Archived - Departmental Plan 2023-2024

From the Ministers

This is a time of real uncertainty in the global economy.

The global economy is slowing down, and interest rates and inflation are elevated around the world. Everyone is contending with the impact of Russia's illegal invasion of Ukraine and the difficult-to-predict consequences of China's economic reopening.

Fortunately, Canada is facing these global headwinds from a position of fundamental strength. On the heels of an unprecedented recovery from the pandemic recession, our unemployment rate is near record lows, more Canadians have good jobs than ever before, and the IMF predicts Canada will see the strongest economic growth in the G7 in the fourth quarter of this year. Canada also maintains the lowest deficit and the lowest net debt-to GDP ratio in the G7, and Moody's has reaffirmed our AAA credit rating with a stable outlook.

This still remains a time of fiscal constraint. Our ability to spend is not infinite, and we know that it is our responsibility, as the federal government, to not pour fuel on the fire of inflation. However, because of our country's proud tradition of sound fiscal management, Canada can afford to make essential investments in times of crisis—and in times of opportunity.

The next few years will be critical to the Canadian economy for a generation. The global net-zero transition is the most significant economic transformation since the Industrial Revolution. At the same time, our democratic partners are seeking to shift their economic dependence away from dictatorships and towards democracies like our own. These shifts represent a once-in-a-generation opportunity to build Canada's 21st century economy—an opportunity our government will continue to invest in.

From stronger public health care, to affordable housing, to affordable child care, and ensuring our robust social safety net is there for those who need it, the investments we have made will help ensure Canada remains the best place in the world to live, work, and raise a family.

For all of the challenges facing the global economy today, there is no country better placed than Canada to thrive. Ensuring that remains true will be our government's focus in the weeks, months, and years ahead. We'll do it by building an economy that works for everyone, where everyone can earn a good day's living for a hard day's work—from coast-to-coast-to-coast.

Today, tomorrow, and for generations to come.

Signed,

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

The Honourable Randy Boissonnault P.C., M.P.

Minister of Tourism and Associate Minister of Finance

Plans at a glance

The Department of Finance Canada (the Department) is responsible for the overall stewardship of the Canadian economy. This includes preparing the annual federal budget, setting overall fiscal and economic policy, and advising the government on tax and tariff policy. It also provides advice on social measures, security issues, financial sector stability, and Canada's international commitments.

In 2023–24, the Department will continue to support the Deputy Prime Minister and Minister of Finance, and the Minister of Tourism and Associate Minister of Finance in advancing the government's priorities, and intends to:

Sound Fiscal Management

- Manage the preparation of the federal budget, as well as economic and fiscal updates.

- Continue to implement the fiscal plans outlined in Budget 2022 and Budget 2023.

- Develop sound policy advice based on an assessment of current and future economic conditions and sound fiscal planning.

- Develop policy options and advice to enhance the fairness, neutrality, competitiveness, and efficiency of Canada's tax system.

Inclusive and Sustainable Economic Growth

- In a challenging global environment, make sound investments in people and workers to support Canada's transition to a prosperous, low-carbon economy – while not making short-term inflation worse or longer lasting.

- Collaborate with departments and other central agencies to advance long-term inclusive economic growth through policies that advance skills training, labour force participation, immigration, and internal trade.

- Work with other government departments and leverage internal expertise to support and provide advice regarding the development of policies and programs intended to advance economic reconciliation for Indigenous Peoples.

- Bolster inclusive economic growth that supports the government's efforts to achieve its 2030 climate goals and accelerate the transition to a net-zero economy no later than 2050.

- Develop and move forward with tax and pollution pricing policies that will help in the adoption of clean technologies and the creation of good-paying jobs, while ensuring that Canadian businesses remain globally competitive and polluting emissions in Canada are reduced.

- Continue to develop and support policies that focus on the efficient management of Crown investments as well as the federal government's debt and international reserves.

- Provide policy advice on maintaining a stable, resilient, and innovative financial sector that continues to meet the needs of Canadians.

Sound Social Policy Framework

- Continue to manage the major transfer payment programs to provinces and territories.

- Work to make life more affordable for middle class Canadians and their families, including through a continued and sustained investment in early learning and child care, and by advancing measures to improve housing affordability.

- Collaborate with other government departments, central agencies, and provincial and territorial governments to develop policy proposals that address the government's priorities across a range of social policy issues from advancing reconciliation and Indigenous Peoples' rights to addressing profound systemic inequities and disparities.

Effective International Engagement

- Collaborate with international partners and organizations to ensure a strong, coordinated, and effective multilateral response to the COVID-19 pandemic and Russia's war in Ukraine, and ensure a strong and sustained global recovery.

- Promote bolder climate actions, working with like-minded countries.

- Support the government in maintaining Canada's leadership and engagement globally, while deepening trading relationships and promoting the rules-based international order.

For more information on the Department of Finance Canada's plans, see the "Core responsibilities: planned results and resources, and key risks" section of this plan.

