Liability working group meeting 1 – July 7, 2022

This discussion guide is provided to assist working group members in preparing for the meeting.

For questions or comments, please contact obbo@fin.gc.ca.

On this page:

Discussion guide

Objective

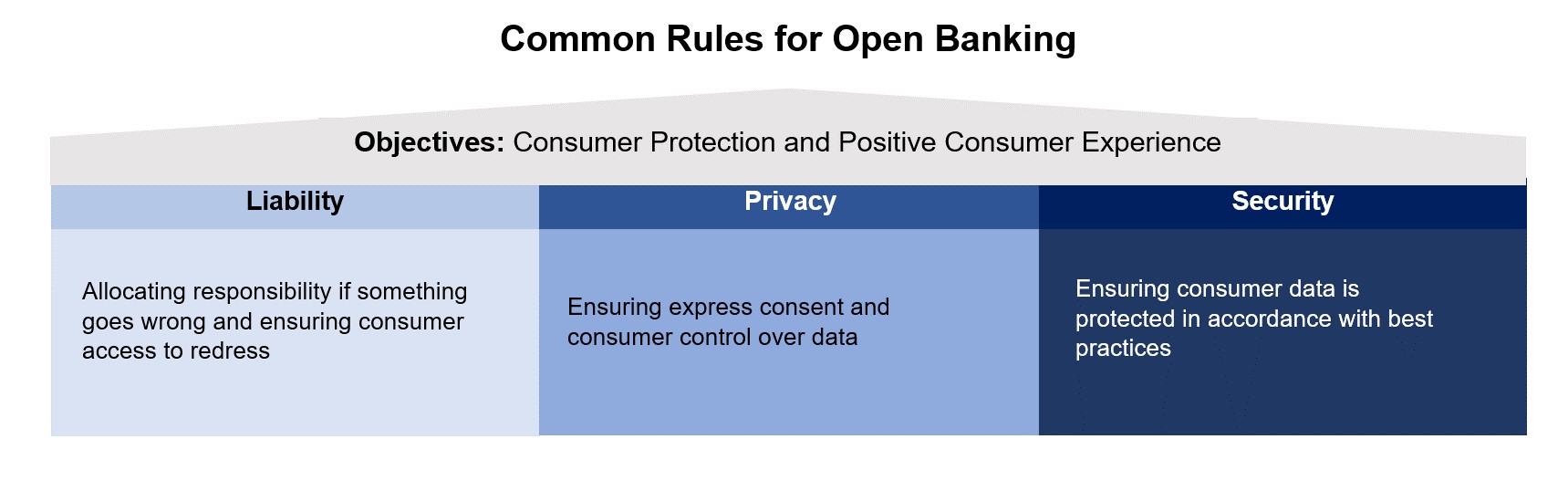

To ensure the efficient functioning of an open banking system, the Advisory Committee on Open Banking (the Committee) recommended that common rules be established in the areas of liability, privacy and security.

The aim of this working group is to draft common rules on liability to recommend to the government.

In their final report, the Committee noted that the core objective for implementing open banking in Canada is to realize consumers’ right to data portability and move to a system of secure, efficient and consumer-permissioned data sharing.

Approach and timelines

Meetings will be held approximately every three weeks. Members are encouraged to review the following material in advance of meetings:

- Canada's Digital Charter: Trust in a digital world

- Final Report, Advisory Committee on Open Banking

- Terms of reference for the open banking working groups and steering committee

- Annex A – Timeline of liability working group topics

The open banking lead, with support from the Department of Finance Canada (the Secretariat), will distribute documents guiding the discussion for each meeting which will also be available on the open banking implementation page. Members may also be asked to draft material for discussion.

Liability working group topics and timeline

Discussion

- Are there other topics that should be considered by the liability working group which were not captured in Annex A?

- What are your views on the proposed timeline and cadence of the work plan?

