Archived - Department of Finance Canada Quarterly Financial Report for the quarter ended December 31, 2019 (unaudited)

Table of contents

- 1.1 Authority, Mandate and Program Activities

- 1.2 Basis of Presentation

- 1.3 Department of Finance Canada – Financial Structure

2. Highlights of fiscal quarter and fiscal year-to-date (YTD) results

4. Significant changes in relation to operations, personnel and programs

5. Approval by Senior Officials

1. Introduction

This Quarterly Financial Report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Directive on Accounting Standards, GC 4400 Departmental Quarterly Financial Reports. This Quarterly Financial Report should be read in conjunction with

the 2019-20 Main Estimates and Supplementary Estimates A of the Department of Finance Canada.

This Quarterly Financial Report has not been subject to an external audit or review.

1.1 Authority, Mandate and Program Activities

The Department of Finance Canada (the Department) provides the Government of Canada with high quality advice on appropriate economic, fiscal, tax, social, security, international and financial sector policies and programs with the goal of strengthening the Canadian economy and maintaining sustainable fiscal policy and social programs.

The Department’s responsibilities include the following:

- Preparing the Federal Budget and the Fall Economic Statement;

- Preparing the Annual Financial Report of the Government of Canada and the Public Accounts of Canada, in cooperation with the Treasury Board of Canada Secretariat and the Receiver General for Canada;

- Developing tax and tariff policy and legislation;

- Managing federal borrowing on financial markets;

- Designing and administering major transfers of federal funds to the provinces and territories;

- Developing financial sector policy and legislation; and

- Representing Canada in various international financial institutions and organizations.

The description of the program activities for the Department can be found in Part II of the Main Estimates and the Departmental Plan.

1.2 Basis of Presentation

This Quarterly Financial Report has been prepared by management using an expenditure basis of accounting, and a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities. The accompanying Statement of Authorities includes the Department’s spending authorities granted by Parliament and those used by the Department, consistent with the Main Estimates and Supplementary Estimates for both fiscal years as well as transfers from Treasury Board central votes that are approved by the end of the quarter.

The authority of Parliament is required before monies can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

The Department uses the accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

1.3 Department of Finance Canada – Financial Structure

The Department has three major categories of expenditure authority. These categories are:

- Voted budgetary authorities: Included in this category are the operational expenditures of the Department itself as well as authorized expenditures under grants and contribution programs. These expenditures must be specifically approved by Parliament through an appropriation act.

- Statutory budgetary authorities: Included in this category are expenditure authorities that are granted through an existing Act of Parliament. Further parliamentary approval is not required for expenditures related to statutory amounts and it is within the normal course of business that statutory expenditures may, in some cases, exceed planned spending estimates.

- Non-budgetary authorities: Included in this category are disbursements made by the Department which do not have a direct budgetary impact to the Government. This includes the value of loans initially disbursed to Crown corporations participating in the Crown Borrowing Framework.

2. Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

This departmental Quarterly Financial Report reflects the results of the current fiscal period in relation to the

2019-20 Main Estimates and Supplementary Estimates A, as well as transfers from Treasury Board Central Votes that were approved by the end of the quarter.