Core responsibilities: planned results and resources, and key risks

This section contains information on the Department of Finance Canada's planned results and resources, and key risks for our core responsibility including:

- A description of the core responsibility

- Highlights of the Department's plans for the results it aims to achieve in the coming year and beyond, organized by theme

- A description of the Department's plan for:

- How the Department will use Gender-based Analysis Plus

- Contributing to the Government of Canada's efforts to implement the United Nations 2030 Agenda for Sustainable Development, and achieve UN Sustainable Development Goals

- Innovating with new approaches to achieve our planned results

- The mitigation of key risks related to achieving those results

- The financial and human resources that the Department will allocate to achieve its planned results

Economic and Fiscal Policy

Description

Develop the federal budget and Fall Economic Statement, as well as provide analysis and advice to the Government of Canada on economic, fiscal, and social policy; federal-provincial relations, including the transfer and taxation payments; the financial sector; tax policy; and international trade and finance.

Planning highlights

In 2023–24, the Department plans to:

Sound Fiscal Management

- Support the government's responsible management of the federal budget and federal debt to preserve Canada's low-debt advantage.

- Tailor the government's debt strategy to respond to Canada's evolving economic needs, to support Canadians and Canadian businesses as the country navigates through slowing economic growth.

- Make new, targeted investments to improve the quality of life of Canadians by building a stronger, greener, and more resilient and sustainable society.

- Continue to manage the government's debt program with the fundamental objectives of raising stable and low-cost funding and maintaining a well-functioning market for Government of Canada securities. The Department will also continue to efficiently manage Canada's foreign reserves and currency system.

- Provide advice on the development of a sustainable bond framework, which would allow the government to issue social or transition bonds, in addition to green bonds.

Federal Government's Green Bonds

The Department of Finance Canada will:

- Continue to monitor the growth of the sustainable finance market in Canada and highlight Canada's investments in climate action and environmental initiatives.

- Continue to support an annual green bond program, including the issuance of Canada's second green bond and the publication of the allocation report for the inaugural green bond before the end of 2022–23.

- Support the development of sustainable finance markets to foster private investments that promote a net-zero emissions economy and protect the environment.

- Develop and support the implementation of proposals aimed at ensuring Canada has a fair tax system, such as a new minimum tax regime to ensure that all wealthy Canadians pay their fair share and a tax on the net value of share buybacks by public corporations in Canada. Canada will also continue to work with international partners on the two-pillar tax reform plan to ensure multinational corporations pay their fair share of tax wherever they do business.

Inclusive and Sustainable Economic Growth

- Establish a permanent Council of Economic Advisors to provide independent advice and policy options on long-term economic growth that will achieve a higher standard of living, better quality of life, inclusive growth, and a more innovative and skillful economy.

- Conduct evidence-based analysis to ensure policies are effective in building a green, equitable, and strong economy.

- Examine policies through the new Quality of Life Framework, and continue to pilot an integrated climate lens, as announced in Budget 2021. Taken together, these assessment tools aim to enhance employment, environment, health, and inclusion while ensuring long-term fiscal viability and reducing the federal debt as a share of the economy over the medium term.

- Continue working with departments and other central agencies to advance long-term inclusive economic growth through policies that advance skills training, labour force participation, inclusion of under-represented groups, immigration, internal trade, and labour mobility.

- Provide policy advice to support a well-functioning financial sector that continues to meet the needs of Canadians. Financial sector priorities include providing advice on:

- Insurance-based strategies for addressing natural disaster protection gaps.

- Canada's financial stability framework.

- The domestic housing finance system.

- Efforts to combat money laundering and terrorist financing, and support development and implementation of financial sanctions.

- Payment system modernization, including implementing a new supervisory framework for retail payments.

- Advance policy thinking on the digitalization of money and cryptocurrencies.

- Reducing credit card transaction fees for small businesses.

- Implementing a made-in-Canada open banking system.

- Fighting predatory lending by lowering the criminal rate of interest.

- Strengthening the sustainability of federally regulated private sector pension plans.

- Establishing a well-functioning sustainable finance market.

Reviewing and Strengthening Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime

- The Department will lead preparations for the 2023 Parliamentary Review of Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime.

- This will include consultations on policy initiatives to respond to new and evolving trends and threats, with a focus on improving operational effectiveness and results.

- Develop and support the implementation of tax measures that will continue supporting the government's climate goals, securing Canada's competitive advantage, and creating opportunities for Canadian workers. These include new investment tax credits for capital invested in clean technologies and clean hydrogen.

- Support the government's commitments to see the Trans Mountain Expansion Project built in the right way and to divest the Trans Mountain Corporation to a new owner or owners in a manner and at a time that protects the public interest and the government's investment. This includes continuing to explore opportunities for meaningful economic participation in Trans Mountain with Indigenous groups who live along the pipeline corridor and marine shipping route, in keeping with the spirit of reconciliation.

- Support the implementation of the Canada Growth Fund, announced in Budget 2022 as a new arm's length public investment fund that will attract substantial private sector investment to meet important national economic policy goals.

- Collaborate with departments and other central agencies to advance policies and programs which promote economic development. This includes measures which support innovative and growing businesses as well as sector-specific strategies in traditional sectors (agriculture, fisheries, mining, and forestry). The Department will facilitate the creation of a new Canada Innovation Corporation

Sound Social Policy Framework

- Convene meetings and undertake consultations with provinces and territories, including finance ministers, to advance issues of shared interest.

- Advance priority policies and critical investments aimed at improving the availability and quality of social and affordable housing.

- Work in collaboration with provinces and territories to advance the 2022-2024 Triennial Review of the Canada Pension Plan.

- Implement the 2024 renewal of the Equalization and Territorial Formula Financing programs.

