and how to use the heritage asset. It serves as a reference within the organization to judge the significance of these items — individually, in relation to each other, and in relation to items not belonging to the heritage asset. It also guides decisions about acquisitions, access, insurance, etc.

Find the policies and procedures that can guide and support your task

Policies are written statements that communicate management’s intent, objectives, requirements, responsibilities, and/or standards concerning the activities of the organization. Procedures describe how each policy will be put into action within the organization. The presence or not of effective policies and procedures will influence many risks to your heritage asset, through activities such as collection management (acquisition, documentation, conservation, lending, deaccessioning), building and site management, user access, public safety and security, disaster preparedness, and insurance.

Coordinate with existing risk systems

There are usually established systems inside and outside the organization that “manage” particular risks to the heritage asset. Each tradition of “risk management” or “security” will speak a different technical dialect and may be wary of collaboration, but they can be an essential source of information for risk assessment, as well as part of an integrated risk management plan.

Legal context

How does the legal context affect risks?

The legal context includes the laws by which your organization and its operation are bound — national and international laws and other legal instruments regulating the use, protection, ownership, and control of cultural heritage. Pay extra attention if the scope of your task includes legally sensitive issues like access to information held by public bodies, first nation or indigenous heritage, illicit traffic, international loans or trade, human rights, and intellectual property.

An international database

An online UNESCO Database of National Cultural Heritage Laws offers access to both national and international legislation related to cultural heritage.

Financial context

Questions

- Is there a conservation/preservation budget in your organization?

- How big and flexible is it?

- How and by whom is it implemented and managed?

- What is the financial value of your heritage asset?

- How is the financial situation in the heritage sector in your country?

- What financial changes, challenges, and opportunities do you expect for the future?

Understand your planning cycle

Understanding how your organization plans and operates financially will put you in a better position to assess risks, to develop risk treatments, and to obtain the funds necessary to implement them.

Especially for implementation of ongoing or long-duration tasks, it is important to incorporate their budgetary requirements into the overall, long-term financial plan of the organization. If necessary and possible, look for extra-budgetary funding opportunities within the financial context of your task.

Governance context

What is the governance context?

Finally, it is important to know how your risk-based task relates to and fits into the policies and orientation of your government towards culture and heritage, as well as into the policies concerning the use of risk management as a tool to improve the performance of government organizations. This is particularly relevant if your organization is a government agency or part of one. Understanding this context and adapting to it provides an effective way to obtain governmental support and to find synergies and develop collaboration with governmental agencies for the implementation of your task.

Contexts change over time

As with all elements of context, the legal, financial, and governmental frameworks are dynamic and will change with time. Keep in mind that it is necessary to keep monitoring and reviewing the context of your risk-based task in order to make the necessary adjustments to allow its successful implementation.

Stakeholders

Who are they?

Any person or organization who can be impacted by or cause an impact (positive or negative) on the activities of your organization and, in particular, on your risk-based task should be considered. These persons and organizations are referred to as stakeholders. They can be both internal and external to your organization. Internal stakeholders include, for instance, the directors, employees, and managers in different layers and departments of the organization, the board of trustees, and shareholders. The organizational chart is a useful tool to help identify internal stakeholders and their hierarchical structure within the organization. External stakeholders include the public and (local) communities related to the heritage asset, tourists, scholars, donors and sponsors, external suppliers of services and products, government agencies, etc.

How do they affect your task?

The impact of stakeholders on your risk-based task will depend on their level of power, influence, interest, and support concerning the task. As you proceed with the identification of stakeholders, it is useful to assign priorities to them according to their importance to the task ahead. Several techniques of Stakeholder Analysis and Mapping are available to help do that, e.g. the article in Wikipedia on Stakeholder analysis.

Engage them

Stakeholders in your heritage asset might perceive risks and their magnitudes differently because of different needs, interests, value systems, assumptions, concepts, etc. Since they can have a significant impact on the risk-based decisions to be made, it is important to develop cooperation between the main stakeholders and the risk assessment team. This includes understanding, discussing, and incorporating their input into the process; involving and engaging them to support risk management strategies by indicating their benefits, costs, etc. Failure to identify and involve major stakeholders from the beginning and throughout your risk-based task will jeopardize its successful implementation.

