Canada’s Defence Industrial Strategy

© His Majesty the King Right of Canada as represented by the Minister of National Defence, Security, Sovereignty and Prosperity: Canada’s Defence industrial Strategy.

Table of contents

- Message from the Ministers

- The Government’s Vision

- Canada’s Defence Industry: Key to Confronting the New Risks

- How We Will Get There: The Key Pillars of Canada’s Defence Industrial Strategy

- Pillar I: Renewing Our Relationship with Industry

- Pillar II: Procuring Strategically: The Defence Investment Agency & “Build–Partner–Buy”

- Pillar III: Investing Purposefully to Strengthen an Innovative Canadian Defence Sector

- Supporting Defence-Related R&D and Innovation

- BOREALIS: A Key Mechanism to Fast-Track Development and Deployment

- Building A Dynamic and Entrepreneurial SMB Defence Sector

- Prioritizing Canadian IP Ownership, Protection, and Access

- Expanding Export Promotion and Support

- Deepening Workforce Development

- Pillar IV: Securing Supply Chains for Key Inputs and Goods

- Pillar V: Working with Key Domestic Partners, Including in Canada’s North and Arctic

- Annex: Commitments Under the Strategy

- Annex: What We Heard in Our Consultations

- Annex: ITB Policy – Key Proposed Changes

- Annex: Snapshot - Defence Investment Agency

Cat. No: D2-719/2026E-PDF

ISBN: 978-0-660-98230-4

Message from the Ministers

As the Ministers responsible for Canada’s national defence; research, innovation and industrial development; and defence acquisitions, we are honoured to present Canada’s Defence Industrial Strategy.

The world has become more volatile and dangerous, and it is more important than ever that Canada be ready and able to defend our territory, our people, and our values. That is why the Government of Canada pledged $81.8 billion in Budget 2025 to increase our investments in defence. It is also why our government pledged $6.6 billion of this funding to Canada’s Defence Industrial Strategy to ensure that Canadian industry plays a central role in this generational effort to rebuild the military.

Russia’s unprovoked aggression against Ukraine and the impacts of COVID-19 have taught the world hard lessons, exposing the risks of relying on uncertain supply chains for critical needs. Long-held assumptions have been upended-about the end of imperial conquest, the durability of peace in Europe, and the resilience of old alliances. In this uncertain world, it is more important than ever that Canada possess the capacity to sustain its own defence and safeguard its own sovereignty. This is especially important when it comes to protecting Canada’s Arctic sovereignty and promoting a secure North, where reliable infrastructure and equipment underpin the Canadian Armed Forces’ and Canadian Coast Guard’s ability to respond to threats and support Northern communities.

Canada needs a strong defence industrial base to produce the equipment required by our military. That is why Canada’s Defence Industrial Strategy establishes a bold new direction: supported by a new Defence Investment Agency, and applies a BUILD–PARTNER–BUY framework. The Government of Canada will focus first on building in Canada, particularly in areas of key sovereign capability or where Canada already has deep strengths. And when we partner with allies to build together, or buy off-the-shelf, we will do so under conditions that flow back into domestic industry and ensure Canadian sovereign control.

Canada’s defence sector is already a vital pillar of the economy, comprising close to 600 defence firms and contributing over $9.6 billion in GDP and 81,200 jobs to the Canadian economy. Canada will build on this foundation over the next decade to dramatically expand domestic industrial capacity and economic impact. We will add up to 125,000 new jobs and position the Canadian defence sector as a powerful engine of growth, innovation, and long-term national resilience.

Achieving our goals will depend on a strong partnership and close collaboration among the Canadian military, multiple government departments and agencies, and Canadian industry. It will require partnerships, including with Arctic and Northern communities. We pledge to work together in a whole-of-government effort to build up Canada’s defence industrial base, ensuring that the Canadian Armed Forces have the capabilities needed to secure our sovereignty—forever keeping Canada the True North, Strong and Free.

Hon. David McGuinty

Minister of National Defence

Hon. Melanie Joly

Minister of Industry

Hon. Stephen Fuhr

Secretary of State

(Defence Procurement)

The Government’s Vision:

A Strong Canadian Defence Industry for a Secure and Prosperous Canada: Pursuing Our Vision

As it advances Canada’s Defence Industrial Strategy, the Government of Canada will be guided by a clear vision:

A robust Canadian defence industry that provides technological and operational advantage to the Canadian Armed Forces and its security partners in their mission to defend Canada, and maximizes growth, job creation and economic benefits for all Canadians.

Our pursuit of the Strategy is spurred by the sure knowledge that Canada’s sovereignty and its national security depend on a strong industrial and technological base that supports defence readiness and economic resilience. The erosion of the rules-based international order and unprecedented economic challenges, including tariffs, risks economic growth and prosperity for Canadians in the short and long term. Our national security and our economic security go hand in hand.

Achieving Results for Canada

By taking the steps required to ensure that Canadian industry can supply the needed capabilities of our armed forces, we will not only advance our sovereignty, but also strengthen our economy. In the next 10 years, Canada’s Defence Industrial Strategy will:

- Build world-leading Canadian firms in key sovereign capability areas;

- Raise maritime fleet serviceability to 75 per cent, land fleets to 80 per cent, and aerospace fleets to 85 per cent to meet training and operational readiness requirements;

- Increase the share of defence acquisitions awarded to Canadian firms to 70 per cent;

- Accelerate procurement of successful Canadian defence R&D innovations;

- Boost government investment in defence-related research and development by 85 per cent;

- Increase total Canadian defence industry revenues by more than 240 per cent;

- Grow defence revenues for Canadian small and medium-sized businesses by more than $5.1 billion annually;

- Increase Canada’s defence exports by 50 per cent;

- Create 125,000 quality new jobs across the Canadian economy.

Canada’s Defence Industry: Key to Confronting the New Risks to Canada’s Security and Economy

As the Government of Canada rolls out its generational $81.8-billion reinvestment in the Canadian Armed Forces, Canada’s defence industry will play a central role-both as a contributor to our national security and our economic prosperity.

A Key Player in the Country’s National Defence

Canada has proven strengths in traditional areas of defence, such as aircraft, aircraft engines and parts. The country also has advanced capabilities in maintenance, repair and overhaul services, and in service support. We are a world leader in training and simulation. The country also produces world-class combat vehicles, munitions, and sophisticated naval vessels. Moreover, Canada’s broader industrial base has strengths in areas increasingly important to defence, including space, artificial intelligence, cyber, quantum technologies, medical countermeasures, robotics, and drones.

Not only is the Canadian defence sector a major supplier to the Canadian Armed Forces, it is also an export powerhouse. Virtually half (49 per cent) of the defence-related products and services produced by Canadian firms are sold abroad. Of these, the majority (69 per cent) go to the United States and our other Five Eyes partners. Global customers recognize the capabilities that Canadian defence firms bring to the table.

An Important Contributor to Jobs and Growth

At the same time, the defence sector is an important contributor to the economy. In 2022, its nearly 600 firms contributed to 81,000 jobs. These companies generated $14.3 billion in revenues that same year and contributed $9.6 billion to GDP. What’s more, the industry is a hotbed of innovation.

The Canadian defence sector is one of the most R&D-intensive, spending $440 million in 2022, the vast majority invested by the industry itself. It is more than three times as R&D-intensive as Canadian manufacturing overall, and its share of employees in high-end STEM jobs is more than 2½ times as great. At a time when the Canadian economy is facing challenges in the form of tariffs, rising protectionism, and other uncertainties, we must recognize and seize the potential for our defence sector to support growth.

This includes growing national champions. In contrast to some of Canada’s global peers, our defence industry is built on a foundation of small and mid-sized firms (SMBs), which account for 92 percent of all firms and 40 percent of sector employment. Growing and scaling Canadian SMBs to serve as anchor firms will play a critical role in strengthening Canada’s defence industrial base.

