Audit of the Federal Workers Compensation Programs - January 2018

From: Employment and Social Development Canada

On this page

- 1. Background

- 2. Audit findings

- 2.1 When occupational injury or illness reporting protocols are followed, injured federal workers receive compensation benefits

- 2.2 Available guidance is out of date and not well communicated

- 2.3 Financial management needs strengthening

- 2.4 Human resource planning is required to strengthen program delivery

- 2.5 Management of claims involving third parties has improved

- 2.6 Implementation of mitigating strategies to better safeguard personal information is delayed

- 3. Conclusion

- 4. Statement of assurance

- Appendix A: Audit criteria assessment

- Appendix B: Federal Workers Compensation programs overview

- Appendix C: Glossary

Alternate formats

Audit of the Federal Workers Compensation Programs[PDF - 539 KB]

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

1. Background

1.1 Context

An audit of the Federal Workers Compensation (FWC) Programs was identified in the approved 2016–2018 Risk-Based Audit Plan for Employment and Social Development Canada (ESDC).

In 1918, the federal government passed legislation by which it would compensate its workers who suffer an occupational injury or illness arising out of or in the course of their employment, or who are slain on duty, at the same rate and under the same conditions as the provincially regulated employees in the same jurisdiction. To accomplish this, the Government Employees Compensation Act (GECA) authorizes provincial workers compensation authorities to determine compensation and administer services to injured federal workers on behalf of the federal government.

The FWC Programs are delivered by the Labour Program’s Federal Workers Compensation Services (FWCS) in National Headquarters (NHQ). Services were transferred from regional offices to NHQ in stages, ending in 2014.

In addition to GECA, the FWCS administers two other programs: the Merchant Seamen Compensation Act and the Public Service Income Benefit Plan for Survivors of Employees Slain on Duty. Further, FWCS also provides claim processing services to Correctional Services Canada in accordance with the Corrections and Conditional Release Regulations. Last, workers compensation benefits to foreign employees of the Government of Canada who are hired and work overseas are covered under Section 7 of GECA. The requirements of Section 7 are sufficiently different from the regular GECA process that Section 7 claims are effectively a separate small program and are managed as such.

GECA had over 53,000 active regular claims during the period of the audit, of which approximately 16,000 were new claims in 2016–2017 which is a typical annual case load. GECA regular claims represent more than 99% of the claim volume processed by the FWCS. The total value of these claims for fiscal year 2016–2017 was just over $165M. The smaller programs, including Section 7 of GECA which is administered separately, had 169 active claims, of which approximately 30 were new. For the smaller programs, FWCS does not pay any direct costs. FWCS’ role is limited to determining eligibility, amount of compensation, and informing the stakeholders of their responsibilities. An overview of FWC Programs is provided in Appendix B.

1.2 Audit objective

The objective of the audit was to assess whether the management and delivery of each of the four FWC Programs are effective and efficient.

1.3 Scope

The scope of this audit included applicable legislation, operational policies and procedures as well as files and systems used by the program areas to deliver FWC Programs. Files and data with active transactions processed or pending during the period from April 1, 2014 to March 31, 2017 were included in the scope of the audit.

Neither the operations of other federal government departments and agencies nor the operations of provincial workers compensation boards (provincial boards) were included in the scope, although publicly available performance information, audits and evaluations were consulted.

The FWC Programs are centralized in NHQ and regional travel was not required.

1.4 Methodology

The audit was performed using a number of methodologies:

- Interviews with employees and managers of the FWC Programs;

- Interviews with departmental staff supporting FWC Programs;

- Review and analysis of guidance, training materials and publicly available material;

- Review and testing of a sample of 200 FWC Programs claim files selected from 2014–2015 through to fiscal year end 2016–2017;

- Aggregation and analysis of performance metrics and timelines;

- Review and analysis of the cost allocation and recovery process;

- Review of audit trails and the processes in place for the protection of personal information; and

- On-site observation and walkthrough of FWCS work areas and file storage.

2. Audit findings

2.1 When occupational injury or illness reporting protocols are followed, injured federal workers receive compensation benefits

Injury reporting process

The audit team found evidence in the GECA claim files and information systems that compensation benefits are paid to eligible injured workers when eligible federal employees report occupational injuries and illness to their employer and the medical system; and federal departments, agencies and crown corporations (employers) report injuries to FWCS using the reporting protocols in place (see diagram below). For regular GECA claims, reimbursement of the provincial board begins shortly after the occupational injury or illness is reported to them and continues until the worker returns to work.