The value pie: Introduction

Why a value pie?

Most of us, and most organizations, have always applied more care to “more valuable” things. The value pie is just a pie chart that shows us how value is distributed throughout the heritage asset.

Risk management must take into account differences in relative value if one is to allocate resources wisely.

What values?

For purposes of this method, “value” is a single parameter that equates to relative significance, or relative importance, of the item. It takes into account and encompasses all component values identified as relevant by the organization and other stakeholders, such as aesthetic, historical, spiritual, etc. The primary guidance to quantify the relative value of items for risk management purposes will be the organization's mandate and the judgements of stakeholders.

Isn’t quantification of heritage value meaningless?

The value pie is not a measure of absolute value. It is not about precise numbers. It is about quantifying, as best we can, the shared feeling that some things are more important than others, so that the priorities established by the risk assessment reflect this feeling. Often, it is simply about specifying what things are similar in value: is a box with 1000 photographs in an archive of 100,000 photographs similar in value to one painting in the collection of 100 paintings?

Don’t values change over time?

Yes. The value pie is not a permanent judgement. It only serves the purposes of this particular risk management cycle. It can and should be modified to reflect changes in value assessments over time.

Use tools to automate calculation

The manual provides examples of the value pie tables, and later their use during analysis, so that a reader can understand the calculation and even perform the calculations manually if necessary, but it is recommended that one use spreadsheet software such as MS Excel® or OpenOffice Calc or the CCI Risk Management Database to make the tables and the value pie graphic.

Use the value pie for visual guidance

The value pie has been developed through experimentation with various groups of students and users. All pie charts take advantage of our ability to understand and judge the relative size of pieces in relation to each other and to the whole. For most people, such diagrams are much more meaningful than numbers. Automated spreadsheets or databases plus a projector allow stakeholders to explore various settings of the pie chart numbers, to see which one “looks about right.”

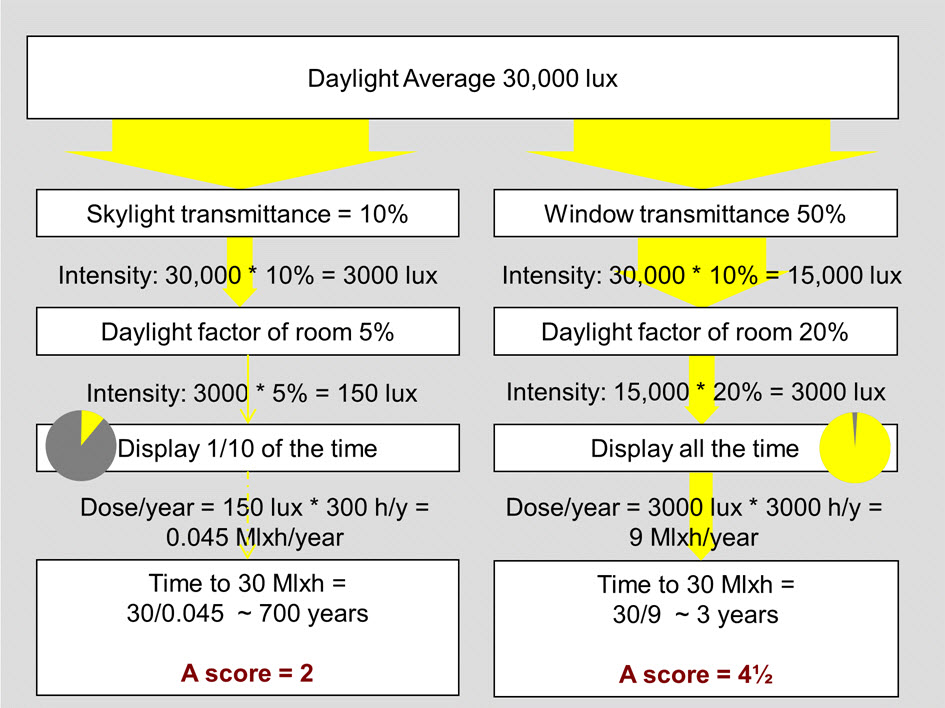

The value pie: Setting up the table

The asset

The “asset” refers to the whole heritage asset. The example provided is for an asset that has a site, a building, and various collections of artifacts.

