Archived - Departmental Plan 2022-2023

From the Ministers

For nearly two years, Canadians have been grappling with COVID-19. And nearly two years ago, the pandemic triggered the steepest economic contraction in Canada since the Great Depression. At its worst, it cost 3 million Canadians their jobs as our real GDP shrank by 17 per cent.

From the outset, our government has understood the most important economic policy has been a strong public health policy. That has meant Canada has the second lowest COVID-19 mortality rate in the G7.

And it has helped our economy.

In November 2021, Canada's real GDP had already recovered to over 100 per cent of its pre-pandemic level. In its January World Economic Outlook Update, the International Monetary Fund forecast that Canada will have the second-fastest GDP growth in the G7 in 2022, and that we will have the fastest GDP growth in the G7 next year.

Our focus on jobs and growth is working. Business bankruptcies are lower and more than 3,000 more businesses were active in Canada as of November 2021 than before the pandemic. We knew that keeping Canadian families and businesses solvent – and preventing economic scarring – would help our economy rebound.

Our government remains committed to the fiscal anchors that we outlined in last spring's budget. We're committed to reducing the federal debt-to-GDP ratio and to unwinding COVID-19-related deficits. Our government will continue to be a responsible and careful fiscal manager.

Despite impressive economic resilience in many parts of the economy, we are mindful of elevated inflation and its impact on the cost of living for Canadians. We know that inflation is a global phenomenon driven by the unprecedented challenge of re-opening the world's economy after COVID-19 lockdowns.

As we look to the years ahead, our focus must be on jobs and economic growth – priorities that will form the foundation of the budget.

Our plan is working. As we finish the fight against COVID-19, we will turn our resolve towards fighting climate change, advancing reconciliation with Indigenous peoples, and building an economy that is stronger, fairer, more competitive, more innovative, and more prosperous.

Signed,

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

The Honourable Randy Boissonnault P.C., M.P.

Minister of Tourism and Associate Minister of Finance

Plans at a glance

The Department of Finance Canada (the department) is responsible for the overall stewardship of the Canadian economy. This includes preparing the annual federal budget, setting overall fiscal and economic policy and advising the government on tax and tariff policy. It also provides advice on social measures, security issues, financial sector stability and Canada’s international commitments.

In 2022-23, the department will continue to support the Deputy Prime Minister and Minister of Finance and the Minister of Tourism and Associate Minister of Finance in advancing the government’s priorities, and intends to:

Sound Fiscal Management

- Manage the preparation of the federal budget, as well as economic and fiscal updates.

- Continue to implement the fiscal plans outlined in Budgets 2021 and 2022.

- Develop sound economic policy advice based on an assessment of current and future economic conditions and accurate fiscal planning.

- Enhance the fairness, neutrality, competitiveness and efficiency of Canada’s tax system.

Inclusive and Sustainable Economic Growth

- Ensure targeted supports remain available, as needed, for Canadian workers and businesses that continue to struggle as the government finishes the fight against COVID-19.

- Deliver fiscal policy support to the economy as needed to ensure a rapid and resilient recovery as the country continues to emerge from the COVID-19 recession.

- Bolster inclusive economic recovery and growth that supports the government’s efforts to achieve its 2030 climate goals and accelerates the transition to a net-zero economy no later than 2050.

- Move forward with tax policies that strengthen Canada’s climate plan and support Canada’s clean energy transition.

- Continue to develop and support policies that focus on the efficient management of Crown investments as well as the federal government’s debt and international reserves.

- Provide policy advice on maintaining a stable, resilient and innovative financial sector that continues to meet the needs of Canadians.

- Collaborate with departments and other central agencies to advance long-term inclusive economic growth through policies that advance skills, training labour force participation immigration and internal trade.

Sound Social Policy Framework

- Continue to manage the major transfer payment programs to provinces and territories.

- Work to make life more affordable for middle class Canadians and their families, including through a continued and sustained investment in early learning and child care, and by taking significant action on housing affordability.

- Collaborate with other government departments, central agencies, and provincial and territorial governments to develop policy proposals that address the government’s priorities across a range of social policy issues from advancing reconciliation and Indigenous Peoples rights to addressing profound systemic inequities and disparities.

Effective International Engagement

- Collaborate with international partners and organizations to ensure a strong, coordinated, and effective multilateral response to the COVID-19 pandemic and ensure a strong and sustained global recovery.

- Engage with other countries to implement the OECD/G20 international tax reform plan.

- Promote bolder climate actions.

- Support the government in its work to achieve realistic, meaningful and pragmatic reforms to the World Trade Organization.

- Support the government in maintaining Canada’s leadership and engagement globally, while deepening market access and trading relationships.

For more information on the Department of Finance Canada’s plans, see the “Core responsibilities: planned results and resources, and key risks” section of this plan.

Core responsibilities: planned results and resources

This section contains information on the department’s planned results and resources for each of its core responsibilities.

Economic and Fiscal Policy

Description

The department is committed to helping the government achieve its priorities through the delivery of high quality information and advice to ensure Canada’s finances are sound, sustainable and inclusive. This includes operational support to develop the federal budget and economic statements/updates, as well as expert analysis and advice in support of a fair and competitive tax system.