- Work with other government departments and central agencies to advance health and social priorities, including public safety and justice, culture, diversity and inclusion.

- Support reconciliation with Indigenous Peoples, including:

- The establishment of a new fiscal relationship with Indigenous Peoples.

- The delivery of government priorities in areas such as Indigenous social and economic policy.

- The application of a distinctions-based lens in funding approaches.

Effective International Engagement

- Continue to monitor and analyze international COVID-19 and Ukraine policy responses and their economic impacts, with a view to ensuring a coordinated global economic recovery.

- Coordinate with allies, including G7 members, on support for Ukraine against the illegal invasion by Russia.

- Work with international counterparts to ensure multilateral development banks use resources efficiently and meet the challenges of today, including the safeguarding of public health and economic stability as well as creating a stronger, greener, and more inclusive economy.

- Continue its efforts to improve debt sustainability and transparency across the international system.

- Lead Canada's engagement in negotiations to modernize multilateral export credit disciplines and orient this support towards climate-friendly projects.

- Further the government's global engagement agenda by:

- Expanding preferential trade through the exploration, negotiation, and implementation of free trade agreements.

- Supporting the government's response to protectionist measures by major trading partners, including a Reciprocal Procurement Policy.

- Engaging with international partners to promote climate ambition and mitigate potential impacts of different climate change mitigation policies (e.g., through Border Carbon Adjustments).

- Continue to monitor and advise on issues related to the import of goods to ensure Canada's manufacturing competitiveness and protect domestic industries against unfair trade practices.

Gender-based Analysis Plus

All budgetary and off-cycle proposals in 2023–24 will continue to be informed by gender and diversity analysis (through the Department of Finance Canada's GBA Plus Template). A consistent approach to this type of analysis ensures that funding decisions are made with an understanding of how diverse groups of Canadians will be affected. Additionally, the Gender Results Framework will continue support budget decision making and priority setting and help track Canada's progress toward gender equality goals.

Gender and diversity analysis is complemented and reinforced by the Quality of Life Framework, which includes an assessment of the nature of expected impacts based on key determinants of quality of life, such as prosperity, health, environment, social cohesion, and good governance.

These efforts will help to ensure that government programs and initiatives continue to support those individuals most in need, as well as help to address long-standing inequalities.

The Department also strives to achieve equality in its workplace and aims to employ a diverse group of employees. When staffing, the Department will consider its Workforce Availability targets, as set by the Treasury Board Secretariat, and work to ensure that these targets are met or exceeded.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

In 2023–24, the Department will remain focused on ensuring Canada's economy grows in a sustainable and inclusive manner. All budgetary and off-cycle funding proposals submitted to the Department must meet strategic environmental assessment requirements and demonstrate that the potential impact on climate change has been considered and mitigated. In reviewing these packages, the Department contributes to achieving Sustainable Development Goal 13.3: Improve education, awareness-raising and human and institutional capacity on climate change mitigation, adaptation, impact reduction and early warning. The Department is also a key contributor to three Federal Sustainable Development Strategy goals: Greening Government; Effective Action on Climate Change; and Clean Energy.

Innovation

In 2023–24 the Department will continue to advance innovation through:

- Social or transition bonds – As announced in Budget 2022, the Department will provide advice on the development of a sustainable bond framework, which would allow the government to issue inaugural social or transition bonds. These will be the first bonds of their kind issued by the Government of Canada. Information will be made publicly available on an annual basis on the allocation of proceeds towards eligible social expenditures as well as on the positive social impact of these expenditures.

- Canada Innovation Corporation – Budget 2022 announced the government's intention to create an operationally independent, market-oriented Canadian innovation and investment agency to proactively work with new and established Canadian industries and businesses to help them make the investments they need to innovate, grow, create jobs, and be competitive in the changing global economy. The Department will work with Innovation, Science and Economic Development Canada to facilitate the creation of this agency, the first of its kind.

- Hybrid work – The Department will continue to implement the hybrid work model, while maintaining a healthy, safe, and respectful workplace. Employee feedback will be sought, and adjustments made based on this feedback where needed.

Key risks

In the context of a dynamic and evolving operating environment, the Department will continue to monitor changes to domestic and global economic and social conditions, including unexpected global events (e.g., conflicts, natural disasters, and pandemics).

The Department will use a forward-looking and proactive approach to continue to effectively manage its existing and emerging risks through ongoing cooperation, engagement, and sharing of expertise and best practice with other federal departments and agencies, provincial and territorial governments, as well as stakeholders and international counterparts.

By leveraging technology and implementing effective and strengthened security and business continuity plans, the Department, as a central agency, a policy department, and a knowledge-based organization, will be able to respond to and mitigate against potential adverse impacts on the government's capacity to advance Canada's domestic and international fiscal, economic, and social policy interests.

