Introduction

In 2020, the COVID-19 pandemic has had an unprecedented impact on the health and economic well-being of people around the world.

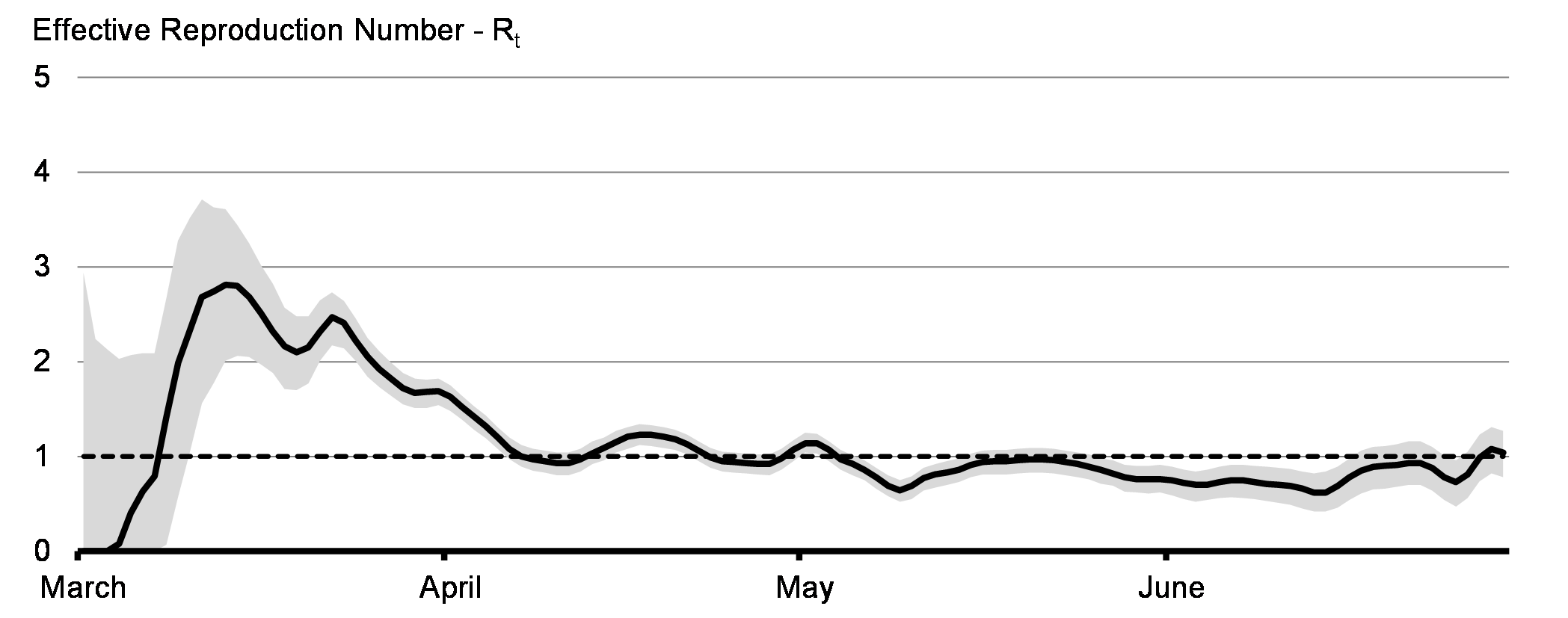

A sudden worldwide wave of lockdown measures, based on the guidance of public health officials, were put in place to contain the virus and save lives. In Canada, the first case of COVID-19 was confirmed in late January. On March 11, the World Health Organization declared the global outbreak of COVID-19 a pandemic. Globally, over 11 million cases of COVID-19 have since been reported. In Canada, the virus has resulted in just over 100,000 reported cases. Public health measures to combat the spread of COVID-19 across the country are flattening the curve and slowing the spread of new cases.

