Archived - Departmental Plan 2017–18

I am pleased to present the 2017–18 Departmental Plan for the Department of Finance Canada. This report replaces the former Report on Plans and Priorities and provides parliamentarians and Canadians with information on the various fiscal and economic policies that contribute to our shared economic and social goals and that are helping to steer Canada toward a more prosperous, inclusive and sustainable economic future. The report also provides detailed information on how the Department of Finance Canada will use its resources to contribute to a strong economy and sound public finances for Canadians, focusing on four priority areas:

- Sound fiscal management to ensure that the revenue to support investments in Canadian social and economic priorities is raised and spent in a fair, responsible and efficient way;

- Sustainable economic growth to create the conditions necessary for strong, inclusive, sustainable, long-term and clean economic growth, thereby increasing Canadians’ standard of living and well-being;

- Sound social policy framework to support the government’s efforts to promote equality of opportunity for all citizens across the country and to meet the government’s priorities for promoting jobs and economic growth; and

- Effective international engagement to contribute to the stability of the global economy, maintain secure and open borders, strengthen inclusive global growth, and support the stability of the global financial sector.

In the past year, we made considerable progress in strengthening the middle class and creating economic opportunities for all Canadians. Major milestones included cutting taxes for the middle class, introducing a new Canada Child Benefit, reaching agreement on an enhanced Canada Pension Plan, and taking bold action to generate economic growth through targeted investments of over $180 billion in infrastructure, including plans to create the new Canada Infrastructure Bank.

As Minister of Finance, my overarching goal is to use the fiscal tools at my disposal to guide Canada’s economy and to vigorously pursue the idea that a healthy economy starts with a strong and growing middle class. Over the coming year, we will remain focused on supporting middle-class jobs by promoting strong, sustainable growth. When the middle class does well, everyone does well. That is why the Government of Canada is committed to making smart and necessary investments that will revitalize the Canadian economy, spur long-term growth and strengthen the middle class.

The Honourable William F. Morneau, P.C., M.P.

Minister of Finance

The Department of Finance Canada’s plans and activities for 2017–18, which include commitments stemming from the Minister’s mandate letter, focus on four priority areas:

Sound fiscal management

Ensure effective management of the economic and fiscal framework, including responsible management of the federal budget and the federal debt, and advise on measures to enhance the competitiveness, efficiency, fairness and simplicity of Canada’s tax system.

- Continue to ensure a sound economic and fiscal framework through a fiscal management approach that is realistic, sustainable, prudent and transparent.

- Develop options to protect the revenue base and follow up on the review of tax expenditures to rationalize poorly targeted and inefficient measures.[1]

- Efficiently manage the federal government’s currency, debt and international reserves.

The Department will focus on sound fiscal management to ensure that the revenue to support investments in Canadian social and economic priorities is raised in the most fair and efficient way possible. Actions in this area support financial stability, sustainable growth, competitiveness and economic prosperity and ensure fairness toward future generations.

Sustainable economic growth

Continue to play a leadership role in putting in place policies that encourage business growth and innovation, facilitate workforce participation and training, ensure opportunities and gains from growth are broadly shared, and contribute to a sound financial system.

- Evaluate and provide advice on the international competitiveness of Canada’s corporate tax system.

- Review and refine the financial sector policy framework to continue to align it with the objectives of financial stability, competition and utility.

- Support the Government of Canada’s economic agenda by providing evidenced-based analysis, research and advice on potential initiatives in various economic sectors.[1]

The Department will focus on creating the conditions necessary for strong, inclusive, sustainable, long-term and clean economic growth, thereby increasing Canadians’ standard of living and well-being.[1] Actions in this area also support financial stability and maintain the safety and soundness of the financial system.

Sound social policy framework

Manage the major transfer programs to provinces and territories, and continue to work with departments and other central agencies to develop policy proposals that are consistent with, and deliver on, the government’s social policy priorities.

- Collaborate with officials at Indigenous and Northern Affairs Canada on establishing a new fiscal relationship with First Nations communities.[1]

- Ensure that the major transfer programs are sustainable and effective for all Canadians.

- Organize and convene the next Finance Ministers’ Meeting to discuss issues of shared interest.[1]

The Department will focus on ensuring a sound social policy framework to support the government’s efforts to promote equality of opportunity for all citizens across the country and to meet the government’s priorities for promoting jobs and economic growth. Actions in this area also respond to current and emerging issues related to social policy and major transfer payment programs.

Effective international engagement

Advance Canada’s leadership internationally by promoting a durable economic recovery.

- Play a leadership role through Canada’s 2018 G7 presidency and role as co-chair of the G20 Framework for Strong, Sustainable and Balanced Growth Working Group.

- Advance and implement Canada’s trade policy framework, including bilateral, regional and multilateral trade negotiations.[1]

- Engage with domestic and international institutions to support international assistance and development.[1]

The Department will focus on effective international engagement to contribute to the stability of the global economy. Actions in this area aim to maintain secure and open borders, strengthen inclusive global growth, and support the stability of the global financial sector.

For more information on the Department of Finance Canada’s plans, priorities and planned results, see the “Planned results” section of this report.

The Department of Finance Canada contributes to a strong economy and sound public finances for Canadians. It does so by monitoring developments in Canada and around the world to provide first-rate analysis and advice to the Government of Canada and by developing and implementing fiscal and economic policies that support the economic and social goals of Canada and its people. The Department also plays a central role in ensuring that government spending is focused on results and delivers value for taxpayer dollars. The Department interacts extensively with other federal organizations and acts as an effective conduit for the views of participants in the economy from all parts of Canada.