In collaboration with other government departments and agencies, the department will continue to advance the government’s social policy agenda as well as ensure Canada has a sound and efficient financial sector and continues its leadership and engagement globally, including through deepening trading relations.

Planning highlights

In 2022-23 the department plans to:

Sound Fiscal Management

- Support the government’s responsible management of the federal budget and federal debt in order to preserve Canada’s low-debt advantage. The government’s strategy will be tailored to respond to Canada’s evolving economic needs, as the country emerges from the COVID-19 crisis.

- Continue to manage the government’s debt program with the fundamental objectives of raising stable and low-cost funding and maintaining a well-functioning market for Government of Canada securities. The department will also continue to efficiently manage Canada’s foreign reserves and currency system.

- Provide advice on the issuance of the federal government’s first ever green bond to support climate and environmental initiatives.

- Develop and support the implementation of proposals aimed at ensuring Canada has a fair tax system such as: a tax on the sale, for personal use, of luxury cars and personal aircraft and boats; a national, tax-based measure targeting the unproductive use of domestic housing owned by non-resident, non-Canadians; and, a Digital Services Tax.

Inclusive and Sustainable Economic Growth

- Support the government’s commitment to take all necessary steps and measures to protect Canadians’ jobs in the face of the COVID-19 pandemic. In 2021, the government announced a significant pivot in its COVID-19 supports to workers and businesses, moving from the very broad-based support that was appropriate at the height of the lockdowns to more targeted measures that will provide help where it is needed most. The department will provide advice on the development and implementation of any required program modifications, the monitoring and execution of the programs, and the assessment of their effectiveness.

- Establish a permanent Council of Economic Advisors to provide independent advice and policy options on long-term economic growth that will achieve a higher standard of living, better quality of life, inclusive growth and a more innovative and skillful economy.

- Examine policies through the new Quality of Life Framework, and pilot an integrated climate lens, announced in Budget 2021. Taken together, these assessment tools aim to enhance employment, environment, health and inclusion while ensuring long-term fiscal viability and reducing the federal debt as a share of the economy over the medium term.

- Deliver on the government’s complex and technical tax policy agenda including implementing new federal tax regimes and addressing the backlog of tax measures from Budget 2021.

- Develop and support the implementation of tax measures that are consistent with the government’s climate goals, such as an investment tax credit for capital invested in Carbon Capture, Utilization and Storage projects as well other tax measures that support climate goals.

- Provide policy advice to support a well-functioning financial sector that continues to meet the needs of Canadians. Financial sector priorities include providing advice on: Canada’s financial stability framework; the domestic housing finance system; efforts to combat money laundering and terrorist financing; insurance-based strategies for addressing natural disaster protection gaps; implementing a new oversight framework for retail payments as well as payments system modernization and governance; selecting an independent ombudsperson to address consumer complaints involving banks; strengthening the sustainability of federally regulated private sector pension plans; and establishing a well-functioning sustainable finance market.

- Support the government’s commitments to see the Trans Mountain Expansion Project built in the right way and to divest the Trans Mountain Corporation to a new owner or owners in a manner and at a time that protects the public interest and the government’s investment. This includes continuing to explore opportunities for meaningful economic participation in Trans Mountain with Indigenous groups who are potentially impacted by the Project, in keeping with the spirit of reconciliation.

- Work with other departments and central agencies to develop the policies and financial tools and mechanisms required to achieve Canada’s 2030 and 2050 decarbonization objectives.

- Collaborate with departments and other central agencies to advance policies and programs which promote economic development. This includes measures which support innovative and growing businesses as well as sector-specific strategies in traditional sectors (agriculture, fisheries, mining and forestry) and bolster economic enablers, such as infrastructure and transport corridors to adapt to changing global supply chains.

- Develop policies and programs aimed at increasing Canada’s housing supply and making home ownership more affordable for Canadians.

Sound Social Policy Framework

- Convene meetings and undertaking consultations with provinces and territories to advance issues of shared interest including minimizing the health, economic and social impacts of the COVID-19 pandemic. The department will also work to launch the Futures Fund for Alberta, Saskatchewan and Newfoundland and Labrador to support local and regional diversification and implementation of place-based strategies.

- Work with other government departments and central agencies to support reconciliation with Indigenous Peoples, including the establishment of a new fiscal relationship with Indigenous Peoples, as well as deliver on government priorities in areas such Indigenous social and economic policy.

- Advance priority policies and critical investments aimed at improving the availability and quality of social and affordable housing.

- Work in collaboration with provinces and territories to launch the 2022-2024 Triennial Review of the Canada Pension Plan (CPP) and the 2024 Renewal of Equalization and Territorial Financing Programs.

- Develop and put in place the regulatory changes necessary to implement the modernization of the Fiscal Stabilization program announced in the 2020 Fall Economic Statement.

Effective International Engagement

- Continue to monitor and analyze international COVID-19 policy responses and their economic impacts, with a view to ensuring a coordinated global economic recovery that is built on science and fosters best practices.

- Continue to advance multilateral and domestic work to implement the OECD/G20 agreement, affirmed by 137 jurisdictions, on a two-pillar plan for international tax reform.

- Further the government’s global engagement agenda by:

- supporting the government’s response to protectionist measures by major trading partners, including a Reciprocal Procurement Policy;

- championing the adoption of a global minimum standard on carbon pricing;

- developing an approach to applying Border Carbon Adjustments; and

- engaging with Canada’s trading partners to discuss financial sector regulatory issues and strengthen the relations between financial regulators.