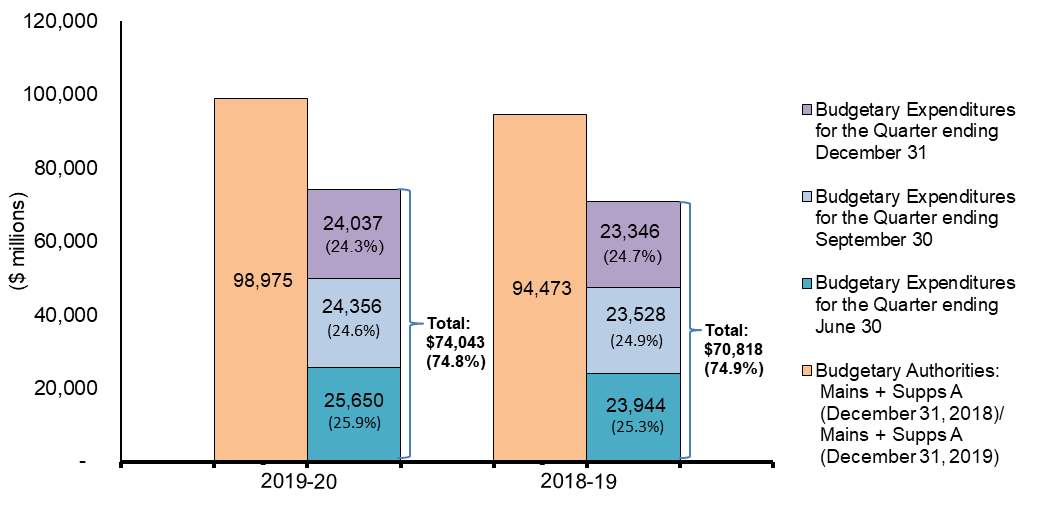

The following graph provides a comparison of budgetary authorities available for the full fiscal year and budgetary expenditures for the first nine months of 2018–19 and 2019-20. Non-budgetary authorities related to the value of loans disbursed to Crown corporations participating in the Crown Borrowing Framework are not reflected in the Estimates.

Comparison of full fiscal year Budgetary Authorities and Year to Date Budgetary Expenditures for the Quarter ended December 31

Sections 2.1 and 2.2 below highlight the significant items that contributed to the increase in the resources available from 2018-19 to 2019-20 and the increase in actual expenditures as at December 31, 2019 compared to December 31, 2018. Full details on authorities and expenditures can be found in Table 1, Statement of Authorities at the end of this document.

2.1 Authorities Analysis

The following table provides a comparison of cumulative authorities by vote for the current and previous fiscal years.

| Authorities Available (in millions) | 2019-20 | 2018-19 | Variance | |

|---|---|---|---|---|

| $ | % | |||

| Budgetary | ||||

| Voted: | ||||

| Vote 1 - Program Authorities | 109.6 | 107.9 | 1.7 | 1.6% |

| Statutory: | ||||

| Major transfers to other levels of government | 73,584.5 | 70,438.9 | 3,145.6 | 4.5% |

| Interest on Unmatured Debt and Interest on Other Liabilities | 24,691.0 | 22,838.0 | 1,853.0 | 8.1% |

| Direct program expenses | 590.4 | 1,088.4 | (498.0) | -45.8% |

| Total statutory | 98,865.9 | 94,365.3 | 4,500.6 | 4.8% |

| Total Budgetary authorities | 98,975.5 | 94,473.2 | 4,502.3 | 4.8% |

| Non-Budgetary | 51.4 | 52.3 | (0.9) | -1.7% |

| Total authorities | 99,026.9 | 94,525.5 | 4,501.4 | 4.8% |

2.1.1 Voted Budgetary Authorities

Total 2019–20 Vote 1 program authorities available as at December 31, 2019 are $109.6 million compared to $107.9 million for the same period in 2018–19, representing an increase of $1.7 million, primarily due to the net effect of the following factors:

Total increases were $6.1 million and consist of:

- $3.1 million for Analytical Capacity Building;

- $1.6 million for Tax Policy Analysis and Development;

- $0.8 million for Open Banking Review; and

- $0.6 million for Strengthening Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime.

These increases were partially offset by the following:

- $2.8 million decrease related to lower amount of lapsing funds from 2018-19 that contributed to the operating budget carry forward into 2019-20;

- $0.9 million decrease for Tsimshian First Nations consultations related to the potential divestiture of Ridley Terminals Inc.; and

- $0.7 million decrease in authorities for various programs.