Created in 1867, the Department of Finance Canada was one of the original departments of the Government of Canada and had as its primary functions bookkeeping, administering the collection and disbursement of public monies, and servicing the national debt. Today, the Department helps the Government of Canada develop and implement strong and sustainable economic, fiscal, tax, social, security, international and financial sector policies and programs. It plays an important central agency role, working with other departments to ensure that the government’s agenda is carried out and that ministers are supported with high-quality analysis and advice.

The Department’s responsibilities include the following:

- Preparing the federal Budget and the Fall Economic Statement;

- Preparing the Annual Financial Report of the Government of Canada and, in cooperation with the Treasury Board of Canada Secretariat and the Receiver General for Canada, the Public Accounts of Canada;

- Developing tax and tariff policy and legislation;

- Managing federal borrowing on financial markets;

- Designing and administering major transfers of federal funds to the provinces and territories;

- Developing financial sector policy and legislation; and

- Representing Canada in various international financial institutions and organizations.

The Minister of Finance is accountable for ensuring that his responsibilities are fulfilled both within his portfolio and with respect to the authorities assigned through legislation.

The Department of Finance Canada leads the government priority of “Growing the middle class” and supports the following three government priorities:

- Economic growth through innovation;

- Increased and diversified international trade and foreign direct investment; and

- Effective action on climate change.

For more general information about the Department, see the “Supplementary information” section of this report. For more information on the Department of Finance Canada’s organizational mandate letter commitments, see the Minister’s mandate letter on the Prime Minister of Canada’s website.

Overall, the global economic situation remains fragile as weak and uneven growth continues to prevail in most advanced economies. Emerging economies (the main driver of global growth) face important risks as they transition toward more moderate consumption-based growth. At the same time, the rise of anti-globalization sentiment raises risks related to an increasing trend toward protectionism. In this uncertain and low-growth global environment, financial markets have been marked by periods of volatility.

Domestically, the Canadian economy is continuing to adjust to weak global economic prospects and low commodity prices. Non-oil-related sectors of the economy have been broadly resilient, and household consumption remains solid. Although business investment and exports remain subdued, both are poised to improve as global demand firms and the dollar remains low. Overall, private sector economists expect economic growth to average slightly less than 2% per year over the 2016 to 2020 period, broadly reflecting the combined impacts of an aging population, weak productivity growth and soft business investment.

Over the planning period, the Department of Finance Canada will need to respond to current and emerging economic, social, fiscal, tax and financial sector policy issues in a way that contributes to the sound management of Canada’s economy. The Department will continue to foster international economic policy coordination, contribute to international efforts to mitigate and prevent economic crises, and manage the allocation of scarce fiscal resources. The complex and horizontal issues with which it is tasked require ongoing discussions, consultations and coordination with central agencies, other departments and governments, and external stakeholders. In this context, the Department of Finance Canada will need to maintain high-level engagement and strong collaborative relationships with domestic and international partners to fulfill its commitments and deliver for Canadians.

The Department operates in an environment where decisions and actions by its employees can have far-reaching impacts on the Canadian public and economy. As a knowledge-based organization, the Department recognizes that its employees are its strength. The Department will continue to focus on providing its employees with a healthy and enabling work environment so that it can attract, develop and retain a high-performing workforce that is fully committed to the success of the organization.

The Department of Finance Canada will identify opportunities for experimentation in new approaches that seek to produce improvements in the Department’s ability to deliver on plans and priorities. In support of this commitment, the Department will foster a work environment that is conducive to experimentation, innovation and intelligent risk-taking and identify program funds devoted to these activities. The Department will use its existing integrated planning process to ensure that commitments to experimentation and innovation are identified and funded; risks and opportunities are assessed; performance is monitored and measured; lessons learned are shared; and results are disseminated. The integrated planning process is in place to ensure a systematic, transparent and fully documented approach to departmental decision making and resource allocation, through the organization and its formal governance structure.

The Department of Finance Canada’s plans and commitments respond to, and are shaped by, changes in the global economic situation and the Canadian outlook. The Department relies on the skills and experience of its employees to detect, monitor and respond to changes in the operating environment. The Department continues to focus on employee development, particularly strengthening analytical capacity. The Department also relies on close and effective collaborative relationships with partners and stakeholders to establish priorities, provide high-quality analysis, and ensure coordinated responses to urgent issues.

Planned activities in support of the Department’s objectives are also vulnerable to information technology issues. The Department relies on efficient and effective information management and technology to deliver informed policy advice and operate as an agile and responsive knowledge-based institution, while protecting its highly sensitive institutional information. Cybersecurity incidents and failures in supporting systems have been identified as risks that could cause serious disruptions and affect the Department’s ability to execute critical government operations, including tax and transfer payments, and public debt-related transactions. A Business Continuity Plan is in place to ensure that critical payments are maintained in case of a system failure. Further, the Department is committed to building on recent improvements to increase the security posture of its information technology (IT) infrastructure and ensure the effective protection of its information assets.

Consistent with the Department of Finance Canada’s Corporate Risk Profile, the following table describes five top risks that may have an impact on the Department’s plans and priorities for 2017–18 and presents the Department’s risk response strategies to mitigate these risks.