- Continue to monitor and advise on issues related to the import of goods to ensure Canada’s manufacturing competitiveness and protect domestic industries against unfair trade practices. The department also will continue its efforts to improve debt sustainability and transparency across the international system.

Gender and diversity analysis

All budgetary and off-cycle proposals in 2022–23 will continue to be informed by gender and diversity analysis (through Finance Canada’s GBA Plus Template). A consistent approach to this type of analysis ensures that funding decisions are made with an understanding of how diverse groups of Canadians will be affected. Additionally, the Gender Results Framework will continue to support budget decision making and priority setting.

Gender and diversity analysis is complemented and reinforced by the Quality of Life Framework, which extends a more thorough assessment of the nature of expected impacts based on key determinants of quality of life now and into the future, such as prosperity, health, environment, social cohesion and good governance.

These efforts will ensure that government programs and initiatives continue to support those individuals most affected by the COVID-19 pandemic, as well as help to address long-standing inequalities.

The department also strives to achieve equality in its workplace and aims to employ a diverse group of employees. When staffing, the department will consider its Workforce Availability targets, as set by the Treasury Board Secretariat, and work to ensure that these targets are met.

United Nations’ (UN) 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

In 2022-23, the department will remain focused on ensuring Canada’s economy grows in a sustainable and inclusive manner by incorporating environmental considerations into its analysis. All budgetary and off-cycle funding proposals submitted to the department must meet strategic environmental assessment requirements and demonstrate that the potential impact on climate change has been considered and mitigated. In reviewing these packages, the department contributes to achieving Sustainable Development Goal (SDG) 13.3: improve education awareness-raising and human and institutional capacity on climate change mitigation, adaption, impact reduction and early warning. The department is also a key contributor to three Federal Sustainable Development Strategy goals: Greening Government; Effective Action on Climate Change; and Clean Energy.

Planned results for Economic and Fiscal Policy

The following table shows planned results, indicators, targets and actual results for the three most recent fiscal years for which actual results are available.

| Departmental result | Departmental result indicator | Target | Date to achieve target | 2018–19 actual result | 2019–20 actual result | 2020–21 actual result |

|---|---|---|---|---|---|---|

| Canadians enjoy stronger, more sustainable, and inclusive economic growth that contributes to higher standards of living | 1.1 Gross Domestic Product (GDP) per capita (ranking among Organisation for Economic Co-operation and Development (OECD) countries) | Ranking among the countries with the 15 highest levels of GDP per capita | March 2023 | Ranked 14th among 36 OECD countries | Ranked 15th among 37 OECD countries | Ranked 15th among 38 OECD countries |

| 1.2 Employment rate among the population 15 to 64 in age (ranking among OECD countries) | Ranking among the countries with the 15 highest employment rates | March 2023 | Ranked 13th among 36 OECD countries | Ranked 13th among 37 OECD countries | Ranked 19th among 38 OECD countriesFootnote 1 | |

| 1.3 Real disposable income across income groupsFootnote 2 | Growth is broad-based across income groups | March 2023 |

Bottom 20%: 1.8% growth Second 20%: 1.2% growth Middle 20%: 1.2% growth Fourth 20%: 1.0% growth Top 20%: 0.5% growth |

Report not yet available | Report not yet available | |

| 1.4 Amount of Canada's annual greenhouse gas emissions (Mt CO2 equivalent) | 40-45% reduction in GHG emissions relative from 2005 levels by 2030. | March 2023 | Data not yet available | Data not yet available | Data not yet availableFootnote 3 | |

| Canada's public finances are sound, sustainable and inclusive | 2.1 Federal debt-to-gross domestic product ratio | Stable over the medium-term (defined as the end of the 5-year projection period for the budget) | March 2023 | Met | Met | MetFootnote 4 |

| 2.2 The annual federal budget includes an assessment of the impact of new expenditure and revenue measures on different groups of women and men | Presence of a clear "Gender Statement" in the annual budget document where the impact of budgetary measures is presented from a gender perspective. | March 2023 | Met | Data not availableFootnote 5 | Met | |

| 2.3 General government net debt to gross domestic product ratio | Low by international standards defined as compared to G7 countries | March 2023 | NA | NA | MetFootnote 6 | |

| Canada has a fair and competitive tax system | 3.1 Taxes on labour income | Lower than the G7 average | March 2023 | Met | Met | Met |

| 3.2 Tax rate on new business investment | Lower than the G7 average | March 2023 | Data not available | Data not available | Data not availableFootnote 7 | |

| Canada has a sound efficient financial sector | 4.1 Percentage of leading international organizations and major ratings agencies that rate Canada's financial policy framework as favourable | 100% | March 2023 | 100% | 100% | 100% |

| 4.2 Ranking of Canada's financial sector in the World Economic Forum's Global Competitiveness Report | Above the G7 average | March 2023 | Above the G7 average Canada: 86 G7 average: 83 |