2.1.2 Statutory Budgetary Authorities

Major transfer to other levels of government increased by $3,145.6 million, from $70,438.9 to $73,584.5, primarily due to the net effect of the following factors:

Total increases were $3,286.6 million and consist of:

- Canada Health Transfer (CHT) – An increase of $1,788.9 million reflecting a 4.6% annual growth rate of Gross Domestic Product (GDP). This CHT grows based on a 3-year moving average of nominal GDP growth, with funding guaranteed to increase by at least 3% per year;

- Fiscal Equalization – An increase of $879.0 million reflecting the 4.6% GDP-based escalator being applied to the

2018–19 level; - Canada Social Transfer – An increase of $424.8 million reflecting the 3.0% annual increased funding commitment that commenced in 2009–10 and which continued in the Jobs, Growth and Long-term Prosperity Act, 2012 for 2014–15 and subsequent years;

- Territorial Financing – An increase of $163.1 million reflecting the incorporation of new and updated data for territorial expenditure requirements and revenue capacities into the program’s legislated formula; and

- Additional Fiscal Equalization to Nova Scotia and Additional Fiscal Equalization Offset Payment to Nova Scotia– A net increase of $30.8 million for these two transfer payments to Nova Scotia.

Decreases were $141.0 million and consist of:

- Alternative Payments for Standing Programs – A decrease of $118.0 million due to higher recoveries as a result of an increase in the estimated value of personal income tax points that were transferred to Québec; and

- Youth Allowance Recovery – A decrease of $23.0 million due to higher recoveries resulting from an increase in the estimated value of personal income tax points transferred to Québec.

Interest on Unmatured Debt and Interest on Other Liabilities increased by $1,853.0 million, from $22,838.0 to $24,691.0, due to the net impact of the following factors:

- Interest on Unmatured Debt – An increase of $2,093.0 million due to the upward revision of forecasted interest rates by private sector economists, consistent with Budget 2019; and

- Interest on Other Liabilities – A decrease of $240.0 million largely reflecting the decrease in the average Government of Canada long-term bond rate forecast for 2019-20.

Direct program expenses decreased by $498.0 million, from $1,088.4 to $590.4 million, primarily due to the following factors:

- $477.3 million decrease in Funding for Canada Infrastructure Bank;

- $11.4 million decrease for Canadian Securities Regulation Regime Transition Office;

- $7.0 million decrease in the Purchase of Domestic Coinage; and

- $3.1 million decrease in debt payments on behalf of poor countries to International Organizations.

These decreases were slightly offset by $0.8 million in increased authorities for various programs.

2.1.3 Non-Budgetary Authorities

Total 2019–20 non-budgetary authorities decreased by $0.9 million, from $52.3 million to $51.4 million, due to the following factor:

- A decrease in authorities for Canada’s purchase of initial shares pursuant to the Asian Infrastructure Investment Bank Agreement Act.

2.2 Expenditure Analysis

The following table provides a comparison of Year-to-Date spending as at December 31 by vote for the current and previous fiscal years.

| Year to date expenditures (in millions) | 2019-20 | 2018-19 | Variance | |

|---|---|---|---|---|

| $ | % | |||

| Budgetary | ||||

| Voted: | ||||

| Vote 1 - Program Expenditures | 78.6 | 73.7 | 4.9 | 6.6% |

| Statutory: | ||||

| Major transfers to other levels of government | 55,500.9 | 53,239.9 | 2,261.0 | 4.2% |

| Interest on Unmatured Debt and Interest on Other Liabilities | 17,832.9 | 17,114.1 | 718.8 | 4.2% |

| Direct program expenses | 630.8 | 389.6 | 241.2 | 61.9% |

| Sub Total Statutory | 73,964.6 | 70,743.6 | 3,221.0 | 4.6% |

| Total Budgetary expenditures | 74,043.2 | 70,817.3 | 3,225.9 | 4.6% |

| Non-Budgetary | 33,145.9 | 32,833.5 | 312.4 | 1.0% |

| Total year to date expenditures | 107,189.1 | 103,650.8 | 3,538.3 | 3.4% |

2.2.1 Voted Budgetary Expenditures

Total 2019–20 Vote 1 program expenditures at the end of the third quarter were $78.6 million compared to $73.7 million for the same period in fiscal year 2018–19, representing an increase of $4.9 million, primarily due to the net effect of the following items:

- $7.1 million for collective agreements and other compensation adjustments; and

- $0.7 million for Tsimshian First Nations Consultations Related to the potential divestiture of Ridley Terminals Inc.