Risk 1: There is a risk that the Department will not have the infrastructure, resources and authorities needed to meet urgent challenges, nor the ability to ensure effective coordinated action by responsible agencies to address a situation affecting the soundness, integrity and reputation of the Canadian financial system.

- Continue training and development of personnel and the recruitment of personnel with specialized knowledge.

- Monitor the use and effectiveness of legal authorities to ensure that they meet the stated objectives and, where appropriate, address unforeseen events by proposing new authorities.

- Promote prudent investment and risk limits, and undertake daily monitoring of financial market activities and risks and regular external evaluation of treasury operations.

- Examine new initiatives that may be needed to respond to the evolving economic situation, conduct analysis on a broad range of financial sector issues, and develop legislative and regulatory proposals related to financial sector statutes.

- Ensure close cooperation with the Bank of Canada, the Office of the Superintendent of Financial Institutions Canada, the Financial Consumer Agency of Canada, the Canada Deposit Insurance Corporation, other government departments and international partners, to scrutinize economic developments and key indicators that might foreshadow problems.

1.1 Economic and Fiscal Policy Framework

1.3 Treasury and Financial Affairs

Internal Services

Sustainable economic growth

Risk 2: There is a risk that ongoing uncertainty and volatility in the global economy will challenge the Department’s ability to provide accurate strategic advice and policy recommendations.

- Continue to monitor high-frequency indicators to provide the most up-to-date information on the speed of the recovery.

- Conduct private sector surveys of the Canadian economic outlook, and assess potential risks.

- Continue to meet regularly with leading private sector economists to discuss the economic outlook and whether the average private sector economic forecast represents a reasonable basis for budgetary planning.

- Provide policy options to the Minister given expected economic conditions.

1.1 Economic and Fiscal Policy Framework

Sound fiscal management

Sustainable economic growth

Sound social policy framework

Effective international engagement

Risk 3: There is a risk that a failure in supporting systems and processes will impact the timely and accurate delivery of tax and transfer payments to provinces, territories and Aboriginal governments, as well as public debt-related transactions.

- Ensure that a Business Continuity Plan (BCP) is in place, and regularly updated, to ensure that tax and transfer payments to other jurisdictions are maintained in case of a failure of supporting systems.

- Ensure that remote access is available to key employees, and ensure that key employees are aware of the BCP’s alternate work site in case of a building failure. Train additional staff as a backup to ensure that payments are maintained.

- Use the previous month’s tax payments and transfer payments rather than the most current estimate, and make adjustments following renewal of normal business operations.

- Store backup copies of critical files off-site.

1.1 Economic and Fiscal Policy Framework

1.2 Transfer and Taxation Payment Programs

1.3 Treasury and Financial Affairs

Internal Services

Sound fiscal management

Sound social policy framework

Risk 4: There is a risk that failed transactions or financial losses will negatively impact the government’s financial position and capacity to meet financial requirements.

- Manage counterparty credit risk within prudent limits, using collateral frameworks where possible.

- Maintain prudent debt issuance strategies (for example, distribution across various maturity sectors, broad investor base, well-functioning government securities markets).

- Maintain sufficient prudential liquidity to manage expected requirements during operational disruptions.

- Maintain prudent investment strategies (for example, diversification, high credit quality counterparties) for liquid financial assets.

1.1 Economic and Fiscal Policy Framework

1.3 Treasury and Financial Affairs

Internal Services

Sound fiscal management

Risk 5: There is a risk that unauthorized IT network access or disruptions will impact the Department’s reputation and its ability to provide policy and advice and execute critical government operations.

- Initiate, in collaboration with Shared Services Canada, the execution of the departmental approach aimed at increasing the security posture of the dual network, desktops and applications.

- Continue to align with Government of Canada IT modernization initiatives, such as Data Centre Consolidation.

- Assess opportunities, in collaboration with Shared Services Canada, to implement additional IT security controls resulting from the departmental threat assessment.

- Develop and implement a departmental IT Security Policy Framework, including strengthening departmental security governance, as well as additional IT security controls resulting from the departmental threat assessment.

- Implement other IT security measures as necessary.

1.1 Economic and Fiscal Policy Framework

1.2 Transfer and Taxation Payment Programs

1.3 Treasury and Financial Affairs

Internal Services

Sound fiscal management

Sustainable economic growth

Sound social policy framework

Effective international engagement

Description

This Program is the main source of advice and recommendations to the Minister of Finance, other ministers and senior government officials on issues, policies and programs of the Government of Canada in the areas of economic, fiscal and social policy; federal-provincial relations; the financial sector; taxation; and international trade and finance. The Program ensures that ministers and senior government officials can make informed decisions on economic, fiscal and financial sector policies, programs and proposals. Ultimately, the Program contributes to building a sound and sustainable fiscal and economic framework that generates sufficient revenues and aligns the management of expenditures with the Budget Plan and the financial operations of the Government of Canada.

Planning highlights

The Department of Finance Canada will continue to ensure a sound economic, social, fiscal and financial policy framework. The Department will assess Canada’s current and future economic conditions to formulate first-rate economic policy advice and to provide the basis for accurate fiscal planning. To make government accounting and financial reporting more consistent, transparent and understandable to Canadians, the Department will expand and refine its forecasting techniques, in collaboration with the Treasury Board of Canada Secretariat.[2]

In 2016, the Government of Canada introduced a new Canada Child Benefit (CCB), a tax-free monthly payment made to eligible families. The CCB is simpler, more generous and better-targeted than the previous system of child benefits it replaced. The Department of Finance Canada will work with Employment and Social Development Canada to study the impact the benefit has on key outcomes such as opportunities that families have to save, to enhance their own financial security, and to invest in their children.