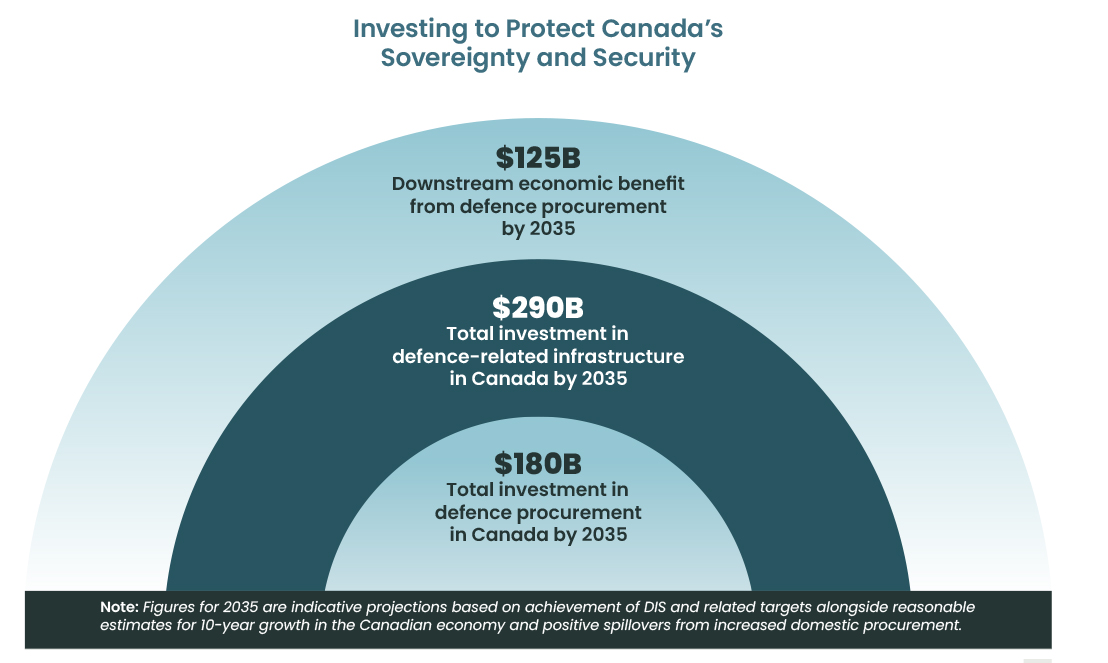

A Robust Defence and A Robust Economy: Mutually Reinforcing Goals

Indeed, never has it been clearer that a strong Canadian defence and a strong defence industrial base are mutually reinforcing. Beyond outright conflict, such as that we have seen in Ukraine, the rise of new powers, increasing protectionism, and shifting dynamics in international relations have also underlined the necessity of thinking differently about the intersection of Canadian sovereignty, defence needs, and economic development. Tariffs and changing trade relationships have placed significant pressure on strategically critical Canadian industries such as steel and aluminum, which employ thousands of Canadians whose livelihoods are now at risk. At the same time, renewed defence spending presents an opportunity to source critical inputs from these sectors as we rebuild the Canadian Armed Forces and fulfill our commitment to invest 5 per cent of annual GDP in Canada’s defence and security by 2035, aligned with the NATO Defence Investment Pledge. Similarly, key industries such as the mining and processing of critical minerals offer substantial economic growth potential while directly strengthening national security. Finally, frontier technologies - in which Canada plays a leading role-such as AI and quantum computing-are game-changing on the battlefield and can also drive economic growth and productivity. As shown in the graphic below, implementing this Defence Industrial Strategy and related targets by 2035 will result in an estimated $180 billion total direct investment in defence procurement, $290 billion total investment in defence-related infrastructure, and $125 billion in downstream economic activity – more than half a trillion dollars of overall investment in Canada.

In sum, we cannot think about Canada’s national defence and defence industrial base as separate silos. Because Canada has embarked on a historic reinvestment in the Canadian Armed Forces, we also have a historic opportunity to strengthen our national defence and our economy at the same time, in mutually reinforcing ways.

Caption

Investing to Protect Canada’s Sovereignty and Security

At the centre of the diagram, the smallest arc is labelled “$180B Total investment in defence procurement in Canada by 2035.” This layer illustrates the projected scale of direct investment in defence procurement by 2035.

The middle arc, shown in the darkest shade, is labelled “$290B Total investment in defence-related infrastructure in Canada by 2035.” This layer indicates the project scale of direct investment in defence-related infrastructure by 2035.

The outermost arc is labelled “$125B Downstream economic benefit from defence procurement by 2035” indicates the projected scale of investments that will contribute to a wider economic growth, industrial capacity, and supply chains beyond the defence sector by 2035.

A note beneath the diagram explains that the figures for 2035 are indicative projections based on achievement of DIS and related targets alongside reasonable estimates for 10-year growth in the Canadian economy and positive spillovers from increased domestic procurement.

How We Will Get There: The Key Pillars of Canada’s Defence Industrial Strategy

Through the leadership of the Defence Investment Agency, the Government’s strategy to strengthen Canada’s defence industrial base is built on five integrated pillars, each designed to ensure that Canada can equip, sustain, and modernize our military while fostering a Canadian defence industry able to meet 21st century challenges:

- Renewing Our Relationship with Industry – Canadian defence companies must be partners in building and sustaining our armed forces. This means building a more strategic relationship with Canadian industry.

- Procuring Strategically Through a New “Build–Partner–Buy” Framework – With these new tools the Government will prioritize domestic production where feasible and partner with trusted allies where necessary, dramatically speeding up defence acquisitions in the process.

- Investing Purposefully to Strengthen an Innovative Canadian Defence Sector – Beyond procurement, long-term defence resilience requires investment in innovation and workforce development. Going forward, we will support R&D, protect intellectual property, nurture small and mid-sized firms, invest in skills and training, and promote exports to create a defence sector that is agile and globally competitive.

- Securing Supply Chains for Key Inputs and Goods – Defence depends on complex supply chains. From critical minerals to specialized components, ensuring reliable access to these materials is essential for both operational readiness and national security. By strengthening domestic production, stockpiling resources, and coordinating with trusted allies, Canada can mitigate the risks of global disruptions and maintain consistent capability for the Canadian Armed Forces.

- Working with Domestic Partners, including in Canada’s North and Arctic –Defence objectives cannot be achieved in isolation. Working closely with the provinces and territories, Indigenous communities, and other key stakeholders will ensure that defence infrastructure and industrial growth are inclusive, sustainable, and geographically balanced. Canada’s North and the Arctic will be a particular focus, as new threats emerge in part due to a changing climate.

The Defence Investment Agency (DIA) is at the centre of this strategy. Created in October 2025, the DIA is designed to accelerate the timeline of defence procurements, leverage defence procurements to strengthen Canada’s defence industrial base, and attract investment into Canada’s defence industry contributing to growing Canada’s economy.

The DIA will enhance collaboration in multilateral capability development and participate in joint defence procurement programs, including those aligned with Canada’s participation in Security Action for Europe (SAFE) and Readiness2030 (formerly ReARM Europe). The DIA will improve interoperability and access for Canadian suppliers. It will capitalize on economies of scale and contribute to national diplomatic efforts. Simply put, the DIA will be responsible for re-equipping our military and driving economic benefit for Canada through the Government’s generational investment in the Canadian Armed Forces.

Initially created as part of Public Services and Procurement Canada (PSPC), the Government’s intention is to establish the DIA as a stand-alone entity through the introduction of legislation in Spring 2026. A snapshot of the DIA’s role is in the annex.

Pillar I: Renewing Our Relationship with Industry

The first pillar of the Government’s strategy to strengthen Canada’s defence industrial base is as simple as it is essential to our collective success: to renew the relationship with Canada’s defence industry. Canadian industry needs to be a full partner in the national task of building up the Canadian Armed Forces. This has several dimensions.

Providing a Long-Term Demand Signal

First, the Government needs to provide a clear, long-term demand signal to Canadian industry for defence and dual-use goods so it can be better prepared to meet the requirements of the Canadian Armed Forces. One of the fundamental challenges facing Canadian industry has been the lack of clear and predictable demand signals and commitments from government, making it difficult for Canadian companies to forecast demand and make informed investment decisions. Canada’s Defence Industrial Strategy will provide that clear demand signal.