These increases were partially offset by the following:

- $1.6 million decrease for the G7 summit held in 2018-19;

- $0.5 million decrease related to travel expenditures;

- $0.4 million decrease related to the purchase of data for Pharmacare research; and

- $0.4 million decrease for various, individually immaterial, expenditures.

2.2.2 Statutory Budgetary Expenditures

Major transfers to other levels of government increased by $2,261.0 million, from $53,239.9 to $55,500.9, primarily due to increases for the following:

- $1,341.7 million related to the Canada Health Transfer;

- $659.3 million related to Fiscal Equalization;

- $318.6 million related to the Canada Social Transfer;

- $271.7 million related to Fiscal Stabilization payments to Alberta and Saskatchewan;

- $129.8 million related to Territorial Financing; and

- $3.1 million related to a payment under subsection 24(1) of the Financial Administration Act resulting from a remission order issued pursuant to subsection 23(2.1) of that Act.

The increases above were offset primarily by higher recoveries in the Alternative Payments for Standing Programs, decreases in the Additional Fiscal Equalization to Nova Scotia and higher Youth Allowances Recovery.

Interest on unmatured debt and interest on other liabilities increased by $718.8 million, from $17,114.1 to $17,832.9, due to the net impact of the following two factors:

- Interest on unmatured debt – An increase of $1,007.7 million, largely reflecting higher Consumer Price Index adjustments on Real Return Bonds and a higher average effective interest rate on the stock of Government of Canada treasury bills; and

- Interest on other liabilities – A decrease of $288.9 million, largely reflecting a decrease in the average Government of Canada long-term bond rate.

Direct program expenses increased by $241.2 million, from $389.6 to $630.8, primarily due to the following factors:

- $245.8 million related to a payment made to the Canada Infrastructure Bank;

- $2.5 million related to a payment made to the Canadian Commercial Corporation;

- $0.5 million related to contributions to employee benefit plans; and

- $0.6 million related to various, individually immaterial, expenditures.

These increases were partially offset by the following:

- $4.5 million decrease in the losses on foreign exchange, due to the revaluation of International Monetary Fund related accounts; and

- $3.7 million decrease in the purchase of domestic coinage.

2.2.3 Non-Budgetary Expenditures

Non-budgetary expenditures at the end of the third quarter of 2019-20 increased by $312.4 million, from $32,833.5 to $33,145.9, primarily due to the following factors:

- An increase of $241.7 million in the value of loans disbursed to Crown corporations participating in the Crown Borrowing Framework;

- An increase of $66.7 million in payments under the Bretton Woods and Related Agreements Act – International Organizations (Gross); and

- An increase of $4.0 million in advances made pursuant to section 13(1) of the Financial Consumer Agency of Canada Act (Gross).

Significant Changes on the Departmental Budgetary Expenditures by Standard Object Table

Table 2 located at the end of this report, presents budgetary expenditures by standard object. The variance of $3,225.8 million in year-to-date expenditures between 2019–20 and 2018-19 by standard object relate mainly to:

- Transfer payments – An increase of $2,261.6 million attributable to the increase in statutory expenditures pursuant to major transfers to other levels of government;

- Public debt charges – An increase of $718.8 million attributable to an increase of $1,007.7 million in interest on unmatured debt offset by a decrease of $288.9 million in interest on other liabilities;

- Other subsidies and payments – An increase of $244.6 million primarily attributable to an increase in the payment to the Canada Infrastructure Bank (CIB); and

- An increase of $0.8 million related to various, individually immaterial, expenditures.