The Department will support strong fiscal management by developing recommendations aimed at improving the fairness, neutrality, efficiency and simplicity of the tax system, including through actions that protect the revenue base, and will follow up on the review of tax expenditures to rationalize poorly targeted and inefficient measures.[2] The Department will work with Employment and Social Development Canada to monitor the impact of the Canada Child Benefit on families with children. To help ensure that economic growth is environmentally sustainable, the Department will provide support for the implementation of the Government of Canada’s pan-Canadian approach to pricing carbon pollution.[2]

The Department will support the implementation of the new multilateral standard for the automatic exchange of tax information and a new system of country-by-country reporting for large multinational enterprises. It will continue to negotiate and re-negotiate international tax treaties to promote trade and investment and reduce the risk of double taxation in accordance with Canadian tax treaty policy. The Department will continue to monitor corporate tax changes by Canada’s key competitors to evaluate and provide advice on the international competitiveness of Canada’s corporate tax system.

The Department will work toward the implementation of the government’s agenda in several economic sectors, such as agriculture, fisheries and clean technology, to provide high-quality and timely analysis and advice on the fiscal and economic implications of sectoral, regional and microeconomic programs and policy issues.[2] The Department will also assist in implementing policies related to the new Innovation Agenda. In addition, the Department will work with Infrastructure Canada to develop the Canada Infrastructure Bank. The establishment of the Canada Infrastructure Bank was announced in the Fall Economic Statement 2016. Legislation to establish this entity will be developed in 2017.[2] The Department will also continue to provide advice on the prudent and effective fiscal management of the government’s corporate assets.

The Department will promote measures that support strong sustainable growth, with attention to policies that facilitate investment in social programs. To ensure that social programs remain sustainable and effective for Canadians, the Department will continue to collaborate with departments and central agencies to review policy proposals that are consistent with, and deliver on, the government’s priorities in areas such as labour markets, Indigenous and Northern issues, justice, public safety, health, arts and culture, and income security. In particular, the Department will collaborate with officials at Indigenous and Northern Affairs Canada on establishing a new fiscal relationship with First Nations communities, including lifting the 2 per cent cap on annual funding increases.[2] The Department will also work with provinces and territories, the joint stewards of the Canada Pension Plan, on issues related to retirement income, as part of the Triennial Review process.[2]

A sound, efficient and competitive financial sector provides a solid foundation to ensure that the savings and investment needs of individuals, businesses and the economy as a whole are met. The Department will review and continue to refine the financial sector policy framework to align it with the objectives of financial stability, competition and utility. In so doing, the Department will provide advice on a range of financial sector policy issues, including a review of the financial institution statutes, measures to inform and protect consumers of financial products and services, the system of domestic housing finance, the oversight of payment systems, pensions and anti-financial crime policy frameworks. In addition, the Department will support Canada’s international financial services trade and investment interests. The Department will also continue efforts to finalize and implement the G20-led financial sector reforms to realize the benefits of a more sound and resilient global financial system.

The Department will continue to support the government’s leadership role internationally in supporting inclusive growth and development. The Department will continue to provide advice on economic cooperation matters that arise through the G7, the G20 and international financial institutions. The Department will prepare for Canada’s role as chair of the G7 in 2018 and will continue to co-chair the G20 Working Group responsible for steering the Framework for Strong, Sustainable and Balanced Growth. The Department will support bilateral, regional and multilateral trade negotiations and will pursue efforts to advance and implement Canada’s trade policy framework in a manner that encourages inclusive trade growth. As necessary, the Department will work with officials in the departments of Innovation, Science and Economic Development and International Trade to develop appropriate investments and strategies for specific sectors to adjust to Canada’s participation in free trade agreements.[2] To support the global development and trade environment, the Department will continue to work on a policy and funding framework to guide Canada’s aid decisions.[2]

The Department’s planned activities respond to complex and horizontal issues that require ongoing discussions, consultations and coordination with central agencies, other departments and governments, and external stakeholders. The Department will need to maintain high-level engagement and strong collaborative relationships with domestic and international partners to succeed in fulfilling its commitments and delivering for Canadians. Furthermore, the Department will continue to strengthen analytical capacity, which has been key in ensuring that the Minister and senior officials are equipped to make informed decisions.

Planned spending for 2017–18 to 2019–20 is expected to remain relatively stable, with minor decreases attributable to sunsetting items. Requirements for full-time equivalents are also projected to remain stable for the next three years.