The onset of an occupational injury or illness triggers a number of actions. The available guidance requires that:

- the injured employee seek immediate medical attention, with the help of the employer if needed;

- the injured employee report the injury to the employer within 24 hours of becoming aware of the injury;Footnote 1

- the manager or supervisor must report the occurrence to: a) the local Occupational Health and Safety (OHS) Committee within 24 hoursFootnote 2, and, b) the FWCS within three days, if the occupational injury or illness required medical attention or resulted in lost time;Footnote 3

- after it has been determined that an occupational injury or illness was caused by a third party, the employee must decide by way of an irrevocable election, within 90 days, between taking action against the third party on their own and foregoing compensation from GECA or to claim workers compensation and assign the right to take action to the Crown. Settlements recovered by the Crown are used to reimburse compensation and litigation costs first, with any excess paid to the injured employee.

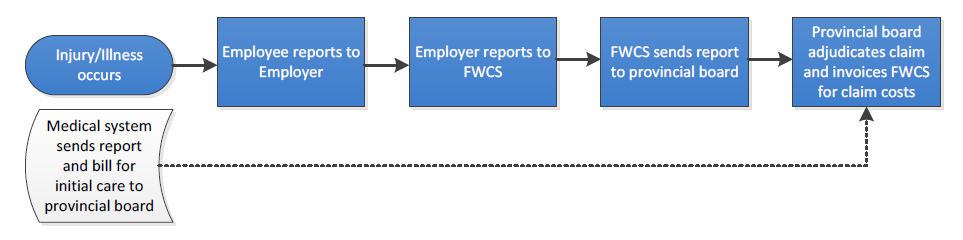

Image description

This figure depicts two potential ways that provincial boards are notified of occupational injury or illness.

The first line describes the illness or injury occurring; the employee reports to employer; the employer then reports to FWCS; FWCS sends the report to the provincial board and finally the provincial board adjudicates the claims invoicing FWCS for claims costs.

The second line describes another way in which the provincial board may be notified of the injury: Injury or illness occurs and the medical system sends a report and a bill for initial care to the provincial board; the provincial board may adjudicate the claim and bill FWCS without having received an employer report of occupational injury or illness.

The audit team was advised that when an employee informs the attending physician that they have been injured at work, the medical system will report an occupational injury or illness to the provincial board. This initiates a compensation action by the provincial board and, if the employee does not report the injury to their employer, may create a claim that cannot be matched by FWCS to a federal employer, despite FWCS efforts to obtain the matching employer report.

Tracking the employer report of injury

Treasury Board’s guidance on Workers CompensationFootnote 4 indicates that employers have a responsibility to ensure that employees are aware of their rights to workers' compensation and that all occupational injuries or illnesses involving lost time or requiring medical attention are reported to FWCS within three days of occurrence. With the guidance in mind the audit team analysed the data set for regular GECA claims from 2015–2016 to determine the time it took an injured employee to receive compensation. Based on the current reporting data, there are four dates that are captured in the system:

- the date employee was injured;

- the date the injury was reported to the employer;

- the date FWCS received the employer injury report; and

- the date the FWCS forwarded the employer injury report to the provincial board.

The audit team discovered that claim data was limited and based on the employer report of injury only. The auditors noted missing employer reports dating back several years during the period of the audit. Analysis of National Injury Compensation System (NICS) data revealed the following number of outstanding employer reports: 176 in 2014, 319 in 2015 and 523 in 2016. We noted that the average reporting times included case files with lengthy reporting delays which skewed the overall reporting results. Therefore, we have included the median number of days in Table 1 below to provide a more representative portrayal of reporting times. We also noted data integrity issues due to incorrect inputting, missing information and negative reporting.Footnote 5

| GECA reporting time | 2015 | 2016 | ||

|---|---|---|---|---|

| Type | Average days | Median days | Average days | Median days |

| From injury to employee report | 22 | Same day | 18 | Same day |

| From employer to FWCS | 53 | 13 | 43 | 11 |

| From FWCS to provincial board | 18 | 11 | 6 | 2 |

| Total days | 93 | 24 | 67 | 13 |

Source: The raw data was extracted from the NICS by FWCS. Median is the value of the mid-point in a series of numbers arranged from smallest to largest.