Quarterly Spending

The following table provides a comparison of quarterly spending by vote for the current and previous fiscal years.

| Expenditures for the Third Quarter (in millions) | 2019-20 | 2018-19 | Variance | |

|---|---|---|---|---|

| $ | % | |||

| Budgetary | ||||

| Voted: | ||||

| Vote 1 - Program Expenditures | 30.7 | 23.9 | 6.8 | 28.5% |

| Statutory: | ||||

| Major transfers to other levels of government | 18,458.0 | 17,624.7 | 833.3 | 4.7% |

| Interest on Unmatured Debt and Interest on Other Liabilities | 5,238.5 | 5,405.1 | (166.6) | -3.1% |

| Direct program expenses | 310.2 | 291.9 | 18.3 | 6.3% |

| Sub Total Statutory | 24,006.7 | 23,321.7 | 685.0 | 2.9% |

| Total Budgetary expenditures | 24,037.4 | 23,345.6 | 691.8 | 3.0% |

| Non-Budgetary | 10,599.0 | 10,830.1 | (231.1) | -2.1% |

| Total expenditures for the third quarter | 34,636.4 | 34,175.7 | 460.7 | 1.3% |

Variance explanations of the quarterly spending are in line with year to date variance explanations provided in Section 2.2.

3. Risks and Uncertainties

The complex and horizontal issues of the Department require ongoing discussions, consultations and coordination with central agencies, other departments and governments, and external stakeholders. In this context, the Department maintains high-level engagement and strong collaborative relationships with domestic and international partners to fulfill its commitments and deliver for Canadians.

The Department’s Corporate Risk Profile provides a snapshot of the Department’s key corporate risks. The Department monitors its corporate risks and associated risk responses to identify areas of opportunity and to reflect progress made in implementing mitigation strategies.

The Department operates in an environment where the decisions and actions of its employees can have far-reaching impacts on the Canadian public and economy. As a knowledge–based organization, the Department recognizes that its employees are its strength. The Department will continue to focus on providing its employees a healthy and enabling work environment, so that it can attract, develop and retain a diverse and high–performing workforce that is fully committed to the success of the organization.

The Department relies on efficient and effective information management (IM) and information technology (IT) to deliver informed policy advice and operate as an agile and responsive knowledge-based institution, while protecting its highly sensitive institutional information.

Cybersecurity incidents and IT failures in supporting systems have been identified as risks that could cause serious disruptions and affect the Department’s ability to execute critical government operations, including tax and transfer payments, and public debt-related transactions. A Business Continuity Plan (BCP) is in place to ensure that critical services are maintained in case of a system failure. Further, the Department is committed to building on recent improvements to increase the security posture of its IT infrastructure and ensure the effective protection of its information assets.

4. Significant Changes in Relation to Operations, Personnel and Programs

Effective November 20, 2019, The Honourable Bill Morneau returned as the Minister of Finance.

Effective November 20, 2019, The Honourable Mona Fortier became the Minister of Middle Class Prosperity and Associate Minister of Finance.

In addition, Rob Stewart, Associate Deputy Minister of Finance (with G7 and G20 responsibilities), left the department when he was appointed as the Deputy Minister of Public Safety Canada on December 11, 2019.

5. Approval by Senior Officials

Approved by:

Paul Rochon, Deputy Minister

Ottawa, Canada

February 28, 2020

Darlene Bess, Chief Financial Officer

Ottawa, Canada

February 28, 2020

| Fiscal year 2019-2020 | Fiscal year 2018-2019 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2020* |

Used during the quarter ended December 31, 2019 |

Year to date used at quarter-end |

Total available for use for the year ending March 31, 2019 * |

Used during the quarter ended December 31, 2018 |

Year to date used at quarter-end |

|

| Budgetary Authorities | ||||||

| Voted authorities | ||||||

| Program expenditures | 109,566 | 30,668 | 78,637 | 107,912 | 23,948 | 73,724 |

| Total voted authorities | 109,566 | 30,668 | 78,637 | 107,912 | 23,948 | 73,724 |