Planned results

| Expected results | Performance indicators | Target | Date to achieve target | 2013–14 Actual results | 2014–15 Actual results | 2015–16 Actual results |

|---|---|---|---|---|---|---|

| A sound economic, social, fiscal and financial policy framework. | Percentage of leading international organizations and major ratings agencies that rate Canada’s economic, social, fiscal and financial policy framework as favourable. | 80% | 2017–18 | Not available* | 100% | 100% |

| Ministers and senior government officials are equipped to make informed decisions on economic, fiscal and financial sector policies, programs and proposals. | Percentage of recommendations/agreed-upon areas for improvement following audits and/or evaluations that are on track or have been implemented within the planned time frames. | 100% | 2017–18 | Not available* | 87.5% | 100% |

| Percentage of recommendations/agreed-upon areas for improvement following the annual federal budget post-mortem process that were implemented. | 100% | 2017–18 | Not available* | 100% | 100% | |

| * The Department changed its Performance Measurement Framework in 2014–15. Consequently, actual results for the current performance indicators are not available for fiscal years before 2014–15. | ||||||

Budgetary financial resources (dollars)

| 2017–18 Main Estimates |

2017–18 Planned spending |

2018–19 Planned spending |

2019–20 Planned spending |

|---|---|---|---|

| 60,243,914 | 60,243,914 | 59,928,914 | 59,641,414 |

Human resources (full-time equivalents)

| 2017–18 Planned full-time equivalents | 2018–19 Planned full-time equivalents | 2019–20 Planned full-time equivalents |

|---|---|---|

| 464 | 464 | 464 |

Description

This Program enables the Government of Canada to meet its transfer and taxation payment commitments. The Program administers transfer and taxation payments to provinces and territories and Aboriginal governments in compliance with legislation and negotiated agreements. The Program also fulfills commitments and agreements with international financial organizations to support the economic advancement of developing countries. The Government of Canada sometimes enters into agreements or enacts legislation to respond to unforeseen pressures. These commitments can result in payments, generally statutory transfer payments, to a variety of recipients, including individuals, organizations and other levels of government.

Planning highlights

The Department of Finance Canada will administer transfer payments to provinces and territories as set out in legislation. The Department will also administer payments to international financial organizations, consistent with the Government of Canada’s commitments.

The Department will continue to manage payments to provinces, territories and Aboriginal governments in accordance with the terms and conditions of Tax Collection Agreements, Tax Administration Agreements, Comprehensive Integrated Tax Coordination Agreements, the Federal-Provincial Fiscal Arrangements Act and the First Nations Goods and Services Tax Act.

The cumulative increase of $4.6 billion in spending over the three-year planning horizon relates to legislated and forecast increases for the Canada Health Transfer, the Canada Social Transfer, Fiscal Equalization and Territorial Formula Financing. These forecast increases are not expected to impact requirements for full-time equivalents; these requirements are expected to remain stable.

Planned results

| Expected results | Performance indicators | Target | Date to achieve target | 2013–14 Actual results | 2014–15 Actual results | 2015–16 Actual results |

|---|---|---|---|---|---|---|

| The Government of Canada meets its transfer and taxation payment commitments. | Degree to which the Government of Canada is meeting its transfer and taxation payment commitments. | Met | 2017–18 | Not available* | Met | Met |

| * The Department changed its Performance Measurement Framework in 2014–15. Consequently, actual results for the current performance indicators are not available for fiscal years before 2014–15. | ||||||

Budgetary financial resources (dollars)

| 2017–18 Main Estimates |

2017–18 Planned spending |

2018–19 Planned spending |

2019–20 Planned spending |

|---|---|---|---|

| 68,450,488,707 | 68,450,488,707 | 70,551,481,211 | 73,069,931,181 |

Human resources (full-time equivalents)

| 2017–18 Planned full-time equivalents | 2018–19 Planned full-time equivalents | 2019–20 Planned full-time equivalents |

|---|---|---|

| 11 | 11 | 11 |

Description

This Program provides analysis, research and advice to ministers and senior government officials on the management of the treasury and the financial affairs of the Government of Canada. The Program ensures that the treasury and financial affairs of the Government of Canada are efficiently managed on behalf of Canadian taxpayers. The Program provides direction for Canada’s debt management activities, including the funding of debt and service costs for new borrowings. This Program manages investments in financial assets so that the Government of Canada can meet its liquidity needs. The Program supports the ongoing refinancing of government debt coming to maturity, the execution of the Budget Plan, and other financial operations of the government, including governance of the borrowing activities of major federal government-backed entities, such as Crown corporations. The Program also oversees the system that ensures that Canada has an adequate supply of circulating Canadian currency (banknotes and coins) to meet the needs of the Canadian economy.

Planning highlights

The Department of Finance Canada will continue to provide policy advice to ensure that the treasury and financial affairs of the Government of Canada are well managed. In collaboration with the Bank of Canada, the Department will continue to manage the debt and international reserves of the Government of Canada and to support the borrowing activity of federal Crown corporations. In cooperation with the Bank of Canada and the Royal Canadian Mint, the Department will support the development of commemorative banknotes and coins and will ensure that the ongoing needs of the Canadian economy for circulating banknotes and coinage are met.

The cumulative increase of $3.2 billion in planned spending from 2017–18 to 2019–20 is related to an increase in interest rates as forecast by private sector economists, consistent with the Fall Economic Statement 2016. These forecast increases are not expected to impact requirements for full-time equivalents; these requirements are expected to remain stable.

