Lockdown Support for Businesses Facing Significant Public Health Restrictions

Backgrounder

November 5, 2020

On October 9, the government proposed new targeted, direct supports for businesses, non-profits and charities facing ongoing economic challenges amidst the second wave of the COVID-19 pandemic. For organizations that are subject to a lockdown and must shut their doors or significantly limit their activities under a public health order issued under the laws of Canada, a province or territory (including orders made by a municipality or regional health authority under one of those laws), the government proposed a top-up under the new Canada Emergency Rent Subsidy to provide additional support while they face lockdowns.

The new Lockdown Support would be available retroactive to September 27, 2020, until June 2021, during periods when businesses are facing eligible public health restrictions. The government is providing the proposed details for the first 12 weeks of the program, until December 19, 2020. The proposed program would align with many aspects of the Canada Emergency Wage Subsidy to provide a simple, easy-to-understand program directly to renters and property owners.

This backgrounder provides information for organizations that have been significantly affected by public health restrictions and may be eligible for additional support for certain rent or property expenses. If your organization is not subject to qualifying public health lockdown restrictions, but you are currently experiencing a decline in revenues, you may still be eligible for the Canada Emergency Rent Subsidy.

Base Rent Subsidy for Organizations Impacted by the Crisis

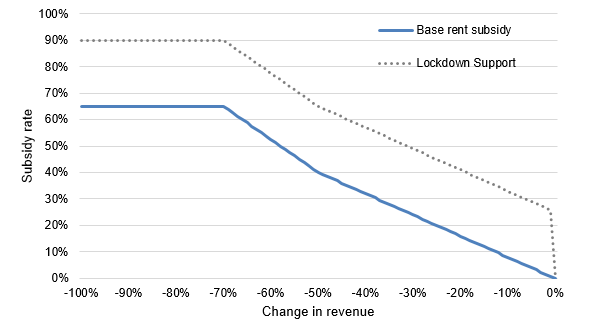

With the introduction of the new Canada Emergency Rent Subsidy, qualifying organizations that have suffered a revenue drop would be eligible for a subsidy on certain expenses. As shown in Table 1 and Figure 1, the maximum base rate would be 65 per cent, available to organizations with a revenue drop of 70 per cent or more. The base rate would then gradually decline to a rate of 40 per cent for organizations with a revenue drop of 50 per cent, and then would gradually reduce to zero for those not experiencing a decline in revenues. This structure mirrors the Canada Emergency Wage Subsidy rate structure for the relevant periods.

Lockdown Support for Locations Significantly Affected by Public Health Restrictions

The new Lockdown Support of 25 per cent would be available to organizations with locations that are temporarily forced to close or temporarily have their business activities significantly restricted by a public health order issued under the laws of Canada or a province or territory. This would include a shutdown of a location as a result COVID-19 outbreak (as declared by a provincial, territorial or regional health authority). This follows a commitment in the Speech from the Throne to provide direct financial support to businesses temporarily shut down as a result of a local public health decision.

Specifically, a public health restriction would be an order that meets the following conditions:

- it is made under the laws of Canada, a province or territory (including orders made by a municipality or regional health authority under one of those laws) in response to the COVID-19 pandemic;

- it is limited in scope based on factors such as defined geographical boundaries, type of business or other activity, or risks associated with a particular location;

- non-compliance with the order is a federal, provincial or territorial offence or can result in the imposition of an administrative monetary penalty or other sanction imposed by the Government of Canada or a province or territory;

- it cannot result from a violation of an order that meets the above conditions; and

- it must be in effect, for a period of at least a week, so that some or all of the activities of the eligible entity at, or in connection with, the qualifying property are required to completely cease. In other words, limitations would be on the type of activity rather than the extent to which an activity may be performed or limits placed on the time during which an activity may be performed.

For an organization to qualify for the Lockdown Support for a qualifying property, the following conditions must apply:

- the organization qualifies for the base Canada Emergency Rent Subsidy; and

- the public health order requires that the organization

- completely shut down the location; or,

- cease some or all of the activities at the location and it is reasonable to conclude that the ceased activities, in the appropriate pre-pandemic prior reference period, were responsible for at least approximately 25 per cent of the revenues of the entity at that location.

If the organization is subject to a public health restriction and has to cease activities for only part of a qualifying period, the Lockdown Support would be pro-rated for the number of days in the period during which the relevant location was affected.

The following examples illustrate some common circumstances where an organization qualifying for the base subsidy may have qualifying property (i.e., a location) that would be eligible for the Lockdown Support.