Chart 1

The toll of COVID-19 on the global economy is expected to be the largest and most sudden contraction since the Great Depression. Global supply chains have been disrupted, trade has slowed and a huge share of economic activity was halted during lockdowns.

Here at home, public health measures meant that schools closed, businesses shut their doors and Canadians stayed home. The economic impacts of COVID-19 were compounded by the shock to commodity prices in the early spring. Millions of Canadians lost their jobs and businesses faced uncertainty like never before.

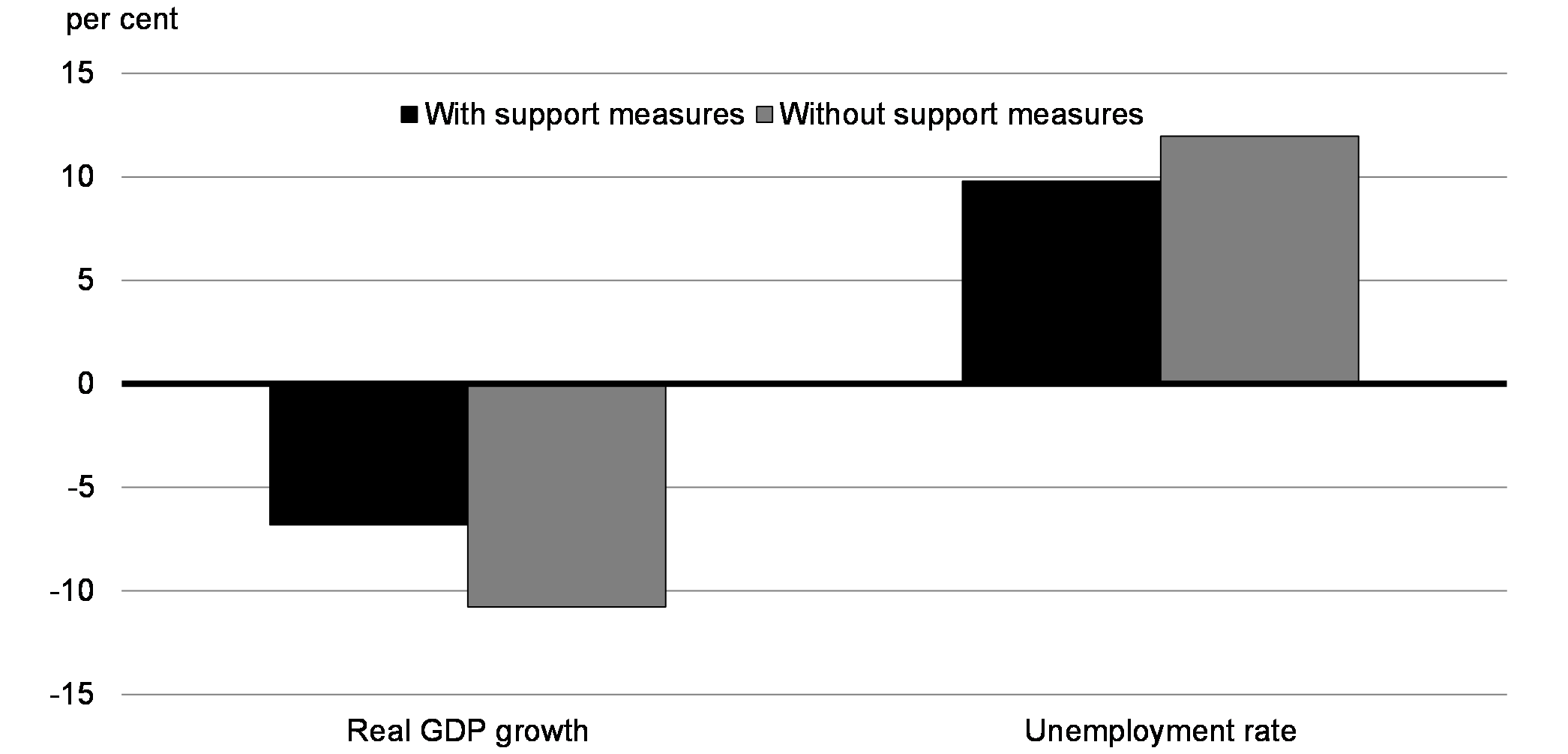

The COVID-19 crisis is the challenge of our generation. The Government of Canada is fulfilling its role to stabilize the economy and has responded with rapid and broad-based emergency support measures aimed at protecting the health of Canadians and providing a safety net to support families, workers and businesses across the country. The decisive and substantial support provided by the government helped prevent further damage to the economy by replacing lost income and avoiding even higher unemployment.

Chart 2

This is both important in the short-term for preventing a larger drop in economic activity than would have otherwise been the case, as well as the long-term, for avoiding prolonged social and economic costs from delayed rehiring and reduced consumption. For example, the Canada Emergency Wage Subsidy has been able to support about 3 million workers at risk of layoff, while the Canada Emergency Response Benefit has helped protect families in need. These programs have helped keep money in the pockets of Canadians so they can pay for housing, groceries and medicine, while also helping businesses stay in place as Canadians get through this together.

“The policy response has been rapid and substantial. Canada has taken many measures to head off macroeconomic destabilization, bolster demand and support households and businesses. . . Increased transfers to households and businesses and reduced tax bills, along with monetary and liquidity support, will limit the depth of economic downturn.”