Above the G7 average Canada: 87 G7 average: 83 |

No data available for 2020Footnote 8 | |

| The Government of Canada's borrowing requirements are met at a low and stable cost to support effective management of the federal debt on behalf of Canadians | 5.1 Percentage of the government's borrowing requirements met within the fiscal year | 100% | March 2023 | 100% | 100% | 100% |

| 5.2 Canada's sovereign rating | Equal to or better than the G7 average | March 2023 | Canada was the second highest rated among G7 countries, tied with the US | Canada was the second highest rated among G7 countries, tied with the US | Canada was the second highest rated among G7 countries, tied with the US | |

| The Government of Canada effectively supports provinces, territories and Indigenous governments | 6.1 Degree to which timely statutory federal transfer programs assist and support provincial and territorial governments in delivering important public services, including accessible and quality health care | 5 (100% of payments reviewed did not reveal errors; 100% of payments to provincial and territorial governments were made within the required time frames) | March 2023 | 5 | 5 | 5 |

| 6.2 Degree to which payment issues identified with respect to tax agreements with provinces, territories and Indigenous governments are addressed | 2 (mostly addressed) | March 2023 | Not applicable | Not applicable | 1 (fully addressed) | |

| Canada maintains its leadership and engagement globally and deepens its trading relationships | 7.1 Canada's overall score on the OECD Trade Facilitation Indicators. | Score of 1.7 or higher | March 2023 | Data not available | Data not available | Data not availableFootnote 9 |

| 7.2 Degree to which Canadian priorities are reflected in initiatives at various international financial institutions to which the Department of Finance Canada provided resources | 4 | March 2023 | Met | Met | Met |

The financial, human resources and performance information for the Department of Finance Canada’s program inventory is available on GC InfoBase.

Planned budgetary spending for Economic and Fiscal Policy

The following table shows, for Economic and Fiscal Policy, budgetary spending for 2022–23, as well as planned spending for that year and for each of the next two fiscal years.

| 2022–23 budgetary spending (as indicated in Main Estimates) | 2022–23 planned spending | 2023–24 planned spending | 2024–25 planned spending |

|---|---|---|---|

| 110,616,722,035 | 110,616,722,035 | 120,961,552,900 | 128,559,704,973 |

Financial, human resources and performance information for the Department of Finance Canada’s program inventory is available on GC InfoBase.

Planned human resources for Economic and Fiscal Policy

The following table shows, in full-time equivalents, the human resources the department will need to fulfill this core responsibility for 2022–23 and for each of the next two fiscal years.

| 2022–23 planned full-time equivalents | 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents |

|---|---|---|

| 677 | 674 | 645 |

There is a decrease in the number of FTEs starting in 2024-25 due to the fact that a number of programs are scheduled to end by 2025.

Financial, human resources and performance information for the Department of Finance Canada’s program inventory is available on GC InfoBase.

Internal services: planned results

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Planning highlights

Through its ongoing modernizing efforts, the department’s Internal Services functions will provide efficient and timely services in support of departmental priorities.

In 2022–23, the Department of Finance Canada will continue to:

- Build a healthy, diverse and productive workforce. More specifically, the department will continue work to establish a culture that values equality, and addresses systemic barriers in order to increase the representation of people who belong to racialized groups, Indigenous Peoples, as well as persons with disabilities within all levels of the organization.

- Coordinate the return of employees to the physical office, while maintaining a healthy, safe and respectful workplace.

- Provide, maintain and promote a healthy and safe hybrid work environment.

- Enable a digital and collaborative workplace while enhancing user experience and strengthening cybersecurity.

- Stabilize the department’s information technology and other core operational functions, ensuring there is adequate equipment, software and technical support for policy work.

- Provide effective stewardship of financial resource management within the department.

- Ensure Canadians have access to factual, non-partisan and plain language information on the Government of Canada’s policies and programs designed to create a healthy and inclusive Canadian economy.

Planned budgetary spending for internal services

The following table shows, for internal services, budgetary spending for 2022–23, as well as planned spending for that year and for each of the next two fiscal years.

| 2022–23 budgetary spending (as indicated in Main Estimates) | 2022–23 planned spending | 2023–24 planned spending | 2024–25 planned spending |

|---|---|---|---|

| 49,021,146 | 49,021,146 | 48,423,181 | 47,914,129 |

Planned human resources for internal services

The following table shows, in full-time equivalents, the human resources the department will need to carry out its internal services for 2022–23 and for each of the next two fiscal years.

| 2022–23 planned full-time equivalents | 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents |

|---|---|---|

| 252 | 252 | 249 |

Planned spending and human resources

This section provides an overview of the department’s planned spending and human resources for the next three fiscal years and compares planned spending for 2022–23 with actual spending for the current year and the previous year.