Planned results

| Expected results | Performance indicators | Target | Date to achieve target | 2013–14 Actual results | 2014–15 Actual results | 2015–16 Actual results |

|---|---|---|---|---|---|---|

| The treasury and financial affairs of the Government of Canada are well managed. | Percentage of recommendations and agreed-upon areas for improvement following evaluations that are on track or have been implemented within the planned time frames. | 100% | 2017–18 | Not available* | 100% | 100% |

| * The Department changed its Performance Measurement Framework in 2014–15. Consequently, actual results for the current performance indicators are not available for fiscal years before 2014–15. | ||||||

Budgetary financial resources (dollars)

| 2017–18 Main Estimates |

2017–18 Planned spending |

2018–19 Planned spending |

2019–20 Planned spending |

|---|---|---|---|

| 21,594,000,000 | 21,594,000,000 | 22,674,000,000 | 24,789,000,000 |

Human resources (full-time equivalents)

| 2017–18 Planned full-time equivalents | 2018–19 Planned full-time equivalents | 2019–20 Planned full-time equivalents |

|---|---|---|

| 28 | 28 | 28 |

Information on the Department of Finance Canada’s Sub-Programs is available on the Department of Finance Canada’s website and in the TBS InfoBase.

Internal Services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal Services refers to the activities and resources of the 10 distinct service categories that support Program delivery in the organization, regardless of the Internal Services delivery model in a department. The 10 service categories are: Management and Oversight Services; Communications Services; Legal Services; Human Resources Management Services; Financial Management Services; Information Management Services; Information Technology Services; Real Property Services; Materiel Services; and Acquisition Services.

Focus people management efforts in two areas: improving talent management and promoting a healthy work environment

The Department of Finance Canada must be able to attract and retain staff with the required expertise and skills to be able to respond to increasing demands for sound and timely policy analysis and advice. The Department will therefore continue to invest in human capital and manage talent through recruitment, performance management, learning plans, development programs, mentoring and job shadowing. The Department will also implement human resources plans and priorities in support of workplace wellness, including mental health.

Modernize information management and information technology tools and strengthen infrastructure and information security

The Department will continue to implement solutions to modernize information management (IM) and information technology (IT) tools to enhance business effectiveness, collaboration and mobility. The Department will work to minimize implementation risks and the impacts on departmental operations. The Department will continue to strengthen IM practices, in partnership with enterprise service organizations, by building on existing tools and using government-wide electronic systems. The Department will also support the implementation of government-wide modernization and transformation activities in the areas of IM and IT, including departmental commitments to the action plan on Open Government. In partnership with Shared Services Canada, the Department will continue to enhance its IT infrastructure to ensure a stable IT network and effective protection of information assets.

Develop and implement a new departmental planning, budgeting and performance information structure

The Department will develop and implement a new planning, budgeting and performance information structure that meets the requirements of the new Treasury Board Policy on Results and that will generate more relevant and precise performance information on departmental results for decision making and government-wide reporting.

Planned spending from 2017–18 to 2019–20 is expected to decrease primarily due to a reduction in legal funding for the Cooperative Capital Markets Regulatory System Initiative and the Financial Sector Legislative Review. These forecast decreases are not expected to impact requirements for full-time equivalents.

Budgetary financial resources (dollars)

| 2017–18 Main Estimates |

2017–18 Planned spending |

2018–19 Planned spending |

2019–20 Planned spending |

|---|---|---|---|

| 38,878,680 | 38,878,680 | 38,073,680 | 37,573,680 |

Human resources (full-time equivalents)

| 2017–18 Planned full-time equivalents | 2018–19 Planned full-time equivalents | 2019–20 Planned full-time equivalents |

|---|---|---|

| 232 | 232 | 232 |

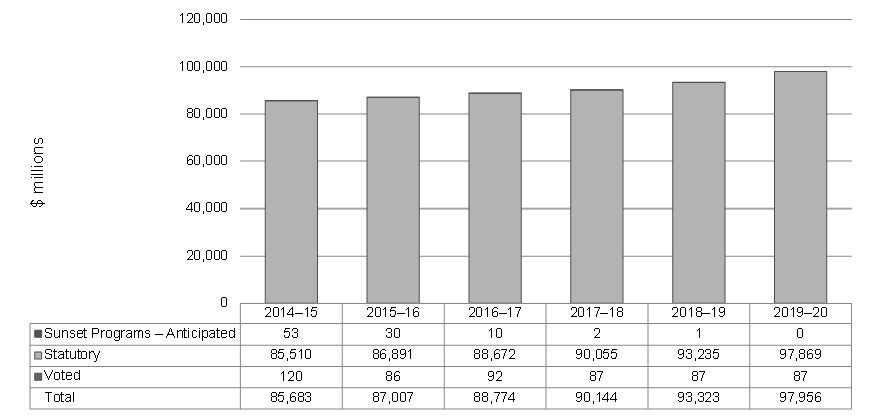

Budgetary planning summary for Programs and Internal Services (dollars)

| Programs and Internal Services | 2014–15 Expenditures | 2015–16 Expenditures |

2016–17 Forecast spending |

2017–18 Main Estimates |

2017–18 Planned spending |

2018–19 Planned spending |

2019–20 Planned spending |

|---|---|---|---|---|---|---|---|

| 1.1 Economic and Fiscal Policy Framework | 124,886,930 | 63,516,872 | 63,392,231 | 60,243,914 | 60,243,914 | 59,928,914 | 59,641,414 |

| 1.2 Transfer and Taxation Payment Programs | 61,902,703,494 | 64,106,557,531 | 66,833,820,104 | 68,450,488,707 | 68,450,488,707 | 70,551,481,211 | 73,069,931,181 |

| 1.3 Treasury and Financial Affairs | 23,600,697,770 | 22,793,429,403 | 21,832,000,000 | 21,594,000,000 | 21,594,000,000 | 22,674,000,000 | 24,789,000,000 |

|

|

|||||||

| Subtotal | 85,628,288,194 | 86,963,503,806 | 88,729,212,335 | 90,104,732,621 | 90,104,732,621 | 93,285,410,125 | 97,918,572,595 |

| Internal Services | 54,866,622 | 43,808,353 | 45,599,315 | 38,878,680 | 38,878,680 | 38,073,680 | 37,573,680 |

|

|

|||||||

| Total | 85,683,154,816 | 87,007,312,159 | 88,774,811,650 | 90,143,611,301 | 90,143,611,301 | 93,323,483,805 | 97,956,146,275 |