| Statutory authorities | ||||||

| Major transfers to other levels of government | ||||||

| Canada Health Transfer (Part V.1 - Federal-Provincial Fiscal Arrangements Act) | 40,372,636 | 10,093,159 | 30,279,477 | 38,583,703 | 9,645,925 | 28,937,777 |

| Canada Social Transfer (Part V.1 - Federal-Provincial Fiscal Arrangements Act) | 14,585,672 | 3,646,418 | 10,939,254 | 14,160,847 | 3,540,213 | 10,620,636 |

| Fiscal arrangements | ||||||

| Fiscal Equalization (Part I - Federal-Provincial Fiscal Arrangements Act) | 19,837,259 | 4,959,315 | 14,877,944 | 18,958,259 | 4,739,564 | 14,218,694 |

| Territorial Financing (Part I.1 - Federal-Provincial Fiscal Arrangement Act) | 3,948,403 | 805,474 | 3,142,929 | 3,785,322 | 772,206 | 3,013,116 |

| Statutory Subsidies (Constitution Acts, 1867-1982, and Other Statutory Authorities) | 42,484 | 1,237 | 22,561 | 42,356 | 1,237 | 22,415 |

| Youth Allowances Recovery (Federal-Provincial Fiscal Revision Act, 1964) | (932,853) | - | (466,427) | (909,825) | - | (454,913) |

| Other major transfers | ||||||

| Addtional Fiscal Equalization Offset Payment to Nova Scotia (Nova Scotia and Newfoundland and Labrador Additional Fiscal Equalization Offset Payments Act) | 8,227 | - | - | 18,092 | - | - |

| Additional Fiscal Equalization to Nova Scotia (Part I - Federal-Provincial Fiscal Arrangements Act) | (72,587) | (22,456) | (67,368) | (113,203) | - | - |

| Fiscal Stabilization (Part II - Federal-Provincial Fiscal Arrangements Act) | - | 271,733 | 271,733 | - | - | - |

| Alternative Payments for Standing Programs (Part VI - Federal-Provincial Fiscal Arrangements Act) | (4,204,769) | (1,296,855) | (3,399,240) | (4,086,656) | (1,074,484) | (3,117,812) |

| Refund of prior year expenditures | - | - | (103,000) | - | - | - |

| Payment under subsection 24(1) of the Financial Administration Act resulting from a remission order issued pursuant to subsection 23(2.1) of that Act | - | - | 3,067 | - | - | - |

| Total major transfers to other levels of government | 73,584,472 | 18,458,025 | 55,500,930 | 70,438,895 | 17,624,661 | 53,239,913 |

| Interest on Unmatured Debt and Interest on Other Liabilities | ||||||

| Interest on Unmatured Debt and Other Public Debt Costs | 18,684,000 | 3,754,373 | 13,308,602 | 16,591,000 | 3,782,595 | 12,300,897 |

| Interest on Other Liabilities | 6,007,000 | 1,484,132 | 4,524,256 | 6,247,000 | 1,622,531 | 4,813,250 |

| Total Interest on Unmatured Debt and Interest on Other Liabilities | 24,691,000 | 5,238,505 | 17,832,858 | 22,838,000 | 5,405,126 | 17,114,147 |

| Direct program expenses | ||||||

| Operating expenses | ||||||

| Purchase of Domestic Coinage | 88,000 | 16,465 | 66,808 | 95,000 | 19,971 | 70,555 |

| Contributions to Employee Benefit Plans | 12,622 | 3,064 | 9,191 | 11,802 | 2,890 | 8,667 |

| Minister of Finance - Salary and motor car allowance | 88 | 22 | 66 | 86 | 22 | 65 |

| Transfer payments | ||||||

| Payments to International Development Association | 441,620 | - | - | 441,610 | - | - |

| Debt payments on behalf of poor countries to International Organizations pursuant to section 18(1) of the Economic Recovery Act | 48,080 | - | - | 51,200 | - | - |

| Canadian Securities Regulation Regime Transition Office (Canadian Securities Regulation Regime Transition Office Act) | - | - | - | 11,400 | - | - |