Groups

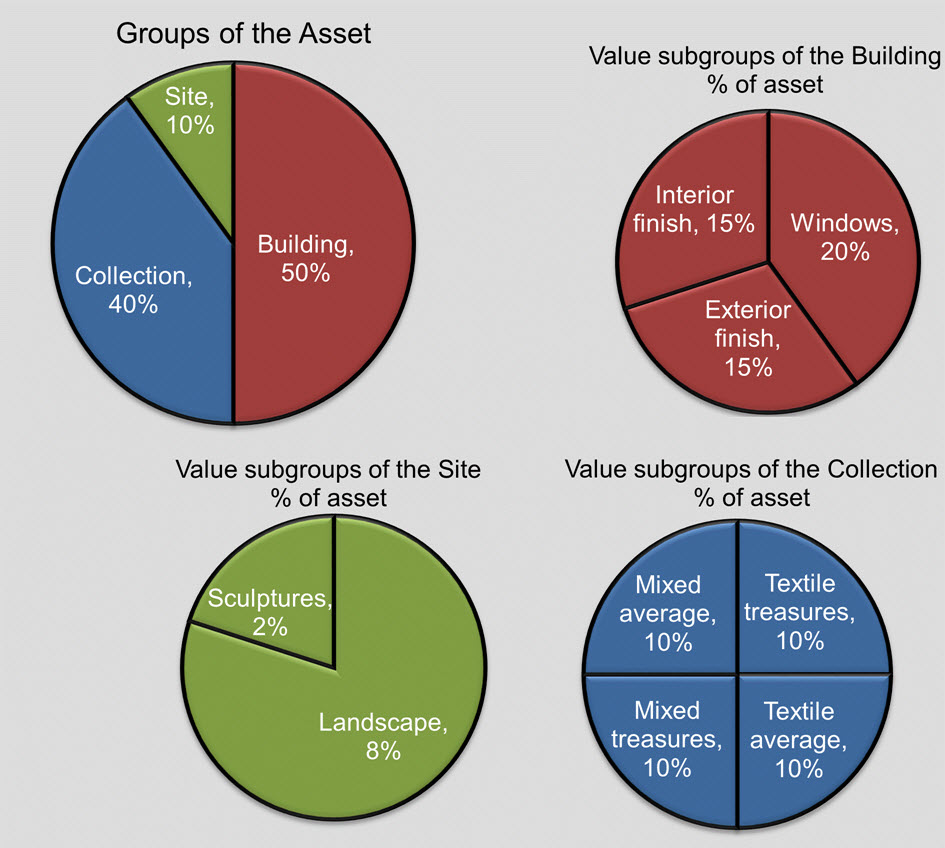

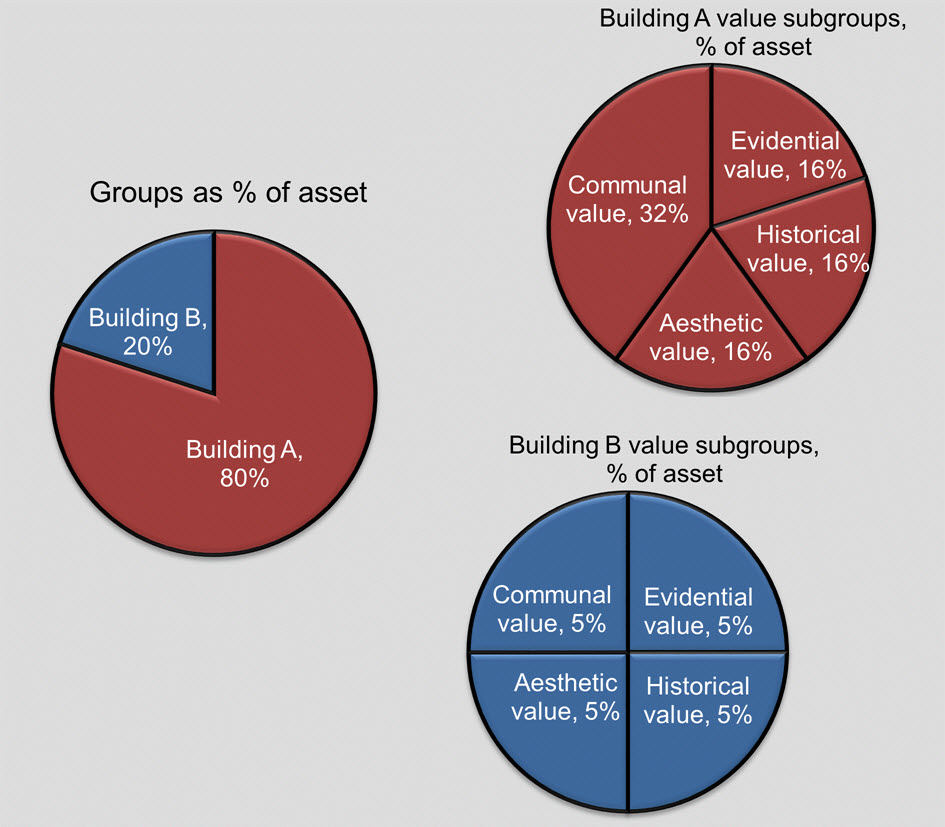

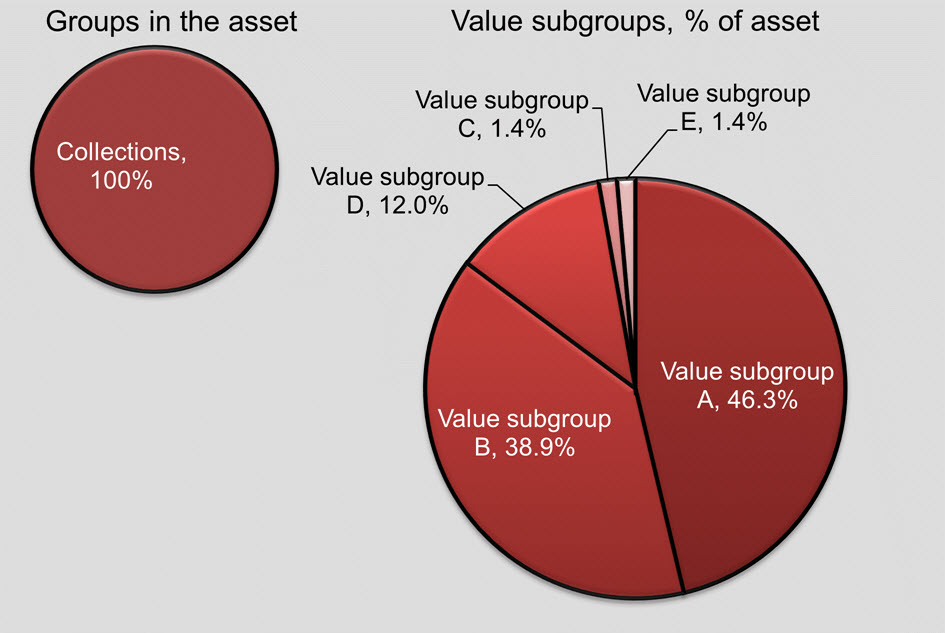

Groups are the first level of division of the asset. In the example of Table 1 and Figure 4, there are three groups: Building, Collections, Site. These have been assigned 50%, 40%, and 10% respectively.