The $1.3 billion increase in actual spending from 2014–15 to 2015–16 was mainly due to a $2.2 billion legislated increase in annual transfer payments within Transfer and Taxation Payment Programs. This increase was offset by a $0.8 billion decrease in expenditures within Treasury and Financial Affairs because of a lower average effective interest rate on interest-bearing debt.

From 2017–18 to 2019–20, the upward trend in planned spending reflects the expectation of a cumulative $4.6 billion increase in transfer payments and a $3.2 billion increase in interest on unmatured debt and interest on other liabilities.

Actual and planned expenditures within Economic and Fiscal Policy Framework and Internal Services have minimal impact on overall departmental expenditures.

On average, sunset programs account for less than 1 per cent of total planned spending.

Economic and Fiscal Policy Framework

The $61.3 million decrease in actual spending from 2014–15 to 2015–16 was mainly due to the cessation of payments to the Canadian Securities Regulation Regime Transition Office. These payments totalled $53.1 million in 2014–15. The remaining decrease of $8.8 million was mainly due to $5.6 million in reduced personnel costs and a $2.2 million decrease in advertising expenditures. Planned spending from 2017–18 to 2019–20 is expected to remain relatively stable, with minor decreases attributable to sunsetting items.

Transfer and Taxation Payment Programs

The cumulative increase of $11.2 billion in spending from 2014–15 to 2019–20 relates to legislated and forecast increases for the Canada Health Transfer, the Canada Social Transfer, Fiscal Equalization and Territorial Formula Financing.

Treasury and Financial Affairs

The $0.8 billion decrease in actual spending from 2014–15 to 2015–16 was related to lower long-term bond rates. The cumulative increase of $3.2 billion in planned spending from 2017–18 to 2019–20 is related to an increase in interest rates as forecast by private sector economists, consistent with the Fall Economic Statement 2016.

Internal Services

The $11.1 million decrease in actual spending from 2014–15 to 2015–16 was due to the completion of the construction of the Department’s new office building in 2014–15. Planned spending from 2017–18 to 2019–20 is expected to decrease, primarily due to a reduction in legal funding for the Cooperative Capital Markets Regulatory System Initiative and the Financial Sector Legislative Review.

Human resources planning summary for Programs and Internal Services (full-time equivalents)

| Programs and Internal Services | 2014–15 Full-time equivalents |

2015–16 Full-time equivalents |

2016–17 Forecast full-time equivalents |

2017–18 Planned full-time equivalents |

2018–19 Planned full-time equivalents |

2019–20 Planned full-time equivalents |

|---|---|---|---|---|---|---|

| 1.1 Economic and Fiscal Policy Framework | 453 | 437 | 447 | 464 | 464 | 464 |

| 1.2 Transfer and Taxation Payment Programs | 0 | 10 | 12 | 11 | 11 | 11 |

| 1.3 Treasury and Financial Affairs | 26 | 29 | 31 | 28 | 28 | 28 |

|

|

||||||

| Subtotal | 479 | 476 | 490 | 503 | 503 | 503 |

| Internal Services | 286 | 271 | 249 | 232 | 232 | 232 |

|

|

||||||

| Total | 765 | 747 | 739 | 735 | 735 | 735 |

Reductions in full-time equivalents from 2014–15 to 2016–17 were mainly due to a reduction in time-limited funding as well as higher requirements for full-time equivalents in 2014–15, associated with the construction of the Department’s new office building. The requirements from 2017–18 to 2019–20 are expected to remain stable.

For information on the Department of Finance Canada’s organizational appropriations, consult the 2017–18 Main Estimates.

The Future-Oriented Condensed Statement of Operations provides a general overview of the Department of Finance Canada’s operations. The forecast of financial information on expenses and revenues is prepared on an accrual accounting basis to strengthen accountability and to improve transparency and financial management.

Because the Future-Oriented Condensed Statement of Operations is prepared on an accrual accounting basis, and the forecast and planned spending amounts presented in other sections of the Departmental Plan are prepared on an expenditure basis, amounts may differ.

A more detailed Future-Oriented Statement of Operations and associated notes, including a reconciliation of the net cost of operations to the requested authorities, are available on the Department of Finance Canada’s website.