Tracking outcomes

FWCS’ mission is “to ensure that federal government employees who have sustained work related injuries receive timely financial, health care and rehabilitation benefits as well as assistance to ensure early and safe return to work”. However, the audit team observed during testing that there is no mechanism to capture when the injured employee first received payment or when they returned to work.

The audit team could not calculate, based on information in the system, the elapsed time from injury to the date a claim decision was made by the provincial board, to the date the injured employee began to receive compensation benefits, or to the date the employee returned to work.

Provincial boards are tracking these outcomes (in other words elapsed time to decision, compensation and return to work) and reporting them for all workers in Canada through the Association of Workers’ Compensation Boards of Canada.Footnote 6 There may be an opportunity as FWCS moves forward with modernization initiatives and the negotiation of new agreements with provincial boards to obtain this information for the federal workforce as part of the claim information provided by the provincial boards.

No enforcement mechanism

On average, the reporting standards for employers and subsequently the FWCS are not met due to delayed employer reporting. While there may be many causes for these delays in reporting by employers, the FWCS has no effective way to enforce compliance. The guidance document from Treasury Board assigns responsibility to employers but does not specify consequences for non-compliance. Therefore, influencing the behaviour of federal government employers is a matter of communication and program awareness. Labour Program may wish to explore potential enforcement mechanisms to improve employer reporting.

Recommendation

Compliance, Operations, and Program Development (COPD) should put in place mechanisms to capture and report injured employee outcomes.

Management response

Management agrees that mechanisms need to be developed to capture and report injured employee outcomes.

Through the establishment of Protected and the development of internal data collection tools, Program intends to collect additional information such as claim duration and return-to-work outcomes to support strengthened monitoring of employer performance and employee outcomes.

Program is also committed to work with employers to collect information on direct payments made to injured employees to better assess income continuity.

Program has identified development and implementation of a Data Quality Assurance Framework and a Performance Measurement Reporting Program as part of its priorities to provide quality performance data to stakeholders.

The actions are expected to be completed by the fourth quarter of 2018–2019.

2.2 Available guidance is out of date and not well communicated

Clarity and accuracy of program guidance

The audit team observed that it was very difficult to locate the correct guidance for FWC Programs and when found, the guidance contained inaccuracies, broken links and unclear messaging. This may have a direct impact on employer reporting as communication and program awareness are fundamental to complete and timely reporting. The following are some of the examples noted during the audit:

- The two key documents issued by the Labour Program with respect to GECA (If You Have an Accident – What to Do and How to Do It, and the Employers Guide to the Government Employees Compensation Act)Footnote 7 refer to contacting the regional offices of the Labour Program for help. The last regional office to transfer its workload to NHQ stopped delivering workers compensation services in January 2015. The fax number listed is out of service and the links to the regional injury compensation offices are broken.

- The audit team also found that guidance and information provided for employees hired overseas (who are covered under Section 7 of GECA) was misleading. Although occupational injuries and illness are to be reported to FWCS, links and contact information in the guidance directed employees and employers to the Workplace Safety and Insurance Board of Ontario even though they are not involved in the management of Section 7 claims.

- For the Correctional Services program, the information brochure made available to injured inmates has incorrect contact information referring them to an out-of-service 800 number.

- The Operations Program Directives (OPDs) which are used by FWCS staff to guide them in delivering the FWC Programs were issued at various dates from 1993 to 2014, prior to the NHQ centralization. Most contain references to job titles and divisions within the Labour Program that no longer exist. Our review found that most of the guidance contained in the OPDs is still valid because the Act and regulations have not changed substantially since their issuance. However, it is difficult to determine from the OPD text which current manager is accountable for which tasks.

Potential confusion regarding OHS and FWC Programs reporting requirements

The audit team noted that guidance from the FWC Programs does not inform federal managers and supervisors that they have a responsibility to report occupational injuries or illnesses involving lost time or requiring medical attention to their OHS committee, nor does the OHS guidance remind employers of their responsibility to report to the FWCS. The FWC Programs employer guidance for GECA does mention that there are two different reporting processes but it is not clear that the accident investigation process is supervised by the OHS Program and no link is provided. Both units are referred to in the respective employer guidance issued at various times as “HRSDCFootnote 8, Labour Program”, which may add to the confusion.