Value subgroups and item count

Value subgroups contain items of equal, or nearly equal, value. In the example of Table 1 and Figure 4, the Collections group has been divided into 4 value subgroups: “Textile treasures” containing 6 items; “Mixed treasures” with 4 items; "Textiles, average" with 1200 items; and "Mixed, average" with 10,000 items. These have been assigned equal slices of the value pie of the Collections group, 1/4 or 25% each. Note that the number of items in each value subgroup is not the same.

The Building group has been divided into 3 value subgroups: 12 windows of equal value (representing together 40% of the value of this group), 1 exterior finish (30%), and 1 interior finish (30%).

The two value subgroups identified within the Site group are: 14 sculptures of equal value (representing together 20% of the value of the site group), and 1 landscape (80% of the site group).

During risk analysis, if necessary, it will be possible to consider different fractions of the interior or exterior finish of the building when analysing different specific risks (similarly for landscape in the Site group.)

Item as a % of the asset

The final column of the Value Pie Table is a key parameter for risk analysis and must always be checked for consistency in order to validate and, if necessary, adjust the % values assigned to the different groups and subgroups. It is the value of each item expressed as a fraction (%) of the whole asset.

In the example, the collections have many more items, but since the Collections group has been assigned equal value to the Building group, each “mixed average” item in the Collections group carries only a very small fraction of the entire asset value, about 0.008%.

On the other hand, each window of the building represents about 1.7% of the value of the whole asset; in other words, each window is valued as equivalent to ~200 of the “mixed average” items in Collections. It can be confusing at first to see such large ratios between items, but they arise simply because groups with very different numbers of items have been given similar total value.

If these results don’t “feel right,” then experiment with the fractions assigned to groups and subgroups. Look for consistency with the organization’s mandate and the judgement of stakeholders. In this example, the ratio is correct because these few windows are essential to the building, and the building is more important than the collection.

| Group | Group as % of the asset | Subgroup | Number of items in the value subgroup | Value subgroup as % of its group | Value subgroup as % of the asset | Each item as % of the asset |

|---|---|---|---|---|---|---|

Building |

50% |

Windows |

12 |

40% |

20% |

1.7% |

Building |

50% |

Exterior finish |

1 |

30% |

15% |

15% |

Building |

50% |

Interior finish |

1 |

30% |

15% |

15% |

Collections |

40% |

Textile treasures |

6 |

25% |

10% |

1.7% |

Collections |

40% |

Textiles, average |

1200 |

25% |

10% |

0.008% |

Collections |

40% |

Mixed treasures |

4 |

25% |

10% |

2.5% |

Collections |

40% |

Mixed, average |

10,000 |

25% |

10% |

0.001% |

Site |

10% |

Landscape |

1 |

80% |

8% |

8% |

Site |

10% |

Sculptures |

14 |

20% |

2% |

0.14% |

© Government of Canada, Canadian Conservation Institute. CCI 96638-0025

Figure 4. Value pies for an asset with three groups and several value subgroups (derived from Table 1).

Description of Figure 4.

There are four pie charts, one large and three small. The large pie chart shows three pieces representing the building at 50% of asset value, the collection at 40% of asset value, and the site at 10% of asset value. The three smaller pie charts show the value subgroups within each of these three pieces, with the same percentages as defined in Table 1 under value subgroups.

The value pie: Using value categories

When value categories exist already

Your organization, or your nation, may already have a system for classifying cultural heritage items into different levels of value, according to predefined criteria. For example, the U.S. Library of Congress has established five levels of value for its collections, named after precious metals:

- Platinum: irreplaceable of the highest intrinsic value

- Gold: significant cultural, historical or artifactual importance

- Silver: materials at increased risk of theft or damage due to fragility

- Bronze: little or no significant cultural, historical or artifactual importance, generally replaceable

- Copper: materials held temporarily

(Hamburg 2000, p. 68)

If this is your situation, use the existing classifications to construct your value pie. In our experience, however, such classification systems are not often in place, and the assessor becomes the first to propose one.

When curatorial categories may apply