Planned spending

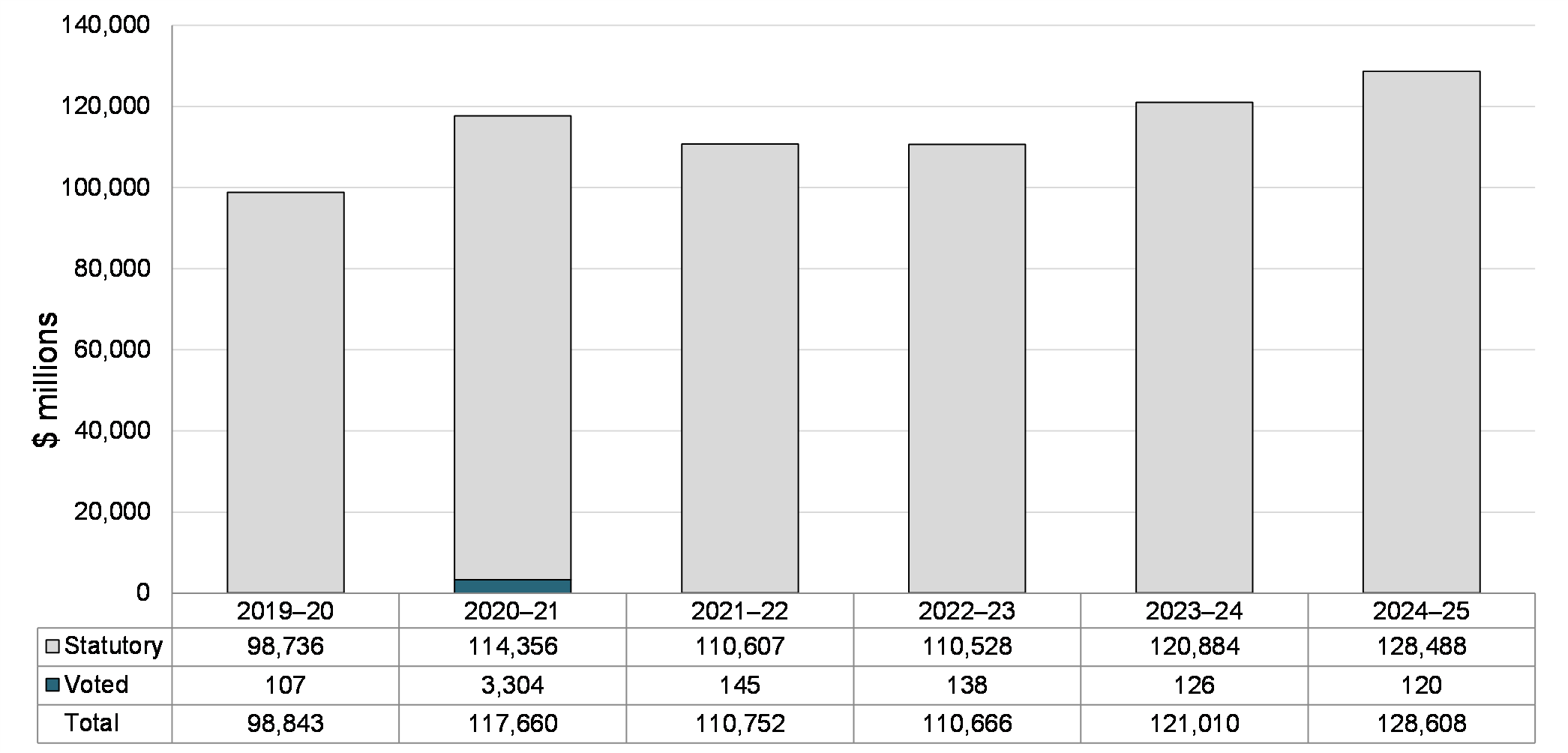

Departmental spending 2019–20 to 2024–25

The following graph presents planned spending (voted and statutory expenditures) over time.

Budgetary planning summary for core responsibilities and internal services (dollars)

Budgetary planning summary for core responsibilities and internal services (dollars)

The following table shows information on spending for each of the Department of Finance Canada’s core responsibilities and for its internal services for 2022–23 and other relevant fiscal years.

| Core responsibilities and internal services | 2019–20 actual expenditures | 2020–21 actual expenditures | 2021–22 forecast spending | 2022–23 budgetary spending (as indicated in Main Estimates) | 2022–23 planned spending | 2023–24 planned spending | 2024–25 planned spending |

|---|---|---|---|---|---|---|---|

| Economic and Fiscal Policy | 98,798,711,515 | 117,609,934,584 | 110,701,437,726 | 110,616,722,035 | 110,616,722,035 | 120,961,552,900 | 128,559,704,973 |

| Internal services | 43,969,170 | 50,293,291 | 50,204,895 | 49,021,146 | 49,021,146 | 48,423,181 | 47,914,129 |

| Total | 98,842,680,685 | 117,660,227,875 | 110,751,642,621 | 110,665,743,181 | 110,665,743,181 | 121,009,976,081 | 128,607,619,102 |

Economic and Fiscal Policy

The cumulative increase of $11.9 billion in spending from 2019–20 to 2021–22 mainly relates to:

- A one-time top-up to the Canada Health Transfer ($4.0 billion) and payments to provinces and territories in respect of Canada’s COVID-19 immunization plan ($1.0 billion) in 2021-22 (cash basis);

- Legislated increases for the Canada Health Transfer payment program ($2.8 billion); and

- An increase in approved authorities for capital and operating expenses for the Canada Infrastructure Bank ($4.0 billion).

The cumulative increase of $17.9 billion in planned spending from 2022-23 to 2024-25 mainly relates to the following statutory items:

- Legislated and forecasted increases to the Canada Health Transfer ($5.9 billion);

- Fiscal arrangements with provinces and territories including Equalization, Territorial Formula Financing and the Canada Social Transfer ($3.6 billion); and

- An increase in market debt reflects revised inflation expectations as noted in the 2021 Economic and Fiscal Update ($7.9 billion).