Training

The audit team was not aware of any specific workers compensation awareness training available at the federal level through either the Canada School of the Public Service or through ESDC. The ESDC orientation for new employees contains a presentation of rights and responsibilities relating to OHS, including a brief mention of what to do when an accident occurs. The related manager training for OHS does not mention FWC Programs or GECA at all. As both OHS and FWCS are resident in the Labour Program, there may be an opportunity for greater cooperation and consultation when developing guidance for both employees and their managers.

Recommendation

COPD should review and update program guidance and develop a communication strategy to ensure that all federal employees and managers are aware of program requirements.

Management response

Management agrees that program guidance needs to be updated and that communication and outreach to employers need to continue.

Program has already taken steps to improve employers’ awareness through the creation of an Interdepartmental Consultation Committee composed of high volume employers and ongoing participation in employers’ fora such as the Human Resources Council and the Public Service Management Advisory Committee.

COPD has partnered with Treasury Board Secretariat to support the engagement and awareness of departments and agencies regarding existing Program requirements.

The actions are expected to be completed by the third quarter of 2019–2020.

2.3 Financial management needs strengthening

Verification of invoices

Each of the ten provincial boards invoices the FWCS monthly for direct costs plus administration fees. Each invoice received contains two parts, a paper copy of the invoice and related support and an electronic copy of the related support. The audit team was informed that the invoice total was assessed for overall reasonableness and the electronic copy of the support was matched with the paper copy.

Per Section 34 of the Financial Administration Act, invoices for goods and services are to be certified prior to payment that the goods or services were received and accepted. In accordance with the ESDC Policy on Commitment Control, Account Verification and Payment Requisitioning, managers with Section 34 delegation are required to do sufficient work to assure that the goods and services were received as invoiced and are acceptable in price and quality. Further, copies of supporting documents and analyses, such as sampling plans and test results, are to be kept on file for quality assurance review.

The audit team found no evidence on file that there was any testing or verification performed with respect to Section 34 beyond the global reasonableness test.

The electronic copy of the supporting documentation to the invoice provides the raw data for transaction level input into NICS. The data upload process identifies items where there is insufficient information to determine the eligibility of the claimant or the identity of the employer. These non-conforming items are transferred to suspense.

Use of suspense

The auditors noted two types of suspense claim. The first type pertains to claims where the injury occurred prior to April 1998, which are commonly referred to as legacy claims within FWCS. The second type pertains to claims that occurred after April 1998 and are being held pending investigation and resolution. These items may be waiting for employer reports, adjudication by the provincial board, or appeal decisions, or, they may represent costs related to errors or disallowed claims. When the additional information is received by FWCS, the item is resolved and transferred out of suspense. Once an item is resolved, it may be billed to the responsible party. Costs relating to ineligible claims may be recovered from third parties, written off, or subsumed in the general administration costs of the program. Protected

In practice, the FWCS will pay first, put non-conforming items into suspense, and investigate later, which is an acceptable practice if managed well. At the time of the audit, there were 91,811 items in suspense relating to 14,405 claimants amounting to over $11M. There were 39,221 suspense items older than three years. The age of these items makes it difficult to find the information needed to clear the item and very challenging to justify recovery of the amounts from employers. At the time of the audit, the average age of a potentially billable item was over 1,000 days. In the opinion of the audit team, the amounts in suspense should be transferred into the appropriate receivable account or written off to general administration within a reasonable time.

In 2015–16 the net amount of suspense generated was $3.5M on a total expenditure in the FWC Programs of $165M. From an accounting perspective the amount in suspense may not be considered material, but it does represent a set of expenditures that could be rebilled, at least in part, to other parties and reduce net expenditures by the Labour Program.

Certain administration costs may not be included in the cost pool

Costs of eligible claims for injuries that occurred after April 1, 1998 are billed to the responsible federal government employer. Eligible legacy claims are paid from the GECA Statutory Fund and not rebilled to the employer. These legacy claims include ongoing disability pensions, claims from delayed onset of symptoms and recurrence of chronic symptoms that result in lost time. These claims are not recoverable from employers and as such should not be in suspense but charged to the appropriate expense code.

