Canada Emergency Rent Subsidy

Backgrounder

November 5, 2020

On October 9, the government proposed the new Canada Emergency Rent Subsidy to provide direct relief to businesses, non-profits, and charities that continue to be economically impacted by the COVID-19 pandemic. The new rent subsidy would be available retroactive to September 27, 2020, until June 2021.

The government is providing the proposed details for the first 12 weeks of the program, until December 19, 2020. The proposed program would, in many ways, mirror the successful Canada Emergency Wage Subsidy, providing a simple, easy-to-understand program for affected qualifying organizations. The new rent subsidy would provide benefits directly to qualifying renters and property owners, without requiring the participation of landlords.

This backgrounder provides information for organizations that have experienced a revenue decline and may qualify for the Canada Emergency Rent Subsidy. If your organization has been subject to a public health order issued under the laws of Canada, a province or territory (including orders made by a municipality or regional health authority under one of those laws), you may be eligible for additional resources under the new Lockdown Support.

Rent Subsidy for Organizations Impacted by the Crisis

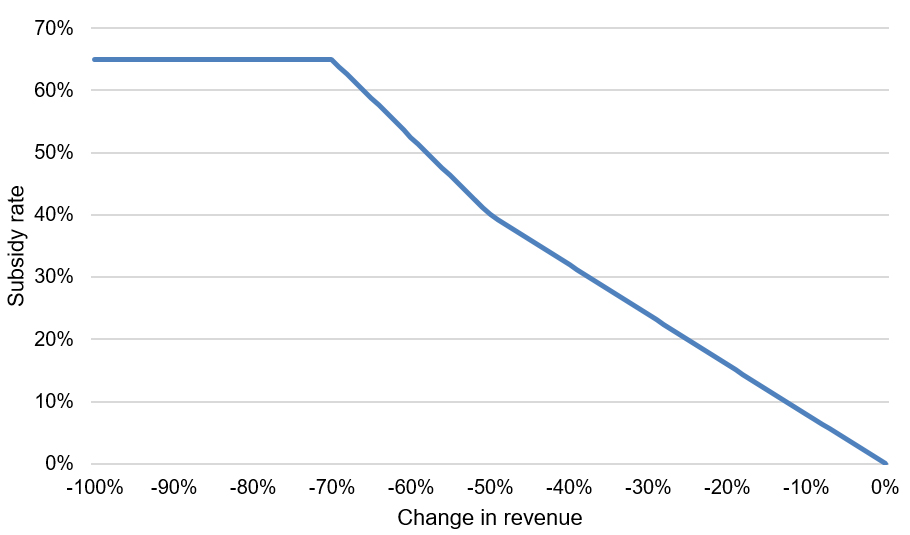

With the introduction of the new rent subsidy, qualifying organizations that have suffered a revenue drop would be eligible for a subsidy on eligible expenses. As shown in Table 1 and Figure 1, below, the maximum base rate subsidy would be 65 per cent, and available to organizations with a revenue drop of 70 per cent or more. The base rate would then decline to a rate of 40 per cent for organizations with a revenue drop of 50 per cent, and then would gradually reduce to zero for those not experiencing a decline in revenues. This structure mirrors the Canada Emergency Wage Subsidy rate structure.

| Revenue Decline | Base Subsidy Rate |

|---|---|

| 70% and over | 65% |

| 50% to 69% | 40% + (revenue drop - 50%) x 1.25 (e.g., 40% + (60% revenue drop – 50%) x 1.25 = 52.5% subsidy rate) |

| 1% to 49% | Revenue drop x 0.8 (e.g., 25% revenue drop x 0.8 = 20% subsidy rate) |

Figure 1

Eligible Expenses

Eligible expenses for a location for a qualifying period would include commercial rent, property taxes (including school taxes and municipal taxes), property insurance, and interest on commercial mortgages (subject to limits) for a qualifying property, less any subleasing revenues. Any sales tax (e.g., GST/HST) component of these costs would not be an eligible expense.

Eligible expenses would be limited to those paid under agreements in writing entered into before October 9, 2020 (and continuations of those agreements) and would be limited to expenses related to real property located in Canada. Expenses that relate to residential property used by the taxpayer (e.g., their house or cottage) would not be eligible. Payments made between non-arm's-length entities would not be eligible expenses. Mortgage interest expenses in respect of a property primarily used to earn, directly or indirectly, rental income from arms-length entities would not be eligible.

Expenses for each qualifying period would be capped at $75,000 per location and be subject to an overall cap of $300,000 that would be shared among affiliated entities.

Eligible Entities

Eligibility criteria for the new rent subsidy would generally align with the Canada Emergency Wage Subsidy program. Eligible entities include individuals, taxable corporations and trusts, non-profit organizations and registered charities. Public institutions are generally not eligible for the subsidy. Eligible entities also include the following groups:

- Partnerships that are up to 50 per cent owned by non-eligible members;

- Indigenous government-owned corporations that are carrying on a business, as well as partnerships where the partners are Indigenous governments and eligible entities;

- Registered Canadian Amateur Athletic Associations;

- Registered Journalism Organizations; and

- Non-public colleges and schools, including institutions that offer specialized services, such as arts schools, driving schools, language schools or flight schools.