Planned results for Economic and Fiscal Policy

The following table shows, for Economic and Fiscal Policy, the planned results, the result indicators, the targets, and the target dates for 2023–24, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental result | Departmental result indicator | Target | Date to achieve target | 2019–20 actual result | 2020–21 actual result | 2021–22 actual result |

|---|---|---|---|---|---|---|

| Canadians enjoy stronger, more sustainable, and inclusive economic growth that contributes to higher standards of living | 1.1 Gross domestic product (GDP) per capita (ranking among Organisation for Economic Co-operation and Development (OECD) countries) | Ranking among the countries with the 15 highest levels of GDP per capita | March 2024 | Ranked 15th among 37 OECD countriesFootnote 1 | Ranked 17th among 38 OECD countriesFootnote 2 | Data not availableFootnote 3 |

| 1.2 Employment rate among the population 15 to 64 in age (ranking among OECD countries) | Ranking among the countries with the 15 highest employment rates | March 2024 | Ranked 13th among 37 OECD countries | Ranked 14th among 38 OECD countries | Ranked 19th among 38 OECD countries (2020 calendar year)Footnote 4 | |

| 1.3 Real disposable income across income groupsFootnote 5 | Growth is broad-based across income groups | March 2024 | Report not available at the time of releaseFootnote 6 | Report not available at the time of releaseFootnote 7 | Met Footnote 8 | |

| 1.4 Amount of Canada's annual greenhouse gas emissions (Mt CO2 equivalent) | 40-45% reduction in greenhouse gas emissions relative from 2005 levels by 2030. | March 2024 | Data not yet available | Data not yet availableFootnote 9 | 672 Mt CO2 eq in 2020. 9.3% below 2005. | |

| Canada's public finances are sound, sustainable and inclusive | 2.1 Ratio of federal debt-to-gross domestic product (GDP) | Stable over the medium-term (defined as the end of the 5-year projection period for the budget) | March 2024 | Met | Met | MetFootnote 10 |

| 2.2 The annual federal budget includes an assessment of the impact of new expenditure and revenue measures on diverse groups of people | Presence of a clear "Gender Statement" in the annual budget document where the impact of budgetary measures is presented from a gender perspective | March 2024 | Data not availableFootnote 11 | Met | Met | |

| 2.3 General government net debt to gross domestic product (GDP) ratio | Low by international standards defined as compared to G7 countries | March 2024 | Not applicable | MetFootnote 12 | Met | |

| Canada has a fair and competitive tax system | 3.1 Taxes on labour income | Lower than the G7 average | March 2024 | Met | Met | Met |

| 3.2 Tax rate on new business investment | Lower than the G7 average | March 2024 | Data not available | Data not availableFootnote 13 | MetFootnote 14 | |

| Canada has a sound efficient financial sector | 4.1 Percentage of leading international organizations and major ratings agencies that rate Canada's financial policy framework as favourable | 100% | March 2024 | 100% | 100% | 100% |

| 4.2 Ranking of Canada's financial sector in the World Economic Forum's Global Competitiveness Report | Above the G7 average | March 2024 | Above the G7 average Canada: 86 G7 average: 83 | No data available | No data availableFootnote 15 | |

| The Government of Canada's borrowing requirements are met at a low and stable cost to support effective management of the federal debt on behalf of Canadians | 5.1 Percentage of the government's borrowing requirements met within the fiscal year | 100% | March 2024 | 100% | 100% | 100% |

| 5.2 Canada's sovereign rating | Equal to or better than the G7 average | March 2024 | Canada was highest rated among G7 countries, tied with Germany | Canada was the second highest rated among G7 countries, tied with the US | Canada was the second highest rated among G7 countries, tied with the US | |

| The Government of Canada effectively supports provinces, territories and Indigenous governments | 6.1 Degree to which timely statutory federal transfer programs assist and support provincial and territorial governments in delivering important public services, including accessible and quality health care | 5 (100% of payments reviewed did not reveal errors; 100% of payments to provincial and territorial governments were made within the required time frames) | March 2024 | 5 | 5 | 5 |

| 6.2 Degree to which payment issues identified with respect to tax agreements with provinces, territories and Indigenous governments are addressed | 2 (mostly addressed) | March 2024 | Not applicable | 1 (fully addressed) | Not applicableFootnote 16 | |

| Canada maintains its leadership and engagement globally and deepens its trading relationships | 7.1 Canada's overall score on the OECD Trade Facilitation Indicators | Score of 1.7 or higher | March 2024 | Met Footnote 17 | Data not available | Data not availableFootnote 18 |

| 7.2 Degree to which Canadian priorities are reflected in initiatives at various international financial institutions to which the Department of Finance Canada provided resources | 4 | March 2024 | Met | Met | Met |

The financial, human resources, and performance information for the Department of Finance Canada's program inventory is available on GC InfoBase.

Planned budgetary spending for Economic and Fiscal Policy

The following table shows, for Economic and Fiscal Policy, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023–24 budgetary spending (as indicated in Main Estimates) | 2023–24 planned spending | 2024–25 planned spending | 2025–26 planned spending |

|---|---|---|---|

| $128,889,898,527 | $128,889,898,527 | $134,107,971,818 | $138,257,172,244 |

Financial, human resources, and performance information for the Department of Finance Canada's program inventory is available on GC InfoBase.

Planned human resources for Economic and Fiscal Policy

The following table shows, in full‑time equivalents, the human resources the Department will need to fulfill this core responsibility for 2023–24 and for each of the next two fiscal years.

| 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents | 2025–26 planned full-time equivalents |

|---|---|---|

| 677 | 648 | 645 |

Financial, human resources, and performance information for the Department of Finance Canada's program inventory is available on GC InfoBase.

Internal services: planned results

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Planning highlights

In 2023–24, the Department of Finance Canada will continue to:

- Implement the departmental hybrid work model, while maintaining a healthy, safe, and respectful workplace.