Ensuring Regular Industry Engagement

Second, Canadian industry needs clear mechanisms to engage with the Government early and regularly. To be effective, this engagement must have multiple dimensions:

- Early understanding of capability needs: Canadian industry requires clarity on the key priorities of the Canadian Armed Forces, including its assessment of threats and capability gaps.

- Opportunities for joint innovation and co-development of solutions: The Canadian defence sector needs to be a partner in joint research and development activities, prototyping, and the development of novel solutions to meet Canada’s defence needs. This will require consideration of Canadian industrial benefits at the onset of the procurement process.

- Structured engagement on defence procurement: Industry partners need to have regular and structured touchpoints with key government partners and engage more consistently as part of procurement processes.

- Strategic planning and roadmaps: Finally, the Canadian defence sector needs greater opportunities to align over the long term with the Government’s defence priorities and investment plans.

Once fully operational, the Defence Investment Agency will provide a coordinating function across government to facilitate these industry interactions.

Facilitating Rapid Accreditation of Industry Personnel and Facilities

Third, the Government needs to greatly accelerate its processes for security clearances and the accreditation of industry-operated secure facilities. Industry also needs support to expand security infrastructure to take advantage of emerging defence opportunities.

Assisting Industry to Navigate Government

Finally, the Government must do more to assist Canadian firms-particularly small and mid-sized businesses (SMB)-in navigating complex administrative processes in government. Even with more efficient defence procurement, Canadian companies will still need to engage with multiple agencies. While the largest contractors may have the capacity to manage this complexity, more can be done to make it easier for industry to work with government. This is a key element of the mandate of the Defence Investment Agency.

Key Actions

To renew its relationship with Canada’s defence industry:

- The Defence Investment Agency will lead the establishment of a permanent Defence Advisory Forum, co-chaired by the Ministers of National Defence, and Industry, and Secretary of State (Defence Procurement), to provide a regular, scheduled venue to engage with the Canadian defence industry. Under the leadership of these Ministers, industry will be given new opportunities for direct engagement including on procurement, participation where feasible in wargames and operational exercises, and industry-government-military staff exchanges.

- The Government will invest to significantly accelerate the security clearance process for defence sector personnel, establish a clear and standardized accreditation process for industry-operated secure facilities.

- The Government will assist industry partners to navigate government processes by providing concierge supports, including by establishing regularly scheduled “industry days” between the Department of National Defence/Canadian Armed Forces, the Defence Investment Agency and Innovation, Science and Economic Development (ISED) to share information; publishing a regularly updated inventory of anticipated procurements to give industry early visibility on opportunities; creating a single-window government service to direct firms to the most appropriate resource in government; and putting in place a dedicated ISED “concierge” service for companies working on defence and dual-use technologies.

Pillar II: Procuring Strategically: The Defence Investment Agency and a New “Build–Partner–Buy” Framework

Canada cannot afford to outsource its national defence, we must BUILD the domestic capabilities essential to preserving our sovereignty, and develop new capabilities where gaps exist. At the same time, Canada cannot act entirely alone, and collaboration can strengthen security while delivering better value. We know defence platforms and technologies often depend on critical inputs from trusted allies, so if we can’t build it ourselves, we will PARTNER with capable nations to co-develop and co-produce systems. Lastly, in other cases, where circumstances might require it, Canada will also BUY systems off the shelf from abroad. When we do, we’ll make sure it’s under conditions that bolster our sovereign control, while reinforcing, rather than replacing, our long-term domestic capability.

Forging Strategic Relationships with Canadian Champions

As part of its commitment to a new approach, the Government of Canada will enter into formal strategic partnerships with identified Canadian industry partners with a view to building world-leading champions that can meet Canada’s needs—securing domestic ownership and control over critical intellectual property (IP) and capacities—while also supporting Canada’s larger geopolitical objectives, relationships with key allies, and economic development goals, including the creation of well-paying jobs and strengthening Canadian industrial capability.

Partners will benefit from advantages such as directed procurement, funding for R&D, support for capital expenditures, export promotion, in-kind contributions, joint development activities and access to research and testing infrastructure. In turn, they will be expected to deliver capability on time and on budget and support national sovereignty through their Canadian supply chains, while also ensuring continued value for money.

Key Actions

- To build up Canadian defence champions, the Government will publish a framework for the identification and onboarding of select Canadian defence firms as key strategic partners, no later than summer 2026.

The New Defence Investment Agency: Accelerating Procurement and Applying a Bold New “BUILD–PARTNER–BUY” Framework

Defence procurement is a complex task involving multiple government agencies, each contributing in vital ways. The Department of National Defence leads in determining the capabilities required by the Canadian Armed Forces to carry out its mission to defend Canada. ISED, in turn, works with the Canadian defence industrial base to support its growth, ensuring that it can contribute effectively to defence-related innovation and manufacturing. Innovation, Science and Economic Development (ISED) is also responsible for the administration of the Industrial and Technological Benefits (ITB) Policy to leverage economic benefits for the defence sector from eligible defence and Coast Guard procurements. Public Services and Procurement Canada (PSPC) has historically managed procurement to ensure it is fair, transparent, and delivers value for taxpayers.

While all these goals are important, the fragmentation of defence procurement across multiple departments—each with its own mandate and processes-has made it slow to respond to urgent military needs. The Defence Investment Agency (DIA), created in October 2025, will address these challenges. Initially created as part of PSPC, the Government’s intention is to establish the DIA as a stand-alone entity. The DIA will play a central role in accelerating military procurement by consolidating processes, reducing duplication, and providing clarity and certainty to both the military and industry partners.

In particular, the DIA will play a central role in pursuing the Government’s new framework of “BUILD–PARTNER–BUY”, integrating previously separate streams of input from defence, industry, and procurement authorities, enabling faster, more coordinated decisions on acquiring new capabilities. Working closely with the lead Ministers, the DIA will work to reach decisions rapidly, focusing on the needs of the Canadian Armed Forces. They will make the appropriate trade-offs to serve Canada’s strategic security interests, build domestic capabilities that secure Canada’s sovereignty and achieve strong economic and industrial benefits.

1. BUILD: Canadian-Made for Critical Defence Capabilities

The DIA will prioritize Canadian suppliers and products. We will develop Canadian capabilities to build a resilient and innovative defence industrial base capable of designing, producing, and sustaining advanced equipment. “Buy Canadian” is not a slogan; it will be the guiding North Star of a new way of doing business in defence acquisitions.

We will build on Canada’s existing strengths, such as shipbuilding, aerospace, space, land systems, and communications. Building in Canada will strengthen our strategic autonomy, make us a more effective and reliable defence partner, and support our resilience in the event of a conflict. We will procure from Canadian firms to build and seize new opportunities in frontier areas, such as AI, quantum, cyber, and advanced materials—technologies essential to the future of warfare and the modern economy.

Taking these essential steps will reduce reliance on foreign suppliers, foster national champions, secure sovereign control of our own equipment and IP, and create value across Canadian supply chains.

Focusing On Home-Grown Strengths and Sovereign Capabilities

While the Government remains committed to supporting growth and innovation across Canada’s broader defence industrial base, it will place a priority on areas of existing strength and on key sovereign capabilities. The Government recognizes that, in some areas, the development of such capabilities will take time.

Sovereign capabilities represent priority investment areas for which the Government aims to maximize secure strategic autonomy and reduce supply chain vulnerabilities. Sustaining and protecting these capabilities in Canada will require a variety of tools. Foremost among these will be to buy Canadian wherever possible, complemented by other measures such as strategic partnerships, targeted long-term investments through a range of governmental programs, or foreign direct investment from reliable partners. While in some cases, producing and buying these capabilities in Canada may impact cost and timelines, it will provide strategic value and freedom to operate for Canada.

Sovereign capabilities are those without which Canada cannot defend its sovereignty or meet its allied commitments. To qualify, a capability must be critical to the ability to defend Canada; an area of strength in Canada or have the potential to be one; and in demand by our Allies and partners to support collective defence and enable exports.