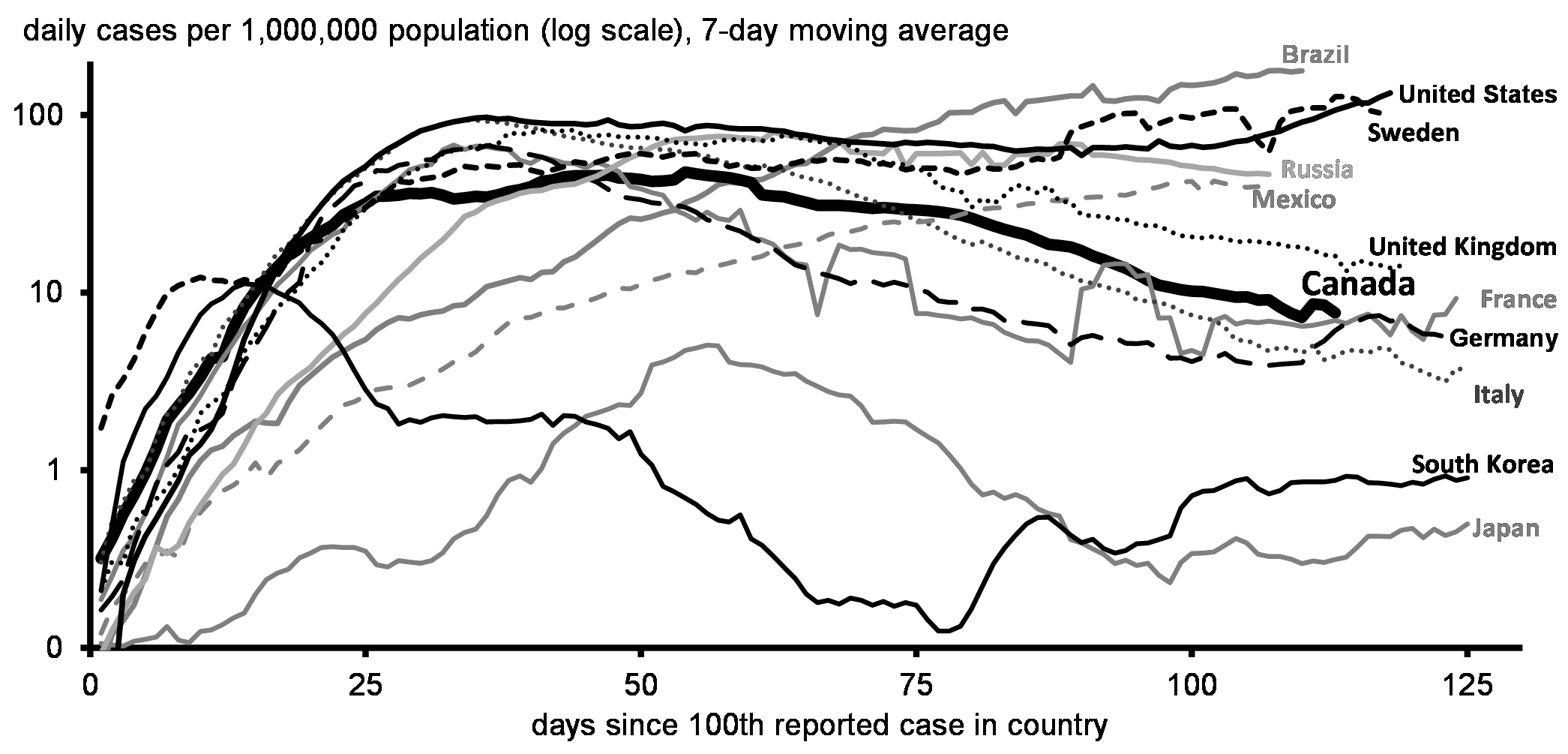

It was evident from the very start that the smartest economic policy was to put public health first. Governments, at every level, worked together in a decisive and coordinated way, implementing restrictions and lockdowns to reduce the transmission of the virus. Canadians have been doing their part to follow the public health guidance, helping flatten the curve of new infections to a level that is now allowing for some reopening of economies. Thanks to the combined efforts of Canadians, businesses, the Bank of Canada, and governments, Canada has managed the economic elements of this crisis well, avoiding worse outcomes experienced by other countries.

Chart 3

(population adjusted)

Through Canada’s COVID-19 Economic Response Plan (the Plan), the government has delivered a robust and comprehensive economic response equivalent to nearly 14 per cent of Canada’s GDP. In this time of unprecedented need, the government is leading the way in providing support and making sure Canadians have the help they need.

Canadian businesses have participated in a mass reorganization of industry the likes of which Canada has not seen since the Second World War. This mobilization has helped to jumpstart scientific research on vaccines and treatments, and spur the domestic production of personal protective equipment, sanitizer and other vital equipment and services needed in the fight against COVID-19.