Internal Services

The cumulative increase of $6.8 million in spending from 2019-20 to 2021-22 is mainly attributable to temporary funding received in Internal Services to support new government initiatives in the areas of tax policy, financial sector policy and economic development and corporate finance.

Planned human resources

The following table shows information on human resources, in full-time equivalents (FTEs), for each of the Department of Finance Canada’s core responsibilities and for its internal services for 2022–23 and the other relevant years.

| Core responsibilities and internal services | 2019–20 actual full-time equivalents | 2020–21 actual full-time equivalents | 2021–22 forecast full-time equivalents | 2022–23 planned full-time equivalents | 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents |

|---|---|---|---|---|---|---|

| Economic and Fiscal Policy | 558 | 569 | 641 | 677 | 674 | 645 |

| Internal services | 286 | 308 | 258 | 252 | 252 | 249 |

| Total | 844 | 877 | 899 | 929 | 926 | 894 |

The increased use of FTEs from 2019-20 to 2021-22 is primarily due to funding received to support work on government priorities in areas such as tax policy and financial sector policy.

The decrease in the number of FTEs starting in 2024-25 is due to the fact that a number of programs are scheduled to end by 2025.

Estimates by vote

Information on the Department of Finance Canada’s organizational appropriations is available in the 2022–23 Main Estimates.

Future-oriented condensed statement of operations

The future-oriented condensed statement of operations provides an overview of the Department of Finance Canada’s operations for 2021–22 to 2022–23.

The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

A more detailed future-oriented statement of operations and associated notes, including a reconciliation of the net cost of operations with the requested authorities, are available on the Department of Finance Canada’s website.

| Financial information | 2021–22 forecast results | 2022–23 planned results |

Difference (2022–23 planned results minus 2021–22 forecast results) |

|---|---|---|---|

| Total expenses | 102,085,893,412 | 106,223,429,459 | 4,137,536,047 |

| Total revenues | 0 | 0 | 0 |

| Net cost of operations before government funding and transfers | 102,085,893,412 | 106,223,429,459 | 4,137,536,047 |

Planned net cost of operations (before government funding and transfers) shows an increase of $4.1 billion in 2022-23, primarily due to legislated and forecast increases in the Canada Health Transfer and fiscal arrangements with provinces and territories transfer payment programs.

Corporate information

Organizational profile

Appropriate minister(s): The Honourable Chrystia Freeland P.C., M.P.

The Honourable Randy Boissonnault P.C., M.P.

Institutional head: Michael Sabia

Ministerial portfolio: Department of Finance Canada

Enabling instrument(s): The Minister of Finance has direct responsibility for a number of Acts and is assigned specific fiscal and tax policy responsibilities relating to other acts that are under the responsibility of other ministers. A list of some of these Acts can be found below:

- Air Travellers Security Charge Act

- Asian Infrastructure Investment Bank Agreement Act

- Bank Act

- Bank for International Settlements (Immunity) Act

- Bank of Canada Act

- Bills of Exchange Act

- Borrowing Authority Act

- Bretton Woods and Related Agreements Act

- Budget Implementation ActsFootnote 10 (under various titles)

- Canada Deposit Insurance Corporation Act

- Canada Pension PlanFootnote 11

- Canada Pension Plan Investment Board Act

- Canadian International Trade Tribunal Act

- Canadian Gender Budgeting Act

- Canadian Payments Act

- Canadian Securities Regulation Regime Transition Office Act

- Cooperative Credit Associations Act

- Currency Act

- Customs Tariff

- Depository Bills and Notes Act

- European Bank for Reconstruction and Development Agreement Act

- Excise Act, 2001

- Excise Tax Act

- Federal-Provincial Fiscal Arrangements Act

- Financial Administration Act

- Financial Consumer Agency of Canada Act

- First Nations Goods and Services Tax Act

- Greenhouse Gas Pollution Pricing Act (Part 1)

- Income Tax Act

- Income Tax Conventions Interpretation Act

- Insurance Companies Act

- Interest Act

- Nova Scotia and Newfoundland and Labrador Additional Fiscal Equalization Offset Payments Act

- Office of the Superintendent of Financial Institutions Act

- Payment Card Networks Act

- Payment Clearing and Settlement Act

- Pension Benefits Standards Act, 1985

- Pooled Registered Pension Plans Act

- Proceeds of Crime (Money Laundering) and Terrorist Financing Act

- Protection of Residential Mortgage or Hypothecary Insurance Act

- Royal Canadian Mint Act

- Special Import Measures Act

- Tax-Back Guarantee Act

- Trust and Loan Companies Act

- Winding-up and restructuring Act (Parts II and III)

Year of incorporation / commencement: 1867Footnote 12

Raison d’être, mandate and role: who we are and what we do

Information on the Department of Finance Canada’s raison d’être, mandate and role is available on the Department of Finance Canada’s website.

Information on the Department of Finance Canada’s mandate letter commitments is available in the Deputy Prime Minister and Minister of Finance Mandate Letter and Minister of Tourism and Associate Minister of Finance Mandate Letter.

Operating context

Information on the operating context is available on the Department of Finance Canada’s website.