- Restrictions on indoor dining: a restaurant that normally earns approximately 25 per cent or more of its revenues in connection with indoor dining could qualify due to its dining room being shut down even if it shifts its activities to take-out orders to make up some of the lost revenues from indoor dining.

- Closure of bars: a bar that is ordered to close down due to a regional public health restriction, and, anticipating low demand for take-out, does not continue operating, could qualify.

- Closure of fitness centres: a fitness center providing group fitness classes that is ordered to close down could qualify, even if, for instance, it moves to online instruction.

- Closure of retail stores: a retail store that is ordered to close down its location in a shopping mall, but that continues to operate providing online sales and curbside pick-up, could qualify so long as its in-store sales normally accounted for at least approximately 25 per cent of its revenues.

- Restrictions on types of personal services: an esthetics studio that earned most of its pre-pandemic revenues from services that cannot be performed while wearing a mask and can no longer be provided due to a public health restriction, could qualify.

- Other closures of certain indoor activities: a theater or an interactive museum that is ordered to close down would qualify.

- Closure in relation to a COVID-19 outbreak on the premises: a soup kitchen that is ordered to close down due to a specific public health restriction arising from a number of its employees contracting COVID-19 would qualify.

The following examples illustrate some common circumstances where an organization would generally not be eligible for the Lockdown Support:

- Reduction in business hours: a bar that is subject to a restriction requiring bars in a region to shut down by 10:00 pm each day would not qualify, as their activities would not be required to cease for a period of at least one week.

- Requirements for physical distancing: a restaurant that earns most of its revenues in connection with indoor dining would not qualify due to a public health restriction limiting patrons to six persons per table, as it could continue to carry on its indoor dining activities.

- Restrictions on travel: a bed and breakfast that sees a decrease in the number of clients due to travel restrictions would not qualify as it can continue to operate, and there is no order to cease its activities.

- Reduction in the number of clients at any one time: a movie theater that is required to limit the number of clients would not qualify, as it would not be required to cease any of its activities.

- Violation of a public health order: a factory that is required to close down due to violating a public health restriction would not qualify because the shut-down resulted from a contravention of public health orders.

| Revenue Decline | Base subsidy rate | Lockdown Support |

|---|---|---|

| 70% and over | 65% | 25% |

| 50% to 69% | 40% + (revenue drop - 50%) x 1.25 (e.g., 40% + (60% revenue drop – 50%) x 1.25 = 52.5% subsidy rate) |

25% |

| 1% to 49% | Revenue drop x 0.8 (e.g., 25% revenue drop x 0.8 = 20% subsidy rate) |

25% |

Figure 1

Eligible Expenses

Eligible expenses for a qualifying property for a qualifying period would include commercial rent, property taxes (including school taxes and municipal taxes), property insurance, and interest on commercial mortgages (subject to limits), less any subleasing revenues. Any sales tax (e.g., GST/HST) component of these costs would not be an eligible expense.

Eligible expenses would be limited to those paid under agreements in writing entered into before October 9, 2020 (and continuations of those agreements) and would be limited to expenses related to real property located in Canada. Expenses that relate to residential property used by the taxpayer (e.g., their house or cottage) would not be eligible. Payments made between non-arm’s-length entities would not be eligible expenses. Mortgage interest expenses in respect of a property primarily used to earn, directly or indirectly, rental income from arms-length entities would not be eligible.

For the purpose of the base subsidy, expenses for each qualifying period would be capped at $75,000 per location and be subject to an overall cap of $300,000 that would be shared among affiliated entities. For the purpose of the new Lockdown Support for those affected by public health restrictions, eligible expenses would be capped at $75,000 per location, but no overall cap would apply.

Eligible Entities

Eligibility criteria would generally align with the Canada Emergency Wage Subsidy program. Eligible entities include individuals, taxable corporations and trusts, non-profit organizations and registered charities. Public institutions are generally not eligible for the subsidy. Eligible entities also include the following groups:

- Partnerships that are up to 50 per cent owned by non-eligible members;

- Indigenous government-owned corporations that are carrying on a business, as well as partnerships where the partners are Indigenous governments and eligible entities;

- Registered Canadian Amateur Athletic Associations;

- Registered Journalism Organizations; and

- Non-public colleges and schools, including institutions that offer specialized services, such as arts schools, driving schools, language schools or flight schools.

In addition, an eligible entity must meet one of the following criteria:

- have a payroll account as of March 15, 2020 or have been using a payroll service;

- have a business number as of September 27, 2020 (and satisfy the Canada Revenue Agency that it is a bona fide rent subsidy claim); or

- meet other prescribed conditions.