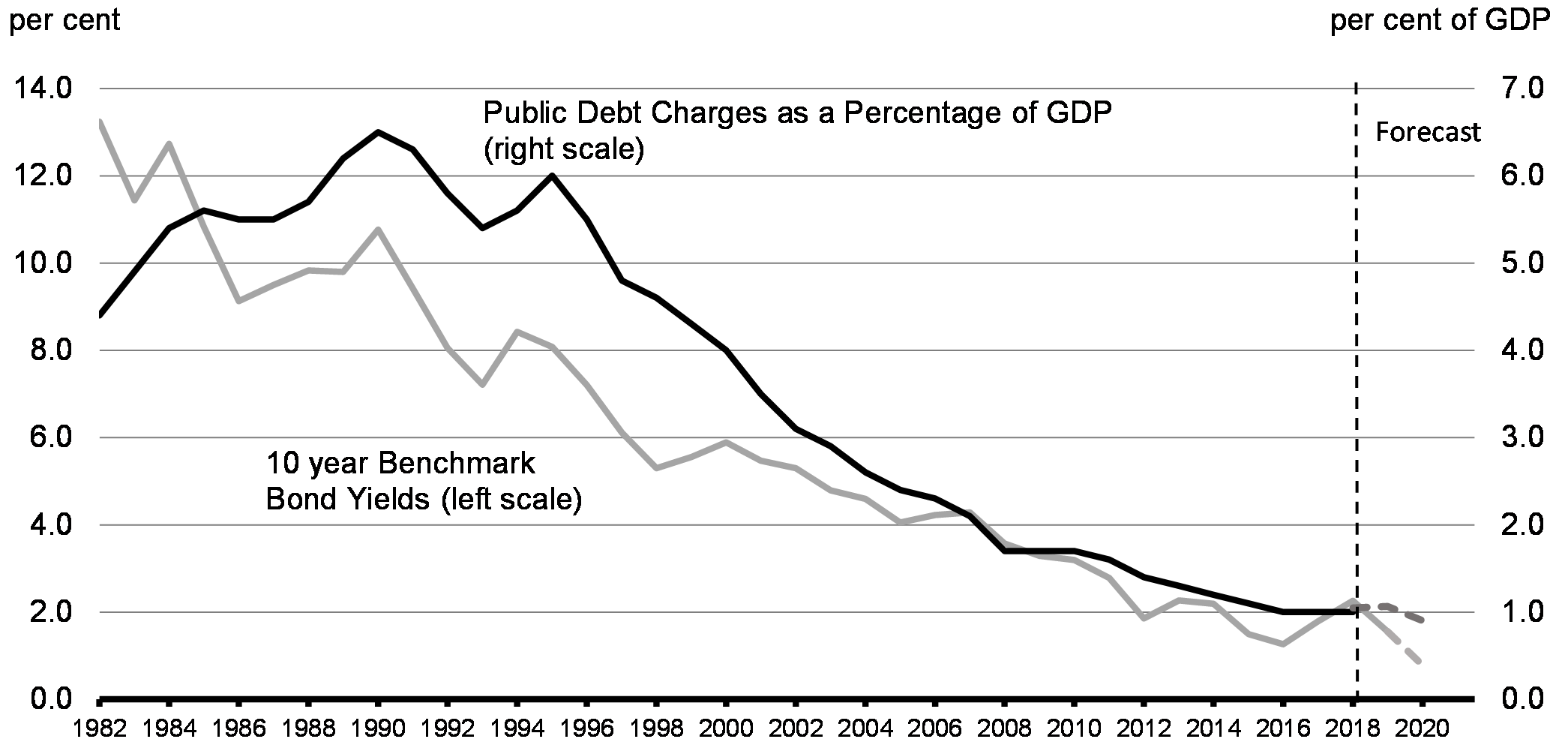

The federal government took on debt to reduce the amount Canadians had to take on. Canada entered this crisis on strong footing, with a net debt-to-GDP ratio considerably lower than its G7 peers. Paired with historically low borrowing costs, the Government of Canada has the necessary fiscal firepower to be there for all Canadians and to pave the way for a prudent long-term recovery.

Safe Restart: Protecting the Health of Canadians

Canada has used its strong fiscal position to put in place the largest economic aid package in generations. The government has deployed its fiscal firepower to counter the impacts of this crisis through responsible and sustainable investments. With considerably low levels of debt, Canada has the room to borrow and support the Canadian economy. In fact, even with Canada’s increased borrowing needs due to the COVID-19 response, public debt charges are expected to fall in 2020-21. Compared to the Economic and Fiscal Update tabled in December, the government projects to save more than $4 billion in debt charges this year thanks to record low interest rates even as borrowing has increased substantially in order to fight COVID-19. Relative to the overall economy, public debt charges are projected to fall below 1 per cent of GDP in 2020-21.

Chart 4

Canada is adjusting its debt management strategy to lock in these rates by issuing more longer-term debt, such as 10-year and 30-year bonds (see Annex 3). The government is taking advantage of the robust market demand for Government of Canada bonds to ensure that much of Canada’s outstanding debt is less vulnerable to interest rate increases, which will maintain Canada’s debt sustainability for generations to come, securing a stronger economic future for all Canadians.

“Extreme economic and financial stress has been met with an exceptional policy response. The severity of the current shocks has demanded a bold policy response. A complementary set of fiscal, monetary and financial policy measures has been put in place to help offset lost income, boost access to credit and lower debt service costs.”