The following is an initial list of the sovereign capabilities for which the new DIA will be prioritizing build-in-Canada. Going forward, the Government’s designation of sovereign capabilities will not be static; it will evolve with the threat landscape, capability needs, technological change, and domestic industrial capacity.

Canada’s Key Sovereign Capabilities

- Aerospace - Aerospace Platforms; Avionics; and Aircraft Communications

- Ammunition - Common Ammunition; Battle-Decisive Munitions; Small Arms; Missiles and Bombs

- Digital Systems - Secure Cloud; Artificial Intelligence; Quantum Computing and Communications; Integrated Command, Control and Communications; High- Assurance Communications Equipment

- In-Service Support - Naval; Land; Air

- Personnel Protection - Medical Counter Measures

- Sensors - Marine Sensors; Quantum Sensors; Electronic Warfare

- Space - Space-Based Intelligence; Surveillance and Reconnaissance; Space Domain Awareness; Satellite Communications; Space Launch

- Specialized Manufacturing - Land Vehicles / Surface Ships, including Icebreakers and Marine Systems

- Training and Simulation - Naval; Land; Air

- Uncrewed and Autonomous Systems - Uncrewed and Autonomous Land, Aerial, Underwater and Surface Systems (including Uncrewed Collaborative Platforms)

2. PARTNER: Work with Trusted Allies to Build Together

Canada will partner in defence acquisitions where it makes sense to do so. When we can’t build a capability fully ourselves, Canada will pursue partnerships with trusted allies and multinational firms to deliver the capabilities needed by our armed forces. We will build together with allies, creating new commercial opportunities for Canadian firms abroad through government-to-government arrangements that bolster exports, innovation, and foreign investment. In areas where domestic capacity is limited, working with trusted allies will deepen Canada’s role in global supply chains, secure new IP, and support the development of new capabilities at home.

Canada has a long history of working closely with the United States and looks forward to a continued strong Canada-U.S. defence relationship. To ensure greater resiliency in uncertain times, Canada is also undertaking efforts to diversify and build new defence-industrial relationships. This includes building a new, ambitious, and comprehensive partnership with the European Union and the United Kingdom-rooted in our shared values and common interests. Canada will also seek similar opportunities to collaborate with partners in the Indo-Pacific, in particular Australia, New Zealand, Japan and the Republic of Korea.

In all these partnership opportunities, Canada will prioritize sovereign control and the development and retention of critical IP.

3. BUY: Acquire from Others with Domestic Reinvestment and Sovereign Control

Finally, if Canada cannot build ourselves or in strategic partnership with allies, we will consider direct acquisitions from foreign suppliers.

Increasingly, defence platforms incorporate very sophisticated technologies. They can be networked and dependent on advanced software, AI, or other frontier technologies. Foreign governments and their national defence contractors want to assert control over these technologies and the IP that goes into them, but such control can lead to restrictions on the end-user having access to the needed IP, schematics and software updates to operate and sustain these platforms. Procurement decisions by the DIA will include steps to mitigate these risks to sovereign control.

Moreover, multinational defence contractors subject to requirements for reinvestment into Canada under the Industrial and Technological Benefits (ITB) Program frequently privilege their own priorities when meeting ITB obligations, investing into indirect work in their Canadian subsidiaries, for example. Canada can and must do more to ensure these foreign firms do a greater percentage of direct work in Canada on new defence contracts, do more work with Canadian-controlled firms, and re-invest more ITB-eligible funding into activities that deepen key Canadian industrial capabilities.

Key Actions

To ensure defence procurement contributes to both the rebuilding of the Canadian Armed Forces and a strong Canadian defence industrial base that can contribute to Canada’s sovereignty and a growing economy, the Defence Investment Agency (DIA) will apply the Government’s new “Build–Partner–Buy” framework to all future defence acquisitions:

- BUILD: In the areas of home-grown strength and key sovereign capabilities, new defence procurements will typically be directed to Canadian firms as a matter of policy. If and as needed, procurement authorities and legal frameworks will be adjusted to enable this approach, including use of the national security exception to direct work to Canadian firms.

- PARTNER: Where Canada lacks the capability to build domestically or there is advantage to working jointly with partners, it will pursue partnerships with trusted allies and multinational firms to deliver the capabilities needed by the Canadian Armed Forces. A priority will be placed on diversifying Canada’s partnership opportunities, focusing initially on partners in Europe, the United Kingdom and Indo-Pacific. Partnerships will be defined by joint work, joint building, and the sharing of key technologies and IP in a manner that reinforces our alliances and underpins Canadian sovereignty.

- BUY: When it is not feasible to build domestically or partner with an ally, Canada will buy equipment from allies, with strong conditions that spur reinvestment into the Canadian defence industrial base and ensure Canadian sovereign control over the operation and sustainment of the newly acquired assets.

A Modern Industrial and Technological Benefits (ITB) Policy

The ITB Policy will continue to play a critical role in ensuring that the Canadian defence industrial base benefits from procurement. This will be particularly true in circumstances where a large contract may be issued to a foreign prime contractor. To ensure that the ITB Policy is as effective as it can be in building up Canadian industry, the Government will enact reforms to sharpen its contribution to the Canadian economy and defence industrial base.

The ITB Policy is currently estimated to contribute more than $5 billion to GDP and over 40,000 jobs annually in Canada. Seven-hundred-plus Canadian organizations are currently benefitting from active ITB projects, including more than 400 SMBs and 55 academic and research organizations.

About half of ITB commitments are directly connected to the defence contracts. These provide Canadian companies with the opportunity to partner with prime contractors to supply parts for the system Canada is buying. For the remainder, contractors make indirect commitments to help support Canada’s defence sector in other ways, such as establishing or expanding manufacturing facilities, transferring technology or expertise to Canadian firms, developing Canadian suppliers (notably SMBs), investing in R&D, and supporting STEM education initiatives.

The Government will continue to apply the ITB Policy to eligible defence and Canadian Coast Guard procurements and will update its terms to ensure new procurements deliver maximum benefits to Canada’s defence industrial base. Reforms will be made in five areas:

- Alignment with key sovereign capabilities: The ITB policy already spells out Key Industrial Capabilities (KICs) – areas where the Government wants procurements to build-up long term Canadian industrial strength. When KICs apply, bidders are scored on how well their proposed Canadian business activity supports those capabilities, and the winning commitments become contractually binding ITB obligations. Early activity in KICs areas can be banked and counted towards future ITB obligations, encouraging firms to establish meaningful partnerships and conduct R&D, even before a contract is won. The existing KICs need to be updated and aligned to Canada's key Sovereign Capabilities. There is also scope to adjust how the ITB Policy's "Value Proposition" requirement is scored to better support the objectives of Canada's Defence Industrial Strategy.

- Strengthening Canadian Innovation and Industrial Capacity: Canada will modernize its approach to defence industrial benefits by introducing mechanisms that incentivize strategic investments, R&D, and IP development. Key priorities include creating a Strategic Investment Transaction to credit investments that expand industrial output and sovereign capabilities, applying enhanced multipliers for high-impact contributions, and introducing a Canadian Company Boost to reward direct work with Canadian firms-especially SMBs. These measures will foster innovation, build resilient supply chains, and position Canada as a leader in defence industrial capability.

- Supporting exports and deeper integration into allied supply chains: Reviewing the ITB Policy’s rigid rules on causality and incrementality could make it more accessible and effective for Canadian companies. By easing the eligibility criteria, firms would be able to claim exports and supply chain activities as ITB credits, reducing administrative complexity and recognizing a broader range of contributions. Such changes could encourage more Canadian businesses to participate fully in ITB projects and better align crediting to economic impact. Canada will pursue targeted flexibilities under the ITB Policy to enhance exports and supply chain activities following continued engagement with industry to understand practical challenges and co-develop solutions.