| Other | ||||||

| Losses on Foreign Exchange | - | 2,576 | 24,286 | - | (10,747) | 28,824 |

| Payment of Liabilities Previously Recorded as Revenue | - | 917 | 3,086 | - | 780 | 2,465 |

| Payment to the Canada Infrastructure Bank (Canada Infrastructure Bank Act) | - | 287,200 | 524,838 | 477,284 | 279,000 | 279,000 |

| Payment under subsection 12(2) of the Canadian Commercial Corporation Act to the Canadian Commercial Corporation | - | - | 2,500 | - | - | - |

| Total direct program expenses | 590,410 | 310,244 | 630,775 | 1,088,382 | 291,916 | 389,576 |

| Total statutory authorities | 98,865,882 | 24,006,774 | 73,964,563 | 94,365,277 | 23,321,703 | 70,743,636 |

| Total budgetary authorities | 98,975,448 | 24,037,442 | 74,043,200 | 94,473,189 | 23,345,651 | 70,817,360 |

| Non-budgetary authorities | ||||||

| Purchase of initial shares pursuant to the Asian Infrastructure Investment Bank Agreement Act | 51,400 | - | - | 52,300 | - | - |

| Advances to Crown corporations (Gross) | - | 10,525,476 | 33,044,207 | - | 10,829,078 | 32,802,486 |

| Advances pursuant to section 13(1) of the Financial Consumer Agency of Canada Act (Gross) | - | 3,000 | 11,000 | - | 1,000 | 7,000 |

| Payments under Bretton Woods and Related Agreements Act- International Organizations (Gross) | - | 70,488 | 90,729 | - | - | 23,991 |

| Total non-budgetary authorities | 51,400 | 10,598,964 | 33,145,936 | 52,300 | 10,830,078 | 32,833,477 |

| Total authorities | 99,026,848 | 34,636,406 | 107,189,136 | 94,525,489 | 34,175,729 | 103,650,837 |

| * Includes only Authorities available for use and granted by Parliament at quarter-end | ||||||

| Fiscal year 2019-2020 | Fiscal year 2018-2019 | |||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2020 |

Expended during the quarter ended December 31, 2019 |

Year to date used at quarter-end |

Planned expenditures for the year ending March 31, 2019 |

Expended during the quarter ended December 31, 2018 |

Year to date used at quarter-end |

|

| Expenditures: | ||||||

| Personnel | 98,132 | 28,850 | 74,327 | 94,655 | 23,395 | 66,724 |

| Transportation and communications | 2,747 | 512 | 1,783 | 3,352 | 801 | 2,375 |

| Information | 1,889 | 75 | 726 | 1,856 | 262 | 1,181 |

| Professional and special services | 14,027 | 3,481 | 7,323 | 13,521 | 2,620 | 8,387 |

| Rentals | 1,885 | 214 | 836 | 1,177 | (357) | 1,551 |

| Repair and maintenance | 322 | 37 | 157 | 648 | 82 | 192 |

| Utilities, materials and supplies | 88,395 | 16,521 | 66,955 | 95,561 | 20,015 | 70,750 |

| Acquisition of machinery and equipment | 1,893 | 420 | 482 | 2,102 | 71 | 488 |

| Transfer payments | 74,075,307 | 18,458,025 | 55,502,030 | 70,945,162 | 17,624,706 | 53,240,403 |

| Public debt charges | 24,691,000 | 5,238,505 | 17,832,858 | 22,838,000 | 5,405,126 | 17,114,147 |

| Other subsidies and payments | 1 | 290,802 | 555,723 | 477,305 | 268,930 | 311,162 |

| Total gross budgetary expenditures | 98,975,598 | 24,037,442 | 74,043,200 | 94,473,339 | 23,345,651 | 70,817,360 |

| Less Revenues netted against expenditures | 150 | - | - | 150 | - | - |

| Total net budgetary expenditures | 98,975,448 | 24,037,442 | 74,043,200 | 94,473,189 | 23,345,651 | 70,817,360 |