Until a vaccine or effective treatment for COVID-19 is found, the pace and trajectory of economic recovery will largely depend on Canada’s prolonged ability to contain the spread of the virus and limit resurgence. Protecting the health of Canadians must remain the first priority for our country and our economy. The public and the private sectors, federal, provincial and territorial governments, and all Canadians must continue to work together to contain the virus and restore confidence.

At the start of this crisis in March, the government provided immediate unconditional health transfers to provinces and territories to help Canada’s world-class health systems better combat this virus. In addition to direct support measures, Canada launched rapid procurement of hundreds of millions of pieces of personal protective equipment, while also contracting with Canadian companies to supply masks, gowns and more. Finally, the government has made major investments in medical research and vaccine development. Recently, the federal government began working intensively and collaboratively with provinces and territories to develop a national plan for a safe restart, to ensure Canada’s economic recovery will be safe, robust and long-lasting. The Government of Canada will continue to support the work being done to fight this virus.

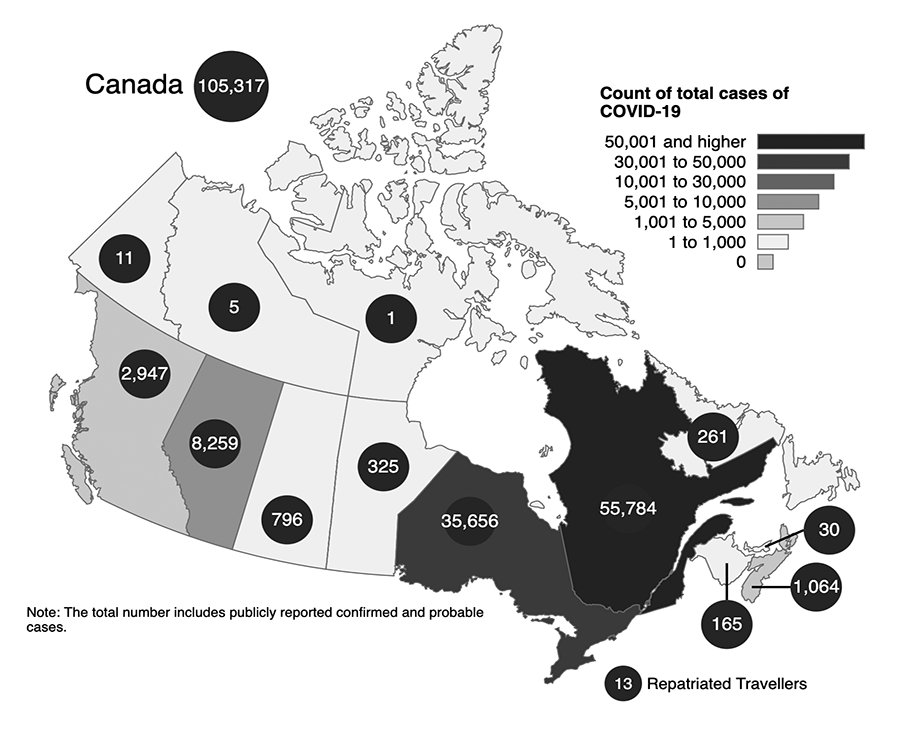

Canada’s four most populous provinces—Alberta, British Columbia, Ontario, and Quebec—have seen the most cases of COVID-19. Quebec and Ontario account for 87 per cent of cases overall, with many outbreaks occurring in long-term facilities. The brave women and men of the Canadian Armed Forces stepped in to care for residents at some facilities. COVID-19 has laid bare many of the social and economic vulnerabilities and inequalities across Canadian society, with the disproportionate impacts in communities where Canadians experience overcrowding, lower incomes and health disparities. Different regions are at different stages of containing the virus, but all must remain vigilant to help prevent further outbreaks and minimize further social and economic impacts.