- Rewarding skills development: There is a strong argument for re-examining the incentives for skills development, particularly the multipliers for contributions to skills development and training. Revising the multiplier policy to broaden eligibility would encourage companies to invest more widely in the workforce. Increasing the Indigenous multiplier, in turn, would ensure continued strong support for Indigenous participation. Such adjustments could make the ITB Policy more effective in building needed defence-sector skills and capabilities.

- Simplifying administration: Clearer and more predictable approval processes will reduce uncertainty. Credit verification could be simplified. The definition and verification of small and mid-sized businesses could be made more practical. Finally, some ITB policies can create disproportionate administrative and financial burdens for smaller businesses. Adjusting these rules could make participation by these firms more feasible, reduce complexity, and better support their growth and innovation.

More generally, Canada’s defence industry has long argued that the current approach to ITBs is too compliance-driven, focusing narrowly on whether contractors meet contractual requirements rather than meeting the intent of the ITB policy. In modernizing the Policy, there is an important opportunity to prioritize activities that strengthen domestic capabilities, foster innovation, create sustainable jobs, support supply chains, R&D, and exports, and allow more flexibility in how value is credited. In this model, the ITB Policy would guide firms toward initiatives that maximize long-term outcomes, with success measured by jobs, skills, and exports rather than narrow compliance metrics. The Government intends to undertake reforms that strike a better balance between criteria and strategic outcomes.

Key Actions

- To maximize the contribution of defence procurement to the growth and dynamism of Canada’s defence industrial base, the Government will advance a package of reforms to the ITB Policy. ISED will publish changes to the ITB Policy in early 2026. Key proposed changes are highlighted in the annex.

Pillar III: Investing Purposefully to Strengthen an Innovative Canadian Defence Sector

Countries that take their national defence seriously also invest in the full ecosystem that underpins a resilient defence industry: R&D and innovation supports, creation and protection of intellectual property (IP), support for a dynamic small and mid-sized businesses sector (SMB), the backing of exports, and development of a highly skilled workforce. All these elements will be key to Canada’s Defence Industrial Strategy.

Supporting Defence-Related R&D and Innovation

The changing nature of war is reshaping global security. Conflict now extends beyond traditional battlefields into cyberspace, space, and the digital domain, driven by technologies such as AI, quantum, autonomous systems, robotics, and advanced cyber and space capabilities. Countries are racing to harness commercial innovations not only to safeguard sovereignty, but also to capture the economic advantages they bring.

The Government is committed to positioning Canada at the global forefront of defence R&D and innovation. This will require a comprehensive approach stretching from fundamental research, through applied R&D, to the development and demonstration of technologies in the field, and ultimately, enable the scaling-up and commercialization of Canadian enterprises. Canada also needs to become better at rapidly bringing the most important discoveries out of the laboratory and into real-world application and to pushing the frontiers of high-risk, high-reward discovery.

Leveraging Investigator-Driven College and University Research

Fundamental and investigator-driven science plays a critical role in advancing knowledge and driving innovations. This research takes place at Canada’s world-leading colleges and universities, supported by billions of dollars annually through the federal research granting councils-Natural Sciences and Engineering Research Council, Social Sciences and Humanities Research Council, and Canadian Institutes of Health Research-as well as the Canada Foundation for Innovation (CFI) and other organizations. In Budget 2025, the Government reinforced its commitment to research with more than $1.6 billion in new funding to attract and equip world-class researchers.

The Government will continue to support discovery-driven research while establishing mechanisms to better connect universities and colleges to defence priorities. To this end, a new Science and Research Defence Advisory Council will bring together leaders from Canada’s post-secondary sector with key federal partners: the Department of National Defence; Innovation, Science and Economic Development; the three granting councils, CFI, and National Research Council (NRC); and BOREALIS. The Council will work to strengthen collaboration with the research community, explore areas of alignment with defence priorities, and integrate incubators and test centres into national defence innovation pipelines.

Supporting Development, Demonstration and Prototyping

The Government will enhance efforts to move discoveries into higher technology readiness levels through development, demonstration and prototyping. It will invest $244 million in small and mid-sized businesses through a new Defence Industry Assist stream of the NRC’s Industrial Research Assistance Program (IRAP) to help them advance defence and dual-use technologies. Wherever feasible, the Government will also open Canadian Armed Forces ranges, training areas, and operational environments to Canadian industry, as testbeds for new capabilities.

Driving Commercialization and Scale-Up

The Government will enhance support for Canadian firms as they commercialize and scale up new discoveries. Where needed, with the leadership of the DIA, we will establish or strengthen innovative procurement pathways within flagship industrial support programs-including the Defence Innovation Program (IDEaS), and Innovative Solutions Canada (ISC)— to enable the Canadian Armed Forces to rapidly acquire newly developed Canadian-made defence technologies. There are also opportunities to improve access for Canadian firms to existing federal supports through the prioritization and acceleration of defence projects under the Strategic Response Fund, the Canadian Space Agency’s Space Technology Development Program, and NRC‑IRAP.

Filling Critical Innovation Gaps

For research to support our national defence it must be responsive. This means filling critical gaps as quickly as possible. The Government has announced or launched new programs to address key research gaps in areas such as quantum technologies, critical minerals, and drones. Drone technology especially is advancing rapidly. As the world has witnessed in Ukraine, drones are changing the nature of war. It is essential Canada be a leader in drone and counter-drone research. To this end, the Government will establish a drone innovation hub at the NRC.

BOREALIS: A Key Mechanism to Fast-Track Development and Deployment

Central to the Government’s defence research strategy will be BOREALIS-the Bureau of Research, Engineering and Advanced Leadership in Innovation and Science. Developing cutting-edge defence innovation requires speed, agility, and risk tolerance. It needs to be led by purpose-built teams spanning research, industry, government, and the military. And it demands access to secure shared laboratories and workspaces, as well as innovative financing and contracting mechanisms.

With an initial Budget 2025 investment of $68.2 million over three years, BOREALIS will provide these tools. It will play a central role in coordinating and accelerating defence research and innovation, particularly in frontier technologies such as AI, quantum, and cybersecurity, to strengthen Canada’s sovereign defence capabilities. As part of this effort, BOREALIS will establish a national network of Defence Innovation Secure Hubs-sites where security-cleared academic researchers can better collaborate with government and industry in a secure environment.

Key Actions

To promote excellence in defence-related R&D, the Government will:

- Establish a new Science and Research Defence Advisory Council in 2026;

- Invest $244 million in small and mid-sized businesses through a Defence Industry Assist stream of NRC–IRAP to help them advance defence and dual-use technologies. Wherever feasible, it will also open Canadian Armed Forces ranges, training areas and operational environments to Canadian industry;

- Create a Drone Innovation Hub in early 2026 at the NRC with an investment of $105 million over three years. It will also acquire new R&D platforms with an investment of $460 million over five years;

- Publish a detailed roadmap for the standup of BOREALIS and select the first round of funded research projects by Q3 of 2026.

Building A Dynamic and Entrepreneurial SMB Defence Sector

Small and mid-sized businesses (SMBs) account for 92 per cent of Canada’s defence industrial base and 40 per cent of its employment. As announced in Budget 2025, the Government is launching the new $4 billion Defence Platform at the Business Development Bank of Canada (BDC). This program will provide needed venture capital and advisory services to businesses in the defence sector, helping SMBs sell into defence and security supply chains and scale up new technologies. In addition, the Government is committing $357.7 million to establish a new Regional Defence Investment Initiative through Canada’s Regional Development Agencies (RDAs). This initiative will support the growth and integration of predominantly SMBs into domestic and international defence supply chains.

Key Actions

To support a robust Canadian SMB defence sector, the Government will:

- Implement the $357.7-million Regional Defence Investment Initiative in early 2026 to support the growth and integration of SMBs into domestic and international defence supply chains;

- Implement in early 2026, the $4-billion investment through BDC’s Defence Platform to provide loans, venture capital, and advisory services to help SMBs contribute to Canada’s defence and security capabilities.