- Build a diverse, inclusive, and accessible workforce. More specifically, the Department will continue work to establish a respectful culture that values equality and workplace wellbeing and addresses systemic barriers in order to increase the representation of people who belong to racialized groups, Indigenous Peoples, as well as persons with disabilities within all levels of the organization.

- Implement departmental solutions designed to simplify, modernize, and innovate information management and information technology (IT) tools and services that enhance business effectiveness, collaboration, and mobility.

- Partner with Shared Services Canada to modernize and transform the Department's existing IT infrastructure, disaster recovery, and business continuity solutions, and leverage cloud technologies for applications and services.

- Invest in the evergreening of IT assets to ensure employees have modern and mobile endpoint devices, and that boardrooms support a hybrid work model.

- Strengthen the departmental security posture.

- Modernize the Department's approach to recruitment and talent management to attract and retain employees with specialized skillsets.

- Provide effective stewardship of financial resource management within the Department.

- Ensure Canadians have access to factual, non-partisan, and plain language information on the Government of Canada's policies and programs designed to create a healthy and inclusive Canadian economy, specifically through the publication and communication of the 2023 federal budget and 2023 Fall Economic Statement.

Planning for Contracts Awarded to Indigenous Businesses

The Department plans to support the Government of Canada's commitment that a mandatory minimum target of 5 per cent of the total value of contracts is awarded to Indigenous businesses beginning in 2023–24 as it:

- Intends to award goods contracts to Indigenous businesses for the purchase of office supplies, IT equipment, and furniture.

- Intends to award services contracts such as temporary help, delivery services, and event management services.

- Ensures all procurement officers will have completed the updated Indigenous Procurement courses by March 31, 2023, and the Department actively participates in the Indigenous Procurement Coordinator meetings through Indigenous Services Canada.

| 5% reporting field description | 2021–22 actual % achieved | 2022–23 forecasted % target | 2023–24 planned % target |

|---|---|---|---|

| Total percentage of contracts with Indigenous businesses | Not applicable | Not applicable | 5% |

Planned budgetary spending for internal services

The following table shows, for internal services, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023–24 budgetary spending (as indicated in Main Estimates) | 2023–24 planned spending | 2024–25 planned spending | 2025–26 planned spending |

|---|---|---|---|

| $47,181,155 | $47,181,155 | $46,840,743 | $46,956,104 |

Planned human resources for internal services

The following table shows, in full‑time equivalents, the human resources the Department will need to carry out its internal services for 2023–24 and for each of the next two fiscal years.

| 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents | 2025–26 planned full-time equivalents |

|---|---|---|

| 253 | 249 | 249 |

Planned spending and human resources

This section provides an overview of the Department's planned spending and human resources for the next three fiscal years and compares planned spending for 2023–24 with actual spending for the current year and the previous year.