Future-Oriented Condensed Statement of Operations

for the year ended March 31, 2018 (dollars)

| Financial information | 2016–17 Forecast results |

2017–18 Planned results |

Difference (2017–18 Planned results minus 2016–17 Forecast results) |

|---|---|---|---|

| Total expenses | 88,802,452,541 | 90,172,020,118 | 1,369,567,577 |

| Total revenues | 109,903 | 109,903 | 0 |

| Net cost of operations before government funding and transfers | 88,802,342,638 | 90,171,910,215 | 1,369,567,577 |

Appropriate minister(s): William F. Morneau

Institutional head: Paul Rochon

Ministerial portfolio: Department of Finance

Enabling instruments: The Minister of Finance has direct responsibility for a number of acts and is assigned specific fiscal and tax policy responsibilities relating to other acts that are under the responsibility of other ministers, including the following:

- Financial Administration Act

- Income Tax Act

- Payment Clearing and Settlement Act

- Federal-Provincial Fiscal Arrangements Act

- First Nations Goods and Services Tax Act

- Customs Act

- Customs Tariff

- Excise Act, 2001

- Excise Tax Act

- Proceeds of Crime (Money Laundering) and Terrorist Financing Act

- Special Import Measures Act

Key legislation and acts are available on the Department of Justice Canada’s website.

Year of incorporation / commencement: 1867

The Department of Finance Canada’s Strategic Outcome and Program Alignment Architecture (PAA) of record for 2017–18 are shown below:

Supporting information on Sub-Programs is available on the Department of Finance’s Canada’s website and in the TBS InfoBase.

The following supplementary information tables are available on the Department of Finance Canada’s website.

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs. The tax measures presented in this report are the responsibility of the Minister of Finance.

Department of Finance Canada

14th Floor

90 Elgin Street

Ottawa, Ontario K1A 0G5

Phone: 613-369-3710

Facsimile: 613-369-4065

TTY: 613-995-1455

Email: finpub@fin.gc.ca

Media Enquiries

Phone: 613-369-4000

Comments or questions regarding Department of Finance Canada publications and budget documents

Email: finpub@fin.gc.ca

appropriation (crédit)

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

budgetary expenditures (dépenses budgétaires)

Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

Core Responsibility (responsabilité essentielle)

An enduring function or role performed by a department. The intentions of the department with respect to a Core Responsibility are reflected in one or more related Departmental Results that the department seeks to contribute to or influence.

Departmental Plan (Plan ministériel)

Provides information on the plans and expected performance of appropriated departments over a three-year period. Departmental Plans are tabled in Parliament each spring.

Departmental Result (résultat ministériel)

A Departmental Result represents the change or changes that the department seeks to influence. A Departmental Result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

Departmental Result Indicator (indicateur de résultat ministériel)

A factor or variable that provides a valid and reliable means to measure or describe progress on a Departmental Result.

Departmental Results Framework (cadre ministériel des résultats)

Consists of the department’s Core Responsibilities, Departmental Results and Departmental Result Indicators.

Departmental Results Report (Rapport sur les résultats ministériels)

Provides information on the actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

full-time equivalent (équivalent temps plein)

A measure of the extent to which an employee represents a full person-year charge against a departmental budget. Full-time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

government-wide priorities (priorités pangouvernementales)

For the purpose of the 2017–18 Departmental Plan, government-wide priorities refers to those high-level themes outlining the government’s agenda in the 2015 Speech from the Throne, namely: Growth for the Middle Class; Open and Transparent Government; A Clean Environment and a Strong Economy; Diversity is Canada’s Strength; and Security and Opportunity.

horizontal initiatives (initiative horizontale)

A horizontal initiative is one in which two or more federal organizations, through an approved funding agreement, work toward achieving clearly defined shared outcomes, and which has been designated (e.g. by Cabinet, a central agency, etc.) as a horizontal initiative for managing and reporting purposes.

Management, Resources and Results Structure (Structure de la gestion, des ressources et des résultats)

A comprehensive framework that consists of an organization’s inventory of programs, resources, results, performance indicators and governance information. Programs and results are depicted in their hierarchical relationship to each other and to the Strategic Outcome(s) to which they contribute. The Management, Resources and Results Structure is developed from the Program Alignment Architecture.

non-budgetary expenditures (dépenses non budgétaires)

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

performance (rendement)

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

performance indicator (indicateur de rendement)

A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

performance reporting (production de rapports sur le rendement)

The process of communicating evidence-based performance information. Performance reporting supports decision making, accountability and transparency.

planned spending (dépenses prévues)

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts that receive Treasury Board approval by February 1. Therefore, planned spending may include amounts incremental to planned expenditures presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

plans (plan)

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

priorities (priorité)

Plans or projects that an organization has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired Strategic Outcome(s).

program (programme)

A group of related resource inputs and activities that are managed to meet specific needs and to achieve intended results and that are treated as a budgetary unit.

Program Alignment Architecture (architecture d’alignement des programmes)

A structured inventory of an organization’s programs depicting the hierarchical relationship between programs and the Strategic Outcome(s) to which they contribute.

results (résultat)

An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.

statutory expenditures (dépenses législatives)

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

Strategic Outcome (résultat stratégique)

A long-term and enduring benefit to Canadians that is linked to the organization’s mandate, vision and core functions.

sunset program (programme temporisé)

A time-limited program that does not have an ongoing funding and policy authority. When the program is set to expire, a decision must be made whether to continue the program. In the case of a renewal, the decision specifies the scope, funding level and duration.

target (cible)

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

voted expenditures (dépenses votées)

Expenditures that Parliament approves annually through an Appropriation Act. The Vote wording becomes the governing conditions under which these expenditures may be made.

1 Planned activities relate to commitments in the Minister’s mandate letter. Further details are provided in the “Planned results” section of this report.

2 This planned activity relates to a commitment in the Minister’s mandate letter.