Prioritizing Canadian IP Ownership, Protection, and Access

The Government recognizes IP and data as foundational to sovereign capability, enabling Canadian companies to scale, compete globally, and become national champions. It will strengthen Canada’s IP position in defence and dual-use technologies by supporting industry in understanding, securing, and leveraging IP and data, including integrating IP considerations into procurement and partnership frameworks and expanding support for business seeking to protect their IP. These measures will help Canadian innovators safeguard their IP as they commercialize ideas and compete internationally.

Canada will also acquire IP advantage through strategic procurement from Canadian firms or, where domestic solutions do not yet exist, through partnerships with allied and partner countries. Procurements led by the DIA will protect Canada’s interests in knowledge transfer, IP rights, and access, ensuring that Canadian industries gain the technical know-how needed to operate, maintain, and repair technologies over the long term.

Key Actions

To strengthen the generation and sovereign control of Canadian defence IP, the Government will:

- Enhance supports to Canadian defence and security firms through ElevateIP and other programs to empower Canadian SMBs to understand, manage and leverage IP, and ensure that they can be maximized for defence and dual-use technologies;

- Specifically prioritize Canadian IP ownership, protection and access in defence procurement processes under the new BUILD-PARTNER-BUY framework.

Expanding Export Promotion and Support

The Government’s support for defence exports has been limited, and Canada has not always succeeded in taking advantage of export opportunities in allied and like-minded markets. This must change. Canada will actively pursue opportunities to grow Canada’s defence exports. The DIA will also consider export potential in its selection of suppliers. In addition, the Government will take further steps:

- Better whole-of-government coordination: the number of players involved in defence-related exports demands coordination. Key federal departments need to work more closely together and with industry—including the Canadian Association of Defence and Security Industries and Aerospace Industries Association of Canada—to prioritize supports for export opportunities and coordinate advocacy efforts abroad. This includes the establishment of dedicated teams that can more effectively support Canadian bids for major international contracts.

- Enhanced support to Canadian firms selling abroad: When it comes to selling Canadian capabilities, the country needs more boots on the ground. This means more Trade Commissioners championing industry’s products, particularly in Europe and the United Kingdom. It means directing Canadian Defence Attachés and other Defence officials to more effectively support trade-promotion initiatives. It means a stronger and more visible Canadian presence at major international defence and aerospace trade shows. Better support for export opportunities also means stronger efforts to receive foreign buyers in Canada.

Key Actions

To support a robust export market for Canadian defence products and services, the Government will:

- Stand up a dedicated unit to lead and coordinate a new whole-of-government strategy that boosts Canadian defence exports. This unit will also lead on the establishment of dedicated new Deal Teams to pursue high-value international defence contracts;

- Substantially increase financial support for export promotion efforts, and add new Trade Commissioners in the UK and key EU markets and ramp up Canada’s presence at major global defence and aerospace trade shows;

Deepening Workforce Development

A strong Canadian industrial base capable of building the equipment Canada’s military needs will require tens of thousands of trained new workers to fill the high-paying, skilled jobs that will be created. To address this challenge, the Government will pursue a comprehensive Canada Defence Skills Agenda focused on four core priorities:

- Building the defence industry talent pipeline: The Government will take decisive action to upskill and retrain existing workers, attract young people to the industry, and expand apprenticeships and trades, to strengthen the talent pipeline for Canada’s defence industrial base. It will modernize federal upskilling programs to prioritize defence-related skills and create opportunities for youth to gain new skills and work experience in the sector. It will collaborate with the provinces and territories to ensure that defence is a clear priority for support under the $450 million in new program funding for workers affected by tariffs and global market shifts. Finally, a new Apprenticeship Service will be established to ensure a ready workforce to build infrastructure and support companies. Defence firms will be a priority of this new service.

- Investing in urgent defence sector skills needs: The Government announced in Budget 2025 an investment of $383 million over five years to establish new sectoral alliances that bring together employers, unions, and industry groups to develop strategies supporting businesses and workers in a changing labour market. The Government also committed $5 billion in funding for the Strategic Response Fund to help businesses adapt, diversify, and grow in response to tariffs, trade pressures, and other challenges. Under the Canada Defence Skills Agenda, the Government will prioritize defence-related skills upgrading.

- Growing the supply of skilled labour: The Government will prioritize the skills needs of the defence sector as it modernizes its labour-market and immigration strategies. It will collaborate with the provinces and territories to enhance labour mobility across Canada and improve the recognition of foreign credentials. While expanding the domestic talent pool, the Government will also focus on growing the pool of skilled workers through the Federal Skilled Worker Program, Federal Skilled Trades Program, and Global Talent Stream.

- Partnering to deliver defence skills: Partnerships with provinces and territories, and First Nations, Inuit, and Métis rights holders, will be critical to building and sustaining the workforce Canada’s defence industry needs. The Government will work with the provinces and territories, and First Nations, Inuit, and Métis rights holders, to align training pathways, expand supports, and ensure that defence industry and miliary personnel can access the resources they need.

Key Actions

- To develop the defence workforce of the future, the Government will implement a Canada Defence Skills Agenda focusing on four key priorities: strengthening the defence industry talent pipeline; investing in urgent defence sector skills needs; growing the supply of skilled labour; and partnering with provinces, territories, and Indigenous rights holders. Federal policies and programming-and both existing and new dollars-will be aligned in support.

Pillar IV: Securing Supply Chains for Key Inputs and Goods

While efforts to localize production and strengthen domestic manufacturing are the focus of Canada’s Defence Industrial Strategy, our national security will also depend on robust efforts to strengthen supply chain security domestically and with trusted allies.

Securing Key Canadian Assets and Technology

A first key step in securing Canada’s supply chains is to ensure that our legal and policy frameworks help protect them from hostile state actors. Canada has a robust suite of legislative and policy tools to safeguard its most sensitive technologies, research, and know-how from malign actors. Foremost among these are the Investment Canada Act, Export and Import Permits Act, and Bank Act, alongside frameworks such as the National Security Guidelines for Research Partnerships and the Policy on Sensitive Technology Research and Affiliations of Concern. The Government will remain vigilant in ensuring that these laws and policies are effectively applied and fit for purpose.

Deepening the Domestic Defence Supply Chain

The second key step is to continuously invest in strengthening Canada’s supply chains. To this end, in conjunction with the DIA, the Department of National Defence is establishing the Canadian Defence Industry Resilience (CDIR) program. The new CDIR will provide targeted support to Canadian businesses to increase their production capacity for defence related goods, equipment, services and materials. Its initial area of focus will be supporting Canadian businesses to expand their defence production capacity for ammunition and explosives, including components and materials. One key component of modern munitions is nitrocellulose, a propellant used in a wide variety of firearms and artillery. A priority under the CDIR will be to establish a Canadian nitrocellulose production capability, with production to start in 2029.

Accessing Essential Raw Materials: Steel, Aluminum, and Critical Minerals

Canada will also take the steps needed to secure a Canadian supply of critical raw materials—steel, aluminum, and critical minerals. These inputs are vital to the defence supply chain, and Canada has them in abundance. Sourcing these materials from Canada will not only enhance our sovereignty, but provide economic benefits, including highly paid jobs, in communities and in regions across the country. This will be core to the mandate of the DIA in the procurement process.

- Steel and aluminum: In the wake of U.S. tariffs, the Government is committed to working with industry to help steel and aluminum producers pivot and retool to manufacture the grades and products required by Canada’s defence sector. This represents a win-win, sustaining jobs and industrial capacity while strengthening Canada’s sovereignty. The Government committed to provide $5 billion investment in funding through the Strategic Response Fund to deliver large-scale, flexible support for industries affected by U.S. tariffs that including automotive manufacturing, steel, aluminum and forest products.

- Critical Minerals: Of the 12 defence-critical raw materials identified by NATO, Canada produces 10, including aluminum, gallium, germanium, graphite, and tungsten. Canada is a global producer of more than 60 minerals and metals and holds the world’s largest deposits of high-grade uranium—an increasingly strategic resource for the defence and security of Canada and its Allies. As global demand accelerates and geopolitical competition intensifies, securing supply chains for these critical minerals has become a strategic imperative. The Government will bring forward plans to expand the production, processing, stockpiling, and procurement of defence-critical minerals, while supporting coordinated action with allies through initiatives such as the G7 Critical Minerals Production Alliance and NATO-led efforts.