Planned spending

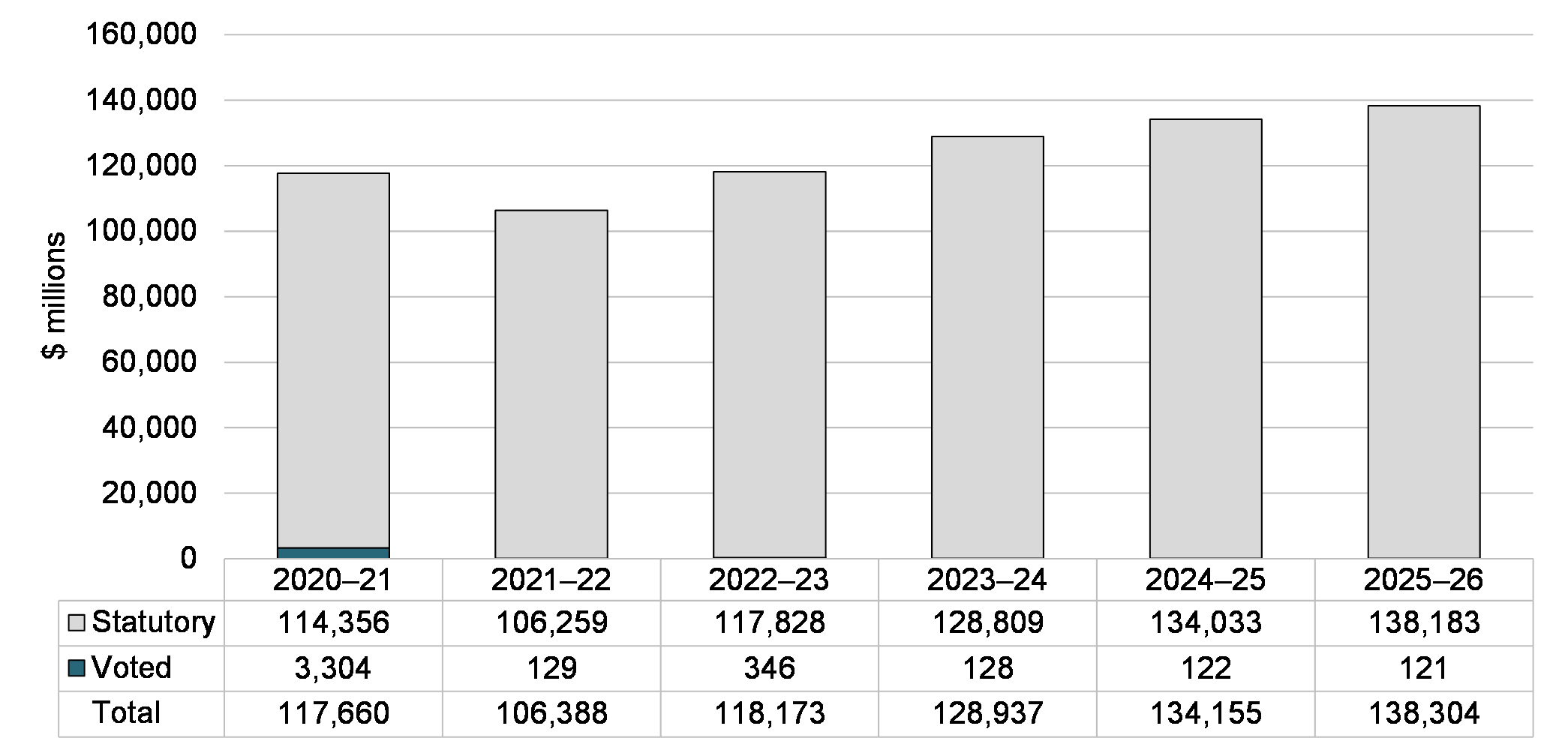

Departmental spending 2020–21 to 2025–26

The following graph presents planned spending (voted and statutory expenditures) over time.

Budgetary planning summary for core responsibilities and internal services (dollars)

Budgetary planning summary for core responsibilities and internal services (dollars)

The following table shows information on spending for the Department of Finance Canada's core responsibility and for its internal services for 2023–24 and other relevant fiscal years.

| Core responsibilities and internal services | 2020–21 actual expenditures | 2021–22 actual expenditures | 2022–23 forecast spending | 2023–24 budgetary spending (as indicated in Main Estimates) | 2023–24 planned spending | 2024–25 planned spending | 2025–26 planned spending |

|---|---|---|---|---|---|---|---|

| Economic and Fiscal Policy | 117,609,934,584 | 106,340,024,056 | 118,116,581,279 | 128,889,898,527 | 128,889,898,527 | 134,107,971,818 | 138,257,172,244 |

| Subtotal | 117,609,934,584 | 106,340,024,056 | 118,116,581,279 | 128,889,898,527 | 128,889,898,527 | 134,107,971,818 | 138,257,172,244 |

| Internal services | 50,293,291 | 48,028,313 | 56,856,042 | 47,181,155 | 47,181,155 | 46,840,743 | 46,956,104 |

| Total | 117,660,227,875 | 106,388,052,369 | 118,173,437,321 | 128,937,079,682 | 128,937,079,682 | 134,154,812,561 | 138,304,128,348 |

Economic and Fiscal Policy

The cumulative net increase of $0.5 billion in spending from 2020–21 to 2022–23 mainly relates to:

- an increase in market debt due to the increase in the outstanding unmatured debt balance and upward revisions to interest rates and Consumer Price Index inflation ($11.2 billion)

- legislated increases for the Canada Health Transfer payment program ($3.3 billion) and payments to help provinces and territories address immediate health care system pressures caused by the pandemic ($2 billion)

- a one-time payment to provinces and territories to support public transit and housing ($0.8 billion)

- offset by decreases in spending related to COVID-19 measures ($16.7 billion).

The cumulative increase of $9.4 billion in planned spending from 2023–24 to 2025–26 mainly relates to the following statutory items:

- legislated and forecasted increases to the Canada Health Transfer ($4.8 billion) and fiscal arrangements with provinces and territories transfer payment programs ($3.2 billion)

- an increase in approved authorities for capital and operating expenses for the Canada Infrastructure Bank ($1.4 billion).

Internal Services

The cumulative increase of $6.6 million in spending from 2020–21 to 2022–23 is mainly attributable to funding received in internal services to support new government initiatives in the areas of tax policy, financial sector policy, and economic development.

Planned human resources

The following table shows information on human resources, in full-time equivalents, for the Department of Finance Canada's core responsibly and for its internal services for 2023–24 and the other relevant years.

| Core responsibilities and internal services | 2020–21 actual full-time equivalents | 2021–22 actual full-time equivalents | 2022–23 forecast full-time equivalents | 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents | 2025–26 planned full-time equivalents |

|---|---|---|---|---|---|---|

| Economic Fiscal Policy | 569 | 589 | 680 | 677 | 648 | 645 |

| Subtotal | 569 | 589 | 680 | 677 | 648 | 645 |

| Internal services | 308 | 310 | 252 | 253 | 249 | 249 |

| Total | 877 | 899 | 932 | 930 | 897 | 894 |

The increased use of full-time equivalents from 2020–21 to 2022–23 is primarily due to funding received to support the work on key government priorities in areas such as tax policy, financial sector policy, and economic development.

Estimates by vote

Information on the Department of Finance Canada's organizational appropriations is available in the 2023–24 Main Estimates.

Future-oriented condensed statement of operations

The future‑oriented condensed statement of operations provides an overview of the Department of Finance Canada's operations for 2022–23 to 2023–24.

The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

A more detailed future‑oriented statement of operations and associated notes, including a reconciliation of the net cost of operations with the requested authorities, are available on the Department of Finance Canada's website.