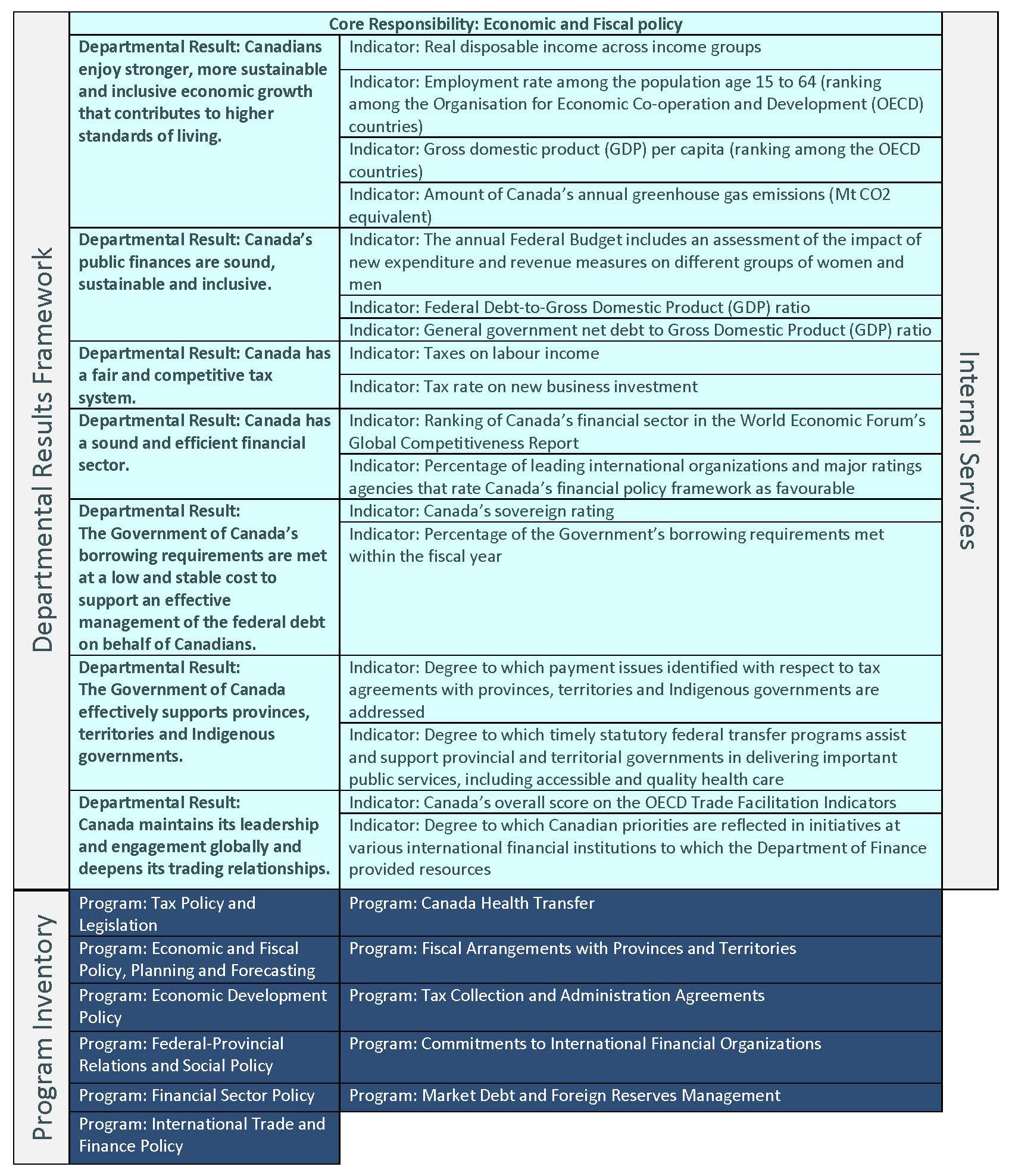

Reporting framework

The Department of Finance Canada’s approved departmental results framework and program inventory for 2022–23 are as follows.

| Structure | 2021–22 | 2022–23 | Change | Reason for change |

|---|---|---|---|---|

| Core responsibility | Economic and Fiscal Policy | Economic and Fiscal Policy | No change | Not applicable |

| Program | Tax Policy and Legislation | Tax Policy and Legislation | No change | Not applicable |

| Program | Economic and Fiscal Policy, Planning and Forecasting | Economic and Fiscal Policy, Planning and Forecasting | No change | Not applicable |

| Program | Economic Development Policy | Economic Development Policy | No change | Not applicable |

| Program | Federal-Provincial Relations and Social Policy | Federal-Provincial Relations and Social Policy | No change | Not applicable |

| Program | Financial Sector Policy | Financial Sector Policy | No change | Not applicable |

| Program | International Trade and Finance Policy | International Trade and Finance Policy | No change | Not applicable |

| Program | Canada Health Transfer | Canada Health Transfer | No change | Not applicable |

| Program | Fiscal Arrangements with Provinces and Territories | Fiscal Arrangements with Provinces and Territories | No change | Not applicable |

| Program | Tax Collection and Administration Agreements | Tax Collection and Administration Agreements | No change | Not applicable |

| Program | Commitments to International Financial Organizations | Commitments to International Financial Organizations | No change | Not applicable |

| Program | Market Debt and Foreign Reserves Management | Market Debt and Foreign Reserves Management | No change | Not applicable |

As noted in the chart above, there were no changes to the department’s Core Responsibility or Programs since 2021-22. However, there are two new Departmental Indicators and one editorial change to an existing indicator, which are outlined in the preceding diagram and further explained below:

- The department has added a new indicator under the Departmental Result “Canadians enjoy stronger, more sustainable and inclusive economic growth that contributes to higher standards of living”. The new indicator is “Amount of Canada’s annual greenhouse gas emissions (Mt CO2 equivalent)” and will show Canada’s progress towards meeting the 2030 target of reducing GHG emissions and shifting to a more sustainable economy.