Ensuring a Supply of Canadian Medical Countermeasures

Our allies have explicitly linked biodefence and medical countermeasure readiness to their economic and national security, developing new strategies and mechanisms to advance this work. Canada has taken similar steps, creating Health Emergency Readiness Canada and a new Life Science Fund to collaborate with international partners and support the development and production of medical countermeasures. To further strengthen Canada’s health emergency resilience, the Government will support targeted investments in life sciences innovation, infrastructure, and workforce development. The Government will also explore mechanisms for stockpiling and enhancing coordination with allies to ensure continuity of essential medical supplies during global disruptions or emergencies.

Key Actions

To secure supply chains for key inputs and goods, the Government will:

- Launch and make initial investments in 2026 in the new Canadian Defence Industry Resilience (CDIR) program to help secure key supply chains for the Canadian Armed Forces. One key focus will be to develop a domestic nitrocellulose production capability, with production scheduled to start in 2029.

- Prioritize funding under the Strategic Response Fund and Life Sciences Fund to support key strategic sectors to participate in Canada’s Defence Industrial Strategy. This could include large-scale transformation projects to assist the steel and aluminum sectors pivot to manufacture key defence inputs. It could also include investments to establish and expand critical biodefence and medical countermeasures capacity.

- Publish by Q2 of 2026 its strategy to expand the production, processing, stockpiling, and procurement of defence-critical minerals, while supporting coordinated action with allies through initiatives such as the G7 Critical Minerals Production Alliance and NATO stockpiling efforts.

Pillar V: Working with Key Domestic Partners, Including in Canada’s North and Arctic

Canada’s defence objectives cannot be achieved by working in isolation. Success will require close collaboration with domestic partners beyond industry, including the provinces and territories, Indigenous rights-holders, and communities across Canada. This will be especially true in Canada’s North. A changing climate is gradually opening new sea routes, creating opportunities for resource exploration and shipping, but also exposing Canada’s North to competition and interference from state and non-state actors. Canada is committed to asserting its sovereignty, strengthening northern defence and surveillance capabilities, and deepening cooperation with its allies to deter and, if necessary, defend against emerging threats in the North and High Arctic.

Collaborating with Provinces and Territories

The provinces and territories must be key partners in successful delivery of Canada’s Defence Industrial Strategy. The Government will establish new and leverage existing federal–provincial–territorial mechanisms focused on defence industry development, workforce planning, and infrastructure priorities. Through these mechanisms, provinces and territories will receive advance notice of major defence infrastructure projects to better align demand for skilled trades and materials in Base and Wing communities. The Government will also make joint investments with provincial and territorial partners in education, STEM programs, skilled trades, and Canadian Armed Forces-college partnerships to strengthen regional defence workforce pipelines. In addition, efforts will be made to accelerate credential recognition and labour mobility, ensuring that skilled workers can move seamlessly to meet defence requirements.

Collaborating with First Nations, Inuit, and Métis Rights Holders

The Government is resolutely committed to engaging Indigenous Peoples through early, meaningful, and respectful consultations, grounded in nation-to-nation, Inuit-Crown, and government-to-government relationships. This approach recognizes the rights, title, and governance of First Nations, Inuit, and Métis, and upholds the Crown’s obligations. Our strategy will reflect the United Nations Declaration on the Rights of Indigenous Peoples, treaties, land claim and self-government agreements, as well as the Inuit Nunangat Policy and Cabinet Directive on its implementation, with distinction-based approaches that honor the unique priorities of each Indigenous nation. The Inuit-Crown Partnership Committee will serve as a forum for implementing the strategy from an Inuit perspective, guided by a distinctions-based Inuit action plan.

The Government will promote Indigenous participation in supply chains, infrastructure development, and procurement, supporting Indigenous-owned firms through direct contracting, public-private partnerships, and regional investment initiatives. Canada’s Defence Industrial Strategy will prioritize the well-being and economic development of Indigenous Peoples, aiming to strengthen communities and ensure that they play a central role in rebuilding Canada’s defence industrial base.

Working with Northern and Arctic Partners

Northern and remote communities are vital to Canada’s defence and sovereignty, particularly in the Arctic, where reliable infrastructure underpins the Canadian Armed Forces’ ability to respond to threats, assert sovereignty, and support local populations.

The Government recognizes the need to reinforce Canada’s Arctic sovereignty. Northern infrastructure is currently stretched and insufficient to meet the scale and complexity of military, industrial, and civilian activities. Addressing this gap requires investments that are climate-resilient, strategically located, and capable of supporting dual-use purposes-balancing operational readiness with socio-economic benefits for northern and Indigenous communities. Indigenous engagement will be central to the Government’s approach of building our necessary northern defence-related infrastructure, ensuring that investments respect rights, advance reconciliation, and deliver tangible, lasting benefits to communities, including through enhanced transportation, communications, energy, and business opportunities.

The Northern Operational Support Hubs NOSH) program exemplifies this commitment in action. With a projected 10–20 year timeline and a $2.67-billion investment, NOSH will establish a dispersed network of principal hubs and secondary nodes to provide critical infrastructure and logistical support for military operations in the North. Sites will be purpose-built or repurposed where feasible and may support other federal, territorial, and municipal agencies, creating multi-purpose benefits for communities. NOSH emphasizes collaboration with Indigenous partners, northern communities, and regional governments to align military operational requirements with shared regional priorities. By delivering dual-use infrastructure such as airports, seaports, medical capacity, and alternative power generation, NOSH will not only strengthen Canada’s defence posture but also enhance community well-being, resilience, and economic opportunity.

Through initiatives like NOSH, the Government underscores its commitment to consult, collaborate, and co-develop solutions with Indigenous Peoples and northern communities as it advances Canada’s Defence Industrial Strategy. Investments in northern and remote infrastructure are designed not just to support defence operations but to create enduring benefits, reflecting a whole-of-government approach that integrates sovereignty, security, and prosperity in Canada’s Arctic and northern regions.

Conclusion

This strategy represents a paradigm shift for Canada – one that will drive collaboration between the government and industry in support of our national security and defence. This Defence Industrial Strategy anchors the Government’s broader mission to build a resilient, innovative, and secure economy – one that safeguards sovereignty, equips the Canadian Armed Forces and Canadian Coast Guard, and builds economic prosperity for Canadians. This strong industrial base will, in turn, help lay the foundation for a more resilient and independent economy that puts Canadian businesses and workers first.

Annex: Commitments Under the Strategy

Pillar I: Renewing Our Relationship with Industry

- To renew its relationship with Canada’s defence industry:

- The Defence Investment Agency will lead the establishment of a permanent Defence Advisory Forum co-chaired by the Ministers of National Defence, and Industry, and Secretary of State (Defence Procurement), to provide a regular, scheduled venue to engage with the Canadian defence industry. Under the leadership of these Ministers, industry will be given new opportunities for direct engagement including on procurement, participation where feasible in wargames and operational exercises, and industry-government-military staff exchanges. [ISED, DND, PSPC-DIA]

- The Government will invest to significantly accelerate the security clearance process for defence sector personnel, establish a clear and standardized accreditation process for industry-operated secure facilities. [PSPC]

- The Government will assist industry partners to navigate government processes by providing concierge supports, including by establishing regularly scheduled “industry days” between National Defence/Canadian Armed Forces, Defence Investment Agency and Innovation, Science and Economic Development (ISED) to share information; publishing a regularly updated inventory of anticipated procurements to give industry early visibility on opportunities; creating a single-window government service to direct firms to the most appropriate resource in government; and putting in place a dedicated ISED “concierge” service for companies working on defence and dual-use technologies. [ISED, DND, PSPC-DIA]

Pillar II: Procuring Strategically: The Defence Investment Agency and a New “Build–Partner–Buy” Framework

- To build up Canadian defence champions, the Government will publish a framework for the identification and onboarding of select Canadian defence firms as key strategic partners, by no later than summer 2026. [ISED]

- To ensure defence procurement contributes to both the rebuilding of the Canadian Armed Forces and a strong Canadian defence industrial base that can contribute to Canada’s sovereignty and a growing economy, the Defence Investment Agency (DIA) will apply the Government’s new “Build–Partner–Buy” framework to all future defence acquisitions: [PSPC-DIA]:

- BUILD: In the areas of home-grown strength and key sovereign capabilities, new defence procurements will typically be directed to Canadian firms as a matter of policy. If and as needed, procurement authorities and legal frameworks will be adjusted to enable this approach, including use of the national security exception to direct work to Canadian firms.