Figure 1

As provinces and territories slowly begin restarting economies, the federal government will continue to lead the way in providing support so that all orders of government can deliver the critical health and social services needed to allow Canadians to safely return to work. This includes increased testing and tracing capacity, providing guaranteed sick leave to deal with COVID-19, securing personal protective equipment, ensuring access to child care, protecting the vulnerable including Canadians in long-term care, supporting people experiencing mental health and problematic substance use challenges, and making sure that municipalities, which deliver many essential services Canadians rely on, have the support they need.

The government will also continue to work in partnership with Indigenous communities to ensure they have access to necessary supports. Much is still uncertain about how this virus will progress and all orders of government need to be prepared for the possibility of further outbreaks.

The actions and investments of governments, across Canada, to date have helped us get this far. But the road towards recovery remains long and uncertain. Today, and in the months to come, Canada’s economic health depends on its public health.

Building a Bridge for Canadians

The federal government’s plan is about building a bridge for Canadians, so as to position the Canadian economy to recover strongly. In a global pandemic and economic downturn, if the government didn’t step in, families would have had to take on more debt or lose what they have worked their entire lives to achieve.

For millions of Canadians, actions taken to contain the virus have meant lost jobs, lost hours and lost wages.

Restoring the jobs that Canadians rely on is a real challenge—one that requires us to work together. The Canada Emergency Wage Subsidy is helping employers keep and rehire millions of Canadians and providing them with certainty about where the next paycheque is coming from. By keeping Canadians attached to their employers, the government has given Canadians more confidence in their futures, ensured they can keep their benefits, and will better position Canada for economic recovery. Businesses, non-profits, and registered charities have received support, enabling them to continue working during this bridging period with the employees they have trained, supported, and worked alongside for years.

The government also created the Canada Emergency Response Benefit (CERB) to provide $500 a week to Canadians who have stopped working or whose work hours have been reduced because of COVID-19, so they could pay for groceries, rent, and medication. The CERB and other supports have worked to effectively replace lost labour income while the economy was in lockdown to help contain the virus.

This pandemic has amplified existing inequalities. Vulnerable groups are experiencing some of the most significant health, social and economic impacts. For instance, women, racialized Canadians, young people, parents without access to child care services, seniors, LGBTQ2 individuals, people with disabilities and those living on low-income have experienced the most drastic effect. These disproportionate impacts can be seen through job losses, the sharp reduction in hours worked, over-representation in frontline work, the additional burden of unpaid care work, and restricted access to community services and supports

(see Annex 1, GBA+ Summary).

To support some of the most vulnerable populations, the government is providing special one-time payments to individuals eligible under existing programs—the Goods and Services Tax Credit, the Canada Child Benefit, Old Age Security with its Guaranteed Income Supplement and the Disability Tax Credit. The government also suspended student debt payments to help support those who just entered the labour force and are the most susceptible to losing their job in a time of crisis. Additionally, the government has invested in shelters, food banks, and community organizations, to ensure that Canadians get the support they need—this includes support for those fleeing gender-based violence.

Indigenous peoples across the country have also felt the impacts of the pandemic and the government is working with First Nations, Inuit, and Métis Nation leaders to provide direct support to their communities. Indigenous communities have been successful in preventing, controlling and stopping the spread of the virus in their communities. The Government of Canada is making investments to build on innovative community-led solutions and support public health, social and economic responses in Indigenous communities. But there is always more to do.

“Our message to Canadians is clear: to every worker and business, in every province and territory, we have your back and we will get through this together.”

From the outset, it was clear that businesses of all sizes and across all sectors would need liquidity support. That’s why the government has made tailored programs so that businesses can get the bridge financing they need. For example, over 688,000 small businesses have received interest-free loans through the Canada Emergency Business Account.

The government will continue to ensure the Plan is working as intended—filling the gaps, supporting Canada’s most vulnerable and leaving no one behind. The government will make the necessary investments to protect the health of Canadians and support the workers that have built a strong Canada.

We’re all in this together.