Calculating Revenues

Revenues will be calculated in the same manner as under the Canada Emergency Wage Subsidy program.

- An entity's revenue for the purposes of the rent subsidy is its revenue from its ordinary activities in Canada earned from arm's-length sources, determined using its normal accounting practices. Revenues from extraordinary items and amounts on account of capital are excluded.

- For registered charities and non-profit organizations, the calculation includes most forms of revenue, excluding revenues from non-arm's length persons. These organizations are allowed to choose whether to include revenue from government sources as part of the calculation. Once chosen, the same approach would have to apply throughout the program period.

- Special rules for the computation of revenue are provided to take into account certain non-arm's-length transactions, such as where an entity sells all of its output to a related company that in turn earns arm's-length revenue.

- Affiliated groups that do not normally compute revenue on a consolidated basis may elect to do so.

Reference Periods for the Drop-in-Revenues Test

Eligibility would generally be determined by the change in an eligible entity's monthly revenues, year-over-year, for the applicable calendar month.

Alternatively, an entity can choose to calculate its revenue decline by comparing its current reference month revenues with the average of its January and February 2020 revenues.

Once an entity has chosen to use either the general or alternative approach, they must use that approach for each of the three periods. The approach chosen would apply for the purpose of both the base Canada Emergency Wage Subsidy and Canada Emergency Rent Subsidy.

An eligible entity would use the greater of its percentage revenue decline for the current qualifying period and that for the previous qualifying period in order to determine its subsidy rate. This would provide certainty and aligns with the practice under the Canada Emergency Wage Subsidy.

Table 2 below outlines each qualifying period and the relevant period for determining change in revenue.

| Qualifying period | General approach | Alternative approach | |

|---|---|---|---|

| Period 8 | September 27 to October 24, 2020 | October 2020 over October 2019 or September 2020 over September 2019 | October 2020 or September 2020 over average of January and February 2020 |

| Period 9 | October 25 to November 21, 2020 | November 2020 over November 2019 or October 2020 over October 2019 | November 2020 or October 2020 over average of January and February 2020 |

| Period 10 | November 22 to December 19, 2020 | December 2020 over December 2019 or November 2020 over November 2019 | December 2020 or November 2020 over average of January and February 2020 |

| Note: The period numbers align with those used for the Canada Emergency Wage Subsidy, for simplicity. Period 8 of the Canada Emergency Wage Subsidy program is the first period for which the rent subsidy will be in effect. | |||

All applications must be made on or before 180 days after the end of the qualifying period.

The estimated cost for the first three periods of the rent subsidy program, including the top-up for locations significantly affected by public health restrictions, is $2.2 billion in 2020-21.

How Organizations Will Benefit

Example 1:

Sonia is the owner of a gym that was fully locked down on September 20 under provincial order. In September, her revenues were down by 50 per cent because of the physical distancing measures, and her revenues in October will fall to zero. Her rent expenses for the period are $10,000. Sonia will be eligible for the 25 per cent Lockdown Support, or $2,500. In addition, Sonia will receive a base rent subsidy of 65 per cent, or $6,500, for a combined total of $9,000.

Example 2:

Restaurant Inc is a chain of restaurants with 10 locations. In September, revenues were down 70 per cent, and in October, revenues were down over 80 per cent when the dining rooms of six of their 10 locations were shut down under a regional public health order effective October 10. Restaurant Inc incurred rent costs of $400,000 in respect of the period, $120,000 of which related to the six locations closed by public health order. Under the rent subsidy, Restaurant Inc will be eligible for a base subsidy rate of 65 per cent plus the new Lockdown Support of 25 per cent with respect to the six locations closed by public health order for the days they were affected (in this case 15 days out of the 28-day period). As shown in Table 3 below, Restaurant Inc will be able to benefit from the base subsidy and the Lockdown Support. The base subsidy would apply on $300,000 in eligible expenses (the monthly cap), for a benefit of $195,000. The Lockdown Support is only capped per location, meaning it would apply on $120,000 of eligible expenses ($20,000 x 6), and is pro-rated to the number of days in the qualifying period that the business was affected by the public health order. As such, the benefit associated with the Lockdown Support would be of $16,071 ($120,000 x 25% x 15/28). This would result in a total rent subsidy of $211,071 for the month of October.

| Subsidy rate | Eligible expenses | Eligible days | Subsidy | |

|---|---|---|---|---|

| Base rent subsidy | 65% | $300,000 | 28 | 65% x $300,000 = $195,000 |

| Lockdown Support | 25% | $20,000 x 6 =$120,000 | 15/28 | 25% x $120,000 x 15/28 = $16,071 |

| Total | $211,071 |