Liability limits for consumers

The Committee recommended that consumers be limited from liability beyond a fixed dollar amount, unless gross negligence or criminal act can be proven. The Committee’s intent is to make sure an open banking regime protects consumers from unauthorized use.

Open banking will provide more protection for consumers than currently in the market today, but consumer errors are still possible. A liability limit, or cap, is the maximum amount a consumer would be responsible to pay as a result of their error. A liability limit is an integral safeguard for an open banking framework that prioritizes consumer welfare.

A liability limit rule might include (1) the maximum dollar amount, if any, that market participants could hold consumers liable, and (2) what would be required for the consumer to be liable.

Discussion

- How should consumers be limited from liability for sharing data under the open banking framework?

- Under what circumstances should consumers be held liable?

- What would be an appropriate dollar limit, and should it vary depending on circumstances?

Annex A – Timeline of liability working group topics

|

Timeline July |

Topic | Outcome |

|---|---|---|

| Meeting 1 | Liability limits for consumers | Common rules on liability limits for consumers |

| Meeting 2 | Complaints handling and redress regime | Common rules on internal and external consumer complaint handling; Common rules on redress |

|

Timeline Aug. to Sept. |

Topic | Outcome |

|---|---|---|

| Meeting 3 | Traceability frameworks | Common rules on monitoring and incident response for data-in-transit and held by accredited participants |

| Meeting 4 | Public accountability | Common rules on public reporting |

|

Timeline Sept. to Oct. |

Topic | Outcome |

|---|---|---|

| Meeting 5 | Liability of use of data | Common rules on liability for using data shared under consumer consent |

| Meeting 6 | Relationship between participants | Common rules on disputes between participants on operations not related to consumer complaints; Common rules on legal relationship of participants. |

| Meeting 7 | Liability under reciprocity | Common rules on reciprocity |

Outcomes

Liability working group topics and timeline

Discussion 1

Are there other topics that should be considered by the liability working group which were not captured in Annex A?

- There was general consensus that the proposed topics for the liability working group were appropriate.

- The breadth of liability as a topic and its interdependence vis-à-vis the other working groups (liability, privacy, security) was noted.

Discussion 2

What are your views on the proposed timeline and cadence of the work plan?

- There was a general consensus that the proposed timeline and cadence of meetings for the liability working group were appropriate.

Liability limits for consumers

Discussion 3

How should consumers be limited from liability for sharing data under the open banking framework?

- There was general consensus that consumers should be limited from liability in all functions of open banking up to a small fixed dollar amount, except in cases where the consumer was proven to have committed gross negligence/gross fault, or criminal acts such as fraud.

- Participants were generally in favour of aligning liability limits to existing standards of practice. Other topics discussed included wilful misconduct and raising a baseline level of digital and financial literacy among open banking consumers.

Discussion 4

Under what circumstances should consumers be held liable?

- Participants discussed specific approaches for supporting digital and financial literacy among open banking consumers. Examples included password management, multifactor authentication, and pooled indemnity funds. No consensus was reached on who or how responsibility should be allocated for these specific cases.

Discussion 5

What would be an appropriate dollar limit, and should it vary depending on circumstances?

- A majority of participants agreed that $50 should be the liability limit for consumers except in cases where the consumer was proven to have committed gross negligence/gross fault, or criminal acts such as fraud.

Liability working group attendees

Members

- Bank of Montreal

- Canadian Imperial Bank of Commerce

- Canadian Western Bank

- Intuit

- Meridian Credit Union

- National Bank of Canada

- Neo Financial

- Option consommateurs

- Plaid

- Portage Ventures

- Public Interest Advocacy Centre

- Servus Credit Union

- Vancity Credit Union

- Wealthsimple

External guests

- Autorité des marchés financiers

- Competition Bureau Canada

- Financial Consumer Agency of Canada

- Office of the Superintendent of Financial Institutions

Chair

- Abraham Tachjian, Open banking lead

Secretariat

- Department of Finance Canada