In addition, an eligible entity must meet one of the following criteria:

- have a payroll account as of March 15, 2020 or have been using a payroll service provider;

- have a business number as of September 27, 2020 (and satisfy the Canada Revenue Agency that it is a bona fide rent subsidy claim); or

- meet other conditions that may be prescribed in the future.

Calculating Revenues

Revenues will be calculated in the same manner as under the Canada Emergency Wage Subsidy program.

- An entity's revenue for the purposes of the rent subsidy is its revenue from its ordinary activities in Canada earned from arm's-length sources, determined using its normal accounting practices. Revenues from extraordinary items and amounts on account of capital are excluded.

- For registered charities and non-profit organizations, the calculation includes most forms of revenue, excluding revenues from non-arm's length persons. These organizations are allowed to choose whether to include revenue from government sources as part of the calculation. Once chosen, the same approach would have to apply throughout the program period.

- Special rules for the computation of revenue are provided to take into account certain non-arm's-length transactions, such as where an entity sells all of its output to a related company that in turn earns arm's-length revenue.

- Affiliated groups that do not normally compute revenue on a consolidated basis may elect to do so.

Reference Periods for the Drop-in-Revenues Test

Eligibility would generally be determined by the change in an eligible entity's monthly revenues, year-over-year, for the applicable calendar month.

Alternatively, an entity can choose to calculate its revenue decline by comparing its current reference month revenues with the average of its January and February 2020 revenues.

Once an entity has chosen to use either the general or alternative approach, they must use that approach for each of the three periods. The approach chosen would apply to both the base Canada Emergency Wage Subsidy and the Canada Emergency Rent Subsidy.

An eligible entity would use the greater of its percentage revenue decline for the current qualifying period and that for the previous qualifying period in order to determine its subsidy rate. This would provide certainty to businesses regarding their expected minimum subsidy rate and aligns with the practice under the Canada Emergency Wage Subsidy.

Table 2, below, outlines each qualifying period and the relevant reference period for determining the change in revenue.

| Qualifying period | General approach | Alternative approach | |

|---|---|---|---|

| Period 8 | September 27 to October 24, 2020 | October 2020 over October 2019 or September 2020 over September 2019 | October 2020 or September 2020 over average of January and February 2020 |

| Period 9 | October 25 to November 21, 2020 | November 2020 over November 2019 or October 2020 over October 2019 | November 2020 or October 2020 over average of January and February 2020 |

| Period 10 | November 22 to December 19, 2020 | December 2020 over December 2019 or November 2020 over November 2019 | December 2020 or November 2020 over average of January and February 2020 |

| Note: The period numbers align with those used for the Canada Emergency Wage Subsidy, for simplicity. Period 8 of the Canada Emergency Wage Subsidy program is the first period for which the rent subsidy will be in effect. | |||

All applications must be made on or before 180 days after the end of the qualifying period.

The estimated cost for the first three periods of the rent subsidy program, including the new Lockdown Support for locations significantly affected by public health restrictions, is $2.2 billion in 2020-21.

How Organizations Will Benefit

Example 1:

Sandy owns a kitchen supply store. The store was closed down in the initial stages of the pandemic in March and April, but has since reopened. With new safety precautions in place Sandy now limits the number of customers in her store. In September and October, her revenues are down 25 per cent compared to last year. She paid $5,000 in eligible rent costs during the first period of the rent subsidy. For this period, she will be eligible for a rent subsidy of 20 per cent, or $1,000.

Example 2:

Matt owns a local chain of three casual dining restaurants. With restrictions on dining room capacity, and patio business declining as cooler weather sets in, his revenues were down 40 per cent in September and 60 per cent in October, compared to the same time last year. Matt incurred $30,000 in eligible rent costs in respect of the first period of the rent subsidy. He will be eligible for a rent subsidy at a rate of 52.5 per cent, for a benefit of $15,750.

Example 3:

MovieCastle Group is a chain of six cinemas. MovieCastle Group fully owns each cinema, which are all incorporated separately. In September, revenues were down 70 per cent, and in October, revenues were down over 80 per cent. MovieCastle Group and its companies incurred rent costs of $600,000 in respect of the period.

Under the rent subsidy, MovieCastle Group will be eligible for a base subsidy rate of 65 per cent on a maximum of $300,000 of rent expenses per period. At each location, only the first $75,000 of rent expenses is eligible for the subsidy. MovieCastle Group members decide to divide the maximum $300,000 for the group equally amongst the six members, and each therefore can claim $50,000 in eligible expenses. The total group benefit will be $195,000 (or 65 per cent of $300,000).