Monthly uploads from provincial boards contain claims that cannot be matched to an employer. When and if resolved after FWCS follow up, these items are billed to the employer. Resolving these items is a manual process that can be time consuming. FWCS officers must request information from the provincial board to identify the employer to request an employer report of injury. FWCS informed the audit team that provincial boards may not recognize Labour’s need to know and are reluctant to share information due to privacy concerns. Protected

FWCS pays certain costs that are currently not recovered from employers: initial claim costs for an employee who later elects to pursue their own third party claim; claim costs that are not matched to an employer; costs associated with errors, overpayments and disallowed claims; and costs for unsuccessful appeals by the employee. The last can be a significant cost; the audit team was informed that 90% of unsuccessful claims in Quebec were appealed by the claimant. In the provincial context, the above costs are added into the cost pool that is used to calculate the various insurance rates charged to employers according to occupation and also informs the administration fees charged to FWCS. In the federal context, it is unclear who is responsible for reimbursing these costs, in whole or in part, or if they should be fully covered by Labour Program’s budget. It is clear, however, that more timely resolution of suspense items may allow for faster reimbursement from employers and reduction in write-offs.

Recommendation

COPD should strengthen financial management practices Protected

Management response

Management agrees that financial management practices should be strengthened. Program is reviewing operational procedures to Protected

Program currently uses the Report of Injury signed by the employee’s supervisor as confirmation that the employee is a federal worker eligible under GECA. Protected

Protected

The actions are expected to be completed by the second quarter of 2018–2019.

2.4 Human resource planning is required to strengthen program delivery

FWCS has experienced a great deal of personnel changes in the 18 months prior to the audit including a new Director General, Director and managers. There were also a large number of vacant positions at the claims management level. The 2013–2014 centralization to NHQ resulted in the loss of many experienced regional claims personnel and, although the unit is rebuilding, the loss of this expertise has had an impact.

FWCS claims processing is transforming from an administrative paper based manual process to that of an enabler in order to partner with client employers to assist them with managing workers compensation benefits.

At the time of the audit the organization chart dated June 2017 provided to the audit team showed a staff complement of a total of 68 full-time, term and casual positions, of which 33 are claims officers. The audit team noted significant vacancies in Program Integrity and Claims Operations. The audit team did not find any evidence of comprehensive human resource planning to ensure that FWCS has the required employees with the necessary skills to meet current and future objectives. Resources are stretched to cover many tasks to support the paper and reporting burden, and, as a result, claims management and oversight is suffering.

Bring Forward system (BF)

NICS has a built-in bring forward, or BF system, to remind claims staff to follow up on a transaction in order to resolve it. For example, a claim without an employer report would be flagged as a BF and once the report was received from the employer the BF would be recorded as actioned. Other pending actions that require the claim report could then occur, such as recovery of a suspense amount. The audit team observed that the number of open BFs remaining on file from the period 2014 to 2017 that required some form of action or multiple actions in the system was greater than 40,000. The audit team did not find evidence that aging reports were used to manage the outstanding BFs. A review of the BF system showed that more than 14,000 of the BFs created since centralization to NHQ were more than two years old.

The audit team drew a sample of 20 transactions with open BFs to determine the status of the claim and why it remained as a BF action item. Of the sample, 30% of the items had been actioned but the system had not been updated to reflect this. The remaining 70% were still pending, several for more than one year.

Unpaid third party disbursements

As of July 2017 the results of audit testing and interviews revealed that $3.9M in negotiated settlements and court awards for occupational injury or illness caused by a third party had not been disbursed. When a settlement cheque is received, disbursements are supposed to be made within three months of receipt and in the following order of precedence: Labour Program, litigation costs, provincial board costs, salary costs and any excess to the claimant. Based on a sample of 25 third party files, the audit team found five files that had disbursements that were not paid within 90 days. The longest delay was 631 days. Towards the end of the audit conduct phase it was noted that disbursements had resumed, not as part of normal operations, but as a special initiative. At the end of the audit field work, there was $2.2M outstanding to be paid and the audit team was informed that another special initiative would be conducted in the fall 2017.

Monitoring of claim cost recovery

Provincial boards claim their cost plus administration fees on a monthly basis. FWCS recovers identifiable claim costs from federal employers on a quarterly basis, where the claim cost can be matched to a federal employer that has filed an employer report. Reimbursement of costs from federal departments and most agencies are settled via the interdepartmental settlement facility within a few days of receipt; however, crown corporations are invoiced and it can take up to 120 days to be paid. The audit team noted that the responsibility for ensuring that these costs were recovered is unclear. FWCS and the Chief Financial Officer Branch accounts receivable team both stated that the other was responsible for tracking cost recoveries. Additionally, there was no evidence provided that the invoices sent out to crown corporations are matched to amounts received.