- The department has added a new indicator under the Departmental Result “Canada’s public finances are sound, sustainable and inclusive”. The new indicator is “General government net debt to Gross Domestic Product (GDP) ratio” and it has been added to complement the current indicators which assess the stability of public finances.

- Lastly, the department has made an editorial amendment to the name of the Departmental Result: “Degree to which Canadian priorities are reflected by international financial institutions’ institutional financing vehicle to which the Department of Finance Canada’s provided resources”. This has been changed to “Degree to which Canadian priorities are reflected in initiatives at various international financial institutions to which the Department of Finance Canada provided resources”.

Supporting information on the program inventory

Supporting information on planned expenditures, human resources, and results related to the Department of Finance Canada’s program inventory is available on GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on the Department of Finance Canada’s website:

- Departmental Sustainable Development Strategy

- Gender-based analysis plus

- Details on transfer payment programs

Federal tax expenditures

The Department of Finance Canada’s Departmental Plan does not include information on tax expenditures.

Tax expenditures are the responsibility of the Minister of Finance. The Department of Finance Canada publishes cost estimates and projections for government-wide tax expenditures each year in the Report on Federal Tax Expenditures. This report provides detailed information on tax expenditures, including objectives, historical background and references to related federal spending programs, as well as evaluations, research papers and gender-based analysis plus.

Organizational contact information

Mailing address

Department of Finance Canada

15th Floor

90 Elgin Street

Ottawa, Ontario K1A 0G5

Telephone: 613-369-3710

TTY: 613-995-1455

Fax: 613-369-4065

Email:fin.publishing-publication.fin@canada.ca

Website(s):Canada.ca

Appendix: definitions

appropriation (crédit)

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

budgetary expenditures (dépenses budgétaires)

Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

core responsibility (responsabilité essentielle)

An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

Departmental Plan (plan ministériel)

A document that sets out a department’s priorities, programs, expected results and associated resource requirements, covering a threeyear- period beginning with the year indicated in the title of the report. Departmental Plans are tabled in Parliament each spring.

departmental result (résultat ministériel)

A change that a department seeks to influence. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

departmental result indicator (indicateur de résultat ministériel)

A factor or variable that provides a valid and reliable means to measure or describe progress on a departmental result.

departmental results framework (cadre ministériel des résultats)

A framework that consists of the department’s core responsibilities, departmental results and departmental result indicators.

Departmental Results Report (rapport sur les résultats ministériels)

A report on a department’s actual performance in a fiscal year against its plans, priorities and expected results set out in its Departmental Plan for that year. Departmental Results Reports are usually tabled in Parliament each fall.

experimentation (expérimentation)

The conducting of activities that explore, test and compare the effects and impacts of policies and interventions in order to inform decision-making and improve outcomes for Canadians. Experimentation is related to, but distinct from, innovation. Innovation is the trying of something new; experimentation involves a rigorous comparison of results. For example, introducing a new mobile application to communicate with Canadians can be an innovation; systematically testing the new application and comparing it against an existing website or other tools to see which one reaches more people, is experimentation.

fulltime equivalent (équivalent temps plein-)

A measure of the extent to which an employee represents a full personyear- charge against a departmental budget. Full-time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

gender-based analysis plus (GBA Plus)(analyse comparative entre les sexes plus [ACS Plus])

An analytical process used to assess how diverse groups of women, men and gender-diverse people experience policies, programs and services based on multiple factors including race, ethnicity, religion, age, and mental or physical disability.

government-wide priorities (priorités pangouvernementales)

For the purpose of the 2022–23 Departmental Plan, government-wide priorities are the high-level themes outlining the government's agenda in the 2021 Speech from the Throne: protecting Canadians from COVID-19; helping Canadians through the pandemic; building back better – a resiliency agenda for the middle class; the Canada we're fighting for.

horizontal initiative (initiative horizontale)

An initiative in which two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

nonbudgetary expenditures- (dépenses non budgétaires)

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

performance (rendement)

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

plan (plan)

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

planned spending (dépenses prévues)

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

program (programme)

Individual or groups of services, activities or combinations thereof that are managed together within a department and that focus on a specific set of outputs, outcomes or service levels.

program inventory (répertoire des programmes)

An inventory of a department’s programs that describes how resources are organized to carry out the department’s core responsibilities and achieve its planned results.

result (résultat)

An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead, they are within the area of the organization’s influence.

statutory expenditures (dépenses législatives)

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

target (cible)

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

voted expenditures (dépenses votées)

Expenditures that Parliament approves annually through an Appropriation Act. The vote wording becomes the governing conditions under which these expenditures may be made.