Financial information |

2022–23 forecast results | 2023–24 planned results | Difference (2023–24 planned results minus 2022–23 forecast results) |

|---|---|---|---|

| Total expenses | 114,487,753,781 | 126,085,044,159 | 11,597,290,378 |

| Total revenues | - | - | - |

| Net cost of operations before government funding and transfers | 114,487,753,781 | 126,085,044,159 | 11,597,290,378 |

Planned net cost of operations (before government funding and transfers) shows an increase of $11.6 billion in 2023–24, primarily due to legislated and forecasted increases in major transfer payments to provinces and territories ($7.1 billion) and a planned increase in interest expense ($6.4 billion), due to the rise in short-term interest rates and the impact of inflation on Real Return Bonds.

Corporate information

Organizational profile

Appropriate minister(s): The Honourable Chrystia Freeland P.C., M.P.

The Honourable Randy Boissonnault P.C., M.P.

Institutional head: Michael Sabia

Ministerial portfolio: Department of Finance Canada

Enabling instrument(s): The Minister of Finance has direct responsibility for a number of Acts and is assigned specific fiscal and tax policy responsibilities relating to other acts that are under the responsibility of other ministers. A complete list of these Acts can be found on the Department of Finance Canada’s website. Some of these Acts are listed below:

- Air Travellers Security Charge Act

- Asian Infrastructure Investment Bank Agreement Act

- Bank Act

- Bank for International Settlements (Immunity) Act

- Bank of Canada Act

- Bills of Exchange Act

- Borrowing Authority Act

- Bretton Woods and Related Agreements Act

- Budget Implementation ActsFootnote 19 (under various titles)

- Canada Deposit Insurance Corporation Act

- Canada Pension PlanFootnote 20

- Canada Pension Plan Investment Board Act

- Canadian International Trade Tribunal Act

- Canadian Gender Budgeting Act

- Canadian Payments Act

- Canadian Securities Regulation Regime Transition Office Act

- Cooperative Credit Associations Act

- Currency Act

- Customs Tariff

- Depository Bills and Notes Act

- European Bank for Reconstruction and Development Agreement Act

- Excise Act, 2001

- Excise Tax Act

- Federal-Provincial Fiscal Arrangements Act

- Financial Administration Act

- Financial Consumer Agency of Canada Act

- First Nations Goods and Services Tax Act

- Greenhouse Gas Pollution Pricing Act (Part 1)

- Income Tax Act

- Income Tax Conventions Interpretation Act

- Insurance Companies Act

- Interest Act

- Nova Scotia and Newfoundland and Labrador Additional Fiscal Equalization Offset Payments Act

- Office of the Superintendent of Financial Institutions Act

- Payment Card Networks Act

- Payment Clearing and Settlement Act

- Pension Benefits Standards Act, 1985

- Pooled Registered Pension Plans Act

- Proceeds of Crime (Money Laundering) and Terrorist Financing Act

- Protection of Residential Mortgage or Hypothecary Insurance Act

- Royal Canadian Mint Act

- Select Luxury Items Tax Act

- Special Import Measures Act

- Tax-Back Guarantee Act

- Trust and Loan Companies Act

- Underused Housing Tax Act

- Winding-up and restructuring Act (Parts II and III)

Year of incorporation / commencement: 1867Footnote 21

Raison d'être, mandate and role: who we are and what we do

Information on the Department of Finance Canada's raison d'être, mandate and role is available on the Department of Finance Canada's website.

Information on the Department of Finance Canada's mandate letter commitments is available in the Deputy Prime Minister and Minister of Finance Mandate Letter and Minister of Tourism and Associate Minister of Finance Mandate Letter.

Operating context

Information on the operating context is available on the Department of Finance Canada's website.