Small programs

Small programs (GECA Section 7, Inmates, Slain Workers and Merchant Seamen) do not involve the provincial boards; rather, they are administered by FWCS program advisors. There is an average of 30 new cases per year for all four small programs. However, the expertise required is different for each. Because the caseload is small for each program, it is difficult to build up enough expertise to make them routine, or in some cases, to give more than one person exposure to these types of files. Therefore, the program advisors assigned to these cases require a greater degree of support and supervision to ensure that compensation decisions and recommendations are made in accordance with the principles of natural justice when adjudicating a claim. The audit team observed at the beginning of the audit that the monitoring and oversight of small programs was not sufficient, however, changes were later implemented to ensure management was providing support and oversight of these programs. This was confirmed through interviews with program advisors.

Recommendation

COPD should develop and implement a comprehensive human resource strategy to strengthen internal capacity to deliver and monitor the programs as well as reducing the backlog of BF items while taking into account planned modernization initiatives.

Management response

Management agrees with the recommendation and is aware of the challenges related to the internal capacity to deliver and monitor the programs as well as implement the planned modernization initiatives.

A Business Plan for Program Operations is being drafted which identifies the current and anticipated resources to transition towards the planned modernization initiatives. Management will request that a Human Resources Audit be performed to ensure proper classification of program employees at which point the Business Plan will be adjusted.

The actions are expected to be completed by the fourth quarter of 2018–2019.

2.5 Management of claims involving third parties has improved

Centralization

In 2012, the Labour Program and ESDC’s Legal Services began a partnership to manage actions taken on behalf of injured employees against third parties. The intent was to reduce rising litigation costs; to optimize recovery possibilities; and to reduce both inventories and processing times. The partnership with the Dispute Resolution Services (DRS) and FWCS provides full back office support to Legal Services during mediation and litigation.

The new approach has led to very positive outcomes, with DRS able to resolve the majority of all new viable third party cases transferred from FWCS, while optimizing recovery possibilities. Since its inception, this partnership has produced recoveries totalling $13.9 million while reducing litigation costs on average by 30% compared to 2011–2012, which was the last year of the former regime.Footnote 9

Emerging challenges

There have been ongoing challenges with obtaining timely information from employers and provincial boards, including medical and other personal information, which is required to successfully pursue a third party claim. The injured worker has 90 days to file their election to either pursue the third party themselves or to claim compensation and assign the right to sue on their behalf to the Crown. After receipt of the employee’s election to receive workers compensation and assign the third party claim to FWCS, DRS may need, in addition to the employer report, police reports, witness reports, salary information, and medical assessments.

In most provinces the statute of limitations is two years from the date of injury to file a claim in court. DRS cannot start work until they receive the complete case file from FWCS so any delay in processing claims impacts the timelines.

The audit team was informed by FWCS that there was a lack of employer awareness regarding third party claims. In relation to the provincial boards, both DRS and FWCS informed the audit team of lengthy delays in the provision of access to key documents. The provincial boards are reluctant to grant access to certain claim information, primarily medical information, stating that their privacy legislation prevents them from sharing this information. In some cases, the board will refuse to share needed information outright. If boards remain unwilling to share needed information until updated agreements are in place, there is a risk that delays may reverse the progress made to date and may result in lower recoveries and increased costs.

2.6 Implementation of mitigating strategies to better safeguard personal information is delayed

A walkthrough of FWCS revealed that adequate measures are in place to protect hard copies of claim information. However, full implementation of mitigation strategies to better safeguard the information contained in and shared on information systems is delayed. Some items have been implemented, such as the use of myKey to authenticate authorized external users of program systems. However, program systems remain limited in their capacity to support audit trails and access log monitoring. The audit team was informed that senior departmental managers are aware of the current system limitations related to missing audit trails and the delays in the implementation of replacement systems.

3. Conclusions

We conclude that the management of the FWC Programs needs strengthening. Recent changes have improved the efficiency in processing regular GECA and small programs claims. There remain opportunities to improve the effectiveness of the management of all FWC Programs with respect to oversight, guidance, communications, and resourcing.