- PARTNER: where Canada lacks the capability to build domestically or there is advantage to working jointly with partners, it will pursue partnerships with trusted allies and multinational firms to deliver the capabilities needed by the Canadian Armed Forces. A priority will be placed on diversifying Canada’s partnership opportunities, focusing initially on Europe and the United Kingdom. Partnerships will be defined by joint work, joint building, and the sharing of key technologies and IP in a manner that reinforces our alliances and underpins Canadian sovereignty.

- BUY: When it is not feasible to build domestically or partner with an ally, Canada will buy equipment from allies, with strong conditions that spur reinvestment into the Canadian defence industrial base and ensure Canadian sovereign control over the operation and sustainment of the newly acquired assets.

- To maximize the contribution of defence procurement to the growth and dynamism of Canada’s defence industrial base, the Government will advance a package of reforms to the ITB Policy. ISED will publish changes to the ITB Policy in early 2026. [ISED]

Pillar III: Investing Purposefully to Strengthen an Innovative Canadian Defence Sector

Supporting Defence-Related R&D and Innovation

- To promote excellence in defence-related R&D, the Government will:

- Establish a new Science and Research Defence Advisory Council in 2026; [ISED, DND]

- Invest $244 million in small and medium-sized businesses through a Defence Industry Assist stream of NRC–IRAP to help them advance defence and dual-use technologies. It will also open to Canadian industry wherever feasible Canadian Armed Forces ranges, training areas and operational environments; [NRC]

- Create a Drone Innovation Hub in early 2026 at the NRC with an investment of $105 million over three years. It will also acquire new R&D platforms with an investment of $460 million over five years; [NRC]

- Publish a detailed roadmap for the standup of BOREALIS and select the first round of funded research projects by Q3 of 2026. [DND, ISED]

Building a Dynamic and Entrepreneurial SMB Defence Sector

- To support a robust Canadian SMB defence sector, the Government will:

- Implement the $357.7 million Regional Defence Investment Initiative to support the growth and integration of SMBs into domestic and international defence supply chains; [RDAs]

- Implement the $4 billion investment in BDC in early 2026 to enable its Defence Platform to provide loans, venture capital, and advisory services to help SMBs contribute to Canada’s defence and security capabilities. [BDC]

Prioritizing Canadian IP Ownership, Protection, and Access

- To strengthen the generation and sovereign control of Canadian defence IP, the Government will:

- Enhance supports to Canadian defence and security firms through Elevate-IP and other programs to empower Canadian SMBs to understand, manage and leverage IP, and ensure that they can be maximized for defence and dual-use technologies; [ISED]

- Specifically prioritize Canadian IP ownership, protection and access in defence procurement processes under the new BUILD-PARTNER-BUY framework. [PSPC-DIA]

Expanding Export Promotion and Support

- To support a robust export market for Canadian defence products and services, the Government will:

- Stand up a dedicated unit to lead and coordinate a new whole-of-government strategy that boosts Canadian defence exports This unit will also lead on the establishment of dedicated new Deal Teams to pursue high-value international defence contracts; [GAC]

- Substantially increase financial support for export promotion efforts to add new Trade Commissioners in the UK and key EU markets and ramp up Canada’s presence at major global defence and aerospace trade shows. [GAC]

Deepening Workforce Development

- To develop the defence workforce of the future, the Government will implement a Canada Defence Skills Agenda focusing on four key priorities: strengthening the defence industry talent pipeline; investing in urgent defence sector skills needs; growing the supply of skilled labour; and partnering with provinces, territories, and Indigenous rights holders. Federal policies and programming—and both existing and new dollars—will be aligned in support. [ESDC]

Pillar IV: Securing Supply Chains for Key Inputs and Goods

To secure supply chains for key inputs and goods, the Government will

- Launch and make initial investments in the new Canadian Defence Industry Resilience (CDIR) program to help secure key supply chains for the Canadian Armed Forces, in 2026. One key focus will be to develop a domestic nitrocellulose production capability, with production scheduled to start in 2029; [DND]

- Prioritize funding under the Strategic Response Fund and Life Sciences Fund to support key strategic sectors to participate in Canada’s Defence Industrial Strategy. This could include large-scale transformation projects to assist the steel and aluminum sectors pivot to manufacture key defence inputs. It could also include investments to establish and expand critical biodefence and medical countermeasures capacity; [ISED]

- Publish its strategy to expand the production, processing, stockpiling, and procurement of defence-critical minerals, while supporting coordinated action with allies through initiatives such as the G7 Critical Minerals Production Alliance and NATO stockpiling efforts, by Q2 of 2026. [DND]

Annex: What We Heard in Our Consultations

Background

Since early 2025, the Government has conducted extensive engagement across Canada’s defence and innovation ecosystem. Through roundtables, site visits, surveys, and conferences, we have gathered insights from industry leaders, internal partners, provinces and territories, academia, and allied counterparts.

These engagements have built a clear picture of what stakeholders expect from a modern defence industrial strategy: one that enables the Canadian Armed Forces (CAF) to access the capabilities they need, while ensuring Canada’s defence industry remains competitive, resilient, and sovereign.

Discussions have focused on both systemic and sector-specific challenges—from procurement and Industrial and Technological Benefits (ITB) policy reforms to supply-chain resilience, R&D investment, and workforce development. Across every forum, participants expressed a shared interest in strengthening Canada’s role as a trusted and capable defence partner, and in ensuring that public investment in innovation and industry supports the CAF’s operational readiness and Canada’s economic security.

The findings summarized in this report reflect the recurring priorities and recommendations voiced throughout these engagements. They provide the foundation for a defence industrial strategy that is industry-informed, capability-driven, and focused on delivering results for Canada’s defence and economy.

Summary of Key Findings

Several themes have emerged regarding what stakeholders feel should be essential elements of a strategy:

- Sovereign Capabilities: A clear definition coupled with strategic investments in critical defence capabilities over which Canada must have security of access, supply, maintenance, and sustainment.

- Strategic Focus on Key Sectors: Identification and prioritization of high-value industries. Common sectors mentioned included AI, quantum, critical minerals, munitions, space systems, aerospace, and shipbuilding.

- Security Clearances and Information Sharing: Streamlined processes to facilitate stakeholders obtaining security clearances and accessing classified information.

- Investment Mechanisms and R&D Support: Greater access to capital for the defence and dual-use sector, and improved funding mechanisms to support defence innovation.

- Procurement and ITB Reforms: Enhanced acquisition processes to provide stability and transparency for Canadian defence firms, and ITB policy reforms to better support strategic sectors.

- International Partnerships and Export Policies: Increased focus on strengthening Canada’s position in global defence supply chains, championing Canadian defence industry abroad, and improving export control mechanisms.

- Arctic and Northern Security: Multi-purpose infrastructure to support national defence and economic development in the North.

- Workforce Development: Measures to build a skilled labour force that can support emerging defence technologies and industrial needs.

- Streamlined and Strategic Engagement: More effective government engagement with industry.

Elements Raised

1. Defining and Supporting Sovereign Capabilities

Stakeholders emphasized that Canada must establish clear criteria for designating sovereign capabilities, and should focus on domestic production, supply chain security, and intellectual property (IP) control of the selected capabilities. They suggested that:

- A defence industrial strategy should determine the capabilities over which Canada needs to have sovereign control and production capacity;