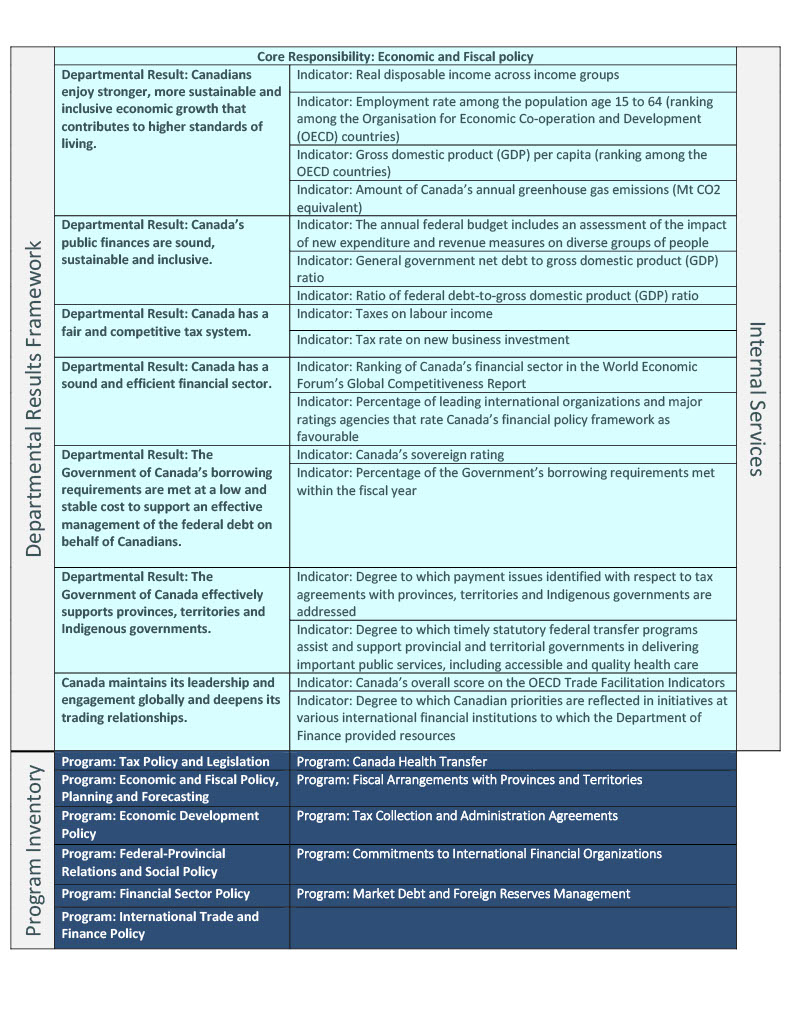

Reporting framework

The Department of Finance Canada's approved departmental results framework and program inventory for 2023–24 are as follows.

Changes to the approved reporting framework since 2022–23

Minor editorial changes were made to the Departmental Results Framework in 2022–23. All changes were to modify language to ensure consistency across the Government of Canada.

Supporting information on the program inventory

Supporting information on planned expenditures, human resources, and results related to the Department of Finance Canada's program inventory is available on GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on the Department of Finance Canada's website:

- Details on transfer payment programs

- Gender-based Analysis Plus

- United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

Federal tax expenditures

The Department of Finance Canada's Departmental Plan does not include information on tax expenditures.

Tax expenditures are the responsibility of the Minister of Finance. The Department of Finance Canada publishes cost estimates and projections for government‑wide tax expenditures each year in the Report on Federal Tax Expenditures. This report provides detailed information on tax expenditures, including objectives, historical background, and references to related federal spending programs, as well as evaluations, research papers, and Gender-based Analysis Plus.

Organizational contact information

Mailing address

Department of Finance Canada

15th Floor

90 Elgin Street

Ottawa, Ontario K1A 0G5

Telephone: 613-369-3710

TTY: 613-995-1455

Fax: 613-369-4065

Email: publishing-publication@fin.gc.ca

Website(s): Canada.ca

Appendix: definitions

appropriation (crédit)

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

budgetary expenditures (dépenses budgétaires)

Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

core responsibility (responsabilité essentielle)

An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

Departmental Plan (plan ministériel)

A document that sets out a department's priorities, programs, expected results and associated resource requirements, covering a three‑year period beginning with the year indicated in the title of the report. Departmental Plans are tabled in Parliament each spring.

departmental result (résultat ministériel)

A change that a department seeks to influence. A departmental result is often outside departments' immediate control, but it should be influenced by program-level outcomes.

departmental result indicator (indicateur de résultat ministériel)

A factor or variable that provides a valid and reliable means to measure or describe progress on a departmental result.

departmental results framework (cadre ministériel des résultats)

A framework that consists of the department's core responsibilities, departmental results and departmental result indicators.

Departmental Results Report (rapport sur les résultats ministériels)

A report on a department's actual performance in a fiscal year against its plans, priorities and expected results set out in its Departmental Plan for that year. Departmental Results Reports are usually tabled in Parliament each fall.

full-time equivalent (équivalent temps plein)

A measure of the extent to which an employee represents a full person‑year charge against a departmental budget. Full‑time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

Gender-based Analysis Plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

An analytical tool used to support the development of responsive and inclusive policies, programs, and other initiatives. GBA Plus is a process for understanding who is impacted by the issue or opportunity being addressed by the initiative; identifying how the initiative could be tailored to meet diverse needs of the people most impacted; and anticipating and mitigating any barriers to accessing or benefitting from the initiative. GBA Plus is an intersectional analysis that goes beyond biological (sex) and socio-cultural (gender) differences to consider other factors, such as age, disability, education, ethnicity, economic status, geography, language, race, religion, and sexual orientation.

government-wide priorities (priorités pangouvernementales)

For the purpose of the 2023–24 Departmental Plan, government-wide priorities are the high-level themes outlining the government's agenda in the 2021 Speech from the Throne: building a healthier today and tomorrow; growing a more resilient economy; bolder climate action; fighting harder for safer communities; standing up for diversity and inclusion; moving faster on the path to reconciliation; and fighting for a secure, just, and equitable world.

high impact innovation (innovation à impact élevé)

High impact innovation varies per organizational context. In some cases, it could mean trying something significantly new or different from the status quo. In other cases, it might mean making incremental improvements that relate to a high-spending area or addressing problems faced by a significant number of Canadians or public servants.

horizontal initiative (initiative horizontale)

An initiative in which two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

non‑budgetary expenditures (dépenses non budgétaires)

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

performance (rendement)

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

plan (plan)

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

planned spending (dépenses prévues)

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

program (programme)

Individual or groups of services, activities or combinations thereof that are managed together within a department and that focus on a specific set of outputs, outcomes or service levels.

program inventory (répertoire des programmes)

An inventory of a department's programs that describes how resources are organized to carry out the department's core responsibilities and achieve its planned results.

result (résultat)

An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead, they are within the area of the organization's influence.

statutory expenditures (dépenses législatives)

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

target (cible)

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

voted expenditures (dépenses votées)

Expenditures that Parliament approves annually through an Appropriation Act. The vote wording becomes the governing conditions under which these expenditures may be made.