We conclude that the delivery of workers compensation services to known injured workers is adequate. There are opportunities to improve the completeness of information received from both the provincial boards and the employers and to strengthen financial management, outcome reporting, and recovery of claims costs.

4. Statement of assurance

In our professional judgement, sufficient and appropriate audit procedures were performed and evidence gathered to support the accuracy of the conclusions reached and contained in this report. The conclusions were based on observations and analyses at the time of our audit. The conclusions are applicable only for the management and delivery of FWC Programs. The evidence was gathered in accordance with the Treasury Board Policy on Internal Audit and the International Standards for the Professional Practice of Internal Auditing.

Appendix A: Audit criteria assessment

Audit criteria

FWC Programs practices and procedures are established and working as intended

- A.1 Roles and responsibilities as well as guidance are defined, documented, and communicated to stakeholders.

- Controlled, but should be strengthened, medium risk exposure

- A.2 Claims management practices support efficient and effective service delivery and case resolution.

- Controlled, but should be strengthened, medium risk exposure

- A.3 Compensation costs are recovered from client departments on a timely basis with supporting documentation.

- Controlled, but should be strengthened, medium risk exposure

Monitoring and reporting mechanisms are in place to facilitate decision making

- B.1. An approach that clearly defines monitoring and reporting is in place.

- Controlled, but should be strengthened, medium risk exposure

- B.2. Monitoring results are reported to senior management to facilitate decision making and enable continuous improvement.

- Controlled, but should be strengthened, medium risk exposure

Privacy and security of personal information is safeguarded in delivering the FWC Programs.

- C.1. Personal information that flows through the business processes occurring in the management and delivery of FWC Programs is appropriately safeguarded.

- Controlled, but should be strengthened, medium risk exposure

Appendix B: Federal Workers Compensation Programs OverviewFootnote 10

Federal programs

Government Employees Compensation Act (GECA)

Regular claims, 53,000 active claims

Persons eligible: Civilian employees of the Public Service of Canada, including Crown Corporations and Agencies.

Program delivery: FWCS: overall claim management; set policies; stakeholder liaison. Provincial boards adjudicate claims.

Initiating a claim: Employers report within 3 days all work-related injuries or illnesses requiring medical care beyond first aid.

GECA 3rd party claim (subrogated)

1,900 active claims

Persons eligible: Employees injured through the actions of a third party.

Program delivery: FWCS assists the Dispute Resolution Services and Department of Justice with negotiations and/or litigation.

Initiating a claim: Employee must decide within 3 months to claim under GECA or pursue litigation on their own.

GECA employees hired overseas (Section 7)

39 active claims

Persons eligible: A foreign citizen hired in their own country by the Canadian Federal Government.

Program delivery: FWCS adjudicates the claim and employer pays all compensation awarded.

Initiating a claim: Employers report within 3 days all work-related injuries or illnesses requiring medical care beyond first aid.

Public Service Income Benefit Plan for Survivors of Employees Slain on Duty

12 active claims

Persons eligible: Survivors of civilian federal public servants with an eligible claim under GECA.

Program delivery: FWCS manages full claim process on behalf of Treasury Board.

Initiating a claim: Employer of slain employee initiates the claim under GECA.

Corrections and Conditional Release Regulations

110 active claims

Persons eligible: Federal penitentiary inmate taking part in an approved Correctional Services Program.

Program delivery: FWCS provides claim processing and recommendations to Correctional Services Canada.

Initiating a claim: Accident is reported within 3 months to FWCS by the Institution or by the inmate.

Merchant Seamen Compensation Act

3 active claims

Persons eligible: Injured merchant seamen not eligible for compensation under provincial or federal workers compensation plan.

Program delivery: FWCS adjudicates the claim and employer pays all compensation awarded.

Initiating a claim: Employer reports accident to FWCS within 60 days.

Appendix C: Glossary

COPD: Compliance, Operations and Program Development

DRS: Dispute Resolution Services

ESDC: Employment and Social Development Canada

FWC: Federal Workers Compensation

FWCS: Federal Workers Compensation Services

GECA: Government Employees Compensation Act

NHQ: National Headquarters

NICS: National Injury Compensation System

OHS: Occupational Health and Safety

OPD: Operations Program Directives

WCB: Workers’ Compensation Boards